Unlock your full potential by mastering the most common Tax Implications interview questions. This blog offers a deep dive into the critical topics, ensuring you’re not only prepared to answer but to excel. With these insights, you’ll approach your interview with clarity and confidence.

Questions Asked in Tax Implications Interview

Q 1. Explain the difference between tax avoidance and tax evasion.

The difference between tax avoidance and tax evasion boils down to legality. Tax avoidance is the legal utilization of tax laws to minimize your tax liability. Think of it like strategically planning your finances to reduce your overall tax burden within the bounds of the law. This could involve claiming allowable deductions, investing in tax-advantaged accounts, or structuring your business to optimize tax efficiency. Tax evasion, on the other hand, is the illegal act of not paying taxes owed. This could involve concealing income, underreporting earnings, or claiming false deductions. It’s a serious crime with severe penalties, including fines and imprisonment.

Example: Legally contributing to a 401(k) to reduce taxable income is tax avoidance. Failing to report income from a side business is tax evasion.

Q 2. Describe your experience with tax research and how you stay updated on tax law changes.

My tax research experience spans over [Number] years, encompassing a wide range of tax laws and regulations. I’ve worked extensively with various tax codes, including [Mention specific tax codes or areas of expertise e.g., IRS code, state-specific tax codes]. I’m proficient in using various research tools like [Mention specific tools e.g., Westlaw, LexisNexis, RIA Checkpoint].

Staying updated on tax law changes is crucial. I subscribe to reputable tax journals and newsletters [mention specific publications]. I regularly attend industry conferences and webinars to learn about legislative updates and judicial rulings. I also actively participate in professional development programs offered by [Mention professional organizations e.g., AICPA, NTA]. This multi-faceted approach ensures I remain well-informed on the latest tax developments and can advise clients effectively.

Q 3. How do you handle complex tax situations with multiple jurisdictions?

Handling complex tax situations involving multiple jurisdictions requires a systematic and meticulous approach. First, I identify all relevant jurisdictions and their respective tax laws. This often involves understanding treaties and agreements between countries to avoid double taxation. Then, I meticulously gather all necessary documentation, ensuring compliance with each jurisdiction’s reporting requirements. I often collaborate with international tax specialists and legal professionals when needed. A thorough understanding of the specific tax treaties is essential; for example, the US has tax treaties with many countries, defining how income earned in one country is taxed in another. This helps prevent double taxation.

Example: A client with business operations in the US and Canada requires a detailed analysis of both countries’ tax laws to determine the optimal tax structure and ensure compliance with both jurisdictions’ reporting requirements. We would carefully analyze the Canada-US tax treaty.

Q 4. What are your strategies for ensuring tax compliance within a company?

Ensuring tax compliance within a company requires a proactive and comprehensive strategy. This includes implementing robust internal controls, such as regularly reviewing financial records, establishing clear processes for tax reporting, and ensuring employees receive adequate training on tax regulations. We also use specialized tax software and engage in regular audits to identify potential compliance issues early on. It’s important to create a culture of compliance, where employees understand the importance of adhering to tax laws and regulations. Proactive communication with tax authorities is also crucial, responding to queries promptly and maintaining accurate records. A well-defined compliance program minimizes risks and protects the company from penalties.

Q 5. Explain the concept of depreciation and its impact on taxable income.

Depreciation is an accounting method that allows businesses to deduct the cost of an asset over its useful life. Instead of recognizing the entire cost in the year of purchase, it’s spread out over several years, reducing taxable income each year. This helps to match the expense of the asset with the revenue it generates.

Impact on Taxable Income: By deducting depreciation, a company reduces its net income, leading to lower tax liability. The specific depreciation method used (straight-line, double-declining balance, etc.) affects the amount deducted each year and, consequently, the tax savings. For example, if a company purchases equipment for $100,000 with a useful life of 10 years, the annual depreciation expense under the straight-line method would be $10,000, reducing taxable income by this amount each year.

Q 6. How do you calculate the capital gains tax on the sale of an asset?

Calculating capital gains tax on the sale of an asset involves several steps. First, determine the cost basis of the asset, which is typically the original purchase price plus any costs incurred to acquire and improve the asset. Then, subtract the cost basis from the selling price to determine the capital gain. This gain is then taxed based on the applicable capital gains tax rate, which varies depending on the holding period (short-term or long-term) and the taxpayer’s income bracket. Short-term gains are taxed at ordinary income rates, while long-term gains typically have lower rates. Finally, any applicable deductions or credits may be considered to arrive at the final tax liability.

