Interviews are opportunities to demonstrate your expertise, and this guide is here to help you shine. Explore the essential Compliance with Government Regulations interview questions that employers frequently ask, paired with strategies for crafting responses that set you apart from the competition.

Questions Asked in Compliance with Government Regulations Interview

Q 1. Explain your understanding of the Sarbanes-Oxley Act (SOX).

The Sarbanes-Oxley Act of 2002 (SOX) is a landmark piece of US legislation designed to protect investors by improving the accuracy and reliability of corporate disclosures. It’s a response to major accounting scandals like Enron and WorldCom. At its core, SOX aims to enhance corporate responsibility and financial reporting transparency.

Key aspects of SOX include establishing stricter rules for corporate governance, including the establishment of independent audit committees; requiring CEOs and CFOs to personally certify the accuracy of financial statements; and strengthening the oversight role of the Public Company Accounting Oversight Board (PCAOB), which regulates auditing firms. Non-compliance can result in significant financial penalties and criminal charges.

Imagine a company where management is cooking the books. SOX provides the framework and legal teeth to prevent that by requiring independent audits, internal controls, and direct accountability from top management. In a practical sense, SOX impacts every stage of a company’s financial reporting, from internal controls to external audits.

Q 2. Describe your experience with HIPAA compliance.

My experience with HIPAA compliance spans several years, encompassing roles in both developing and implementing compliance programs. I’ve worked with organizations to assess their current state of HIPAA compliance, identify gaps, and develop remediation plans. This includes conducting risk assessments, developing and delivering training programs for employees, implementing data security protocols, and managing breach response planning.

Specifically, I’ve been involved in the implementation of technical safeguards, such as encryption and access controls, and administrative safeguards, like developing policies and procedures to ensure the privacy and security of protected health information (PHI). I’ve also had experience in handling PHI breaches, including reporting to the appropriate authorities and affected individuals. A memorable project involved helping a healthcare provider transition to a new electronic health record (EHR) system while maintaining strict HIPAA compliance throughout the process. It required meticulous planning and execution to ensure data integrity and patient privacy were never compromised.

Q 3. How familiar are you with GDPR regulations?

I’m very familiar with the General Data Protection Regulation (GDPR). It’s a comprehensive data privacy regulation in the European Union and the European Economic Area, impacting how organizations collect, process, and store personal data of EU residents. The GDPR has significantly raised the bar for data protection globally, influencing legislation in other parts of the world.

My understanding covers key aspects like the principles of data protection, the rights of data subjects (e.g., right to access, right to be forgotten), and the obligations of data controllers and processors. I’m experienced in conducting GDPR gap analyses, developing data protection policies and procedures, and implementing technical and organizational measures to ensure compliance. For example, I’ve helped organizations implement consent management systems, data breach notification protocols, and data protection impact assessments (DPIAs).

Think of it like this: GDPR gives individuals more control over their personal data. Organizations must be transparent about how they use that data and take robust measures to protect it. Non-compliance leads to hefty fines.

Q 4. What is your experience with conducting internal compliance audits?

I have extensive experience conducting internal compliance audits across various industries. My approach involves a risk-based methodology, focusing on areas with the highest potential for non-compliance. This includes reviewing policies and procedures, conducting interviews with staff, examining documentation and systems, and testing controls. I’ve used various auditing frameworks and methodologies, adapting them based on the specific regulatory requirements and the organization’s risk profile.

A recent example involved auditing a financial institution’s compliance with anti-money laundering (AML) regulations. The audit encompassed reviewing transaction monitoring systems, employee training records, and suspicious activity reports. This resulted in identifying gaps in the AML program and recommending improvements to enhance compliance. My reports typically include findings, conclusions, and recommendations for corrective action, along with a prioritized remediation plan.

Q 5. How would you identify and assess compliance risks within an organization?

Identifying and assessing compliance risks is a systematic process. It starts with understanding the applicable regulations and identifying the organization’s activities that are subject to those regulations. This involves a thorough risk assessment that considers factors like the organization’s size, industry, operations, and the potential impact of non-compliance.

