Cracking a skill-specific interview, like one for Commercial Real Estate Due Diligence, requires understanding the nuances of the role. In this blog, we present the questions you’re most likely to encounter, along with insights into how to answer them effectively. Let’s ensure you’re ready to make a strong impression.

Questions Asked in Commercial Real Estate Due Diligence Interview

Q 1. Explain the process of conducting a Phase I Environmental Site Assessment.

A Phase I Environmental Site Assessment (ESA) is the first step in evaluating the environmental condition of a commercial property. It’s a non-invasive investigation designed to identify potential or existing environmental contamination. Think of it as a preliminary health check for the land. The process typically involves:

- Review of historical records: This includes searching databases for past environmental incidents, such as spills, waste disposal practices, and the presence of hazardous substances. We check things like environmental databases, government records, and even old Sanborn maps (old fire insurance maps that can reveal historical building usage).

- Site reconnaissance: A physical inspection of the property to visually identify potential environmental concerns. This might involve looking for signs of past industrial activity, unusual staining in the soil, or the presence of underground storage tanks (USTs).

- Interviews with stakeholders: Talking to current and previous owners, operators, and neighbors can provide valuable insights into the property’s history and potential environmental issues.

- Report preparation: The findings are compiled into a comprehensive report that summarizes the investigation and identifies any potential environmental concerns. This report typically classifies the site as having no recognized environmental condition (REC), indicating a potential REC, or a confirmed REC. The level of risk dictates the next steps, such as further investigation (Phase II).

For example, I recently conducted a Phase I ESA for a former dry cleaning business. The historical records revealed the use of perchloroethylene (PCE), a known carcinogen. The site reconnaissance showed soil staining consistent with a PCE release, leading to a recommendation for a Phase II investigation to confirm the extent of contamination.

Q 2. What are the key financial metrics you analyze during due diligence?

Analyzing the financial metrics of a commercial property during due diligence is crucial for understanding its profitability and value. Key metrics include:

- Net Operating Income (NOI): This is the property’s income after operating expenses are deducted. It’s a fundamental metric for valuing income-producing properties. We scrutinize the components of NOI, ensuring that expenses are reasonable and appropriately categorized.

- Capitalization Rate (Cap Rate): This is the ratio of NOI to the property’s purchase price. It represents the rate of return on the investment. A higher cap rate generally indicates a more attractive investment opportunity. We compare the cap rate to market averages for comparable properties to determine if the price is justified.

- Cash Flow: This is the actual cash generated by the property after all expenses, including debt service, are paid. It’s a key indicator of the property’s ability to generate funds for the owner.

- Debt Service Coverage Ratio (DSCR): This is the ratio of NOI to the annual debt service. A higher DSCR indicates a greater ability to service the debt obligations. We carefully examine the loan terms and potential refinancing risks.

- Operating Expense Ratio (OER): This ratio shows operating expenses as a percentage of revenue. Analyzing trends in this ratio over time provides valuable insights into operational efficiency.

We always benchmark these metrics against market data and comparable properties to assess the reasonableness of the seller’s projections.

Q 3. How do you identify and assess potential environmental liabilities in a commercial property?

Identifying and assessing environmental liabilities is critical to avoid costly surprises after acquisition. We use a multi-pronged approach:

- Phase I and II ESAs: As explained previously, these assessments are instrumental in identifying potential and confirmed environmental contamination. Phase II involves more intrusive testing to confirm the presence and extent of contamination.

- Review of environmental permits and compliance records: We check if the property is in compliance with all relevant environmental regulations. Past violations can lead to significant remediation costs.

- Review of insurance policies: We examine the property’s environmental insurance coverage, assessing its adequacy to cover potential liabilities.

- Due diligence questionnaires and seller disclosures: We carefully review these documents to identify potential environmental issues that the seller may have encountered. We probe for any undisclosed issues.

- Environmental consultants’ reports: Depending on the findings of our initial assessments, we may engage independent environmental consultants for expert analysis and recommendations.

For instance, a recent assessment revealed a former gas station on the property. We immediately initiated a Phase I ESA, which uncovered potential soil and groundwater contamination from leaked gasoline. This led to negotiations to allocate funds for environmental remediation in the purchase agreement.

Q 4. Describe your experience with reviewing title reports and surveys.

Title reports and surveys are fundamental to verifying property ownership and boundaries. My experience involves:

- Reviewing title reports for encumbrances: I meticulously examine title reports for liens, easements, covenants, restrictions, and other encumbrances that could affect ownership, usage, or value. This includes reviewing chains of title and ensuring clear ownership.

- Analyzing surveys for accuracy: I verify that the survey accurately reflects the property’s boundaries and improvements. Discrepancies can lead to boundary disputes and legal challenges.

