Are you ready to stand out in your next interview? Understanding and preparing for Basic Bookkeeping and Accounting Knowledge interview questions is a game-changer. In this blog, we’ve compiled key questions and expert advice to help you showcase your skills with confidence and precision. Let’s get started on your journey to acing the interview.

Questions Asked in Basic Bookkeeping and Accounting Knowledge Interview

Q 1. Explain the difference between debit and credit.

Debit and credit are fundamental concepts in double-entry bookkeeping. They represent opposite sides of a transaction, ensuring the accounting equation always balances. Think of it like a scale: debits are on one side, credits on the other. To keep the scale balanced, every transaction requires both a debit and a credit entry.

Debits increase the balance of asset, expense, and dividend accounts, while they decrease the balance of liability, owner’s equity, and revenue accounts. Remember the mnemonic DEAD CLIC: Debits Expenses, Assets, and Dividends; Credits Liabilities, Income, and Capital.

Credits increase the balance of liability, owner’s equity, and revenue accounts, while they decrease the balance of asset, expense, and dividend accounts.

Example: If you purchase office supplies with cash, you would debit (increase) the Office Supplies (asset) account and credit (decrease) the Cash (asset) account. Both entries are equal in value, keeping the accounting equation balanced.

Q 2. What are the basic accounting equations?

The basic accounting equation is the foundation of double-entry bookkeeping. It states that a company’s assets are always equal to the sum of its liabilities and owner’s equity. This equation is represented as:

Assets = Liabilities + Owner's EquityAssets represent what a company owns (cash, accounts receivable, equipment, etc.). Liabilities represent what a company owes to others (accounts payable, loans, etc.). Owner’s Equity represents the owner’s investment in the company (capital contributions, retained earnings).

This equation must always remain balanced. Every transaction affects at least two accounts to maintain this balance. Imagine it like a seesaw; if you add weight to one side (debit), you must add equal weight to the other (credit) to keep it level.

Q 3. How do you record a sales transaction?

Recording a sales transaction involves recognizing the revenue generated and the increase in assets (usually cash or accounts receivable). Let’s say a company sold goods for $1000 cash.

The journal entry would be:

Debit Cash $1000

Credit Sales Revenue $1000This entry increases the cash account (debit) reflecting the increase in assets, and increases the sales revenue account (credit) reflecting the increase in revenue.

If the sale was made on credit (accounts receivable), the journal entry would be:

Debit Accounts Receivable $1000

Credit Sales Revenue $1000In this case, accounts receivable (asset) increases because the company expects payment later.

Q 4. How do you record a purchase transaction?

Recording a purchase transaction depends on whether the purchase was made on credit or with cash. Let’s assume a company purchased supplies worth $500 on credit.

The journal entry would be:

Debit Supplies $500

Credit Accounts Payable $500This entry increases the supplies (asset) account and increases the accounts payable (liability) account, because the company owes the supplier money. If the purchase was made with cash:

Debit Supplies $500

Credit Cash $500This entry increases supplies (asset) and decreases cash (asset). The increase in one asset is offset by the decrease in another.

Q 5. What is the purpose of a trial balance?

A trial balance is a summary report listing all the general ledger accounts and their debit or credit balances at a specific point in time. Its primary purpose is to verify that the total debits equal the total credits in the accounting system. This helps detect errors in recording transactions. If the debits and credits don’t match, it signals a mistake somewhere in the accounting process—requiring investigation and correction.

Think of it like a checkpoint in a race. You’re ensuring that your bookkeeping is accurate and balanced before you proceed to further financial statements.

Q 6. What are adjusting entries and why are they necessary?

Adjusting entries are made at the end of an accounting period to update accounts for transactions or events that haven’t been fully recorded yet. They’re crucial for ensuring the accuracy of the financial statements. These are often necessary because of the time lag between a transaction occurring and when it is recorded.

Examples:

- Accrued Expenses: Recording expenses incurred but not yet paid (e.g., salaries earned by employees but not yet paid).

- Accrued Revenues: Recording revenues earned but not yet received (e.g., interest earned on a savings account but not yet credited).

- Prepaid Expenses: Adjusting the balance of prepaid expenses to reflect the portion used during the period (e.g., adjusting prepaid insurance).

- Unearned Revenues: Adjusting the balance of unearned revenue to reflect the portion earned during the period (e.g., adjusting unearned subscription fees).

Without adjusting entries, financial statements would not accurately reflect the company’s financial position and performance.

Q 7. Explain the difference between accrual and cash accounting.

Accrual and cash accounting are two different methods of recording financial transactions. The key difference lies in when revenue and expenses are recognized.

Cash Accounting: Revenue and expenses are recorded only when cash changes hands. If you receive a payment, the revenue is recorded; if you pay a bill, the expense is recorded. It’s simple to understand and use but can be less accurate in reflecting a company’s true financial position.

Accrual Accounting: Revenue is recorded when it’s earned, regardless of when cash is received, and expenses are recorded when they are incurred, regardless of when cash is paid. This method provides a more accurate picture of a company’s financial performance, as it matches revenues and expenses to the period they relate to, adhering to the matching principle.

Example: Imagine you provide a service in December but receive payment in January. Under cash accounting, the revenue is recorded in January. Under accrual accounting, the revenue is recorded in December, when the service was provided. Accrual accounting is the generally accepted accounting principle (GAAP) for most businesses.

Q 8. How do you reconcile a bank statement?

Bank statement reconciliation is the process of comparing your business’s bank statement with your internal accounting records to ensure they match. Think of it like double-checking your work – you’re verifying that all transactions recorded in your books are reflected accurately on the bank statement, and vice-versa. Any discrepancies need to be investigated and corrected.

Here’s a step-by-step process:

- Gather your documents: You’ll need your bank statement, your company’s check register or cash disbursements journal, and any deposit slips.

- Prepare your bank reconciliation: Usually, a worksheet is used to compare the bank balance and the book balance. The bank balance is the balance shown on your statement. The book balance is the cash balance shown in your accounting records.

- Adjust the bank balance: Identify any transactions recorded in your books but not yet reflected on the bank statement. These include outstanding checks (checks you’ve written but haven’t cleared the bank) and deposits in transit (deposits you’ve made but haven’t been processed by the bank). Add deposits in transit and subtract outstanding checks from the bank balance.

- Adjust the book balance: Identify any transactions recorded on the bank statement but not yet recorded in your books. Common examples include bank charges, NSF (non-sufficient funds) checks, and interest earned. Add any interest earned and subtract bank charges and NSF checks from the book balance.

- Compare the adjusted balances: Once both balances have been adjusted, they should match. If they don’t, carefully review your steps and investigate any remaining discrepancies. This might involve contacting the bank to clarify unusual activity.

Example: Imagine you have a bank balance of $10,000. You have outstanding checks totaling $1,000 and a deposit in transit of $500. Your book balance is $9,000. After adjusting, your bank balance becomes $9,500 ($10,000 – $1,000 + $500), matching your adjusted book balance.

Q 9. What are some common errors in bookkeeping?

Common bookkeeping errors can significantly impact the accuracy of financial reports. These errors can range from simple mistakes to more systematic issues. Here are some of the most frequently encountered errors:

- Incorrect data entry: Typing errors, incorrect account codes, and transposed numbers are common culprits. Imagine incorrectly entering $100 as $1,000—that’s a significant difference!

- Missed transactions: Failing to record all income and expenses leads to an inaccurate picture of your financial situation. A small, forgotten invoice can snowball into a bigger problem over time.

- Improper matching of invoices: Not properly linking invoices to payments can cause delays and confusion, making it hard to track your accounts payable and receivable.

- Errors in calculating depreciation: Incorrectly calculating depreciation can significantly distort your asset values and profitability.

- Failure to reconcile bank statements: As discussed earlier, this can lead to undiscovered errors and fraudulent activities.

- Inconsistent use of accounting methods: Switching between different accounting methods inconsistently can create confusion and inaccurate reporting.

Many of these errors can be prevented with careful attention to detail, regular review of transactions, and the use of accounting software with built-in error-checking features.

Q 10. How do you handle discrepancies in accounts?

Discrepancies in accounts are a fact of life in bookkeeping. The key is a systematic approach to identifying and resolving them. The first step is always to trace the discrepancy back to its source.

Here’s a systematic approach:

- Review Supporting Documentation: Begin by carefully examining all source documents related to the account in question, including invoices, receipts, bank statements, and other relevant paperwork.

- Compare to Previous Periods: See if similar discrepancies have occurred in the past. A pattern might reveal a systemic error.

- Reconcile Bank Statements: As mentioned earlier, bank reconciliations are crucial in identifying and correcting many discrepancies.

- Check for Data Entry Errors: Carefully double-check all data entry for typos or other inaccuracies.

- Verify Account Codes: Make sure transactions have been assigned the correct account codes. Incorrect coding can lead to significant errors.

- Investigate Unusual Activity: Look for unusual transactions or patterns that might indicate fraud or errors.

- Consult with a Professional: If you’re unable to resolve the discrepancy yourself, it’s best to seek help from a qualified accountant or bookkeeper.

Example: If your bank balance doesn’t reconcile with your books, systematically check for outstanding checks, deposits in transit, bank charges, and NSF checks. This methodical process is far more effective than guessing.

