Interviews are opportunities to demonstrate your expertise, and this guide is here to help you shine. Explore the essential Market and Audience Analysis interview questions that employers frequently ask, paired with strategies for crafting responses that set you apart from the competition.

Questions Asked in Market and Audience Analysis Interview

Q 1. Explain the difference between quantitative and qualitative market research.

Quantitative and qualitative market research are two distinct approaches to understanding consumer behavior and market dynamics. They differ fundamentally in their methods, data types, and the types of insights they provide.

Quantitative research focuses on numerical data and statistical analysis. Think of it as measuring the ‘what’—how many people prefer a particular product, or what percentage of the market share a competitor holds. Methods include surveys with closed-ended questions, experiments (like A/B testing), and analyzing sales data. The results are typically presented in charts, graphs, and statistical summaries.

Qualitative research, on the other hand, aims to explore the ‘why’ behind consumer behavior. It delves into the motivations, attitudes, and perceptions that drive purchasing decisions. Methods include focus groups, in-depth interviews, and ethnographic studies (observing consumers in their natural environment). The data gathered is usually textual or visual, requiring analysis of themes, patterns, and meanings.

In essence: Quantitative research provides breadth (wide-ranging data on large samples), while qualitative research provides depth (rich insights into smaller samples).

Example: Imagine launching a new energy drink. Quantitative research might show that 60% of respondents prefer a citrus flavor. Qualitative research could then explore *why* they prefer citrus—is it the refreshing taste, the perceived health benefits, or a specific association with an active lifestyle?

Q 2. Describe your experience with various market research methodologies (e.g., surveys, focus groups, A/B testing).

Throughout my career, I’ve extensively utilized a variety of market research methodologies. My experience spans from designing and implementing large-scale surveys to moderating insightful focus groups and conducting rigorous A/B testing.

- Surveys: I have experience crafting surveys using both online platforms (e.g., SurveyMonkey, Qualtrics) and offline methods. I focus on creating clear, concise questions to avoid bias and ensure high response rates. For instance, in a recent project, we used a survey to assess customer satisfaction with a new software update, leading to actionable improvements based on the quantitative feedback.

- Focus Groups: I’ve moderated numerous focus groups, guiding discussions to uncover in-depth consumer perspectives and opinions. I’m skilled in creating a comfortable environment where participants feel free to share their honest feedback. This methodology proved invaluable in understanding the emotional connection consumers had with a particular brand of coffee, which informed their new marketing strategy.

- A/B Testing: I’ve designed and analyzed multiple A/B tests to optimize website design, advertising campaigns, and email marketing. This allows us to empirically measure the effectiveness of different approaches and make data-driven decisions. For example, we ran an A/B test on two different website landing pages, resulting in a 15% increase in conversion rates using the winning design.

My expertise lies in not just conducting these methods independently, but in integrating them for a holistic understanding. Combining quantitative data from surveys with qualitative insights from focus groups often paints a far more complete picture than any single method alone.

Q 3. How do you segment a market? Provide examples of different segmentation approaches.

Market segmentation is the process of dividing a broad consumer or business market, normally consisting of existing and potential customers, into sub-groups of consumers based on some type of shared characteristics. This allows for targeted marketing efforts, increasing efficiency and effectiveness.

There are several common approaches to market segmentation:

- Demographic Segmentation: Dividing the market based on readily measurable characteristics like age, gender, income, education, occupation, family size, etc. Example: Targeting a new line of luxury cosmetics towards high-income women aged 35-55.

- Geographic Segmentation: Grouping customers based on their location – country, region, city, climate, etc. Example: A ski resort marketing primarily to people living in colder climates within a certain driving radius.

- Psychographic Segmentation: Segmenting based on psychological factors like values, attitudes, lifestyles, interests, and personality traits. Example: Marketing an eco-friendly product line to environmentally conscious consumers.

- Behavioral Segmentation: Categorizing customers based on their actions, including purchasing habits, usage rates, brand loyalty, and response to marketing campaigns. Example: Offering loyalty programs to reward frequent customers and encourage repeat purchases.

Often, a combination of segmentation approaches provides the most effective results. For example, a company might target young, urban professionals (demographic & geographic) who are environmentally conscious (psychographic) and frequent online shoppers (behavioral).

Q 4. What are the key performance indicators (KPIs) you would track to measure the success of a marketing campaign?

The key performance indicators (KPIs) used to measure marketing campaign success vary depending on the campaign’s objectives, but some common and crucial ones include:

- Return on Investment (ROI): Measures the profitability of the campaign by comparing the cost of the campaign to the revenue generated. A high ROI indicates a successful campaign.

- Website Traffic (Unique Visitors, Page Views, Bounce Rate): These metrics show how well the campaign is driving traffic to the website. A low bounce rate suggests engaging content.

- Conversion Rate: The percentage of website visitors who complete a desired action, such as making a purchase or signing up for a newsletter. A higher conversion rate indicates effective marketing messaging.

- Engagement Rate (Likes, Shares, Comments): These metrics reflect how well the campaign resonates with the target audience and encourages interaction on social media platforms.

- Brand Awareness (Social Mentions, Search Volume): Tracks how well the campaign is increasing brand recognition and visibility.

- Customer Acquisition Cost (CAC): The cost of acquiring a new customer. A lower CAC indicates higher efficiency in customer acquisition.

- Customer Lifetime Value (CLTV): The predicted revenue a customer will generate over their entire relationship with the company. A high CLTV signals customer loyalty and campaign effectiveness.

