The thought of an interview can be nerve-wracking, but the right preparation can make all the difference. Explore this comprehensive guide to Financial Counseling Standards Board (FICSB) Certification interview questions and gain the confidence you need to showcase your abilities and secure the role.

Questions Asked in Financial Counseling Standards Board (FICSB) Certification Interview

Q 1. Explain the core ethical principles outlined in the FICSB Code of Ethics.

The FICSB Code of Ethics centers around upholding the highest standards of professionalism and client well-being. Its core principles revolve around:

- Integrity: This means maintaining honesty and transparency in all interactions with clients and stakeholders. It involves avoiding conflicts of interest and disclosing any potential biases. For example, I would clearly state any affiliations with specific financial institutions.

- Objectivity: Financial counseling should be impartial, based on factual information and the client’s best interests, not personal gain. I always strive to present a balanced perspective, exploring multiple solutions and not pushing any specific product or service.

- Competence: This emphasizes ongoing professional development and staying updated on best practices. I regularly attend conferences, workshops, and engage in continuing education to maintain my knowledge of financial regulations and best counseling techniques.

- Confidentiality: Protecting client information is paramount. All discussions and data remain confidential unless legally obligated to disclose otherwise. I inform clients upfront about data privacy practices and adhere strictly to relevant regulations.

- Diligence: This highlights the importance of thoroughness, accuracy, and timeliness in all aspects of the counseling process. I meticulously review all financial documents and provide detailed explanations of recommendations.

Q 2. Describe the different types of financial counseling you’re qualified to provide.

As a FICSB-certified financial counselor, I’m qualified to provide a wide range of services, including:

- Budgeting and Debt Management: Helping clients create realistic budgets, develop strategies for debt reduction, and navigate the complexities of credit management.

- Financial Goal Setting: Assisting clients in defining their short-term and long-term financial objectives (e.g., saving for retirement, homeownership, education), and crafting plans to achieve them.

- Financial Education: Providing clients with the knowledge and skills necessary to make informed financial decisions. This often includes teaching concepts like compound interest, investing basics, and risk management.

- Consumer Credit Counseling: Advising clients on responsible credit use and helping them resolve credit issues like high debt or damaged credit scores.

- Housing Counseling: Providing guidance on home buying, mortgage options, and foreclosure prevention.

The scope of my services depends on the client’s needs and my expertise. I always ensure I’m working within my competency and refer clients to specialists when necessary.

Q 3. How do you assess a client’s financial situation using FICSB-recommended methods?

Assessing a client’s financial situation involves a thorough and systematic approach. FICSB-recommended methods include:

- Gathering Information: I begin by collecting comprehensive financial data through interviews, reviewing documents like pay stubs, bank statements, tax returns, and credit reports.

- Analyzing Income and Expenses: I meticulously analyze the client’s income sources and expenditure patterns to identify areas for improvement and potential financial challenges. This often involves using budgeting software or spreadsheets.

- Evaluating Assets and Liabilities: I create a net worth statement to assess the client’s overall financial health by comparing their assets (e.g., savings, investments, property) against their liabilities (e.g., debts, loans).

- Identifying Financial Goals: A crucial part of the assessment is understanding the client’s financial goals and aspirations. This helps tailor the counseling process to their specific needs and priorities.

- Assessing Risk Tolerance: Understanding a client’s risk tolerance is vital for recommending suitable financial strategies, particularly when discussing investments.

This comprehensive approach provides a clear picture of the client’s current financial standing and allows for the development of a personalized plan.

Q 4. What budgeting methods do you employ, and how do they align with FICSB guidelines?

I employ several budgeting methods, aligning with FICSB guidelines which emphasize realistic and sustainable approaches. These include:

- 50/30/20 Budget: This allocates 50% of after-tax income to needs, 30% to wants, and 20% to savings and debt repayment. It’s a simple yet effective starting point for many clients.

- Zero-Based Budgeting: This method assigns every dollar a specific purpose, ensuring that all income is accounted for. It requires careful tracking and planning but can be highly effective for debt reduction.

- Envelope System: This involves allocating cash to different spending categories and using physical envelopes to track spending. It can help control impulse purchases and promote mindful spending.

The choice of method depends on the client’s financial situation, personality, and learning style. I often work collaboratively with clients to find the approach that best fits their needs and preferences. I also emphasize the importance of regular budget review and adjustments.

Q 5. How do you identify and address potential conflicts of interest in your practice?

Identifying and addressing conflicts of interest is crucial for maintaining ethical practice. I proactively mitigate potential conflicts through:

- Transparency: I openly disclose any potential conflicts, such as affiliations with financial institutions or products I might recommend. Clients are always informed of my potential biases and the reasons behind my recommendations.

- Referral Networks: I have a network of trusted professionals (e.g., tax advisors, attorneys) to refer clients to when a conflict arises or when their needs are beyond my expertise.

- Documentation: I meticulously document all interactions and decisions to ensure transparency and accountability. This helps prevent misunderstandings and provides a clear record of the counseling process.

- Prioritization of Client Interests: In any situation where a conflict of interest might arise, I prioritize the client’s best interests and avoid actions that could benefit me personally at their expense. My primary responsibility is serving my client’s best interest.

By consistently applying these practices, I maintain the integrity of my work and ensure that clients receive unbiased and objective advice.

