Unlock your full potential by mastering the most common Claims Management and Investigation interview questions. This blog offers a deep dive into the critical topics, ensuring you’re not only prepared to answer but to excel. With these insights, you’ll approach your interview with clarity and confidence.

Questions Asked in Claims Management and Investigation Interview

Q 1. Explain your experience handling high-value claims.

Handling high-value claims requires a meticulous and strategic approach, differing significantly from routine claims. It involves a higher level of scrutiny, more detailed investigation, and often necessitates specialized expertise.

In my experience, I’ve managed claims exceeding $1 million, primarily in the areas of commercial property damage and professional liability. For instance, I handled a case involving a manufacturing plant fire resulting in significant property damage and business interruption. This involved coordinating with multiple experts – engineers, accountants, and fire investigators – to determine the cause of the fire, assess the extent of the damage, and negotiate a fair settlement with the insured and potentially involved third parties. Another example involved a claim against a law firm for alleged professional negligence. This needed a deep dive into legal documentation and expert testimony to assess the validity and extent of the liability.

Key elements in managing high-value claims include:

- Thorough documentation: Maintaining a detailed record of every step taken, from initial report to final settlement.

- Expert engagement: Collaborating with specialists to accurately assess damages and liability.

- Negotiation skills: Successfully navigating complex negotiations with parties involved, including insurers, claimants, and legal counsel.

- Risk management: Identifying and mitigating potential risks to the company.

Q 2. Describe your process for investigating a potential fraud claim.

Investigating a potential fraud claim requires a systematic and thorough approach, focusing on identifying inconsistencies and gathering compelling evidence. My process typically follows these steps:

- Initial Assessment: Carefully review the claim documentation for any red flags, inconsistencies, or suspicious patterns. This might include discrepancies in dates, locations, or descriptions of the event.

- Data Gathering: Collect all relevant information, including statements from the claimant, witnesses, and any supporting documentation such as medical records, police reports, and financial records.

- Verification: Verify the information provided by the claimant through independent sources. This could involve contacting medical providers, employers, or other witnesses.

- Specialized Investigation: If necessary, I’ll engage specialists such as forensic accountants, private investigators, or even law enforcement if criminal activity is suspected.

- Documentation: Meticulously document every step of the investigation, including all evidence gathered and conclusions drawn.

- Report & Recommendation: Prepare a comprehensive report summarizing the findings of the investigation and providing a recommendation on the claim’s validity.

For example, I once investigated a claim for a stolen vehicle where the claimant provided inconsistent information about the time and location of the theft. Further investigation revealed discrepancies in their insurance history and ultimately led to a determination of fraudulent activity.

Q 3. How do you prioritize competing claims with varying levels of urgency?

Prioritizing competing claims requires a well-defined system that considers urgency and potential impact. I utilize a matrix approach that considers several factors. This usually involves:

- Urgency: Claims posing immediate financial risk or those subject to stringent deadlines (e.g., statutory time limits) take precedence.

- Potential Liability: Claims with higher potential liability, regardless of urgency, require prompt attention to mitigate potential losses.

- Complexity: Complex claims may require more time and resources, and their priority is adjusted accordingly.

- Claim Size: High-value claims often require more attention even if they aren’t immediately urgent.

I frequently use a prioritized task management system (like Jira or Asana) to visually track the status of all claims, ensuring nothing falls through the cracks. A simple example would be prioritizing a claim involving a serious injury with potential for significant liability over a less severe, less expensive claim, even if the less severe claim was reported earlier.

Q 4. What software or tools are you proficient in for claims management?

I’m proficient in several claims management software and tools, including:

- Guidewire ClaimCenter: A comprehensive claims management system offering features such as claim intake, investigation tracking, and reporting.

- Xactware: Software for estimating property damage, particularly beneficial for construction and auto claims.

- Microsoft Excel & Access: I use these for data analysis, report generation and maintaining databases related to claims data.

My experience with these systems allows me to efficiently manage large volumes of claims data, generate reports, and track key performance indicators (KPIs).

Q 5. Detail your experience with reserving claims.

Reserving claims is a critical aspect of claims management that involves estimating the financial resources needed to settle a claim. Accurate reserving is crucial for financial forecasting and risk management. My experience involves using both deterministic and probabilistic reserving methods.

Deterministic reserving focuses on estimating the expected cost based on available information, while probabilistic reserving uses statistical methods to consider uncertainty. Factors influencing reserve estimates include:

- Nature of the claim: The type and severity of the claim (e.g., property damage, liability).

- Claim history: Past claims with similar characteristics.

- Expert opinions: Estimates from physicians, engineers, or other relevant experts.

- Legal factors: Potential legal liabilities and defense costs.

I routinely use various reserving models to generate estimates, and regularly review and adjust reserves as the claim progresses and more information becomes available. This ensures that the reserve remains accurate and aligns with the evolving claim circumstances.

Q 6. How do you handle difficult or uncooperative claimants?

Handling difficult or uncooperative claimants requires patience, empathy, and a strategic approach focused on de-escalation and communication. My strategy usually involves:

- Active Listening: Understanding the claimant’s perspective and concerns.

- Clear Communication: Clearly explaining the claims process and expectations in a non-confrontational manner.

- Empathy: Showing understanding and acknowledging the claimant’s situation.

- Documentation: Thoroughly documenting all interactions, including attempts to contact the claimant and the claimant’s responses.

- Escalation: If communication proves unsuccessful, involving supervisors or legal counsel when appropriate.

For example, I’ve had cases where claimants were initially hesitant to cooperate. By actively listening to their concerns, explaining the process patiently and demonstrating empathy, I successfully navigated the challenges and obtained necessary information for a fair resolution.

Q 7. Explain your understanding of subrogation and its application.

Subrogation is the right of an insurer, who has paid a claim to its insured, to recover the amount paid from a third party who may be legally responsible for the loss. In simpler terms, if your insurance company pays out for damage caused by someone else’s negligence, they can then sue that negligent party to recoup their costs. This process helps to control insurance costs and ensures fairness.

Applying subrogation effectively involves:

- Identifying potentially liable parties: Determining who might be responsible for the loss.

- Investigating liability: Gathering evidence to support the claim against the third party.

- Negotiating with the liable party: Seeking a settlement or pursuing legal action if necessary.

- Managing legal proceedings: If litigation becomes necessary, handling legal representation and discovery.

For instance, if a car accident was caused by a drunk driver, and my client’s insurance company paid for the damages, the insurer has the right to sue the drunk driver to recover the funds paid. This ensures that the responsible party, not the policyholders, ultimately bears the financial burden of the accident.

Q 8. Describe your experience with different types of insurance claims (e.g., auto, property, liability).

