Are you ready to stand out in your next interview? Understanding and preparing for Internal Revenue Manual interview questions is a game-changer. In this blog, we’ve compiled key questions and expert advice to help you showcase your skills with confidence and precision. Let’s get started on your journey to acing the interview.

Questions Asked in Internal Revenue Manual Interview

Q 1. Explain the significance of the Internal Revenue Manual (IRM) in IRS operations.

The Internal Revenue Manual (IRM) is the cornerstone of IRS operations, serving as the comprehensive guide for all IRS employees. Think of it as the IRS’s rulebook, detailing procedures, policies, and legal authorities for everything from tax audits to taxpayer service. Its significance lies in ensuring consistency, fairness, and adherence to the law across all IRS activities. It dictates how agents handle tax returns, conduct investigations, and interact with taxpayers, maintaining uniformity in IRS practices nationwide. Without the IRM, the IRS would operate inconsistently, potentially leading to unfairness and legal challenges.

Q 2. Describe the structure and organization of the IRM.

The IRM is a massive, intricately structured document organized into several parts and sections. It’s not a single document but a vast collection of constantly updated instructions. It’s organized by subject matter, allowing IRS employees to quickly find relevant guidelines. For instance, one part might deal with examination procedures, while another focuses on collection activities. Within each part, sections and subsections further break down the material. This hierarchical structure enables employees to easily navigate and find the specific information they need. The IRM also includes appendices and updates to reflect legislative changes and evolving IRS practices. Think of it as a vast, constantly-updated library tailored to the needs of IRS employees.

Q 3. How does the IRM guide the conduct of tax audits?

The IRM provides a detailed framework for conducting tax audits, outlining every step from selecting taxpayers for audit to issuing final determinations. It dictates the types of evidence that agents can use, the procedures for interviewing taxpayers, and the rules for handling taxpayer disputes. For example, the IRM specifies the documentation required to support audit findings, the methods for calculating tax deficiencies, and the communication protocols with taxpayers. It ensures agents follow consistent and legally sound procedures, protecting both the IRS’s interests and taxpayer rights. It minimizes bias and ensures fairness in the audit process by standardizing the approach for every audit.

Q 4. What are the key sections of the IRM relevant to revenue agents?

Revenue agents rely heavily on several key sections of the IRM. These include sections dealing with examination techniques (how to conduct an audit), handling taxpayer disputes, documenting audit findings, and applying the Internal Revenue Code. Specific examples include sections on conducting interviews, analyzing financial records, and determining taxpayer liability. Furthermore, sections on taxpayer rights and taxpayer confidentiality are crucial for revenue agents to uphold ethical standards and legal requirements during audits. These sections ensure agents understand their responsibilities and operate within the bounds of the law and IRS policy. Failing to follow the outlined procedures can lead to errors, delays, and legal issues.

Q 5. Explain the IRM’s role in ensuring taxpayer rights.

The IRM plays a vital role in safeguarding taxpayer rights. It explicitly outlines taxpayer rights throughout the audit and collection processes. For example, taxpayers have the right to representation, to examine documents used against them, and to appeal decisions. The IRM ensures that agents are aware of and adhere to these rights. It also details the procedures agents must follow when explaining the audit process to taxpayers, answering their questions, and addressing their concerns. This focus on taxpayer rights prevents abuse of power and ensures fair treatment. It’s a crucial aspect of maintaining public trust in the IRS.

Q 6. How does the IRM address taxpayer confidentiality?

The IRM contains strict guidelines on maintaining taxpayer confidentiality. It prohibits the unauthorized disclosure of taxpayer information and specifies how sensitive data should be handled, stored, and secured. This includes both electronic and paper records. Violations can result in serious disciplinary action, including termination. The IRM emphasizes the importance of protecting taxpayer privacy, reflecting the legal and ethical obligations of the IRS. Specific procedures for accessing and using taxpayer data are clearly defined, ensuring that only authorized personnel with a legitimate need can view this sensitive information. Think of it as a strict security protocol designed to prevent data breaches and protect taxpayer privacy.

Q 7. Describe the process for handling taxpayer disputes according to the IRM.

The IRM provides a detailed framework for handling taxpayer disputes. It outlines the process for taxpayers to appeal IRS decisions, from informal discussions to formal appeals within the IRS and to the courts. The IRM explains the different levels of appeal and the procedures involved at each stage. It also clarifies the rules for evidence, the roles of various IRS personnel, and the timelines for resolving disputes. For example, it dictates how appeals officers conduct hearings, review evidence, and issue decisions. This structured process ensures fairness and provides taxpayers with opportunities to challenge IRS determinations. If a taxpayer disagrees with an audit result, the IRM guides them through the available options to address their concerns and ensures a fair and consistent resolution process.

