Interviews are opportunities to demonstrate your expertise, and this guide is here to help you shine. Explore the essential Account Takeover (ATO) interview questions that employers frequently ask, paired with strategies for crafting responses that set you apart from the competition.

Questions Asked in Account Takeover (ATO) Interview

Q 1. Explain the different types of Account Takeover (ATO) attacks.

Account Takeover (ATO) attacks come in various forms, all aiming to gain unauthorized access to a user’s account. We can categorize them broadly as:

- Credential Stuffing: This is like trying every key on a keyring until one unlocks the door. Attackers use lists of stolen usernames and passwords (obtained from data breaches) to try accessing accounts across multiple platforms. Imagine a hacker having a list of millions of email addresses and passwords from a previous breach, trying them systematically on your online banking site.

- Phishing and Social Engineering: This is deception, pure and simple. Attackers trick users into revealing their credentials through deceptive emails, websites, or messages. Think of a fake email pretending to be your bank, asking you to update your password by clicking a malicious link.

- Malware: Malicious software like keyloggers (which record keystrokes) or spyware (which monitors your activity) can steal your credentials without you ever realizing it. Imagine a virus secretly recording every key you press, including your password as you log in to your email.

- Session Hijacking: This involves intercepting an active user session to gain control of the account. Think of someone eavesdropping on your online banking session and stealing your session ID, giving them access to your account without your password.

- Brute-Force Attacks: This is a more straightforward, yet time-consuming method. Attackers try various combinations of usernames and passwords until they find a match. It’s like trying every possible combination on a combination lock.

Understanding these different types allows for a more targeted and effective security strategy.

Q 2. Describe common attack vectors used in ATO.

Attack vectors are the pathways attackers use to breach accounts. Common vectors for ATO include:

- Weak or reused passwords: Using simple, easily guessed, or recycled passwords is an open invitation for attackers.

- Phishing emails and websites: Deceptive communications that trick users into revealing credentials are highly effective.

- Compromised devices: Malware installed on a user’s computer or mobile device can steal credentials or record keystrokes.

- Public Wi-Fi networks: Using unsecured Wi-Fi can expose your connection to eavesdropping, making your credentials vulnerable.

- Vulnerable websites and applications: Exploiting weaknesses in the security of websites or apps can expose user data, including credentials.

- Social media vulnerabilities: Information disclosed on social media can be used to guess passwords or answer security questions.

- Third-party applications: Using apps with weak security practices can give attackers access to your account.

Protecting against ATO requires addressing vulnerabilities across all these vectors.

Q 3. What are the key indicators of compromise (IOCs) associated with ATO?

Key Indicators of Compromise (IOCs) for ATO can be subtle or obvious. Identifying them requires vigilance and a proactive security posture. Some crucial IOCs include:

- Unusual login locations: A login from an unexpected geographic location is a strong indicator of a potential ATO.

- Multiple failed login attempts: Repeated failed login attempts, especially with different credentials, suggest a brute-force or credential stuffing attack.

- Unexpected account activity: Unusual transactions, password changes, or email modifications are red flags.

- Suspicious emails from the compromised account: Phishing emails sent from the victim’s account to their contacts are a clear sign of compromise.

- Account access from unfamiliar devices: Logins from unknown or unusual devices should raise suspicion.

- Changes to security questions or recovery methods: Unauthorized alterations of these settings can facilitate account takeover.

Monitoring for these IOCs helps detect and respond to ATO attempts quickly.

Q 4. How do you identify suspicious login attempts?

Identifying suspicious login attempts involves a combination of technical and behavioral analysis. Key elements include:

- Geolocation monitoring: Track login locations and flag unusual activity outside expected regions.

- Login frequency analysis: Detect unusually high numbers of login attempts within a short time period.

- Failed login attempt tracking: Monitor failed login attempts and identify patterns indicating brute-force attacks.

- Device fingerprinting: Identify logins from unfamiliar devices based on their characteristics.

- Behavioral analysis: Compare login patterns against the user’s typical activity to spot deviations.

- Using security information and event management (SIEM) systems: SIEM systems aggregate security logs from various sources and can detect anomalies suggestive of malicious activity.

Implementing robust logging and monitoring systems is crucial for identifying these suspicious activities.

Q 5. Explain multi-factor authentication (MFA) and its role in ATO prevention.

Multi-Factor Authentication (MFA) is a security measure requiring users to provide multiple forms of verification to gain access. Instead of just a password (something you know), it might also request something you have (like a security token) or something you are (biometrics like a fingerprint). This significantly strengthens account security against ATO.

Role in ATO Prevention: MFA adds an extra layer of protection, making it significantly harder for attackers to gain access even if they have your password. Even if an attacker obtains your password through phishing or credential stuffing, they’ll still need the second factor (or factors) to log in. This significantly reduces the success rate of ATO attacks.

Examples include using a one-time code sent to your phone (OTP) alongside your password, or using a security key alongside your password.

Q 6. Discuss the importance of strong password policies in preventing ATO.

Strong password policies are foundational in ATO prevention. Weak passwords are easily guessed or cracked, leaving accounts vulnerable. A strong password policy should include:

- Minimum password length: Passwords should be at least 12 characters long.

- Password complexity requirements: Require a mix of uppercase and lowercase letters, numbers, and symbols.

- Password reuse restrictions: Prevent users from reusing passwords across multiple accounts.

- Regular password changes: Implement periodic password changes to minimize the window of vulnerability.

- Password expiration policies: Set a reasonable expiration period for passwords, encouraging users to update them regularly.

- Password management tools: Encourage users to use password managers to generate and securely store strong, unique passwords.

Educating users on the importance of strong passwords and enforcing a robust policy is crucial for reducing ATO risks.

Q 7. How do you investigate an ATO incident?

