Preparation is the key to success in any interview. In this post, we’ll explore crucial Acquisitions and Rights Management interview questions and equip you with strategies to craft impactful answers. Whether you’re a beginner or a pro, these tips will elevate your preparation.

Questions Asked in Acquisitions and Rights Management Interview

Q 1. Explain the difference between copyright and trademark.

Copyright and trademark are both forms of intellectual property protection, but they protect different things. Copyright protects original works of authorship, including literary, dramatic, musical, and certain other intellectual works. Think of it as protecting the expression of an idea. A trademark, on the other hand, protects brands and brand identifiers, such as logos, slogans, and brand names. It protects the source of the goods or services.

Copyright Example: The specific wording and structure of a novel are protected by copyright. Someone can’t simply copy and paste the book. However, someone could write a different novel about the same general theme or topic.

Trademark Example: The Coca-Cola logo and the name “Coca-Cola” are protected trademarks. Another company can’t use a confusingly similar name or logo for a similar beverage.

In short: Copyright protects creative works; trademark protects brand identity.

Q 2. Describe your experience negotiating contracts for intellectual property acquisition.

I have extensive experience negotiating contracts for intellectual property (IP) acquisition. This often involves complex negotiations with multiple stakeholders, including authors, artists, publishers, and rights holders. My approach is always collaborative, prioritizing building strong relationships to ensure a fair and mutually beneficial outcome.

For example, in one project, we negotiated the rights to a popular children’s book series. We had to carefully consider factors such as territory, duration of rights, permitted uses (print, digital, merchandise, etc.), and payment structures (advance, royalties, bonuses). The negotiations required a deep understanding of the legal implications of different clauses, and the ability to navigate different perspectives to achieve a deal that satisfied both parties’ needs.

I’m proficient in crafting and reviewing contracts, ensuring that all aspects of the IP acquisition are clearly defined and legally sound. This includes addressing issues of exclusivity, warranties, indemnities, and dispute resolution mechanisms. I always strive to ensure that any contract protects my client’s interest while remaining legally compliant.

Q 3. How do you identify and assess the value of intellectual property?

Identifying and assessing the value of intellectual property is a multifaceted process. It goes beyond simply looking at the revenue generated; it requires a comprehensive understanding of the IP’s potential future earnings.

My approach involves:

- Market Research: Analyzing market demand, competitive landscape, and potential for growth.

- Financial Analysis: Reviewing historical revenue data (if available), projecting future earnings based on various scenarios.

- Legal Due Diligence: Ensuring the IP is properly protected and free from encumbrances.

- Qualitative Assessment: Considering factors like brand recognition, creative quality, and potential for synergy with existing assets.

For example, the value of a patent for a revolutionary technology would depend not only on current sales but also on the potential for future licensing agreements or the development of new products. Similarly, the value of a famous character could be estimated by considering its use in future films, merchandise, and other ventures.

Ultimately, the valuation is a combination of quantitative and qualitative factors, resulting in a fair market value that reflects the IP’s potential and current performance.

Q 4. What strategies do you use to secure rights for various media platforms?

Securing rights for various media platforms requires a strategic approach tailored to each platform’s specific requirements and audience. This involves understanding the nuances of different licensing agreements and adapting them accordingly.

My strategies include:

- Comprehensive Rights Acquisition: Negotiating for broad rights that cover multiple platforms (e.g., film, television, digital, merchandise) to maximize revenue potential.

- Platform-Specific Agreements: Adapting the agreements to address the unique needs of each platform, whether it’s streaming, theatrical release, or online distribution.

- Ancillary Rights: Securing rights for potential secondary uses like video games, stage adaptations, and merchandise.

- Clear Definition of Rights: Explicitly defining the scope of the licensed rights, including geographical restrictions, duration, and permitted uses to avoid future disputes.

For example, securing rights for a film might involve negotiations with distributors for theatrical release, streaming services for online distribution, and broadcasters for television airing, each with specific contractual terms.

Q 5. How do you manage complex rights clearances?

