The right preparation can turn an interview into an opportunity to showcase your expertise. This guide to Property Valuation and Assessment interview questions is your ultimate resource, providing key insights and tips to help you ace your responses and stand out as a top candidate.

Questions Asked in Property Valuation and Assessment Interview

Q 1. Explain the three approaches to property valuation (sales comparison, income capitalization, cost approach).

Property valuation employs three primary approaches: the Sales Comparison Approach, the Income Capitalization Approach, and the Cost Approach. Each offers a unique perspective on determining a property’s value, and appraisers often use a combination to arrive at a final estimate.

Sales Comparison Approach: This approach relies on analyzing recent sales of comparable properties. It’s like comparing the price of used cars – you look at similar models, mileage, and condition to estimate the value of the car you’re interested in. We identify similar properties that have recently sold, adjust for differences (e.g., size, location, features), and use those sales to estimate the subject property’s value.

Income Capitalization Approach: This method is best suited for income-producing properties like rental buildings or commercial spaces. It focuses on the property’s ability to generate income. Imagine a rental property; its value is directly linked to the rent it can command and the operating expenses. We estimate the property’s Net Operating Income (NOI) and apply a capitalization rate (Cap Rate) to determine value. We’ll delve deeper into NOI and Cap Rate later.

Cost Approach: This approach estimates value by determining the cost of replacing or reproducing the property as new, less depreciation. Think of it like building a new house; the cost of construction, plus the value of the land, minus any depreciation, provides an indication of the property’s worth. This is particularly useful for newer buildings or specialized properties where comparable sales data is limited.

Q 2. Describe the different types of depreciation and how they are considered in valuation.

Depreciation represents the loss in value of a property over time due to various factors. In property valuation, we consider three main types:

- Physical Deterioration: This refers to the wear and tear on a property due to age, use, and lack of maintenance. Think of peeling paint, a leaky roof, or worn-out carpets. This is a reduction in physical soundness and is often curable (repairable) or incurable (e.g., major structural issues).

- Functional Obsolescence: This occurs when a property’s features become outdated or inefficient relative to newer properties. For instance, a house without central air conditioning in a hot climate, or a small kitchen in a large home, would suffer from functional obsolescence. This can be curable (e.g., updating the kitchen) or incurable (e.g., a layout that can’t easily be improved).

- External Obsolescence: This is caused by factors outside the property itself, such as changes in the surrounding neighborhood. For example, a once-desirable area may suffer from increased crime, or a new highway may negatively impact the property’s quiet setting. This type is generally incurable.

In valuation, we estimate the amount of depreciation for each type and deduct it from the reproduction cost in the cost approach. The extent of depreciation significantly impacts the final estimated value.

Q 3. What are the key factors influencing property values in a given market?

Property values are influenced by a complex interplay of market forces. Key factors include:

- Location: This is arguably the most crucial factor. Proximity to amenities, schools, employment centers, and transportation greatly influences desirability and price.

- Market Conditions: Supply and demand, interest rates, and economic trends all significantly impact property values. A booming economy often leads to higher prices, while a recession may drive them down.

- Property Characteristics: Size, age, condition, features, and the overall quality of construction directly influence value. A well-maintained, updated property will generally command a higher price.

- Economic Factors: Local job market, population growth, and income levels play a role in determining demand and affordability.

- Government Regulations: Zoning laws, building codes, property taxes, and environmental regulations all impact property values.

- Interest Rates: Lower interest rates generally make financing more affordable, leading to increased demand and higher prices, while higher interest rates have the opposite effect.

Q 4. How do you identify and adjust for comparable sales in the sales comparison approach?

Identifying and adjusting for comparable sales is critical in the Sales Comparison Approach. It involves a systematic process:

- Identify Comparable Properties: Find properties that are similar to the subject property in terms of location, size, age, features, and condition. The more similar, the better the comparison. We typically aim for at least three to five comparables.

- Analyze Differences: Once comparables are selected, analyze how they differ from the subject property. These differences could be in size, age, condition, location, or features. We need to account for these differences quantitatively.

