Interviews are more than just a Q&A session—they’re a chance to prove your worth. This blog dives into essential Student Loan Repayment interview questions and expert tips to help you align your answers with what hiring managers are looking for. Start preparing to shine!

Questions Asked in Student Loan Repayment Interview

Q 1. Explain the difference between Income-Driven Repayment (IDR) plans and Standard Repayment plans.

The key difference between Income-Driven Repayment (IDR) plans and Standard Repayment plans lies in how your monthly payments are calculated. Standard Repayment plans offer a fixed monthly payment amount over a 10-year period, calculated based on your total loan amount and interest rate. This can be a significant burden for borrowers with high loan balances or low incomes.

IDR plans, on the other hand, calculate your monthly payment based on your discretionary income and family size. This means your payment will be significantly lower, potentially much more manageable, if your income is below a certain threshold. Several IDR plans exist, each with slightly different formulas and eligibility criteria (e.g., Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE)). The benefit is affordability, but the downside is you may end up paying more interest over the life of the loan due to the extended repayment period (often 20 or 25 years). Imagine a recent graduate with significant student loan debt and a low-paying entry-level job – an IDR plan would provide much-needed financial relief compared to a standard plan, allowing them to pay off other debts or save money.

Q 2. Describe the process of student loan consolidation.

Student loan consolidation is the process of combining multiple federal student loans into a single loan with a new interest rate and repayment schedule. This simplifies repayment by reducing the number of payments and potentially lowering your monthly payment, although this is not always guaranteed. The process typically involves applying through a federal loan consolidator (usually the Department of Education). You’ll need to provide information about your existing loans, and the consolidator will determine the new loan terms based on factors like your loan balances and credit history. It’s important to note that while consolidation simplifies management, it may not reduce your overall cost; you could pay more in interest over time if you opt for a longer repayment period. For example, someone with five different federal student loans might find consolidation helpful for streamlined payment management. However, they must carefully consider the potential impact on the total interest paid before consolidating.

Q 3. What are the eligibility requirements for Public Service Loan Forgiveness (PSLF)?

Public Service Loan Forgiveness (PSLF) is a program that forgives the remaining balance of your federal student loans after you’ve made 120 qualifying monthly payments under an IDR plan while working full-time for a qualifying government or non-profit organization. The eligibility requirements are stringent. You must:

- Have direct loans (not all federal loans qualify).

- Be employed full-time by a qualifying employer (federal, state, local, or tribal government; or a non-profit organization that meets certain criteria).

- Make 120 qualifying monthly payments under an IDR plan.

- Consolidate if needed to obtain eligible loans.

Missing even one of these criteria will disqualify you. For instance, a teacher working at a public school would be eligible, but a teacher working at a private school may not be, depending on the school’s non-profit status verification. It’s crucial to carefully track payments and ensure they meet the program’s requirements to successfully navigate the PSLF application process.

Q 4. How do you handle a borrower experiencing financial hardship?

When a borrower experiences financial hardship, several options are available. The first step is to assess their situation thoroughly. This involves understanding the nature and extent of their hardship, such as job loss, reduced income, or unexpected medical expenses. Next, we explore options like Income-Driven Repayment (IDR) plans, if not already in use. IDR plans adjust payments based on income, offering more affordable monthly payments. If an IDR plan isn’t sufficient, we might consider temporary solutions like forbearance or deferment (explained in the next answer). These pause payments, but interest usually continues to accrue, except for certain types of deferment. For extreme circumstances, exploring loan rehabilitation is also possible, as it can help improve credit standing after default. A personalized approach, considering the individual’s circumstances and available programs, is essential to determine the most effective solution.

Q 5. What is the difference between forbearance and deferment?

