Interviews are more than just a Q&A session—they’re a chance to prove your worth. This blog dives into essential Market Feasibility Studies interview questions and expert tips to help you align your answers with what hiring managers are looking for. Start preparing to shine!

Questions Asked in Market Feasibility Studies Interview

Q 1. Explain the key stages involved in conducting a market feasibility study.

A market feasibility study systematically assesses the viability of a new product, service, or business venture in a specific market. It’s a crucial step before significant investment, helping to minimize risk and maximize chances of success. The key stages typically include:

- Problem Definition & Opportunity Analysis: Clearly articulating the problem the product/service solves and the opportunity it presents. This involves preliminary market research to identify a potential need.

- Market Research & Analysis: This is the core of the study, involving gathering and analyzing data about the target market, competition, and market trends. This phase employs various techniques, including surveys, interviews, and secondary data analysis.

- Target Market Identification & Analysis: Defining the specific customer segments most likely to purchase the offering. This includes demographic, psychographic, and behavioral characteristics.

- Competitive Analysis: A deep dive into existing competitors, identifying their strengths and weaknesses, market share, pricing strategies, and competitive advantages. This helps understand your potential positioning.

- Market Sizing & Forecasting: Estimating the current and future size of the target market and potential market share. This often involves using market research reports, industry data, and forecasting models.

- Financial Projections: Developing pro forma financial statements, including projected revenue, costs, and profitability. This allows for an assessment of the financial feasibility of the venture.

- Marketing & Sales Strategy: Outlining a plan for reaching and converting target customers, including marketing channels, pricing strategies, and sales tactics.

- Risk Assessment & Mitigation: Identifying potential risks and developing strategies to mitigate them. This includes factors like economic downturns, changing consumer preferences, and competitor actions.

- Feasibility Report & Recommendations: Compiling all findings into a comprehensive report that includes conclusions and recommendations on whether to proceed with the venture.

Q 2. Describe your experience in defining the scope of a market feasibility study.

Defining the scope is paramount. A poorly defined scope leads to wasted resources and inconclusive results. My approach involves collaborating closely with clients to understand their objectives and constraints. This starts with clarifying the specific product or service being evaluated, the geographical market, and the timeframe of the study. For instance, if a client wants to launch a new type of organic coffee, we’d define the scope to include specific coffee types (e.g., espresso, drip), target demographics (e.g., millennials, environmentally conscious consumers), and a geographic region (e.g., a specific city or state). We then establish key questions the study needs to answer, such as market size, competitive landscape, pricing strategies, and potential marketing channels. This collaborative process ensures everyone is aligned on the goals and deliverables, creating a focused and efficient study.

For example, in a study for a tech startup launching a new app, we precisely defined the scope to include only the US market initially, focusing on specific age groups and demographic segments, excluding international expansion for the first phase. This helped to keep the study manageable and focused on providing actionable insights for the immediate launch.

Q 3. How do you identify target markets for a new product or service?

Identifying target markets requires a multi-faceted approach combining quantitative and qualitative research. It’s about understanding who your ideal customer is and what motivates them to buy. We start by segmenting the overall market into smaller, more homogenous groups based on various characteristics. These may include:

- Demographics: Age, gender, income, education, occupation, family size, etc.

- Psychographics: Lifestyle, values, attitudes, interests, personality traits, etc.

- Geographic location: Region, urban vs. rural, climate, etc.

- Behavioral factors: Purchase history, brand loyalty, usage patterns, media consumption habits, etc.

We then use techniques like market surveys, focus groups, and interviews to gather detailed information about these segments. For example, when analyzing the target market for a new fitness app, we might segment by age (young adults vs. older adults), activity level (beginners vs. advanced), fitness goals (weight loss, muscle gain, overall health), and device preferences (smartphones vs. tablets). This segmentation allows us to tailor marketing efforts and product features to resonate effectively with each specific segment. Further analysis might reveal one segment to be the most promising, allowing us to prioritize our resources.

Q 4. What are the primary sources of data you utilize in a market feasibility study?

Data is the lifeblood of a market feasibility study. I rely on a combination of primary and secondary sources. Secondary data sources provide a foundation and context, while primary data provides specific insights into the target market and the proposed product/service.

- Secondary data sources: These include market research reports (e.g., from Nielsen, Mintel, Statista), industry publications, government statistics, company websites, and academic journals. These provide broader market trends and contextual information.

- Primary data sources: These involve direct interaction with potential customers and include surveys (online, telephone, in-person), focus groups, interviews, and observational studies. These provide direct feedback on consumer preferences, needs, and perceptions.

For example, in a study for a new sustainable clothing line, we used secondary data from market research reports to understand the overall size of the sustainable fashion market and its growth trends. We then conducted primary research through online surveys and focus groups to gather data on consumer attitudes toward sustainable fashion, preferred materials, price sensitivity, and shopping habits. This combination allowed for a comprehensive understanding of the market and potential customer base.

Q 5. How do you assess the competitive landscape in a market feasibility study?

Assessing the competitive landscape is crucial for understanding your potential for success. This involves identifying all direct and indirect competitors, analyzing their strengths and weaknesses, and understanding their market share and strategies. My approach uses a structured framework:

- Identify Competitors: A thorough search identifies all companies offering similar products or services, both direct (offering virtually the same thing) and indirect (offering substitutes or alternatives).

- Analyze Competitor Strengths and Weaknesses: This involves evaluating factors like product quality, pricing, marketing efforts, customer service, distribution channels, and brand reputation. SWOT analysis is a useful tool here.

- Market Share Analysis: Determining the market share of each competitor provides insights into their relative success and market dominance. This often involves analyzing sales data, market research reports, and industry publications.

- Competitive Strategies: Analyzing competitors’ strategies – their pricing, marketing, product development, and customer service approaches – reveals opportunities and potential challenges.

- Competitive Advantage: Identifying what makes your product or service unique and superior to competitors. This is about identifying a sustainable competitive advantage.

For instance, analyzing the competitive landscape for a new restaurant would involve identifying existing restaurants in the area (direct competitors), as well as other food outlets like cafes and fast-food chains (indirect competitors). We would then assess their menus, pricing, location, atmosphere, and marketing strategies to understand their strengths and weaknesses and determine how to differentiate our offering. Perhaps a unique menu, specific ambiance, or targeted customer base will be identified as a key competitive advantage.

Q 6. Explain your approach to market sizing and forecasting.

Market sizing and forecasting are critical for determining the potential financial viability of a new venture. Market sizing involves estimating the current size of the target market, while forecasting projects future growth. My approach combines top-down and bottom-up methods:

- Top-down approach: Starts with overall market data (e.g., from industry reports) and breaks it down into segments to estimate the size of your target market.

- Bottom-up approach: Starts by estimating the potential number of customers within your target market and projecting their average purchase frequency and value.

Forecasting involves extrapolating past trends and incorporating various factors, like economic growth, technological advancements, and changes in consumer behavior. We often use statistical methods and forecasting models (like linear regression or time series analysis) to project future demand. Qualitative factors, such as industry expert opinions and emerging trends, are also factored in. The accuracy of forecasting depends on the availability of reliable data and the validity of the underlying assumptions. It’s important to present multiple scenarios (best-case, worst-case, and most-likely) to reflect uncertainty inherent in forecasting.

For example, in the coffee market, a top-down approach might start with the total coffee market size in the US, then refine this down to the segment of specialty coffee, organic coffee, and finally, our specific type of organic coffee. The bottom-up approach might involve estimating the number of potential customers based on demographics and projected market penetration.

Q 7. How do you analyze market trends and their potential impact?

Analyzing market trends is essential for understanding the dynamics of the market and anticipating potential opportunities and threats. This involves monitoring various factors that can influence market demand and competition. My approach involves:

- Identify Key Trends: We look at macroeconomic trends (economic growth, inflation, interest rates), technological advancements, changing consumer preferences (lifestyle changes, health concerns, environmental consciousness), regulatory changes, and competitive activity (new product launches, mergers and acquisitions).

- Data Collection: We gather data from various sources, including market research reports, industry publications, news articles, social media, and consumer surveys.

