Preparation is the key to success in any interview. In this post, we’ll explore crucial Understanding global macroeconomic trends interview questions and equip you with strategies to craft impactful answers. Whether you’re a beginner or a pro, these tips will elevate your preparation.

Questions Asked in Understanding global macroeconomic trends Interview

Q 1. Explain the concept of aggregate demand and aggregate supply.

Aggregate demand (AD) and aggregate supply (AS) are macroeconomic concepts illustrating the relationship between the overall price level and the quantity of goods and services demanded and supplied in an economy. Think of it like this: AD represents the total demand for everything in the economy – from groceries to cars to houses – at a given price level. AS represents the total supply of all goods and services at that same price level.

Aggregate Demand (AD): AD is the sum of consumption (C), investment (I), government spending (G), and net exports (NX): AD = C + I + G + NX. If prices fall, consumers generally buy more, boosting AD. Conversely, higher prices can decrease AD.

Aggregate Supply (AS): AS reflects the economy’s capacity to produce goods and services at various price levels. In the short run, AS can be relatively flat, meaning output can increase without much change in prices. However, in the long run, AS is typically vertical, representing the economy’s potential output dictated by factors like labor, capital, and technology. The point where AD and AS intersect determines the equilibrium price level and real GDP (gross domestic product).

Example: Imagine a sudden increase in consumer confidence. This leads to increased consumption (C), thus shifting the AD curve to the right. If the economy is operating below its potential, this will lead to higher output and employment. However, if the economy is already at full capacity (long-run AS), the primary effect will be inflationary pressure.

Q 2. Describe the Phillips curve and its limitations.

The Phillips curve illustrates the inverse relationship between inflation and unemployment. It suggests that lower unemployment is associated with higher inflation, and vice versa. This relationship stems from the idea that when unemployment is low, workers have more bargaining power, leading to higher wages and subsequently higher prices.

Limitations: The original Phillips curve, based on historical data, didn’t account for supply shocks or stagflation (high inflation and high unemployment). The 1970s stagflation showed that the relationship wasn’t always stable. The curve shifted, rendering the initial inverse relationship unreliable. Furthermore, the Phillips curve doesn’t consider other factors affecting inflation and unemployment, such as changes in productivity, expectations, and government policies.

Modern interpretations of the Phillips curve acknowledge that the relationship is more complex and depends on factors like expectations of inflation. The concept of a ‘long-run Phillips curve’ suggests that there’s a natural rate of unemployment where inflation remains stable. Attempts to push unemployment below this rate will lead to accelerating inflation.

Q 3. What are the key differences between monetary and fiscal policy?

Monetary and fiscal policies are both macroeconomic tools used to influence the economy, but they operate through different channels.

- Monetary Policy: Controlled by the central bank, monetary policy involves manipulating the money supply and interest rates to influence aggregate demand. Tools include changing reserve requirements for banks, adjusting the discount rate (the interest rate at which commercial banks can borrow from the central bank), and open market operations (buying or selling government securities). The goal is to control inflation and manage economic growth.

- Fiscal Policy: Controlled by the government, fiscal policy involves adjusting government spending and taxation to influence aggregate demand. Increased government spending or tax cuts are expansionary (stimulative), while decreased government spending or tax increases are contractionary (restrictive). Fiscal policy aims to boost economic activity during recessions or curb inflation during periods of rapid growth.

Key Differences: Monetary policy is more flexible and can be implemented quickly, whereas fiscal policy involves legislative processes, making it slower to implement. Monetary policy primarily affects interest rates and investment, while fiscal policy directly impacts aggregate demand through government spending and consumer spending influenced by taxation.

Example: During a recession, the central bank might lower interest rates (monetary policy) to encourage borrowing and investment, while the government might increase spending on infrastructure projects (fiscal policy) to create jobs and stimulate economic activity.

Q 4. How does inflation impact economic growth?

Inflation’s impact on economic growth is complex and not always straightforward. Moderate inflation can sometimes stimulate economic growth by encouraging investment and spending, as people try to avoid the erosion of their purchasing power. However, high or unexpected inflation can significantly harm growth.

Negative Impacts: High inflation creates uncertainty, making it difficult for businesses to plan and invest. It can also erode purchasing power, reducing consumer spending and potentially leading to a decline in aggregate demand. High inflation can also lead to distortions in the economy, as relative prices become unpredictable. This can misallocate resources, hindering efficient production.

Example: Hyperinflation, like that experienced in Weimar Germany or Zimbabwe, completely destroys economic activity, leading to severe economic collapse. Even moderate, but persistent, inflation can lead to reduced investment and slower economic growth as businesses struggle to predict future costs and profits.

Q 5. Discuss the role of central banks in managing inflation.

Central banks play a crucial role in managing inflation through monetary policy. Their primary goal is often price stability, meaning keeping inflation at a low and stable level. They monitor various economic indicators, such as inflation rates, unemployment rates, and economic growth, to assess the overall state of the economy.

Tools and Strategies: Central banks use various tools, including interest rate adjustments, reserve requirements, and open market operations, to influence the money supply and interest rates. If inflation is rising too quickly, they might raise interest rates to make borrowing more expensive, thus slowing down economic activity and reducing inflationary pressure. Conversely, if inflation is too low or the economy is slowing down, they might lower interest rates to stimulate borrowing and investment.