Managing complex rights clearances requires meticulous organization, detailed record-keeping, and a strong understanding of copyright law. It’s a process that often involves navigating multiple rights holders and licenses.

My approach typically involves:

- Centralized Database: Maintaining a comprehensive database of all acquired rights, including licenses, contracts, and associated documentation. This makes tracking easy.

- Clear Communication: Maintaining open and consistent communication with all rights holders throughout the process to manage expectations and address any issues promptly.

- Due Diligence: Performing thorough due diligence to ensure that all necessary rights are secured before production or distribution begins.

- Risk Assessment: Identifying and mitigating potential risks associated with rights clearances, such as potential infringement claims or disputes with rights holders.

For example, producing a documentary could necessitate clearing music rights, archival footage rights, and interview rights, requiring coordination with numerous parties.

Q 6. Describe your experience with due diligence in acquisitions.

Due diligence in acquisitions is crucial to ensuring a successful transaction and avoiding costly mistakes. My due diligence process typically encompasses a thorough review of the target company’s intellectual property portfolio, financial records, and legal compliance.

The process includes:

- IP Audit: A detailed review of the target’s IP assets to verify ownership, identify any potential infringement issues, and assess the value of the IP portfolio.

- Financial Review: Analyzing the target’s financial statements to ensure the accuracy of reported revenue and assess its financial health.

- Legal Review: Examining contracts, licenses, and other legal documents to identify potential risks and liabilities.

- Compliance Review: Assessing the target’s compliance with relevant laws and regulations, including intellectual property laws.

For instance, before acquiring a software company, we would thoroughly examine their patents and software licenses to confirm their ownership and check for any potential conflicts or pending litigation.

Q 7. How familiar are you with different types of licensing agreements?

I am very familiar with various types of licensing agreements. The specific type chosen depends on the needs of the licensor and licensee.

Some common types include:

- Exclusive License: Grants the licensee exclusive rights to use the IP within a defined scope.

- Non-Exclusive License: Allows the licensor to grant licenses to multiple parties simultaneously.

- Sole License: Similar to exclusive but allows the licensor to retain some rights to use the IP.

- Sub-license: Allows a licensee to grant further licenses to others.

- Perpetual License: Grants the licensee rights indefinitely.

- Limited License: Grants rights for a specified duration or limited uses.

Understanding the nuances of each is crucial for successful IP management. For instance, an exclusive license can provide significant leverage but carries greater responsibility for the licensee. A non-exclusive license allows the licensor to generate multiple revenue streams but may result in lower royalties per licensee.

Q 8. Explain your process for tracking and managing rights renewals.

Rights renewal tracking is crucial for avoiding costly lapses. My process starts with a meticulously maintained database, ideally a dedicated Rights Management Information System (RMIS). This system flags upcoming renewals well in advance, typically using a customized alert system based on various parameters such as the type of right, the territory involved, and the renewal date. I then conduct a thorough review of each impending renewal, assessing the asset’s ongoing value and market conditions. This review includes confirming the current rights holder, verifying any outstanding payments, and negotiating renewal terms. For example, if a particular book’s rights are expiring, I’ll analyze sales data, check for new editions or translations, and gauge the market’s continuing interest. Only after this analysis do I initiate renewal negotiations with the rights holder. The whole process is documented and updated within the RMIS, ensuring a clear audit trail.

- Step 1: Database entry and alert setup.

- Step 2: Pre-renewal analysis (value assessment, market research).

- Step 3: Negotiation and renewal agreement.

- Step 4: Documentation and update of RMIS.

Q 9. How do you handle rights disputes or conflicts?

Rights disputes are unfortunately common. My approach focuses on proactive communication and a thorough understanding of the relevant contracts. I begin by carefully reviewing the original agreement, identifying any ambiguities or conflicting clauses. Then, I attempt to resolve the conflict through direct negotiation with the involved parties. This might involve clarifying contractual language, presenting supporting evidence, or suggesting mutually beneficial compromises. If negotiation fails, mediation is often a valuable next step, offering a less adversarial way to reach a resolution. As a last resort, litigation might become necessary, though this is generally avoided due to the time and cost involved. For instance, I once successfully resolved a dispute over the geographic scope of a film license by presenting evidence of market usage demonstrating clear intent and preventing a potential costly lawsuit.