By tracking these KPIs, we can gain valuable insights into campaign performance and make data-driven adjustments to optimize future campaigns.

Q 5. How do you analyze customer data to identify trends and patterns?

Analyzing customer data to identify trends and patterns involves a multi-step process that combines data mining techniques with a strong understanding of the business context.

- Data Collection & Cleaning: First, we gather relevant customer data from various sources, including CRM systems, website analytics, social media, and surveys. Then, we clean and prepare the data, handling missing values and inconsistencies to ensure data quality.

- Data Exploration & Visualization: We explore the data using descriptive statistics and data visualization tools (like histograms, scatter plots, and heatmaps) to understand the data distribution and identify potential patterns.

- Pattern Recognition: We use statistical methods like clustering, association rule mining, or time series analysis to identify meaningful relationships and patterns within the data. For instance, we might discover that customers who purchase product A also tend to purchase product B.

- Trend Analysis: We analyze trends over time to understand how customer behavior is changing. For example, we might observe a growing preference for a specific product feature or a shift in purchasing patterns.

- Interpretation & Actionable Insights: Finally, we interpret the findings in the context of the business objectives and translate them into actionable insights. This might involve recommending new product development, targeting specific customer segments, or adjusting marketing strategies.

For example, by analyzing customer purchase history and website browsing behavior, we might discover a latent segment of customers who are interested in sustainable products. This insight can then be leveraged to create targeted marketing campaigns.

Q 6. Describe your experience with data visualization tools (e.g., Tableau, Power BI).

I have extensive experience with various data visualization tools, including Tableau and Power BI. My proficiency extends beyond simply creating charts and graphs; I leverage these tools to communicate complex data insights in a clear, concise, and compelling manner for both technical and non-technical audiences.

Tableau: I use Tableau to create interactive dashboards and visualizations that allow users to explore data dynamically. For example, I’ve used Tableau to build dashboards tracking key marketing KPIs in real-time, providing immediate feedback on campaign performance. Its strong data connectivity and intuitive drag-and-drop interface make it ideal for quickly building insightful visualizations from diverse datasets.

Power BI: I leverage Power BI for its robust reporting and data modeling capabilities. I frequently use it to build comprehensive reports summarizing customer behavior, market trends, and campaign results. Power BI’s integration with other Microsoft products streamlines the workflow for businesses already invested in the Microsoft ecosystem.

My expertise in these tools enables me to effectively communicate complex data insights to stakeholders, facilitating data-driven decision-making at all levels of the organization.

Q 7. How would you identify your target audience for a new product?

Identifying the target audience for a new product is crucial for a successful launch. This process involves a combination of research methods and a deep understanding of the product itself.

- Product Definition: Begin by clearly defining the product’s features, benefits, and intended use. Understanding the product’s core value proposition is essential.

- Market Research: Conduct thorough market research to identify potential customer segments. This might involve surveys, focus groups, competitive analysis, and analysis of existing market data.

- Persona Development: Create detailed buyer personas, representing ideal customers within each identified segment. These personas should include demographic information, psychographic characteristics, needs, pain points, and motivations.

- Prioritize Segments: Based on market size, profitability potential, and the feasibility of reaching the segment, prioritize the most promising target audience(s).

- Test & Iterate: Once a target audience is identified, test marketing messages and strategies to refine your understanding and ensure resonance with the chosen segment. Iterate on your approach based on feedback and results.

Example: Let’s say we’re launching a new subscription box for sustainable living products. Market research might reveal that environmentally conscious millennials and Gen Z with a disposable income are a key segment. We would then develop buyer personas representing this segment, outlining their values, shopping habits, and preferences to tailor marketing messages accordingly.

Q 8. How do you use market research to inform product development?

Market research is the backbone of successful product development. It allows us to understand customer needs, preferences, and pain points before investing significant resources into creation. I use a multi-faceted approach, starting with qualitative research – such as focus groups and in-depth interviews – to gain a deep understanding of the ‘why’ behind customer behavior. This helps uncover unmet needs and identify potential opportunities. Then, I leverage quantitative research – surveys, A/B testing, and data analytics – to validate initial findings and quantify market size and potential.

For example, when developing a new mobile app, I would first conduct interviews to understand user frustrations with existing apps in that category. This might reveal a need for better user interface design or more personalized features. Then, I’d use surveys to determine the ideal pricing strategy and target audience demographics, ensuring a product-market fit.

This iterative process of qualitative and quantitative research ensures that the final product aligns with actual market demand, minimizing the risk of failure and maximizing the chances of success.

Q 9. What are some common challenges in conducting market research, and how have you overcome them?

Conducting market research presents several challenges. One common hurdle is gathering representative data. Biases can creep in if the sample population doesn’t accurately reflect the target market. For example, relying solely on online surveys might exclude segments of the population with limited internet access. Another challenge is managing data volume and complexity. Analyzing large datasets requires sophisticated tools and statistical expertise.

To overcome these, I employ rigorous sampling techniques to ensure representativeness, for example, using stratified sampling to proportionally represent subgroups within the population. I also utilize advanced statistical software and data visualization tools to effectively handle and interpret large datasets. Finally, I always carefully review methodology to identify and mitigate potential biases, ensuring the integrity and reliability of the research findings.

Q 10. How do you interpret statistical data to inform business decisions?

