Interviews are opportunities to demonstrate your expertise, and this guide is here to help you shine. Explore the essential Knowledge of Regulatory and Compliance Frameworks interview questions that employers frequently ask, paired with strategies for crafting responses that set you apart from the competition.

Questions Asked in Knowledge of Regulatory and Compliance Frameworks Interview

Q 1. Explain the difference between a regulation and a guideline.

Regulations and guidelines both aim to ensure compliance, but they differ significantly in their enforceability and consequences for non-compliance. Think of it like this: regulations are the law, while guidelines are best practices.

- Regulations are legally binding rules established by governmental or regulatory bodies. Non-compliance can result in severe penalties, including fines, legal action, or even business closure. Examples include environmental protection laws or financial reporting standards like SOX.

- Guidelines, on the other hand, are recommendations or best practices developed by organizations or industry groups. While they don’t carry the weight of law, they offer a framework for achieving compliance and often reflect industry standards. Failure to follow guidelines might not result in direct legal penalties but could lead to reputational damage or increased vulnerability to risks.

For instance, a regulation might mandate the secure storage of customer data, whereas a guideline might suggest specific encryption methods to enhance security, even beyond the minimal regulatory requirements. Both contribute to a robust compliance posture, but only non-compliance with the regulation has direct legal ramifications.

Q 2. Describe your experience with conducting compliance audits.

Throughout my career, I’ve conducted numerous compliance audits across various industries. My approach is methodical and risk-based, prioritizing areas of highest potential non-compliance. This involves:

- Planning and scoping: Defining the audit objectives, identifying relevant regulations and standards, and determining the scope of the audit.

- Data gathering: Collecting evidence through document review, interviews, and system testing.

- Analysis and evaluation: Assessing the collected data against relevant regulations and standards, identifying gaps and deficiencies.

- Reporting: Preparing a comprehensive report detailing findings, risks, and recommendations for improvement.

- Follow-up: Monitoring the implementation of corrective actions.

For example, during an audit of a healthcare provider, I identified a vulnerability in their patient data management system that could violate HIPAA regulations. My report detailed the issue, its potential impact, and recommended remediation steps, including system upgrades and staff training.

Q 3. How do you stay updated on changes in relevant regulations?

Staying updated on regulatory changes is crucial for maintaining compliance. I utilize a multi-faceted approach:

- Subscription to regulatory updates: I subscribe to newsletters, alerts, and publications from relevant regulatory bodies (e.g., the SEC, FDA, etc.).

- Professional networking: I actively participate in industry conferences and workshops to learn about the latest developments and best practices.

- Monitoring legal and industry publications: I regularly review legal journals, industry publications, and news sources for relevant updates.

- Utilizing specialized software and databases: Several tools provide real-time updates and analysis of regulatory changes, helping to track compliance obligations more efficiently.

This proactive approach ensures I’m aware of emerging trends and potential compliance challenges, enabling me to advise clients effectively and mitigate potential risks before they materialize.

Q 4. What is your experience with developing and implementing compliance programs?

I have extensive experience in developing and implementing compliance programs tailored to specific organizational needs and regulatory requirements. My approach is centered on a risk-based framework, ensuring that resources are allocated effectively to address the most critical areas. This involves:

- Risk assessment: Identifying and analyzing potential compliance risks.

- Policy and procedure development: Creating clear, concise, and easily understandable policies and procedures that align with regulatory requirements.

- Training and awareness programs: Educating employees on compliance requirements and best practices.

- Monitoring and auditing: Regularly monitoring compliance activities and conducting audits to identify and address any issues.

- Reporting and communication: Reporting compliance status to management and stakeholders.

In one project, I helped a financial institution develop a robust anti-money laundering (AML) compliance program, incorporating risk-based customer due diligence procedures, transaction monitoring systems, and comprehensive employee training. This program significantly reduced the organization’s risk exposure and enhanced its regulatory compliance posture.

Q 5. Describe a time you identified a compliance issue. How did you address it?

During a compliance audit for a manufacturing company, I discovered that their waste disposal practices did not fully comply with local environmental regulations. Specifically, they lacked proper documentation for hazardous waste disposal.

To address this, I followed these steps:

- Documented the finding: I meticulously documented the non-compliance issue, including specific examples and the potential legal and environmental consequences.

- Communicated the finding: I presented my findings to the company’s management, clearly explaining the risks and potential penalties.

- Developed a remediation plan: Collaboratively with the company, I developed a remediation plan that included implementing a comprehensive waste management system, providing employee training, and updating their documentation practices.

- Monitored implementation: I monitored the implementation of the remediation plan to ensure its effectiveness and compliance with regulations.

This systematic approach ensured that the company rectified the compliance issue and avoided potential legal and reputational damage.

Q 6. What are the key components of a successful compliance program?

A successful compliance program rests on several key pillars:

- Strong leadership commitment: Compliance must be championed from the top down. Leaders must demonstrate a clear commitment to ethical conduct and compliance.

- Risk-based approach: Focus on identifying and addressing the most significant compliance risks.

- Clear policies and procedures: Establish documented policies and procedures that are easily accessible and understood by all employees.

- Effective training and communication: Provide regular training and communication to ensure that employees understand their compliance responsibilities.

- Monitoring and auditing: Regularly monitor compliance activities and conduct audits to identify and address any issues.

- Continuous improvement: Continuously review and update the compliance program to address emerging risks and regulatory changes.

- Reporting and accountability: Establish clear reporting mechanisms and hold individuals accountable for compliance.

Think of it as a well-oiled machine: each component is crucial for smooth operation. A single weak link can compromise the entire system.

Q 7. How familiar are you with [Specific Regulation, e.g., GDPR, HIPAA, SOX]?

