Interviews are opportunities to demonstrate your expertise, and this guide is here to help you shine. Explore the essential W-2 Verification interview questions that employers frequently ask, paired with strategies for crafting responses that set you apart from the competition.

Questions Asked in W-2 Verification Interview

Q 1. Explain the process of W-2 verification.

W-2 verification is a crucial process ensuring accuracy in reporting employee wages and tax withholdings. It involves meticulously comparing information reported on the employee’s W-2 form with internal payroll records. This cross-referencing helps identify and rectify discrepancies before they escalate into significant legal or financial problems.

The process typically begins with obtaining W-2 data from employees (either electronically or physically) and then importing this data into a payroll system or a dedicated verification software. Next, each data point (employee name, social security number, gross wages, tax withholdings, etc.) on the W-2 is compared against the company’s own payroll records. Any inconsistencies are flagged for investigation and resolution.

Imagine it like comparing two sets of blueprints for a house – the W-2 is one blueprint and the payroll records are another. Every wall, door, and window must match. Any discrepancies indicate a potential error needing attention.

Q 2. What are the common errors found during W-2 verification?

Common errors in W-2 verification range from simple typographical mistakes to more complex data inconsistencies. Some frequently encountered errors include:

- Incorrect Social Security Number (SSN): A simple transposition of numbers can lead to significant tax reporting issues.

- Mismatch in Wages: Differences between reported gross wages, federal and state withholdings, and other compensation details.

- Incorrect Employee Name or Address: Spelling errors or outdated information can delay tax refunds or cause other complications.

- Missing or Incorrect Employer Identification Number (EIN): This number is crucial for correct tax filing.

- Errors in Box 12 (various codes): These codes represent additional payments like 401k contributions, which need precise accuracy.

These errors, if left uncorrected, can trigger IRS scrutiny and result in penalties for both the employer and the employee.

Q 3. How do you identify discrepancies in employee data on a W-2?

Identifying discrepancies involves a systematic comparison of data points. I typically use data analysis tools to automate this, but manual checks are always part of the process. I focus on key fields:

- Employee Name and SSN: Exact matches are crucial. Any variation needs immediate attention.

- Gross Wages: Compare year-to-date (YTD) wages in payroll records with the W-2. Discrepancies may be due to missing payments, incorrect hourly rates, or overtime calculation errors.

- Tax Withholdings: Verify the accuracy of federal, state, and local tax withholdings against payroll data. Inconsistencies might arise from incorrect tax rates or filing status updates.

- Other Compensation: Compare reported amounts for bonuses, commissions, and other forms of compensation.

For instance, if the W-2 shows a gross income of $50,000, but payroll records show $52,000, there’s a $2,000 discrepancy that needs thorough investigation.

Q 4. Describe your experience with W-2 form correction procedures.

W-2 form correction procedures require careful documentation and adherence to IRS guidelines. The process usually starts with identifying the specific error, then gathering supporting evidence (e.g., payroll records, pay stubs, corrected tax forms). We prepare a corrected W-2 form (Form W-2c) and distribute this corrected version to the employee and file a corrected W-2 with the Social Security Administration (SSA) and the IRS. It’s critical to keep meticulous records of all correspondence and actions taken during the correction process.

In one instance, we discovered a significant discrepancy in bonus payments on multiple employees’ W-2s. We investigated, pinpointed the error in our payroll system’s bonus calculation formula, corrected the formula, generated the corrected W-2c forms, and followed IRS procedures to notify the affected employees and government agencies.

Q 5. What are the legal implications of inaccurate W-2 reporting?

Inaccurate W-2 reporting carries substantial legal and financial repercussions. For employers, these can include:

- Penalties and fines from the IRS: These can be significant, depending on the severity and intent of the error.

- Legal actions from employees: Employees may sue for damages resulting from errors affecting their tax returns or other financial matters.

- Reputational damage: Inaccurate reporting can severely damage an employer’s reputation and credibility.

For employees, errors can lead to delays in tax refunds, incorrect tax assessments, and potential audits. Understanding and correcting W-2 inaccuracies is crucial to protect the interests of both the employer and the employee.

Q 6. Explain the importance of data validation in W-2 verification.

Data validation is paramount in W-2 verification. It involves implementing checks and balances to ensure data accuracy and integrity. This might include:

- Data type validation: Ensuring that fields contain the correct data type (e.g., numbers for wages, text for names).

- Range checks: Verifying that values fall within a reasonable range (e.g., wages should be positive).

- Consistency checks: Confirming that data is consistent across multiple fields (e.g., SSN matches across payroll and W-2 data).

- Cross-referencing: Comparing data with other sources to identify inconsistencies.

By rigorously validating data, we significantly reduce the risk of errors and enhance the reliability of the W-2 verification process. Think of it as spell-checking a critical document before submitting it; it saves time and avoids potentially costly mistakes.

Q 7. How do you handle conflicting information during W-2 verification?

Handling conflicting information during W-2 verification necessitates a methodical approach. I prioritize verifying the source’s reliability and accuracy. I begin by:

- Reviewing supporting documentation: Pay stubs, employee contracts, and other relevant records can help resolve conflicts.

- Contacting the employee: Clarification directly from the employee is often essential.

- Reconciling payroll records: Thorough review of payroll entries and calculations to pinpoint the source of the conflict.

- Consulting with tax professionals: In complex situations, seeking expert advice is advisable.

For instance, if the employee claims a different income than the payroll records reflect, I would first verify the payroll records for errors and then contact the employee to confirm the discrepancy. If the error is on the payroll side, I’d initiate a W-2 correction; if on the employee’s side, the employee needs to address the inconsistency with their tax advisor.

Q 8. What software or tools are you familiar with for W-2 processing and verification?

