Interviews are more than just a Q&A session—they’re a chance to prove your worth. This blog dives into essential Collections Software (e.g., FICO, Experian) interview questions and expert tips to help you align your answers with what hiring managers are looking for. Start preparing to shine!

Questions Asked in Collections Software (e.g., FICO, Experian) Interview

Q 1. Explain your understanding of the Fair Debt Collection Practices Act (FDCPA).

The Fair Debt Collection Practices Act (FDCPA) is a U.S. federal law designed to protect consumers from abusive, deceptive, and unfair debt collection practices. It sets strict guidelines for how debt collectors can contact debtors, what information they can share, and what actions they can take. Think of it as a consumer’s bill of rights when it comes to debt collection.

Key provisions include restrictions on the times of day collectors can call (generally, not before 8 am or after 9 pm), limitations on the number of calls they can make, and a requirement to identify themselves as debt collectors. They are prohibited from using harassment tactics, threats, or false or misleading representations. For instance, they can’t falsely claim to be an attorney or government agency. The FDCPA also outlines the debtor’s rights, including the right to request validation of the debt and the right to dispute the debt.

In my experience, a strong understanding of the FDCPA is crucial for maintaining ethical and legal compliance within the collections process. Non-compliance can lead to significant fines and reputational damage for a company. We regularly conduct training sessions to ensure our team is well-versed in its provisions to avoid violations.

Q 2. Describe your experience with FICO scoring models in collections.

FICO scores play a significant role in debt collection strategies. They provide a numerical representation of a borrower’s creditworthiness, helping us assess the likelihood of successful debt recovery. Higher FICO scores generally indicate a lower risk, meaning the debtor is more likely to pay. Conversely, lower scores signal a higher risk and require a more tailored approach.

In my previous role, we utilized FICO scores to segment our accounts. Accounts with higher scores were prioritized for less aggressive collection methods, such as automated email reminders or friendly phone calls. Accounts with lower scores often required more intense strategies, including referral to specialized collection agencies or legal action – always adhering to FDCPA guidelines, of course.

We also used FICO score trends to monitor the effectiveness of our strategies. If we saw that the average FICO score among successfully collected accounts was improving, it indicated that our strategies were working effectively. This data-driven approach is essential for optimizing collection efforts and minimizing losses.

Q 3. How familiar are you with Experian’s collection software solutions?

I am very familiar with Experian’s collection software solutions. I have extensive experience using their platforms, including their account management tools, automated dialer systems, and reporting dashboards. I find their solutions to be robust and feature-rich, offering a comprehensive suite of tools to manage the entire debt collection lifecycle.

Specifically, I’ve worked extensively with Experian’s skip tracing capabilities, which are integral to locating debtors who have become difficult to contact. Their integration with various databases significantly improves the efficiency of this process, which is often a significant bottleneck in collections.

I also appreciate their reporting and analytics capabilities. The detailed reports they generate allow us to effectively monitor key performance indicators (KPIs) such as collection rates, average time to collection, and costs associated with different collection strategies. This data-driven approach allows for continuous optimization of our processes.

Q 4. What strategies do you employ to improve collection rates?

Improving collection rates involves a multi-faceted approach. It’s not just about aggressive tactics; it’s about strategic planning and employing a variety of methods tailored to individual debtor circumstances. I employ several key strategies, including:

- Early intervention: Contacting debtors as soon as possible after delinquency.

- Account segmentation: Categorizing accounts based on risk and applying different strategies accordingly (as discussed regarding FICO scores).

- Personalized communication: Tailoring communication to the individual debtor’s situation and preferences.

- Multiple communication channels: Utilizing phone calls, emails, text messages, and letters.

- Negotiation and settlement options: Offering payment plans or settlements to resolve debts amicably.

- Regular performance monitoring and optimization: Continuously analyzing results and adjusting strategies as needed.

For example, for a high-risk, low-FICO-score debtor, I might prioritize direct phone calls followed by certified letters outlining legal options, while for a high-FICO score debtor, an initial email outlining payment plans might be sufficient.

Q 5. How do you prioritize accounts for collection efforts?

Prioritizing accounts for collection efforts is crucial for maximizing efficiency and minimizing losses. I use a combination of factors to determine the priority of accounts:

- Days delinquent: Accounts that are significantly overdue are prioritized.

- Debt amount: Larger debts receive higher priority due to their greater financial impact.

- Debtor’s FICO score: Accounts with higher scores might be prioritized for less aggressive methods, while lower scores might necessitate more intensive strategies.

- Past payment history: Debtors with a history of consistent payments might receive more lenient treatment, while those with a poor history might require more assertive action.

- Legal considerations: Accounts nearing the statute of limitations might be prioritized to ensure collection before the deadline.