My familiarity with GDPR (General Data Protection Regulation) is extensive. I understand its core principles, including data minimization, purpose limitation, and accountability. I’m proficient in assessing GDPR compliance, identifying potential vulnerabilities, and developing remediation strategies. I have experience in assisting organizations with data protection impact assessments (DPIAs), drafting data processing agreements, and managing data breaches in accordance with GDPR requirements.

For example, I’ve helped numerous clients map their data flows, implement appropriate technical and organizational measures, and develop robust consent mechanisms to ensure compliance with GDPR’s stringent data processing requirements. I’m equally comfortable discussing the nuances of data subject rights and cross-border data transfers under GDPR’s framework.

Q 8. Explain the concept of risk assessment in compliance.

Risk assessment in compliance is the systematic process of identifying, analyzing, and evaluating potential risks that could lead to a violation of regulatory requirements or internal policies. Think of it like a pre-flight check for an airplane – you meticulously examine every aspect to minimize the chance of problems during the flight. In compliance, we assess the likelihood and potential impact of various risks to determine the appropriate level of response.

This process typically involves:

- Identifying potential risks: This could include anything from data breaches to failing to meet environmental regulations, or even employee misconduct.

- Analyzing the likelihood of each risk: We assign probabilities based on historical data, industry trends, and internal factors.

- Evaluating the potential impact: We consider the severity of consequences if a risk materializes, including financial penalties, reputational damage, or legal action.

- Developing risk mitigation strategies: Once risks are assessed, we create plans to reduce their likelihood or impact. This might involve implementing new controls, improving training, or increasing oversight.

For example, a financial institution might assess the risk of money laundering. They’d identify vulnerabilities in their systems, estimate the likelihood of a successful laundering attempt, and evaluate the potential financial and reputational damage. Based on this assessment, they’d implement stricter KYC (Know Your Customer) procedures and employee training to mitigate the risk.

Q 9. How do you measure the effectiveness of a compliance program?

Measuring the effectiveness of a compliance program is crucial for demonstrating its value and ensuring continuous improvement. It’s not just about ticking boxes; it’s about proving the program is actually working to prevent violations and protect the organization. We use a variety of metrics, both quantitative and qualitative, to do this.

- Key Risk Indicators (KRIs): These are metrics that signal potential compliance issues. Examples include the number of near misses, the rate of audit findings, and the number of reported violations.

- Compliance Audit Results: Regular internal and external audits provide a snapshot of compliance strengths and weaknesses. The rate of remediation of audit findings is a particularly important metric.

- Employee Training Completion Rates and Assessment Scores: This shows how well the training program is educating employees about their compliance responsibilities.

- Number and Type of Compliance Violations: A decrease in violations, particularly those that could lead to significant penalties, demonstrates the program’s success.

- Employee Feedback and Surveys: Gathering employee feedback helps identify areas for improvement in the compliance program. Are employees confident in the reporting mechanisms? Do they understand the policies?

Imagine a manufacturing company. They might track the number of safety incidents as a KRI. A reduction in these incidents over time, alongside positive audit results and high employee training completion rates, indicates a successful compliance program focused on workplace safety.

Q 10. What is your experience with compliance training and education?

Throughout my career, I’ve been heavily involved in developing and delivering compliance training and education programs across diverse industries. I have experience designing engaging and interactive training materials, tailoring content to specific roles and responsibilities, and utilizing various delivery methods, including online modules, in-person workshops, and webinars. My focus is always on making the training relevant, practical, and easily understood by the target audience, ensuring knowledge retention and practical application.

For instance, in a previous role, I designed a comprehensive anti-bribery and corruption training program. This involved creating interactive scenarios, case studies, and quizzes to reinforce learning. The program was delivered using an online learning management system, making it easily accessible to employees worldwide. Post-training assessments showed a significant increase in employee understanding and confidence in applying the program’s principles.

Q 11. How would you handle a conflict between a regulation and company policy?

Conflicts between regulations and company policy are unfortunately not uncommon. When faced with such a scenario, a methodical approach is critical. The overarching principle is to prioritize compliance with the more stringent requirement. Here’s my approach:

- Identify the conflict: Clearly define the specific points of conflict between the regulation and the company policy.

- Determine which requirement is more stringent: This may involve careful legal interpretation and consultation with legal counsel.

- Prioritize compliance with the more stringent requirement: This is non-negotiable. Failing to meet the more stringent requirement exposes the company to greater risk.

- Document the conflict and the resolution: Maintain a clear record of the conflict, the analysis undertaken, and the decision made. This creates an audit trail.

- Review and update company policy: Once the conflict is resolved, the company policy should be updated to reflect the regulatory requirements or to create alignment.

For example, if a company policy allows for a slightly longer data retention period than what a data privacy regulation permits, the company must adhere to the shorter retention period mandated by the regulation and update its policy accordingly.

Q 12. Describe your experience with reporting compliance violations.

Reporting compliance violations is a critical aspect of a robust compliance program. My experience involves establishing and maintaining clear reporting channels, ensuring confidentiality, and conducting thorough investigations. It’s essential to make reporting easy and accessible for employees, while fostering a culture of open communication and accountability.

I’ve implemented anonymous reporting systems, whistleblower hotlines, and regular internal audits to detect and address compliance violations. My approach is to investigate every reported violation thoroughly, objectively, and fairly, taking appropriate disciplinary action where necessary. It is also crucial to learn from the violation to prevent recurrence, and that requires thorough root cause analysis. Documentation is key; every step of the investigation and remediation process must be meticulously recorded.