Forbearance and deferment are both temporary pauses in student loan payments, but they differ significantly. Deferment is a postponement of payments granted for specific reasons (e.g., unemployment, graduate school enrollment, economic hardship). During deferment, depending on the loan type, interest may or may not accrue. For example, interest generally does not accrue during an unemployment deferment for subsidized loans, while it does on unsubsidized loans. Forbearance, on the other hand, is a temporary suspension of payments granted at the lender’s discretion, usually due to financial hardship. Interest usually continues to accrue during forbearance, adding to the principal balance, thus increasing the overall cost of the loan. Think of deferment as a planned pause for qualifying events, while forbearance is an emergency stop for unexpected financial difficulties. Choosing between them depends on the reason for needing payment relief and the borrower’s financial situation.

Q 6. Explain the process of loan rehabilitation.

Loan rehabilitation is a process to restore your defaulted federal student loan to good standing. It involves making consistent, on-time payments for a certain period, typically nine to ten months (depending on the loan and the servicer’s rules). Once you complete the required rehabilitation payments, your default status is removed. This significantly improves your credit score, and it makes you eligible for certain benefits, like consolidation and income-driven repayment plans. It’s a crucial step towards recovering from default; however, it does not reduce your principal balance or the interest that accrued while the loan was in default. The rehabilitation process involves working with your loan servicer to create a payment plan that aligns with your current financial capacity.

Q 7. What are some common reasons for student loan default?

Student loan default occurs when a borrower fails to make payments for a specific period (typically 270 days for federal loans). Several factors contribute to this:

- Unexpected Job Loss or Reduced Income: A significant change in financial circumstances can make payments difficult.

- Underestimation of Loan Repayment Burden: Borrowers may underestimate the long-term financial commitment involved in repaying their loans.

- Lack of Financial Literacy: A lack of understanding of repayment options and budgeting strategies contributes to difficulties.

- High Debt Burden: Carrying significant student loan debt along with other financial obligations can be overwhelming.

- Life Changes: Major life events like illness, divorce, or unexpected expenses can impact a borrower’s ability to manage their debt.

Effective financial planning, budgeting, and awareness of available repayment options are crucial to prevent default.

Q 8. How do you calculate a borrower’s monthly payment under an IDR plan?

Calculating a borrower’s monthly payment under an Income-Driven Repayment (IDR) plan isn’t a simple formula like a standard loan. It depends on several factors, primarily the borrower’s discretionary income and family size. The government uses a complex formula that considers your Adjusted Gross Income (AGI) from your tax return, the poverty guideline for your family size and state, and your loan balance. This determines your payment, typically a percentage of your discretionary income.

Here’s a simplified breakdown: First, your AGI is calculated. Then, the poverty guideline for your family size is subtracted from your AGI to find your discretionary income. Finally, a percentage (this percentage varies depending on the specific IDR plan – REPAYE, PAYE, IBR, or ICR) of this discretionary income is applied to determine your monthly payment. This calculation is typically handled by your loan servicer, and it’s updated annually based on your tax information.

Example: Let’s say a borrower’s AGI is $50,000, the poverty guideline for their family size is $20,000, and their IDR plan uses a 10% calculation. Their discretionary income is $30,000 ($50,000 – $20,000), and their monthly payment would be $250 ($30,000 * 0.10 / 12 months).

It’s crucial to note that these are simplified illustrations. The actual calculations involve more variables and are quite sophisticated. Each IDR plan has its own nuances.

Q 9. What are the implications of missing a student loan payment?

Missing a student loan payment has serious consequences. It immediately impacts your credit score, potentially making it harder to rent an apartment, get a car loan, or even secure a job in certain fields. Beyond the credit hit, you’ll likely incur late fees, which vary by lender. More significantly, your loan could enter delinquency, leading to further negative impacts. Delinquency can progress to default, resulting in wage garnishment, tax refund offset, and difficulty obtaining federal financial aid in the future.

The impact on your credit score is substantial. A missed payment stays on your report for seven years, negatively affecting your creditworthiness. For example, a missed payment could reduce your credit score by 50-100 points, making it harder to obtain favorable interest rates on future loans. Repeated defaults could severely damage your financial future for many years.

Q 10. What are the various repayment options available to borrowers?

Borrowers have several repayment options for their federal student loans. The best choice depends on individual circumstances, income, and loan type.

