The right preparation can turn an interview into an opportunity to showcase your expertise. This guide to Knowledge of Fraud Schemes interview questions is your ultimate resource, providing key insights and tips to help you ace your responses and stand out as a top candidate.

Questions Asked in Knowledge of Fraud Schemes Interview

Q 1. Explain the different types of financial statement fraud.

Financial statement fraud involves the intentional misrepresentation of a company’s financial position or performance. This is done to deceive stakeholders, such as investors, creditors, and regulatory bodies. There are several key methods employed:

- Revenue Inflation: This involves overstating sales or prematurely recognizing revenue. For example, a company might record sales that haven’t actually been made or ship goods before the end of the quarter to inflate quarterly earnings.

- Expense Understatement: This involves underreporting expenses to boost profitability. Examples include delaying expense recognition, improperly classifying expenses as assets, or failing to record expenses altogether. Imagine a company delaying the recording of significant maintenance costs to make their bottom line look healthier for a particular reporting period.

- Asset Overstatement: This involves exaggerating the value of assets on the balance sheet. This could involve inflating the value of inventory, property, plant, and equipment, or even creating fictitious assets entirely. For instance, a company might overestimate the value of its real estate holdings to secure a larger loan.

- Liability Understatement: This involves hiding or downplaying liabilities to improve the company’s financial health. Examples include failing to record contingent liabilities (potential future obligations) or underreporting debts.

Identifying financial statement fraud requires a thorough analysis of financial statements, comparing them to industry benchmarks and prior periods, and scrutinizing supporting documentation.

Q 2. Describe the common characteristics of a Ponzi scheme.

A Ponzi scheme is a fraudulent investment operation where the operator, an individual or organization, pays returns to its investors from new capital paid to the operators by new investors, rather than from profit earned through legitimate sources. It’s a classic pyramid scheme, built on a house of cards.

Common characteristics include:

- High and consistent returns: Ponzi schemes promise abnormally high returns with little or no risk, often exceeding market averages significantly.

- Lack of transparency: The scheme’s operations are typically shrouded in secrecy, with little or no disclosure about investments or how the returns are generated. Investors often have difficulty understanding how the promised returns are achieved.

- Unregistered investments: Ponzi schemes often operate outside regulatory frameworks, avoiding the scrutiny of securities regulators.

- Difficult-to-trace investments: It can be challenging to determine where the investor’s money is being invested. The operator may use vague explanations or avoid giving specifics.

- Early investors get paid with money from later investors: This is the core mechanic of a Ponzi scheme. It’s unsustainable and collapses when new investors dry up.

- Pressure tactics: Operators often use high-pressure sales tactics to lure in new investors, emphasizing the urgency of investing before it’s ‘too late’.

Think of it like a chain letter: it only works as long as new participants join. Once the inflow of new money stops, the whole system implodes.

Q 3. What are the key elements of the fraud triangle?

The fraud triangle is a model that explains the three factors that must be present for fraudulent activity to occur: opportunity, pressure, and rationalization.

- Opportunity: This refers to the situation that allows the fraud to take place. This could be weak internal controls, a lack of oversight, or an inadequate segregation of duties. Imagine a company with one person handling both accounting and cash management – that’s a huge opportunity for fraud.

- Pressure: This is the internal or external force that motivates someone to commit fraud. This could be financial pressure (e.g., debt, gambling addiction), personal pressures (e.g., family issues), or workplace pressures (e.g., pressure to meet unrealistic targets).

- Rationalization: This is the justification that a fraudster uses to convince themselves that their actions are acceptable or even necessary. They might tell themselves they are ‘only borrowing the money’ or that ‘the company owes it to them’.

All three elements must be present for fraud to occur. Addressing any one of these elements significantly reduces the likelihood of fraudulent activity.

Q 4. How would you investigate a suspected case of check kiting?

Check kiting involves creating cash by writing checks on accounts with insufficient funds, relying on a delay in clearing times between banks to create a temporary balance. Investigating suspected check kiting involves several steps:

- Gather Bank Statements: Obtain bank statements for all relevant accounts over a period of time, typically several months. Pay close attention to timing of deposits and withdrawals.

