The right preparation can turn an interview into an opportunity to showcase your expertise. This guide to Budget Management and Financial Tracking interview questions is your ultimate resource, providing key insights and tips to help you ace your responses and stand out as a top candidate.

Questions Asked in Budget Management and Financial Tracking Interview

Q 1. Explain the different types of budgeting methods.

Budgeting methods vary depending on the organization’s size, complexity, and goals. Here are a few common types:

- Zero-based budgeting (ZBB): This approach starts each budget cycle from scratch. Every expense must be justified and approved, regardless of prior year’s spending. It’s effective for identifying inefficiencies but can be time-consuming. Imagine building a house – you don’t automatically include last year’s blueprints; you evaluate each element’s necessity for the new design.

- Incremental budgeting: This is the most common method, using the previous year’s budget as a base and adjusting it based on projected changes. It’s simpler and faster than ZBB, but might perpetuate past inefficiencies. Think of it like updating a software program – you build upon the existing features, making incremental changes.

- Activity-based budgeting (ABB): This method links budget allocations directly to specific activities or projects. It provides greater transparency and accountability by tracking costs against outcomes. For example, instead of a generic ‘marketing budget,’ ABB allocates funds to specific campaigns with measurable results.

- Value-based budgeting (VBB): This approach prioritizes spending on initiatives delivering the highest value to the organization. This often involves a rigorous assessment of ROI for different projects. Think of it as investing – prioritizing ventures with high potential returns.

The best method depends on your organization’s needs. A small startup might benefit from incremental budgeting, while a large corporation might prefer activity-based or value-based budgeting for greater control and transparency.

Q 2. Describe your experience with variance analysis.

Variance analysis is crucial for understanding deviations between budgeted and actual financial results. My experience involves identifying the root causes of these variances and recommending corrective actions. For example, I once worked with a manufacturing company experiencing significant material cost overruns. Through detailed analysis, I discovered inefficiencies in their procurement process. We implemented a new vendor selection strategy and improved inventory management, resulting in a 15% reduction in material costs within the next quarter. This involved comparing actual costs with budgeted costs for each material, analyzing purchasing patterns, and negotiating better terms with suppliers. The analysis relied on clearly defined metrics and a robust reporting system to track progress and identify trends.

Q 3. How do you identify and address budget overruns?

Addressing budget overruns requires a systematic approach. First, I’d thoroughly investigate the cause – was it due to unexpected expenses, inaccurate forecasting, cost overruns on specific projects, or changes in market conditions? Once the root cause is identified, I’d implement corrective actions such as:

- Negotiating with vendors: Exploring better pricing or payment terms.

- Cutting unnecessary expenses: Identifying areas where spending can be reduced without compromising quality or performance.

- Re-allocating resources: Shifting funds from less critical areas to address the overrun.

- Seeking additional funding: If the overrun is significant and cannot be addressed internally.

- Improving forecasting accuracy: Refining forecasting models and incorporating more accurate data.

Regular monitoring and reporting are essential to detect and address potential overruns early. A proactive approach, rather than a reactive one, is key. Think of it like maintaining a car – regular checkups prevent major breakdowns.

Q 4. What are some key performance indicators (KPIs) you use to track financial performance?

Key Performance Indicators (KPIs) are crucial for tracking financial performance. The specific KPIs used will depend on the organization and its goals, but some common ones include:

- Budget variance: The difference between actual and budgeted figures.

- Return on Investment (ROI): Measures the profitability of investments.

- Net Profit Margin: Indicates profitability relative to revenue.

- Cost of Goods Sold (COGS): Tracks the direct costs associated with producing goods or services.

- Cash flow: Monitors the movement of cash into and out of the business.

- Debt-to-equity ratio: Assesses the company’s financial leverage.

These KPIs, alongside others tailored to specific departmental needs, provide a comprehensive view of financial health and help identify areas needing improvement.

Q 5. How do you prioritize competing budget requests?

Prioritizing competing budget requests requires a structured approach. I typically use a multi-criteria decision analysis method, considering factors such as:

- Alignment with strategic goals: Requests that support the organization’s overarching strategy are prioritized.

- Return on investment (ROI): Projects with higher potential ROI are given preference.

- Urgency and time sensitivity: Requests with immediate needs are often prioritized.

- Risk assessment: Projects with higher risks might require more careful consideration.

- Resource availability: Realistic assessment of available resources.

A scoring system can be used to objectively rank requests based on these criteria. This ensures transparency and fairness in the allocation process. For example, each criterion could be scored on a scale of 1-5, with higher scores representing stronger alignment with the criterion. The total score for each request then helps determine priorities.

Q 6. Describe your experience with forecasting and budgeting software.

I have extensive experience with various forecasting and budgeting software packages, including Anaplan, SAP BPC, and Oracle Hyperion. My proficiency extends beyond simply using these tools; I understand their underlying functionalities, enabling me to design and implement customized reporting and analysis processes. For example, using Anaplan, I built a model that allowed for real-time monitoring of project budgets, providing immediate alerts for potential overruns. This allowed for quicker intervention and improved cost control. Proficiency in these tools helps ensure data integrity, accurate forecasting, and effective budget management.

Q 7. How do you ensure budget accuracy and reliability?

Ensuring budget accuracy and reliability requires a combination of meticulous processes and technological tools. This includes:

- Accurate data collection: Using reliable sources and implementing robust data validation processes.

- Regular reconciliation: Comparing budgeted figures with actual results frequently to identify discrepancies.

- Robust forecasting models: Using historical data, market trends, and other relevant factors to create realistic budget projections.

- Effective internal controls: Implementing checks and balances to prevent errors and fraud.

- Regular review and updates: The budget should be reviewed and updated regularly to reflect changes in the business environment.

- Use of budgeting software: Leveraging automation for data entry, calculation, and reporting.

By combining careful planning, robust processes, and reliable technology, we can ensure a high degree of accuracy and reliability in the budgeting process.

Q 8. How do you communicate budget information to stakeholders?

Communicating budget information effectively requires tailoring the message to the audience. For executive stakeholders, I focus on high-level summaries, key performance indicators (KPIs), and overall financial health. Visual aids like dashboards and charts are crucial here. For departmental managers, I provide more granular detail, focusing on their specific budget allocations, variances, and potential challenges. Regular meetings, both formal and informal, are vital for open communication and addressing concerns. For instance, I might present a summary report highlighting key variances from the budget, using color-coding to quickly identify areas needing attention. This might include a comparison of actual vs. budgeted spending, alongside explanations of any significant deviations.

For team members, the communication should be more focused on their individual tasks and responsibilities within the budget. Clear communication channels are essential to ensure everyone understands their role in managing costs and resources. This could include regular updates via email or team meetings discussing individual project budgets and progress.

Q 9. How do you handle budget changes and revisions?

Budget changes and revisions are inevitable. My approach involves a structured process. First, I identify the reason for the change – is it due to unforeseen circumstances, shifting priorities, or new opportunities? Then, I document the proposed changes, quantifying their impact on the overall budget. This requires careful analysis and potentially re-allocating resources. For example, if a project is unexpectedly delayed, I’d analyze its current spend and forecast the likely impact on the overall budget, suggesting alternative resource allocations from other projects to minimize the overall financial implications.

