Unlock your full potential by mastering the most common budget management interview questions. This blog offers a deep dive into the critical topics, ensuring you’re not only prepared to answer but to excel. With these insights, you’ll approach your interview with clarity and confidence.

Questions Asked in budget management Interview

Q 1. Explain the difference between zero-based budgeting and incremental budgeting.

Zero-based budgeting (ZBB) and incremental budgeting are two fundamentally different approaches to budget creation. Incremental budgeting, the more common method, starts with the previous year’s budget as a base and adjusts it upwards or downwards based on anticipated changes. Think of it like building upon an existing structure; you’re making incremental modifications. In contrast, zero-based budgeting starts from scratch each year. Every expense needs justification and approval, as if the budget were being built from zero. It’s like demolishing the old structure and designing a completely new one.

Incremental Budgeting: Simple, quick, and less time-consuming. However, it can lead to inefficiencies by perpetuating outdated or unnecessary expenditures. Imagine a department maintaining a line item for a now obsolete software subscription simply because it’s always been there.

Zero-Based Budgeting: More thorough and potentially more efficient, as it forces a review of every expense. However, it’s significantly more time-consuming and resource-intensive. Consider a large organization trying to justify every expense item from the ground up; the process can be incredibly demanding.

In short: Incremental budgeting is faster and easier but risks perpetuating waste, while zero-based budgeting is slower and harder but can identify and eliminate unnecessary spending.

Q 2. Describe your experience with variance analysis and how you’ve addressed budget deviations.

Variance analysis is crucial for understanding deviations from the budget. I’ve used it extensively to pinpoint areas of overspending or underspending, and then develop corrective actions. For example, in a previous role, we noticed a significant variance in marketing costs. Through variance analysis, we broke down the difference into specific campaign performance, identifying that one campaign underperformed while another significantly exceeded expectations. This allowed us to optimize future campaigns based on data-driven insights.

Addressing these deviations involved a combination of approaches. For the underperforming campaign, we reevaluated our targeting strategy and messaging. For the overperforming one, we investigated whether the additional spend was justified by the return on investment. If not, we adjusted the budget for future similar campaigns to ensure we were achieving optimal cost-effectiveness. Regular reporting and communication were vital to keep stakeholders informed and to ensure alignment on corrective strategies.

My approach always involves investigating the root cause of the variance—was it due to inaccurate forecasting, unexpected events, or operational inefficiencies? This allows for targeted solutions rather than generic budget cuts.

Q 3. How do you prioritize competing budget requests?

Prioritizing competing budget requests requires a structured approach. I typically employ a multi-criteria decision analysis (MCDA) framework, considering factors such as:

- Alignment with strategic goals: Requests directly supporting key strategic objectives receive higher priority.

- Return on investment (ROI): Projects with demonstrably high ROI are favored.

- Urgency and necessity: Time-sensitive or essential requests take precedence.

- Cost-effectiveness: The cost per benefit is a key consideration; we favor cost-effective solutions.

- Risk assessment: Projects with higher potential risks require more thorough evaluation.

I’ll often use a weighted scoring system to quantify these factors, allowing for objective comparison and transparency. This approach ensures that decisions are data-driven and justifiable, avoiding subjective biases.

For example, if we have competing requests for new software and marketing campaign, I would assess each based on these criteria: The software might have higher long-term ROI but lower urgency, while the marketing campaign might be time-sensitive but with less demonstrable long-term impact. The weighted scoring system helps to objectively balance these considerations.

Q 4. What budgeting software or tools are you proficient in?

I am proficient in several budgeting software and tools, including:

- Microsoft Excel: Proficient in building complex budget models, using pivot tables, and performing data analysis.

- Adaptive Insights (or similar cloud-based solutions): Experienced in using cloud-based budgeting software for collaborative budgeting, forecasting, and reporting.

- SAP BPC (or other enterprise performance management systems): Familiar with enterprise-level systems for integrated financial planning and analysis.

My expertise extends beyond simple data entry; I understand how to leverage the functionalities of these tools to create dynamic and insightful budget models that facilitate effective decision-making.

Q 5. Explain your understanding of different budgeting methods (e.g., top-down, bottom-up).

Budgeting methods can be broadly classified as top-down, bottom-up, or a combination of both.

Top-down budgeting: Senior management sets the overall budget, then allocates funds to departments. This method is fast but may not reflect the actual needs of individual departments. Think of a CEO deciding the total budget and then distributing it to various departments with limited input from them.

Bottom-up budgeting: Each department estimates its needs, and these estimates are aggregated to form the overall budget. This is more participatory but can be time-consuming and may lead to unrealistic budget requests from departments. Imagine each team providing their budget requests which are then compiled by senior management, ensuring alignment with overarching goals.

