Preparation is the key to success in any interview. In this post, we’ll explore crucial Adhering to Ethical and Legal Standards interview questions and equip you with strategies to craft impactful answers. Whether you’re a beginner or a pro, these tips will elevate your preparation.

Questions Asked in Adhering to Ethical and Legal Standards Interview

Q 1. Describe your understanding of the Sarbanes-Oxley Act (SOX).

The Sarbanes-Oxley Act of 2002 (SOX) is a landmark piece of legislation designed to protect investors by improving the accuracy and reliability of corporate disclosures. It was enacted in response to major corporate accounting scandals like Enron and WorldCom. SOX established stricter regulations for financial reporting, corporate governance, and internal controls.

Key aspects of SOX include: stricter rules for financial reporting, including the establishment of the Public Company Accounting Oversight Board (PCAOB) to oversee audits; increased corporate responsibility for financial reporting, placing greater emphasis on the CEO and CFO’s certification of financial statements; and stronger internal controls, requiring companies to establish and maintain robust internal control systems over financial reporting.

Think of it as a significant upgrade to the building codes for publicly traded companies, designed to prevent future collapses. Failure to comply can result in hefty fines and even criminal prosecution for executives.

Q 2. Explain the concept of ‘materiality’ in a legal and ethical context.

Materiality, in a legal and ethical context, refers to the significance of an item or event. It asks: would this information influence the decisions of a reasonable investor or other stakeholder? If the answer is yes, then it’s considered material. This concept applies to financial reporting, disclosures, and various other business operations.

For instance, a small discrepancy in office supplies wouldn’t be material, but a significant unreported debt or misstatement of revenue certainly would be. Ethically, even if something isn’t legally material, if it could damage the company’s reputation or erode trust, it’s ethically important to disclose it. The threshold for materiality can be subjective and depends on the specific context, but it’s always assessed from the perspective of a reasonable stakeholder.

Imagine a company omitting a small, insignificant expense. That’s probably not material. However, hiding a large sum of money siphoned from the company is undoubtedly material, both legally and ethically, because it materially misrepresents the financial health of the company and constitutes a serious breach of trust.

Q 3. How would you handle a situation where a colleague suggests bending company policy?

If a colleague suggests bending company policy, my first step would be to understand their reasoning and the specific situation. I would ask clarifying questions to understand the context and potential consequences. Then, I would explain why following policy is crucial – not just for legal compliance, but also for maintaining ethical integrity and protecting the company’s reputation.

If their reasoning is based on a perceived injustice or inefficiency, I’d encourage them to raise their concerns through proper channels – perhaps by suggesting improvements to the policy itself. If they persist in suggesting an unethical action, I would escalate the matter to my supervisor or the ethics hotline. Documentation of the conversation is crucial. I would not participate in any action that violates company policy or ethical standards.

It’s important to remember that protecting the company’s integrity and ethical standing is a shared responsibility. Reporting unethical behaviour is not ‘ratting’ but rather upholding ethical standards and contributing to a healthy workplace.

Q 4. What are the key components of a strong corporate ethics program?

A strong corporate ethics program is multifaceted. Key components include:

- A clearly defined code of conduct: This document should outline the company’s ethical values and expectations for employee behavior.

- Ethics training programs: Regular training helps employees understand the code of conduct and apply ethical principles in their daily work.

- Whistleblower protection: A confidential reporting mechanism allows employees to report ethical violations without fear of retaliation. This is crucial for maintaining transparency and accountability.

- Regular ethics audits: These assessments help identify areas of weakness in the ethics program and ensure its effectiveness.

- Strong leadership commitment: Ethical behavior starts at the top. Leaders must model ethical conduct and actively promote an ethical culture.

- Enforcement and accountability: There must be consequences for violating the code of conduct, and these consequences should be consistently applied.

Think of it like a strong foundation for a building. Each component is critical, and the absence of even one can compromise the entire structure’s integrity.

Q 5. Explain the difference between legal compliance and ethical conduct.

