Interviews are more than just a Q&A session—they’re a chance to prove your worth. This blog dives into essential Site Acquisition and Negotiation interview questions and expert tips to help you align your answers with what hiring managers are looking for. Start preparing to shine!

Questions Asked in Site Acquisition and Negotiation Interview

Q 1. Explain your experience in identifying and securing suitable sites for [specific industry/project].

My experience in identifying and securing suitable sites, specifically for large-scale renewable energy projects, involves a multi-faceted approach. It begins with a thorough understanding of project requirements, including land size, access to infrastructure (transmission lines, roads), environmental considerations, and zoning regulations. I utilize GIS mapping and aerial imagery analysis to identify potential sites that meet these criteria. Then, I perform a preliminary feasibility study, considering factors like soil conditions, topography, and proximity to existing infrastructure. For example, in a recent project, we needed a site with minimal environmental impact and access to a high-voltage transmission line. Using GIS, we narrowed down hundreds of potential sites to a shortlist of five, each analyzed for its environmental sensitivity and proximity to the transmission network, ultimately selecting a former agricultural field that met all our requirements. Once suitable locations are pinpointed, I engage in direct negotiations with landowners or their representatives.

Q 2. Describe your process for negotiating land acquisition deals, including strategies for overcoming challenges.

My land acquisition negotiation process is systematic and iterative. It starts with careful due diligence – researching the property’s title history, environmental status, and any encumbrances. Then I prepare a comprehensive offer, justified by market analysis and comparable sales. Negotiations themselves are a collaborative process; I aim to build rapport and understanding with the seller while firmly advocating for my client’s interests. Challenges often arise from differing expectations on price, timelines, or contingencies. For instance, I once encountered a seller hesitant to accept our offer due to concerns about future development restrictions. To overcome this, we worked with the local authorities to secure a pre-approval letter, ensuring the seller that development wouldn’t be hampered, ultimately resulting in a successful transaction. Strategies include creative financing solutions, phased acquisitions, or alternative deal structures to accommodate seller needs. Throughout the process, meticulous documentation and clear communication are crucial for transparency and accountability.

Q 3. How do you assess the risk associated with a particular site acquisition project?

Risk assessment in site acquisition is paramount. I use a structured approach, evaluating risks across several categories: environmental (contamination, wetlands, endangered species), regulatory (zoning, permitting, approvals), legal (title issues, easements), financial (market fluctuations, cost overruns), and social (community opposition, public perception). Each risk is assessed based on its likelihood and potential impact. For example, a site with a history of industrial activity would require extensive environmental due diligence, potentially including soil testing and Phase I/II Environmental Site Assessments. This helps quantify the environmental remediation cost, a significant financial risk. A quantitative risk matrix, incorporating weighted scores for each risk factor, provides a clear picture of the overall risk profile. This allows for informed decision-making and mitigation strategies, such as contingency planning for potential delays or cost overruns.

Q 4. What are the key legal and regulatory considerations in site acquisition?

Legal and regulatory considerations are deeply interwoven with site acquisition. Key aspects include title examination to ensure clear ownership and absence of encumbrances (easements, liens). Zoning regulations dictate permissible land uses, requiring careful review to ensure compliance with the project’s intended purpose. Environmental regulations, such as the Clean Water Act and Endangered Species Act in the US (or equivalent regulations in other jurisdictions), demand adherence to strict guidelines concerning environmental impact assessments and permitting. Other crucial aspects include property tax assessments, building codes, and any applicable local ordinances. Often, I collaborate closely with legal counsel and environmental consultants to navigate these complex regulatory landscapes. Failing to conduct thorough legal and regulatory due diligence can lead to significant delays, cost overruns, or even project cancellation.

Q 5. How do you manage stakeholder expectations throughout the site acquisition process?

Managing stakeholder expectations is crucial for a successful site acquisition. This involves consistent communication, setting clear expectations about timelines and milestones, and proactively addressing concerns. I use regular updates, progress reports, and transparent communication channels to keep stakeholders informed. For example, I’ve used project management software to track progress, enabling all stakeholders to monitor the process. For complex projects with numerous stakeholders (landowners, investors, regulatory bodies, community groups), a robust communication plan outlining roles, responsibilities, and communication channels is essential. Addressing concerns proactively and resolving conflicts through open dialogue fosters trust and collaboration. By actively listening to feedback and addressing any issues promptly, I maintain positive relationships and foster project success.

