The thought of an interview can be nerve-wracking, but the right preparation can make all the difference. Explore this comprehensive guide to Demographic and Market Research interview questions and gain the confidence you need to showcase your abilities and secure the role.

Questions Asked in Demographic and Market Research Interview

Q 1. Explain the difference between qualitative and quantitative market research.

Qualitative and quantitative market research are two distinct approaches that complement each other in providing a comprehensive understanding of the market. Qualitative research focuses on understanding the why behind consumer behavior, exploring in-depth opinions, motivations, and experiences. It’s about gaining rich insights, often using smaller sample sizes. Quantitative research, on the other hand, focuses on the what – measuring and quantifying market phenomena. It uses statistical analysis on larger datasets to identify trends and patterns. Think of it like this: qualitative research is like having an in-depth conversation with a few key customers, while quantitative research is like sending a survey to thousands and analyzing the aggregated responses.

- Qualitative Examples: Focus groups, in-depth interviews, ethnographic studies.

- Quantitative Examples: Surveys, experiments, data analysis from sales figures.

For instance, a company launching a new product might conduct qualitative research (focus groups) to understand consumer preferences and design features, and then follow up with quantitative research (surveys) to assess the market size and potential demand for the product.

Q 2. Describe your experience with various data collection methods (e.g., surveys, focus groups, interviews).

My experience spans a wide range of data collection methods. I’ve extensively used surveys – both online and offline – employing different question types like Likert scales, multiple-choice, and open-ended questions to gather diverse data. I’ve facilitated numerous focus groups, skillfully guiding discussions to elicit valuable insights while ensuring participant comfort and unbiased contributions. I’m adept at conducting in-depth interviews, utilizing various probing techniques to uncover nuanced perspectives. Furthermore, I’ve employed observational methods in field research to directly observe consumer behavior in natural settings, which adds a valuable layer of qualitative data. I’ve also worked with secondary data sources like government reports and market intelligence databases to supplement primary research.

For example, in a recent project for a food company, we used surveys to understand consumer preferences for different flavors, focus groups to gather feedback on packaging design, and in-depth interviews with key influencers to gauge the potential market reach.

Q 3. How do you ensure the accuracy and reliability of your research data?

Ensuring data accuracy and reliability is paramount. My approach involves a multi-pronged strategy starting with meticulous planning. This includes carefully defining the research objectives, selecting the appropriate sample size using statistical power analysis, and designing instruments (questionnaires, interview guides) that are clear, unambiguous, and free from bias. Pilot testing is crucial to identify and rectify any issues before full-scale data collection.

During data collection, I employ rigorous quality control measures, including data validation checks to identify inconsistencies or outliers. After data collection, I use statistical methods like reliability analysis (Cronbach’s alpha for questionnaires) to assess the internal consistency of the data. For quantitative data, I conduct descriptive statistics to understand the data distribution and identify potential issues.

Transparency is key, so I meticulously document all research procedures, including data cleaning and analysis methods, to ensure replicability and accountability. This systematic approach significantly improves the credibility and trustworthiness of our findings.

Q 4. What statistical methods are you proficient in using for data analysis?

My statistical proficiency encompasses a wide array of techniques relevant to market research. I’m proficient in descriptive statistics (mean, median, mode, standard deviation) to summarize and present data effectively. Inferential statistics are also crucial to my work; I regularly employ techniques such as t-tests, ANOVA, and chi-square tests to examine relationships between variables and test hypotheses. For more complex analyses, I utilize regression analysis (linear, logistic) to model relationships between variables and predict outcomes. Factor analysis helps me to reduce the dimensionality of large datasets and identify underlying factors influencing consumer behavior. Finally, I’m also experienced in cluster analysis for market segmentation.

For example, in a recent study on customer satisfaction, I used regression analysis to identify factors influencing customer loyalty, then used cluster analysis to segment customers into different groups based on their loyalty levels.

Q 5. Explain your experience in developing and implementing market research plans.

Developing and implementing a market research plan is a systematic process that requires careful consideration of multiple factors. It begins with clearly defining the research objectives, aligning them with the overall business goals. Next, I identify the target population and determine the optimal sample size and sampling method. Then, the most appropriate data collection methods are selected based on the research questions and available resources. A detailed timeline, including all stages from data collection to report writing, is created and adhered to. A budget is also established, outlining all costs associated with the research.

Throughout the process, continuous monitoring and evaluation are essential. Regular progress reports are provided to stakeholders, keeping them informed about the research’s progress and addressing any challenges encountered. This ensures the research plan remains adaptable and responsive to changing circumstances.

For instance, in a recent project for a new mobile app launch, I developed a comprehensive plan that included quantitative surveys to assess market size and potential users, qualitative interviews with early adopters, and A/B testing during the app’s beta phase to fine-tune its features.

Q 6. How do you interpret and present complex research findings to stakeholders?

Presenting complex research findings to stakeholders requires clear, concise, and engaging communication. I avoid technical jargon and focus on visually appealing presentations using charts, graphs, and infographics to illustrate key findings. I begin by summarizing the research objectives and methodology, providing context for the data. Then, I highlight the most important findings, using storytelling techniques to make the information relatable and memorable.