Interpreting statistical data is crucial for making informed business decisions. I don’t just look at raw numbers; I focus on understanding the story the data tells. This involves analyzing trends, identifying correlations, and understanding statistical significance.

For instance, if we see a statistically significant correlation between increased social media advertising spend and a rise in website traffic, we can conclude that our advertising campaign is likely effective. However, I’d also look at other factors to ensure causality and not just correlation. Perhaps a concurrent media event also influenced traffic. A robust interpretation also includes considering confidence intervals and margin of error to avoid drawing overly simplistic or misleading conclusions.

Ultimately, my goal is to translate complex statistical findings into clear, actionable insights that guide strategic decisions.

Q 11. Explain your experience with competitive analysis.

Competitive analysis is an ongoing process of identifying, assessing, and understanding competitors’ strengths and weaknesses. It’s about more than just listing competitors; it’s about deeply understanding their strategies, market positioning, and customer base.

My approach involves analyzing competitors’ websites, marketing materials, and product offerings. I also review customer reviews and social media mentions to gauge their brand perception. I use various frameworks like Porter’s Five Forces to analyze industry dynamics and identify opportunities and threats.

For example, when analyzing a competitor’s marketing campaign, I wouldn’t just look at the ads themselves, but also examine their targeting strategy, budget allocation, and overall message. This gives a comprehensive picture of their approach and helps identify potential areas for differentiation or improvement in our own strategy.

Q 12. How do you stay up-to-date with industry trends and best practices in market research?

Staying current in market research requires a multi-pronged approach. I regularly read industry publications such as the Journal of Marketing Research and Marketing Science. I also actively participate in industry conferences and webinars to network with peers and learn about the latest methodologies and technologies. Following thought leaders on social media and subscribing to relevant newsletters are additional ways I keep my knowledge base updated.

Continuous learning is essential in this rapidly evolving field. New tools and techniques are constantly emerging, and staying ahead of the curve allows me to deliver the most effective and insightful market research for my clients.

Q 13. Describe your experience using market research to measure ROI.

Measuring ROI on market research can be challenging, but it’s crucial to justify its value. It’s not always about directly linking research to sales, but rather about demonstrating its impact on overall business outcomes. I use a variety of metrics to assess ROI, including:

- Improved product development: Did the research lead to a better product that generated higher sales or customer satisfaction?

- Enhanced marketing effectiveness: Did it help refine targeting, messaging, or channel selection, resulting in increased efficiency or better conversion rates?

- Reduced risk: Did it prevent costly mistakes by identifying potential problems or market gaps before significant investment?

- Better strategic decision-making: Did it provide insights that led to more profitable decisions?

I often use a combination of qualitative and quantitative data to build a comprehensive picture. For example, I might track changes in customer satisfaction scores alongside sales figures to assess the overall impact of a product development initiative informed by market research.

Q 14. How would you measure the effectiveness of a social media campaign?

Measuring the effectiveness of a social media campaign involves analyzing various key performance indicators (KPIs). The specific metrics depend on the campaign’s objectives. However, some common metrics include:

- Reach and impressions: How many unique users saw the campaign’s content?

- Engagement: Likes, comments, shares, and other interactions indicating audience interest.

- Website traffic: Did the campaign drive traffic to the company website?

- Conversions: Did it lead to desired actions, such as purchases, sign-ups, or form submissions?

- Brand mentions and sentiment: What are people saying about the brand on social media, and what’s the overall sentiment (positive, negative, or neutral)?

I use analytics dashboards provided by social media platforms and web analytics tools like Google Analytics to track these metrics. Furthermore, I analyze qualitative data such as comments and feedback to understand the campaign’s resonance with the target audience.

Ultimately, a successful campaign will demonstrate a clear link between social media activity and achieving the pre-defined business objectives.

Q 15. How do you handle conflicting data from different research sources?

Conflicting data is a common challenge in market research. It’s rarely a case of one perfect source; instead, we often find inconsistencies between different studies, datasets, or methodologies. My approach involves a systematic triangulation of data sources, not simply dismissing discrepancies.

- Source Evaluation: First, I critically assess the credibility of each source. This considers factors like the methodology employed (sample size, sampling method, questionnaire design), the reputation of the research firm or institution, the potential biases inherent in the data collection, and the relevance of the data to the specific research question.

- Data Reconciliation: If discrepancies exist, I try to understand the underlying reasons. Are the differences due to varying definitions, time periods, geographical scope, or target demographics? I might explore the possibility of methodological differences leading to skewed results.

- Weighting and Aggregation: I often employ weighting techniques to incorporate data from multiple sources, prioritizing more reliable and relevant data. This might involve assigning higher weights to studies with larger sample sizes or more robust methodologies. Finally, I synthesize the findings to arrive at a comprehensive understanding.

- Qualitative Insights: Sometimes, conflicting quantitative data can be clarified by incorporating qualitative insights from interviews, focus groups, or customer reviews. Qualitative data can help to understand the ‘why’ behind the quantitative discrepancies.

For example, if one report shows a growing market for eco-friendly products while another shows stagnation, I would investigate the differences in their target demographics, geographical regions, or definitions of ‘eco-friendly’. Perhaps one report focuses on a niche luxury market while the other examines mass-market trends.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. Describe your experience working with large datasets.

I have extensive experience working with large datasets, often exceeding millions of rows. My experience includes utilizing tools like SQL, Python (with libraries like Pandas and NumPy), and specialized statistical software such as R and SPSS. I’m proficient in data cleaning, transformation, and analysis techniques.

