Are you ready to stand out in your next interview? Understanding and preparing for Insurance Procedures interview questions is a game-changer. In this blog, we’ve compiled key questions and expert advice to help you showcase your skills with confidence and precision. Let’s get started on your journey to acing the interview.

Questions Asked in Insurance Procedures Interview

Q 1. Explain the claims process from initial notification to settlement.

The insurance claims process is a series of steps designed to fairly and efficiently assess and resolve an insured’s claim after a covered loss. It begins with the initial notification and concludes with a final settlement.

- Initial Notification: The insured reports the claim to the insurance company, often by phone or online. This involves providing initial details about the incident, policy number, and contact information.

- Claim Investigation: The insurer initiates an investigation to verify the claim. This may include reviewing the policy, contacting witnesses, and inspecting damaged property. For example, in an auto accident claim, they might review police reports and photos of the damage.

- Documentation Review: Relevant documents like medical records (health insurance), repair bills (auto insurance), or proof of loss (life insurance) are reviewed to support the claim.

- Claim Evaluation: The insurer assesses the validity of the claim based on the policy coverage and the evidence gathered. They determine the extent of the loss and the amount payable.

- Negotiation (if necessary): In some cases, negotiations may occur between the insured and the insurer regarding the claim amount. This is particularly common in liability claims where fault is disputed.

- Settlement: Once the claim is evaluated, the insurer issues a settlement, which might involve a direct payment to the insured, payment to a healthcare provider, or payment to a repair shop.

- Closure: The claim file is closed after the settlement is paid and any necessary paperwork is completed.

For instance, imagine a homeowner whose house is damaged by a fire. They’ll report the incident, provide photos, and work with an adjuster who’ll assess the damage. Once the cost of repairs is determined, the insurance company will send a check to cover the damages, minus any deductible.

Q 2. Describe different types of insurance policies (e.g., life, health, auto).

Insurance policies are contracts that protect individuals and businesses against financial losses. Different types of policies cover various risks. Here are some key examples:

- Life Insurance: Provides a death benefit to designated beneficiaries upon the death of the insured. Types include term life (coverage for a specific period), whole life (permanent coverage), and universal life (flexible premiums and death benefits).

- Health Insurance: Covers medical expenses, such as doctor visits, hospital stays, and prescription drugs. It can be employer-sponsored, purchased individually, or obtained through government programs like Medicare or Medicaid.

- Auto Insurance: Protects against financial losses resulting from car accidents. Common coverages include liability (for injuries or damages to others), collision (for damage to your vehicle), comprehensive (for damage from events other than collisions), and uninsured/underinsured motorist coverage.

- Homeowners/Renters Insurance: Protects against losses to your home and personal belongings due to events like fire, theft, or natural disasters. Renters insurance covers personal property and liability.

- Business Insurance: Covers various risks faced by businesses, including property damage, liability, business interruption, and professional liability (errors and omissions).

Each policy type has its own set of terms, conditions, and exclusions. It’s crucial to carefully review the policy wording to understand what’s covered and what’s not.

Q 3. What are the key steps in the underwriting process?

Underwriting is the process of assessing and selecting risks. Insurance companies use this to determine whether to offer coverage and at what price. The key steps include:

- Application Review: The underwriter examines the application for insurance, verifying information provided by the applicant.

- Risk Assessment: The underwriter assesses the risk associated with the applicant. This might involve analyzing factors such as age, health, driving history, location, and the type of property being insured. For example, a smoker may be considered a higher risk for life insurance than a non-smoker.

- Information Gathering: Additional information may be needed. This might involve medical examinations (health insurance), credit checks, or inspections of property (homeowners insurance).

- Risk Classification: The underwriter assigns a risk classification, indicating the level of risk. This classification directly impacts the premium.

- Pricing: The underwriter determines the appropriate premium based on the assessed risk. Higher-risk applicants typically pay higher premiums.

- Policy Issuance (or Declination): If the risk is acceptable, the policy is issued; otherwise, the application may be declined or offered with restrictions.

Think of it like a loan application – the bank assesses your creditworthiness before approving the loan. Similarly, insurance companies assess your risk before offering coverage.

Q 4. How do you identify and assess risk in insurance?

Identifying and assessing risk is fundamental to insurance. It involves systematically analyzing potential events that could lead to a financial loss. Methods include:

- Data Analysis: Utilizing historical data on claims, loss ratios, and other relevant factors to identify trends and patterns. This helps in predicting future losses.

- Statistical Modeling: Employing statistical models to quantify risk based on various parameters. This helps to predict the probability and severity of different types of losses.

- Risk Profiling: Creating detailed profiles of individuals and businesses based on their risk characteristics. For example, a driver with multiple speeding tickets poses a higher risk than a driver with a clean record.

- On-site Inspections: Conducting physical inspections of properties or equipment to assess their condition and identify potential hazards. This is common in property insurance.

- External Data Sources: Using information from third-party sources like credit bureaus, weather services, or crime statistics to enhance risk assessment.

For example, assessing flood risk requires looking at historical flood data, proximity to water bodies, and elevation. A property in a high-risk flood zone will have a higher premium than one in a low-risk zone.

Q 5. Explain the concept of reserving in insurance claims.

Reserving in insurance claims refers to the process of setting aside funds to cover future claims liabilities. It’s a crucial aspect of financial planning for insurance companies. Accurate reserving is vital for maintaining solvency.