Next, I present the revised budget to relevant stakeholders, explaining the rationale behind the changes and securing their approval. Transparency is critical. After approval, the revised budget is communicated to all affected parties. Finally, I monitor the revised budget closely, tracking performance and making adjustments as needed. This entire process is documented thoroughly for auditing and future reference. Version control is key to track different versions of the budget.

Q 10. Explain your experience with zero-based budgeting.

Zero-based budgeting (ZBB) is a powerful approach where each budget item is justified from scratch each year, rather than simply basing it on the previous year’s figures. My experience with ZBB has involved leading teams through the process of defining objectives, identifying activities necessary to achieve those objectives, and then assigning resources accordingly. This demands a meticulous approach, requiring each department to prioritize its activities and demonstrate the value and cost-effectiveness of each initiative.

For example, in a previous role, we implemented ZBB across the marketing department. Instead of simply increasing the budget for social media marketing by a set percentage, we analyzed the return on investment (ROI) for each social media platform and reallocated resources accordingly. This led to a more efficient use of marketing funds and a demonstrably higher ROI. Implementing ZBB can be resource-intensive initially, but it often results in a leaner, more efficient budget in the long run. It requires extensive collaboration and buy-in from various stakeholders.

Q 11. What is your approach to developing a comprehensive budget?

Developing a comprehensive budget is a collaborative and iterative process. It begins with defining clear objectives and aligning them with the organization’s strategic goals. This ensures the budget supports the overall mission. Next, I gather data from various departments, forecasting revenues and expenses. This involves understanding historical data, market trends, and anticipated changes. The forecasting part requires strong analytical skills and often involves detailed financial modeling.

Following this, I consolidate the data into a comprehensive budget document, identifying potential risks and opportunities. This often includes contingency planning to address unexpected circumstances. This draft is reviewed with stakeholders to address concerns and obtain buy-in. Finally, the budget is finalized and implemented, with regular monitoring and adjustments throughout the budget period. I use a combination of spreadsheets and budgeting software for efficiency and accuracy. For example, I might use a spreadsheet for initial data gathering and forecasting, then import this data into specialized budgeting software for more robust analysis and reporting.

Q 12. Describe a situation where you had to make difficult budget decisions.

In a previous role, we faced unexpected cost overruns on a major project. This meant we had to make difficult choices about resource allocation. After a thorough analysis of the project’s current status and potential future costs, we identified several areas where we could reduce spending without compromising the project’s core objectives. This included renegotiating contracts with suppliers, delaying non-critical features, and reallocating resources from less critical projects.

The decision-making process was transparent and involved discussions with all affected stakeholders. We had to carefully consider the potential impact of each decision on various teams and departments. Ultimately, we were able to mitigate the impact of the cost overruns and successfully complete the project, minimizing financial damage and preserving the organization’s financial health.

Q 13. How do you reconcile budget discrepancies?

Reconciling budget discrepancies starts with identifying the source of the discrepancy. This often involves a detailed review of financial records, comparing actual spending to budgeted amounts. I use a systematic approach, checking for errors in data entry, inconsistencies in accounting practices, or unexpected expenses. For instance, if there’s a significant variance in a specific expense category, I would thoroughly investigate each transaction within that category to identify the cause. Technology plays a crucial role; I leverage accounting software with robust reporting and reconciliation features.

Once the source of the discrepancy is identified, I work to correct the error, whether that involves adjusting the budget, revising forecasts, or addressing underlying issues in spending habits. Documentation of the reconciliation process is crucial for transparency and audit trails. This entire process emphasizes meticulous attention to detail and a commitment to accuracy.

Q 14. How familiar are you with accrual and cash accounting?

I’m very familiar with both accrual and cash accounting. Accrual accounting recognizes revenue when earned and expenses when incurred, regardless of when cash changes hands. This provides a more comprehensive picture of a company’s financial performance over time. Cash accounting, on the other hand, records transactions only when cash is received or paid. It provides a simpler view of cash flow but can be less accurate in reflecting a company’s overall financial position.

My experience involves working with both methods, understanding their strengths and limitations. The choice between accrual and cash accounting depends on the specific needs of the business and regulatory requirements. For example, larger businesses often use accrual accounting to comply with Generally Accepted Accounting Principles (GAAP), while smaller businesses might use cash accounting for its simplicity. I’m comfortable interpreting financial statements prepared under either method and can adapt my budgeting strategies accordingly.

Q 15. Explain your process for tracking expenses.

My expense tracking process is meticulous and adaptable to different organizational needs. It begins with a clear categorization system. I prefer a combination of methods, starting with dedicated budgeting software or spreadsheets (like Google Sheets or Excel) to input all transactions. This allows for automated calculations and visualizations. For example, I might categorize expenses into broad categories like ‘Salaries,’ ‘Rent,’ ‘Marketing,’ and then sub-categorize further (e.g., ‘Marketing’ could have subcategories like ‘Online Advertising,’ ‘Print Materials,’ ‘Events’).

Alongside digital tracking, I also maintain physical receipts, organized chronologically and by category, for auditing purposes. Regular reconciliation is key – comparing my digital records with my physical receipts, ensuring everything aligns. This two-pronged approach provides a robust system with built-in checks and balances. Discrepancies trigger immediate investigation to identify and correct errors. For larger organizations, I would advocate integrating the expense tracking system with the accounting software for seamless data flow and reporting.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. How do you monitor and control spending?

Monitoring and controlling spending involves proactive measures and regular reviews. First, I establish a baseline budget – a detailed plan outlining expected income and expenses. This acts as a benchmark against which actual spending can be compared. Regular monitoring involves comparing actual spending against the budget, ideally on a weekly or monthly basis. Any significant deviations trigger an immediate investigation. For example, if marketing expenses exceed the budget by 15%, I investigate the reasons: were there unexpected campaign costs, or is the budget itself inaccurate?

Controlling spending often involves adjusting spending patterns or reallocating funds. If a project is over budget, I would explore strategies like renegotiating contracts, postponing non-essential activities, or seeking additional funding if necessary. This requires clear communication with stakeholders, explaining any necessary adjustments and their rationale. Regular reporting, coupled with robust financial dashboards, provide a clear picture of spending trends and potential risks.

Q 17. What is your experience with financial reporting?

My experience with financial reporting spans diverse contexts, from creating simple balance sheets and income statements for small businesses to generating complex financial reports for larger corporations using tools like ERP systems (Enterprise Resource Planning). I’m proficient in creating reports that meet various stakeholder needs – from concise summaries for management to detailed analyses for investors. I understand the importance of accurate, timely, and transparent reporting and adhere to generally accepted accounting principles (GAAP) or relevant accounting standards.

I can prepare and interpret different types of reports, including variance analysis (comparing budgeted vs. actual figures), cash flow statements, and profitability analysis. I’m adept at using data visualization techniques, creating charts and graphs to communicate key insights effectively. For example, I’ve successfully presented financial reports to boards of directors, highlighting key performance indicators (KPIs) and recommending strategic adjustments based on the data.

Q 18. How do you use financial data to make strategic decisions?