Q 11. What is the importance of accurate record-keeping?

Accurate record-keeping is the cornerstone of successful financial management. It’s crucial for several reasons:

- Accurate Financial Reporting: Accurate records ensure that financial statements accurately reflect the financial health of the business. This is vital for making informed business decisions.

- Tax Compliance: Accurate records are essential for filing accurate and timely tax returns, avoiding penalties and audits.

- Investor Confidence: Investors and lenders rely on accurate financial information to assess the risk and potential of the business. Inaccurate records can severely damage investor confidence.

- Operational Efficiency: Well-maintained records enable efficient tracking of expenses, inventory, and other key aspects of the business, leading to better operational efficiency.

- Fraud Detection: Accurate record-keeping makes it easier to detect and prevent fraud, safeguarding the business’s assets.

- Planning and Forecasting: Accurate records provide the data needed for effective business planning and forecasting, enabling better strategic decision-making.

Imagine trying to run a marathon without knowing how far you’ve run or how much energy you have left. Accurate record-keeping is your GPS for financial success.

Q 12. Explain the process of preparing a balance sheet.

A balance sheet is a snapshot of a company’s financial position at a specific point in time. It shows what a company owns (assets), what it owes (liabilities), and the difference between the two (equity). The fundamental accounting equation underlies the balance sheet: Assets = Liabilities + Equity

Preparing a balance sheet involves the following steps:

- Identify Assets: List all assets owned by the company, including current assets (cash, accounts receivable, inventory) and non-current assets (property, plant, and equipment, intangible assets).

- Identify Liabilities: List all obligations owed by the company, including current liabilities (accounts payable, short-term loans) and non-current liabilities (long-term loans, bonds payable).

- Calculate Equity: Equity is calculated by subtracting total liabilities from total assets. It represents the owners’ stake in the business.

- Organize the Information: Present the information in a clear and organized manner, typically with assets listed first, followed by liabilities and equity.

Example: If a company has assets of $100,000 and liabilities of $60,000, its equity will be $40,000 ($100,000 – $60,000).

Q 13. Explain the process of preparing an income statement.

An income statement, also called a profit and loss (P&L) statement, shows a company’s financial performance over a period of time, such as a month, quarter, or year. It summarizes revenues, costs, and expenses to determine the net income or net loss.

The process of preparing an income statement generally involves these steps:

- Determine Revenue: Identify all revenue generated during the period. This includes sales revenue, service revenue, and other income.

- Calculate Cost of Goods Sold (COGS): If applicable, determine the direct costs associated with producing goods sold. This includes raw materials, direct labor, and manufacturing overhead.

- Calculate Gross Profit: Subtract COGS from revenue. This represents the profit earned before considering operating expenses.

- Identify and Calculate Operating Expenses: Determine all operating expenses incurred during the period, such as salaries, rent, utilities, and marketing costs.

- Calculate Operating Income: Subtract operating expenses from gross profit. This represents the profit earned from the company’s core operations.

- Account for Other Income and Expenses: Include any other income or expenses, such as interest income or interest expense.

- Calculate Net Income: Subtract total expenses from total revenues to determine the net income (or net loss) for the period.

Example: If a company has revenue of $200,000, COGS of $80,000, and operating expenses of $60,000, its gross profit is $120,000 ($200,000 – $80,000), and its operating income is $60,000 ($120,000 – $60,000). After accounting for other income and expenses, let’s say the net income is $55,000.

Q 14. What is depreciation and how is it calculated?

Depreciation is the systematic allocation of the cost of a tangible asset over its useful life. It reflects the decline in value of an asset due to wear and tear, obsolescence, or other factors. It’s not about estimating the asset’s market value, but rather spreading its cost over the period it benefits the business.

Several methods exist for calculating depreciation, including:

- Straight-Line Depreciation: The simplest method, it allocates an equal amount of depreciation expense each year. The formula is:

Annual Depreciation = (Asset Cost - Salvage Value) / Useful Life- Where:

Asset Costis the original cost of the asset.Salvage Valueis the estimated value of the asset at the end of its useful life.Useful Lifeis the estimated number of years the asset will be used.- Declining Balance Depreciation: This method accelerates depreciation in the early years of an asset’s life. A fixed depreciation rate is applied to the asset’s net book value each year.

- Units of Production Depreciation: This method bases depreciation on the actual use of the asset. Depreciation is calculated based on the number of units produced or hours of use.

Example (Straight-Line): If a machine costs $10,000, has a salvage value of $1,000, and a useful life of 5 years, the annual depreciation expense using the straight-line method would be $1,800 (($10,000 – $1,000) / 5).

Q 15. What is accounts receivable and how is it managed?

Accounts receivable (A/R) represents money owed to a business by its customers for goods or services sold on credit. Think of it as a company’s short-term loan to its clients. Managing A/R effectively is crucial for cash flow.

- Invoicing: Accurate and timely invoices are the foundation. These should clearly detail the goods/services provided, payment terms, and due date. Consider using invoicing software to streamline this process.

- Tracking Payments: Implement a system to track payments received. This might involve dedicated A/R software, spreadsheets, or a combination. Regularly reconcile payments against invoices to ensure accuracy.

- Credit Policy: Establish a clear credit policy, outlining credit limits, payment terms, and procedures for handling late payments. This minimizes risk and ensures consistency.

- Follow-up on Overdue Payments: Proactively follow up on overdue payments. This could involve friendly reminders, escalating to more formal communication as needed.

- Aging Reports: Generate aging reports to monitor the status of outstanding invoices. These reports categorize invoices by their age (e.g., 0-30 days, 31-60 days, etc.), allowing you to identify potential problems early.

Example: Imagine a bakery sells a cake for $50 on credit. The $50 becomes part of the bakery’s accounts receivable until the customer pays.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. What is accounts payable and how is it managed?

Accounts payable (A/P) represents money a business owes to its suppliers or vendors for goods or services purchased on credit. It’s essentially the business’s short-term debt. Efficient A/P management is essential for maintaining good supplier relationships and avoiding late payment penalties.

- Processing Invoices: Set up a systematic process for receiving, reviewing, and approving invoices. This often involves verifying the goods/services received against the invoice.

- Matching: Match the invoice with the purchase order and receiving report to ensure accuracy and prevent fraud.

- Coding: Properly code each invoice to the correct general ledger account. This ensures accurate financial reporting.

- Payment Processing: Establish a schedule for paying invoices, often based on payment terms. Consider using automated payment systems to streamline the process.

- Vendor Relationship Management: Maintain positive relationships with vendors by promptly addressing any discrepancies or issues.

Example: A restaurant buys ingredients from a supplier on credit. The amount owed to the supplier represents the restaurant’s accounts payable.

Q 17. Explain the concept of inventory management.

Inventory management involves overseeing the procurement, storage, and sale of goods. The goal is to maintain optimal stock levels, minimizing storage costs while avoiding stockouts that can disrupt sales. Effective inventory management hinges on several key elements:

- Forecasting Demand: Accurately predicting future demand is crucial to order the right amount of inventory. This involves analyzing historical sales data, considering seasonal trends, and anticipating market changes.

- Ordering: Determining the optimal order quantity involves balancing carrying costs (storage, insurance, etc.) with ordering costs (placing orders, shipping, etc.). Techniques like Economic Order Quantity (EOQ) can be helpful.

- Storage and Handling: Proper storage and handling practices prevent damage, spoilage, and loss. This includes using appropriate facilities, implementing security measures, and managing stock rotation (FIFO – First In, First Out).

- Inventory Tracking: A reliable system for tracking inventory levels is essential. This could be a simple spreadsheet, dedicated inventory management software, or barcode scanning technology. Regular inventory counts help verify accuracy.

- Cycle Counting: Regularly counting a subset of inventory items helps prevent large discrepancies from accumulating.

Example: A clothing retailer uses sales data to forecast demand for winter coats. They use this forecast to place orders with their suppliers, ensuring they have enough stock for the peak season without overstocking and incurring unnecessary storage costs.

Q 18. What is a general ledger and its purpose?

The general ledger is the central record-keeping system in accounting. It’s like the master database containing all the financial transactions of a business. Each transaction is recorded in individual accounts, providing a comprehensive overview of the company’s financial position.

Purpose:

- Record Keeping: Provides a detailed record of all financial transactions.

- Financial Reporting: Forms the basis for generating financial statements like the balance sheet and income statement.

- Auditing: Enables auditors to verify the accuracy of financial records.

- Decision Making: Provides data for management to make informed business decisions.

Example: A sale would be recorded in the Sales Revenue account, while the cost of goods sold would be recorded in the Cost of Goods Sold account. These transactions, among others, would all be recorded in the general ledger.

Q 19. What are some common bookkeeping software programs?

Many bookkeeping software programs are available, ranging from simple spreadsheet applications to sophisticated enterprise resource planning (ERP) systems. The choice depends on the size and complexity of the business.

- QuickBooks: A popular choice for small and medium-sized businesses, offering various plans to meet different needs.

- Xero: Cloud-based accounting software known for its user-friendly interface and integration capabilities.

- FreshBooks: Specifically designed for freelancers and small businesses, with features geared towards invoicing and expense tracking.