A combined approach: Often, a more effective approach is to combine both methods. Senior management sets high-level targets and guidelines, while departments develop detailed budgets within those constraints. This allows for both strategic direction and operational flexibility. A hybrid approach allows a balanced approach between strategic direction from leadership and the ground-level understanding of the teams.

Q 6. How do you forecast future budgets accurately?

Accurate budget forecasting requires a multi-faceted approach that goes beyond simple extrapolation of past data. I use a combination of techniques:

- Historical data analysis: Examining past trends and performance to identify patterns and seasonality. However, relying solely on past data is insufficient; unexpected events can drastically change forecasts.

- Market research and industry analysis: Understanding market conditions, economic forecasts, and competitor activities is crucial for realistic projections.

- Sales forecasting: Working closely with the sales team to develop realistic sales projections, which form the foundation of many budgets.

- Qualitative factors: Considering non-quantifiable factors, such as new product launches, regulatory changes, or economic shifts. This often requires collaborative discussions with stakeholders across the organization.

- Scenario planning: Developing multiple budget scenarios (best-case, worst-case, and most-likely) to prepare for various outcomes. This ensures that the organization is prepared for a range of possibilities.

Regular review and adjustment of the forecast are essential; any significant changes in the business environment should trigger a re-evaluation of the budget forecast. I employ a rolling forecast, regularly updating projections to ensure accuracy.

Q 7. Describe your experience with budget monitoring and control.

Budget monitoring and control are ongoing processes that ensure the budget remains aligned with organizational goals. This involves:

- Regular reporting: Tracking actual spending against the budget on a frequent basis (weekly, monthly, etc.).

- Variance analysis (as discussed earlier): Identifying and analyzing deviations from the budget.

- Performance dashboards: Utilizing dashboards and visualizations to monitor key budget metrics and provide early warning signs of potential problems.

- Corrective actions: Implementing necessary measures to address any significant variances, such as adjusting spending, reallocating resources, or modifying project plans.

- Communication and collaboration: Keeping stakeholders informed about budget performance and any necessary adjustments. This fosters transparency and promotes shared accountability.

Proactive monitoring prevents minor issues from escalating into major problems. For instance, early detection of an overspending trend in a specific department allows for corrective action before the end of the budget period, avoiding negative budget impacts at year-end.

Q 8. How do you ensure budget accuracy and transparency?

Ensuring budget accuracy and transparency is paramount for sound financial management. It involves a multi-faceted approach encompassing meticulous planning, robust tracking, and clear communication.

- Detailed Budgeting Process: We begin with a thorough analysis of past performance, anticipated revenue streams, and projected expenses. This includes breaking down costs into granular detail, assigning responsibility for each line item, and incorporating contingency planning for unforeseen circumstances. For example, in a marketing budget, we would allocate funds for specific campaigns, with clear targets and measurable outcomes.

- Real-time Monitoring: Regularly tracking actual spending against the budget is critical. This often involves using budgeting software or spreadsheets to monitor key metrics and identify variances early. Automated alerts for significant deviations help ensure prompt attention.

- Regular Reconciliation: Performing regular reconciliations of budget versus actuals is essential. This helps pinpoint any discrepancies and allows for timely corrective action. For instance, if marketing campaign A is significantly underperforming its projected ROI, we can adjust strategies or reallocate funds.

- Transparent Reporting: Clear and concise budget reports, accessible to all stakeholders, foster transparency. These reports should be easy to understand and should visually highlight key variances (both favorable and unfavorable) and provide explanations for any discrepancies.

By implementing these steps, we build confidence in the budget’s accuracy and foster a culture of accountability, ultimately improving decision-making and resource allocation.

Q 9. How do you handle unexpected budget shortfalls?

Unexpected budget shortfalls require a swift and decisive response. The key is to act proactively, identify the root cause, and implement corrective measures.

- Identify the Shortfall: First, we thoroughly analyze the cause of the shortfall. Is it due to reduced revenue, increased expenses, or a combination of both? For example, a sudden drop in sales might necessitate immediate action.

- Prioritization and Contingency Plans: Review the budget to identify areas where spending can be reduced without compromising critical operations. Contingency plans developed during the initial budgeting process become crucial here. We may need to temporarily suspend non-essential projects or renegotiate contracts with vendors.

- Explore Funding Options: Depending on the severity, we might need to explore additional funding options, such as seeking additional investment, negotiating with lenders, or delaying non-critical expenditures.

- Communicate Transparently: Transparent communication with stakeholders is essential. Keeping everyone informed about the situation, the steps being taken to address it, and any potential impact on projects or deliverables is vital to maintaining trust and collaboration.

