Every successful interview starts with knowing what to expect. In this blog, we’ll take you through the top Collection Strategies interview questions, breaking them down with expert tips to help you deliver impactful answers. Step into your next interview fully prepared and ready to succeed.

Questions Asked in Collection Strategies Interview

Q 1. Describe your experience implementing different collection strategies.

Throughout my career, I’ve implemented a variety of collection strategies, adapting my approach based on the specific client, industry, and debt type. This includes everything from proactive strategies focused on preventing delinquency, to reactive strategies employed when payments are past due. For instance, I’ve successfully implemented:

Early intervention strategies: This involves regular communication with clients showing early signs of financial difficulty. This might include automated email reminders before a payment is due or personalized phone calls offering payment plans.

Stage-based collection strategies: This involves escalating the intensity of collection efforts based on the age of the debt. For example, friendly reminders for slightly overdue payments, followed by formal demand letters and, if necessary, legal action for severely delinquent accounts.

Negotiated payment plans: I have extensive experience in negotiating payment plans with debtors, tailoring the terms to their individual circumstances while ensuring the client’s interests are also protected. This often involves assessing the debtor’s financial situation and collaboratively creating a repayment schedule that is both feasible and beneficial for both parties.

Third-party collection agency utilization: In cases where internal efforts are unsuccessful, I’ve strategically engaged reputable third-party collection agencies, carefully selecting those aligned with our ethical guidelines and compliance requirements. This requires careful oversight and ongoing monitoring of their performance and adherence to regulations.

Each strategy requires a careful analysis of the specific debt portfolio and a deep understanding of relevant laws and regulations. I am adept at tailoring strategies to maximize recovery rates while maintaining ethical and legal compliance.

Q 2. What metrics do you use to measure the effectiveness of collection strategies?

Measuring the effectiveness of collection strategies is crucial for continuous improvement. I rely on a suite of key performance indicators (KPIs) including:

Recovery Rate: This measures the percentage of outstanding debt successfully recovered. A higher recovery rate indicates greater effectiveness.

Days Sales Outstanding (DSO): This metric tracks the average number of days it takes to collect payments. A lower DSO signifies improved efficiency.

Collection Costs: Analyzing the cost of collecting each dollar helps determine the profitability of the collection process. Minimizing costs while maximizing recovery is key.

Customer Satisfaction: Even during difficult collection processes, maintaining a respectful and professional approach is crucial. Tracking customer feedback helps gauge the effectiveness of communication and overall client experience.

First Contact Resolution Rate: This reflects the percentage of issues resolved on the first contact with the debtor. A high rate suggests efficient communication and problem-solving.

Regularly monitoring these KPIs allows for data-driven decision-making, identifying areas for improvement and optimizing collection strategies for better performance.

Q 3. How do you prioritize accounts for collection efforts?

Prioritizing accounts for collection efforts is essential to maximize resources and recovery rates. I typically use a tiered approach, considering several factors:

Age of Debt: The longer a debt remains outstanding, the lower the likelihood of recovery. Older debts are typically prioritized.

Debt Amount: Larger debts represent a greater potential for recovery, making them a higher priority.

Customer Risk Profile: Accounts with a higher risk of default or those demonstrating a lack of cooperation are prioritized for swift action.

Payment History: Customers with a consistent history of late payments require more proactive and frequent engagement.

I employ various tools, including customized scoring models and automated prioritization systems, to effectively manage and prioritize the accounts in the collection portfolio, ensuring that resources are allocated efficiently and effectively.

Q 4. Explain your approach to handling difficult or irate debtors.

Handling difficult or irate debtors requires empathy, patience, and a structured approach. My strategy focuses on:

Active Listening: Understanding the debtor’s situation and concerns is crucial. I begin by listening carefully to their perspective without interruption.

Empathetic Communication: Even while enforcing payment responsibilities, I strive to remain empathetic and understanding. Recognizing their frustration helps build rapport.

Clear and Concise Communication: I avoid jargon and clearly outline the options available, such as payment plans or alternative solutions.

Documentation: Maintaining detailed records of all communications and agreements is critical for legal protection and dispute resolution.

Escalation Protocols: If necessary, I escalate the matter to a supervisor or legal counsel, ensuring adherence to company policies and legal regulations.

Remember, maintaining a calm and professional demeanor, even in challenging situations, is key to de-escalation and successful resolution.

Q 5. What strategies do you employ to improve collection efficiency?

Improving collection efficiency is an ongoing process. My strategies include:

Process Automation: Automating tasks such as sending reminders, generating reports, and managing communication frees up time for more complex cases, thereby increasing efficiency.

Data Analytics: Using data analysis to identify trends and patterns in delinquency helps pinpoint areas for improvement in prevention and collection strategies.

Staff Training: Providing ongoing training to staff on effective communication techniques, negotiation skills, and legal compliance enhances their capabilities.