- Trend Analysis: We analyze the trends to understand their potential impact on the market and the proposed product/service. This might involve creating timelines, charting key metrics, and mapping out possible scenarios.

- Scenario Planning: We develop different scenarios based on various combinations of trends to assess their potential impact. This helps to prepare for different outcomes.

For example, analyzing trends in the electric vehicle market would involve considering factors like government regulations promoting EVs, technological advancements in battery technology, changes in consumer attitudes toward sustainability, and competition from established automakers. We might develop different scenarios based on variations in government subsidies, consumer adoption rates, and technological breakthroughs. This helps in assessing potential market size and growth trajectory, informing investment decisions and market entry strategies.

Q 8. What methods do you use to assess market demand?

Assessing market demand involves understanding the size, needs, and purchasing power of your target customer base. It’s like figuring out how many people want your product and are willing to pay for it. I employ a multi-pronged approach:

- Market Research Surveys: These are questionnaires distributed to potential customers to gauge interest, preferences, and willingness to pay. For example, if launching a new type of coffee, I’d survey coffee drinkers to understand their current coffee consumption, price sensitivity, and preferences for different roasts and flavors.

- Competitive Analysis: Studying competitors’ offerings, pricing strategies, and market share reveals gaps and opportunities. If a competitor’s product is lacking a crucial feature, that’s a potential opening for my product.

- Secondary Data Analysis: Leveraging existing market research reports, industry publications, and government statistics provides a broader context. This involves researching industry trends and growth forecasts to understand the overall market potential.

- Focus Groups: These small group discussions help gather in-depth insights into customer perceptions, needs, and behaviors. For a new app, focus groups allow direct feedback on usability and features.

By combining these methods, I build a comprehensive understanding of the market’s size, potential, and the specific needs it demands, allowing for a data-driven decision.

Q 9. How do you evaluate the potential risks and challenges associated with a new market entry?

Evaluating risks is crucial for informed decision-making. It’s like navigating a ship; you need to be aware of potential storms before setting sail. My evaluation process typically includes:

- Market Entry Barriers: I identify and assess factors hindering market entry, such as high capital requirements, stringent regulations, or strong incumbents. For example, launching a pharmaceutical drug requires significant investment in research and regulatory approvals.

- Competitive Landscape: I thoroughly analyze existing competitors, their strengths and weaknesses, and their potential responses to new entrants. A market dominated by a few powerful players could be incredibly challenging to penetrate.

- Economic and Political Risks: I consider factors like economic downturns, political instability, or changes in government policy. A sudden economic recession could severely impact consumer spending and the viability of a new product.

- Technological Risks: Rapid technological changes could render a product obsolete or make it difficult to compete. Think of the rapid obsolescence of some mobile phone technologies.

- Regulatory Risks: Changes in regulations or compliance requirements could significantly impact the business. For example, new environmental regulations could increase the cost of production.

By identifying and mitigating these risks through careful planning and contingency measures, we can significantly increase the chances of success.

Q 10. Describe your experience in developing financial projections for a new venture.

Developing financial projections requires a thorough understanding of the business model and market dynamics. It’s like creating a roadmap for financial success. My process typically involves:

- Revenue Projections: Forecasting sales volume and pricing strategies based on market demand and pricing analysis. This often involves creating different scenarios (best-case, worst-case, and most likely).

- Cost Projections: Estimating fixed costs (rent, salaries) and variable costs (materials, manufacturing). Detailed analysis of the cost structure is critical for profitability.

- Profit and Loss Statements: Creating projected income statements for the next 3-5 years, showing revenues, expenses, and net profit.

- Cash Flow Projections: Forecasting cash inflows and outflows, which is essential for assessing the need for external funding and managing liquidity. This is particularly important for new ventures with high upfront costs.

- Balance Sheets: Projecting assets, liabilities, and equity. This shows the financial health and stability of the business over time.

I utilize spreadsheet software (like Excel) and financial modeling tools to build these projections, allowing for sensitivity analysis to test different assumptions and assess the impact of various scenarios.

Q 11. How do you assess the potential return on investment (ROI) for a new product or service?

Assessing ROI is crucial for determining the financial viability of a new product or service. It’s all about measuring the return on your investment. My approach involves:

- Estimating Total Investment: Calculating all costs associated with developing and launching the product, including research and development, marketing, and manufacturing.

- Projecting Total Revenue: Estimating the total revenue the product is expected to generate over its life cycle.

- Calculating Net Profit: Subtracting total costs from total revenue.

- Calculating ROI: Using the formula:

ROI = (Net Profit / Total Investment) * 100% - Considering Time Value of Money: Using discounted cash flow (DCF) analysis to account for the fact that money earned today is worth more than money earned in the future.

The higher the ROI, the more attractive the investment. A positive ROI indicates profitability, while a negative ROI signals potential losses. However, ROI should always be considered alongside other qualitative factors like market share and strategic alignment.

Q 12. How do you present findings from a market feasibility study to stakeholders?

Presenting findings to stakeholders requires clear communication and data visualization. Think of it as telling a compelling story with data. My approach involves:

- Executive Summary: A concise overview of the key findings and recommendations, highlighting the most important aspects of the study.

- Visualizations: Using charts and graphs to present data effectively. This makes complex data easier to understand and interpret.

- Key Findings: Presenting the core insights gathered from the market research, focusing on areas such as market size, competition, and potential risks.

- Financial Projections: Presenting the key financial projections, including revenue, costs, and ROI. Visualizing these projections adds clarity.

- Recommendations: Providing actionable recommendations based on the findings of the study, including clear next steps.

- Q&A Session: Allowing time for questions and discussion to ensure stakeholders fully understand the findings and recommendations.

The presentation should be tailored to the audience, using language and level of detail appropriate to their expertise and interests. The overall goal is to provide sufficient information for them to make informed decisions.

Q 13. What are some common pitfalls to avoid in conducting a market feasibility study?

Avoiding common pitfalls is essential for a successful market feasibility study. It’s like avoiding potholes on a road trip – you want a smooth journey. Here are some common pitfalls to avoid:

- Insufficient Market Research: Relying on limited data or anecdotal evidence can lead to inaccurate conclusions. Thorough research is paramount.

- Ignoring Competition: Failing to properly analyze competitors can lead to overlooking critical factors impacting market entry and success.

- Unrealistic Financial Projections: Overly optimistic financial forecasts can lead to flawed decision-making. Use realistic assumptions based on thorough analysis.

- Ignoring Potential Risks: Not adequately addressing potential risks can lead to unforeseen problems and project failure. Develop contingency plans to mitigate these risks.

- Bias in Data Collection: Using biased samples or survey questions can skew results and lead to inaccurate conclusions.

- Lack of Clarity in Objectives: Starting a study without clear, well-defined goals can lead to wasted time and resources.

A well-planned and executed feasibility study minimizes these pitfalls, leading to more accurate and actionable insights.

Q 14. How do you handle conflicting data or information in your analysis?

Handling conflicting data requires a methodical approach. It’s like being a detective, piecing together clues that may not seem to fit at first. My approach involves:

- Identifying the Source of Conflict: Determining the reason for the discrepancy. Are the data sets from different sources? Are the methodologies different?

- Evaluating Data Quality: Assessing the reliability and validity of each data source. Is one source more reputable or reliable than the other?

- Triangulation: Using multiple data sources and methods to validate findings and identify inconsistencies. The more sources align, the more confidence one has in the results.

- Sensitivity Analysis: Testing the impact of varying assumptions and data points on the overall conclusions. This helps understand the range of potential outcomes.

- Qualitative Research: Incorporating qualitative research methods (interviews, focus groups) to gather in-depth insights that can help explain discrepancies in quantitative data.

- Transparency: Clearly documenting all data sources, methodologies, and assumptions, including any conflicts and how they were addressed.

By applying a critical and analytical lens to all data, and clearly documenting the process, one can arrive at the most robust and reliable conclusions despite any initial discrepancies.

Q 15. Explain your experience with different market research methodologies (e.g., surveys, focus groups, etc.)