- Adjust for Differences: Adjust the sale prices of the comparables to reflect the identified differences. For example, if a comparable has a larger lot size than the subject property, we may subtract a certain dollar amount per square foot to account for that difference. This is often done using a percentage or dollar value adjustment based on market data.

- Reconcile Adjusted Prices: After making adjustments, the adjusted prices of the comparables should cluster around a central value. This final value becomes the estimated value of the subject property. This reconciliation process weighs the comparables based on quality, relevance, and reliability of information.

For example, if a comparable sold for $500,000 but had a larger living area than the subject property, we’d deduct a certain amount per square foot of the difference to get a more accurate adjusted price for comparison. The process requires market knowledge and professional judgment.

Q 5. Explain the concept of highest and best use.

Highest and Best Use is the most profitable, legally permissible, physically possible, and financially feasible use of a property. It’s the optimal use that maximizes the property’s value. It’s not necessarily the current use. For example, an old gas station on a busy corner might be worth more if it was redeveloped into a convenience store. The current use (gas station) isn’t the highest and best use if a higher value can be achieved through another use.

Determining the highest and best use requires careful analysis considering several factors such as zoning regulations, market demand, potential uses, construction costs, and projected returns. It’s a crucial concept in property valuation because it forms the basis for estimating the property’s value based on its potential rather than its current state.

Q 6. How do you calculate net operating income (NOI)?

Net Operating Income (NOI) represents the income generated by a property after deducting all operating expenses but before considering debt service (mortgage payments). It’s a key metric in the income capitalization approach.

The calculation is as follows:

NOI = Potential Gross Income (PGI) - Vacancy and Credit Loss - Operating Expenses

Let’s break down each component:

- Potential Gross Income (PGI): This is the total rental income the property could generate if fully occupied and at market rates.

- Vacancy and Credit Loss: This accounts for potential periods of vacancy and bad debts from tenants.

- Operating Expenses: These are ongoing expenses associated with maintaining the property. They can include property taxes, insurance, utilities, repairs, and maintenance.

For example, if a property has a PGI of $100,000, vacancy and credit loss of $5,000, and operating expenses of $25,000, the NOI would be: $100,000 – $5,000 – $25,000 = $70,000

Q 7. What is capitalization rate and how is it determined?

The capitalization rate (Cap Rate) is a fundamental concept in real estate investment. It represents the rate of return an investor would receive on a property based on its net operating income (NOI).

It’s calculated as follows:

Cap Rate = NOI / Property Value

The Cap Rate is expressed as a percentage and is used to estimate property value by rearranging the formula:

Property Value = NOI / Cap Rate

Determining the appropriate Cap Rate involves considering various factors, including market conditions, property type, risk, and the investor’s required rate of return. Cap rates are often derived from market data by analyzing the sale prices and NOI of comparable income-producing properties. A higher Cap Rate generally indicates a higher risk and a lower property value, while a lower Cap Rate suggests lower risk and higher property value.

For instance, if a property has an NOI of $70,000 and a market-derived Cap Rate of 7%, its estimated value would be $70,000 / 0.07 = $1,000,000

Q 8. Describe the different methods of estimating land value.

Estimating land value is crucial in property valuation, and several methods exist, each with its strengths and weaknesses. The choice of method often depends on data availability, property characteristics, and the purpose of the valuation.

- Sales Comparison Approach: This is the most common method. It involves analyzing recent sales of comparable properties (similar size, location, features) and adjusting their prices to reflect differences between the subject property and the comparables. For instance, if a comparable property sold for $100,000 and had a larger lot size than the subject property, we’d adjust the $100,000 downwards to account for this difference.

- Allocation Approach: This method involves determining the total value of the improved property (land and building) and then allocating a percentage to the land based on market-derived ratios. For example, if the total value of a property is $500,000 and land typically represents 20% of the total value in that area, the land value would be estimated at $100,000.