The process typically involves:

- Identifying applicable regulations: Determining all laws, rules, and regulations that apply to the organization’s operations.

- Mapping activities to regulations: Linking specific organizational activities to the corresponding regulatory requirements.

- Assessing risk likelihood and impact: Determining the probability of a compliance failure and its potential consequences.

- Prioritizing risks: Focusing on the highest-priority risks based on their likelihood and impact.

- Developing a risk mitigation plan: Outlining strategies and actions to address identified risks.

For example, a retail company processing customer credit card information must assess risks related to PCI DSS compliance. Failing to do so could lead to significant data breaches and financial penalties.

Q 6. Describe your approach to developing and implementing a compliance program.

My approach to developing and implementing a compliance program is based on a holistic and risk-based framework. It focuses on establishing a culture of compliance within the organization, fostering accountability, and ensuring ongoing monitoring and improvement. The process typically involves these steps:

- Risk assessment and gap analysis: Identifying the organization’s compliance risks and determining where it falls short of regulatory requirements.

- Policy and procedure development: Creating clear, concise policies and procedures that align with relevant regulations.

- Training and awareness: Educating employees about compliance requirements and their roles in maintaining compliance.

- Implementation and monitoring: Putting the compliance program into practice and regularly monitoring its effectiveness.

- Auditing and reporting: Conducting regular audits and reporting on compliance status to management and relevant stakeholders.

- Continuous improvement: Regularly reviewing and updating the compliance program to address emerging risks and regulatory changes.

Imagine building a house. A robust compliance program is like the foundation – you need a strong base to ensure the structure can withstand challenges. Each step builds upon the previous, creating a strong and sustainable system.

Q 7. How do you stay current with changes in government regulations?

Staying current with changes in government regulations requires a multifaceted approach. I utilize several methods to ensure I am always up-to-date:

- Subscription to regulatory updates: Subscribing to newsletters, alerts, and legal updates from reputable sources covering relevant areas.

- Professional development: Attending industry conferences, webinars, and training sessions to learn about emerging issues and best practices.

- Networking with peers: Engaging with other compliance professionals to share insights and stay informed about current challenges and trends.

- Monitoring regulatory websites: Regularly reviewing government agency websites for new rules, guidance, and enforcement actions.

- Utilizing legal research tools: Employing specialized legal research databases to stay abreast of legislative and judicial developments.

Compliance is an ongoing process, not a one-time event. Keeping up-to-date is crucial to maintaining compliance and protecting the organization from legal and reputational risks.

Q 8. Explain your understanding of the Foreign Corrupt Practices Act (FCPA).

The Foreign Corrupt Practices Act (FCPA) is a United States law that prohibits bribery of foreign officials to obtain or retain business. It’s a crucial piece of legislation impacting multinational corporations. The FCPA has two main components: the anti-bribery provisions and the accounting provisions. The anti-bribery provisions prohibit the offering, promising, paying, or authorizing the payment of anything of value to a foreign official to influence a business decision. This includes direct payments, but also encompasses indirect payments through intermediaries. The accounting provisions require companies to maintain accurate books and records and implement internal controls to prevent fraud. Think of it like this: imagine you’re a US company trying to secure a lucrative contract in another country. The FCPA states you absolutely cannot offer a bribe to a government official to win that contract, regardless of how common such practices might be in that particular nation. Failure to comply results in significant penalties, including hefty fines and imprisonment for both individuals and corporations.

For example, a company offering a lavish gift to a foreign official in exchange for a contract would be in violation. Similarly, a company that knowingly allows its employees to use slush funds to pay bribes would also violate the FCPA. The act extends beyond direct payments to encompass subtle forms of bribery, such as offering expensive gifts or providing lavish travel arrangements.

Q 9. How would you handle a situation where a colleague violates company compliance policies?