Example: If an asset was purchased for $10,000 and sold for $20,000 after being held for more than one year, the long-term capital gain is $10,000. The tax on this gain will depend on the applicable long-term capital gains tax rate for the individual’s income bracket.

Q 7. What are the implications of the recent tax reform on businesses?

The implications of recent tax reforms on businesses are multifaceted and depend heavily on the specifics of the reform. Generally, reforms can impact corporate tax rates, deductions, credits, and investment incentives. For instance, a reduction in the corporate tax rate could increase profitability, while changes to depreciation rules could affect the timing of tax deductions. Furthermore, reforms can alter the attractiveness of different investment strategies. Some reforms might incentivize investment in specific sectors or technologies, while others may lead to restructuring of businesses to take advantage of new tax benefits. Each specific reform needs careful analysis to understand its effect on individual businesses.

It’s crucial to conduct a thorough analysis of the changes to understand how they affect specific business models and profitability. Businesses should seek professional tax advice to adapt their strategies and comply with the new regulations.

Q 8. Describe your experience with tax planning for individuals or corporations.

My experience in tax planning spans over a decade, encompassing both individual and corporate clients. For individuals, I’ve helped optimize retirement planning through strategies like maximizing contributions to tax-advantaged accounts like 401(k)s and Roth IRAs. I also assist with minimizing capital gains taxes through strategic asset allocation and timing. For corporations, my work focuses on minimizing their overall tax burden through various means, such as exploring deductions, credits, and the optimal corporate structure. For example, I recently helped a small business transition from a sole proprietorship to an S-corporation, significantly reducing their overall tax liability. This involved analyzing their income, expenses, and projected future growth to determine the most tax-efficient structure. I also conduct thorough tax research to ensure compliance with all current regulations and to identify opportunities to legally minimize tax burdens. My approach emphasizes proactive planning rather than reactive problem-solving.

Q 9. How do you handle tax audits and investigations?

Handling tax audits and investigations requires a methodical and proactive approach. My first step is to thoroughly review all relevant documentation and records. This ensures I have a complete understanding of the transactions and financial activities under scrutiny. I then meticulously organize the information, creating a clear and easily accessible record trail for the auditing agency. Next, I’ll work closely with the client to understand the specific areas of concern and develop a comprehensive response strategy. This might involve preparing detailed explanations, providing supporting documentation, and engaging in open communication with the auditor. My goal is to be fully transparent and cooperative, while ensuring that the client’s rights are protected. In cases where there are disagreements, I use my expertise in tax law to negotiate a resolution that is fair and beneficial for my client. I have a proven track record of successfully navigating audits, minimizing penalties, and achieving favorable outcomes for my clients. For instance, I recently resolved a complex audit involving international transactions by meticulously documenting the application of the relevant double taxation treaties, resulting in a significant reduction in the proposed tax assessment.

Q 10. Explain the differences between various tax forms (e.g., 1040, 1120, etc.).

Different tax forms serve different purposes, catering to various taxpaying entities. The 1040 is the U.S. Individual Income Tax Return, used by individuals to report their income, deductions, and credits. The 1120 is the U.S. Corporate Income Tax Return, used by C-corporations to report their income and expenses. Other significant forms include the 1065 (for partnerships), 1041 (for trusts and estates), and 1120-S (for S-corporations). The key differences lie in the type of entity filing the return and the specific information required. For example, a 1120 would include information on corporate officers and shareholders, whereas a 1040 would focus on individual income sources like wages, interest, and capital gains. Understanding these distinctions is critical for accurately reporting income and ensuring compliance. Choosing the wrong form can lead to significant penalties and delays.

Q 11. What is your understanding of transfer pricing regulations?

Transfer pricing regulations govern how multinational corporations price transactions between related entities (e.g., parent company and subsidiary). The goal is to prevent tax avoidance through artificial shifting of profits to low-tax jurisdictions. These regulations require that transactions between related parties are conducted at ‘arm’s length,’ meaning at the price that would be agreed upon by unrelated parties in a comparable transaction. Determining the arm’s length price often involves complex economic analysis, considering factors such as comparable uncontrolled prices (CUPs), cost-plus methods, and profit split methods. Non-compliance can result in significant penalties and adjustments to taxable income in multiple jurisdictions. I have extensive experience in conducting transfer pricing analyses, preparing documentation, and navigating the complexities of international tax regulations in this area. I can help companies develop and implement transfer pricing policies that are compliant with both domestic and international regulations.