While legal compliance and ethical conduct often overlap, they are not interchangeable. Legal compliance means adhering to all applicable laws and regulations. Ethical conduct, on the other hand, goes beyond simply following the law; it involves acting in a morally right and responsible way, even when the law doesn’t explicitly prohibit a certain action.

For example, a company might legally be allowed to outsource manufacturing to a country with lax labor laws. However, ethically, they might choose not to because of concerns about worker exploitation. Legal compliance sets the minimum standard, while ethical conduct sets the higher, aspirational standard.

Legal compliance is about avoiding penalties; ethical conduct is about building trust and doing the right thing, even when it’s challenging.

Q 6. Describe your experience with conducting internal investigations.

I have extensive experience conducting internal investigations, adhering to strict confidentiality protocols and legal frameworks. My approach involves a systematic process, including:

- Defining the scope: Clearly outlining the purpose and parameters of the investigation.

- Gathering evidence: Collecting relevant documents, conducting interviews, and analyzing data, all while respecting legal privileges and maintaining proper chain of custody for physical evidence.

- Interviewing witnesses: Employing effective interviewing techniques to gather accurate and unbiased information.

- Analyzing findings: Carefully reviewing the evidence to determine the facts and draw conclusions.

- Reporting the findings: Preparing a comprehensive and objective report outlining the findings and recommendations.

In previous roles, I have investigated allegations of fraud, misconduct, and policy violations. I always strive to maintain objectivity, fairness, and due process throughout the investigative process, ensuring that all involved parties are treated respectfully and given an opportunity to provide their perspective.

Q 7. How familiar are you with the Health Insurance Portability and Accountability Act (HIPAA)?

I am very familiar with the Health Insurance Portability and Accountability Act (HIPAA). It’s a US federal law designed to protect the privacy and security of Protected Health Information (PHI). HIPAA regulations apply to covered entities, such as healthcare providers, health insurers, and healthcare clearinghouses, as well as their business associates.

Key aspects of HIPAA include the Privacy Rule, which limits the ways PHI can be used and disclosed; the Security Rule, which establishes security standards for protecting electronic PHI; and the Breach Notification Rule, which mandates notification procedures in case of a data breach. Understanding HIPAA is crucial for ensuring patient confidentiality and compliance with federal law.

Non-compliance with HIPAA can result in serious penalties, including hefty fines and reputational damage. It is essential to treat patient data with utmost care and ensure that all activities involving such data are in full compliance with the law. For example, I understand the importance of access controls, encryption, and data disposal procedures as part of effective HIPAA compliance.

Q 8. What steps would you take to ensure data privacy and security?

Data privacy and security are paramount. My approach is multifaceted and proactive, focusing on prevention and remediation. It starts with a robust framework built on several key pillars:

- Data Minimization and Purpose Limitation: Collecting only necessary data and using it solely for its intended purpose. For example, if we’re collecting email addresses for newsletter subscriptions, we wouldn’t use them for targeted advertising without explicit consent.

- Strong Access Controls: Implementing strict access control measures, using role-based access, and employing multi-factor authentication to limit access to sensitive data to only authorized personnel. This prevents unauthorized access even if credentials are compromised.

- Data Encryption: Employing encryption both in transit (while data travels across networks) and at rest (when data is stored). This renders data unintelligible to unauthorized individuals even if a breach occurs. For example, using HTTPS for secure communication and AES-256 encryption for data storage.

- Regular Security Audits and Penetration Testing: Conducting regular security assessments, vulnerability scans, and penetration testing to identify and address weaknesses in our systems before malicious actors can exploit them. This is like having a regular check-up for our data infrastructure.

- Incident Response Plan: Developing a comprehensive incident response plan that outlines steps to take in the event of a data breach or security incident. This includes protocols for containment, eradication, recovery, and notification of affected parties.

- Employee Training: Providing regular security awareness training to employees to educate them about phishing attempts, social engineering, and best practices for handling sensitive information. This fosters a security-conscious culture.

