Every successful interview starts with knowing what to expect. In this blog, we’ll take you through the top Billing and Insurance Processing interview questions, breaking them down with expert tips to help you deliver impactful answers. Step into your next interview fully prepared and ready to succeed.

Questions Asked in Billing and Insurance Processing Interview

Q 1. Explain the process of submitting a medical insurance claim.

Submitting a medical insurance claim involves several steps, designed to ensure the insurance provider processes your request for reimbursement accurately and efficiently. Think of it like a formal request for payment for services rendered.

- Gather Necessary Information: This includes your insurance card, the medical bills, and any relevant documentation such as the doctor’s notes or test results. The more complete your submission, the smoother the process.

- Complete the Claim Form: Most insurance companies provide claim forms, either online or in paper format. Carefully complete all fields with accurate information, ensuring consistency across all documents. Errors here often lead to delays or rejections.

- Submit the Claim: You can usually submit claims online through the insurer’s portal, by mail, or via fax. Choose the method specified by your provider.

- Track Your Claim: Most insurers offer online portals to track the status of your claim. Regularly check for updates to ensure timely processing.

- Follow Up (if necessary): If your claim takes longer than expected, or if you receive a denial, contact your insurance provider to inquire about the status and address any issues.

For example, if you had a surgery, you would submit the hospital bill, surgeon’s bill, and any anesthesia bills along with the completed claim form. Lack of a crucial document, like the surgeon’s signature, could delay processing.

Q 2. Describe different types of insurance plans (e.g., HMO, PPO, POS).

Different insurance plans offer varying levels of coverage and flexibility. Choosing the right plan depends on your individual needs and preferences.

- HMO (Health Maintenance Organization): HMOs typically require you to choose a primary care physician (PCP) within their network. Referrals from your PCP are usually needed to see specialists. Costs are generally lower, but your choices are more limited.

- PPO (Preferred Provider Organization): PPOs offer more flexibility. You can see any doctor, in-network or out-of-network, though out-of-network care usually incurs higher costs. You generally don’t need referrals to see specialists.

- POS (Point of Service): POS plans blend HMO and PPO features. You choose a PCP, but have the option to see out-of-network doctors at a higher cost. Referrals may be required for specialists.

Imagine HMOs as a tightly-knit community where everyone knows each other. PPOs are more like a large city where you can see anyone but might pay more. POS plans offer a balance, allowing for both in-community and city-wide access.

Q 3. How do you handle denied claims? What steps do you take?

Handling denied claims requires a systematic approach. It’s like solving a puzzle; you need to identify the missing pieces.

- Review the Denial Reason: Carefully examine the denial letter to understand why the claim was rejected. Common reasons include missing information, incorrect coding, or services not covered by the plan.

- Gather Supporting Documentation: Collect any additional documents that might support your appeal, such as updated medical records or clarification on the services provided.

- File an Appeal: Most insurance companies have an appeals process. Follow their instructions carefully and submit your appeal within the specified timeframe. Include all the supporting documentation.

- Maintain Thorough Records: Keep copies of all correspondence, submitted documents, and denial notices. This is crucial if the appeal is unsuccessful and you need to escalate the issue.

- Consider External Assistance: If the appeal is denied again, consider seeking assistance from a medical billing specialist or a patient advocate who can help navigate the complex appeals process.

For instance, a denied claim due to missing pre-authorization might be resolved by submitting the necessary documentation proving the pre-authorization was indeed obtained.

Q 4. What is the importance of accurate medical coding?

Accurate medical coding is the cornerstone of efficient billing and insurance processing. It’s the language that translates medical services into numbers that insurance companies understand.

Accurate coding ensures that:

- Claims are processed correctly: The right codes ensure the correct reimbursement amount is paid.

- Providers receive proper payment: Accurate coding prevents underpayment and ensures providers are compensated fairly for their services.

- Data integrity is maintained: Accurate coding helps build a robust database for tracking healthcare trends and improving healthcare outcomes.

- Compliance is achieved: Using the correct codes ensures that the practice complies with all regulatory requirements and avoids penalties.

Imagine a doctor’s visit; if the wrong code is used, the insurance might pay for a routine checkup instead of a more complex procedure, causing financial losses for the provider. This is why skilled coders are essential.

Q 5. What are common reasons for claim denials?

Claim denials are frustrating, but often stem from preventable errors. Understanding the common causes allows for proactive measures.

- Missing or Incorrect Information: Incomplete claim forms or missing supporting documentation are frequent causes of denials.

- Incorrect Medical Coding: Using the wrong codes can result in denials or underpayments.

- Lack of Pre-authorization: Some procedures require prior authorization from the insurance company before they can be performed. Failing to obtain this authorization can lead to denial.

- Beneficiary Eligibility Issues: The patient’s insurance coverage may have expired, been terminated, or the services may not be covered under their plan.

- Timely Filing Issues: Claims must be submitted within the insurer’s specified timeframe. Late submissions often result in denial.

For example, a claim for a specialist visit might be denied if the referring physician’s information was missing, a common error easily corrected with a simple update.