Example: The Federal Reserve (the central bank of the U.S.) regularly adjusts its federal funds rate to control inflation. During periods of high inflation, they increase the rate, making borrowing more expensive for banks, which, in turn, increases borrowing costs for consumers and businesses.

Q 6. Explain the impact of interest rate changes on economic activity.

Changes in interest rates significantly influence economic activity by affecting borrowing costs and investment decisions. Interest rates are the price of borrowing money.

Impact of Increased Interest Rates: Higher interest rates make borrowing more expensive for businesses and consumers. This can lead to reduced investment in new projects, less consumer spending on durable goods (like cars and houses), and a decrease in aggregate demand. The effect is usually a slowdown in economic growth, but it can help curb inflation.

Impact of Decreased Interest Rates: Lower interest rates make borrowing cheaper, encouraging businesses to invest in new projects and consumers to spend more, particularly on large purchases. This leads to increased aggregate demand and typically stimulates economic growth. However, it can also fuel inflation if the economy is already operating near its capacity.

Example: A central bank raising interest rates to combat high inflation will likely see a decrease in business investment and consumer spending in the short term, leading to slower economic growth. However, this can help control inflation over the longer term. Conversely, lower interest rates during a recession can boost investment and consumption, helping to recover from an economic downturn.

Q 7. Describe the current state of the global economy and its key challenges.

The global economy is currently facing a complex and uncertain environment. Key challenges include:

- High Inflation: Many countries are grappling with persistently high inflation, driven by factors such as supply chain disruptions, increased energy prices, and strong consumer demand. This is forcing central banks to aggressively raise interest rates, potentially triggering a global recession.

- Slowing Growth: The global economy is experiencing slowing growth, with several major economies facing the risk of recession. Factors include the war in Ukraine, high energy prices, and persistent supply chain bottlenecks.

- Geopolitical Instability: The war in Ukraine, rising tensions between major powers, and increasing trade protectionism are creating uncertainty and disrupting global supply chains.

- Debt Levels: High levels of public and private debt in many countries pose a significant risk to financial stability. Rising interest rates are increasing the cost of servicing this debt, potentially leading to defaults and financial crises.

- Climate Change: The increasing frequency and severity of extreme weather events are posing significant risks to global economic activity and impacting agricultural production and infrastructure.

The interplay of these challenges makes predicting the future trajectory of the global economy difficult. Policymakers face tough choices in navigating these intertwined issues, and coordinated international cooperation will likely be crucial in mitigating the risks.

Q 8. Analyze the impact of globalization on national economies.

Globalization, the increasing interconnectedness of nations through trade, investment, and technology, has profoundly impacted national economies. It’s a double-edged sword, offering significant benefits alongside potential drawbacks.

- Benefits: Increased trade leads to specialization and economies of scale, boosting overall productivity and economic growth. Consumers benefit from lower prices and greater product variety. Foreign direct investment (FDI) flows into developing nations, creating jobs and fostering technological advancements.

- Drawbacks: Increased competition can hurt domestic industries, leading to job losses in certain sectors. Globalization can exacerbate income inequality, as the benefits are not always evenly distributed. There’s also increased vulnerability to global economic shocks, as national economies become more intertwined.

Example: China’s integration into the global economy led to massive economic growth, lifting millions out of poverty. However, it also resulted in significant environmental challenges and concerns about worker exploitation in some industries.

Practical Application: Governments must carefully manage globalization through policies that promote competitiveness while mitigating potential negative consequences, such as providing retraining programs for workers displaced by automation or investing in education to enhance workforce skills.

Q 9. How do exchange rate fluctuations affect international trade?

Exchange rate fluctuations, the changes in the value of one currency relative to another, significantly impact international trade. A country’s currency appreciating (becoming stronger) makes its exports more expensive for foreign buyers and imports cheaper for domestic consumers. Conversely, a depreciating currency (becoming weaker) makes exports cheaper and imports more expensive.

- Appreciation: Reduces a country’s competitiveness in international markets, potentially leading to a decline in exports and an increase in imports. This can result in a trade deficit.

- Depreciation: Boosts a country’s competitiveness, potentially increasing exports and decreasing imports. However, it also increases the cost of imported goods, potentially leading to inflation.

Example: If the US dollar strengthens against the Euro, European goods become cheaper for Americans, but American goods become more expensive for Europeans. This can lead to a decrease in US exports to Europe and an increase in US imports from Europe.

Practical Application: Businesses involved in international trade need to carefully manage currency risk through hedging strategies, like using forward contracts or options, to mitigate the impact of exchange rate fluctuations on their profits.

Q 10. Discuss the effects of trade wars on global economic growth.

Trade wars, characterized by escalating tariffs and trade restrictions between countries, significantly harm global economic growth. They disrupt established trade patterns, increase costs for businesses and consumers, and create uncertainty in the global economy.

- Reduced Trade: Tariffs increase the price of imported goods, reducing the volume of trade between countries. This harms businesses that rely on international trade and reduces overall economic activity.

- Increased Prices: Higher tariffs are passed on to consumers through higher prices for imported goods, decreasing consumer purchasing power and reducing overall demand.

