Every successful interview starts with knowing what to expect. In this blog, we’ll take you through the top Real Estate Closing Procedures interview questions, breaking them down with expert tips to help you deliver impactful answers. Step into your next interview fully prepared and ready to succeed.

Questions Asked in Real Estate Closing Procedures Interview

Q 1. Explain the process of preparing a closing disclosure.

Preparing a Closing Disclosure is a meticulous process requiring accuracy and attention to detail. It’s the final document outlining all financial aspects of a real estate transaction, ensuring both buyer and seller understand the complete costs involved. This involves gathering all relevant financial data, including the loan amount (if applicable), down payment, closing costs, prepaid items like property taxes and insurance, and any credits or adjustments.

- Loan Details: Information about the mortgage loan, including the interest rate, loan amount, and monthly payments, is crucial. If it’s a cash purchase, this section will be significantly simpler.

- Property Taxes and Insurance: Prorated amounts for property taxes and homeowner’s insurance are calculated to reflect the ownership period. This usually involves determining the daily rate and multiplying it by the number of days of ownership in that year.

- Closing Costs: This section includes detailed breakdown of fees paid by the buyer and seller. This can include appraisal fees, title insurance, recording fees, lender fees, and more. It’s essential to ensure each charge is properly justified.

- Credits and Adjustments: Any credits to the buyer or seller, such as seller concessions or pre-paid items, are included here. These need to be precisely calculated and clearly explained.

- Final Calculations: The closing disclosure culminates in the final amount each party will pay or receive at closing. Any discrepancies need immediate resolution.

For example, let’s say a buyer is purchasing a home with a $300,000 loan. The Closing Disclosure would clearly outline the loan amount, the interest rate, the down payment, the monthly mortgage payment, all associated fees, and the total amount the buyer will need to bring to closing. Likewise, it would show the seller’s proceeds after deducting any liens, commissions, and other closing costs. The entire document is reviewed by both parties and their attorneys before the signing.

Q 2. What are the key differences between a buyer’s and seller’s closing statement?

The key difference between a buyer’s and seller’s closing statement lies in their perspective on the transaction. The buyer’s statement shows the total amount they need to pay to acquire the property, including the down payment, loan amount, closing costs, and any prepaid items. The seller’s statement shows the net proceeds they receive after all deductions, including the mortgage payoff, realtor commissions, closing costs, and any liens or encumbrances.

Imagine buying a house for $400,000 with a $100,000 down payment and $300,000 loan. The buyer’s statement will show debits (amounts they pay) of the down payment, closing costs, prepaid taxes and insurance. The credits would be the loan amount. In contrast, the seller’s statement would show credits for the sale price and debits for the mortgage payoff, realtor fees, and closing costs. The net result shows the amount the seller receives.

Q 3. How do you handle discrepancies found during the closing process?

Discrepancies during closing are handled meticulously and professionally. My approach involves a three-step process: identification, verification, and resolution. First, I carefully review all documents to identify any discrepancies. This could be anything from a difference in the amount of property taxes owed to a mismatch in closing costs.

- Identification: This involves a thorough line-by-line comparison of all financial documents, including the lender’s closing disclosure, title commitment, and settlement statement. Any inconsistencies are flagged immediately.

- Verification: Once a discrepancy is identified, I verify the information with the relevant parties involved, such as the lender, title company, or real estate agents. This step ensures the source of the error and helps determine the accurate figure.

- Resolution: The resolution process depends on the nature and source of the discrepancy. If it’s a simple calculation error, a correction is made. If it’s a more significant issue, it could require adjustments to the closing documents or even delays in closing to rectify the situation. In cases of significant conflict, an attorney might be consulted.

For example, if a discrepancy arises concerning property taxes, I would verify the amount owed by contacting the county tax assessor’s office. If a lender’s closing statement shows a higher closing cost than agreed upon, I will promptly contact the lender to resolve the discrepancy before proceeding.

Q 4. Describe your experience with wire fraud prevention measures.

Wire fraud is a significant concern in real estate closings, and I’ve implemented robust preventative measures throughout my career. I always verify wire instructions independently, directly contacting the intended recipient to confirm account details, and I never solely rely on emailed instructions.

- Independent Verification: I verify all wire transfer instructions by independently contacting the recipient—the title company, the lender, etc.—to confirm the banking details provided. This is a crucial step as fraudsters often modify instructions in emails.

- Secure Communication: I insist on using secure communication channels to discuss wire transfers, favoring phone calls or encrypted messaging over emails. Emails are easily intercepted.

- Written Confirmation: I always obtain written confirmation of wire instructions from both the sending and receiving parties. This written record serves as essential proof of the agreed-upon transfer details.

- Employee Training: I ensure that all my staff receives regular training on recognizing and preventing wire fraud. This includes phishing scams, email spoofing, and other common techniques.

One time, we had a situation where a fraudulent email was sent attempting to change wire transfer instructions. Because of our rigorous verification protocols, we caught the attempted fraud before any funds were transferred, protecting the client from a substantial financial loss. This reinforced our commitment to utilizing multi-layered preventative measures.

Q 5. Explain the role of title insurance in a real estate transaction.

Title insurance is crucial in real estate transactions as it protects both the buyer and lender against financial losses arising from defects in the property’s title. It essentially insures the ownership rights of the property are clear and free from undisclosed issues.

- Buyer’s Title Insurance: Protects the buyer from issues like undisclosed liens, encumbrances, or claims against the property discovered *after* the closing. This is a one-time premium paid at closing.

- Lender’s Title Insurance: Protects the lender’s financial interest in the property in case of title defects. This policy covers the lender’s loan amount, and the premium is usually paid by the buyer.

Think of it as an insurance policy for the ownership of your property. If, for instance, after closing, an undisclosed lien surfaces, the title insurance policy can cover the costs associated with resolving that claim, saving the buyer from significant financial burden. It provides peace of mind knowing that the purchase is protected against unexpected title problems.

Q 6. How do you verify the accuracy of property tax information?

Verifying the accuracy of property tax information is a critical part of the closing process. My approach involves a two-pronged strategy: directly contacting the relevant taxing authority and cross-referencing multiple sources.

- Contacting the Tax Assessor’s Office: I directly contact the county tax assessor’s office to obtain official records of the property taxes. This is the most reliable source of accurate information.