- Standard Repayment: A fixed monthly payment over 10 years.

- Graduated Repayment: Payments start low and gradually increase over 10 years.

- Extended Repayment: Longer repayment period (up to 25 years), resulting in lower monthly payments but higher overall interest.

- Income-Driven Repayment (IDR) Plans: Payments are based on your income and family size. These include REPAYE, PAYE, IBR, and ICR. They offer forgiveness after 20 or 25 years of payments, depending on the plan.

- Income-Contingent Repayment (ICR): A type of IDR plan that typically results in lower monthly payments than standard repayment.

For private student loans, options vary widely based on the lender. Contact your lender to discuss possible repayment plans, including potentially hardship deferment or forbearance.

Q 11. What is the role of a student loan servicer?

The student loan servicer acts as the intermediary between the borrower and the lender (usually the government). They handle all aspects of loan management, including:

- Billing and Payment Processing: Sending statements and processing payments.

- Account Management: Providing account information and answering borrower questions.

- Repayment Plan Management: Helping borrowers choose and enroll in repayment plans.

- Deferment and Forbearance: Managing temporary suspensions of payments.

- Loan Consolidation: Combining multiple loans into a single loan.

- Default Prevention and Management: Working with borrowers who are struggling to make payments.

In essence, the servicer is responsible for ensuring the smooth and efficient management of the loan from disbursement to repayment.

Q 12. Describe your experience working with borrowers facing delinquency.

I have extensive experience working with borrowers facing delinquency. My approach is always empathetic and solution-oriented. I begin by understanding the circumstances leading to delinquency – job loss, unexpected medical expenses, or simply a lack of understanding of repayment options. Then, I collaborate with them to explore available options, including:

- Income-Driven Repayment (IDR) Plans: Switching to an IDR plan can significantly reduce monthly payments.

- Deferment or Forbearance: Temporary pauses in payments, which may be appropriate in short-term hardship situations.

- Loan Rehabilitation: Making a series of on-time payments to bring the loan out of default.

- Consolidation: Streamlining payments by consolidating multiple loans.

I also provide comprehensive financial counseling and connect borrowers with relevant resources, like credit counseling agencies or government assistance programs. My goal is not just to prevent default but to equip borrowers with the knowledge and tools to manage their finances effectively in the long term.

One memorable case involved a single mother who had fallen behind on payments due to an unexpected medical emergency. By working together and switching her to an IDR plan, we successfully brought her account current and helped her develop a sustainable long-term repayment strategy.

Q 13. How do you stay updated on changes in student loan regulations?

Staying updated on student loan regulations is crucial in this field. I utilize several strategies:

- Federal Student Aid Website: The official website is the primary source for the latest information on regulations, programs, and policy changes.

- Professional Organizations: Membership in professional organizations, such as the National Association of Student Financial Aid Administrators (NASFAA), provides access to updates, webinars, and publications.

- Legal and Regulatory Updates: I regularly review legal updates and newsletters related to student loan legislation and case law.

- Industry Publications: Keeping abreast of current events and regulatory changes through trade publications and journals focused on student loan management.

Staying informed ensures I can provide accurate and up-to-date advice to borrowers, and it helps me effectively navigate the complexities of the student loan system.

Q 14. What strategies do you use to communicate effectively with borrowers?

Effective communication with borrowers is paramount. I use a multi-faceted approach:

- Clear and Concise Language: Avoiding jargon and using simple language that is easy for everyone to understand.

- Multiple Communication Channels: Offering a variety of options, including phone calls, emails, and secure online messaging, to accommodate different preferences.

- Active Listening: Truly listening to borrowers’ concerns and understanding their unique situations. Empathy is key.

- Personalized Communication: Tailoring communication to each borrower’s specific needs and circumstances.

- Written Confirmation: Providing written confirmation of agreements and important information to avoid misunderstandings.

- Proactive Communication: Reaching out to borrowers proactively, rather than just responding to their inquiries.