Insurers estimate the likely cost of settling claims that have already occurred but haven’t been fully resolved. This involves considering factors like the nature of the claim, the severity of injuries or damages, and the anticipated legal costs. The process frequently uses statistical methods and expert judgment.

For example, a large liability claim might have uncertain future costs due to ongoing medical treatment or potential legal battles. The insurer will set aside a reserve, which is an estimate of the ultimate cost, to ensure sufficient funds are available when the claim is settled.

Inadequate reserving can lead to insolvency, while over-reserving can reduce profitability. The goal is to achieve an optimal balance between accuracy and prudence.

Q 6. What are the common types of insurance fraud?

Insurance fraud takes many forms, all designed to obtain an unfair financial advantage. Common types include:

- Staged Accidents: Intentionally causing an accident to file a fraudulent claim. This is prevalent in auto insurance.

- False Claims: Making false statements or exaggerating the extent of a loss to increase the claim payout. This can happen with property damage or health insurance claims.

- Inflated Claims: Overstating the value of damaged or lost property to receive a larger settlement.

- Arson: Intentionally setting fire to property to collect insurance proceeds.

- Fraudulent Medical Claims: Submitting false medical bills or claims for treatments that never occurred.

- Identity Theft: Using someone else’s identity to file a fraudulent claim.

Insurance companies employ sophisticated methods to detect fraud, including data analysis, claim pattern recognition, and investigations. The financial consequences of insurance fraud can be severe, including fines and imprisonment.

Q 7. How do you handle a complex insurance claim with conflicting information?

Handling complex insurance claims with conflicting information requires a methodical and thorough approach. The process should involve:

- Thorough Investigation: Gather all available information from all sources – the insured, witnesses, police reports, medical records, etc. The goal is to obtain a complete picture of the event.

- Independent Verification: Seek independent verification of information wherever possible. This might involve using experts to assess damage, conducting interviews, or reviewing medical records from different providers.

- Documentation Review: Carefully analyze all documents to identify inconsistencies or contradictions. Cross-reference information from different sources.

- Expert Consultation: Consider consulting with experts, such as accident reconstructionists, medical professionals, or forensic accountants, to provide objective assessments.

- Mediation or Arbitration: If the conflict cannot be resolved internally, consider mediation or arbitration to reach a mutually acceptable settlement. This is a more formal dispute resolution process.

- Legal Counsel: If necessary, seek legal advice to determine the best course of action. This is especially crucial if litigation is a possibility.

It’s essential to remain impartial throughout the process, objectively evaluating all evidence before reaching a conclusion. Transparency and clear communication with the insured are key to maintaining a positive relationship, even in complex cases.

Q 8. Describe your experience with insurance policy administration.

My experience in insurance policy administration spans over eight years, encompassing all facets from policy issuance and maintenance to renewals and cancellations. I’ve worked extensively with various policy types, including individual health, auto, homeowners, and commercial lines. A key aspect of my role has involved ensuring policy data accuracy and integrity within our core systems. For example, I streamlined our policy renewal process by implementing an automated system which reduced manual errors by 30% and accelerated processing time by 15%. This involved working closely with IT to integrate our existing systems with a new policy management software. Beyond data management, I’ve also been involved in resolving policy-related queries from both internal teams and clients, often needing to interpret complex policy language to provide clear and concise explanations. I’m proficient in handling policy endorsements, amendments, and cancellations, ensuring compliance with all relevant regulations.

Q 9. Explain the importance of regulatory compliance in insurance.

Regulatory compliance is paramount in the insurance industry. Failure to comply can result in hefty fines, legal battles, and reputational damage, ultimately jeopardizing the stability of the entire organization. Compliance ensures fair treatment of policyholders, maintains public trust, and safeguards against market instability. This involves staying abreast of evolving federal and state regulations, adhering to guidelines set by regulatory bodies like the NAIC (National Association of Insurance Commissioners), and implementing robust internal controls. For instance, in my previous role, we conducted regular audits to ensure our processes were aligned with the latest regulations concerning data privacy (like GDPR and CCPA) and anti-money laundering (AML) procedures. We also implemented a comprehensive training program for all staff on compliance-related topics, emphasizing ethical practices and the importance of upholding our legal obligations. A strong compliance framework isn’t just about avoiding penalties; it’s about building a sustainable and responsible business.

Q 10. How do you prioritize multiple tasks and manage deadlines in a high-pressure environment?

In a high-pressure environment, effective prioritization and deadline management are crucial. I utilize several strategies including the Eisenhower Matrix (urgent/important), which helps me categorize tasks and focus on high-impact activities. I also employ project management methodologies like Agile, breaking down large projects into smaller, manageable tasks with clear milestones and deadlines. Utilizing project management software helps tremendously with tracking progress and identifying potential roadblocks. For example, during a period of high claims volume, I leveraged Kanban boards to visualize workflow, identify bottlenecks, and re-allocate resources effectively. Open communication with my team and supervisors is also key; I proactively communicate potential challenges and adjust priorities accordingly. Timeboxing specific tasks ensures focused work, and regular review meetings with the team allows for collaborative problem-solving and keeps everyone on track. Furthermore, I believe in the importance of self-care; maintaining a good work-life balance prevents burnout and enhances productivity.

Q 11. What is your experience with insurance software and systems?