Financial data is the lifeblood of strategic decision-making. I use it to identify trends, assess risks, and optimize resource allocation. For example, by analyzing sales data, I can identify high-performing products or services and strategically allocate more resources to maximize profitability. Conversely, I would analyze underperforming areas to identify opportunities for improvement or potential restructuring.

I use various analytical techniques, including ratio analysis (liquidity, profitability, solvency), trend analysis, and forecasting, to extract valuable insights. This data informs strategic decisions on areas such as capital investment, pricing strategies, market entry, and product development. Clear communication of these insights, using visual aids and concise narratives, is essential for securing buy-in from stakeholders.

Q 19. Describe your experience with internal controls related to budgeting and financial tracking.

Strong internal controls are crucial for maintaining the integrity of financial data and preventing fraud. My experience includes implementing and maintaining internal controls related to budgeting and financial tracking, encompassing separation of duties (different people handling different aspects of financial processes), authorization procedures (approval levels for different expenditure amounts), and regular audits (internal and external). For example, I’ve implemented a system where purchase orders require approval at different levels based on the amount, ensuring accountability and preventing unauthorized purchases.

I’m also experienced in implementing robust data security measures, including access controls and regular data backups. I’m familiar with various internal control frameworks, including COSO (Committee of Sponsoring Organizations of the Treadway Commission), and ensure compliance with these frameworks to minimize the risk of errors and fraud. Documenting processes and procedures is vital to ensure consistency and compliance.

Q 20. How do you stay up-to-date with changes in accounting standards and regulations?

Staying current with accounting standards and regulations is a continuous process. I achieve this by regularly reviewing publications from professional accounting bodies (like the Financial Accounting Standards Board (FASB) in the US, or the International Accounting Standards Board (IASB) internationally), attending industry conferences and webinars, and participating in professional development programs. I also subscribe to relevant journals and newsletters to stay informed about changes in legislation and best practices.

Networking with other professionals in the field provides insights into emerging trends and challenges. Furthermore, I leverage online resources and professional development courses to maintain my expertise in relevant software and tools. This continuous learning ensures my skills and knowledge remain relevant and aligned with current best practices.

Q 21. How do you handle budget constraints?

Handling budget constraints requires a strategic and proactive approach. The first step is to prioritize expenses, differentiating between essential and non-essential items. A thorough cost analysis can identify areas where savings can be achieved. This may involve negotiating lower prices with suppliers, exploring alternative, cost-effective options, or streamlining processes to reduce waste. For example, if marketing spend is constrained, we might shift from expensive television advertising to more cost-effective digital marketing campaigns.

Open communication with stakeholders is crucial. Transparent discussions regarding budget limitations and potential trade-offs are necessary to manage expectations and ensure collaboration. This may involve making difficult decisions, such as delaying non-critical projects or reducing the scope of certain initiatives. Prioritization, cost optimization, and clear communication are paramount to navigating budget constraints effectively and minimizing negative impact.

Q 22. What is your experience with financial modeling?

Financial modeling is the process of creating an abstract representation of a real-world financial situation. This involves building mathematical models that project future financial performance based on various assumptions and inputs. It’s essentially a sophisticated forecasting tool used for decision-making.

My experience encompasses building various models, from simple forecasting models predicting revenue growth based on historical data and market trends, to complex discounted cash flow (DCF) analyses to value potential investments or mergers and acquisitions. For example, I once created a model for a client considering expanding into a new market. The model incorporated variables such as market size, competitor analysis, marketing costs, and operating expenses to predict profitability over a five-year period. This allowed the client to make an informed decision about the viability of the expansion.

I’m also proficient in using sensitivity analysis to test the robustness of the model and identify key drivers of financial performance. This allows us to understand which assumptions have the biggest impact on the overall outcome and to plan for potential risks.

Q 23. Describe your experience with different financial statements (Income Statement, Balance Sheet, Cash Flow Statement).

Financial statements are the cornerstone of financial reporting, providing a snapshot of a company’s financial health. The three main statements—Income Statement, Balance Sheet, and Cash Flow Statement—provide a comprehensive view, each offering a unique perspective.

Income Statement: This statement shows a company’s revenues and expenses over a period of time (e.g., a quarter or a year), resulting in the net income or loss. Think of it like a summary of your company’s operating performance. I’ve used income statements extensively to analyze profitability trends, identify cost inefficiencies, and assess the impact of pricing changes. For instance, I helped a retail client improve their gross margin by analyzing their income statement and identifying areas for cost reduction in their supply chain.

Balance Sheet: This is a snapshot of a company’s assets, liabilities, and equity at a specific point in time. It shows what a company owns (assets), what it owes (liabilities), and the difference between the two (equity). Imagine it as a photo of the company’s financial position on a particular date. I regularly use balance sheets to assess a company’s solvency, liquidity, and capital structure. For example, I used balance sheet analysis to determine the appropriate level of debt financing for a client looking to expand its operations.

Cash Flow Statement: This statement tracks the movement of cash both into and out of a company over a period of time. It breaks down cash flows into operating, investing, and financing activities. It’s like a detailed record of all cash transactions. I use cash flow statements frequently to understand a company’s ability to meet its short-term obligations and to fund its long-term investments. In one project, I helped a manufacturing company improve its cash flow by optimizing its inventory management and negotiating better payment terms with suppliers.

Q 24. How do you identify and mitigate financial risks?

Identifying and mitigating financial risks is crucial for maintaining financial health. My approach is proactive and multi-faceted.

Risk Identification: I begin by identifying potential risks through various means including reviewing financial statements, industry analysis, economic forecasts, and conducting internal audits. Specific examples include credit risk (customers not paying), market risk (changes in demand), operational risk (supply chain disruptions), and liquidity risk (insufficient cash on hand).

Risk Assessment: Once risks are identified, I assess their likelihood and potential impact. This often involves using qualitative and quantitative methods, assigning probabilities and potential financial losses to each risk.

Risk Mitigation: Based on the assessment, I develop mitigation strategies. These might include diversification (spreading investments), hedging (using financial instruments to protect against losses), insurance (protecting against unforeseen events), or implementing internal controls (improving processes to reduce operational risks). For instance, during a period of high inflation, I advised a client to hedge against commodity price increases using derivative contracts.

Regular monitoring and review are essential. I establish systems for tracking key risk indicators and regularly update the risk assessment to ensure that mitigation strategies remain effective.

Q 25. What software or tools are you proficient in for budget management and financial tracking?

Proficiency in budget management and financial tracking software is essential. My expertise includes:

Microsoft Excel:For budgeting, forecasting, financial modeling, and data analysis. I’m skilled in using advanced functions like VBA macros to automate tasks and improve efficiency.SAP:Experience with SAP’s financial modules for enterprise-level financial management and reporting.Oracle Financials:Proficient in using Oracle’s financial modules for budgeting, accounting, and financial reporting.Adaptive Insights (now Workday Adaptive Planning):Expertise in cloud-based budgeting and planning solutions.QuickBooks:Experience with this popular small business accounting software for financial tracking and reporting.

Beyond specific software, I’m adept at using data visualization tools such as Tableau and Power BI to communicate financial data effectively.

Q 26. Explain your understanding of cost-benefit analysis.