Q 12. How do you assess tax risks and implement mitigation strategies?

Assessing tax risks involves identifying potential areas where a client may face tax liabilities or penalties. This requires a thorough understanding of the client’s business operations, financial activities, and relevant tax laws. I use a combination of qualitative and quantitative methods, including reviewing financial statements, analyzing transactions, and considering industry best practices. For example, I assess the risk associated with specific tax positions, the likelihood of an audit, and the potential consequences of non-compliance. Once risks are identified, I develop mitigation strategies, such as improving record-keeping, implementing internal controls, and structuring transactions in a tax-efficient manner. This may involve adjusting business strategies or proactively seeking rulings from tax authorities to clarify uncertain tax positions. My goal is to minimize the client’s exposure to tax risks, ensuring their long-term financial security. A proactive risk assessment can save significant time, money, and stress in the long run.

Q 13. Describe your experience with international tax compliance.

My experience with international tax compliance is substantial. I’ve worked with clients operating in various countries, navigating the intricacies of different tax systems, double taxation treaties, and foreign tax credits. This includes advising clients on cross-border transactions, foreign investment, and the implications of operating in multiple jurisdictions. I’m particularly adept at identifying and leveraging tax benefits available under international agreements. A recent example involved a client expanding into Europe. I helped them structure their operations to minimize their global tax burden by leveraging tax treaties and establishing a compliant presence in their chosen EU member state. This involved meticulous analysis of various tax implications, including VAT (Value Added Tax), corporate income tax, and withholding taxes.

Q 14. How familiar are you with various tax software and systems?

I am proficient in several tax software and systems, including industry-standard programs like Thomson Reuters ONESOURCE, GoDaddy Bookkeeping, and various state-specific tax preparation applications. I am also familiar with cloud-based accounting software like Xero and QuickBooks Online, enabling efficient data management and integration with tax preparation software. My skills extend to data analysis and reporting using spreadsheet software like Microsoft Excel to provide insights and visualizations that help clients understand their tax positions better. My experience encompasses both individual and corporate tax software, allowing me to adapt to the specific needs of diverse clientele. Staying updated on the latest technology and software ensures I can efficiently and accurately handle complex tax situations for my clients.

Q 15. Explain the concept of tax credits and deductions.

Tax credits and deductions are both ways to reduce your tax liability, but they work differently. Think of your taxable income as a pizza. A deduction is like getting a slice taken off the pizza before calculating the cost. It reduces your taxable income, thereby reducing the amount of tax you owe proportionally. A tax credit, on the other hand, is like getting a discount on the entire pizza’s cost after the bill is calculated. It directly reduces the amount of tax you owe, dollar for dollar.

- Deduction: Reduces your taxable income. For example, a home office deduction lowers your taxable income by the amount of expenses related to your home office. If your taxable income was $50,000 and you had a $5,000 deduction, your taxable income becomes $45,000.

- Credit: Directly reduces your tax liability. For example, the Earned Income Tax Credit (EITC) provides a direct reduction in your tax owed based on your income and family size. If you owe $5,000 in taxes and have a $2,000 tax credit, your tax liability is reduced to $3,000.

Credits are generally more valuable than deductions because they offer a greater tax savings, especially for lower-income taxpayers.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. How do you handle discrepancies in tax reporting?

Discrepancies in tax reporting can stem from various sources: data entry errors, differences in accounting methods, or even intentional misreporting. My approach involves a methodical investigation. First, I thoroughly reconcile the reporting entities’ records with the tax forms. I carefully compare all income and expense entries, identifying any differences. For example, if a bank statement shows a different deposit amount than reported on the tax return, I investigate the cause. This may involve contacting the client for clarification or reviewing supporting documentation.

If the discrepancy is minor and can be easily explained by a simple error, I’ll make the necessary corrections and update the filings. For more significant discrepancies or those indicating potential fraud, I escalate the issue to the appropriate authorities and document all steps taken. Transparency and thorough record-keeping are essential in handling such situations. It’s about finding the root cause, not just the surface symptom, to ensure accurate and compliant tax reporting.

Q 17. What is your experience with indirect taxes like VAT or GST?

I have extensive experience working with indirect taxes like VAT (Value Added Tax) and GST (Goods and Services Tax). My experience includes assisting businesses in registering for these taxes, understanding their application across various transactions (sales, imports, exports), ensuring compliance with reporting requirements, and managing tax credits and refunds. I’m familiar with the intricacies of input and output tax calculations and navigating the specific regulations and rates in different jurisdictions. I’ve helped clients successfully navigate audits related to indirect taxes and developed strategies to minimize their indirect tax liability while adhering to all regulations. For example, I helped a client understand the nuances of reverse charge mechanism for GST applicable on their import transactions, leading to significant cost savings.