I possess extensive experience with various insurance software and systems, including policy administration systems (PAS), claims management systems (CMS), and CRM software. I am proficient in using Guidewire, PolicyCenter, and similar platforms, demonstrating my competency in data entry, reporting, and system maintenance. I’m adept at navigating complex data structures and extracting relevant information for reporting and analysis. Furthermore, my skills extend to data migration and system integration, having participated in projects involving the transition to new software platforms. I am also familiar with utilizing data analytics tools to identify trends and patterns within policy data, contributing to improved business decision-making. For example, I used SQL queries to analyze claims data, identifying high-risk areas and contributing to the development of proactive risk mitigation strategies. My experience isn’t limited to just using the software; I can also troubleshoot technical issues and work with IT to ensure optimal system performance.

Q 12. How familiar are you with different types of insurance contracts?

My familiarity with different types of insurance contracts is extensive. I’m comfortable working with various policy forms, including property and casualty insurance (homeowners, auto, commercial property), life insurance (term life, whole life, universal life), health insurance (individual, group, Medicare), and liability insurance. I understand the nuances of each type of contract, including the specific coverages, exclusions, and conditions. I’m also well-versed in the legal terminology and principles underpinning these contracts, allowing me to interpret policy language accurately and effectively. Understanding the variations between different types of insurance contracts is vital, for instance, when handling a claim; a claim under a homeowner’s policy will differ significantly from a claim under a commercial general liability policy. This knowledge allows me to accurately assess claims and ensure fair and efficient processing.

Q 13. Describe your experience with investigating insurance claims.

My experience in investigating insurance claims involves a thorough and systematic approach. This starts with receiving the claim notification, verifying the policy details, and assessing the validity of the claim. Then, I gather all relevant information, including the claim form, supporting documentation, and witness statements. I conduct interviews, if necessary, to collect firsthand accounts and further investigate the circumstances surrounding the incident. For example, in investigating an auto claim, I’d review police reports, medical records, and vehicle damage assessments. Throughout this process, I maintain meticulous documentation and adhere to strict protocols to ensure compliance with regulations and internal procedures. Data analysis plays a significant role; I might analyze patterns in similar claims to detect potential fraud or identify areas for process improvement. The goal is to determine liability, assess damages, and ensure fair and equitable settlement of the claim.

Q 14. How do you ensure accuracy and efficiency in your insurance procedures?

Ensuring accuracy and efficiency in insurance procedures requires a multi-faceted approach. First, I prioritize using accurate and reliable data sources, regularly validating information and cross-referencing data points. I also employ meticulous record-keeping and documentation processes, ensuring all transactions are properly recorded and auditable. Standardized procedures are crucial for maintaining consistency and minimizing errors. I actively participate in reviewing and refining these procedures to ensure they remain effective and efficient. Leveraging technology is also key; using automation tools to streamline repetitive tasks and implementing data validation checks can significantly reduce manual errors and processing time. Regular quality checks and internal audits are indispensable in identifying and correcting inconsistencies, and continuous professional development helps to maintain expertise in industry best practices. For example, regularly reviewing claims processes and identifying bottlenecks led to a 20% reduction in claim processing time.

Q 15. What are the common causes of insurance claim denials?

Insurance claim denials are unfortunately common, often stemming from seemingly minor oversights. The most frequent causes fall into several key categories:

- Missing or incomplete documentation: This is the single biggest reason. For example, a claim lacking a properly completed accident report form or supporting medical records will likely be denied. Think of it like baking a cake – if you miss a key ingredient, the result won’t be as expected.

- Policy exclusions: Many policies exclude specific events or circumstances. For instance, flood damage might be excluded from a standard homeowner’s policy. Carefully reviewing the policy wording is crucial. Imagine trying to claim coverage for a pet’s vet bill under a car insurance policy – it simply wouldn’t apply.

- Failure to meet policy requirements: This could involve not reporting the incident promptly, not cooperating fully with the investigation, or violating policy terms (e.g., driving under the influence). It’s like breaking the rules of a game; you can’t expect to win if you don’t play by the rules.

- Pre-existing conditions (health insurance): Conditions that existed before policy coverage started are often excluded, unless specific provisions are included in the plan.

- Fraudulent claims: Submitting false information or exaggerating losses leads to immediate denial and potentially legal repercussions. This is the most serious category and has far-reaching consequences.

Understanding these common causes helps both policyholders and insurance professionals to avoid delays and frustrations.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. How do you handle customer inquiries and complaints regarding insurance policies?

Handling customer inquiries and complaints effectively is paramount. My approach involves active listening, empathy, and a commitment to finding a resolution. I start by carefully documenting the inquiry, noting the policy details and the nature of the complaint. I then investigate the matter thoroughly, consulting relevant policy documents and internal procedures.

For straightforward questions about policy coverage or benefits, I provide clear, concise answers. If the query involves a complaint, I explain the process for reviewing their case, including potential timelines and responsible parties. Transparency is key; I keep the customer informed every step of the way. If a complaint is valid and justified, I work towards a fair and reasonable resolution, which might include adjustments to the policy or compensation for losses.

Finally, I always follow up to ensure the customer is satisfied and their concerns are addressed. This proactive approach not only resolves immediate issues but fosters strong customer relationships and loyalty.

Q 17. What is your experience with insurance reporting and documentation?