- Reconcile Bank Accounts: Compare bank statements to internal records, looking for discrepancies in timing and amounts. The goal is to identify instances where checks are deposited into one account while insufficient funds exist in another.

- Analyze Check Clearing Patterns: Trace the movement of funds between accounts. Check kiting often involves a pattern of checks bouncing between multiple accounts.

- Identify Unusual Activity: Look for patterns of deposits just before the end of the month or other reporting periods, followed by withdrawals shortly after. This suggests an attempt to artificially inflate account balances temporarily.

- Interview Employees: Interview individuals who had access to the relevant accounts to understand their role in the transactions and identify potential motivations. You’ll want to gather evidence through interviews and examine documentation such as transaction records.

- Examine Supporting Documentation: Look for any documentation that might support or contradict the findings from the bank statements and reconciliations. This might include invoices, purchase orders, or internal memos.

The key is to track the flow of funds across multiple accounts and time periods to expose the artificial inflation of cash balances.

Q 5. Explain the process of conducting a forensic data analysis for fraud detection.

Forensic data analysis for fraud detection involves using data analysis techniques to identify patterns, anomalies, and inconsistencies that may indicate fraudulent activities. This process usually follows these steps:

- Data Acquisition: This step involves gathering all relevant data from various sources like databases, spreadsheets, and accounting systems. Data should be preserved in its original form to meet legal and evidentiary requirements. This also involves securing and protecting the data to maintain its integrity and prevent alteration or destruction.

- Data Preparation: The collected data needs to be cleaned, transformed, and organized to make it suitable for analysis. This includes handling missing values, resolving inconsistencies, and converting data into a usable format. Data needs to be standardized and formatted to allow for efficient analysis and comparisons.

- Data Analysis: Various analytical techniques are applied, including statistical analysis, data mining, and machine learning. Techniques like Benford’s Law (analyzing the frequency of leading digits in numerical data) can help identify potential anomalies. Outlier detection algorithms can pinpoint unusual transactions or patterns.

- Interpretation and Reporting: The results of the data analysis need to be interpreted in the context of the specific fraud investigation. This step involves drawing conclusions about potential fraudulent activities and creating a comprehensive report detailing the findings, methodology, and conclusions.

- Validation and Documentation: The findings must be thoroughly validated to ensure accuracy and reliability. All procedures and findings must be meticulously documented to support the investigation and any potential legal proceedings.

Advanced techniques might include using predictive modeling to identify high-risk transactions or individuals based on historical patterns.

Q 6. What are some red flags to watch for in vendor fraud?

Vendor fraud encompasses a range of schemes aimed at defrauding a company through fraudulent transactions with vendors or suppliers. Some red flags to watch out for include:

- Unusual Pricing: Prices significantly higher than market rates or those charged to other customers. This could suggest collusion or inflated invoices.

- Duplicate Invoices: Multiple invoices for the same goods or services being submitted for payment.

- Missing or Incomplete Documentation: Lack of supporting documentation, such as purchase orders, delivery receipts, or contracts.

- Ghost Vendors: Payments made to fictitious vendors or vendors that do not actually exist.

- Unusually Close Relationships: Close personal or familial relationships between company employees and vendors.

- Lack of Competitive Bidding: Always contracting with the same vendor without exploring other options, potentially suggesting a lack of competition and opportunity for price manipulation.

- Unexplained Payment Discrepancies: Differences between the amount invoiced and the amount paid without a clear explanation.

- Unusual Payment Methods: Payments to vendors made in unusual ways, such as cash or wire transfers to offshore accounts.

Regularly reviewing vendor accounts, performing audits, and establishing clear procurement procedures are crucial to mitigating vendor fraud.

Q 7. How can you utilize data analytics to identify potential fraudulent activities?

Data analytics plays a vital role in identifying potential fraudulent activities. By analyzing large datasets, patterns and anomalies indicative of fraud can be uncovered.

- Anomaly Detection: Algorithms can identify transactions or patterns that deviate significantly from established norms. For example, a sudden spike in unusually large transactions or a series of transactions from unusual locations might trigger an alert.

- Benford’s Law Analysis: This technique analyzes the distribution of leading digits in numerical data. Deviations from Benford’s Law can suggest data manipulation or falsification.