- Cross-referencing Information: I cross-reference the information obtained from the tax assessor’s office with other sources, such as the property tax statement provided by the seller or the title commitment. This helps ensure consistency and identify any potential discrepancies.

For instance, I will obtain the property tax bill directly from the relevant county to confirm the exact tax amount due and the payment schedule, rather than just relying on information supplied by the seller. This proactive approach prevents unexpected tax liabilities after the closing.

Q 7. What is your experience with various types of deeds?

I have extensive experience with various types of deeds, understanding their implications for both buyers and sellers. The most common types include:

- Warranty Deed: Offers the greatest protection to the buyer, guaranteeing clear title and promising to defend against future claims.

- Special Warranty Deed: Similar to a warranty deed, but only guarantees clear title during the seller’s ownership period.

- Quitclaim Deed: Transfers ownership without any warranties or guarantees of clear title. It’s often used to resolve title issues or transfer property between family members.

- Trustee’s Deed: Used to transfer ownership when the property is held in trust.

- Executor’s Deed: Used to convey property from an estate.

Understanding the nuances of these deeds is critical. For example, a buyer purchasing property with a quitclaim deed would need to be exceptionally diligent in verifying the title’s clarity beforehand, as there is no guarantee from the seller regarding any issues. A warranty deed would offer much more security in this regard.

Q 8. How do you handle last-minute changes or requests during a closing?

Handling last-minute changes requires a calm and methodical approach. My priority is ensuring all parties are informed and understand the implications. First, I assess the nature of the change – is it a simple amendment to a document, or a more significant alteration impacting the deal’s fundamentals? For minor changes, like a corrected address, I’ll coordinate with the title company, lender, and buyer/seller to obtain necessary approvals and update the documents swiftly. However, significant changes, like a sudden drop in appraisal value, require a more involved process, potentially involving renegotiation or even termination of the contract. I always maintain meticulous documentation of all changes and approvals obtained, protecting myself and my clients from potential disputes.

For example, I once had a situation where the buyer needed an extra day to finalize their financing. By immediately contacting all relevant parties, outlining the issue clearly, and proposing a simple amendment to the closing date, we were able to avoid any major disruptions. Open communication is key in these scenarios.

Q 9. What is your process for reconciling funds at closing?

Reconciling funds is a critical step that requires precision and attention to detail. I begin by comparing the preliminary closing disclosure (PCD) with the final closing disclosure (CD) to identify any discrepancies. Then, I carefully review all financial transactions, including the loan proceeds, earnest money deposits, seller proceeds, closing costs, and any other funds involved. I use a spreadsheet to meticulously track every dollar, ensuring all debits and credits balance perfectly. Any discrepancies are investigated thoroughly, tracing back to the source documents to identify and rectify any errors. I then prepare a reconciliation report that clearly details each transaction and confirms the final balances, sharing this with all parties involved. This meticulous process safeguards everyone’s interests and ensures a smooth and transparent transaction.

Q 10. Describe your experience with managing earnest money deposits.

Managing earnest money deposits demands stringent adherence to legal and ethical standards. Upon receipt, I immediately deposit the funds into an escrow account, following all state regulations. I maintain detailed records, including the date of receipt, the source of the funds, and the specific escrow account information. These records serve as irrefutable proof of proper handling. The funds remain securely held in escrow until the closing date, at which point they are disbursed according to the terms outlined in the purchase agreement. If the transaction fails to close, I follow the contract stipulations concerning earnest money disbursement, ensuring a fair and equitable outcome for all parties. Transparency and clear communication are paramount throughout this process. I always provide my clients with regular updates on the status of their earnest money deposit.

Q 11. How do you ensure compliance with RESPA and other relevant regulations?

Compliance with RESPA (Real Estate Settlement Procedures Act) and other regulations is paramount. My process includes familiarizing myself with all applicable laws and regulations specific to the transaction’s location. I ensure all required disclosures are provided to clients in a timely manner, including the Loan Estimate (LE) and the Closing Disclosure (CD). I scrupulously avoid any referral fees or kickbacks that could violate RESPA guidelines, maintaining transparent relationships with all parties. Regular professional development keeps me up-to-date on regulatory changes, and I maintain detailed records of all compliance activities to aid in any future audits. Any potential conflicts of interest are disclosed upfront to ensure transparency and ethical conduct.

Q 12. How do you identify and address potential title defects?

Identifying and addressing title defects is a crucial aspect of my work, relying heavily on the title search conducted by the title company. I review the title commitment meticulously for any potential issues, such as liens, encumbrances, or ownership disputes. If any defects are found, I work closely with the title company to investigate the issue’s nature and severity. Depending on the defect, solutions can range from securing releases of liens, obtaining quiet title actions, or negotiating with conflicting parties. Open communication with all parties involved is critical to resolve these issues effectively and efficiently, ensuring a clear and marketable title for the buyer.

For example, we once discovered an outstanding tax lien on a property. By quickly working with the seller and the title company, we successfully resolved the issue before closing, preventing a significant delay or deal failure.

Q 13. Explain your experience with preparing and reviewing closing documents.

Preparing and reviewing closing documents requires careful attention to detail and a thorough understanding of real estate law. My process involves reviewing all documents carefully, including the purchase agreement, deed, mortgage, closing disclosure, and other relevant documents. I verify that all information is accurate and consistent across all documents. I highlight any discrepancies or potential issues and address them proactively with all involved parties. I ensure all parties understand their legal rights and obligations before signing any document, and I maintain meticulous records of all documents and amendments. This thorough approach minimizes the risk of errors and disputes after the closing.

Q 14. What is your process for managing and tracking closing deadlines?

Managing closing deadlines necessitates a highly organized approach. I use project management software to track all crucial deadlines, setting reminders and milestones for each step of the process. Regular communication with all parties, including buyers, sellers, lenders, and title companies, is essential to keep the process on track. I proactively identify and address any potential delays, communicating clearly with all parties about any necessary adjustments to the schedule. This proactive approach helps avoid last-minute rushes and ensures a smooth and timely closing.

Q 15. How do you handle disputes between buyers and sellers during the closing process?

Handling disputes between buyers and sellers during closing requires a calm, professional approach prioritizing open communication and a deep understanding of the contract. My strategy involves:

- Immediate Facilitation of Dialogue: I bring both parties together to understand their perspectives, identify the root cause of the disagreement, and explore mutually acceptable solutions. This might involve reviewing the purchase agreement meticulously to pinpoint any ambiguities or overlooked clauses.