My experience encompasses a wide range of market research methodologies, each chosen strategically based on the research objectives and available resources. I’ve extensively used surveys, both online and offline, to gather quantitative data on market size, customer preferences, and purchase behavior. For instance, in a study for a new sustainable food product, we employed an online survey to reach a geographically diverse sample and gather data on consumer willingness to pay a premium for eco-friendly options.

Focus groups are invaluable for qualitative insights. I’ve facilitated numerous focus groups to understand the underlying reasons behind consumer choices, explore unmet needs, and gauge reactions to new product concepts. In one project involving a new mobile app, focus groups helped us identify usability issues and refine the app’s design before launch.

Furthermore, I’m proficient in conducting in-depth interviews, which offer a more personalized and detailed understanding of individual consumer experiences. These are particularly helpful when exploring niche markets or complex purchase decisions. Finally, I’ve leveraged observational research, like ethnographic studies, to directly observe consumer behavior in their natural environment, providing valuable contextual data that often goes unnoticed in other methods.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. How do you ensure the accuracy and reliability of your data?

Ensuring data accuracy and reliability is paramount. My approach is multi-faceted and begins with meticulous study design. This includes carefully defining the target population, selecting an appropriate sampling method (e.g., random sampling, stratified sampling), and developing clear, unbiased questionnaires or interview guides.

Data validation is critical. I employ rigorous quality control measures throughout the data collection process, including data cleaning and checking for inconsistencies or outliers. For instance, in a survey, I would flag responses that are unusually quick or that show response patterns indicating a lack of engagement. Statistical analysis is then used to verify the reliability and validity of the data. For example, I’d use Cronbach’s alpha to assess the internal consistency of survey scales, and various tests for significance and validity will be done on our gathered data.

Finally, I always strive for transparency, documenting my methodologies thoroughly so that the entire process and its limitations are clearly understood. This allows for critical evaluation of the findings and enhances the credibility of the study.

Q 17. How do you incorporate qualitative data into your quantitative analysis?

Integrating qualitative and quantitative data is crucial for a holistic understanding of the market. Quantitative data provides the ‘what’ – the numbers, trends, and market size. Qualitative data offers the ‘why’ – the underlying motivations, attitudes, and beliefs driving these trends. I use a mixed-methods approach, often employing qualitative data to inform the interpretation of quantitative findings.

For example, if a quantitative survey reveals a declining market share for a product, qualitative interviews can help understand the reasons behind this decline. Perhaps customers are dissatisfied with a specific feature or have switched to a competitor’s product. This insight allows for more effective strategic recommendations. I often use qualitative data to segment my quantitative data, allowing for a more targeted analysis and better actionability of the data. For example, clustering my quantitative results based on themes obtained through qualitative data helps better refine a company’s target market.

Q 18. How do you adapt your approach to market feasibility studies based on different industry contexts?

My approach to market feasibility studies is highly adaptable depending on the industry context. The methodologies and data points considered will vary significantly between, say, the technology sector and the food and beverage industry.

In the technology sector, I would focus on factors like technological feasibility, competitor analysis, and adoption rates. In the food and beverage industry, factors such as regulatory compliance, supply chain logistics, and consumer preferences (taste, health consciousness) become critical. Understanding the specific industry dynamics, regulatory landscape, and competitive environment is fundamental to developing a relevant and insightful feasibility study. This means tailoring the scope of research, the methods employed, and the metrics used to evaluate market potential.

For example, in a study for a new pharmaceutical product, extensive regulatory analysis and clinical trial data would be essential, while such data would be less relevant when evaluating the feasibility of a new mobile app.

Q 19. Describe your experience using market research software or tools.

I am proficient in using various market research software and tools. My experience includes using survey platforms like Qualtrics and SurveyMonkey for designing, distributing, and analyzing online surveys. I also utilize data analysis software like SPSS and R for statistical analysis and data visualization. Furthermore, I’m familiar with various qualitative data analysis software packages to help organize and code qualitative data gathered from interviews and focus groups.

Beyond this, I am experienced in using tools for competitive analysis and market sizing, such as databases provided by companies like Statista and IBISWorld. Proficiency in these tools allows for efficient data collection, analysis, and reporting, which is crucial in meeting project deadlines and ensuring the accuracy of my work. Using these tools allows me to streamline and accelerate many data processing activities and reduce the risk of human error in analyzing datasets.

Q 20. How do you measure the success of a market feasibility study?

The success of a market feasibility study isn’t solely measured by the final report. It’s judged by its impact on decision-making and its contribution to the client’s business outcomes. A successful study provides actionable insights that lead to informed decisions, whether it’s deciding to launch a product, enter a new market, or adjust a business strategy.

I measure success by considering several factors: the quality of the data and analysis, the clarity and relevance of the recommendations, the client’s satisfaction with the process and results, and ultimately, whether the recommendations lead to positive business outcomes. For example, if our study leads to a successful product launch that achieves its target market share or if a strategic pivot driven by our study delivers significant financial benefits to our client, then we consider that a successful study. Sometimes, a successful study is one that advises a client *against* pursuing a particular opportunity due to identified significant market risks.

Q 21. How do you determine the appropriate sample size for a market research study?

Determining the appropriate sample size is crucial for ensuring the accuracy and reliability of the study findings. The required sample size depends on several factors, including the desired level of confidence, the margin of error, and the variability within the population. Larger samples generally provide more precise estimates, but they also increase the cost and time required for data collection.

I typically use statistical power analysis techniques to determine the appropriate sample size. This involves specifying the desired power (usually 80% or higher), the significance level (typically 5%), and an estimate of the population variability. Software packages like G*Power can be used to calculate the necessary sample size based on these parameters. For instance, if I’m conducting a survey to estimate the proportion of consumers who would purchase a new product, I would use a power analysis to calculate the number of respondents needed to achieve a statistically significant result with a specified margin of error.

Furthermore, I take into account the practical constraints, such as budget and time limitations, while striving for a balance between statistical rigor and practical feasibility. I might use stratified sampling to ensure representation from different segments of the population if a larger sample size is not feasible.

Q 22. What are some key economic indicators you consider in a market feasibility study?

Economic indicators are crucial for assessing market viability. We don’t just look at one; rather, we build a comprehensive picture. Key indicators include:

- Market Size and Growth Rate: This tells us the current size of the potential market and how fast it’s expanding. For example, analyzing the Compound Annual Growth Rate (CAGR) of a particular industry provides insights into its growth trajectory.

- GDP and Disposable Income: A strong GDP and rising disposable incomes suggest increased consumer spending power, directly influencing demand for products and services.

- Inflation Rates: High inflation can impact consumer spending habits and input costs, which needs to be factored into pricing and profitability analysis.

- Unemployment Rates: High unemployment often correlates with reduced consumer confidence and spending, impacting the potential market.

- Interest Rates: Interest rates affect borrowing costs for both businesses and consumers; high rates can stifle investment and consumer spending.

- Consumer Price Index (CPI): CPI helps in understanding the cost of living and how price changes affect consumer purchasing behavior.

By analyzing these indicators, we can predict future market trends and assess the potential for success.

Q 23. How do you assess the regulatory environment and its impact on market entry?

Assessing the regulatory environment is critical. It can make or break a venture. My approach involves:

- Identifying Relevant Regulations: This requires thorough research into all applicable laws and regulations at local, regional, and national levels. This includes environmental regulations, licensing requirements, industry-specific rules, and consumer protection laws.

- Analyzing Permitting and Licensing Processes: I evaluate the complexity, cost, and time required to obtain necessary permits and licenses. Delays can significantly impact time-to-market and profitability.

- Assessing Compliance Costs: We calculate the ongoing costs associated with complying with regulations, including legal fees, consulting fees, and potential penalties for non-compliance.

- Identifying Potential Legal and Regulatory Risks: We identify potential legal challenges, including lawsuits or government actions that could hinder market entry or operations.

- Future Regulatory Changes: We also try to anticipate potential changes in regulations that may impact the business model. For example, if we are entering a market with emerging environmental regulations, this should be factored into the long-term financial projections.

This comprehensive analysis allows us to make informed decisions on market entry, mitigating potential risks and ensuring compliance.

Q 24. Explain your experience in using statistical analysis in market research.

