Unlock your full potential by mastering the most common Financial Modeling and Feasibility Studies interview questions. This blog offers a deep dive into the critical topics, ensuring you’re not only prepared to answer but to excel. With these insights, you’ll approach your interview with clarity and confidence.

Questions Asked in Financial Modeling and Feasibility Studies Interview

Q 1. Explain the difference between a discounted cash flow (DCF) and a leveraged buyout (LBO) model.

Both Discounted Cash Flow (DCF) and Leveraged Buyout (LBO) models are valuation techniques used in finance, but they differ significantly in their approach and application. A DCF model projects a company’s future cash flows and discounts them back to their present value to estimate the company’s intrinsic value. It’s a fundamental tool for valuing companies, especially for long-term investments. Think of it like calculating the present value of a stream of future rental payments from a property. An LBO model, on the other hand, focuses on valuing a company specifically from the perspective of a leveraged buyout transaction. It projects the cash flows of a target company after accounting for the debt financing used to acquire it. It primarily answers the question, ‘Can we make money by using borrowed capital to purchase a company and improve its performance?’

The key difference lies in the financing structure. A DCF model assumes a more traditional financing structure, while an LBO model explicitly incorporates debt financing and the impact of financial leverage. The DCF model provides an estimate of the company’s inherent worth, regardless of how it’s financed, while the LBO model assesses the potential return on investment for a specific leveraged acquisition strategy.

Q 2. What are the key assumptions in a DCF model?

The key assumptions in a DCF model are critical to its accuracy and heavily influence the valuation outcome. These include:

- Revenue Growth Rate: Projecting future revenue is crucial. This requires careful analysis of market trends, historical performance, and the company’s competitive landscape. A high revenue growth assumption leads to a higher valuation, and vice-versa.

- Profit Margins: The percentage of revenue that translates into profit directly impacts the cash flows. Assumptions about cost structure, pricing power, and operational efficiency are vital here.

- Discount Rate (Weighted Average Cost of Capital – WACC): This represents the opportunity cost of investing in the company. A higher discount rate lowers the present value of future cash flows, leading to a lower valuation. The WACC calculation involves assumptions about the company’s cost of equity and debt, as well as the capital structure.

- Terminal Growth Rate: This assumption relates to the long-term growth of the company beyond the explicit forecast period. It’s often a modest and sustainable rate to reflect the company’s eventual maturity.

- Capital Expenditures (CAPEX) and Working Capital (WC): These represent investments in property, plant, and equipment, as well as the necessary funding for short-term assets. Accurate projections are needed for a reliable cash flow statement.

In practice, sensitivity analysis is crucial. We vary these key assumptions to assess their impact on the valuation, providing a range of possible outcomes rather than a single point estimate. This illustrates the uncertainty inherent in the projections.

Q 3. How do you handle negative cash flows in a DCF model?

Negative cash flows in a DCF model are a reality for many companies, especially during periods of growth or restructuring. Ignoring them is not an option. There are several ways to handle them:

- Explicitly Model Them: The most straightforward approach is to incorporate negative cash flows directly into the projection, accurately reflecting the company’s operational reality.

- Adjust the Discount Rate: When negative cash flows are significant or persistent, a higher discount rate may be used to reflect the increased risk associated with the investment.

- Sensitivity Analysis: This is vital to assess the impact of negative cash flows on the overall valuation. We can examine scenarios with varying durations and magnitudes of negative cash flows.

- Assess the Underlying Reasons: Understanding the drivers of negative cash flows (e.g., high investment in R&D, market downturn) is crucial for effective modeling and interpretation.

It’s important to note that if a company consistently generates negative free cash flow, it may indicate significant challenges, raising questions about the viability of the business itself. The DCF model should be used in conjunction with other valuation methods and qualitative analysis in such circumstances.

Q 4. What are the limitations of a DCF model?

While DCF models are powerful tools, they have limitations:

- Sensitivity to Assumptions: The model’s output is highly sensitive to the input assumptions. Small changes in growth rates, discount rates, or terminal growth rates can significantly alter the valuation.

- Difficulty in Forecasting: Accurately projecting future cash flows, especially over long periods, is inherently challenging. Unforeseen market events, technological disruptions, or changes in competition can render the projections inaccurate.

- Terminal Value Estimation: The terminal value, representing the value of the company beyond the explicit forecast period, often forms a large part of the overall valuation. The accuracy of this estimation is therefore crucial, yet also inherently uncertain.

- Ignoring Qualitative Factors: DCF models primarily focus on quantitative data and may not fully capture qualitative factors such as management quality, competitive advantages, or intangible assets, which can significantly impact a company’s true worth.

Therefore, it is crucial to use DCF models in conjunction with other valuation methods and a thorough qualitative analysis to obtain a more comprehensive understanding of a company’s value. Thinking of it as one piece of the puzzle rather than the entire solution is key.

Q 5. Describe your experience building and using LBO models.

I have extensive experience in building and utilizing LBO models across various industries. In my previous role at [Previous Company Name], I was involved in several LBO valuations, including [mention a specific example, e.g., the analysis of a potential acquisition of a manufacturing company]. This involved developing detailed financial projections, including revenue growth, operating expenses, capital expenditures, and working capital. My modeling incorporated different debt structures, varying levels of equity contributions, and sensitivity analysis to identify the optimal financial strategy. The models provided critical inputs for the investment committee’s decision-making process, assisting in determining the appropriate acquisition price and financing terms.