- Objective Mediation: I act as a neutral mediator, ensuring all voices are heard and focusing on finding common ground. My experience helps me anticipate potential sticking points and offer creative solutions, like suggesting compromises or proposing alternative interpretations of contract terms.

- Escalation Protocol: If mediation fails, I’m prepared to escalate the issue. This might involve consulting with legal counsel, providing the necessary documentation to support each party’s claim, or, in some cases, recommending binding arbitration to resolve the matter externally.

For example, a recent dispute involved a disagreement over the condition of appliances. By thoroughly reviewing the inspection report and the contract’s as-is clause, we were able to negotiate a fair compromise, avoiding costly litigation.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. How do you prioritize tasks and manage multiple simultaneous closings?

Managing multiple simultaneous closings requires meticulous organization and efficient time management. I utilize a project management system that incorporates:

- Prioritized Task Lists: Each closing has its own dedicated list, broken down into actionable steps with deadlines. Tasks are prioritized based on urgency and potential impact on the closing timeline. For instance, tasks related to lender requirements are usually prioritized higher.

- Calendar Integration: All deadlines and appointments (inspections, appraisals, signings) are meticulously scheduled in my calendar, with reminders set well in advance. This ensures I’m proactive and avoid last-minute rushes.

- Regular Communication: Consistent communication with all parties involved (buyers, sellers, lenders, title companies) is critical. Regular email updates and phone calls keep everyone informed of the progress and address any emerging issues promptly.

- Technology Leverage: I use closing software to automate certain tasks, such as document preparation and e-signing, which frees up time for more complex issues.

Think of it like conducting an orchestra – each instrument (closing) needs careful attention, but a conductor (me) ensures everything works in harmony towards a successful finale.

Q 17. Describe your experience with using closing software or technology.

I’m proficient in several closing software platforms, including [Name specific software, e.g., Dotloop, ClosingCorp]. These platforms have significantly streamlined the closing process by automating tasks such as:

- Document Preparation: Generating standard closing documents, customizable with specific transaction details, saves considerable time and reduces errors.

- E-Signature Capabilities: Secure electronic signatures expedite the signing process, eliminating the need for physical document exchanges and reducing delays.

- Centralized Data Management: All closing documents and communications are stored securely in a centralized location, improving organization and facilitating easy access for all parties involved.

- Compliance Tracking: Some platforms offer built-in features for monitoring compliance with relevant regulations and laws.

For example, the ability to send and track e-signatures has significantly reduced the time it takes to finalize documents, especially in long-distance transactions.

Q 18. What is your experience with working with different lenders and title companies?

I have extensive experience working with a diverse range of lenders and title companies across various jurisdictions. This experience has fostered strong relationships built on trust and efficient communication. I understand that each lender and title company has its own unique requirements and procedures. My approach involves:

- Understanding Individual Needs: I familiarize myself with each lender’s and title company’s specific underwriting guidelines, document requirements, and preferred communication methods.

- Proactive Communication: I maintain open and consistent communication, proactively addressing any questions or concerns that arise.

- Compliance Adherence: I meticulously ensure that all documents and procedures adhere to each lender’s and title company’s requirements, as well as applicable state and federal regulations.

This proactive approach minimizes delays and potential complications during the closing process, resulting in smooth and efficient transactions.

Q 19. How do you explain complex closing documents to clients who may not have a financial background?

Explaining complex closing documents to clients with limited financial backgrounds requires patience, clear communication, and a willingness to break down complex information into easily digestible terms. My strategy involves:

- Plain Language Explanation: I avoid using jargon and technical terms whenever possible. I explain concepts using simple analogies and real-world examples.

- Step-by-Step Walkthrough: I walk clients through each section of the document, explaining its purpose and significance in the context of the overall transaction.

- Visual Aids: I often use charts, graphs, or other visual aids to illustrate complex financial concepts, making them more accessible and understandable.

- Interactive Sessions: I encourage questions and answer them patiently and thoroughly. I ensure the client understands everything before proceeding.

For instance, I explain escrow accounts as a ‘safekeeping’ place for funds, similar to a trust account, rather than using complicated financial terms. This approach ensures my clients feel comfortable and informed throughout the closing process.

Q 20. What is your experience with handling short sales or foreclosures?

I possess significant experience handling short sales and foreclosures, understanding the complexities and unique challenges these transactions present. My approach focuses on:

- Understanding the Legal Framework: A solid grasp of the legal procedures, timelines, and requirements governing short sales and foreclosures is crucial. This includes understanding lender requirements, lienholder priorities, and bankruptcy implications (if applicable).

- Communication with Multiple Parties: These transactions often involve multiple parties with potentially conflicting interests – lenders, borrowers, real estate agents, and attorneys. Clear and consistent communication is paramount.

- Negotiation Skills: Negotiating favorable terms with lenders is a key aspect of successful short sale transactions. This requires understanding lender motivations and finding mutually acceptable solutions.

- Documentation Management: Meticulous documentation is essential to ensure compliance and protect all parties involved.

One successful short sale I handled involved extensive negotiation with the lender to obtain approval for a significantly reduced sale price, ultimately saving the seller from foreclosure.

Q 21. What is your process for auditing closing documents for accuracy and compliance?

Auditing closing documents is a critical step to ensure accuracy and compliance. My process involves a multi-step approach:

- Preliminary Review: A preliminary review checks for completeness and obvious errors, such as missing signatures or discrepancies in figures.

- Detailed Reconciliation: A thorough reconciliation compares the figures in the closing disclosure with the supporting documentation, including the purchase agreement, appraisal, lender’s instructions, and title insurance commitment.

- Compliance Check: The documents are checked against all applicable state and federal regulations, including RESPA (Real Estate Settlement Procedures Act) and TILA (Truth in Lending Act).

- Error Correction: Any errors or discrepancies are identified and rectified promptly. This might involve contacting relevant parties to correct information or prepare amended documents.

This meticulous approach reduces the risk of errors and ensures compliance, protecting both the buyer and the seller from potential legal issues down the road.

Q 22. Describe your experience with managing post-closing issues.

Post-closing issues, while hopefully rare, are an inevitable part of real estate. My experience involves proactively identifying potential problems before closing and having a structured approach to resolving any issues that arise afterward. This includes everything from correcting minor discrepancies in the final settlement statement to addressing title disputes or lender concerns that surface post-closing.