These measures are not isolated steps but interwoven components of a holistic security strategy. Continuous monitoring and improvement are crucial for maintaining robust data protection.

Q 9. How would you respond to a whistleblower report?

Responding to a whistleblower report requires a delicate balance of protecting the whistleblower and investigating the allegations thoroughly. My approach involves:

- Confidentiality and Protection: Ensuring the whistleblower’s anonymity and protection from retaliation. This might involve establishing a secure reporting channel and providing legal counsel.

- Thorough Investigation: Conducting a prompt, impartial, and thorough investigation of the allegations. This may involve interviewing witnesses, collecting evidence, and consulting with legal and ethics experts.

- Objective Assessment: Objectively assessing the evidence gathered during the investigation, avoiding bias or prejudgment. This requires a structured approach, documenting all findings and their sources.

- Appropriate Action: Taking appropriate action based on the findings of the investigation. This might include corrective measures, disciplinary actions, or reporting to relevant authorities.

- Documentation: Maintaining detailed records of the entire process, including the report itself, the investigation, findings, and actions taken. This is critical for transparency and accountability.

For example, if a whistleblower alleges accounting fraud, I would immediately initiate a confidential investigation, potentially engaging an external forensic accounting firm to maintain impartiality. The outcome would determine whether internal disciplinary action, regulatory reporting, or even legal action is warranted.

Q 10. Describe your experience with regulatory reporting requirements.

Throughout my career, I’ve been involved in regulatory reporting across various sectors, including finance and healthcare. I’m familiar with regulations like GDPR, HIPAA, and SOX. My experience encompasses:

- Data Mapping and Classification: Identifying and classifying sensitive data to ensure compliance with relevant regulations. This involves understanding what constitutes personally identifiable information (PII) and other protected data.

- Compliance Program Development: Developing and implementing compliance programs, including policies, procedures, and training materials to ensure adherence to regulations.

- Regular Reporting: Preparing and submitting required reports to regulatory bodies, ensuring accuracy, completeness, and timeliness of submissions. This might involve using specialized reporting software and maintaining detailed audit trails.

- Audits and Inspections: Participating in and responding to regulatory audits and inspections, demonstrating compliance with relevant regulations.

For instance, in a financial institution, I’d ensure compliance with anti-money laundering (AML) regulations by diligently monitoring transactions, submitting Suspicious Activity Reports (SARs) as required, and participating in audits to verify compliance. In healthcare, understanding HIPAA requirements and ensuring patient data privacy would be paramount.

Q 11. How would you assess the ethical implications of a new business venture?

Assessing the ethical implications of a new business venture requires a systematic approach. I’d use a framework that considers:

- Stakeholder Analysis: Identifying all stakeholders affected by the venture, including customers, employees, investors, communities, and the environment.

- Potential Impacts: Evaluating the potential positive and negative impacts of the venture on each stakeholder group. This might involve considering economic, social, environmental, and ethical aspects.

- Ethical Principles: Applying relevant ethical principles such as fairness, transparency, accountability, and respect for human rights to guide decision-making.

- Risk Assessment: Identifying and assessing potential ethical risks and developing mitigation strategies.

- Legal Compliance: Ensuring that the venture complies with all applicable laws and regulations.

For example, if considering a new product line that might generate substantial waste, I’d assess the environmental impact, explore sustainable alternatives, and factor in the costs of waste management and potential legal ramifications. A thorough ethical review is vital to ensuring long-term sustainability and reputation.

Q 12. How do you stay up-to-date on changes in relevant laws and regulations?

Staying updated on changes in relevant laws and regulations is crucial. My strategies include:

- Subscription to Legal and Regulatory Updates: Subscribing to newsletters, alerts, and publications from reputable legal and regulatory bodies. This provides timely notifications of changes.

- Professional Development: Participating in continuing education courses, workshops, and conferences focused on ethics and compliance. This ensures I stay abreast of the latest developments and best practices.

- Networking with Professionals: Networking with other professionals in the field to exchange knowledge and insights on emerging trends and regulatory challenges. This provides a valuable perspective from peers.