Technology Upgrades: Investing in advanced collection software with features such as automated dialing, predictive modeling, and customer relationship management (CRM) capabilities significantly improves efficiency.

Continuous Monitoring and Improvement: Regularly reviewing KPIs and analyzing results allows for continuous optimization of collection processes.

By continuously seeking opportunities for improvement, we can optimize efficiency and maximize recovery rates.

Q 6. How do you adapt collection strategies to different customer segments?

Adapting collection strategies to different customer segments is vital for success. I tailor my approach based on factors such as:

Customer Value: High-value customers may warrant more personalized and flexible approaches, while lower-value customers might require more standardized processes.

Payment History: Customers with a history of timely payments may receive gentler reminders, whereas those with a history of delinquency might need more assertive strategies.

Industry and Demographics: Different industries and customer demographics may require different communication styles and approaches. For example, a young professional might respond differently than a senior citizen.

Communication Preferences: Respecting customer preferences for communication channels (email, phone, mail) is crucial for effectiveness and positive relationships.

Segmenting customers and personalizing the collection approach maximizes recovery rates while minimizing negative impacts on customer relationships.

Q 7. What is your experience with various collection software or systems?

I have extensive experience with various collection software and systems, including:

CRM Systems (Salesforce, Microsoft Dynamics): These systems help manage customer interactions, track payment history, and automate communication.

Automated Dialers: These systems improve efficiency by automating outbound calls to debtors.

Debt Management Software: These specialized platforms provide tools for managing accounts receivable, generating reports, and tracking KPIs.

Legal and Compliance Software: This software ensures adherence to relevant regulations and assists with legal documentation.

My proficiency in these systems allows me to efficiently manage large volumes of data, automate tasks, and streamline the collection process, contributing to improved performance and compliance.

Q 8. How do you identify and address the root causes of delinquent accounts?

Identifying the root cause of delinquent accounts is crucial for effective collection strategies. It’s not just about getting the money back; it’s about understanding why the payment wasn’t made. This involves a multi-faceted approach.

- Financial Hardship: A thorough review of the debtor’s financial situation is paramount. This includes examining their income, expenses, and overall debt burden. For example, a recent job loss or unexpected medical bills might be the reason for delinquency.

- Communication Breakdown: Sometimes, simple miscommunication can lead to late payments. Perhaps the debtor didn’t receive a statement, misunderstood payment terms, or experienced difficulty contacting the creditor. Proactive communication is key.

- Billing Errors: Incorrect billing or discrepancies in account statements are common culprits. A detailed audit of the account ensures that the balance is accurate and any billing errors are promptly rectified.

- Disputes Regarding Services or Products: The debtor might be disputing the quality of goods or services provided, leading to a refusal to pay. Addressing these concerns is crucial.

Addressing these root causes requires a combination of careful investigation, empathetic communication, and a willingness to explore flexible payment arrangements where appropriate. For instance, if a debtor genuinely faces financial hardship, a payment plan might be a viable solution.

Q 9. Describe your experience with legal collection processes.

My experience with legal collection processes encompasses the entire spectrum, from initial demand letters to the filing of lawsuits and pursuing judgments. I’m proficient in preparing the necessary documentation, interacting with legal counsel, and managing the entire legal process. I understand the importance of adhering strictly to legal and ethical guidelines, such as the Fair Debt Collection Practices Act (FDCPA).

For instance, I’ve been involved in cases where negotiation failed, and legal action became necessary. This involved meticulously documenting all communication attempts, preparing detailed affidavits, and coordinating with legal professionals to file lawsuits and obtain judgments. In one particular case, we successfully recovered a significant sum through a judgment against a debtor who had initially refused all communication. The key was thorough documentation and a precise understanding of the legal procedures.

Q 10. How do you balance the need for recovery with maintaining positive customer relationships?

Balancing recovery with positive customer relationships requires a delicate touch. It’s about treating debtors with respect and understanding while remaining firm in pursuing payment. Aggressive tactics can damage relationships and hinder future business.

My approach focuses on empathy and clear communication. I begin by understanding the debtor’s situation and exploring options such as payment plans or settlement offers. Even during the collection process, I maintain a professional and courteous tone, ensuring that communication is clear and respectful. For example, I might offer a reduced settlement amount to encourage payment, or suggest a payment plan that fits the debtor’s budget. This strategy often leads to faster resolution and protects customer relationships.

Q 11. Explain your understanding of Fair Debt Collection Practices Act (FDCPA).

The Fair Debt Collection Practices Act (FDCPA) is a federal law designed to protect consumers from abusive debt collection practices. It sets strict guidelines on how debt collectors can interact with debtors. My understanding of the FDCPA is comprehensive, and I ensure all my actions adhere strictly to its provisions.

- Restrictions on Contact Times: The FDCPA limits when debt collectors can contact debtors (generally not before 8:00 a.m. or after 9:00 p.m.).