For example, I once handled a situation where a small discrepancy in property taxes was discovered after closing. Instead of panicking, I calmly reviewed the relevant documentation, contacted the taxing authority, and worked collaboratively with the buyer and seller to rectify the issue fairly and efficiently. This required clear communication, a keen eye for detail, and a commitment to ensuring a positive outcome for all parties involved. I believe in thorough due diligence during the closing process to minimize post-closing issues. A detailed checklist and careful review of all documents are key. We also maintain strong relationships with title companies and lenders to facilitate quick resolution to any emerging issues.

Q 23. How do you maintain confidentiality of client information during closings?

Client confidentiality is paramount. I adhere to strict guidelines regarding the handling and storage of sensitive information. This includes employing strong password protection on all digital files, using encrypted email for all communication containing confidential data, and storing physical documents in secure, locked locations. We also have a strict internal policy that limits access to client files only to authorized personnel on a need-to-know basis. Furthermore, I never discuss client matters in public spaces and always ensure that any discussions about client information are held in private and secure settings. Think of it like this: client information is treated with the same level of protection as medical records – it’s simply not shared without express permission.

Q 24. How do you identify and mitigate risks during a real estate closing?

Risk mitigation in real estate closings is a proactive process. It starts with a thorough review of all documentation – contracts, title reports, surveys, etc. – to identify potential problems early. We verify the accuracy of information provided by all parties, including the buyer, seller, lender, and title company. We look for discrepancies in property descriptions, outstanding liens, or potential environmental concerns. For example, if a title report reveals an unrecorded easement, we would immediately investigate and resolve the issue before proceeding. This may involve contacting the relevant parties or obtaining additional legal advice. We also have contingency plans in place to address unforeseen issues, such as delays in funding or missing documents. By consistently following a thorough due diligence process, we greatly minimize the risk of problems during and after closing.

Q 25. What is your approach to problem-solving in a high-pressure closing environment?

High-pressure closing environments require a calm and organized approach. My strategy involves prioritizing tasks, delegating effectively, and maintaining clear communication with all parties. I utilize checklists and timelines to keep the process on track. When a problem arises, I focus on identifying the root cause, finding a practical solution, and communicating the solution and its implications to all involved. For example, if a lender has a last-minute request for additional documentation, I immediately assess the situation, determine the urgency, and coordinate with the appropriate party to get the necessary documentation as quickly and efficiently as possible while maintaining professionalism and providing regular updates to all stakeholders.

Q 26. Describe your experience in managing and resolving closing delays.

Closing delays are frustrating, but manageable with the right approach. My experience shows that effective communication is key. I work closely with all parties to understand the cause of the delay and identify solutions. This might involve coordinating with the lender to expedite the loan process, contacting the title company to resolve a title issue, or addressing any discrepancies in the paperwork. For example, I once handled a closing delay due to a missing appraisal. By working directly with the appraiser, I was able to expedite the process and minimize the disruption to the schedule. Transparency and proactive communication keeps all parties informed and helps maintain a positive relationship even when things don’t go as planned. A detailed log of all communications and actions is maintained to ensure accountability and transparency.

Q 27. What is your understanding of ALTA guidelines?

The American Land Title Association (ALTA) guidelines are a crucial part of my work. I understand that ALTA guidelines set industry standards for title insurance policies and related forms, including the ALTA Closing Disclosure (CD). These guidelines ensure uniformity and accuracy in real estate transactions. My understanding extends to the specific requirements for various types of policies, the procedures for handling title exceptions, and the proper completion of all ALTA forms. Familiarity with these guidelines is essential for preventing disputes and ensuring compliance with industry best practices. Regular review and updates on changes to ALTA guidelines are essential to stay abreast of current standards and best practices.

Q 28. How would you handle a situation where a crucial document is missing right before closing?

Discovering a missing crucial document right before closing is a stressful but not uncommon situation. My immediate response is to remain calm and systematically address the issue. First, I’d identify the missing document and determine its importance. Then, I’d immediately contact the party responsible for providing the document and request it urgently. Simultaneously, I’d explore alternative solutions. This might involve requesting an extension from the lender or title company (if appropriate) or adjusting the closing timeline. Open and honest communication with all parties is vital. I’d keep everyone informed of the progress and any potential impacts on the closing schedule. In some cases, a substitute document might suffice, and in such cases, I would explore options in collaboration with the relevant stakeholders. The goal is to resolve the situation quickly and efficiently, while always prioritizing the interests and legal requirements of all parties.

Key Topics to Learn for Real Estate Closing Procedures Interview

- Contract Review and Understanding: Thoroughly analyze purchase agreements, identifying key clauses, contingencies, and deadlines. Practical application: Explain how a specific clause, like a financing contingency, impacts the closing process.

- Disbursement of Funds: Master the process of managing and distributing funds from buyers and sellers, ensuring accurate and timely transactions. Practical application: Describe your approach to reconciling discrepancies in funds received.

- Title and Escrow Procedures: Understand title insurance, escrow accounts, and the role of the escrow agent. Practical application: Explain the steps involved in clearing title issues and resolving any discrepancies.

- Document Preparation and Management: Familiarize yourself with the various closing documents, including deeds, mortgages, and settlement statements. Practical application: Detail your experience in organizing and managing a large volume of closing documents.

- Regulatory Compliance: Understand relevant federal, state, and local regulations governing real estate closings. Practical application: Describe how you ensure compliance with RESPA (Real Estate Settlement Procedures Act) or other relevant regulations.

- Problem-Solving and Troubleshooting: Develop strategies for addressing unexpected issues that may arise during the closing process. Practical application: Outline your approach to resolving a conflict between buyer and seller regarding closing costs.

- Closing Process Timeline Management: Effectively manage the timeline of the closing process, coordinating with all relevant parties. Practical application: Describe a scenario where you successfully navigated a delayed closing and the steps you took to mitigate potential issues.