Q 6. Describe your experience with due diligence procedures in site acquisition.

Due diligence is a critical phase. It involves a comprehensive investigation of the property, encompassing title searches, environmental assessments (Phase I, II, and potentially III depending on findings), geotechnical surveys to assess soil conditions, and utility surveys to identify underground infrastructure. We also examine zoning and building codes, ensuring compliance with project specifications. For example, a recent project involved a detailed environmental assessment to identify and remediate soil contamination discovered during Phase I investigation. This rigorous process helps identify and mitigate potential risks before a binding agreement is finalized. A thorough due diligence process minimizes surprises and protects my client’s investment, preventing costly issues arising after acquisition.

Q 7. How do you handle complex negotiations involving multiple stakeholders?

Negotiations with multiple stakeholders require a strategic approach. I begin by identifying the key stakeholders and understanding their individual interests and priorities. I prioritize building trust and rapport with each party, emphasizing the mutual benefits of collaboration. Employing a phased negotiation strategy can be beneficial – addressing individual concerns incrementally before tackling larger issues. For instance, I once negotiated an acquisition involving landowners, utility companies, and government agencies. I facilitated a series of bilateral meetings, addressing specific concerns of each stakeholder group, building consensus, and eventually culminating in a mutually beneficial agreement. Active listening, compromise, and creative solutions are essential to achieve a successful outcome in these complex negotiations.

Q 8. What is your approach to resolving conflicts that arise during site acquisition negotiations?

Conflict resolution in site acquisition negotiations hinges on proactive communication and a collaborative approach. My strategy involves identifying the root cause of the conflict, actively listening to all parties involved, and finding common ground. I believe in building rapport with the opposing party, understanding their perspective, and focusing on mutual benefits rather than adversarial positions.

For instance, in one negotiation, a landowner was hesitant due to concerns about environmental impact. Instead of dismissing their concerns, I presented detailed environmental assessments and mitigation plans, alleviating their apprehension and leading to a successful agreement. I also utilize various conflict resolution techniques such as mediation or arbitration if necessary, always striving for a win-win outcome.

- Active Listening: Truly understanding the other party’s position.

- Compromise: Finding mutually acceptable solutions.

- Professionalism: Maintaining a respectful and courteous demeanor throughout the process.

- Documentation: Maintaining detailed records of all communication and agreements.

Q 9. Explain your experience with environmental impact assessments in relation to site acquisition.

Environmental impact assessments (EIAs) are critical in site acquisition. My experience involves working closely with environmental consultants to conduct thorough EIAs, identifying potential environmental risks and developing mitigation strategies. This includes reviewing site history for potential contamination, assessing the impact on local flora and fauna, and adhering to all relevant environmental regulations. The EIA findings directly influence the negotiation process, often impacting the purchase price or requiring specific remediation efforts.

In a recent project, an initial assessment revealed potential soil contamination on the proposed site. This led to extensive negotiations with the seller regarding the remediation costs, ultimately resulting in a price adjustment that reflected the environmental liabilities. This demonstrated the importance of a robust EIA in protecting both the client’s investment and the environment.

Q 10. How familiar are you with eminent domain and its implications?

Eminent domain, the power of the government to take private property for public use with just compensation, is a complex legal concept I am intimately familiar with. Understanding its implications is crucial for any site acquisition professional. This involves knowing the legal requirements for invoking eminent domain, the process for determining just compensation (which often involves appraisals and negotiations), and the potential legal challenges that can arise. It’s important to note that eminent domain is a last resort and should only be considered after all other options for acquisition have been exhausted.

It’s vital to be aware of the legal precedents and jurisdictional differences concerning eminent domain. While it can provide access to necessary land, it also carries significant legal and reputational risks if not handled correctly. Negotiating with the government and private landowners when eminent domain is a possibility requires a nuanced and strategic approach.

Q 11. Describe your experience with title searches and other due diligence processes.

