Feeling uncertain about what to expect in your upcoming interview? We’ve got you covered! This blog highlights the most important Lien Searches interview questions and provides actionable advice to help you stand out as the ideal candidate. Let’s pave the way for your success.

Questions Asked in Lien Searches Interview

Q 1. Explain the different types of liens.

Liens are claims against a property, essentially a legal right to seize the property to satisfy a debt. There are many types, but some of the most common include:

- Mechanic’s Liens: Filed by contractors, subcontractors, material suppliers, etc., for unpaid work or materials provided to improve real property. Think of a roofer who isn’t paid for their work – they can file a mechanic’s lien.

- Tax Liens: Placed on property due to unpaid property taxes. These are typically filed by the government at the local, state, or federal level.

- Judgment Liens: Arise from court judgments where a creditor wins a lawsuit and is awarded money. If the debtor doesn’t pay, the creditor can place a lien on their property to recover the debt. For example, if someone loses a car accident lawsuit, a judgment lien could be placed on their house.

- Mortgage Liens: The most common type, securing a loan used to purchase or improve real estate. Your mortgage is essentially a lien on your property.

- Attachment Liens: A pre-judgment lien that allows a creditor to secure a claim against property while a lawsuit is pending. This is a preventative measure to protect the creditor’s interests.

Understanding the different types is crucial because each has specific filing requirements, priorities (who gets paid first in case of multiple liens), and enforcement procedures.

Q 2. Describe the process of conducting a lien search.

Conducting a lien search involves systematically checking public records to identify any liens against a specific property. The process typically involves these steps:

- Identify the property: Obtain the property’s legal description (address, parcel number, etc.).

- Determine the relevant jurisdictions: Liens can be filed at the county, state, or even federal level, depending on the type of lien. You need to search each relevant jurisdiction’s records.

- Access the appropriate databases: This might involve visiting county recorder’s offices, using online search portals, or engaging specialized lien search companies.

- Search the records: Use the property’s legal description to search for recorded liens. Pay close attention to the lien’s filing date, amount, and type.

- Review and document the results: Carefully review all found liens, noting key details and making copies of relevant documents. This information needs to be accurately documented.

- Interpret the findings: Analyze the results to understand the potential impact of the liens on the property’s value and ownership.

It’s a meticulous process requiring attention to detail and a solid understanding of property records.

Q 3. What databases do you typically use for lien searches?

The databases used for lien searches vary by location, but common sources include:

- County Recorder’s Offices: The primary source for most liens, particularly mechanic’s liens and mortgages. Many counties now offer online access.

- State Tax Agencies: For tax liens, you’ll need to check with the relevant state’s tax agency.

- Federal Court Records: For federal tax liens or liens arising from federal court judgments.

- Commercial Lien Search Companies: These companies aggregate data from multiple sources and offer comprehensive search services. They are often used for large-scale projects or when speed is critical.

- Online Property Search Portals: Some online platforms offer property records including liens, though it’s wise to cross-check with official sources.

The choice of database depends on the specific lien type, location, and the level of detail required.

Q 4. How do you verify the accuracy of lien search results?

Verifying the accuracy of lien search results is paramount. Several steps help ensure accuracy:

- Cross-referencing: Compare results from multiple databases or sources. Inconsistencies should be investigated.

- Document review: Review the original lien documents themselves. Confirm details like the lien amount, filing date, and property description.

- Contacting relevant parties: If discrepancies exist, contact the county recorder’s office or the lien holder to clarify the information.

- Using reputable sources: Utilize established and trusted databases and search companies.

- Understanding lien lifecycles: Be aware that liens can be released or satisfied. Check for any releases or satisfaction documents.

Accuracy is not just important for legal compliance; it also protects against financial losses. Inaccurate information could lead to costly mistakes.

Q 5. What are the legal implications of an incomplete lien search?

An incomplete lien search carries significant legal and financial risks. For example:

- Financial losses: Uncovered liens could result in the loss of a property investment or create unexpected financial burdens.

- Legal disputes: Failure to disclose known liens can lead to lawsuits and legal challenges, potentially causing significant financial damage and reputational harm.

- Breach of contract: In some transactions (e.g., real estate sales), an incomplete lien search might be a breach of contract if it’s considered a material omission of information.

- Title issues: Unresolved liens can cloud a property title, making it difficult or impossible to sell or refinance.

A thorough and accurate search is a fundamental aspect of due diligence, and the consequences of negligence can be severe.