- Abstraction Approach: This involves deducting the depreciated value of the improvements from the total property value to arrive at the land value. This requires accurate estimates of both the total property value and the building’s depreciation. This approach is often used when demolition is a likely scenario.

- Income Capitalization Approach (for land only): While primarily used for the entire property, this can be adapted to estimate land value by capitalizing the land’s potential income. This is typically done for properties with high income-generating potential like commercial land.

It’s important to note that often a combination of these approaches is used to arrive at the most credible estimate of land value, providing a triangulation of results for a more robust valuation.

Q 9. What are the key elements of a comprehensive appraisal report?

A comprehensive appraisal report is a detailed document that provides a credible opinion of a property’s value. Key elements include:

- Identification of the Property: A complete legal description, address, and property characteristics.

- Client and Intended Users: Clearly stating who commissioned the appraisal and for what purpose.

- Scope of Work: Defining the appraisal’s objectives and the methods used.

- Data Collection and Analysis: Detailed research and analysis of comparable sales, market data, and property characteristics.

- Valuation Approaches and Reconciliation: Applying appropriate valuation methods (sales comparison, cost, income) and explaining how the final value was determined.

- Appraiser’s Qualifications and Certifications: Demonstrating the appraiser’s expertise and compliance with professional standards.

- Assumptions and Limiting Conditions: Transparency about any assumptions made and limitations of the appraisal.

- Appraiser’s Opinion of Value: The final estimate of value, presented clearly and concisely.

- Appendices: Supporting data, maps, photographs, and other relevant documentation.

Think of it like a meticulously researched and documented legal brief, presenting a defensible argument for a property’s value. Each section adds to the credibility and reliability of the final valuation.

Q 10. How do you handle properties with unique or unusual features?

Properties with unique or unusual features present a challenge, requiring a nuanced approach to valuation. The key is to meticulously document the features and assess their impact on market value.

- Thorough Research: Examine similar properties with similar unusual features, even if geographically dispersed. Online databases and specialized appraisal publications may be helpful.

- Adjustments to Comparable Sales: Carefully analyze comparable sales, making appropriate adjustments for the unique features. For example, a property with a unique architectural style might require positive adjustments, while a property with environmental concerns might require negative adjustments.

- Cost Approach Considerations: The cost approach becomes more relevant for unusual features as it focuses on the cost of reproduction or replacement. Estimating the cost to replicate the unique features might be necessary.

- Expert Consultation: Consulting with specialists like architects, engineers, or environmental consultants might be necessary to accurately assess the value impact of the unusual features. For example, a historic property might require a consultation with a preservation specialist.

- Market Analysis: A deep dive into market trends and buyer preferences is essential to determine how these unusual features influence demand and pricing.

Handling such properties requires creativity, careful analysis, and a willingness to go beyond standard valuation techniques. The goal is to establish a fair market value that reflects the unique characteristics.

Q 11. Explain the concept of market value versus assessed value.

Market value and assessed value are closely related but distinct concepts.

- Market Value: Represents the most probable price a property should bring in a competitive and open market, assuming a reasonable exposure time, a willing buyer and seller, and an arm’s-length transaction (no special relationship between buyer and seller). It’s the price a property would likely sell for today, under typical market conditions.

- Assessed Value: Is the value assigned to a property by a local government for tax purposes. This value is not necessarily equal to market value; it’s often a percentage of market value and might lag behind market fluctuations. For example, a property’s assessed value may be 80% of its market value.

The difference can be significant. Market value is determined using professional appraisal methods, while assessed value is often determined based on mass appraisal techniques which utilize simplified models, and sometimes outdated data. The assessed value is primarily used for calculating property taxes.

Q 12. What are the ethical considerations in property valuation?

Ethical considerations are paramount in property valuation. Appraisers must adhere to strict standards of conduct to maintain public trust and ensure the integrity of their work.

- Independence and Objectivity: Appraisers must remain impartial and avoid conflicts of interest. This means disclosing any potential biases and ensuring their valuation is not influenced by personal relationships or financial incentives.