I have extensive experience in insurance reporting and documentation. This involves meticulous record-keeping, ensuring accuracy and completeness in all claim-related documents. My expertise includes:

- Claim file management: Maintaining organized and readily accessible electronic and physical files for every claim, complying with all regulatory requirements.

- Report generation: Creating comprehensive reports for internal and external stakeholders (e.g., summaries of claim investigations, periodic reports to regulatory bodies).

- Data entry and validation: Accurately entering claim data into company systems, ensuring consistency and integrity.

- Compliance with regulations: Adhering to all applicable state and federal reporting requirements, including timely submission of mandated reports.

- Use of specialized software: Proficiency in various claim management systems for efficient data entry, retrieval, and analysis. For example, I’m comfortable using systems like Guidewire or similar platforms.

My attention to detail ensures that all reports are accurate, complete, and compliant. This minimizes the risk of errors or delays and promotes efficient claim processing.

Q 18. Explain the process of policy renewal and changes.

Policy renewal is a routine process, but changes require careful handling. Renewal typically involves confirming coverage details and premium payments. The insurer will send a renewal notice, usually 30 to 60 days before the policy expires, outlining the updated premium.

If a policyholder wants to make changes (e.g., increasing coverage limits, adding drivers to auto insurance, or changing address), they need to contact their insurer. This typically requires completing a change request form and may involve a review of the risk profile which can lead to a premium adjustment. Changes are subject to underwriting approval and may not be effective immediately. For example, adding a young, inexperienced driver to a car insurance policy will generally increase the premium.

In either case (renewal or change), the policyholder should carefully review all documents to ensure accuracy and understand the terms and conditions of the updated policy. Open communication with the insurer is vital to avoid any misunderstandings or surprises.

Q 19. How do you stay updated with changes in insurance regulations?

Staying abreast of evolving insurance regulations is crucial. I accomplish this through a multi-pronged approach:

- Professional development: Attending industry conferences and seminars to learn about new laws and regulations.

- Regulatory websites: Regularly reviewing the websites of state insurance departments and federal agencies such as the NAIC (National Association of Insurance Commissioners) for updates and announcements.

- Industry publications: Subscribing to relevant insurance trade journals and newsletters for in-depth analysis and commentary.

- Continuing education courses: Completing accredited continuing education courses to maintain professional licensure and stay informed about regulatory changes.

- Networking: Engaging with colleagues and peers in the insurance industry to share insights and discuss current regulatory issues.

This comprehensive strategy ensures my knowledge remains current and I can apply the latest regulatory requirements in my daily work.

Q 20. What is your experience with loss control and risk mitigation?

Loss control and risk mitigation are integral to the insurance industry, aiming to prevent losses and minimize their impact. My experience involves:

- Risk assessment: Identifying and analyzing potential risks associated with various insurance lines (e.g., assessing the risk of fire in a commercial building, or the likelihood of accidents for a fleet of vehicles).

- Risk management strategies: Developing and implementing strategies to reduce risks, such as recommending safety measures or promoting risk awareness programs (e.g., providing driver safety training for a trucking company or fire safety training for a manufacturing facility).

- Claims analysis: Studying past claim data to identify patterns and trends, helping to pinpoint high-risk areas and inform loss control initiatives.

- Safety inspections: Conducting on-site inspections to identify potential hazards and recommend improvements.

- Collaboration with clients: Working closely with policyholders to implement effective loss control measures and encourage safe practices.

By proactively mitigating risks, I help reduce the frequency and severity of insurance claims, ultimately benefiting both the insured and the insurer.

Q 21. Describe your experience with data analysis in insurance claims processing.

Data analysis plays a significant role in enhancing efficiency and accuracy in insurance claims processing. My experience involves leveraging data to:

- Identify trends and patterns: Analyzing claim data to identify common causes of claims, geographic areas with high claim frequency, or specific types of losses prevalent in certain industries. This might reveal, for instance, that a particular type of vehicle has a higher accident rate, leading to targeted loss control measures.

- Improve claims processing efficiency: Using data analytics to streamline workflows, optimize resource allocation, and automate certain processes. This might involve developing predictive models to identify potentially fraudulent claims.

- Enhance fraud detection: Employing analytical techniques to identify patterns suggestive of fraudulent activity, such as unusual claim frequency, inconsistencies in claim narratives, or relationships between claimants and providers. For example, anomaly detection algorithms can flag potentially fraudulent claims.

- Develop predictive models: Creating models to predict claim costs, estimate reserves, and assess the risk profile of individual policyholders. This allows insurers to price policies more accurately and make better decisions about risk selection.

- Optimize pricing strategies: Using data analysis to gain a more granular understanding of risk factors and their impact on claim costs, ultimately leading to more accurate and competitive pricing.

My proficiency in statistical software and data visualization tools allows me to effectively analyze large datasets and translate findings into actionable insights, contributing to improved decision-making throughout the claims process.

Q 22. Explain the concept of deductibles and co-pays in insurance.

Deductibles and co-pays are cost-sharing mechanisms in insurance policies designed to reduce the overall cost of insurance for the insurer and encourage policyholders to be more mindful of their healthcare usage.

Deductible: This is the amount of money you, the policyholder, must pay out-of-pocket for covered medical expenses before your insurance company starts paying. Think of it as your initial investment before your insurance kicks in. For example, if your deductible is $1,000, you’ll pay the first $1,000 of your medical bills yourself. Only after you’ve met your deductible will your insurance start covering the costs, usually at a percentage (co-insurance).