- Comparing title and survey information: I ensure consistency between the title report and the survey, checking for any discrepancies that could raise concerns about ownership or potential encroachments.

- Identifying potential title issues: I flag potential problems such as conflicting claims, boundary disputes, or unrecorded easements, which can significantly impact the transaction.

- Working with title companies and surveyors: I collaborate with these professionals to clarify any ambiguities or resolve identified issues.

In a recent transaction, a title report revealed an unrecorded easement that impacted the planned development of the property. Early identification allowed us to renegotiate the purchase price to reflect the limitations imposed by this easement.

Q 5. How do you evaluate the accuracy and reliability of financial statements provided by a seller?

Evaluating the reliability of financial statements requires a critical and skeptical approach. We conduct several checks:

- Verification of revenue and expenses: We compare the reported figures with historical data, industry benchmarks, and market trends. Any significant deviations require explanation and verification.

- Review of accounting methods: We ensure that the financial statements are prepared using Generally Accepted Accounting Principles (GAAP) or other relevant standards, examining consistency of reporting over time.

- Analysis of lease agreements: We review lease agreements to verify rental income and expense figures. We check for unusual lease terms or concessions that may inflate reported income.

- Independent verification: We might request independent audits or reviews of the financial statements, especially for large or complex transactions.

- Reconciliation of bank statements: We often compare the bank statements to verify the cash balances reported in the financial statements.

We recently discovered discrepancies between a seller’s reported NOI and our independent calculations. Further investigation revealed that certain expenses were inappropriately categorized, leading to a downward adjustment of the purchase price.

Q 6. What are the common risks associated with acquiring a commercial property?

Acquiring commercial real estate involves numerous risks. Some common ones include:

- Environmental liabilities: Contamination from previous occupants can lead to significant remediation costs.

- Title defects: Issues with ownership, easements, or encumbrances can complicate the transaction or impact the property’s use.

- Changes in market conditions: Economic downturns, interest rate hikes, or shifts in tenant demand can affect property value and income.

- Lease defaults: Vacancies due to tenant defaults can significantly impact income and profitability.

- Construction defects: Hidden structural or mechanical problems can lead to costly repairs.

- Regulatory changes: New zoning regulations or environmental laws could impact the property’s use and value.

- Unexpected operating expenses: Higher-than-anticipated operating costs can reduce profitability.

Careful due diligence, including comprehensive inspections and thorough analysis of financial and legal documents, is essential to mitigate these risks.

Q 7. Explain your understanding of lease abstracts and their importance in due diligence.

Lease abstracts are summaries of key information from lease agreements. They are essential during due diligence because they provide a quick overview of the income stream and tenant occupancy of a property. Key information included in a lease abstract includes:

- Tenant name and contact information: Allows for direct communication regarding lease terms and conditions.

- Lease commencement and expiration dates: Indicates the remaining lease term and potential for future vacancy.

- Rent amount and payment terms: Provides a clear picture of the property’s income stream.

- Options to renew or extend: Shows the potential for long-term stability of the income stream.

- Key provisions: Summarizes important clauses, such as rent escalations, tenant improvements, and permitted uses.

Without lease abstracts, you’d have to manually review each lease agreement, which is incredibly time-consuming and prone to error. A thorough review of lease abstracts helps to assess the stability and financial performance of the property, identifying potential risks such as expiring leases, high tenant turnover, or unfavorable lease terms.

Q 8. How do you analyze the operating expenses of a commercial property?

Analyzing operating expenses (OpEx) for a commercial property is crucial for determining its profitability and potential return on investment. It involves a thorough review of historical expense data, comparing it to market benchmarks, and projecting future expenses. Think of it like reviewing a household budget, but on a much larger scale.

- Data Collection: I begin by meticulously gathering historical expense statements (typically for the past 2-3 years) from the seller. This includes everything from property taxes and insurance to maintenance, utilities, and management fees.

- Expense Categorization: I then categorize each expense to identify potential anomalies or inconsistencies. For example, unusually high repair costs might indicate deferred maintenance.

- Benchmarking: I compare the property’s OpEx to market benchmarks for similar properties in the same area. This allows me to identify areas where expenses are significantly above or below average, requiring further investigation.

- Reconciliation: I reconcile the provided expenses with the actual invoices, receipts, and other supporting documentation to verify their accuracy.

- Projections: Finally, based on historical data, market conditions, and any planned capital improvements, I create projections for future operating expenses. This forms the basis for evaluating the property’s net operating income (NOI).

For example, I once discovered a significant discrepancy in a property’s insurance costs. By digging deeper, I found the previous owner had failed to renew the policy at the most favorable rate, resulting in a potential cost savings of thousands of dollars annually for the buyer.

Q 9. How do you assess the market value of a commercial property?