Q 6. Explain the difference between a mechanic’s lien and a tax lien.

While both are liens placed on property, they differ significantly:

- Mechanic’s Lien: Secures payment for labor, services, or materials provided to improve real property. It’s filed by contractors, subcontractors, or suppliers who haven’t been paid for their work. These are specific to the improvement project.

- Tax Lien: Secures payment of property taxes owed to a governmental entity. It’s not related to a specific improvement project but arises from the owner’s failure to pay taxes on the property itself.

The key difference lies in the origin of the debt: one is for improvements, the other for unpaid taxes. This impacts the priority of the lien, filing procedures, and the parties involved.

Q 7. How do you handle conflicting lien information?

Conflicting lien information requires careful investigation and resolution. Steps to take include:

- Verify the information: Cross-reference the conflicting information with multiple sources to ensure accuracy. Original documents are critical.

- Determine the lien priority: Lien priority typically follows a ‘first-to-file’ rule, meaning the oldest lien generally takes precedence. However, some liens (like tax liens) may have super-priority.

- Contact lien holders: Communicate with the parties involved to clarify the discrepancies. Obtain documentation supporting their claims.

- Consult legal counsel: In complex cases, it’s advisable to seek legal advice to determine the best course of action.

- Document everything: Meticulously document all steps taken, including communication with parties, findings, and decisions made. This is crucial for legal protection.

Resolving conflicting lien information requires a systematic approach, a deep understanding of lien law, and, when necessary, professional legal assistance.

Q 8. How do you prioritize lien searches in a high-volume environment?

Prioritizing lien searches in a high-volume environment requires a strategic approach focusing on efficiency and accuracy. Think of it like a triage system in a hospital – the most critical cases get addressed first. We prioritize based on several factors:

- Urgency: Closings with imminent deadlines take precedence. These are time-sensitive and delays can be costly.

- Risk Assessment: Searches for properties with known complexities (multiple owners, extensive history) or high-value transactions are prioritized to mitigate potential issues.

- Client Importance: High-value clients or those with a history of timely payment may receive preferential treatment.

- Workflow Management: Using a robust workflow management system allows us to track progress, assign tasks efficiently, and identify bottlenecks. This could include using a Kanban board or a dedicated project management software.

For example, imagine we have three searches: a small residential refinance due tomorrow, a large commercial property purchase with a complicated ownership structure, and a standard residential sale next week. We’d prioritize the refinance first (high urgency), followed by the commercial property (high risk), and lastly the standard residential sale (lower urgency and risk).

Q 9. Describe your experience with different lien search software or platforms.

My experience with lien search software spans various platforms, each with its strengths and weaknesses. I’ve worked with both proprietary systems offered by title companies and third-party vendors. Some examples include (but aren’t limited to) LexisNexis, CoreLogic, and proprietary systems offered by individual title agencies. These systems vary in their search capabilities, data sources, and user interfaces.

For instance, one system might excel in providing a detailed visual representation of the property’s ownership history, while another might be superior in its ability to identify specific types of liens (e.g., mechanics’ liens, tax liens). Choosing the right software often depends on the specific needs of the client or company; factors to consider include the type of properties frequently searched, the required level of detail, and integration with other systems. A robust system should allow for automated report generation, facilitate easy data export, and support thorough auditing capabilities.

Q 10. How do you interpret lien release documents?

Interpreting lien release documents requires meticulous attention to detail. It’s crucial to verify that the document is authentic and accurately reflects the intended release. This involves several steps:

- Verification of Signatures: Ensure all signatures are properly notarized and match the parties involved in the original lien.

- Confirmation of Lien Details: The release must explicitly identify the lien being released, including the lien number, date of filing, and amount.

- Payment Confirmation: Verify the release states that the underlying debt has been fully satisfied. This might involve examining a separate proof of payment document.

- Check for Conditions: Some releases may be conditional, meaning the release is only valid upon the fulfillment of certain obligations. These conditions need to be identified and verified.

- Review for Errors: Thoroughly review the document for any inconsistencies, spelling errors, or ambiguities that could affect its validity.

Imagine a situation where a release document misspells the property’s address. This could create confusion and potentially invalidate the release. It’s our responsibility to identify such issues and prevent them from affecting title insurance or other processes dependent on the validity of the release.

Q 11. What is the statute of limitations for filing various types of liens?

The statute of limitations for filing various types of liens varies significantly by jurisdiction and the type of lien. There is no single universal timeframe. It’s crucial to know the specific laws of the state and county where the property is located.