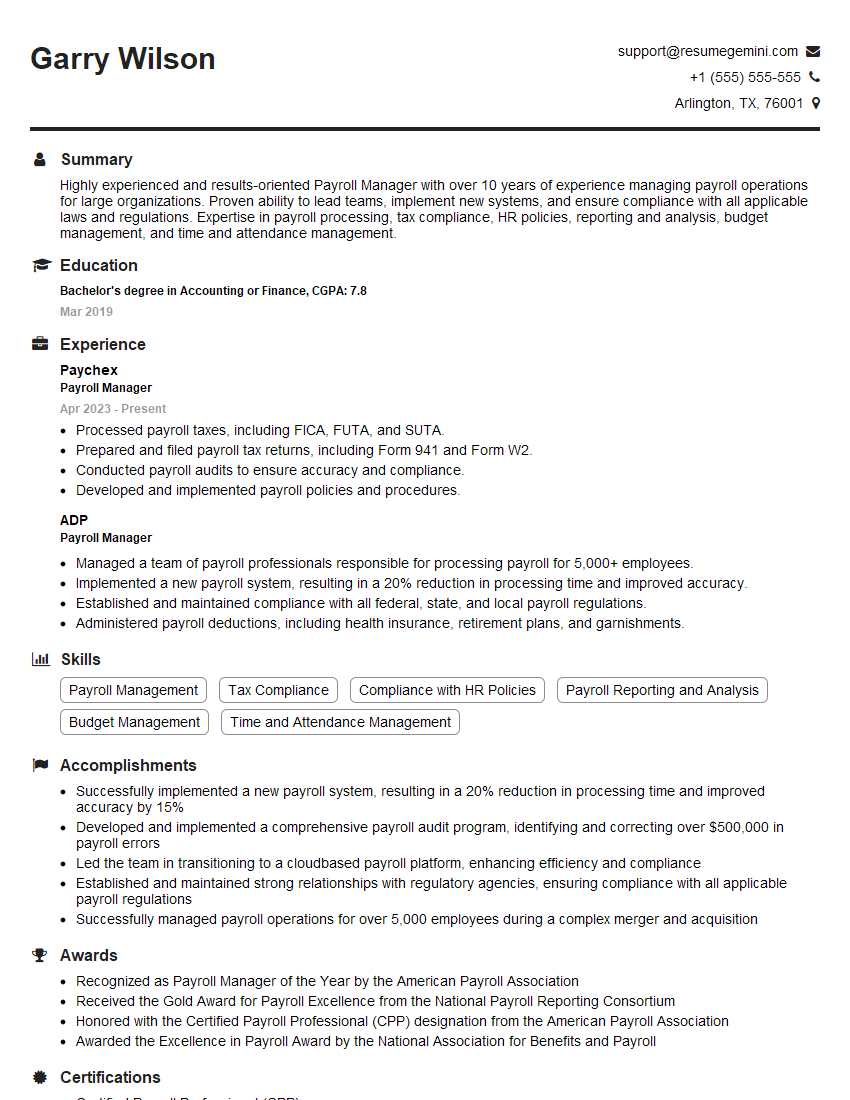

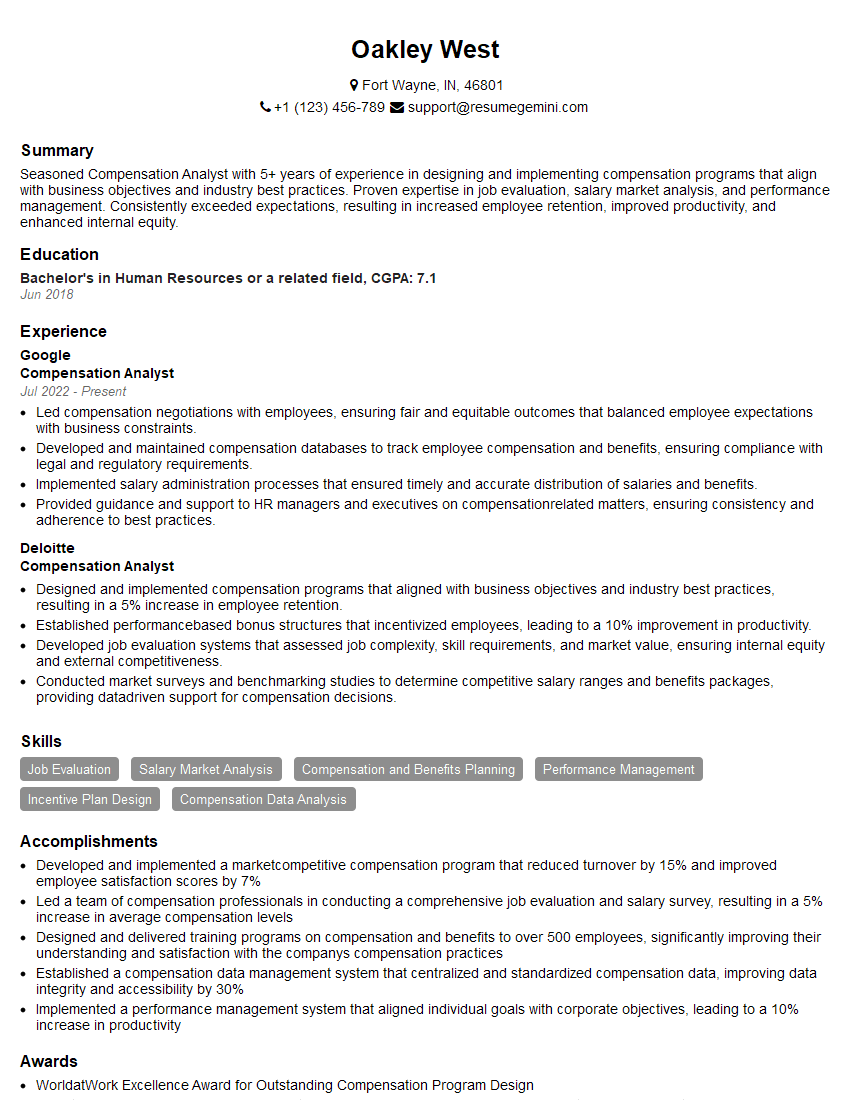

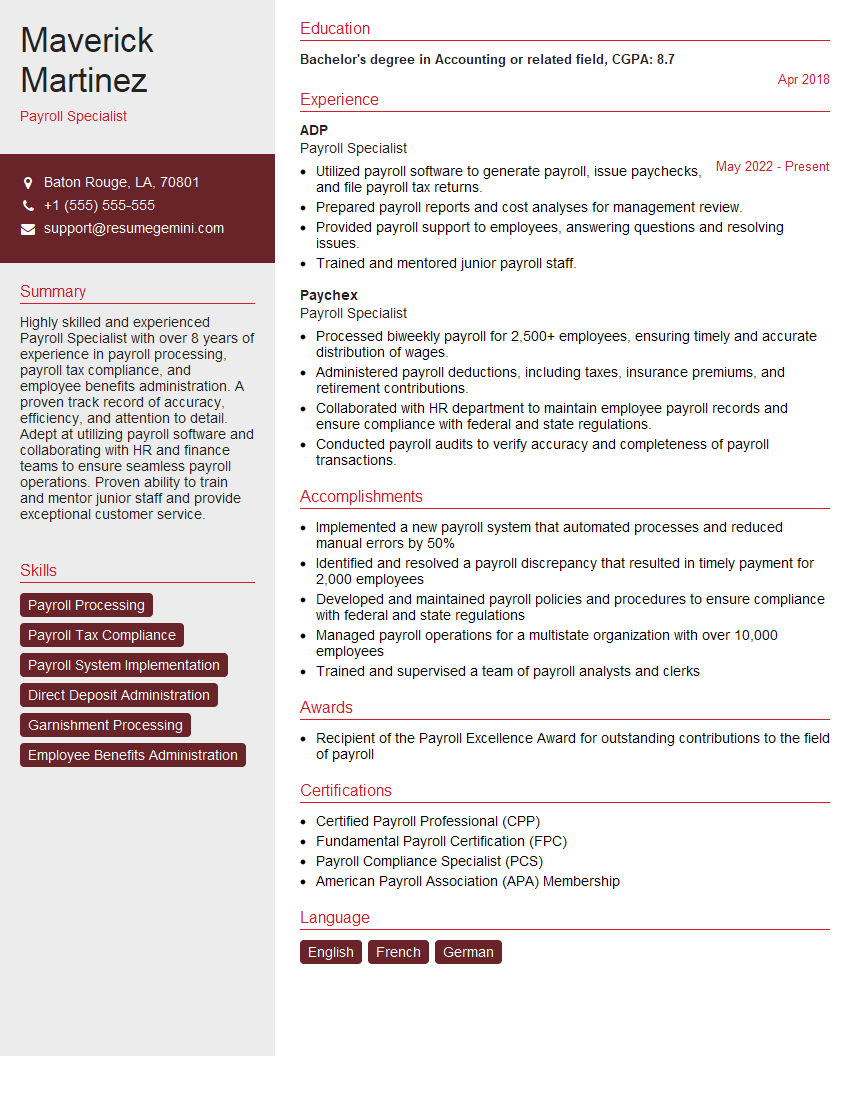

My experience encompasses a range of software and tools for W-2 processing and verification. I’m proficient in payroll software like ADP, Paychex, and UKG Pro, all of which offer robust W-2 generation and reporting capabilities. Beyond these comprehensive systems, I’m also comfortable using spreadsheet software like Microsoft Excel and Google Sheets for data manipulation, analysis, and reconciliation. For larger-scale operations or when dealing with complex data integration, I have experience utilizing data management tools like SQL to query and verify data from various sources. Finally, I’m familiar with dedicated W-2 management platforms which streamline the entire process, from data entry to distribution and verification.

For example, in a previous role, we used ADP Workforce Now to generate W-2s, and then utilized Excel to perform detailed cross-checks against employee records and tax filing data. This dual approach ensured both efficiency and accuracy.

Q 9. How do you ensure the accuracy and completeness of W-2 data?

Ensuring the accuracy and completeness of W-2 data is paramount. My approach is multi-faceted and begins with meticulous data entry, rigorously verifying every piece of information against source documents, such as employee onboarding paperwork, time sheets, and pay stubs. I perform multiple levels of checks and balances, using both automated and manual processes. Automated checks involve using software capabilities to flag inconsistencies, such as mismatched social security numbers or discrepancies in reported earnings. Manual checks include comparing the W-2 data to previous year’s filings and employee self-reported information.

A critical step is performing a thorough reconciliation with payroll data. This involves comparing the total wages reported on the W-2s to the total wages recorded in the payroll system. Any discrepancies trigger immediate investigation. Finally, I implement a rigorous review process, often involving a second pair of eyes, before finalizing and distributing the W-2s. Think of it like a three-legged stool: data entry accuracy, reconciliation with payroll, and thorough review – all are equally important for reliability.

Q 10. Describe your experience with W-2 reconciliation.

W-2 reconciliation is a cornerstone of my expertise. It’s the process of comparing the total wages and taxes reported on W-2 forms to the corresponding figures recorded in the company’s payroll system. This ensures that the numbers match and that no income or tax has been incorrectly reported. My process typically involves:

- Data Extraction: Gathering data from the payroll system and W-2 reports.

- Data Cleaning: Ensuring consistent formatting and addressing any data quality issues.

- Comparison: Using spreadsheet software or dedicated reconciliation tools to compare the data. I often utilize pivot tables in Excel to easily aggregate data and highlight discrepancies.

- Investigation: Investigating any discrepancies found, verifying data sources, and identifying the root cause of the error (e.g., data entry mistake, payroll processing error, etc.).

- Correction: Correcting errors and updating relevant records. Documentation of the corrections is crucial.

