Interviews are opportunities to demonstrate your expertise, and this guide is here to help you shine. Explore the essential Empathy and understanding of clients in financial distress interview questions that employers frequently ask, paired with strategies for crafting responses that set you apart from the competition.

Questions Asked in Empathy and understanding of clients in financial distress Interview

Q 1. Describe your approach to building rapport with a client experiencing financial hardship.

Building rapport with a financially distressed client begins with genuine empathy and a non-judgmental approach. It’s about creating a safe space where they feel comfortable sharing their vulnerabilities. I start by actively listening, acknowledging their situation without minimizing their struggles, and validating their feelings. I might say something like, “I understand this is a difficult time, and I’m here to listen and help in any way I can.” I then focus on understanding their specific circumstances, their goals, and their fears, using open-ended questions to encourage them to share their story. I avoid interrupting or offering solutions prematurely; instead, I focus on creating a connection built on trust and understanding. A key aspect is mirroring their body language subtly to demonstrate empathy and build trust.

For example, if a client appears anxious, I might adjust my tone to be calmer and slower, mirroring their hesitant pace of speech. This small act of mirroring can create a sense of connection and make them feel heard and understood.

Q 2. How do you identify a client’s emotional state during a financial consultation?

Identifying a client’s emotional state involves keen observation and attentive listening. I look for both verbal and nonverbal cues. Verbal cues include their tone of voice, the language they use (e.g., using words like ‘overwhelmed’ or ‘hopeless’), and the content of their speech. Nonverbal cues are equally important, such as their body language (e.g., slumped posture, fidgeting), facial expressions (e.g., frowning, tearfulness), and even their breathing patterns. A client who is anxious might speak rapidly and nervously, while a depressed client might speak slowly and monotonously. I also pay attention to how they respond to my questions – are they hesitant, evasive, or emotionally charged?

For instance, if a client avoids eye contact, speaks in a low and hesitant tone, and repeatedly mentions feeling ‘lost’ or ‘defeated,’ I can infer that they are experiencing feelings of depression and hopelessness. This observation allows me to tailor my approach to address their emotional needs alongside their financial situation.

Q 3. Explain how you would handle a client expressing anger or frustration about their financial situation.

Handling a client’s anger or frustration requires patience, understanding, and a calm demeanor. I would first allow them to express their feelings without interruption, actively listening and validating their emotions. I might say, “I understand your frustration, and I appreciate you sharing this with me.” Once they’ve had a chance to vent, I would attempt to reframe the situation by focusing on finding solutions collaboratively. I might ask questions like, “What specifically is causing you the most frustration?” or “What would make this situation feel more manageable?” I would avoid arguing or becoming defensive, instead emphasizing my role as a supportive guide. I would also remind them that their feelings are valid and that together, we can work through this.

For example, if a client is angry about late fees, I would acknowledge their anger, explain the reasons behind the fees in a clear and non-confrontational way, and then explore potential solutions, such as setting up a payment plan or negotiating a reduced fee.

Q 4. What techniques do you use to actively listen and understand a client’s financial narrative?

Active listening involves more than just hearing; it’s about truly understanding the client’s perspective. I use several techniques to achieve this. First, I employ nonverbal cues such as maintaining eye contact, nodding, and mirroring their body language (appropriately). Second, I use verbal affirmations like, “I understand,” or “Tell me more.” Third, I paraphrase and summarize what they’ve said to ensure my understanding is accurate and to show them that I’m paying attention. This also allows them to clarify any misunderstandings. Finally, I ask clarifying questions to delve deeper into their story and gain a more complete picture of their financial narrative.

For example, instead of simply saying, “So, you’re having trouble paying your mortgage,” I would ask, “Can you tell me more about what’s making it difficult for you to pay your mortgage? What are the specific challenges you’re facing?” This open-ended question encourages the client to share more details and helps build a stronger understanding of their situation.

Q 5. How do you adapt your communication style to meet the diverse needs of clients in financial distress?

Adapting my communication style is crucial for effectively supporting diverse clients. I consider factors like age, cultural background, education level, and communication preferences. For example, I might use simpler language and avoid jargon when speaking with a client who is less financially literate. With elderly clients, I might adjust my pace of speech and ensure comfortable seating arrangements. I also pay close attention to their body language and adjust my approach accordingly. A quiet, reserved client might require a more gentle and patient approach than an outspoken, assertive one. Understanding their cultural background is crucial – what is considered polite or appropriate communication in one culture may be perceived differently in another. Building trust and rapport requires sensitivity and adaptability.

For example, if I’m working with a client who is non-native English speaker, I might use visual aids or a translator to ensure clear communication.

Q 6. Describe a situation where you had to empathize with a client facing a challenging financial decision. What was your approach?

I recall a client who was facing foreclosure. She was an elderly woman who had been a homemaker for most of her life and had limited financial literacy. She was overwhelmed, scared, and deeply ashamed. My approach was to first validate her feelings and reassure her that she wasn’t alone. I listened patiently as she described her situation, emphasizing her feelings rather than focusing solely on the financial details. I asked open-ended questions to help her articulate her fears and hopes for the future. We explored various options together, ensuring she fully understood the implications of each choice before making a decision. In the end, she chose to sell her home, a deeply emotional decision, but she felt empowered because she had made the choice herself, with my support and understanding.