- Monitoring Regulatory Websites: Regularly reviewing the websites of relevant regulatory agencies for updates, announcements, and guidance documents.

This multi-pronged approach helps me stay informed, allowing me to proactively adapt to evolving legal and regulatory landscapes.

Q 13. Explain your understanding of conflict of interest and how to mitigate it.

A conflict of interest arises when an individual’s personal interests could potentially influence their professional judgment or actions. This can compromise objectivity and fairness. Mitigation strategies include:

- Disclosure: Openly disclosing any potential conflicts of interest to relevant parties. This promotes transparency and allows for appropriate action to be taken.

- Recusal: Recusing oneself from decisions or activities where a conflict of interest exists. This avoids any appearance of bias or impropriety.

- Independent Review: Seeking independent review of decisions or actions where a potential conflict of interest may exist. This ensures impartiality and objectivity.

- Establishing Policies and Procedures: Developing clear policies and procedures to address conflicts of interest, including guidelines for disclosure, recusal, and conflict resolution.

For instance, if a team member is evaluating a vendor in which they have a personal investment, they should disclose this information and recuse themselves from the selection process to ensure an objective and fair evaluation.

Q 14. Describe a time you had to make a difficult ethical decision. What was the outcome?

In a previous role, I faced a situation where a colleague was consistently cutting corners in their work, compromising the accuracy of reports. While this wasn’t illegal, it violated our company’s ethical standards and potentially exposed the company to reputational risk. This was difficult because this colleague was a close friend.

I initially tried to address the issue privately, explaining the potential consequences of their actions. However, the behavior continued. Ultimately, I chose to report the issue to my supervisor, following our company’s established whistleblowing procedure. This was a challenging decision, but I felt it was necessary to uphold ethical standards. The outcome was that a formal investigation was conducted, leading to corrective actions and additional training for the colleague. While the friendship was strained initially, over time, we were able to repair our relationship, and the colleague learned a valuable lesson about professional responsibility.

Q 15. How would you handle a situation where a superior asks you to perform an unethical action?

Facing a request from a superior to perform an unethical action is a serious ethical dilemma. My approach would be guided by a framework prioritizing integrity and legal compliance. First, I would politely but firmly express my concerns, explaining why the requested action violates my ethical principles and potentially relevant laws or regulations. I’d try to understand the reasoning behind the request to see if a mutually acceptable alternative solution exists that aligns with ethical and legal standards.

If my concerns are dismissed and the unethical pressure persists, I would escalate the matter. Depending on the severity and organizational structure, this could involve reporting to a higher authority within the company, such as the ethics officer or legal department. Ultimately, if internal channels fail to address the issue, I would consider seeking external advice or reporting the matter to the appropriate regulatory bodies. Protecting my integrity and adhering to the law is paramount.

For example, if a superior asked me to falsify data in a report to meet a sales target, I would explain the serious legal and ethical implications of such an action, highlighting the potential consequences for the company and myself. I would propose alternative strategies to achieve the sales target ethically and legally.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. What are the potential consequences of non-compliance with relevant regulations?

Non-compliance with relevant regulations can lead to a wide range of severe consequences, impacting both the organization and individuals involved. These consequences can be financial, legal, and reputational.

- Financial Penalties: Organizations can face hefty fines and penalties, potentially impacting profitability and shareholder value. The amount varies widely depending on the severity of the violation and the regulatory body involved.

- Legal Action: This can include lawsuits, injunctions, and even criminal charges against both the company and employees. This can lead to significant legal costs and potentially imprisonment.

- Reputational Damage: Non-compliance can severely damage an organization’s reputation, leading to a loss of customer trust, difficulty attracting and retaining talent, and negative media coverage. This reputational damage can be long-lasting and difficult to repair.

- Loss of Licenses or Permits: In some industries, non-compliance can lead to the revocation of operating licenses or permits, forcing the company to cease operations.

- Contractual Issues: Non-compliance can lead to breach of contract claims and difficulties securing future contracts.