- Regression Analysis: Can help identify relationships between different variables, highlighting potentially suspicious correlations. For example, unexpected links between expense reports and personal credit card payments could flag a problem.

- Clustering Techniques: These group similar transactions together, making it easier to spot unusual clusters of activity that could indicate fraudulent behavior.

- Network Analysis: Can map relationships between individuals and entities, potentially revealing collusion or fraudulent networks.

By combining these techniques with strong internal controls and regular audits, organizations can greatly improve their fraud detection capabilities.

For example, analyzing sales data might reveal unexpected spikes in sales figures in specific regions or time periods. Further investigation could uncover potential revenue inflation schemes. Similarly, analyzing expense reports may uncover suspicious patterns of expenses that don’t align with business activities.

Q 8. Describe your experience with anti-money laundering (AML) regulations.

My experience with Anti-Money Laundering (AML) regulations spans over a decade, encompassing both the regulatory landscape and practical application within financial institutions. I’ve been directly involved in developing and implementing AML compliance programs, conducting risk assessments, and investigating suspicious activity reports (SARs). This includes staying abreast of evolving regulations like the Bank Secrecy Act (BSA) in the US and equivalent legislation globally. I’m proficient in identifying red flags indicative of money laundering, such as unusual transaction patterns, structuring, and shell corporations. For instance, I once uncovered a complex money laundering scheme involving multiple shell companies and offshore accounts, which required in-depth analysis of transactional data and meticulous tracing of funds.

My work involves understanding the Customer Due Diligence (CDD) requirements, including Know Your Customer (KYC) procedures and enhanced due diligence for high-risk clients. I’ve designed and delivered training programs to staff on AML compliance, ensuring a comprehensive understanding of the regulations and their practical application. Successfully navigating the complexities of AML regulations requires a proactive and adaptable approach, constantly updating knowledge to meet emerging threats and regulatory changes.

Q 9. What are some common methods used to conceal fraudulent transactions?

Fraudsters employ a variety of methods to conceal fraudulent transactions, often layering techniques to obfuscate their activities. Common methods include:

- Structuring: Breaking down large transactions into smaller amounts to avoid triggering reporting thresholds. For example, depositing $9,999 repeatedly instead of a single $100,000 deposit.

- Smurfing: Using multiple individuals to deposit smaller amounts of money to avoid detection.

- Shell Corporations: Creating fake companies to disguise the source and destination of funds.

- Offshore Accounts: Utilizing accounts in jurisdictions with weak financial regulations or banking secrecy laws.

- Money Mules: Utilizing unsuspecting individuals to transfer funds across borders or through various accounts.

- Cryptocurrency: Using cryptocurrencies for transactions due to their pseudonymous nature, making tracing difficult.

- False Invoicing: Creating fake invoices to justify fraudulent payments.

The sophistication of these methods varies, but uncovering them often relies on careful analysis of transactional data, identifying unusual patterns, and corroborating information from various sources.

Q 10. Explain the concept of ‘beneficially owned’ in relation to fraud investigations.

In fraud investigations, ‘beneficially owned’ refers to the natural person(s) who ultimately owns or controls a legal entity, such as a company or trust. This is crucial because fraudsters often hide behind complex corporate structures to obscure their true ownership and control. Identifying the beneficial owner is vital in determining who is ultimately responsible for fraudulent activities. For example, if a company is found to be involved in a fraud scheme, the investigation must determine who the real owner(s) are – the individuals who benefit financially from the scheme, even if their names don’t appear on official company documents.

Determining beneficial ownership can be challenging, requiring extensive due diligence, including reviewing company registration documents, analyzing transaction patterns, and potentially using investigative techniques to uncover hidden ownership structures. Understanding beneficial ownership is crucial in building a strong case and ensuring that the right individuals are held accountable for their actions.

Q 11. How do you assess the risk of fraud within an organization?

Assessing fraud risk within an organization requires a holistic approach, combining qualitative and quantitative methods. I typically use a risk assessment framework incorporating:

- Internal Controls Assessment: Evaluating the effectiveness of existing internal controls designed to prevent and detect fraud.