By creating a trusting and transparent relationship built on clear, consistent communication, I can better assist borrowers in navigating the complexities of student loan repayment.

Q 15. Explain the process of applying for student loan forgiveness programs.

Applying for student loan forgiveness programs can seem daunting, but breaking it down into steps makes it manageable. The process varies depending on the specific program (e.g., Public Service Loan Forgiveness, Teacher Loan Forgiveness, Income-Driven Repayment plans leading to forgiveness). Generally, it involves these key steps:

- Identify eligible programs: Research which programs align with your employment, loan type, and repayment history. The federal government’s StudentAid.gov website is a crucial resource.

- Gather necessary documentation: This usually includes proof of employment (for PSLF, this might be employment verification letters spanning many years), tax returns (to verify income for IDR plans), and loan documentation. Thoroughly check your loan servicer’s website for specific requirements.

- Complete the application: Each program has its own application process. Some may require online forms, while others might involve submitting paper applications. Pay close attention to deadlines and instructions.

- Monitor your application status: Track your application progress through the relevant agency’s online portal. Regularly check for updates and respond promptly to any requests for additional information.

- Appeal if necessary: If your application is denied, carefully review the reasons and determine if an appeal is warranted. Gather any supporting evidence and submit a well-reasoned appeal.

For example, applying for PSLF requires consistent employment in a qualifying public service job for 120 months (10 years) of on-time payments under an income-driven repayment plan. Failing to accurately document each month of employment can lead to rejection, emphasizing the importance of meticulous record-keeping.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. How do you handle complex cases involving multiple loan types?

Handling complex cases with multiple loan types requires a systematic approach. I begin by meticulously documenting each loan: its type (federal subsidized, federal unsubsidized, Grad PLUS, private), servicer, balance, interest rate, and repayment plan. I then create a comprehensive spreadsheet to visualize this information. This allows me to identify the most pressing issues, prioritize repayment strategies, and explore options like consolidation (combining multiple federal loans into one) or refinancing (replacing private loans with potentially lower interest rates). I prioritize loans with the highest interest rates first to minimize total interest paid. For example, I might recommend consolidating high-interest private loans while focusing on meeting the requirements of a federal forgiveness program for federal loans.

Consider a client with Federal Perkins Loans, Federal Stafford Loans, and private loans. My strategy would be to:

- Assess eligibility for income-driven repayment plans on federal loans.

- Explore refinancing options for the private loans to potentially lower interest.

- Develop a repayment plan that balances aggressive repayment of high-interest loans with maintaining progress toward loan forgiveness programs.

Q 17. What is your understanding of the CARES Act and its impact on student loan repayment?

The Coronavirus Aid, Relief, and Economic Security (CARES) Act significantly impacted student loan repayment. Its most notable provision was the suspension of federal student loan payments, interest accrual, and collections activities from March 2020 to August 2022. This provided crucial financial relief to millions of borrowers facing economic hardship due to the pandemic. The act also suspended payments for certain types of federal student loans. This pause temporarily halted the progression towards loan forgiveness for many borrowers in income-driven repayment plans, which had the added benefit of preventing negative credit implications associated with missed payments during this time. In short, the CARES Act was a substantial intervention designed to minimize the financial stress on student loan borrowers amidst an unprecedented crisis.

Q 18. What experience do you have with different types of student loans (e.g., federal, private)?

My experience encompasses both federal and private student loans. I am familiar with the nuances of various federal loan programs, including Stafford Loans (subsidized and unsubsidized), Grad PLUS Loans, Perkins Loans, and consolidation loans. I understand the eligibility requirements, repayment options (standard, extended, income-driven), and forgiveness programs associated with each. Furthermore, I have considerable experience with private student loans, understanding that their terms, repayment options, and interest rates often differ significantly from federal loans and may lack the same borrower protections. I am adept at analyzing the financial implications of each loan type to develop personalized repayment strategies.

For instance, I’ve assisted borrowers who consolidated high-interest private loans with federal loans to reduce their overall monthly payments and potentially qualify for income-driven repayment plans.