- Reporting: Generating reports summarizing the reconciliation process and any identified discrepancies.

For instance, I once uncovered a discrepancy due to a payroll system glitch that miscalculated bonus payments for a small group of employees. The reconciliation process not only identified the error but pinpointed its exact cause, leading to timely corrections and preventing potential tax issues.

Q 11. How do you maintain confidentiality when handling sensitive employee data?

Confidentiality is paramount when handling sensitive employee data. I adhere to strict security protocols, including password-protecting all files, utilizing secure file-sharing systems, and encrypting sensitive data both in transit and at rest. I follow company policies regarding data access, ensuring that only authorized personnel have access to W-2 information. I never discuss employee data with unauthorized individuals. Physical security of documents is also important; paper copies, if any, are stored in locked cabinets.

Furthermore, I am always mindful of the regulations surrounding data privacy, such as HIPAA (if applicable) and state-specific privacy laws. I regularly update my knowledge of these regulations to ensure compliance. Think of it like guarding a vault – multiple layers of security are essential to protect the valuable assets within.

Q 12. What is your process for resolving W-2 discrepancies with employees?

Resolving W-2 discrepancies with employees requires a professional and empathetic approach. I start by verifying the discrepancy using source documents and payroll data. Once the error is confirmed, I contact the employee promptly, explaining the situation clearly and concisely, without using technical jargon. I provide supporting documentation to justify the correction. I then work collaboratively with the employee to resolve the issue. This might involve submitting corrected W-2 forms to the IRS and updating the employee’s tax records.

Open and honest communication is crucial. I always strive to maintain a positive and respectful relationship with the employee throughout the process. I will usually document all communication and actions taken to maintain a record for audit purposes. A calm and patient approach ensures a smoother resolution, turning a potentially negative experience into a positive interaction.

Q 13. Explain the difference between a W-2 and a 1099 form.

The W-2 and 1099 forms both report income, but they serve different purposes and apply to different types of workers. A W-2 form reports wages paid to employees by an employer. Employees are those who work for a company and receive a regular paycheck subject to various payroll taxes (Social Security, Medicare, and potentially federal and state income tax withholdings). A 1099 form, on the other hand, reports payments made to independent contractors or freelancers. These individuals are self-employed, not considered employees, and are responsible for paying their own self-employment taxes.

Think of it this way: if you are an employee on a company’s payroll, you’ll receive a W-2. If you are hired for a specific project and not part of the company’s payroll, you’ll likely receive a 1099.

Q 14. How do you handle W-2 verification for part-time employees?