Q 8. What are the procedures for handling fraudulent tax returns as outlined in the IRM?

The Internal Revenue Manual (IRM) outlines a rigorous process for handling fraudulent tax returns. It begins with detection, often through automated systems flagging suspicious filings. Once identified, a specialized team investigates, verifying information against databases and potentially contacting third parties. This involves meticulous record-keeping and adherence to strict evidence-gathering protocols to ensure the investigation is legally sound and can withstand scrutiny. If fraud is confirmed, the case proceeds to criminal investigation, potentially involving referral to the Department of Justice. The IRM emphasizes careful documentation at every stage to protect taxpayer rights and maintain the integrity of the process. Think of it like a detective solving a complex crime scene – every detail matters.

For example, if a return shows unusually high deductions or claims a nonexistent business, flags will be raised. The investigation might involve comparing the taxpayer’s reported income with data from employers, banks, or other sources. If discrepancies are found, further investigation will occur before a determination of fraud is made. The entire process is designed to be thorough and fair.

Q 9. Explain the IRM’s guidance on collecting unpaid taxes.

The IRM provides detailed guidance on collecting unpaid taxes, emphasizing a graduated approach. It starts with polite and informative notices and offers various payment options, such as installment agreements. If these fail, the IRS may levy wages, bank accounts, or other assets. The process is highly regulated to protect taxpayer rights while ensuring the government’s financial interests are met. It considers the taxpayer’s financial situation to determine the best collection strategy. The emphasis is on finding a solution that works for both the taxpayer and the IRS.

For example, if someone owes a significant tax debt, the IRS might initially propose an installment agreement allowing them to pay the debt over time. If that fails, the IRS could then proceed with stronger enforcement actions. The entire process is documented carefully to ensure transparency and accountability.

Q 10. How does the IRM address ethical considerations for IRS employees?

The IRM dedicates significant sections to ethical considerations, stressing the importance of impartiality, confidentiality, and adherence to the law. It emphasizes the need for IRS employees to act with integrity, avoid conflicts of interest, and handle taxpayer information with the utmost care. Violation of these standards can lead to disciplinary action, including termination. The IRM provides training and resources to ensure employees understand and uphold these ethical principles. It’s a matter of public trust – maintaining the integrity of the IRS is paramount.

For instance, an IRS agent cannot disclose a taxpayer’s information to unauthorized individuals, even family members. Any perceived conflict of interest, like having a personal relationship with a taxpayer, must be reported and managed transparently. The IRM’s emphasis on ethics ensures consistent, fair treatment of all taxpayers.

Q 11. What are the penalties for non-compliance with the IRM?

Penalties for non-compliance with the IRM can range from minor disciplinary actions to termination, depending on the severity of the violation. For instance, failing to follow established procedures for handling taxpayer information could result in suspension. More serious infractions, such as intentional misconduct or violation of taxpayer rights, can lead to criminal prosecution. The IRS holds its employees to high ethical and professional standards. The consequences of non-compliance reflect this rigorous commitment.

Imagine an agent deliberately ignoring established procedures for handling a sensitive case. This could lead to disciplinary action and, in serious cases, criminal charges. The penalties serve as a strong deterrent against negligence or intentional wrongdoing.

Q 12. How does the IRM handle taxpayer appeals?

The IRM details a structured process for taxpayer appeals. Taxpayers have the right to challenge IRS decisions through various channels, starting with an informal conference with the original examiner. If unsatisfied, they can proceed to a formal appeals process within the IRS. This process involves presenting evidence and arguments before an appeals officer, who makes an independent determination. The taxpayer can also pursue further action within the court system if necessary. The IRM ensures that taxpayers have access to a fair and impartial appeals process.

For example, if a taxpayer disagrees with an audit finding, they can request a meeting with the appeals officer to present their case. The appeals officer will review the evidence and make a decision, potentially adjusting the tax liability. This multi-step process allows for multiple opportunities for resolution.

Q 13. Describe the different types of audits covered in the IRM.

The IRM covers various audit types, each with its own procedures and objectives. These include correspondence audits (based on reviewing submitted documentation), office audits (conducted in an IRS office), and field audits (conducted at the taxpayer’s place of business or residence). The type of audit depends on the complexity of the tax return and the nature of any potential discrepancies. Each audit type has specific guidelines ensuring fairness and efficiency. Think of it as a tiered system – the complexity of the case determines the scope of the audit.

A simple return might receive a correspondence audit where documents are exchanged by mail. A more complex return, involving a business, could necessitate a field audit with on-site examinations.