- Prohibition of Harassment: Debt collectors are prohibited from using abusive, threatening, or harassing language or tactics.

- Validation of Debts: Debtors have the right to request validation of the debt, meaning the collector must provide verification of the debt amount and the creditor’s ownership of the debt.

- Communication Requirements: Collectors must identify themselves as debt collectors and provide certain information in their communications.

Violation of the FDCPA can lead to significant penalties, therefore strict compliance is paramount. I regularly review the FDCPA guidelines and participate in relevant training to stay up-to-date.

Q 12. How do you handle disputes regarding account balances?

Handling disputes regarding account balances requires a methodical and thorough approach. The first step is to carefully review the debtor’s claims. This includes verifying the accuracy of the account statement, identifying any potential discrepancies, and examining any supporting documentation provided by the debtor.

If the discrepancy is valid, I promptly correct the error and issue a revised statement. If the dispute is unfounded, I explain the reasoning behind the charges clearly and professionally, providing supporting documentation as needed. I document every step of the dispute resolution process meticulously. For instance, I keep records of all communications, including emails and phone calls, and maintain detailed notes on the actions taken. This documentation is crucial in case of further escalation of the dispute.

Q 13. What is your experience with skip tracing or locating debtors?

Skip tracing, the process of locating debtors who have become unreachable, is a crucial skill in debt collection. I have extensive experience utilizing various skip tracing techniques. This includes using both online resources and traditional methods.

- Online Databases: I utilize people search engines, social media platforms, and public records databases to locate debtors’ current addresses and contact information.

- Public Records: Accessing public records such as court documents, property records, and voter registration databases can yield valuable information.

- Network and Collaboration: Collaboration with other debt collectors or agencies can sometimes provide leads on hard-to-find debtors.

Success in skip tracing depends on diligence and a systematic approach. I start by exhausting all readily available online resources, then progressively employ more sophisticated methods. Every successful location update is meticulously recorded to maintain accuracy and efficiency.

Q 14. How do you manage your workload and prioritize tasks within a high-volume environment?

Managing a high-volume workload effectively requires a systematic approach. I prioritize tasks based on urgency, age of debt, and potential recovery value. I use a combination of tools and techniques to stay organized and efficient.

- Prioritization Matrix: I use a prioritization matrix (e.g., Eisenhower Matrix) to categorize tasks based on urgency and importance. This ensures that critical tasks receive immediate attention.

- Task Management Software: I utilize task management software to track my progress, set deadlines, and ensure accountability. This provides a clear overview of my workload and prevents tasks from slipping through the cracks.

- Time Blocking: I allocate specific time blocks for different tasks, improving focus and reducing distractions. This allows me to dedicate focused time to complex cases without interruptions.

- Regular Review and Adjustment: I regularly review my workload and adjust my priorities as needed. Flexibility is crucial in a high-volume environment.

This multi-pronged strategy ensures that I remain productive and efficient even in a fast-paced environment. Regularly reviewing and adjusting my approach allows for continuous improvement in workflow optimization.

Q 15. Describe your experience with reporting and analysis of collection data.

Reporting and analyzing collection data is crucial for optimizing collection strategies. My experience involves using various tools and techniques to track key metrics, identify trends, and make data-driven decisions. This includes:

- Data Extraction and Cleaning: I’m proficient in extracting data from various systems (CRM, ERP, etc.), cleaning it to ensure accuracy, and transforming it into a usable format for analysis.

- Key Performance Indicator (KPI) Tracking: I regularly track KPIs such as Days Sales Outstanding (DSO), collection rate, and write-off rate. For example, a consistently high DSO might indicate a need to review our collection procedures or credit policies.

- Trend Analysis: I use data visualization tools to identify trends in delinquency rates, payment patterns, and overall collection performance. This helps predict future challenges and proactively adjust strategies.

- Reporting and Presentation: I create clear and concise reports, using dashboards and visualizations, to communicate findings to stakeholders. These reports often include recommendations for improvement based on the data analysis.

For instance, in a previous role, I discovered through data analysis that a specific industry segment had a significantly higher delinquency rate. This led to implementing a more stringent credit approval process for that segment, resulting in a 15% reduction in DSO within six months.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. How do you stay updated on changes and best practices in collection strategies?

The field of collection strategies is constantly evolving. To stay updated, I employ a multi-faceted approach:

- Professional Associations: I’m an active member of industry associations like the Association of Credit and Collection Professionals (ACA), attending conferences and webinars to learn about the latest best practices and regulatory changes.

- Industry Publications and Journals: I regularly read publications dedicated to credit and collection management, keeping abreast of new techniques and technologies.

- Online Resources and Webinars: I leverage online platforms and webinars offered by industry experts to deepen my understanding of specific areas, such as advanced analytics or regulatory compliance.

- Networking: I actively network with peers in the industry to share experiences and learn from their successes and challenges.