If a colleague violated company compliance policies, my first step would be to understand the situation thoroughly. I’d speak to the colleague privately, ensuring confidentiality and a non-judgmental approach. The goal is to determine if the violation was unintentional or deliberate, and the extent of the infraction. If it was unintentional – perhaps due to a lack of training – I’d help them understand the policy and provide resources for additional training. However, if the violation was deliberate or constituted a serious breach, I would follow established company reporting procedures. This often involves escalating the matter to a compliance officer, legal counsel, or a designated ethics hotline. The process is carefully documented to protect both the company and the individual involved, maintaining fairness and objectivity throughout the procedure. It’s a delicate balance, aiming to correct the issue while also considering the individual’s role and career within the organization.

Q 10. Describe your experience with reporting compliance violations.

I have extensive experience reporting compliance violations, having worked in environments with robust reporting mechanisms. In previous roles, I’ve reported issues ranging from minor procedural inconsistencies to potentially serious breaches of regulations like the FCPA or data privacy laws. My approach always prioritizes thorough documentation, accuracy, and following established internal protocols. This includes gathering all relevant information, such as dates, times, individuals involved, and any supporting evidence. I’ve consistently ensured that my reports are objective, factual, and clearly outline the nature and potential impact of the violation. This approach allows for a fair and efficient investigation and resolution of the reported issue. Confidentiality is also paramount, ensuring the protection of individuals involved while maintaining transparency within the bounds of the investigative process. I view compliance reporting as an integral part of maintaining a strong ethical and legal framework within any organization.

Q 11. How familiar are you with the Dodd-Frank Act?

I am very familiar with the Dodd-Frank Act, a landmark piece of legislation passed in response to the 2008 financial crisis. It’s incredibly broad, encompassing several areas related to financial regulation, but key aspects relevant to compliance include the Whistleblower Protection provisions and the enhanced corporate governance requirements. The whistleblower protection offers significant financial incentives for individuals to report potential violations, encouraging greater transparency and accountability within the financial industry. The increased scrutiny on corporate governance necessitates a robust compliance framework within organizations, focusing on risk management, internal controls, and executive compensation.

Specifically, I understand the implications of the act for financial institutions and publicly traded companies, including strengthened oversight of executive compensation and enhanced transparency in financial reporting. I am adept at navigating the complexities of the Dodd-Frank Act, ensuring adherence to the various regulations it mandates.

Q 12. What is your experience with data security and privacy regulations?

My experience with data security and privacy regulations is extensive, encompassing a range of international and national laws. I’m familiar with regulations such as GDPR (General Data Protection Regulation), CCPA (California Consumer Privacy Act), and HIPAA (Health Insurance Portability and Accountability Act). My experience includes developing and implementing data security policies, conducting data risk assessments, and managing data breach response plans. I’m proficient in understanding data classification, access controls, and encryption methodologies. In practical terms, this means I can help an organization understand its obligations under these regulations, implement appropriate safeguards, and ensure compliance with ongoing changes in the legal landscape. I’ve assisted organizations in achieving compliance through conducting regular audits, training employees on best practices, and fostering a data security-conscious culture.

Q 13. How would you communicate compliance requirements to employees at different levels of the organization?

Communicating compliance requirements effectively requires a tailored approach, recognizing that employees at different levels within the organization will have varying levels of understanding and responsibilities. For senior management, communication focuses on strategic risk management and compliance program effectiveness. This often involves presenting compliance metrics, identifying emerging risks, and discussing potential budgetary implications. Mid-level managers require training on specific compliance procedures and their roles in ensuring adherence. This could include interactive workshops, case studies, and regular updates on regulatory changes. For front-line employees, the focus is on practical application of policies and procedures. This frequently involves clear, concise instructions, easily accessible resources, and readily available channels for reporting violations. I utilize a multi-faceted approach including training sessions, webinars, intranet resources, and regular communications, ensuring that compliance messages are consistent, clear, and accessible across the entire organization.

Q 14. Explain your experience with risk assessments related to compliance.

My experience with compliance-related risk assessments is comprehensive. I utilize a structured methodology, typically starting with identifying all relevant laws and regulations applicable to the organization. Next, I assess the likelihood and potential impact of non-compliance for each area, considering factors such as the severity of potential penalties, reputational damage, and operational disruption. This assessment utilizes various tools and techniques, including questionnaires, interviews, and data analysis, to comprehensively evaluate the organization’s vulnerabilities. Based on this analysis, I develop mitigation strategies to address the identified risks, including implementing new controls, strengthening existing ones, and providing additional training to employees. Finally, I regularly monitor and review the effectiveness of these controls, ensuring they remain adequate and align with evolving regulatory requirements and business changes. My approach emphasizes a proactive and dynamic risk management strategy, enabling the organization to identify and mitigate compliance risks effectively.