Q 14. Explain the IRM’s guidelines for conducting interviews with taxpayers.

The IRM provides extensive guidelines for interviewing taxpayers, emphasizing professionalism, respect, and clarity. Agents must identify themselves, explain the purpose of the interview, and respect the taxpayer’s rights. They should conduct the interview in a neutral and non-threatening manner, ensuring the taxpayer understands the process and can ask questions. Detailed records of the interview must be kept. Maintaining a respectful and professional demeanor is crucial to ensure fairness and the integrity of the process.

For example, an agent must clearly articulate the reason for the interview and what information is being sought. They need to explain the taxpayer’s rights during the interview, including the right to have an attorney or representative present. Proper documentation of the interview ensures accuracy and provides evidence in case of any disputes.

Q 15. How does the IRM guide the selection of cases for audit?

The Internal Revenue Manual (IRM) doesn’t prescribe a single, rigid method for case selection. Instead, it provides a framework based on risk assessment and resource prioritization. Think of it as a sophisticated targeting system. The IRS uses various data analytics tools and statistical methods to identify returns with a higher likelihood of containing errors or non-compliance. This includes analyzing income and deduction patterns, comparing reported income with third-party information (like W-2s and 1099s), and flagging returns with unusual or inconsistent entries. For example, a return reporting significantly higher deductions than similar taxpayers in the same industry might trigger further scrutiny. The IRM also emphasizes the importance of considering factors like taxpayer history, industry-specific risks, and available resources when deciding which cases to audit. It’s not just about finding the biggest discrepancies; it’s about efficiently allocating resources to yield the greatest impact on tax revenue and compliance.

The process involves several steps: First, data is analyzed to identify high-risk returns. Then, a selection process, often involving multiple levels of review, determines which returns will be subjected to a full audit, a partial audit, or no action at all. This selection process is carefully documented to ensure transparency and accountability. Ultimately, the IRM guides the selection towards a balanced approach that aims for both accuracy and fairness.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. What are the IRM’s requirements for documentation and record-keeping?

The IRM is incredibly thorough in its documentation and record-keeping requirements. It mandates meticulous record-keeping at every stage of the audit process, from initial case selection to final determination. Imagine building a case in court – every detail matters. The IRM dictates the specific types of documentation needed, how it should be stored (often electronically with robust security measures), and how long it needs to be retained. This includes not only the taxpayer’s documentation but also the IRS’s internal records of all actions, communications, and decisions related to the case. This rigorous documentation ensures accuracy, transparency, and the ability to reconstruct the audit process if necessary, for example, if a case is challenged. It also serves as a safeguard against errors and ensures consistent application of tax laws.

Think of it like this: if a taxpayer challenges the audit results, the IRS needs to be able to thoroughly and accurately justify its decisions. The IRM ensures this is possible by requiring specific documentation at each step. Failure to maintain proper documentation can lead to challenges in defending IRS actions and even jeopardize the outcome of the case.

Q 17. How does the IRM address the use of technology in tax administration?

The IRM acknowledges the crucial role of technology in modern tax administration. It outlines guidelines for the appropriate use of various technologies, including data analytics, artificial intelligence, and secure communication systems. The goal is to enhance efficiency, accuracy, and compliance monitoring. Think of how technology has revolutionized other industries – the IRS is similarly leveraging its capabilities to improve the taxpayer experience and enhance enforcement. For instance, data analytics helps identify trends and patterns of non-compliance, allowing the IRS to target resources more effectively. Technology also allows for more secure and efficient communication with taxpayers, minimizing delays and misunderstandings. However, the IRM also emphasizes the importance of data security and privacy, recognizing that the sensitive nature of taxpayer information demands stringent safeguards.

For example, the use of machine learning algorithms helps flag potentially fraudulent returns more quickly, while secure online portals allow taxpayers to access their information and communicate with the IRS more easily. The IRM ensures that the implementation of these technologies adheres to strict privacy standards and minimizes any potential risks.

Q 18. Describe the IRM’s guidelines on the use of information technology.

The IRM’s guidelines on information technology (IT) are comprehensive and cover a wide range of topics, from data security to software usage. It stresses the importance of using authorized software and hardware, following established security protocols, and ensuring data integrity. Every IRS employee is expected to understand and abide by these guidelines, which are regularly updated to reflect evolving technologies and security threats. Imagine a bank’s security protocols – the IRS has similarly stringent guidelines to protect sensitive taxpayer data. The use of IT is governed by strict controls to prevent unauthorized access, data breaches, and misuse of information. This includes access controls, encryption, regular security audits, and employee training programs. The IRM underscores the critical need for regular updates and maintenance of systems to ensure continuous protection against cyber threats and vulnerabilities.