- Fraud Risk Factors Analysis: Identifying factors that increase the organization’s susceptibility to fraud, such as weak internal controls, inadequate segregation of duties, or a culture of non-compliance.

- Data Analysis: Analyzing transactional data to identify unusual patterns or anomalies that may indicate fraudulent activity.

- External Environment Analysis: Considering external factors such as industry trends, economic conditions, and regulatory changes that might increase fraud risk.

- Employee Surveys/Interviews: Gathering employee feedback to assess perceptions of fraud risks and the organization’s culture.

The output of this assessment is a prioritized list of fraud risks, allowing the organization to focus its resources on addressing the most significant threats. This assessment is then used to develop and refine a fraud prevention and detection plan.

Q 12. What are some effective internal controls to prevent fraud?

Effective internal controls are the first line of defense against fraud. These controls should be designed to prevent, detect, and investigate fraudulent activities. Some examples include:

- Strong Segregation of Duties: Ensuring that no single individual has complete control over a transaction or process. This prevents collusion and makes it harder for someone to commit fraud undetected.

- Authorization and Approval Processes: Establishing clear procedures for authorizing transactions, ensuring multiple levels of review and approval before payments are made.

- Regular Reconciliation: Performing regular reconciliation of accounts and records to detect discrepancies.

- Independent Audits: Conducting regular internal and external audits to assess the effectiveness of internal controls and identify any weaknesses.

- Robust Monitoring Systems: Implementing systems for real-time transaction monitoring, flagging suspicious activity based on pre-defined rules and thresholds.

- Background Checks: Conducting thorough background checks for employees, especially those in sensitive positions.

- Whistleblower Hotlines: Establishing confidential reporting channels for employees to report suspected fraud.

A strong ethical culture within the organization is also crucial. Employees should be encouraged to report suspicious behavior and management should take all reports seriously.

Q 13. How do you document your findings in a fraud investigation?

Documenting findings in a fraud investigation is critical for several reasons: it provides a record of the investigation process, supports any legal action, and helps prevent future fraud. My documentation follows a comprehensive approach:

- Detailed Chronological Record: Maintaining a detailed chronological record of all investigative steps, including dates, times, individuals interviewed, and evidence collected.

- Evidence Logs: Creating meticulously maintained logs of all evidence collected, including its chain of custody.

- Interview Transcripts: Preparing verbatim transcripts of all interviews conducted.

- Data Analysis Reports: Generating reports summarizing data analysis performed and identifying key findings.

- Financial Statements and Supporting Documents: Including relevant financial statements, invoices, bank statements, and other supporting documents.

- Narrative Report: Composing a comprehensive narrative report summarizing the investigation’s findings, conclusions, and recommendations.

All documentation is carefully organized, stored securely, and maintained in accordance with relevant legal and regulatory requirements. This thorough documentation provides a strong foundation for reporting to management, regulatory authorities, or law enforcement as needed.

Q 14. Describe your experience using forensic accounting software.

I have extensive experience using various forensic accounting software packages, including ACL, IDEA, and CaseWare IDEA. These tools are essential for efficiently analyzing large datasets, identifying anomalies, and uncovering hidden patterns in financial data. My proficiency includes:

- Data Extraction and Cleaning: Extracting data from various sources (databases, spreadsheets, etc.) and cleaning it to ensure accuracy and consistency.

- Data Analysis Techniques: Utilizing various data analysis techniques, such as Benford’s Law analysis, outlier detection, and statistical modeling, to identify potential fraudulent activity.

- Data Visualization: Creating visualizations, such as charts and graphs, to present findings in a clear and concise manner.

- Report Generation: Generating comprehensive reports summarizing the analysis performed and identifying key findings.

For example, using ACL, I once analyzed a company’s transactional data to identify duplicate payments and uncovered a scheme where an employee was fraudulently processing duplicate invoices. The software’s capabilities to identify such anomalies, which would be impossible to spot manually in a large dataset, were crucial to the success of the investigation. My skills in using these tools significantly enhance my ability to conduct efficient and effective fraud investigations.

Q 15. Explain the differences between fraud and error.