Cost-benefit analysis (CBA) is a systematic approach to evaluating the trade-offs between the costs and benefits of a decision. It involves comparing the monetary value of the costs to the monetary value of the benefits of a project or decision to determine whether it’s worthwhile.

The process typically includes:

- Identifying Costs: This encompasses all costs associated with the project, including direct and indirect costs, initial investment costs, operational costs, and potential future costs.

- Identifying Benefits: This involves identifying all benefits, both tangible (e.g., increased revenue) and intangible (e.g., improved customer satisfaction). These benefits need to be quantified as much as possible in monetary terms.

- Discounting: Future benefits and costs are discounted to their present value to account for the time value of money. This is crucial because money today is worth more than the same amount in the future due to its earning potential.

- Comparison: The present value of the benefits is compared to the present value of the costs. If the present value of the benefits exceeds the present value of the costs, the project is considered worthwhile. Metrics such as Net Present Value (NPV) and Internal Rate of Return (IRR) are commonly used to assess the financial viability of a project.

For example, I helped a non-profit organization use CBA to evaluate whether to invest in a new fundraising campaign. By quantifying the costs of the campaign (e.g., marketing expenses, staff time) and the potential benefits (e.g., increased donations), we were able to determine that the campaign was financially sound and would achieve its goals.

Q 27. How do you use data visualization to communicate financial information?

Data visualization is crucial for communicating complex financial information effectively. Instead of presenting walls of numbers, I use visuals to tell a story with the data. This improves understanding and facilitates better decision-making.

My approach involves selecting the right chart or graph type depending on the data and the message I want to convey. For instance:

- Line charts: To show trends over time (e.g., revenue growth).

- Bar charts: To compare different categories (e.g., sales by region).

- Pie charts: To show proportions (e.g., expense categories as a percentage of total expenses).

- Dashboards: To present multiple key metrics in a concise and easily digestible format.

I’m proficient in using tools like Tableau and Power BI to create interactive and visually appealing dashboards. For example, I created a dashboard for a client that showed key financial metrics such as revenue, expenses, profit margin, and cash flow in real time, allowing them to monitor performance and take corrective action promptly.

Q 28. Describe your experience with developing and implementing financial policies.

Developing and implementing financial policies is a critical aspect of financial management. My experience includes creating and overseeing the implementation of policies across various areas, ensuring compliance and promoting sound financial practices.

This involves:

Policy Development: Collaborating with stakeholders to define clear objectives and develop policies that align with the organization’s overall strategic goals. This includes considerations for budgeting, expense management, revenue recognition, risk management, internal controls, and audit procedures.

Policy Implementation: Ensuring that the policies are effectively communicated and understood throughout the organization, providing training and support where necessary. Regular reviews are essential to keep policies current and relevant.

Policy Enforcement: Establishing mechanisms for monitoring compliance and taking corrective actions when necessary. This may involve audits, reviews, and reporting procedures.

For example, I worked with a rapidly growing tech company to develop a new expense reimbursement policy. This involved creating clear guidelines, establishing procedures for approval, and implementing a system for tracking and monitoring expenses. This not only improved financial control but also ensured consistent and equitable treatment of employees.

Key Topics to Learn for Budget Management and Financial Tracking Interview

- Budgeting Fundamentals: Understanding different budgeting methods (zero-based, incremental, etc.), forecasting techniques, and variance analysis. Practical application: Explain how you’d develop a budget for a new project, considering potential risks and contingencies.

- Financial Statement Analysis: Interpreting income statements, balance sheets, and cash flow statements to assess financial health and performance. Practical application: Describe how you’d use financial statements to identify areas for cost reduction or revenue improvement within a department.

- Cost Accounting: Understanding cost allocation methods (direct, indirect), activity-based costing, and cost-benefit analysis. Practical application: Explain how you would track and analyze the costs associated with a specific project to ensure it remains within budget.

- Financial Tracking and Reporting: Utilizing software and tools for accurate financial data entry, reconciliation, and report generation. Practical application: Describe your experience with different financial tracking software and the types of reports you’ve generated.

- Performance Measurement and KPIs: Defining key performance indicators (KPIs) related to budget management and tracking, and using data to monitor progress and make adjustments. Practical application: Explain how you’d set up a system to track progress against a budget and identify potential issues early on.

- Risk Management and Control: Identifying and mitigating financial risks, implementing internal controls to ensure accuracy and prevent fraud. Practical application: Describe a situation where you identified and addressed a financial risk.