- Competence and Due Diligence: Appraisers must possess the necessary knowledge and skills to perform valuations accurately and thoroughly, adhering to accepted appraisal standards and practices.

- Transparency and Disclosure: All assumptions, limiting conditions, and data sources should be clearly documented and disclosed in the appraisal report. This ensures transparency and allows users to understand the basis of the valuation.

- Confidentiality: Appraisers must maintain the confidentiality of their clients’ information. Disclosure of appraisal details should be done only with the client’s consent, except when required by law.

- Adherence to Professional Standards: Following professional guidelines and standards of practice set by organizations like the Appraisal Institute helps maintain high ethical standards and instills trust in the profession.

Ethical breaches can have serious consequences, impacting the appraiser’s reputation and potentially leading to legal action or disciplinary proceedings.

Q 13. How do you deal with discrepancies between different valuation methods?

Discrepancies between different valuation methods are common and often highlight the complexities of property valuation. Handling these discrepancies requires a careful and reasoned approach.

- Review Data and Methodology: Re-examine the data used in each approach, checking for errors or inconsistencies. Ensure the methodology applied for each approach is appropriate given the property’s characteristics.

- Identify Potential Causes of Discrepancies: Consider factors that might contribute to the differences. This could involve data limitations, inconsistencies in comparable sales, or the inherent limitations of each valuation approach.

- Qualitative Analysis: Incorporate qualitative factors that might not be fully captured in quantitative data, such as market trends, buyer preferences, and unique property features. For example, a beautiful view might be difficult to capture in a sales comparison approach but adds qualitative value.

- Reconciliation: Weigh the strengths and weaknesses of each approach and arrive at a final value, justifying the weighting assigned to each method in the report. Often, a weighted average, providing clear justification for the weighting, is used.

- Documentation: Clearly document the reconciliation process in the appraisal report, explaining the reasons for any significant weighting of one approach over another.

The goal is not to eliminate discrepancies entirely, but to understand their causes and arrive at a well-supported and defensible final value estimate that takes into account the range of valuation findings.

Q 14. What are the potential sources of error in property valuation?

Several sources of error can impact the accuracy of property valuations. Being aware of these potential errors is crucial for minimizing their impact.

- Data Errors: Inaccurate or incomplete data, such as incorrect information on comparable sales or property characteristics, can lead to significant valuation errors. For example, an incorrect lot size can significantly distort the value calculation.

- Bias and Subjectivity: Unconscious bias or subjective judgments by the appraiser can influence the selection of comparables and the application of adjustments.

- Inappropriate Methodology: Using an unsuitable valuation method for a particular property type or market condition can lead to inaccurate results. For example, applying the income approach to a property with no rental history is inappropriate.

- Market Volatility: Rapid changes in market conditions can render data quickly outdated, affecting the reliability of the valuation. For example, a sudden increase in interest rates will impact buyer demand and thus property value.

- Lack of Comparable Sales: In markets with limited recent sales data, finding truly comparable properties can be difficult, affecting the accuracy of the sales comparison approach. This often happens in rural or niche markets.

- Omission of Important Factors: Failing to account for significant factors affecting value, such as environmental concerns or legal restrictions, can lead to misrepresentation of value.

Implementing robust quality control measures, such as peer review and thorough data verification, can mitigate the risk of errors and improve the accuracy and reliability of property valuations.

Q 15. What is your experience with different appraisal software and technology?

Throughout my career, I’ve gained proficiency in several appraisal software packages, including industry-leading platforms like Appraisal Institute’s software, ARGUS Enterprise, and Real Estate Valuation Software (REVS). My experience extends beyond simply using these tools; I understand their underlying methodologies and can effectively leverage their features to enhance the accuracy and efficiency of my valuations. For instance, ARGUS Enterprise is particularly useful for complex commercial properties, allowing for detailed cash flow analysis and sensitivity testing. I’m also adept at utilizing cloud-based solutions for data management and collaboration, ensuring seamless workflows and secure data storage. I am always keen to learn and adopt new technologies to improve my workflow and the quality of my assessments.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. Describe your experience with various property types (residential, commercial, industrial).