Q 10. How do you ensure compliance with copyright laws in your work?

Copyright compliance is paramount. My approach involves a multi-layered strategy. First, we ensure all acquisitions are properly vetted for ownership and licensing. This means carefully examining contracts, conducting due diligence, and verifying copyright registration information, if applicable. Second, we use a combination of internal training and external legal counsel to educate our team about best practices in copyright management. This includes regularly updating our internal policies and procedures to reflect current laws and industry standards. Finally, we maintain detailed records of all rights acquisitions and usage, providing an audit trail for all our activities. For instance, we utilize software that scans projects for potential copyright infringements before release, preventing costly problems down the line.

Q 11. What is your experience with international copyright laws?

International copyright law varies significantly from country to country. My experience encompasses working with multiple jurisdictions, including the US, UK, EU, and several Asian markets. This includes understanding and navigating differences in copyright duration, registration procedures, and enforcement mechanisms. I’ve also worked extensively with international licensing agreements, adapting contracts to comply with the laws of each relevant territory. For instance, negotiating rights in Japan involved not only understanding local copyright laws, but also local cultural customs and business practices. I’ve built relationships with legal counsel specializing in international copyright in these key regions, which helps me effectively navigate complex jurisdictional challenges.

Q 12. Describe your experience with royalty calculations and payments.

Royalty calculations and payments are a critical aspect of rights management. My experience spans various royalty models, including percentage-based royalties, advance payments, and tiered structures. I’ve used various software tools to automate calculations, ensuring accuracy and efficiency. The process involves carefully reviewing sales reports, applying the correct royalty rates based on the contract, and promptly remitting payments to rights holders. I work closely with accounting and finance to ensure all payments are accurate, timely, and compliant. It’s important to maintain clear and transparent communication with rights holders regarding royalty statements. For example, generating regular reports and providing a clear explanation of all calculations enhances trust and facilitates a positive relationship with authors and publishers.

Q 13. How do you utilize technology to manage rights and acquisitions?

Technology plays a crucial role in managing rights and acquisitions. We use a combination of tools, including a dedicated RMIS (Rights Management Information System), contract management software, and digital asset management (DAM) systems. The RMIS is the central hub, tracking rights information, renewal dates, and royalty details. Contract management software facilitates secure storage and easy retrieval of contracts. DAM systems manage the digital assets themselves, integrating with the RMIS to link assets to their associated rights information. These tools streamline workflows, improve accuracy, and enable efficient collaboration. For example, our RMIS integrates directly with our sales data, enabling automated royalty calculations and payment processing, eliminating manual errors and greatly improving efficiency.

Q 14. Explain your experience with database management of rights information.

Effective database management of rights information is crucial for avoiding errors and disputes. Our database is structured to allow for easy searching and retrieval of information, and employs a relational database model to capture the complex relationships between assets, rights holders, territories, and usage types. This ensures data integrity and facilitates accurate reporting. It includes metadata fields for every detail from the contract’s terms to the payment history. We regularly audit the database to ensure accuracy and implement rigorous quality control measures to maintain data integrity. For example, we use a system of cross-referencing and validation checks to ensure consistency across various data points, catching inconsistencies before they can lead to problems.

Q 15. How do you prioritize competing acquisition projects?

Prioritizing competing acquisition projects requires a strategic approach balancing potential return with resource constraints. I use a multi-criteria decision analysis (MCDA) framework, which involves:

- Defining Criteria: Establishing key factors like strategic alignment, market potential, financial viability (ROI, payback period), risk assessment, and available resources (budget, personnel).

- Weighting Criteria: Assigning weights to each criterion based on their relative importance to the overall organizational goals. For example, a company focused on rapid growth might prioritize market potential more heavily than a company focused on stability and profitability.

- Scoring Projects: Each project is scored against each criterion using a consistent scale (e.g., 1-5, or a weighted scoring system). This requires thorough due diligence and market research.