Next Steps

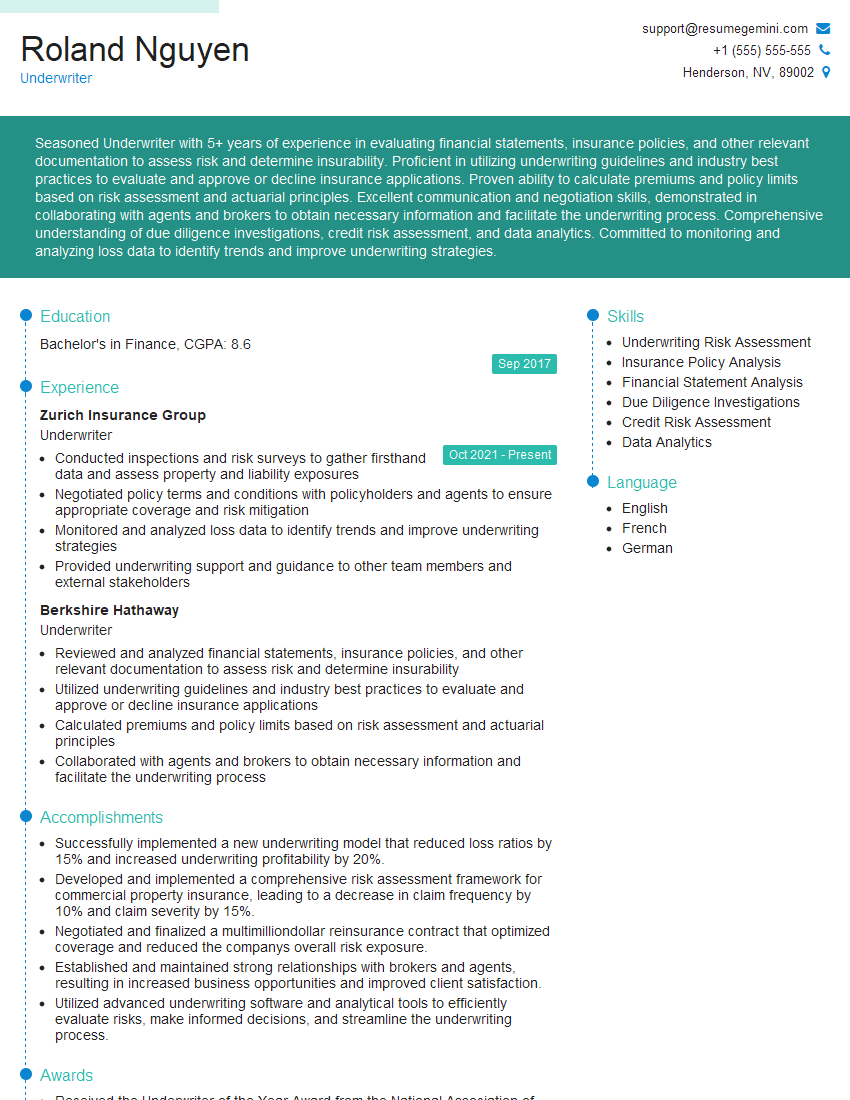

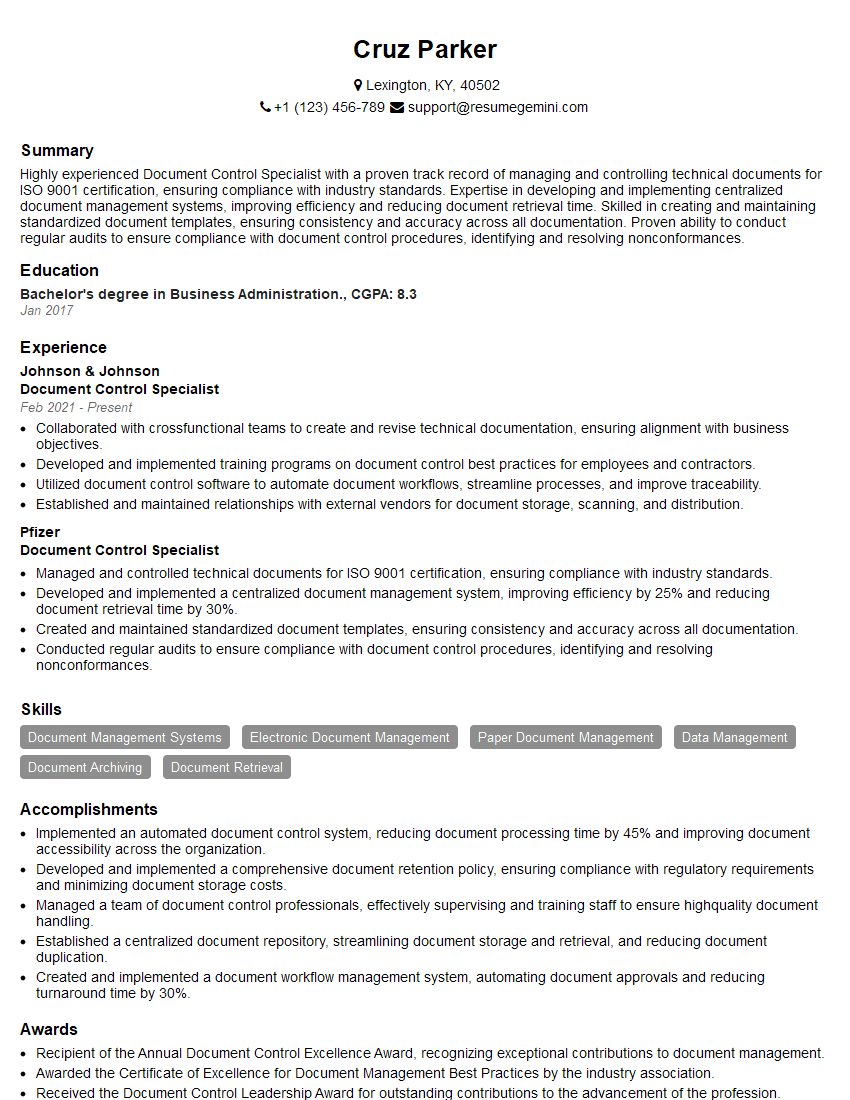

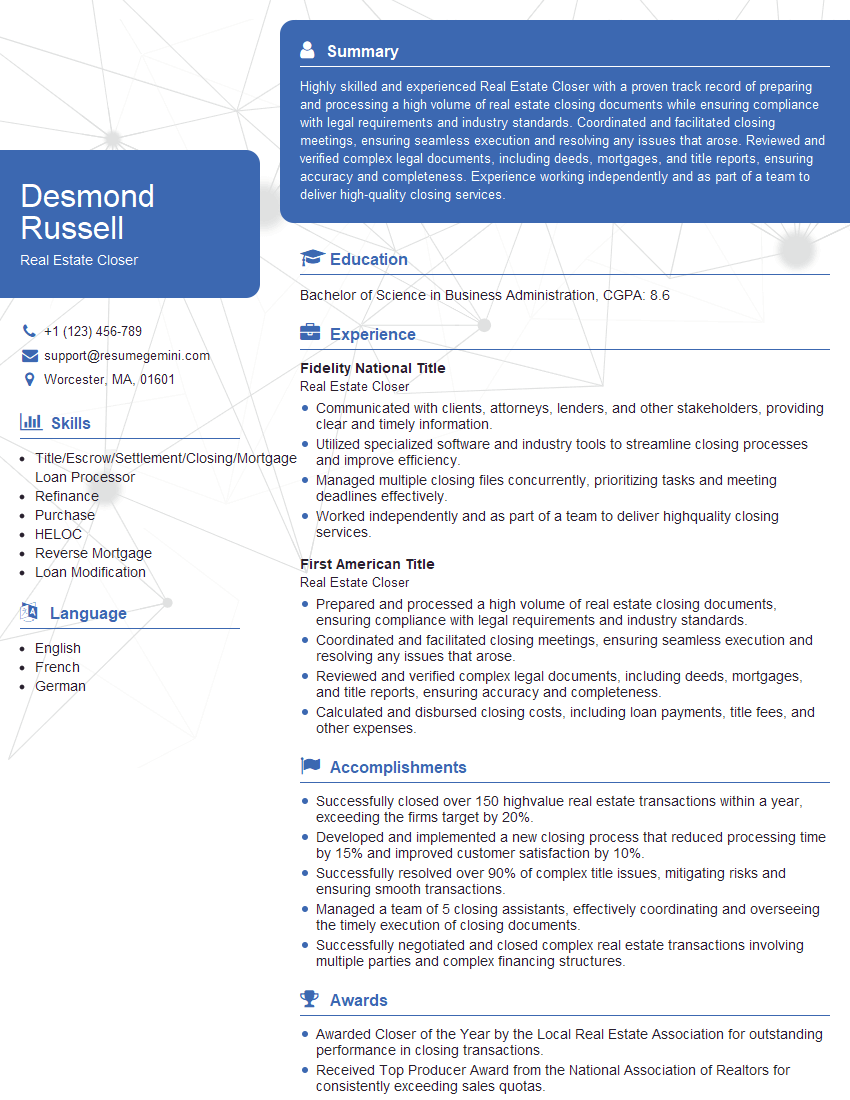

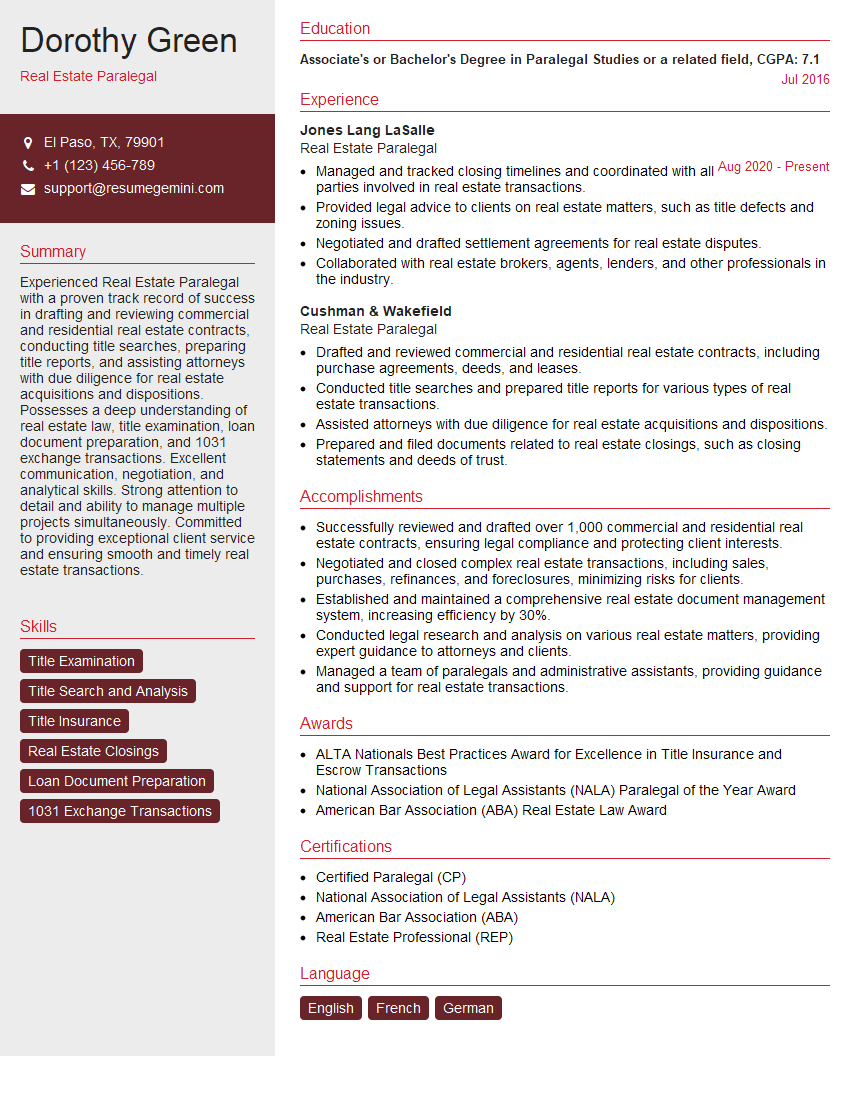

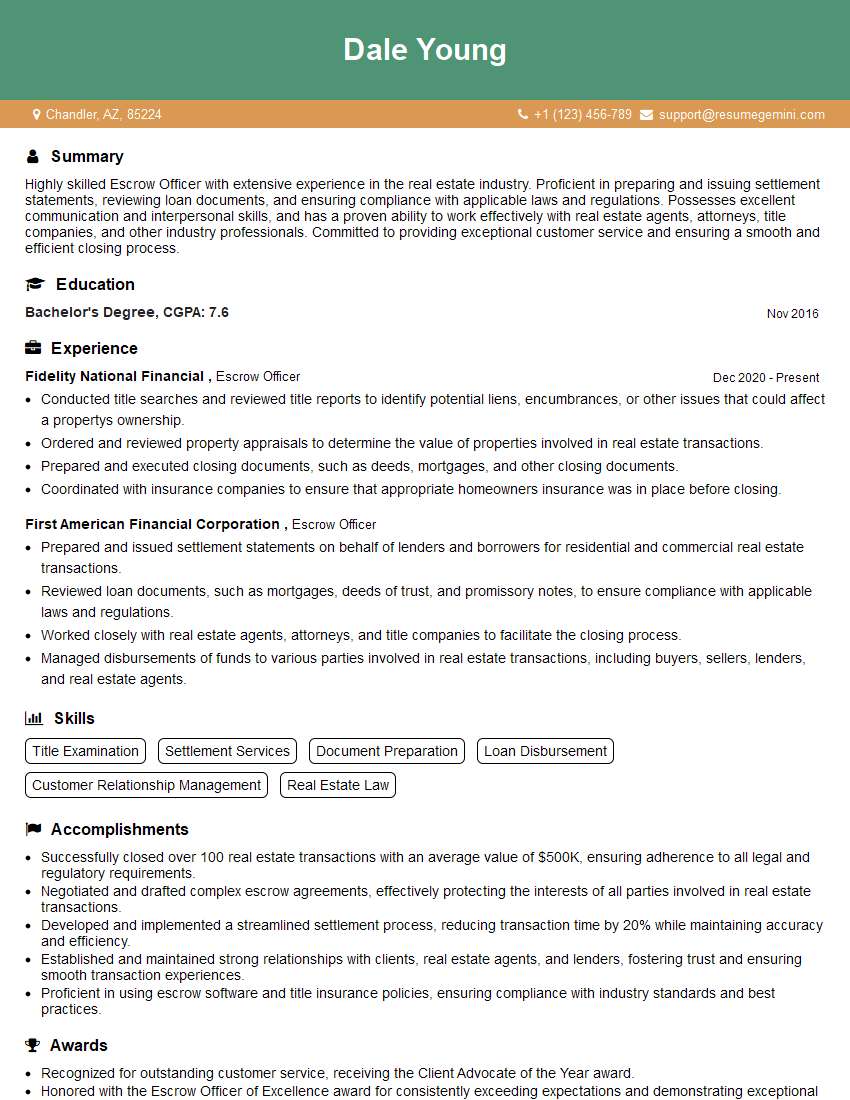

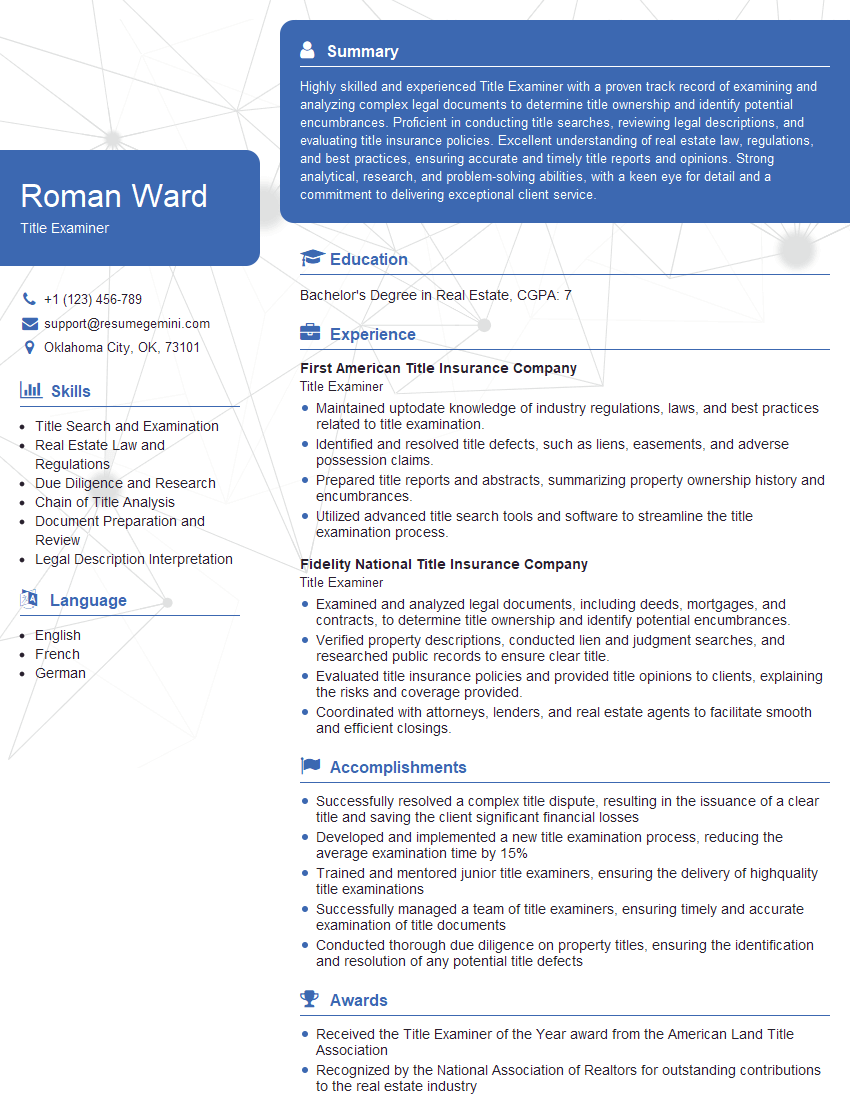

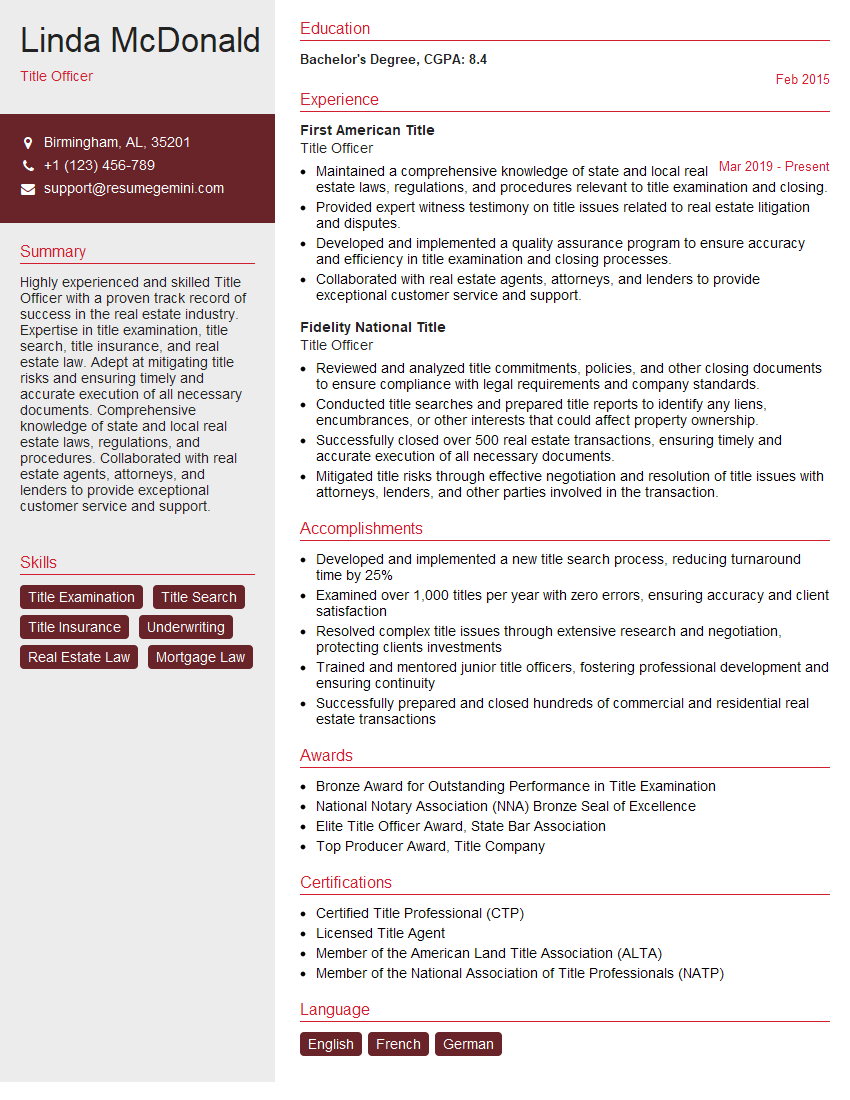

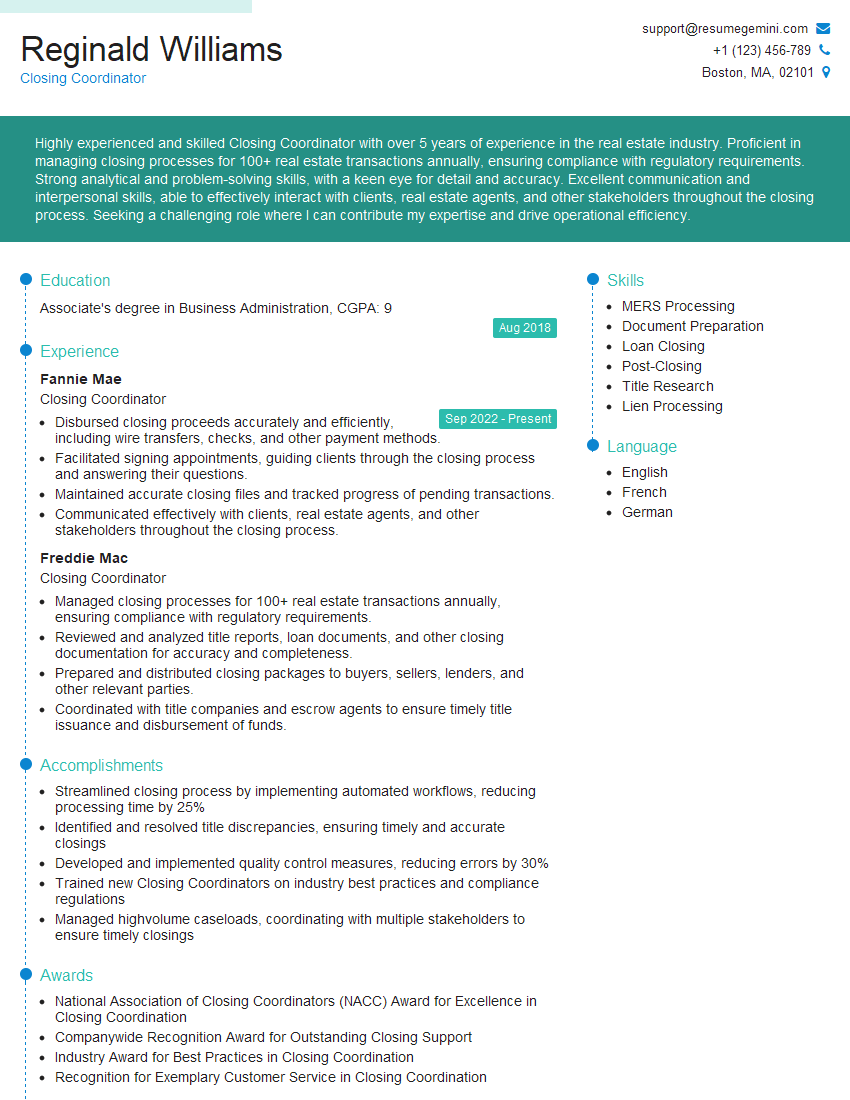

Mastering Real Estate Closing Procedures is crucial for career advancement in this dynamic field. A strong understanding of these processes demonstrates professionalism, attention to detail, and problem-solving skills – highly valued attributes in this industry. To significantly boost your job prospects, create an ATS-friendly resume that highlights your expertise. ResumeGemini is a trusted resource to help you build a professional and impactful resume that gets noticed. Examples of resumes tailored to Real Estate Closing Procedures are available to guide you.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

I Redesigned Spongebob Squarepants and his main characters of my artwork.

https://www.deviantart.com/reimaginesponge/art/Redesigned-Spongebob-characters-1223583608

IT gave me an insight and words to use and be able to think of examples

Hi, I’m Jay, we have a few potential clients that are interested in your services, thought you might be a good fit. I’d love to talk about the details, when do you have time to talk?

Best,

Jay

Founder | CEO