Title searches and due diligence are paramount in site acquisition. My experience encompasses conducting thorough title searches to identify any encumbrances, liens, or other issues that could affect the property’s ownership or value. This also includes reviewing survey data to verify property boundaries and verifying zoning regulations to ensure compliance with intended use. Due diligence also involves reviewing environmental reports, conducting physical site inspections, and assessing any potential liability risks associated with the property.

For example, in a recent project, a title search revealed a previously unrecorded easement, which could have significantly impacted the development plan. Early identification through diligent review allowed us to renegotiate terms with the seller and avoid costly surprises later in the process.

Q 12. How do you evaluate the financial viability of a potential site acquisition?

Evaluating the financial viability of a site acquisition is a multi-faceted process. It starts with a detailed cost-benefit analysis, considering the purchase price, acquisition costs (legal fees, environmental assessments, etc.), development costs, and projected revenue streams. Discounted cash flow (DCF) analysis is a crucial tool for forecasting the project’s long-term profitability. This includes considering factors such as interest rates, inflation, and the project’s timeline.

I also perform sensitivity analysis to understand how changes in key variables (e.g., construction costs, rental rates) might affect the project’s financial performance. The assessment also includes a thorough risk assessment, identifying potential challenges and developing mitigation strategies to minimize financial exposure.

Q 13. What software or tools do you use for site acquisition and analysis?

I utilize a variety of software and tools for site acquisition and analysis. This includes Geographic Information Systems (GIS) software for spatial analysis and mapping, allowing for detailed evaluation of site characteristics and surrounding infrastructure. Financial modeling software, such as Excel or specialized real estate investment analysis tools, is critical for financial projections and sensitivity analysis. Additionally, I utilize project management software to track progress, manage documents, and collaborate with team members.

For example, using GIS, I can analyze proximity to transportation networks, utilities, and potential environmental hazards, creating a comprehensive site suitability assessment. Financial modeling software allows for detailed ‘what-if’ scenarios to assess the financial implications of different development plans.

Q 14. What is your preferred negotiation style?

My preferred negotiation style is collaborative and principled. I strive to build strong relationships based on trust and mutual respect. While assertive in representing my client’s interests, I focus on finding mutually beneficial solutions that create long-term value. This involves active listening, clear communication, and a willingness to compromise. I believe that a successful negotiation is not about winning or losing, but about achieving a fair and equitable outcome that satisfies all parties involved.

This approach has consistently resulted in successful site acquisitions, even in challenging situations where conflicting interests were initially apparent. It fosters collaboration, making the whole process more efficient and pleasant.

Q 15. How do you handle difficult negotiators?

Handling difficult negotiators requires a blend of empathy, strategic planning, and assertive communication. It’s less about winning and more about finding mutually beneficial solutions. I begin by actively listening to understand their concerns and underlying motivations. Often, seemingly intractable positions stem from fear of the unknown, unmet needs, or perceived unfairness.

My approach involves building rapport, framing the negotiation as a collaborative problem-solving exercise, and presenting options that address their concerns. For example, if a landowner is hesitant due to environmental concerns, I’ll proactively offer environmental impact assessments and mitigation strategies. If they’re worried about the financial terms, I’ll present a detailed breakdown of the offer and explore creative financing solutions. If necessary, I’ll involve mediators to facilitate a productive dialogue and help bridge the gap. The key is to remain calm, professional, and persistent, always focusing on the shared goal of a successful transaction.

In one instance, a landowner was initially resistant to selling due to strong emotional attachment to their property. Instead of pushing, I spent time understanding their history with the land, demonstrating genuine respect for their connection to it. By addressing their emotional needs alongside the financial aspects, I was able to build trust and eventually reach an agreement that satisfied both parties.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. How do you prioritize competing deadlines and tasks during a site acquisition project?

Prioritizing competing deadlines and tasks in site acquisition requires meticulous project management. I utilize a combination of techniques to ensure efficiency and timely completion. Firstly, I create a detailed project schedule using tools like Gantt charts, breaking down the acquisition process into smaller, manageable tasks with clearly defined timelines and dependencies. This allows for a clear visualization of the critical path and potential bottlenecks.