- Calculating Weighted Scores: The score for each criterion is multiplied by its weight, and the results are summed to arrive at a total weighted score for each project.

- Ranking Projects: Projects are then ranked based on their total weighted scores, providing a clear prioritization order. This helps in making objective decisions, even with competing interests.

For example, let’s say we’re evaluating two projects: a high-risk, high-reward tech startup and a more established, lower-risk media company. The MCDA framework would allow a structured comparison, clearly highlighting which aligns better with our company’s risk appetite and strategic objectives.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. Describe a situation where you had to negotiate a challenging contract.

In one instance, I negotiated a contract for the acquisition of a large music catalog. The rights holder was hesitant to relinquish complete control and insisted on retaining certain usage rights, which were not standard. This complicated matters, as it involved balancing their desire for ongoing control with our need for unrestricted commercial exploitation. The challenge lay in finding a compromise that was acceptable to both parties.

My approach involved building rapport with the rights holder, understanding their concerns, and presenting alternative solutions that addressed their needs. We eventually reached an agreement by offering a tiered royalty structure, a longer initial term with option for renewals, and transparency in reporting. This collaborative approach prevented a breakdown in negotiations, allowing us to secure the catalog while accommodating the rights holder’s concerns.

Q 17. How do you build and maintain relationships with rights holders?

Building and maintaining strong relationships with rights holders is crucial for successful acquisitions and ongoing collaboration. I prioritize transparency, open communication, and mutual respect. This involves:

- Proactive Communication: Regular updates, prompt responses, and clear communication throughout the acquisition process and beyond.

- Fair Dealing: Ensuring fair compensation and contractual terms, addressing concerns promptly and professionally.

- Building Trust: Demonstrating integrity, professionalism, and a genuine interest in the rights holders’ work and goals.

- Long-Term Perspective: Focusing on building sustainable relationships, recognizing that future collaborations may arise.

- Personalized Approach: Treating each rights holder as a unique individual and tailoring communication and approach accordingly.

For example, I regularly attend industry events to network and build relationships, and I always follow up after negotiations, regardless of the outcome. This fosters goodwill and may lead to future opportunities.

Q 18. What metrics do you use to measure success in acquisitions?

Success in acquisitions is measured across several key metrics, including:

- Financial Performance: Return on investment (ROI), net present value (NPV), payback period, and revenue generated from acquired assets.

- Market Share: Increase in market share resulting from the acquisition.

- Synergies Realized: Achievement of cost savings, revenue increases, or other benefits from integrating the acquired assets.

- Compliance: Adherence to all legal and regulatory requirements throughout the acquisition process.

- Client Satisfaction: Positive feedback from rights holders and other stakeholders regarding the acquisition process and ongoing management.

Beyond financial metrics, qualitative factors such as improved brand reputation and strategic alignment with business goals also contribute to overall success.

Q 19. How do you deal with conflicting rights claims?

Conflicting rights claims are a common challenge in acquisitions. My approach involves a systematic investigation and resolution process:

- Identify and Verify Claims: Thoroughly investigate all claims, verifying their legitimacy and scope through legal research and due diligence.

- Analyze Ownership Documentation: Carefully review all relevant documentation, including contracts, assignments, and registrations, to identify the true owner of the rights.

- Negotiation and Mediation: Attempt to resolve conflicts amicably through negotiation and mediation between the conflicting parties.

- Legal Action: If amicable resolution fails, pursue legal action to resolve the dispute through litigation or arbitration.

- Risk Mitigation: Develop strategies to mitigate future risks, such as improving due diligence processes and strengthening contractual agreements.

A thorough understanding of copyright law, trademark law, and other relevant legal frameworks is essential in navigating these complex situations.

Q 20. Describe your process for auditing rights.

Our rights auditing process ensures the accuracy and completeness of our rights information, which is vital for efficient management and exploitation. The process typically involves:

- Inventory Compilation: Creating a comprehensive inventory of all acquired rights, including details such as title, author, copyright status, and usage rights.

