Feeling uncertain about what to expect in your upcoming interview? We’ve got you covered! This blog highlights the most important Title and Settlement Procedures interview questions and provides actionable advice to help you stand out as the ideal candidate. Let’s pave the way for your success.

Questions Asked in Title and Settlement Procedures Interview

Q 1. Explain the process of conducting a title search.

A title search is a crucial process in real estate transactions that involves examining public records to determine the ownership history of a property and uncover any potential claims or defects affecting the title. Think of it as a comprehensive background check for a property. It meticulously traces the chain of title, which is the chronological sequence of owners and their conveyances (deeds, mortgages, etc.) from the original grant of the land to the present day. This process helps to ensure a clear and marketable title, meaning the seller has the legal right to sell the property without any encumbrances that could jeopardize the buyer’s ownership.

- Abstract of Title: A historical summary of the property’s ownership. This is compiled by manually reviewing public records.

- Computer-Assisted Title Search: Modern title companies leverage sophisticated software to search vast databases of recorded documents, significantly expediting the process. The software indexes key terms and allows for faster retrieval of relevant information.

- Examination of Public Records: Title examiners scrutinize documents like deeds, mortgages, liens, judgments, tax records, and other official records filed at the county courthouse or other relevant government offices. They are looking for any clouds on the title that may affect the transfer of ownership.

For instance, a title search might reveal an outstanding mortgage, a tax lien, or a boundary dispute, all of which would need to be addressed before the sale can proceed smoothly.

Q 2. What are the key components of a title commitment?

A title commitment is a crucial document issued by a title insurance company after conducting a title search. It’s essentially a preliminary report summarizing the title search findings and outlining the insurance coverage the company is willing to provide. It acts as a promise to insure the title, subject to certain exceptions. Think of it as an insurance proposal for your property’s title.

- Schedule A: This section identifies the property and the current owner, as well as the estate being insured (fee simple, life estate, etc.).

- Schedule B: This details the exceptions to coverage, which are items discovered during the title search that the title company will not insure. These could include easements, encroachments, or certain types of liens.

- Schedule C: This section lists any requirements that must be met before the policy is issued, like recording of documents or the resolution of identified title defects.

- Commitment to Issue a Policy: This section indicates that the title company will issue a title insurance policy once all conditions in Schedule C are fulfilled.

- Policy Premium Amount: This states the premium amount the buyer and seller will pay for the title insurance policy.

Understanding the exceptions is vital, especially for the buyer, as they may require further investigation or resolution.

Q 3. Describe different types of title insurance policies.

Title insurance protects against financial losses due to defects or problems with a property’s title that were not discovered during the title search. There are two primary types of policies:

- Owner’s Policy: This protects the buyer (the new owner) against financial losses due to title defects that existed before the purchase. This policy protects the buyer’s ownership and their investment in the property. It typically remains in effect as long as the buyer or their heirs own the property.

- Lender’s Policy: This protects the lender (mortgage company) against losses if there are problems with the property’s title that affect the mortgage. This policy protects the lender’s financial interest in the property. This coverage usually terminates once the mortgage is paid off.

Some title companies may offer extended coverage policies that offer broader protection or cover additional risks. It is essential to understand the specific coverage of each policy before making a decision.

Q 4. How do you identify and resolve title defects?

Identifying and resolving title defects requires a systematic approach. Once a defect is identified in the title search, the next steps are taken to resolve the issue:

- Identification: During the title search, the examiner will identify any potential defects, such as unpaid property taxes, outstanding mortgages, or boundary disputes.

- Verification: The identified issues must be verified to determine their validity and impact. Further research may be necessary to confirm the existence and extent of a defect.

- Resolution: This involves rectifying the issues. For instance, outstanding taxes are paid; outstanding mortgages are satisfied; or boundary disputes are resolved through legal means or surveys.

- Documentation: Each step in the resolution process is meticulously documented to ensure a clear and complete record.

- Title Update: Once the defects are cleared, the title is updated to reflect the changes. This might involve recording new documents such as releases of liens or corrected deeds.

For instance, if an outstanding mortgage is discovered, the seller needs to provide proof of payment or a mortgage satisfaction before the title can be cleared. A complex defect, such as a boundary encroachment, may necessitate a legal resolution or survey to establish property lines definitively.

Q 5. Explain the role of an escrow account in a real estate transaction.

An escrow account is a neutral third-party account that holds funds related to a real estate transaction until the closing. Think of it as a secure vault protecting everyone’s money. It ensures that the buyer’s funds and the seller’s proceeds are disbursed only after all conditions of the sale have been met.

The escrow agent (usually a title company or attorney) manages the account, receives and disburses funds, pays off any outstanding liens or mortgages, and ensures all parties are protected. The escrow process reduces the risk of fraud and ensures that the transaction is completed smoothly and securely.

For example, the buyer’s down payment, loan proceeds (if any), and closing costs are deposited into escrow. The seller’s proceeds, after paying off existing debts and closing costs, are then disbursed from the escrow account.

Q 6. What are the common closing costs involved in a real estate transaction?

Closing costs are various expenses involved in finalizing a real estate transaction. These costs can vary depending on the location and specifics of the sale. They are typically paid by either the buyer or seller, or sometimes split between the two parties. These costs can include:

- Loan origination fees: Charges from the lender for processing a mortgage.