W-2 verification for part-time employees follows the same principles as for full-time employees. The process is identical; the only difference is the volume of data involved will generally be less. I ensure that all earnings, including hourly wages, bonuses, and any other compensation are accurately reported. I verify the information against time sheets, pay stubs, and employee records. The same reconciliation processes apply to ensure data accuracy and consistency between payroll data and the reported W-2 information.

It’s crucial to treat part-time employees with the same level of care and attention to detail as full-time employees to ensure accuracy and compliance.

Q 15. What are your strategies for efficient W-2 verification processes?

Efficient W-2 verification hinges on a multi-pronged approach. My strategy begins with automation wherever possible. This includes using software that can automatically compare employee data against the W-2 information received from employers. Think of it like a sophisticated spell-checker, but for tax documents. It flags discrepancies instantly, saving hours of manual review.

Secondly, I implement robust data validation checks. This involves creating custom rules within our systems to identify illogical entries, such as negative income amounts or social security numbers with incorrect formatting. This is like having a second set of eyes, ensuring the data integrity of each W-2.

Finally, a strong focus on process standardization is key. This means creating clear, consistent procedures for data entry, verification, and reconciliation. This consistency significantly reduces errors and allows for streamlined workflows. A well-defined checklist, for instance, is invaluable for consistent data review.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. Describe your experience working with different payroll systems.

My experience spans various payroll systems, including ADP, Paychex, and Gusto. I’ve worked with both cloud-based and on-premise solutions. Each system has its own nuances regarding data export formats and functionalities. For instance, ADP’s reporting capabilities are slightly different from Paychex’s. Understanding these nuances is crucial for efficient data extraction and reconciliation.

In my previous role, we integrated a new payroll system that significantly improved our W-2 processing times. This involved customizing data mapping to ensure seamless data transfer between the system and our verification platform. It wasn’t always smooth sailing; I had to troubleshoot integration issues, such as data type mismatches and address discrepancies in formatting. The successful transition though, resulted in a 30% reduction in processing time.

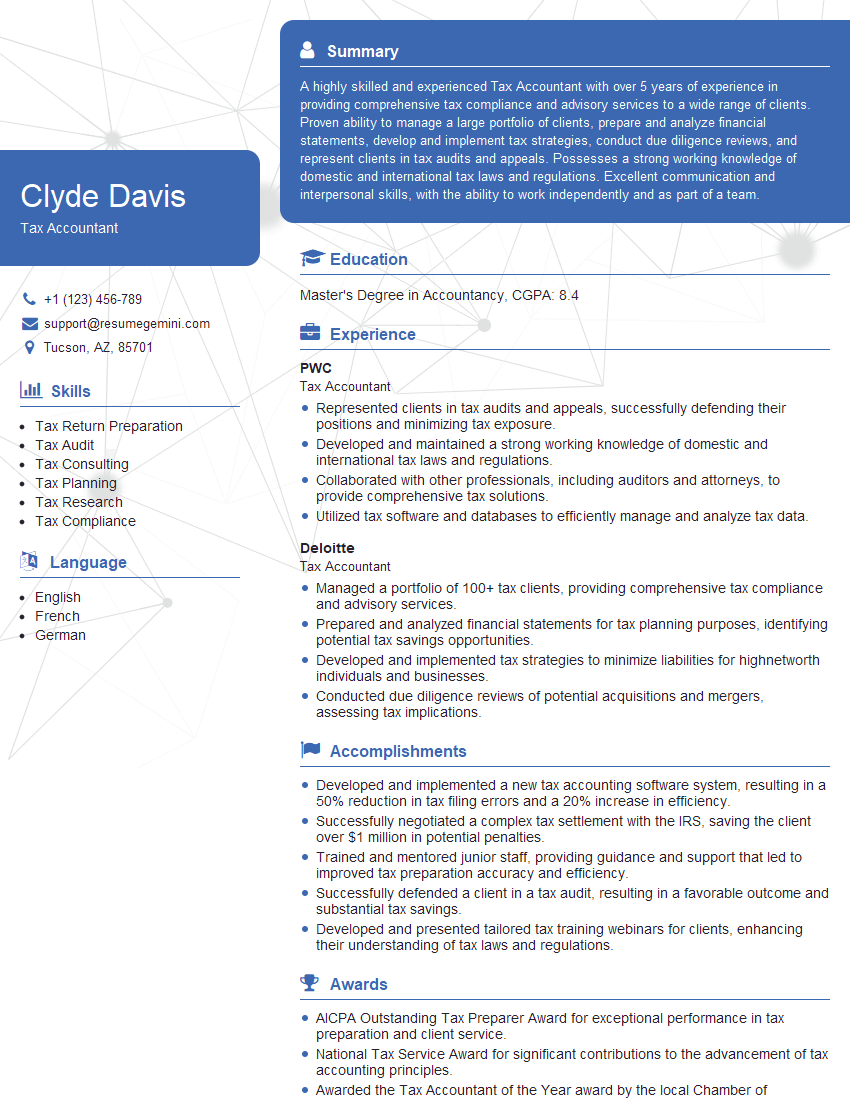

Q 17. How do you ensure compliance with all relevant tax regulations?

Compliance is paramount. My approach is proactive rather than reactive. This means staying updated on all IRS regulations and state-specific tax laws related to W-2 reporting. I regularly review IRS publications and attend relevant webinars to ensure my knowledge remains current. I’m familiar with the intricacies of Form W-2, including the various boxes and their significance.

We use a combination of automated checks and manual reviews to ensure accuracy and adherence to regulations. For example, our system automatically checks for inconsistencies in the social security number, employee name, and reported income. Any discrepancies trigger a review by a qualified team member. We maintain meticulous documentation of all verification procedures and maintain comprehensive audit trails to demonstrate our commitment to compliance. Think of it as keeping a detailed logbook of every step we take, ready for any audit.

Q 18. How do you manage large volumes of W-2 data?

Managing large volumes of W-2 data necessitates strategic data handling. We leverage database management systems (DBMS) to organize and efficiently access the data. This allows for fast searching, sorting, and filtering. It’s like having a super-organized library for our W-2 forms.

Furthermore, we employ data warehousing techniques to consolidate information from different sources. This aggregated data provides a holistic view and allows for comprehensive analysis. For example, we can easily identify trends in income reporting or identify potential areas for errors. We also utilize data visualization tools to present this information in a clear, concise way, facilitating quick decision-making and problem identification.

Q 19. What are some common challenges in W-2 verification, and how do you overcome them?

Common challenges include data entry errors, inconsistencies between employee records and W-2 information, and missing or late W-2 forms.