My experience encompasses a broad spectrum of property types, including residential, commercial, and industrial properties. In the residential sector, I’ve valued everything from single-family homes to large multi-family complexes, utilizing various approaches such as the sales comparison, cost, and income approaches. My commercial experience includes office buildings, retail spaces, and mixed-use developments, where I frequently employ discounted cash flow (DCF) analysis and capitalization rate methodologies. In the industrial sector, I’ve assessed warehouses, manufacturing plants, and distribution centers, focusing on factors like functional utility and location advantages. This diverse experience allows me to tailor my approach to the specific characteristics and market dynamics of each property type.

Q 17. How do you stay up-to-date on current market trends and valuation techniques?

Staying current in the dynamic world of property valuation requires a multifaceted approach. I actively participate in professional organizations such as the Appraisal Institute, attending conferences and webinars to learn about the latest valuation techniques and market trends. I regularly review industry publications, including journals and market reports, to stay abreast of economic indicators, legislative changes, and emerging technologies. Moreover, I maintain a robust network of industry contacts, exchanging information and insights with fellow appraisers and market experts. This continuous learning ensures my valuations are grounded in the most current and relevant data.

Q 18. How do you manage time effectively when conducting multiple valuations?

Managing multiple valuations efficiently involves a strategic approach. I begin with a clear prioritization based on deadlines and complexity. I utilize project management tools to track progress, deadlines, and resource allocation. I break down each valuation into manageable tasks, assigning specific timeframes to each. Furthermore, I leverage technology to streamline data collection and analysis. For example, using automated data extraction tools saves significant time compared to manual data entry. Finally, efficient communication with clients and stakeholders minimizes delays and ensures everyone is informed about the progress. This structured approach helps ensure timely delivery of high-quality valuations, even under pressure.

Q 19. Explain your experience with data analysis and market research in property valuation.

Data analysis and market research are cornerstones of my valuation practice. I employ statistical software packages like SPSS and R to analyze large datasets, identifying trends and patterns relevant to property values. This might involve analyzing comparable sales data, identifying key market drivers, and performing regression analysis to determine the impact of various property features on value. My market research goes beyond simply gathering data; it involves interpreting the information in the context of the specific property and its market. This includes considering local economic conditions, demographic trends, and recent transactions. A recent project required detailed analysis of rental rates across multiple submarkets to accurately estimate the income potential of a large apartment complex. The comprehensive data analysis facilitated a precise and defensible valuation.

Q 20. What are the limitations of the different approaches to property valuation?

Each approach to property valuation—sales comparison, cost, and income—has inherent limitations. The sales comparison approach relies on the availability of comparable sales, which can be challenging in niche markets or for unique properties. The cost approach is limited by the accuracy of construction cost estimates and may not accurately reflect market conditions for older properties. The income approach is sensitive to assumptions about occupancy rates, operating expenses, and discount rates, making it vulnerable to errors in forecasting. Therefore, it’s crucial to select the most appropriate approach, or a combination, based on the property type and available data, acknowledging the limitations of each. Furthermore, it is important to clearly articulate these limitations in the appraisal report.

Q 21. Describe a challenging valuation assignment you faced and how you solved it.

One challenging assignment involved valuing a historic building with significant deferred maintenance. The building had unique architectural features, limited comparable sales, and considerable functional obsolescence. To overcome this, I employed a hybrid approach. I started with the cost approach, carefully detailing the rehabilitation costs and adjusting for functional obsolescence. I then used the sales comparison approach, adapting comparable sales data from similar buildings in different markets to account for the unique characteristics of the subject property. Finally, I incorporated an income approach, considering potential rental income after renovations. By combining these methods and rigorously documenting my adjustments, I produced a defensible valuation that satisfied all stakeholders. The key was a flexible approach that combined multiple valuation techniques and thorough analysis to account for the complexities of the property.