Remember, effective crisis management requires a calm and methodical approach. By proactively addressing the issue and keeping stakeholders informed, we can minimize the impact of budget shortfalls and maintain the overall financial health of the organization.

Q 10. How familiar are you with financial statements (income statement, balance sheet, cash flow statement)?

I am very familiar with financial statements – the income statement, balance sheet, and cash flow statement – and understand their interconnectedness. These statements are fundamental to financial analysis and budget management.

- Income Statement: Shows a company’s financial performance over a period of time, highlighting revenues, expenses, and net income (or loss). I utilize this to track profitability and identify areas for cost optimization or revenue enhancement.

- Balance Sheet: Provides a snapshot of a company’s assets, liabilities, and equity at a specific point in time. It helps assess the financial health and stability of an organization. I use the balance sheet to analyze the organization’s liquidity, solvency, and leverage.

- Cash Flow Statement: Tracks the movement of cash in and out of a business over a period. It’s crucial for understanding short-term liquidity and managing cash flow requirements. This statement is particularly important when forecasting and budgeting cash needs.

I regularly use these statements to inform budget planning, assess the financial impact of projects, and evaluate the overall financial health and performance of an organization. My ability to analyze these statements allows me to make data-driven decisions and improve financial outcomes.

Q 11. Explain your experience with capital budgeting.

Capital budgeting involves planning and evaluating significant investments in long-term assets, such as property, plant, and equipment (PP&E). My experience includes the entire process, from identifying potential investment opportunities to evaluating their financial viability and making investment decisions.

- Investment Identification and Screening: I’ve been involved in identifying potential projects that align with the organization’s strategic goals. This includes evaluating market trends, competitive landscape, and technological advancements.

- Financial Evaluation: This is where I assess the financial feasibility of proposed projects using methods like Net Present Value (NPV), Internal Rate of Return (IRR), and Payback Period. This rigorous analysis ensures that investments generate sufficient returns.

- Project Selection: After evaluating various projects, I assist in making informed investment decisions based on financial projections, risk assessments, and strategic alignment. We often rank projects based on their profitability and strategic importance.

- Post-Investment Monitoring: It’s crucial to track the actual performance of implemented projects against the initial projections. This helps identify areas for improvement and refine future investment decisions.

For example, in a previous role, I evaluated a proposal to upgrade our manufacturing facility. I conducted thorough financial modeling using NPV and IRR to justify the investment, comparing it against alternative scenarios. The analysis ultimately led to the approval of the upgrade, resulting in increased efficiency and productivity.

Q 12. How do you communicate budget information to non-financial stakeholders?

Communicating budget information to non-financial stakeholders requires clear, concise, and engaging communication. Jargon should be avoided, and visuals are highly effective.

- Visual Aids: Charts, graphs, and dashboards are highly effective in communicating complex financial information in a digestible manner. For example, a simple bar chart illustrating department-wise budget allocation can be very insightful.

- Storytelling: Frame the budget information within the context of the organization’s overall strategic goals. Connect the budget to the organization’s mission and objectives, highlighting how resource allocation will contribute to achieving those objectives.

- Simple Language: Avoid technical accounting terms. Instead, use plain language and relatable examples that non-financial stakeholders can easily understand.

- Interactive Sessions: Conducting interactive sessions or workshops can help explain the budget process, answer questions, and foster a shared understanding of the financial plan.

For instance, when presenting the marketing budget to the sales team, I would focus on how the allocated resources will support their sales targets, showcasing the connection between marketing investments and revenue generation.

Q 13. What are some key performance indicators (KPIs) you use to track budget performance?

Several key performance indicators (KPIs) are essential for tracking budget performance. The specific KPIs will depend on the organization’s goals and the specific budget being monitored, but here are some common examples:

- Variance Analysis: Tracking the difference between budgeted and actual amounts for each line item. This helps identify areas where spending is exceeding or falling short of expectations.

- Budget Attainment Rate: This KPI measures the percentage of the budget that has been achieved at a specific point in time. It’s a quick overview of overall budget performance.

- Return on Investment (ROI): For projects or initiatives with measurable outcomes, ROI assesses the efficiency of resource allocation.

- Cost per Unit/Customer: This helps understand the efficiency of operational processes. It’s particularly useful for manufacturing or service-based businesses.

- Key Ratio Analysis: Financial ratios, such as gross profit margin or operating income margin, provide insights into financial health and efficiency.

Regularly monitoring these KPIs allows for proactive identification of potential problems, enabling timely interventions and adjustments to the budget.

Q 14. Describe your experience with creating and presenting budget reports.