To overcome these, we implement data validation rules to catch errors early. We proactively communicate with employers to obtain missing or incorrect information. For example, a friendly reminder email can go a long way. We also employ reconciliation techniques, systematically comparing data from multiple sources to identify and resolve discrepancies. We use a phased approach – initial automated checks, followed by manual review of flagged entries to ensure accuracy. It’s like a multi-layered security system for data integrity.

Q 20. Explain your understanding of IRS regulations concerning W-2 reporting.

My understanding of IRS regulations concerning W-2 reporting is comprehensive. I am intimately familiar with the requirements for timely filing, accurate reporting of wages, taxes withheld, and other relevant information. I know the implications of non-compliance, including penalties and potential legal repercussions.

I understand the different types of W-2 forms and their uses (W-2, W-2c). I’m also aware of the various deadlines for employers to distribute and file W-2 forms with the Social Security Administration (SSA) and the IRS. The proper completion of all data fields, including correct employee identification and wage information, is critical, and I have the expertise to ensure that our processes facilitate this.

Q 21. How do you prioritize tasks during peak periods of W-2 processing?

During peak periods, prioritization is key. We use a tiered system. High-priority tasks, such as resolving critical data discrepancies that may delay payroll processing, are tackled immediately.

We leverage workflow management tools to assign tasks efficiently based on team member expertise and workload. We also frequently communicate with stakeholders, ensuring transparency and managing expectations. Clear communication helps to prevent bottlenecks and ensures everyone is on the same page, preventing unnecessary delays. It’s similar to managing a complex project with multiple moving parts: careful planning, collaboration, and communication are all essential for success.

Q 22. Describe your experience with W-2 audits.

My experience with W-2 audits spans over ten years, encompassing various roles from payroll specialist to audit team lead. I’ve been involved in both internal audits, ensuring compliance within our own organization, and external audits, assisting clients in navigating IRS scrutiny. I’m proficient in identifying discrepancies, analyzing data for inconsistencies, and rectifying errors. For instance, in one audit, I uncovered a systematic error in the reporting of employee benefits, leading to a significant underpayment of taxes. By meticulously reviewing payroll records and comparing them to W-2 data, I successfully identified and corrected the issue, preventing potential penalties and ensuring tax compliance. My expertise extends to understanding the nuances of different tax codes and regulations, enabling me to effectively navigate complex audit situations.

A key aspect of my approach is a proactive stance. This includes implementing robust internal controls to prevent errors from occurring in the first place, rather than solely focusing on reactive measures. This proactive strategy has proven significantly more efficient and cost-effective in the long run.

Q 23. How would you handle a situation where a W-2 is missing or incomplete?

Handling a missing or incomplete W-2 requires a systematic approach. First, I would attempt to locate the missing form internally, reviewing employee files and payroll databases. If that fails, I’d contact the employee directly, requesting they provide a copy of their W-2 from their employer. If the employer is unreachable or unwilling to cooperate, I would explore alternative sources of information, such as the employee’s tax return or pay stubs, to gather the necessary data for accurate reporting. For incomplete forms, I would contact the employer to request a corrected W-2 with the missing information. I’d document all communication and actions meticulously. For example, if an employee’s social security number is missing, I would initiate a formal request to the employer, keeping a record of the date of request and any responses received. This ensures a clear audit trail and facilitates swift resolution.

Q 24. What are your strategies for preventing W-2 errors?

Preventing W-2 errors involves a multi-faceted strategy. This begins with robust data entry procedures, including double-checking information and implementing validation rules to catch inconsistencies immediately. We use data-matching software to compare employee information across systems, flagging potential discrepancies before they become errors. Regular training for payroll staff on W-2 regulations and best practices is crucial. Finally, a thorough review process, involving multiple team members, helps to identify errors before the W-2s are finalized and distributed. Think of it like a quality control system for your payroll data: multiple checks at different stages significantly reduce the chances of errors slipping through.

- Data Validation: Implementing software that checks for inconsistencies like incorrect Social Security Numbers or missing information.

- Regular Training: Keeping payroll staff up-to-date with the latest tax laws and W-2 requirements.

- Cross-Verification: Having multiple people review data before finalizing the W-2s.

Q 25. How do you identify and report potential payroll fraud?

Identifying and reporting potential payroll fraud requires a keen eye for anomalies. I would look for inconsistencies in payroll data such as unusually high payments, payments to non-existent employees, or payments made to employees outside of the usual payroll cycle. I’d also scrutinize expense reports and compare them to employee time sheets to identify any potential discrepancies. Using data analytics tools to identify outliers and unusual patterns is extremely helpful. For example, a sudden spike in overtime pay for a specific employee might warrant further investigation. If I identify any suspicious activity, I would immediately escalate the issue to the appropriate internal authorities and, depending on the severity, possibly external law enforcement agencies. Thorough documentation of all findings and steps taken is crucial for transparency and accountability.

Q 26. How do you utilize technology to improve the efficiency of W-2 verification?

Technology significantly enhances W-2 verification efficiency. We leverage payroll software with integrated W-2 generation and distribution capabilities. This automates much of the process, reducing manual data entry and the associated risk of errors. Furthermore, we use data analytics dashboards that provide real-time visibility into potential issues, allowing for proactive identification and resolution. Secure file-sharing platforms streamline communication with employees and the IRS. For example, we use secure cloud storage to ensure that W-2 information is readily accessible to authorized personnel while being protected from unauthorized access. The use of Optical Character Recognition (OCR) technology can also improve the speed and accuracy of data entry from paper documents.

Q 27. What are the key performance indicators (KPIs) you would use to measure the success of W-2 verification processes?

Key performance indicators (KPIs) for measuring W-2 verification success include the accuracy rate (percentage of W-2s prepared without errors), the timeliness of W-2 distribution, the cost per W-2 processed, and the number of corrections or adjustments needed after initial distribution. Furthermore, tracking the number of IRS inquiries or audits related to W-2s provides valuable insight into compliance effectiveness. By monitoring these KPIs, we can identify areas for improvement and measure the overall efficiency and accuracy of our processes. For example, a consistently low accuracy rate might indicate a need for additional training or a review of internal controls. Similarly, a high number of IRS inquiries could point to systematic issues requiring immediate attention.

Key Topics to Learn for W-2 Verification Interview

- Understanding W-2 Forms: Deep dive into the structure and meaning of each data field on a W-2 form. This includes understanding the different types of W-2 forms and their variations.

- Data Validation Techniques: Learn about various methods to verify the accuracy and authenticity of W-2 data, including cross-referencing with other documentation and using data validation tools.

- Identifying Red Flags and Potential Fraud: Explore common discrepancies and inconsistencies in W-2 forms that may indicate fraudulent activity. Practice identifying these patterns and understanding their implications.

- Data Reconciliation Processes: Understand the procedures involved in comparing W-2 data against payroll records, tax returns, and other relevant sources to identify discrepancies and resolve issues.