Assessing the market value of a commercial property is a complex process that combines quantitative and qualitative analysis. There’s no single magic formula; it requires a deep understanding of market dynamics and property specifics.

- Comparable Sales Analysis (CMA): This is the cornerstone of market valuation. I identify recent sales of comparable properties – those similar in size, location, age, and condition – and adjust their sale prices to account for differences.

- Income Capitalization Approach: This method values the property based on its potential income stream. It involves estimating the property’s net operating income (NOI) and applying a capitalization rate (cap rate), which reflects the market’s required return on investment.

- Cost Approach: This method estimates the value based on the cost of replacing the property, less depreciation. It’s particularly useful for newer properties or unique buildings where comparable sales are scarce.

- Market Research: Understanding the local market is key. I analyze factors like supply and demand, vacancy rates, rental growth potential, and economic conditions to refine my valuation. News articles, local market reports, and discussions with brokers and property managers can all be helpful.

For instance, during the valuation of a retail property, I considered the recent expansion of a nearby shopping mall, which increased competition and potentially impacted rental rates, leading to a more conservative valuation.

Q 10. What is your experience with reviewing appraisal reports?

Reviewing appraisal reports is a critical part of my due diligence process. I don’t just accept the appraisal at face value; I critically evaluate its methodology, assumptions, and conclusions. Think of it as a quality control check for the valuation process.

- Methodology Review: I examine the appraiser’s chosen approach (CMA, Income Capitalization, Cost Approach), ensuring it’s appropriate for the property type and market conditions. I look for justification of the selection and any limitations.

- Data Validation: I verify the accuracy of the data used in the appraisal, particularly the comparable sales data. Are the comparables truly comparable? Are adjustments reasonable?

- Assumptions Assessment: I scrutinize the appraiser’s assumptions regarding occupancy rates, rental growth, and expense projections. Are these assumptions realistic given the current market and property-specific circumstances?

- Conclusion Analysis: Finally, I assess the overall conclusion and its consistency with the supporting data and analysis. Does the final value seem reasonable given the market and the property’s characteristics? Are there any significant caveats or uncertainties mentioned?

In one instance, I identified an error in an appraisal report where the appraiser had incorrectly adjusted the sale price of a comparable property due to a misunderstanding of lease terms. This resulted in a significant overvaluation, which I was able to correct, saving the buyer a substantial amount.

Q 11. Describe your experience with analyzing rent rolls and tenant occupancy.

Analyzing rent rolls and tenant occupancy is fundamental to understanding a commercial property’s income potential and risk profile. A rent roll is like the property’s financial report card, showing its income-generating capabilities.

- Rent Roll Verification: I start by comparing the rent roll data to lease agreements and other supporting documentation to ensure accuracy and completeness. Are all leases accounted for? Are the rent amounts, lease terms, and tenant contact information correct?

- Lease Analysis: I analyze lease terms, including lease expirations, renewal options, rent escalation clauses, and tenant responsibilities. Understanding lease structures is crucial for projecting future cash flows.

- Tenant Creditworthiness: I assess the creditworthiness of existing tenants using credit reports and other available information. High tenant turnover or financially stressed tenants can signal significant risks.

- Occupancy Rate Analysis: I calculate the occupancy rate and compare it to market averages. A low occupancy rate can indicate issues with the property, management, or the market itself.

- Rent Comparables: I compare rental rates to those of similar properties in the area to identify any potential discrepancies and assess the market competitiveness of the property’s current rents.

For example, during the analysis of an office building’s rent roll, I discovered several leases were nearing expiration without renewal options. This allowed me to appropriately adjust the property’s projected income and factored this risk into the overall valuation.

Q 12. What are the key legal considerations in a commercial real estate transaction?

Key legal considerations in commercial real estate transactions are multifaceted and require expert legal counsel. Here are some primary areas of concern:

- Title and Ownership: Ensuring clear and marketable title is paramount. This involves conducting a title search to identify any liens, encumbrances, or other claims against the property.

- Zoning and Land Use Regulations: Verifying compliance with all applicable zoning ordinances and land use regulations is crucial. Any violations could significantly impact the property’s value and use.

- Environmental Concerns: Conducting environmental due diligence is necessary to identify and assess potential environmental hazards, such as asbestos, lead paint, or soil contamination.

- Leases and Tenancy Agreements: A comprehensive review of all existing leases is vital to understanding the tenant mix, lease terms, and potential liabilities.

- Building Codes and Permits: Confirming compliance with building codes and the existence of necessary permits for construction or renovations is essential.

- Surveys and Boundaries: A current survey is crucial to verify the property’s boundaries and identify any easements or encroachments.

Failure to address these legal considerations can lead to costly disputes, delays, and even the loss of the investment.

Q 13. How do you identify and mitigate potential legal risks in a commercial property acquisition?

