The right preparation can turn an interview into an opportunity to showcase your expertise. This guide to Budgeting and Money Management interview questions is your ultimate resource, providing key insights and tips to help you ace your responses and stand out as a top candidate.

Questions Asked in Budgeting and Money Management Interview

Q 1. Explain the difference between a budget and a forecast.

A budget and a forecast are both crucial financial planning tools, but they serve different purposes. Think of a budget as a detailed plan for how you’ll spend and allocate your resources over a specific period, say, a year. It’s a fixed roadmap, outlining intended expenses and revenues. A forecast, on the other hand, is a prediction of future financial performance. It’s an estimate, based on available data and assumptions, of what might happen, rather than a strict commitment.

Example: A company might budget $1 million for marketing expenses in 2024, allocating specific amounts to different campaigns. Their forecast, however, might predict that their sales revenue will reach $5 million in the same year, based on market trends and past performance. The budget is a firm plan; the forecast is a probabilistic projection.

- Budget: Detailed, fixed, often approved, action-oriented.

- Forecast: Projected, flexible, subject to revision, informational.

Q 2. Describe your experience with variance analysis.

Variance analysis is a core skill in my budgeting and financial management practice. It involves comparing actual results to the budgeted or planned figures to identify and understand deviations. This process is critical for evaluating performance, uncovering areas for improvement, and making informed decisions. My approach typically involves:

- Identifying Variances: Calculating the difference between actual and budgeted values for each line item in the budget. For example, comparing actual marketing spending to the budgeted amount.

- Analyzing Variances: Determining the causes of significant variances. Was the marketing overrun due to unexpected advertising costs, or a more effective campaign that exceeded the budget to capitalize on strong results? Understanding the ‘why’ is crucial.

- Reporting and Communicating: Presenting variance analysis findings clearly and concisely to relevant stakeholders, highlighting key insights and recommendations for corrective actions.

For instance, in my previous role, I identified a significant positive variance in sales revenue. Through variance analysis, we discovered that a new product launch had performed exceptionally well, exceeding our projections. This allowed us to allocate more resources to this product line and adjust future forecasts accordingly.

Q 3. How do you handle budget overruns?

Budget overruns are a reality in any organization. My approach to handling them is proactive and systematic. It begins with understanding why the overrun occurred. Was it due to unforeseen circumstances (e.g., supply chain disruptions), inaccurate budgeting (e.g., underestimated costs), or poor performance (e.g., inefficient project management)?

Once the root cause is identified, I take the following steps:

- Investigate and Document: Thoroughly investigate the reasons for the overrun, gathering relevant data and evidence. Proper documentation is vital.

- Implement Corrective Actions: Develop and implement actions to prevent future overruns. This might include improving cost estimation methods, enhancing project management processes, or renegotiating contracts.

- Seek Approval for Budget Revisions: If necessary, I present a revised budget to management, outlining the reasons for the overrun and proposing necessary adjustments.

- Monitor and Control: Closely monitor spending and performance post-overrun to ensure that corrective actions are effective and that the budget remains on track.

Ultimately, the goal is to learn from the overrun, improve future budgeting processes, and ensure financial stability.

Q 4. What budgeting methods are you familiar with (e.g., zero-based, incremental)?

I’m experienced with several budgeting methods, each with its strengths and weaknesses. Here are a few:

- Zero-Based Budgeting (ZBB): Each budget cycle starts from scratch. Every expense needs justification, regardless of past spending. This approach is great for eliminating unnecessary expenses but can be time-consuming.

- Incremental Budgeting: This is a simpler method where the current year’s budget is adjusted based on a percentage increase or decrease from the previous year. While efficient, it may perpetuate inefficient spending patterns.

- Activity-Based Budgeting (ABB): This method links budget allocations directly to specific activities or projects. It’s useful for organizations with diverse operations, providing a clearer picture of cost drivers.

- Value-Based Budgeting (VBB): Resources are allocated based on their expected value and contribution to strategic goals. This approach prioritizes investments with the highest return.

The best method depends on the organization’s size, complexity, and strategic goals. In practice, I often find that a hybrid approach, combining elements of different methods, works best.

Q 5. Explain the importance of cash flow management.

Cash flow management is the lifeblood of any organization. It’s the process of monitoring and controlling the inflow and outflow of cash to ensure that there’s enough liquidity to meet immediate obligations and invest in future growth. Without proper cash flow management, even profitable businesses can fail.

The importance stems from the need to:

- Meet Short-Term Obligations: Pay salaries, suppliers, rent, and other immediate expenses.

- Manage Working Capital: Maintain sufficient cash to cover day-to-day operational needs.

- Invest in Growth Opportunities: Capitalize on new projects, acquisitions, and expansion plans.

- Avoid Financial Distress: Prevent situations like bounced checks and defaults on loans.

Effective cash flow management involves techniques like forecasting cash flows, optimizing accounts receivable and payable, and securing lines of credit.

Q 6. How do you prioritize competing budget requests?

Prioritizing competing budget requests requires a structured approach. My process usually involves:

- Alignment with Strategic Goals: Evaluating each request based on its alignment with the organization’s overall strategic goals. Requests that directly contribute to key objectives are given higher priority.

- Return on Investment (ROI): Assessing the potential return on investment for each request. Projects with a higher expected ROI are generally preferred.

- Risk Assessment: Evaluating the potential risks associated with each request. Requests with higher risk may require more justification or a more conservative approach.

- Resource Constraints: Considering the availability of resources (financial, human, etc.). Requests that are within resource constraints are prioritized.