Q 18. Explain the process of preparing a tax return for a small business.

Preparing a tax return for a small business involves a multi-step process, starting with gathering all the necessary financial documents. This includes profit and loss statements, balance sheets, bank statements, invoices, receipts, and any other relevant documents supporting income and expenses. I then categorize these records by type of expense (e.g., cost of goods sold, salaries, rent, marketing) to match with applicable tax deductions and credits.

Next, I apply the appropriate accounting methods (cash or accrual) as per the client’s choice and ensure compliance with generally accepted accounting principles (GAAP). I calculate the net income, and then apply the relevant tax rates and deductions. I ensure all tax forms (like Schedule C for self-employed individuals or Form 1120 for corporations) are accurately completed. Finally, I review the return meticulously for accuracy before filing. Throughout this process, I maintain detailed records of all calculations and supporting documentation to facilitate easy audits and ensure transparency.

Q 19. How do you manage tax deadlines and ensure timely filing?

Managing tax deadlines effectively involves utilizing a robust system for tracking due dates. I employ a combination of calendar reminders, specialized tax software, and project management tools. My calendar is meticulously updated with all relevant tax deadlines for each client. I send out reminders to my clients well in advance of due dates, and maintain detailed project files with all relevant documentation and deadlines. This proactive approach minimizes the risk of missed deadlines and potential penalties. I also build in buffer time to account for any unforeseen delays or complexities that might arise during the tax preparation process.

Q 20. Explain the implications of different accounting methods on tax liability.

Different accounting methods significantly impact tax liability. The two primary methods are cash basis and accrual basis. Under the cash basis, income and expenses are recognized when cash changes hands – received or paid. The accrual basis recognizes income when earned and expenses when incurred, regardless of when cash is exchanged. For example, if a business provides services in December but receives payment in January, the cash basis recognizes the income in January, whereas the accrual basis recognizes it in December.

The choice of method influences the timing of income and expense recognition, directly affecting the taxable income in a given year. Accrual accounting can often lead to higher reported income initially due to the recognition of receivables, potentially resulting in a higher immediate tax liability. Conversely, cash accounting may defer tax liability until the cash is received. The choice is highly dependent on the business’s size, complexity, and industry regulations; and always needs to be consistent with the business’s chosen accounting standards. The IRS sets specific requirements and thresholds for selecting a method.

Q 21. What is your understanding of the tax implications of mergers and acquisitions?

Mergers and acquisitions (M&A) have significant tax implications. The tax consequences depend on the structure of the transaction (e.g., stock purchase, asset purchase), the valuation of assets, and the applicable tax laws. A stock purchase generally results in the acquiring company taking on the target company’s tax attributes, including tax losses and credits. This can be advantageous in mitigating tax liabilities. An asset purchase allows for a step-up or step-down in the basis of the acquired assets, affecting depreciation and amortization deductions in the future. Further complexities arise concerning the treatment of goodwill, intangible assets, and potential capital gains taxes on the sale of assets.

Careful tax planning before, during, and after an M&A transaction is crucial to minimizing tax liabilities and maximizing tax benefits. It often involves analyzing the tax implications of different deal structures, ensuring proper valuations, and optimizing the allocation of purchase price among acquired assets. This involves close coordination with legal and financial advisors to achieve a tax-efficient outcome. Ignoring the tax implications of M&A can result in significant financial losses for both parties involved.

Q 22. How do you stay current with changes in tax laws and regulations?

Staying current in the dynamic world of tax law requires a multi-pronged approach. I subscribe to several reputable tax journals and publications, such as the Journal of Taxation and Tax Notes Today, which provide in-depth analysis of legislative changes and court rulings. I also actively participate in continuing professional education (CPE) courses offered by organizations like the AICPA and state bar associations. These courses cover updates to tax codes, regulations, and relevant case law. Finally, I leverage online resources and tax software updates, which often provide immediate notifications of important changes. This combination of formal education, professional journals, and technological tools ensures I remain informed and compliant with the latest tax developments.

Q 23. How would you explain complex tax concepts to someone without a financial background?