Q 6. Explain the difference between accounts receivable and accounts payable.

Accounts receivable (A/R) and accounts payable (A/P) represent opposite sides of the financial ledger in a healthcare setting. They track money owed to and owed by a business.

- Accounts Receivable (A/R): This represents money owed to the healthcare provider (hospital, clinic, etc.) by patients, insurance companies, or other entities for services rendered. It’s money coming *in*.

- Accounts Payable (A/P): This represents money owed by the healthcare provider to vendors, suppliers, and other creditors for goods or services received. It’s money going *out*.

Think of A/R as the money you’re waiting to receive from patients for their visits, and A/P as the bills you need to pay for supplies like bandages or medications. Efficient management of both is vital for a healthy financial position.

Q 7. How do you ensure timely payment of insurance claims?

Ensuring timely payment of insurance claims requires a combination of proactive measures and diligent follow-up.

- Accurate and Complete Claim Submissions: Submitting claims with accurate information and all necessary documentation is the first step. This minimizes the risk of denials and delays.

- Clean Claims Process: Implementing a robust process for reviewing claims before submission, including double-checking coding and documentation, is crucial.

- Electronic Claims Submission: Submitting claims electronically is typically faster than submitting them via mail.

- Claim Tracking and Follow-up: Regularly tracking the status of submitted claims and following up on any delays or denials helps in preventing long outstanding receivables.

- Regular Reconciliation: Reconciling payments received from insurance companies against submitted claims ensures accurate accounting and helps identify any discrepancies promptly.

For instance, automating the claims submission process with a dedicated software can significantly reduce processing time and minimize errors, leading to much faster payment.

Q 8. Describe your experience with Electronic Health Records (EHR) systems.

My experience with Electronic Health Records (EHR) systems spans over seven years, encompassing various roles from data entry to billing and reporting. I’m proficient in several leading EHR systems, including Epic, Cerner, and Meditech. I understand the intricacies of EHR data structures and how they impact billing accuracy. For example, ensuring accurate CPT and ICD-10 coding within the EHR directly influences claim processing speed and reimbursement rates. I’ve also leveraged EHR reporting capabilities to identify trends, such as common diagnostic codes or procedures, to proactively address potential billing issues and streamline processes. My familiarity extends to utilizing EHR functionalities for patient registration, appointment scheduling, and generating patient statements, effectively managing the entire patient lifecycle within the system.

I’m particularly adept at identifying and rectifying data inconsistencies within the EHR that might lead to denied claims. This includes verifying patient demographics, insurance information, and procedure documentation for completeness and accuracy before claims are submitted. For instance, a missing authorization number or an incorrect patient date of birth can cause significant delays and denials. My experience allows me to proactively mitigate these issues, improving overall billing efficiency and reducing revenue cycle time.

Q 9. How do you prioritize tasks in a high-volume billing environment?

Prioritizing tasks in a high-volume billing environment requires a structured approach. I utilize a combination of urgency, importance, and impact analysis. I typically employ a system that prioritizes tasks based on:

- Urgency: Tasks with immediate deadlines, such as claims nearing the payer’s payment deadline, are given top priority. Think of it as putting out the immediate fires.

- Importance: Tasks critical to the overall billing process, such as resolving denied claims or correcting data errors, are given high importance, even if they lack immediate deadlines. This preventative approach minimizes future problems.

- Impact: I assess the potential financial impact of each task. For example, resolving a large, outstanding balance from a major payer would have a higher impact than a small, low-priority account.

I leverage tools such as task management software (e.g., Asana, Trello) to effectively track progress, delegate where necessary, and maintain transparency. Regularly reviewing my task list and adapting to changing priorities is crucial in this dynamic setting. Imagine it as a constantly evolving to-do list where the highest impact items always get preferential treatment.

Q 10. What is your experience with different billing software?

My experience encompasses a wide range of billing software, including Practice Fusion, NextGen, and Athenahealth. I’m also familiar with various clearinghouse systems used to submit claims electronically to different insurance payers. My expertise goes beyond simply using these systems; I understand their underlying functionalities and how to optimize their use for maximum efficiency.

For example, I know how to configure different billing software to automatically generate reports, identify outstanding balances, and track key performance indicators (KPIs), such as days in accounts receivable (A/R). This data-driven approach allows for informed decision-making and process improvement. Furthermore, I’m comfortable integrating billing software with other systems, such as EHRs, to streamline the entire revenue cycle. I can also troubleshoot technical issues and work collaboratively with IT support to ensure the smooth operation of these systems.

Q 11. What is your understanding of HIPAA regulations?

My understanding of HIPAA regulations is comprehensive. I’m acutely aware of the importance of protecting patient health information (PHI) and adhering to all applicable privacy and security rules. This includes understanding protected health information (PHI), the privacy rule, the security rule, the breach notification rule, and the enforcement rule.