The key difference between fraud and error lies in intent. Fraud is an intentional act to deceive, manipulate, or misrepresent facts for personal gain or to cause a loss to another party. Error, on the other hand, is an unintentional mistake or oversight. Think of it like this: accidentally miscalculating a sum is an error; intentionally altering financial records to hide embezzlement is fraud.

For example, accidentally recording a sale twice in an accounting system is an error. However, deliberately creating false invoices to receive payments is fraud. Fraud investigations typically require a higher level of scrutiny to establish intent, unlike error detection which might involve simpler reconciliation processes.

- Fraud: Intentional deception, misrepresentation, or concealment for personal gain.

- Error: Unintentional mistake or oversight.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. What is the role of whistleblowers in fraud detection?

Whistleblowers play a crucial role in fraud detection as they are often the first to identify suspicious activities within an organization. Their inside knowledge and observations can provide critical leads, which may otherwise remain hidden. They act as an early warning system, helping to prevent significant financial losses and reputational damage.

Effective whistleblower programs rely on providing safe and confidential channels for reporting. These channels protect whistleblowers from retaliation and encourage them to come forward with information without fear of reprisal. The information they provide helps investigators to prioritize leads, gather evidence, and build a comprehensive case for prosecution or internal disciplinary action. Without whistleblowers, many fraud schemes might go undetected for extended periods.

Q 17. How do you handle conflicts of interest in a fraud investigation?

Conflicts of interest can severely compromise the integrity of a fraud investigation. If an investigator has a personal relationship with a suspect or a financial stake in the outcome, their impartiality is questionable. Handling these conflicts requires transparency and proactive measures.

My approach is to identify and disclose any potential conflicts at the outset. If a conflict arises that cannot be reasonably mitigated, I would recuse myself from the investigation to ensure objectivity. Strict adherence to professional ethics and maintaining clear documentation of all decisions made are paramount to prevent any perception of bias. In some cases, an independent investigator might be brought in.

Q 18. What are your strategies for interviewing suspects in fraud cases?

Interviewing suspects in fraud cases requires a strategic and methodical approach. My strategy begins with thorough preparation. I gather all available documentation, identify key questions, and anticipate possible responses. I avoid accusatory language and instead focus on building rapport to encourage open communication.

The interview is conducted in a neutral setting and is carefully documented. I ask open-ended questions to gather detailed information, and I pay close attention to both verbal and nonverbal cues. Body language, inconsistencies in statements, and evasiveness can all be indicators of deception. Finally, I always ensure that the suspect’s rights are respected throughout the process. A skilled interviewer can often elicit valuable information even from reluctant suspects.

Q 19. Explain your experience working with law enforcement agencies.

I’ve had extensive experience collaborating with law enforcement agencies on numerous fraud investigations. This collaboration typically involves sharing evidence, providing expert testimony, and assisting with the legal process. I understand the legal requirements and procedures, and I am adept at communicating complex financial information to law enforcement personnel.

My work with these agencies has been instrumental in successfully prosecuting several high-profile fraud cases. The collaborative nature of these relationships allows us to leverage each other’s strengths and expertise, leading to more effective outcomes. Strong communication and mutual trust are vital for successful partnerships.

Q 20. Describe a time you uncovered a significant fraud scheme.

In a previous role, I uncovered a significant payroll fraud scheme involving ghost employees. The scheme had been ongoing for several years, resulting in substantial financial losses for the company. I initiated the investigation by analyzing payroll data and identifying unusual patterns. My analysis revealed several employees who were receiving payments without corresponding work activity. This led to interviews with managers, review of time-keeping records, and ultimately the exposure of the fraudulent scheme.

The investigation required meticulous data analysis, diligent interviewing, and close collaboration with internal audit and law enforcement. The case highlighted the importance of strong internal controls and regular audits in preventing and detecting fraud. The successful prosecution of those involved resulted in significant financial recovery for the company.

Q 21. How do you prioritize multiple fraud investigations?

Prioritizing multiple fraud investigations requires a systematic approach. I use a risk-based methodology, considering factors such as the potential financial impact, the urgency of the situation, and the availability of resources. I assign risk scores to each investigation and prioritize those with the highest potential impact and urgency.