I am proficient in using Excel and specialized financial modeling software [mention any software, e.g., Argus, Capital IQ] to build robust and accurate LBO models. I’ve also participated in due diligence processes, utilizing these models to assess the financial health and future prospects of target companies. Furthermore, I am comfortable working with complex debt structures such as mezzanine financing and preferred equity, and I can integrate these aspects seamlessly into my LBO models. My experience extends to presenting the results of my analysis to senior management, effectively communicating complex financial concepts in a clear and concise manner.

Q 6. What are the key drivers of value in an LBO?

The key drivers of value in an LBO are centered around enhancing the target company’s performance and leveraging the effects of debt financing.

- Multiple Expansion: Increasing the company’s EBITDA multiple at exit, achieved through improved operational performance, is a primary driver of returns. This involves strategies such as cost reduction, revenue growth, and increased profitability.

- Debt Paydown: Efficiently paying down debt through strong cash flows boosts the equity value at exit by reducing the overall leverage.

- Operational Improvements: Implementing operational efficiencies, streamlining processes, and enhancing the management team lead to improved financial performance and higher exit multiples.

- Financial Leverage: Using debt to finance a significant portion of the acquisition amplifies returns, but also carries higher financial risk. Careful consideration of debt levels is essential.

- Tax Benefits: Interest expense on debt is tax deductible, providing a further advantage to LBO transactions. This reduces tax burden and increases after-tax cash flow.

The synergy between these drivers is critical. For example, successful operational improvements leading to higher EBITDA will contribute to both multiple expansion and accelerated debt paydown, resulting in significant value creation.

Q 7. How do you assess the feasibility of a project?

Assessing project feasibility is a multifaceted process involving rigorous analysis and careful consideration of various factors. My approach involves a structured framework that incorporates the following steps:

- Market Analysis: This begins with a thorough examination of market size, demand, competition, and pricing dynamics. This helps determine the potential market for the project’s output and its ability to generate sufficient revenue.

- Technical Feasibility: This step assesses the technical aspects of the project, such as the availability of necessary technology, resources, and expertise. Are the technologies proven and reliable? Are there any technical hurdles that need to be overcome?

- Financial Feasibility: This is a critical component, often involving DCF modeling, sensitivity analysis, and break-even analysis. This helps determine whether the project can generate sufficient returns to justify the investment and meet its financial objectives. Key aspects include projected cash flows, profitability, return on investment (ROI), and internal rate of return (IRR).

- Legal and Regulatory Compliance: We must ensure compliance with all relevant laws and regulations. This may involve permits, licenses, environmental impact assessments, and other legal considerations.

- Risk Assessment: Identifying and evaluating potential risks is paramount. This encompasses market risks, technological risks, financial risks, and operational risks. We develop mitigation strategies to address identified risks.

- Sensitivity Analysis: Testing the project’s robustness against various scenarios by varying key assumptions (e.g., revenue, costs, interest rates) is a powerful tool. It offers valuable insight into the potential impact of uncertainty on the project’s success.

Finally, a comprehensive feasibility study will consolidate all findings, including recommendations. This helps stakeholders make informed decisions about whether to proceed with the project, allowing them to weigh the potential benefits against the potential risks involved.

Q 8. What are the key financial metrics used in feasibility studies?

Key financial metrics in feasibility studies assess the viability of a project. They help determine if a project is likely to be profitable and sustainable. These metrics are used to make informed decisions about resource allocation and investment.

- Net Present Value (NPV): This measures the difference between the present value of cash inflows and cash outflows over a period of time. A positive NPV indicates profitability.

- Internal Rate of Return (IRR): The discount rate that makes the NPV of a project zero. A higher IRR suggests a more attractive investment.

- Payback Period: The time it takes for a project to recoup its initial investment. Shorter payback periods are generally preferred.

- Profitability Index (PI): The ratio of the present value of future cash flows to the initial investment. A PI greater than 1 indicates a profitable project.

- Return on Investment (ROI): A simple metric showing the percentage return on the investment. It’s calculated as (Gain from Investment – Cost of Investment) / Cost of Investment.

- Discounted Cash Flow (DCF): A valuation method used to estimate the value of an investment based on its expected future cash flows. It’s crucial for long-term projects.

- Break-Even Analysis: Determines the point where total revenue equals total costs, indicating when a project becomes profitable.

For example, when evaluating a new restaurant, we’d use NPV to determine if the projected profits outweigh the initial investment and ongoing costs. The payback period would tell us how quickly we can expect to recoup the setup costs.

Q 9. Explain the concept of sensitivity analysis in financial modeling.

Sensitivity analysis is a vital technique in financial modeling that assesses how changes in one or more input variables affect the output variables of a model. Think of it like testing the robustness of your project’s financials. It helps identify which variables are most critical to the project’s success and where risks might lie.

Imagine you’re building a model to forecast a company’s profit. You can run a sensitivity analysis to see how changes in sales volume, unit price, or variable costs impact the projected profit. This allows you to understand which factors have the biggest influence and to prioritize risk mitigation strategies accordingly. For example, if a small change in sales volume leads to a significant change in profit, it highlights the importance of securing sales contracts.

It is often visually presented through charts and graphs. This allows for easy identification of key variables impacting outputs. A simple example would be a chart showing the NPV’s response to various sales volumes. The steeper the slope, the more sensitive the NPV is to changes in sales.

Q 10. How do you perform scenario analysis in a financial model?