My experience spans a wide range of insurance claims, encompassing auto, property, and liability claims. In auto claims, I’ve handled everything from minor fender benders to complex multi-vehicle accidents, including assessing vehicle damage, reviewing medical reports, and negotiating settlements. Property claims have involved residential and commercial properties, dealing with fire damage, water damage, theft, and vandalism. This includes thorough damage assessments, working with contractors for repairs, and handling disputes with contractors or other parties. Finally, in liability claims, I’ve investigated and managed claims arising from bodily injury, property damage, and product liability. This involves investigating the circumstances of the incident, gathering evidence, interviewing witnesses, and determining liability. I am familiar with the nuances of each type of claim and tailor my approach accordingly.

For example, in one auto claim, I successfully negotiated a lower settlement than initially proposed by the claimant by presenting compelling evidence that contradicted the claimant’s version of events. In a property claim involving a significant water damage, I coordinated with a team of experts, including plumbers and contractors, to ensure a timely and cost-effective repair.

Q 9. How do you ensure compliance with regulatory requirements in claims handling?

Compliance is paramount in claims handling. I meticulously ensure adherence to all relevant state and federal regulations, including those concerning privacy (like HIPAA), fair claims practices, and anti-fraud laws. This involves staying updated on changes in regulations, maintaining accurate and complete claim files, and regularly reviewing our internal procedures to ensure compliance. We also utilize specialized software to assist with this process, flagging potential compliance issues and allowing for efficient reporting.

For instance, I meticulously document every interaction with claimants and third parties, including phone calls, emails, and meetings. This ensures transparency and traceability, helping us to demonstrate compliance during audits or investigations. We also conduct regular compliance training within the team to keep everyone abreast of best practices and recent regulatory updates. Failure to comply can lead to significant fines and reputational damage, so proactive compliance is a top priority.

Q 10. How do you manage your workload and prioritize tasks efficiently in a high-pressure environment?

Managing workload in a high-pressure claims environment requires a structured approach. I utilize project management techniques, like prioritizing tasks based on urgency and impact using a system such as Eisenhower Matrix (Urgent/Important). I also employ time management tools like time blocking and task lists. This enables me to efficiently allocate time to high-priority claims while ensuring that all claims are handled promptly and effectively. Additionally, I prioritize clear communication with my team and supervisors, so they’re aware of my workload and any potential bottlenecks.

For example, I might prioritize a claim involving a seriously injured claimant over a claim with minor property damage. By effectively delegating tasks where appropriate, and using efficient communication channels, I am able to handle peaks of activity effectively, keeping all parties informed of the progress.

Q 11. What is your experience with claim lifecycle management?

Claim lifecycle management is a core competency of mine. I have extensive experience managing claims from first notice of loss (FNOL) to final settlement. This includes the initial intake and assessment of the claim, investigation of the incident, evaluation of liability and damages, negotiation with claimants and third parties, and ultimately, the final resolution. My approach is structured and ensures that all necessary steps are completed efficiently and effectively, minimizing delays and maximizing accuracy. I leverage technology and software to track the progress of each claim, ensuring accountability and transparency at every stage.

A typical lifecycle might involve: 1. FNOL and initial claim registration; 2. Investigation (evidence gathering, witness statements); 3. Loss assessment (damage evaluation, medical records review); 4. Reserve setting (financial projection of claim cost); 5. Negotiation and settlement; 6. Documentation and closure.

Q 12. Explain your knowledge of indemnity and liability.

Indemnity and liability are fundamental concepts in claims management. Indemnity refers to the insurer’s obligation to compensate the insured for covered losses. This compensation aims to restore the insured to their pre-loss financial position. Liability, on the other hand, refers to the legal responsibility for causing a loss or injury. Determining liability is crucial in many claims, especially those involving third parties. We must establish who is at fault to determine who bears the responsibility for the loss.

For example, in a car accident, indemnity would cover the insured’s vehicle repairs and medical expenses if they have a valid claim. If the insured is found liable for the accident, the insurer might be required to compensate the other party’s damages, thus illustrating liability. Understanding this distinction is vital for efficient and fair claim resolution.

Q 13. Describe your approach to negotiating claim settlements.

My negotiation approach is collaborative and results-oriented. I aim to achieve fair and equitable settlements that satisfy both the claimant and the insurer. This involves thorough preparation, including a strong understanding of the claim facts, applicable law, and the claimant’s needs. I communicate openly and honestly with claimants, explaining the process clearly and addressing their concerns. I’m skilled in active listening and finding mutually acceptable solutions. My goal isn’t just to minimize payouts but to ensure fair and just resolutions.

I might employ various negotiation techniques such as compromise, principled negotiation, and sometimes even mediation, depending on the complexity of the case. The key is to build rapport and trust with the claimant to reach a resolution efficiently.

Q 14. How do you maintain accurate records and documentation for claims?

Maintaining accurate records and documentation is essential for compliance, audit trails, and successful claim resolution. I utilize a combination of digital and physical record-keeping systems, ensuring that all documentation is securely stored and readily accessible. This includes claim files, correspondence, investigation reports, medical records, and settlement agreements. Every piece of information is meticulously cataloged and indexed, using a system that ensures efficient retrieval when needed. This rigorous process minimizes errors, enhances transparency, and protects the insurer against potential disputes.

We employ specialized claim management software that provides a centralized repository for all claim-related documents, ensuring easy access and version control. Regular audits of our record-keeping systems further ensure accuracy and compliance with all relevant regulations.

Q 15. How do you identify and mitigate potential risks in claims processes?

Identifying and mitigating risks in claims processes is crucial for efficient and cost-effective claims management. It involves a proactive approach, combining preventative measures with robust investigation and control mechanisms.

Risk Identification: This starts with analyzing historical claim data to identify trends, such as high-frequency claim types, specific injury patterns, or problematic providers. We can also use predictive modeling to forecast potential future risks based on various factors like seasonal patterns or economic indicators. For instance, a spike in slip-and-fall claims during winter months might indicate a need for improved snow removal procedures.

Risk Assessment: Once risks are identified, we assess their likelihood and potential impact. A risk matrix can help prioritize risks based on severity and probability. For example, a low-probability, high-impact risk (e.g., a major catastrophic event) requires different mitigation strategies than a high-probability, low-impact risk (e.g., minor clerical errors).

Risk Mitigation: This involves implementing control measures to reduce the likelihood or impact of identified risks. Examples include: improved training for staff to reduce errors, enhanced fraud detection systems, implementing stricter verification processes for medical documentation, and regular audits to ensure compliance with policies and procedures. Imagine implementing a new software that automatically flags potentially fraudulent claims based on certain criteria; this significantly reduces the risk of fraudulent payouts.

By continuously monitoring and evaluating the effectiveness of our risk mitigation strategies, we can adapt and improve our processes, ensuring a robust and efficient claims management system.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. Explain your understanding of different types of claim denials.

Claim denials occur when an insurer rejects all or part of a claim. There are various reasons for denials, categorized broadly into several types:

Medical Necessity Denials: These occur when the insurer determines that the medical treatment or service wasn’t necessary for the claimed injury or illness. This often involves reviewing medical records and consulting with medical professionals to assess the appropriateness of care provided.