Interactive elements, such as Q&A sessions, are incorporated to facilitate discussion and address any stakeholder concerns. A written report, including detailed methodology, data analysis, and supporting evidence, is provided as a comprehensive record. I always tailor the communication style and level of detail to the audience’s knowledge and understanding, ensuring the information is easily digestible and actionable.

For example, when presenting findings from a customer segmentation study to the marketing team, I focused on the distinct characteristics of each segment, illustrating how targeted marketing strategies could be tailored to maximize engagement and ROI for each group.

Q 7. Describe your experience with market segmentation techniques.

Market segmentation is crucial for effective marketing strategies. I’m experienced in applying various segmentation techniques, choosing the most appropriate approach based on the research objectives and available data. Common methods include geographic segmentation (dividing markets by location), demographic segmentation (age, gender, income, education), psychographic segmentation (lifestyle, values, personality), and behavioral segmentation (purchase history, brand loyalty).

I also utilize advanced techniques like cluster analysis to identify naturally occurring segments based on multiple variables. For instance, using data on customer demographics, purchase behavior, and website activity, cluster analysis can uncover distinct customer groups with unique needs and preferences. Once segments are identified, I develop detailed profiles outlining the key characteristics and behaviors of each group, informing targeted marketing efforts.

In a recent project for a clothing retailer, we used a combination of demographic and psychographic segmentation to identify distinct customer segments with different preferences for styles and pricing, allowing the retailer to tailor its marketing messages and product offerings for maximum impact.

Q 8. How familiar are you with different sampling methods?

Sampling methods are crucial in demographic and market research because it’s often impractical to survey everyone. I’m proficient in various techniques, each with its strengths and weaknesses.

- Probability Sampling: Every member of the population has a known chance of being selected. This includes simple random sampling (like drawing names from a hat), stratified sampling (dividing the population into subgroups and sampling from each), cluster sampling (sampling groups or clusters), and systematic sampling (selecting every nth individual). Probability sampling allows for generalization to the broader population.

- Non-probability Sampling: The probability of selection is unknown. This is often used when a complete population list is unavailable or when speed and cost-effectiveness are priorities. Examples include convenience sampling (selecting readily available individuals), quota sampling (ensuring representation of specific subgroups), and snowball sampling (referrals from existing participants). Non-probability samples are not easily generalizable but can be valuable for exploratory research.

For instance, in a study on consumer preferences for a new product, stratified sampling would be ideal to ensure representation of different age groups, income levels, and geographic locations. Convenience sampling might be used for initial feedback during product development.

Q 9. How do you handle missing data in your analysis?

Missing data is a common challenge in research. My approach is multifaceted and depends on the nature and extent of the missing data.

- Understanding the Mechanism: Is the data missing completely at random (MCAR), missing at random (MAR), or missing not at random (MNAR)? This determines the appropriate handling strategy.

- Imputation Techniques: For MCAR or MAR, I employ imputation methods like mean/median imputation (simple but potentially distorting), regression imputation (predicting missing values based on other variables), or multiple imputation (creating several plausible datasets and combining results). For MNAR, more sophisticated methods may be needed, potentially involving model-based approaches.

- Deletion Methods: In some cases, listwise deletion (excluding entire cases with missing values) or pairwise deletion (using available data for each analysis) might be appropriate, particularly if the missing data is minimal and not systematically biased.

- Sensitivity Analysis: I always perform sensitivity analyses to assess the impact of different missing data handling methods on the results. This helps understand the robustness of my findings.

For example, in a survey on customer satisfaction, if some respondents skipped a particular question, I might use regression imputation to predict their responses based on their answers to other related questions, provided those variables show good correlation.

Q 10. What software are you proficient in using for data analysis (e.g., SPSS, R, SAS)?

I’m highly proficient in several statistical software packages commonly used in demographic and market research. My expertise includes:

- R: A powerful open-source language offering extensive statistical capabilities and flexibility for data manipulation, visualization, and complex modeling. I’m comfortable using packages like

dplyrfor data wrangling,ggplot2for visualization, and various packages for specialized statistical analyses. - SPSS: A user-friendly commercial package with a wide array of statistical procedures and excellent capabilities for survey data management. I can efficiently use SPSS for descriptive statistics, hypothesis testing, and regression analysis.

- SAS: A comprehensive system for data management, analysis, and reporting, particularly useful for large datasets and complex projects. I have experience utilizing SAS for advanced statistical modeling and data mining techniques.

The choice of software depends on the project’s specific needs and available resources. For example, for a large-scale customer segmentation project with substantial data cleaning and manipulation, I might prefer SAS, while for a quicker exploratory analysis of smaller datasets, R might be more efficient.

Q 11. How do you ensure the ethical conduct of market research projects?

Ethical conduct is paramount in market research. My commitment involves adhering to rigorous standards throughout the research process:

- Informed Consent: Ensuring participants understand the study’s purpose, procedures, and their rights, obtaining their explicit consent before participation.