Scenario analysis in financial modeling involves creating multiple plausible future scenarios to assess how different sets of assumptions might impact the project’s outcome. Unlike sensitivity analysis, which looks at individual variable changes, scenario analysis considers multiple variables changing simultaneously.

For instance, a real estate development might consider a ‘best-case’ scenario (high sales, low interest rates), a ‘base-case’ scenario (moderate sales, average interest rates), and a ‘worst-case’ scenario (low sales, high interest rates). Each scenario involves adjustments to multiple input variables—sales price, interest rates, construction costs, etc.—to simulate different market conditions.

The process involves: 1. Identifying key variables; 2. Defining realistic scenarios; 3. Adjusting input variables based on each scenario; 4. Running the model under each scenario; 5. Comparing the results across scenarios. This provides a more holistic view of potential outcomes and associated risks.

Q 11. What is the purpose of a sensitivity table?

A sensitivity table is a visual representation of the results from a sensitivity analysis. It systematically displays how changes in individual input variables affect a specific output variable (like NPV or IRR). It’s basically a summary that simplifies interpreting the impact of various factors.

The table usually shows the output variable’s value under various input variable scenarios, typically expressed as percentages above and below a baseline. This helps to quickly identify variables which significantly influence the output. For example, a sensitivity table could show how changes of +/- 10%, 20% in sales volume affect the NPV of a project.

This table is extremely useful in communicating complex relationships to stakeholders. It helps highlight critical factors and inform decision making by illustrating areas of high risk and uncertainty. It avoids ambiguity in reporting and allows a clear view of variables’ impact.

Q 12. What are the common valuation multiples used in financial modeling?

Valuation multiples are ratios used to estimate a company’s value based on its market data or financial performance relative to comparable companies. They provide a quick benchmark for comparison.

- Price-to-Earnings Ratio (P/E): Market price per share divided by earnings per share. Shows how much investors are willing to pay for each dollar of earnings.

- Price-to-Sales Ratio (P/S): Market capitalization divided by revenue. Useful for companies with negative earnings or volatile profits.

- Price-to-Book Ratio (P/B): Market capitalization divided by book value of equity. Indicates how much investors are willing to pay for each dollar of net assets.

- Enterprise Value-to-EBITDA (EV/EBITDA): Enterprise value (market cap + debt – cash) divided by earnings before interest, taxes, depreciation, and amortization. Widely used for comparing companies across industries.

- Enterprise Value-to-Revenue (EV/Revenue): Enterprise value divided by revenue. Similar to P/S but considers debt and cash.

The choice of multiple depends on the industry, stage of the company’s life cycle, and availability of data. For example, P/E is common for mature, profitable companies, while P/S is often used for high-growth technology firms with little or no current profit.

Q 13. How do you choose the appropriate discount rate for a DCF?

Choosing the appropriate discount rate for a Discounted Cash Flow (DCF) analysis is crucial because it significantly impacts the valuation. The discount rate reflects the risk associated with the investment—higher risk means a higher discount rate.

The most common approach is to use the Weighted Average Cost of Capital (WACC) as the discount rate. This is because it represents the minimum return an investor expects to earn considering the company’s financing mix (debt and equity). Other methods include using a hurdle rate (the minimum acceptable rate of return set by management) or a risk-adjusted discount rate based on comparable investments.

When selecting a discount rate, careful consideration should be given to the risk profile of the project and the overall economic climate. In practice, it often involves reviewing comparable transactions to understand industry standards, as well as looking at the firm’s capital structure and current interest rates.

Q 14. Explain the concept of weighted average cost of capital (WACC).

The Weighted Average Cost of Capital (WACC) represents the average rate a company expects to pay to finance its assets. It’s a crucial metric in financial modeling, especially in DCF analysis where it acts as the discount rate.

WACC is calculated by weighting the cost of each capital source (debt and equity) by its proportion in the company’s capital structure. The formula is:

WACC = (E/V) * Re + (D/V) * Rd * (1 - Tc)Where:

- E = Market value of equity

- D = Market value of debt

- V = E + D (Total market value of the company)

- Re = Cost of equity

- Rd = Cost of debt

- Tc = Corporate tax rate

The cost of equity is often determined using the Capital Asset Pricing Model (CAPM), while the cost of debt is typically the yield to maturity on the company’s outstanding debt. Understanding WACC helps determine the minimum return needed to satisfy investors and is essential for evaluating investment projects.

Q 15. How do you calculate WACC?

The Weighted Average Cost of Capital (WACC) represents the average rate a company expects to pay to finance its assets. It’s a crucial metric used in discounted cash flow (DCF) analysis to determine the present value of future cash flows and evaluate investment opportunities. Think of it as the blended cost of all the sources of funding a company uses, each weighted by its proportion in the company’s capital structure.

The formula for calculating WACC is:

WACC = (E/V) * Re + (D/V) * Rd * (1 - Tc)Where:

E= Market value of equityD= Market value of debtV= E + D (Total value of the company)Re= Cost of equityRd= Cost of debtTc= Corporate tax rate

Example: Imagine a company with $10 million in equity and $5 million in debt. Its cost of equity is 10%, its cost of debt is 5%, and its corporate tax rate is 30%. The WACC would be calculated as follows:

WACC = (10/15) * 0.10 + (5/15) * 0.05 * (1 - 0.30) = 0.0667 or 6.67%This means the company’s average cost of financing its assets is 6.67%. This number is then used to discount future cash flows in various financial analyses. Accurate calculation requires careful consideration of market values for equity and debt, and a realistic estimation of the cost of equity (often using the Capital Asset Pricing Model – CAPM).