Q 15. How do you prioritize compliance issues and allocate resources accordingly?

Prioritizing compliance issues and allocating resources requires a risk-based approach. I begin by identifying all applicable regulations and then assessing the potential risks associated with non-compliance in each area. This involves considering the likelihood of a violation and the potential severity of the consequences (fines, reputational damage, legal action). A risk matrix, often visually represented, is incredibly helpful here.

For example, a high-risk, high-likelihood violation like data breaches under GDPR would naturally receive a larger allocation of resources than a low-risk, low-likelihood violation, like a minor paperwork error. After the risk assessment, I develop a prioritized list and allocate budget and personnel accordingly, focusing resources on mitigating the highest-risk areas first. This might involve implementing new software, hiring specialists, or increasing training frequency.

This prioritization is not static; it’s regularly reviewed and updated to reflect changes in the regulatory landscape, business operations, and emerging threats. Regular reassessment ensures the compliance program remains effective and efficient.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. Describe your experience with conducting compliance training.

My experience with compliance training spans several industries, including finance and healthcare. I’ve designed and delivered training programs ranging from short, targeted sessions focusing on specific regulations (like HIPAA or SOX) to comprehensive multi-day courses covering a broader range of compliance topics.

My approach is interactive and engaging, moving beyond simple lectures to incorporate case studies, role-playing exercises, and quizzes. I tailor the content and delivery method to the specific audience and their level of understanding. For example, a technical training for IT staff on data security would differ significantly from a high-level overview for executive management.

After delivering the training, I always assess its effectiveness through post-training assessments and follow-up questionnaires. This data provides critical feedback on areas needing improvement and ensures the training remains relevant and impactful.

Q 17. How would you measure the effectiveness of a compliance program?

Measuring the effectiveness of a compliance program is crucial for ensuring its ongoing success. It’s not enough just to *have* a program; it needs to demonstrably *work*. I use a multifaceted approach incorporating leading and lagging indicators.

- Leading Indicators: These measure the *proactive* aspects of the program, reflecting the efforts made to prevent non-compliance. Examples include the number of compliance training hours completed, the number of risk assessments conducted, and the effectiveness of internal audits.

- Lagging Indicators: These measure the *reactive* aspects, focusing on the outcomes of the program. Examples include the number of compliance violations, the number of regulatory inquiries, and the financial impact of non-compliance (fines, penalties).

By tracking both leading and lagging indicators, I gain a comprehensive understanding of the program’s effectiveness. A robust program will show a decrease in lagging indicators over time, while simultaneously exhibiting strong leading indicators demonstrating ongoing effort and vigilance.

Q 18. What metrics would you use to monitor compliance?

The metrics used to monitor compliance depend on the specific regulations and the nature of the business. However, some key metrics I consistently track include:

- Incident Rate: Number of compliance incidents (violations, near misses) per employee or per transaction.

- Audit Findings: Number of critical, major, and minor findings identified during internal and external audits.

- Training Completion Rate: Percentage of employees who have completed mandatory compliance training.

- Policy Acknowledgement Rate: Percentage of employees who have acknowledged and understood relevant policies and procedures.

- Time to Remediation: The average time taken to address and resolve compliance issues.

- Regulatory Inquiry Rate: The frequency of inquiries or investigations from regulatory bodies.

- Financial Impact of Non-Compliance: The cost of fines, penalties, and remediation efforts.

These metrics are regularly reported, analyzed, and used to inform improvements to the compliance program. Trends in these metrics can signal emerging risks or weaknesses requiring immediate attention.

Q 19. Describe your experience with using compliance management software.

I have extensive experience using compliance management software, including solutions from vendors such as [Vendor A] and [Vendor B] (replace with actual vendor names, avoiding specific product names for confidentiality). These tools have significantly enhanced my ability to manage compliance programs efficiently and effectively.