Q 6. Explain your understanding of responsible lending practices.

Responsible lending practices involve ensuring that borrowers are fully informed and understand the terms and conditions of a loan before they commit. This includes:

- Transparency: Clearly disclosing all fees, interest rates, and repayment terms in plain language. Avoid using complicated jargon or hidden fees.

- Affordability: Assessing the borrower’s ability to repay the loan without causing undue financial hardship. This involves considering income, expenses, and existing debts.

- Fair Pricing: Offering loans at competitive interest rates and avoiding predatory lending practices that exploit borrowers’ vulnerabilities.

- Due Diligence: Thoroughly verifying the borrower’s information and identity to minimize the risk of fraud.

- Responsible Marketing: Avoiding misleading or deceptive advertising practices that could entice borrowers into taking on more debt than they can handle.

As a financial counselor, I advocate for responsible lending practices and educate clients on how to evaluate loan offers critically. I advise clients to compare various loan products, carefully review the fine print, and ensure they completely understand the terms before signing any agreement.

Q 7. Describe a situation where you had to handle a difficult client interaction, and how you resolved it.

I once had a client who was deeply in debt and extremely resistant to making even small changes to her spending habits. She became defensive during our sessions, expressing frustration and blaming external factors for her financial situation.

My approach focused on empathy and active listening. I acknowledged her feelings, validating her frustration without condoning her spending habits. Instead of directly criticizing her spending, I engaged her in a collaborative discussion, helping her identify her spending triggers and exploring alternative options. We started with small, achievable goals rather than overwhelming her with drastic changes. For example, we focused on tracking expenses for a week before making any significant budgeting adjustments. This gradual approach, combined with ongoing support and encouragement, helped her build confidence and ultimately develop a sustainable budget. Over time, she became more receptive to advice and actively participated in the process, demonstrating significant progress in debt reduction.

Q 8. How do you maintain client confidentiality while adhering to FICSB standards?

Maintaining client confidentiality is paramount in financial counseling, and the FICSB standards emphasize this heavily. It’s not just about following regulations; it’s about building trust. I adhere to strict protocols, beginning with obtaining informed consent before sharing any information. This means clearly explaining how client data will be used, stored, and protected. I only access client information that is strictly necessary for providing the services they have requested. I utilize secure electronic systems for storing and transferring sensitive data, and I ensure that all my electronic devices and software are up-to-date with security patches. Furthermore, I never discuss client matters with anyone outside our agency without explicit permission, and I treat all communications as confidential and appropriately secure.

For instance, if a client shares information about a difficult family situation impacting their finances, that information is solely for understanding their financial struggles and developing appropriate strategies. I would never share that information without their direct consent, even with colleagues discussing their case anonymously. My commitment to confidentiality extends beyond the scope of our sessions, encompassing all forms of communication.

Q 9. What strategies do you use to empower clients to manage their finances independently?

Empowering clients is at the heart of effective financial counseling. It’s about shifting from a dependency model to a collaborative partnership. My strategy involves several key steps. First, I focus on building financial literacy by providing clear explanations of complex concepts. I use plain language, avoiding jargon, and tailor explanations to the client’s individual understanding. Second, I encourage active participation in setting goals. Clients are better motivated when they’re invested in the process. Third, I utilize a strengths-based approach; I highlight their existing skills and resources. Even if clients feel financially overwhelmed, they often possess valuable skills or resources they might overlook.

For example, I might work with a client to create a realistic monthly budget, showing them how to track their spending and identify areas for improvement. Rather than simply telling them what to do, I guide them through the process and help them build confidence in managing their finances. Throughout this process, I’m constantly reinforcing their self-efficacy by highlighting their progress and celebrating achievements, no matter how small.

Q 10. Explain your understanding of debt management strategies and which methods align with FICSB recommendations.

Debt management is a crucial aspect of financial counseling. FICSB emphasizes developing realistic and sustainable plans. I begin by helping clients understand the full scope of their debt, including interest rates and payment terms. Then, we prioritize debts based on interest rates and minimum payments. We explore strategies like the debt snowball (paying off the smallest debt first for motivation) or the debt avalanche (paying off the highest-interest debt first for cost savings). Debt consolidation or balance transfers might be considered if it results in lower interest rates. I advise clients to avoid high-cost debt solutions, like payday loans or predatory lenders, which often worsen the financial situation.

FICSB recommendations stress the importance of a holistic approach, considering the client’s entire financial picture. We look at income, expenses, and savings goals to build a strategy that works within their budget. Regular communication and adjustments are critical as unexpected circumstances might arise. For example, if a client experiences a job loss, we immediately revise the plan to accommodate the changed circumstances, possibly negotiating with creditors for forbearance.

Q 11. How do you work with clients facing financial emergencies?

Financial emergencies can be incredibly stressful. My immediate priority is to help clients stabilize their situation. This involves assessing their immediate needs and exploring available resources. We might identify emergency funds, government assistance programs (such as SNAP or unemployment benefits), charitable organizations, or short-term loans with reasonable interest rates. The goal is to address the immediate crisis while creating a plan to prevent future emergencies.

For instance, if a client faces eviction, I’d immediately work with them to contact their landlord, explore rental assistance programs, and identify temporary housing options. Simultaneously, we’d begin developing a long-term budget to prevent future housing instability.