For instance, a company failing to comply with data privacy regulations like GDPR could face substantial fines and damage to its reputation, potentially leading to a loss of customers who value their data privacy.

Q 17. What is your understanding of intellectual property rights?

Intellectual property (IP) rights are the legal rights granted to the creators of original works, allowing them exclusive control over the use and distribution of their creations. This includes various forms of IP such as:

- Patents: Protect inventions and innovations.

- Copyrights: Protect original artistic and literary works, including books, music, and software.

- Trademarks: Protect brand names and logos.

- Trade Secrets: Protect confidential information that gives a business a competitive edge.

Understanding IP rights is crucial for ensuring ethical and legal conduct in business. Respecting these rights involves obtaining proper licenses or permissions before using copyrighted material or patented inventions. It also necessitates protecting one’s own IP through registration and appropriate legal measures. Failure to do so can result in costly infringement lawsuits.

For example, using a copyrighted image on a company website without permission is an infringement and can lead to legal repercussions. Similarly, manufacturing a product that infringes on an existing patent can result in significant financial penalties.

Q 18. How would you implement an ethics training program for employees?

Implementing an effective ethics training program requires a multi-faceted approach. It should be tailored to the specific needs and culture of the organization, focusing on practical application rather than simply theoretical knowledge.

- Needs Assessment: Begin with a thorough assessment to identify existing ethical challenges and gaps in understanding. This can involve surveys, interviews, and reviews of past incidents.

- Program Design: Develop a program that includes interactive modules, case studies, and scenarios relevant to employees’ roles and responsibilities. This should cover relevant laws, regulations, company policies, and ethical decision-making frameworks.

- Delivery Methods: Offer training through a variety of formats, including online modules, workshops, and in-person sessions, catering to diverse learning styles.

- Ongoing Reinforcement: Ethics training shouldn’t be a one-time event. Reinforce the learning through regular reminders, updates on new regulations, and ongoing opportunities for ethical discussion and problem-solving.

- Assessment and Feedback: Include assessments to gauge employee understanding and provide feedback for improvement. Track participation and effectiveness to ensure the program is meeting its objectives.

- Leadership Buy-in: Ensure that leadership actively promotes and participates in the ethics program, demonstrating a commitment to ethical conduct throughout the organization.

A successful program might include role-playing scenarios where employees practice navigating ethical dilemmas and receive feedback on their responses.

Q 19. Explain your understanding of anti-bribery and anti-corruption laws (e.g., FCPA).

Anti-bribery and anti-corruption laws, such as the Foreign Corrupt Practices Act (FCPA) in the US, aim to prevent businesses from engaging in bribery or corrupt practices to gain an unfair advantage. The FCPA prohibits US companies and individuals from bribing foreign officials to obtain or retain business. These laws also often cover other forms of corruption such as extortion, embezzlement, and money laundering.

Understanding these laws involves knowing the prohibited activities, the potential penalties for non-compliance (which can include significant fines and imprisonment), and the importance of maintaining robust internal controls and compliance programs. A strong compliance program includes implementing policies, training employees, and conducting regular audits to ensure compliance. Due diligence in selecting business partners is also crucial to mitigate corruption risks.

For example, offering a foreign official a significant gift or payment in exchange for a government contract would be a clear violation of the FCPA. Likewise, failing to implement a robust anti-bribery and anti-corruption program can expose a company to significant legal and financial risks.

Q 20. Describe your experience with contract review and negotiation.

My experience with contract review and negotiation involves a thorough process designed to protect the interests of my organization while maintaining ethical and legal compliance. This includes:

- Careful Review: I meticulously examine contracts for clarity, completeness, and adherence to applicable laws and regulations. I pay particular attention to clauses concerning liability, payment terms, intellectual property rights, and confidentiality.

- Risk Assessment: I identify potential risks and liabilities associated with the contract and propose mitigation strategies.

- Negotiation: I engage in constructive negotiation with the other party to achieve mutually acceptable terms, ensuring our organization’s interests are adequately protected.