- Cost-Benefit Analysis: Performing a detailed cost-benefit analysis for each request to determine the net benefit.

Often, this involves a scoring system where each request is evaluated based on these criteria and a weighted average score is used to rank requests.

Q 7. What software or tools have you used for budgeting and financial analysis?

Throughout my career, I’ve utilized several software tools and platforms for budgeting and financial analysis. My experience includes:

- Microsoft Excel: A fundamental tool for creating budgets, performing calculations, and generating reports. I’m proficient in using advanced Excel functions for financial modeling and analysis.

- Oracle Hyperion Planning: A powerful enterprise performance management (EPM) system for budgeting, forecasting, and reporting. My experience spans building and maintaining financial models within this platform.

- SAP BPC (Business Planning and Consolidation): Another EPM system for consolidated financial planning and reporting. I’ve worked with SAP BPC to manage complex budgets across multiple entities.

- Adaptive Insights (now part of Workday): Cloud-based financial planning and analysis software, offering robust budgeting and forecasting capabilities. I’ve used Adaptive Insights for its collaborative features and real-time data visualization.

My proficiency in these tools, coupled with my strong analytical skills, allows me to develop and manage effective budgeting and financial planning processes.

Q 8. Describe your experience with financial modeling.

Financial modeling is the process of creating a simplified representation of a company’s or project’s financial performance using mathematical formulas and assumptions. It’s essentially a predictive tool, allowing us to explore different scenarios and make informed decisions. My experience encompasses developing a wide range of models, from simple budgeting exercises to complex discounted cash flow (DCF) analyses and Monte Carlo simulations. For example, I once built a model for a startup predicting revenue growth based on various marketing campaign strategies, enabling them to optimize their spending and allocate resources effectively. Another project involved building a three-statement model for a large corporation to forecast their financial position under different economic conditions. This allowed them to proactively manage their liquidity and mitigate potential risks.

I am proficient in using software like Excel, which is a mainstay, but also have experience with more sophisticated tools like Python with libraries like Pandas and NumPy for larger-scale modelling and more complex analyses.

Q 9. How do you ensure budget accuracy?

Budget accuracy is paramount. To ensure this, I employ a multi-pronged approach. First, I establish a robust budgeting process involving detailed data collection and thorough review of historical data. This involves meticulously analyzing past spending patterns to identify trends and potential areas for improvement. Second, I incorporate regular monitoring and variance analysis. This means regularly comparing actual spending against the budgeted amounts, promptly investigating any significant deviations, and implementing corrective actions. Third, I utilize technology. Spreadsheet software with built-in features for tracking and comparing data assists significantly. Finally, collaboration is key. Regular meetings with department heads and stakeholders ensure everyone is aligned and informed about potential issues.

For instance, during a recent project, we discovered a significant variance in marketing expenses. Through investigation, we found an oversight in the initial budget, resulting in the underestimation of certain campaign costs. By identifying and correcting this discrepancy, we could reallocate funds to maintain project goals.

Q 10. How do you communicate budget information to non-financial stakeholders?

Communicating budget information effectively to non-financial stakeholders requires simplifying complex financial data into easily understandable terms. I avoid technical jargon and use visual aids like charts, graphs, and dashboards. Explaining the ‘why’ behind the numbers is crucial. For example, instead of simply stating ‘Marketing budget is reduced by 15%’, I would explain that this reduction is a strategic decision to prioritize other high-return initiatives while still ensuring adequate marketing reach. Storytelling is also important – framing budgetary information within the context of the overall business goals helps individuals understand the bigger picture and their contribution to the success of the company.

I often use analogies to illustrate complex concepts. Imagine the budget as a household budget – it’s about allocating resources efficiently to meet both short-term and long-term goals. This helps to make complex financial data relatable and understandable for everyone.

Q 11. What are some key performance indicators (KPIs) you track in a budget?

Key Performance Indicators (KPIs) are essential for monitoring budget performance and measuring success. The specific KPIs tracked depend on the context but usually include metrics such as:

- Revenue Growth: Tracks the increase in sales or revenue over time.

- Cost of Goods Sold (COGS): Measures the direct costs associated with producing goods or services.

- Gross Profit Margin: Indicates profitability after deducting COGS from revenue.

- Operating Expenses: Tracks administrative and operational expenses.

- Net Profit Margin: Shows the percentage of revenue remaining after all expenses are deducted.

- Return on Investment (ROI): Measures the profitability of an investment.

- Budget Variance: Tracks the difference between actual spending and budgeted amounts.

Regularly reviewing these KPIs allows for proactive identification of potential problems and allows for timely adjustments to the budget to stay on track.

Q 12. Explain the concept of Return on Investment (ROI).

Return on Investment (ROI) is a crucial metric that measures the profitability or efficiency of an investment. It indicates the amount of return generated for every dollar invested. The formula is straightforward: ROI = (Net Profit / Cost of Investment) * 100. For example, if an investment of $10,000 generates a net profit of $2,000, the ROI is 20%. ROI is a valuable tool for comparing the relative attractiveness of different investment opportunities. A higher ROI generally suggests a more profitable investment. However, it’s important to consider the time horizon involved, as a higher ROI over a longer period might be preferable to a lower ROI over a shorter term. Also, other factors such as risk should always be assessed alongside ROI figures.

Q 13. How do you identify and mitigate financial risks?