Q 12. How do you incorporate technology and digital tools into your financial counseling sessions?

Technology plays a significant role in modern financial counseling. I use secure client portals for document sharing and communication, ensuring confidentiality and convenience. Budgeting apps and financial tracking tools are invaluable for clients to monitor their spending and progress towards goals. I might use video conferencing for sessions, expanding accessibility for clients in remote areas or those with mobility issues. Data visualization tools help illustrate complex financial concepts in a clear and understandable way.

For instance, I might use a budgeting app to collaboratively create a client’s budget, allowing them to easily track their spending in real-time. This visual representation often improves engagement and understanding. I also utilize secure messaging within the client portal to maintain regular communication between sessions.

Q 13. What are the key components of a comprehensive financial plan, according to FICSB best practices?

A comprehensive financial plan, aligned with FICSB best practices, encompasses several key components. First is a detailed assessment of the client’s current financial situation, including income, assets, liabilities, and debts. This is followed by setting clear financial goals, such as saving for retirement, buying a house, or paying off debt. Then comes the development of a detailed budget to manage expenses and allocate resources to achieve goals. Risk management is critical, including insurance planning and strategies for handling unexpected events. Finally, the plan needs regular reviews and adjustments to adapt to changes in the client’s life or economic conditions.

The plan should also include strategies for investment and wealth building, tailored to the client’s risk tolerance and time horizon. It is essential to educate the client on the plan, ensure understanding, and help them build the skills and confidence to manage their finances independently. The process should be iterative and collaborative, with consistent communication and support.

Q 14. How do you adapt your counseling approach to clients with diverse financial backgrounds and needs?

Adaptability is crucial. I understand that diverse backgrounds bring unique financial situations and needs. My approach is culturally sensitive and avoids making assumptions. I actively listen to understand clients’ experiences, perspectives, and priorities. I might adapt my communication style, using plain language and avoiding financial jargon. I also consider cultural nuances that might impact financial decision-making and tailor my recommendations accordingly. Understanding factors like immigration status, language barriers, and access to resources is vital for effective counseling.

For example, working with an immigrant family might require familiarity with resources specific to their needs, such as organizations that provide support for new arrivals. Similarly, someone with a disability might require assistance navigating programs for accessibility and financial support.

Q 15. How do you measure the success of your financial counseling interventions?

Measuring the success of financial counseling interventions isn’t solely about a client’s immediate financial improvement; it’s about long-term behavioral change and sustainable financial health. We use a multi-faceted approach.

- Quantitative Measures: We track key metrics like debt reduction percentage, credit score improvement, savings rate increase, and the client’s attainment of specific financial goals (e.g., creating an emergency fund, paying off a high-interest credit card). These are objectively measured using data from credit reports, bank statements, and client-provided information.

- Qualitative Measures: Regular check-ins and client feedback forms are crucial. We assess changes in the client’s financial knowledge, confidence in managing their finances, and their ability to make informed financial decisions. For example, a client might initially struggle with budgeting, but after several sessions demonstrate significantly improved budgeting skills and a reduction in impulsive spending.

- Goal Attainment: Success is ultimately defined by the client achieving their personalized financial goals, whether it’s buying a home, paying off student loans, or securing a comfortable retirement. We work collaboratively to establish realistic, measurable, achievable, relevant, and time-bound (SMART) goals.

By combining quantitative and qualitative data, we gain a holistic understanding of the impact of our interventions and continuously refine our strategies to maximize effectiveness. For instance, if we see a consistent failure to meet savings goals, we might adjust our approach to focus more on behavioral strategies like creating automated savings plans.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. Describe your experience with various debt relief options (e.g., debt consolidation, debt settlement).

My experience encompasses a range of debt relief strategies, tailored to each client’s unique financial situation and risk tolerance.

- Debt Consolidation: I’ve helped numerous clients consolidate high-interest debts into a single lower-interest loan, often through a balance transfer credit card or personal loan. This simplifies repayment and can significantly reduce interest payments. For example, a client with several credit cards carrying high interest rates might consolidate their debt into a single loan with a lower APR, making their monthly payments more manageable.

- Debt Settlement: This involves negotiating with creditors to settle debt for less than the full amount owed. It’s a more aggressive strategy, often involving temporary hardship and impacting credit scores. I thoroughly explain the risks and benefits before recommending this option. This approach is generally a last resort after exploring all other options and is only suitable for clients who understand the consequences.

- Debt Management Plans (DMPs): I guide clients through the process of establishing DMPs with credit counseling agencies. These plans involve consolidating monthly payments into one, often with reduced interest rates and fees. The agency negotiates with creditors on the client’s behalf.

The choice of debt relief strategy is not one-size-fits-all. It requires careful consideration of the client’s financial situation, credit history, risk appetite, and long-term financial goals. My role involves providing unbiased guidance and helping the client choose the most appropriate path for their circumstances.

Q 17. Explain your knowledge of consumer credit laws and regulations.

A strong understanding of consumer credit laws and regulations is fundamental to ethical and effective financial counseling. My knowledge covers several key areas:

- Fair Credit Reporting Act (FCRA): I’m proficient in understanding consumers’ rights regarding their credit reports, including the process of disputing inaccurate information and accessing their credit scores.