- Retaliation: Trade wars often involve retaliatory measures from affected countries, further escalating tensions and harming global trade.

Example: The US-China trade war of 2018-2020 led to increased tariffs on billions of dollars’ worth of goods, resulting in higher prices for consumers and uncertainty for businesses in both countries. Global economic growth was negatively impacted.

Practical Application: International cooperation and negotiation are crucial to resolving trade disputes and avoiding trade wars. Organizations like the World Trade Organization play a significant role in mediating such disputes and promoting free and fair trade.

Q 11. Explain the concept of purchasing power parity (PPP).

Purchasing Power Parity (PPP) is a theory that compares different countries’ currencies through a “basket of goods” approach. It suggests that exchange rates should adjust to equalize the price of an identical basket of goods and services in different countries.

In essence, PPP aims to determine the real value of currencies, accounting for differences in the cost of living. If a Big Mac costs $5 in the US and €4 in Europe, and the exchange rate is $1 = €1, then the dollar is overvalued against the Euro according to PPP because the Big Mac costs more in the US.

Example: While the nominal exchange rate might show $1 = 70 Indian Rupees, the PPP exchange rate might be significantly different, reflecting the lower cost of living in India. A basket of goods costing $100 in the US might only cost the equivalent of $50 in India based on PPP.

Practical Application: PPP is crucial for comparing economic output and living standards across countries with vastly different price levels. It offers a more accurate picture of relative wealth than using nominal exchange rates alone. International organizations like the IMF use PPP adjustments to create more accurate comparisons of GDP per capita across countries.

Q 12. What are the different measures of economic growth?

Several measures assess economic growth, each offering a different perspective:

- Gross Domestic Product (GDP): The total value of goods and services produced within a country’s borders in a specific period. It’s the most widely used measure, reflecting the overall size of the economy. GDP can be nominal (current prices) or real (adjusted for inflation).

- Gross National Product (GNP): Similar to GDP, but includes the income earned by a country’s residents, regardless of where it’s earned. This accounts for income from foreign investments.

- Real GDP per capita: Real GDP divided by the population. This provides a measure of average income per person and is often used to compare living standards across countries.

- GDP growth rate: The percentage change in real GDP from one period to the next. This shows the rate at which the economy is expanding or contracting.

Example: A country with a high GDP growth rate might be experiencing rapid economic expansion, but a low real GDP per capita might indicate low living standards. It’s important to use multiple metrics for a holistic view.

Practical Application: These measures are essential for policymakers to understand the state of the economy, formulate policies (like monetary and fiscal policy), and monitor the effectiveness of those policies.

Q 13. How does government debt affect economic stability?

Government debt, the total amount of money a government owes to its creditors (individuals, businesses, and other governments), can significantly impact economic stability. High levels of debt can lead to several issues:

- Higher Interest Rates: Increased borrowing by the government can drive up interest rates, making it more expensive for businesses and individuals to borrow money, potentially slowing down economic growth.

- Crowding Out Effect: Government borrowing can compete with private sector borrowing, reducing the amount of funds available for private investment and hindering economic expansion.

- Debt Crisis: If a country’s debt becomes unsustainable, it can lead to a debt crisis, potentially triggering a financial crisis and economic recession.

- Inflation: High levels of government debt can sometimes lead to increased money supply, which may contribute to inflation.

Example: The Greek debt crisis of 2010 demonstrated the severe consequences of unsustainable government debt. Greece faced high interest rates, economic recession, and had to implement austerity measures to manage its debt.

Practical Application: Maintaining a sustainable level of government debt is essential for economic stability. This requires responsible fiscal policy, including controlling spending, increasing revenue through taxation, and managing debt effectively.

Q 14. Describe the impact of technological advancements on productivity.

Technological advancements significantly boost productivity by improving efficiency and creating new possibilities. This has broad implications for economic growth and the overall structure of the economy.

- Automation: Automation through robotics and AI increases efficiency in production processes, leading to higher output with less labor input.

- Innovation: New technologies lead to the development of new products and services, creating new markets and economic opportunities.

- Improved Communication & Collaboration: Advancements in communication and information technology facilitate better collaboration among businesses and individuals, boosting productivity.

Example: The development of the internet and mobile technology revolutionized communication, making information readily available and facilitating global commerce. This boosted productivity across various sectors.

Practical Application: While technological advancements drive productivity gains, it’s also important to consider the potential impact on employment. Policies that support workforce retraining and upskilling are necessary to prepare workers for the jobs of the future. Governments need to adapt education and infrastructure policies to align with ongoing technological changes.

Q 15. Explain the concept of the business cycle.

The business cycle refers to the periodic fluctuations in economic activity that an economy experiences over time. It’s characterized by periods of expansion (growth) and contraction (recession). Think of it like the waves of the ocean – sometimes they’re high (expansion), and sometimes they’re low (contraction).

A typical cycle includes four phases:

- Expansion: Characterized by increasing employment, rising consumer spending, and overall economic growth. Businesses invest more, and production increases.

- Peak: The highest point of the expansion phase, where economic activity reaches its maximum.

- Contraction (Recession): A period of declining economic activity, marked by job losses, reduced consumer spending, and decreased business investment. A recession is technically defined as two consecutive quarters of negative GDP growth.