This situation highlighted the importance of empathy not just in offering solutions, but also in creating a safe space for clients to process their emotions and make informed decisions based on their own values and priorities.

Q 7. How would you explain complex financial concepts to a client who is struggling to understand?

Explaining complex financial concepts to a struggling client requires patience, simplicity, and the use of relatable analogies. I avoid jargon and technical terms whenever possible, using plain language instead. I break down complex information into smaller, easily digestible chunks. I also utilize visual aids such as charts, graphs, or simple diagrams to illustrate key points. Real-life examples and analogies can make abstract concepts more tangible. I might use simple analogies to explain complex topics, for example, explaining compound interest using a snowball rolling down a hill to demonstrate how it grows over time.

For example, to explain the concept of APR (Annual Percentage Rate), instead of defining it technically, I might say, “Imagine you’re borrowing money. The APR is like the total cost of borrowing that money throughout the year, including any fees or interest.” I would then use a concrete example, showing how different APRs translate into different total amounts repaid.

Q 8. What strategies do you employ to help clients feel empowered and in control during a financial crisis?

Empowering clients during a financial crisis hinges on shifting the narrative from helplessness to agency. This involves a collaborative approach, focusing on what the client can control, rather than dwelling on what they can’t.

I start by actively listening to their concerns, validating their feelings, and reframing their situation in a positive light. For example, instead of saying “You’re in a lot of debt,” I might say, “Let’s explore strategies to manage your debt effectively.”

- Goal Setting: We collaboratively define achievable short-term and long-term goals. This provides a sense of direction and accomplishment along the way. Example: instead of aiming for complete debt elimination in one year (potentially overwhelming), we might aim to reduce it by 10% in the first three months.

- Budgeting & Tracking: I guide them through creating and sticking to a realistic budget, often using budgeting apps or spreadsheets. Regularly reviewing their progress helps maintain control and identify areas for improvement. This fosters a sense of ownership and accountability.

- Education & Empowerment: I explain financial concepts clearly, avoiding jargon. We explore different debt management options (e.g., debt consolidation, debt management plans), empowering them to make informed decisions. Providing resources and tools adds to their confidence.

The key is to foster a partnership where the client feels heard, understood, and actively involved in the solution-finding process. It’s about building their confidence in their own ability to navigate their financial challenges.

Q 9. How do you maintain professional boundaries while providing emotional support to a distressed client?

Maintaining professional boundaries while providing emotional support is crucial to both the client’s and my well-being. It’s a delicate balance, requiring empathy without over-involvement.

I achieve this by setting clear expectations from the outset: My role is to provide financial guidance and support, not to offer therapy or become a close confidante. I listen compassionately to their emotional distress, but I avoid offering personal opinions or advice outside my professional expertise.

- Time Limits: Sticking to scheduled appointments prevents sessions from becoming overly emotional or blurring boundaries.

- Referral to Other Professionals: If a client’s emotional needs exceed my capabilities, I readily refer them to a therapist or counselor.

- Professional Detachment: I consciously maintain emotional distance, avoiding becoming emotionally invested in their personal life beyond the scope of our professional relationship. While empathy is important, detachment ensures objectivity and prevents burnout.

Remember, offering emotional support in a professional setting is not about becoming their friend; it’s about providing a safe space for them to discuss their challenges and collaborate on solutions within the bounds of our professional relationship. This approach ensures both the client’s well-being and the integrity of the professional interaction.

Q 10. What resources would you suggest to a client struggling with overwhelming debt?

For clients overwhelmed by debt, I suggest a multi-pronged approach encompassing both immediate relief and long-term solutions.

- Credit Counseling Agencies: Non-profit credit counseling agencies offer debt management plans (DMPs) that negotiate with creditors to reduce interest rates and monthly payments. They provide budgeting guidance and financial education.

- Debt Consolidation Loans: If the client has good credit, a consolidation loan can combine multiple debts into a single, lower-interest loan, simplifying repayments. However, this option isn’t suitable for everyone.

- Government Assistance Programs: Depending on their situation and location, clients may be eligible for government assistance programs, such as housing assistance or food stamps, that can alleviate some financial pressures.

- Debt Settlement: This involves negotiating with creditors to settle debt for a lower amount than the full balance. It negatively impacts credit scores and should be considered cautiously.

Before recommending any specific resource, I conduct a thorough assessment of the client’s financial situation, considering their income, expenses, and credit history. The appropriate solution depends on their unique circumstances.

Q 11. Describe your experience navigating ethical considerations in working with clients in financial distress.

Ethical considerations are paramount in working with clients facing financial distress. Maintaining client confidentiality, avoiding conflicts of interest, and acting with integrity are non-negotiable.

One example is avoiding recommending products or services that benefit me financially rather than the client. I prioritize transparency in disclosing any potential conflicts of interest. Furthermore, I always maintain client confidentiality, following all relevant data protection regulations.

A challenging ethical dilemma might involve a client who is clearly making poor financial decisions despite my advice. In this case, my role is to provide information and support, while respecting their autonomy to make their own choices. However, if I suspect illegal activity (e.g., fraud), I have a legal and ethical obligation to report it. Balancing client autonomy with professional responsibility requires careful judgment and adherence to ethical codes of conduct.

Q 12. How do you recognize signs of financial abuse or exploitation in your clients?