- Documentation: I maintain comprehensive documentation of all negotiations and agreements, creating a clear and auditable record.

- Legal Advice: When necessary, I seek advice from legal counsel to ensure complex legal aspects are properly addressed.

For instance, I have negotiated contracts that included clauses protecting our organization’s intellectual property rights and limiting our liability in case of unforeseen circumstances. I’ve also successfully renegotiated unfavorable contract terms to ensure a more balanced agreement.

Q 21. How familiar are you with GDPR (General Data Protection Regulation)?

The General Data Protection Regulation (GDPR) is a comprehensive data privacy regulation in the European Union. It aims to give individuals more control over their personal data and places significant obligations on organizations that process personal data. My understanding of GDPR encompasses its key principles, including:

- Lawfulness, fairness, and transparency: Data processing must have a legal basis and be transparent to individuals.

- Purpose limitation: Data must be collected for specified, explicit, and legitimate purposes.

- Data minimization: Only necessary data should be collected.

- Accuracy: Data should be accurate and kept up to date.

- Storage limitation: Data should be kept only as long as necessary.

- Integrity and confidentiality: Data should be processed securely and confidentially.

- Accountability: Organizations are responsible for demonstrating compliance.

Compliance with GDPR involves implementing technical and organizational measures to protect personal data, providing individuals with rights regarding their data (such as the right of access, rectification, and erasure), and notifying competent authorities of data breaches. Non-compliance can result in significant fines.

For example, a company must obtain explicit consent before collecting and processing personal data. It must also implement appropriate security measures to prevent unauthorized access or disclosure of personal data.

Q 22. What is your approach to risk assessment and mitigation in relation to ethical and legal issues?

My approach to risk assessment and mitigation regarding ethical and legal issues is systematic and proactive. It begins with identifying potential risks. This involves analyzing our operations, considering relevant laws and regulations (like data privacy laws, anti-bribery acts, etc.), and understanding industry best practices. I then evaluate the likelihood and potential impact of each identified risk. For instance, a data breach has a high impact and may be relatively likely if security protocols are weak. A minor violation of company policy might have a low impact.

Mitigation strategies are then developed based on the risk assessment. High-impact, high-likelihood risks demand robust mitigation measures, such as comprehensive security training and robust data encryption. Lower-risk scenarios may only require updated policies or minor process improvements. The effectiveness of mitigation strategies is regularly monitored and adjusted as needed. This process utilizes a framework, often documented in a formal risk register, to track identified risks, their likelihood and impact, and implemented mitigation plans. This ensures transparency and accountability.

Q 23. How would you handle a situation where there is a conflict between company policy and personal values?

Conflicts between company policy and personal values are delicate situations requiring careful consideration. My first step would be to thoroughly understand both sides of the conflict. I’d examine the company policy to understand its rationale and legal basis. Simultaneously, I’d reflect on my personal values and whether they are based on firmly held ethical principles or mere personal preference. If possible, I would seek clarification on the policy’s intent or interpretation from my supervisor or ethics officer.

If the conflict remains unresolved after clarification, I’d consider whether alternative solutions could resolve the conflict. If an ethical compromise isn’t possible, I’d carefully document the situation, outlining my concerns and the steps I took to resolve the conflict. In extreme cases where the company policy violates fundamental ethical principles or the law, I may be compelled to escalate the issue to higher authorities, or even consider alternative employment. Open communication and careful documentation are crucial to navigating such situations professionally and ethically.

Q 24. Explain the role of an ethics committee or board.

An ethics committee or board plays a vital role in ensuring ethical conduct within an organization. They act as an independent body providing guidance, oversight, and decision-making on complex ethical issues. Their responsibilities typically include developing codes of conduct, reviewing and investigating ethical complaints, providing advice on ethical dilemmas, and ensuring compliance with relevant laws and regulations. They serve as a neutral and objective party to consider ethical conflicts, often offering mediation and dispute resolution services. Think of them as the organization’s ethical conscience, helping to prevent ethical breaches and fostering a culture of integrity.