- Fair Debt Collection Practices Act (FDCPA): I advise clients on their rights when dealing with debt collectors, ensuring they are not subjected to harassment or unfair practices. I help clients identify and avoid predatory lenders.

- Truth in Lending Act (TILA): This helps me explain to clients the intricacies of loan terms, interest rates, and fees, empowering them to make informed borrowing decisions. I ensure they understand all aspects of a credit agreement before signing.

- Bankruptcy Laws: While not always recommended, I have knowledge of bankruptcy as a potential last resort option and can explain the different types of bankruptcy and their implications. I always prioritize exploring less drastic options first.

Staying updated on changes in consumer credit laws and regulations is crucial. I regularly attend continuing education courses and review relevant legal updates to ensure my knowledge remains current and accurate.

Q 18. How do you handle situations where a client is unwilling to follow your recommendations?

When a client is unwilling to follow my recommendations, I address the situation with empathy and understanding. The key is to discover the underlying reasons for their resistance.

- Active Listening and Empathy: I start by actively listening to their concerns and validating their feelings. Often, resistance stems from fear, lack of understanding, or perceived limitations. For example, a client may resist creating a budget because they fear it will restrict their lifestyle.

- Collaborative Goal Setting: We revisit their financial goals and explore alternative strategies that align with their preferences and values. Perhaps we can modify the budget to accommodate their needs or find alternative ways to achieve their financial objectives.

- Education and Empowerment: I re-explain concepts, provide additional resources, or offer alternative approaches to increase their understanding and confidence. Sometimes, a simple shift in perspective is all that’s needed.

- Realistic Expectations: We might adjust the timeline for achieving goals to make them more achievable and less daunting. Breaking down large tasks into smaller, manageable steps can improve compliance.

- Referral if Necessary: If a client consistently refuses to engage in collaborative problem-solving, I might refer them to another professional who can better assist their needs. Sometimes, additional support from a therapist or counselor is necessary.

My ultimate goal is to empower clients to make informed decisions, even if those decisions differ from my initial recommendations. The counseling relationship should be built on trust and mutual respect.

Q 19. How do you ensure the accuracy and reliability of financial information you provide to clients?

Ensuring accuracy and reliability is paramount. I adhere to strict protocols:

- Source Verification: I always verify financial information from multiple reputable sources, such as official websites of financial institutions, government databases, and verified publications. I never rely on a single source.

- Data Integrity: I maintain meticulous records of all client interactions and data obtained. This includes client files, meeting notes, and communication logs, ensuring traceability and accountability.

- Client Involvement: I encourage clients to actively participate in reviewing and verifying their financial data. This collaborative approach reduces errors and fosters trust.

- Continuing Education: I remain current on best practices in financial information management and adhere to relevant professional standards and certifications such as the FICSB certification, ensuring adherence to ethical and professional guidelines.

- Technology Usage: I utilize secure, encrypted software and platforms to store and manage sensitive client information, complying with all relevant data privacy regulations.

By adhering to these practices, I ensure that the financial information I provide to clients is both accurate and reliable, forming the basis for informed and effective decision-making.

Q 20. Describe your experience with different types of financial planning software or tools.

My experience with financial planning software and tools is extensive, ranging from budgeting apps to comprehensive financial planning software.

- Budgeting Apps (e.g., Mint, YNAB): I use these tools to help clients track their income and expenses, identify areas for improvement, and create realistic budgets. The visualization features are beneficial for clients who struggle with traditional budgeting methods.

- Financial Planning Software (e.g., MoneyGuidePro, RightCapital): These more advanced platforms allow me to create comprehensive financial plans, including retirement projections, investment strategies, and tax planning scenarios. They help me present complex information in a clear and understandable manner to clients.

- Credit Report and Score Monitoring Services (e.g., Credit Karma, Experian): These tools are invaluable for monitoring client credit scores, identifying potential issues, and tracking progress in improving their credit health.

- Spreadsheet Software (e.g., Microsoft Excel, Google Sheets): These are fundamental tools for organizing and analyzing client financial data, creating custom reports, and presenting information in a clear format.

My software choices depend on the client’s specific needs and the complexity of their financial situation. I select tools that are user-friendly, secure, and integrate well with other systems. I am also adept at explaining how these tools can empower clients to manage their finances independently after our sessions conclude.

Q 21. How do you protect yourself and your clients from fraud and scams?

Protecting clients (and myself) from fraud and scams is a top priority. My strategies include:

- Education and Awareness: I educate clients on common types of financial scams (e.g., phishing, advance-fee fraud, investment scams) and teach them how to identify red flags. I encourage them to be skeptical of unsolicited offers and to verify information from multiple reputable sources.

- Due Diligence: I thoroughly vet all financial products and services before recommending them to clients. This includes checking the legitimacy of companies, reviewing client testimonials, and considering potential risks.

- Data Security: I use strong passwords, firewalls, antivirus software, and data encryption to protect client information from unauthorized access. I comply with all relevant data privacy regulations.

- Referral Network: I have a network of trusted professionals (lawyers, accountants) to whom I can refer clients if they suspect fraud or require additional legal or professional assistance.