- Trough: The lowest point of the contraction phase, marking the end of the recession and the beginning of a new expansion.

Understanding the business cycle is crucial for policymakers, businesses, and investors to make informed decisions. For example, during an expansion, businesses might invest in new capacity, while during a contraction, they might cut back on spending.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. How do you forecast economic growth?

Forecasting economic growth is a complex process, but it typically involves analyzing a range of economic indicators and applying econometric models. Think of it like predicting the weather – you need a lot of data and sophisticated tools to get a reasonably accurate forecast.

Key factors considered include:

- GDP Growth: Analyzing past trends and projecting future growth rates.

- Consumer Spending: Consumer confidence indices and spending patterns provide insights into future demand.

- Investment: Business investment plans and capital expenditures indicate future production capacity.

- Government Spending: Fiscal policies and government expenditure plans play a significant role.

- Interest Rates: Monetary policy decisions influence investment and borrowing.

- Inflation: High inflation can hinder economic growth.

- Global Economic Conditions: International trade and global economic events significantly impact national economies.

Econometric models, which are statistical models that use mathematical equations to represent economic relationships, are frequently employed. These models use historical data to predict future outcomes. However, it’s important to remember that economic forecasts are not perfect; unexpected events can significantly alter the predicted trajectory.

Q 17. What are the leading indicators of a recession?

Leading indicators are economic variables that tend to change *before* a recession begins, providing early warnings. They act like a canary in a coal mine, alerting us to potential danger.

Some key leading indicators include:

- Yield Curve Inversion: When long-term interest rates fall below short-term interest rates, it often signals a recession. This is because it indicates that investors expect slower economic growth in the future.

- Consumer Confidence Index: A decline in consumer confidence suggests reduced consumer spending, a major driver of economic growth.

- Housing Starts: A sharp decline in housing starts can signal a broader economic slowdown.

- Stock Market Performance: While not always a perfect predictor, a prolonged bear market can reflect underlying economic weakness.

It’s crucial to remember that no single indicator guarantees a recession. Instead, economists look at a combination of leading indicators to assess the overall probability of a downturn.

Q 18. Analyze the impact of demographic shifts on economic growth.

Demographic shifts, such as changes in population size, age structure, and migration patterns, significantly impact economic growth. A young, growing population can fuel economic expansion, while an aging population can lead to slower growth.

Here’s how demographic shifts affect economic growth:

- Aging Population: An aging population often leads to a shrinking workforce and reduced consumer spending, potentially slowing economic growth. Increased healthcare costs associated with an older population also strain government budgets.

- Shrinking Workforce: A smaller workforce can limit productivity growth and economic output, particularly if there aren’t sufficient skilled workers to fill available jobs.

- Increased Dependency Ratio: A higher dependency ratio (the ratio of dependents – children and the elderly – to the working-age population) puts pressure on social security systems and can reduce overall economic output.

- Migration: Immigration can increase the labor supply and boost economic growth, while emigration can have the opposite effect. The skill level of migrants also plays a crucial role.

Governments often implement policies to address these challenges, such as encouraging immigration, increasing retirement ages, and reforming pension systems. For example, countries with aging populations might invest heavily in automation to offset labor shortages.

Q 19. Discuss the role of international organizations (e.g., IMF, World Bank) in managing the global economy.

International organizations like the International Monetary Fund (IMF) and the World Bank play crucial roles in managing the global economy. Think of them as the global economic ‘doctors’ and ‘engineers’.

The IMF’s primary role is to:

- Promote international monetary cooperation: Facilitate exchange rate stability and the smooth functioning of international payments systems.

- Provide financial assistance: Lend money to countries facing balance-of-payments difficulties, often with conditions attached to ensure economic reforms.

- Surveillance: Monitor global and national economies to identify potential risks and vulnerabilities.

The World Bank’s main focuses are:

- Poverty reduction: Provide financial and technical assistance to developing countries to reduce poverty and improve living standards.

- Economic development: Support infrastructure development, education, and other projects that promote long-term economic growth.

Both organizations collaborate with governments, businesses, and civil society to address global economic challenges, ranging from financial crises to climate change. Their effectiveness is often debated, however, with criticisms ranging from imposing overly strict conditions on loans to overlooking the needs of certain populations.

Q 20. Explain the concept of sovereign risk.

Sovereign risk refers to the risk that a country will default on its debt obligations. It’s the risk that a government won’t be able to pay back its loans or honor its financial commitments. Think of it like the risk a lender takes when lending money to an individual with a poor credit history – but on a national scale.

Factors contributing to sovereign risk include:

- Political instability: Frequent changes in government or political unrest can deter investors.

- External debt burden: A high level of external debt makes it difficult for a country to meet its financial obligations.

- Corruption: Corruption can lead to inefficient use of public funds and a lack of transparency, eroding investor confidence.

High sovereign risk generally leads to higher borrowing costs for the country, as investors demand a higher return to compensate for the increased risk.

Q 21. How do you assess the creditworthiness of a country?

Assessing a country’s creditworthiness involves analyzing various economic and political factors to determine the likelihood of it defaulting on its debt. Credit rating agencies, such as Moody’s, Standard & Poor’s, and Fitch, play a significant role in this process. They use complex models and numerous data points to arrive at credit ratings.