Recognizing financial abuse or exploitation requires careful observation and questioning. Warning signs include:

- Unexplained withdrawals or transactions: Significant amounts of money disappearing from the client’s accounts without explanation.

- Controlling behavior by another person: A partner or family member consistently making financial decisions for the client, restricting their access to funds, or forcing them to make unwise financial choices.

- Unusual pressure to make financial decisions: The client feeling pressured to sign documents or make transactions they don’t understand or feel comfortable with.

- Inconsistencies in the client’s story: Discrepancies in their financial narrative or reluctance to provide details about their finances.

If I suspect abuse, I approach the situation cautiously and sensitively. I might start by asking open-ended questions, creating a safe space for the client to disclose any potential concerns. If abuse is confirmed or strongly suspected, I refer the client to appropriate agencies, such as domestic violence shelters or law enforcement, providing support and resources.

Q 13. How would you respond to a client who is hesitant to disclose personal financial information?

Hesitancy to disclose personal financial information is common, often stemming from shame, embarrassment, or fear of judgment. My approach focuses on building trust and creating a safe space for open communication.

I begin by validating their feelings and emphasizing that I’m there to help, not to judge. I explain how the information is essential to develop an effective plan and that their privacy will be respected. I don’t pressure them; instead, I offer gradual disclosure, starting with less sensitive information and building trust gradually.

For example, I might start by asking about their overall financial goals and concerns, without immediately delving into specific numbers. As our relationship develops and trust grows, they’ll often be more willing to share detailed information. Building rapport and demonstrating genuine care is crucial in overcoming this hurdle.

Q 14. Explain your process for developing a personalized financial plan for a client in a difficult financial situation.

Developing a personalized financial plan for a client in a difficult situation is a multi-step process:

- Assessment: I gather comprehensive financial information, including income, expenses, assets, liabilities, and debts. I also assess their financial literacy, goals, and risk tolerance.

- Goal Setting: Together, we define realistic and achievable short-term and long-term goals. These might include debt reduction, improving credit scores, or building an emergency fund.

- Budgeting & Cash Flow Management: We create a detailed budget, identifying areas for savings and expense reduction. We explore strategies to improve cash flow, such as negotiating lower interest rates or finding additional income sources.

- Debt Management Strategy: We explore the most appropriate debt management strategies, considering the client’s specific circumstances. This might include debt consolidation, debt management plans, or debt settlement.

- Financial Education: I provide ongoing education, empowering the client to make informed decisions and build financial skills for long-term success.

- Monitoring & Review: We regularly review the plan, making adjustments as needed based on the client’s progress and changing circumstances. This ensures the plan remains relevant and effective.

Throughout this process, maintaining open communication, empathy, and a collaborative approach is essential to ensure the plan aligns with the client’s needs and empowers them to regain control of their financial future.

Q 15. How do you help clients develop realistic financial goals during a time of crisis?

Helping clients establish realistic financial goals during a crisis requires a delicate balance of empathy and practical strategy. It’s not about imposing a rigid plan but collaboratively crafting a path forward that acknowledges their current situation while inspiring hope.

My approach begins with active listening. I aim to understand the client’s emotional state, their immediate concerns (e.g., housing, food security), and their long-term aspirations, even if they seem distant now. Then, I help them break down large, overwhelming goals into smaller, manageable steps. For example, instead of focusing on ‘paying off all debt,’ we might start with ‘reducing credit card debt by 10% in the next three months.’ This creates a sense of accomplishment and builds momentum. We also explore various debt management strategies, budget adjustments, and potential sources of financial assistance (government programs, charitable organizations).

A crucial aspect is identifying and challenging unrealistic expectations. This requires gentle yet firm communication. I might say something like, “I understand wanting to return to your pre-crisis financial state quickly, but given our current resources, that might not be immediately feasible. However, we can focus on stabilizing your situation and gradually build towards your long-term goals.” Regular check-ins and adjustments to the plan are essential, ensuring it remains relevant and achievable as the client’s circumstances evolve.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. What steps would you take if a client is unresponsive or unwilling to engage in financial planning?

Unresponsiveness or unwillingness to engage can stem from various factors: overwhelm, shame, distrust, or simply feeling lost and hopeless. My response would be multi-faceted. First, I’d acknowledge and validate their feelings. I might say something like, “I understand this is a difficult time, and it’s okay to feel overwhelmed. We’ll take it one step at a time.” I would also explore the reasons behind their reluctance, focusing on creating a safe and non-judgmental space.

I’d offer flexibility in communication methods. Some clients might prefer email or phone calls over in-person meetings. If appropriate, I’d involve a trusted family member or friend to help facilitate communication and support the client. I’d also suggest starting with smaller, less daunting tasks, gradually building trust and confidence. If the unresponsiveness continues despite these efforts, I would reassess the situation and consider referring the client to other support services, such as a therapist or counselor, to address the underlying emotional barriers to engagement.

Q 17. Describe a situation where you had to manage conflicting priorities or demands from a client in crisis.

I once worked with a client facing both imminent foreclosure and a critical health issue requiring extensive medical care. The client prioritized saving their home, viewing the mortgage as their primary concern. However, neglecting their health risked further financial strain in the long run, possibly through lost income or increased medical debt. This created a direct conflict.