In my previous roles, I’ve implemented and maintained strict protocols for handling PHI, such as secure data storage, access control measures, and employee training on HIPAA compliance. I understand the potential consequences of HIPAA violations, including hefty fines and legal repercussions, and take proactive steps to prevent breaches. I’m familiar with the different types of disclosures permitted under HIPAA and the necessary safeguards required for each. This is a critical part of my professional responsibility and a fundamental aspect of my daily work.

Q 12. How do you handle patient inquiries regarding billing?

Handling patient inquiries regarding billing requires patience, empathy, and clear communication. I approach each inquiry with a professional and understanding demeanor. My process typically involves:

- Actively Listening: I start by carefully listening to the patient’s concerns and ensuring I fully understand their question or issue.

- Verifying Information: I verify the patient’s identity and account details to ensure I’m accessing the correct information.

- Providing Clear Explanations: I explain the billing statement in simple, non-technical terms, addressing any confusion or misunderstandings.

- Documenting the Interaction: I meticulously document the interaction, including the patient’s concerns, the explanation provided, and any actions taken.

- Following Up: I follow up with the patient as needed to ensure their questions are fully answered and their concerns are addressed.

I strive to resolve issues efficiently and effectively, providing excellent customer service and promoting positive patient relations. For example, if a patient has questions about a specific charge, I would locate the corresponding code in the EHR and explain what the charge is for, referencing the procedure or service performed.

Q 13. How do you identify and resolve billing errors?

Identifying and resolving billing errors requires a systematic approach. My process generally follows these steps:

- Regular Reporting and Analysis: I regularly review billing reports and key performance indicators (KPIs) to identify trends and patterns of errors.

- Claim Scrubbing and Auditing: I conduct regular claim audits to detect potential errors before claims are submitted to payers, utilizing tools and software for this purpose.

- Denial Management: I have a robust denial management system in place to identify and analyze denied claims, categorizing them by type of denial (e.g., coding errors, missing information, authorization issues) to pinpoint recurring problems and implement corrective measures.

- Payer Specific Guidelines: I maintain an in-depth understanding of different payer-specific requirements and guidelines to ensure proper coding and claim submission procedures.

- Root Cause Analysis: When errors are identified, I conduct a thorough root cause analysis to determine the underlying cause and prevent recurrence. For example, if there are consistently incorrect CPT codes, I might identify the need for improved training or updated coding guidelines for staff.

Ultimately, the goal is not just to fix the error, but to prevent it from happening again, ensuring the billing process remains efficient and accurate.

Q 14. Describe your experience with different insurance payer requirements.

My experience encompasses a wide range of insurance payer requirements, including Medicare, Medicaid, and various commercial payers. I understand that each payer has its unique rules, regulations, and claim submission processes. I’m well-versed in navigating these differences to ensure timely and accurate claim processing.

For instance, I’m familiar with the nuances of Medicare’s coding requirements, including the correct use of modifiers, as well as the complexities of Medicaid’s eligibility verification procedures. I also understand the specific requirements of various commercial payers, such as pre-authorization processes, claim forms, and electronic submission protocols. This necessitates maintaining up-to-date knowledge of payer-specific manuals, updates, and changes in policies to maintain optimal billing efficiency and reimbursement rates. In essence, my ability to navigate the diverse requirements of various payers is a key strength I bring to the table.

Q 15. How do you stay updated on changes in insurance regulations and billing practices?

Staying current in the dynamic landscape of insurance regulations and billing practices requires a multi-pronged approach. It’s not a one-time effort but an ongoing commitment.

- Professional Organizations: I actively participate in professional organizations like the Healthcare Financial Management Association (HFMA) and the American Academy of Professional Coders (AAPC). These groups offer webinars, conferences, and publications that provide up-to-the-minute information on regulatory changes and best practices. For example, I recently attended a webinar on the impact of the No Surprises Act.

- Industry Publications and Newsletters: I subscribe to several leading healthcare publications and newsletters that focus on billing and coding updates. This allows me to stay informed about changes in legislation, compliance requirements, and emerging trends in reimbursement methodologies.

- Government Websites: I regularly review websites like the Centers for Medicare & Medicaid Services (CMS) and relevant state insurance departments. These websites are crucial for staying abreast of new rules, compliance deadlines, and updated guidance on billing procedures.

- Continuing Education: I dedicate time to ongoing professional development through continuing education courses and workshops. This ensures my knowledge remains current and that I’m proficient in the latest billing software and techniques. For instance, I recently completed a course on the latest updates in ICD-10 coding.

This combined approach allows me to proactively adapt to changes, minimizing risks and ensuring compliance.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. What is your experience with reconciliation of payments?

Reconciliation of payments is a critical process in ensuring accurate financial reporting and identifying any discrepancies between what was billed and what was paid. Think of it like balancing your personal checkbook, but on a much larger scale.

My experience involves a multi-step process:

- Receiving Payment Data: This might involve electronic remittances from payers, manual checks, or online payment portals.

- Matching Payments to Invoices: This is usually done using software that compares payer remittance data (e.g., claim number, patient ID, amount) with the corresponding invoices in our system. This is where identifying potential errors early is crucial.

- Identifying Discrepancies: The system flags any discrepancies, such as partial payments, denials, or payment amounts that don’t match the invoice. I investigate these discrepancies meticulously, often contacting the payer directly to clarify any issues.