Staying updated isn’t just about reading; it’s about critically evaluating new information and adapting it to our specific organizational context. I always consider the ethical implications of any new strategy before implementing it.

Q 17. Explain your understanding of different collection methods (e.g., phone, email, mail).

Different collection methods have varying effectiveness depending on the debtor and the situation. My experience includes:

- Phone Calls: This method allows for direct communication, immediate feedback, and the opportunity to build rapport and negotiate payment plans. However, it can be time-consuming and may require multiple attempts.

- Emails: Emails are efficient for sending reminders, providing account summaries, and delivering formal notices. However, they lack the personal touch of a phone call and may be overlooked.

- Mail (Letters): Formal letters are useful for legally required notices, such as demand letters. They provide a documented record of communication but are the slowest method.

I believe in a multi-channel approach, often starting with a friendly phone call followed by emails and letters if necessary. The choice of method depends on the debtor’s communication preferences and the urgency of the situation. For example, a high-value delinquent account might warrant a series of phone calls and personalized emails, while a low-value account might only need a standard letter.

Q 18. What is your experience with negotiating payment plans?

Negotiating payment plans is a crucial skill in collections. My approach involves:

- Understanding the Debtor’s Situation: I actively listen to understand the debtor’s financial circumstances and any extenuating factors. This empathy builds trust and increases the likelihood of a successful negotiation.

- Proposing Realistic Payment Plans: I propose payment plans that are both acceptable to the debtor and protect the creditor’s interests. This often involves considering the debtor’s income, expenses, and overall debt burden.

- Documenting Agreements: All agreed-upon payment plans are meticulously documented in writing, ensuring clarity and avoiding future misunderstandings. This documentation includes payment amounts, due dates, and any associated fees or penalties.

- Monitoring Compliance: I closely monitor the debtor’s adherence to the payment plan and take appropriate action if payments are missed.

I once negotiated a payment plan with a small business owner facing significant financial difficulties. By working collaboratively and understanding their challenges, we created a manageable payment plan that allowed them to stay afloat and prevented the account from going to collections.

Q 19. How do you identify and mitigate collection risks?

Identifying and mitigating collection risks requires proactive measures and a thorough understanding of the debtor’s creditworthiness. This includes:

- Pre-Approval Credit Checks: Thorough credit checks before extending credit are essential to assess the debtor’s risk profile.

- Monitoring Account Activity: Regularly monitoring account activity for signs of delinquency or unusual payment patterns can help identify potential problems early on.

- Diversification of Debtor Base: A diversified debtor base reduces the overall risk. Relying too heavily on a small number of clients can be disastrous if one or more defaults.

- Insurance and Guarantees: In certain cases, securing insurance or guarantees can help mitigate potential losses.

For instance, if we identify a cluster of accounts from a particular geographic region experiencing financial distress, we may need to adjust our collection strategies for that area, potentially allocating more resources or offering more flexible payment plans.

Q 20. How do you handle situations with bankrupt or insolvent debtors?

Handling bankrupt or insolvent debtors requires understanding legal procedures and acting within legal boundaries. My approach involves:

- Filing a Claim: If a debtor declares bankruptcy, I would file a proof of claim with the bankruptcy court to ensure our claim is considered in the distribution of assets.

- Reviewing Bankruptcy Documents: I would carefully review the debtor’s bankruptcy filings to understand the specifics of their financial situation and their proposed repayment plan.

- Attending Creditor Meetings: Participation in creditor meetings provides insights into the debtor’s financial condition and allows us to engage with other creditors.

- Legal Counsel: I would consult with legal counsel to ensure we comply with all applicable laws and regulations throughout the bankruptcy process.

It’s important to remember that while recovering the full amount may be challenging, the process is about maximizing recovery within the legal framework. Understanding the bankruptcy code and working within its parameters is crucial.

Q 21. Describe your experience with collection agency partnerships.

Partnering with collection agencies can be a valuable strategy for handling difficult accounts and maximizing recovery rates. My experience involves:

- Agency Selection: Careful selection of agencies is vital, considering factors like reputation, expertise, and compliance with regulations. I would thoroughly vet potential partners before entering into any agreement.

- Contract Negotiation: Negotiating clear contracts that outline responsibilities, fees, and performance metrics is crucial to protect our interests.

- Account Transfer and Communication: Efficient and secure transfer of account information and regular communication with the agency to track progress are essential.

- Performance Monitoring: Continuously monitoring the agency’s performance against agreed-upon metrics ensures accountability and allows for timely adjustments if needed.

In a previous role, we partnered with a specialized agency to recover outstanding payments from international clients. Their expertise in international collections led to a significant increase in our recovery rate, demonstrating the benefits of strategic partnerships.

Q 22. How do you ensure compliance with all relevant regulations and laws?