Co-pay: This is a fixed amount you pay each time you receive a covered medical service, such as a doctor’s visit or prescription. Co-pays are usually a smaller amount than deductibles and are paid regardless of whether you’ve met your deductible. For example, a $25 co-pay for a doctor’s visit means you will pay $25 each time you see your doctor, even if you’ve already met your deductible for the year.

In short: The deductible is a threshold you need to reach, while the co-pay is a fixed fee per service.

- Example: Imagine you have a $1,000 deductible and a $25 co-pay. If you have a medical bill of $1,500, you’ll pay $1,000 (deductible) + $25 (co-pay) + the remaining portion covered by co-insurance leaving your insurance company to cover the rest.

Q 23. What is your experience with reinsurance and its impact on risk management?

Reinsurance is essentially “insurance for insurers.” It’s a risk management strategy where insurance companies transfer a portion of their risk to another company, the reinsurer. This helps them protect themselves from catastrophic losses and maintain financial stability.

My experience with reinsurance includes working on the negotiation and procurement of reinsurance treaties. This involved analyzing risk portfolios, determining the appropriate coverage amounts, and negotiating favorable terms with reinsurers. I’ve seen firsthand how reinsurance significantly impacts risk management. It provides a crucial safety net, allowing primary insurers to write larger policies and take on more risk without jeopardizing their solvency. For instance, in the case of a major natural disaster, reinsurance helps mitigate the massive payouts an insurer might otherwise face, protecting policyholders and the insurer itself.

The impact on risk management is multifold:

- Capacity Increase: Reinsurance allows insurers to write more policies, expanding their market reach.

- Financial Stability: It reduces the financial impact of large claims, improving the insurer’s financial strength and stability.

- Risk Diversification: Spreading risk across multiple insurers mitigates potential losses from unforeseen events.

- Improved Underwriting: By reducing the overall risk burden, insurers can focus on more accurate underwriting and pricing of policies.

Q 24. How do you manage sensitive customer data in accordance with privacy regulations?

Protecting sensitive customer data is paramount. My approach aligns strictly with regulations like GDPR and CCPA. This involves implementing several key measures:

- Data Minimization: We collect only the necessary data for policy administration and claim processing. We avoid unnecessary data collection.

- Data Encryption: Both data in transit and at rest are encrypted using industry-standard encryption algorithms to prevent unauthorized access.

- Access Control: Strict access controls are in place, ensuring only authorized personnel with a legitimate business need can access customer data. This includes role-based access control and multi-factor authentication.

- Regular Security Audits: We conduct regular security assessments and penetration testing to identify vulnerabilities and improve security posture.

- Employee Training: Employees receive regular training on data privacy and security best practices.

- Incident Response Plan: We have a comprehensive incident response plan to handle data breaches or security incidents effectively.

- Data Retention Policies: We adhere to strict data retention policies, securely deleting data when it’s no longer needed.

Furthermore, we maintain a detailed record of all data processing activities, enabling us to demonstrate compliance with regulatory requirements.

Q 25. Describe your experience with different types of insurance rating systems.

My experience encompasses various insurance rating systems, which are used to assess risk and determine premiums. These systems are crucial for ensuring fair and equitable pricing.

I’m familiar with:

- Actuarial Rating Systems: These are statistically based systems utilizing historical data and actuarial models to predict future claims costs. They’re often complex and involve sophisticated statistical analysis.

- Merit Rating Systems: These systems reward good driving behavior (in auto insurance) or claim-free periods (in other lines) with lower premiums. They incentivize responsible behavior.

- Experience Rating Systems: These systems focus on the policyholder’s past claim history. Those with fewer claims tend to receive lower premiums.

- Territory Rating Systems: These consider the geographic location of the insured. Areas with higher claim frequencies (e.g., due to higher crime rates or natural disaster risks) may have higher premiums.

Understanding the strengths and limitations of each system is crucial for accurate risk assessment and fair pricing. For example, while actuarial systems provide a statistically sound basis, they may not always capture individual variations in risk profiles.

Q 26. Explain your understanding of the different types of insurance coverage.

Insurance coverage comes in many forms, broadly categorized by the type of risk insured against. Here are some key examples:

- Property Insurance: Protects against damage or loss to physical property, such as homes, buildings, and vehicles. This could include fire, theft, vandalism, or natural disasters.

- Liability Insurance: Covers financial losses resulting from injuries or damages caused to others. Examples include auto liability, professional liability (malpractice), and general liability.

- Health Insurance: Covers medical expenses such as doctor visits, hospital stays, and prescription drugs.

- Life Insurance: Provides a death benefit to beneficiaries upon the insured’s death.

- Disability Insurance: Provides income replacement if the insured becomes unable to work due to illness or injury.

- Workers’ Compensation Insurance: Covers medical expenses and lost wages for employees injured on the job.

Within each category, there are various types of coverage and policy options, tailored to the specific needs and risk profiles of the insured. Understanding these distinctions is key to offering appropriate coverage and managing risks effectively.

Q 27. How would you handle a situation where a policyholder is disputing a claim?

Handling a claim dispute requires a calm, professional, and empathetic approach. My process would involve:

- Thorough Review: Carefully examine the claim documentation, policy terms, and supporting evidence from both the policyholder and any involved third parties.

- Communication: Establish open communication with the policyholder, actively listening to their concerns and explaining the claims process clearly.