- Confidentiality and Anonymity: Protecting participants’ identities and data security through appropriate measures like data encryption and de-identification.

- Transparency and Honesty: Clearly communicating the research methods and limitations, avoiding misleading or deceptive practices.

- Data Integrity: Maintaining the accuracy and completeness of data, avoiding manipulation or fabrication of results.

- Adherence to Regulations: Complying with relevant laws and regulations, such as those related to data privacy (e.g., GDPR) and consumer protection.

For example, before conducting any interviews, I always provide detailed information about the study and obtain participants’ written informed consent. I also use pseudonyms or anonymization techniques to protect their privacy in all reports and publications.

Q 12. Describe your experience working with large datasets.

I have extensive experience working with large datasets, often involving millions of records. My strategies for managing and analyzing such data include:

- Data Management Techniques: Efficient data storage and retrieval using databases (e.g., SQL) or specialized data management tools. This includes optimizing data structures and employing techniques to manage and handle large files effectively.

- Data Cleaning and Preprocessing: Developing robust processes to handle missing data, outliers, and inconsistencies in large datasets, often leveraging scripting languages (like Python) to automate these tasks.

- Parallel Processing and Distributed Computing: Utilizing techniques like parallel processing or distributed computing to accelerate computationally intensive analyses, particularly for complex statistical modeling.

- Data Reduction and Dimensionality Reduction: Employing methods like principal component analysis (PCA) or factor analysis to reduce the dimensionality of the data while preserving essential information. This streamlines analysis and makes it more manageable.

For instance, in a project analyzing consumer purchasing behavior based on loyalty card data, I utilized SQL to query and extract the relevant information from a massive database, and then employed PCA in R to reduce the number of variables while maintaining the key patterns in the data for more efficient clustering and segmentation.

Q 13. How do you identify and address potential biases in research data?

Bias in research data can significantly distort results. My approach to identifying and addressing bias involves:

- Sampling Bias: Carefully considering sampling methods to minimize selection bias, ensuring the sample represents the population of interest. This often includes using appropriate probability sampling techniques.

- Measurement Bias: Designing questionnaires and data collection instruments with carefully worded questions to avoid leading or biased responses. Pilot testing is critical to refine instruments and identify potential biases.

- Response Bias: Addressing non-response bias by analyzing non-respondents and exploring reasons for non-participation. Weighting techniques may be employed to adjust for unequal representation in the sample.

- Interviewer Bias: Training interviewers to adhere to standardized procedures and minimize their influence on responses. Using standardized interview scripts and employing blind or double-blind studies when appropriate.

- Confirmation Bias: Being mindful of preconceived notions and actively seeking data that may challenge existing hypotheses. Maintaining a critical and objective perspective during data analysis and interpretation.

For example, if conducting a survey on political opinions, I would carefully select a representative sample to minimize sampling bias and use neutral wording in the survey questions to minimize measurement bias. Analysis would account for any potential response bias due to unequal participation across demographics.

Q 14. Explain your understanding of demographic trends and their impact on markets.

Demographic trends significantly influence market dynamics. Understanding these trends is crucial for effective market research and strategic planning.

- Population Growth and Aging: Aging populations in many developed countries lead to increased demand for healthcare services and age-related products, while a younger population in developing countries drives demand for different goods and services.

- Urbanization: The increasing concentration of populations in urban areas affects retail strategies, transportation needs, and housing demands.

- Changing Household Structures: The rise in single-person households, dual-income families, and multigenerational households influences consumer spending patterns and product preferences.

- Income Distribution and Economic Inequality: Changes in income distribution shape consumer behavior and market segmentation strategies. Understanding different income brackets and their spending habits is crucial.

- Education Levels and Skills: Higher education levels often correlate with higher incomes and influence consumer preferences for technological products, services, and experiences.

- Cultural Shifts and Technological Advancements: Changing cultural norms and rapid technological advancements significantly impact consumer behavior and the adoption of new products and services.

For example, anticipating the growing elderly population, a company might focus on developing products and services specifically designed to meet the needs of older adults, such as assistive technologies or senior-friendly housing.

Q 15. Describe your experience with forecasting and predictive modeling.

Forecasting and predictive modeling are crucial in demographic and market research. They allow us to anticipate future trends based on historical data and current market dynamics. My experience involves employing various statistical and machine learning techniques to build models that predict things like future sales, customer churn, or shifts in consumer preferences.

For example, I’ve used time series analysis (ARIMA, Prophet) to forecast product demand based on past sales data, incorporating seasonal effects and external factors like economic indicators. I’ve also utilized regression models (linear, logistic, multiple) to predict customer acquisition costs based on marketing campaign variables. Furthermore, machine learning methods like Random Forests and Gradient Boosting Machines have been invaluable in identifying high-potential customer segments.

The success of these models relies heavily on data quality and feature engineering. Regular model evaluation and refinement through techniques like backtesting and cross-validation are paramount to ensure accuracy and reliability. I always strive for transparency in model building and clearly communicate the assumptions and limitations of each model to stakeholders.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. How do you measure the success of a market research project?