Identifying and mitigating financial risks is a critical aspect of effective budget management. This involves a proactive approach involving several key steps. First, I conduct a thorough risk assessment, identifying potential threats to the budget. This might include economic downturns, changes in market conditions, supply chain disruptions, or unexpected expenses. Second, I develop contingency plans for each identified risk. This might involve setting aside funds in a reserve account or exploring alternative sourcing options. Third, I implement risk monitoring mechanisms to track potential risks and respond proactively. This involves regularly reviewing financial statements, industry reports, and market trends.

For instance, during a recent project, we anticipated potential supply chain disruptions. We mitigated this risk by negotiating longer-term contracts with key suppliers and identifying alternative suppliers if necessary. This proactive strategy helped us maintain budget stability despite unforeseen supply chain challenges.

Q 14. Describe your experience with cost reduction strategies.

Cost reduction strategies are vital for improving profitability and maintaining budget stability. My experience includes implementing various strategies, such as:

- Process optimization: streamlining workflows to eliminate redundancies and improve efficiency.

- Negotiating better deals with suppliers: leveraging purchasing power to secure lower prices.

- Technology implementation: using automation and software to reduce labor costs and improve productivity.

- Waste reduction: implementing measures to minimize waste in materials, energy, and time.

- Outsourcing: transferring non-core functions to external vendors to reduce overhead costs.

For example, I once helped a company reduce its energy consumption by implementing a comprehensive energy efficiency program. This resulted in significant savings on utility bills, contributing positively to the bottom line. Another example was negotiating better payment terms with key suppliers which improved our cash flow and allowed for more aggressive investing.

Q 15. How do you develop a long-term financial plan?

Developing a robust long-term financial plan is crucial for achieving your financial goals, whether it’s buying a house, retiring comfortably, or securing your family’s future. It’s not a one-time task but an ongoing process of review and adjustment. The process typically involves these key steps:

Define your goals: Be specific! Instead of ‘save for retirement,’ aim for ‘have $1 million saved by age 65.’ Consider short-term, mid-term, and long-term goals.

Assess your current financial situation: This includes your income, expenses, assets (e.g., savings, investments), and liabilities (e.g., debt). Use budgeting tools or spreadsheets to track this accurately.

Develop a budget: Allocate your income to meet your expenses and savings goals. The 50/30/20 rule (50% needs, 30% wants, 20% savings/debt repayment) is a helpful guideline. Track your spending to ensure you stay on track.

Plan for retirement: Determine how much you’ll need in retirement and create a savings and investment plan to achieve that goal. Consider using tools that project future retirement income.

Manage debt strategically: Develop a plan to pay off high-interest debt as quickly as possible. Prioritize debts with the highest interest rates.

Invest wisely: Diversify your investments across different asset classes (stocks, bonds, real estate) to manage risk. Consider your risk tolerance and time horizon when making investment decisions.

Protect yourself: Obtain adequate insurance coverage (health, life, disability, property) to protect yourself from unexpected events.

Regularly review and adjust: Life changes (marriage, job loss, children) require adjusting your financial plan. Review your plan at least annually, or more frequently if significant changes occur.

For example, a young professional might prioritize paying off student loans and building an emergency fund before focusing on long-term investments like retirement accounts. An older individual closer to retirement would shift their focus towards maximizing retirement income and minimizing risk.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. What is your experience with different accounting principles (e.g., GAAP, IFRS)?

I have extensive experience working with both Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS). GAAP is the accounting standard primarily used in the United States, emphasizing the principle of conservatism and focusing on historical cost. IFRS is used internationally and is considered more principles-based, allowing for more flexibility in certain accounting treatments.

My experience includes applying these principles in various contexts, such as:

Financial statement preparation: I’ve prepared balance sheets, income statements, and cash flow statements under both GAAP and IFRS, ensuring accuracy and compliance with relevant standards.

Financial analysis: I’ve used financial statements prepared under both frameworks to analyze a company’s financial health and performance, making informed decisions based on the data.

Auditing: I’ve participated in audits, ensuring compliance with GAAP and IFRS requirements and identifying areas for improvement in financial reporting.

Internal controls: I’ve helped implement internal control systems to ensure the accuracy and reliability of financial information prepared under both GAAP and IFRS.

The key difference in my approach lies in understanding the specific nuances of each standard and adapting my methods accordingly. For example, the treatment of inventory under GAAP (typically LIFO or FIFO) differs from IFRS, requiring careful consideration during the analysis.

Q 17. How do you handle unexpected financial events?

Handling unexpected financial events requires a proactive approach. The most crucial element is having an emergency fund – typically 3-6 months’ worth of living expenses – in a readily accessible account. This fund acts as a buffer against job loss, medical emergencies, or unexpected home repairs.

Beyond the emergency fund, a well-structured plan includes:

Identifying potential risks: Regularly assess potential financial risks, such as job insecurity, health issues, or economic downturns.

Developing contingency plans: Create specific plans for how you would handle various scenarios. For instance, if you lose your job, what are your immediate steps (reduce spending, explore job opportunities)?

Seeking professional advice: Don’t hesitate to consult with financial advisors or other professionals for guidance during a crisis. They can offer valuable insights and strategies.

Negotiating and restructuring debt: If faced with overwhelming debt, contact creditors to negotiate lower payments or explore debt consolidation options.

Utilizing available resources: Explore government assistance programs, charities, or community resources if needed.

For example, if a sudden medical expense arises, the emergency fund would cover the immediate costs, preventing the need for high-interest debt. Having a plan in place minimizes panic and facilitates a more rational response.