My approach involved careful negotiation and prioritization. I helped the client understand the interconnectedness of their financial and health challenges. We explored options that addressed both needs: negotiating a forbearance with the mortgage lender while also exploring options like Medicaid or other assistance programs for medical expenses. It was a delicate process, requiring strong communication and sensitivity. The key was to help them see the larger picture and collaboratively develop a plan that, while imperfect, offered a path to address the most pressing issues without ignoring the long-term implications. We focused on securing short-term stability while setting the groundwork for a longer-term recovery plan.

Q 18. How do you measure the success of your interventions with clients facing financial difficulties?

Measuring success with clients facing financial difficulties goes beyond simply looking at numerical data. While improved credit scores, reduced debt, or increased savings are important indicators, they don’t capture the holistic impact of the intervention. My assessment involves both quantitative and qualitative measures.

Quantitative measures include tracking changes in debt levels, credit scores, and savings rates. Qualitative measures focus on the client’s reported well-being, their confidence in managing their finances, and their overall sense of control over their situation. I use regular check-in meetings, feedback surveys, and even informal conversations to gauge their progress and identify any challenges that might require adjustments to the plan. A client’s increased sense of empowerment and self-efficacy, even in the absence of dramatic financial improvements, is a significant measure of success. The goal is not just financial stability but also emotional resilience and improved financial literacy.

Q 19. What are the common challenges you encounter when working with clients experiencing financial distress?

Working with clients in financial distress presents several common challenges. One is the emotional toll it takes. Clients often experience intense stress, anxiety, shame, and hopelessness, which can make it difficult for them to engage in rational decision-making. Another challenge is the lack of trust. Many have had negative past experiences with financial institutions, making them hesitant to open up about their situation.

Navigating complex financial systems and regulations can also be difficult. Understanding eligibility for government assistance programs, negotiating with creditors, and unraveling complicated debt structures often require extensive research and expertise. Finally, a significant challenge is the potential for relapse. Clients may experience setbacks or unexpected financial difficulties that can derail their progress. Maintaining consistent support and developing long-term strategies to prevent future crises is crucial.

Q 20. How do you remain resilient and avoid burnout when working with emotionally vulnerable clients?

Resilience is crucial in this field. Burnout is a real risk when working with emotionally vulnerable clients. My strategies include maintaining clear boundaries between my professional and personal life, prioritizing self-care activities (exercise, healthy eating, mindfulness), and engaging in regular supervision or peer support. I also rely on a strong support network of colleagues, friends, and family.

Recognizing my emotional capacity and limitations is vital. I regularly evaluate my caseload and adjust it as needed to avoid feeling overwhelmed. If I find myself struggling to manage the emotional weight of a client’s situation, I don’t hesitate to seek support from colleagues or mental health professionals. It’s essential to remember that providing effective support to clients requires me to be emotionally healthy myself.

Q 21. Describe your experience using technology or software to support your work with clients in financial distress.

Technology plays a vital role in my work. I utilize budgeting apps (like Mint or YNAB) to help clients track their spending and create realistic budgets. Secure client portals allow for efficient document sharing and communication. Financial planning software assists in projecting cash flow, analyzing debt, and exploring various financial scenarios. For example, I might use software to demonstrate the impact of different debt repayment strategies or to illustrate the long-term benefits of saving and investing.

Data analytics tools provide insights into client demographics and financial behaviors, helping me identify patterns and tailor my interventions accordingly. Online resources and educational materials are invaluable in enhancing client financial literacy and empowering them to make informed decisions. While technology enhances efficiency and accessibility, it’s crucial to prioritize human interaction and empathetic communication – technology should complement, not replace, the personal connection that’s vital in building trust and rapport with clients in distress.

Q 22. How do you handle situations where a client’s financial problems are intertwined with other life challenges?

Financial distress rarely exists in isolation. Often, a client’s financial problems are deeply intertwined with other life challenges like job loss, illness, relationship breakdown, or addiction. My approach involves understanding the whole picture, not just the financial aspects. I begin by actively listening to the client, creating a safe and non-judgmental space for them to share their experiences. This holistic approach allows for a more comprehensive assessment of their needs and the development of a tailored support plan.

For example, a client facing bankruptcy might also be struggling with depression stemming from a recent divorce. Simply addressing the bankruptcy without acknowledging and addressing the emotional distress will likely be ineffective. In this scenario, I would work collaboratively with the client, perhaps referring them to a therapist or social worker while simultaneously developing a financial recovery plan. This integrated approach addresses both the root causes and the symptoms of their distress.

Q 23. How would you respond to a client who is feeling overwhelmed and hopeless about their finances?

Responding to a client feeling overwhelmed and hopeless requires empathy, patience, and a structured approach. I start by validating their feelings. Phrases like, “I understand this is incredibly difficult,” or “It’s understandable you’re feeling overwhelmed,” create a connection and demonstrate understanding. I then actively listen to their concerns without interruption, letting them fully express their emotions.

Following this, I shift to a more problem-solving approach, breaking down their financial situation into manageable steps. We would collaboratively analyze their income, expenses, debts, and assets. This process empowers them by shifting focus from the overwhelming entirety of the situation to smaller, actionable tasks. I might introduce budgeting tools or explore debt management strategies, always emphasizing achievable goals and celebrating even small victories to gradually rebuild their confidence.

Finally, I ensure the client understands they are not alone and connect them with appropriate resources, such as credit counseling services or government assistance programs.