This prioritization system is implemented using specialized software that allows us to dynamically adjust the order of accounts based on these factors and allows for efficient workflow management for our collectors.

Q 6. Explain your experience with skip tracing techniques.

Skip tracing is the process of locating debtors who have become difficult to contact. It often involves using multiple resources and techniques to gather information. My experience includes utilizing both manual and automated methods.

Manual techniques involve searching public records (such as property records, voter registration lists, and court records), using people search engines, and contacting known associates or relatives of the debtor. Automated methods leverage specialized software and databases that cross-reference information from various sources to locate individuals. Experian’s skip tracing tools, as mentioned earlier, are incredibly valuable in this context.

A successful skip trace involves methodical investigation. I start with readily available information and progressively use more advanced tools as needed. This often involves piecing together fragmented information to create a complete picture of the debtor’s whereabouts. Ethical considerations are paramount; we always adhere to legal requirements and ensure all actions are respectful of privacy.

Q 7. Describe your experience using automated dialer systems.

Automated dialer systems (also known as auto-dialers) are a crucial tool in debt collection, enabling efficient contact with a large number of debtors. However, their use must be carefully managed to comply with the FDCPA and other relevant regulations. Improper use can result in serious penalties.

My experience includes working with auto-dialers that allow for scheduled calls, personalized messaging, and call routing based on account characteristics. These systems can significantly reduce the time and resources required to contact debtors, improving collection efficiency. However, it’s critical to ensure that the system complies with TCPA (Telephone Consumer Protection Act) rules by properly managing call frequency, times of day, and providing clear options for consumers to opt out of receiving automated calls.

We continuously monitor the auto-dialer’s performance, tracking metrics such as connect rates, call abandonment rates, and regulatory compliance to ensure optimal efficiency and adherence to legal guidelines. Our priority is to leverage technology to improve efficiency while upholding the highest ethical and legal standards.

Q 8. How do you handle disputes related to debt collection?

Handling debt disputes effectively involves a structured process that prioritizes fairness and compliance. It starts with meticulously documenting the debt, including the original agreement, payment history, and all communication with the debtor.

Upon receiving a dispute, we thoroughly investigate the claim. This involves verifying the accuracy of the debt information against our internal records and possibly reviewing any supporting documentation provided by the debtor. We may also contact third-party verifiers if necessary.

If the dispute is valid, we work collaboratively with the debtor to find a mutually agreeable solution, possibly involving a modified payment plan or debt reduction. If the dispute is deemed invalid, we explain our reasoning clearly and professionally, providing supporting evidence, ensuring we adhere to all relevant regulations like the Fair Debt Collection Practices Act (FDCPA).

Throughout the process, all communication is carefully documented, ensuring transparency and a clear audit trail. We follow up with the debtor regularly, keeping them informed of the progress and offering assistance where possible. A successful dispute resolution process fosters positive customer relations while minimizing legal risks.

Q 9. What are the key performance indicators (KPIs) you track in collections?

Key Performance Indicators (KPIs) in debt collection are crucial for monitoring efficiency and effectiveness. We track a range of metrics, categorized broadly into recovery rates, operational efficiency, and compliance.

- Recovery Rate: This measures the percentage of outstanding debt successfully recovered. We track this by delinquency bucket (e.g., 30-60 days, 60-90 days), account type, and collection strategy.

- First Call Resolution Rate: This indicates the percentage of calls resolved successfully on the first attempt, highlighting efficiency and effective communication skills.

- Average Days to Resolve: This metric measures the average time taken to resolve a debt, helping identify bottlenecks in the process.

- Cost Per Collection: This evaluates the cost-effectiveness of various collection strategies, enabling optimization.

- Compliance Rate: Crucially, we track compliance with all relevant regulations, ensuring adherence to legal standards and minimizing risk. This includes monitoring call recordings and written communications.

By regularly analyzing these KPIs, we can identify areas for improvement, refine our strategies, and maximize the return on investment while maintaining ethical and legal standards.

Q 10. How do you identify and mitigate risks associated with debt collection?

Risk mitigation in debt collection is paramount, focusing on legal compliance, operational efficiency, and minimizing reputational damage. We employ several key strategies:

- Robust Validation Procedures: We thoroughly verify debt information before initiating collection activities, preventing inaccuracies and potential legal issues.

- Regular Compliance Audits: We conduct frequent internal and external audits to ensure ongoing compliance with all relevant regulations, such as the FDCPA.

- Staff Training: Our collection agents receive comprehensive training on ethical collection practices, legal requirements, and effective communication skills.

- Technology Solutions: We leverage sophisticated collections software (like FICO and Experian) with built-in compliance features to automate tasks, reduce manual errors, and ensure data accuracy.

- Risk Scoring and Segmentation: We segment debtors based on risk profiles to tailor collection strategies and minimize the likelihood of aggressive or inappropriate actions.