Coding and Billing Errors: Incorrect or incomplete coding of medical procedures or services leads to claim denials. This highlights the importance of accurate billing practices and the use of appropriate Current Procedural Terminology (CPT) and International Classification of Diseases (ICD) codes.

Lack of Pre-authorization: Some medical services require pre-authorization from the insurer before the treatment is provided. Failure to obtain this authorization will result in a denial.

Policy Exclusion Denials: These occur when the claimed injury or illness is explicitly excluded from coverage under the policy’s terms and conditions. For example, pre-existing conditions may be excluded in some policies.

Benefit Exhaustion Denials: Claims might be denied if the policyholder has already used up the maximum amount of coverage allowed for a particular benefit.

Timeliness Denials: If a claim is not filed within the specified timeframe according to the policy, it may be denied.

Understanding the reason for a denial is key to resolving the issue. Detailed review of the denial reason, along with relevant policy documents and medical records, enables effective appeal strategies.

Q 17. How do you handle complex claims involving multiple parties?

Handling complex claims involving multiple parties requires a structured and organized approach. Think of it like orchestrating a complex symphony – each instrument (party) plays a crucial role, and effective coordination is paramount.

Thorough Investigation: This involves collecting evidence from all involved parties, including witnesses, medical providers, police reports (if applicable), and reviewing contracts or agreements.

Detailed Documentation: Meticulous record-keeping is essential. This includes maintaining a comprehensive file of all communication, evidence, and decisions made throughout the process. This is crucial for transparency and potential legal proceedings.

Communication and Collaboration: Open communication with all parties – claimants, witnesses, legal representatives, and other insurers – is critical. This fosters transparency and helps resolve disputes efficiently.

Expert Consultation: If necessary, we may consult with medical specialists, engineers, or legal professionals to obtain expert opinions on specific aspects of the claim.

Negotiation and Settlement: When multiple parties are involved, negotiation plays a vital role in reaching a fair and equitable settlement that addresses the interests of all involved.

Legal Counsel: In cases with significant complexity or potential litigation, engaging legal counsel to navigate the legal landscape and protect the interests of the insurer is paramount.

A clear, well-defined process, effective communication, and expert involvement are key to successfully resolving complex, multi-party claims.

Q 18. Describe your experience with independent medical examinations (IMEs).

Independent Medical Examinations (IMEs) are crucial in assessing the extent and nature of an injury or illness claimed in an insurance claim. An independent physician, not previously involved in the claimant’s treatment, conducts the examination. My experience encompasses all aspects of IME management, from initial request to report review.

Selecting the IME Physician: Choosing a qualified and unbiased physician with relevant expertise is crucial. This ensures the examination is thorough, objective, and adheres to professional standards.

Scheduling and Logistics: Coordinating the examination appointment, ensuring appropriate medical records are provided to the physician, and handling any necessary communication with the claimant and physician are critical aspects of my role.

Report Review and Analysis: Once the IME report is received, I review it carefully for accuracy, completeness, and consistency with the available medical evidence and the claimant’s statements. I often compare the findings with other medical records and witness statements.

Utilizing IME Findings: IME reports inform the claims handling process, helping to determine the validity of the claimant’s injury claims and guide further investigations or settlements. For instance, if an IME indicates that a claimant’s condition is not as severe as claimed, it can support a decision to reduce the claim settlement amount. However, the report isn’t taken as the absolute truth; all evidence is considered holistically.

IMEs play a critical role in balancing the interests of claimants and insurers by providing an objective assessment of the medical condition and ensuring fair and accurate claim resolution.

Q 19. How do you stay current with changes in claims legislation and regulations?

Staying abreast of changes in claims legislation and regulations is paramount in claims management. This requires a multi-faceted approach:

Subscription to Professional Journals and Newsletters: Regularly reviewing industry publications allows us to stay updated on emerging trends and legislative changes. This provides insights into potential impacts on claims handling procedures and legal implications.

Attendance at Industry Conferences and Seminars: Networking and attending conferences offers valuable opportunities to learn from experts, share best practices, and stay abreast of the latest developments.

Monitoring Regulatory Websites: Regularly checking the websites of relevant regulatory bodies (e.g., state insurance departments, federal agencies) is crucial to stay informed about new rules and updates.

Collaboration with Legal Counsel: Consulting with legal experts allows us to obtain in-depth analysis of complex legal matters and their implications for claims handling.

Internal Training Programs: Implementing internal training programs to educate claims staff on new laws, regulations, and best practices is essential to ensure compliance and consistency.

Proactive monitoring of regulatory changes helps us maintain compliance, avoid potential penalties, and ensure our claims handling practices are always up-to-date and aligned with the current legal framework.

Q 20. Explain your understanding of the claims reserving process.

The claims reserving process involves estimating the ultimate cost of settling claims. It’s a crucial aspect of financial planning for insurance companies. Think of it as forecasting the financial obligations based on current claim information.

Data Collection and Analysis: This process begins with gathering data on claims, including the initial claim amount, the nature of the injury or loss, the stage of the claim (e.g., reported, investigation, settlement), and any relevant medical or other evidence.

Reserving Methods: Various methods exist for estimating reserves, ranging from simple methods such as incurred but not reported (IBNR) reserves to more sophisticated actuarial models. The choice of method depends on factors like data availability, claim complexity, and the insurer’s risk appetite.

Regular Review and Adjustment: Reserves are not static; they are reviewed and adjusted periodically as new information becomes available throughout the life of a claim. This dynamic adjustment ensures that the reserve reflects the most current estimate of the final settlement cost. For example, if new medical evidence emerges indicating a more severe injury, the reserve will be increased.

Impact on Financial Reporting: Accurate claims reserving is essential for financial reporting purposes, enabling insurers to accurately assess their liabilities and plan for future payouts.

Proper claims reserving ensures the financial stability of an insurance company by accurately forecasting future liabilities and allowing for sound financial planning and risk management.

Q 21. What is your experience with using data analytics in claims management?

Data analytics plays a transformative role in modern claims management. It allows for a data-driven approach, shifting from reactive to proactive management.

Fraud Detection: Data analytics techniques, such as machine learning algorithms, can identify patterns and anomalies suggestive of fraudulent claims, allowing for early intervention and prevention of unwarranted payouts. For example, algorithms can flag claims with unusual patterns of medical billing or geographical clustering.

Predictive Modeling: Predictive models can forecast claim costs, identify high-risk claims, and predict claim settlement times. This allows for more effective resource allocation and proactive risk management strategies.

Performance Monitoring: Data analytics can monitor the performance of claims handlers, identify areas for improvement, and track key performance indicators (KPIs), such as average claim handling time and claim settlement costs. This supports continuous improvement and enhances efficiency.

Claim Severity Prediction: By analyzing various factors, including injury type, medical history, and treatment plans, data analytics models can predict the severity of claims and adjust reserves accordingly.