Q 18. How do you ensure compliance with financial regulations?

Ensuring compliance with financial regulations is paramount. This involves a multi-faceted approach encompassing understanding, implementation, and ongoing monitoring.

Staying informed: Keep abreast of relevant regulations through professional development, industry publications, and regulatory agency websites. This includes staying updated on changes in tax laws, securities laws, and other relevant legislation.

Implementing robust internal controls: Establish and maintain a strong system of internal controls to prevent fraud, ensure accuracy in financial reporting, and comply with relevant regulations. This involves segregation of duties, regular audits, and appropriate authorization procedures.

Maintaining accurate records: Keep detailed and organized financial records, ensuring compliance with record-keeping requirements mandated by various regulations. This includes proper documentation of transactions, supporting evidence, and audit trails.

Seeking professional guidance: Consult with legal and accounting professionals to ensure compliance with complex regulations and to address any ambiguities.

Regular compliance reviews: Conduct periodic internal reviews to assess compliance with relevant regulations and identify potential areas for improvement.

Failure to comply with financial regulations can lead to significant penalties, including fines, legal action, and reputational damage. Proactive compliance is crucial for maintaining the integrity of financial operations.

Q 19. Explain the time value of money.

The time value of money (TVM) is a core financial concept stating that money available at the present time is worth more than the same amount in the future due to its potential earning capacity. This is because money can earn interest or returns over time.

Several factors influence the time value of money:

Interest rates: Higher interest rates increase the future value of money and decrease the present value.

Inflation: Inflation erodes the purchasing power of money over time.

Risk: Higher-risk investments generally offer a higher potential return but also carry a greater chance of loss.

Time horizon: The longer the time horizon, the greater the impact of compounding interest and inflation.

We use TVM calculations (often involving formulas or financial calculators) to determine the present value or future value of investments, loans, or other financial streams. For example, understanding TVM is critical when comparing investment options, calculating loan payments, or planning for retirement. A dollar today is worth more than a dollar tomorrow because you could invest that dollar today and earn a return.

Q 20. What is your experience with debt management?

My experience in debt management involves strategic planning and execution to minimize the burden of debt while optimizing financial resources. This goes beyond simply making payments; it’s about proactively managing debt to improve one’s financial health.

My approach involves:

Debt consolidation: Combining multiple debts into a single loan with a potentially lower interest rate or more manageable payment schedule.

Debt prioritization: Focusing on paying off high-interest debt first, such as credit cards, to minimize interest charges and accelerate debt reduction.

Budgeting and expense reduction: Developing a detailed budget to identify areas where spending can be reduced, freeing up funds for debt repayment.

Debt negotiation: Negotiating with creditors to lower interest rates, reduce monthly payments, or establish more favorable repayment terms.

Debt management plans: If necessary, utilizing debt management plans offered by credit counseling agencies to restructure debts and create a realistic repayment plan.

Financial counseling: Providing guidance and support to individuals or businesses struggling with debt, helping them develop sustainable debt management strategies.

For instance, I’ve helped clients successfully consolidate high-interest credit card debt into a lower-interest personal loan, significantly reducing their monthly payments and accelerating their debt-free journey. A thorough understanding of debt management allows for strategic allocation of resources and improved financial well-being.

Q 21. How do you use financial statements for decision-making?

Financial statements—balance sheets, income statements, and cash flow statements—are fundamental tools for informed decision-making. They provide a snapshot of a company’s financial health and performance over time.

I utilize financial statements in several ways:

Ratio analysis: Calculating key financial ratios (liquidity, profitability, solvency) to assess a company’s financial strength and identify potential risks or opportunities. For example, a high debt-to-equity ratio might signal increased financial risk.

Trend analysis: Examining financial data over multiple periods to identify trends and patterns in performance. This helps to anticipate future performance and make proactive adjustments.

Benchmarking: Comparing a company’s financial performance to its industry peers or competitors to identify areas of strength and weakness.

Investment decisions: Analyzing financial statements to assess the investment potential of a company. This helps determine whether a company is a good investment based on its profitability and financial health.

Creditworthiness assessment: Evaluating a company’s creditworthiness based on its financial statements to determine its ability to repay debts.

For example, by analyzing the income statement, I can identify cost-cutting opportunities or areas for revenue growth. The balance sheet allows me to assess a company’s liquidity and solvency, informing investment and lending decisions. Using a combination of these statements helps provide a holistic view of a company’s financial situation.

Q 22. What is your experience with performance reporting?

Performance reporting is the process of measuring and communicating the financial and operational results of a business against its planned targets. It’s crucial for identifying areas of success, pinpointing weaknesses, and making data-driven decisions. My experience encompasses developing and implementing key performance indicator (KPI) dashboards, analyzing variances between budgeted and actual results, and presenting findings to senior management. For example, in my previous role at Acme Corp, I developed a comprehensive dashboard tracking sales, marketing ROI, and customer acquisition costs. This enabled us to identify a significant underperformance in our social media marketing campaign, leading to a reallocation of resources and a subsequent 20% increase in lead generation.

- Data collection and analysis using various software tools.

- Variance analysis to identify the root causes of deviations from the budget.

- Preparation of regular performance reports, incorporating charts, graphs and key insights.

- Presentation of findings and recommendations to stakeholders.

Q 23. Describe your experience with capital budgeting.