I have firsthand experience reporting violations to relevant regulatory authorities when necessary, ensuring compliance with all reporting requirements and deadlines. This includes preparing accurate and comprehensive reports detailing the nature of the violation, the steps taken to investigate and remediate the issue, and any preventative measures implemented.

Q 13. How familiar are you with internal controls and their role in compliance?

Internal controls are the backbone of a strong compliance program. They are the processes, policies, and procedures designed to ensure the organization operates in compliance with applicable laws, regulations, and internal policies. They are crucial for mitigating risks, preventing fraud, and ensuring data integrity. My experience involves designing, implementing, and evaluating various internal controls across different organizational functions.

These controls can be preventative (designed to stop violations before they occur) or detective (designed to identify violations after they have occurred). Examples include segregation of duties, authorization controls, reconciliation procedures, regular audits, and monitoring of key performance indicators.

In a previous role, I was involved in implementing a robust system of internal controls for a healthcare provider. This included implementing stricter access controls to patient data, enhancing the process for verifying patient information, and establishing a rigorous system for tracking and reporting potential compliance breaches. This strengthened the organization’s compliance posture and significantly reduced the risk of violations.

Q 14. What is your experience with data privacy regulations?

I possess extensive experience with a range of data privacy regulations, including GDPR (General Data Protection Regulation), CCPA (California Consumer Privacy Act), and HIPAA (Health Insurance Portability and Accountability Act). My expertise extends to understanding the intricacies of each regulation, designing and implementing compliant data handling practices, conducting data protection impact assessments (DPIAs), and managing data breaches.

My understanding extends beyond simply complying with the letter of the law. I’m proficient in incorporating privacy-by-design principles into systems and processes, ensuring data protection is integrated from the outset rather than being an afterthought. This includes working with various stakeholders—technical teams, legal departments, and business units—to ensure that data privacy is a shared responsibility throughout the organization.

For example, I have worked with organizations to develop and implement data subject access request (DSAR) procedures, to ensure the organization can respond to requests for access to personal data in a timely and compliant manner. I have also been involved in the development of data breach response plans, outlining the steps to be taken in the event of a data breach, including notification procedures to affected individuals and regulatory bodies.

Q 15. Explain your understanding of corporate governance and its relationship to compliance.

Corporate governance is the system of rules, practices, and processes by which a company is directed and controlled. It involves balancing the interests of a company’s many stakeholders, such as shareholders, management, employees, customers, suppliers, financiers, government, and the community. Effective corporate governance ensures accountability, fairness, and transparency in a company’s operations.

Compliance, on the other hand, refers to adhering to all applicable laws, regulations, and internal policies. It’s about ensuring the company operates within the bounds of the law and its own ethical standards. The relationship is symbiotic: strong corporate governance provides a framework that facilitates compliance. A robust governance structure helps establish clear lines of authority, responsibilities, and accountability, making it easier to implement and monitor compliance programs. Conversely, consistent compliance strengthens the company’s reputation and enhances its governance credibility.

For example, a company with a strong board of directors that actively oversees risk management and compliance will be better positioned to prevent and detect violations than a company with weak governance. The board’s oversight ensures that compliance programs are adequately resourced and effective.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. How would you manage stakeholder expectations regarding compliance?

Managing stakeholder expectations regarding compliance requires proactive and transparent communication. This involves clearly articulating the company’s compliance goals, processes, and performance. I would utilize a multi-pronged approach:

- Regular Reporting: Provide consistent updates to stakeholders on compliance performance through reports, presentations, and meetings. This includes highlighting successes, challenges, and corrective actions.

- Open Communication Channels: Establish clear channels for stakeholders to voice concerns or ask questions about compliance-related matters. This can include dedicated email addresses, helplines, or regular forums.

- Stakeholder Engagement: Proactively engage with key stakeholders to understand their expectations and address their concerns. This could involve surveys, focus groups, or individual meetings.

- Transparency and Accountability: Be transparent about compliance failures and take responsibility for corrective actions. This builds trust and demonstrates a commitment to continuous improvement.

For instance, I’d create a dedicated compliance section on the company’s website, detailing our policies and providing regular updates on our performance. This transparency helps manage expectations and promotes trust.

Q 17. How do you prioritize compliance tasks and manage competing deadlines?

Prioritizing compliance tasks and managing competing deadlines requires a structured approach. I typically use a risk-based prioritization framework:

- Risk Assessment: Identify all compliance obligations and assess their associated risks. This involves considering the potential severity and likelihood of non-compliance.

- Prioritization Matrix: Categorize tasks based on their risk level (high, medium, low) and urgency (immediate, short-term, long-term). High-risk, immediate tasks get top priority.

- Resource Allocation: Allocate resources (time, personnel, budget) based on the prioritized tasks. This ensures that high-priority tasks receive the necessary attention.

- Project Management Tools: Utilize project management software or tools (e.g., Gantt charts) to track progress, manage deadlines, and identify potential roadblocks.

- Regular Monitoring and Adjustment: Regularly review and adjust the prioritization matrix based on changes in the regulatory landscape, risk assessments, or business needs.

Imagine a scenario where we face impending changes to data privacy regulations and a looming audit. Using this framework, the data privacy update becomes a high-priority, immediate task, while other compliance initiatives might be rescheduled based on their relative risk and importance.

Q 18. Describe your approach to documenting compliance activities.

Documenting compliance activities is crucial for demonstrating adherence to regulations and internal policies. My approach focuses on creating a comprehensive, auditable trail:

- Centralized Repository: Maintain a centralized repository for all compliance-related documents, including policies, procedures, training materials, audit reports, and incident reports.

- Version Control: Implement version control to track changes to documents and ensure everyone is working with the most up-to-date versions.