By leveraging the power of data analytics, we can optimize claims processes, enhance efficiency, and reduce costs while ensuring fair and timely claim settlements. It’s no longer about reacting to claims but rather anticipating and managing them proactively.

Q 22. Describe a time you had to deal with a difficult claimant. How did you resolve the situation?

Dealing with difficult claimants requires a delicate balance of empathy and firmness. One instance involved a claimant who was convinced their claim was being unfairly processed, leading to aggressive and hostile communication. Instead of escalating the situation, I prioritized active listening. I carefully reviewed the claim file with them, step-by-step, explaining the process and the specific evidence we were relying on. I acknowledged their frustration and validated their feelings, emphasizing that I understood their concerns. This approach allowed me to build trust. We then identified the points of contention. It turned out a minor procedural detail was causing the misunderstanding. I clarified the process and offered a revised timeline for review. The claimant, having felt heard and understood, became significantly more cooperative. The situation was resolved amicably through clear communication and demonstrating a commitment to fairness.

Q 23. How do you build rapport with claimants and other stakeholders?

Building rapport is crucial in claims management. With claimants, I focus on active listening, empathy, and clear communication. This means carefully hearing their story, validating their emotions, and explaining the process in a way they understand, avoiding jargon. For instance, I might say, ‘I understand this is a stressful time for you,’ before explaining the next steps. With stakeholders, professional communication, transparency, and regular updates are key. I make sure everyone is informed and their concerns are addressed promptly. For example, I might schedule regular meetings with internal teams to keep everyone synchronized and aligned on claim strategy.

Q 24. Explain your experience in managing claim disputes.

Managing claim disputes often involves negotiation and mediation. I’ve handled disputes ranging from disagreements over liability to the amount of compensation. My approach involves thoroughly investigating the facts, documenting all communication, and presenting a clear and concise summary of my findings. I aim to find a mutually agreeable solution whenever possible. If negotiation fails, I’m comfortable escalating the dispute to alternative dispute resolution methods like arbitration or litigation, ensuring compliance with legal and regulatory requirements. A successful example involved a dispute over property damage where both parties had conflicting accounts. Through careful examination of evidence, including witness statements and photos, I was able to present a neutral assessment, which led to a fair settlement acceptable to both parties.

Q 25. Describe your experience with different types of investigations (e.g., accident reconstruction, surveillance).

My experience encompasses various investigation types. Accident reconstruction involved analyzing accident reports, witness statements, and vehicle damage to determine the cause and liability. This frequently requires using specialized software and applying physics principles. Surveillance investigations have involved using video footage and other forms of evidence to verify the claimant’s statements and assess the validity of the claim. For example, in a slip and fall case, surveillance footage helped confirm the claimant’s version of events, strengthening the case for compensation. Each investigation type necessitates meticulous attention to detail and adherence to legal and ethical guidelines.

Q 26. How do you handle confidential information in the claims process?

Handling confidential information is paramount. I adhere strictly to data protection regulations and company policies. This includes limiting access to sensitive data on a need-to-know basis, using secure systems for storing and transmitting information, and implementing strong password protocols. I never discuss confidential information in public spaces and always ensure documents are securely disposed of. Any breaches are reported immediately according to established procedures. Protecting claimant privacy is not just a procedural matter; it’s an ethical imperative.

Q 27. What is your approach to continuous improvement in claims handling?

Continuous improvement in claims handling requires a proactive approach. I actively seek feedback from claimants, stakeholders, and colleagues to identify areas for enhancement. I regularly review claim handling processes, looking for inefficiencies or bottlenecks. This includes analyzing claim cycle times, identifying trends in disputes, and evaluating the effectiveness of different investigation techniques. The use of data analytics helps in identifying patterns and improving decision-making. For instance, analyzing claim denial rates can pinpoint areas needing procedural improvement. Participation in professional development activities and staying updated with industry best practices are crucial.

Q 28. Explain your experience with claim audits and quality control.

Claim audits and quality control are integral to ensuring accuracy and efficiency. I’ve participated in both internal and external audits, reviewing claim files for compliance with regulations, accuracy of information, and adherence to company procedures. This includes verifying the appropriate application of policy, assessing the thoroughness of investigations, and ensuring fair and consistent claim handling. Quality control measures often include regular performance reviews, feedback sessions, and the development of standardized operating procedures. These measures improve accuracy, reduce errors, and maintain a high level of service for claimants.

Key Topics to Learn for Claims Management and Investigation Interview

- Claims Intake and Assessment: Understanding the initial steps in receiving and evaluating a claim, including verifying coverage and identifying potential red flags.

- Investigative Techniques: Mastering methods for gathering evidence, interviewing witnesses, and analyzing documentation to determine liability and damages. Practical application includes understanding different types of evidence and their admissibility.

- Liability Determination: Applying legal principles and policy guidelines to determine the extent of an insurer’s responsibility for a claim. This includes understanding policy exclusions and coverage limits.

- Loss Quantification and Valuation: Accurately assessing the financial impact of a claim, including property damage, medical expenses, and lost wages. Practical application involves using various valuation methods and understanding depreciation.

- Negotiation and Settlement: Developing strong negotiation skills to reach fair and efficient settlements with claimants and their representatives. This includes understanding different negotiation strategies and tactics.

- Fraud Detection and Prevention: Identifying and mitigating instances of fraudulent claims. Practical application includes recognizing common fraud patterns and implementing anti-fraud measures.

- Regulatory Compliance: Understanding and adhering to relevant laws and regulations governing claims handling. This includes state-specific regulations and federal laws.

- Documentation and Reporting: Maintaining accurate and thorough records throughout the claims process, including clear and concise reporting to stakeholders.

- Claims Management Systems (CMS): Familiarity with different types of claims management software and their applications.

- Communication and Interpersonal Skills: Effectively communicating with claimants, adjusters, lawyers, and other stakeholders. Problem-solving includes conflict resolution and handling difficult situations.