Statistical analysis is fundamental to market research. I regularly use various techniques, depending on the data and research questions. For instance:

- Regression Analysis: This helps in identifying relationships between variables. For example, we can use it to determine the relationship between advertising spend and sales revenue.

- Correlation Analysis: This helps determine the strength of the relationship between different variables. For example, we can analyze if there’s a correlation between customer demographics and purchasing habits.

- Market Segmentation: I use clustering techniques to group customers with similar characteristics, allowing for more targeted marketing efforts. For example, clustering customers based on their purchase behavior can help in creating distinct marketing campaigns.

- Hypothesis Testing: This allows us to test assumptions about the market. For example, we might test the hypothesis that a new product feature will lead to increased sales.

- Forecasting: Time-series analysis, such as ARIMA models, are applied to predict future market demand based on historical data.

I utilize statistical software packages like R and SPSS to conduct these analyses, ensuring rigor and accuracy.

Q 25. How do you validate your findings and ensure their credibility?

Validating findings is critical for ensuring credibility. My approach involves:

- Triangulation: We use multiple data sources – surveys, interviews, secondary research, and observational data – to validate our findings. If different sources support the same conclusion, it strengthens the credibility of our results.

- Peer Review: Internal and external experts review our methodology and findings to identify any potential biases or errors.

- Sensitivity Analysis: We test the robustness of our conclusions by altering key assumptions and parameters to see how much they impact the overall results.

- Transparency: We document our methods, data sources, and assumptions clearly and comprehensively, allowing others to scrutinize our work.

- Data Quality Checks: We rigorously check the quality of our data, looking for inaccuracies or outliers that could skew the results.

By employing these validation techniques, we produce reliable and trustworthy market feasibility studies that guide informed business decisions.

Q 26. How do you deal with uncertainty and limitations in market data?

Uncertainty is inherent in market research. To address data limitations, I use several techniques:

- Scenario Planning: We develop multiple scenarios based on different assumptions about the future market conditions. This provides a range of potential outcomes, helping us prepare for both best-case and worst-case scenarios.

- Qualitative Research: In-depth interviews and focus groups can provide valuable insights that supplement quantitative data and help understand the ‘why’ behind the numbers.

- Expert Interviews: Consulting with industry experts can provide valuable insights and help to address data gaps. This adds a layer of subjective knowledge to the analysis.

- Data Imputation: When appropriate, I use statistical techniques to estimate missing data values, but always clearly state these limitations in the report.

- Robustness Checks: We conduct sensitivity analysis to test how sensitive our conclusions are to changes in assumptions or data limitations. This helps us understand the level of uncertainty associated with our findings.

Transparency regarding limitations is key; it builds trust and allows clients to understand the scope of certainty of the analysis.

Q 27. Describe a situation where a market feasibility study helped you make a critical business decision.

In a recent project for a renewable energy company, we conducted a feasibility study for a new solar panel manufacturing facility. Initial market research showed high growth potential, but our study revealed significant regulatory hurdles and supply chain risks. The detailed analysis of permitting processes, land acquisition costs, and potential delays highlighted considerable financial risks, particularly regarding access to raw materials.

Based on our findings, the company decided against proceeding with the facility at that time. Instead, they opted for a phased approach, focusing first on securing key supply chain partnerships and navigating the regulatory landscape before committing to a large-scale investment. This strategic decision, directly influenced by our feasibility study, avoided potentially significant financial losses.

Q 28. How do you communicate complex market data in a clear and concise manner?

Communicating complex data clearly is crucial. My approach involves:

- Visualizations: Charts, graphs, and maps effectively communicate complex data in a visually appealing and easily understandable way. I use a variety of visual tools depending on the type of data and the audience.

- Storytelling: I frame the data within a narrative, explaining the key findings in a clear and concise manner, avoiding technical jargon whenever possible.

- Executive Summary: I provide a concise summary of the key findings and recommendations at the beginning of the report, tailored to the specific needs and interests of the intended audience.

- Interactive Dashboards: For larger projects, I develop interactive dashboards that allow clients to explore the data in more detail at their own pace.

- Plain Language: I avoid technical jargon and explain complex concepts in simple, easy-to-understand terms. All technical terms are defined when introduced.

The goal is to empower clients with the information they need to make sound business decisions, regardless of their technical expertise.

Key Topics to Learn for Market Feasibility Studies Interview

- Market Analysis: Understanding target audiences, their needs, and purchasing behaviors. Practical application: Conducting competitive analyses to identify market gaps and opportunities.

- Demand Forecasting: Projecting future demand for a product or service. Practical application: Utilizing various forecasting techniques (e.g., regression analysis, time series analysis) to support your projections.

- Supply Analysis: Evaluating the availability and cost of resources needed to produce or deliver a product or service. Practical application: Assessing the capacity of existing suppliers and identifying potential supply chain challenges.

- Financial Projections: Developing pro forma financial statements (income statement, balance sheet, cash flow statement) to assess the financial viability of a project. Practical application: Using financial models to demonstrate profitability and return on investment.

- Risk Assessment: Identifying and evaluating potential risks and uncertainties associated with the project. Practical application: Developing mitigation strategies to address potential risks and uncertainties.

- Marketing Strategies: Developing and evaluating marketing plans to reach target audiences. Practical application: Considering various marketing channels and their effectiveness in reaching specific demographics.

- Competitive Analysis: Analyzing the competitive landscape, including strengths, weaknesses, opportunities, and threats (SWOT analysis). Practical application: Identifying competitive advantages and developing strategies to differentiate your product or service.

- Regulatory Considerations: Understanding relevant regulations and legal requirements. Practical application: Ensuring compliance with all applicable laws and regulations.

- Report Writing and Presentation Skills: Communicating findings clearly and concisely through written reports and presentations. Practical application: Structuring reports logically and using visual aids to enhance communication.