- Clear and Concise Documentation: Ensure all documents are clearly written, easy to understand, and consistently formatted.

- Detailed Records: Maintain detailed records of all compliance activities, including dates, times, individuals involved, and outcomes.

- Secure Storage: Securely store all documents in accordance with data protection regulations.

For example, we might use a document management system that allows for version control, access control, and audit trails. This ensures that all compliance activities are properly documented and easily retrievable for internal and external audits.

Q 19. What is your experience with using compliance management software?

I have extensive experience using several compliance management software solutions, including [mention specific software, e.g., Archer, ServiceNow, MetricStream]. My experience encompasses implementing, configuring, and utilizing these systems to streamline compliance processes, automate tasks, and track performance. I’m proficient in using these tools to manage policies, conduct risk assessments, track audits, and report on compliance metrics. I understand the importance of integrating these systems with other enterprise systems to create a holistic view of compliance performance. Furthermore, I can effectively train colleagues on the proper use and maintenance of these systems.

Q 20. How would you handle pressure to compromise compliance standards?

Handling pressure to compromise compliance standards is a critical aspect of my role. My approach is unwavering: I will not compromise compliance, even under significant pressure. I would:

- Assess the Pressure: Understand the source and nature of the pressure. Is it from internal stakeholders or external forces? What are their motivations?

- Document the Request: Document any requests or directives to compromise compliance, including the source, date, and details of the request.

- Escalate the Issue: If the pressure is coming from within the company, I would escalate the issue to my supervisor or the compliance committee. If it’s from an external source, I would consult with legal counsel.

- Refer to Policy: Clearly communicate the company’s compliance policies and the potential legal and reputational consequences of non-compliance.

- Seek External Advice: If necessary, I would seek guidance from external legal or compliance experts.

Maintaining ethical integrity is paramount. Compromising compliance can have severe repercussions, including hefty fines, legal action, and irreparable damage to the company’s reputation. Protecting the organization from such risks is my top priority.

Q 21. What is your understanding of sanctions and compliance with them?

Sanctions are penalties imposed by governments or international organizations on individuals, entities, or countries for violating international law or national laws. Compliance with sanctions involves adhering to these restrictions and prohibitions. This includes screening transactions, individuals, and entities against sanctioned lists maintained by various organizations such as the Office of Foreign Assets Control (OFAC) in the US, the European Union, and the United Nations. Non-compliance can lead to significant financial penalties, legal ramifications, and reputational damage.

My understanding extends to the various types of sanctions (e.g., asset freezes, trade restrictions, travel bans) and the different regulatory bodies involved. I’m familiar with the complexities of navigating international sanctions regulations and employing effective screening and monitoring procedures to ensure full compliance. I also understand the importance of keeping abreast of evolving sanctions regulations and adapting our compliance programs accordingly. A robust sanctions compliance program involves regular screening, training, and internal audits to mitigate risk.

Q 22. Describe your experience with conducting compliance investigations.

Conducting compliance investigations requires a systematic and thorough approach. It starts with identifying the potential violation, gathering evidence, interviewing relevant individuals, and analyzing the findings to determine the extent of the non-compliance and potential corrective actions. My experience includes leading investigations into potential breaches of data privacy regulations (like GDPR or CCPA), anti-bribery laws (like the FCPA), and internal policies related to financial reporting. For example, in one instance, we investigated a potential data breach involving a compromised server. This involved securing the server, conducting forensic analysis of the system logs, interviewing employees, and ultimately implementing enhanced security protocols. The entire process followed a well-defined methodology, documented meticulously at each stage, ensuring a fair and objective outcome. The investigation culminated in a report outlining the findings, the root cause of the breach, and recommended corrective and preventative actions.

Q 23. How familiar are you with whistleblower protection laws?

I’m very familiar with whistleblower protection laws, both domestically and internationally. These laws are crucial for fostering ethical conduct within organizations by protecting individuals who report illegal or unethical activities. Understanding these laws is critical to ensuring fair treatment of whistleblowers while also navigating the complexities of internal investigations. My knowledge covers various aspects, including the legal requirements for confidentiality, the process for reporting violations, and the potential repercussions for retaliating against whistleblowers. For instance, I’m well-versed in the Sarbanes-Oxley Act (SOX) in the US and the EU’s Whistleblower Directive, understanding their nuances and how they impact investigation procedures and the protection afforded to individuals reporting misconduct.

Q 24. Explain the importance of ethical considerations in compliance.

Ethical considerations are paramount in compliance. They form the bedrock upon which a robust compliance program is built. Without ethical considerations, compliance becomes merely a checklist of regulations rather than a commitment to integrity and responsible conduct. Ethical considerations ensure fair treatment of all stakeholders, promote transparency, and build trust both internally and externally. For example, a company committed to ethical compliance might prioritize transparency in its supply chain, ensuring fair labor practices and environmental responsibility, even if those practices are not explicitly mandated by law. Ignoring ethical considerations can lead to reputational damage, legal repercussions, and a toxic work environment.

Q 25. How do you contribute to a culture of compliance within an organization?

Contributing to a culture of compliance involves more than just implementing policies; it’s about embedding ethical conduct into the organization’s DNA. This is achieved through various strategies. First, I prioritize clear communication of expectations – making sure every employee understands the compliance program’s goals and their individual responsibilities. Second, I actively promote a culture of open communication and reporting; encouraging employees to raise concerns without fear of reprisal. This involves regular training, workshops, and easily accessible reporting mechanisms. Third, I advocate for strong leadership commitment to compliance, demonstrating that ethical behavior starts at the top. Finally, I use data analytics to monitor compliance performance, identify trends, and proactively address potential risks. A strong culture of compliance not only reduces risk but also fosters employee trust and enhances the organization’s reputation.