- Zoho Books: Another cloud-based option that offers a comprehensive suite of accounting and business management tools.

- Sage 50cloud: More robust accounting software suitable for larger businesses with complex financial requirements.

Choosing the right software depends on factors like budget, business size, and specific accounting needs.

Q 20. How do you maintain data integrity in bookkeeping?

Maintaining data integrity in bookkeeping is paramount. Inaccurate data can lead to poor decision-making and even legal issues. Here are key strategies:

- Data Backup and Recovery: Regularly back up data to prevent loss due to hardware failure or other unforeseen events. Have a recovery plan in place.

- Access Control: Implement appropriate access controls to prevent unauthorized access or modification of data.

- Data Validation: Use data validation techniques to ensure data accuracy. This could involve using automated checks, cross-referencing data, and regularly reconciling accounts.

- Regular Reconciliation: Reconcile bank statements, credit card statements, and other accounts regularly to identify and correct discrepancies.

- Internal Controls: Establish robust internal controls to prevent errors and fraud. This might involve segregation of duties, authorization procedures, and regular audits.

- Software Updates: Keep bookkeeping software updated to benefit from bug fixes and security enhancements.

Example: Regularly reconciling the bank statement with the company’s cash book helps identify any discrepancies, ensuring the accuracy of cash balances.

Q 21. What are your strengths in bookkeeping/accounting?

My strengths in bookkeeping and accounting lie in my meticulous attention to detail, my proficiency in using accounting software, and my ability to explain complex financial information clearly and concisely. I’m adept at organizing and analyzing financial data, identifying trends and anomalies, and creating accurate financial reports. I’ve had experience with various accounting methods and possess a strong understanding of generally accepted accounting principles (GAAP). I am also a quick learner, adaptable to new software and procedures, and always strive for accuracy and efficiency in my work. In a previous role, I successfully implemented a new accounting system, which streamlined our processes and improved the accuracy of our financial reporting. This involved training staff on the new system and troubleshooting any issues that arose. I am confident in my ability to contribute significantly to your organization.

Q 22. Describe your experience with payroll processing.

My payroll processing experience spans over five years, encompassing various payroll systems and methodologies. I’m proficient in calculating gross pay, net pay, deductions (taxes, insurance, 401k contributions etc.), and generating accurate payroll reports. I have experience with both manual and automated payroll systems, including ADP and Paychex. In my previous role at [Previous Company Name], I was responsible for processing payroll for over 100 employees, ensuring timely and accurate payments while adhering to all relevant legal and regulatory requirements. I’m familiar with different pay schedules, including weekly, bi-weekly, and monthly, and have handled various payroll-related tasks such as managing employee data, resolving payroll discrepancies, and responding to employee inquiries. For example, I successfully resolved a complex issue involving a miscalculation of overtime pay by meticulously reviewing time sheets and applying the correct regulations, ultimately preventing a significant financial loss for the company.

Q 23. How do you handle stressful situations in the workplace?

I handle stressful situations by employing a structured approach. First, I take a deep breath and assess the situation calmly, identifying the root cause of the stress. Next, I prioritize tasks based on urgency and importance, focusing on what needs immediate attention. I leverage my organizational skills to break down complex problems into smaller, manageable steps. Effective communication is key; I openly discuss challenges with my colleagues and supervisors, seeking assistance or brainstorming solutions collaboratively. For instance, during a period of high volume during tax season, I proactively organized my workload, delegated tasks where possible, and communicated transparently with the team, leading to successful completion of all deadlines without compromising accuracy.

Q 24. What is your experience with financial reporting?

My experience in financial reporting includes preparing various financial statements, such as balance sheets, income statements, and cash flow statements. I’m adept at using accounting software like QuickBooks and Xero to generate accurate and timely reports. I’ve also created customized reports for management, providing key financial insights into profitability, liquidity, and other crucial metrics. In my previous role, I was responsible for monthly financial reporting, analyzing variances between actual and budgeted results, and preparing presentations for senior management. I am familiar with different accounting standards, including Generally Accepted Accounting Principles (GAAP) and understand the importance of adhering to these standards to ensure transparency and accuracy in financial reporting. A significant project involved analyzing the financial performance of a new product line, identifying key trends, and developing strategies to improve its profitability. This required meticulous data analysis and the creation of insightful reports that were instrumental in making strategic business decisions.

Q 25. How do you ensure compliance with accounting regulations?

Ensuring compliance with accounting regulations is a paramount concern for me. I stay updated on the latest changes in accounting standards and tax laws through professional development courses, industry publications, and networking with other accounting professionals. I maintain meticulous records and documentation to support all financial transactions. I’m also familiar with various compliance regulations such as Sarbanes-Oxley Act (SOX) if applicable, ensuring that all financial processes are conducted in compliance with these regulations. For example, before processing a transaction, I carefully review all supporting documentation, cross-referencing with internal policies and external regulations to ensure that the transaction is compliant with all applicable rules. Regular internal audits and adherence to a robust internal control system further help in maintaining compliance. This proactive approach has helped prevent potential legal and financial risks in my previous roles.

Q 26. How do you prioritize tasks and manage your time effectively?

I prioritize tasks using a combination of methods, including Eisenhower Matrix (urgent/important), and the Pareto Principle (80/20 rule). I leverage project management tools like Trello or Asana to effectively manage multiple projects simultaneously. I break down large projects into smaller, manageable tasks and create a detailed schedule with realistic deadlines. I regularly review my progress and adjust my plan as needed. Effective time management involves minimizing distractions, focusing on one task at a time, and utilizing time-blocking techniques to allocate dedicated time slots for specific activities. For example, I dedicate specific hours each day for high-focus tasks, eliminating distractions such as emails or meetings during this time. This strategy has significantly improved my productivity and enabled me to consistently meet deadlines.

Q 27. Describe your experience with different accounting methods.

I have experience with both accrual and cash accounting methods. Accrual accounting recognizes revenue when earned and expenses when incurred, regardless of when cash changes hands. This provides a more accurate picture of a company’s financial performance over time. Cash accounting, on the other hand, recognizes revenue and expenses only when cash is received or paid. I understand the advantages and disadvantages of each method and can apply the appropriate method based on the specific needs of a business. For instance, a small business might use cash accounting for its simplicity, while a larger corporation might use accrual accounting for more comprehensive financial reporting. I’ve also worked with different inventory valuation methods such as FIFO (First-In, First-Out) and LIFO (Last-In, First-Out), understanding how these impact the cost of goods sold and ultimately, the company’s profitability.

Q 28. What are your salary expectations for this role?

Based on my experience and the requirements of this role, my salary expectations are in the range of $[Lower Bound] to $[Upper Bound] per year. This range reflects my skills, qualifications, and the market rate for similar positions. I’m open to discussing this further and am confident that my contributions will significantly benefit your organization.

Key Topics to Learn for Basic Bookkeeping and Accounting Knowledge Interview

- The Accounting Equation: Understanding the fundamental relationship between assets, liabilities, and equity (A = L + E) and its practical application in balance sheet preparation.

- Debits and Credits: Mastering the double-entry bookkeeping system, including understanding how debits and credits affect different account types (assets, liabilities, equity, revenue, expenses).

- Chart of Accounts: Familiarity with organizing and categorizing financial transactions using a chart of accounts, ensuring consistent and accurate record-keeping.

- Journal Entries: Recording financial transactions chronologically in a journal, including understanding the process of posting to ledgers.

- Trial Balance: Preparing a trial balance to ensure the equality of debits and credits and identify potential errors in the accounting process.

- Financial Statements: Understanding the purpose and preparation of key financial statements: Income Statement, Balance Sheet, and Statement of Cash Flows. This includes interpreting key ratios and metrics derived from these statements.

- Basic Inventory Management: Understanding different inventory costing methods (FIFO, LIFO) and their impact on the financial statements.

- Accounts Receivable and Payable: Managing accounts receivable (money owed to the business) and accounts payable (money owed by the business), including procedures for tracking and collecting outstanding balances.

- Bank Reconciliation: Reconciling bank statements with internal accounting records to identify discrepancies and ensure accuracy.

- Payroll Fundamentals: Basic understanding of payroll processing, including deductions, taxes, and generating paychecks.