In a recent project analyzing consumer behavior for a major telecom company, I worked with a dataset of over 5 million customer records. This involved cleaning the data to address missing values and inconsistencies, segmenting the customers based on various demographic and behavioral characteristics using techniques such as k-means clustering, and conducting regression analysis to identify key predictors of churn. I then visualized the findings using tools such as Tableau to communicate insights effectively to stakeholders.

Managing large datasets effectively involves careful planning and resource management. This includes choosing appropriate storage solutions (cloud-based or on-premise), developing efficient data processing pipelines, and employing parallel processing techniques whenever feasible to minimize processing time. Robust data validation and error handling are crucial to ensure data quality and accuracy.

Q 17. What is your experience with data mining techniques?

Data mining is crucial for uncovering hidden patterns and insights within large datasets. My experience encompasses a range of techniques, including:

- Association Rule Mining: Identifying relationships between variables, such as the frequent co-purchase of items in a retail setting (e.g., discovering that customers who buy diapers also often buy beer).

- Classification: Building models to predict categorical outcomes, like whether a customer will churn or not, using techniques like decision trees, support vector machines, or logistic regression.

- Clustering: Grouping similar data points together, for example, segmenting customers based on their purchasing behavior or demographics using techniques like k-means or hierarchical clustering.

- Regression Analysis: Identifying the relationship between a dependent variable and one or more independent variables. For example, predicting sales based on advertising spend and seasonality.

In a project for a financial institution, I used association rule mining to identify patterns in fraudulent transactions. This allowed the development of a fraud detection system with improved accuracy.

I am familiar with various algorithms and understand the strengths and weaknesses of each technique, choosing the most appropriate approach based on the specific research question and dataset characteristics.

Q 18. Explain your understanding of market sizing and forecasting.

Market sizing and forecasting are crucial for strategic business planning. Market sizing involves estimating the current size of a market, often expressed in terms of revenue or units sold. Forecasting projects future market growth and potential, based on various factors and historical trends.

My approach typically involves a combination of:

- Top-Down Approach: Starting with the overall market size and then breaking it down into smaller segments based on factors like geography, demographics, and product type.

- Bottom-Up Approach: Estimating the market size from the ground up by analyzing the sales of individual players in the market and extrapolating to the overall market.

- Statistical Modeling: Utilizing regression analysis or time series models to forecast future market growth based on historical data and market trends.

- Expert Interviews: Gathering insights from industry experts to refine forecasts and account for qualitative factors not easily captured in quantitative data.

For example, when assessing the market for electric vehicles, I would consider factors like government regulations, consumer preferences, technological advancements, and the pricing of competing technologies. This involves combining quantitative data on EV sales with qualitative inputs from experts in the automotive industry and forecasts of economic growth.

The accuracy of market sizing and forecasting depends on the quality and reliability of the data used, and a thorough understanding of the market dynamics and influencing factors is critical.

Q 19. How do you ensure the accuracy and reliability of your market research data?

Ensuring data accuracy and reliability is paramount. I employ several strategies:

- Data Source Validation: Thoroughly vetting the credibility and reliability of data sources, considering factors like methodology, sample size, and potential biases.

- Data Cleaning and Validation: Employing rigorous data cleaning techniques to identify and correct errors, inconsistencies, and outliers. This might involve using automated scripts or manual review.

- Triangulation of Data Sources: Comparing data from multiple sources to identify inconsistencies and ensure accuracy. This is particularly important when dealing with conflicting information.

- Statistical Testing: Applying statistical tests to assess the significance of findings and to ensure the results are not due to random chance.

- Transparency and Documentation: Maintaining meticulous records of data sources, cleaning processes, and analytical methods to ensure reproducibility and transparency.

For example, if I am using survey data, I would carefully review the questionnaire design, sampling method, and response rate to assess the potential for bias. I would also compare the survey results with other data sources, such as sales figures or industry reports, to validate the findings.

Q 20. Describe your experience with conjoint analysis or other advanced statistical techniques.

I have considerable experience with conjoint analysis, a powerful technique for understanding consumer preferences and trade-offs between different product attributes. Conjoint analysis allows us to quantify the relative importance of various features and predict consumer choice behavior based on different product configurations.

Beyond conjoint analysis, I’m proficient in various other advanced statistical techniques, including:

- Regression Analysis (Linear, Logistic, etc.): Modeling the relationship between variables to understand how changes in one variable affect another.

- Time Series Analysis: Analyzing data collected over time to identify trends and patterns and forecast future values.

- Causal Inference Methods: Employing techniques like instrumental variables or difference-in-differences to establish causal relationships between variables.

- Factor Analysis and Principal Component Analysis (PCA): Reducing the dimensionality of large datasets by identifying underlying latent factors or principal components.

In a recent project, we utilized conjoint analysis to optimize the pricing and feature set for a new smartphone. By understanding the relative importance of features like camera quality, battery life, and storage capacity, we were able to develop a product configuration that maximized consumer appeal and profitability.

Q 21. How do you communicate complex market research findings to both technical and non-technical audiences?

Communicating complex market research findings effectively to diverse audiences is critical. My approach is to tailor my communication style to the audience’s level of technical expertise.

For technical audiences, I use precise language, detailed data visualizations, and statistical results. I might include technical reports with detailed methodology and statistical outputs. For example, I would present a regression analysis with its associated R-squared, p-values, and confidence intervals.