Q 22. What is your understanding of USPAP (Uniform Standards of Professional Appraisal Practice)?

USPAP, or Uniform Standards of Professional Appraisal Practice, is the generally accepted set of standards for the appraisal profession in the United States. It’s essentially a rulebook that ensures consistent, ethical, and credible valuation practices. Think of it as the gold standard, guiding appraisers in all aspects of their work, from defining the scope of the appraisal to reporting the final value estimate.

USPAP covers a broad range of topics, including:

- Ethics: Maintaining independence and objectivity, avoiding conflicts of interest.

- Competency: Having the necessary skills, knowledge, and experience to perform the appraisal.

- Scope of Work: Clearly defining the appraisal’s purpose, intended users, and the type and extent of research involved.

- Appraisal Process: Following a systematic procedure that includes data collection, analysis, and reporting.

- Reporting: Presenting the findings in a clear, concise, and comprehensive manner, adhering to specific reporting requirements.

Compliance with USPAP is crucial for appraisers because it protects the integrity of the appraisal process and fosters public trust. Failure to adhere to USPAP can lead to disciplinary action and legal ramifications.

Q 23. How do you handle situations where limited data is available for a valuation?

Limited data is a common challenge in property valuation. When faced with this situation, I employ a multi-pronged approach. First, I meticulously explore all available data sources. This includes not just recent sales of comparable properties, but also information on prior sales, listings, and even assessments from the local tax authority. I also consider broader market trends using local real estate market reports and national indices.

Second, I leverage advanced analytical techniques. This might involve adjusting comparable sales to account for differences in features, location, and market conditions, using statistical methods to refine the analysis. If necessary, I employ income capitalization or cost approach methods, adjusting them based on the limited data available.

Third, I explicitly state the limitations of the appraisal in my report. Transparency is key; I clearly articulate the challenges posed by limited data and the potential impact on the reliability of the valuation. This ensures the client understands the degree of certainty associated with the estimated value. For example, I might use qualifiers like ‘within a range of…’ to reflect the uncertainty.

Finally, I might recommend further data gathering, suggesting actions the client could take to improve the accuracy of future appraisals, such as commissioning a professional survey or environmental assessment.

Q 24. What are the key differences between a market value and a fair market value appraisal?

While often used interchangeably, ‘market value’ and ‘fair market value’ have subtle yet important differences within the context of property appraisal. ‘Fair market value’ is the most commonly used and is defined as the price at which a property would change hands between a willing buyer and a willing seller, both being reasonably well-informed, and neither being under duress.

The key distinction lies in the implied conditions. ‘Fair market value’ emphasizes the concept of a hypothetical transaction under ideal conditions. There’s no pressure on either party, both have full information, and the sale is conducted in a free and open market. ‘Market value’ is a broader term and can encompass various valuation approaches under different conditions. For instance, a distressed property sale may provide a market value indication, but not necessarily a fair market value given the seller’s urgency.

In my work, I predominantly use the ‘fair market value’ standard due to its emphasis on a hypothetical transaction representing an ideal market exchange. This aligns with the need for unbiased and reliable valuations.

Q 25. How do you account for environmental factors (e.g., contamination) in your valuation?

Environmental factors, such as contamination, significantly impact property value. When evaluating a property, I consider environmental concerns proactively. This involves reviewing environmental site assessments (ESAs), checking for any recorded environmental incidents with relevant regulatory agencies (like the EPA), and researching the history of the property for potential contamination.

The presence of contamination can dramatically reduce value, depending on the type, extent, and potential remediation costs. I incorporate these factors into my valuation by either making adjustments to comparable sales, or, if the contamination is severe, employing a discounted cash flow analysis which specifically accounts for the costs of cleanup and potential liabilities. In some cases, the impact of contamination might necessitate the use of specialized environmental consultants to determine the extent of the problem and provide estimates for remediation.

I clearly disclose the presence and impact of environmental factors in my appraisal report, explaining how these elements influenced my value conclusion. This is crucial for transparency and to fully inform clients and stakeholders about potential risks and uncertainties.