For example, a mechanic’s lien might have a much shorter statute of limitations (e.g., 90 days to file) than a tax lien (which may be several years). Similarly, the time frame for taking action to enforce a lien after filing might also differ significantly. I always consult the relevant state statutes and court rules to determine the precise limitations, relying on up-to-date legal resources. Failure to meet these deadlines can result in the lien becoming unenforceable. It’s a critical aspect of lien search analysis to prevent potential issues with title and subsequent property transactions.

Q 12. Explain the importance of chain of title in lien searches.

The chain of title is a historical record of ownership transfers for a property. It’s fundamentally important in lien searches because it shows who owned the property at the time each lien was filed and if the lien has been transferred to a subsequent owner. Think of it like a family tree for a property – showing all the owners going back in time. Without the chain of title, it is impossible to determine whether the lien is properly attached to the present property owner or to a previous owner.

For example, if a lien was filed against a property 10 years ago, and the property has changed hands three times since then, the chain of title will reveal whether the current owner is responsible for the debt. If the chain shows that the current owner didn’t own the property when the lien was filed and the lien wasn’t transferred to them, they would likely not be legally responsible. A gap or missing link in the chain of title could raise red flags and warrants further investigation. It’s an essential step in ensuring the accuracy of our lien analysis and legal conclusions.

Q 13. How do you ensure compliance with relevant regulations when conducting lien searches?

Compliance is paramount in lien searches. We must adhere to federal and state regulations, such as the Fair Credit Reporting Act (FCRA) and any state-specific laws concerning data privacy and information security. Our processes include:

- Data Security Protocols: We use secure systems to store and transmit sensitive information, complying with data encryption standards and access control measures.

- Accuracy and Reliability: We rely on reputable data sources and employ rigorous quality control checks to ensure the accuracy of our searches and reports. We maintain documentation and audit trails of our processes.

- Confidentiality: All client data is treated as strictly confidential and is only accessed by authorized personnel. We comply with all confidentiality and privacy obligations.

- Continuing Education: Staying up-to-date on relevant laws and regulations is crucial, through professional development courses and monitoring legal updates.

For instance, if we identify a potential violation of the FCRA during a search, we immediately take corrective action to prevent any negative impact on the affected individual and ensure that our processes comply with the regulations.

Q 14. What are the common errors to avoid when conducting a lien search?

Several common errors can undermine the accuracy of a lien search. Avoiding these pitfalls is essential for maintaining professional standards and protecting clients from potential financial losses.

- Incomplete Searches: Failing to search all relevant jurisdictions or databases can lead to missed liens. A systematic approach is crucial, utilizing multiple data sources and cross-checking information.

- Misinterpretation of Documents: Incorrectly interpreting lien documents due to lack of knowledge or attention to detail could lead to erroneous conclusions.

- Ignoring Statues of Limitations: Overlooking the statutes of limitations for filing and enforcing liens can lead to inaccurate assessments of the lien’s validity.

- Data Errors and Outdated Information: Relying on outdated or inaccurate data sources results in unreliable findings. Regularly updating data sources is essential.

- Lack of Proper Documentation: Insufficient or unclear documentation makes the search process difficult to track and review. Thorough documentation is crucial for verification and error prevention.

Imagine a scenario where a lien is missed because only one database is used in the search. This oversight can have significant implications for the client, highlighting the importance of rigorous and thorough search processes.

Q 15. How do you handle a situation where a lien is discovered after a closing?

Discovering a lien after closing is a serious issue, potentially leading to significant financial and legal repercussions for all parties involved. The first step is to immediately identify the type of lien, the lienholder, and the amount owed. This often requires a thorough review of all previously obtained title documents and a supplemental lien search.

Next, we need to determine the validity of the lien. Was it properly filed and recorded? Was there a procedural error? Depending on the state’s laws and the nature of the lien (e.g., mechanic’s lien, tax lien), the validity can be challenged. This might involve legal counsel to negotiate with the lienholder or initiate legal action to have the lien removed.

Finally, we explore solutions. This could involve the buyer, seller, or even the closing agent contributing funds to satisfy the lien, potentially leading to financial disputes among parties. A strong understanding of relevant state statutes and case law is paramount in determining the best path forward and mitigating potential losses.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. Describe a situation where you had to investigate a complex lien issue. What was your approach?

I once encountered a complex lien issue involving a commercial property with multiple overlapping liens. There were mechanic’s liens from several contractors, a tax lien, and a judgment lien, all filed at different times and with varying degrees of clarity. My approach was systematic and meticulous.