Compliance is paramount in debt collection. It’s not just about avoiding legal trouble; it’s about maintaining ethical standards and building trust. My approach involves a multi-faceted strategy. First, I meticulously stay updated on all relevant federal and state laws, including the Fair Debt Collection Practices Act (FDCPA), the Telephone Consumer Protection Act (TCPA), and any state-specific regulations. I regularly attend industry conferences and webinars to stay abreast of changes. Second, I ensure our internal collection processes strictly adhere to these regulations. This includes carefully reviewing all communication templates to avoid prohibited language or practices. For example, we avoid contacting debtors before 8 am or after 9 pm, and we never threaten violence or use abusive language. Third, we conduct regular internal audits to identify and correct any compliance gaps proactively. Think of it like a regular health check for our collection processes. Finally, we maintain detailed records of all communications and actions, readily available for audits by regulatory bodies.

Q 23. What is your experience with automated collection systems?

I have extensive experience with automated collection systems, specifically using software to automate tasks such as sending automated reminders, generating reports, and managing communication logs. In my previous role, we implemented a system that automated the initial contact process, significantly reducing manual workload. This system allowed us to send personalized emails and text messages based on debtor profiles, increasing response rates. We also used automated dialer systems for outbound calls, but always ensuring strict compliance with the TCPA. For example, we programmed the system to only call during permitted times and to immediately stop dialing if a debtor requested not to be contacted. Example automation: Automated email sequence for 30, 60, and 90 days past due accounts.. The automation didn’t replace human interaction; rather, it freed up our team to focus on more complex cases requiring personalized negotiation and problem-solving.

Q 24. How do you track and document all communication with debtors?

Tracking and documenting communication is critical for compliance and effective debt recovery. We utilize a comprehensive CRM system to record every interaction with a debtor – be it a phone call, email, text message, or letter. Each interaction is logged with a timestamp, the method of contact, a summary of the conversation, and any agreed-upon actions. For example, if a payment arrangement is made, the details of the agreement, including payment amounts and dates, are meticulously recorded. We also use secure file storage to maintain copies of all correspondence, including letters and emails. This detailed documentation serves multiple purposes: It protects us from legal challenges, allows us to track the effectiveness of different collection strategies, and facilitates seamless handover between team members should an agent leave the company. Think of it as a meticulous audit trail, ensuring complete transparency and accountability.

Q 25. How do you contribute to a positive team environment in a high-pressure collection setting?

Working in collections can be demanding, but a supportive team environment is essential for maintaining morale and productivity. I actively contribute to a positive team culture by fostering open communication, mutual respect, and a sense of shared purpose. I believe in leading by example – consistently demonstrating professionalism, empathy, and resilience. I also actively participate in team-building activities and offer support and encouragement to colleagues, especially when facing challenging situations. For example, I’ve organized team lunches, shared success stories to boost morale, and offered peer-to-peer coaching sessions to help colleagues develop their skills. Creating a collaborative atmosphere where everyone feels valued and respected is key to navigating the pressures of the job. It’s about being a supportive teammate and a strong leader.

Q 26. Describe your experience using data analytics to improve collection results.

Data analytics plays a pivotal role in improving collection results. In my previous role, I leveraged data analytics to identify patterns in debtor behavior, helping us tailor our strategies for optimal effectiveness. For instance, we analyzed data to segment our debtor base based on factors such as payment history, income levels, and response to different communication methods. This allowed us to personalize our outreach efforts, resulting in significantly higher resolution rates. We also used predictive modeling to identify debtors most likely to default, allowing us to prioritize proactive interventions. Example: Analyzing payment history to predict future delinquency and adjust collection strategies accordingly.. By continually monitoring key performance indicators (KPIs), like collection rates and average days delinquent, we were able to fine-tune our strategies, improving efficiency and maximizing recovery rates.

Q 27. How would you handle a situation with a large influx of delinquent accounts?

A sudden surge in delinquent accounts requires a strategic and coordinated response. My approach would involve a three-pronged strategy: First, I’d assess the situation to understand the root cause of the influx. Is it a seasonal trend, a change in economic conditions, or a problem with internal processes? This analysis helps guide our response. Second, I would prioritize and triage accounts based on factors like age of debt, debtor’s financial situation, and potential recovery value. This allows us to focus our resources on the accounts with the highest potential return. Third, I’d assemble the team and assign tasks based on individual strengths. We might need to implement temporary shifts in staffing or utilize automated systems to manage high call volumes while maintaining compliance. This includes creating clear communication protocols and allocating resources effectively. The key is to maintain a calm and organized approach, avoiding panic and ensuring we handle the situation systematically and efficiently.

Q 28. What is your salary expectation for this role?

My salary expectation for this role is commensurate with my experience and the responsibilities involved. Based on my research of similar positions and my qualifications, I am seeking a salary range of [Insert Salary Range]. However, I am open to discussing this further and am confident we can reach an agreement that reflects the value I bring to your organization.