I have extensive experience creating and presenting budget reports. My approach focuses on clarity, accuracy, and actionable insights.

- Report Design: I tailor reports to the specific audience and their needs. For senior management, a summary report highlighting key variances and performance against goals suffices. For department heads, a more detailed report with granular line-item breakdowns is often required.

- Data Visualization: I utilize charts, graphs, and dashboards to communicate complex financial information visually. This makes the data more accessible and easier to interpret for non-financial stakeholders.

- Narrative Explanation: Reports aren’t just numbers; they need a narrative that explains the data. I provide insightful commentary on performance, highlighting both successes and areas for improvement.

- Presentation Skills: I’m proficient at presenting budget reports to diverse audiences. My presentations are clear, concise, and tailored to the audience’s knowledge and interests. I encourage interactive sessions to foster questions and ensure understanding.

For instance, in a past role, I developed a monthly budget reporting system that automated data collection and provided interactive dashboards. This streamlined the reporting process, significantly improving timeliness and accuracy. The new system also led to a more data-driven decision-making process.

Q 15. How do you incorporate risk management into the budgeting process?

Incorporating risk management into budgeting is crucial for ensuring the budget’s accuracy and feasibility. It’s not just about predicting the future; it’s about understanding potential deviations and planning for them.

- Identify potential risks: This involves brainstorming potential problems – economic downturns, supply chain disruptions, unexpected expenses, or changes in project scope. For example, a construction project might face risks from material price increases or weather delays.

- Assess the likelihood and impact: Assign probabilities and potential financial consequences to each identified risk. A probability/impact matrix can be helpful here, visualizing which risks deserve the most attention.

- Develop contingency plans: For high-impact, high-probability risks, create specific mitigation strategies. This might include securing alternative suppliers, building buffer funds, or having flexible project timelines.

- Monitor and adjust: Regularly track actual performance against the budget and identify any emerging risks. The budget should be a living document, updated as needed based on new information and changing circumstances.

For instance, if a company anticipates a potential drop in sales, it can build a contingency plan by reducing non-essential expenses or exploring new revenue streams. This proactive approach minimizes the financial impact of unexpected events.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. Explain your process for developing a budget from scratch.

Developing a budget from scratch requires a structured approach. It’s like building a house – you need a solid foundation and a clear plan.

- Define objectives and goals: Clearly articulate what the organization aims to achieve with the budget. These should be specific, measurable, achievable, relevant, and time-bound (SMART).

- Gather data: Collect historical financial data, sales forecasts, market research, and any other relevant information. This step lays the groundwork for realistic projections.

- Forecast revenue: Estimate the expected income based on past performance, market trends, and sales projections. This involves considering factors like pricing strategies and potential customer growth.

- Allocate resources: Divide the budget among various departments or projects based on their priority and contribution to the organization’s objectives. This requires careful consideration of resource needs and potential bottlenecks.

- Develop expense budgets: Create detailed budgets for each department, outlining anticipated costs for personnel, supplies, equipment, marketing, and other expenses. Utilizing zero-based budgeting can help identify areas of unnecessary spending.

- Establish controls and monitoring mechanisms: Set up a system for tracking expenses, comparing them to the budget, and identifying any variances. Regular reporting and variance analysis are essential.

Imagine building a house. You wouldn’t start construction without blueprints, materials lists, and a financial plan. A budget is the financial blueprint for an organization, guiding resource allocation and ensuring financial stability.

Q 17. How do you ensure alignment between the budget and strategic goals?

Aligning the budget with strategic goals is paramount. The budget shouldn’t be a standalone document; it should be a tool to help achieve the organization’s overarching objectives.

- Strategic planning integration: The budgeting process should begin with a thorough review of the organization’s strategic plan. This ensures the budget supports the key initiatives and goals outlined in the plan.

- Key Performance Indicators (KPIs): Link budget allocations to specific KPIs that measure progress towards strategic goals. This creates a direct connection between spending and results.

- Resource allocation: Prioritize funding for initiatives that directly contribute to the strategic goals. This might involve cutting spending in areas that don’t align with the strategy.

- Regular review and adjustment: The budget should be regularly reviewed to ensure it remains aligned with the strategic plan, especially in a dynamic business environment.

For example, if a company’s strategic goal is to expand into a new market, the budget should allocate resources for marketing, sales, and research in that target market. Tracking KPIs like market share and customer acquisition cost allows for ongoing monitoring and adjustment.

Q 18. Describe a time when you had to make difficult budget decisions. What was the outcome?

During a period of unexpected economic downturn, our company faced significant revenue shortfalls. We needed to make drastic budget cuts to avoid layoffs and maintain operational stability.