- Title insurance premiums: Payments for owner’s and lender’s title insurance.

- Appraisal fees: Cost of a professional appraisal to determine the property’s value.

- Recording fees: Government fees for recording documents related to the transfer of ownership.

- Transfer taxes: Taxes levied by the state or local government on the transfer of property ownership.

- Escrow fees: Fees charged by the escrow company or agent for managing the escrow account.

- Homeowner’s insurance premiums: First year’s insurance premium.

It’s crucial for both parties to understand and budget for these costs, which can significantly add to the overall transaction price.

Q 7. How do you handle discrepancies in funds at closing?

Discrepancies in funds at closing are rare but can occur due to errors in calculations or missing funds. When a discrepancy arises, the escrow agent plays a crucial role in identifying and rectifying the problem. The escrow agent carefully reconciles all funds, ensuring each party receives the correct amount.

If a discrepancy arises, the escrow agent immediately contacts all involved parties to resolve the issue before the transaction proceeds. The cause of the discrepancy is investigated thoroughly, whether it’s a mathematical error, a missing payment, or a disagreement on closing costs.

For example, if the buyer’s down payment is short, the escrow agent will notify the buyer to provide the missing funds before closing. If a discrepancy arises regarding the distribution of proceeds to the seller, the escrow agent works diligently to determine the root cause, often collaborating with the involved parties to resolve the situation.

The process is transparent, and detailed records are maintained for each stage of the reconciliation process. The discrepancy must be resolved before the transaction can be officially completed to ensure all parties’ financial interests are protected.

Q 8. What are the legal implications of failing to disclose relevant information during a closing?

Failing to disclose relevant information during a closing carries significant legal implications, potentially leading to lawsuits and substantial financial penalties. This is because full disclosure is a cornerstone of real estate transactions, ensuring all parties are making informed decisions. A lack of transparency can invalidate the contract or create grounds for rescission.

For example, undisclosed material defects in the property (e.g., foundation issues, hidden water damage) could result in the buyer suing the seller or their agent for misrepresentation or fraud. Similarly, undisclosed liens or encumbrances on the title could leave the buyer liable for unforeseen debts. The penalties can include not only financial compensation to the injured party but also legal fees and reputational damage.

The specific legal ramifications depend on the jurisdiction and the nature of the undisclosed information. State laws governing real estate transactions dictate the standards of disclosure, and failure to meet these standards could result in violations of consumer protection laws. It’s crucial for all parties involved, including sellers, buyers, and real estate professionals, to exercise due diligence and ensure complete and accurate disclosure.

Q 9. How do you ensure compliance with RESPA regulations?

Ensuring compliance with the Real Estate Settlement Procedures Act (RESPA) requires a multi-faceted approach, focusing on transparency, accuracy, and adherence to specific regulations. RESPA aims to protect consumers from abusive practices in the real estate settlement process. Key areas of compliance include:

- Accurate Good Faith Estimates (GFEs): Providing borrowers with an accurate estimate of closing costs before the transaction, minimizing surprises at closing.

- Prohibition of Kickbacks and Referral Fees: Strictly avoiding any undisclosed payments or incentives between settlement service providers to ensure impartiality and prevent inflated costs.

- Disclosure of Affiliated Business Arrangements (ABAs): Openly disclosing any relationships between the settlement service providers, allowing consumers to make informed choices.

- Maintaining Accurate Records: Keeping meticulous records of all transactions and communications, readily available for audits.

- Compliance with HUD-1 or Closing Disclosure forms: Accurately completing and providing these standardized forms to ensure full transparency of all costs.

Regular training for all staff involved in the closing process is crucial, along with implementing internal controls and regularly auditing procedures to ensure consistent adherence to RESPA guidelines. Failure to comply can result in significant fines and legal repercussions for both the company and involved individuals.

Q 10. Explain the process of preparing closing documents.

Preparing closing documents is a meticulous process requiring precision and attention to detail. It involves gathering numerous documents from various sources, verifying their accuracy, and compiling them into a comprehensive package for the closing. The steps generally include:

- Gathering Necessary Documents: This includes the purchase agreement, title report, loan documents, survey, appraisal, insurance policies, and any relevant addendums.

- Reviewing and Verifying Documents: Thoroughly examining each document for accuracy, inconsistencies, or missing information.

- Calculating Closing Costs: Accurately calculating all charges, including lender fees, title insurance premiums, recording fees, taxes, and other expenses, for both the buyer and seller.

- Preparing the Closing Disclosure (CD): Creating a detailed CD (replacing the HUD-1) that clearly outlines all settlement charges and financial details for both parties.

- Preparing the Deed and other Transfer Documents: Ensuring all documents accurately reflect the terms of the purchase agreement and are properly executed.

- Preparing Wire Transfer Instructions: Creating secure and accurate instructions for the funds transfer.

- Final Review: Conducting a final review of all documents before the closing to catch any errors or discrepancies.

Think of it like assembling a complex jigsaw puzzle – each piece (document) must fit perfectly, or the whole picture (the closing) is jeopardized. Software and systems play a key role in automating parts of this process and reducing errors.