Key factors considered include:

- Economic growth and stability: Consistent economic growth and stable macroeconomic conditions are positive indicators.

- Government debt levels: High levels of government debt relative to GDP increase the risk of default.

- Budget deficits: Large and persistent budget deficits signal fiscal weakness.

- External debt levels: High levels of external debt increase vulnerability to external shocks.

- Political stability: Political stability and effective governance are essential for sound economic management.

- Currency stability: A stable currency reduces the risk of exchange rate losses that could hinder debt repayment.

- Inflation: High inflation erodes the value of debt and can create economic instability.

The credit rating agencies combine these factors to produce a credit rating, which reflects the country’s creditworthiness. Higher credit ratings indicate lower risk, leading to lower borrowing costs. Lower ratings signal higher risk and higher borrowing costs.

Q 22. Describe the impact of climate change on the global economy.

Climate change poses a significant and multifaceted threat to the global economy. Its impacts are not limited to environmental damage; they ripple through various sectors, causing substantial economic losses and disruptions.

- Physical Damage: More frequent and intense extreme weather events (hurricanes, floods, droughts, wildfires) directly damage infrastructure, disrupt supply chains, and reduce agricultural yields. Think of the devastation caused by Hurricane Katrina or the ongoing wildfires in Australia – these events cost billions in damages and lost productivity.

- Resource Scarcity: Changes in precipitation patterns and rising sea levels threaten access to freshwater resources, impacting agriculture and industry. Water scarcity already constrains economic activity in many regions, and climate change will exacerbate this problem.

- Health Impacts: Increased heat waves, the spread of vector-borne diseases, and air pollution related to climate change impose significant healthcare costs and reduce worker productivity. The economic burden of heat-related illnesses alone is projected to grow substantially.

- Transition Costs: Shifting to a low-carbon economy requires substantial investments in renewable energy, energy efficiency, and climate adaptation measures. While this transition offers long-term benefits, it also involves short-term economic costs and potential job displacement in carbon-intensive industries. The transition presents opportunities, but managing the transition effectively is crucial.

In essence, climate change acts as a systemic risk, impacting multiple economic sectors simultaneously. Addressing it requires a comprehensive strategy involving mitigation (reducing greenhouse gas emissions) and adaptation (adjusting to the unavoidable impacts of climate change).

Q 23. Explain the concept of economic inequality and its impact.

Economic inequality refers to the uneven distribution of income, wealth, and opportunities within and between countries. It’s measured in various ways, such as the Gini coefficient (a measure of income inequality) and the wealth share held by the top 1%.

- Social Instability: High levels of inequality can fuel social unrest, protests, and political instability, undermining economic growth and social cohesion. The Arab Spring uprisings, partly fueled by economic grievances, illustrate this point.

- Reduced Aggregate Demand: A large portion of the population with limited purchasing power constrains aggregate demand, hindering economic growth. This is because a significant segment of the population cannot afford to buy goods and services, limiting overall economic activity.

- Slower Economic Growth: Studies suggest that higher inequality is associated with slower economic growth in the long run. This is because inequality can stifle investment in human capital (education and health) and reduce social mobility.

- Increased Poverty: Inequality exacerbates poverty, trapping individuals and families in a cycle of deprivation. This limits their opportunities and reduces their potential contribution to the economy.

Addressing economic inequality requires a multi-pronged approach, including investments in education and healthcare, progressive taxation, social safety nets, and policies that promote fair labor practices. It’s not just a social justice issue; it’s also an economic one with far-reaching consequences.

Q 24. What are the potential risks associated with high levels of global debt?

High levels of global debt pose several significant risks to the global economy. This includes both public debt (owed by governments) and private debt (owed by businesses and individuals).

- Debt Crises: Countries or companies with high debt burdens become vulnerable to debt crises, which can trigger financial instability and economic recession. The sovereign debt crisis in Europe in the early 2010s serves as a stark example.

- Reduced Investment: High debt levels can crowd out private investment as governments compete for scarce capital, leading to slower economic growth.

- Fiscal Constraints: Governments with large debt burdens face fiscal constraints, limiting their ability to respond effectively to economic shocks or invest in public goods like education and infrastructure.

- Currency Instability: High debt levels can increase vulnerability to currency fluctuations, impacting trade and investment.

- Increased Interest Rates: Higher levels of debt can lead to increased interest rates, making borrowing more expensive for businesses and consumers, slowing economic activity.

Managing global debt requires a combination of fiscal discipline, structural reforms, and international cooperation. Sustainable debt management strategies are crucial to ensuring long-term economic stability.

Q 25. How do you assess the impact of geopolitical events on the global economy?

Geopolitical events, such as wars, trade disputes, and political instability, can significantly impact the global economy through various channels.

- Disruption of Trade and Supply Chains: Conflicts and sanctions disrupt global trade flows and supply chains, leading to shortages, price increases, and reduced economic activity. The war in Ukraine dramatically illustrated the impact of geopolitical events on global commodity markets.

- Capital Flight: Political instability and uncertainty can cause capital flight, reducing investment and potentially triggering currency crises.

- Increased Uncertainty: Geopolitical risks increase uncertainty, making businesses hesitant to invest and consumers hesitant to spend, dampening economic growth.