Next Steps

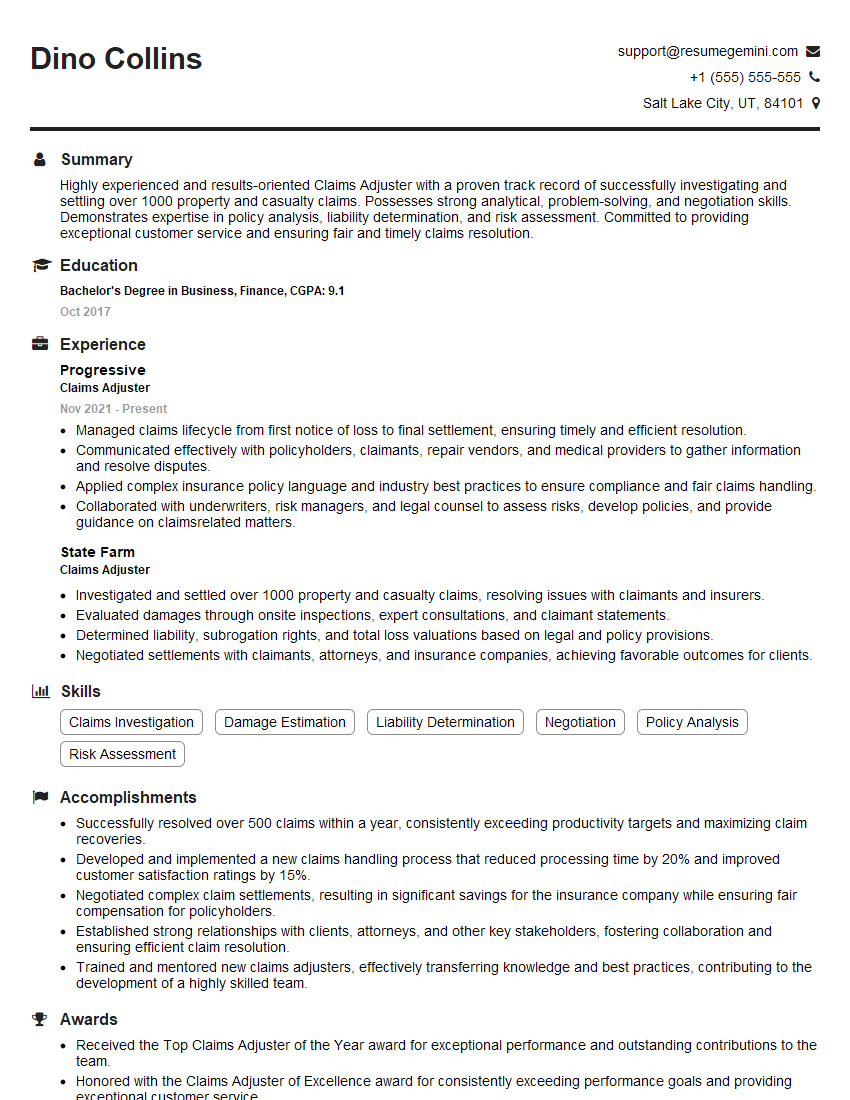

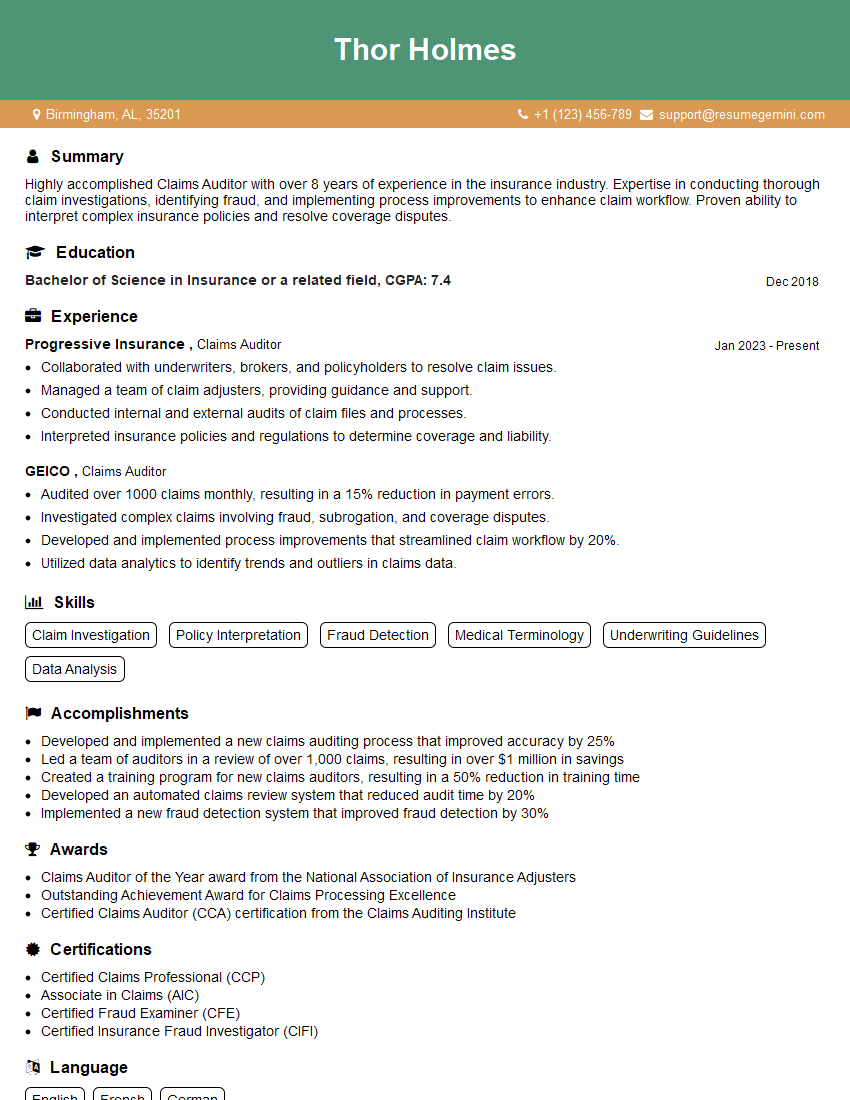

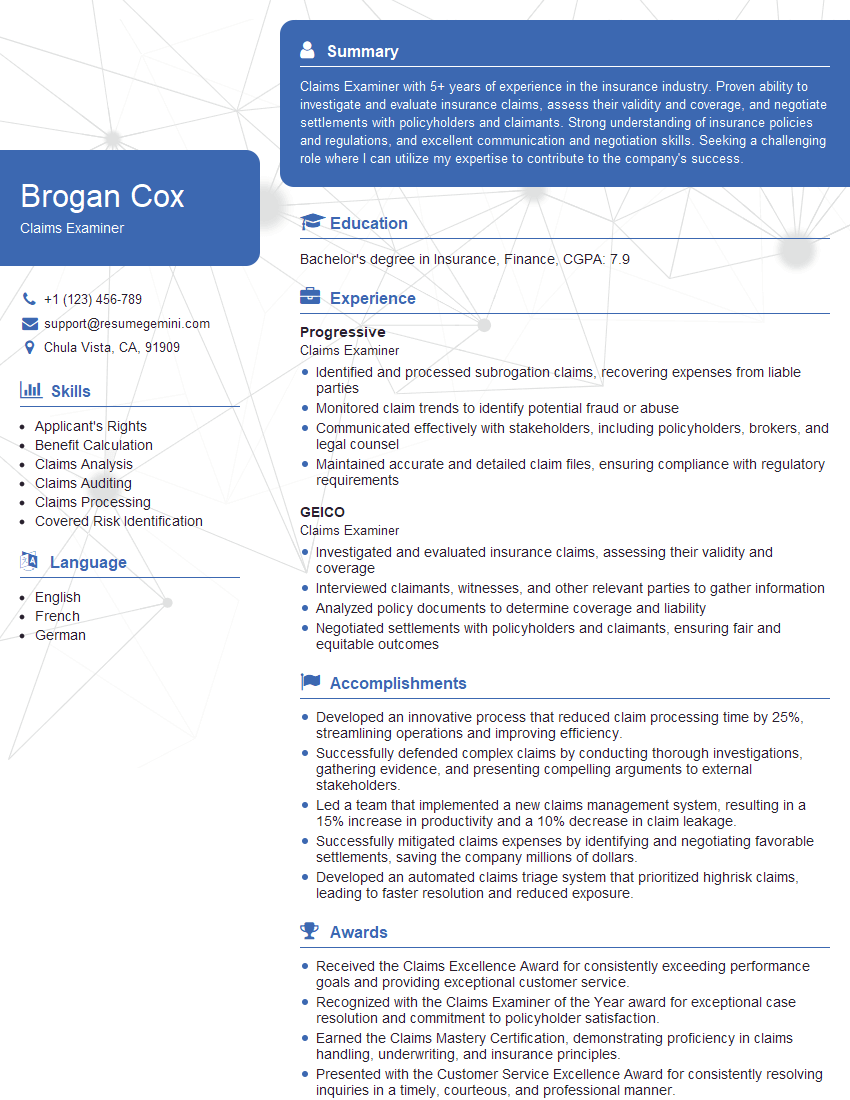

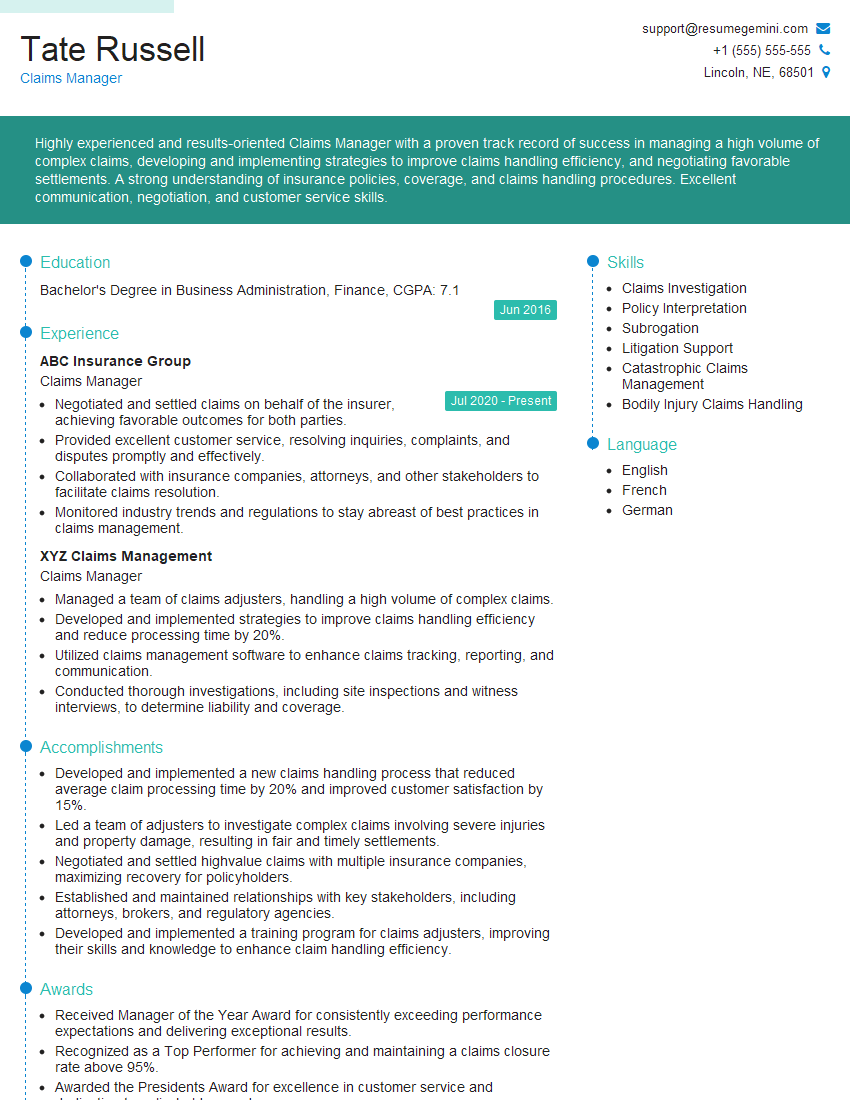

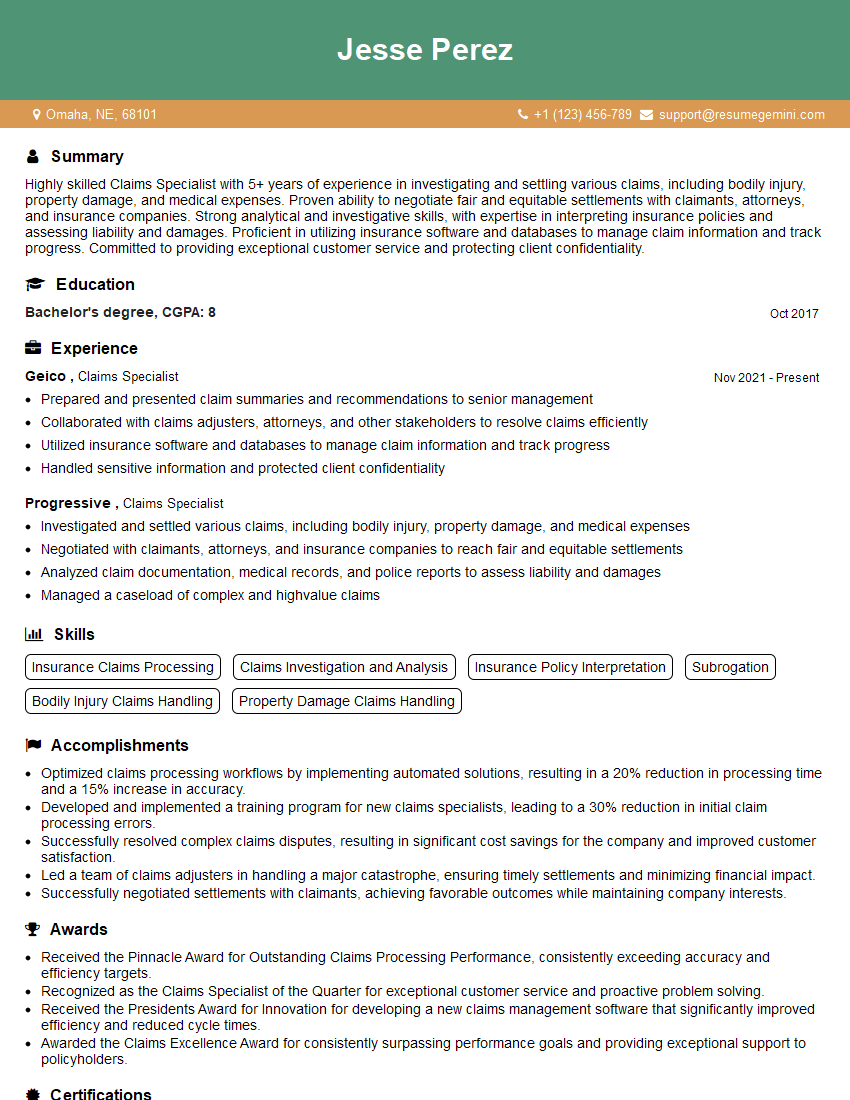

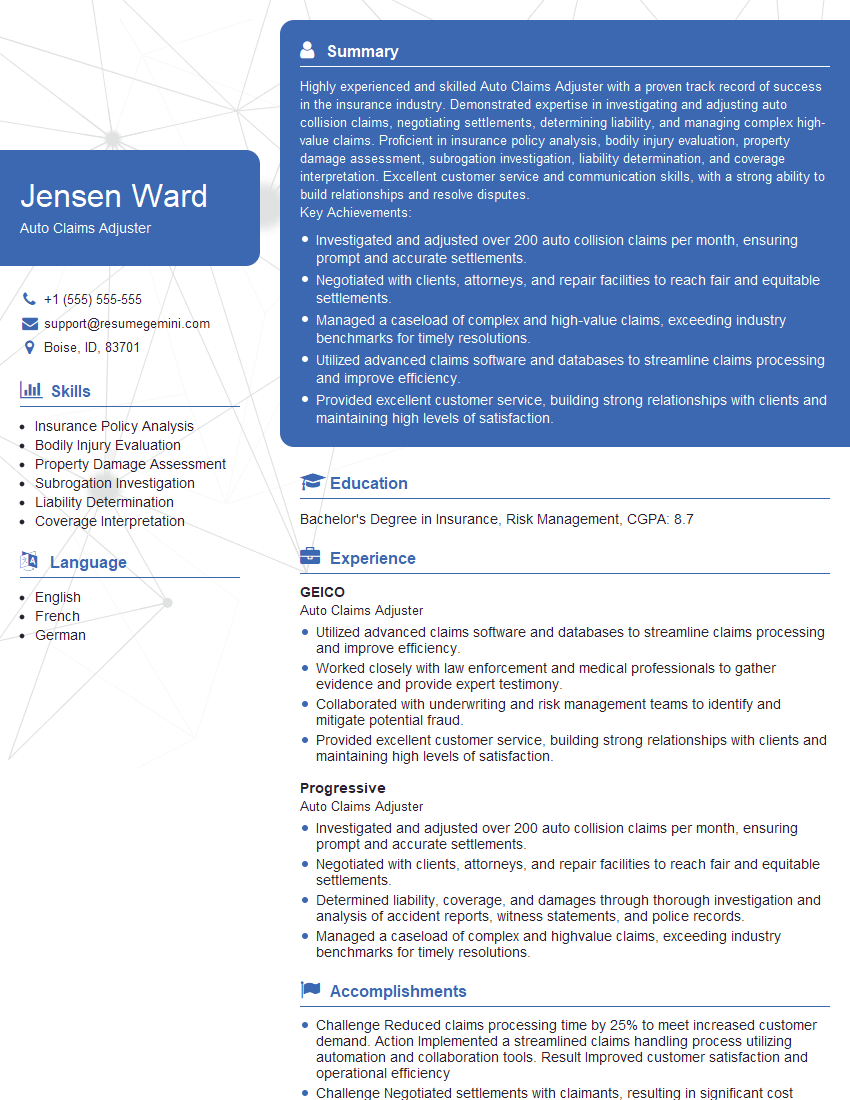

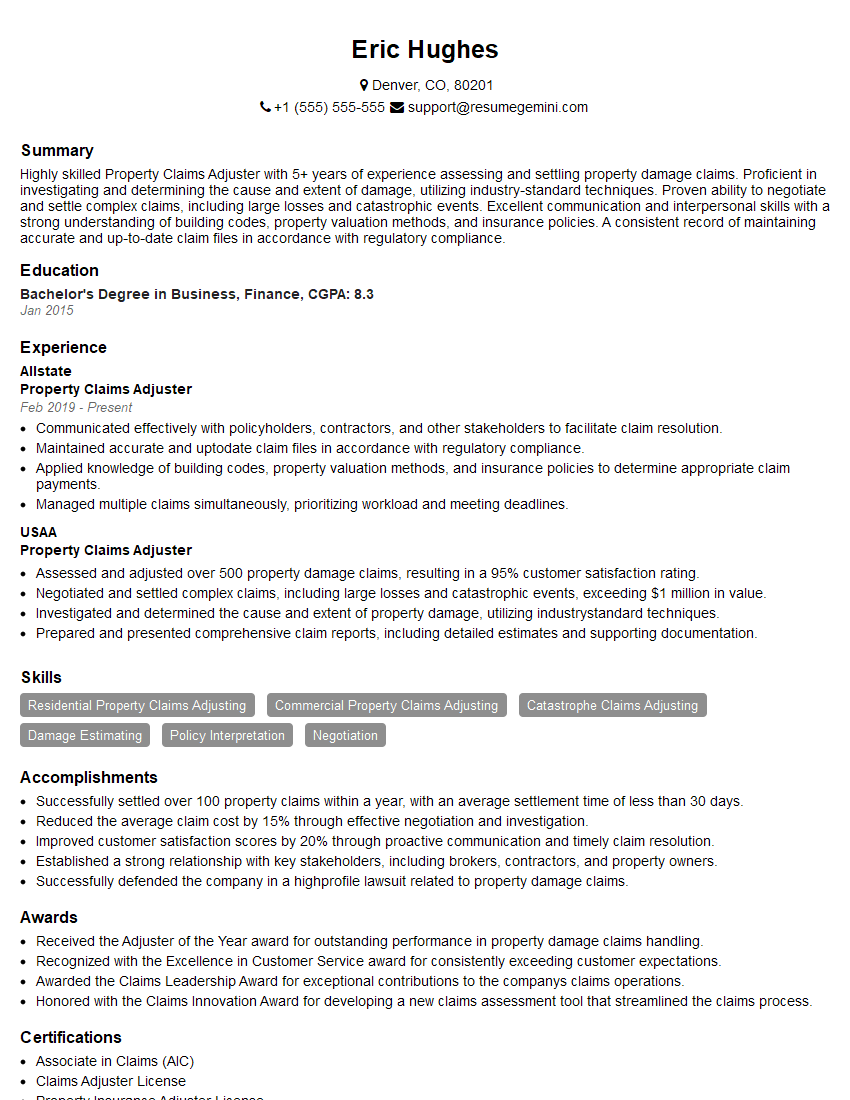

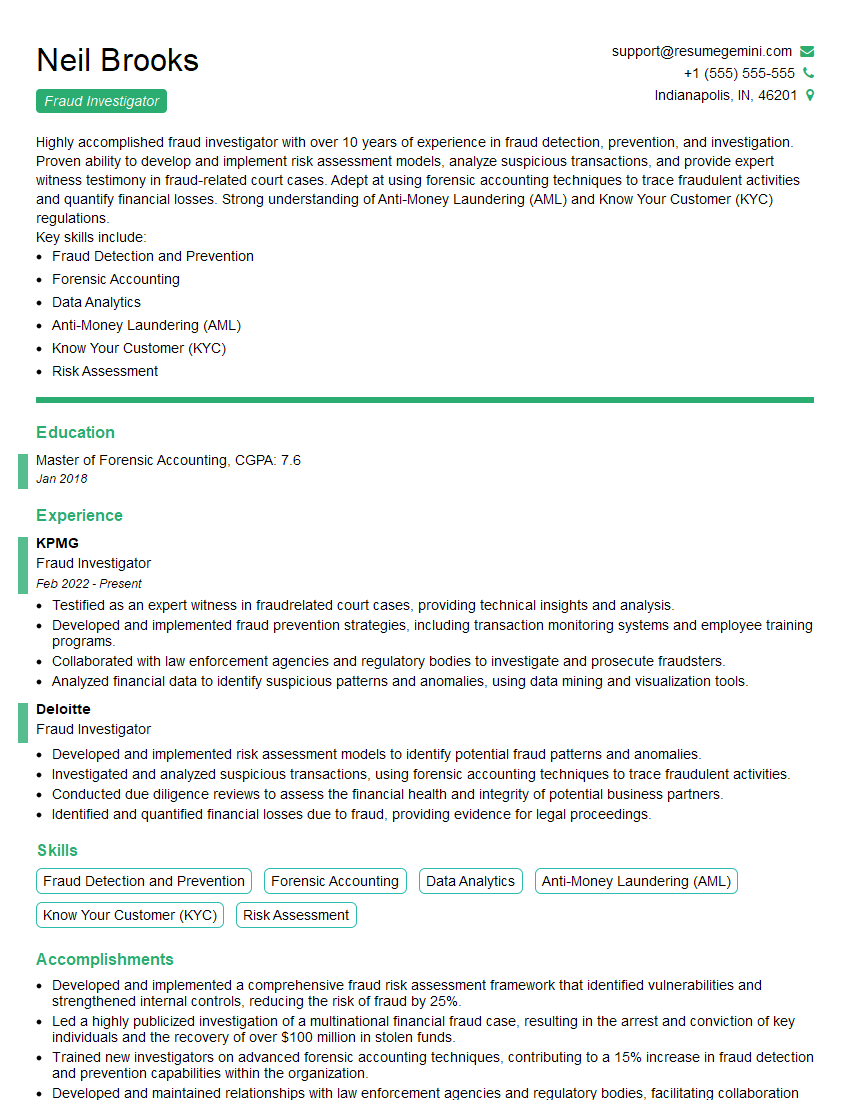