Q 24. What are the legal and regulatory considerations that impact your work with clients in financial distress?

Legal and regulatory considerations are paramount in my work. I must adhere to strict confidentiality guidelines, as stipulated by laws like the Gramm-Leach-Bliley Act (GLBA) in the US, which protects client financial information. I also need to be aware of and comply with regulations surrounding debt collection practices, including the Fair Debt Collection Practices Act (FDCPA) in the US, which prevents abusive or deceptive debt collection methods.

Furthermore, I need to understand and be compliant with laws pertaining to bankruptcy, foreclosure, and other insolvency procedures. My advice must always be grounded in these legal frameworks, and I must be aware of the client’s rights and avoid providing advice that could be legally problematic. I often work in conjunction with legal professionals to ensure compliance and to provide clients with the best possible legal support.

Q 25. How do you collaborate effectively with other professionals (e.g., social workers, lawyers) when supporting clients facing financial hardship?

Collaboration is crucial when supporting clients in financial hardship. I regularly work with social workers, lawyers, and other professionals to provide comprehensive and integrated care. Effective collaboration involves open communication, shared goals, and respect for each professional’s expertise. I begin by obtaining informed consent from the client to share relevant information with other professionals.

For example, if a client is facing eviction due to unpaid rent, I would collaborate with a social worker to assess their eligibility for housing assistance programs while simultaneously working with a lawyer to explore options for preventing the eviction. Regular case conferences with all involved professionals ensure consistency in our approach and maximize the effectiveness of our interventions. Detailed case notes and clear communication channels maintain transparency and accountability.

Q 26. Describe your understanding of different financial products and services available to clients in distress.

My understanding of financial products and services for clients in distress is comprehensive. This includes knowledge of debt management plans, debt consolidation loans, credit counseling, bankruptcy options (Chapter 7, Chapter 13), government assistance programs (such as food stamps, housing assistance), and various types of foreclosure prevention programs.

I am also familiar with non-profit organizations that offer financial literacy programs and free or low-cost financial guidance. My understanding extends to the pros and cons of each option and I tailor my advice to the client’s specific circumstances, carefully weighing the long-term implications of each choice. I am diligent in ensuring the client fully understands the terms and conditions of any product or service before they make a decision.

Q 27. How do you identify and address potential biases in your interactions with clients from diverse backgrounds?

Identifying and addressing biases is vital for equitable service delivery. I am acutely aware of potential biases related to race, ethnicity, gender, age, and socioeconomic status that could unconsciously influence my interactions with clients. My approach involves continuous self-reflection and ongoing professional development to understand and mitigate these biases.

For instance, I actively avoid making assumptions based on a client’s background. Instead, I rely on fact-based assessments and actively listen to the client’s unique perspective. I also utilize culturally sensitive communication strategies and actively seek feedback from clients to ensure my approach is inclusive and respectful of their cultural values and beliefs. I regularly review my practices to identify any potential areas for improvement.

Q 28. What strategies do you use to build trust and credibility with clients who have experienced financial setbacks?

Building trust and credibility with clients who have experienced financial setbacks requires demonstrating empathy, competence, and integrity. I begin by establishing a rapport through active listening and genuine concern. I avoid judgmental language and focus on empowering the client through collaborative problem-solving.

Transparency and clear communication are essential. I explain complex financial concepts in simple terms, ensuring the client fully understands their options. I follow through on commitments and maintain regular contact, providing updates and support throughout the process. I emphasize my role as an advocate, working to protect their interests and ensure they receive fair treatment. By consistently demonstrating competence and integrity, I help rebuild the client’s trust and confidence in their ability to navigate their financial challenges.

Key Topics to Learn for Empathy and Understanding of Clients in Financial Distress Interview

- Active Listening and Non-Verbal Communication: Understanding the client’s emotional state beyond their words. Practice recognizing signs of stress and anxiety.

- Identifying Underlying Needs: Moving beyond the immediate financial problem to uncover the client’s deeper concerns and motivations. For example, understanding the impact of financial hardship on their family or long-term goals.

- Building Rapport and Trust: Establishing a safe and comfortable space for open communication. Demonstrating genuine care and concern for the client’s well-being.

- Appropriate Communication Strategies: Tailoring your communication style to the client’s individual needs and emotional state. Using clear, concise language, avoiding jargon, and demonstrating patience.

- Problem-Solving and Solution-Oriented Approach: Collaboratively exploring options and developing realistic, achievable solutions that address both the immediate financial crisis and long-term stability. This includes understanding the limitations of available resources.

- Ethical Considerations and Confidentiality: Maintaining strict confidentiality and adhering to professional ethical guidelines while providing support and guidance.

- Recognizing and Managing Your Own Emotions: Understanding the potential emotional toll of working with clients in distress and developing strategies for self-care and stress management. This ensures you can remain empathetic and effective.

- Navigating Difficult Conversations: Developing skills to handle challenging interactions, including delivering bad news or addressing difficult questions with sensitivity and professionalism.