For example, a case involving immediate financial loss or potential regulatory violations would take precedence over a less urgent case with a lower financial risk. This approach ensures that resources are allocated effectively, and the most critical investigations are addressed promptly. Regular reassessment of priorities is essential as new information emerges or circumstances change. Using project management tools helps to maintain organization and track progress across multiple cases.

Q 22. What is your understanding of the Sarbanes-Oxley Act (SOX)?

The Sarbanes-Oxley Act of 2002 (SOX) is a landmark piece of legislation in the United States designed to protect investors by improving the accuracy and reliability of corporate disclosures. It was enacted in response to major corporate accounting scandals, such as Enron and WorldCom. SOX significantly impacts how companies operate, particularly in areas of financial reporting and internal controls.

Key aspects of SOX include establishing stricter rules for corporate governance, including the creation of independent audit committees and stricter requirements for CEO and CFO certifications of financial statements. It also mandates the establishment and maintenance of robust internal controls over financial reporting, often assessed using frameworks like COSO. Non-compliance can result in severe penalties, including hefty fines and even imprisonment.

Imagine SOX as a robust security system for a company’s financial reporting. It’s designed to detect and prevent fraud, ensuring transparency and accountability. It requires regular audits, documentation, and rigorous checks and balances to ensure that the financial information presented is accurate and reliable.

Q 23. Explain your experience with different forensic auditing techniques.

My forensic auditing experience encompasses a wide array of techniques, tailored to the specifics of each case. These techniques are crucial in uncovering and documenting financial irregularities.

- Data Analytics: I use advanced data analytics tools and techniques like Benford’s Law analysis to identify anomalies in large datasets. For example, I might use this to detect patterns of unusual transactions or inconsistencies in accounting records.

- Document Examination: Thorough review and analysis of source documents, including invoices, receipts, contracts, and bank statements, are essential. This helps to verify the authenticity and accuracy of transactions.

- Interviewing: I conduct structured interviews with individuals involved in the relevant transactions or processes. These interviews, using techniques that promote honesty and collaboration, are vital in gathering information and assessing credibility.

- Reconciliation: I regularly perform bank reconciliations, account reconciliations, and other types of reconciliations to identify discrepancies and missing information.

- Net-working: Collaboration with law enforcement and other investigators is crucial to share knowledge and insights, especially in complex fraud cases.

For instance, in a recent case of suspected embezzlement, I used data analytics to identify unusual patterns of transactions made late at night. This, coupled with document examination and interviews, led to the discovery of fraudulent activities and the recovery of significant funds.

Q 24. How do you handle sensitive information in fraud investigations?

Handling sensitive information in fraud investigations is paramount. I adhere to strict confidentiality protocols and regulations, prioritizing data security and privacy above all else.

- Data Encryption: All sensitive data is encrypted both in transit and at rest, using industry-standard encryption algorithms.

- Access Control: Access to sensitive information is strictly controlled and limited to authorized personnel on a need-to-know basis. This often involves using secure data rooms and access control systems.

- Chain of Custody: A strict chain of custody is maintained for all physical and electronic evidence to ensure its integrity and admissibility in court.

- Data Disposal: Secure methods of data disposal are employed when data is no longer needed, ensuring that sensitive information is permanently deleted and cannot be recovered.

- Compliance with Regulations: Adherence to all applicable regulations, such as HIPAA, GLBA, and GDPR, is essential when dealing with sensitive personal information.

Think of it like handling classified documents – only authorized personnel with proper clearance can access them, and all access is carefully logged and monitored.

Q 25. What are your knowledge of various types of computer fraud?

Computer fraud encompasses a vast landscape of illegal activities exploiting vulnerabilities in computer systems and networks. Some common types include:

- Phishing: This involves tricking individuals into revealing sensitive information like usernames, passwords, or credit card details.

- Malware: Malicious software, such as viruses, worms, and ransomware, can compromise systems, steal data, or disrupt operations.

- Data Breaches: Unauthorized access to sensitive data, often resulting in identity theft or financial loss.

- Insider Threats: Employees or insiders with access to systems can misuse their privileges for personal gain or malicious purposes.

- Denial-of-Service (DoS) Attacks: These attacks flood systems with traffic, rendering them inaccessible to legitimate users.