Identifying and mitigating legal risks in commercial property acquisitions requires a proactive approach involving legal counsel and a thorough due diligence process. It’s like a risk management plan for your investment.

- Comprehensive Due Diligence: This is the first line of defense. It involves performing thorough title searches, environmental assessments, zoning reviews, and lease analysis, as previously discussed.

- Legal Counsel: Engage experienced real estate attorneys specializing in commercial transactions to review all legal documents and provide expert advice throughout the process.

- Risk Assessment: Identify potential legal risks based on the findings of the due diligence process and weigh the likelihood and potential impact of each risk.

- Contractual Protection: Negotiate favorable terms in the purchase and sale agreement to allocate risks appropriately and protect the buyer’s interests. This might include contingencies for environmental issues, title defects, or zoning compliance.

- Insurance: Secure appropriate insurance coverage to mitigate potential financial losses arising from unforeseen events or liabilities.

For instance, I once advised a client to include an environmental contingency clause in the purchase agreement, allowing them to back out of the deal if environmental testing revealed unacceptable contamination. This clause saved them a potentially disastrous investment.

Q 14. Explain your experience with reviewing property insurance policies.

Reviewing property insurance policies is a critical aspect of due diligence, ensuring the property is adequately protected against various risks. It’s like making sure you have the right coverage for your valuable asset.

- Policy Coverage Review: I examine the policy to understand the coverage amounts, deductibles, and exclusions for various perils, such as fire, flood, windstorm, and liability.

- Policy Limits: I determine if the policy limits are sufficient to cover the replacement cost of the building and its contents. Underinsurance can result in significant financial losses in the event of a major claim.

- Endorsements and Riders: I review any endorsements or riders to identify any specific coverage enhancements or limitations. These often address specialized needs, such as flood or earthquake insurance.

- Claims History: I check the insurer’s records for previous claims and their handling to assess the insurer’s reliability and the potential for future rate increases.

- Policy Expiration: I verify the policy’s expiration date to ensure there is adequate time for renewal and seamless coverage transition.

In one case, a review of an insurance policy revealed inadequate flood coverage, despite the property being located in a high-risk flood zone. This allowed the buyer to negotiate improved coverage with the seller or obtain a more suitable policy, potentially avoiding a considerable financial risk.

Q 15. How do you identify and assess potential physical risks associated with a commercial property?

Identifying and assessing physical risks in commercial real estate requires a multi-faceted approach. Think of it like a thorough medical exam for a building. We start with a visual inspection, looking for obvious signs of deterioration like cracks in the foundation, water damage, or failing roofing systems. Then, we delve deeper. This involves:

- Environmental Site Assessments (ESAs): These uncover potential contamination issues, such as asbestos, lead paint, or underground storage tanks (USTs). Failing to identify these can lead to costly remediation later. For example, I once worked on a deal where an ESA revealed a previous dry cleaner’s operation on the site, resulting in significant soil contamination and a major impact on the deal’s viability.

- Structural Engineer Reports: These reports provide detailed assessments of the building’s structural integrity, checking for seismic vulnerabilities, foundation stability, and the overall condition of load-bearing elements. I’ve used these reports to negotiate significant price reductions when structural issues were discovered.

- MEP (Mechanical, Electrical, Plumbing) Inspections: These check the building’s mechanical systems – HVAC, plumbing, electrical – identifying outdated or inefficient systems, potential safety hazards, and likely upcoming repair costs. Think of it as assessing the building’s vital organs. A recent project saw us uncover a faulty fire suppression system, requiring immediate attention and impacting the closing timeline.

- Roof Inspections: A crucial aspect of any physical risk assessment. A failing roof can lead to significant water damage and costly repairs. We usually employ specialized roof inspectors to identify leaks, degradation, and potential lifespan issues.

By systematically addressing these areas, we create a comprehensive picture of the property’s physical condition and identify potential risks, allowing for informed decision-making and negotiation.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. Describe your experience working with property tax assessments.

My experience with property tax assessments is extensive. It’s a critical part of due diligence, as inaccurate assessments can significantly impact a property’s value and profitability. My work involves:

- Reviewing assessment notices: We meticulously examine tax records to identify any discrepancies between the assessed value and the market value. Sometimes, assessments lag behind market changes, leading to over or under-assessment.

- Appealing assessments: If we find the assessment to be inaccurate, we prepare and file appeals with the relevant taxing authorities. This often involves gathering market data, comparable sales information, and employing professional appraisal support to demonstrate the property’s true market value. I’ve successfully reduced property tax assessments by millions of dollars through skillful appeal strategies.

- Analyzing tax implications: We project future tax liabilities and incorporate this information into financial models. It’s crucial to understand the long-term impact of property taxes on investment returns.