For example, access to sensitive taxpayer data is strictly controlled by multi-factor authentication and role-based access control. Any attempt to access unauthorized data is logged and investigated. These protocols are clearly defined and enforced within the IRM to maintain the confidentiality, integrity, and availability of the IRS’s data assets.

Q 19. Explain the IRM’s role in ensuring compliance with tax laws.

The IRM plays a pivotal role in ensuring compliance with tax laws. It provides the framework for IRS agents and employees to correctly interpret and apply tax laws and regulations. The IRM serves as a comprehensive guide, offering detailed explanations, examples, and procedures for handling various tax situations. It ensures consistency in the application of tax laws across different IRS offices and agents, reducing discrepancies and promoting fairness. Think of the IRM as the IRS’s internal rulebook – it defines procedures, clarifies ambiguities in the tax code, and helps maintain a level playing field for all taxpayers. By providing clear guidance on how to conduct audits, investigate potential fraud, and collect taxes, the IRM fosters a culture of compliance and accountability within the IRS itself.

For example, the IRM provides specific guidance on how to handle deductions for charitable contributions, ensuring that the IRS applies the same standards nationwide. This consistency prevents unfair treatment of taxpayers based on location or individual interpretation.

Q 20. How does the IRM help maintain consistency in tax enforcement?

The IRM is critical in maintaining consistency in tax enforcement across different IRS offices and personnel. Its standardized procedures, guidelines, and interpretations of tax laws ensure that all taxpayers are treated fairly and equitably, regardless of where they live or who their assigned agent is. This consistency reduces inconsistencies and promotes fairness. Imagine a situation where similar cases are handled differently in different parts of the country – that would be unjust and inefficient. The IRM aims to prevent such scenarios by establishing uniform standards for all aspects of tax enforcement. The guidelines help standardize audit procedures, ensure proper documentation, and maintain a consistent approach to resolving disputes. Regular training and updates ensure all IRS employees are aware of and adhere to the latest revisions, reinforcing consistency.

For instance, the IRM provides a detailed explanation of how to calculate penalties for late filing, ensuring that the same penalty is applied to a late filer in California as to a late filer in New York. This avoids arbitrary and inconsistent application of penalties across different locations.

Q 21. What are the IRM’s provisions for handling sensitive taxpayer information?

The IRM contains stringent provisions for handling sensitive taxpayer information, emphasizing strict confidentiality and security. It outlines detailed procedures for accessing, storing, using, and disposing of taxpayer data, aligning with various privacy laws and regulations. Think of it like a highly secure vault – access is strictly controlled, and rigorous security measures are in place. The IRM dictates the use of secure systems and networks, access controls, encryption, and regular security audits. Employees are rigorously trained on data privacy protocols, and any violations are subject to severe penalties. The guidelines encompass the entire lifecycle of taxpayer data, from its initial collection to its ultimate disposal, minimizing any potential risks of data breaches or unauthorized access.

For instance, the IRM dictates specific procedures for handling taxpayer social security numbers, ensuring that this sensitive data is not exposed or misused. These procedures include secure storage, limited access controls, and regular audits to verify compliance with privacy regulations. The IRM’s focus on data security is paramount, as it protects both the taxpayer’s privacy and the integrity of the IRS itself.

Q 22. How does the IRM address issues of diversity and inclusion?

The Internal Revenue Manual (IRM) reflects the IRS’s commitment to diversity and inclusion through various provisions. It doesn’t explicitly have a dedicated ‘diversity and inclusion’ section like a standalone chapter, but the principles are embedded throughout. For example, the IRM emphasizes fair and equitable treatment of all taxpayers regardless of race, religion, gender, national origin, or other protected characteristics. This is evident in guidelines for conducting audits, handling taxpayer inquiries, and resolving disputes. The IRM also promotes a diverse workforce within the IRS itself, advocating for equal opportunity in hiring, promotion, and training. Specific guidance on preventing discrimination and harassment is woven into sections dealing with workplace conduct and employee relations. Think of it like this: the IRM’s approach isn’t compartmentalized; diversity and inclusion are foundational principles that underpin all aspects of IRS operations and are reflected in the overall ethos and procedures detailed within the manual.

Q 23. Describe the IRM’s provisions for employee training and development.

The IRM dedicates significant portions to employee training and development. It outlines mandatory training programs covering areas like tax law updates, auditing techniques, taxpayer service, and ethics. Beyond mandated training, the IRM supports ongoing professional development through opportunities for specialized training, conferences, and self-study. The manual also details performance management systems that encourage employee growth and provide feedback mechanisms. For example, a new revenue agent might receive initial training on individual income tax returns, then later have opportunities for advanced training in specialized areas like international taxation or partnership taxation. This ensures continuous competency and enhances the IRS’s capacity to effectively manage the complexities of the tax system. The IRM also highlights the importance of leadership development programs for managers to foster a supportive and effective work environment.