Q 19. How do you prioritize tasks and manage your workload effectively?

Effective task prioritization and workload management are crucial in this role. I utilize a combination of techniques. I start with a comprehensive to-do list, categorized by urgency and importance (using the Eisenhower Matrix – Urgent/Important). This allows me to focus on critical tasks first. I also utilize project management software to track deadlines, delegate where appropriate, and monitor progress. Regularly reviewing my schedule and adjusting priorities as needed is key to maintaining efficiency. For example, if a client is nearing the end of their eligibility period for a loan forgiveness program, I’ll prioritize their case to ensure timely submission of necessary documentation.

Q 20. How do you ensure compliance with federal regulations regarding student loan servicing?

Compliance with federal regulations is paramount in student loan servicing. I stay abreast of changes in regulations through continuous professional development, including webinars, conferences, and reviewing updates from agencies like the Department of Education and the Federal Student Aid office. I meticulously document all client interactions and loan servicing activities, adhering to strict record-keeping protocols. I regularly audit my own work to ensure adherence to guidelines and best practices. Furthermore, I have a strong understanding of the Fair Credit Reporting Act (FCRA) and the Fair Debt Collection Practices Act (FDCPA) to ensure fair and ethical treatment of borrowers.

Q 21. Describe your experience using student loan servicing software.

I have extensive experience with several leading student loan servicing software platforms. I am proficient in using these systems to access borrower information, update accounts, process payments, communicate with clients, and generate reports. My skills include navigating complex data sets, identifying errors, and troubleshooting system issues. I am comfortable with the use of these systems to track a client’s progress towards loan forgiveness programs and generate reports documenting this progress. This expertise allows me to ensure accuracy and efficiency in all aspects of loan servicing.

Q 22. What are some common challenges faced by student loan borrowers?

Student loan borrowers often face a multitude of challenges. One major hurdle is understanding the repayment process itself. The sheer volume of information – different repayment plans, interest accrual, deferment options – can be overwhelming for recent graduates juggling new responsibilities. Another common challenge is financial instability. Unexpected job loss, illness, or family emergencies can easily derail repayment plans, leading to delinquency and potentially default.

- High interest rates: Student loan interest can accumulate rapidly, significantly increasing the total amount owed over time. This is particularly challenging for those with high loan balances.

- Difficulty tracking payments: Managing multiple loans from different lenders can be complex, making it difficult to stay organized and ensure timely payments.

- Lack of financial literacy: Many borrowers lack the financial knowledge to effectively manage their loans and make informed decisions about repayment strategies.

- Unexpected life events: Unforeseen circumstances like job loss, medical expenses, or family emergencies can severely impact a borrower’s ability to make payments.

For example, I’ve worked with several clients who were struggling with repayment due to unexpected medical bills. Understanding their individual circumstances allowed me to help them explore options like forbearance or income-driven repayment plans.

Q 23. What are your strategies for addressing borrower concerns and complaints?

Addressing borrower concerns and complaints requires a multi-pronged approach emphasizing empathy, clear communication, and proactive problem-solving. My strategy begins with active listening. I ensure borrowers feel heard and understood before attempting to offer solutions. I then systematically investigate the issue, gathering all relevant information to understand the root cause. This often involves reviewing loan documentation, payment history, and communicating directly with the servicing institution if necessary.

I strive to provide clear and concise explanations, avoiding jargon and using plain language that everyone can easily understand. I offer various resolution options, carefully explaining the pros and cons of each, empowering borrowers to make informed decisions. For example, I might explain the differences between deferment, forbearance, and income-driven repayment plans, helping borrowers select the most appropriate option for their situation. Finally, I follow up with the borrower to ensure the issue is resolved and they are satisfied with the outcome.

I also believe in proactive communication. Regularly reaching out to borrowers to provide updates and answer any questions helps prevent potential problems from escalating.

Q 24. How would you handle a situation where a borrower disputes a payment amount?