For non-technical audiences, I use clear, concise language, avoiding jargon. I focus on the key takeaways and implications of the findings, using visual aids like charts, graphs, and infographics to present the information in an easily digestible format. I avoid overwhelming them with technical details, instead focusing on the actionable insights.

Regardless of the audience, I emphasize storytelling. I weave the data into a compelling narrative that highlights the key findings and their relevance to the business objectives. I also utilize interactive dashboards and presentations to engage the audience and facilitate discussion.

Q 22. How do you prioritize market research projects based on business needs?

Prioritizing market research projects hinges on aligning them with overarching business objectives. I use a framework that combines urgency, impact, and feasibility. First, I identify all potential research projects, then I assess each based on:

- Urgency: How quickly do we need this information to make critical decisions? Projects with immediate needs, like launching a new product within a tight timeframe, take precedence.

- Impact: How significantly will the research findings influence business strategy and bottom-line results? Projects with the potential for high returns on investment (ROI) are prioritized. For example, research confirming a significant market gap for a new product would have a higher impact than research on a minor feature.

- Feasibility: Considering budget, time constraints, and available resources, how realistically can we conduct this research effectively? A project requiring extensive fieldwork might be delayed if resources are limited.

This three-pronged approach helps me create a ranked list of research projects, ensuring that we focus our efforts on the initiatives that offer the greatest strategic value and are achievable within our constraints.

Q 23. What tools and technologies are you familiar with for market research?

My toolkit spans a variety of qualitative and quantitative market research methods and technologies. For quantitative research, I’m proficient in using statistical software like SPSS and R for data analysis. I also have experience with online survey platforms such as SurveyMonkey and Qualtrics. For qualitative research, I utilize tools like NVivo for thematic analysis of interview transcripts and focus group recordings.

Beyond software, I’m adept at leveraging social media listening tools to gauge public sentiment and understand consumer behavior online. I regularly use Google Analytics and other web analytics platforms to analyze website traffic and user behavior. Furthermore, I’m comfortable using data visualization tools like Tableau and Power BI to present findings in a clear and compelling manner.

Q 24. Describe a time you had to present a market research report under tight deadlines.

During the launch of a new mobile application, we needed to complete a comprehensive market analysis and user feedback report within two weeks. The pressure was immense, as the marketing campaign launch was dependent on the insights we gathered. To manage the tight deadline, we employed a streamlined approach:

- Prioritized Key Questions: We focused on the most critical questions impacting the launch, streamlining our research scope to the essentials.

- Leveraged Agile Methodology: We worked in short sprints, allowing for rapid iteration and adjustments based on initial findings.

- Parallel Data Collection: We concurrently conducted online surveys, user interviews, and competitor analysis, maximizing efficiency.

- Team Collaboration: The entire team worked extended hours, collaborating closely to ensure data analysis and report writing were completed simultaneously.

While it was challenging, we successfully delivered a concise yet comprehensive report, providing actionable insights that informed the marketing strategy. The app launch was a success, demonstrating the value of effective time management and collaborative teamwork in high-pressure situations.

Q 25. How do you identify potential biases in market research data?

Identifying biases is crucial for ensuring the validity and reliability of market research. I employ a multi-faceted approach:

- Sampling Bias: I carefully examine the sampling methodology to ensure the sample accurately represents the target population. Non-representative samples can lead to skewed results. For instance, relying solely on online surveys might exclude individuals without internet access.

- Question Bias: Leading questions or biased wording can influence respondent answers. I use neutral and objective language in questionnaires and interview guides, avoiding any suggestion of a preferred response.

- Response Bias: Social desirability bias, where respondents answer in ways they perceive as socially acceptable, is a common issue. I can mitigate this by assuring anonymity and confidentiality, and using techniques like randomized response.

- Interviewer Bias: In qualitative research, the interviewer’s presence can influence responses. Training interviewers to maintain neutrality and avoid leading questions is essential.

- Confirmation Bias: I actively seek to challenge my own assumptions and interpretations to avoid selectively focusing on data that confirms pre-existing beliefs. I encourage diverse perspectives on the data analysis.

By meticulously examining these potential sources of bias, I strive to ensure the integrity of my research findings.

Q 26. Explain your understanding of different sampling methods.

Sampling methods are critical in selecting a representative subset of the target population for research. Different methods cater to various research objectives and resource constraints:

- Probability Sampling: Every member of the population has a known chance of being selected. This ensures a more generalized representation. Examples include:

- Simple Random Sampling: Each member has an equal chance.

- Stratified Sampling: The population is divided into subgroups (strata), and random samples are drawn from each stratum.

- Cluster Sampling: The population is divided into clusters, and some clusters are randomly selected for sampling.

- Non-Probability Sampling: The probability of selection is unknown. This is often used when resources are limited, or specific characteristics are targeted. Examples include:

- Convenience Sampling: Selecting readily available participants (e.g., surveying shoppers in a mall).

- Quota Sampling: Participants are selected to meet pre-defined quotas based on certain characteristics.

- Snowball Sampling: Participants refer other potential participants.

The choice of sampling method depends heavily on the research question, budget, time constraints, and desired level of generalizability. A clear understanding of the strengths and limitations of each method is crucial for selecting the most appropriate approach.

Q 27. How do you incorporate ethical considerations into your market research practices?

Ethical considerations are paramount in market research. I adhere to a strict code of conduct that emphasizes:

- Informed Consent: Participants must be fully informed about the study’s purpose, procedures, and their rights before participating. They should be free to withdraw at any time.