Q 11. How do you manage high-volume closing schedules?

Managing high-volume closing schedules necessitates a robust and organized system. Key strategies include:

- Efficient Workflow Management: Implementing a streamlined workflow, possibly using project management software, to track each transaction’s progress and identify potential bottlenecks.

- Team Collaboration and Communication: Fostering effective communication and collaboration amongst the team members, ensuring everyone is on the same page and informed of any potential delays or issues.

- Prioritization and Scheduling: Prioritizing transactions based on urgency and deadlines, using scheduling tools to optimize time management and resource allocation.

- Automation of Repetitive Tasks: Automating repetitive tasks such as document preparation and data entry to increase efficiency.

- Regular Monitoring and Reporting: Regularly monitoring the progress of all transactions, identifying potential delays and addressing them promptly.

Think of it like an air traffic control system for real estate closings – coordinating multiple flights (transactions) to ensure smooth landings (successful closings) without collisions (delays or errors).

Q 12. What is your experience with wire fraud prevention measures?

My experience with wire fraud prevention measures emphasizes a multi-layered approach. We implement stringent protocols to protect clients and our company from this increasingly prevalent crime. These include:

- Verifying Wire Instructions Directly: Always independently verifying wire instructions with the involved parties, avoiding reliance solely on emailed instructions.

- Using Secure Communication Channels: Utilizing secure communication channels for sensitive information, avoiding the use of email for financial details whenever possible.

- Implementing Multiple Points of Verification: Employing a multi-step verification process for all wire transfers, involving multiple personnel to reduce the risk of fraud.

- Regular Staff Training: Providing ongoing training to staff on identifying and mitigating wire fraud schemes.

- Staying Updated on Current Scams: Staying abreast of the latest fraud techniques to proactively adapt security measures.

Wire fraud is a serious threat, and a proactive approach, including staff training and robust verification systems, is essential for prevention.

Q 13. Describe your proficiency with title software and systems.

I am proficient in several title software and systems, including [Insert specific software examples here, e.g., RamQuest, SoftPro, TitlePoint]. My expertise extends to utilizing these systems for various tasks, including:

- Order Entry and Tracking: Efficiently managing title orders and tracking their progress through the entire process.

- Title Searches and Examination: Conducting comprehensive title searches and examining title reports for accuracy and potential issues.

- Document Preparation and Management: Preparing closing documents accurately and efficiently.

- Reporting and Analytics: Generating reports to track key metrics and gain insights into closing performance.

I can effectively use these systems to streamline workflows, enhance accuracy, and improve overall efficiency in the title and settlement process. I regularly update my skills to keep pace with software advancements and industry best practices.

Q 14. How do you handle challenging clients or unexpected issues during closing?

Handling challenging clients or unexpected issues during closing requires patience, diplomacy, and a problem-solving approach. My strategy involves:

- Active Listening and Empathy: Actively listening to the client’s concerns and showing empathy to understand their perspective.

- Clear and Concise Communication: Communicating clearly and concisely, ensuring the client understands the process and any potential issues.

- Proactive Problem-Solving: Proactively identifying and addressing potential issues before they escalate into major problems.

- Collaboration and Teamwork: Collaborating with other team members, including attorneys and lenders, to find effective solutions.

- Escalation Protocol: Having a clear escalation protocol for issues that cannot be resolved at the initial level.

For example, if a client is upset about an unexpected closing cost, I would explain the cost clearly, referencing the Closing Disclosure, and potentially exploring options to mitigate the impact. The key is maintaining professionalism and providing solutions, not just reacting to problems.

Q 15. What is your understanding of ALTA guidelines?

ALTA (American Land Title Association) guidelines are a set of best practices and standards for title insurance and settlement procedures. They aim to ensure accuracy, efficiency, and a consistent approach across the title industry. These guidelines cover various aspects, including the title search process, the handling of documents, the issuance of title insurance policies, and the conduct of the closing process itself. Think of them as a comprehensive rulebook for the title industry, promoting best practices to minimize risk and protect all parties involved.

For example, ALTA guidelines detail specific requirements for title searches, ensuring examiners thoroughly investigate the property’s history for any potential issues like liens, encumbrances, or conflicting claims. They also provide guidelines on the preparation of closing documents, helping to standardize processes and minimize errors. Adherence to ALTA guidelines provides a significant level of protection to buyers and lenders.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. Explain the process of reviewing survey documents.

Reviewing survey documents is a critical step in the title process. The survey visually depicts the property’s boundaries, identifying improvements, easements, and any encroachments. My process begins with a visual inspection, comparing the survey to the legal description of the property to identify any discrepancies. I then meticulously examine the survey for accuracy, ensuring that all elements are clearly defined and consistent with the property’s legal description. This includes verifying the location of buildings, fences, and other structures relative to property lines. Any discrepancies or ambiguous areas must be further investigated.

For example, I’d investigate if the survey shows a fence encroaching on a neighbor’s property, requiring a boundary resolution or further negotiation. Similarly, I would scrutinize any easements for their exact location and extent. The ultimate goal is to ensure the survey accurately reflects the property’s physical attributes and legal boundaries to prevent future disputes.