For example, a sophisticated phishing campaign might mimic a legitimate email from a bank, leading users to enter their credentials on a fake website controlled by the attacker. This highlights the need for strong cybersecurity practices and employee awareness training.

Q 26. Explain the concept of occupational fraud and its key characteristics.

Occupational fraud is a type of fraud committed by employees against their employers. It’s often characterized by deceit, concealment, and conversion of an organization’s assets.

Key Characteristics:

- Trust Violation: Occupational fraud fundamentally involves a breach of trust between the employee and the employer.

- Concealment: Fraudsters actively try to hide their actions to avoid detection, often through manipulation of records or collusion with others.

- Conversion: The fraudulent act usually involves converting assets (money, property, information) for personal gain.

- Opportunity: The existence of opportunities within the organization’s internal controls facilitates the fraud.

- Motivation: A mix of pressures (financial, lifestyle), opportunities, and rationalization often drives an individual to commit occupational fraud.

A classic example is an accounts payable clerk who creates false invoices to a fictitious vendor and diverts the funds into their personal account. This involves violating trust, concealing the fraudulent transactions, and converting company funds for personal use.

Q 27. How do you stay up-to-date with the latest fraud schemes and techniques?

Staying current with evolving fraud schemes and techniques is crucial. I employ a multi-faceted approach:

- Professional Development: I actively participate in continuing professional education (CPE) courses and seminars focused on fraud examination and forensic accounting.

- Industry Publications: I regularly read industry publications, journals, and newsletters to stay informed about emerging trends and techniques.

- Networking: I maintain a strong network of contacts within the fraud examination and forensic accounting communities, exchanging insights and best practices.

- Online Resources: I utilize online resources and databases to research specific fraud schemes and emerging threats.

- Case Studies: Analyzing past case studies provides valuable learning opportunities and demonstrates the impact of evolving fraud schemes.

Think of it as being a detective – constantly learning new investigative methods, profiling criminals, and staying ahead of their tactics.

Q 28. Describe your experience with fraud risk assessments and reporting.

My experience with fraud risk assessments and reporting involves a systematic approach to identify vulnerabilities, assess the likelihood and impact of potential fraud, and design appropriate mitigation strategies.

Risk Assessment Process:

- Identify Vulnerabilities: This involves evaluating internal controls, processes, and systems to identify potential weaknesses that could be exploited by fraudsters.

- Assess Likelihood and Impact: Once vulnerabilities are identified, I assess the likelihood of fraud occurring and the potential financial and reputational impact.

- Develop Mitigation Strategies: Based on the risk assessment, I recommend appropriate mitigation strategies to reduce the likelihood and impact of fraud.

- Reporting: I prepare comprehensive reports summarizing the findings of the risk assessment, including identified vulnerabilities, assessed risks, recommended mitigation strategies, and a prioritized action plan.

The reporting process often includes visualizations and key performance indicators (KPIs) to help management understand the results effectively. The goal is to provide management with actionable insights to enhance the organization’s fraud prevention capabilities.

Key Topics to Learn for Knowledge of Fraud Schemes Interview

- Types of Fraud: Understanding the landscape – from accounting fraud and insurance fraud to financial statement fraud and cybercrime. Consider the motivations behind each type and common methods used.

- Fraud Detection Techniques: Explore both preventative measures (internal controls, risk assessments) and detective methods (data analysis, anomaly detection, forensic accounting techniques). Be prepared to discuss practical applications of these techniques in real-world scenarios.

- Regulatory Compliance: Familiarize yourself with relevant laws and regulations (e.g., SOX, FCPA) and their impact on fraud prevention and detection. Understand how these regulations influence organizational practices.

- Fraud Investigation Process: Outline the key steps involved in a typical fraud investigation, from initial assessment and evidence gathering to reporting and remediation. Discuss the importance of maintaining a proper chain of custody.

- Data Analytics in Fraud Detection: Understand how data analytics tools and techniques (e.g., predictive modeling, machine learning) are used to identify patterns and anomalies indicative of fraudulent activity. Be prepared to discuss specific examples.

- Case Studies and Examples: Review well-known fraud cases to understand how different schemes were perpetrated and detected. This will strengthen your understanding of practical applications and problem-solving.