Measuring the success of a market research project depends heavily on its objectives. A well-defined scope and clear Key Performance Indicators (KPIs) are essential from the outset. These KPIs might include:

- Achieving a pre-defined level of accuracy in forecasting: For instance, predicting market share within a specific margin of error.

- Identifying significant market segments: Successfully pinpointing demographics or psychographics that demonstrate high potential for product adoption.

- Gaining actionable insights leading to improved business decisions: This could be the launch of a new product, modification of an existing strategy, or refinement of a marketing campaign.

- Client satisfaction: Meeting the client’s needs and expectations regarding timeliness, thoroughness, and clarity of results.

Beyond these quantifiable metrics, qualitative feedback from stakeholders is also crucial to understand the broader impact of the research. Did the insights drive meaningful changes in the client’s business? Did the research enhance their understanding of the market?

Q 17. How familiar are you with A/B testing and experimental design?

I am very familiar with A/B testing and experimental design. These are powerful tools for making data-driven decisions in marketing and product development. A/B testing involves comparing two versions of a variable (e.g., a website headline, email subject line, product feature) to see which performs better. Proper experimental design ensures the validity and reliability of the results.

This involves careful consideration of factors like:

- Sample size: Ensuring a sufficient number of participants to detect statistically significant differences.

- Randomization: Assigning participants to different groups randomly to minimize bias.

- Control group: A group that doesn’t receive the treatment (the new version of the variable) serves as a baseline for comparison.

- Statistical analysis: Using appropriate statistical tests (e.g., t-tests, chi-squared tests) to analyze the results and determine statistical significance.

For example, I’ve conducted A/B tests on website landing pages to optimize conversion rates, and on email campaigns to improve open and click-through rates. Understanding statistical power and effect size helps me determine the necessary sample size for meaningful results.

Q 18. Describe your experience with competitor analysis.

Competitor analysis is essential for understanding the competitive landscape and identifying opportunities for growth. My approach involves a multi-faceted analysis, including:

- Market share analysis: Determining the market share held by each competitor.

- Financial analysis: Examining the financial performance of competitors (revenues, profits, expenses).

- Product analysis: Assessing the features, pricing, and quality of competitor products.

- Marketing analysis: Analyzing their marketing strategies, including their target audience, messaging, and channels.

- Strengths and weaknesses analysis: Identifying the competitive advantages and disadvantages of each competitor.

Data sources for this analysis can include market reports, financial statements, company websites, social media, and customer reviews. I use this information to create comprehensive profiles of each competitor, allowing my clients to make informed decisions about product development, pricing, and marketing.

For example, I recently conducted a competitor analysis for a client in the food industry, identifying a gap in the market for a particular type of product, which led to the development of a new product line.

Q 19. Explain your understanding of causal inference and its application in market research.

Causal inference is about determining whether a change in one variable actually *causes* a change in another variable, rather than just observing a correlation. This is crucial in market research because it moves beyond simply observing trends to understanding the underlying drivers of those trends.

In market research, we often use causal inference techniques to answer questions like:

- Does a new marketing campaign increase sales?

- Does a price reduction lead to increased demand?

- Does a specific product feature improve customer satisfaction?

Methods for establishing causality include randomized controlled trials (RCTs), instrumental variables, regression discontinuity design, and difference-in-differences. RCTs are the gold standard, but they are not always feasible. Other methods are used when RCTs are impractical or impossible. Understanding the limitations and assumptions of each method is critical for drawing valid conclusions.

For example, using a difference-in-differences approach, we could compare the sales of a product in a region where a new marketing campaign was launched to the sales of the same product in a control region without the campaign. This would help determine if the campaign truly caused an increase in sales.

Q 20. How do you deal with conflicting research findings?

Conflicting research findings are common in market research, often stemming from differences in methodology, sampling techniques, data sources, or the time frame of the study. Resolving these conflicts requires a systematic approach:

- Review the methodologies: Carefully examine the research designs, sampling methods, and data collection techniques of each study to identify potential sources of bias or error.

- Assess the data quality: Evaluate the reliability and validity of the data used in each study. Consider factors like sample size, response rates, and data collection methods.

- Identify potential confounding factors: Determine if there are any other variables that could have influenced the results. Were there external factors influencing the market during the period of the study?

- Reconcile the findings: If possible, combine the findings from different studies using meta-analysis techniques. This involves statistically combining the results of multiple studies to produce a more robust estimate of the effect.

- Consider the context: Examine the context in which each study was conducted, including the time period, geographic location, and target audience.

- Communicate uncertainties: Transparency is key. Clearly communicate any limitations or uncertainties associated with the findings to stakeholders.

Often, a deeper investigation into the underlying data and methodology is necessary to determine the most reliable conclusion.

Q 21. How do you present your findings to a non-technical audience?

Presenting findings to a non-technical audience requires clear, concise, and engaging communication. I avoid technical jargon and use visuals like charts, graphs, and infographics to illustrate key findings. I focus on the ‘so what?’ – the implications of the research for the business – rather than getting bogged down in methodological details.

My presentations typically include:

- A clear executive summary: Highlighting the main findings and their implications.

- Visualizations: Charts and graphs to make the data easily understandable.