Q 17. How do you verify the legitimacy of all parties involved in a transaction?

Verifying the legitimacy of parties is paramount to avoid fraud. This involves several steps. First, I verify the identity of individuals using government-issued photo IDs. For corporations or other entities, I confirm their legal existence through state records or other authoritative sources like the Secretary of State. I also check for any known aliases or past legal issues that might be relevant. This cross-referencing with various databases provides a thorough background check.

In addition, I often require notarized signatures and verification of power of attorney, where applicable. For larger transactions, independent third-party verification might be used, especially in cases where there’s higher risk or suspicion. For instance, in a real estate transaction where a power of attorney is used, I would verify the authority and authenticity of the power of attorney document before proceeding.

Q 18. What is your experience with different types of deeds?

My experience encompasses a wide range of deeds, including Warranty Deeds, which offer the strongest protection for buyers by guaranteeing clear title and the grantor’s ability to convey the property. Quitclaim Deeds transfer ownership as it exists without warranties, often used to resolve boundary disputes or to clear up minor title issues. Special Warranty Deeds guarantee clear title only during the grantor’s ownership period. I am also proficient in handling deeds of trust, which are used to secure loans, and deeds in lieu of foreclosure, utilized to avoid the formal foreclosure process.

Understanding the nuances of each deed type is crucial for accurate title examination and risk assessment. For example, a buyer relying solely on a quitclaim deed may be at a greater risk compared to one utilizing a warranty deed. The understanding of these nuances allows me to advise clients on the level of risk associated with each type of deed.

Q 19. How do you handle lien priority disputes?

Lien priority disputes arise when multiple liens are placed on a property, creating uncertainty about which takes precedence. Resolving these requires a deep understanding of recording statutes, which dictate the order of priority based on the date and time each lien was recorded. I meticulously examine all recorded documents to establish the exact chronological order of liens. When there are conflicting claims or ambiguities, I might need to consult with attorneys specializing in lien priority disputes.

For instance, a mechanic’s lien filed after a mortgage but recorded before it could create a conflict. I would carefully analyze the recording dates and times, possibly relying on court interpretations of relevant statutes to determine the correct priority. In some cases, negotiation or litigation might be necessary to resolve the dispute.

Q 20. How do you ensure accurate recording of documents?

Accurate document recording is vital for maintaining a clear and reliable chain of title. I employ several strategies to ensure accuracy. This includes using electronic recording systems wherever available to ensure quick and accurate registration, minimizing the risk of errors associated with manual processing. In all cases, I perform rigorous quality checks before submission. This includes verifying names, dates, property descriptions, and the signatures of all parties. I use checklists and software to help maintain a consistent and thorough process.

Post-recording, I confirm the successful recording with the relevant county office or registry and obtain copies of the recorded documents to verify accuracy and completeness, providing a final record of the transaction in the public record.

Q 21. What is your experience with various types of property ownership?

My experience covers a broad spectrum of property ownership types, including sole ownership (where one person owns the property outright), joint tenancy (where two or more owners have equal rights and survivorship), tenancy in common (where two or more owners may have unequal shares and no survivorship), and community property (where property acquired during a marriage is jointly owned). Additionally, I have experience with various forms of corporate ownership, including LLCs, partnerships, and corporations.

Understanding these different forms of ownership is critical for determining the appropriate parties involved in the transaction and for ensuring that the title is properly transferred. For example, in a joint tenancy, the death of one owner automatically transfers ownership to the surviving owner. In a tenancy in common, however, the ownership passes according to the will of the deceased owner. These distinctions are crucial for a smooth and legally sound title transfer.

Q 22. Describe your approach to identifying and mitigating potential risks in a title.

Identifying and mitigating title risks is paramount to a smooth real estate transaction. My approach is multifaceted and begins with a thorough examination of the title abstract, which is a historical summary of all recorded documents affecting the property. This involves scrutinizing every deed, mortgage, lien, judgment, easement, and other encumbrances to uncover potential issues.

- Incomplete Records: I check for any gaps in the chain of title, which could indicate unrecorded interests. For example, a missing deed could suggest a potential claim against the property. I’d investigate this thoroughly, possibly contacting previous owners or conducting further searches.

- Encroachments: I review surveys and compare them with property lines to identify any encroachments, like a neighbor’s fence being built partially on the subject property. This requires careful analysis and potentially obtaining updated surveys to ensure compliance.

- Liens and Judgments: I meticulously review all liens, judgments, and tax assessments to ensure they’re properly paid or discharged. Unpaid liens can create major obstacles to closing. I confirm the status of each lien with the relevant authorities.

- Easements and Rights-of-Way: I carefully examine all easements, confirming their validity and impact on the property. For example, a utility easement might limit building options. I ensure all parties are aware of any restrictions.

Mitigating risks involves addressing identified issues through curative actions like obtaining releases of liens, obtaining affidavits, or negotiating with affected parties. The goal is to clear the title and make it marketable before closing.

Q 23. How do you handle last-minute changes or requests during a closing?

Last-minute changes are unfortunately a common occurrence in real estate closings. My approach prioritizes calm, clear communication and a proactive, flexible mindset. I maintain constant contact with all parties – buyers, sellers, lenders, and agents – to anticipate potential issues and to stay informed of any developments.