- Confidentiality and Anonymity: Protecting participant data is crucial. I ensure data is anonymized whenever possible and stored securely, complying with relevant data privacy regulations like GDPR and CCPA.

- Transparency: Research findings should be presented honestly and accurately, avoiding manipulation or misrepresentation.

- Avoiding Deception: Participants should not be misled or deceived in any way. If deception is unavoidable, it needs rigorous ethical review and justification.

- Respect for Participants: Participants should be treated with respect and dignity throughout the research process. This includes avoiding undue pressure or coercion.

I prioritize ethical research practices to maintain participant trust, protect their well-being, and ensure the credibility of my findings.

Q 28. How do you use audience analysis to inform content marketing strategy?

Audience analysis is fundamental to developing an effective content marketing strategy. By thoroughly understanding our target audience, we can create content that resonates, engages, and converts. This involves:

- Identifying Key Demographics: Age, gender, location, income, education, occupation, etc., help us tailor content to specific groups.

- Understanding Psychographics: Values, attitudes, interests, lifestyle, and personality traits provide insights into audience motivations and preferences. For example, understanding a target audience’s concern for sustainability can guide the creation of environmentally-conscious content.

- Analyzing Behaviors: Online behavior (website visits, social media activity), purchasing habits, and media consumption patterns provide valuable information on where and how to reach the audience.

- Defining Buyer Personas: Creating fictional representations of ideal customers helps visualize and understand target audiences. These personas serve as guides for content creation and campaign development.

Once we have a comprehensive understanding of our audience, we can create targeted content that addresses their needs, speaks to their interests, and ultimately drives desired actions. This includes adjusting messaging, tone, and content format (blogs, videos, infographics, etc.) to optimize engagement.

Key Topics to Learn for Market and Audience Analysis Interview

- Market Sizing and Segmentation: Understanding different market segmentation techniques (geographic, demographic, psychographic, behavioral) and applying them to estimate market size and potential. This includes practical exercises in calculating market share and potential.

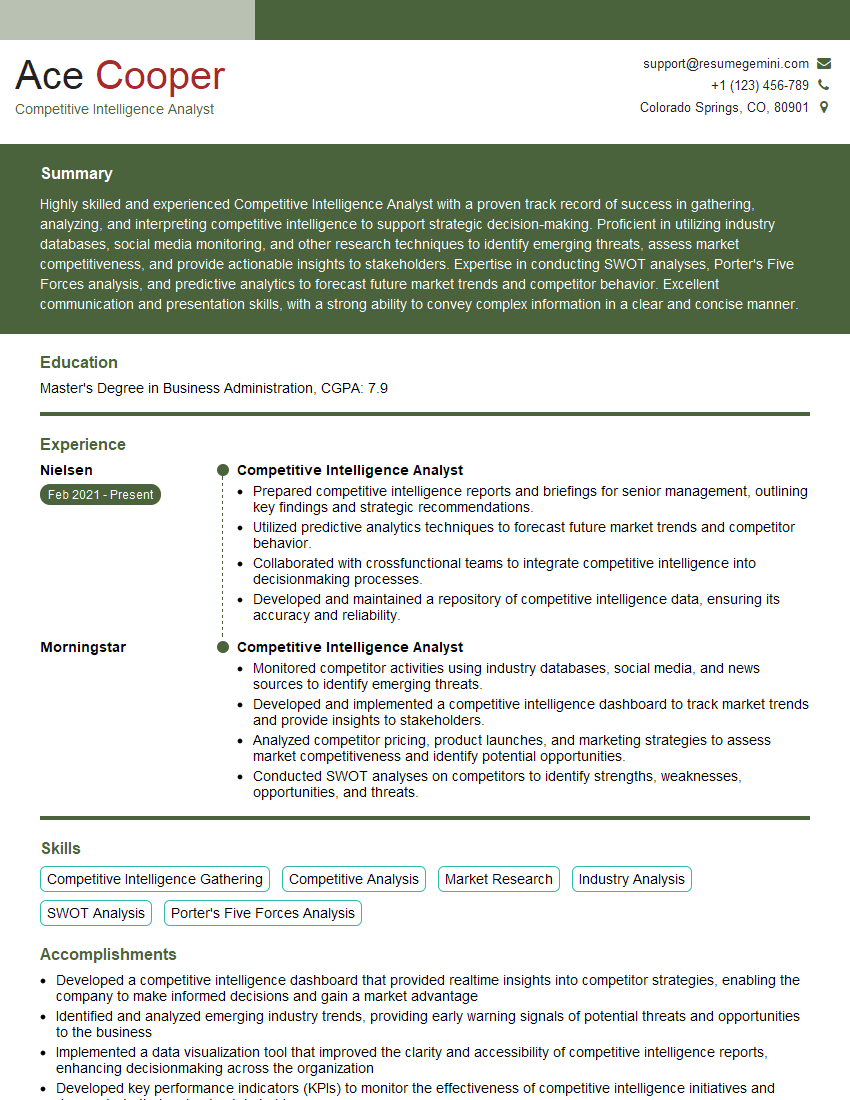

- Competitive Analysis: Analyzing competitors’ strengths, weaknesses, strategies, and market positioning. Practical application includes developing competitive matrices and identifying opportunities for differentiation.

- Audience Research Methods: Mastering various qualitative and quantitative research methods such as surveys, focus groups, interviews, and data analysis to understand audience needs, preferences, and behaviors. This includes understanding the strengths and limitations of each method and choosing the appropriate one for a given scenario.