- Documentation Review: Reviewing all relevant documentation, such as contracts, agreements, and chain-of-title documents.

- Gap Analysis: Comparing the inventory with existing records to identify any gaps or discrepancies.

- Rights Clearance Verification: Verifying rights clearances, especially for underlying works.

- Data Reconciliation: Reconciling data from different sources to ensure consistency and accuracy.

- Regular Audits: Conducting regular audits to identify any changes or issues that may have arisen since the last audit.

This process minimizes the risk of legal disputes and maximizes the value of the rights portfolio. We use dedicated software to streamline this process and ensure data integrity.

Q 21. How familiar are you with fair use doctrine?

I am very familiar with the fair use doctrine. Fair use is a legal doctrine in the United States that permits limited use of copyrighted material without acquiring permission from the rights holder. It’s a complex area of law and requires careful consideration of four factors:

- Purpose and Character of the Use: Is the use transformative (adding new meaning or message)? Non-commercial use is more likely to be considered fair use.

- Nature of the Copyrighted Work: Using factual works is more likely to be considered fair use than using fictional works.

- Amount and Substantiality of the Portion Used: Using a smaller portion of the work is more likely to be considered fair use.

- Effect of the Use Upon the Potential Market: Does the use harm the market for the original work?

Each case is evaluated on a case-by-case basis, and there’s no single definitive answer. Improper use of the fair use doctrine can lead to expensive litigation. Therefore, it’s crucial to consult with legal counsel before relying on it.

For example, using a short excerpt of a song in a documentary with critical commentary might be considered fair use, while using the entire song for commercial purposes without permission is likely copyright infringement.

Q 22. How do you evaluate the risks associated with an acquisition?

Evaluating the risks in an acquisition is crucial for a successful outcome. It’s like buying a house – you wouldn’t do it without a thorough inspection. My approach involves a multi-faceted risk assessment encompassing due diligence across several key areas.

- Financial Risk: This includes evaluating the target company’s financial statements, looking for inconsistencies, hidden liabilities, or unsustainable business models. For example, I’d analyze revenue streams, debt levels, and cash flow projections to understand their financial health and potential future performance.

- Legal Risk: This involves scrutinizing contracts, intellectual property rights, and potential litigation. A comprehensive legal review is essential to identify any potential lawsuits or contractual obligations that could impact the acquisition. Imagine acquiring a company only to discover they’re embroiled in a major copyright infringement case.

- Operational Risk: This focuses on the target’s operational efficiency, management team, and technology infrastructure. Are their processes streamlined? Is their technology outdated? A thorough operational audit helps uncover potential inefficiencies or integration challenges after the acquisition.

- Reputational Risk: This examines the target company’s public image, brand reputation, and potential negative publicity. A poor reputation can severely impact the acquiring company’s image and value. I’d conduct thorough background checks and social media analysis to assess potential reputational risks.

- Integration Risk: This assesses the challenges of merging two organizations – different cultures, systems, and processes. Successful integration requires careful planning and execution to minimize disruption and maximize synergy. Failure to address cultural differences, for example, can lead to employee attrition and lost productivity.

By systematically evaluating these risks, I can develop mitigation strategies and create a realistic valuation that reflects potential challenges and opportunities.

Q 23. How do you manage the budget for acquisitions?

Budget management for acquisitions is a critical skill, demanding a balance between ambition and fiscal responsibility. It’s about strategic allocation of funds to maximize ROI.

- Detailed Budget Breakdown: I begin by creating a comprehensive budget that includes all anticipated costs, including due diligence fees, legal fees, advisory fees, transaction costs, and post-acquisition integration expenses. This budget serves as a roadmap, enabling proactive financial planning.

- Contingency Planning: Unexpected costs are inevitable. A well-structured budget always includes a contingency fund (typically 10-20% of the total budget) to handle unforeseen expenses or challenges. This prevents budget overruns and ensures financial flexibility.

- Regular Monitoring and Reporting: Consistent monitoring of spending against the budget is crucial. I utilize project management tools to track expenses, identify potential deviations, and implement corrective actions. Regular reports are shared with stakeholders to maintain transparency and accountability.