- Refugee Flows: Large-scale refugee flows can impose significant economic and social costs on host countries.

- Energy Security: Geopolitical tensions can impact energy prices and security of supply, affecting economic activity across all sectors.

Analyzing the impact of geopolitical events requires a nuanced understanding of the specific event, its potential consequences, and the interconnectedness of the global economy. Effective risk management and proactive diplomacy are crucial in mitigating the negative economic consequences.

Q 26. Discuss the role of financial markets in transmitting macroeconomic shocks.

Financial markets play a crucial role in transmitting macroeconomic shocks across the global economy. They act as both amplifiers and dampeners, depending on the nature of the shock and the market’s response.

- Amplification: A negative shock, such as a financial crisis in one country, can spread rapidly through financial markets. For example, the 2008 financial crisis originated in the US but quickly spread globally through interconnected financial institutions and markets.

- Contagion Effect: Financial markets can transmit shocks through contagion effects, where the failure of one institution triggers a domino effect, leading to widespread instability. This is often exacerbated by interconnectedness and lack of transparency.

- Capital Flows: Changes in investor sentiment can lead to rapid shifts in capital flows, affecting exchange rates, interest rates, and asset prices. This can amplify or dampen the initial macroeconomic shock.

- Price Discovery: Financial markets play a crucial role in price discovery, reflecting expectations about future economic conditions. These expectations can influence business investment and consumer spending.

Understanding the role of financial markets in transmitting macroeconomic shocks is crucial for effective policymaking. Regulation, international cooperation, and early warning systems are essential to mitigate the risks associated with rapid transmission of shocks.

Q 27. Explain the challenges associated with forecasting emerging market economies.

Forecasting emerging market economies presents unique challenges compared to forecasting developed economies.

- Data Limitations: Data availability and quality can be significantly lower in emerging markets, making accurate forecasting more difficult. Data may be incomplete, inconsistent, or subject to significant revisions.

- Policy Uncertainty: Political and economic policies in emerging markets can be volatile and unpredictable, making it difficult to incorporate policy changes into forecasting models.

- External Shocks: Emerging markets are often more vulnerable to external shocks, such as fluctuations in commodity prices and global capital flows, which can significantly impact their economies.

- Institutional Weaknesses: Weak institutions, including corruption and lack of transparency, can introduce uncertainties into economic forecasting.

- Rapid Structural Changes: Emerging markets often experience rapid structural changes, such as urbanization and industrialization, making it challenging to capture these dynamic processes in forecasting models.

Effective forecasting in emerging markets requires a combination of quantitative and qualitative methods, careful consideration of data limitations, and a deep understanding of the political and economic context. Incorporating insights from local experts is also crucial.

Q 28. Describe different econometric models used to analyze macroeconomic data.

Various econometric models are used to analyze macroeconomic data, each with its own strengths and weaknesses. The choice of model depends on the specific research question and the available data.

- Vector Autoregression (VAR): VAR models analyze the interrelationships between multiple time series variables. They are useful for analyzing the dynamic effects of shocks to the economy.

Example: A VAR model could analyze the impact of a monetary policy shock on inflation and output. - Autoregressive Integrated Moving Average (ARIMA): ARIMA models are used to forecast univariate time series data. They are particularly useful for forecasting variables like GDP growth or inflation.

- Structural Vector Autoregression (SVAR): SVAR models extend VAR models by imposing restrictions based on economic theory. This helps to identify the structural shocks driving the data. For example, identifying the impact of a supply shock versus a demand shock on inflation.

- Dynamic Stochastic General Equilibrium (DSGE): DSGE models are complex macroeconomic models based on microeconomic foundations. They are used to simulate the effects of policy changes on the economy, often involving calibrated parameters and agent-based modelling. These are computationally intensive and require substantial economic theory assumptions.

- Panel Data Models: Panel data models combine time series and cross-sectional data to analyze the effects of macroeconomic variables across different countries or regions over time. They can control for unobserved heterogeneity across entities, allowing more rigorous causal inference.

The selection of the appropriate econometric model involves careful consideration of the data characteristics, the research question, and the underlying economic theory. It’s not just about choosing the most sophisticated model but the most appropriate one for the specific context.

Key Topics to Learn for Understanding Global Macroeconomic Trends Interview

- Global Economic Growth & Forecasting: Understand key indicators (GDP, inflation, unemployment), their interrelationships, and common forecasting models. Be prepared to discuss the limitations of these models and the impact of unexpected events.

- Monetary Policy & Central Banking: Analyze the roles of central banks in managing inflation, interest rates, and exchange rates. Discuss the effectiveness of different monetary policy tools and their potential side effects, considering both developed and emerging market contexts.

- Fiscal Policy & Government Spending: Evaluate the impact of government spending and taxation on economic growth and stability. Understand the concept of fiscal multipliers and the challenges of managing public debt.

- International Trade & Finance: Analyze the impact of globalization, trade agreements, and exchange rate fluctuations on national economies. Discuss the role of international organizations like the IMF and World Bank.

- Economic Shocks & Crises: Understand the causes and consequences of various economic shocks (e.g., oil price shocks, financial crises). Be prepared to discuss policy responses and strategies for mitigation and recovery.