- Understanding tax jurisdictions: We’re always aware of the nuances of tax laws and regulations within different jurisdictions. Tax laws vary greatly, and overlooking local regulations can be quite costly.

Essentially, my expertise here allows me to identify potential tax savings and mitigate financial risk associated with property taxation.

Q 17. What is your experience with zoning regulations and building codes?

Zoning regulations and building codes are fundamental to understanding the permissible uses and development potential of a commercial property. They act as a blueprint for what can and cannot be done on a site. My work encompasses:

- Reviewing zoning ordinances: We carefully analyze local zoning regulations to understand permitted uses, building height restrictions, density limits, parking requirements, and setbacks. I once prevented a deal from proceeding because the proposed use was not permitted under the current zoning.

- Analyzing building codes: We examine building codes to ensure the property meets all safety and construction standards. This also helps to identify any potential code violations that could lead to costly repairs or legal issues.

- Understanding variance and permit processes: This involves assessing the feasibility of obtaining necessary variances or permits for proposed renovations or changes in use. Navigating these processes requires a strong understanding of local regulations and how to effectively interact with building authorities.

- Assessing the impact of future code changes: We look ahead to anticipate how future code changes may impact the property’s operations and value. A proactive approach helps manage risks and capitalize on opportunities.

Understanding these regulatory frameworks is crucial for mitigating risk and maximizing the value of a commercial property investment.

Q 18. How do you assess the condition of a commercial property’s infrastructure?

Assessing a commercial property’s infrastructure is crucial. We’re not just looking at the ‘pretty’ exterior; we’re looking at the ‘bones’ of the building. Our assessment involves:

- HVAC systems: We assess the efficiency, age, and overall condition of heating, ventilation, and air conditioning systems. Inefficient systems can lead to high operating costs. I recently discovered an HVAC system nearing the end of its life in a property, which was factored into the negotiation.

- Plumbing systems: We check for leaks, corrosion, and the overall condition of the pipes and fixtures. Plumbing problems can cause significant damage and disruption.

- Electrical systems: We assess the capacity, safety, and overall condition of the electrical system, including wiring, panels, and fixtures. Outdated electrical systems are safety hazards and can limit the potential uses of the property.

- Roofing systems: A major structural component, a thorough inspection involves assessing the materials, condition, and remaining lifespan. A failing roof is a significant cost and risk.

- Foundation: We inspect the foundation for cracks, settling, and other structural problems. Foundation issues are among the most costly to repair.

Through detailed inspections and engineering reports, we identify potential infrastructure failures and ensure we fully understand the repair and replacement costs.

Q 19. Describe your experience with conducting a title search.

Conducting a thorough title search is paramount. Think of it as performing a background check on the property. It involves examining the chain of title to identify any clouds on the title—that is, anything that could impact the property’s ownership or marketability. My experience includes:

- Reviewing title commitments: We meticulously review title commitments, which are essentially summaries of the title history, highlighting any potential issues. This involves identifying any liens, encumbrances, easements, or other claims against the property.

- Identifying title defects: We identify and analyze any defects, such as missing documentation, conflicting claims, or potential legal disputes. These defects can significantly delay or even prevent a transaction.

- Working with title insurance companies: We coordinate with title insurance companies to secure title insurance, which protects buyers from losses due to title defects. I’ve often worked to negotiate favorable terms with title insurance providers.

- Understanding survey information: We carefully review survey information to ensure the property boundaries are accurately defined and that there are no encroachments. Survey discrepancies can lead to costly boundary disputes.

A clear title is essential for a smooth transaction. My experience ensures we identify and address any title issues before they become major problems.

Q 20. How do you interpret and analyze a pro forma statement?

A pro forma statement is a projected financial statement for a property. It’s essentially a financial forecast. Think of it as a roadmap for the future performance of an investment property. My interpretation and analysis focus on several key areas:

- Revenue projections: We scrutinize the assumptions underlying the projected rental income, occupancy rates, and other revenue streams. Are the rent projections realistic given the market conditions and the property’s characteristics?

- Expense projections: We carefully review the projected operating expenses, including property taxes, insurance, maintenance, and management fees. Are these expenses realistic and appropriately budgeted?

- Cash flow analysis: We analyze the projected net operating income (NOI) and cash flow, assessing the property’s ability to generate positive cash flow and meet its debt obligations.

- Sensitivity analysis: We perform sensitivity analysis to assess how changes in key assumptions (e.g., vacancy rates, operating expenses) would impact the projected returns.

By critically reviewing and analyzing these aspects, we can determine the viability and potential profitability of a given investment opportunity. I frequently use pro forma statements to identify potentially unrealistic expectations and negotiate better terms.

Q 21. Explain your understanding of capitalization rates and their use in real estate valuation.