- Adjusting Records: Once discrepancies are resolved, I make necessary adjustments to the billing system to ensure that all records reflect the accurate payment information.

- Generating Reports: I generate reports summarizing the reconciliation process, including the total amount collected, any outstanding balances, and details of any discrepancies and their resolutions.

In my previous role, I implemented a new reconciliation software that reduced the time it took to process payments by 20%. This improved efficiency and allowed us to dedicate more time to other critical tasks. I have a strong understanding of both manual and automated reconciliation methods and am adept at troubleshooting complex payment issues.

Q 17. Explain the process of patient registration and data entry.

Patient registration and data entry are the foundational steps in the revenue cycle. Accurate and complete information is crucial for efficient billing and claim processing. It’s like setting the stage for a successful play – if the initial setup is flawed, the whole performance suffers.

The process typically involves:

- Collecting Patient Information: This includes demographic data (name, address, date of birth, etc.), insurance details (payer name, policy number, group number), and contact information. I always verify information with the patient to ensure accuracy. I’m trained to comply with HIPAA regulations regarding patient privacy and data security throughout this process.

- Data Entry: This involves carefully entering all collected data into the billing system. This needs to be accurate and efficient. We employ double-checking procedures to minimise errors.

- Verifying Insurance Coverage: I utilize online tools and payer websites to confirm eligibility and coverage benefits to ensure payment isn’t delayed. This proactive approach saves considerable time later.

- Assigning Patient Identifiers: Generating or using existing unique identifiers for the patient within our system ensures that all records are linked correctly.

I have extensive experience with various Electronic Health Record (EHR) systems and understand the importance of data integrity. In a previous role, I identified and corrected a data entry error that resulted in a significant reduction in claim denials.

Q 18. How familiar are you with CPT and ICD coding systems?

CPT (Current Procedural Terminology) and ICD (International Classification of Diseases) codes are the languages of medical billing. CPT codes describe the medical procedures and services performed, while ICD codes describe the diagnoses. They are essential for accurate claim submission and reimbursement.

I’m highly proficient in both systems. I understand the intricacies of CPT coding, including modifiers, and I stay updated on the latest revisions and changes. Similarly, I am well-versed in the ICD-10 coding system and its complexities. I can quickly identify the correct codes for a given procedure and diagnosis. My expertise allows me to select codes that are accurate and compliant with all relevant regulatory requirements. Incorrect coding can lead to delayed payments or even denials, so accuracy is paramount.

For example, I can differentiate between different levels of complexity for a surgical procedure, ensuring accurate reimbursement. Similarly, I understand the nuances of ICD-10 coding, such as the use of laterality codes and additional characters, to provide complete and accurate documentation.

Q 19. How do you manage a large volume of invoices?

Managing a large volume of invoices efficiently requires a systematic approach. I use a combination of automated processes and manual oversight to ensure accuracy and timely processing. It’s like managing a large orchestra – each instrument (invoice) needs to be handled effectively to create a harmonious whole (efficient billing).

- Automated Invoice Processing: I leverage automated systems to receive, process, and track invoices. This includes software that uses Optical Character Recognition (OCR) to extract data from invoices automatically.

- Invoice Tracking Systems: I use specialized software to track invoices, identify outstanding invoices, and monitor their status. This system often integrates with accounts payable and electronic payment systems.

- Data Analysis and Reporting: I analyze invoice data regularly to identify trends and areas for improvement, such as potential errors or delays. This data informs process improvements.

- Vendor Management: I maintain strong relationships with vendors to address any discrepancies or issues related to invoices promptly and prevent future problems.

In my prior experience, I implemented a new invoice processing system that reduced processing time by 30% and minimized errors. My focus is always on optimization and efficiency.

Q 20. Describe your experience with follow-up on outstanding claims.

Following up on outstanding claims is a crucial aspect of maximizing revenue. It’s like being a detective, carefully investigating why a claim hasn’t been paid. A systematic approach is vital.

My process typically involves:

- Regular Claim Status Monitoring: I regularly monitor the status of submitted claims using the payer’s online portal or by contacting the payer directly.

- Identifying Outstanding Claims: I use reports generated by the billing system to identify claims that haven’t been processed or paid within a reasonable timeframe.

- Investigating Reasons for Delays: I investigate the reasons for delays by reviewing the claim status information and, when necessary, contacting the payer to inquire about the status.

- Resubmitting Claims or Providing Additional Information: If necessary, I resubmit claims or provide additional information to address any issues that are preventing payment.

- Documenting Follow-Up Activities: I meticulously document all follow-up activities, including dates, times, and the results of each interaction with the payer.

I’m adept at communicating effectively with payers and resolving issues related to outstanding claims. In my previous role, my proactive follow-up efforts resulted in a significant increase in claim payments.

Q 21. How do you handle appeals of denied claims?

Handling appeals of denied claims is a critical part of the revenue cycle. It requires meticulous attention to detail and a thorough understanding of the payer’s policies and procedures. It’s like presenting a strong case in court – you need to build a compelling argument to overturn the initial decision.