Q 26. How would you adapt your compliance approach to different industries?

Adapting my compliance approach to different industries is crucial due to the varying regulatory landscapes and industry-specific risks. For example, the compliance requirements for a financial institution are vastly different from those of a healthcare provider. My approach involves thoroughly researching the relevant regulations, industry best practices, and potential risks specific to the sector. This includes understanding the key compliance frameworks – like HIPAA for healthcare or Dodd-Frank for finance – and tailoring the compliance program accordingly. I also consider the organization’s size, structure, and risk profile when designing and implementing the program, ensuring a proportionate and effective approach.

Q 27. Describe your experience with conducting due diligence on third-party vendors.

Conducting due diligence on third-party vendors is critical for mitigating risks associated with outsourcing. This process involves a comprehensive evaluation of the vendor’s compliance practices, financial stability, and operational capabilities. My approach includes reviewing contracts, conducting background checks, assessing their compliance programs, and validating their security measures. For example, when evaluating a technology vendor, I would assess their data security protocols, their certifications (like ISO 27001), and their incident response plan to ensure they meet the necessary standards. Thorough due diligence helps mitigate potential risks such as data breaches, reputational damage, and legal liabilities associated with third-party relationships.

Q 28. What are your strengths and weaknesses in the area of regulatory compliance?

My strengths lie in my analytical skills, my ability to translate complex regulations into practical guidance, and my experience in leading and managing investigations. I’m adept at identifying and assessing risks, developing tailored compliance programs, and working collaboratively with various stakeholders. One area where I’m constantly striving for improvement is staying abreast of the rapidly evolving regulatory landscape, particularly in emerging technologies. To address this, I dedicate time to continuous learning, participating in industry conferences, and engaging with relevant professional organizations. I proactively seek feedback to refine my approach and ensure I’m always delivering the best possible support to the organization.

Key Topics to Learn for Knowledge of Regulatory and Compliance Frameworks Interview

- Data Privacy Regulations: Understand core principles like data minimization, purpose limitation, and accountability. Explore practical application in data handling procedures and incident response planning.

- Financial Regulations (e.g., KYC/AML): Grasp the theoretical underpinnings of Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. Practice applying these frameworks to real-world scenarios involving risk assessment and transaction monitoring.

- Industry-Specific Compliance: Identify key regulations relevant to your target industry (e.g., HIPAA for healthcare, SOX for finance). Develop a strong understanding of their practical implications and potential consequences of non-compliance.

- Risk Management and Internal Controls: Learn about different risk management frameworks (e.g., COSO) and their application in designing and implementing effective internal controls. Consider how to identify and mitigate regulatory risks.

- Auditing and Compliance Monitoring: Understand the process of conducting compliance audits, including documentation review, testing procedures, and reporting. Explore the role of continuous monitoring and improvement in maintaining compliance.

- Regulatory Reporting and Disclosure: Familiarize yourself with the requirements for regulatory reporting and disclosure in your area of expertise. Practice creating accurate and timely reports.

- Ethical Considerations and Professional Conduct: Understand the ethical implications of regulatory compliance and demonstrate a commitment to professional conduct and integrity.