Key Topics to Learn for Collection Strategies Interview

- Regulatory Compliance: Understanding and adhering to Fair Debt Collection Practices Act (FDCPA) and other relevant regulations. Practical application: Analyzing a collection scenario to identify potential compliance risks.

- Debt Negotiation and Settlement: Mastering various negotiation techniques to reach mutually agreeable payment plans. Practical application: Developing a negotiation strategy for a delinquent account, considering the debtor’s financial situation.

- Account Analysis and Prioritization: Effectively assessing the risk and potential return of various accounts to optimize collection efforts. Practical application: Utilizing data analysis to identify high-value accounts requiring immediate attention.

- Communication and Empathy: Building rapport with debtors to foster collaboration and achieve positive outcomes. Practical application: Crafting empathetic yet assertive communication strategies for difficult conversations.

- Technology and Software Proficiency: Demonstrating familiarity with collection management software and various technological tools. Practical application: Explaining how to utilize automated systems to enhance efficiency and track progress.

- Legal Aspects of Collections: Understanding the legal framework surrounding debt collection, including litigation processes. Practical application: Recognizing situations requiring legal intervention and outlining appropriate next steps.

- Performance Metrics and Reporting: Tracking key performance indicators (KPIs) and generating accurate reports to demonstrate success. Practical application: Interpreting collection data to identify areas for improvement and inform strategic decision-making.