By proactively identifying and addressing potential risks, we minimize legal exposure, safeguard our reputation, and maintain positive relationships with debtors.

Q 11. Describe your experience with regulatory compliance in debt collection.

Regulatory compliance is the cornerstone of our debt collection operations. We adhere strictly to all relevant federal and state laws, including the Fair Debt Collection Practices Act (FDCPA), state-specific regulations, and industry best practices. This involves:

- Thorough Staff Training: Our agents receive regular updates on legal changes and best practices to ensure they remain compliant.

- Regular Audits: We conduct internal audits to monitor compliance and identify areas for improvement.

- Call Recording and Monitoring: All calls are recorded and monitored for compliance with legal restrictions on contact frequency, time of day, and communication content.

- Documentation Management: We maintain meticulous records of all communication and actions taken, ensuring a clear audit trail.

- Compliance Software: Utilizing software solutions with built-in compliance features helps automate processes and mitigate potential violations.

Maintaining regulatory compliance is not just a legal requirement; it is essential for building trust with debtors and protecting our company’s reputation.

Q 12. How do you manage difficult or abusive debtors?

Managing difficult or abusive debtors requires a calm, professional, and empathetic approach. Our priority is to de-escalate the situation while maintaining compliance with legal regulations.

We utilize de-escalation techniques such as active listening, remaining calm and respectful, and clearly stating our policies and procedures. If the debtor’s behavior becomes abusive or threatening, we document the interaction thoroughly and may temporarily suspend contact, notifying relevant authorities if necessary. We may also involve legal counsel if the situation warrants it.

A key aspect is providing the debtor with opportunities to express their concerns and negotiate a solution. This might involve setting up a payment plan or exploring debt reduction options. The goal is to find a resolution that is fair to both parties and complies with all relevant regulations.

Q 13. Explain your experience with debt negotiation and settlement strategies.

Debt negotiation and settlement strategies are crucial for maximizing recovery rates while minimizing potential conflicts. Our approach is tailored to the individual debtor’s circumstances and financial situation.

We begin by assessing the debtor’s ability to repay the debt. This might involve reviewing their financial statements, employment history, and other relevant information. Based on this assessment, we propose a payment plan that is both manageable for the debtor and beneficial for the creditor.

Negotiation often involves exploring options such as debt consolidation, reducing interest rates, or settling the debt for a lump-sum payment lower than the original amount. We always ensure that any settlement agreement is legally sound and complies with all applicable regulations. We carefully document all agreements and ensure both parties fully understand the terms.

Q 14. What is your experience with different collection channels (e.g., phone, mail, email)?

We utilize a multi-channel approach to debt collection, adapting to individual debtor preferences and optimizing efficiency. Each channel offers unique advantages and considerations.

- Phone Calls: This allows for direct, personalized communication, enabling efficient negotiation and immediate resolution. However, it requires skilled agents capable of handling difficult conversations and adhering to strict communication protocols.

- Mail: Formal letters provide a documented record of communication and are useful for initial contact or when providing detailed information. However, they can be slower and less effective than other channels.

- Email: Email is a cost-effective method for sending updates, payment reminders, and important documents. However, it requires careful crafting of messages to maintain a professional and courteous tone.

- Online Portals: Secure online portals enable debtors to easily manage their accounts, make payments, and communicate with us. This approach offers convenience and transparency.

We strategically combine these channels to enhance communication effectiveness and provide debtors with options based on their preferences and the specific circumstances of their debt.

Q 15. How do you leverage data analytics to improve collection performance?

Data analytics is crucial for optimizing collection performance. We use it to identify trends, predict behavior, and personalize strategies. For example, we might analyze historical data to segment debtors based on their payment patterns, risk scores (from FICO or Experian), and demographics. This allows us to tailor our communication and collection strategies for each segment.

Imagine a segment of debtors consistently paying late but eventually paying in full. We might implement a proactive strategy focusing on reminders and early intervention. Conversely, a segment showing no payment activity might necessitate a more aggressive approach. We also use predictive modeling – for instance, using machine learning to predict which debtors are most likely to respond positively to a specific offer. This helps maximize resources and improve overall recovery rates. Key performance indicators (KPIs) such as Days Sales Outstanding (DSO) and recovery rates are constantly monitored and analyzed to refine our strategies.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. Explain your proficiency in using collection software like FICO or Experian.