- Value Engineering: Throughout the process, I actively seek opportunities to optimize spending without compromising quality or the acquisition’s strategic goals. This involves exploring alternative solutions, negotiating better terms with vendors, and leveraging existing resources.

- Post-Acquisition Integration Budget: A significant portion of the budget should be dedicated to the integration phase. I carefully plan and allocate resources to address technological, operational, and cultural integration, ensuring a seamless transition.

Effective budget management requires discipline, foresight, and a strong understanding of the acquisition process. It’s about making informed decisions to achieve maximum value within the allocated resources.

Q 24. How do you stay current with changes in copyright law?

Staying abreast of copyright law changes is paramount. It’s a dynamic field, constantly evolving with technological advancements and societal shifts. My strategy is multi-pronged.

- Subscription to Legal Updates: I subscribe to reputable legal news services and journals specializing in intellectual property law. This provides timely updates on legislative changes, court decisions, and emerging legal trends.

- Professional Development: I actively participate in relevant conferences and workshops to network with other legal professionals and learn about the latest developments in copyright law. This includes attending seminars led by leading copyright experts.

- Networking with Legal Experts: I maintain a network of contacts within the legal community, including attorneys and consultants specializing in intellectual property rights. This informal network provides valuable insights and perspectives.

- Monitoring Government Websites: I regularly review the websites of relevant governmental bodies – such as the Copyright Office – for official announcements, legislative proposals, and policy updates.

- Internal Training: I organize and conduct internal training sessions to ensure that my team is fully informed about the latest copyright law developments and best practices.

This proactive approach ensures that our acquisition strategies and rights management practices always comply with the latest legal requirements and mitigate potential legal risks.

Q 25. Explain your experience with open-source licensing.

My experience with open-source licensing is extensive. Understanding the nuances of various open-source licenses is critical for avoiding legal pitfalls and ensuring compliance. It’s like understanding the terms and conditions before using a software application, but with far-reaching legal implications.

I’m familiar with the key licenses, including:

- MIT License: A permissive license that grants broad rights to users, allowing them to use, modify, and distribute the software with minimal restrictions.

- GPL (GNU General Public License): A copyleft license requiring that derivative works are also licensed under GPL, ensuring that the software remains open-source.

- Apache License 2.0: A permissive license similar to MIT, offering a balance between freedom and legal protection for the copyright holder.

I’ve handled acquisitions where open-source components were integral parts of the target’s products. This required a careful review of the licenses to ensure compliance and to understand the potential implications for future development and distribution. For example, we once acquired a company whose core product relied on a GPL-licensed library. This meant we needed to ensure our own modifications and derivative works were also released under GPL, affecting our overall product strategy.

My expertise extends to negotiating custom licenses and ensuring proper attribution and compliance with open-source communities’ best practices. Understanding the legal implications of different open-source licenses is vital in evaluating the risks and opportunities associated with acquiring companies that utilize open-source technologies.

Q 26. How do you anticipate and mitigate potential legal risks in acquisitions?

Anticipating and mitigating legal risks in acquisitions is a proactive and multifaceted process. It’s about identifying potential legal landmines before they become major problems. My approach involves:

- Comprehensive Due Diligence: This is the cornerstone of legal risk mitigation. It involves a thorough review of the target company’s legal documents, contracts, intellectual property rights, compliance history, and litigation history. This helps unearth any potential legal issues early on.

- Legal Counsel: I engage experienced legal counsel specializing in mergers and acquisitions, intellectual property, and antitrust law. They provide critical insights and guidance throughout the process, ensuring compliance with all relevant laws and regulations.

- Contractual Review: Every contract associated with the target company undergoes rigorous scrutiny to identify potential liabilities, obligations, and hidden risks. This includes reviewing supply agreements, customer contracts, and employment contracts.

- Intellectual Property Audit: A thorough review of the target company’s intellectual property portfolio—patents, trademarks, copyrights, trade secrets—is vital to confirm ownership, validity, and freedom from infringement. We verify that all licenses are in order and that there are no outstanding infringement claims.