Next Steps

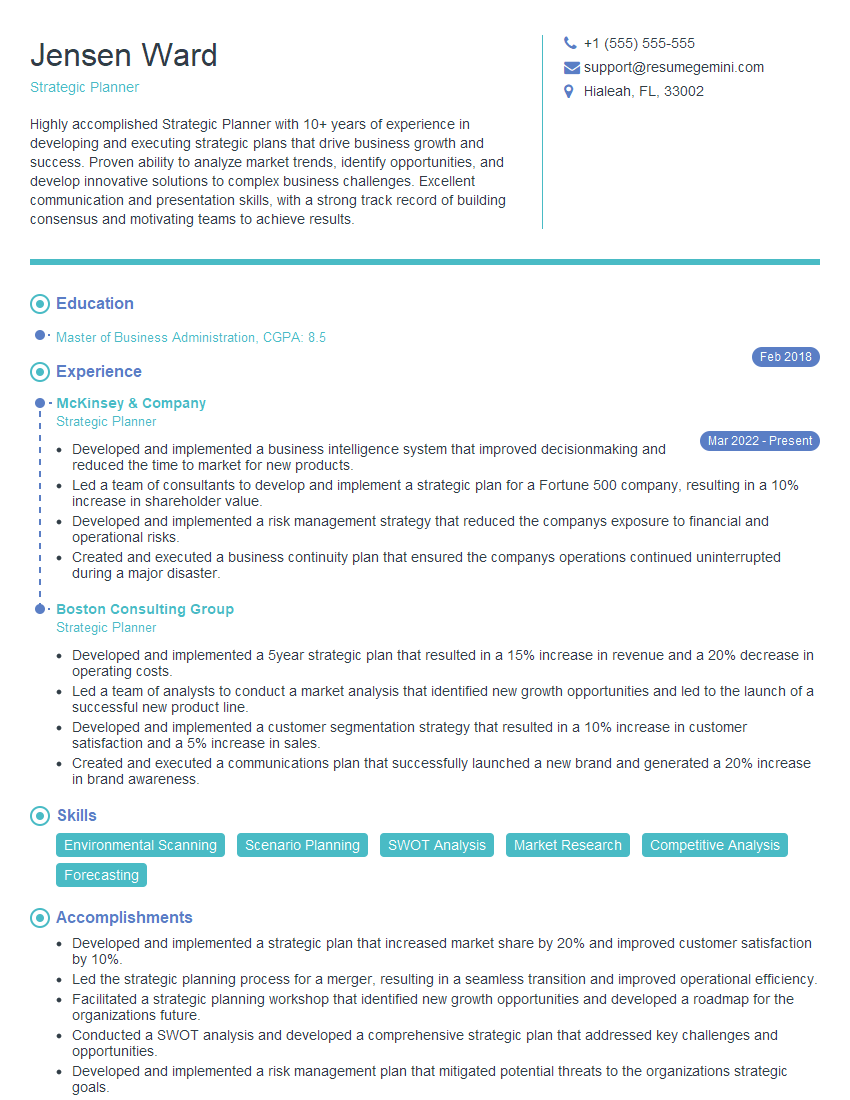

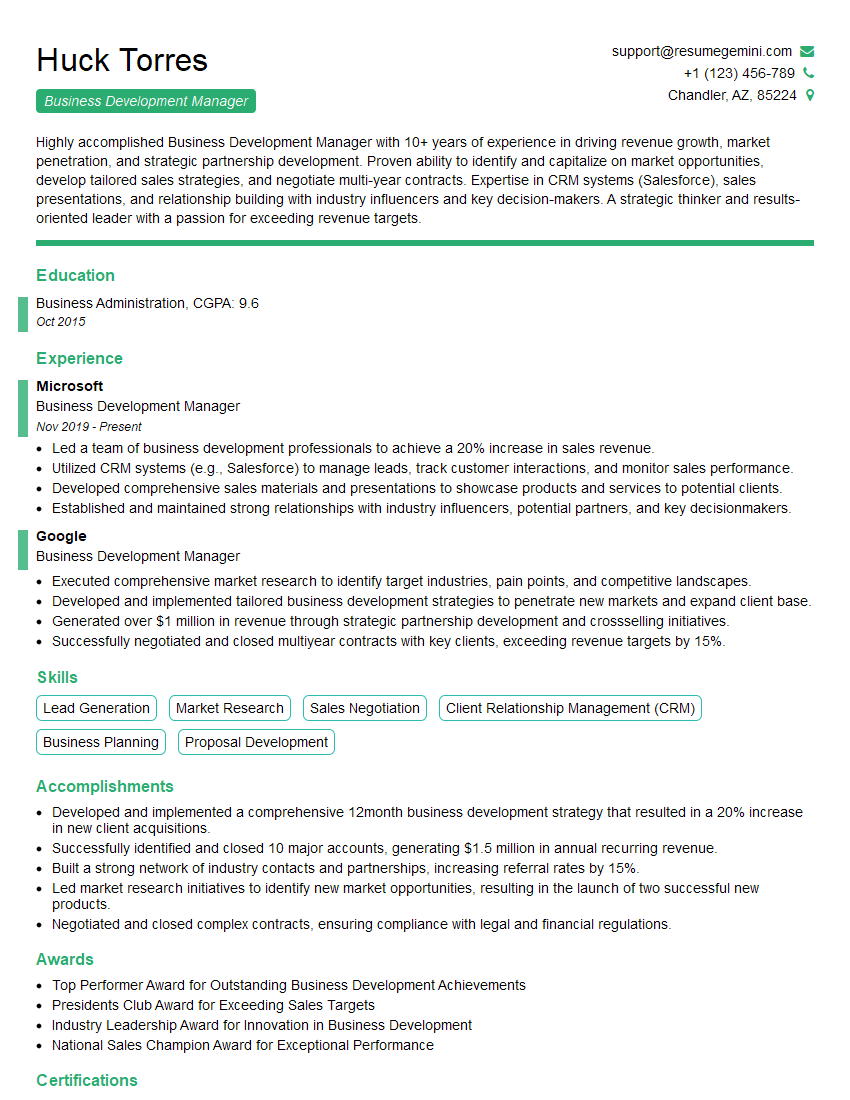

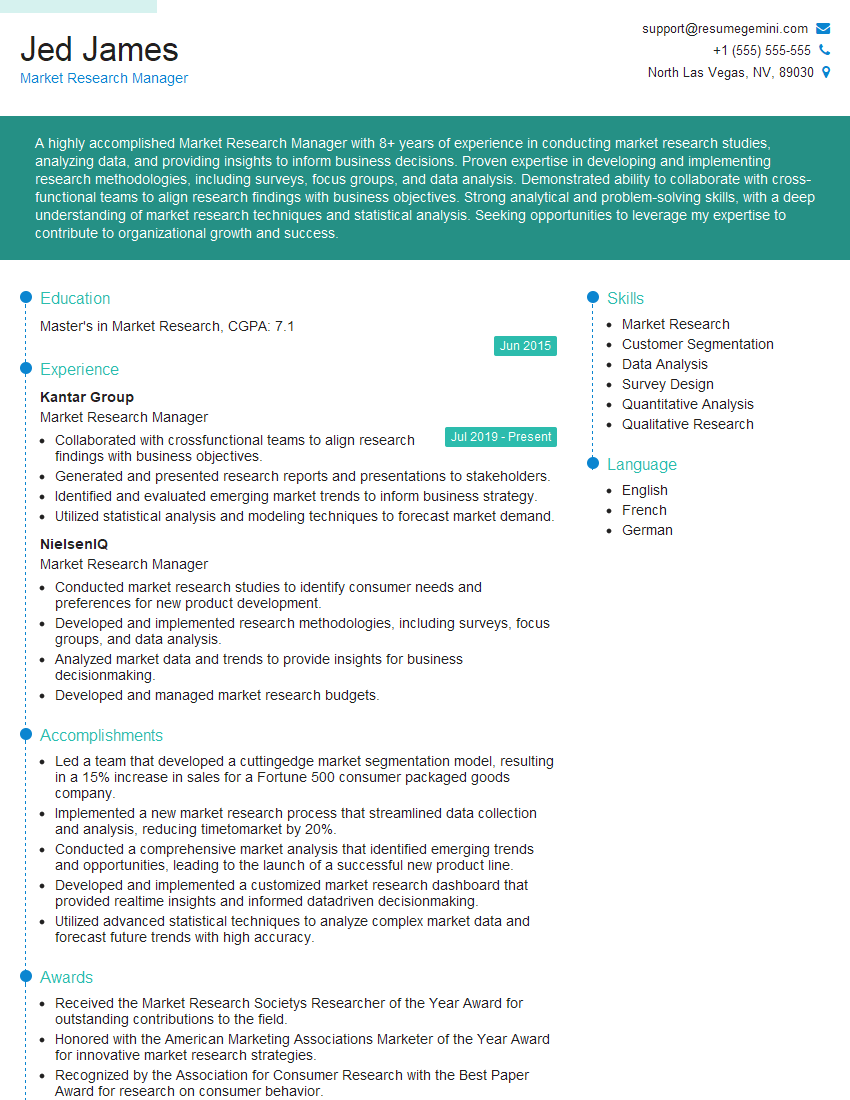

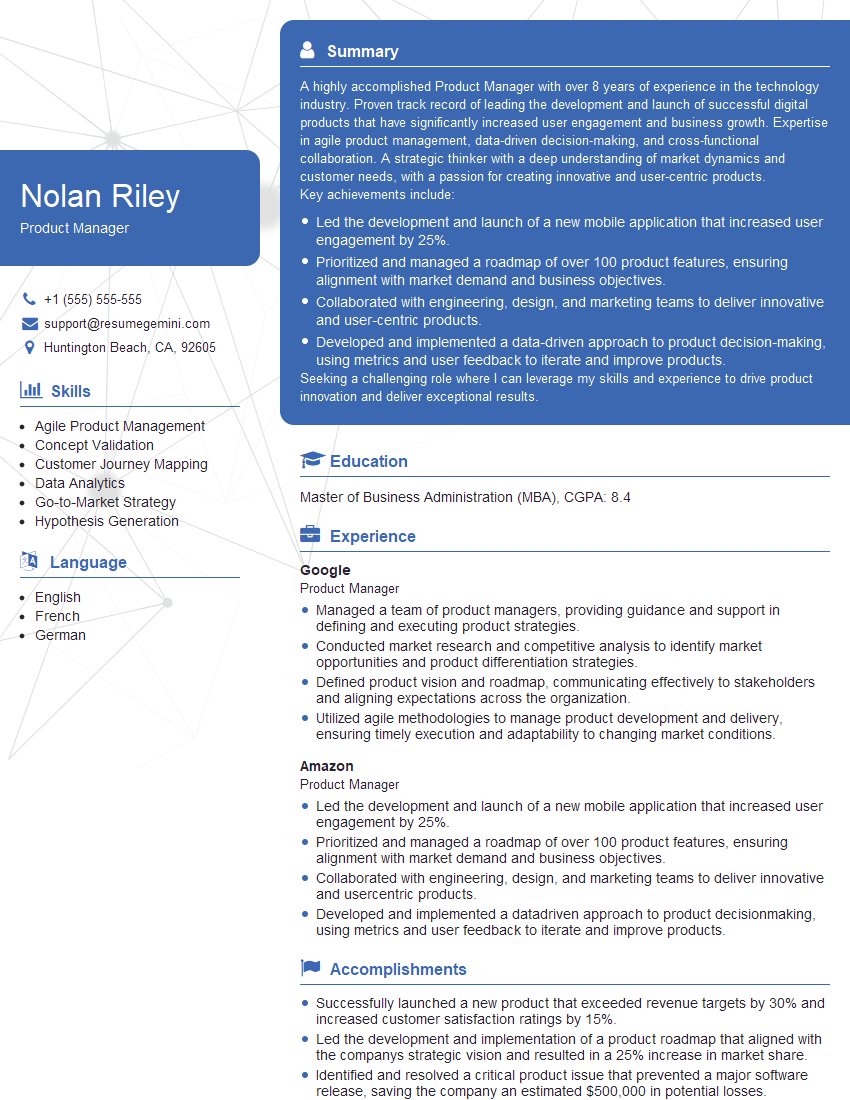

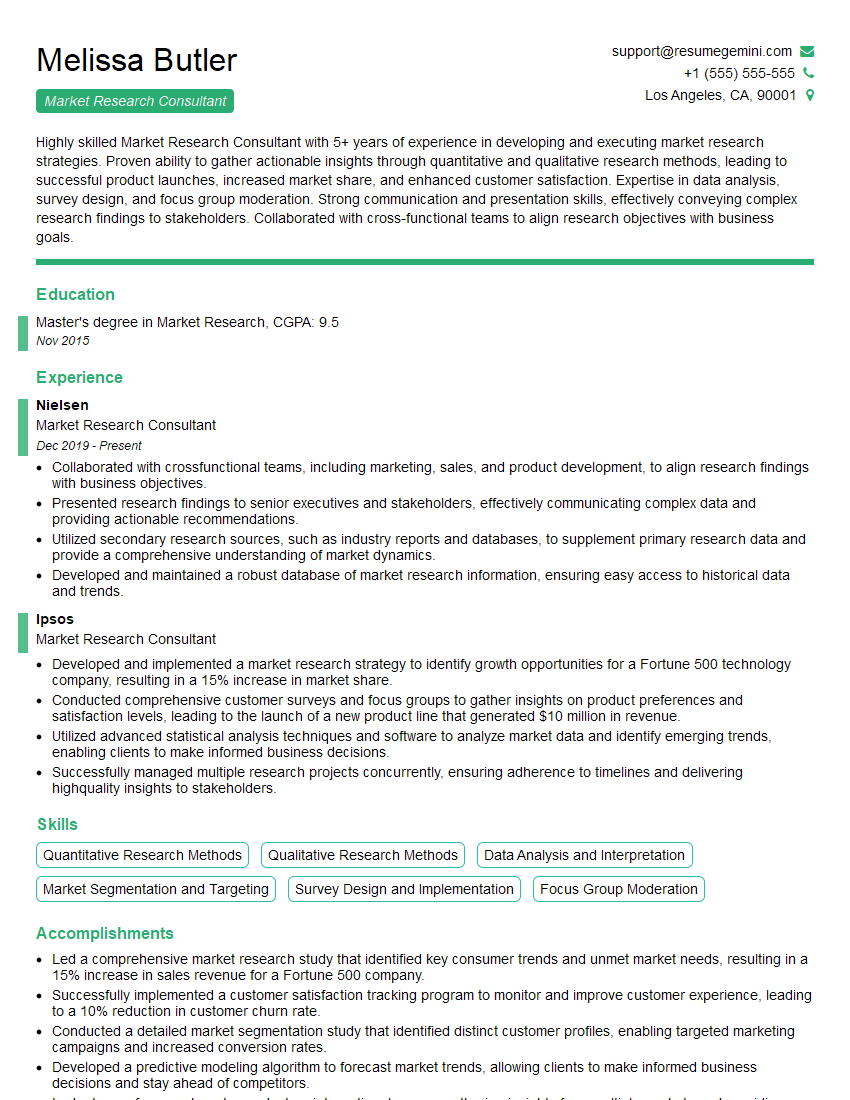

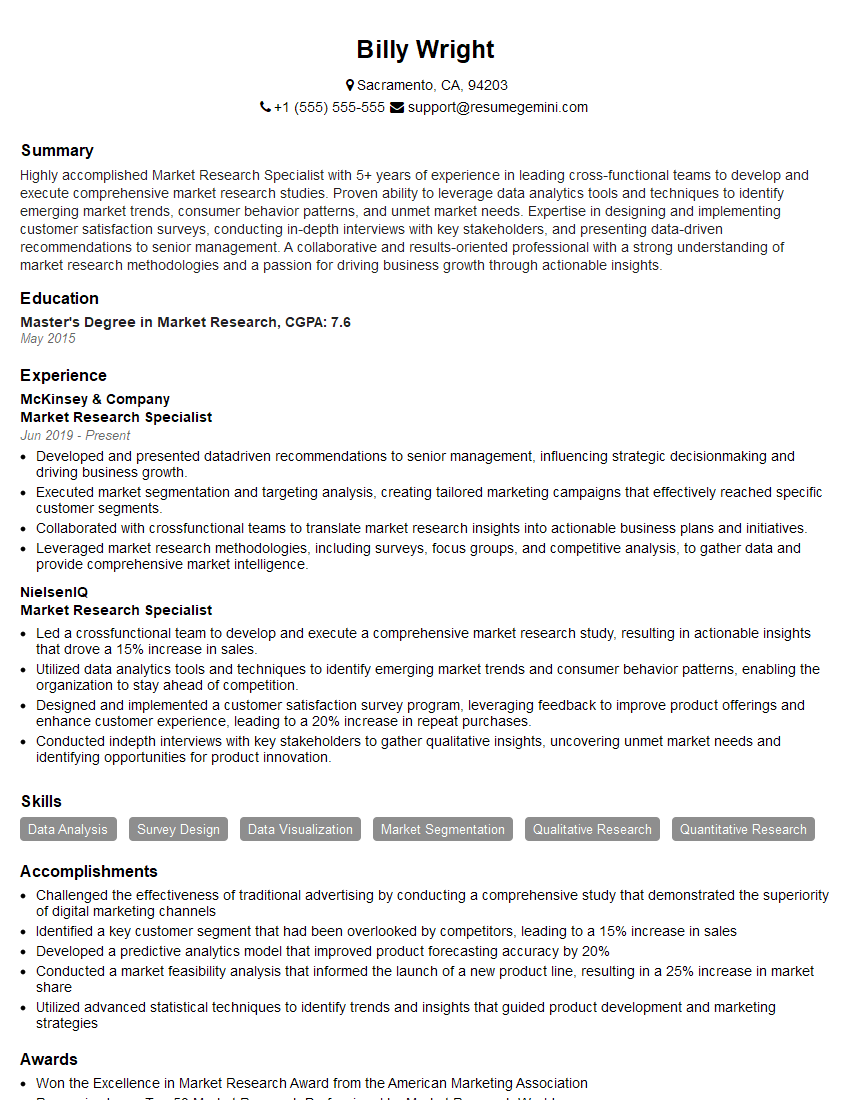

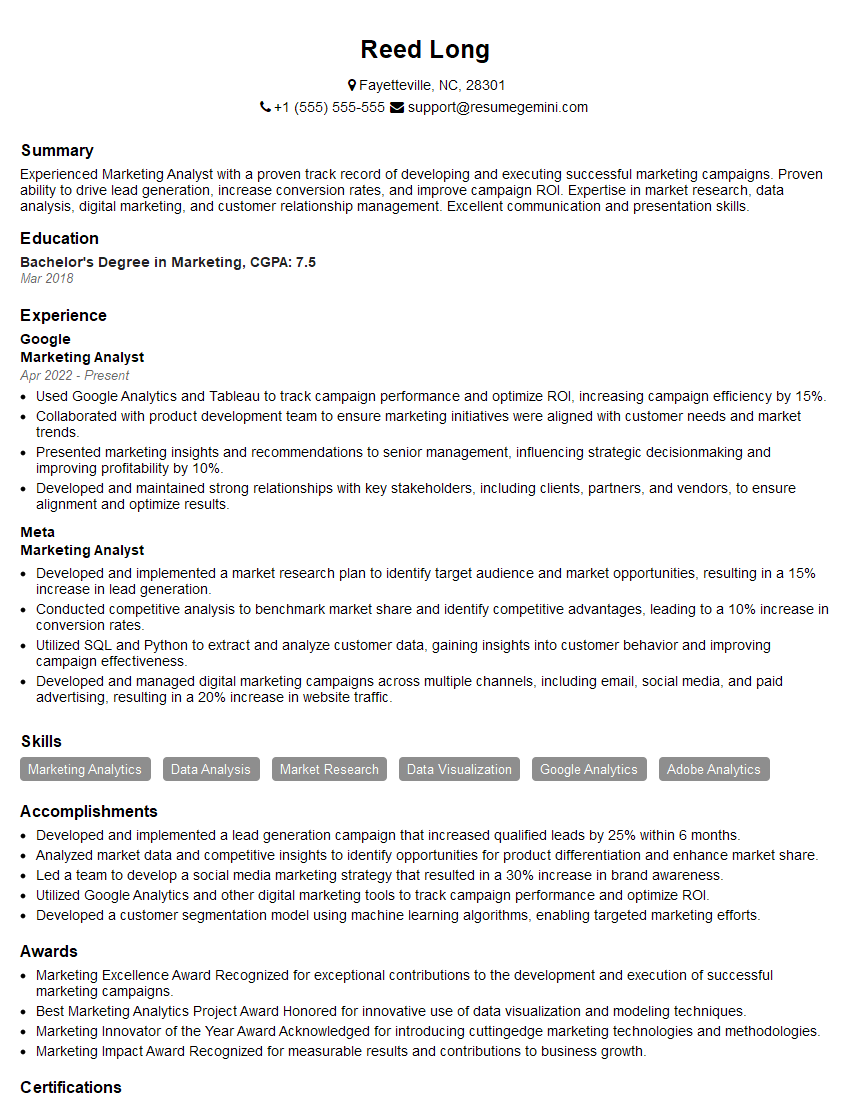

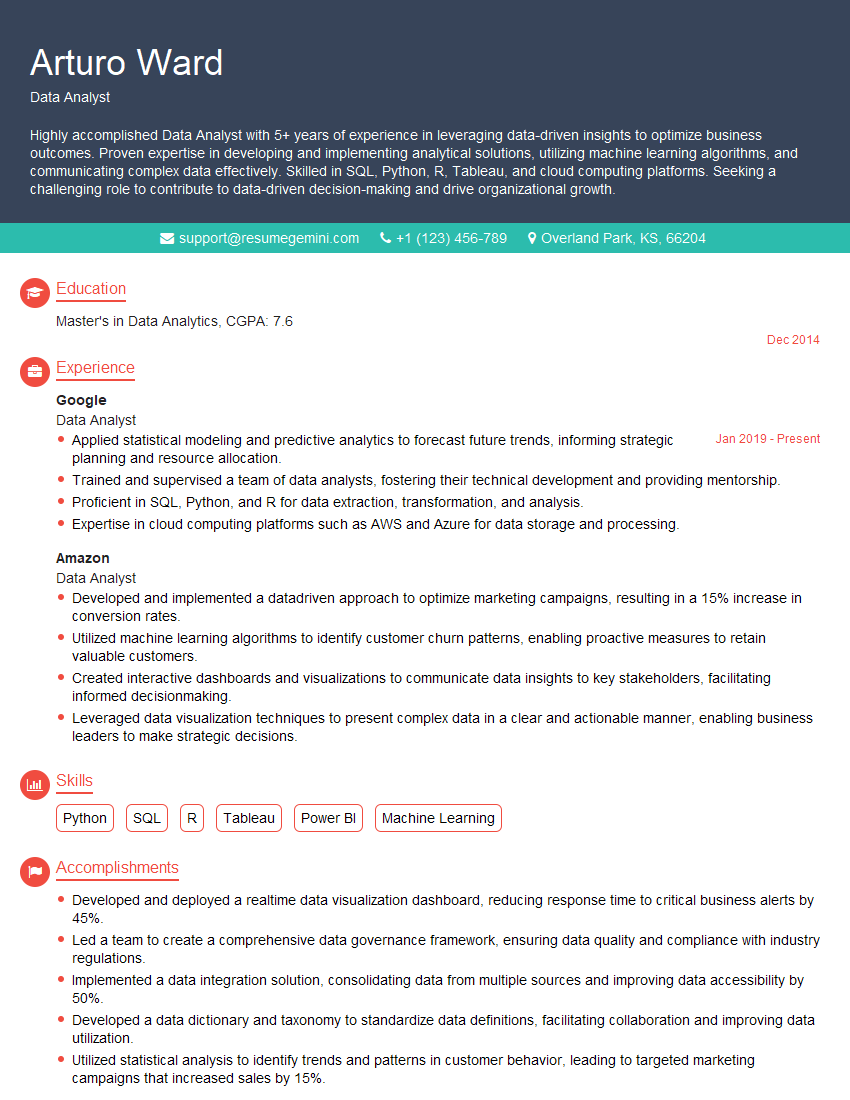

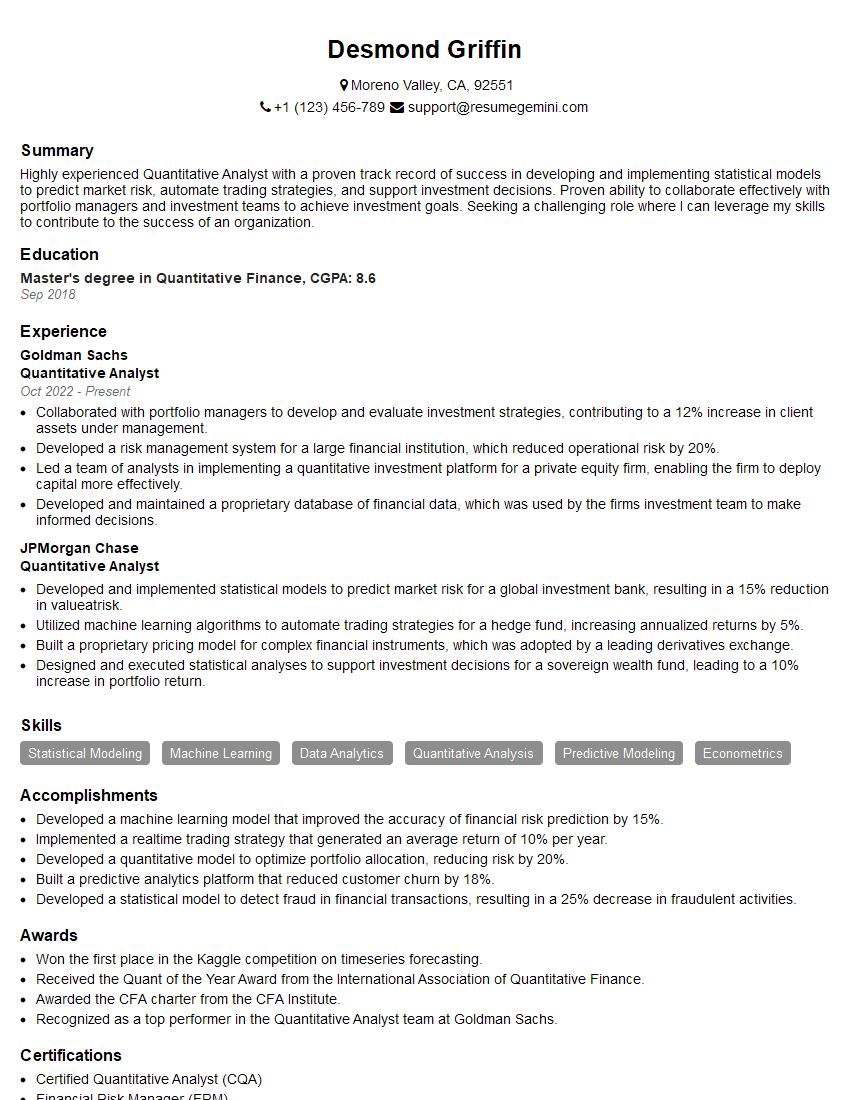