- Documentation Review: I carefully review all updated documents promptly and thoroughly to ensure accuracy and compliance with all relevant regulations. This includes reviewing new disclosures or amended agreements.

- Negotiation and Problem Solving: I effectively negotiate compromises and solutions to accommodate reasonable requests while safeguarding the interests of all parties. This could involve adjusting closing costs, modifying contract terms, or obtaining appropriate waivers.

- Time Management: I meticulously manage time, adjusting schedules and tasks as needed to ensure a smooth closing process, even with unexpected changes. This includes prioritizing crucial tasks and communicating timeline updates transparently.

- Contingency Planning: I’ve learned to anticipate potential issues and develop contingency plans to mitigate the impact of last-minute changes. This minimizes disruption and stress.

Ultimately, my goal during a closing is to resolve unexpected situations professionally and efficiently, ensuring all parties are informed and satisfied. I’ve successfully navigated many unexpected requests by remaining adaptable and by facilitating open communication among all stakeholders.

Q 24. Explain your understanding of the role of a title insurance company.

A title insurance company plays a crucial role in real estate transactions by providing insurance protection against potential title defects. This ensures a buyer receives clear and marketable title to the property.

- Title Examination and Search: The company conducts a thorough examination of the property’s title history, searching public records to identify any potential claims or issues.

- Issuance of Title Insurance: Based on their examination, they issue title insurance policies to protect buyers and lenders from financial losses arising from unforeseen title defects. These policies essentially guarantee the title’s validity.

- Title Clearing and Risk Mitigation: They work to clear up any identified title defects through curative actions. This might involve obtaining releases of liens or resolving boundary disputes.

- Closing Services: Many title companies provide closing and settlement services, handling the disbursement of funds, recording of documents, and other administrative tasks involved in the transfer of ownership.

In essence, a title insurance company acts as a risk mitigator and provides an essential layer of protection for all parties involved in a real estate transaction, ensuring a secure and legally sound transfer of ownership.

Q 25. Describe your experience with commercial real estate closings (if applicable).

Yes, I possess significant experience with commercial real estate closings. These transactions are often substantially more complex than residential closings, involving a greater number of stakeholders and more intricate legal issues.

- Due Diligence: My work involves a deeper level of due diligence, reviewing environmental reports, lease agreements, and operating statements to assess the financial viability of the property. I check for any zoning restrictions or building code violations.

- Financing and Lending: I handle complex financing structures involving multiple lenders and loan documents. I need to ensure all loans and financing are properly documented and secured.

- Partnership and Corporate Structures: I have experience navigating the complexities of commercial real estate deals involving various corporate and partnership structures. It requires careful examination of all agreements and documents to determine the ownership and liability of all parties.

- Negotiation of Complex Terms: I’m comfortable negotiating complex contractual terms and conditions that often arise in commercial transactions. This can include purchase price adjustments, assignment of leases, or stipulations about future operations.

I am proficient in handling the nuances of commercial real estate closings, including leasehold interests, ground leases, and other specialized arrangements. My experience ensures successful closings for complex transactions, protecting all parties’ interests.

Q 26. How do you stay updated with changes in title and settlement laws and regulations?

Staying current in the ever-evolving landscape of title and settlement laws and regulations is crucial for my role. I employ a multi-pronged approach to ensure I remain well-informed.

- Continuing Education Courses: I regularly participate in continuing education courses and seminars offered by professional organizations like the American Land Title Association (ALTA).

- Professional Organizations and Publications: I actively engage with professional organizations, subscribing to industry publications and attending conferences to learn about changes in legislation and best practices.

- State and Federal Regulatory Updates: I monitor state and federal regulatory changes through government websites and legal databases. I pay close attention to updates pertaining to title insurance, real estate law, and related regulations.

- Networking with Peers: I maintain a strong professional network, regularly communicating with other title professionals to exchange information and discuss emerging trends and challenges.

This commitment to ongoing professional development ensures I am always abreast of the latest legal and regulatory updates, enabling me to provide accurate and compliant services to my clients.

Q 27. Explain your process for resolving title objections.

Resolving title objections requires a systematic and thorough approach. It begins with a clear understanding of the nature of the objection itself.

- Identification and Analysis: I carefully identify and analyze the specific title objection. This involves reviewing the objection’s details and researching relevant documents and legal precedents.

- Communication with Stakeholders: I immediately communicate with all relevant parties—buyers, sellers, lenders, and potentially other claimants—to understand their perspectives and explore potential solutions.

- Curative Actions: I determine the appropriate curative actions needed to address the objection. This might involve obtaining releases of liens, conducting additional title searches, obtaining affidavits, or negotiating with claimants.

- Documentation and Record Keeping: Throughout this process, I maintain detailed records of all communications, actions taken, and supporting documentation. This ensures transparency and accountability.

- Legal Counsel (When Necessary): In complex cases, I collaborate with legal counsel to develop an appropriate strategy and navigate any legal challenges.

My experience demonstrates that proactive communication, thorough research, and collaborative problem-solving are key to efficiently resolving title objections and ensuring a smooth closing.

Q 28. What is your experience with reviewing and interpreting title insurance policies?