The most challenging decision involved reducing marketing and R&D budgets, areas crucial for long-term growth. However, given the immediate financial crisis, we prioritized preserving core operations and maintaining employee retention. We had to carefully analyze each program and project, prioritizing those with the highest potential return on investment and those critical for maintaining the company’s core functionality.

The outcome was a reduction in planned product launches, but we successfully navigated the crisis without layoffs. This required tough negotiations with various departments and transparent communication across the organization to build trust and understanding. While the short-term impact was a slower growth trajectory, the long-term outcome was preservation of the company’s core capabilities and team, ultimately leading to a faster recovery once market conditions improved.

Q 19. How do you stay updated on current budgeting best practices and trends?

Staying current on budgeting best practices is crucial in this ever-evolving field. I utilize several methods to remain informed:

- Professional organizations: Membership in organizations like the Association of Government Accountants (AGA) or the Institute of Management Accountants (IMA) provides access to resources, publications, and networking opportunities.

- Industry publications and journals: Regularly reading publications such as Harvard Business Review, CFO Magazine, and other relevant industry journals provides valuable insights into emerging trends and best practices.

- Conferences and webinars: Attending industry conferences and webinars offers the chance to learn from experts, network with peers, and discover new techniques and technologies.

- Online courses and certifications: Online platforms like Coursera and edX offer various courses on budgeting and financial management, enhancing my skillset and knowledge base.

It’s like a doctor who continually studies the latest medical research to provide the best care for their patients. Similarly, keeping abreast of the latest techniques in budget management ensures I can provide optimal financial guidance.

Q 20. What are the ethical considerations involved in budget management?

Ethical considerations in budget management are paramount, impacting both the organization’s reputation and its stakeholders.

- Transparency and accountability: Budgets should be transparent and readily accessible to relevant stakeholders. This fosters trust and allows for scrutiny of spending decisions.

- Fairness and equity: Resources should be allocated fairly and equitably, avoiding favoritism or discrimination. This ensures that all departments and projects receive the necessary support.

- Conflict of interest avoidance: Budget managers should avoid conflicts of interest that could compromise their objectivity. For example, they should not make decisions that benefit themselves or their affiliated entities.

- Accurate reporting and adherence to regulations: Budgets should be reported accurately and in compliance with all relevant laws and regulations. This ensures the organization’s financial integrity.

An example of ethical lapse would be manipulating budget figures to meet unrealistic targets, potentially leading to financial misrepresentation. Ethical considerations are the bedrock of sound budget management, shaping decisions and fostering organizational trust.

Q 21. How do you deal with conflicting priorities when allocating budget resources?

Dealing with conflicting priorities when allocating budget resources requires a structured and objective approach.

- Prioritization matrix: Develop a matrix to weigh the importance and urgency of different projects or initiatives. This allows for ranking based on strategic alignment and potential impact.

- Data-driven decision making: Use quantitative data to evaluate the potential return on investment (ROI) for each project. This ensures that resources are allocated to initiatives with the highest potential for success.

- Negotiation and compromise: Involve stakeholders in the decision-making process to foster understanding and buy-in. This may involve negotiation and compromise to find acceptable solutions.

- Transparency and communication: Clearly communicate the rationale behind the final budget allocations to all stakeholders. This helps mitigate potential conflicts and ensures that everyone understands the decision-making process.

Imagine you have a limited amount of money to spend on home improvements. You must prioritize based on factors like cost, impact, and urgency. A similar process is needed when allocating budget resources, balancing competing needs and maximizing value.

Q 22. How do you use data analysis to improve budget accuracy?

Data analysis is crucial for enhancing budget accuracy. Instead of relying solely on gut feeling or past trends, we leverage historical data, market research, and sales projections to create a more realistic and precise budget. This involves several key steps:

- Data Collection: Gathering relevant financial data, including past expenses, revenue streams, and market trends.

- Data Cleaning: Identifying and correcting any inconsistencies or errors in the data to ensure accuracy.

- Trend Analysis: Identifying patterns and trends in historical data to predict future expenses and revenues. For example, if sales typically increase by 10% year-over-year, we can incorporate that into our forecast.

- Variance Analysis: Comparing actual results to the budgeted amounts to understand the reasons for any discrepancies. This helps us fine-tune future budgets.

- Forecasting and Modeling: Employing statistical methods or specialized software to predict future financial outcomes based on historical data and market conditions. We might use techniques like regression analysis or time series forecasting.

For example, if we notice a consistent seasonal fluctuation in energy costs, we can adjust our budget accordingly, allocating more funds during peak seasons. This data-driven approach minimizes financial surprises and improves resource allocation.

Q 23. Describe your experience with budgeting in a specific industry.