The capitalization rate (Cap Rate) is a key metric in real estate valuation. It’s a simple yet powerful tool that expresses the relationship between a property’s net operating income (NOI) and its value. Think of it as the rate of return an investor can expect on a property based solely on its income stream.

The formula is: Cap Rate = NOI / Property Value

For example, if a property generates an NOI of $100,000 and is valued at $1,000,000, the cap rate is 10%. A higher cap rate generally indicates a higher return on investment and may signify a riskier or a more undervalued property. Conversely, lower cap rates often reflect less risk but potentially lower returns.

My use of cap rates in valuation involves:

- Market analysis: We compare a subject property’s cap rate to the cap rates of comparable properties in the same market to assess its relative value. This is particularly crucial for identifying under or over-valued properties.

- Investment decision-making: Cap rates help us compare different investment opportunities and determine which offers the best risk-adjusted return.

- Negotiation: Understanding cap rates helps us negotiate fair purchase prices. By analyzing market cap rates, we can justify offers and ensure alignment with the market value.

Ultimately, understanding and effectively using cap rates is crucial for making informed decisions in commercial real estate investment.

Q 22. How do you determine the appropriate discount rate for a commercial real estate investment?

Determining the appropriate discount rate for a commercial real estate investment is crucial because it directly impacts the valuation. It represents the minimum rate of return an investor requires to compensate for the risk involved. This isn’t a single, universally applicable number; it’s tailored to the specific investment.

Several factors influence the discount rate:

- Risk-free rate: This is the return you could earn on a virtually risk-free investment, like a U.S. Treasury bond. It’s the base rate, representing the time value of money.

- Risk premium: This accounts for the inherent risks associated with the specific property and market. Factors like location, property type, lease terms, tenant quality, and economic conditions all play a role. A higher risk necessitates a higher premium.

- Capital structure: The mix of debt and equity financing affects the discount rate. Highly leveraged investments typically require a higher discount rate because of increased financial risk.

- Market conditions: Prevailing interest rates and market sentiment have a significant impact. In a high-interest-rate environment, the discount rate will generally be higher.

Practical Application: Let’s say the risk-free rate is 3%, and you assess a risk premium of 5% for a specific retail property due to its location in a less-desirable area. Your discount rate would be 8% (3% + 5%). If the property was in a prime location with strong tenants, the risk premium might be only 2%, resulting in a 5% discount rate.

Many investors utilize the Weighted Average Cost of Capital (WACC) as their discount rate, which incorporates the cost of both debt and equity financing.

Q 23. What are the key elements of a purchase and sale agreement?

A Purchase and Sale Agreement (PSA) is a legally binding contract outlining the terms and conditions under which a commercial property is bought and sold. It’s a critical document, and thorough due diligence is essential before signing.

Key elements include:

- Property Description: A precise legal description of the property, including address, parcel ID, and any included easements or rights.

- Purchase Price and Terms: The total purchase price, payment schedule (e.g., earnest money deposit, financing terms), and closing date.

- Earnest Money Deposit: A sum deposited as good faith to demonstrate the buyer’s commitment. It is typically held in escrow.

- Contingencies: Conditions that must be met before the sale can proceed, such as financing, appraisal, inspections, and title review. These protect the buyer from unforeseen issues.

- Due Diligence Period: A timeframe allocated to the buyer for conducting thorough investigation of the property’s condition, title, leases, and other aspects.

- Closing Costs: Allocation of expenses associated with closing the transaction (e.g., transfer taxes, recording fees).

- Representations and Warranties: Statements made by the seller about the property’s condition, title, and compliance with regulations. Material misrepresentations can void the contract.

- Default Provisions: Clauses specifying the consequences of breach of contract by either party.

Failure to carefully review and understand every aspect of the PSA can have significant financial implications for both buyer and seller. It is highly recommended to seek legal counsel throughout the entire process.

Q 24. Explain your understanding of different types of commercial real estate leases.

Commercial real estate leases are diverse, and understanding their nuances is essential for due diligence. The most common types include:

- Gross Lease: The landlord pays all operating expenses (property taxes, insurance, maintenance). Simple for the tenant, but less control over costs for the landlord.

- Net Lease (Single Net, Double Net, Triple Net): The tenant pays some operating expenses in addition to rent. Single-net includes property taxes, double-net adds insurance, and triple-net adds maintenance. This shifts more responsibility to the tenant, typically resulting in lower rental rates for them.

- Modified Gross Lease: A hybrid lease where the landlord covers some operating expenses, while the tenant pays others, often based on a pro-rata share.

- Percentage Lease: Rent is based on a percentage of the tenant’s gross sales, common for retail properties. It aligns the landlord’s and tenant’s interests in the business’s success.

- Ground Lease: The tenant leases the land and is responsible for constructing and maintaining the building on it. These are long-term leases, often decades.