Capital budgeting involves the process of evaluating and selecting long-term investments that align with a company’s strategic goals. This could include purchasing new equipment, building a new facility, or investing in a new product line. My experience includes conducting thorough financial analyses of potential capital projects, utilizing techniques such as Net Present Value (NPV) and Internal Rate of Return (IRR) to determine their profitability. For instance, at Beta Industries, I led the assessment of a proposed expansion project, meticulously analyzing projected cash flows, factoring in potential risks, and presenting a comprehensive recommendation to the executive team, ultimately securing approval for an investment which delivered a 15% ROI within two years.

- Project feasibility studies.

- Cash flow projections and discounted cash flow analysis.

- Risk assessment and mitigation strategies.

- Sensitivity analysis to assess project vulnerability.

Q 24. How do you evaluate investment opportunities?

Evaluating investment opportunities requires a systematic approach. I typically use a multi-faceted framework that encompasses qualitative and quantitative analysis. Quantitatively, I employ techniques such as NPV, IRR, and Payback Period to assess the financial viability of an investment. Qualitatively, I consider factors like market demand, competitive landscape, regulatory environment, and management team expertise. Each investment is unique, and the weight given to quantitative and qualitative factors will depend on the specific context. For example, when evaluating a new technology venture, the qualitative aspects related to technology disruption and market acceptance become as crucial as the financial projections. It’s a holistic approach that balances risk and reward.

- Financial modeling and forecasting.

- Sensitivity analysis and scenario planning.

- Market research and competitor analysis.

- Risk assessment and mitigation planning.

Q 25. What is your understanding of working capital management?

Working capital management focuses on efficiently managing a company’s short-term assets and liabilities to ensure smooth operations. It’s about optimizing the balance between current assets (like cash, inventory, and receivables) and current liabilities (like accounts payable and short-term debt). Effective working capital management improves liquidity, reduces financing costs, and enhances profitability. My experience includes developing strategies to optimize inventory levels, improve cash flow forecasting, and negotiate favorable payment terms with suppliers. For instance, at Gamma Co., I implemented a just-in-time inventory system, reducing inventory holding costs by 12% and improving cash flow significantly.

- Cash flow forecasting and management.

- Inventory management and optimization.

- Accounts receivable and payable management.

- Short-term financing strategies.

Q 26. Explain the concept of Net Present Value (NPV).

Net Present Value (NPV) is a crucial capital budgeting technique that calculates the difference between the present value of cash inflows and the present value of cash outflows over a period of time. In simple terms, it tells you how much value an investment will add to your business today. A positive NPV indicates a profitable investment, while a negative NPV suggests the investment would decrease the value of the business. The calculation considers the time value of money—the idea that money available now is worth more than the same amount in the future due to its potential earning capacity. For example, an investment with a NPV of $10,000 indicates that it would increase the company’s value by $10,000 today.

The formula is: NPV = Σ [Ct / (1 + r)^t] - C0 where:

- Ct = net cash inflow during the period t

- r = discount rate (reflecting the cost of capital)

- t = number of time periods

- C0 = initial investment

Q 27. How do you build a comprehensive budget?

Building a comprehensive budget involves a structured process. It starts with defining the budget’s purpose and scope. Then, we need to gather historical data, forecast future revenues and expenses, and establish clear targets. This process involves collaborating with various departments to get their input on anticipated spending and revenue. Once the data is collected, it’s analyzed and organized into different categories, such as operating expenses, capital expenditures, and financing. The budget should be flexible and reviewed regularly, allowing for adjustments based on actual performance. Regular monitoring and variance analysis are crucial for effective budget management.

- Define the budget’s purpose and scope.

- Gather historical data and forecast future revenues and expenses.

- Collaborate with various departments.

- Develop detailed revenue and expense budgets.

- Establish clear targets and metrics.

- Regular monitoring and variance analysis.

Q 28. What are your strengths in budgeting and financial analysis?

My strengths lie in my analytical skills, financial modeling expertise, and ability to communicate complex financial information clearly and concisely. I am proficient in various budgeting and forecasting techniques, including zero-based budgeting, rolling forecasts, and activity-based budgeting. I have a proven track record of developing and implementing effective budget control systems and improving financial performance. My experience includes the use of various software packages such as Excel, specialized financial planning and analysis (FP&A) software, and database management systems. I also possess strong interpersonal skills, allowing me to effectively collaborate with colleagues across different departments to achieve common budgeting objectives. I’m adept at identifying areas for cost reduction and efficiency improvements, offering practical solutions that enhance profitability.

Key Topics to Learn for Budgeting and Money Management Interview

- Budgeting Fundamentals: Understanding different budgeting methods (e.g., zero-based budgeting, 50/30/20 rule), creating and maintaining a personal or business budget, and analyzing budget variances.

- Financial Statement Analysis: Interpreting income statements, balance sheets, and cash flow statements to assess financial health and performance. Practical application includes identifying areas for improvement in spending and revenue generation.

- Forecasting and Financial Planning: Developing short-term and long-term financial forecasts, incorporating risk assessment, and creating contingency plans. This includes applying forecasting techniques to anticipate cash flow needs.

- Cost Control and Expense Management: Identifying cost drivers, implementing cost-saving measures, and negotiating with vendors. Practical application involves analyzing expenses to find areas for optimization.

- Investment Strategies (if applicable): Understanding basic investment principles, asset allocation, and risk management, particularly relevant for roles involving investment decisions.

- Performance Measurement and Reporting: Tracking key financial metrics, preparing financial reports, and presenting findings to stakeholders. This includes understanding different Key Performance Indicators (KPIs) relevant to budgeting and financial management.