Next Steps

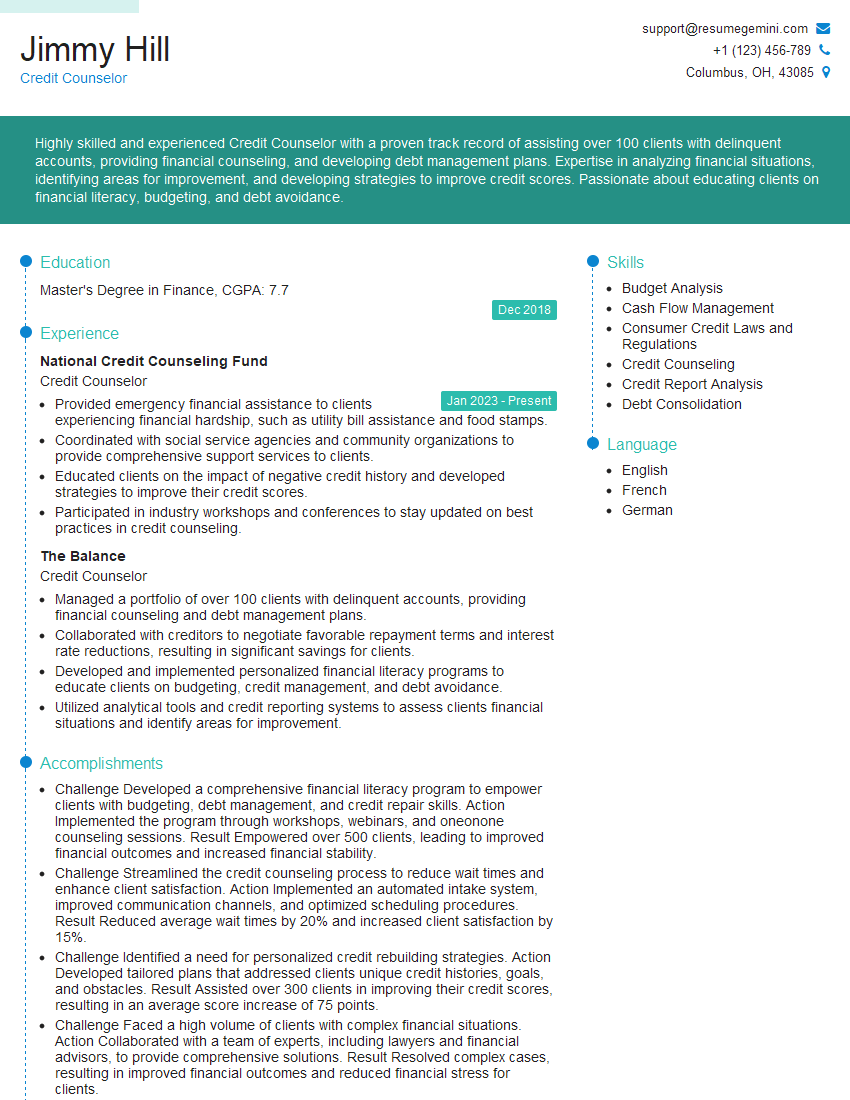

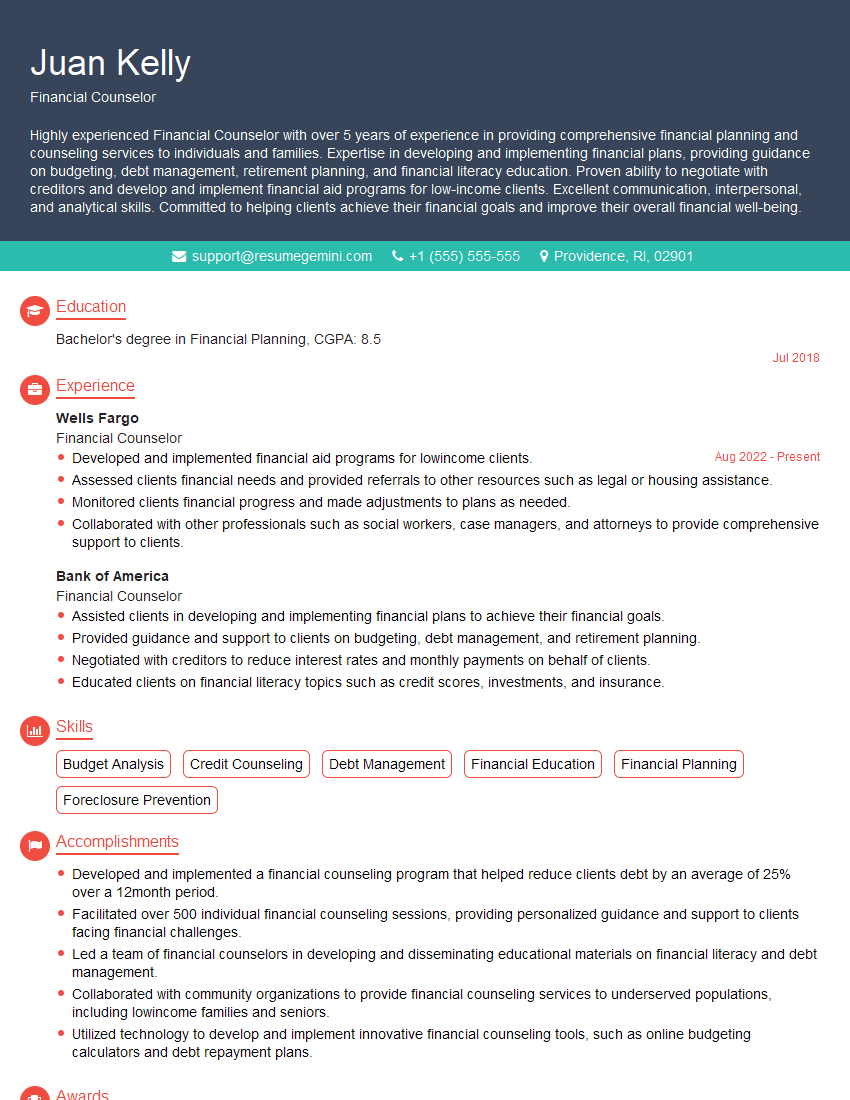

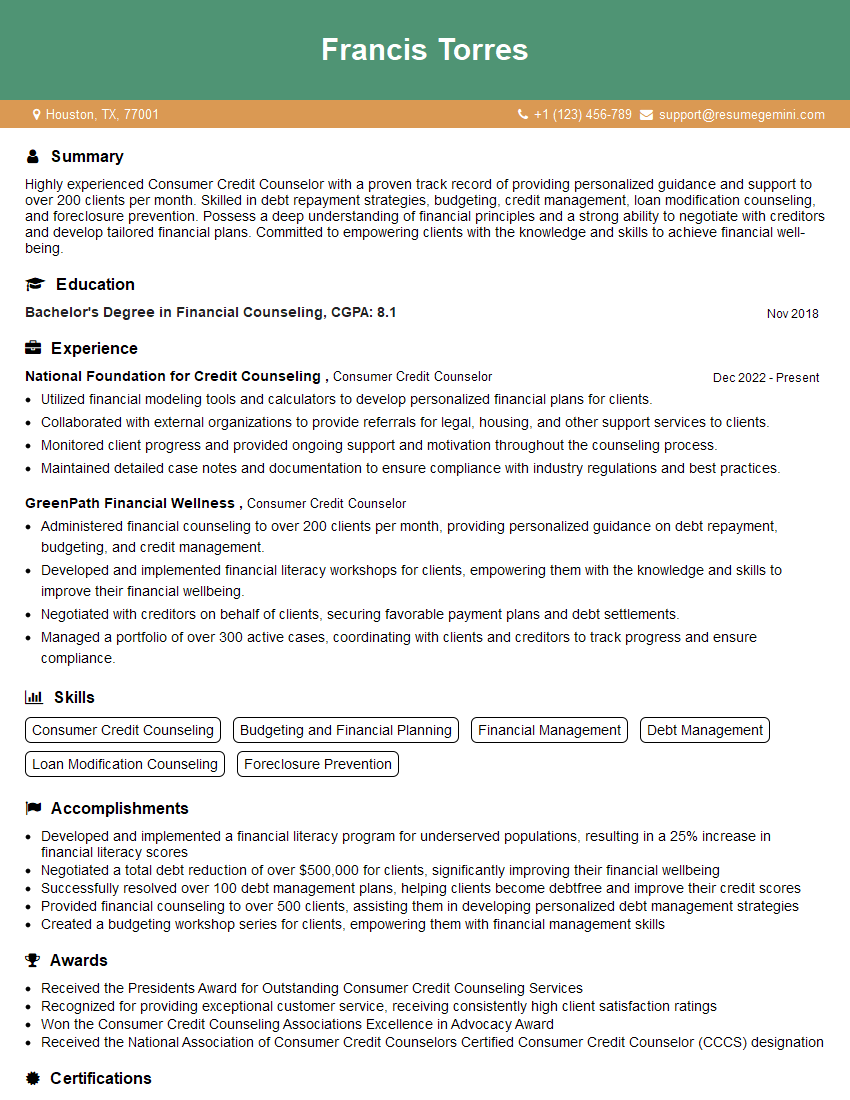

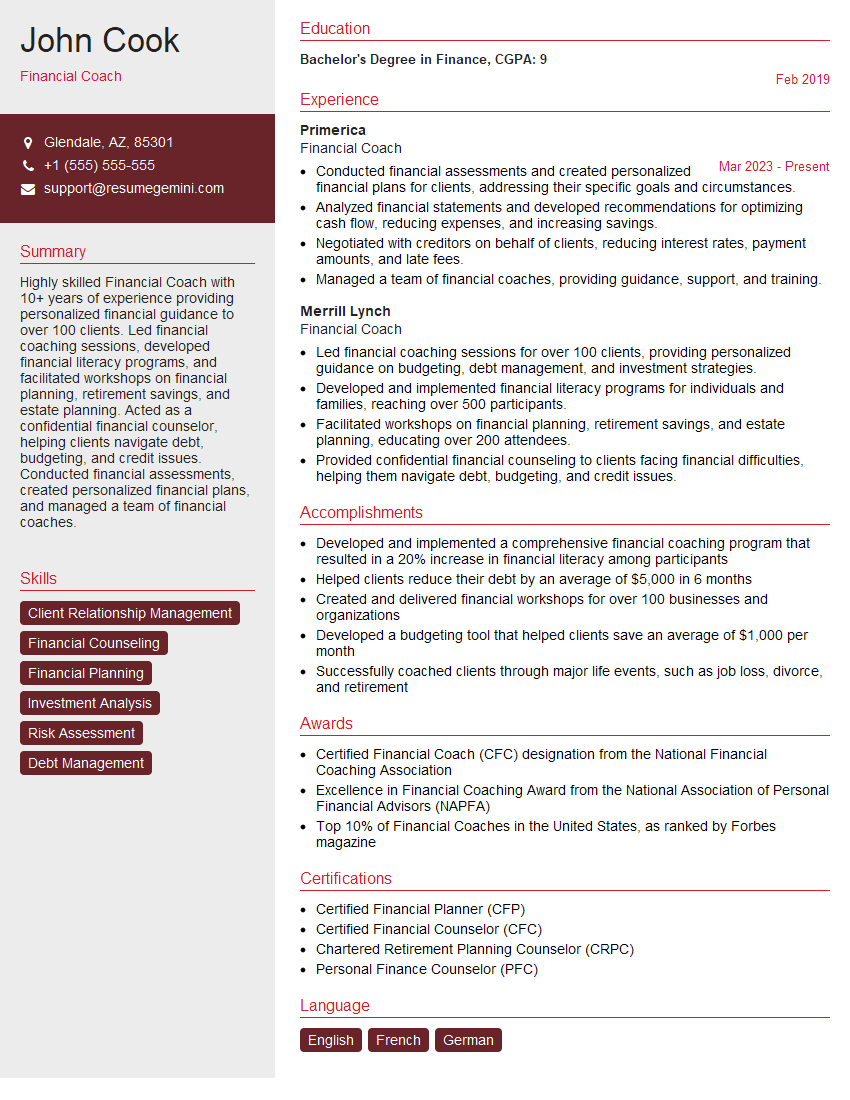

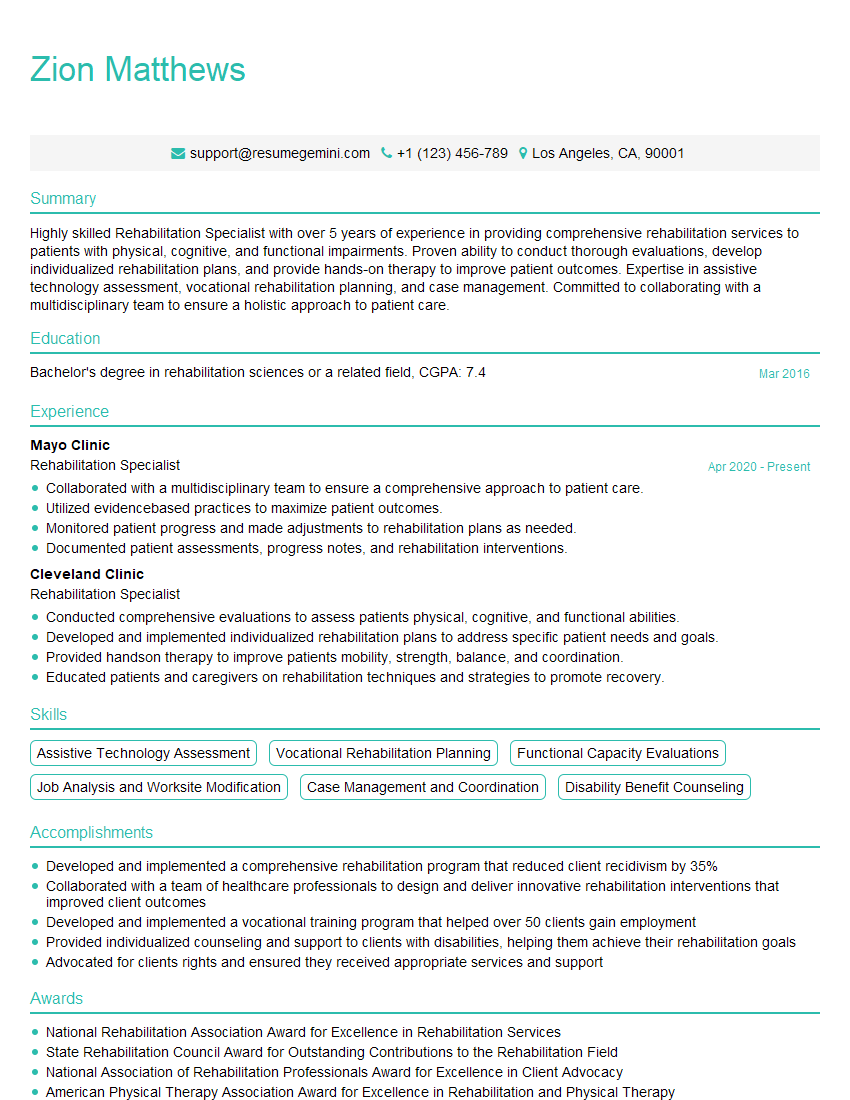

Mastering empathy and understanding of clients in financial distress is crucial for building a successful and rewarding career in financial services. It demonstrates your commitment to client well-being and positions you as a valuable asset to any organization. To significantly increase your job prospects, focus on building an ATS-friendly resume that clearly showcases these vital skills. ResumeGemini is a trusted resource to help you create a compelling and effective resume that highlights your abilities. Examples of resumes tailored to showcasing empathy and understanding of clients in financial distress are available to guide you.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

Hi, I’m Jay, we have a few potential clients that are interested in your services, thought you might be a good fit. I’d love to talk about the details, when do you have time to talk?

Best,

Jay

Founder | CEO