I possess extensive experience reviewing and interpreting title insurance policies. Understanding these policies is vital for protecting clients’ interests and ensuring successful closings.

- Policy Analysis: I thoroughly analyze the policy’s wording to identify the scope of coverage and any exclusions. This ensures a clear understanding of the risks covered and those that are not.

- Exception Identification: I meticulously identify any exceptions or limitations on the policy’s coverage. Exceptions may relate to specific title issues not insured against.

- Coverage Interpretation: I interpret the policy’s provisions to ascertain the extent of financial protection offered to the insured party. This is critical to understanding what constitutes a covered claim.

- Claim Management (When Necessary): In the unfortunate event of a claim, I can guide the insured through the claims process, ensuring appropriate documentation and communication with the title insurance company.

My ability to interpret and apply the provisions of a title insurance policy effectively is essential for my role, allowing me to ensure my clients receive the full benefit of the coverage they’ve purchased.

Key Topics to Learn for Title and Settlement Procedures Interview

- Title Examination & Abstracting: Understanding the process of reviewing title records, identifying potential issues (liens, encumbrances), and preparing a title abstract. Practical application: Analyzing a sample title report and identifying potential problems.

- Real Estate Closings & Settlement Procedures: Mastering the steps involved in a successful closing, including document preparation, disbursement of funds, and regulatory compliance. Practical application: Working through a simulated closing scenario, calculating closing costs, and addressing potential discrepancies.

- Escrow Accounts & Disbursements: Thorough understanding of escrow account management, including fund deposit, disbursement, and reconciliation processes. Practical application: Reconciling a sample escrow account statement and identifying any potential irregularities.

- Title Insurance & its Role: Comprehending the different types of title insurance, their coverage, and their importance in protecting buyers and lenders. Practical application: Explaining the differences between lender’s and owner’s title insurance and determining appropriate coverage scenarios.

- Relevant Laws & Regulations: Familiarity with state and federal laws governing real estate transactions and title insurance. Practical application: Identifying the legal implications of specific scenarios within a title and settlement context.

- Problem-Solving & Risk Management: Developing strategies for identifying, analyzing, and mitigating potential risks during title and settlement processes. Practical application: Developing a risk mitigation plan for a complex title issue.

- Technology & Software Proficiency: Demonstrating familiarity with relevant title and settlement software and technologies. Practical application: Discussing experience with common title software and its application in daily tasks.