- Storytelling: Using narratives to connect the data to the business context and make the findings more relatable.

- Key takeaways: Summarizing the key actionable insights.

- Recommendations: Suggesting specific actions based on the findings.

I also tailor my communication style to the specific audience. For example, I might use more simplified language and visuals when presenting to senior management, focusing on high-level implications, whereas a presentation to a marketing team would incorporate more detail and specific recommendations.

Q 22. Explain your experience with different types of surveys (e.g., online, phone, in-person).

My experience spans various survey methodologies, each with its strengths and weaknesses. Online surveys, using platforms like Qualtrics or SurveyMonkey, offer cost-effectiveness and wide reach, enabling quick data collection from geographically dispersed respondents. However, they can suffer from lower response rates and potential sampling biases if the online population doesn’t accurately represent the target demographic. Phone surveys, while more expensive and time-consuming, allow for deeper engagement with respondents through interactive questioning and clarification, leading to richer data. They also tend to have higher response rates compared to online surveys. However, they can be affected by interviewer bias and geographical limitations. Finally, in-person surveys, typically conducted in shopping malls or other public spaces, provide the highest quality of data due to the direct interaction and observation of respondent behavior. However, they are the most costly and time-intensive approach, and geographic reach is limited. In my career, I’ve successfully managed projects employing all three methods, tailoring the approach to the specific research objective, budget, and target population.

For example, in a recent study on consumer preferences for sustainable products, we used an online survey to reach a large, geographically diverse sample quickly and cost-effectively. To gain deeper insights into nuanced feelings and purchasing behaviors for a niche product, we supplemented this with in-person interviews in select locations. This mixed-methods approach gave us a comprehensive understanding of the market.

Q 23. What are your strengths and weaknesses in performing market research?

My strengths lie in my ability to design robust research methodologies, analyze complex datasets, and communicate findings clearly and concisely. I’m adept at identifying and mitigating biases in data collection, ensuring the validity and reliability of my results. I excel at translating complex statistical analyses into actionable insights for business decision-making. I am proficient in various statistical software packages such as SPSS and R.

A weakness I’m constantly working on is staying completely up-to-date with the ever-evolving technological landscape of market research. New tools and platforms emerge constantly. To mitigate this, I actively participate in industry webinars, attend conferences, and dedicate time to exploring new software solutions to ensure my skillset remains competitive. I also regularly review and contribute to the discussion within relevant online communities and forums.

Q 24. How do you stay current with the latest trends in demographic and market research?

Staying current in this dynamic field requires a multifaceted approach. I regularly subscribe to and read leading industry publications such as the Journal of Marketing Research and Marketing Science. I actively participate in professional organizations like the American Marketing Association, attending conferences and webinars to learn about the latest research methodologies and trends. I follow key influencers and thought leaders in the field on social media platforms like LinkedIn and Twitter, engaging with their posts and joining relevant discussions. I also maintain a close watch on emerging technologies, such as AI-powered analytics tools and big data applications, as they continue to revolutionize the market research landscape. This continuous learning ensures my expertise stays sharp and relevant.

Q 25. How have you used data visualization to communicate insights?

Data visualization is crucial for effectively communicating research findings. I utilize various tools, including Tableau and Power BI, to create compelling and insightful visuals. For example, in a project assessing brand awareness, I used interactive dashboards to display geographic variations in brand recognition, comparing different demographic segments using bar charts, maps, and pie charts. This allowed stakeholders to quickly grasp key trends and make data-driven decisions. Another instance involved using network diagrams to illustrate customer journey mapping, uncovering crucial pain points in the customer experience. The visual representation of complex data made it easy to understand and act upon, improving customer satisfaction and business performance. I always strive to ensure that my visualizations are clear, concise, and tailored to the audience’s level of understanding.

Q 26. Describe a time you had to overcome a challenge in a market research project.

In a recent project analyzing the potential market for a new tech gadget, we encountered difficulties obtaining a representative sample of our target demographic – young adults aged 18-25. Our initial online survey yielded a biased sample, overrepresenting students and underrepresenting young professionals. To overcome this, we implemented a multi-pronged approach. We refined our sampling methodology, using stratified sampling to ensure accurate representation across different sub-groups within the target demographic. We also diversified our recruitment strategies, moving beyond relying solely on online panels. We partnered with relevant student organizations and utilized social media marketing to increase reach and achieve a more balanced response rate. This more comprehensive approach significantly improved the quality and reliability of our data, leading to more accurate market projections.

Q 27. How do you define and measure customer satisfaction?

Customer satisfaction is defined as the extent to which a customer’s expectations are met or exceeded by a product or service. Measuring it requires a multi-faceted approach. We use a combination of quantitative and qualitative methods. Quantitative methods include customer satisfaction surveys (using scales like the Net Promoter Score or Customer Satisfaction Score), transaction-based feedback, and website analytics. Qualitative methods include focus groups and customer interviews to get deeper insights into the reasons behind customer satisfaction or dissatisfaction. This integrated approach provides a comprehensive understanding of customer perception, enabling effective identification of areas for improvement.