- Regulatory Compliance: We assess the target’s compliance with relevant industry regulations and laws, considering factors such as data privacy, antitrust, and environmental regulations. Non-compliance can lead to significant penalties and reputational damage.

By anticipating and proactively mitigating potential legal risks, I help minimize disruptions and secure a smoother, more successful acquisition.

Q 27. What is your experience with the different stages of the acquisition lifecycle?

I’ve been involved in numerous acquisitions across various stages of the lifecycle, from initial target identification to post-acquisition integration. Each stage requires a unique skillset and approach.

- Target Identification and Selection: This involves market research, identifying potential targets that align with strategic goals, and conducting preliminary assessments of their financial and operational performance.

- Due Diligence: As mentioned earlier, this is a crucial stage involving in-depth financial, legal, and operational reviews. This phase is critical for identifying potential risks and challenges.

- Negotiation and Valuation: This stage involves negotiating the acquisition terms, including price, payment structure, and other key conditions. It requires strong negotiation skills and a deep understanding of the target company’s value.

- Legal Documentation: This stage focuses on drafting and reviewing all legal documents, including acquisition agreements, intellectual property assignments, and other relevant contracts. Accuracy and precision are crucial.

- Closing the Transaction: This involves finalizing all legal and financial arrangements and completing the transfer of ownership. Meticulous planning and coordination are essential.

- Post-Acquisition Integration: This crucial stage involves integrating the acquired company into the acquiring organization. It includes addressing operational, technological, and cultural challenges to maximize synergy and realize the acquisition’s value.

My experience encompasses successfully navigating each of these stages, contributing to several successful acquisitions and integrations.

Q 28. Describe your experience with digital rights management (DRM) technologies.

My experience with Digital Rights Management (DRM) technologies is extensive. DRM is a multifaceted field involving various technologies and strategies for controlling access to digital content. It’s like a sophisticated lock and key system for digital assets.

I’ve worked with various DRM solutions, including:

- Watermarking: Embedding imperceptible digital fingerprints within the content to identify the source and prevent unauthorized copying.

- Encryption: Protecting the content by scrambling it so that only authorized users with the decryption key can access it.

- Access Control: Implementing systems to restrict access to content based on user roles, subscriptions, or other criteria.

- Content Expiration: Setting an expiration date for access, ensuring that content is only available for a specific period.

In acquisitions, understanding the DRM technologies employed by the target company is crucial for evaluating the potential impact on content distribution and revenue streams. For instance, I’ve been involved in negotiations where the acquired company’s DRM system proved incompatible with our existing infrastructure. This required careful planning and investment in integrating or replacing the system, impacting the integration budget and timeline. Thorough understanding of these technologies is essential to ensure a smooth transition and minimize disruption.

Moreover, I also have experience in assessing the efficacy of existing DRM systems, identifying vulnerabilities, and suggesting improvements to enhance security and protect intellectual property.

Key Topics to Learn for Acquisitions and Rights Management Interview

- Copyright Law Fundamentals: Understanding copyright ownership, licensing, and infringement is paramount. Consider scenarios involving different types of works and international copyright laws.

- Contract Negotiation and Drafting: Practice analyzing and negotiating contracts, focusing on key clauses related to rights, usage fees, territories, and timelines. Develop strong skills in identifying potential risks and loopholes.

- Rights Clearance Processes: Learn the intricacies of identifying rights holders, obtaining permissions, and managing the clearance process efficiently. Explore different clearance strategies for various media and platforms.

- Due Diligence in Acquisitions: Understand the importance of thorough due diligence in assessing the legal and financial aspects of acquiring rights. This includes identifying potential legal risks and valuing intellectual property.

- Digital Rights Management (DRM): Familiarize yourself with various DRM technologies and their implications for managing and protecting digital content. Explore the challenges and best practices in this area.

- Database Management and Organization: Develop skills in organizing and managing large datasets of rights information. Consider best practices for efficient tracking and retrieval of rights information.