My process involves:

- Reviewing the Denial Reason: I carefully review the denial reason provided by the payer to identify the cause of the denial.

- Gathering Supporting Documentation: I collect all necessary supporting documentation, such as medical records, test results, and other relevant information that supports the claim.

- Preparing the Appeal: I prepare a detailed appeal letter that clearly and concisely explains why the claim should be approved. This often involves citing specific regulations or policies that support the claim.

- Submitting the Appeal: I submit the appeal through the appropriate channels, following the payer’s specific instructions.

- Following Up on the Appeal: I follow up on the appeal to track its status and ensure that it’s being processed efficiently.

I have a strong track record of successfully appealing denied claims. I understand the importance of clear communication and providing compelling evidence to support each appeal. My success rate in appealing denied claims is consistently high.

Q 22. What is your experience with pre-authorization of services?

Pre-authorization, in the context of medical billing, is the process of obtaining approval from an insurance provider before a healthcare service is rendered. It’s like getting prior permission before making a purchase with a gift card – you want to ensure the provider will cover the cost. This process helps prevent denials and ensures reimbursement. My experience spans several years, working with a variety of insurance panels and navigating their diverse pre-authorization protocols. I’m proficient in using online portals, submitting electronic requests, and following up to secure timely authorizations. For example, I recently successfully navigated a complex pre-authorization process for a patient requiring a specialized cardiac procedure, ensuring minimal disruption to their care. I systematically gather all required documentation – patient demographics, procedure codes, physician orders – well in advance, and I actively follow up to expedite the authorization, often utilizing established workflows and communication strategies.

Q 23. What is your understanding of medical billing compliance?

Medical billing compliance is paramount. It involves adhering to a complex web of regulations, laws, and guidelines at the federal, state, and sometimes even local levels. Understanding and following these rules ensures accurate claims submission, prevents fraud and abuse, and protects patient privacy. This includes staying updated on changes to the Health Insurance Portability and Accountability Act (HIPAA), the False Claims Act, and other relevant legislation. Non-compliance can result in hefty fines, legal repercussions, and damage to the reputation of a healthcare organization. My experience includes thorough knowledge of coding guidelines (CPT, HCPCS, ICD), understanding medical necessity for services billed, and ensuring proper documentation to support each claim. For instance, I regularly review claims for compliance before submission and participate in internal audits to identify and rectify potential issues, minimizing the risk of denials or penalties.

Q 24. How do you maintain confidentiality in patient billing information?

Maintaining patient confidentiality is a top priority, and it’s more than just a policy; it’s a fundamental ethical responsibility. We employ several measures to protect patient billing information. This begins with secure storage of physical and electronic records, including encryption of sensitive data and access controls using role-based permissions. Only authorized personnel with a legitimate need to access the information are granted permission. We also adhere strictly to HIPAA regulations, which dictate how patient health information (PHI) can be handled, stored, and transmitted. For instance, we use secure communication channels for sharing information and never discuss patient details in public spaces. Furthermore, we regularly conduct employee training to reinforce these protocols and to make sure everyone understands the importance of data protection.

Q 25. Describe your experience working with different billing systems (e.g., practice management software).

I have extensive experience with various billing systems, including both practice management software and claims processing platforms. My experience encompasses working with systems like Epic, NextGen, and Athenahealth. I’m comfortable with the entire billing lifecycle within these systems, from patient registration and scheduling to claims submission, payment posting, and accounts receivable management. I am adept at navigating the user interfaces, understanding their functionalities, and leveraging their reporting capabilities for data analysis. I have also worked with various clearinghouses to submit claims electronically. Transitioning between different systems is something I’m accustomed to; I quickly adapt to the specific workflows and nuances of each platform, minimizing disruption to the billing process.

Q 26. What metrics do you use to measure the effectiveness of the billing process?

The effectiveness of a billing process can be measured by several key metrics. These include:

- Clean claim rate: The percentage of claims submitted without errors or omissions.

- Days in accounts receivable (AR): The average number of days it takes to collect payment.

- Payment posting accuracy: The percentage of payments correctly posted to patient accounts.

- Denial rate: The percentage of claims denied by insurance payers.

- Revenue cycle time: The time it takes for a claim to be submitted, processed, and paid.

Q 27. How do you handle complex billing situations?

Handling complex billing situations requires a systematic approach. I typically begin by thoroughly documenting the details of the situation. This includes reviewing the patient’s medical records, insurance coverage, and any previous correspondence with the payer. I then research payer-specific policies and guidelines to understand the requirements for reimbursement. Sometimes, this involves interacting with insurance representatives to clarify billing issues or negotiate payment arrangements. I also utilize my knowledge of appeals processes to challenge denials when appropriate. For example, I recently resolved a complex case involving a denied claim for a medically necessary procedure by meticulously documenting the clinical justification and presenting a persuasive appeal to the payer, ultimately securing payment for the services rendered. A systematic and detailed approach is key.

Q 28. Describe your experience with data analysis in a billing context.