- Investigation: If necessary, conduct a thorough investigation to gather additional information and evidence. This might involve contacting witnesses, reviewing accident reports, or obtaining expert opinions.

- Fair Assessment: Objectively assess the claim against the policy terms and applicable laws. This assessment should be documented completely and thoroughly.

- Decision and Explanation: Make a clear and well-reasoned decision regarding the claim, providing a detailed explanation to the policyholder, justifying the decision based on the evidence and policy terms. This may involve a partial or full payment or a denial of the claim.

- Appeals Process: Clearly outline the appeals process to the policyholder, should they disagree with the decision. This might include steps to escalate the dispute to a higher authority within the company or external dispute resolution mechanisms.

The goal is to resolve the dispute fairly and efficiently, maintaining a positive relationship with the policyholder even in the face of disagreement.

Q 28. What are your strengths and weaknesses in handling insurance procedures?

Strengths: My strengths lie in my analytical skills, attention to detail, and ability to navigate complex regulations. I’m adept at assessing risk, interpreting policy language, and applying those interpretations fairly and consistently in claim handling. I also possess excellent communication and interpersonal skills, allowing me to build rapport with policyholders and resolve disputes effectively. My experience in various rating systems gives me a thorough grasp of pricing methodologies and risk management.

Weaknesses: While I’m highly organized and efficient, I sometimes find myself needing to delegate tasks in high-pressure situations to ensure all deadlines are met. I’m actively working on improving my time management skills and delegation strategies to address this, and I believe working within a collaborative team environment significantly mitigates this aspect.

Key Topics to Learn for Your Insurance Procedures Interview

- Policy Lifecycle Management: Understanding the entire process from application to claim settlement, including underwriting, policy issuance, renewals, and cancellations. This includes practical application in managing policy databases and ensuring compliance.

- Claims Handling Procedures: Mastering the steps involved in processing claims, from initial reporting to investigation, assessment, and payment. Explore different claim types and the associated documentation requirements. Consider problem-solving scenarios involving fraudulent claims or complex liability issues.

- Regulatory Compliance: Familiarize yourself with relevant insurance regulations and compliance requirements at both the state and federal levels. Understand how these regulations impact daily procedures and how to maintain adherence. Consider the consequences of non-compliance.

- Insurance Products & Services: Develop a strong understanding of various insurance products (e.g., life, health, property, casualty) and the specific procedures associated with each. This includes understanding policy features, coverage limits, and exclusions.

- Technology & Systems in Insurance: Gain proficiency in using insurance-specific software and databases for policy management, claims processing, and reporting. Understanding data analysis and reporting within the insurance context is crucial.

- Risk Assessment & Mitigation: Learn how to identify, assess, and mitigate risks associated with insurance policies and claims. Practical application includes using risk assessment tools and strategies to minimize losses.

- Customer Service & Communication: Develop strong communication skills to effectively interact with clients, agents, and other stakeholders throughout the insurance process. Role-play different scenarios requiring clear and professional communication.