Next Steps

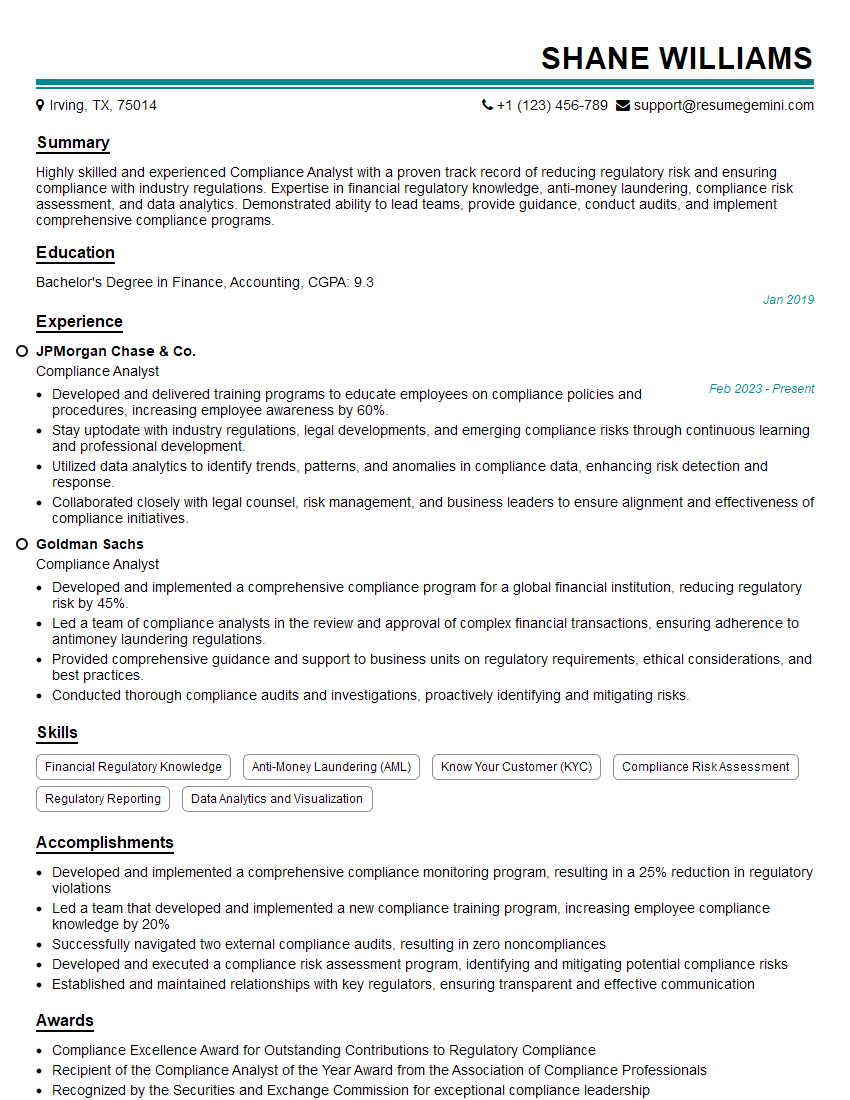

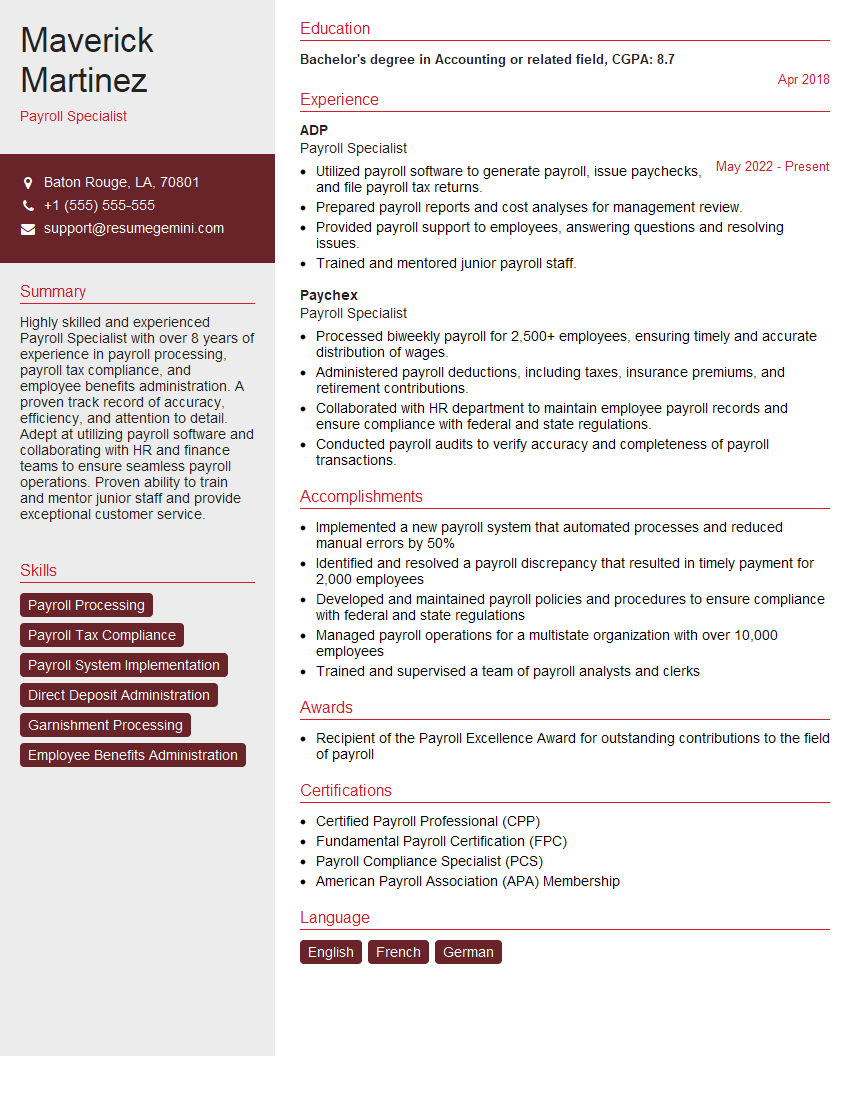

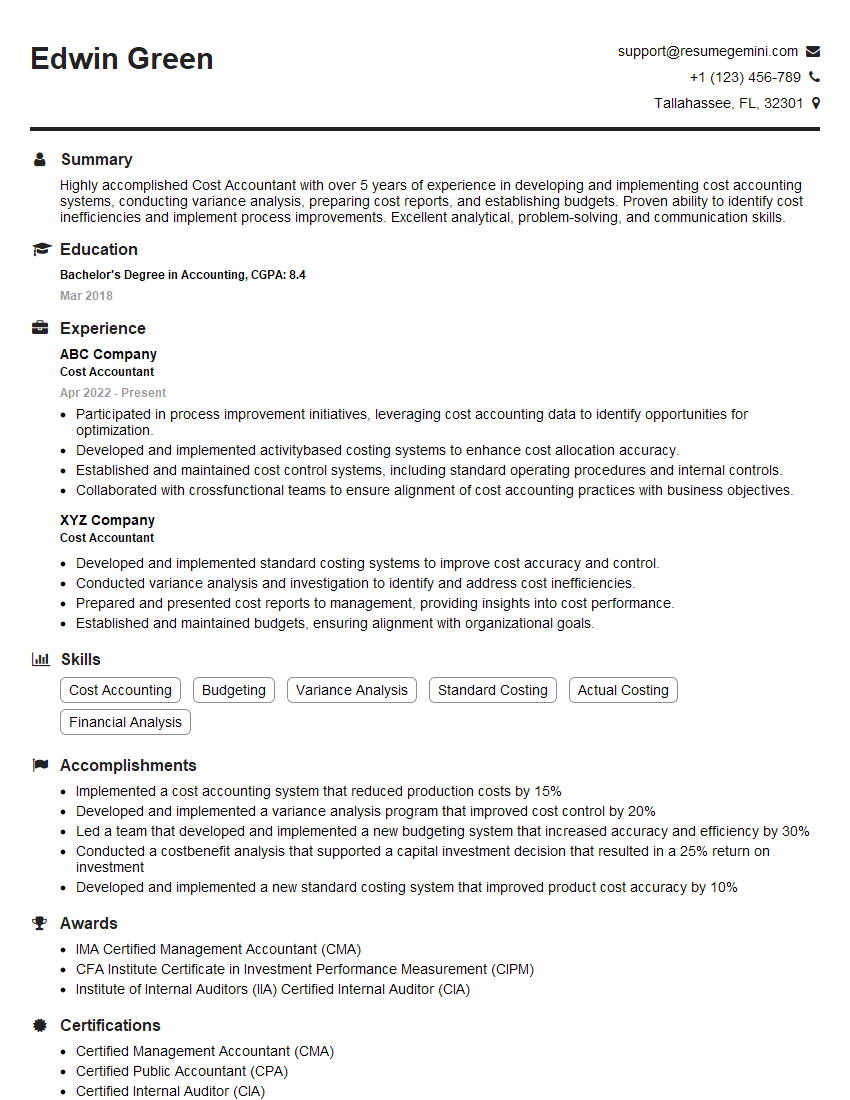

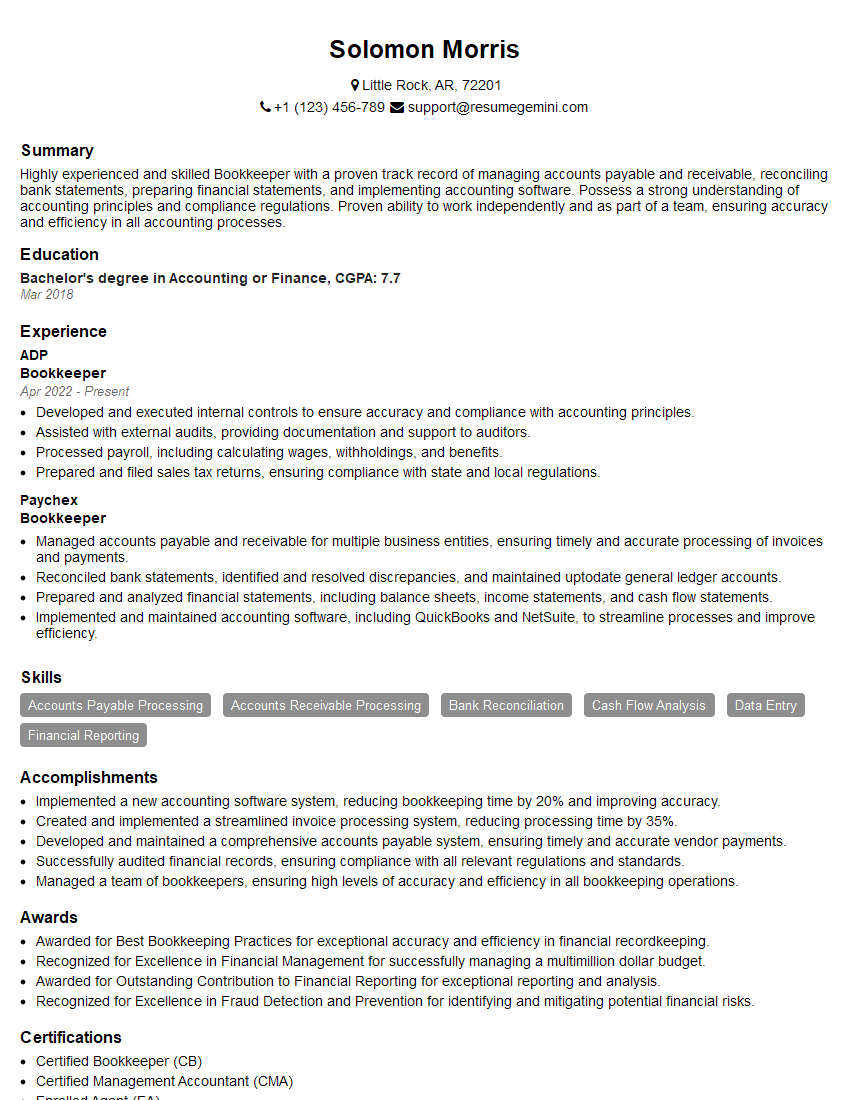

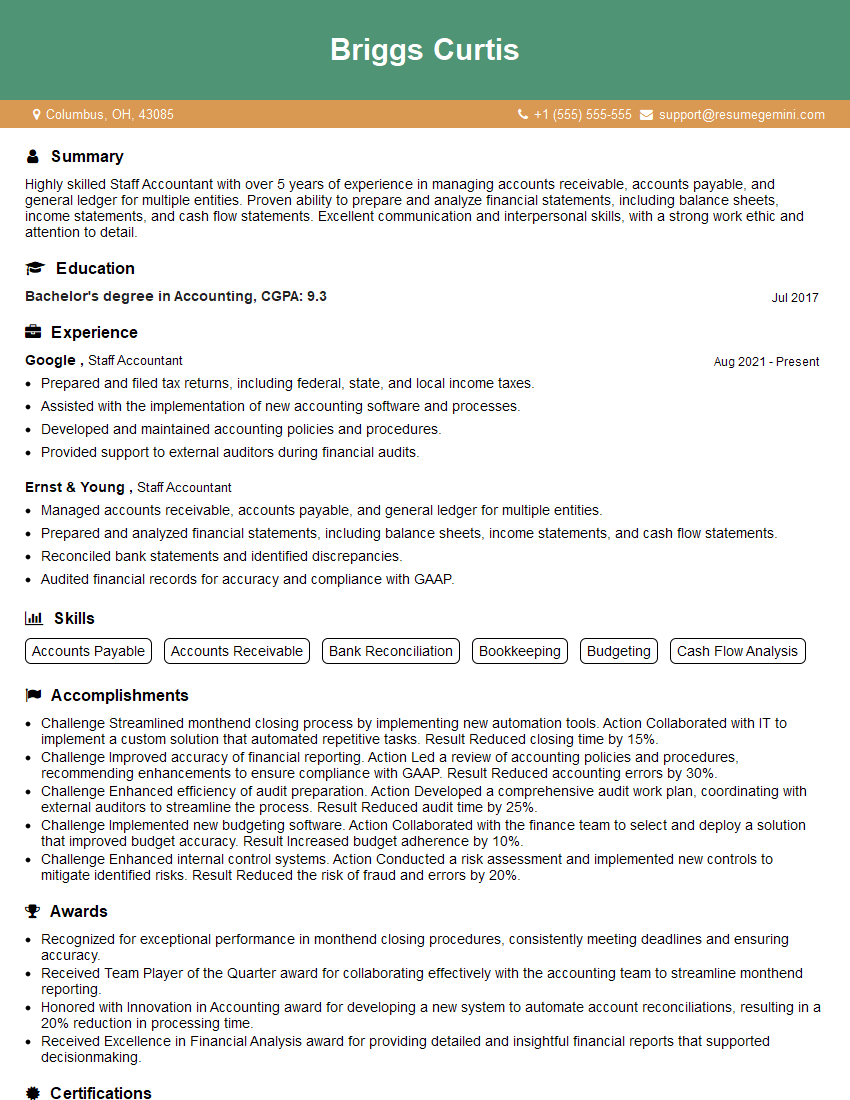

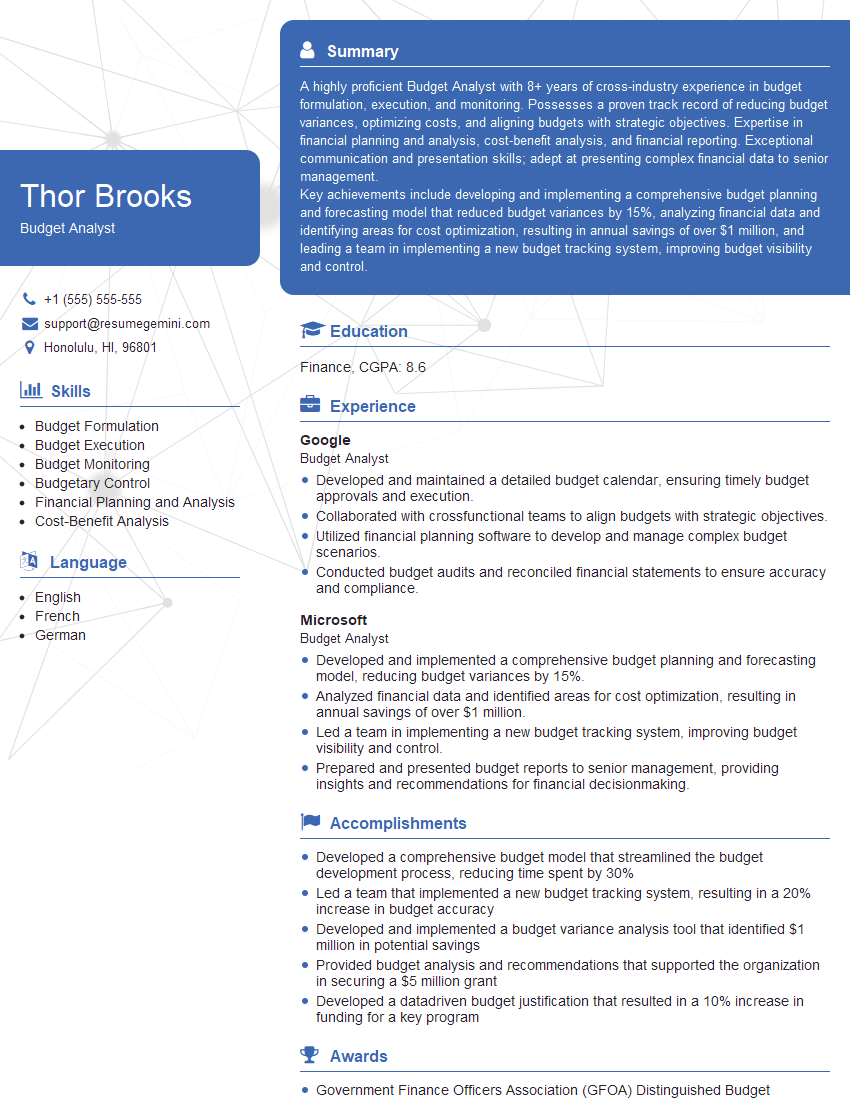

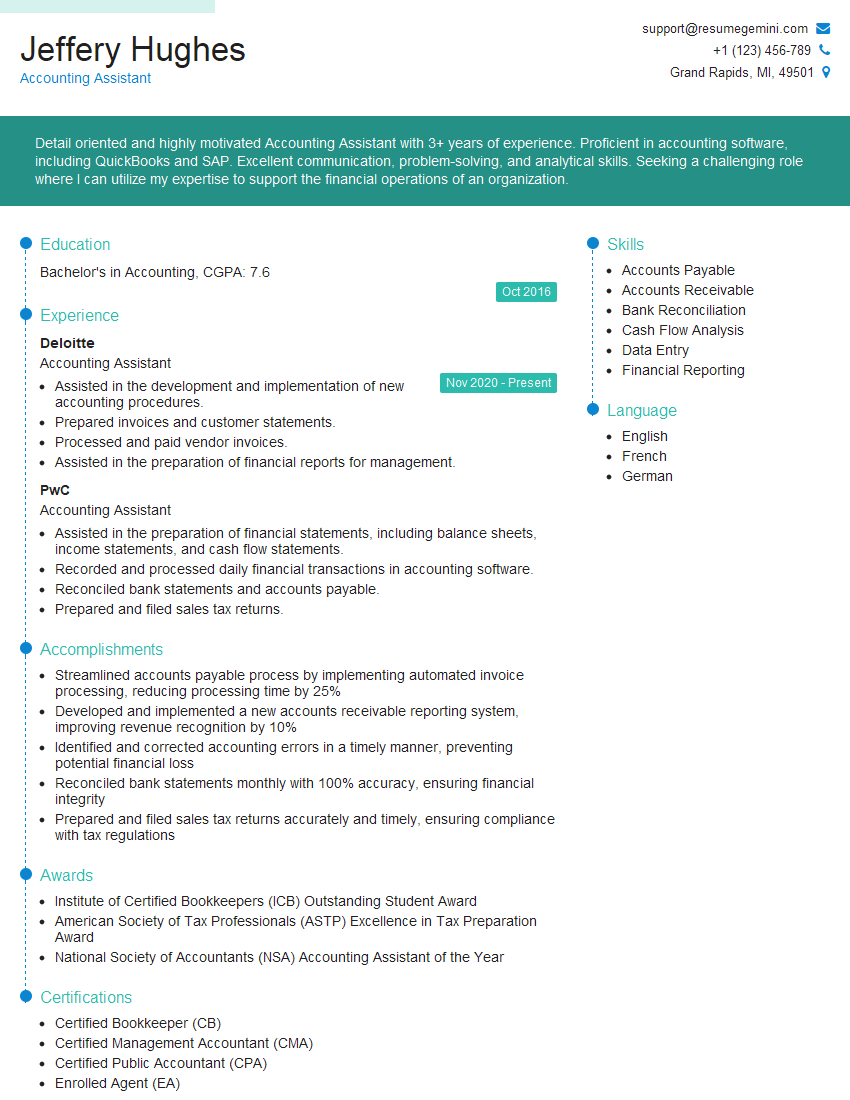