First, I meticulously documented each lien: the type of lien, the date of filing, the amount claimed, the lienholder’s details, and any associated court documents. Then, I prioritized the liens based on their priority – understanding that the chronological order of filing and their type significantly affect payment order. I reviewed each lien’s supporting documentation for accuracy and compliance with state laws.

I created a detailed timeline of events to visualize the relationships between the liens and potential overlapping claims. This visual representation helped us identify potential conflicts and strategic points to address. Finally, I consulted with legal counsel to assess the validity and prioritization of each lien and the potential legal implications of each scenario to devise the most effective resolution strategy for our client.

Q 17. How do you stay updated on changes in lien laws and regulations?

Staying abreast of changes in lien laws and regulations requires a multi-faceted approach. I regularly subscribe to legal updates and newsletters from reputable sources specializing in real estate law. I also actively participate in professional development activities, attending seminars and webinars focused on lien law changes and best practices. This is critical as lien laws vary significantly state by state and are constantly being amended.

Furthermore, I maintain a network of colleagues and legal professionals, exchanging information and insights on recent developments. I also actively monitor legislative changes at the state level through official government websites and legal databases. This combination of proactive learning and networking ensures I remain a knowledgeable and dependable resource for my clients.

Q 18. What is your experience with different types of property (residential, commercial)? How does this affect lien searches?

My experience encompasses both residential and commercial property lien searches. While the fundamental principles remain the same, the scope and complexity differ significantly. Residential searches usually involve fewer records and stakeholders. Commercial properties, particularly large developments, may involve numerous parties, such as general contractors, subcontractors, material suppliers, and numerous governmental agencies, greatly increasing the complexity of the search and the potential number of liens.

Commercial lien searches also often involve reviewing UCC filings (Uniform Commercial Code) related to financing, which are less relevant in residential searches. The types of liens encountered also vary. For example, mechanic’s liens are common in both contexts but construction lien issues in commercial projects are significantly more intricate and legally demanding. My experience allows me to tailor my search strategy and level of scrutiny to the specific property type.

Q 19. How familiar are you with UCC filings and their relevance to lien searches?

I am very familiar with UCC filings. The Uniform Commercial Code (UCC) is a set of laws that govern commercial transactions, including secured transactions. A UCC filing is a public record indicating a secured interest in personal property. This is especially crucial in lien searches for commercial properties because these filings can reveal security interests in equipment or inventory—which can be subject to liens if not properly paid. For example, a company that leases or finances equipment for a commercial project might have a security interest in that equipment which would need to be considered during the search.

In a lien search context, if a company financing equipment for a project fails to pay its creditors, those creditors could file a lien against the equipment. Therefore, incorporating UCC searches into commercial property lien searches is crucial in order to ensure a complete understanding of potential encumbrances on a property.

Q 20. How would you explain the concept of a lien search to a non-technical audience?

Imagine buying a house. A lien search is like a background check for the property. It’s a thorough investigation to uncover any outstanding debts or claims against the property that could affect your ownership. Think of it as uncovering any hidden financial baggage. These debts could be unpaid taxes, construction bills (mechanics liens), or court judgments.

If a lien exists, it means someone claims they’re owed money from the property’s owner, and they could seize or sell the property to recover their debt. A lien search helps you avoid this risk and ensures a clear title, protecting your investment. It provides peace of mind knowing there are no hidden financial liabilities before you finalize the purchase.

Q 21. How do you maintain confidentiality of lien search information?

Maintaining the confidentiality of lien search information is paramount. We adhere to strict privacy policies and data protection regulations. Access to our database and search results is restricted to authorized personnel only, with individual user access tracked and audited. All sensitive data is encrypted both in transit and at rest.

We utilize secure data storage and transmission methods, and we routinely update our security protocols to meet evolving threats. We also implement strict access controls and regularly train our staff on data security best practices and ethical considerations. We only share information with authorized individuals on a need-to-know basis and in compliance with all applicable laws and regulations.

Q 22. What is your experience working with different record keeping systems?

My experience encompasses a wide range of record-keeping systems used in lien searches. This includes navigating both proprietary software used by specific counties or states, as well as more generalized databases and online portals. For example, I’m proficient with the various county recorder websites across California, each with its own unique interface and search functionalities. I’ve also worked extensively with commercial lien search databases such as LexisNexis and Accurint, which offer broader, nationwide coverage. Understanding the nuances of each system – its strengths, weaknesses, and specific search parameters – is crucial for efficient and accurate lien searches.