Q 26. How do you incorporate recent sales data into your valuation model?

Recent sales data is the cornerstone of my valuation model, particularly when using the sales comparison approach. I begin by identifying comparable properties—those with similar characteristics—that have sold recently in the same geographic area. Then, I carefully analyze each sale, noting factors such as:

- Date of Sale: Accounting for shifts in market conditions over time.

- Property Features: Size, age, condition, amenities—comparing the subject property to each comparable.

- Location: Proximity to amenities, schools, transportation, and other factors.

- Terms of Sale: Financing terms, concessions, and any other factors affecting the sale price.

I adjust the sale prices of comparables to reflect differences between them and the subject property. This process, called reconciliation, involves using statistical techniques and professional judgment. I may use software tools to help with this process, and ultimately I arrive at a range of values, indicating my confidence level in the final estimate. The results are then thoroughly documented and explained in the appraisal report.

Q 27. Describe your experience working with clients and stakeholders in the valuation process.

My experience with clients and stakeholders is built on clear communication and collaboration. I begin each project by defining the scope of work and the intended use of the appraisal, making sure the client understands the process and expectations. This ensures we’re all on the same page from the start.

Throughout the valuation process, I maintain open communication, providing regular updates and responding promptly to any queries. I explain complex concepts in simple terms, avoiding jargon whenever possible. I also ensure that the final report is easy to understand, addressing any questions the client or stakeholder might have.

In cases where multiple stakeholders are involved (e.g., lenders, buyers, sellers), I facilitate discussions and ensure all parties have access to the necessary information. This proactive approach minimizes misunderstandings and promotes a smooth valuation process. For example, in one instance I mediated a discussion between a buyer and seller regarding the valuation of a property, ultimately helping them reach an agreement based on the appraisal’s findings.

Q 28. How do you ensure the accuracy and reliability of your valuations?

Accuracy and reliability are paramount in my valuations. I adhere strictly to USPAP standards, ensuring ethical conduct and a rigorous methodology. I utilize multiple data sources and analytical techniques to cross-validate findings. This reduces the reliance on any single data point and helps to identify potential biases or errors.

Peer review is a critical component of my quality control process. I regularly submit my work to colleagues for review, seeking feedback on my methodology, data analysis, and report writing. This external scrutiny ensures objectivity and helps to identify potential areas for improvement.

Finally, I meticulously document every step of the appraisal process. This creates a transparent and auditable record, allowing for easy verification and review of the methodology and supporting evidence. This comprehensive documentation not only improves accuracy and reliability but also protects me and the client in case of any disputes or challenges.

Key Topics to Learn for Property Valuation and Assessment Interview

- Fundamentals of Valuation: Understanding different valuation approaches (e.g., market, income, cost) and their appropriate application in various property types.

- Data Analysis and Research: Gathering, analyzing, and interpreting relevant market data, including comparable sales, rental rates, and economic indicators. Practical application: Demonstrate your ability to identify and adjust for relevant differences between comparable properties.

- Property Characteristics and Features: Assessing the impact of physical characteristics (size, location, condition) and features (amenities, upgrades) on property value. Practical application: Explain how to account for depreciation and obsolescence.

- Legal and Regulatory Frameworks: Familiarity with relevant laws, regulations, and ethical standards governing property valuation and assessment in your region.

- Financial Modeling and Analysis: Applying financial principles to analyze property cash flows, profitability, and investment returns (e.g., discounted cash flow analysis, capitalization rates).

- Risk Assessment and Mitigation: Identifying and evaluating potential risks affecting property value, such as environmental hazards, market fluctuations, or legal challenges. Practical application: Discuss strategies for mitigating identified risks.

- Reporting and Communication: Preparing clear, concise, and well-supported valuation reports that effectively communicate your findings to clients or stakeholders.

- Advanced Valuation Techniques: Depending on the role, you might explore more advanced techniques like highest and best use analysis, appraisal review, and mass appraisal methods.