- Data Analysis and Interpretation: Proficiency in analyzing market data (e.g., sales figures, market trends, customer demographics) using statistical tools and techniques to draw meaningful insights and inform strategic decisions. Practical application includes interpreting data visualizations and presenting findings clearly.

- Developing Audience Personas: Creating detailed profiles of ideal customers based on research findings to guide marketing and product development efforts. This includes understanding how to use personas to inform messaging and targeting strategies.

- Market Trend Analysis: Identifying and analyzing emerging market trends and their potential impact on the business. This includes understanding how to use various data sources (e.g., industry reports, news articles, social media) to stay informed about current trends.

- Presenting Findings and Recommendations: Effectively communicating market and audience insights to stakeholders through clear, concise presentations and reports. This includes developing compelling narratives and supporting findings with data.

Next Steps

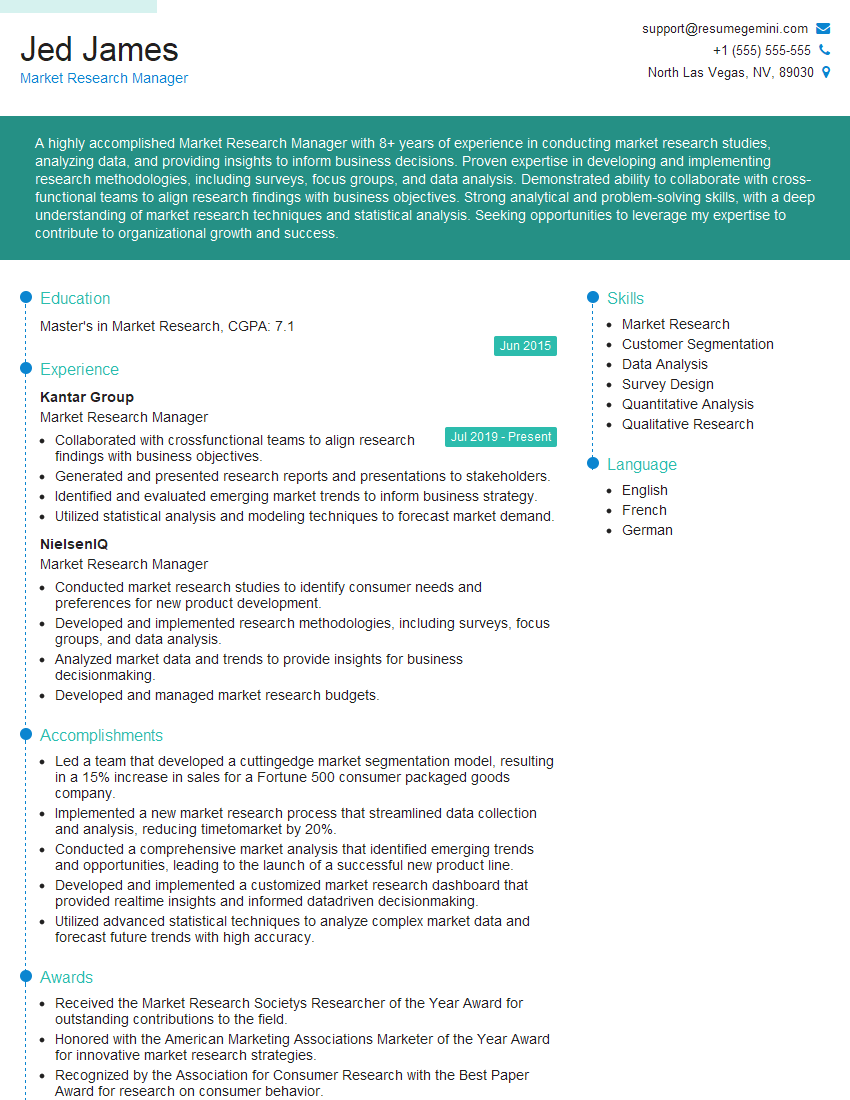

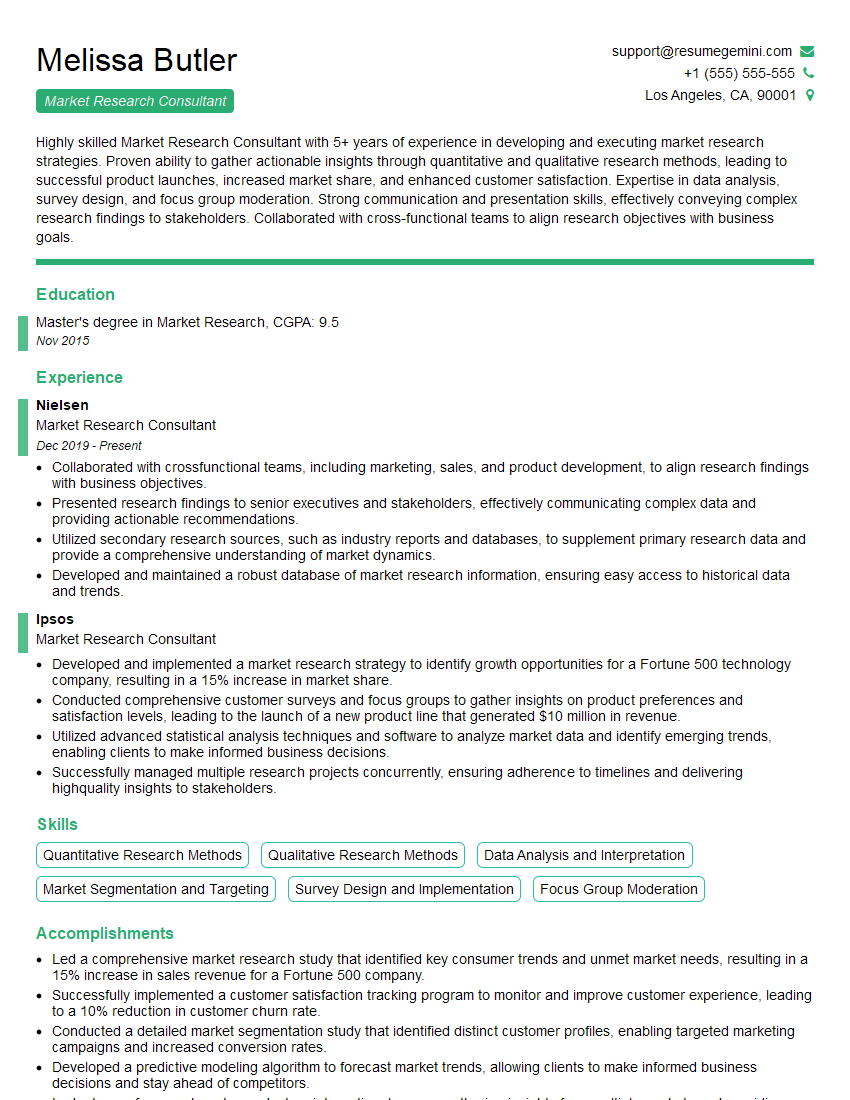

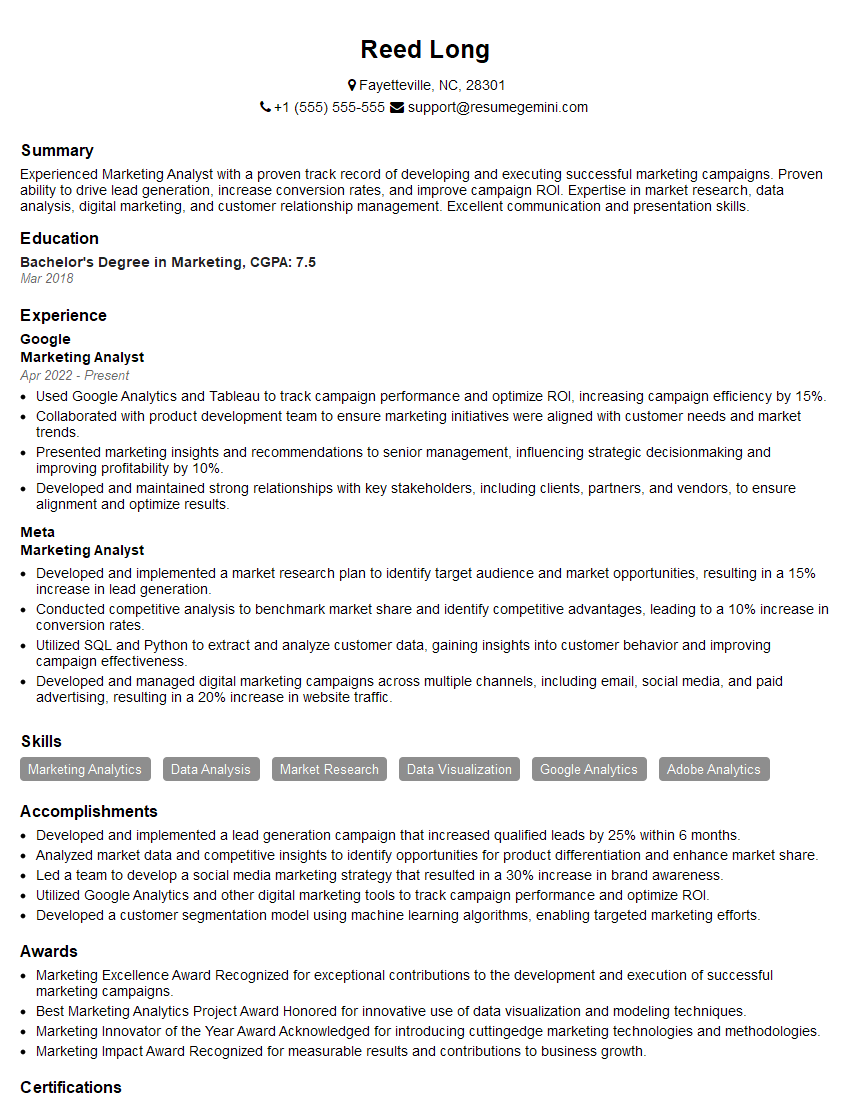

Mastering Market and Audience Analysis is crucial for career advancement in many fields, opening doors to roles with greater responsibility and impact. A strong understanding of these concepts allows you to make data-driven decisions, contributing significantly to a company’s success. To enhance your job prospects, create an ATS-friendly resume that effectively highlights your skills and experience. ResumeGemini is a trusted resource that can help you build a professional and impactful resume tailored to the specific requirements of Market and Audience Analysis roles. Examples of resumes tailored to this field are available to further guide you.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

Hi, I’m Jay, we have a few potential clients that are interested in your services, thought you might be a good fit. I’d love to talk about the details, when do you have time to talk?

Best,

Jay

Founder | CEO