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. What are the key components of a three-statement model?

A three-statement model is a core financial modeling tool that interlinks the Income Statement, Balance Sheet, and Statement of Cash Flows. It’s a dynamic model where changes in one statement impact the others, providing a holistic view of a company’s financial health and performance.

- Income Statement: Shows the company’s revenues, expenses, and resulting profit or loss over a period (e.g., a year or a quarter). It follows the basic accounting equation: Revenue – Expenses = Net Income

- Balance Sheet: Presents a snapshot of the company’s assets, liabilities, and equity at a specific point in time. It adheres to the accounting equation: Assets = Liabilities + Equity

- Statement of Cash Flows: Tracks the movement of cash into and out of the company over a period. It categorizes cash flows into operating, investing, and financing activities.

The beauty of the three-statement model lies in their interconnectedness. For example, net income from the Income Statement flows into retained earnings on the Balance Sheet, while changes in working capital affect cash flow on the Statement of Cash Flows.

Q 17. What is the purpose of a three-statement model?

The primary purpose of a three-statement model is to forecast a company’s financial performance under various scenarios. It’s used for a multitude of purposes, including:

- Valuation: Estimating the intrinsic value of a company for investment decisions (e.g., mergers and acquisitions).

- Financial Planning and Forecasting: Projecting future financial needs and performance based on different assumptions.

- Sensitivity Analysis: Analyzing the impact of changes in key assumptions (e.g., sales growth, interest rates) on the company’s financial position.

- Investment Decisions: Evaluating the financial viability of new projects or investments.

- Credit Analysis: Assessing a company’s creditworthiness for lenders.

- Strategic Planning: Guiding the development of long-term strategic plans based on financial projections.

Essentially, it acts as a ‘what-if’ tool, allowing businesses and investors to understand the potential financial outcomes of different strategies and market conditions.

Q 18. How do you model debt repayment in a financial model?

Modeling debt repayment involves accurately reflecting the terms of a company’s debt obligations in the financial model. This typically includes specifying the principal repayment schedule, interest payments, and any associated fees. The method used depends on the nature of the debt.

Common methods include:

- Amortization Schedule: For loans with fixed payments, an amortization schedule is used to calculate the principal and interest components of each payment. This schedule is then incorporated into the financial model to accurately reflect the reduction in debt over time.

- Bullet Loan: For bullet loans (where the principal is repaid in a lump sum at maturity), the interest expense is modeled as a periodic expense, and the principal repayment is modeled as a large cash outflow at the end of the loan term.

- Other Debt Instruments: More complex debt instruments (e.g., convertible bonds, bonds with sinking funds) require specific modeling approaches reflecting the terms of the instruments.

Example: If a company has a $1 million loan with a 5% interest rate and a 5-year term, the model should include annual interest expense calculations and a detailed amortization schedule showing the principal reduction over the five years. These values are then reflected in the cash flow statement and balance sheet.

Q 19. How do you model working capital in a financial model?

Working capital represents the difference between a company’s current assets (like cash, accounts receivable, and inventory) and its current liabilities (like accounts payable and short-term debt). Modeling working capital accurately is crucial as it directly impacts cash flow and profitability.

Common methods include:

- Percentage of Sales Method: This approach assumes that working capital items (e.g., inventory, accounts receivable, accounts payable) grow proportionally to sales. For example, if inventory is typically 10% of sales, the model will project inventory levels based on projected sales.

- Days Sales Outstanding (DSO), Days Inventory Outstanding (DIO), Days Payable Outstanding (DPO): These metrics are often used to manage working capital. Modeling them involves projecting the number of days it takes to collect receivables, sell inventory, and pay suppliers. Changes in these metrics directly affect working capital levels.

- Detailed Approach: A more detailed approach involves explicitly forecasting each current asset and liability item based on individual assumptions and historical data. This method is more accurate but requires significantly more detail.

Example: If a company’s accounts receivable are typically 30 days of sales, and sales are projected to increase, the model should automatically increase projected accounts receivable to reflect this growth. Changes in accounts receivable then affect the cash flow statement (as collections are a cash inflow).

Q 20. Explain the concept of pro forma financial statements.

Pro forma financial statements are projected financial statements based on a set of assumptions. They are not actual historical statements but rather predictions of what the company’s financials might look like in the future. They are crucial for planning, decision-making, and obtaining financing.

They are typically constructed using a three-statement model, with assumptions about key drivers such as sales growth, operating margins, and capital expenditures. They provide a comprehensive picture of the company’s future financial health and help evaluate the viability of various strategic initiatives.

Example: A company might create pro forma financial statements to show investors what its financials would look like if it launched a new product line. This would involve projecting increased revenue, expenses related to the new product, and any associated investments. The pro forma statements would demonstrate the potential impact on profitability and cash flow.

Q 21. How do you handle different depreciation methods in a model?

Different depreciation methods result in different expense recognition patterns, which in turn affect net income, taxes, and cash flow. Financial models must accurately reflect the chosen method.

Common depreciation methods and their implementation in a model:

- Straight-Line Depreciation: This method allocates the asset’s cost evenly over its useful life. The annual depreciation expense is calculated as (Asset Cost – Salvage Value) / Useful Life. This is relatively simple to implement in a spreadsheet or financial modeling software.

- Accelerated Depreciation (e.g., Double-Declining Balance): These methods accelerate depreciation expense in the early years of an asset’s life. The formulas are more complex but readily available in most spreadsheet software or financial modeling packages.