Next Steps

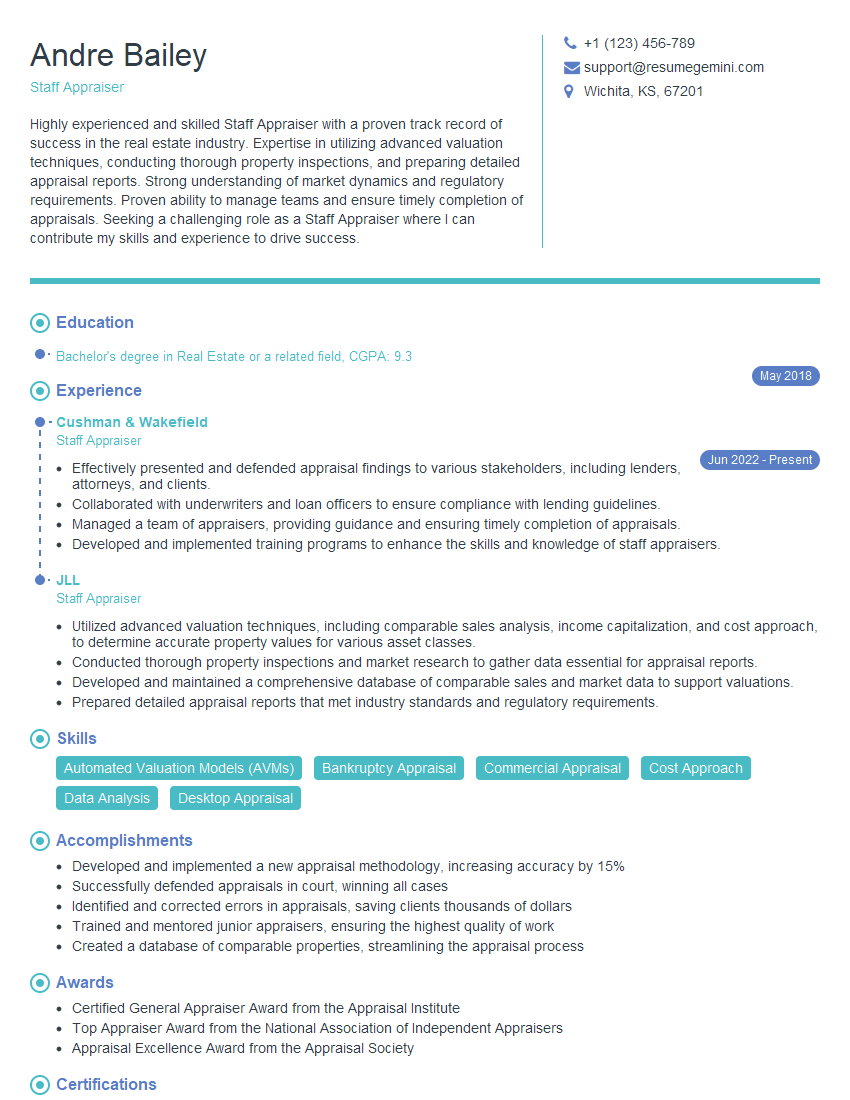

Mastering Property Valuation and Assessment opens doors to exciting career opportunities with significant growth potential. A strong understanding of these principles is highly valued by employers. To maximize your job prospects, invest time in creating an ATS-friendly resume that effectively highlights your skills and experience. ResumeGemini is a trusted resource that can significantly enhance your resume-building experience. Leverage their tools and resources to craft a professional resume that showcases your expertise. Examples of resumes tailored to Property Valuation and Assessment are available to help you get started.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

I Redesigned Spongebob Squarepants and his main characters of my artwork.

https://www.deviantart.com/reimaginesponge/art/Redesigned-Spongebob-characters-1223583608

IT gave me an insight and words to use and be able to think of examples

Hi, I’m Jay, we have a few potential clients that are interested in your services, thought you might be a good fit. I’d love to talk about the details, when do you have time to talk?

Best,

Jay

Founder | CEO