Next Steps

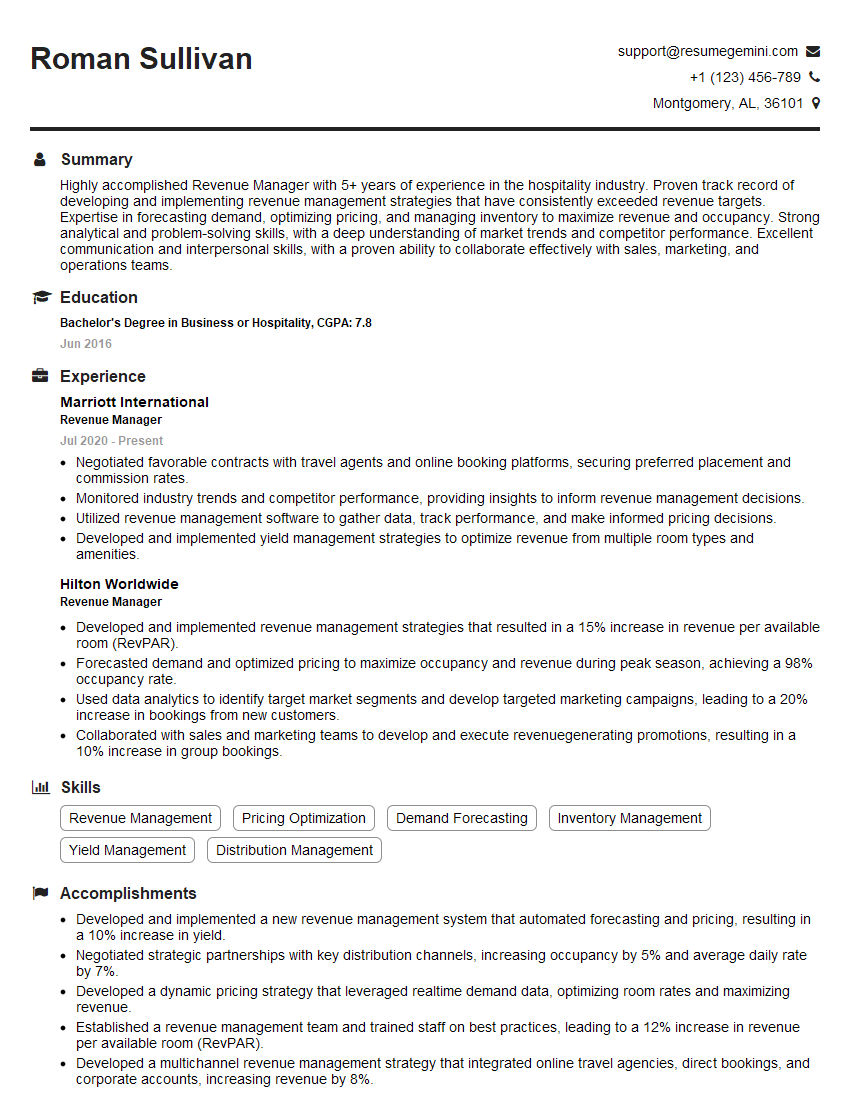

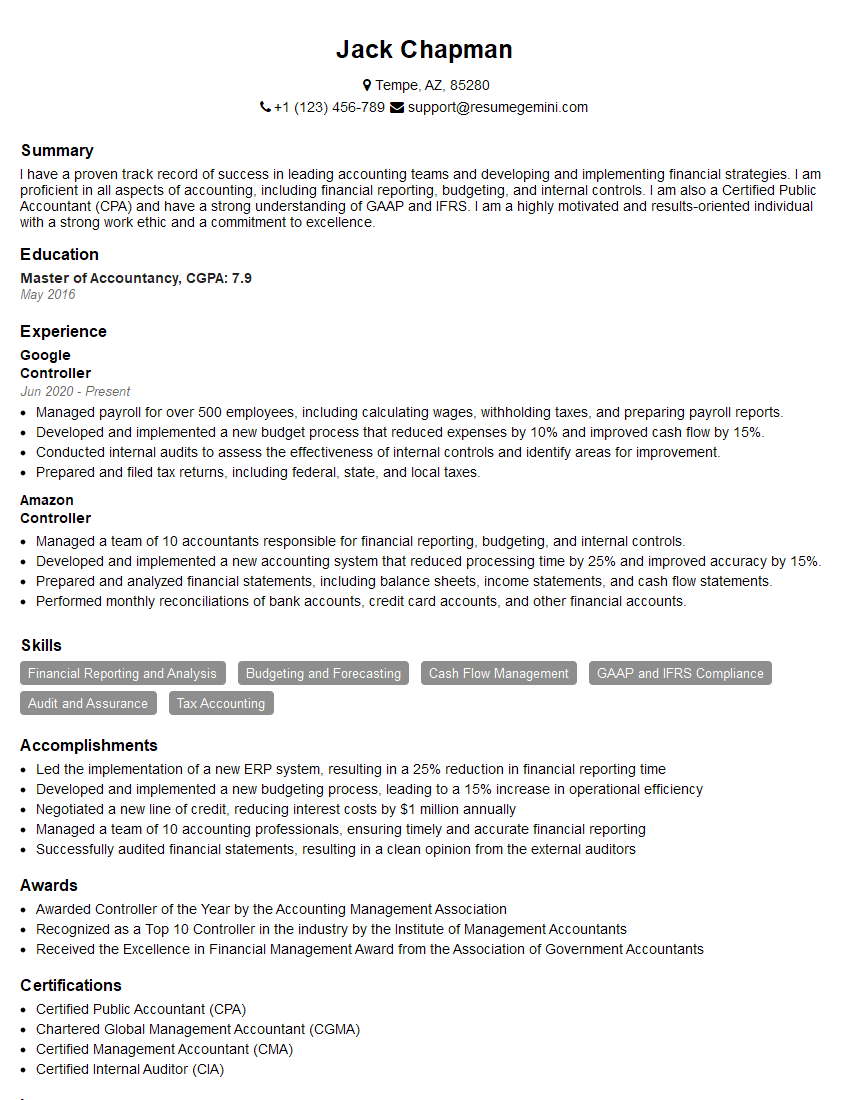

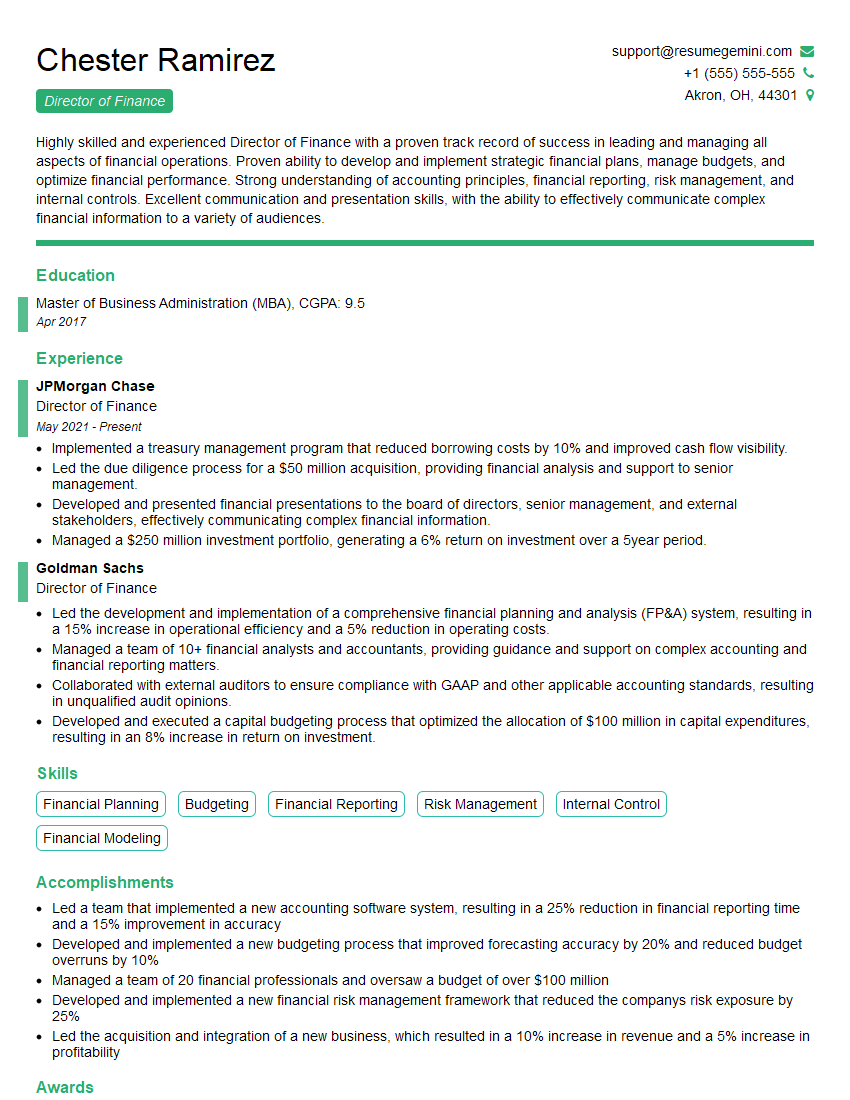

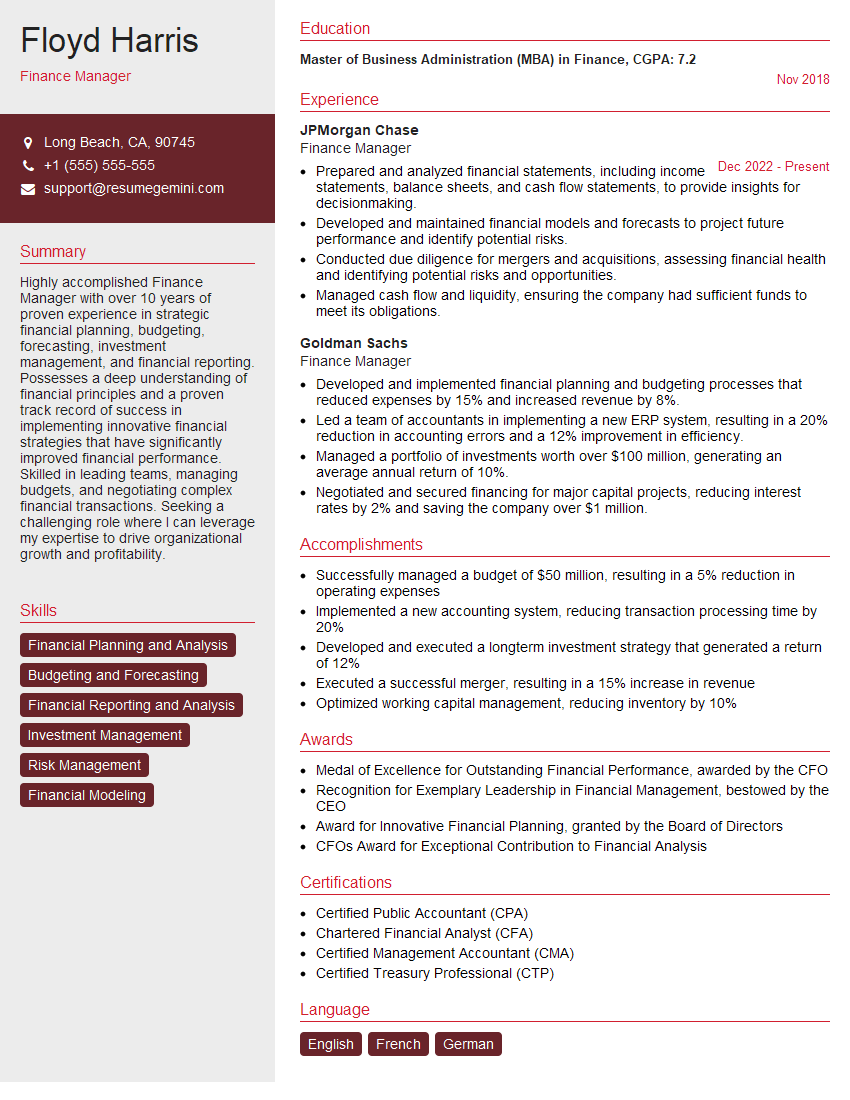

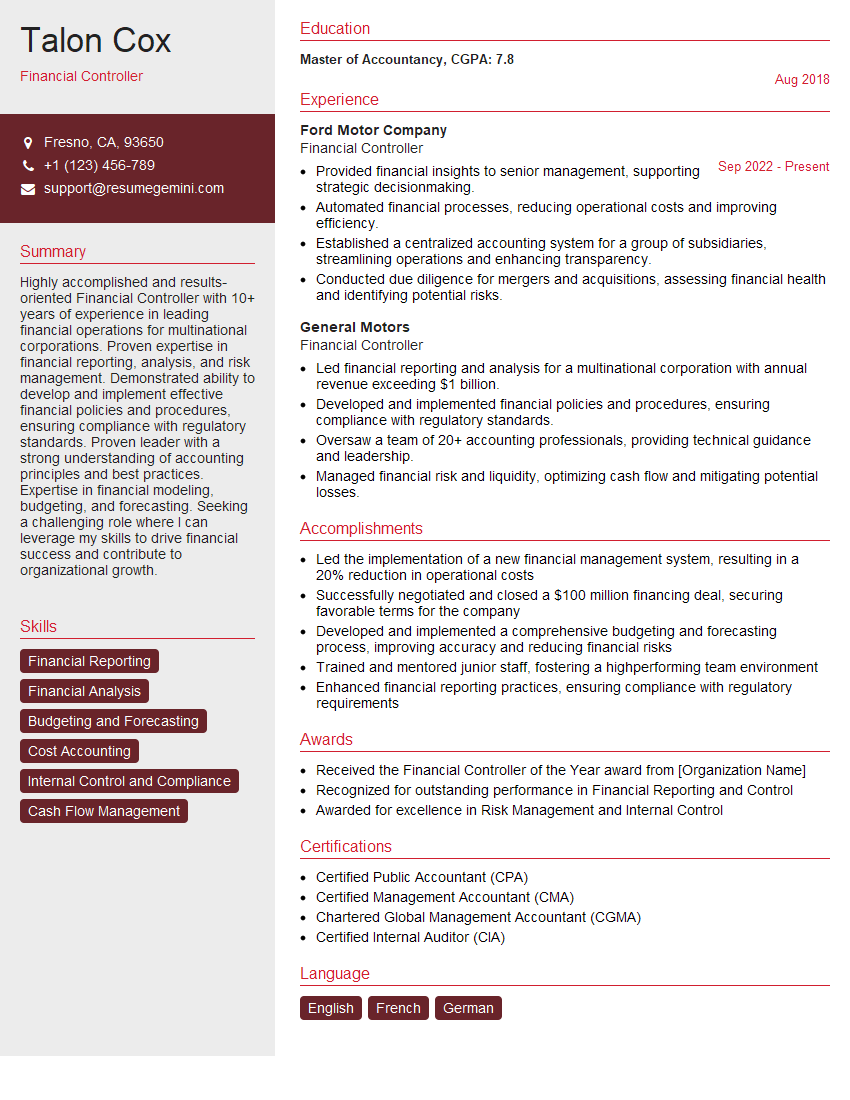

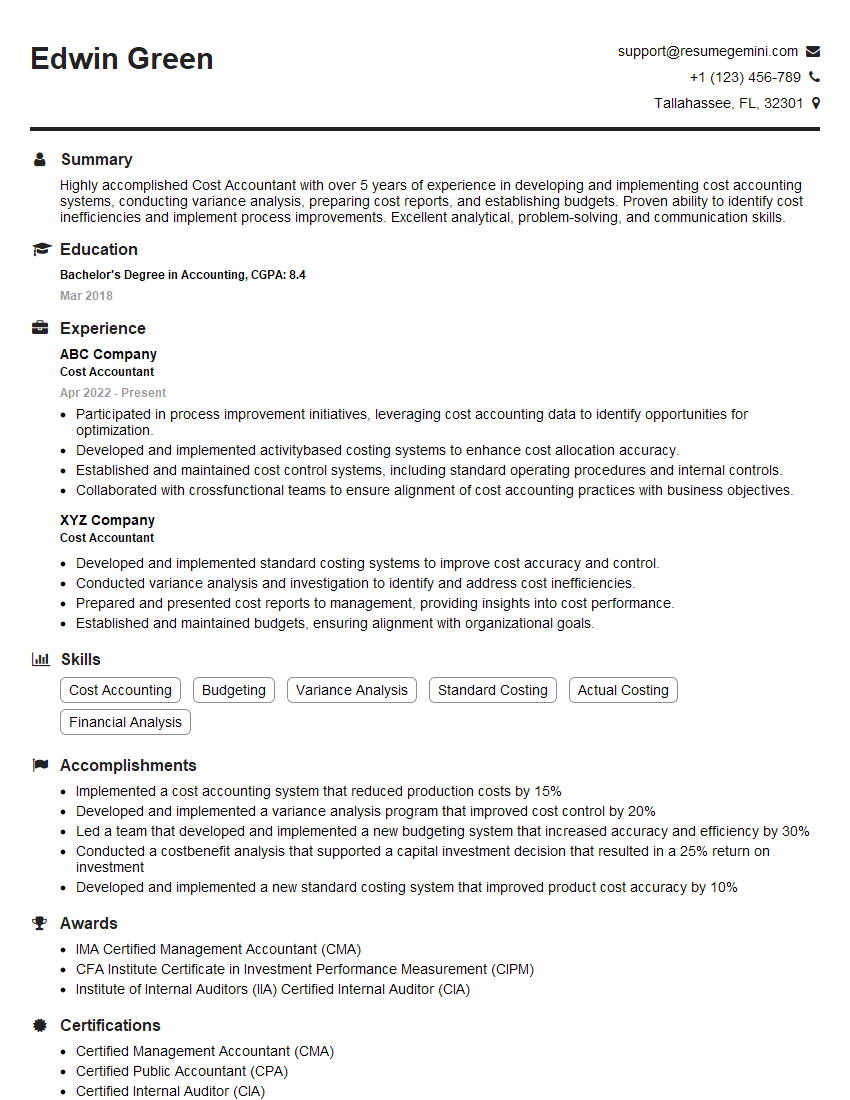

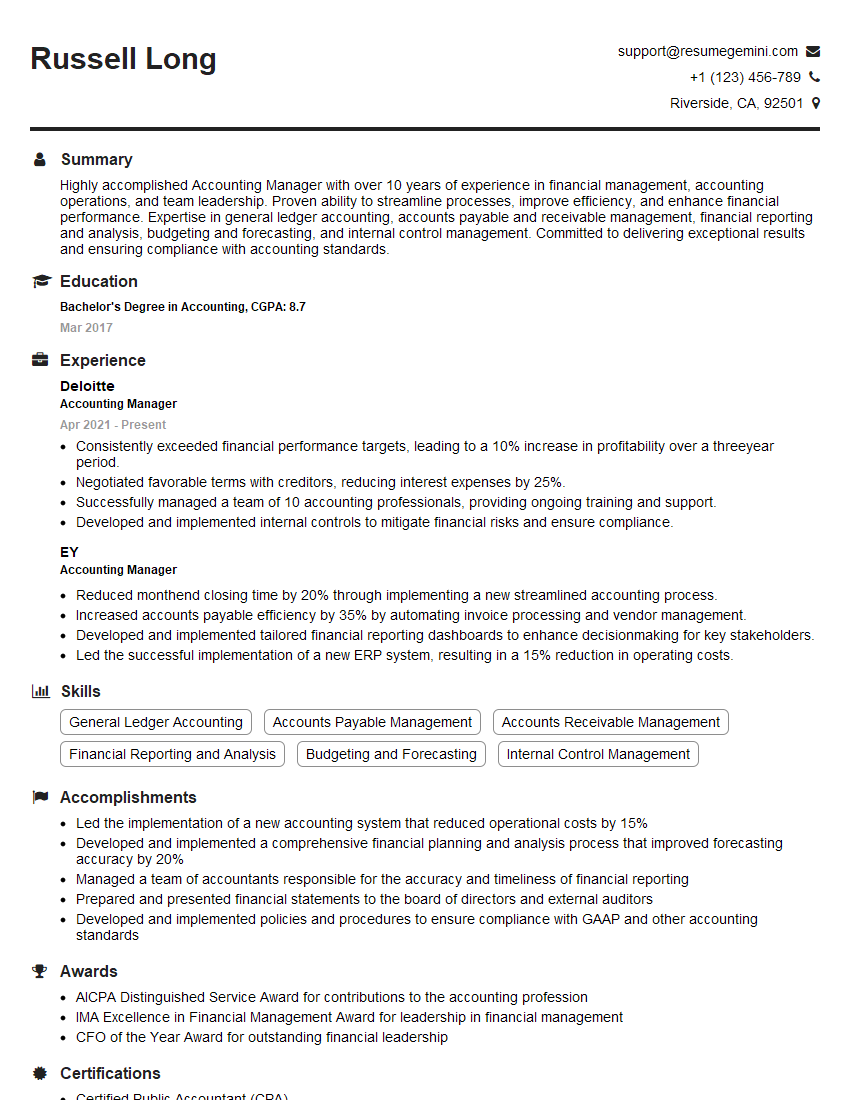

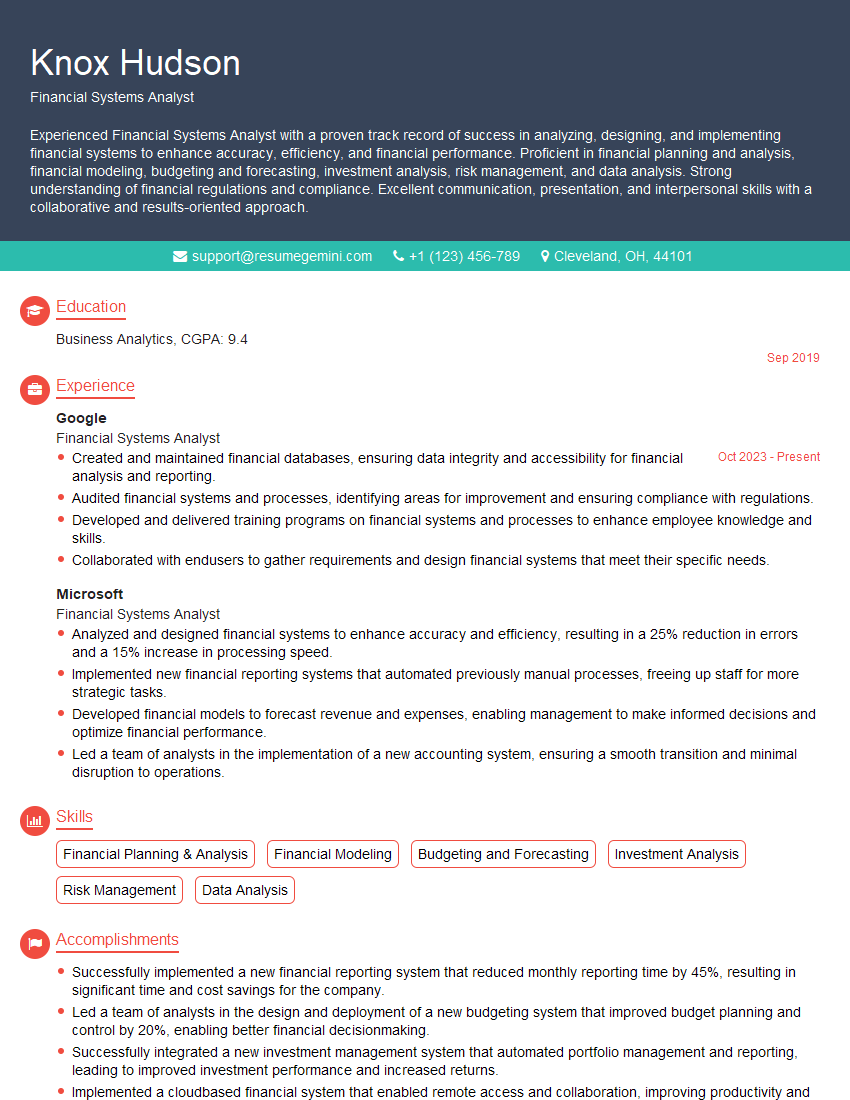