Q 28. How do you use market research to inform strategic business decisions?

Market research is the backbone of informed strategic business decisions. It provides crucial data to understand market trends, consumer behavior, and competitive landscapes. For example, a company considering launching a new product can use market research to assess demand, identify target segments, and refine the product offering based on consumer feedback. Market research can also be used to assess the effectiveness of marketing campaigns, optimize pricing strategies, and even inform decisions about mergers and acquisitions. In essence, by providing a deep understanding of the market, consumer preferences, and competitive dynamics, market research equips businesses with the insights needed to make sound, strategic decisions that drive growth and profitability.

Key Topics to Learn for Demographic and Market Research Interview

- Quantitative Research Methods: Understanding and applying techniques like surveys, experiments, and statistical analysis to gather and interpret numerical data about target populations.

- Qualitative Research Methods: Employing methods such as focus groups, interviews, and ethnographic studies to explore in-depth insights into consumer behavior and attitudes.

- Sampling Techniques: Mastering probability and non-probability sampling methods to ensure representative and reliable data collection, understanding the implications of sample size and bias.

- Data Analysis & Interpretation: Proficiency in using statistical software (e.g., SPSS, R) to analyze data, identify trends, and draw meaningful conclusions. Understanding key statistical concepts like correlation, regression, and significance testing.

- Market Segmentation & Targeting: Applying demographic, psychographic, and behavioral data to identify and profile distinct customer segments for effective marketing strategies.

- Report Writing & Presentation: Clearly and concisely communicating research findings through compelling reports and presentations, tailored to different audiences (e.g., executives, marketing teams).

- Ethical Considerations in Research: Understanding and adhering to ethical guidelines in data collection, analysis, and reporting, ensuring data privacy and informed consent.

- Predictive Modeling & Forecasting: Utilizing data analysis techniques to forecast market trends, customer behavior, and potential business outcomes.