My proficiency with collection software like FICO and Experian extends beyond basic data entry. I’m adept at utilizing their scoring models to assess debtor risk, automating collection workflows, and leveraging their reporting capabilities for comprehensive performance analysis. For instance, I can use FICO’s scoring algorithms to prioritize high-risk accounts requiring immediate attention, while simultaneously utilizing Experian’s data to verify debtor information and identify potential assets. I’m comfortable with various functionalities, including automated dialing systems, account management tools, and reporting dashboards, which allow me to track key metrics and identify areas for improvement. I understand the nuances of integrating this software with other CRM systems and reporting tools for seamless data flow and reporting. I’ve successfully designed and implemented automated workflows to reduce manual effort and improve efficiency.

Q 17. How do you track and measure the effectiveness of your collection efforts?

Tracking and measuring collection effectiveness involves a multi-faceted approach focusing on several key performance indicators (KPIs). We track the overall recovery rate (percentage of outstanding debt collected), the average days to recovery (time taken to collect a debt), the cost per recovery (expenses incurred in collection), and the number of successful contacts. We also monitor individual agent performance and team performance, using these metrics to identify areas of strength and weakness. For example, if an agent consistently has a high cost per recovery, we may provide additional training on negotiation techniques. Regular reporting, utilizing the built-in reporting tools of FICO or Experian, provides a clear picture of the effectiveness of our strategies and allows us to make data-driven decisions for improvement. Detailed dashboards allow for quick identification of trends, outliers, and potential problem areas.

Q 18. Describe your experience working with collection agencies.

My experience working with collection agencies has been extensive, involving both internal collaboration and external partnerships. I’ve worked closely with agencies to develop efficient strategies for handling high-volume debt portfolios, ensuring compliance with all relevant regulations (e.g., Fair Debt Collection Practices Act). This includes negotiating contracts, establishing clear communication protocols, and monitoring their performance against pre-defined KPIs. I understand the complexities of managing relationships with multiple agencies, and I’ve been involved in selecting and evaluating potential partners based on their performance track record, specialization, and cost-effectiveness. I prioritize building strong working relationships to ensure consistent communication and smooth operations.

Q 19. Explain your understanding of different debt types (e.g., consumer, commercial).

Understanding different debt types is fundamental in collections. Consumer debt typically refers to personal loans, credit card debt, and medical bills. It is governed by strict regulations, like the FDCPA. Commercial debt, on the other hand, involves businesses and their financial obligations, such as unpaid invoices, loans to businesses, etc. It typically involves different legal processes and collection methods than consumer debt. The strategies employed for each differ significantly, reflecting the legal and ethical considerations involved. For instance, pursuing a consumer debtor requires strict adherence to the FDCPA while commercial debt collection might involve more direct legal action. Having a strong understanding of these nuances is critical for effective and compliant collection practices.

Q 20. How do you maintain accurate records and documentation in the collection process?

Maintaining accurate records and documentation is paramount in the collection process – both for legal compliance and efficient operations. We use specialized collection software (like FICO or Experian) that provides a centralized repository for all communication, payment history, and legal documentation. Every interaction with a debtor, whether it’s a phone call, email, or letter, is meticulously logged and documented within the system. This ensures a complete audit trail and facilitates efficient retrieval of information. We strictly adhere to regulatory requirements concerning data storage and security, employing encryption and access controls to protect sensitive information. This detailed documentation is not only vital for compliance, but also crucial for internal reporting and performance analysis.

Q 21. Describe your experience with reporting and analysis in a collection environment.

Reporting and analysis form the backbone of effective collection management. I have extensive experience creating and presenting comprehensive reports on key metrics, including recovery rates, DSO, aging of receivables, and cost analysis. I utilize various reporting tools and techniques, including pivot tables, charts, and dashboards, to visually represent complex data and identify trends. I leverage the reporting capabilities of FICO and Experian systems to generate customized reports that cater to specific needs and allow for deep-dive analysis. This data-driven approach helps identify bottlenecks, optimize workflows, and forecast future performance. For example, I might create a report showing the effectiveness of different communication channels (phone, email, mail) for each debtor segment, leading to a more targeted and effective communication strategy.

Q 22. How do you handle aging accounts and delinquent payments?

Managing aging accounts and delinquent payments is crucial for maintaining a healthy financial portfolio. It involves a multi-stage process that starts with proactive identification and escalates through increasingly assertive strategies. We begin by segmenting accounts based on their delinquency status (e.g., 30, 60, 90+ days past due). This allows for targeted interventions. For accounts 30-60 days past due, we might employ automated email or SMS reminders, offering payment arrangements. For accounts beyond 60 days, we initiate personal contact via phone calls, exploring options like payment plans or hardship programs. For severely delinquent accounts (90+ days), more assertive actions may be necessary, such as referring the account to a collections agency or pursuing legal action, always adhering to Fair Debt Collection Practices Act (FDCPA) guidelines.

For example, if a customer consistently misses payments, our system would automatically flag the account and trigger a series of automated communications. If these fail, a skilled collections agent will contact the customer to understand the situation and work towards a mutually agreeable resolution. We utilize sophisticated aging reports within our collection software (like FICO or Experian) to continuously monitor and analyze these trends, enabling proactive management and improved recovery rates.