Example: A restaurant might be on a percentage lease, allowing for variable rent based on sales performance. An office building might use a triple-net lease, putting more responsibility for expenses on the tenant.

Q 25. How do you evaluate the creditworthiness of commercial tenants?

Evaluating the creditworthiness of commercial tenants is paramount for assessing the investment risk. A strong tenant history translates to stable income streams and reduced vacancy risk.

Methods include:

- Credit Reports: Obtaining commercial credit reports (e.g., from Dun & Bradstreet, Experian) to assess their payment history, financial strength, and potential risk.

- Financial Statements: Reviewing the tenant’s financial statements (balance sheets, income statements, cash flow statements) to evaluate their liquidity, profitability, and overall financial health.

- Bank References: Contacting the tenant’s bank to inquire about their financial standing and credit history.

- Lease History: Examining their track record with previous landlords, including payment history and lease compliance.

- Industry Analysis: Understanding the tenant’s industry and its current market conditions helps assess potential business risk.

Practical Example: Before leasing to a startup, we’d require a detailed business plan, projections, and potentially personal guarantees from the owners to mitigate the risk of default. For a large, established corporation, the focus would be on their overall financial stability and credit rating.

Q 26. Describe your experience with using real estate databases and market research tools.

My experience with real estate databases and market research tools is extensive. I regularly use platforms such as CoStar, LoopNet, and CommercialCafe to gather data on comparable sales, market rents, and property characteristics. I also utilize tools like ARGUS and Excel for detailed financial analysis and modeling.

This data is crucial for conducting thorough market research, identifying comparable properties for valuation, and assessing the investment potential of a given property. I am proficient in extracting relevant information, analyzing trends, and incorporating the data into investment decision-making processes. My skills extend to leveraging public records and government datasets to supplement commercial database information, ensuring a comprehensive understanding of the market landscape.

For example, recently, I used CoStar to identify comparable sales for a retail property in a specific market. Analyzing the data, including sale prices, lease terms, and property features, allowed me to make a more accurate valuation compared to relying on a single source.

Q 27. What is your experience with financial modeling in the context of commercial real estate?

Financial modeling is an integral part of my due diligence process. I utilize various software tools, primarily Argus and Excel, to construct detailed pro forma models that project future cash flows and profitability for potential investments. These models take into account factors such as rental income, operating expenses, debt service, capital expenditures, and tax implications.

My experience encompasses creating models for various property types, including office, retail, industrial, and multifamily. I’m adept at incorporating sensitivity analysis to test the impact of various assumptions on the overall return profile. This allows us to identify key risk factors and potential upside opportunities, informing decision-making processes.

For example, when analyzing an apartment complex, I’d incorporate various vacancy rate scenarios, potential rent growth, and operating expense increases into the model. This provides a range of potential outcomes, helping to establish the investment’s risk profile and potential return.

Q 28. How do you handle discrepancies or inconsistencies found during the due diligence process?

Discrepancies and inconsistencies during due diligence are expected; thorough investigation is key. My approach involves a systematic process:

- Identification and Documentation: Meticulously document every discrepancy, including the source of information and any supporting evidence.

- Verification and Validation: Cross-reference the information with multiple sources to validate or invalidate the findings. I utilize property records, leases, operating statements, and other relevant documentation to seek clarification.

- Communication and Follow-Up: Communicate the findings to the appropriate parties (seller, brokers, inspectors) and seek clarification or additional information. I carefully document all communication.

- Impact Assessment: Assess the materiality of the discrepancy. A minor discrepancy might be easily rectified, whereas a significant issue could necessitate a renegotiation of terms or withdrawal from the transaction.

- Decision-Making: Based on the assessment, a decision is made on how to proceed. This could involve negotiating with the seller, requesting further investigation, or terminating the deal.

Example: If an appraisal came in significantly lower than the purchase price, I’d investigate the reasons thoroughly, perhaps scrutinizing the appraiser’s methodology or comparing it to other recent appraisals in the area before deciding on the next step.

Key Topics to Learn for Commercial Real Estate Due Diligence Interview

- Property Condition Assessment: Understanding the physical condition of the property, including building systems, structural integrity, and environmental concerns. Practical application: Analyzing inspection reports to identify potential liabilities and capital expenditure needs.

- Title and Ownership Due Diligence: Examining the chain of title, identifying easements, encroachments, and other title defects that could impact ownership. Practical application: Interpreting title commitments and identifying potential title curative issues.

- Environmental Due Diligence: Assessing potential environmental hazards, such as asbestos, lead paint, and soil contamination. Practical application: Evaluating Phase I Environmental Site Assessments (ESAs) and determining the need for further investigation.