- Budgeting and Financial Planning: Understand the financial aspects of rights acquisitions, including budgeting, forecasting, and return on investment analysis.

- Industry Best Practices and Trends: Stay updated on current industry trends and best practices in acquisitions and rights management, particularly concerning emerging technologies and changing legal landscapes.

Next Steps

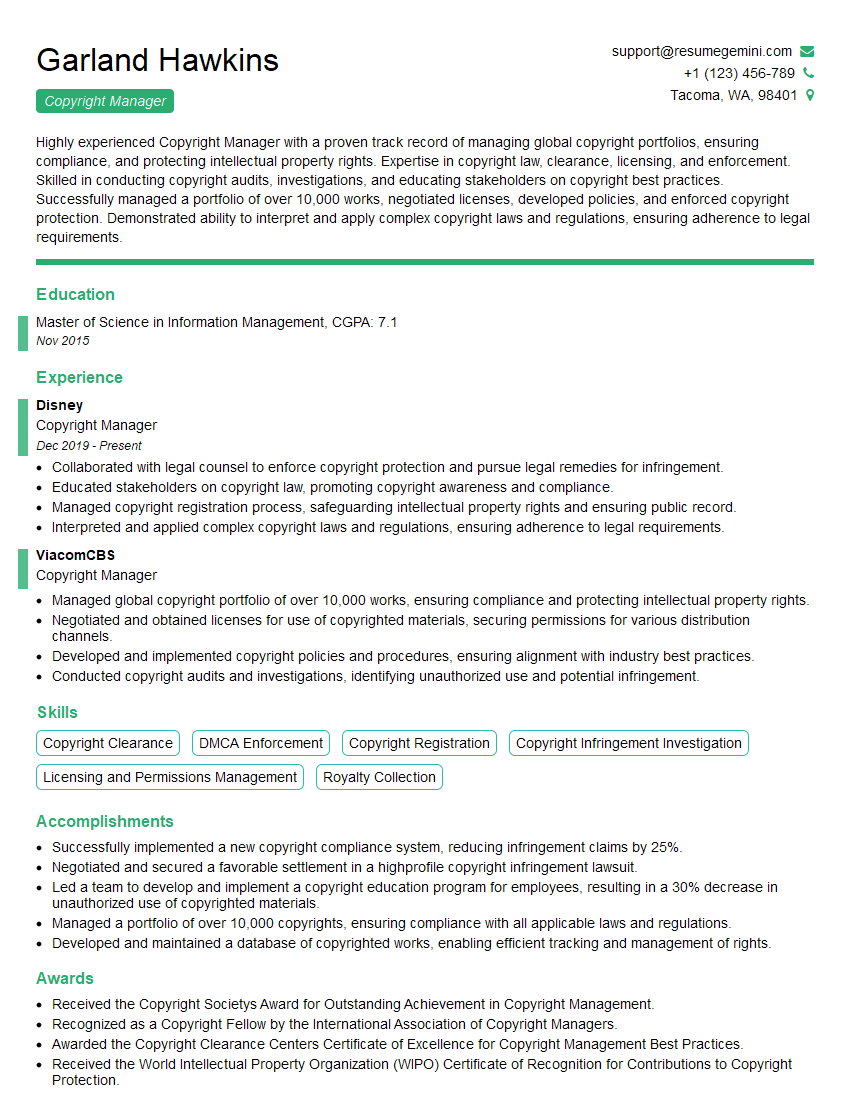

Mastering Acquisitions and Rights Management opens doors to exciting and rewarding careers in media, publishing, entertainment, and technology. A strong understanding of these concepts is highly sought after, significantly enhancing your job prospects. To increase your chances of landing your dream role, crafting an ATS-friendly resume is crucial. ResumeGemini is a trusted resource that can help you build a professional and impactful resume, optimized for applicant tracking systems. Examples of resumes tailored to Acquisitions and Rights Management are available within ResumeGemini to help guide you.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

Hi, I’m Jay, we have a few potential clients that are interested in your services, thought you might be a good fit. I’d love to talk about the details, when do you have time to talk?

Best,

Jay

Founder | CEO