Next Steps

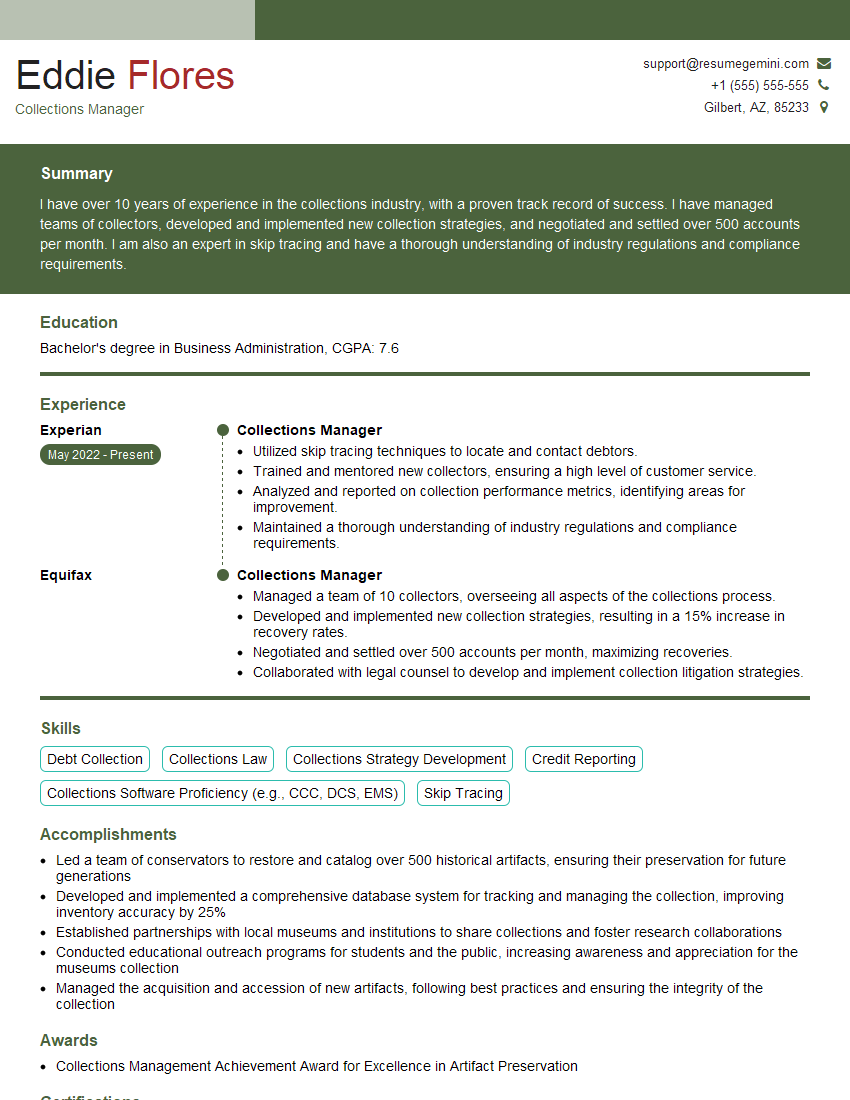

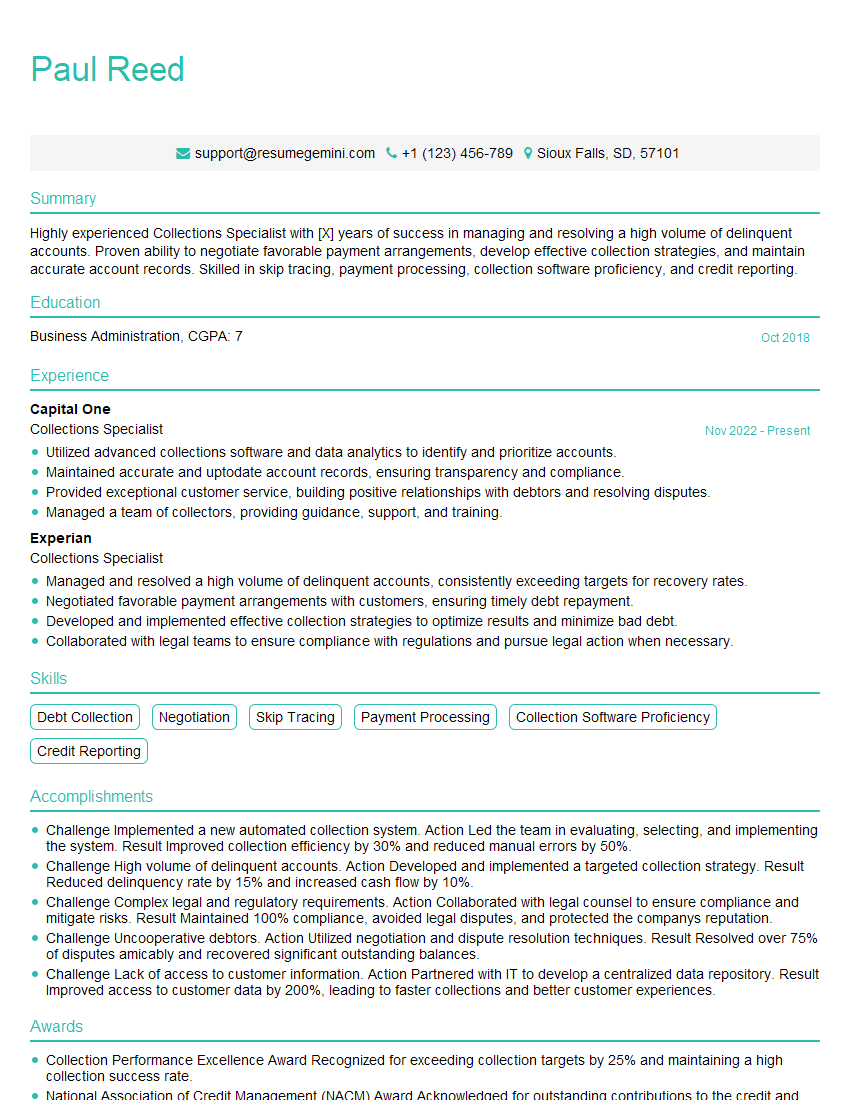

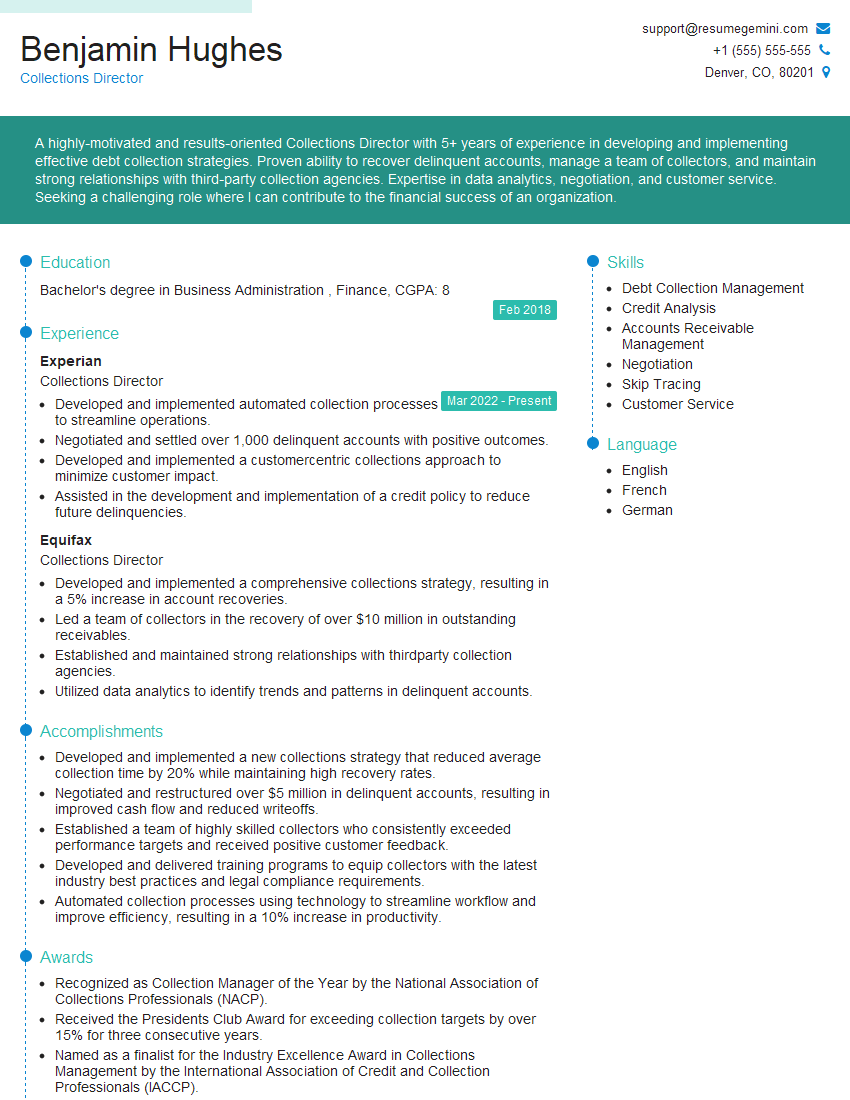

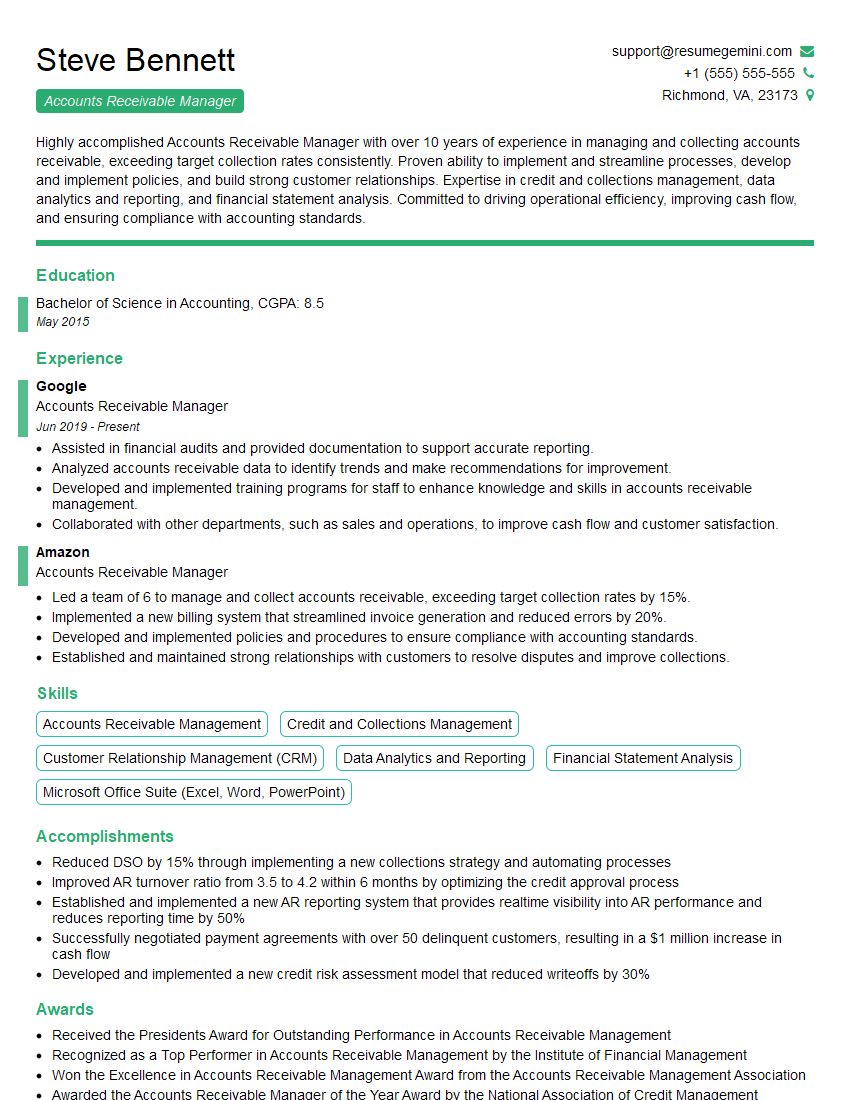

Mastering Collection Strategies is crucial for career advancement in the financial services industry. It demonstrates your ability to manage risk, resolve complex problems, and contribute significantly to an organization’s bottom line. To maximize your job prospects, it’s essential to create a compelling and ATS-friendly resume that highlights your skills and experience. ResumeGemini is a trusted resource that can help you build a professional and impactful resume. Examples of resumes tailored to Collection Strategies are available to guide you through the process, showcasing the best way to present your qualifications. Take advantage of these resources and present yourself as the ideal candidate!

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

Hi, I’m Jay, we have a few potential clients that are interested in your services, thought you might be a good fit. I’d love to talk about the details, when do you have time to talk?

Best,

Jay

Founder | CEO