Investigating an ATO incident requires a systematic approach. The process typically involves:

- Containment: Immediately block the compromised account to prevent further damage.

- Evidence collection: Gather all relevant logs, including login attempts, account activity, and system events.

- Incident timeline reconstruction: Determine the sequence of events leading to the compromise.

- Vulnerability analysis: Identify the vulnerabilities that allowed the attack to succeed.

- Root cause analysis: Determine the underlying reasons for the compromise, such as weak passwords, phishing, or malware.

- Remediation: Implement necessary security controls to prevent similar attacks in the future.

- Post-incident review: Document the incident response process, identify lessons learned, and refine security policies and procedures.

A thorough investigation can help prevent future incidents and improve overall security.

Q 8. What are the steps involved in containing an ATO incident?

Containing an Account Takeover (ATO) incident requires immediate and decisive action. Think of it like containing a fire – you need to quickly isolate the blaze before it spreads. The process involves several key steps:

- Immediate Isolation: The first priority is to immediately disable the compromised account. This prevents further unauthorized access and data breaches. Change the password immediately, and if possible, lock the account entirely.

- Incident Response Team Activation: Assemble your incident response team. This team should include security professionals, IT staff, legal counsel, and potentially public relations depending on the severity of the breach. Clearly defined roles and responsibilities within the team are crucial for efficient response.

- Containment and Investigation: Investigate the extent of the compromise. Determine what data has been accessed, what systems were impacted, and how the attacker gained access. This often involves analyzing logs, reviewing network traffic, and potentially conducting forensic analysis.

- Malware Removal and System Restoration: Remove any malware or malicious code from affected systems (This is discussed in more detail in the next question). Restore systems from clean backups, ensuring that the restored systems are patched and secured.

- Vulnerability Remediation: Identify and fix the vulnerabilities that allowed the ATO to occur. This might involve patching software, strengthening password policies, implementing multi-factor authentication (MFA), and improving security awareness training.

- Post-Incident Review: Conduct a thorough post-incident review to learn from the experience and improve future security measures. Document all actions taken, identify areas for improvement, and update your incident response plan.

For example, imagine an employee’s email account was compromised. The immediate action would be to change the password and then investigate if any sensitive information was accessed or shared. Then, a review of the employee’s security practices would be implemented to ensure this doesn’t happen again.

Q 9. Describe the process of eradicating malware related to an ATO incident.

Eradicating malware related to an ATO incident is a critical step in the recovery process. It requires a systematic approach, combining automated tools with manual intervention:

- Isolate Infected Systems: Disconnect the compromised systems from the network to prevent the malware from spreading. This is the equivalent of isolating a patient with a contagious disease.

- Malware Analysis: Analyze the malware to understand its functionality, capabilities, and potential impact. This may involve using sandbox environments to study the malware’s behavior without risking further damage.

- Removal Using Security Tools: Use antivirus software, endpoint detection and response (EDR) solutions, and other security tools to scan and remove the malware. Often, specialized malware removal tools might be necessary.

- Manual Cleanup: Manual cleanup might be necessary to remove remnants of the malware that automated tools missed. This includes reviewing system logs, registry entries, and checking for suspicious processes.

- System Restoration: Restore systems from a known good backup that predates the infection. This is the most reliable way to ensure complete malware removal. If a backup isn’t available, a clean installation of the operating system and applications may be necessary.

- Verification: Thoroughly verify that the malware has been completely removed. Conduct repeated scans and monitor the system for any suspicious activity.

Imagine a situation where ransomware was used to compromise an account. After isolating the infected machine, we would employ specialized ransomware removal tools and then conduct a thorough scan and review of system logs before restoring the system from a clean backup.

Q 10. How do you recover accounts compromised in an ATO attack?

Recovering compromised accounts requires a multi-step process focused on security and user experience. The process aims to restore access while minimizing the risk of further compromise:

- Password Reset: Force a password reset. The user should create a strong, unique password that adheres to the organization’s password policy. This ensures the attacker no longer has access to the account.

- Multi-Factor Authentication (MFA) Enforcement: Immediately enable MFA if not already in place. MFA adds an extra layer of security that significantly reduces the risk of account takeover. Consider using strong authentication methods like FIDO2 security keys.

- Account Review and Auditing: Review the account activity logs to identify suspicious actions. Check for any unauthorized access attempts, data exfiltration, or other malicious activities. This information helps in understanding the extent of the breach.

- Data Recovery (If Applicable): Recover any data that was potentially compromised or deleted. Backups are crucial here! If no backups exist, specialized data recovery services might be required.

- User Education and Awareness: Educate the user about the security breach and best practices to prevent future incidents. Reinforce the importance of strong passwords, MFA, and phishing awareness.

- Monitoring: Continuously monitor the recovered account for any suspicious activity. This proactive approach ensures that any remaining security issues are identified and addressed immediately.

For instance, if a user’s banking account is compromised, the bank would reset the password, enable MFA, review account transactions for fraudulent activity, and work to recover any lost funds. They’d then educate the user on better security practices.

Q 11. What are some common vulnerabilities exploited in ATO attacks?

ATO attacks exploit various vulnerabilities; here are some common ones:

- Weak or Reused Passwords: This is the most common vulnerability. Users often choose easily guessable passwords or reuse the same password across multiple accounts. Attackers utilize password cracking techniques or leverage leaked credentials from other data breaches.

- Phishing and Social Engineering: Attackers use deceptive tactics like phishing emails, SMS messages, or phone calls to trick users into revealing their credentials. These attacks often exploit social engineering principles, playing on users’ trust and emotions.

- Malware Infections: Malware such as keyloggers, spyware, and trojans can steal user credentials and sensitive information. These infections often occur through malicious attachments or links in emails or through compromised websites.

- Vulnerable Applications and Systems: Outdated software and unpatched systems present vulnerabilities that attackers can exploit to gain unauthorized access to accounts. Regular patching and updates are crucial.