Q 23. Explain your understanding of the different stages of the debt collection lifecycle.

The debt collection lifecycle can be broken down into several key stages. It starts with Early Stage Collection, focusing on proactive communication and payment reminders. This often involves automated communications and friendly follow-ups. The next stage is Mid-Stage Collection, where more assertive methods are employed, including personalized phone calls, exploring payment arrangements, and offering hardship options. Late-Stage Collection involves more intensive measures, like forwarding the account to a collections agency or initiating legal proceedings. Finally, Charge-off and Recovery is the stage where the debt is written off, but efforts continue to recover funds through various means. Each stage has its own specific strategies, and the transition between stages is usually data-driven, based on the debtor’s response and the account’s aging.

Think of it like a funnel; you start with a broad base of delinquent accounts, and as you move through the stages, the number of accounts shrinks, but the recovery value per account increases.

Q 24. How do you ensure compliance with industry best practices and regulations?

Compliance is paramount in collections. We rigorously adhere to all relevant regulations, including the Fair Debt Collection Practices Act (FDCPA), the Fair Credit Reporting Act (FCRA), and state-specific regulations. Our compliance program involves regular training for our staff on these regulations and best practices. We maintain meticulous records of all communications with debtors, ensuring that every interaction is documented and compliant. We also utilize collection software with built-in compliance features, such as automated call recording and scripting that prevents agents from making non-compliant statements. We conduct regular audits and reviews of our processes to identify and address potential compliance gaps, and we stay updated on any changes in regulations.

For example, we strictly adhere to limitations on the times of day we can contact debtors and the number of contacts allowed per week. Any potential violations are immediately investigated and addressed.

Q 25. How do you identify and address potential fraud in collections?

Identifying and addressing fraud in collections requires a multi-faceted approach. We use sophisticated fraud detection systems that analyze various data points, including account activity, communication patterns, and debtor information, to identify suspicious behavior. These systems flag potentially fraudulent accounts for review by our fraud team. This team investigates flagged accounts meticulously, verifying identities, reviewing payment history, and comparing information across different sources. We also implement robust authentication measures, requiring multiple forms of identification before making any significant changes to an account. Furthermore, regular training keeps our team aware of evolving fraud schemes and best practices for prevention and detection.

For example, if an account suddenly shows numerous payments from different sources with unusual patterns, our fraud detection system would flag it for investigation.

Q 26. Describe your experience with integrating collection software with other systems.

I have extensive experience integrating collection software with various other systems, including Customer Relationship Management (CRM) systems, accounting software, and general ledger systems. This typically involves using Application Programming Interfaces (APIs) to exchange data between systems. For example, I’ve worked on projects integrating FICO’s collection software with Salesforce to streamline communication and case management. The integration ensures that account information is updated in real-time across all systems, improving efficiency and reducing manual data entry. Successful integration requires a deep understanding of the data structures of each system and the ability to map data fields effectively. It also requires careful planning and testing to ensure data integrity and system stability after the integration.

Example API call: POST /api/accounts - {“accountID”: 12345, “status”: “delinquent”}

Q 27. How would you handle a situation where a customer refuses to pay their debt?

When a customer refuses to pay their debt, a structured approach is crucial. First, I’d attempt to understand the reason behind their refusal. Is it due to a genuine hardship, a dispute over the debt, or simply unwillingness to pay? Empathetic listening is key. If a hardship is identified, we explore options like payment plans or debt consolidation programs. If there’s a genuine dispute, we would review the account thoroughly and provide the necessary documentation to support the debt. If the refusal stems from unwillingness to pay, we would escalate the case according to our established protocols. This might involve further attempts at negotiation, referral to a collections agency, or, as a last resort, legal action.

Documentation at each step is vital for future reference and to protect against potential legal disputes.

Q 28. What are your strengths and weaknesses in a collection role?

My strengths lie in my analytical skills, my ability to build rapport with clients, and my experience navigating complex regulations. I am highly proficient in using collections software and have a strong track record of improving collection rates. I’m also adept at finding creative solutions to complex debt recovery scenarios.

A potential weakness is my tendency to be detail-oriented, sometimes leading to spending more time on a single case than necessary. However, I’m actively working on improving time management strategies to optimize my workflow, balancing thoroughness with efficiency.

Key Topics to Learn for Collections Software (e.g., FICO, Experian) Interview

- Data Management and Analysis: Understanding how these platforms handle and analyze large datasets of consumer credit information. Focus on data cleaning, transformation, and interpretation for effective decision-making.

- Scoring Models and Algorithms: Familiarize yourself with the underlying scoring models used to assess credit risk. Explore how these models are applied and the factors influencing their accuracy.