Q 24. Explain the IRM’s procedures for handling Freedom of Information Act (FOIA) requests.

The IRM provides detailed procedures for handling Freedom of Information Act (FOIA) requests. This involves a multi-step process, beginning with the receipt and logging of the request. The IRS has specific guidelines for determining which documents are releasable and which are exempt under FOIA exemptions. The process includes searching for responsive documents, redacting exempt information, and ultimately responding to the requester within the legally mandated timeframe. The IRM also covers procedures for appealing denials of FOIA requests. It emphasizes transparency and adherence to legal requirements. Think of it as a carefully constructed roadmap designed to balance the public’s right to information with the need to protect sensitive information. Failure to adhere to the IRM’s FOIA procedures could lead to legal challenges and reputational damage for the IRS.

Q 25. How does the IRM guide the IRS’s interactions with other government agencies?

The IRM guides IRS interactions with other government agencies through clearly defined procedures for information sharing, collaboration, and data exchange. These procedures are crucial for efficient tax administration and the prevention of tax fraud. For instance, the IRM outlines protocols for collaborating with agencies like the Department of Justice (DOJ) in criminal tax investigations, and with state and local tax authorities in multi-jurisdictional matters. The IRM prioritizes secure information sharing while adhering to privacy regulations. It also defines the roles and responsibilities of IRS employees when interacting with other agencies, ensuring a coordinated and effective approach to complex tax issues. This inter-agency cooperation is essential for a comprehensive and effective tax system.

Q 26. What are the key updates and revisions to the IRM in recent years?

Recent years have seen significant updates to the IRM, primarily reflecting changes in tax law, technology, and IRS operational strategies. Key updates often relate to: new tax legislation; updated technological tools and processes within the IRS (e.g., enhancements to digital communication with taxpayers or changes in data management systems); revised procedures addressing specific taxpayer service issues; and incorporation of lessons learned from internal audits or operational reviews. These changes are often reflected in amended IRM sections or entirely new chapters. Because the IRM is a living document, it’s difficult to give specific examples of past revisions without knowing a specific timeframe, but the core focus is always on improving efficiency, accuracy, and taxpayer service while adhering to the ever-evolving legal landscape.

Q 27. Explain how the IRM incorporates legal precedents and court decisions.

The IRM incorporates legal precedents and court decisions by regularly reviewing and updating its provisions to reflect changes in tax law and judicial interpretations. When courts rule on a particular tax issue, the IRS generally updates the IRM to reflect the new legal standard. This ensures that IRS employees apply the correct legal principles in their work and minimizes the risk of legal challenges. The IRM does this not by literally copying court decisions into the manual, but by extracting the relevant legal principles established by these decisions and translating them into procedural guidelines and best practices for IRS personnel. This ensures consistency and fairness across all IRS operations while maintaining an updated legal understanding that aligns with established case law. This dynamic incorporation of legal precedents is crucial for maintaining the legality and effectiveness of IRS actions.

Q 28. Describe a situation where you had to consult the IRM to resolve a complex tax issue.

I once encountered a complex case involving a taxpayer claiming substantial deductions for losses from a business operating in a foreign country. The taxpayer’s documentation was incomplete and raised questions regarding the legitimacy of certain expenses. I consulted the IRM sections pertaining to international taxation, specifically those sections dealing with substantiation requirements for foreign income and deductions. The IRM provided guidance on the necessary documentation to support these claims, including specific types of records and the level of detail needed. After carefully reviewing the taxpayer’s submission against the IRM guidelines, we were able to identify significant discrepancies, prompting a further investigation and ultimately a revision of the claimed deductions. The IRM was instrumental in ensuring we followed proper procedures, maintained consistency in our application of tax law, and ultimately rendered a fair and legally sound determination.

Key Topics to Learn for Internal Revenue Manual Interview

- Tax Law Fundamentals: Understand the core principles of US tax law as outlined in the IRM, including individual and corporate taxation.

- Examination Procedures: Familiarize yourself with the various examination techniques and processes described in the IRM, focusing on practical application in real-world scenarios.

- Compliance and Enforcement: Grasp the IRS’s role in ensuring tax compliance and the procedures for handling non-compliance cases. Understand the ethical considerations involved.

- Internal Revenue Code (IRC) Integration: Learn how the IRM interprets and applies the provisions of the IRC. Practice connecting IRM guidelines to specific code sections.