- Reporting Suspicious Activity: I know to report any suspected fraudulent activity to the appropriate authorities, such as the Federal Trade Commission (FTC) or the Securities and Exchange Commission (SEC).

Continuous vigilance and proactive measures are crucial in protecting both myself and my clients from financial fraud and scams. This involves staying updated on emerging scams and educating clients on ways to safeguard their financial well-being.

Q 22. Explain your understanding of the importance of continuing education in financial counseling.

Continuing education in financial counseling is paramount for several reasons. The financial landscape is constantly evolving, with new regulations, investment vehicles, and technological advancements emerging regularly. Staying abreast of these changes is crucial to providing clients with accurate, relevant, and effective advice. Without continuous learning, a counselor risks offering outdated or even harmful strategies.

For example, changes in tax laws, the rise of fintech apps, or shifts in retirement planning best practices necessitate ongoing professional development. Failing to adapt means potentially misguiding clients and compromising their financial well-being. It also ensures counselors remain competent and maintain ethical standards, ultimately enhancing their professional credibility and client trust.

- Enhanced Client Outcomes: Up-to-date knowledge directly translates to better results for clients, helping them achieve their financial goals more effectively.

- Ethical Practice: Staying current ensures adherence to ethical codes of conduct and prevents the provision of outdated or inaccurate information.

- Professional Credibility: Continuous learning demonstrates a commitment to excellence and builds trust among clients and peers.

Q 23. What resources do you utilize to stay up-to-date on changes in financial regulations and best practices?

To stay current, I utilize a variety of resources, including:

- Professional Organizations: I actively participate in the Financial Planning Association (FPA), the National Association of Personal Financial Advisors (NAPFA), and similar organizations that offer webinars, conferences, and publications on the latest trends and regulatory updates. These provide peer-to-peer learning opportunities and access to expert insights.

- Regulatory Bodies: I regularly review materials from the SEC, CFPB, and other relevant regulatory agencies to stay informed about changes in laws and compliance requirements. I subscribe to their newsletters and announcements.

- Reputable Financial Publications: I read respected journals and publications such as the Journal of Financial Planning and other industry-specific magazines and online resources to learn about new research and best practices.

- Continuing Education Courses: I actively participate in continuing education courses offered by accredited providers to fulfill my certification requirements, and also to explore specific areas of interest or emerging trends.

Q 24. How do you maintain your professional certifications and adhere to continuing education requirements?

Maintaining my professional certifications involves diligently tracking my continuing education credits and submitting the required documentation to the certifying body. This typically involves completing a certain number of hours of approved courses within a specified timeframe. I meticulously keep records of all my completed courses, including certificates of completion and course descriptions, to ensure seamless compliance. I usually plan my continuing education well in advance, scheduling courses strategically to meet my annual requirements and avoid last-minute rushes. Many organizations offer online courses, allowing flexibility in scheduling and accommodating busy professional lives.

For example, if my certification requires 30 hours of continuing education annually, I’ll break this down into smaller, manageable chunks throughout the year, perhaps attending webinars or taking online modules regularly rather than trying to cram everything in at the end.

Q 25. Describe your familiarity with relevant legal and regulatory frameworks in financial counseling.

My familiarity with relevant legal and regulatory frameworks is extensive. I understand the importance of adhering to regulations set forth by bodies like the Securities and Exchange Commission (SEC), the Consumer Financial Protection Bureau (CFPB), and state-specific licensing boards. This includes a deep understanding of laws pertaining to fiduciary duty, investment advisory regulations, consumer protection acts, and data privacy laws. I am acutely aware of the legal and ethical implications of my advice and ensure all my actions are compliant. This knowledge is not just theoretical; it’s directly integrated into how I counsel clients and manage their financial data. For instance, I am meticulous about obtaining informed consent, safeguarding client information, and disclosing any potential conflicts of interest.

Q 26. How do you address cultural and linguistic barriers in providing financial counseling services?

Addressing cultural and linguistic barriers is crucial for effective financial counseling. I approach this through several methods:

- Language Access: I utilize translation services or bilingual staff when necessary to ensure clear communication with clients who don’t speak English fluently. I also make sure any materials provided are translated accurately.

- Cultural Sensitivity: I take time to understand the client’s cultural background and adapt my communication style accordingly. This includes being mindful of potential differences in financial values, attitudes towards debt, and family structures. For example, understanding a client’s cultural values around saving and spending can influence the approach to developing a financial plan.

- Culturally Competent Training: I regularly seek out training in cultural competency to enhance my awareness and understanding of diverse client needs.

- Community Resources: I am aware of and utilize resources within the community that support diverse populations and can refer clients to these resources when appropriate.

Q 27. Explain your understanding of the impact of financial stress on mental and physical health.

Financial stress significantly impacts mental and physical health. The constant worry about money can lead to anxiety, depression, sleep disturbances, and even physical ailments like high blood pressure and heart problems. The impact can be particularly acute during challenging economic times or when facing unexpected financial setbacks like job loss or medical emergencies. I’ve witnessed firsthand how clients burdened by financial difficulties exhibit increased levels of stress and anxiety, leading to difficulty in decision-making and overall diminished well-being.

For example, a client facing mounting debt may experience anxiety that affects their sleep, impacting their daily productivity and relationships. Recognizing this connection allows me to tailor my counseling to address not just the financial issues but also the emotional toll they take on the client’s life.