Their composition is key; ideally, they comprise members with diverse backgrounds, expertise, and perspectives – including legal, compliance, HR, and independent outside members. This ensures a comprehensive and objective approach to ethical considerations.

Q 25. How would you determine if a particular business decision is ethically sound?

Determining the ethical soundness of a business decision requires a multi-faceted approach. I typically apply a framework that considers various ethical perspectives. For example, I would examine the decision’s impact using frameworks such as utilitarianism (does it maximize overall good?), deontology (does it adhere to moral duties and principles?), and virtue ethics (does it align with virtues like honesty and fairness?).

I also consider the stakeholders affected by the decision—employees, customers, shareholders, community, and the environment. What are the potential benefits and harms to each stakeholder group? Transparency and fairness are vital aspects of ethical decision-making, therefore I assess whether the decision is transparent and its rationale clearly understood. Finally, legal compliance is a must. A decision might be ethically sound in some ways but still illegal. Therefore, a thorough legal review is crucial.

Q 26. Describe your understanding of environmental, social, and governance (ESG) factors.

Environmental, Social, and Governance (ESG) factors are non-financial considerations that increasingly influence investment decisions and overall business strategy. Environmental factors encompass a company’s impact on the environment, including its carbon footprint, waste management, and resource consumption. Social factors relate to a company’s relationships with its employees, customers, suppliers, and the wider community; considering labor practices, diversity and inclusion, human rights, and community engagement. Governance factors focus on a company’s leadership, executive pay, risk management, and internal controls.

Investors and stakeholders are increasingly scrutinizing ESG performance, recognizing that these factors are crucial to long-term sustainability and profitability. Strong ESG performance signals good management and reduced risk, while poor performance can lead to reputational damage, financial penalties, and difficulty attracting investors and talent. Integrating ESG into business strategy isn’t just ethically sound, it also enhances resilience and long-term value creation.

Q 27. How would you build a culture of ethics and compliance within an organization?

Building a culture of ethics and compliance requires a multi-pronged approach. First, it starts at the top – leadership must visibly champion ethical conduct and demonstrate a commitment to integrity in all aspects of their work. This sets the tone for the organization. A robust code of ethics clearly outlining ethical principles and expectations should be developed and regularly communicated to all employees. This needs to be more than just a document; employees should understand how it applies to their daily work.

Comprehensive ethics training is essential to educate employees on ethical dilemmas and decision-making frameworks. Regular ethics updates and refresher training are important as legal and ethical landscapes change. Mechanisms should be in place for reporting ethical concerns – whistleblowing mechanisms – where employees can report violations without fear of retaliation. Transparency and accountability are also crucial; investigations of ethical violations should be thorough and fair, and consequences should be applied consistently. Finally, actively celebrating ethical conduct and recognizing employees who demonstrate strong ethical behavior reinforces the desired culture.

Key Topics to Learn for Adhering to Ethical and Legal Standards Interview

- Understanding Ethical Frameworks: Explore various ethical theories (e.g., utilitarianism, deontology) and their application in professional contexts. Consider how these frameworks inform decision-making in ambiguous situations.

- Legal Compliance: Review relevant laws and regulations pertaining to your industry. Focus on practical application, such as understanding data privacy laws (e.g., GDPR, CCPA) and intellectual property rights.

- Conflict of Interest Management: Learn how to identify, analyze, and mitigate potential conflicts of interest. Practice articulating strategies for transparent and ethical conduct in challenging scenarios.

- Whistleblowing and Reporting Mechanisms: Understand the importance of reporting unethical or illegal activities. Familiarize yourself with internal reporting procedures and external avenues for reporting.

- Data Privacy and Security: Explore best practices for handling sensitive information and protecting data from breaches. Understand the ethical and legal implications of data collection, storage, and use.

- Professional Codes of Conduct: Research and understand the ethical codes relevant to your profession. Prepare examples of how you have adhered to these codes in past experiences.