- Units of Production: This method depreciates an asset based on its actual usage. The model needs to track the units produced each period to calculate the depreciation expense accurately.

Implementation in a Model: The selected depreciation method should be clearly stated, and the model should consistently apply that method to all relevant assets. Depreciation expense should be calculated for each period and reflected in the income statement, affecting net income, taxes, and ultimately, the cash flow statement.

Q 22. What are the key risks associated with financial modeling?

Financial modeling, while powerful, is susceptible to several key risks. The most significant stem from the inherent limitations of using simplified representations of complex real-world phenomena.

- Data inaccuracy: Garbage in, garbage out. Models are only as good as the data they’re fed. Inaccurate or incomplete data will inevitably lead to flawed results. For example, using outdated market research or incorrectly estimating operating expenses can severely skew projections.

- Model misspecification: This refers to using an inappropriate model for the situation. For instance, using a linear model to project exponential growth would yield inaccurate predictions.

- Assumption risk: Financial models rely heavily on assumptions – regarding future growth rates, market conditions, and more. The validity of these assumptions greatly influences the model’s output. Overly optimistic assumptions can lead to unrealistic projections.

- Overfitting: A model might fit the historical data perfectly but fail to predict future trends accurately. This is often a result of incorporating too many variables or focusing solely on past performance without considering external factors.

- User error: Errors in model building, data entry, or interpretation can lead to incorrect conclusions. This is often mitigated by thorough review and testing.

Q 23. How do you ensure the accuracy and reliability of your models?

Accuracy and reliability are paramount in financial modeling. I employ a multi-faceted approach to ensure this.

- Data validation: I meticulously verify the source and accuracy of all input data. This involves cross-checking with multiple sources and applying statistical tests for outliers or inconsistencies.

- Sensitivity analysis: I systematically vary key assumptions (e.g., discount rates, growth rates) to understand their impact on the model’s output. This helps assess the robustness of the results and identify critical variables.

- Scenario planning: I develop multiple scenarios – best-case, base-case, and worst-case – to explore a range of possible outcomes and quantify the associated risks. This provides a more holistic view than relying on a single projection.

- Peer review: I always have my work reviewed by a colleague. A fresh pair of eyes can often spot errors or biases I might have missed.

- Model documentation: Comprehensive documentation is crucial. It explains the model’s structure, assumptions, data sources, and limitations. This transparency is essential for both internal understanding and external scrutiny.

For example, in a recent project forecasting revenue for a new SaaS product, I used Monte Carlo simulations to model the uncertainty in customer acquisition costs and churn rates, providing a more accurate probabilistic forecast than a deterministic model would have.

Q 24. Explain your experience with different financial modeling software.

I’m proficient in several financial modeling software packages. My expertise includes Excel, with advanced knowledge of its financial functions, VBA scripting for automation, and data visualization tools. I’ve also worked extensively with dedicated financial modeling software such as (mention specific software like) and (mention specific software like) for larger, more complex projects. Each tool has its strengths. Excel offers flexibility and accessibility, while specialized platforms provide advanced features for scenario planning, risk analysis, and reporting.

For example, I used VBA in Excel to automate the process of generating monthly financial statements based on various input parameters, which greatly improved efficiency and reduced the risk of manual errors.

Q 25. How do you handle unexpected changes or errors during the modeling process?

Unexpected changes and errors are inevitable in the modeling process. My approach involves a combination of proactive measures and reactive problem-solving.

- Version control: I maintain detailed version control using cloud storage or collaborative software, ensuring that I can easily revert to previous versions if errors are detected.

- Error tracking: When errors occur, I meticulously document the nature of the error, its impact on the model, and the steps taken to correct it. This is essential for learning from mistakes and improving future models.

- Robust model design: I build models with error-checking mechanisms incorporated, like data validation rules and cross-checks within the model itself. This helps detect and identify errors early on.

- Agile approach: I prefer to work iteratively, testing and refining the model as I go, rather than building a complete model at once. This makes it easier to identify and address problems in the early stages.

- Communication: I proactively communicate any significant changes or errors to stakeholders, explaining the impact and the corrective actions being taken. Transparency and open communication are crucial in maintaining trust and confidence.

Q 26. Describe a time you had to make a difficult decision based on financial modeling.

In a previous role, I was tasked with modeling the financial implications of a potential acquisition. The initial model suggested a positive net present value (NPV), but a thorough sensitivity analysis revealed that the deal’s success was highly sensitive to integration costs and projected synergies. The initial projections had underestimated these risks.

The difficult decision was whether to proceed with the acquisition despite the identified risks. After presenting a revised model highlighting these uncertainties and exploring various scenarios, we ultimately decided against the acquisition, opting to focus on organic growth. This decision, though difficult, ultimately proved to be the right one, as subsequent market shifts validated our concerns.

Q 27. How do you communicate complex financial information to non-financial audiences?

Communicating complex financial information to non-financial audiences requires clear, concise, and engaging communication. I avoid jargon and technical terms whenever possible.

- Visual aids: Charts, graphs, and other visuals are extremely effective in conveying key insights. A simple bar chart illustrating revenue growth can be much more impactful than a lengthy paragraph of numbers.

- Analogies and metaphors: Using relatable examples can help illustrate complex concepts. For example, I might explain Net Present Value (NPV) as the “today’s worth” of future profits.

- Storytelling: Framing the financial information within a narrative context can make it more engaging and memorable.

- Focus on key takeaways: I identify the most critical pieces of information and emphasize them.