Next Steps

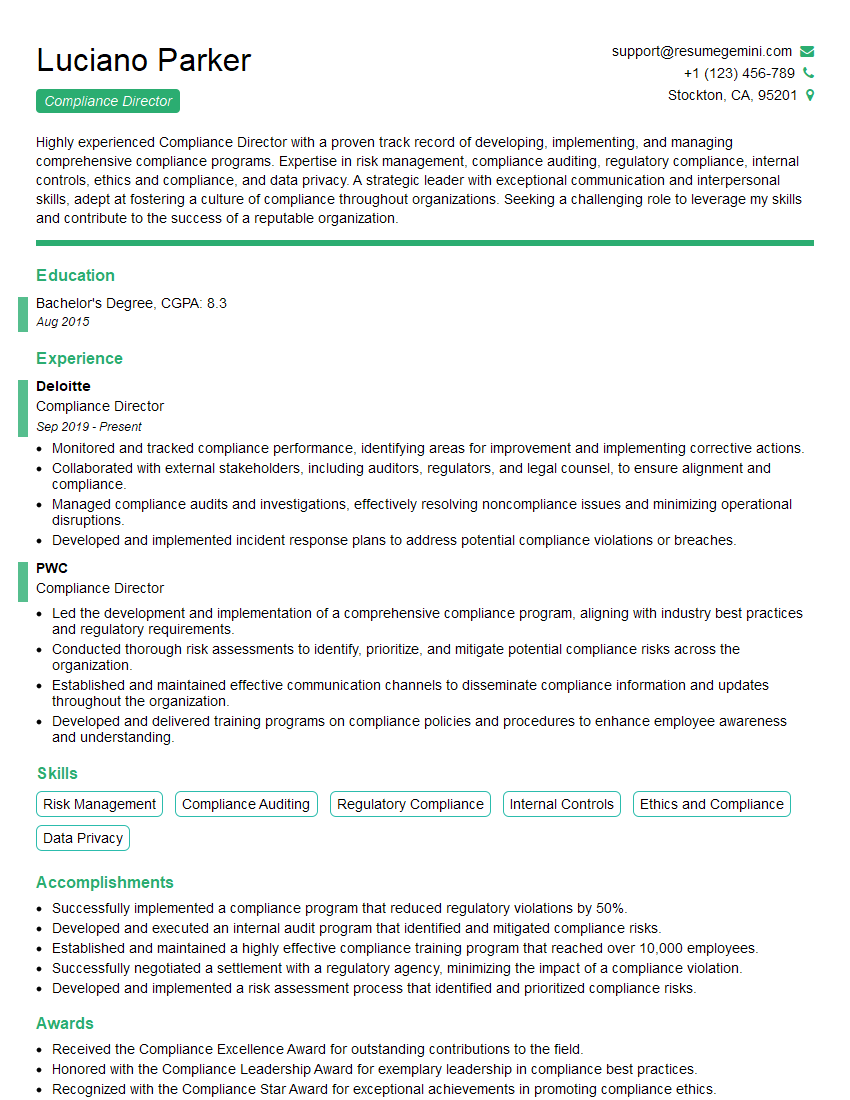

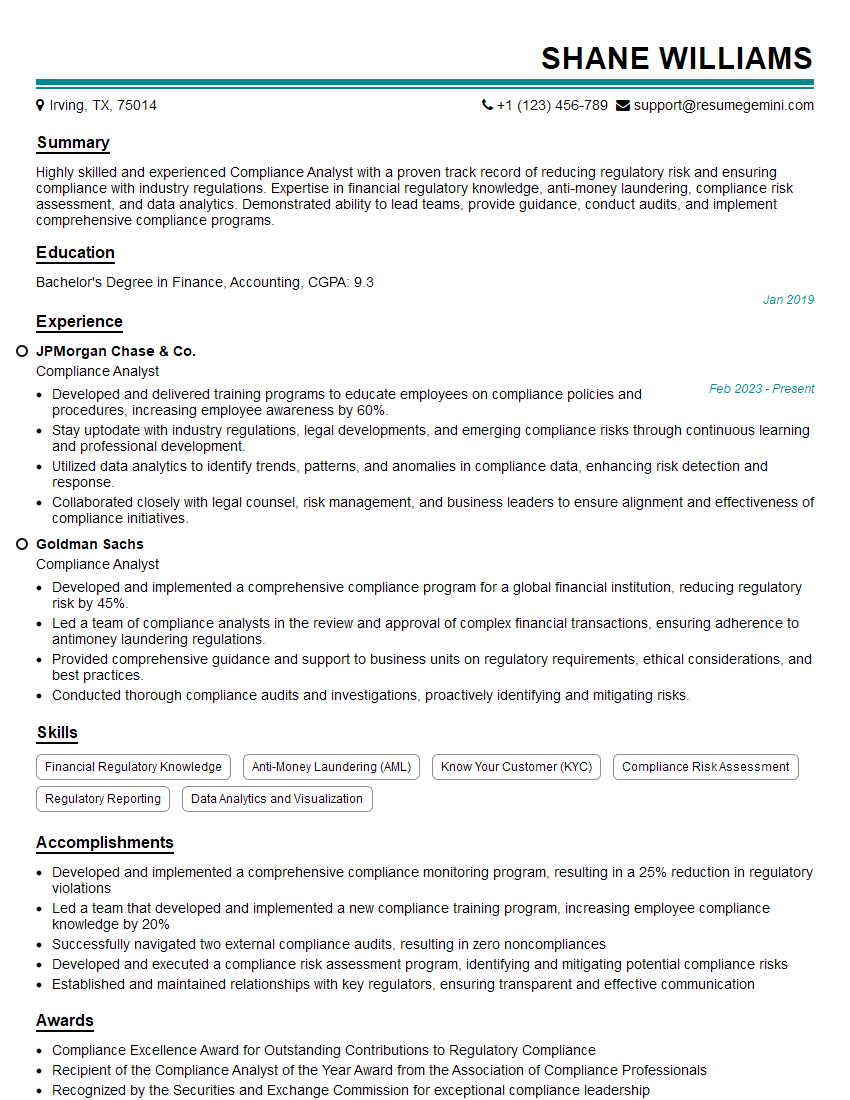

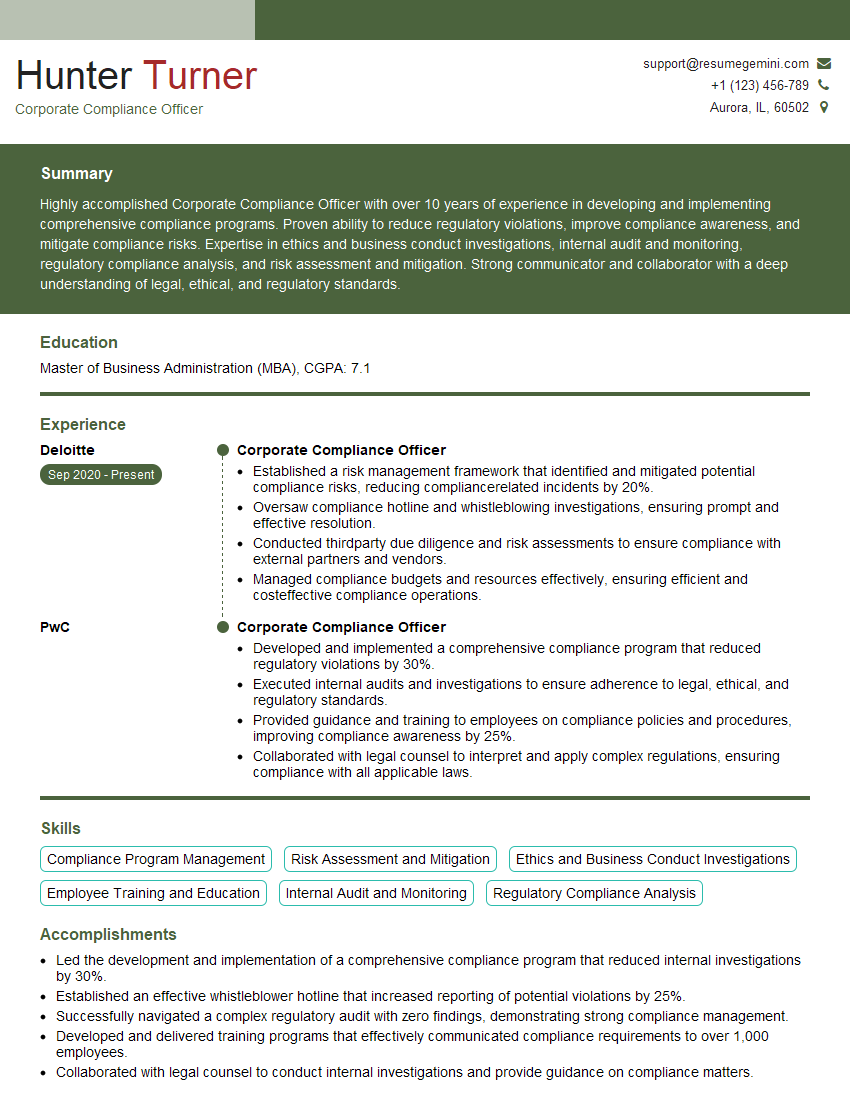

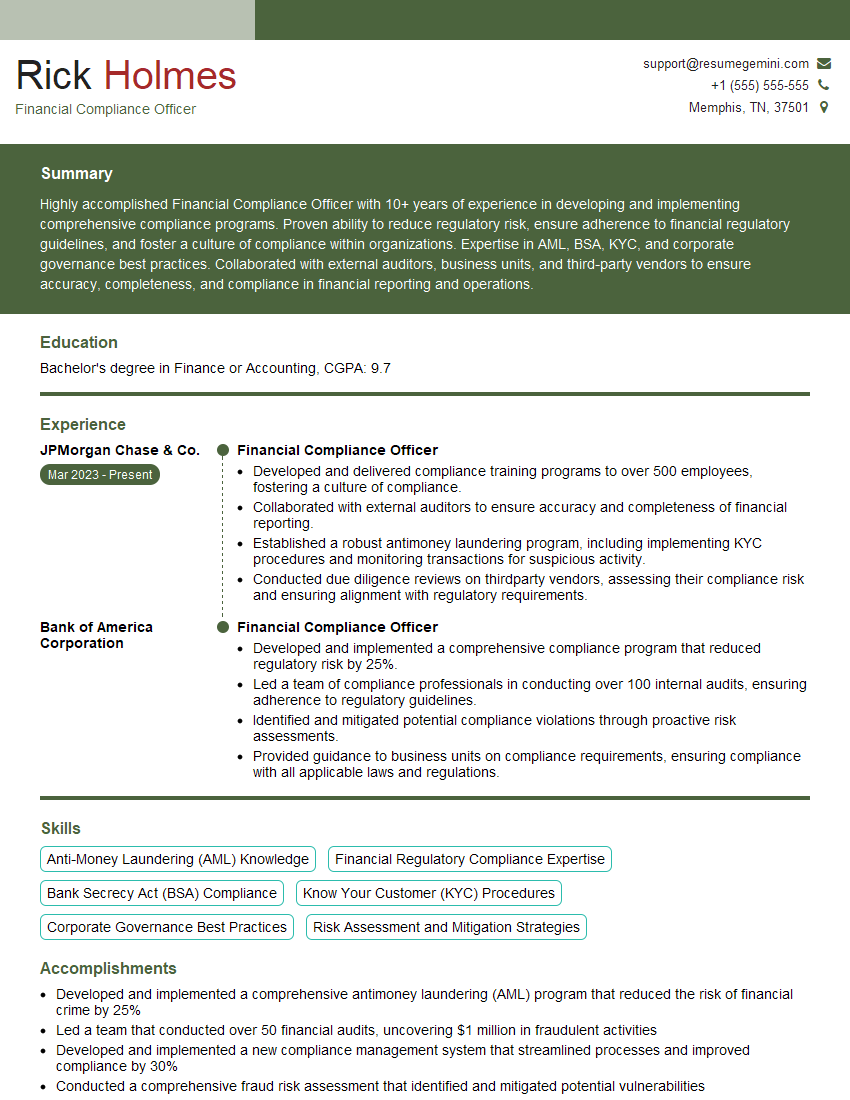

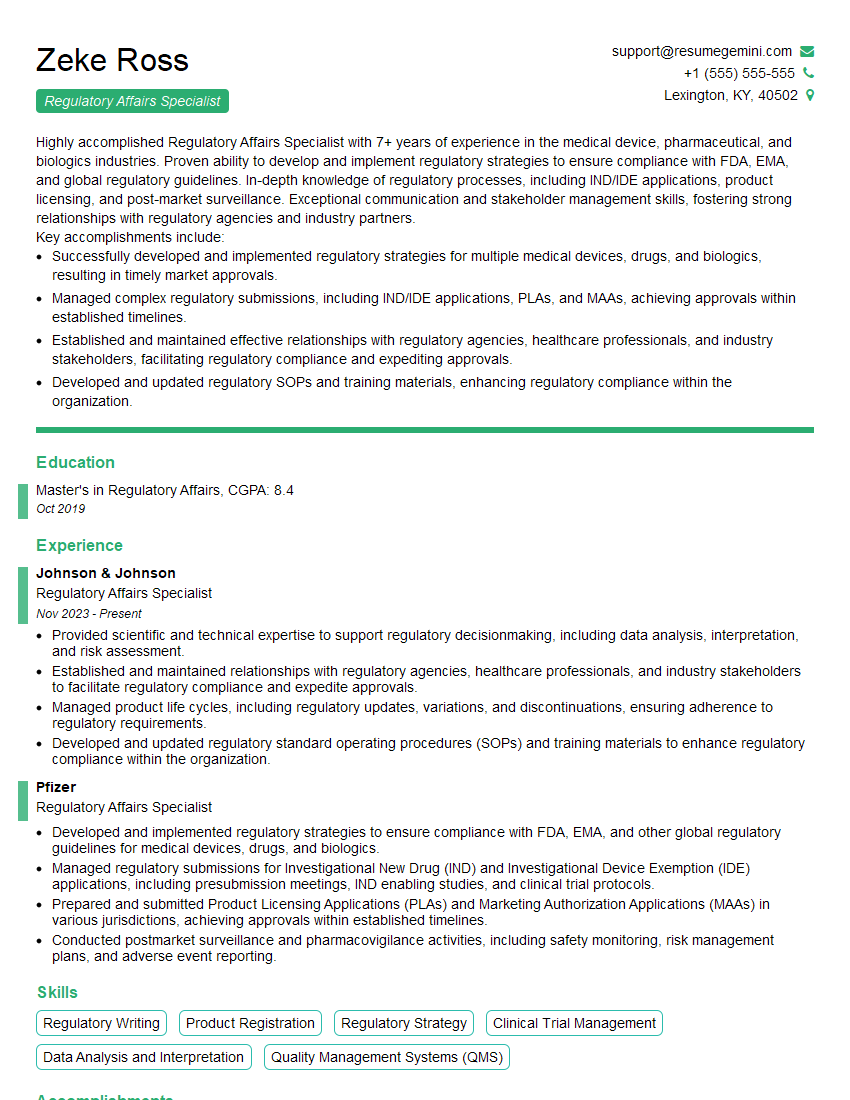

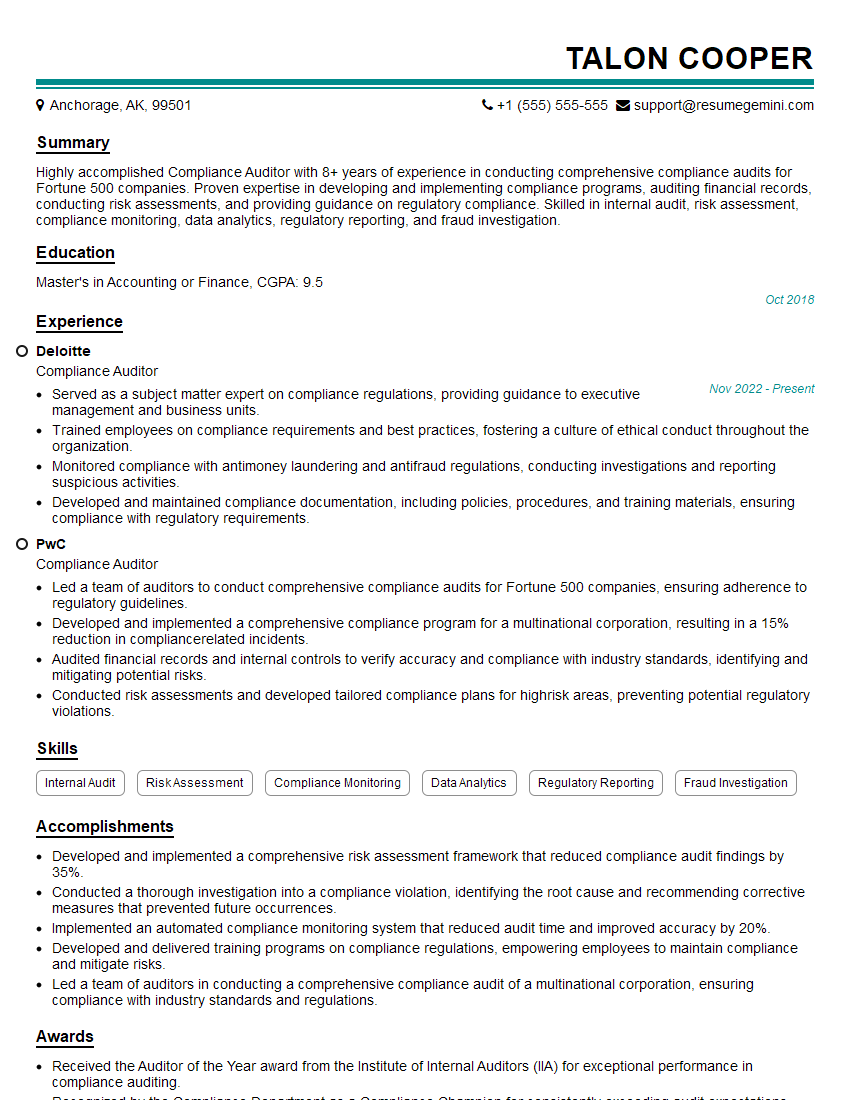

Mastering Knowledge of Regulatory and Compliance Frameworks is crucial for career advancement in today’s regulated industries. A strong understanding of these frameworks demonstrates your commitment to ethical practices and risk mitigation, making you a highly valuable asset to any organization. To maximize your job prospects, create an ATS-friendly resume that effectively highlights your skills and experience. ResumeGemini is a trusted resource that can help you build a professional and impactful resume. Examples of resumes tailored to Knowledge of Regulatory and Compliance Frameworks are available to guide you. Invest time in crafting a compelling resume – it’s your first impression!

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

Hi, I’m Jay, we have a few potential clients that are interested in your services, thought you might be a good fit. I’d love to talk about the details, when do you have time to talk?

Best,

Jay

Founder | CEO