- Credential Stuffing: Attackers use stolen credentials from other data breaches to try and access accounts on different websites. They try different combinations of usernames and passwords until they find a successful login.

For example, an attacker might use a phishing email that mimics a legitimate bank to steal a user’s login credentials. Once obtained, the attacker would use those credentials to access the user’s bank account, demonstrating the exploitation of both social engineering and weak password practices.

Q 12. Explain your experience with security information and event management (SIEM) tools in relation to ATO detection.

Security Information and Event Management (SIEM) tools are essential for ATO detection. They aggregate and analyze security logs from various sources, enabling the identification of suspicious activity indicative of an ATO attempt or a successful takeover. My experience with SIEM tools, such as Splunk, QRadar, or Elastic Stack, involves:

- Log Correlation: SIEMs correlate events across different systems to detect patterns indicative of malicious activity. For example, a failed login attempt followed by a successful login from an unusual location could suggest an ATO.

- Real-time Monitoring: SIEMs provide real-time monitoring of security events, enabling quick detection and response to ATO attempts. This allows for timely intervention and minimizes potential damage.

- Alerting and Reporting: SIEMs generate alerts based on predefined rules and thresholds, notifying security personnel of suspicious activity. They also generate reports on security events, enabling analysis of trends and vulnerabilities.

- Threat Detection: SIEMs can be configured to detect various types of ATO attacks by using pre-built rules or creating custom rules based on specific threat intelligence. This proactive approach prevents many ATO incidents.

- Incident Response: During an ATO incident, SIEM data provides valuable insights into the attack’s progression and scope. This data helps in the investigation and containment process.

In one particular case, I utilized Splunk to analyze login attempts. We identified a spike in failed login attempts from a specific IP address, followed by successful logins from a different geographic location, all pointing to an attempted ATO. The immediate response prevented further data breaches.

Q 13. How do you use threat intelligence to prevent ATO?

Threat intelligence plays a crucial role in preventing ATO. It provides insights into emerging threats, attacker tactics, techniques, and procedures (TTPs), and indicators of compromise (IOCs). This information enables proactive security measures:

- Identifying Emerging Threats: Threat intelligence feeds alert us to new malware, phishing campaigns, or other ATO techniques, enabling us to proactively implement protective measures. This is like having advanced warning of an impending storm.

- Blocking Known Bad Actors: Threat intelligence identifies known malicious IP addresses, domains, or email addresses involved in ATO attacks. We can configure firewalls, email filters, and other security systems to block these known bad actors.

- Detecting IOCs: Threat intelligence provides IOCs, such as specific file hashes, URLs, or registry keys associated with malware used in ATO attacks. We can use these IOCs to detect and block malicious activity within our network.

- Proactive Security Hardening: Based on threat intelligence, we can proactively harden our systems and applications to reduce the risk of ATO. This may involve patching vulnerabilities, enforcing strong password policies, or implementing MFA.

For example, by monitoring threat feeds, we learned about a new phishing campaign targeting our industry. We then updated our security awareness training materials to educate employees about this specific threat, thus proactively preventing potential ATO incidents.

Q 14. What are the legal and regulatory implications of ATO incidents?

ATO incidents have significant legal and regulatory implications, varying depending on the jurisdiction and the nature of the data compromised. Key considerations include:

- Data Breach Notification Laws: Many jurisdictions have laws requiring organizations to notify affected individuals and regulatory bodies of data breaches. Failure to comply with these laws can result in substantial fines.

- Privacy Regulations: Regulations like GDPR (in Europe), CCPA (in California), and other privacy laws impose strict requirements on how personal data is collected, processed, and protected. ATO incidents can violate these regulations, leading to penalties.

- Industry-Specific Regulations: Certain industries, such as finance and healthcare, face stricter regulations regarding data security. ATO incidents in these sectors can result in severe penalties and reputational damage.

- Civil Litigation: Individuals whose data was compromised in an ATO incident may sue the organization for damages, including financial losses, reputational harm, and emotional distress. This can lead to costly legal battles.

- Insurance Claims: Organizations may need to file insurance claims to cover the costs associated with ATO incidents, including investigation, remediation, notification, and legal expenses. This underscores the importance of adequate cyber insurance coverage.

For instance, if a healthcare provider experiences an ATO incident leading to the exposure of patient medical records, they could face substantial fines under HIPAA (Health Insurance Portability and Accountability Act) and potential lawsuits from affected patients. The reputational damage alone could be devastating.

Q 15. Describe your experience with incident response frameworks (e.g., NIST Cybersecurity Framework).

My experience with incident response frameworks, primarily the NIST Cybersecurity Framework (CSF), is extensive. I’ve utilized it across numerous engagements to guide incident response activities, from initial identification to recovery and lessons learned. The CSF’s five core functions – Identify, Protect, Detect, Respond, and Recover – provide a structured approach for handling security incidents, including Account Takeovers (ATO). For example, during a recent ATO incident, we used the ‘Detect’ function to leverage security information and event management (SIEM) data to pinpoint suspicious login attempts. The ‘Respond’ function then guided our actions in containing the breach, isolating affected systems, and recovering compromised accounts. The framework’s flexibility allows adaptation to various organizational contexts and threat scenarios, ensuring a consistent and effective response.

Beyond NIST CSF, I’m also familiar with other frameworks such as ISO 27001 and the MITRE ATT&CK framework. The MITRE ATT&CK framework, in particular, is invaluable for understanding adversary tactics and techniques, providing insights into how ATO attacks might be carried out and helping us develop more effective detection and prevention strategies.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. How do you assess the risk of ATO within an organization?