Furthermore, I’m adept at utilizing various data management tools to organize and maintain the integrity of lien search results. This includes using spreadsheets to track searches, consolidating data from multiple sources, and employing dedicated case management software to ensure traceability and accountability.

Q 23. How do you manage your workload effectively when handling multiple lien searches simultaneously?

Managing multiple lien searches simultaneously requires a structured approach. I use a combination of prioritization techniques and organizational tools to ensure efficiency. First, I analyze each request, identifying the urgency and complexity of the search. High-priority, time-sensitive searches, such as those needed for a closing, take precedence. I then use a task management system, often a digital project management tool, to break down each search into smaller, manageable tasks (e.g., identifying relevant jurisdictions, conducting the search, reviewing results, preparing reports).

I also leverage automation wherever possible. For instance, I might use scripting or macros to automate repetitive tasks like data entry or formatting reports, freeing up time for more complex searches. Finally, consistent communication with clients keeps them informed about progress and allows for efficient adjustment of priorities if needed.

Q 24. What is your proficiency with relevant software and technology?

My proficiency in relevant software and technology is a key asset. I’m skilled in utilizing various online search platforms and databases specifically designed for lien searches, including county recorder websites and commercial platforms like LexisNexis and Accurint. I’m also proficient with various software applications for data analysis, such as Microsoft Excel and Access, to manage and analyze large datasets. Furthermore, my experience includes using GIS (Geographic Information Systems) software to aid in the location and identification of specific properties, which can greatly enhance the efficiency and accuracy of the lien search process.

Beyond these, I’m adept at using various document management systems to store and retrieve search results securely. This ensures proper audit trails and data integrity across all projects. I’m also comfortable learning new software and adapting to evolving technologies within the lien search industry.

Q 25. Describe your experience prioritizing tasks and meeting deadlines.

Prioritizing tasks and meeting deadlines is paramount in my role. I employ a multifaceted approach. Firstly, I prioritize tasks based on urgency and importance, using techniques such as the Eisenhower Matrix (urgent/important) to categorize and schedule my workload. Secondly, I meticulously track deadlines using project management tools and calendars, setting reminders to stay on schedule. Thirdly, I break down large tasks into smaller, more manageable units to improve focus and track progress more effectively.

For example, if I have multiple lien searches due, I’ll prioritize those with imminent deadlines first, allocating sufficient time for each step – from initial data gathering to report generation and client communication. I regularly review my schedule and proactively address potential delays to ensure timely completion.

Q 26. How do you handle pressure and tight deadlines in a lien search process?

Handling pressure and tight deadlines in lien searches requires a calm, methodical approach. I maintain a high level of organization, leveraging my task management systems to ensure I stay on track. This includes regularly reviewing my workload, identifying potential bottlenecks, and proactively communicating any challenges to my supervisors or clients. When faced with extremely tight deadlines, I focus my attention on the most critical aspects of the search, prioritizing accuracy over exhaustiveness (while always maintaining a high level of accuracy, of course).

Furthermore, I prioritize clear and concise communication to manage expectations and avoid misunderstandings. I might request additional resources or adjust timelines collaboratively to maintain efficiency and accuracy under pressure. It’s crucial to remember that maintaining accuracy is non-negotiable, and prioritization ensures that even under pressure, the integrity of my work remains paramount.

Q 27. What steps do you take to ensure data integrity in your lien search reports?

Data integrity is paramount in lien searches; errors can have significant legal and financial consequences. My approach involves several key steps. Firstly, I utilize multiple sources to verify information, cross-referencing data from various databases and county records. This helps to identify and correct inconsistencies or discrepancies. Secondly, I meticulously document every step of the search process, maintaining a detailed audit trail of sources and methodologies. This documentation allows for easy traceability and verification of findings.

Thirdly, I perform rigorous quality checks on all reports before dissemination, carefully reviewing the data for accuracy and completeness. This includes verifying property addresses, lien amounts, and filing dates. Finally, I employ robust data management procedures, storing information securely and managing backups to prevent data loss and maintain the integrity of my findings. This multi-layered approach ensures a high degree of accuracy and reliability in my lien search reports.

Key Topics to Learn for Lien Searches Interview

- Understanding Lien Types: Master the different types of liens (e.g., mechanic’s liens, tax liens, judgment liens) and their implications.

- Lien Search Databases and Tools: Become proficient in navigating various lien search databases and utilizing different search tools effectively. Understand the limitations and nuances of each.