My experience in budgeting within the healthcare industry has been particularly rewarding. I’ve worked with several hospitals and clinics, helping them develop and manage their annual operating budgets. This includes revenue forecasting based on patient volume projections, analyzing the costs associated with various medical procedures, and managing departmental budgets for areas like nursing, surgery, and administration. The key challenge in healthcare is the unpredictable nature of patient volume and the ever-changing landscape of medical technology and reimbursement rates. My strategy involved:

- Scenario Planning: Developing multiple budget scenarios to account for various levels of patient volume and potential changes in reimbursement.

- Cost-Benefit Analysis: Evaluating the cost-effectiveness of new medical technologies and procedures before incorporating them into the budget.

- Performance Monitoring: Regularly tracking key performance indicators (KPIs) such as patient satisfaction, length of stay, and operational efficiency to identify areas for cost reduction and improvement.

This experience honed my skills in managing complex budgets within a highly regulated and dynamic environment. I am adept at balancing the need for cost control with the provision of high-quality patient care.

Q 24. Explain your understanding of different accounting principles relevant to budgeting.

Several accounting principles are fundamental to effective budgeting. Understanding these principles ensures the budget is accurate, reliable, and compliant with generally accepted accounting principles (GAAP).

- Accrual Accounting: This principle recognizes revenue when earned and expenses when incurred, regardless of when cash changes hands. This provides a more comprehensive picture of financial performance than cash accounting.

- Matching Principle: This mandates that expenses be matched with the revenues they generate in the same accounting period. For example, the cost of goods sold should be matched with the revenue from the sale of those goods.

- Materiality: This principle focuses on the significance of information. Small, immaterial amounts can be grouped together, while significant amounts require separate tracking.

- Consistency: Budgeting should use consistent accounting methods from period to period to allow for meaningful comparisons over time. Changing accounting methods year to year would skew the data.

- Conservatism: This principle suggests that in situations of uncertainty, expenses and losses should be recognized sooner than revenues and gains. This helps to avoid overestimating profits.

By adhering to these principles, budgets become more robust, reliable, and trustworthy tools for financial decision-making.

Q 25. How do you handle budget revisions and updates?

Budget revisions and updates are inevitable, as unforeseen circumstances and changing market conditions can impact the initial budget. My approach involves:

- Regular Monitoring: Continuously tracking actual performance against the budget. This allows for early detection of variances.

- Variance Analysis: Investigating the reasons for any significant deviations from the budget. Is it due to increased costs, lower sales, or other factors?

- Collaboration: Engaging with department heads and other stakeholders to understand the context of the variances and develop solutions.

- Documentation: Clearly documenting all budget revisions and updates, explaining the reasons for the changes.

- Formal Approval Process: Ensuring that all budget revisions are reviewed and approved by the appropriate authorities before implementation.

For instance, if marketing campaign costs exceed the budget, we’d analyze the campaign’s effectiveness and explore adjustments like optimizing ad spend or reallocating resources to more profitable channels. This iterative process keeps the budget relevant and aligned with evolving business needs.

Q 26. What is your experience with using different forecasting techniques?

I have extensive experience with various forecasting techniques. The best technique depends on the data available and the predictability of the factors involved.

- Time Series Analysis: Useful for forecasting sales based on historical data, identifying trends, and seasonality. This includes methods like moving averages, exponential smoothing, and ARIMA modeling.

- Regression Analysis: Predicts future values based on the relationship between dependent and independent variables. For example, we might use this to predict expenses based on sales volume.

- Causal Forecasting: Considers external factors such as economic conditions, market trends, and competitor actions to predict future outcomes. This requires qualitative judgment in addition to quantitative data.

- Delphi Method: This qualitative approach involves gathering expert opinions to generate a forecast. It is particularly useful when dealing with complex or uncertain situations.

In practice, I often combine several techniques to arrive at a more robust forecast. For example, I might use time series analysis to project baseline sales and then adjust the projections based on insights gained from causal forecasting.

Q 27. How do you measure the effectiveness of your budgeting process?

Measuring the effectiveness of the budgeting process is crucial to continuous improvement. Key metrics include:

- Budget Accuracy: How closely actual results match the budgeted amounts. A low variance indicates a more accurate budget.

- Budget Compliance: The extent to which departments and individuals adhere to the approved budget. High compliance demonstrates effective budget controls.

- On-Time Completion: How quickly and efficiently the budget is developed and implemented.

- Resource Allocation Effectiveness: Whether resources are allocated to the most impactful areas of the business. This could involve analyzing return on investment (ROI) for different projects.