Assessing ATO risk requires a multi-faceted approach. It begins with identifying assets at risk – typically user accounts with access to sensitive data or systems. We then evaluate the likelihood of a successful attack by considering factors such as the strength of passwords (or lack thereof, using MFA), vulnerability of systems, and the sophistication of potential attackers. Think of it like evaluating the security of a house – a flimsy door and unlocked windows (weak passwords, no MFA) make it an easy target. We also look at the potential impact of a successful ATO. A compromised admin account poses a much greater risk than a regular user account.

The assessment process involves:

- Vulnerability Scanning: Identifying weaknesses in systems and applications that could be exploited.

- Penetration Testing: Simulating real-world attacks to expose vulnerabilities.

- Social Engineering Assessments: Evaluating the susceptibility of employees to phishing and other social engineering tactics.

- Review of security controls: Examining the effectiveness of implemented security measures like multi-factor authentication, access controls and security awareness training.

Ultimately, the risk assessment provides a prioritized list of vulnerabilities and potential attack vectors, enabling informed decision-making about resource allocation for remediation.

Q 17. Explain your understanding of social engineering and its role in ATO.

Social engineering is manipulation designed to trick individuals into revealing sensitive information or granting access to systems. In the context of ATO, it’s a highly effective attack vector. Attackers might use phishing emails, pretending to be legitimate organizations to obtain credentials, or they might leverage pretexting – creating a false scenario to gain trust and information. Imagine a scenario where an attacker poses as IT support, calling an employee and asking for their password to ‘troubleshoot’ a problem. This is a classic example of social engineering used for an ATO.

To mitigate social engineering risks, strong security awareness training is crucial. Employees must be educated to recognize phishing attempts, understand the importance of strong password hygiene, and know who to contact if they suspect suspicious activity. Regular phishing simulations can also help assess and improve employee awareness and resilience to such attacks.

Q 18. How do you perform vulnerability assessments to identify ATO risks?

Vulnerability assessments for ATO risks involve a combination of automated and manual techniques. Automated tools scan systems for known vulnerabilities, such as weak passwords, outdated software, and misconfigurations. These tools often utilize vulnerability databases like the National Vulnerability Database (NVD) to identify potential weaknesses. Manual assessments, often performed by security professionals, focus on identifying vulnerabilities not easily detected by automated tools. This might involve reviewing system configurations, analyzing access controls, and assessing the overall security posture of the organization.

For example, automated tools might identify weak passwords or the use of default credentials. Manual assessment would involve analyzing user access rights, looking for excessive permissions or accounts with unnecessary privileges. The combination of both automated and manual techniques provides a more comprehensive view of the organization’s vulnerability landscape.

Q 19. Describe your experience with penetration testing methodologies related to ATO.

My experience encompasses various penetration testing methodologies relevant to ATO, including credential stuffing, brute-force attacks, and exploiting known vulnerabilities in authentication systems. I use ethical hacking techniques to simulate real-world attacks, attempting to compromise user accounts to identify vulnerabilities before malicious actors can exploit them. This involves testing the robustness of authentication mechanisms, password policies, and account lockout policies. For example, I might perform credential stuffing attacks, using lists of stolen credentials obtained from other breaches, to see if any of them work against the organization’s systems.

During penetration tests, I meticulously document findings, including detailed steps to reproduce the attack and recommendations for remediation. The goal is not just to find vulnerabilities but also to provide actionable insights to help organizations strengthen their security posture and prevent future ATO attempts. A comprehensive report is crucial – not just identifying weaknesses but providing prioritised recommendations and remediation steps.

Q 20. How do you monitor and analyze user behavior to detect potential ATO attempts?

Monitoring and analyzing user behavior is essential for detecting ATO attempts. This typically involves leveraging security information and event management (SIEM) systems and user and entity behavior analytics (UEBA) tools. These tools collect and analyze logs from various sources, such as authentication servers, network devices, and applications. We look for anomalies in user activity, such as unusual login locations, times, or devices. For example, a sudden login from a different country or a significant increase in failed login attempts could indicate a potential ATO attempt. Machine learning algorithms can be utilized to identify patterns and behaviors indicative of malicious activity.

Furthermore, real-time monitoring of authentication events allows for prompt response to suspicious activity, enabling a rapid containment of a potential breach. The combination of robust monitoring and advanced analytics is vital for proactive threat detection and effective response.

Q 21. What are some best practices for securing user accounts?

Securing user accounts requires a multi-layered approach, combining technical and procedural controls. Here are some best practices:

- Strong Password Policies: Enforce strong, unique passwords with minimum length and complexity requirements. Password managers can help users manage complex passwords securely.

- Multi-Factor Authentication (MFA): Implement MFA wherever possible, requiring users to provide multiple forms of authentication, such as something they know (password), something they have (phone), and something they are (biometrics). This adds a significant layer of security and makes it substantially harder for attackers to gain access, even if they obtain a password.

- Regular Security Awareness Training: Educate users on the risks of phishing, social engineering, and malware. Regular training keeps employees vigilant and updated about the latest threats.

- Access Control Management: Implement the principle of least privilege, granting users only the access they need to perform their job duties. Regularly review and update user permissions.

- Account Monitoring and Auditing: Monitor user activity for suspicious behavior and regularly audit user accounts to identify and remove inactive or unnecessary accounts.

- Password Rotation Policy: Implement regular password changes to minimize the window of vulnerability.

- Vulnerability Management Program: Implement a robust program for identifying and remediating vulnerabilities in software and systems regularly.

By implementing these best practices, organizations can significantly reduce their risk of ATOs and improve the overall security of their user accounts.

Q 22. How do you utilize logs and system monitoring tools to investigate ATO incidents?

Investigating Account Takeover (ATO) incidents relies heavily on meticulously analyzing logs and leveraging system monitoring tools. Think of these tools as a detective’s toolkit – they provide the crucial evidence to reconstruct the timeline of an attack and identify the culprit.