- Lease Analysis: Reviewing existing leases to understand occupancy, rental rates, lease terms, and potential lease expirations. Practical application: Identifying potential risks and opportunities related to lease expirations and tenant defaults.

- Financial Due Diligence: Analyzing the financial performance of the property, including income statements, operating statements, and cash flow projections. Practical application: Evaluating the property’s profitability and identifying potential discrepancies in financial reporting.

- Legal and Regulatory Compliance: Ensuring compliance with all relevant zoning laws, building codes, and environmental regulations. Practical application: Identifying potential legal and regulatory risks that could impact the property’s value or operation.

- Risk Assessment and Mitigation: Identifying and evaluating potential risks associated with the property and developing strategies to mitigate those risks. Practical application: Developing a comprehensive risk management plan to protect the investment.

Next Steps

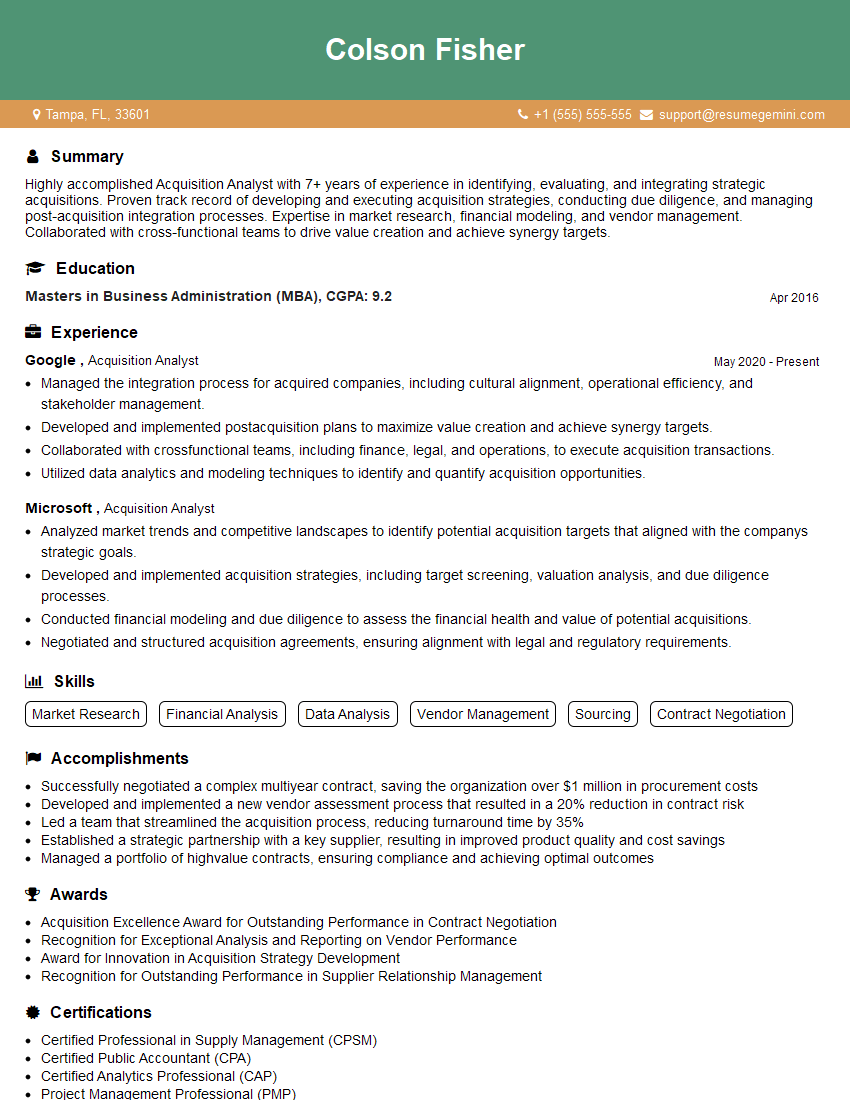

Mastering Commercial Real Estate Due Diligence is crucial for career advancement in this dynamic field. A strong understanding of these processes demonstrates a high level of competency and opens doors to exciting opportunities. To significantly increase your chances of landing your dream role, a well-crafted, ATS-friendly resume is essential. ResumeGemini is a trusted resource that can help you build a compelling resume showcasing your skills and experience effectively. ResumeGemini offers examples of resumes tailored specifically to Commercial Real Estate Due Diligence, providing you with the template and inspiration you need to create a winning application.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

I Redesigned Spongebob Squarepants and his main characters of my artwork.

https://www.deviantart.com/reimaginesponge/art/Redesigned-Spongebob-characters-1223583608

IT gave me an insight and words to use and be able to think of examples

Hi, I’m Jay, we have a few potential clients that are interested in your services, thought you might be a good fit. I’d love to talk about the details, when do you have time to talk?

Best,

Jay

Founder | CEO