- Inflation & Deflation: Analyze the causes and consequences of inflation and deflation. Discuss different types of inflation (demand-pull, cost-push) and the tools used to control them. Understand the impact on consumer behavior and investment decisions.

- Unemployment & Labor Markets: Analyze different types of unemployment (frictional, structural, cyclical) and their implications for economic growth and social welfare. Discuss the impact of technological change and globalization on labor markets.

- Data Analysis & Interpretation: Demonstrate proficiency in interpreting macroeconomic data, identifying trends, and drawing informed conclusions. Practice using economic indicators to support your analysis and predictions.

Next Steps

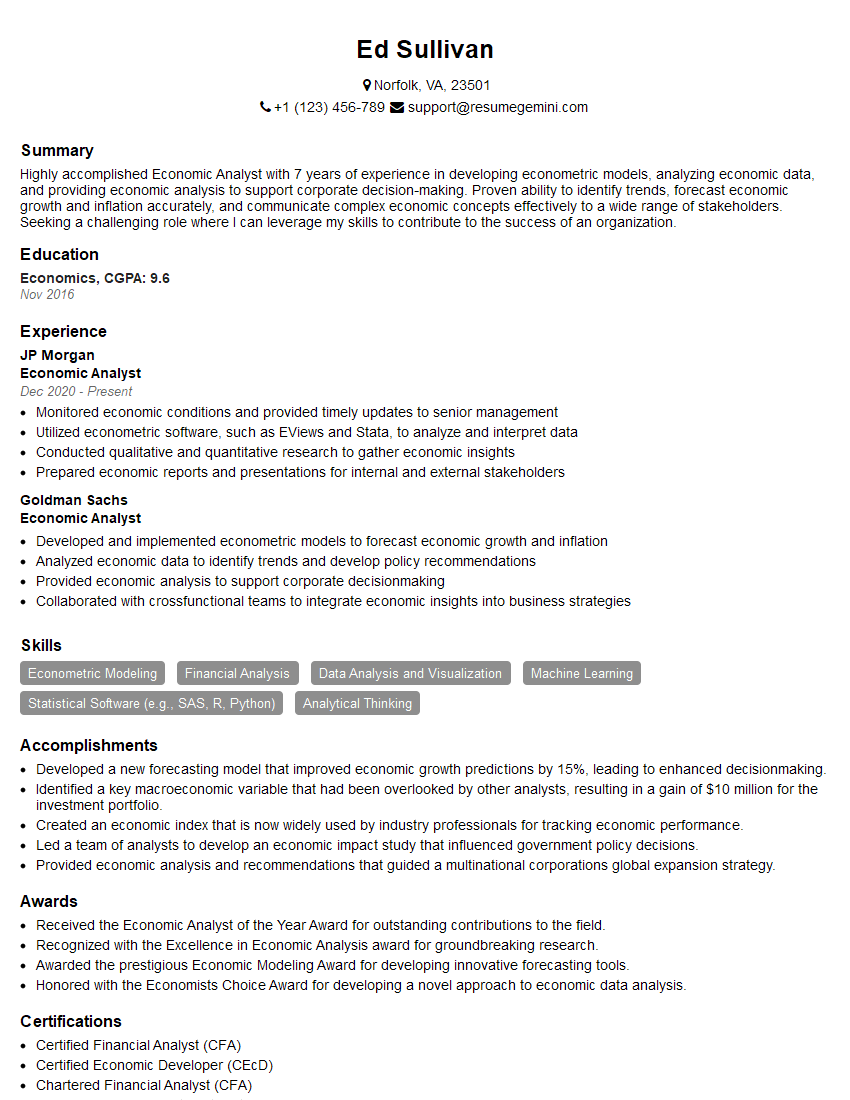

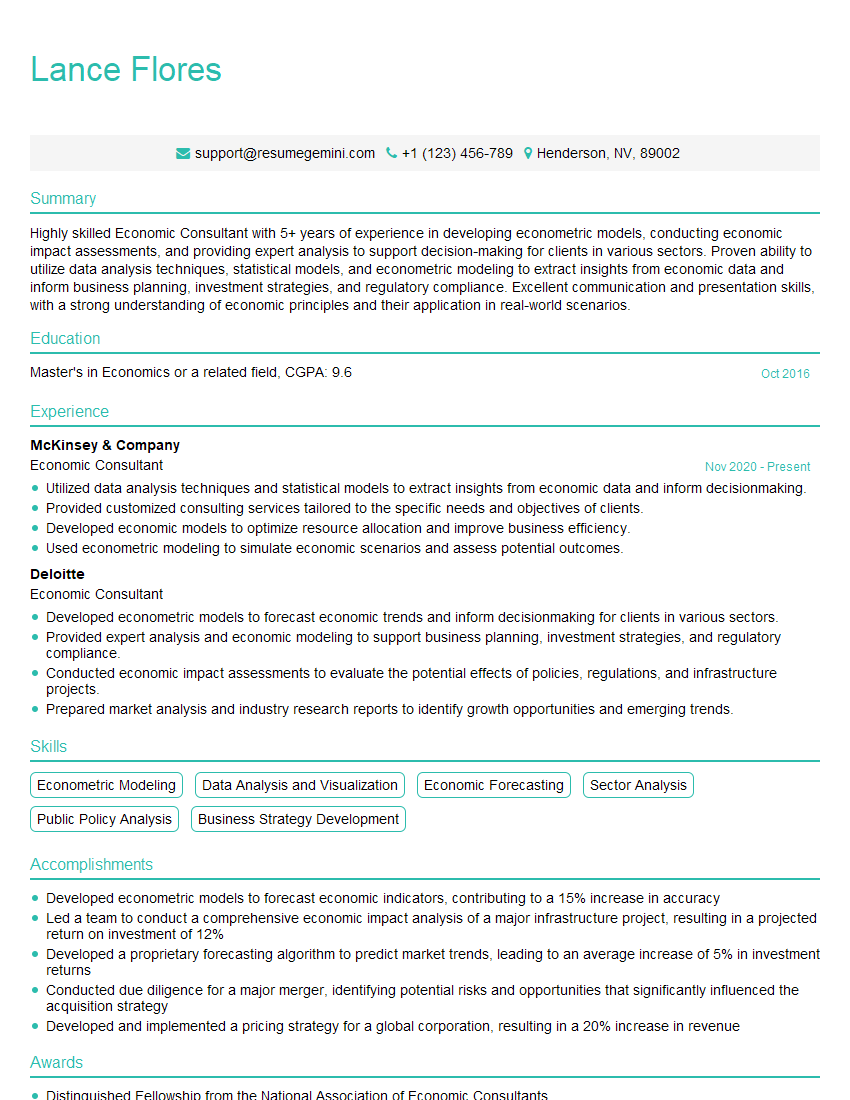