Specifically, I’ve used these tools for:

- Policy and Procedure Management: Centralized storage, version control, and easy access to all relevant compliance documents.

- Risk Assessment and Management: Conducting risk assessments, tracking identified risks, and assigning ownership for mitigation efforts.

- Training Management: Scheduling and tracking employee training, managing training records, and delivering online training modules.

- Audit Management: Scheduling and managing internal audits, documenting findings, and tracking remediation efforts.

- Reporting and Analytics: Generating reports on key compliance metrics to track progress and identify areas for improvement.

The use of such software ensures a more streamlined, automated, and auditable process, reducing manual effort and improving overall efficiency.

Q 20. How do you handle conflicts between regulatory requirements and business objectives?

Conflicts between regulatory requirements and business objectives are inevitable. My approach involves a structured process to navigate these conflicts:

- Identify and Document the Conflict: Clearly define the specific regulatory requirement and the conflicting business objective.

- Analyze the Potential Impact: Assess the potential consequences of non-compliance (fines, legal action, reputational damage) versus the impact of altering the business objective.

- Explore Alternative Solutions: Brainstorm alternative approaches that might satisfy both the regulatory requirement and the business objective. This might involve modifying processes, seeking regulatory clarification, or exploring technological solutions.

- Seek Internal and External Advice: Consult with legal counsel, regulatory experts, and senior management to determine the best course of action.

- Document the Decision and Rationale: Maintain clear documentation explaining the decision-making process, the rationale behind the chosen course of action, and any potential risks.

The goal is to find a solution that minimizes risk while still allowing the business to achieve its objectives, even if it requires compromise on one or both sides. Transparency and proper documentation are paramount in this process.

Q 21. What is your understanding of internal controls related to compliance?

Internal controls are the processes, policies, and procedures implemented to ensure compliance with regulations, laws, and company policies. They’re the backbone of a strong compliance program. Effective internal controls provide reasonable assurance that objectives are met, including those related to financial reporting, operational efficiency, and compliance with laws and regulations.

Key elements of internal controls related to compliance include:

- Segregation of Duties: Distributing responsibilities to prevent fraud and errors.

- Authorization and Approval Processes: Establishing clear approval processes for key transactions and decisions.

- Documentation and Record Keeping: Maintaining accurate and complete records of all transactions and activities.

- Monitoring and Surveillance: Regularly monitoring activities to identify potential issues and weaknesses.

- Independent Audits: Conducting regular internal and external audits to assess the effectiveness of internal controls.

Strong internal controls not only help ensure compliance but also improve operational efficiency, reduce risk, and enhance the overall integrity of the organization. They are not merely a checklist, but an ongoing, adaptive system designed to safeguard the organization’s interests.

Q 22. Describe a time you identified a compliance gap and how you addressed it.

During a recent audit of our data security protocols, I identified a significant compliance gap concerning the handling of Personally Identifiable Information (PII). Our existing system lacked adequate encryption during data transfer, violating several key regulations, including GDPR and CCPA. To address this, I followed a structured approach. First, I conducted a thorough risk assessment to determine the potential impact of the non-compliance. This involved identifying vulnerabilities and calculating potential fines or reputational damage. Then, I developed a remediation plan that involved implementing end-to-end encryption using industry-standard protocols like TLS 1.3. This included not only updating our internal systems but also negotiating with third-party vendors to ensure seamless integration. We also implemented robust employee training on the updated protocols. Finally, I worked with the IT department to conduct rigorous testing and validation of the new system before deploying it company-wide. This systematic approach ensured a smooth transition and effectively closed the compliance gap. The success was measured through subsequent audits that confirmed full compliance with the relevant regulations.

Q 23. How do you ensure the accuracy and completeness of compliance documentation?