Next Steps

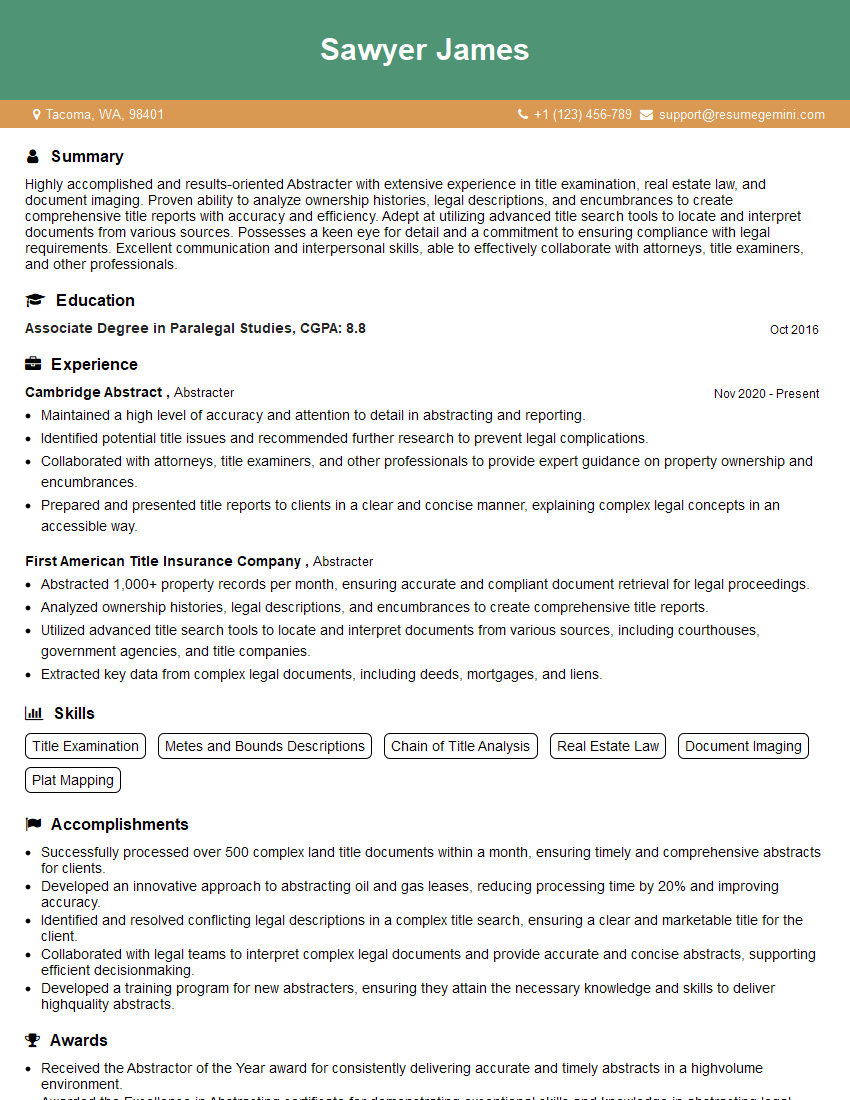

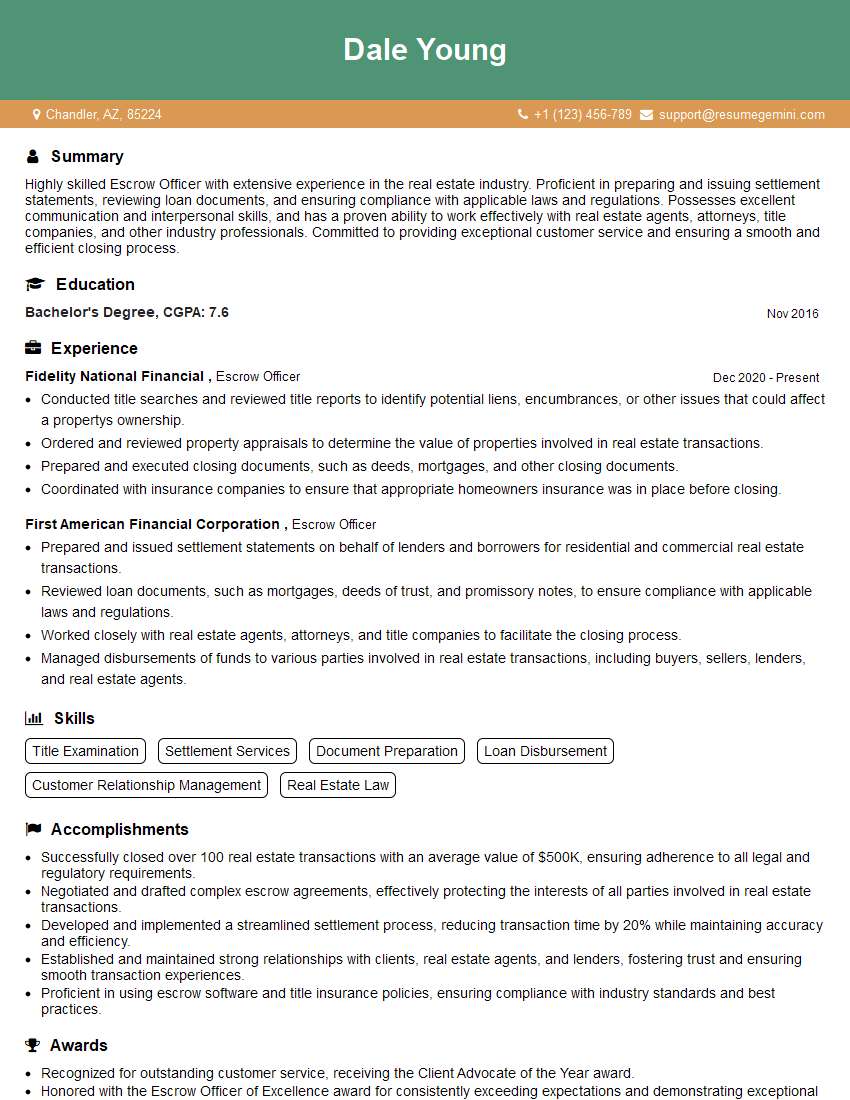

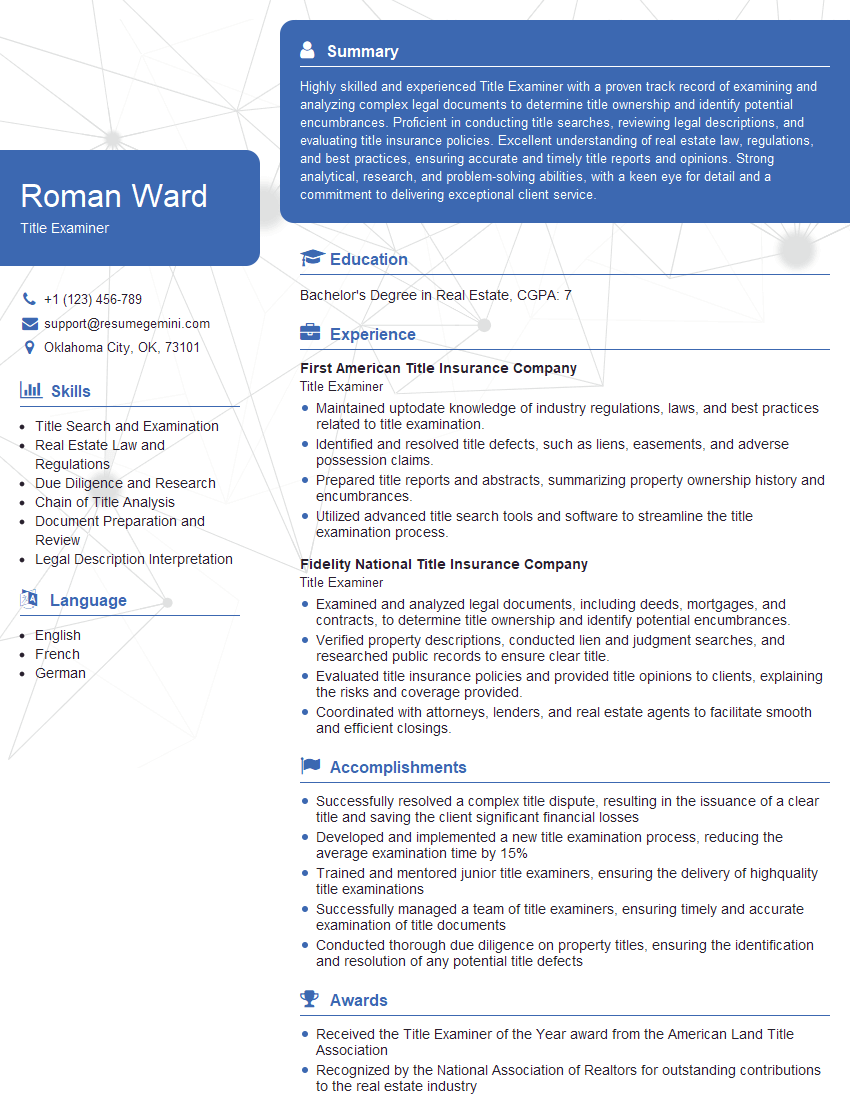

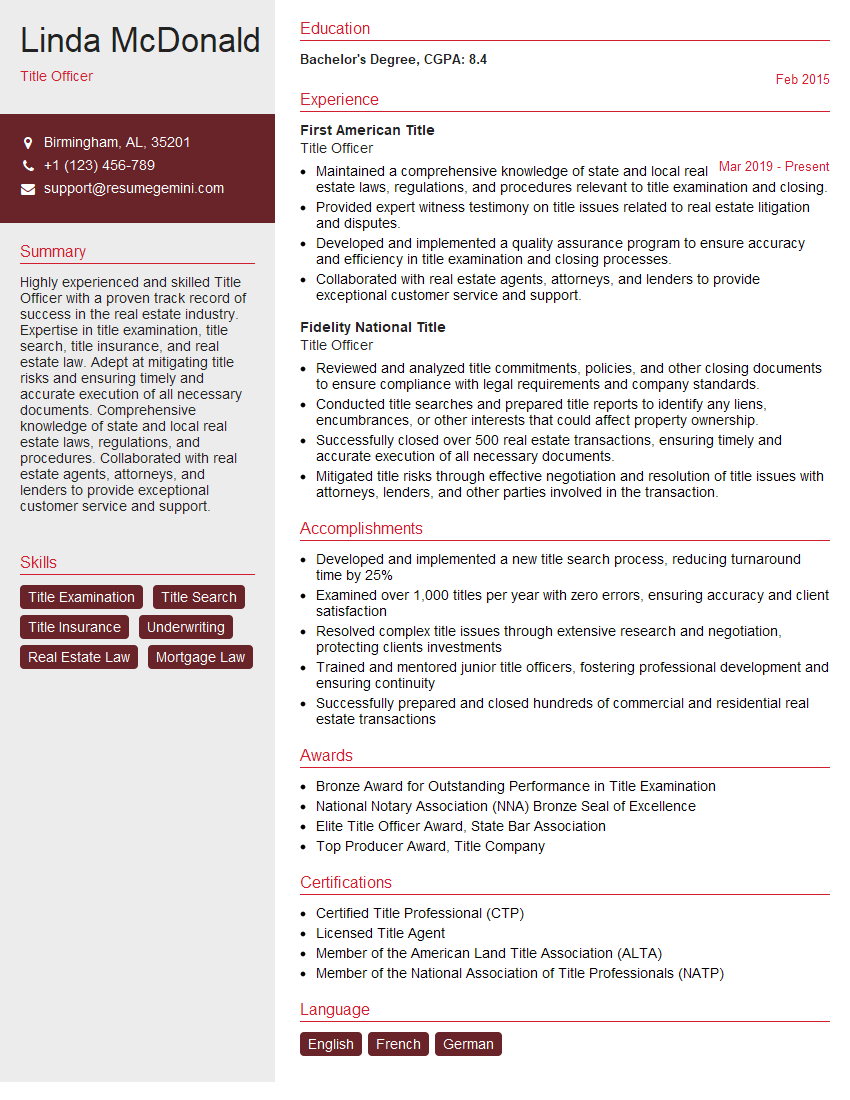

Mastering Title and Settlement Procedures is crucial for career advancement in the real estate industry, opening doors to higher-paying roles and increased responsibility. A strong understanding of these procedures demonstrates competence, attention to detail, and risk management skills – highly valued attributes in this field. To increase your job prospects, it’s essential to craft an ATS-friendly resume that highlights your skills and experience effectively. ResumeGemini is a trusted resource to help you build a professional resume that showcases your qualifications. Examples of resumes tailored specifically to Title and Settlement Procedures are available to help guide your creation of a winning application.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

Hi, I’m Jay, we have a few potential clients that are interested in your services, thought you might be a good fit. I’d love to talk about the details, when do you have time to talk?

Best,

Jay

Founder | CEO