- Case Studies and Scenarios: Practice analyzing hypothetical ethical dilemmas and developing solutions that align with both ethical principles and legal requirements. Consider the consequences of different actions.

Next Steps

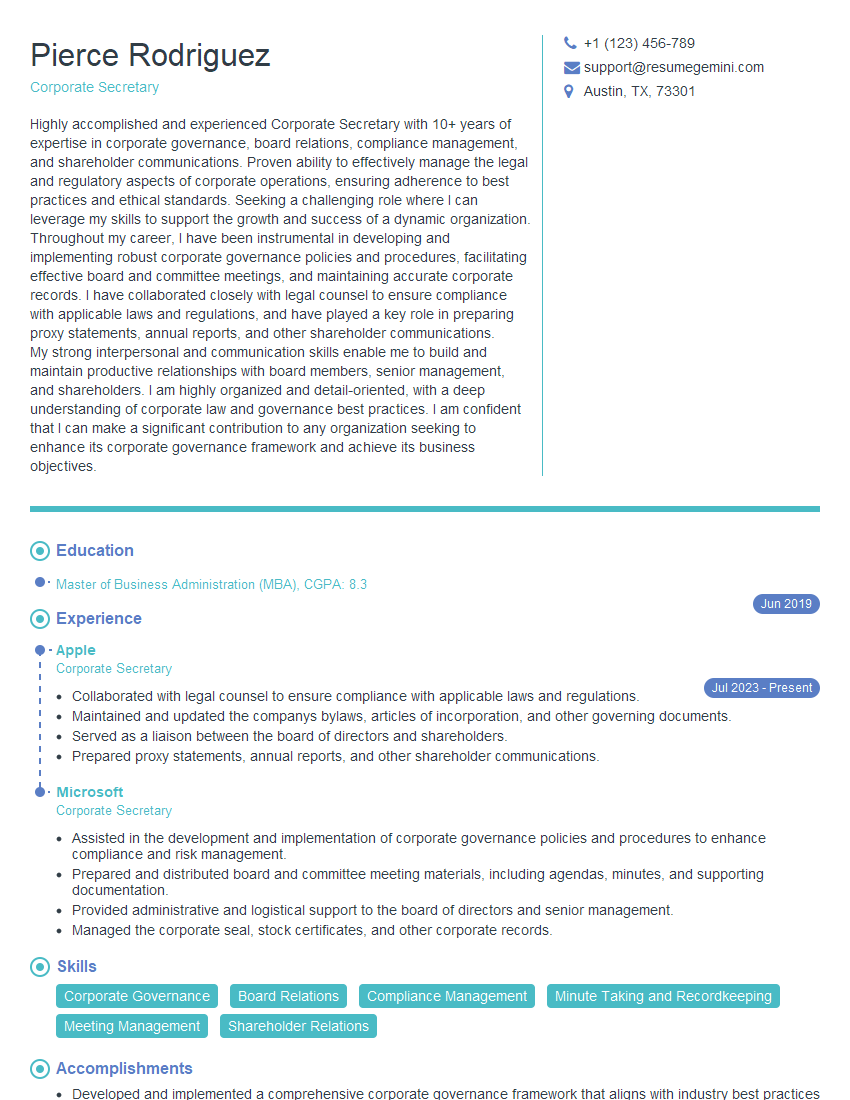

Mastering ethical and legal standards is crucial for career advancement. Demonstrating a strong commitment to integrity builds trust with employers and clients, opening doors to greater responsibility and opportunities. To maximize your job prospects, create an ATS-friendly resume that highlights your ethical awareness and relevant skills. ResumeGemini is a trusted resource to help you build a professional resume that showcases your strengths effectively. Examples of resumes tailored to showcasing expertise in Adhering to Ethical and Legal Standards are available, allowing you to see how to best present your qualifications.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

Hi, I’m Jay, we have a few potential clients that are interested in your services, thought you might be a good fit. I’d love to talk about the details, when do you have time to talk?

Best,

Jay

Founder | CEO