Ensuring accuracy and completeness in compliance documentation is paramount. I approach this through a multi-layered strategy. First, we utilize a centralized document management system which allows for version control and easy access for all relevant stakeholders. This eliminates the risk of working with outdated versions. Second, we have established clear documentation protocols which includes templates for various types of compliance documentation, ensuring consistency and preventing omission of critical information. This includes checklists and standardized formats for audits, policies, and training records. Third, we implement a robust review and approval process. All documentation undergoes a thorough review by at least two individuals, one of whom has specialized compliance expertise. This helps identify inconsistencies or missing data before the documents are finalized. Finally, regular audits are conducted to verify the accuracy and completeness of the existing documents and identify any potential gaps. Think of it like a carefully curated library, with clear organization, version control, and quality checks ensuring every book is accurate and up-to-date.

Q 24. What is your experience with interacting with regulatory agencies?

I have extensive experience interacting with regulatory agencies, including the FTC, SEC, and various state agencies. This involves preparing and submitting reports, responding to inquiries, and participating in audits. My approach is proactive and collaborative. I believe in open communication and transparency. I strive to understand the agency’s perspective and work with them to address any concerns effectively. For example, during a recent SEC audit, we proactively identified a minor discrepancy in our financial reporting. By promptly disclosing this and providing comprehensive documentation explaining the situation, we successfully mitigated any potential penalties. Maintaining a positive working relationship with these agencies is crucial for minimizing risks and navigating any challenges that may arise.

Q 25. How do you manage stakeholder expectations related to compliance?

Managing stakeholder expectations related to compliance requires clear communication and proactive engagement. This involves setting clear expectations from the outset, ensuring all stakeholders understand their roles and responsibilities. I leverage regular communication, such as newsletters, town hall meetings, and training sessions, to keep stakeholders informed about relevant compliance matters. I also utilize various communication channels, tailoring my approach based on the audience and the level of detail required. For instance, senior management receives high-level summaries and key performance indicators (KPIs), while employees receive more specific guidance regarding their individual responsibilities. This approach fosters a shared understanding of compliance expectations, promoting collaboration and accountability.

Q 26. Describe your experience with remediation of compliance deficiencies.

Remediation of compliance deficiencies requires a systematic and thorough approach. I typically start by identifying the root cause of the deficiency, conducting a thorough investigation to understand why the non-compliance occurred. Then, I develop a comprehensive remediation plan that outlines the steps necessary to address the issue and prevent recurrence. This plan includes specific timelines, responsible parties, and measurable outcomes. For example, when we discovered a lapse in our data backup procedures, resulting in a partial data loss, I immediately implemented a multi-pronged approach that involved restoring the data from available backups, strengthening our backup procedures, investing in new backup technology, and initiating comprehensive employee training on the updated procedures. Progress is carefully monitored, and corrective actions are taken as needed, ensuring consistent compliance with the relevant regulations. Finally, we conduct post-remediation audits to verify the effectiveness of the implemented changes.

Q 27. How would you improve a company’s existing compliance program?

Improving a company’s existing compliance program often involves a holistic review and enhancement process. I would start by assessing the current program’s effectiveness, identifying gaps and areas for improvement through risk assessments, gap analysis, and interviews with key stakeholders. Then, I would focus on enhancing key elements like risk management, establishing clear lines of accountability, and implementing a robust training program. This would involve customizing training materials to align with specific roles and responsibilities and developing interactive training modules. Additionally, I would advocate for integrating compliance into the company’s overall business strategy, making it an integral part of the decision-making process. This includes embedding compliance considerations into project planning and product development. Finally, I would recommend regular audits and continuous improvement cycles to ensure the program remains effective and adaptable to the ever-changing regulatory landscape.

Q 28. What are the key challenges you foresee in maintaining compliance in the coming years?

Maintaining compliance in the coming years presents several significant challenges. The increasing complexity and frequency of regulatory changes across various jurisdictions pose a considerable hurdle. The rise of data privacy concerns and the expansion of data protection regulations, like GDPR and CCPA, will require organizations to adapt their data handling practices continuously. Furthermore, the increasing reliance on technology and automation introduces new cybersecurity risks, necessitating robust security measures. Finally, the growing emphasis on ethical and sustainable business practices is leading to new compliance obligations relating to environmental, social, and governance (ESG) factors. To effectively navigate these challenges, organizations will need to develop agile and adaptive compliance programs, invest in advanced technologies, and cultivate a strong culture of compliance across the organization.