My process typically starts with identifying the compromised account and then working backward. I begin by examining authentication logs for suspicious activity, such as login attempts from unusual geographic locations, unexpected times of day, or using unfamiliar devices. System logs, including those from web servers, databases, and network devices, are then scrutinized for signs of unusual activity, such as failed login attempts, data exfiltration attempts, or unauthorized access to sensitive files.

- Example: If an account is accessed from multiple locations within a short timeframe, it suggests potential credential stuffing or a compromised session. Analyzing the IP addresses can reveal geographical patterns and potentially identify the attacker’s location or network.

- Security Information and Event Management (SIEM) systems are invaluable in this process, providing a centralized view of security events across the entire IT infrastructure. SIEMs allow for the correlation of events from various sources, enabling a more comprehensive picture of the attack.

- Intrusion Detection Systems (IDS) and Intrusion Prevention Systems (IPS): These systems provide real-time monitoring for malicious activity, providing alerts and logs that are vital during an ATO investigation.

By carefully correlating these logs, I can create a detailed timeline of the attack, identify the attack vector, and ultimately determine the root cause of the compromise. This information is crucial for remediation and preventing future attacks.

Q 23. Describe your experience with various authentication methods and their security implications.

Authentication methods are the gatekeepers of our systems, and their security implications are profound. A weak authentication method can be the single point of failure leading to an ATO. I’ve worked extensively with various methods, understanding their strengths and weaknesses:

- Password-based authentication: While simple, it’s vulnerable to password cracking, phishing, and credential stuffing. Multi-factor authentication (MFA) significantly strengthens it, but even then, robust password policies (length, complexity, and regular changes) are crucial.

- Multi-factor authentication (MFA): This adds an extra layer of security, requiring users to provide multiple forms of authentication, such as a password and a one-time code from an authenticator app. This drastically reduces the likelihood of successful ATOs, even with stolen credentials. I have experience implementing various MFA methods including TOTP (Time-based One-Time Passwords), U2F (Universal 2nd Factor), and biometrics.

- Biometrics: Fingerprint, facial recognition, and other biometric authentication methods offer a strong level of security when implemented correctly. However, they can be vulnerable to spoofing or data breaches if not carefully secured.

- Single Sign-On (SSO): SSO simplifies access management by allowing users to access multiple applications with a single set of credentials. However, the security of SSO relies heavily on the security of the identity provider, and a compromise of the provider can lead to a cascade of ATOs.

My experience allows me to choose the most appropriate authentication method for each specific scenario, considering the sensitivity of the data, the risk profile of the users, and the overall security posture of the organization. For example, high-value accounts might require MFA and biometric authentication, while less sensitive accounts might be sufficient with strong password policies and MFA.

Q 24. Explain your knowledge of access control models and their relevance to ATO prevention.

Access control models are the foundation of a robust ATO prevention strategy. They define who can access what resources, and under what conditions. Understanding different models is key to securing an environment. I am familiar with the following models:

- Role-Based Access Control (RBAC): Users are assigned roles, each with predefined permissions. This simplifies management and ensures that access is granted based on job function, rather than individual users. For instance, an accountant might have access to financial data, but not HR records.

- Attribute-Based Access Control (ABAC): This is a more granular approach, where access is based on attributes of the user, the resource, and the environment. This allows for more dynamic and context-aware access control. For example, access could be granted only during specific business hours or from approved locations.

- Mandatory Access Control (MAC): This is a highly restrictive model, often used in high-security environments, where access is based on security labels assigned to users and resources. It’s particularly effective in preventing data leakage but can be complex to manage.

The relevance of these models to ATO prevention is clear: By implementing a well-defined access control model and regularly reviewing and updating access permissions, organizations can limit the damage caused by a compromised account. Even if an account is taken over, the attacker will only have access to the resources permitted by that account’s role or attributes.

Q 25. What are some common techniques used to bypass MFA?

Multi-factor authentication (MFA) is a significant hurdle for attackers, but it’s not foolproof. Sophisticated adversaries employ several techniques to bypass MFA:

- SIM swapping: Attackers gain control of a victim’s mobile phone number, enabling them to receive MFA codes intended for the victim.

- Phishing and social engineering: Attackers use deceptive tactics to trick victims into revealing their MFA codes or credentials. This could involve convincing victims to share codes under false pretenses or by using convincing phishing emails.

- Credential stuffing attacks: Attackers use stolen credentials obtained from other breaches to try to access accounts. Often, these attacks leverage compromised usernames and passwords, coupled with automated attempts to guess or brute-force MFA codes.

- Exploiting vulnerabilities in MFA systems: While less common, attackers can exploit weaknesses in the implementation of MFA systems or in the underlying infrastructure to bypass the authentication process.

- Session hijacking: Attackers capture an active session’s cookies or tokens to gain unauthorized access, potentially bypassing MFA requirements.

The key to mitigating these attacks is a layered defense, including robust MFA implementation, strong security awareness training to educate users about phishing and social engineering, and proactive monitoring and detection of suspicious activity. Regular security audits of MFA systems are also crucial.

Q 26. How do you implement and manage security awareness training to mitigate ATO risks?

Security awareness training is not just a box to tick; it’s a crucial element in building a strong defense against ATOs. It empowers employees to recognize and avoid phishing attempts, malicious links, and other social engineering tactics. My approach involves a multi-faceted strategy:

- Regular training modules: We use interactive training modules focusing on real-world scenarios, demonstrating how attackers operate. These modules cover topics such as password hygiene, phishing recognition, and suspicious email identification.

- Simulated phishing campaigns: These controlled campaigns help assess the effectiveness of the training and identify vulnerabilities within the organization. They provide a safe environment to learn from mistakes without real-world consequences.

- Gamification: Introducing game-like elements in training to enhance engagement and knowledge retention. This makes learning fun and impactful.