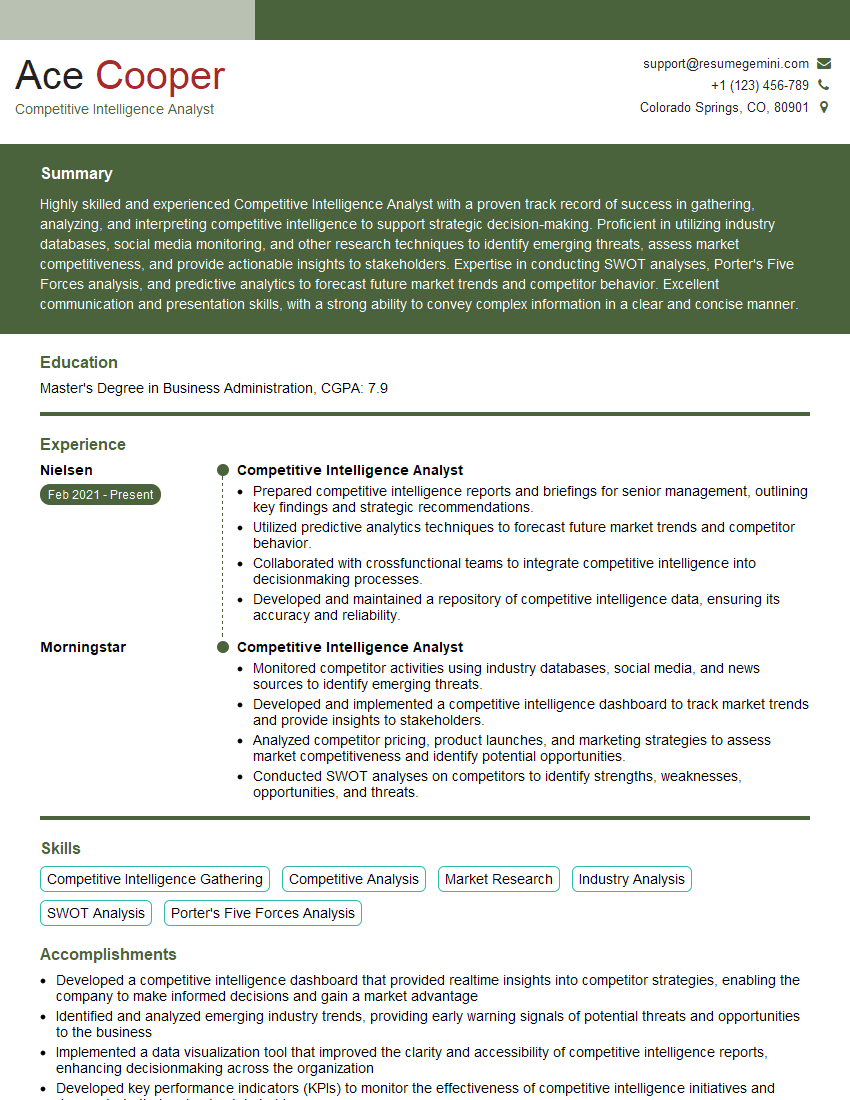

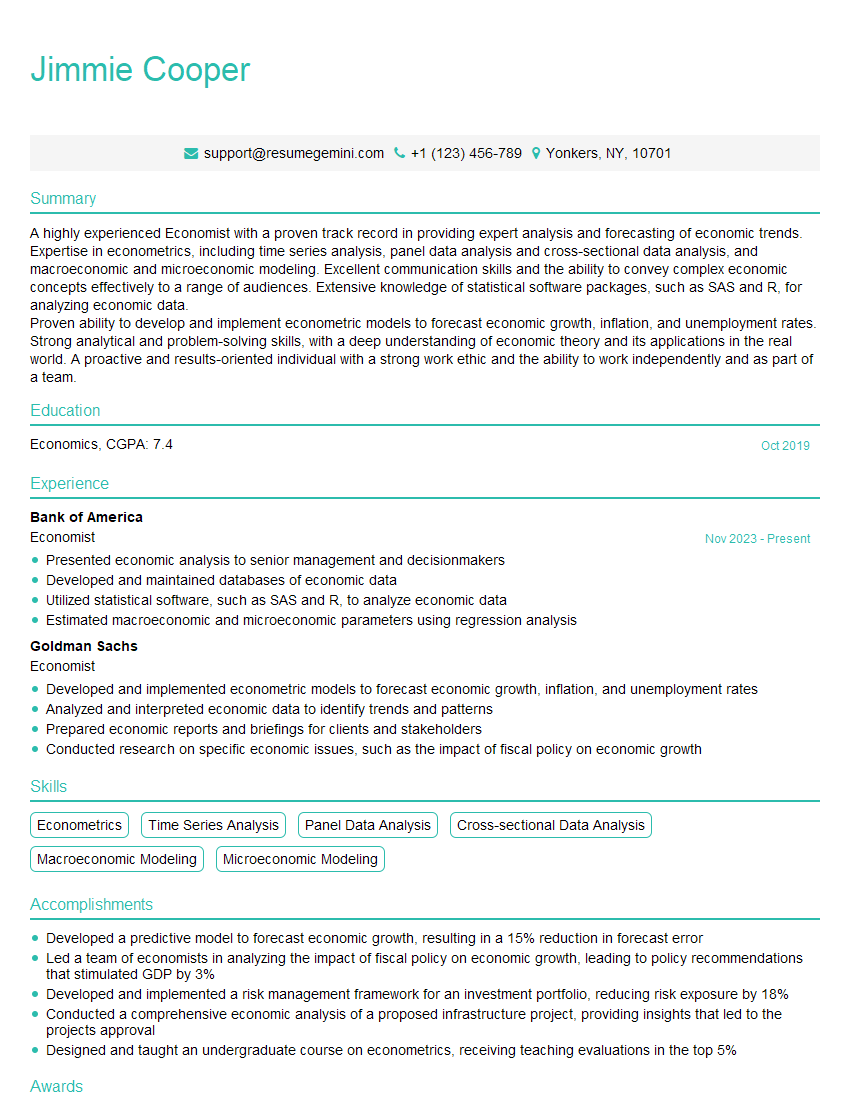

Mastering Market Feasibility Studies is crucial for career advancement in many industries, opening doors to exciting roles with increased responsibility and earning potential. To significantly boost your job prospects, focus on crafting an ATS-friendly resume that highlights your skills and experience effectively. ResumeGemini is a trusted resource to help you build a professional and impactful resume tailored to your specific career goals. Examples of resumes tailored to Market Feasibility Studies are available to guide you through this process.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

I Redesigned Spongebob Squarepants and his main characters of my artwork.

https://www.deviantart.com/reimaginesponge/art/Redesigned-Spongebob-characters-1223583608

IT gave me an insight and words to use and be able to think of examples

Hi, I’m Jay, we have a few potential clients that are interested in your services, thought you might be a good fit. I’d love to talk about the details, when do you have time to talk?

Best,

Jay

Founder | CEO