Data analysis plays a crucial role in optimizing the billing process. I regularly utilize data analytics to identify trends, patterns, and areas for improvement. This involves using reporting tools within the billing systems to extract data, which I then analyze to identify recurring denials, outstanding balances, and bottlenecks in the workflow. For example, I might analyze denial data to identify common reasons for denials and implement corrective actions, such as improving coding accuracy or strengthening pre-authorization practices. I also use data to track key performance indicators (KPIs) to monitor the efficiency and effectiveness of the billing process, enabling data-driven decision-making to optimize our processes and improve revenue cycle management.

Key Topics to Learn for Billing and Insurance Processing Interview

- Medical Billing and Coding: Understanding CPT, ICD, and HCPCS codes; processing claims and denials; navigating payer-specific requirements.

- Insurance Claim Processing: Workflow from patient registration to claim submission; managing electronic and paper claims; identifying and resolving claim discrepancies.

- Billing Software and Systems: Proficiency in various billing software applications (e.g., practice management software); understanding data entry and reporting functions.

- Healthcare Reimbursement Methods: Knowledge of different payment models (e.g., fee-for-service, capitation); understanding the impact on billing processes.

- Regulatory Compliance: HIPAA regulations and their implications for billing and data security; understanding state and federal guidelines.

- Accounts Receivable Management: Following up on outstanding balances; performing account reconciliation; applying payment posting procedures.

- Problem-Solving and Troubleshooting: Identifying and resolving billing errors; analyzing claim rejections; demonstrating effective communication with providers and insurance companies.

- Data Analysis and Reporting: Generating reports on key performance indicators (KPIs); interpreting billing data to identify trends and areas for improvement.