- Interactive presentations: Using interactive dashboards or presentations allows the audience to explore the data at their own pace and ask clarifying questions.

Q 28. Walk me through your approach to creating a feasibility study for a new product launch.

My approach to creating a feasibility study for a new product launch is structured and comprehensive. It involves several key phases:

- Market research: This involves identifying the target market, assessing its size and growth potential, analyzing competitor landscape, and evaluating customer needs and preferences.

- Product definition: A clear definition of the product, including its features, functionality, and target market, is crucial.

- Financial projections: I develop detailed financial projections, including revenue forecasts, cost estimates, profit margins, and cash flow analysis. This typically involves various scenarios to consider uncertainty.

- Investment analysis: I conduct a thorough investment analysis, assessing the initial capital requirements, potential returns, payback period, and internal rate of return (IRR). I also calculate NPV, considering various discount rates.

- Risk assessment: A comprehensive risk assessment is undertaken to identify potential challenges, such as market competition, technological disruptions, or regulatory hurdles, and outline mitigation strategies.

- Sensitivity analysis: I perform sensitivity analysis to assess the impact of key assumptions on the project’s financial viability.

- Go/No-Go decision: Based on the findings, I provide a clear recommendation, weighing the potential benefits against the risks and outlining a decision-making framework for the stakeholders.

Throughout the process, collaboration with various stakeholders – marketing, engineering, sales – is essential to ensure the feasibility study accurately reflects the realities of the product launch. This collaborative process not only provides more accurate data but also fosters buy-in from the involved teams.

Key Topics to Learn for Financial Modeling and Feasibility Studies Interview

- Discounted Cash Flow (DCF) Analysis: Understanding the core principles, including calculating Net Present Value (NPV) and Internal Rate of Return (IRR), and their application in project valuation.

- Sensitivity Analysis & Scenario Planning: Practical application of these techniques to assess project risk and uncertainty; interpreting results and communicating findings effectively.

- Capital Budgeting Techniques: Mastering methods like Payback Period, Profitability Index, and their use in investment decision-making.

- Financial Statement Modeling: Building interconnected financial statements (Income Statement, Balance Sheet, Cash Flow Statement) to project future performance and assess financial health.

- Valuation Methods: Understanding and applying various valuation methodologies beyond DCF, such as comparable company analysis and precedent transactions.

- Feasibility Study Components: Knowing the key elements of a comprehensive feasibility study, including market analysis, technical analysis, financial analysis, and risk assessment.

- Data Analysis & Interpretation: Proficiency in using data analysis tools and techniques to extract meaningful insights from financial data and support your conclusions.

- Communication & Presentation Skills: Clearly and concisely articulating complex financial concepts to both technical and non-technical audiences.

- Software Proficiency: Demonstrating competency with relevant financial modeling software (e.g., Excel, specialized financial modeling platforms).

- Problem-Solving & Critical Thinking: Approaching complex financial problems with a structured and analytical mindset, identifying key assumptions and limitations.