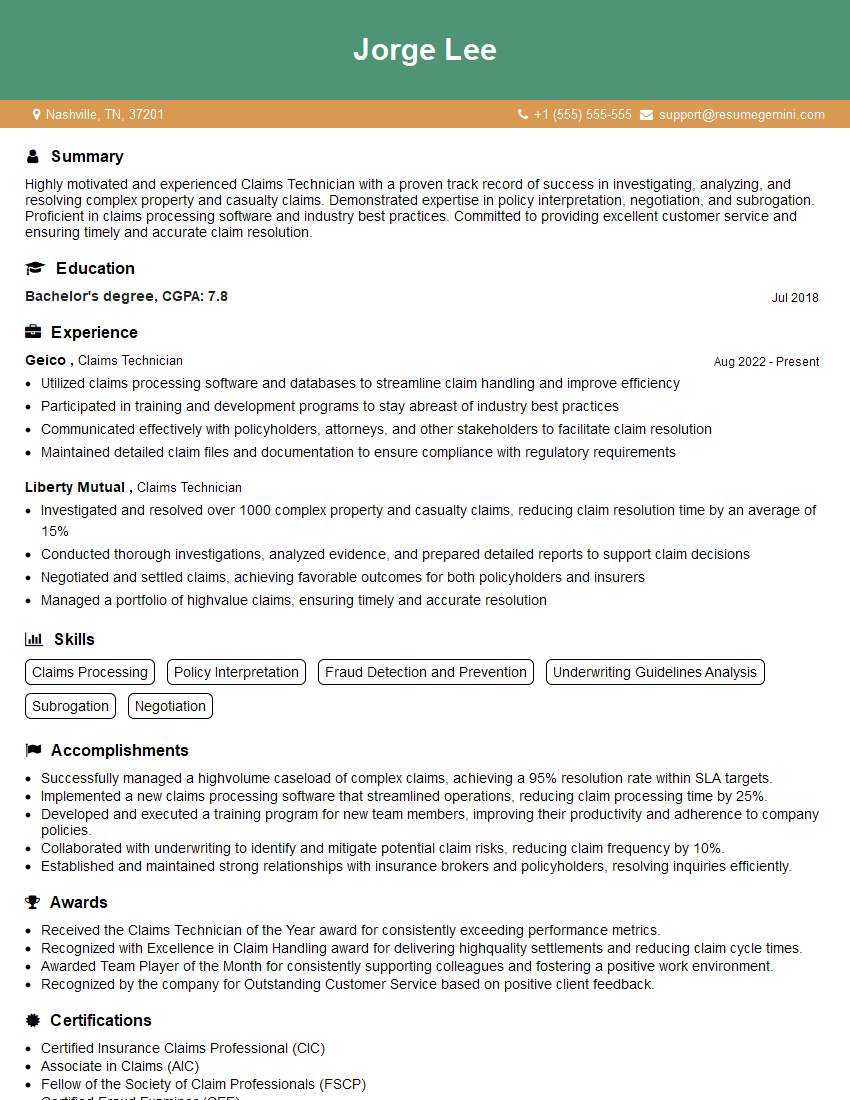

Mastering Claims Management and Investigation opens doors to rewarding and challenging careers with excellent growth potential. As you prepare, focus on building a strong and ATS-friendly resume that showcases your skills and experience effectively. To help you create a truly impactful resume, we recommend using ResumeGemini. ResumeGemini provides tools and resources to build professional resumes, and they offer examples specifically tailored to the Claims Management and Investigation field to help you stand out from the competition. Invest the time in crafting a compelling resume – it’s your first impression and a key factor in securing your dream role.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

Hi, I’m Jay, we have a few potential clients that are interested in your services, thought you might be a good fit. I’d love to talk about the details, when do you have time to talk?

Best,

Jay

Founder | CEO