- Software Proficiency: Demonstrating familiarity with budgeting and financial management software (e.g., Excel, budgeting software). This also includes showcasing proficiency in data analysis and visualization using relevant tools.

Next Steps

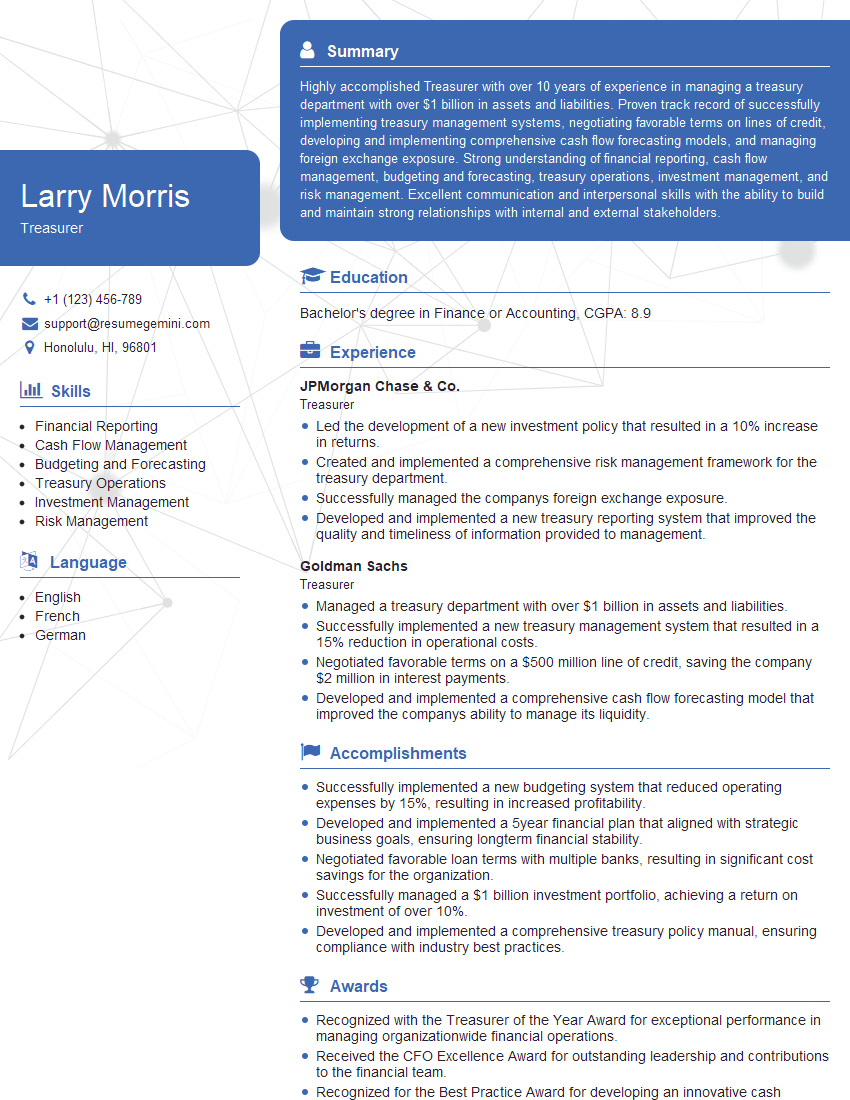

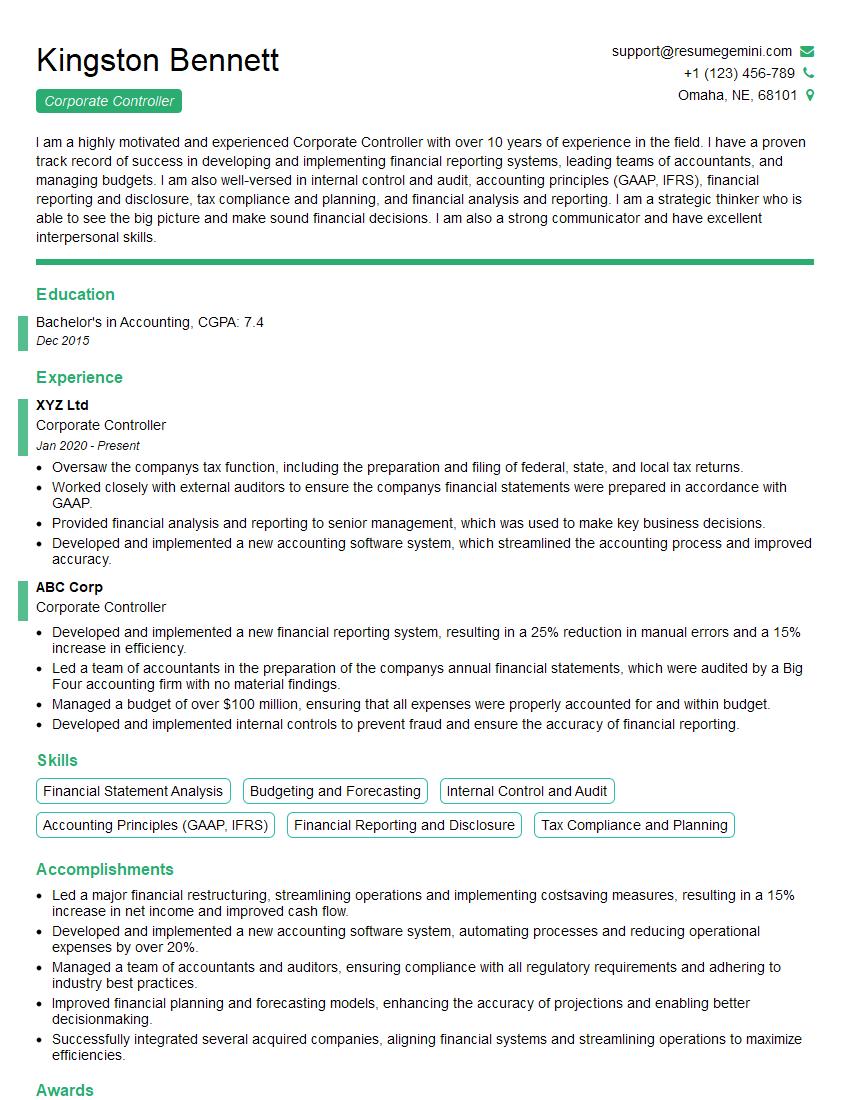

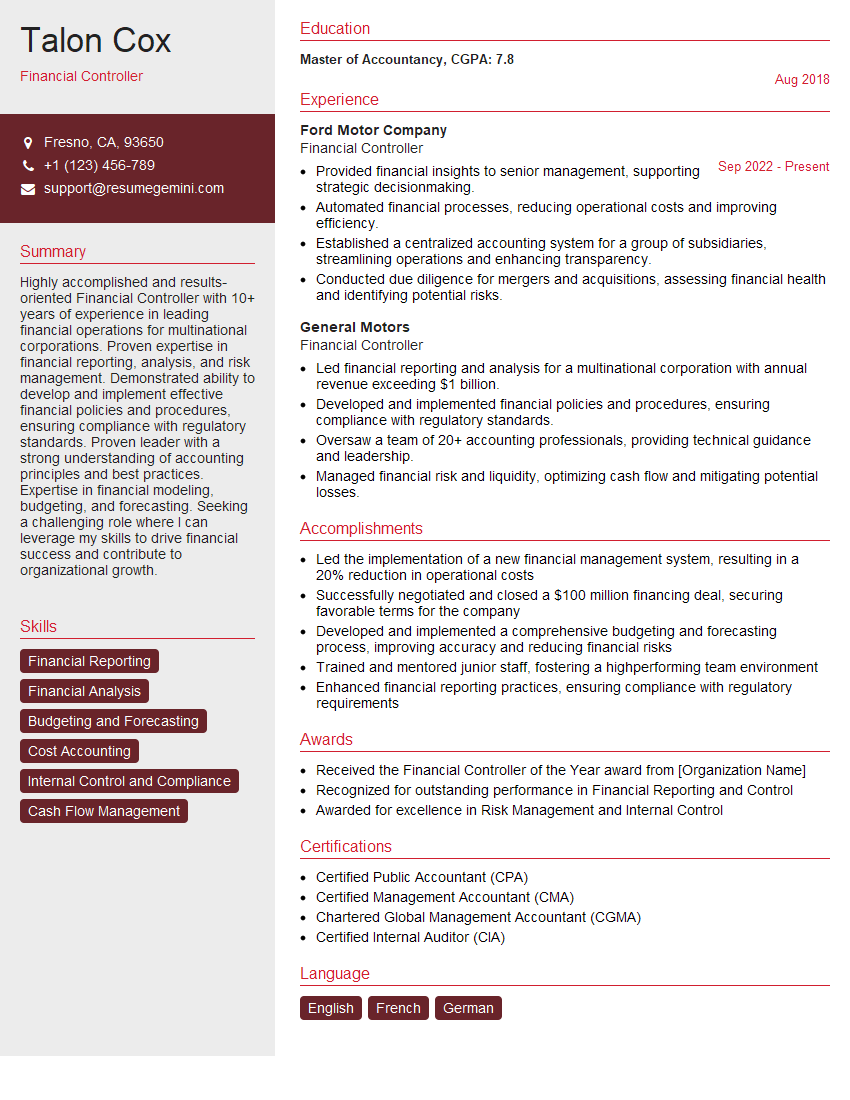

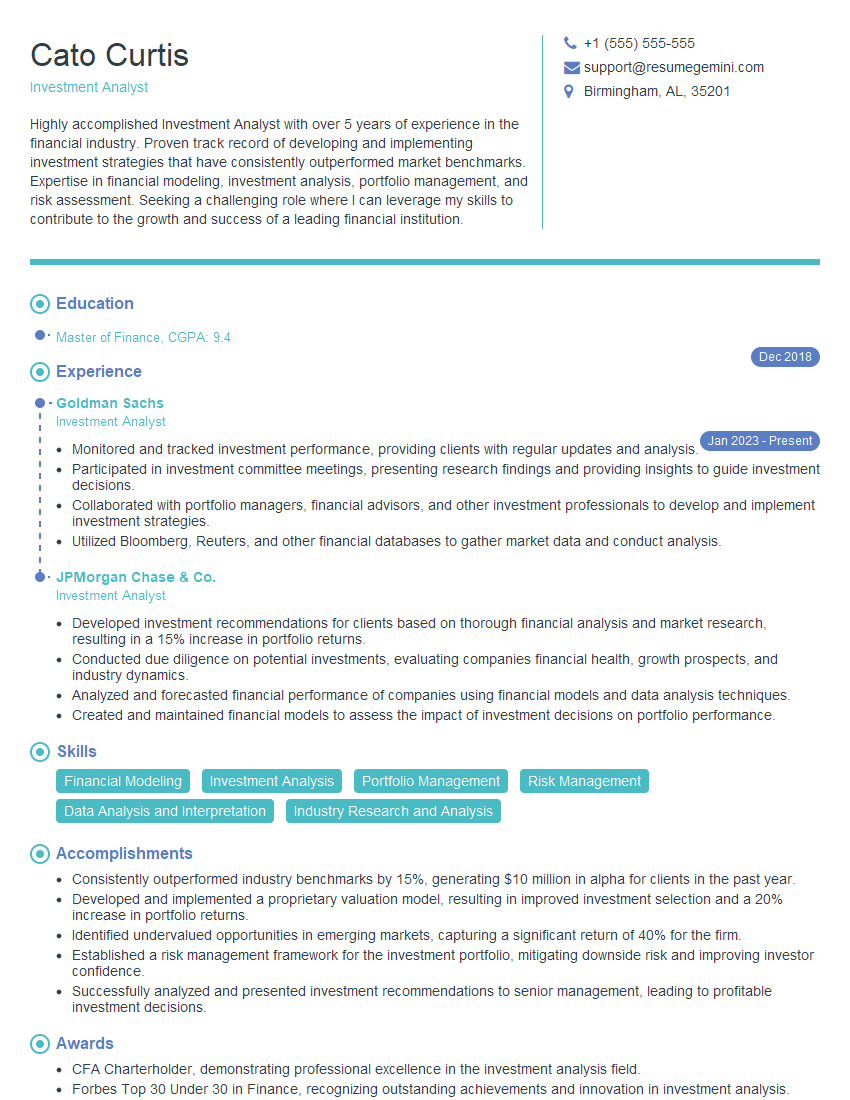

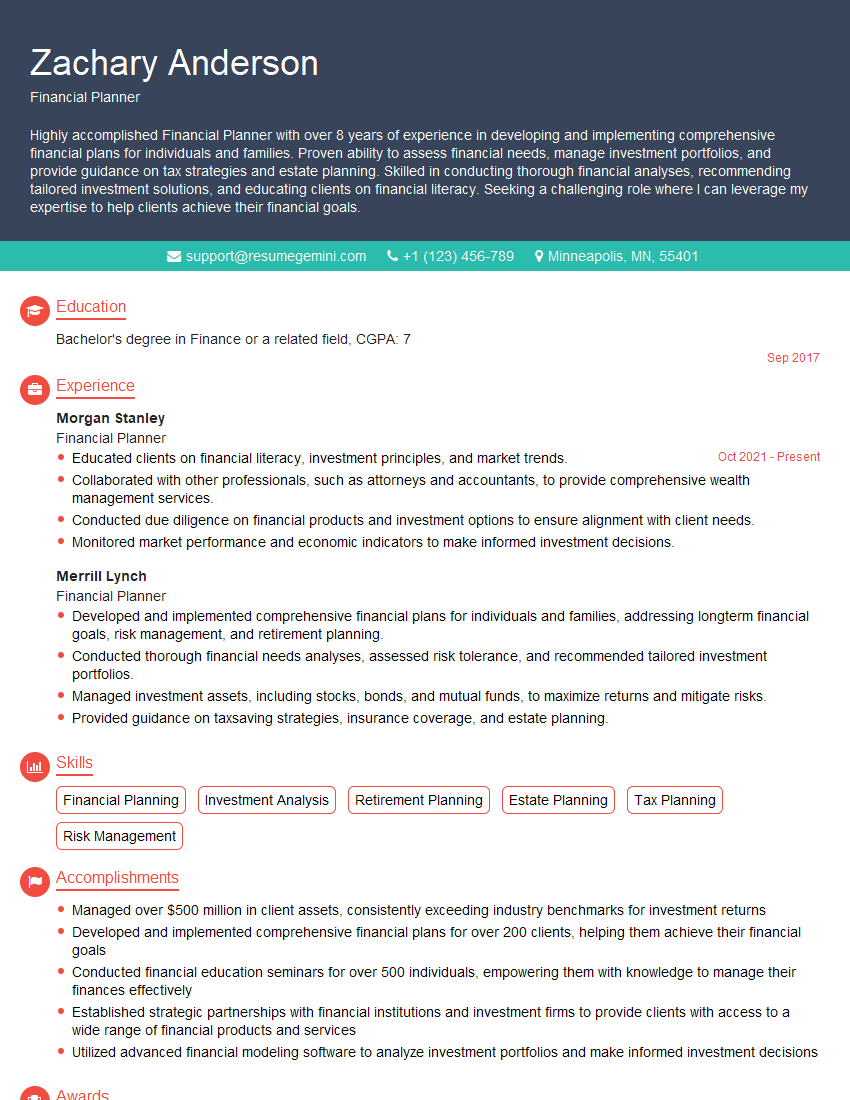

Mastering budgeting and money management is crucial for career advancement in numerous fields, opening doors to leadership roles and higher earning potential. A strong understanding of these principles demonstrates responsibility, analytical skills, and a proactive approach to financial planning – highly valued attributes in today’s job market. To significantly boost your job prospects, creating an ATS-friendly resume is essential. ResumeGemini is a trusted resource that can help you build a professional and impactful resume tailored to your skills and experience. Examples of resumes specifically designed for Budgeting and Money Management roles are available through ResumeGemini, empowering you to present your qualifications effectively to potential employers.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

Hi, I’m Jay, we have a few potential clients that are interested in your services, thought you might be a good fit. I’d love to talk about the details, when do you have time to talk?

Best,

Jay

Founder | CEO