Next Steps

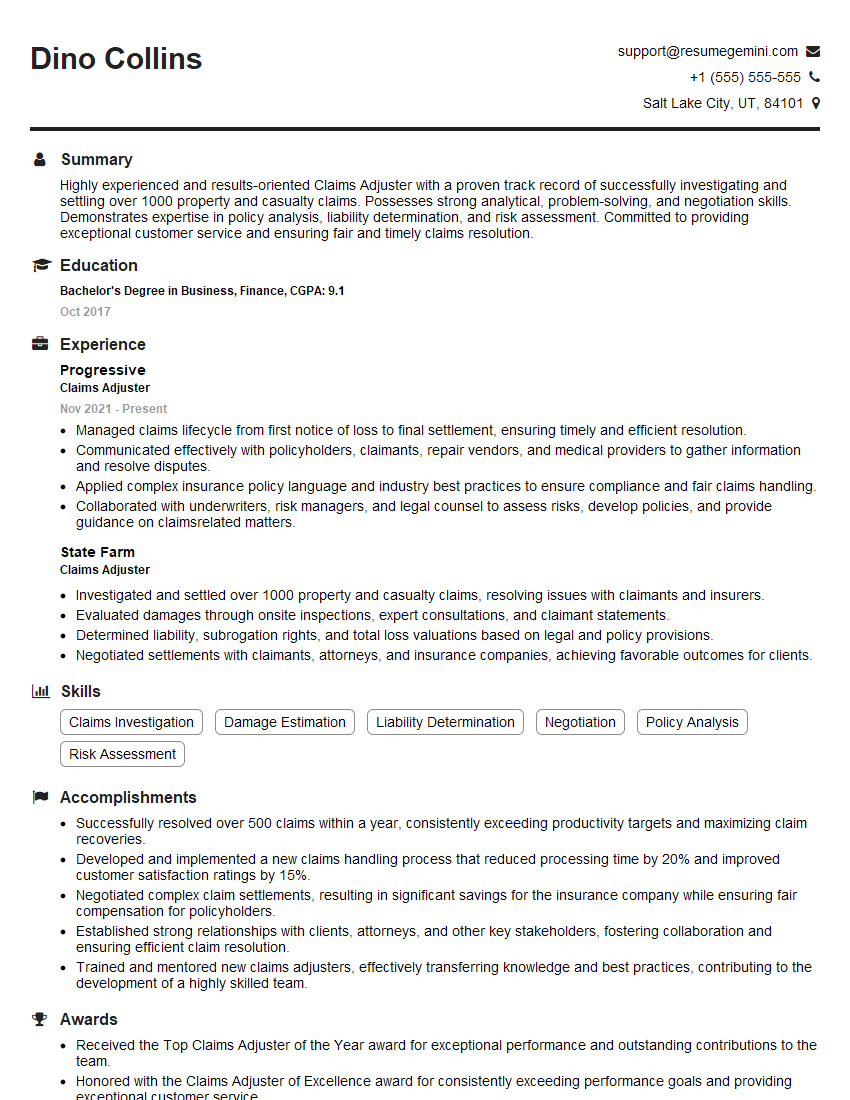

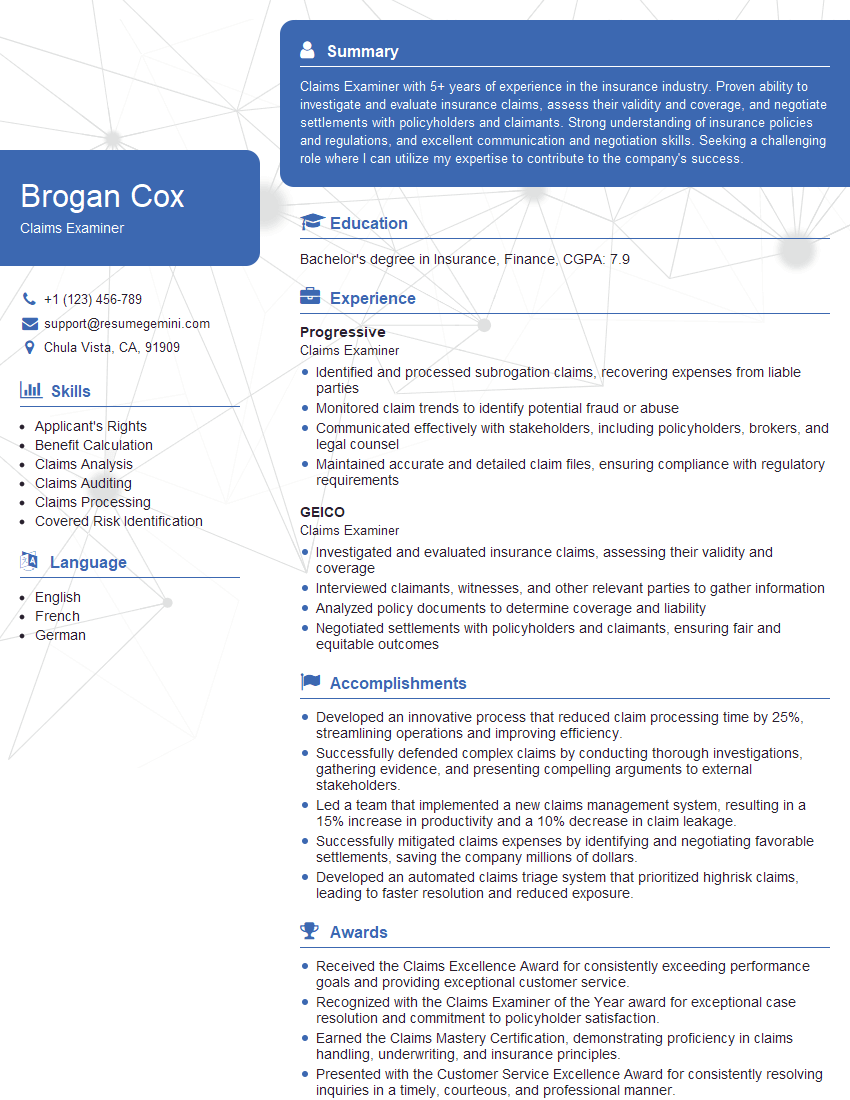

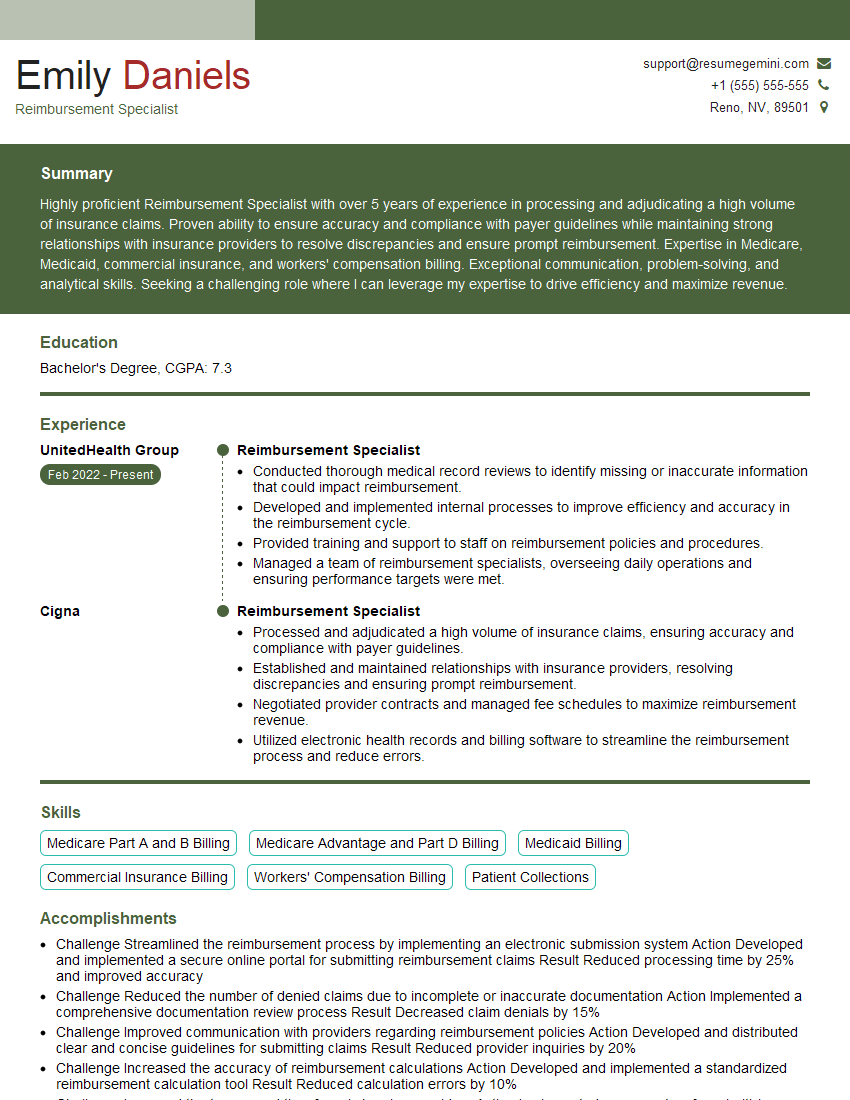

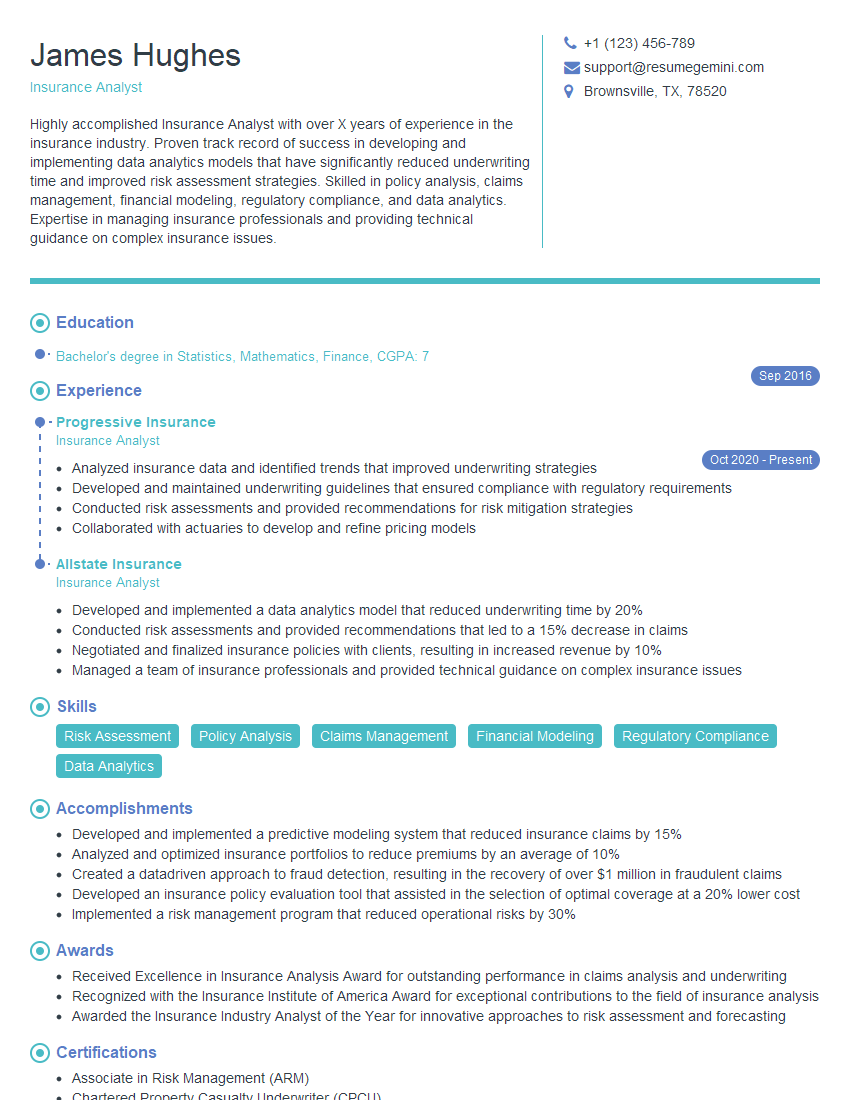

Mastering Billing and Insurance Processing opens doors to rewarding careers in a growing healthcare industry, offering opportunities for advancement and specialization. A strong, ATS-friendly resume is crucial for showcasing your skills and experience to potential employers. To significantly enhance your job prospects, we encourage you to leverage the power of ResumeGemini. ResumeGemini provides a user-friendly platform to create compelling resumes tailored to specific industries. Examples of resumes specifically designed for Billing and Insurance Processing professionals are available to help guide your creation process. Invest in crafting a resume that reflects your unique qualifications and experience – it’s your first impression with a prospective employer.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

I Redesigned Spongebob Squarepants and his main characters of my artwork.

https://www.deviantart.com/reimaginesponge/art/Redesigned-Spongebob-characters-1223583608

IT gave me an insight and words to use and be able to think of examples

Hi, I’m Jay, we have a few potential clients that are interested in your services, thought you might be a good fit. I’d love to talk about the details, when do you have time to talk?

Best,

Jay

Founder | CEO