- Compliance and Regulatory Aspects: Familiarize yourself with relevant laws, regulations, and industry best practices related to W-2 verification and data privacy.

- Technological Tools and Software: Explore different software and tools used for automated W-2 verification, data analysis, and reporting. Understand their functionalities and limitations.

- Problem-Solving and Troubleshooting: Develop skills in identifying, analyzing, and resolving issues related to W-2 verification processes, including dealing with incomplete or conflicting data.

- Data Security and Privacy: Understand the importance of maintaining data security and protecting sensitive employee information during the W-2 verification process. Familiarize yourself with relevant data privacy regulations.

Next Steps

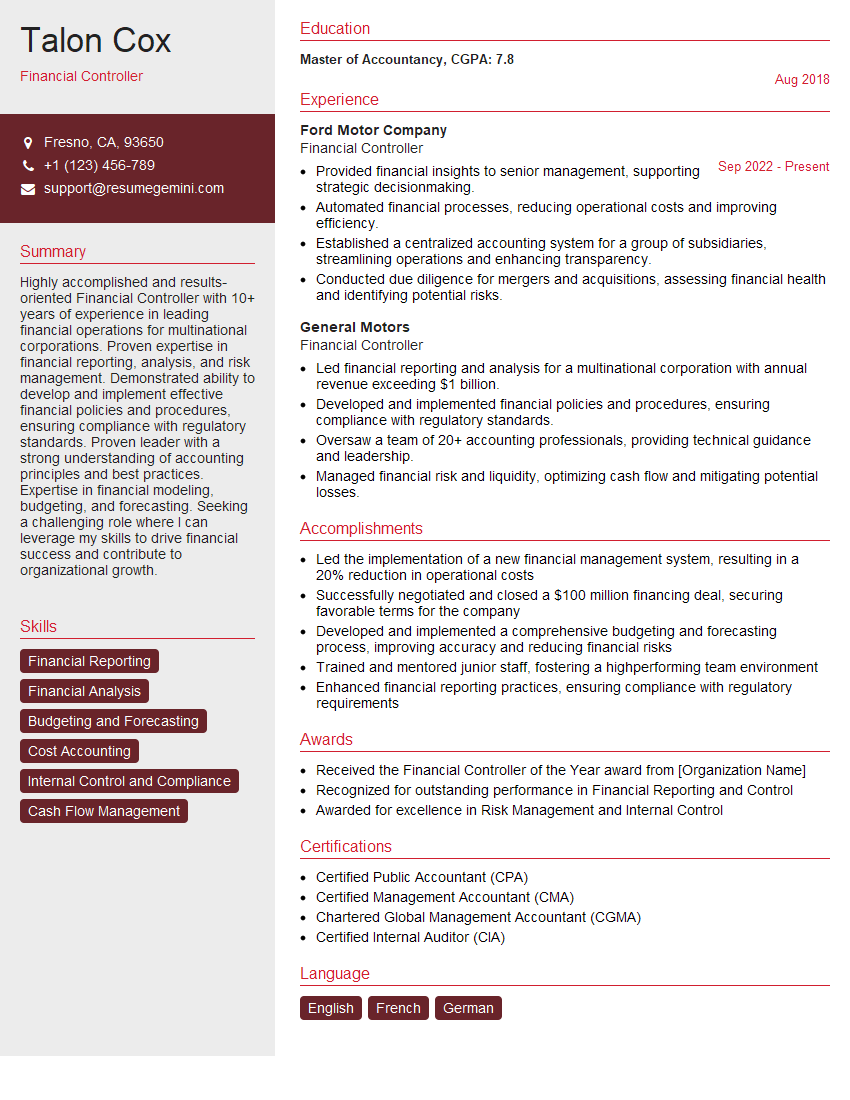

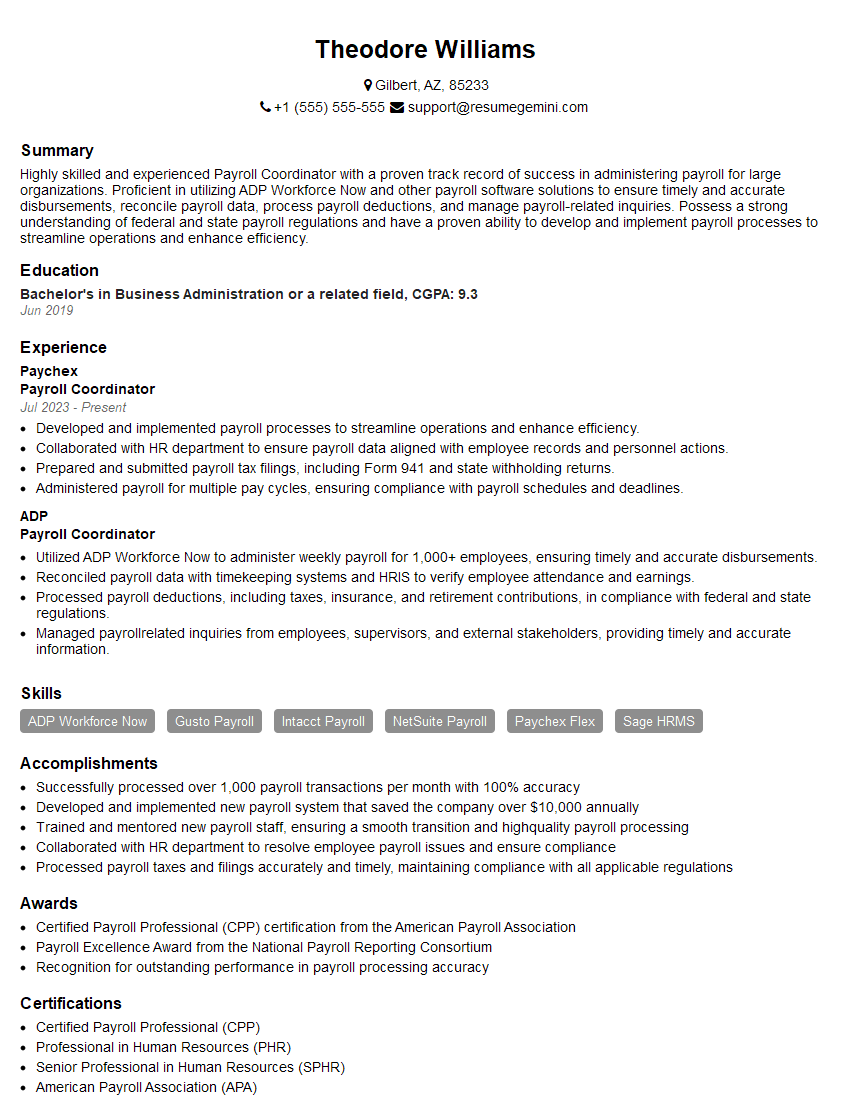

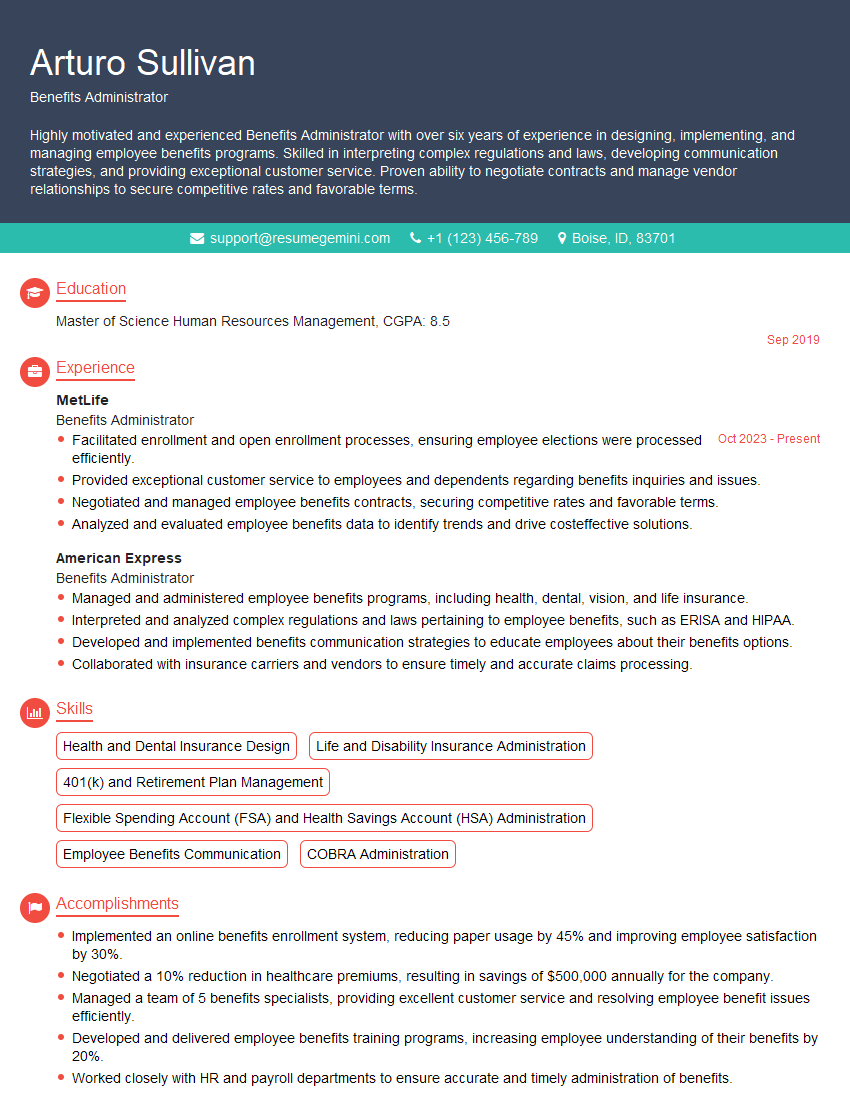

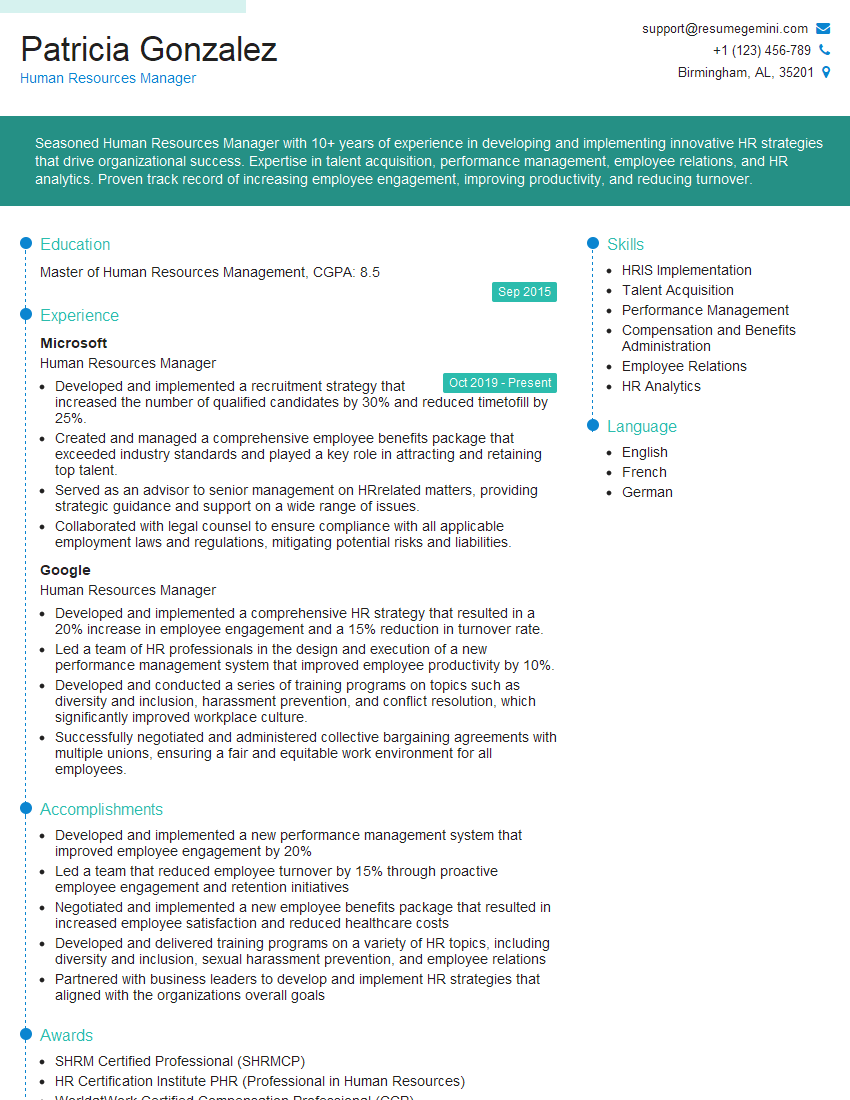

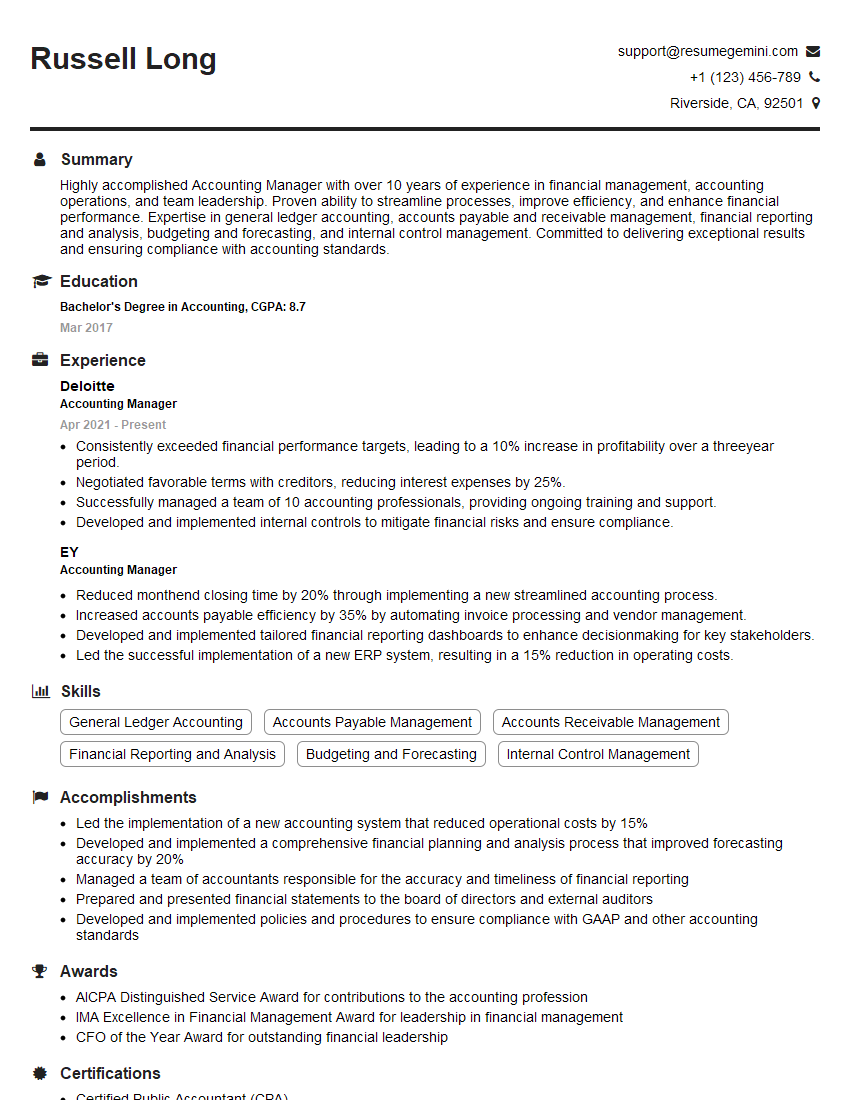

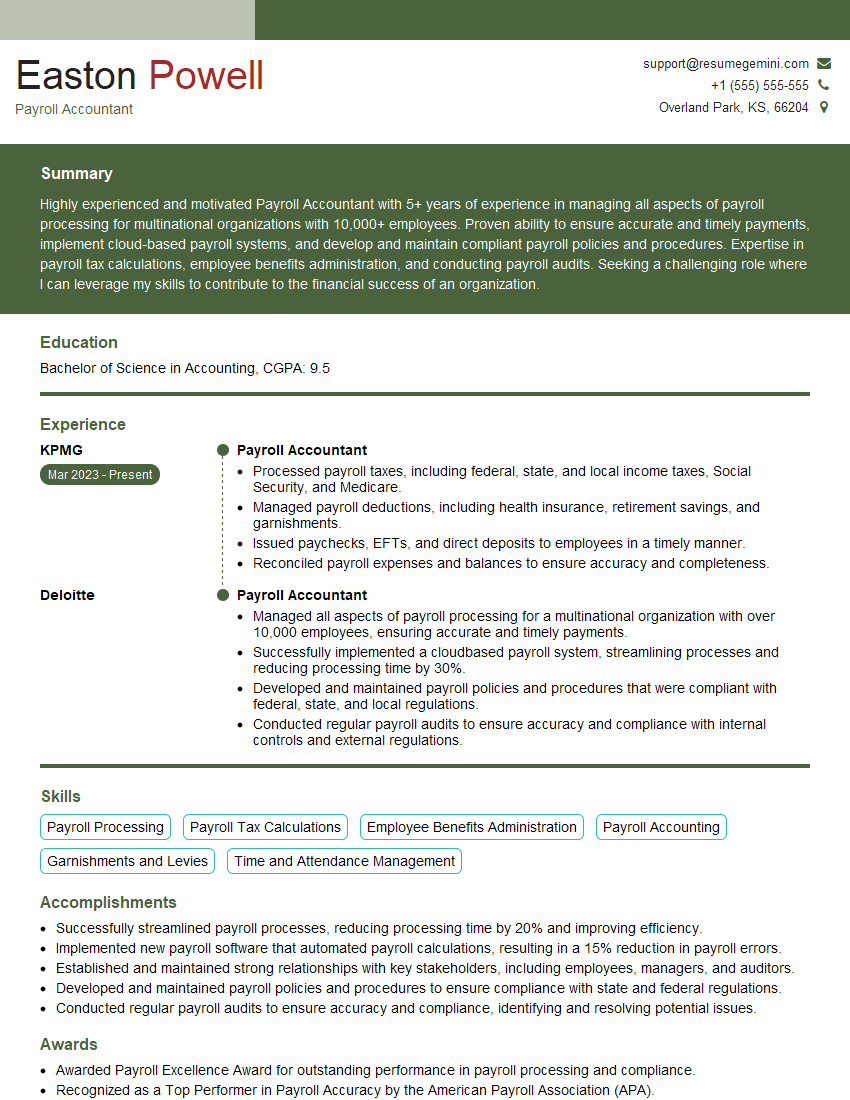

Mastering W-2 verification opens doors to rewarding careers in finance, accounting, and human resources, offering excellent opportunities for growth and advancement. To maximize your job prospects, crafting a compelling and ATS-friendly resume is crucial. ResumeGemini is a trusted resource to help you build a professional resume that showcases your skills and experience effectively. They provide examples of resumes tailored to W-2 Verification roles, giving you a head start in presenting yourself as the ideal candidate. Invest time in creating a strong resume – it’s your first impression on potential employers!

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

I Redesigned Spongebob Squarepants and his main characters of my artwork.

https://www.deviantart.com/reimaginesponge/art/Redesigned-Spongebob-characters-1223583608

IT gave me an insight and words to use and be able to think of examples

Hi, I’m Jay, we have a few potential clients that are interested in your services, thought you might be a good fit. I’d love to talk about the details, when do you have time to talk?

Best,

Jay

Founder | CEO