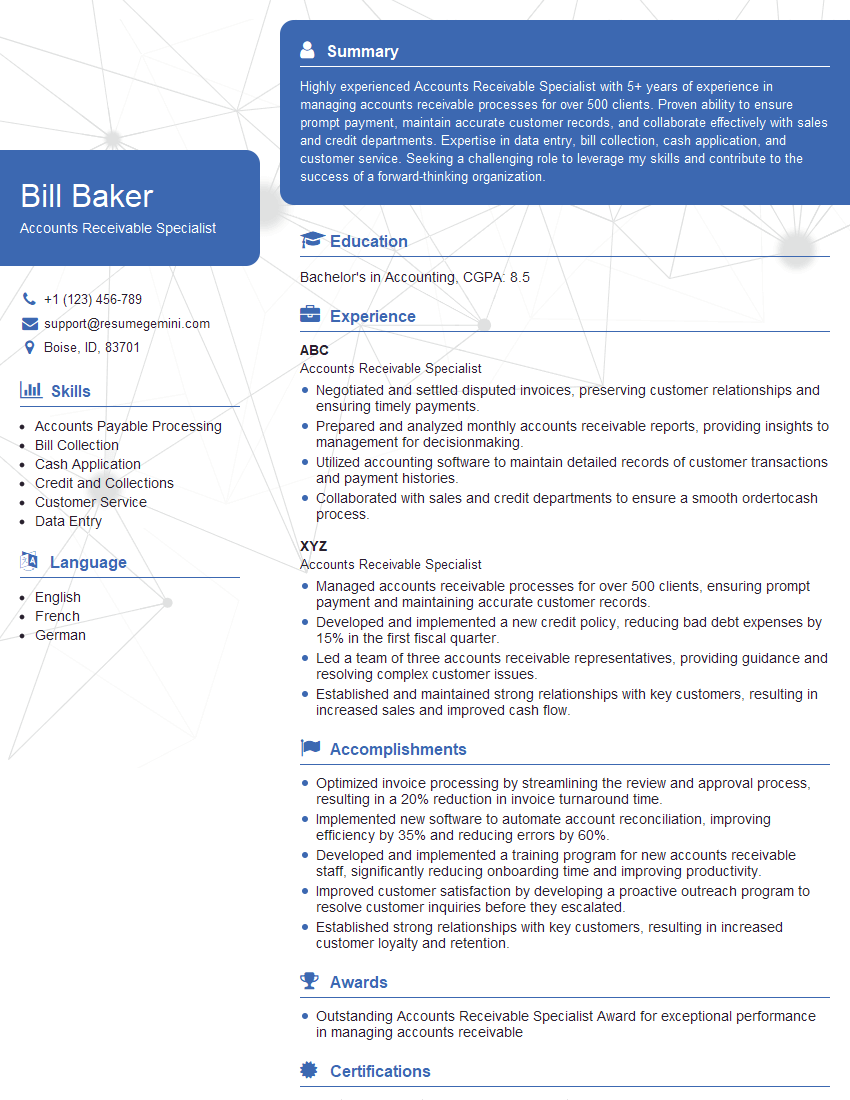

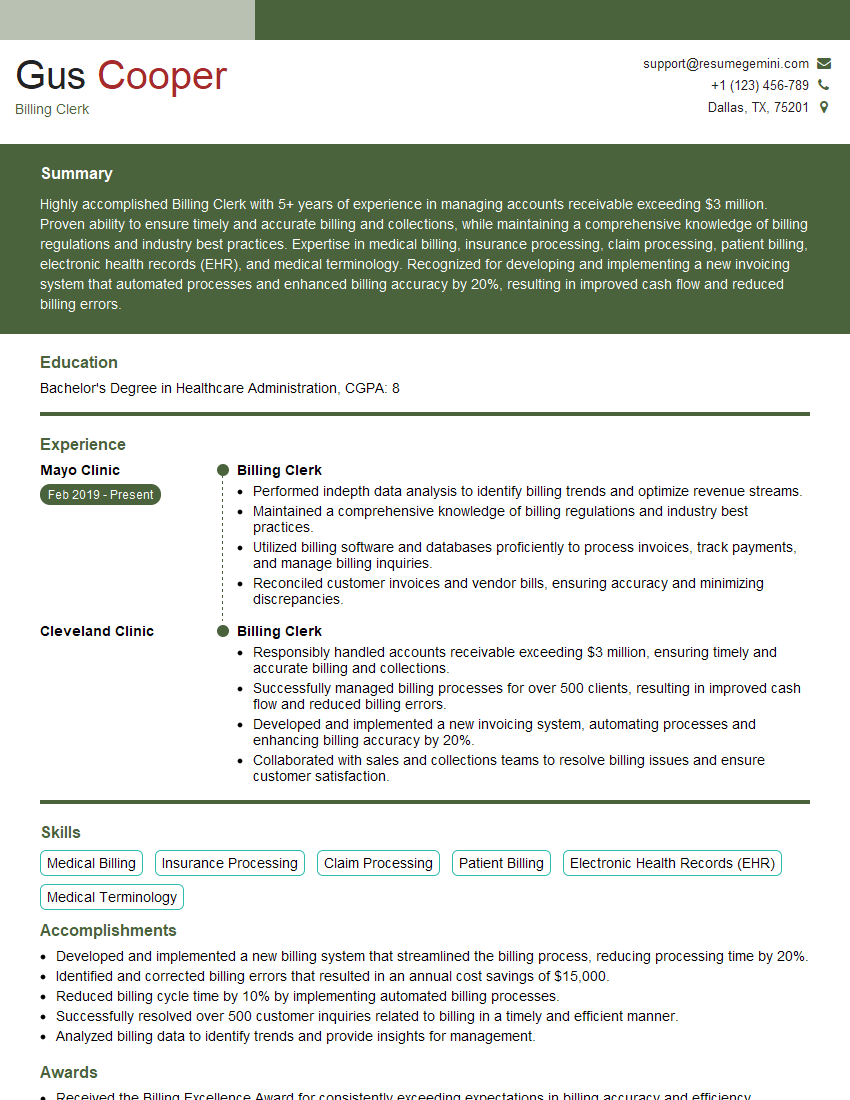

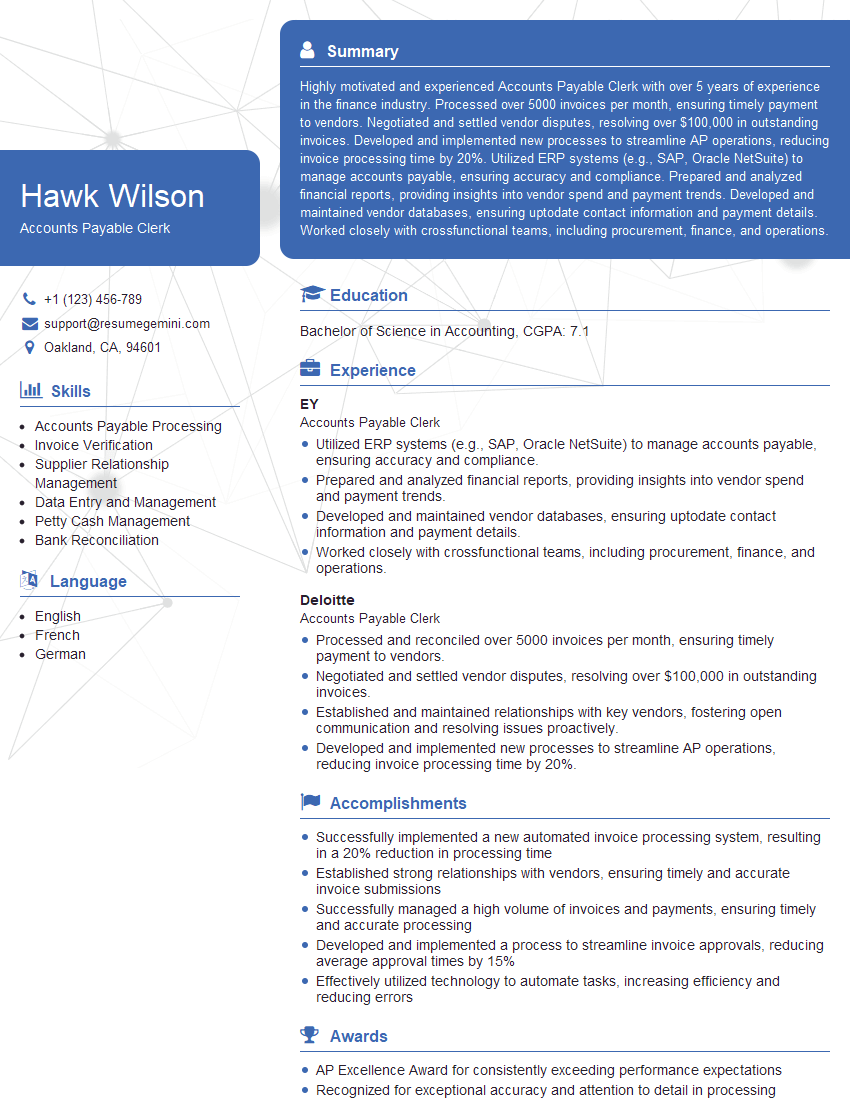

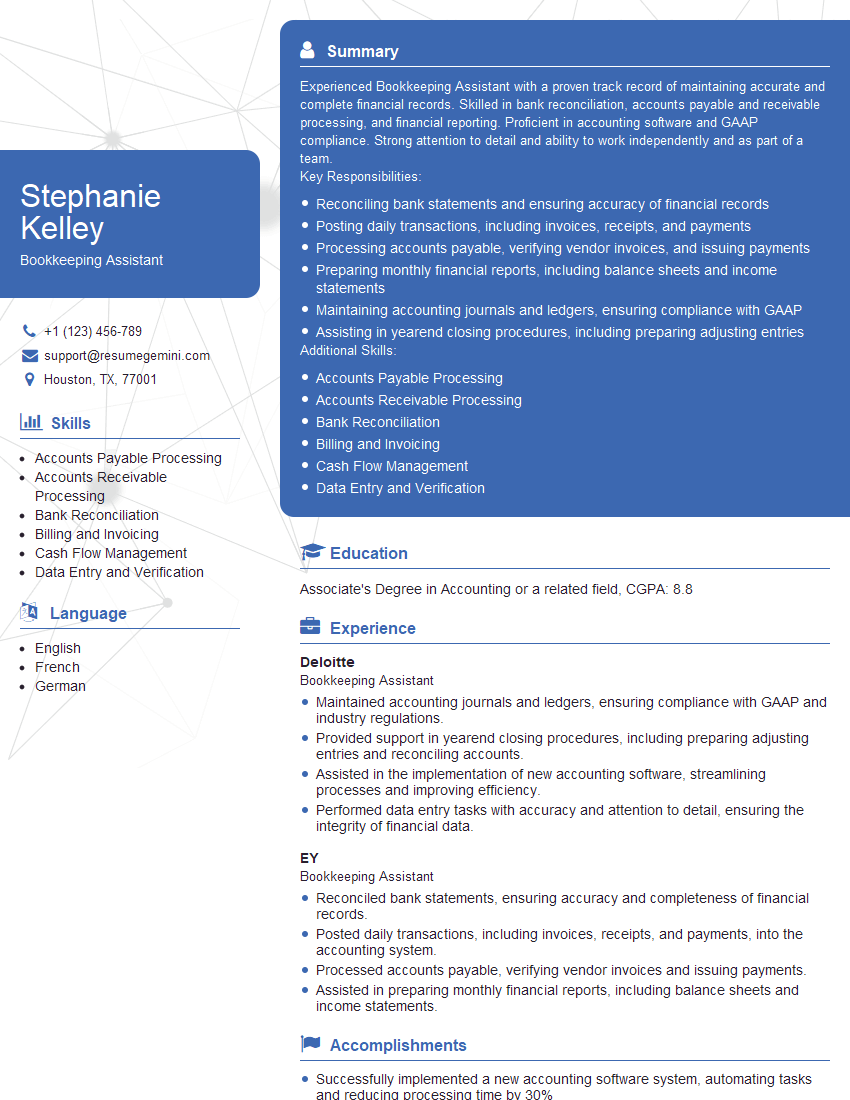

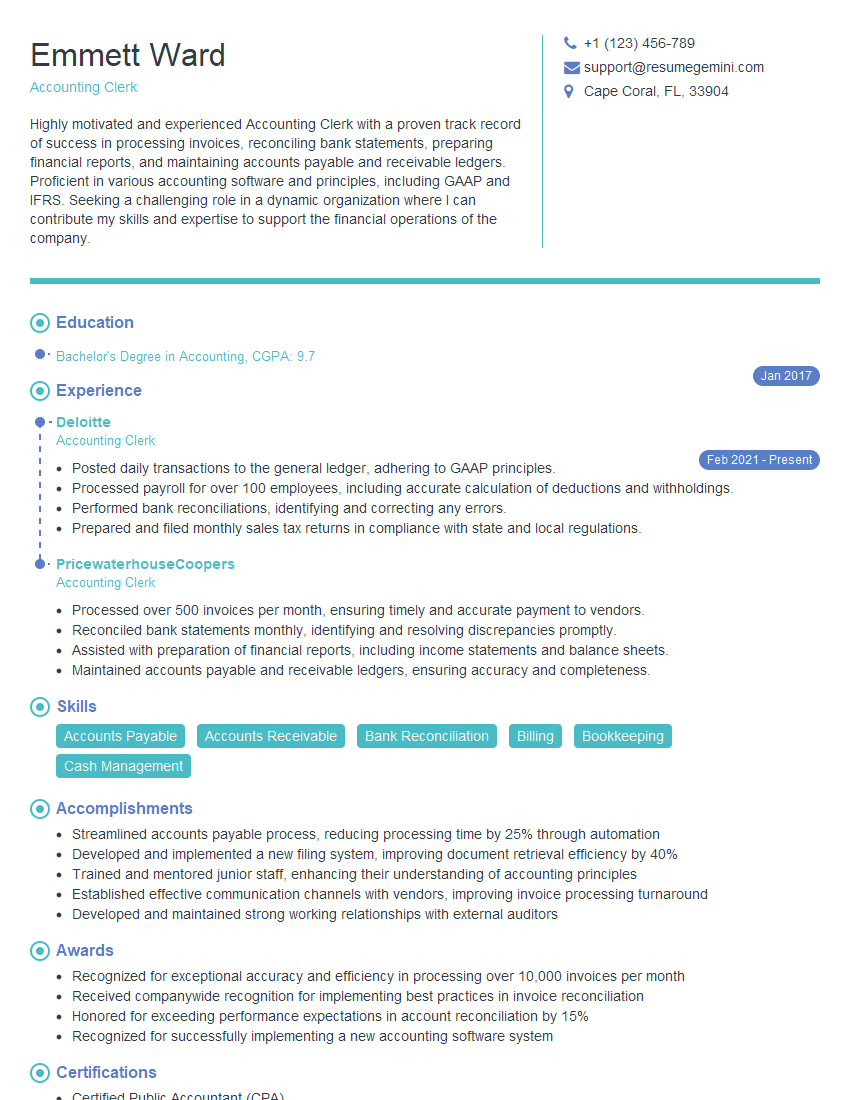

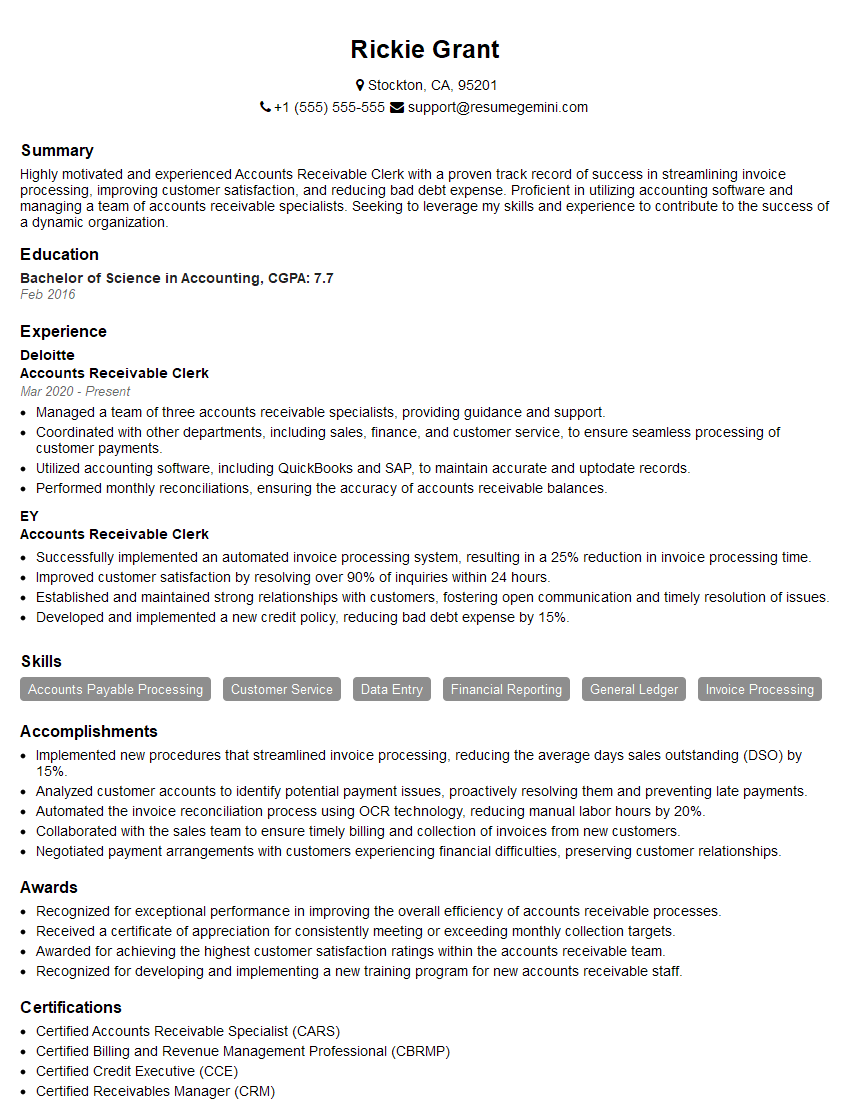

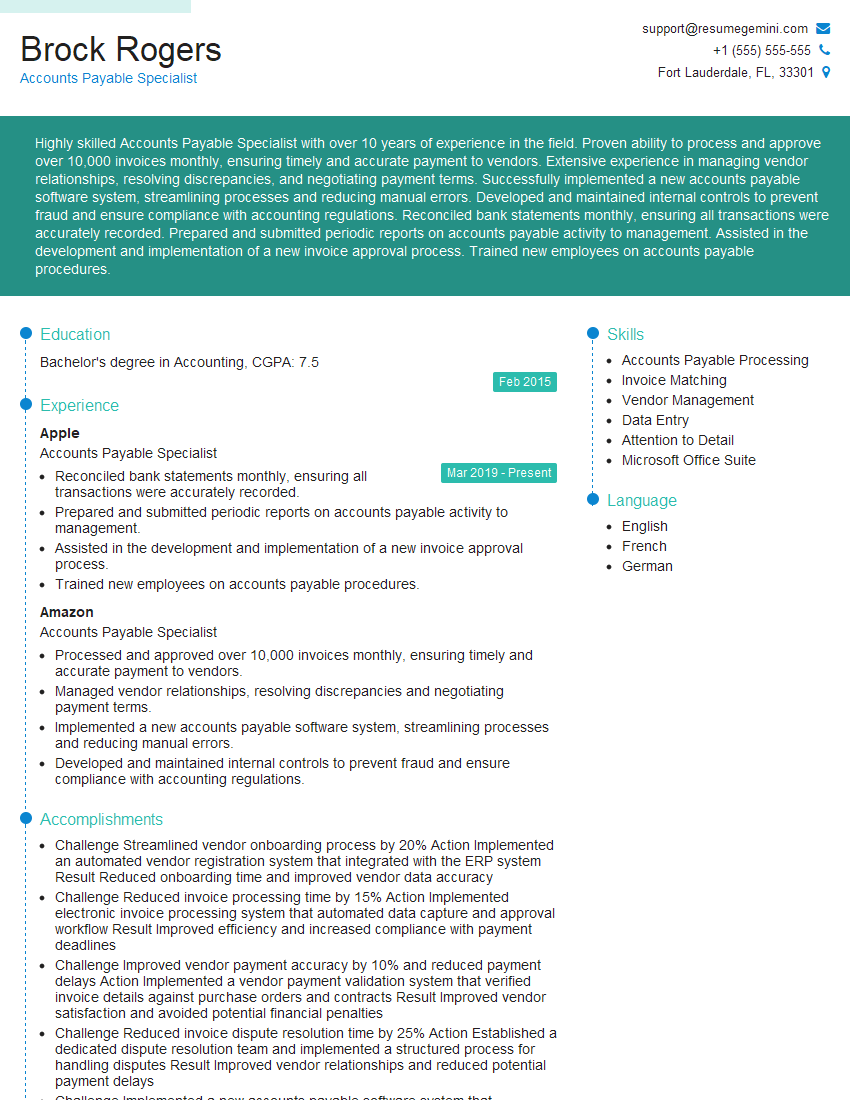

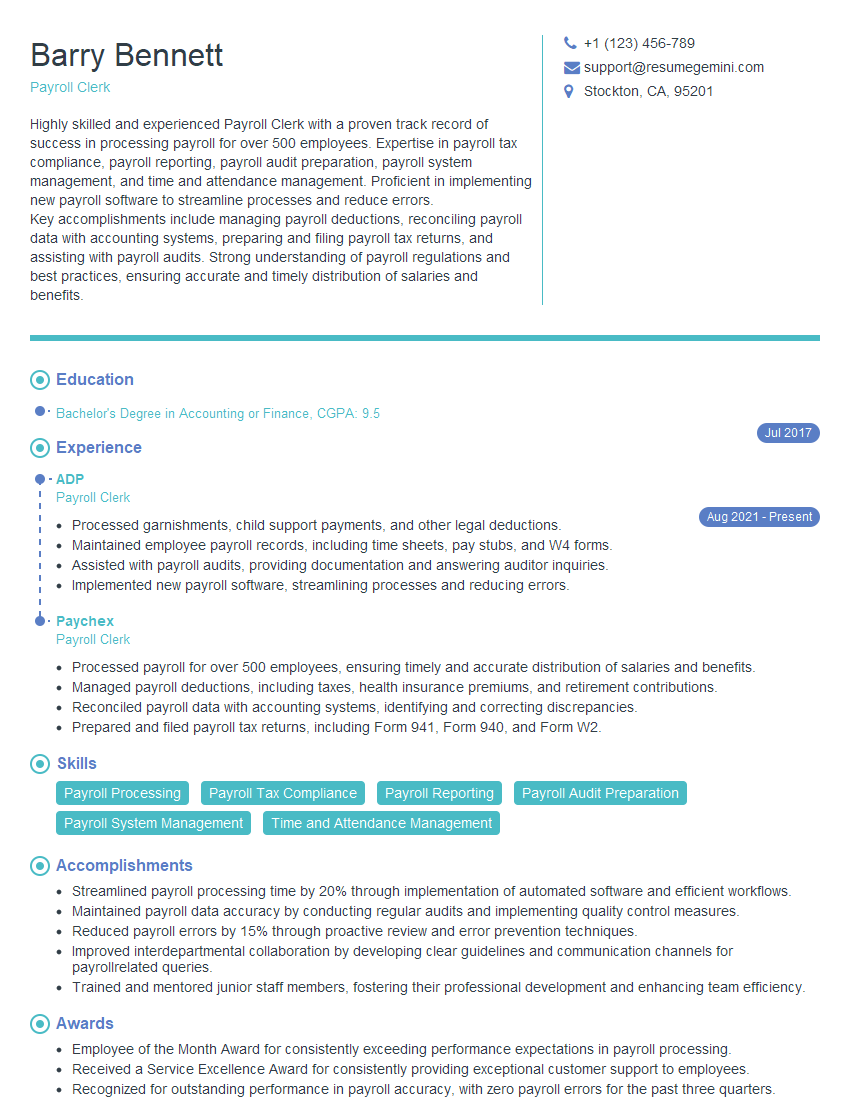

Mastering basic bookkeeping and accounting knowledge is crucial for career advancement in numerous fields, opening doors to exciting opportunities and higher earning potential. A strong understanding of these concepts demonstrates professionalism, attention to detail, and valuable analytical skills highly sought after by employers. To maximize your job prospects, create a compelling and ATS-friendly resume that showcases your skills and experience effectively. ResumeGemini is a trusted resource that can help you build a professional resume tailored to highlight your expertise. Examples of resumes tailored to Basic Bookkeeping and Accounting Knowledge are available to help you get started.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

Hi, I’m Jay, we have a few potential clients that are interested in your services, thought you might be a good fit. I’d love to talk about the details, when do you have time to talk?

Best,

Jay

Founder | CEO