Q 28. How do you incorporate client education and financial literacy into your counseling sessions?

Client education and financial literacy are cornerstones of my counseling sessions. I don’t simply provide advice; I empower clients to understand their finances and make informed decisions. This is achieved through:

- Interactive Sessions: Instead of lectures, I use interactive methods like budgeting workshops, simulations, and personalized financial planning exercises. I aim to create a collaborative learning experience rather than a passive one.

- Plain Language: I avoid jargon and use simple, straightforward language to ensure the information is easily understood. I also adapt my language and examples based on the client’s background and understanding of finance.

- Resource Provision: I provide clients with access to helpful resources, including educational websites, budgeting apps, and reputable financial literacy materials. This ensures ongoing learning and support beyond our sessions.

- Goal Setting: We work together to set achievable financial goals, making the learning process relevant and motivating. This sense of progress helps to build confidence and encourages ongoing engagement with financial management.

Key Topics to Learn for Financial Counseling Standards Board (FICSB) Certification Interview

- Ethical and Legal Considerations: Understand the core ethical principles governing financial counseling and the legal ramifications of non-compliance. Be prepared to discuss case studies illustrating ethical dilemmas and appropriate responses.

- Financial Planning Principles: Demonstrate a firm grasp of budgeting, debt management, investing, and retirement planning. Be ready to apply these principles to diverse client scenarios and explain your reasoning.

- Client Communication and Counseling Techniques: Showcase your ability to build rapport with clients, actively listen, and effectively communicate complex financial information in a clear and understandable manner. Discuss different counseling styles and their appropriateness in various situations.

- Risk Management and Assessment: Explain your understanding of assessing client risk tolerance and implementing strategies to mitigate financial risks. Be ready to discuss specific risk assessment tools and methodologies.

- Financial Statement Analysis and Interpretation: Demonstrate your ability to analyze financial statements (balance sheets, income statements, cash flow statements) to identify financial strengths, weaknesses, and opportunities for improvement. Practice interpreting these statements within the context of a client’s overall financial situation.

- Financial Product Knowledge: Display familiarity with various financial products and services (e.g., insurance, loans, investments) and their suitability for different client profiles. Be prepared to discuss the pros and cons of different options.

- Technology and Tools in Financial Counseling: Discuss your proficiency in using relevant software and technology for financial planning and client management. Highlight any experience with specific tools or platforms.