Explaining complex tax concepts to someone without a financial background requires patience and a focus on clear, concise communication. I avoid jargon and use simple analogies to illustrate key principles. For instance, when explaining deductions, I might compare them to discounts at a store – they reduce the overall price (taxable income) you pay. Similarly, I use real-life scenarios. For example, explaining capital gains taxes, I’d describe selling a stock at a profit, highlighting the difference between the purchase and sale price being the taxable gain. I often break down complex topics into smaller, manageable pieces, starting with the basics and gradually adding layers of complexity as understanding grows. Visual aids like charts and graphs can also be very helpful.

Q 24. Describe your experience with tax controversy and dispute resolution.

I have extensive experience in tax controversy and dispute resolution. In one case, a client faced an IRS audit regarding deductions related to business expenses. I meticulously gathered and organized all supporting documentation, including receipts, invoices, and contracts. I meticulously prepared a detailed response to the IRS, outlining the client’s position and providing legal precedent supporting the claimed deductions. Through careful negotiation and persuasive presentation, we successfully resolved the dispute, reducing the assessed tax liability significantly. This experience highlighted the importance of thorough documentation, strong communication, and a deep understanding of tax law in navigating tax controversies. My approach always prioritizes a collaborative solution, but I’m prepared to escalate to litigation if necessary.

Q 25. How do you use technology and data analysis to improve tax processes?

Technology and data analysis are essential for modern tax processes. I utilize tax software such as TaxAct and UltraTax for efficient tax preparation and compliance. These platforms automate many routine tasks, reducing the potential for errors and freeing up time for more complex analysis. I also leverage data analytics tools to identify trends and patterns in client data, allowing for proactive tax planning and the identification of potential tax savings opportunities. For instance, I can analyze historical tax data to identify areas where deductions might be maximized or potential tax liabilities mitigated. This data-driven approach significantly improves the accuracy and efficiency of our tax services.

Q 26. Describe a challenging tax problem you solved and how you approached it.

One challenging case involved a client’s complex international tax situation involving multiple jurisdictions and varying tax treaties. The client, a multinational corporation, had investments and operations in several countries. Determining the correct tax implications for each transaction required navigating different tax codes, accounting standards, and currency exchange rates. My approach involved systematically breaking down the problem into manageable components. I started by mapping out all international transactions, then researched the applicable tax treaties and relevant case law for each jurisdiction. I used specialized tax software to model different scenarios and calculate potential tax liabilities under various interpretations. Through careful analysis and collaboration with international tax specialists, we devised a compliant and tax-efficient strategy for the client, significantly reducing their global tax burden. This case emphasized the importance of meticulous research, international tax expertise, and a structured approach to problem-solving.

Q 27. What are your strengths and weaknesses in the area of tax compliance?

My strengths lie in my meticulous attention to detail, strong analytical skills, and ability to communicate complex information clearly. I possess a deep understanding of tax law and its practical application, allowing me to provide sound and efficient tax advice. My organizational skills are crucial for managing multiple clients and complex tax situations, especially during peak season. A potential area for improvement is delegation. While I excel at managing my workload independently, proactively delegating tasks to junior team members could enhance overall efficiency. I am actively working on improving in this area by implementing time management techniques and refining my leadership skills.

Q 28. How do you prioritize tasks and manage your workload during tax season?

During tax season, effective prioritization and workload management are critical. I use a project management system that allows me to categorize tasks by urgency and importance, using a matrix that ranks tasks by their impact and effort required. This enables me to focus on high-impact tasks first. I also employ time-blocking techniques, allocating specific time slots for different tasks to ensure efficient use of my time. Proactive communication with clients is key to managing expectations and setting realistic deadlines. Finally, I build in buffer time to account for unexpected issues or delays. This structured approach helps me handle the demands of tax season effectively and minimizes stress.

Key Topics to Learn for Tax Implications Interview

- Individual Income Tax: Understanding tax brackets, deductions, credits, and the standard deduction. Practical application: Calculating an individual’s taxable income and tax liability.

- Corporate Income Tax: Familiarize yourself with corporate tax rates, depreciation methods, and the implications of different business structures. Practical application: Analyzing a company’s tax burden and exploring strategies for tax minimization (within legal boundaries).

- Sales and Use Tax: Grasp the principles of sales tax calculation, exemptions, and nexus. Practical application: Determining the appropriate sales tax rate for various transactions and understanding the implications of state and local tax laws.

- International Tax: Gain a basic understanding of tax treaties, foreign tax credits, and the complexities of international tax planning. Practical application: Analyzing the tax implications of cross-border transactions.