Next Steps

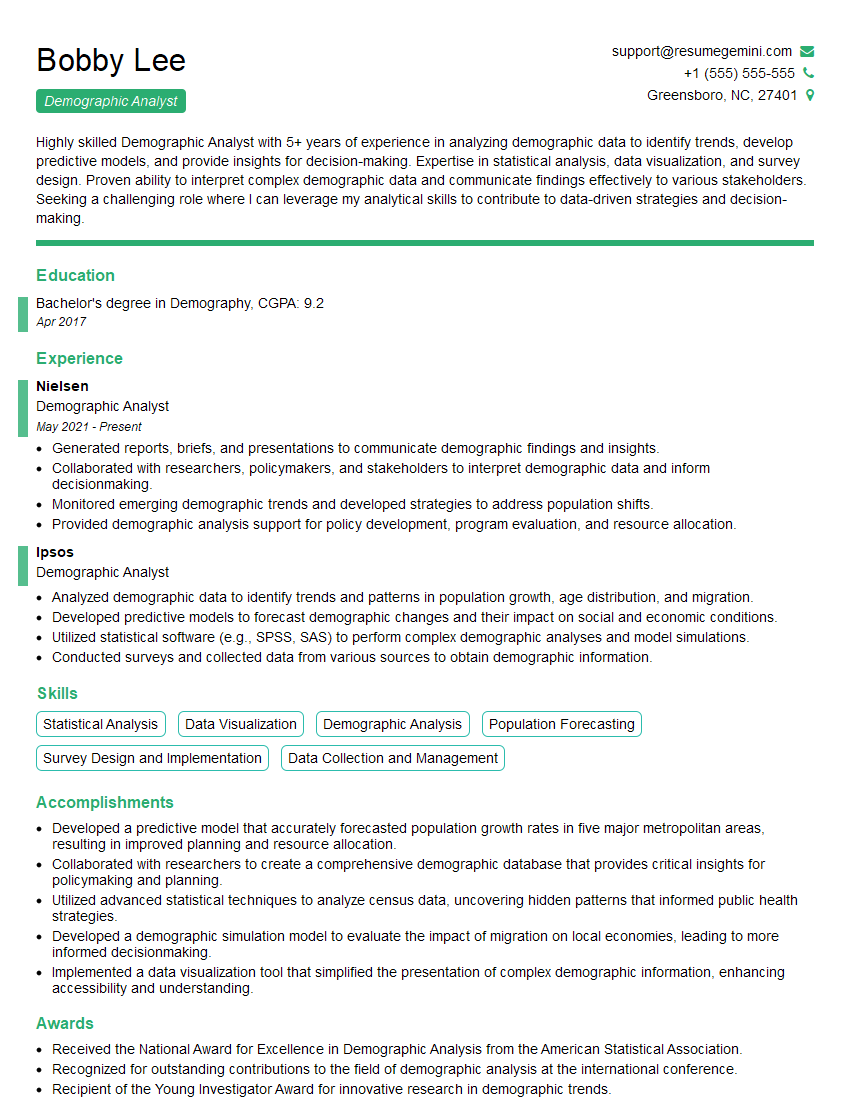

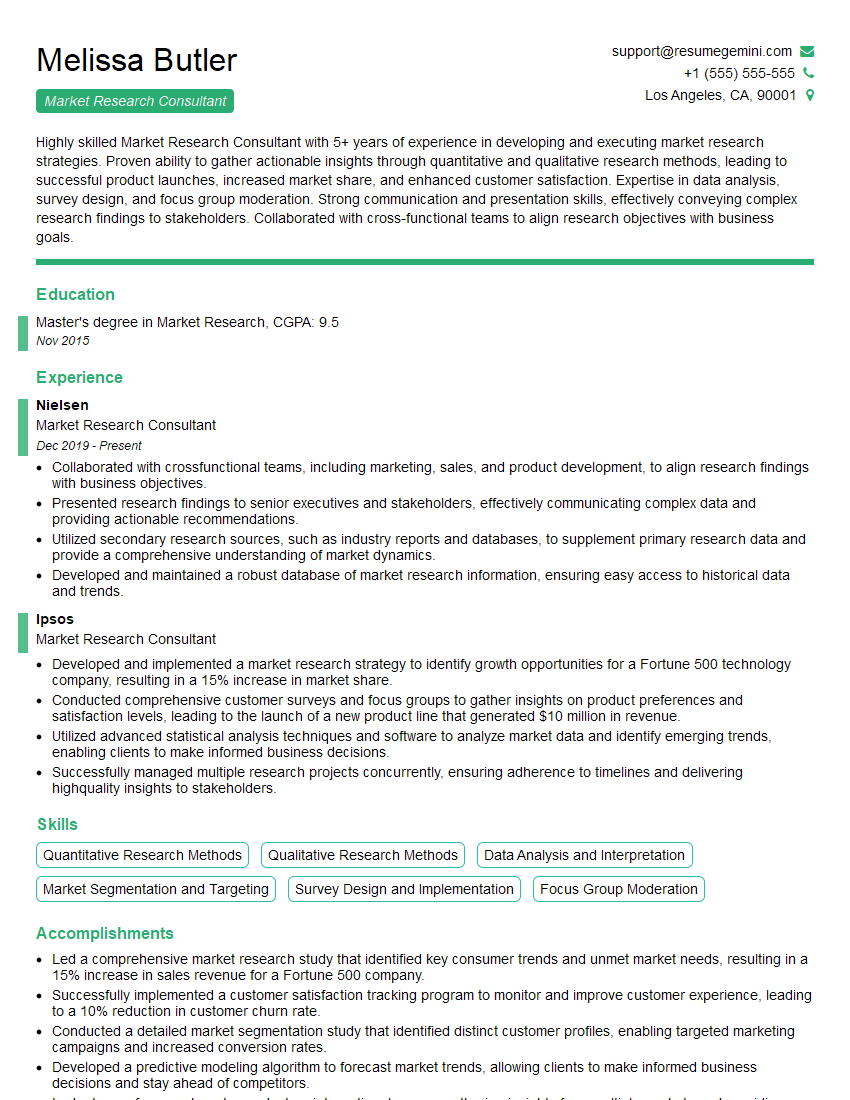

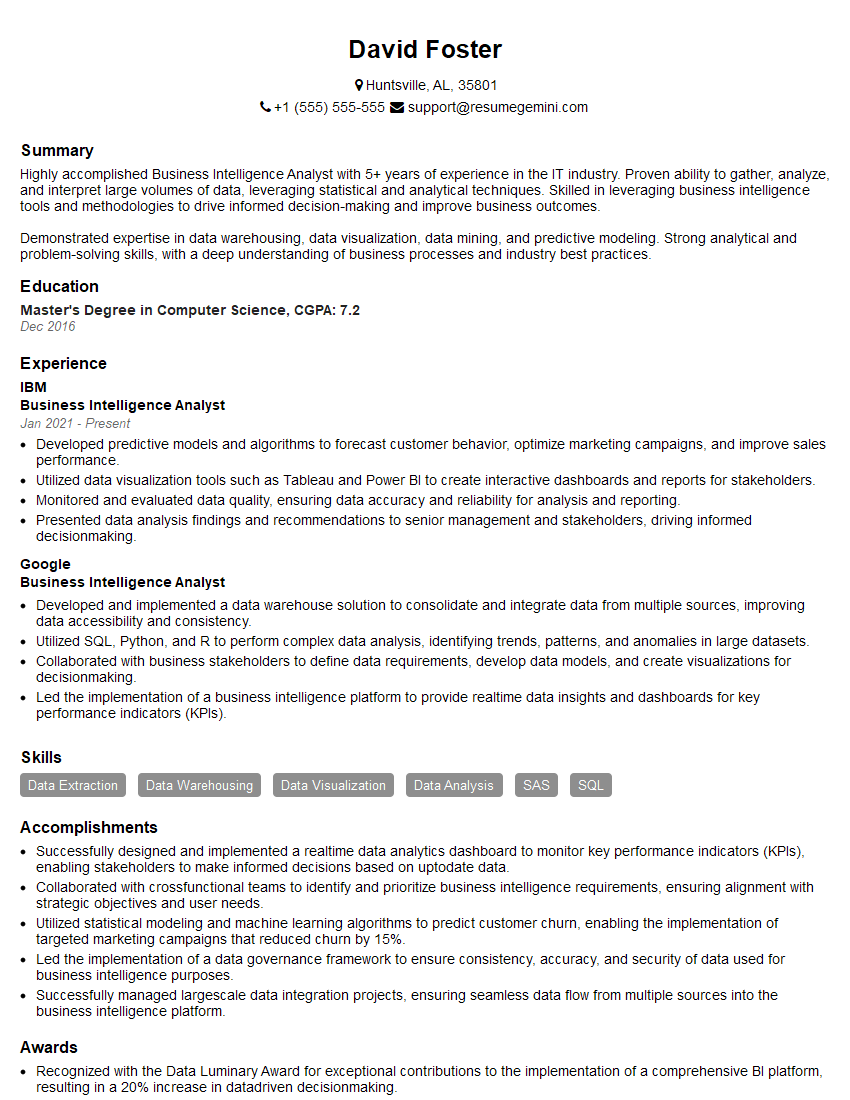

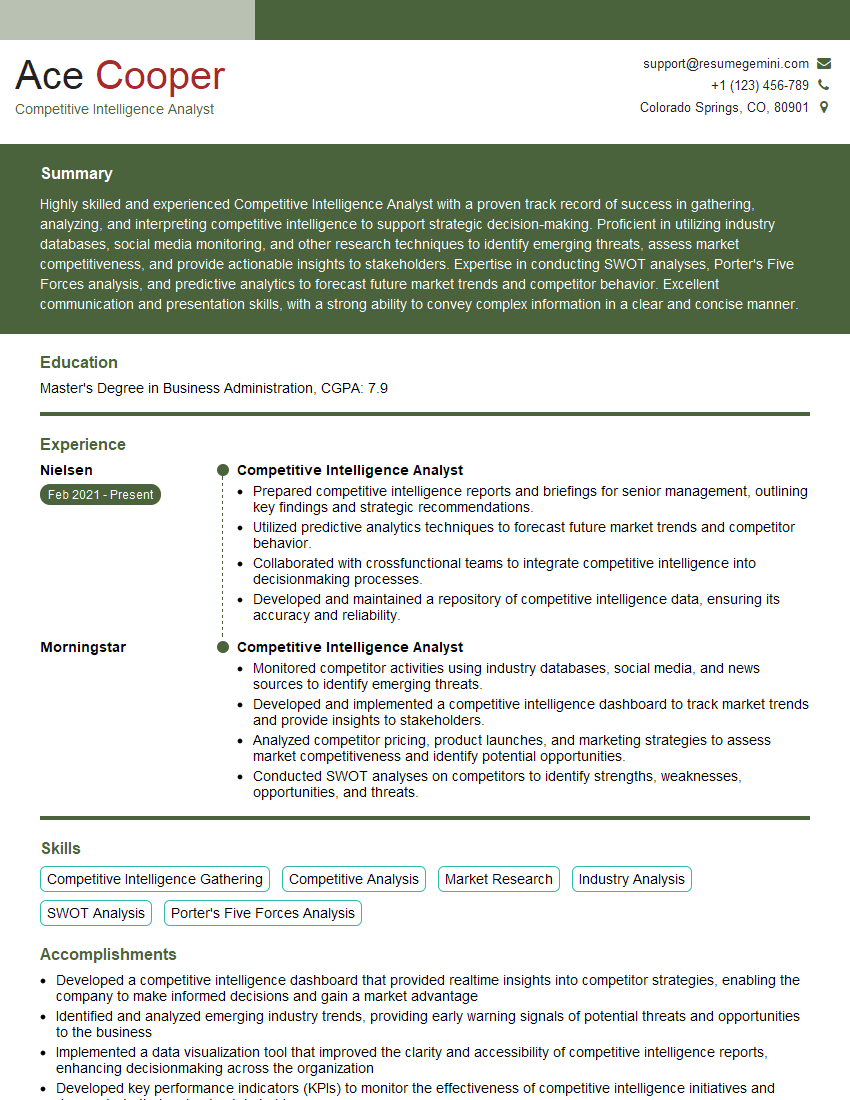

Mastering Demographic and Market Research opens doors to exciting career opportunities in diverse fields, offering high earning potential and intellectual stimulation. A strong understanding of these techniques is crucial for success in roles requiring data-driven decision-making. To significantly boost your job prospects, crafting an ATS-friendly resume is essential. ResumeGemini can help you build a powerful, impactful resume that highlights your skills and experience effectively. We offer examples of resumes tailored to the Demographic and Market Research field to guide you. Invest time in creating a compelling resume – it’s your first impression with potential employers.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

I Redesigned Spongebob Squarepants and his main characters of my artwork.

https://www.deviantart.com/reimaginesponge/art/Redesigned-Spongebob-characters-1223583608

IT gave me an insight and words to use and be able to think of examples

Hi, I’m Jay, we have a few potential clients that are interested in your services, thought you might be a good fit. I’d love to talk about the details, when do you have time to talk?

Best,

Jay

Founder | CEO