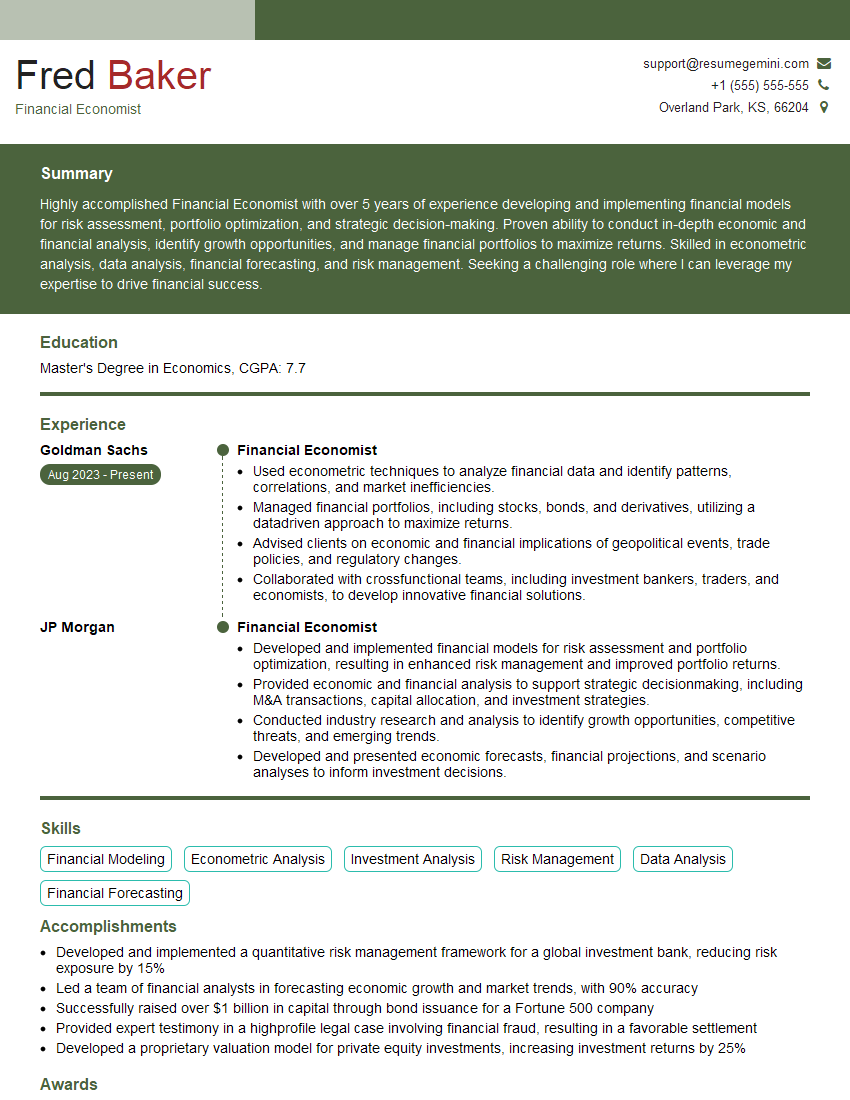

Mastering global macroeconomic trends is crucial for a successful career in finance, economics, and related fields. A strong understanding of these concepts will make you a highly sought-after candidate. To maximize your job prospects, create an ATS-friendly resume that effectively highlights your skills and experience. ResumeGemini is a trusted resource that can help you build a professional and impactful resume. They even provide examples of resumes tailored to roles focusing on understanding global macroeconomic trends – take a look for inspiration!

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

Hi, I’m Jay, we have a few potential clients that are interested in your services, thought you might be a good fit. I’d love to talk about the details, when do you have time to talk?

Best,

Jay

Founder | CEO