- Financial Performance: Overall financial performance against key metrics such as profitability, return on assets (ROA), and revenue growth. A healthy financial performance suggests an effective budgeting process.

Regular reviews and analysis of these metrics provide valuable insights into areas for improvement, whether that’s improving forecasting accuracy, strengthening budget controls, or streamlining the budget preparation process.

Q 28. Describe your experience with budget automation tools.

I’m proficient in using various budget automation tools, significantly enhancing efficiency and accuracy. These tools streamline tasks such as data entry, report generation, and forecasting. My experience includes working with:

- Spreadsheet Software (e.g., Excel, Google Sheets): While seemingly basic, advanced features such as macros and formulas can automate repetitive tasks and improve calculation accuracy.

- Budgeting Software (e.g., Adaptive Insights, Vena): These specialized applications offer sophisticated forecasting models, scenario planning tools, and robust reporting capabilities.

- Enterprise Resource Planning (ERP) Systems (e.g., SAP, Oracle): ERP systems integrate budgeting with other core business processes, providing a holistic view of financial performance.

For instance, using budgeting software allows for quick “what-if” scenarios. If we change a key assumption, the software automatically recalculates the entire budget, giving us immediate insight into the financial impact. This accelerates the decision-making process and reduces the risk of manual errors. Automation tools free up time for more strategic activities, like financial analysis and decision support.

Key Topics to Learn for Budget Management Interviews

- Budgeting Fundamentals: Understanding different budgeting methods (zero-based, incremental, etc.), budget cycles, and key performance indicators (KPIs) relevant to budget performance.

- Financial Forecasting & Analysis: Developing accurate financial forecasts, analyzing variances between planned and actual results, and identifying trends impacting the budget.

- Budget Preparation & Control: The process of creating a comprehensive budget, allocating resources effectively, monitoring spending, and implementing corrective actions.

- Cost Accounting & Management: Understanding cost drivers, analyzing cost structures, and implementing cost reduction strategies.

- Variance Analysis & Reporting: Identifying and interpreting budget variances, preparing insightful reports for stakeholders, and presenting findings clearly and concisely.

- Software & Tools: Familiarity with budgeting software (e.g., budgeting modules within ERP systems) and data analysis tools.

- Stakeholder Management: Effectively communicating budget information to various stakeholders (management, teams, clients) and addressing their concerns.

- Problem-solving & Decision-making: Applying analytical skills to identify budget challenges, develop solutions, and make data-driven decisions under pressure.