- Interpreting Lien Search Results: Practice analyzing search results to identify relevant information, such as lien holder, lien amount, and filing date. Learn to distinguish between active and satisfied liens.

- Legal Aspects of Liens: Develop a foundational understanding of the legal principles governing liens, including priority and enforcement procedures.

- Practical Application: Real-world Scenarios: Consider how lien searches are used in due diligence for real estate transactions, loan applications, and other business contexts. Practice problem-solving related to conflicting liens or incomplete information.

- Data Analysis and Reporting: Learn to effectively summarize and present lien search findings in a clear and concise manner, suitable for different audiences.

- Ethical Considerations: Understand the ethical implications of handling sensitive financial data related to liens and maintaining data privacy.

Next Steps

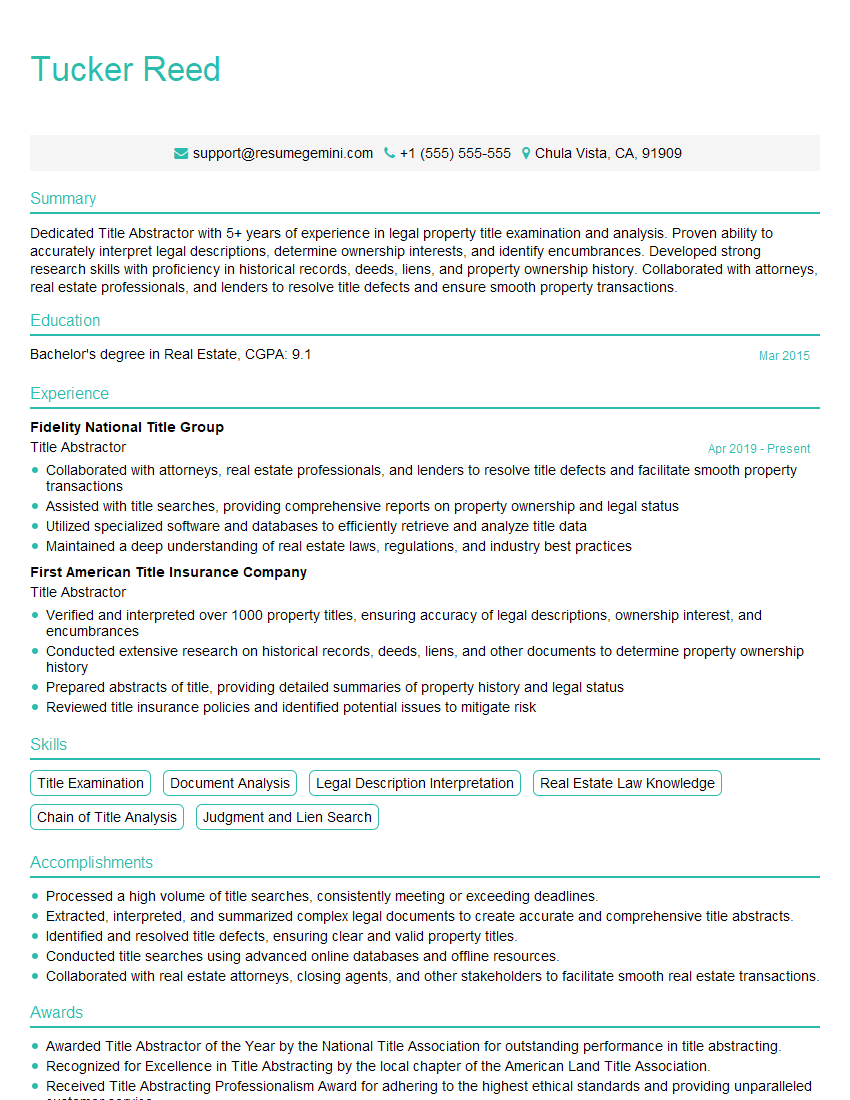

Mastering lien searches is crucial for career advancement in fields requiring thorough due diligence and risk assessment. A strong understanding of this process significantly enhances your value to employers. To improve your job prospects, create an ATS-friendly resume that highlights your skills and experience. We highly recommend using ResumeGemini, a trusted resource for building professional resumes, to craft a compelling document that showcases your abilities effectively. Examples of resumes tailored to Lien Searches are available to help guide you.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

Hi, I’m Jay, we have a few potential clients that are interested in your services, thought you might be a good fit. I’d love to talk about the details, when do you have time to talk?

Best,

Jay

Founder | CEO