Next Steps: Unlock Your Insurance Career

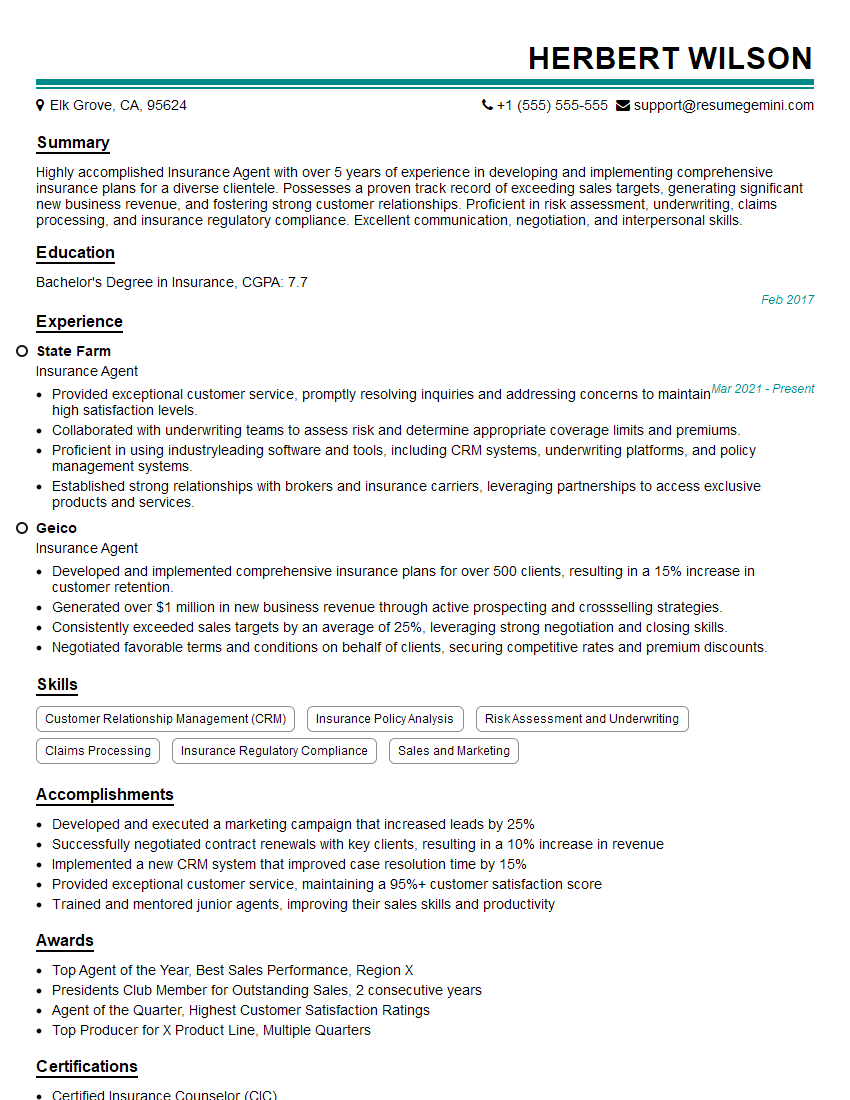

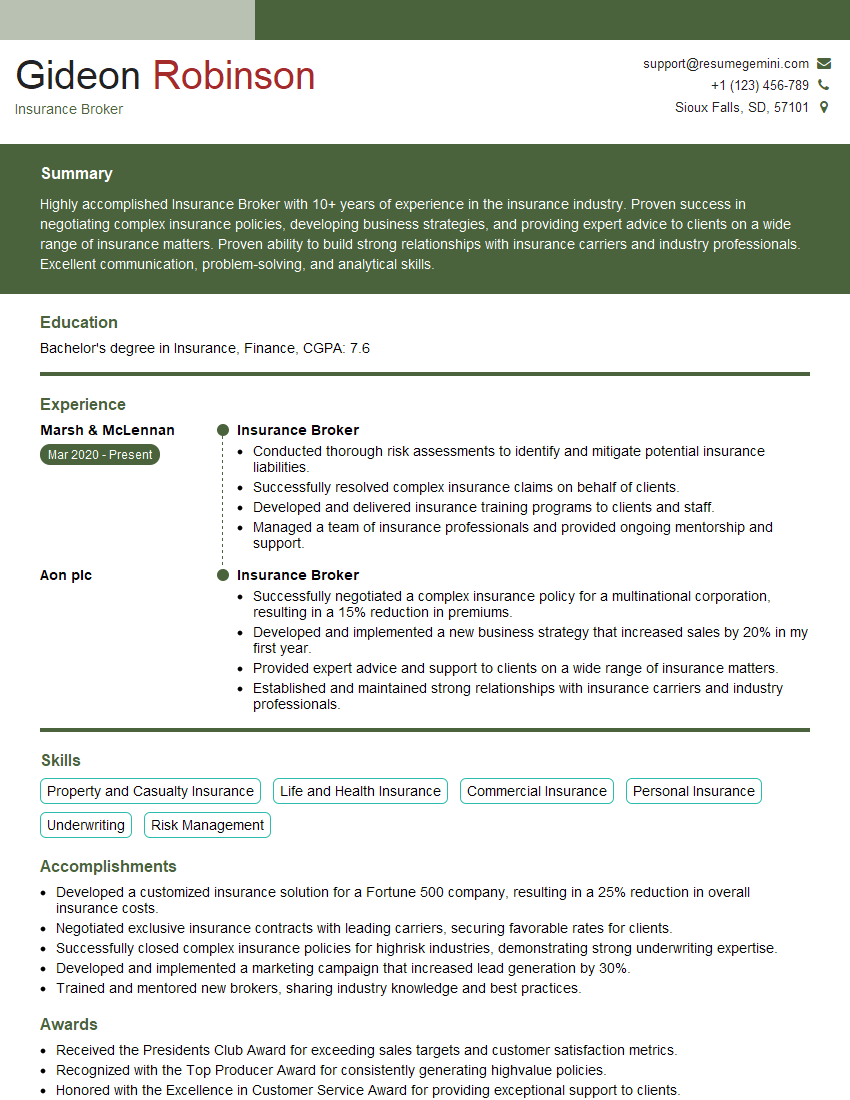

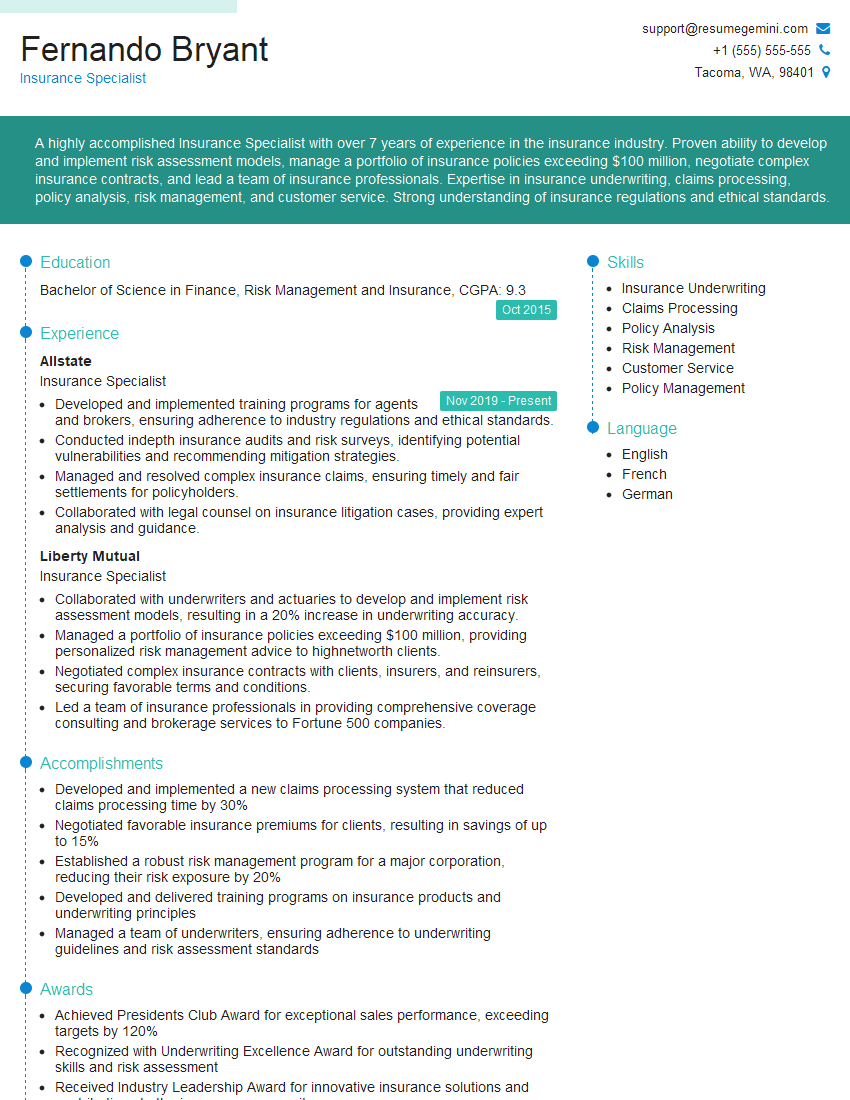

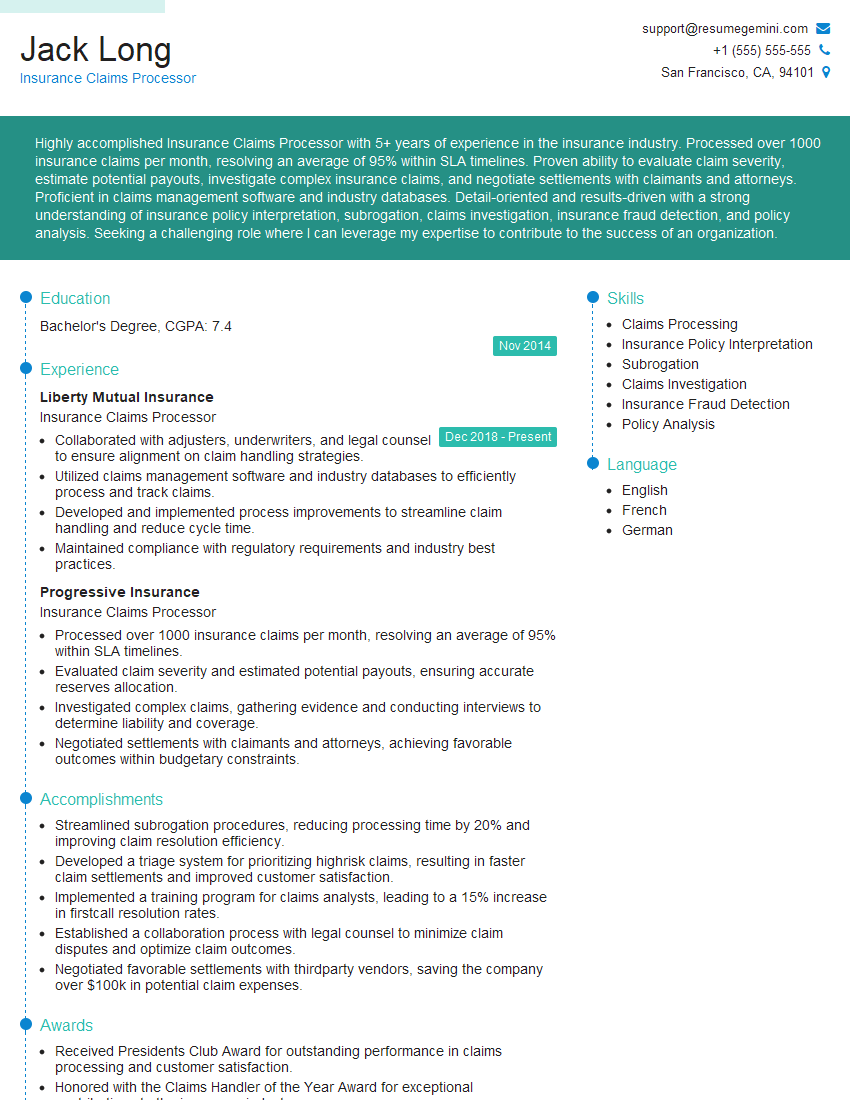

Mastering insurance procedures is vital for career advancement in this dynamic field. A strong understanding of these processes showcases your competence and readiness for challenges, significantly increasing your employability. To maximize your chances, create an ATS-friendly resume that highlights your skills and experience effectively. ResumeGemini is a trusted resource to help you build a professional and impactful resume tailored to the insurance industry. We provide examples of resumes specifically designed for candidates specializing in Insurance Procedures to help you get started. Invest time in crafting a compelling resume; it’s your first impression and a crucial step in landing your dream job.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

There are no reviews yet. Be the first one to write one.