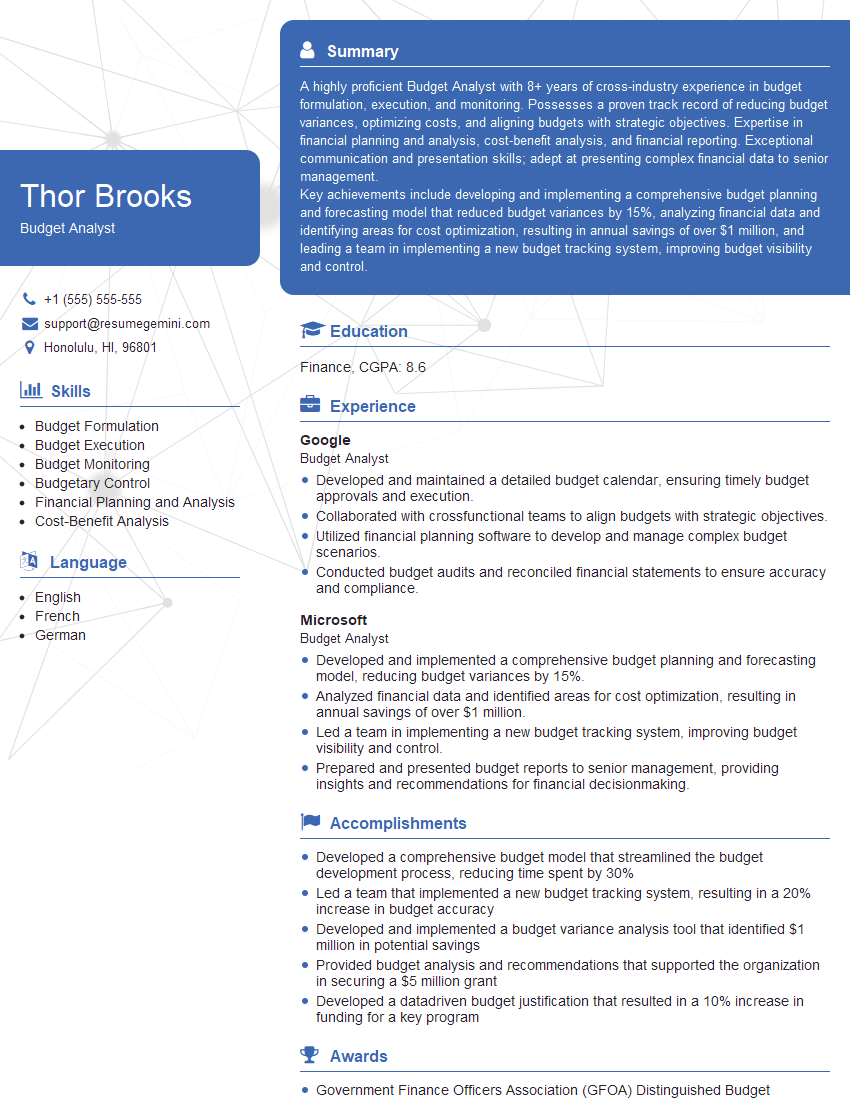

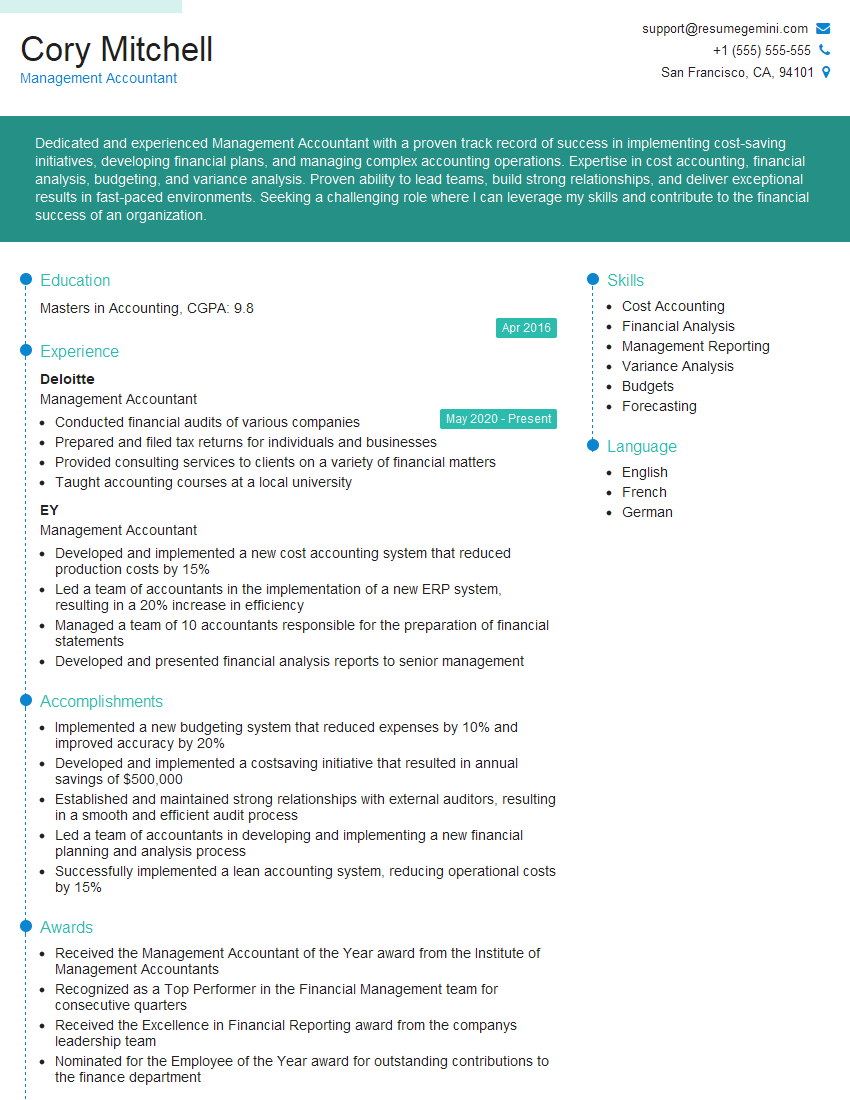

Mastering Budget Management and Financial Tracking is crucial for career advancement in finance and related fields. Strong analytical skills and the ability to communicate financial information effectively are highly valued. To enhance your job prospects, focus on creating an ATS-friendly resume that highlights your relevant skills and experience. ResumeGemini is a trusted resource for building professional resumes that make a lasting impression on recruiters. Examples of resumes tailored to Budget Management and Financial Tracking are available to help you create a compelling application that showcases your expertise. Take the next step towards your dream career today!

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

Hi, I’m Jay, we have a few potential clients that are interested in your services, thought you might be a good fit. I’d love to talk about the details, when do you have time to talk?

Best,

Jay

Founder | CEO