Next Steps

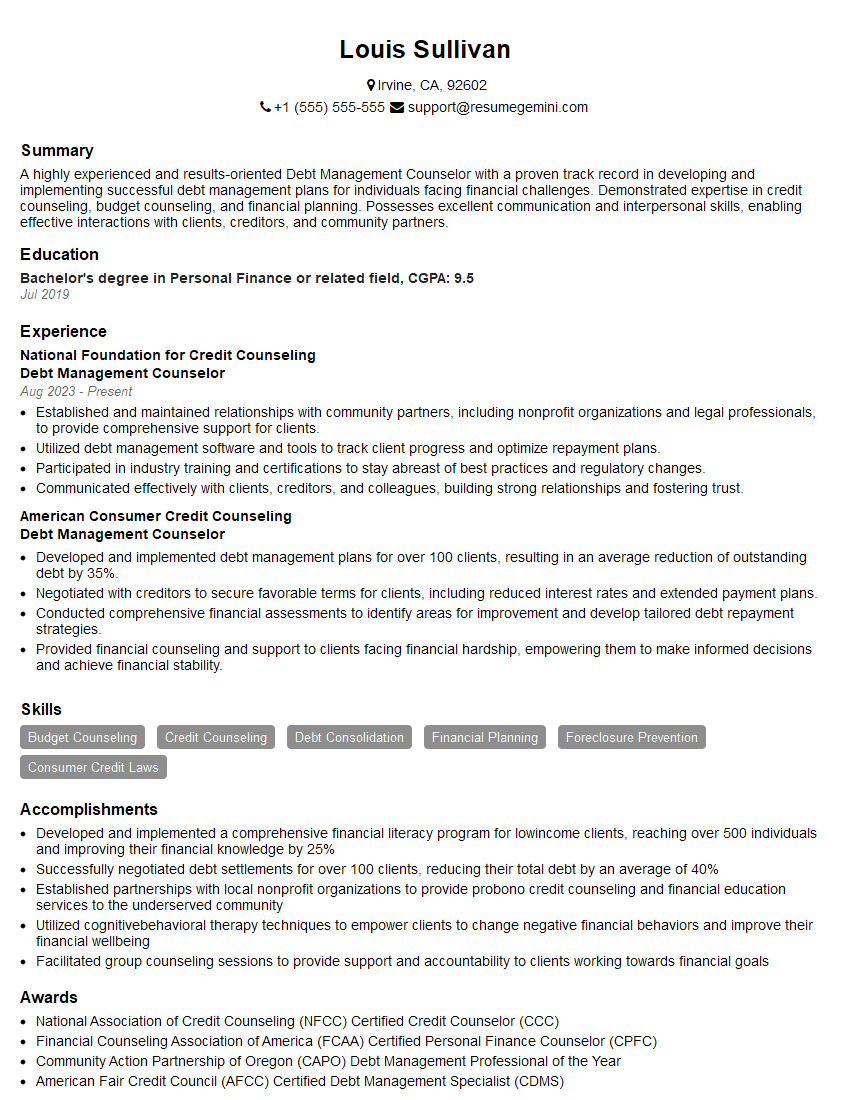

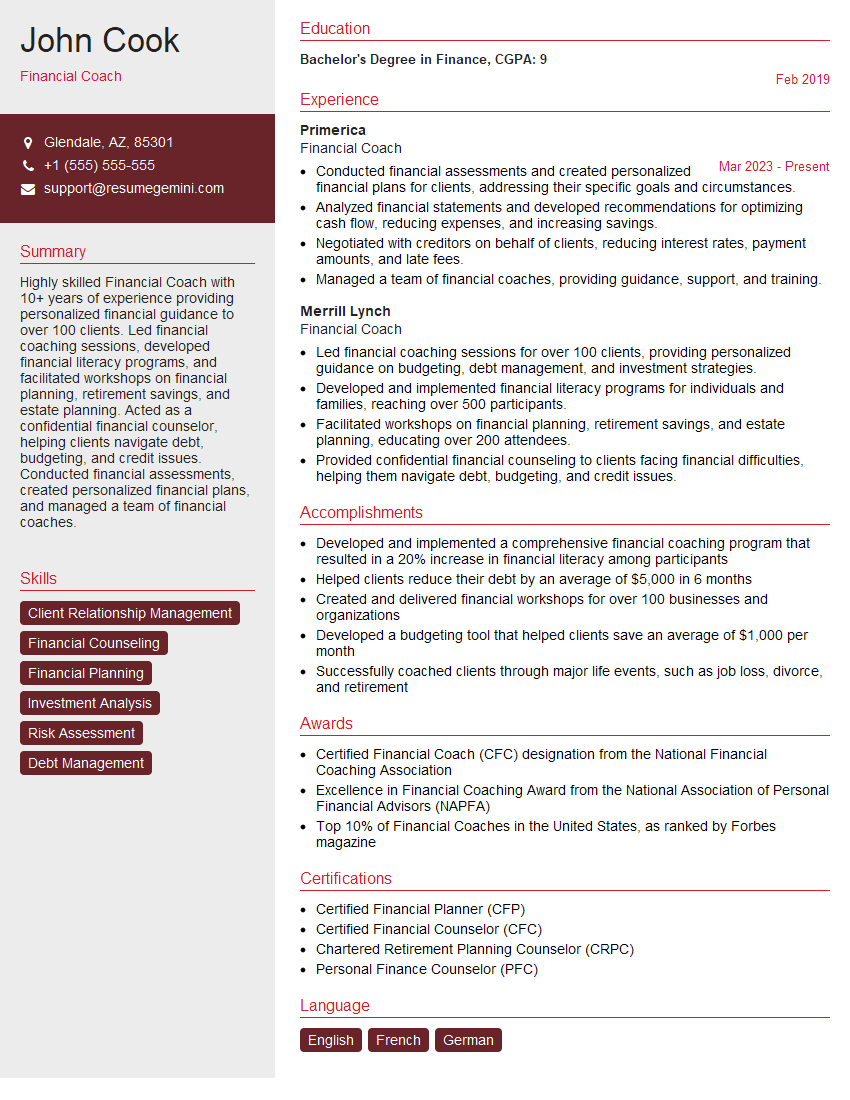

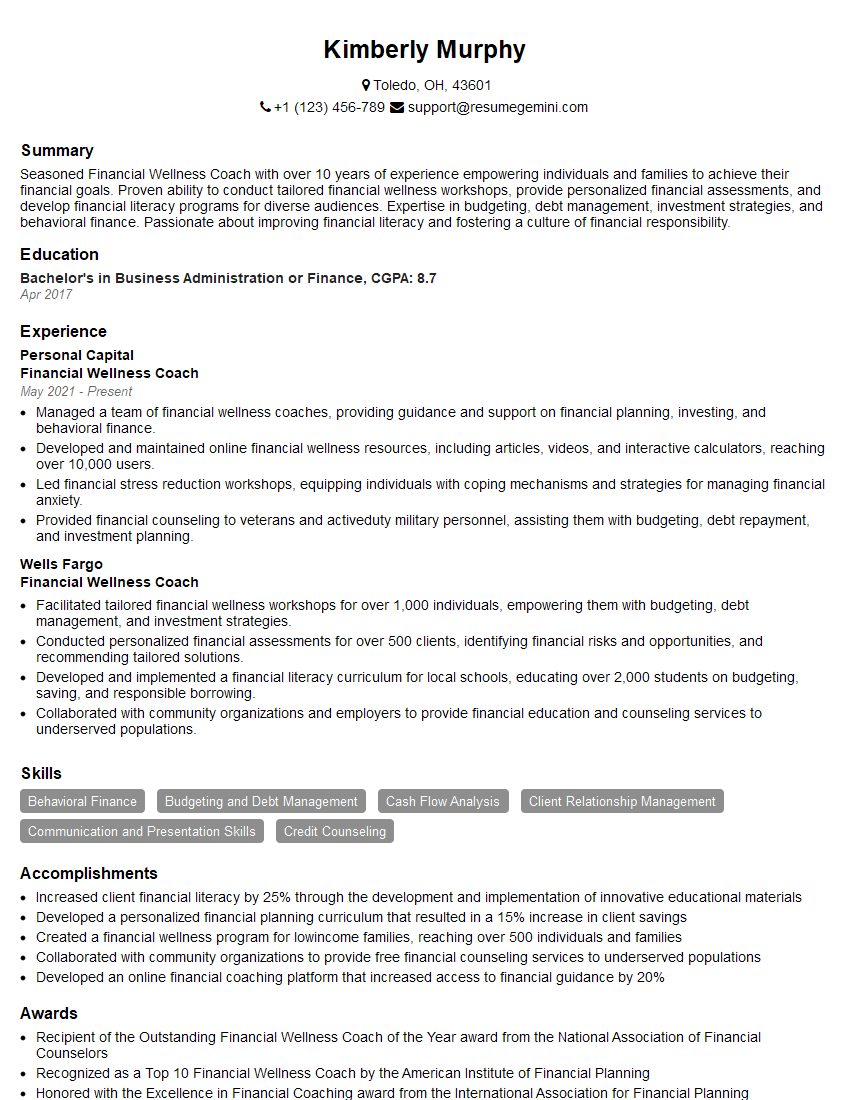

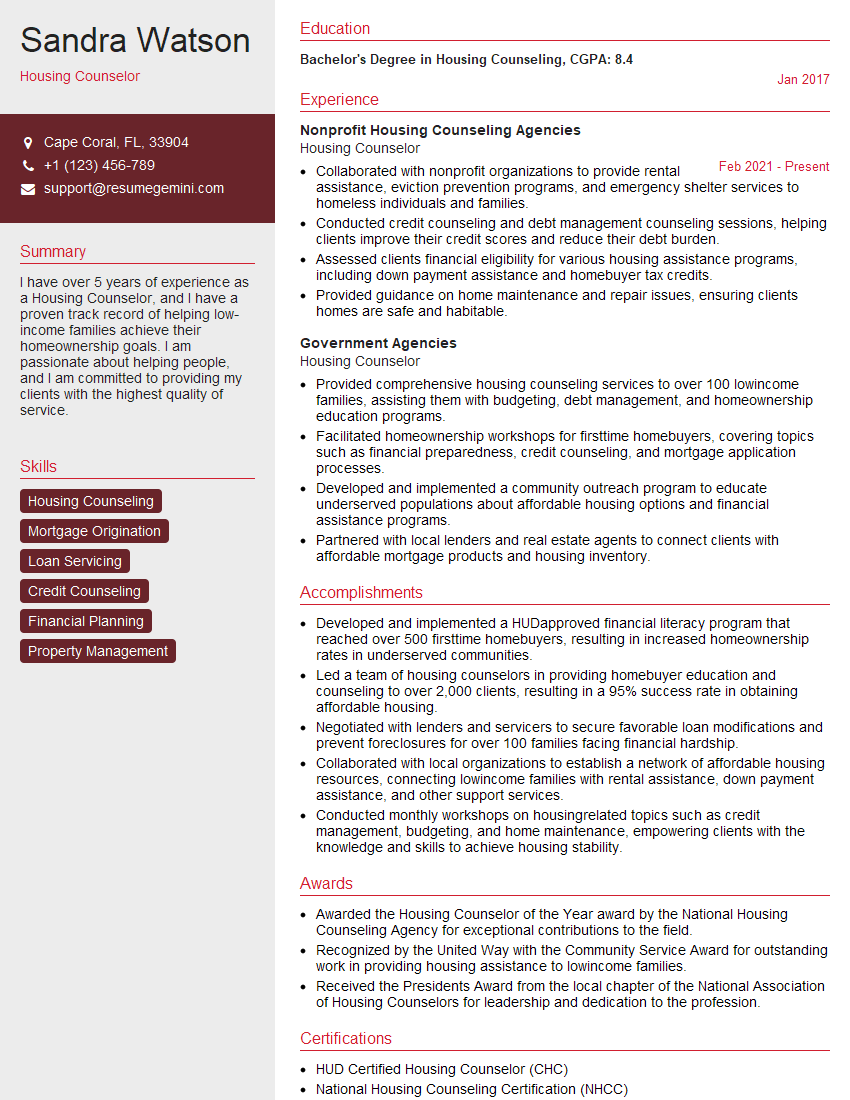

Mastering the FICSB Certification significantly enhances your career prospects in the financial counseling field, opening doors to higher-paying positions and greater professional recognition. To maximize your job search success, it’s crucial to create a compelling and ATS-friendly resume that highlights your skills and experience effectively. We strongly recommend leveraging ResumeGemini, a trusted resource for building professional resumes, to craft a document that showcases your qualifications optimally. Examples of resumes tailored to the FICSB Certification are available to help guide you through the process. Investing the time to create a strong resume is an investment in your future career success.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

I Redesigned Spongebob Squarepants and his main characters of my artwork.

https://www.deviantart.com/reimaginesponge/art/Redesigned-Spongebob-characters-1223583608

IT gave me an insight and words to use and be able to think of examples

Hi, I’m Jay, we have a few potential clients that are interested in your services, thought you might be a good fit. I’d love to talk about the details, when do you have time to talk?

Best,

Jay

Founder | CEO