- Tailored training: Content is tailored to specific roles and responsibilities, ensuring that employees receive relevant and targeted information. A CEO’s training needs will differ significantly from a junior employee’s.

- Continuous reinforcement: Regular reminders and updates are critical to ensure that the training remains fresh and relevant. This can involve short, regular email updates or reminders about best practices.

By actively engaging employees in security awareness programs and reinforcing the importance of security best practices, we significantly reduce the risk of human error, a major factor contributing to ATOs.

Q 27. Describe your experience working with security automation tools to improve ATO response times.

Security automation is paramount in accelerating ATO response times. Manual investigations are slow and prone to errors, particularly in large organizations. I’ve extensive experience using tools to automate various aspects of ATO response:

- Security Orchestration, Automation, and Response (SOAR) platforms: These platforms streamline security operations, automating tasks such as threat detection, incident response, and remediation. They integrate with various security tools, creating a cohesive security ecosystem.

- Automated threat intelligence feeds: Integrating with threat intelligence platforms enables automated blocking of known malicious IP addresses and URLs, preventing many ATO attempts before they even begin.

- Automated account lockout policies: Implementing automated account lockout mechanisms after a certain number of failed login attempts helps prevent brute-force attacks.

- Automated vulnerability scanning and penetration testing: Regularly scanning for vulnerabilities and conducting penetration testing identifies weaknesses that could be exploited by attackers. Automation helps ensure these tasks are conducted regularly and efficiently.

For instance, a SOAR platform can automatically detect suspicious login attempts from unusual locations, trigger an investigation, isolate the compromised account, and initiate remediation steps – all within minutes. This rapid response significantly minimizes the impact of an ATO.

Q 28. Explain how you would integrate ATO prevention measures into a company’s overall security strategy.

Integrating ATO prevention measures into a company’s overall security strategy requires a holistic and proactive approach. It’s not a standalone initiative; it’s deeply intertwined with other security functions. My approach involves:

- Risk assessment: Identifying the organization’s most valuable assets and assessing their vulnerability to ATOs. This helps prioritize security controls based on the potential impact of a compromise.

- Layered security: Implementing a layered security approach, combining multiple security controls to create a robust defense. This includes strong authentication, access control, intrusion detection, and security awareness training.

- Incident response planning: Developing a comprehensive incident response plan specifically addressing ATOs, outlining clear procedures for detection, investigation, containment, and recovery. This plan should include roles, responsibilities, and communication protocols.

- Regular security audits and penetration testing: Conducting regular security audits and penetration testing to identify weaknesses and vulnerabilities that attackers could exploit.

- Continuous monitoring and improvement: Continuously monitoring the effectiveness of security controls and making adjustments based on emerging threats and lessons learned. This involves regularly reviewing logs, analyzing security events, and keeping security systems updated.

By embedding ATO prevention measures within the broader security framework, we create a resilient security posture that proactively protects against attacks, minimizes the impact of successful compromises, and enhances the overall security of the organization.

Key Topics to Learn for Account Takeover (ATO) Interview

- Understanding ATO Vectors: Explore common attack methods like phishing, credential stuffing, malware, and social engineering. Consider the technical details and human vulnerabilities involved.

- Threat Detection and Prevention: Learn about implementing multi-factor authentication (MFA), anomaly detection systems, and behavioral biometrics. Discuss practical applications in real-world scenarios.

- Incident Response and Remediation: Understand the process of identifying, containing, and eradicating ATO incidents. Practice formulating effective response plans and communication strategies.

- Vulnerability Assessment and Penetration Testing: Explore ethical hacking techniques used to identify weaknesses in systems and processes that could lead to ATO. Discuss how to analyze and interpret findings.

- Data Loss Prevention (DLP) and Security Awareness Training: Understand the role of DLP in mitigating ATO risks and the importance of educating users about security best practices. Consider the practical implementation challenges.

- Regulatory Compliance and Legal Considerations: Familiarize yourself with relevant regulations like GDPR, CCPA, and industry-specific compliance standards related to data breaches and ATO incidents. Discuss the legal implications of ATO events.

- Security Information and Event Management (SIEM) Systems: Understand how SIEM systems are used to detect and respond to ATO attempts. Focus on log analysis, alert management, and incident correlation.