- Data Analysis and Research: Develop skills in using IRS databases and resources to effectively research tax issues and support findings. Prepare examples of how you’ve used data to solve problems.

- Communication and Collaboration: The IRM emphasizes clear and effective communication. Practice explaining complex tax concepts in a concise and understandable manner. Prepare for scenarios requiring teamwork and collaboration.

- Specific Areas of the IRM: Depending on the specific role, focus on relevant sections of the IRM dealing with individual income tax, corporate tax, estate and gift tax, or other specialized areas.

Next Steps

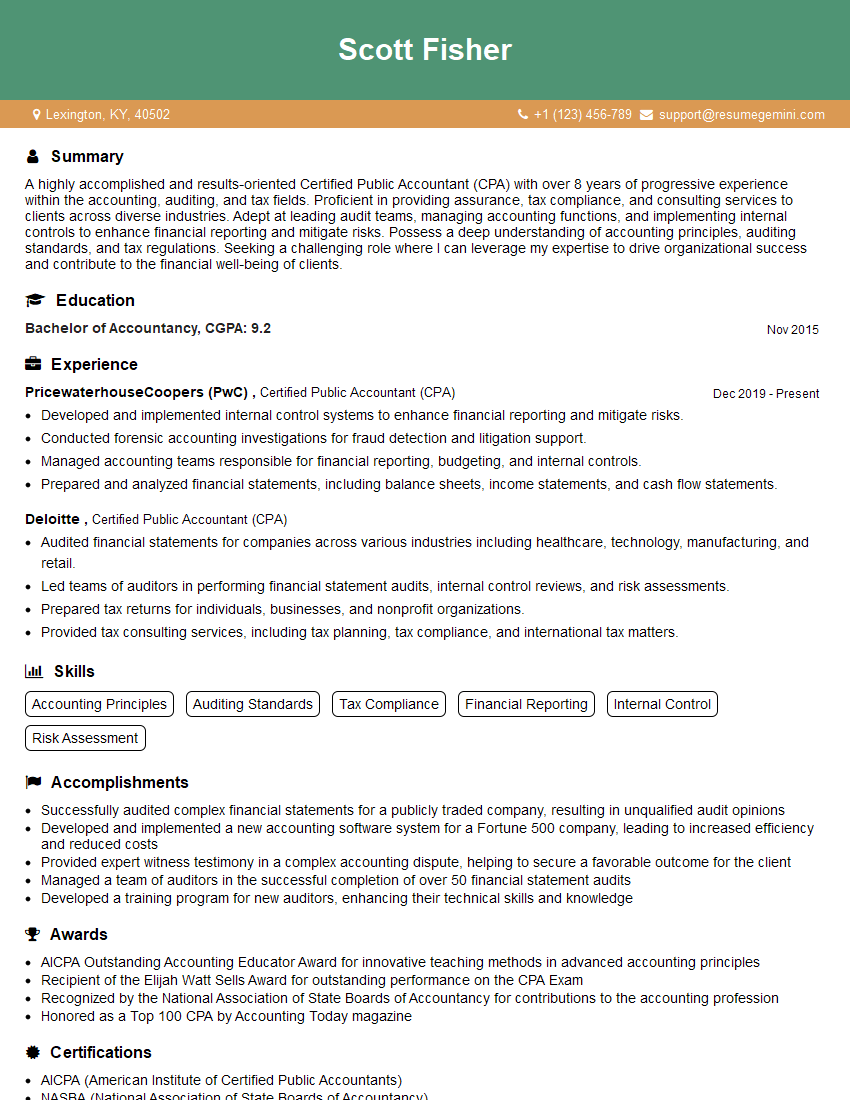

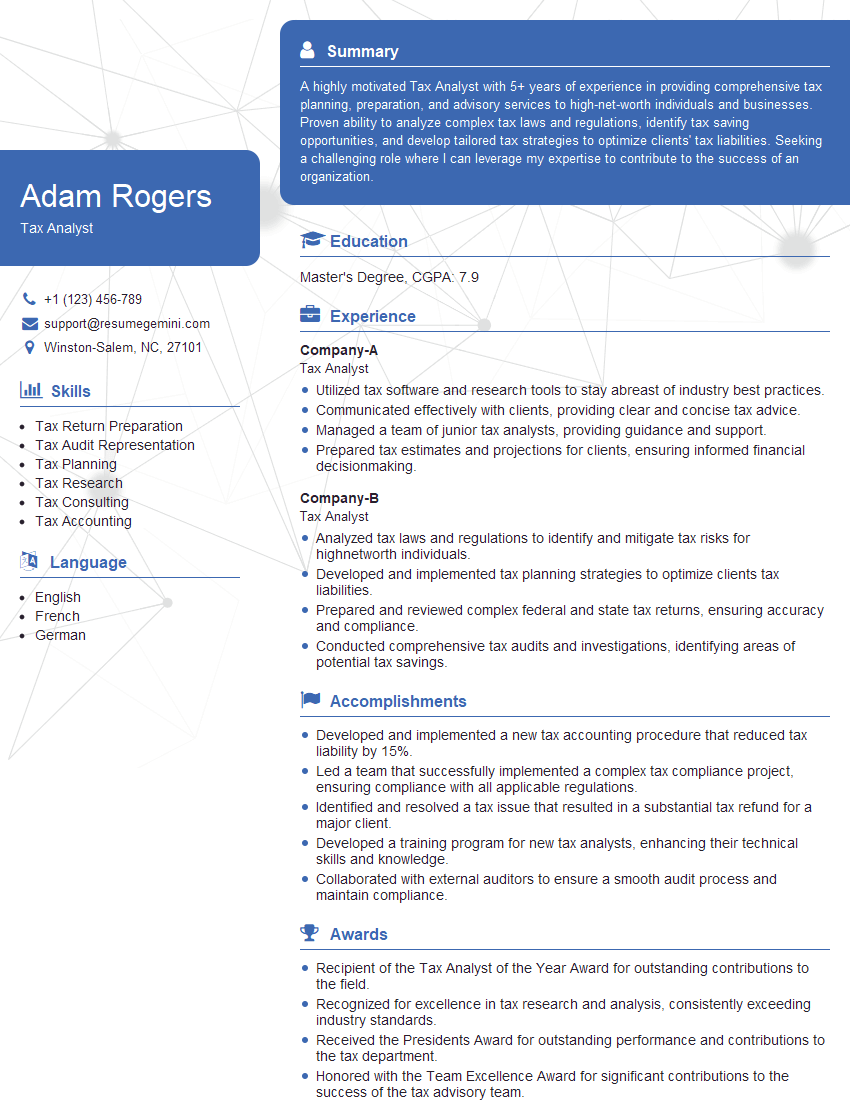

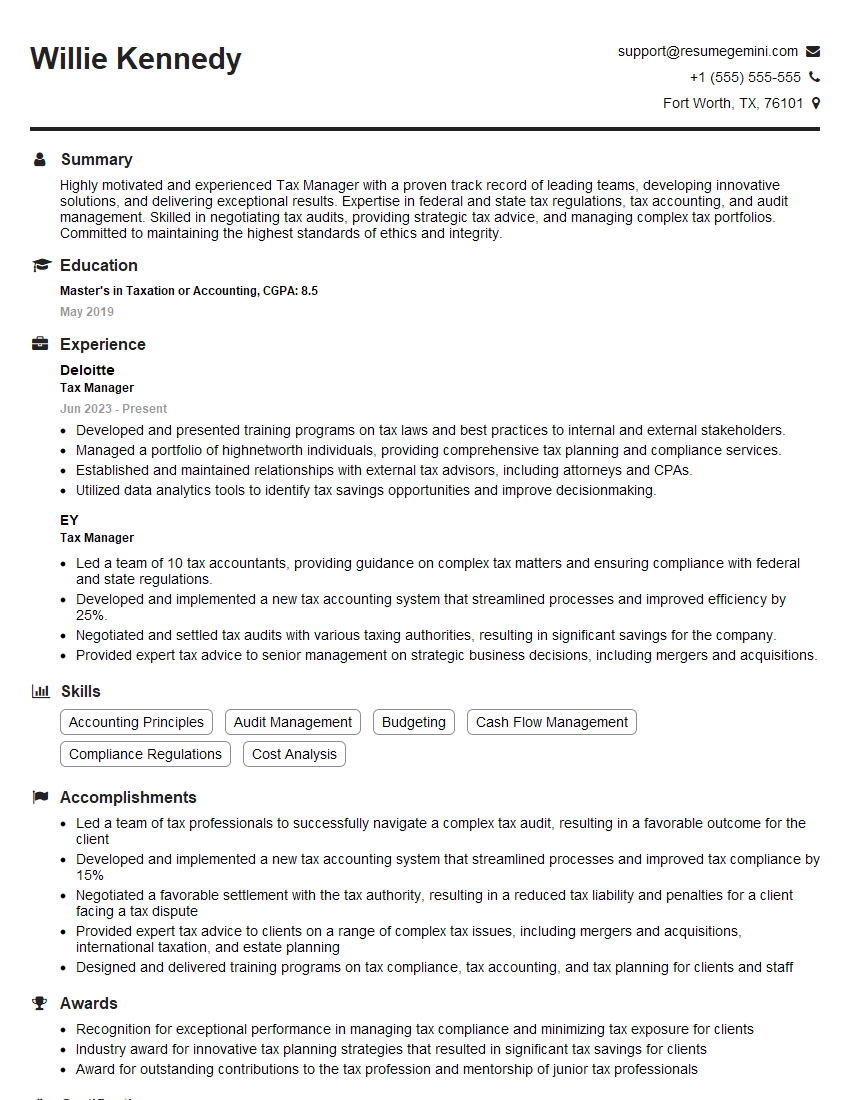

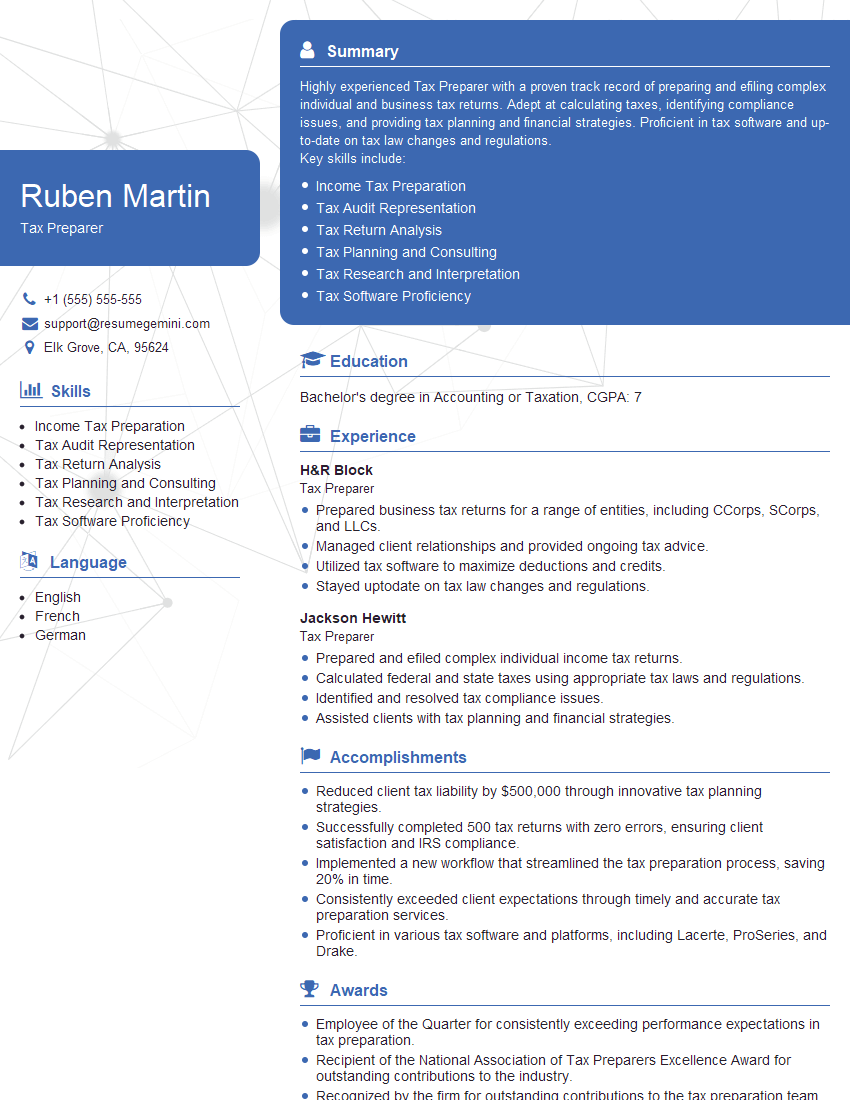

Mastering the Internal Revenue Manual is crucial for a successful career within the IRS or related fields. A strong understanding of the IRM demonstrates commitment to excellence and proficiency in tax administration. To maximize your job prospects, crafting an ATS-friendly resume is essential. ResumeGemini is a trusted resource to help you build a professional and impactful resume that highlights your skills and experience. Examples of resumes tailored to the Internal Revenue Manual are provided to give you a head start. Invest time in refining your resume; it’s your first impression on potential employers.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

I Redesigned Spongebob Squarepants and his main characters of my artwork.

https://www.deviantart.com/reimaginesponge/art/Redesigned-Spongebob-characters-1223583608

IT gave me an insight and words to use and be able to think of examples

Hi, I’m Jay, we have a few potential clients that are interested in your services, thought you might be a good fit. I’d love to talk about the details, when do you have time to talk?

Best,

Jay

Founder | CEO