Key Topics to Learn for Compliance with Government Regulations Interview

- Regulatory Frameworks: Understanding the core principles and structures of relevant government regulations (e.g., HIPAA, GDPR, SOX). Focus on the “why” behind these regulations and their impact on organizations.

- Risk Assessment and Mitigation: Learn how to identify, assess, and mitigate compliance risks. Practice applying different risk management frameworks and developing practical mitigation strategies.

- Internal Controls and Audits: Gain a thorough understanding of internal control systems and their role in ensuring compliance. Familiarize yourself with common audit methodologies and best practices.

- Data Privacy and Security: Explore the critical aspects of data protection and security within a compliance context. Understand the practical implications of data breaches and how to prevent them.

- Policy Development and Implementation: Learn how to develop and implement effective compliance policies and procedures that are both legally sound and practically achievable within an organization.

- Reporting and Monitoring: Understand the importance of accurate reporting and ongoing monitoring to ensure continuous compliance. Practice summarizing complex compliance information clearly and concisely.

- Ethical Considerations and Professional Responsibility: Explore the ethical dimensions of compliance and the professional responsibilities of compliance officers. Consider real-world scenarios and ethical dilemmas.

Next Steps

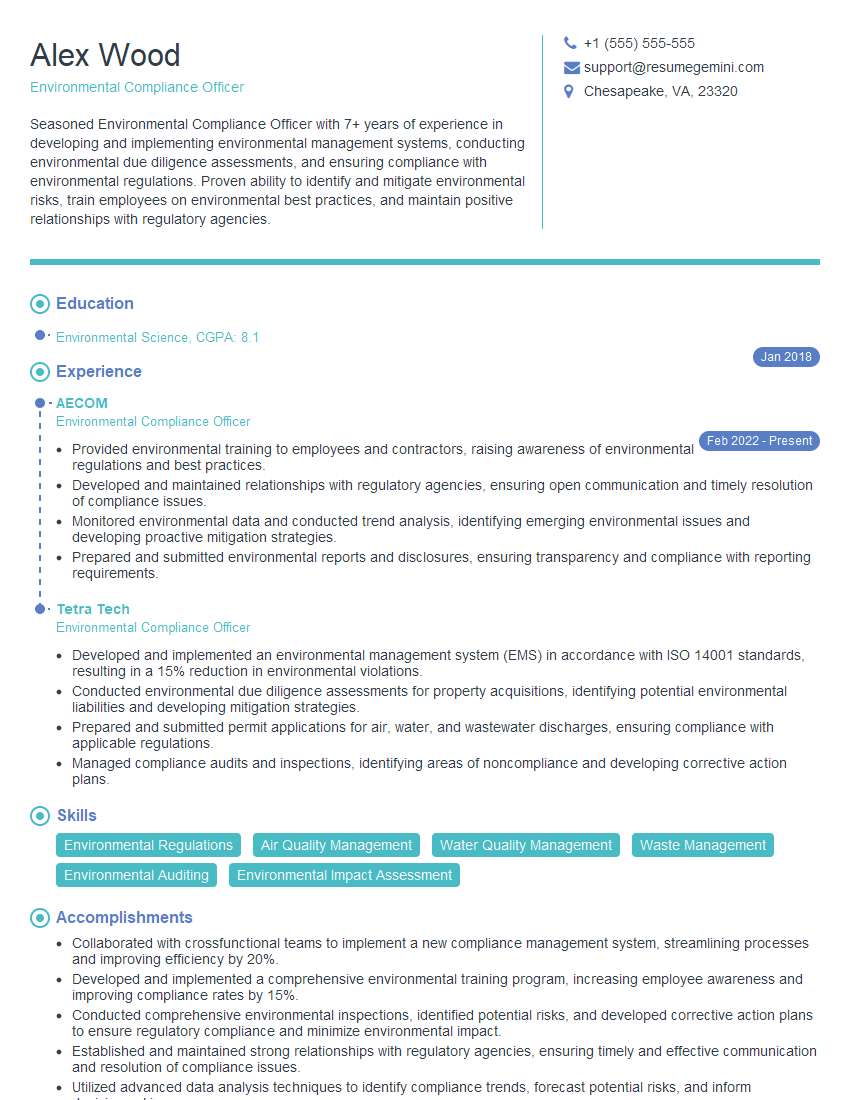

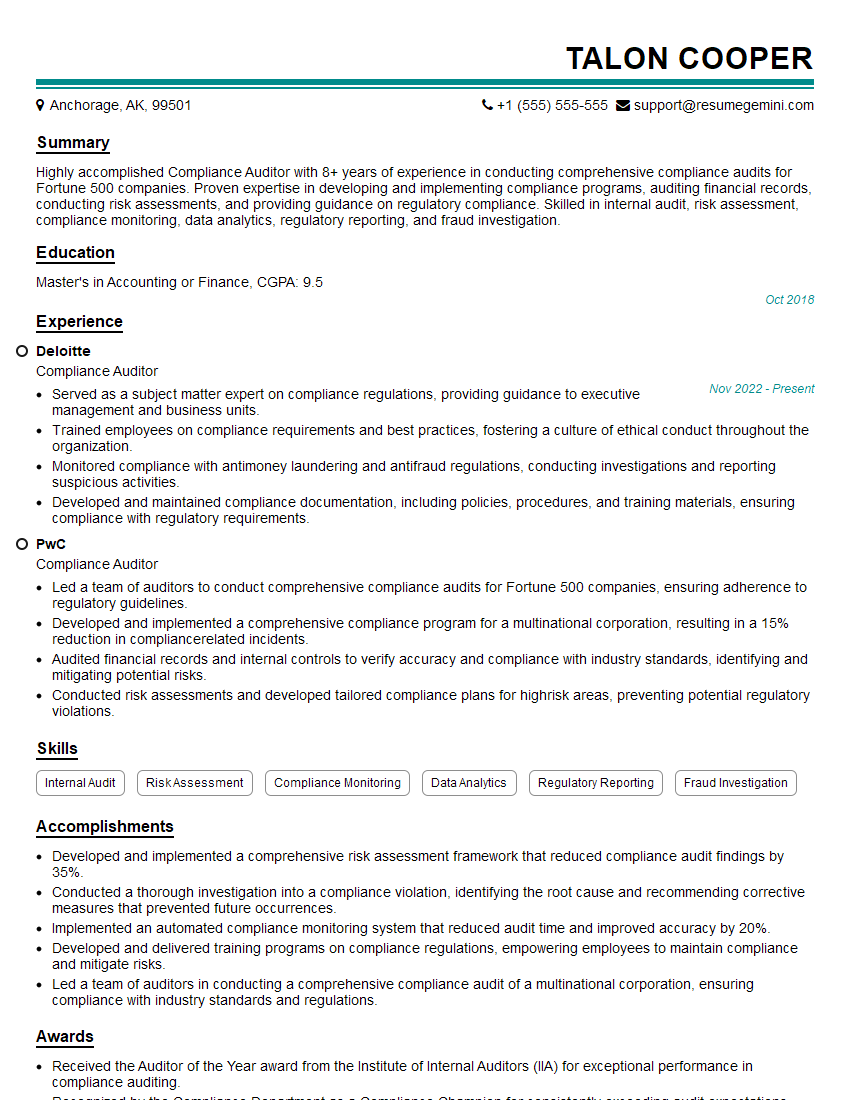

Mastering Compliance with Government Regulations opens doors to rewarding and impactful careers. Organizations increasingly value professionals with this expertise, offering opportunities for significant growth and responsibility. To enhance your job prospects, create an ATS-friendly resume that highlights your skills and experience effectively. ResumeGemini is a trusted resource to help you build a professional and compelling resume that stands out. We provide examples of resumes tailored to Compliance with Government Regulations to guide you in crafting your own impactful document. Take the next step towards your dream career today!

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

Hi, I’m Jay, we have a few potential clients that are interested in your services, thought you might be a good fit. I’d love to talk about the details, when do you have time to talk?

Best,

Jay

Founder | CEO