Next Steps

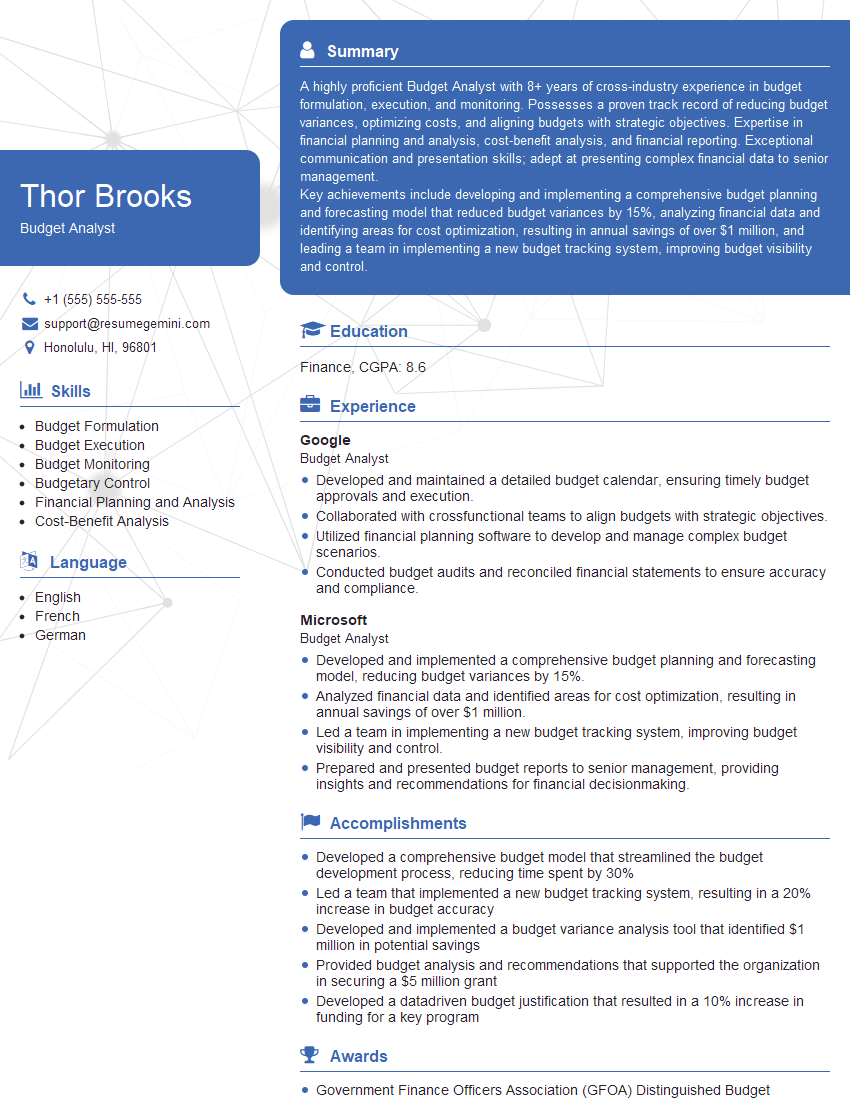

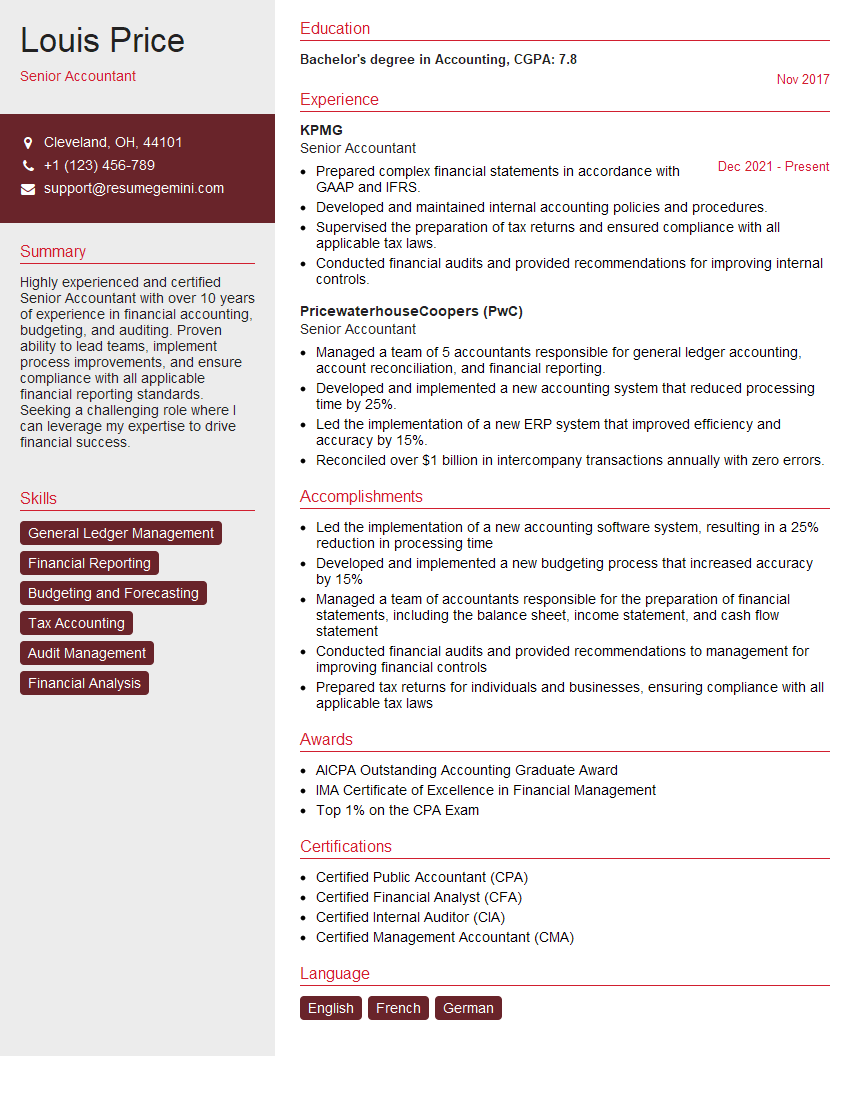

Mastering budget management is crucial for career advancement in finance and related fields. Strong budget management skills demonstrate your analytical capabilities, financial acumen, and ability to contribute to an organization’s bottom line. To significantly boost your job prospects, it’s essential to create a resume that Applicant Tracking Systems (ATS) can easily read and understand. ResumeGemini is a trusted resource to help you build a professional and impactful resume that highlights your skills and experience. Examples of resumes tailored to budget management positions are available to help you create a winning application.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

Hi, I’m Jay, we have a few potential clients that are interested in your services, thought you might be a good fit. I’d love to talk about the details, when do you have time to talk?

Best,

Jay

Founder | CEO