- Regulatory Compliance: Grasp the legal and regulatory frameworks governing the use of collections software and consumer credit data. Understanding Fair Debt Collection Practices Act (FDCPA) compliance is crucial.

- Reporting and Analytics: Learn how to generate meaningful reports and interpret key performance indicators (KPIs) related to collections efficiency and portfolio performance. Practice visualizing data effectively.

- System Integration and Workflow: Understand how collections software integrates with other systems within a company’s infrastructure (e.g., CRM, accounting). Familiarize yourself with typical workflow processes.

- Strategic Collections Strategies: Explore various collections strategies and tactics, including early intervention strategies, account prioritization, and communication best practices.

- Problem-Solving and Troubleshooting: Prepare for scenario-based questions where you’ll need to diagnose and resolve issues related to data accuracy, system errors, or workflow inefficiencies.

- Software Specific Features (FICO/Experian): While avoiding specific questions, explore the unique features and functionalities offered by FICO and Experian platforms to demonstrate your in-depth knowledge.

Next Steps

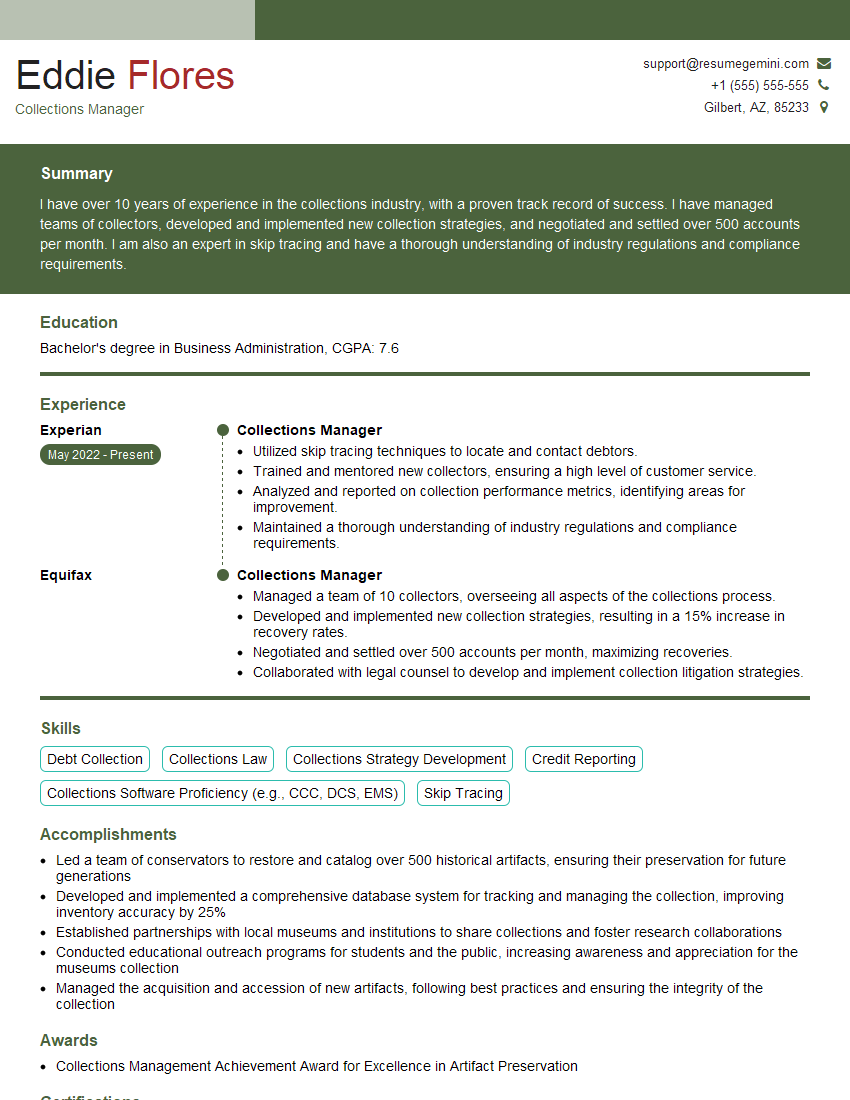

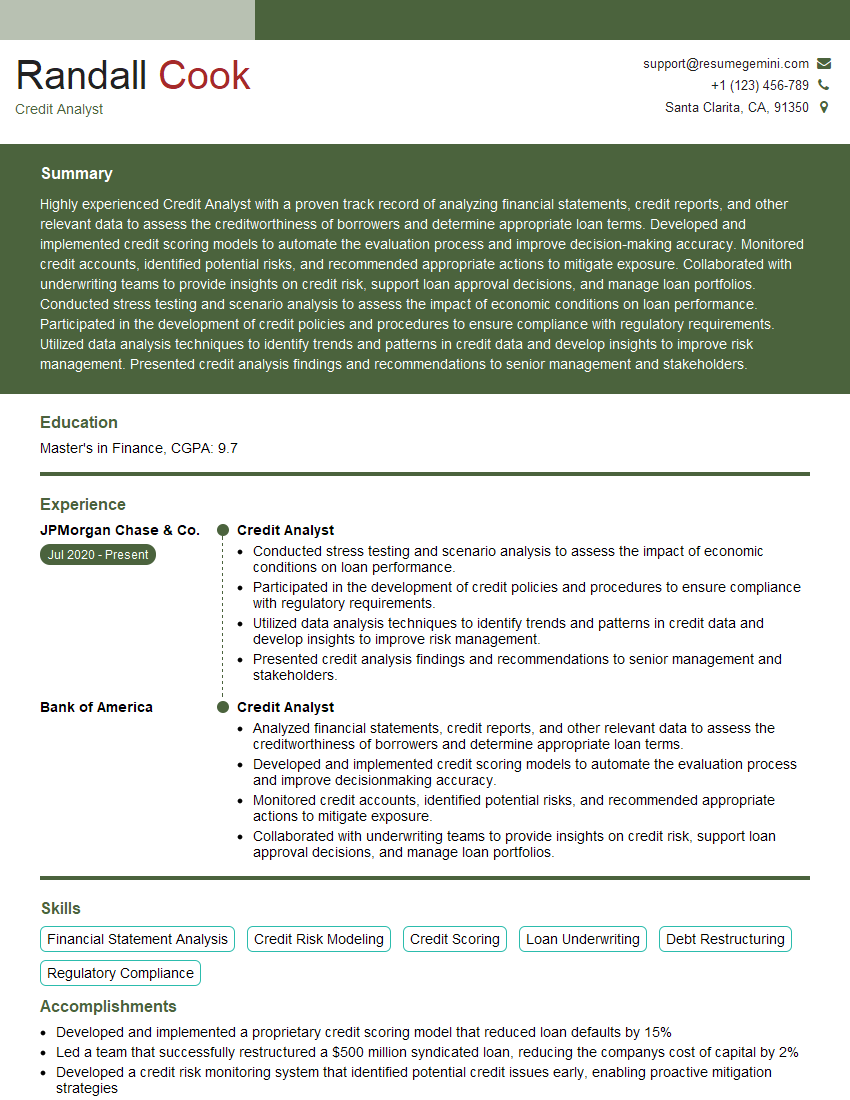

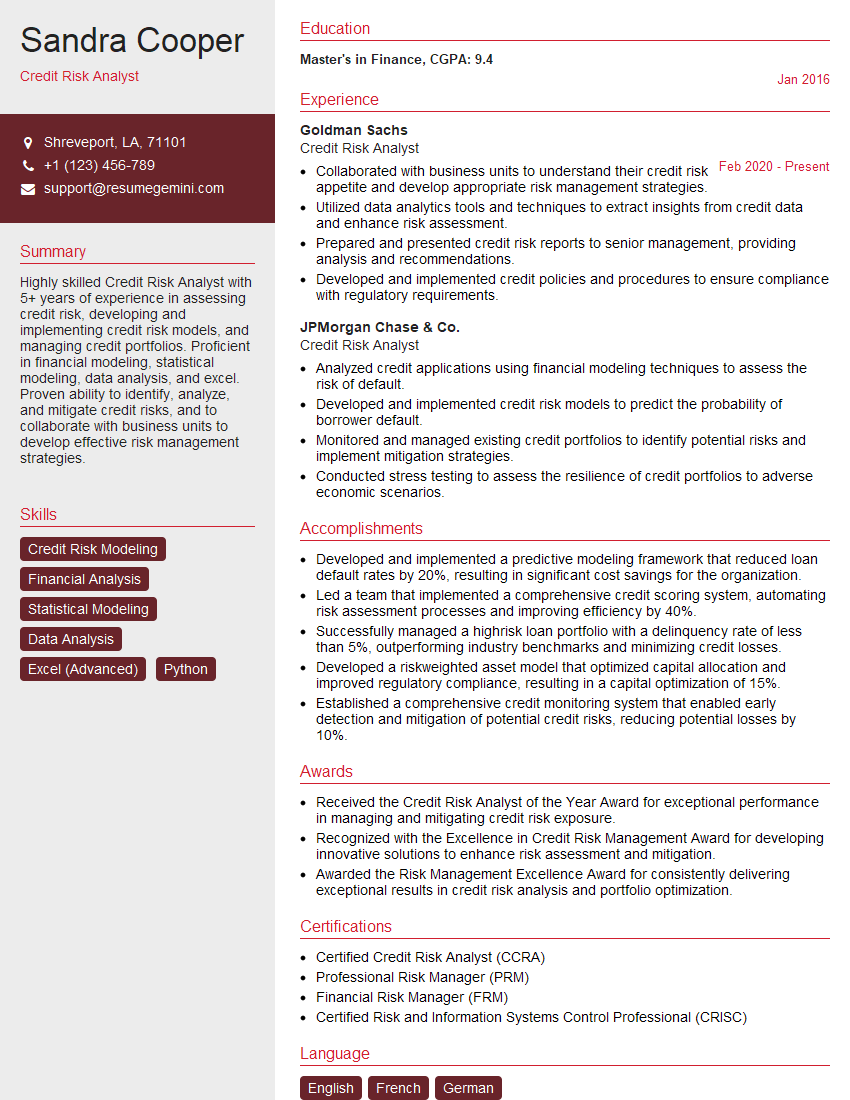

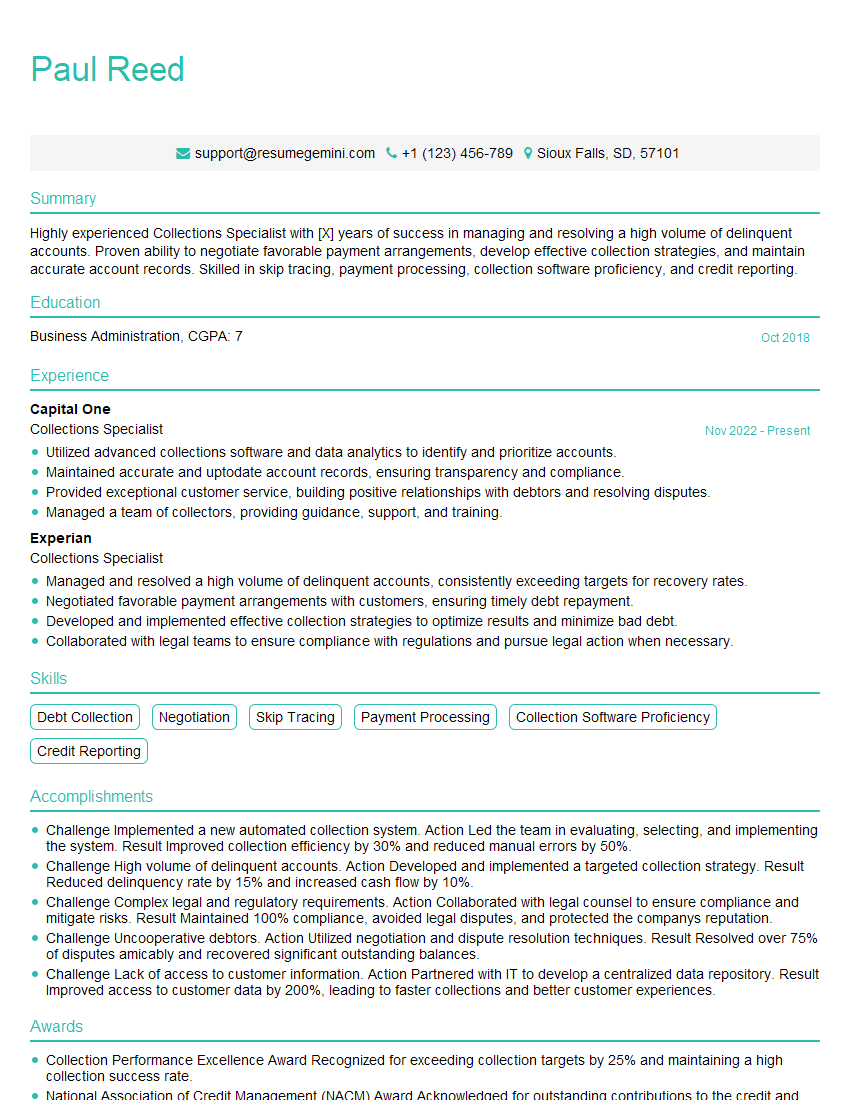

Mastering Collections Software like FICO and Experian is vital for advancing your career in the finance and collections industries. These platforms are essential tools for effective debt recovery and risk management, opening doors to higher-paying roles and increased responsibility. To maximize your job prospects, focus on creating a strong, ATS-friendly resume that highlights your relevant skills and experience. ResumeGemini is a trusted resource to help you build a professional and impactful resume that gets noticed. Examples of resumes tailored to showcasing expertise in Collections Software (e.g., FICO, Experian) are available to guide you.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

Hi, I’m Jay, we have a few potential clients that are interested in your services, thought you might be a good fit. I’d love to talk about the details, when do you have time to talk?

Best,

Jay

Founder | CEO