Next Steps

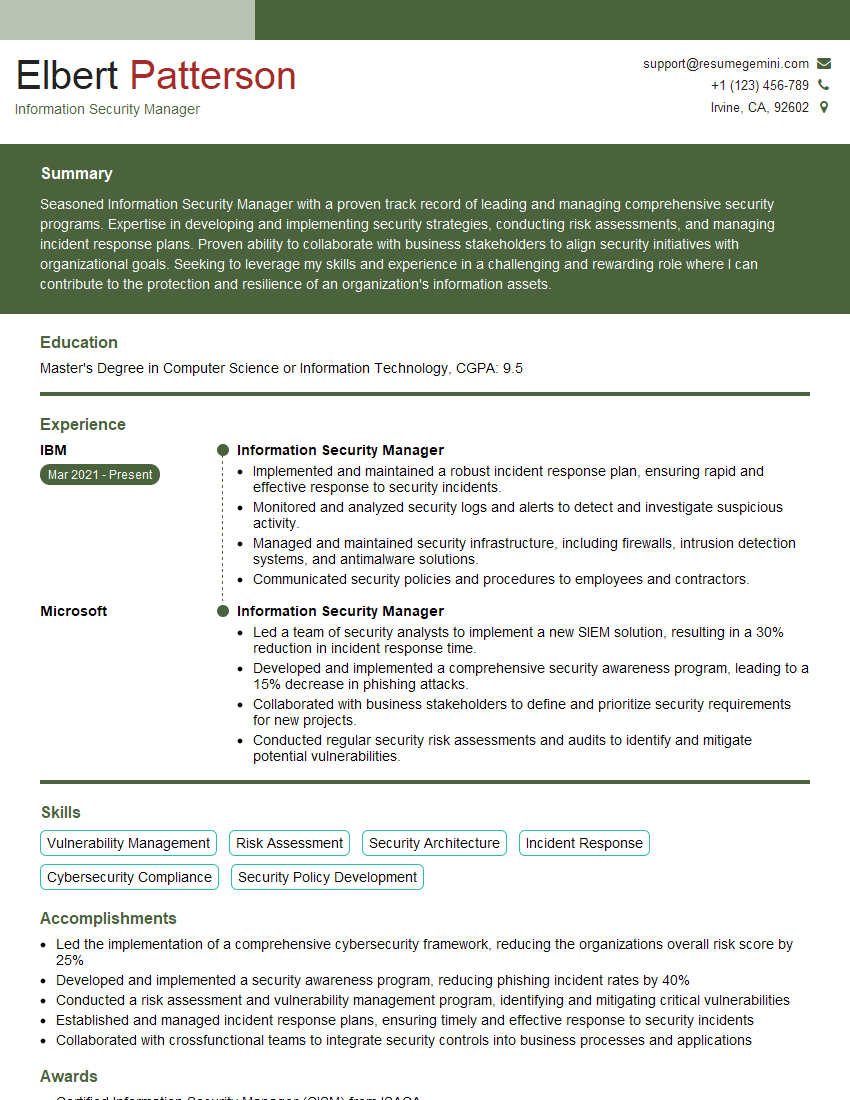

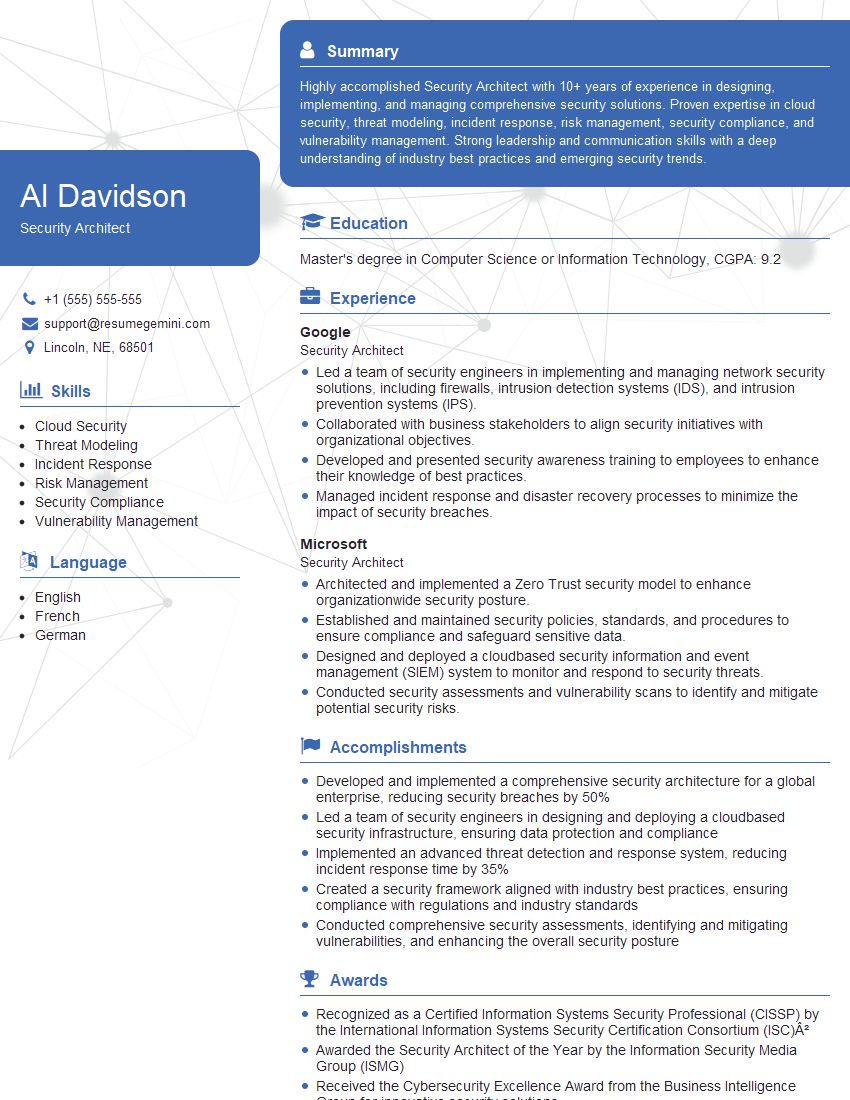

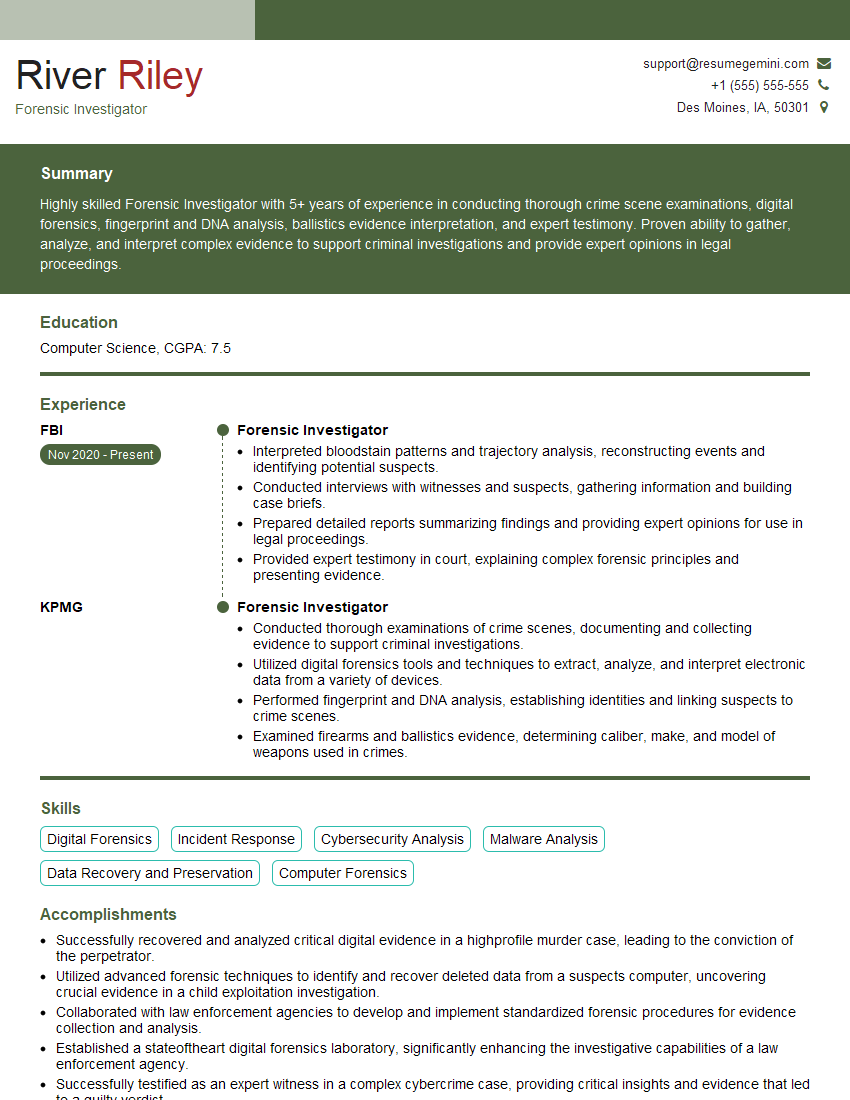

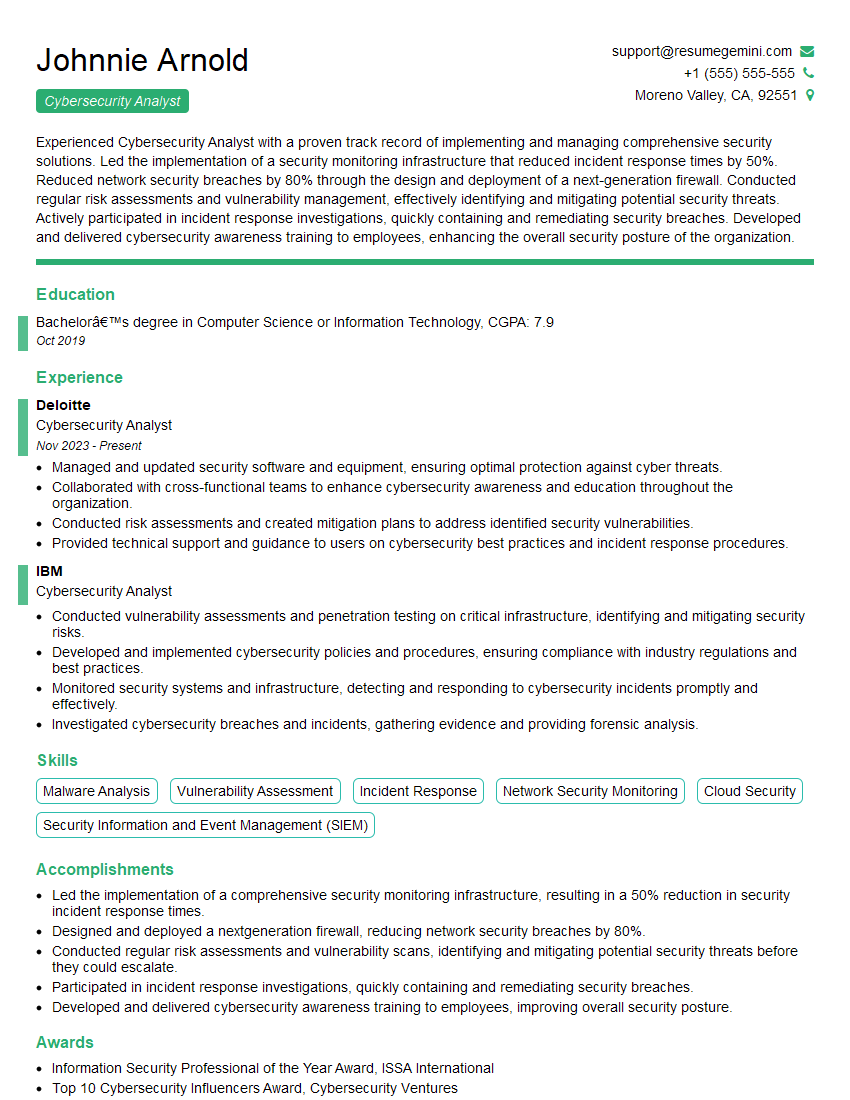

Mastering Account Takeover (ATO) security is crucial for a thriving career in cybersecurity. The demand for skilled professionals in this area is consistently high, offering excellent growth opportunities. To maximize your job prospects, invest time in crafting an ATS-friendly resume that highlights your relevant skills and experience. ResumeGemini is a trusted resource to help you build a professional and impactful resume, ensuring your qualifications stand out to recruiters. Examples of resumes tailored to Account Takeover (ATO) roles are available to guide you. Take advantage of these resources to present yourself effectively and land your dream job.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

Hi, I’m Jay, we have a few potential clients that are interested in your services, thought you might be a good fit. I’d love to talk about the details, when do you have time to talk?

Best,

Jay

Founder | CEO