- Ethical Considerations: Be prepared to discuss the ethical implications of fraud detection and investigation, including whistleblower protection and the importance of objectivity.

Next Steps

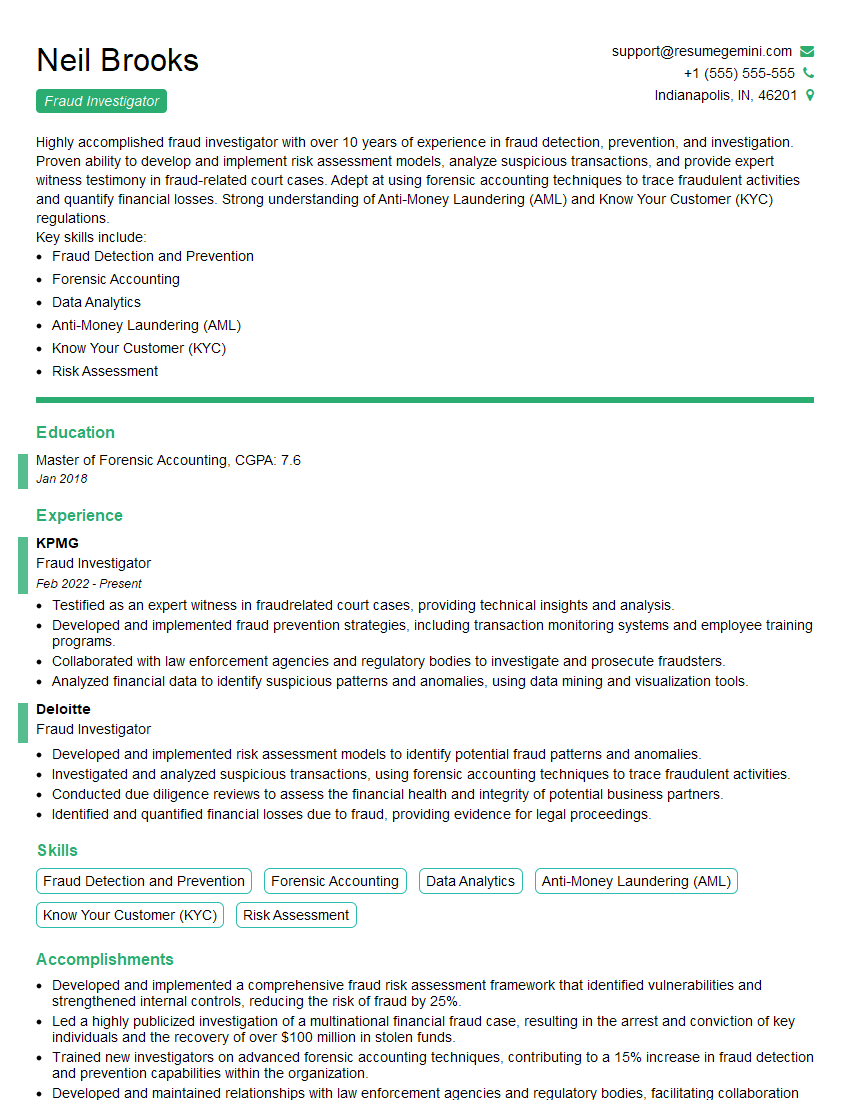

Mastering knowledge of fraud schemes is crucial for career advancement in fields like finance, accounting, and cybersecurity. A deep understanding of fraud detection and prevention techniques is highly valued by employers, making you a valuable asset in today’s risk-averse environment. To significantly boost your job prospects, it’s essential to craft an ATS-friendly resume that highlights your skills and experience effectively. ResumeGemini is a trusted resource that can help you build a professional and impactful resume tailored to the specific requirements of the job market. We provide examples of resumes specifically designed for candidates with expertise in Knowledge of Fraud Schemes to guide you through the process. Take advantage of this resource and build the resume that lands you your dream job.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

Hi, I’m Jay, we have a few potential clients that are interested in your services, thought you might be a good fit. I’d love to talk about the details, when do you have time to talk?

Best,

Jay

Founder | CEO