Next Steps

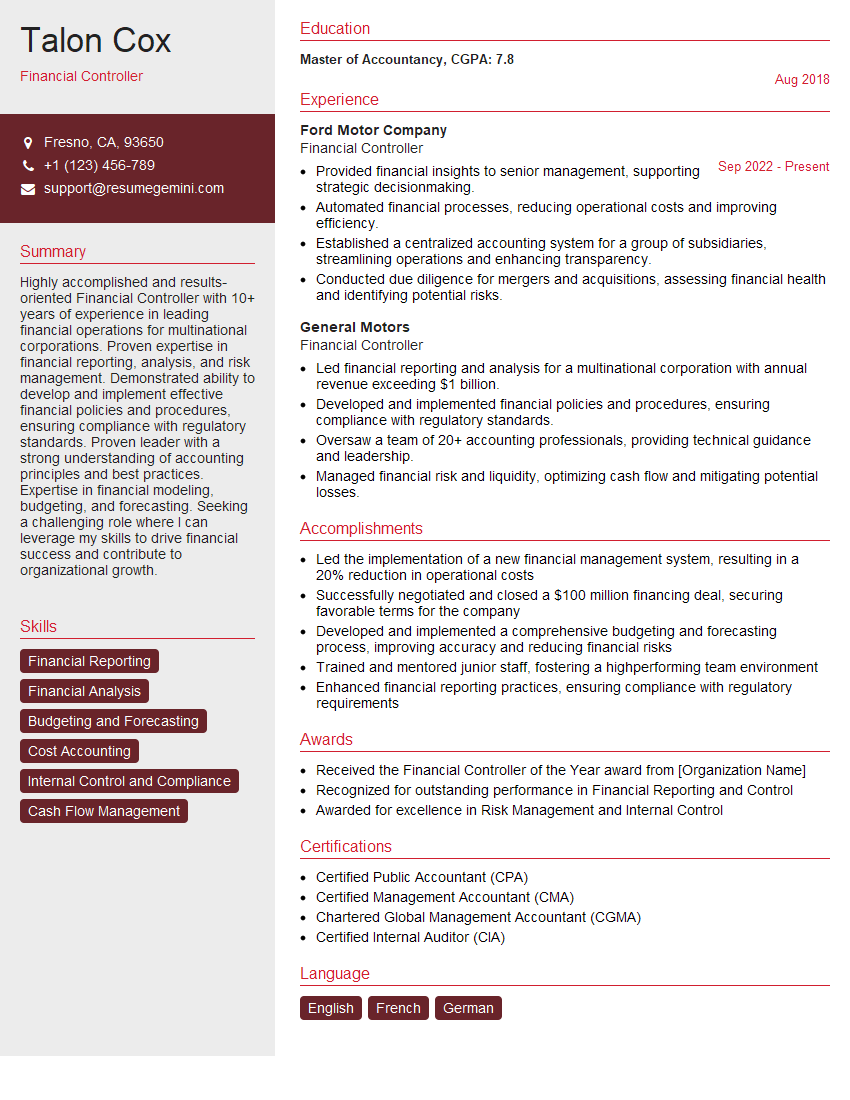

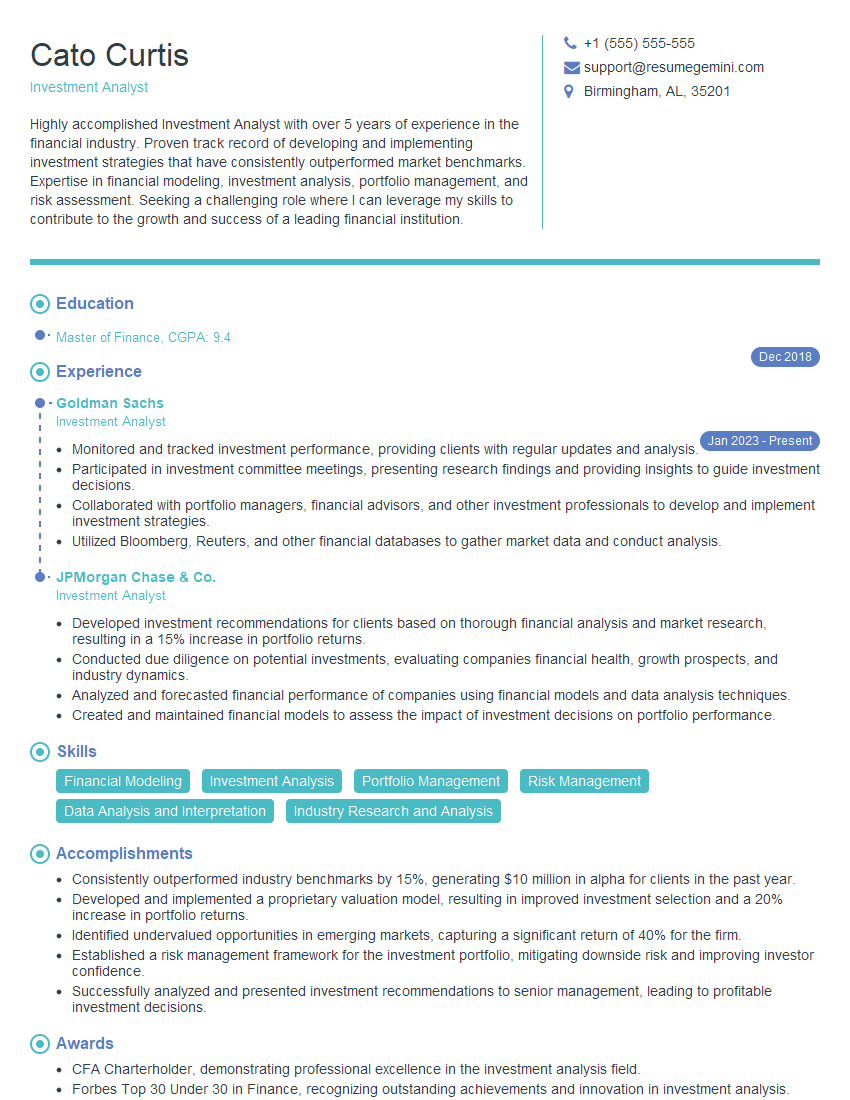

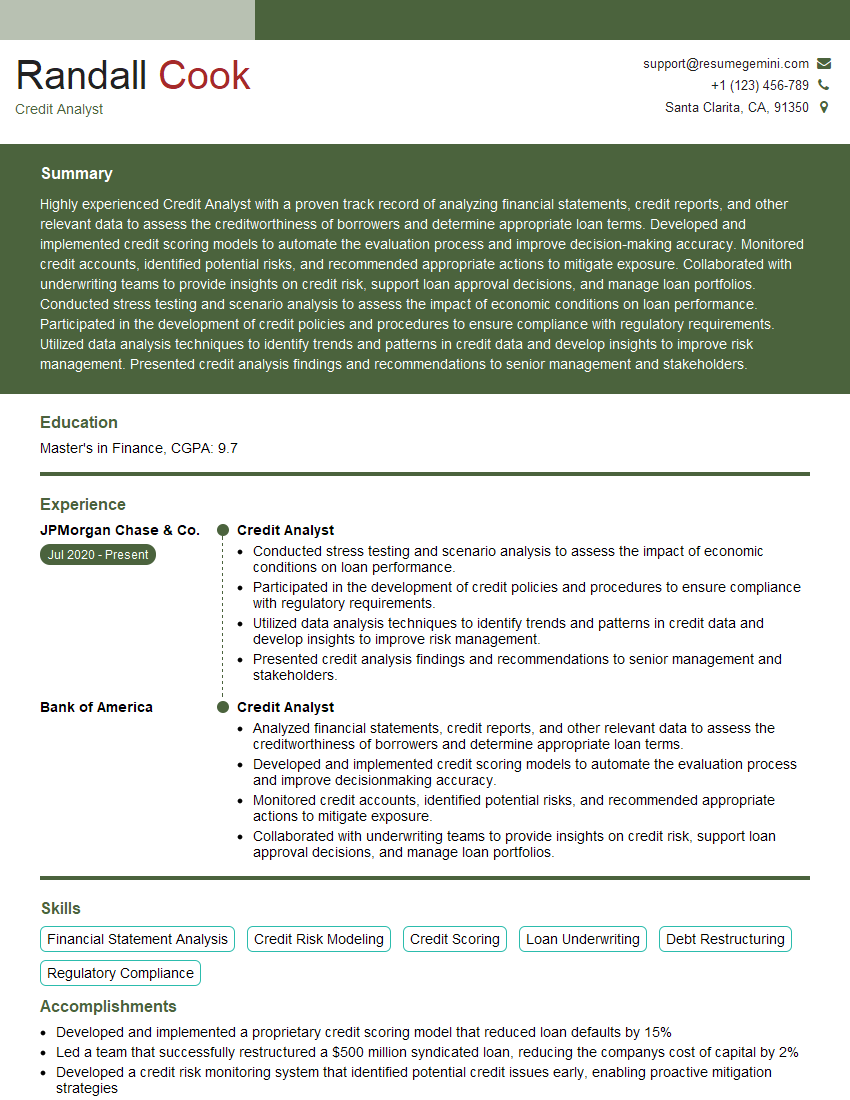

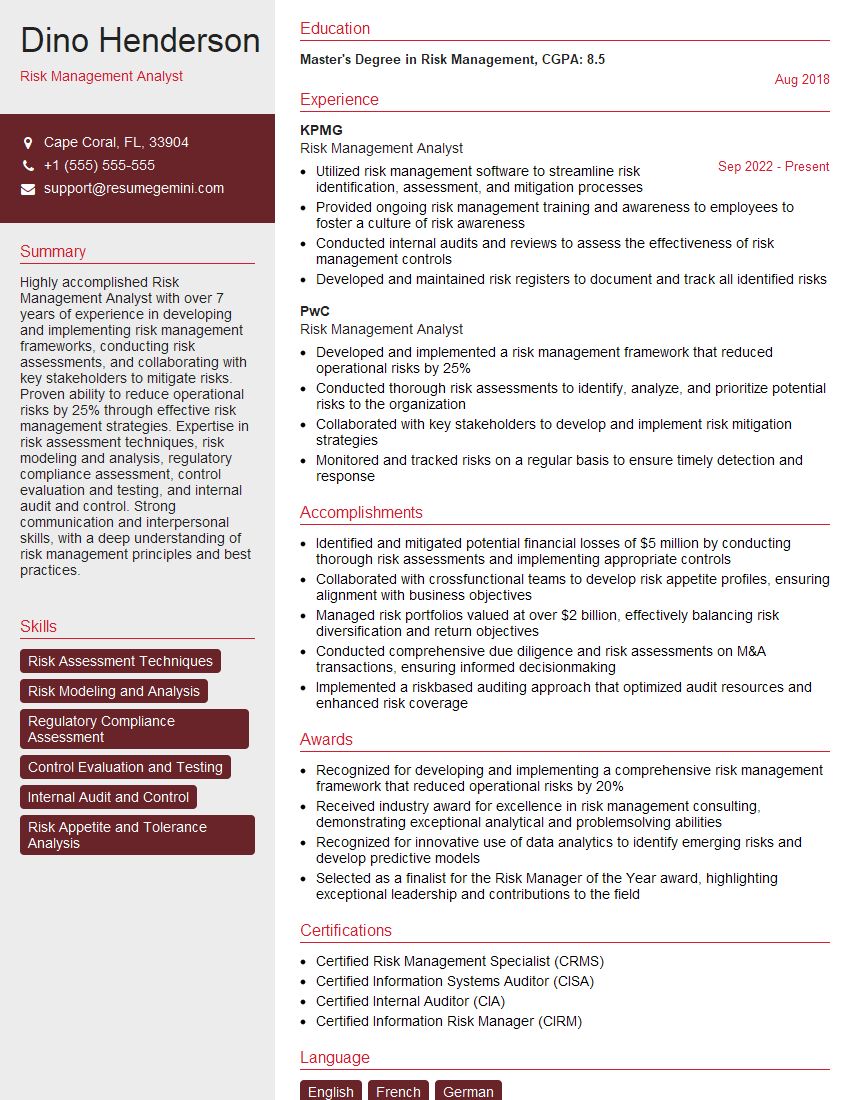

Mastering Financial Modeling and Feasibility Studies is crucial for career advancement in finance, opening doors to roles with greater responsibility and higher earning potential. An ATS-friendly resume is your key to unlocking these opportunities. It needs to showcase your skills and experience effectively to get noticed by recruiters. To build a truly impactful resume that highlights your expertise in Financial Modeling and Feasibility Studies, we encourage you to leverage ResumeGemini. ResumeGemini provides a user-friendly platform and valuable resources to help you craft a professional resume, and examples of resumes tailored to Financial Modeling and Feasibility Studies are available to guide you.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

I Redesigned Spongebob Squarepants and his main characters of my artwork.

https://www.deviantart.com/reimaginesponge/art/Redesigned-Spongebob-characters-1223583608

IT gave me an insight and words to use and be able to think of examples

Hi, I’m Jay, we have a few potential clients that are interested in your services, thought you might be a good fit. I’d love to talk about the details, when do you have time to talk?

Best,

Jay

Founder | CEO