- Tax Research and Compliance: Develop skills in interpreting tax laws and regulations and applying them to real-world scenarios. Practical application: Using tax codes and rulings to resolve tax issues and ensure compliance.

- Tax Planning and Strategy: Learn how to develop effective tax strategies for individuals and businesses to minimize their tax liabilities legally. Practical application: Analyzing different tax planning options and recommending optimal strategies.

- Ethics in Taxation: Understand the ethical considerations and responsibilities involved in tax practice. Practical application: Recognizing and avoiding conflicts of interest and maintaining client confidentiality.

Next Steps

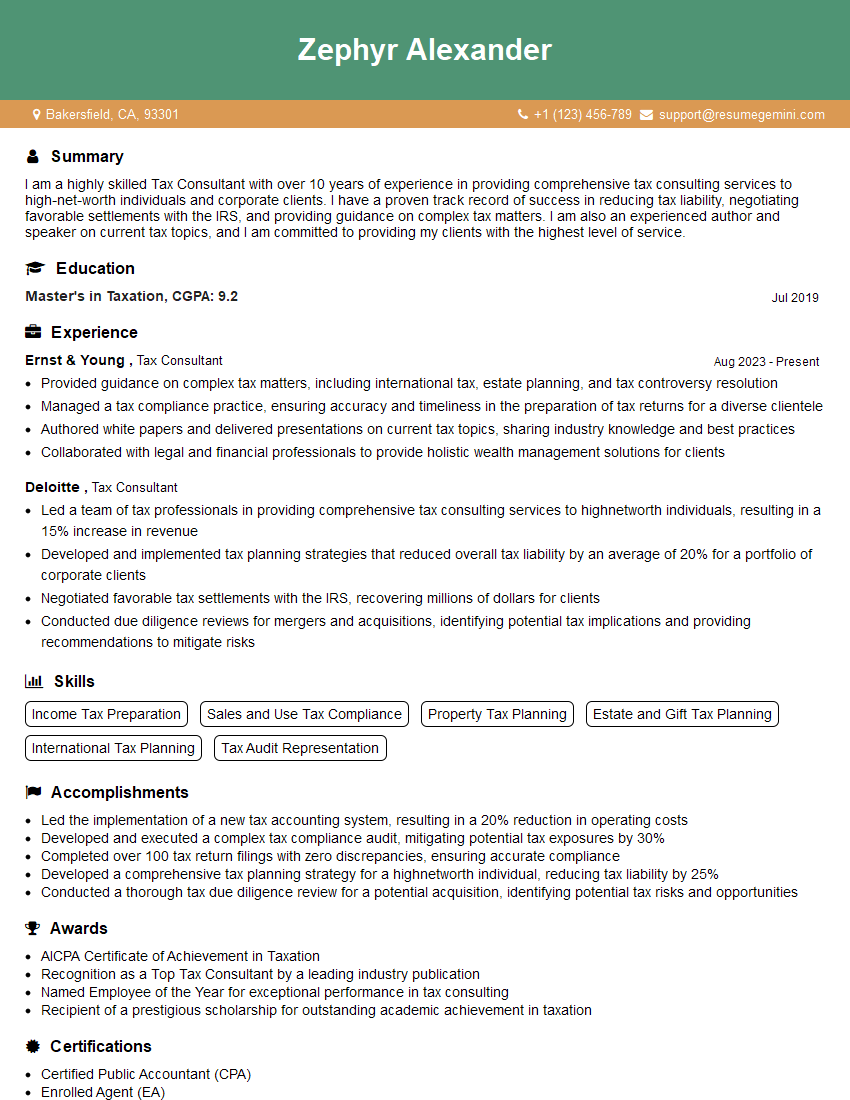

Mastering tax implications is crucial for career advancement in finance, accounting, and related fields. A strong understanding of tax principles opens doors to higher-paying roles and greater responsibility. To enhance your job prospects, creating an ATS-friendly resume is essential. ResumeGemini can significantly improve your resume’s effectiveness, helping you stand out to recruiters. Leverage ResumeGemini’s tools to build a compelling resume that showcases your tax expertise. Examples of resumes tailored to Tax Implications are available to guide you.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

I Redesigned Spongebob Squarepants and his main characters of my artwork.

https://www.deviantart.com/reimaginesponge/art/Redesigned-Spongebob-characters-1223583608

IT gave me an insight and words to use and be able to think of examples

Hi, I’m Jay, we have a few potential clients that are interested in your services, thought you might be a good fit. I’d love to talk about the details, when do you have time to talk?

Best,

Jay

Founder | CEO