When a borrower disputes a payment amount, a thorough and unbiased investigation is critical. My first step is to carefully review the borrower’s statement and compare it to our internal records, paying close attention to details such as payment dates, amounts, and any applicable fees or interest charges. I would also verify the borrower’s loan details, including the loan amount, interest rate, and repayment plan.

If discrepancies exist, I would meticulously trace the payment back through our systems, investigating for potential errors in processing or calculation. I’d document each step of the process. If the error is on our end, I would swiftly correct it and issue a corrected statement and, if applicable, a refund. If the discrepancy is due to a misunderstanding on the borrower’s part, I would patiently explain the calculation and provide supporting documentation to clarify the situation. Throughout the process, I maintain professional, respectful communication, ensuring the borrower feels heard and understood.

In the case of persistent disagreements, I might involve a supervisor or escalate the issue to a dedicated dispute resolution team, ensuring the matter receives the appropriate attention and a fair resolution is reached.

Q 25. What is your experience with different types of income documentation?

My experience encompasses a wide range of income documentation, including W-2s, pay stubs, tax returns (1040), bank statements, and self-employment income documentation. I’m proficient in verifying income information from various sources to ensure accuracy and compliance with federal guidelines. Understanding the nuances of different income types is crucial, particularly when assessing eligibility for income-driven repayment plans.

For instance, verifying self-employment income requires a more in-depth review, often involving analyzing tax returns and bank statements to determine adjusted gross income. This is more complex than simply reviewing a W-2, which clearly states an employee’s annual salary. I have experience working with borrowers in various employment situations—from salaried employees to gig workers and independent contractors—and am adept at interpreting the relevant documentation for each.

Q 26. How do you ensure data accuracy in student loan accounts?

Data accuracy is paramount in student loan accounts. My approach to ensuring accuracy involves a combination of robust processes and technology. We utilize data validation rules and checks at various points in the loan lifecycle. These checks verify data input, ensuring consistency and preventing errors from entering the system. For example, automated checks might confirm the consistency between a borrower’s reported income and data received from third-party sources. Regular data audits and reconciliation are also performed to identify and correct discrepancies.

Furthermore, we implement robust data security measures to prevent unauthorized access and modification. Employee training programs ensure staff are equipped to handle sensitive data responsibly. We utilize secure data storage and transfer protocols to minimize risks. Finally, we have a clear escalation path for handling data discrepancies, ensuring timely resolution and accurate information updates.

Q 27. Describe your experience with the different stages of the loan lifecycle.

My experience covers the entire student loan lifecycle, from origination to repayment and, in some cases, loan discharge. I’ve worked extensively with borrowers throughout each phase:

- Origination: Assisting borrowers with loan applications, understanding their eligibility, and selecting the appropriate loan type.

- Disbursement: Ensuring timely and accurate disbursement of funds to educational institutions.

- Repayment: Guiding borrowers through repayment options, managing payment processing, and addressing repayment issues.

- Default prevention and resolution: Working with borrowers facing financial hardship to explore options to prevent default and assist them in navigating the default resolution process.

- Loan forgiveness programs: Assisting borrowers in navigating and applying for loan forgiveness programs, such as Public Service Loan Forgiveness (PSLF) or Teacher Loan Forgiveness.

This comprehensive understanding allows me to effectively address borrower needs at every stage of their loan journey.

Q 28. What are your salary expectations for this position?

My salary expectations for this position are in the range of $75,000 to $90,000 per year, commensurate with my experience and expertise in student loan repayment. This range reflects the market value for professionals with my skills and the responsibilities associated with this role. I am, of course, open to discussing this further based on the specifics of the position and the overall compensation package.

Key Topics to Learn for Student Loan Repayment Interview

- Federal Student Loan Programs: Understand the differences between Direct Loans, FFEL, and Perkins Loans; their repayment plans (Standard, Extended, Graduated, Income-Driven); and the implications for borrowers.

- Income-Driven Repayment (IDR) Plans: Learn the nuances of various IDR plans (IBR, PAYE, REPAYE, ICR), their eligibility criteria, and how to calculate monthly payments based on income and family size. Practice applying these calculations in hypothetical scenarios.

- Loan Forgiveness Programs: Familiarize yourself with programs like PSLF (Public Service Loan Forgiveness), Teacher Loan Forgiveness, and other potential forgiveness options. Understand eligibility requirements and limitations.

- Default and Delinquency: Understand the consequences of loan default and delinquency, including credit score impact, wage garnishment, and tax refund offset. Explore strategies for avoiding default and managing financial hardship.

- Refinancing and Consolidation: Learn about the benefits and drawbacks of refinancing and consolidating student loans. Understand the implications for interest rates, loan terms, and eligibility.

- Student Loan Counseling and Debt Management: Understand the role of student loan counselors and debt management strategies. Be prepared to discuss ethical considerations and best practices.

- Regulatory Compliance: Gain a basic understanding of relevant federal regulations and laws governing student loan repayment.

- Problem-Solving Scenarios: Practice analyzing case studies involving borrowers facing various financial challenges and propose solutions that align with ethical and legal guidelines.

Next Steps

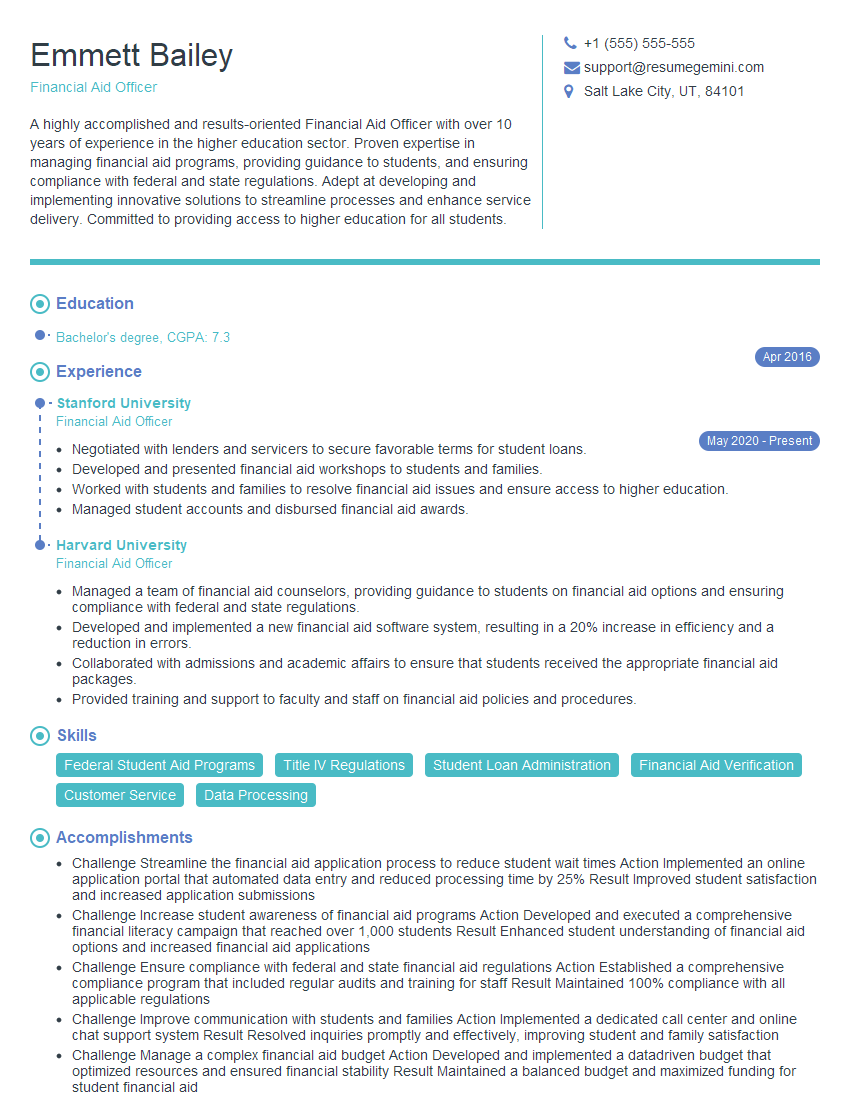

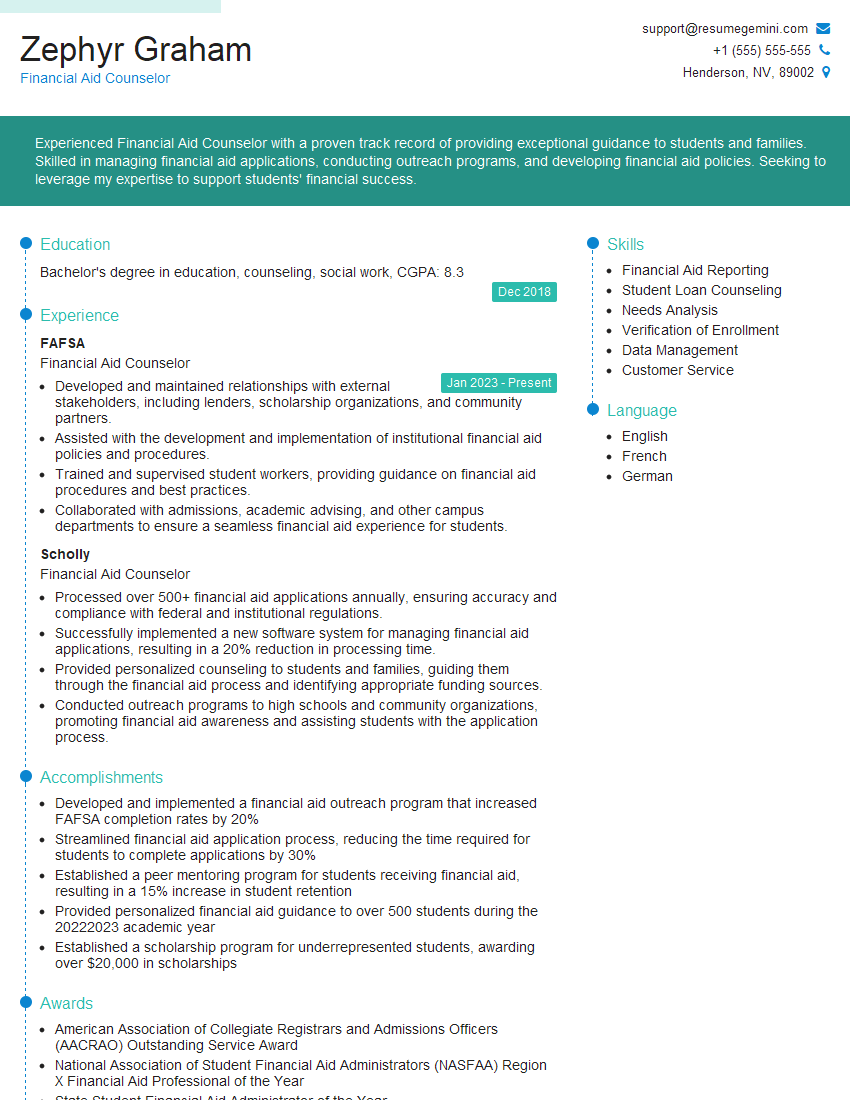

Mastering student loan repayment principles significantly enhances your career prospects in the finance and public service sectors. A strong understanding of these concepts demonstrates valuable analytical, problem-solving, and client-service skills highly sought after by employers. To increase your chances of landing your dream job, it’s crucial to have an ATS-friendly resume that showcases your expertise effectively. ResumeGemini is a trusted resource to help you build a professional and impactful resume that highlights your skills and experience in the best possible light. Examples of resumes tailored to the Student Loan Repayment field are available to further assist you in this process.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

Hi, I’m Jay, we have a few potential clients that are interested in your services, thought you might be a good fit. I’d love to talk about the details, when do you have time to talk?

Best,

Jay

Founder | CEO