Secondly, I assign priorities to tasks based on their impact on the overall project timeline and potential risks. Urgent tasks with high impact are prioritized. I regularly review and update the schedule, adapting to changing circumstances. For example, if a survey is delayed, I’ll proactively communicate with other stakeholders and adjust subsequent tasks to mitigate potential delays. Finally, I leverage project management software to track progress, allocate resources effectively, and ensure transparency among team members. This allows for proactive identification and resolution of issues, minimizing delays and cost overruns.

Q 17. How do you build and maintain relationships with landowners and other stakeholders?

Building and maintaining strong relationships with landowners and stakeholders is paramount to successful site acquisition. It’s about fostering trust and open communication. I start by being respectful and understanding of their perspectives, acknowledging their concerns, and addressing them directly. I emphasize transparency and provide clear, consistent communication throughout the process, keeping them informed of progress and potential challenges.

I make it a point to build personal connections by actively listening, demonstrating genuine interest in their needs, and being responsive to their inquiries. This often involves face-to-face meetings, where I can build rapport and show my commitment to a fair and equitable agreement. Following up regularly after the deal is closed, maintaining contact for future opportunities, shows that the relationship is valued beyond a single transaction. Building this long-term relationship network is a key component of my success.

Q 18. What is your experience with different types of land ownership and easements?

My experience encompasses a wide range of land ownership types, including fee simple ownership (where the owner holds complete title to the land), leasehold estates (where the owner holds the right to use the land for a specific period), and various forms of shared ownership. I’m also well-versed in different types of easements, such as utility easements (allowing access for utility lines), access easements (providing access to a property), and conservation easements (restricting development to protect natural resources).

Understanding these complexities is crucial in site acquisition. For instance, negotiating a leasehold acquisition requires careful consideration of lease terms, renewal options, and potential restrictions. Similarly, dealing with easements necessitates a thorough understanding of their limitations and potential impact on development plans. I always conduct thorough title searches and engage legal counsel to ensure a clear understanding of ownership and potential encumbrances before proceeding with any negotiation.

Q 19. Describe a time you successfully navigated a complex site acquisition negotiation.

One complex negotiation involved acquiring a parcel of land situated in a historically sensitive area. The landowner was initially hesitant due to concerns about preserving the historical integrity of the site. The negotiation was further complicated by competing offers and environmental regulations.

To navigate this successfully, I employed a multi-pronged strategy: First, I conducted extensive research to understand the historical significance of the site and the environmental sensitivities. Next, I presented a detailed plan that addressed the landowner’s concerns, including commitments to archaeological surveys, preservation of historical features, and adherence to strict environmental regulations. Finally, I collaborated with heritage conservation experts and environmental consultants to validate my plan, strengthening my negotiating position. The combination of careful planning, a comprehensive proposal, and a collaborative approach led to a successful acquisition that satisfied all stakeholders, including the preservation of the historical site and a fair deal for the landowner.

Q 20. How do you handle unforeseen challenges or delays during a project?

Unforeseen challenges and delays are inevitable in site acquisition. My approach is to proactively mitigate risks through thorough due diligence and contingency planning. This involves identifying potential problems early on, such as zoning issues, environmental concerns, or title disputes. When challenges arise, I utilize a structured problem-solving approach.

First, I identify the nature and scope of the challenge. Then, I assemble a team of experts (engineers, lawyers, environmental consultants) to assess the situation and develop solutions. Communication is key—I keep all stakeholders informed, explaining the issue and outlining the steps being taken to address it. I explore alternative solutions and negotiate with affected parties to find mutually acceptable resolutions. Documenting every step of the process is essential for managing risk and demonstrating accountability. Flexibility and adaptability are crucial in navigating unexpected hurdles, ensuring the project stays on track while maintaining stakeholder trust.

Q 21. Describe your experience with site surveying and assessment.

My experience with site surveying and assessment is extensive. I understand that a thorough understanding of the physical characteristics of a site is critical for successful acquisition and development. This includes the involvement of qualified surveyors to conduct topographic surveys, boundary surveys, and utility location surveys.

I work closely with surveyors to obtain accurate data on site topography, dimensions, and potential constraints. This information is crucial for determining site suitability, feasibility studies, and cost estimations. Further assessments may be needed to evaluate environmental conditions (soil testing, water quality analysis, presence of endangered species), which are equally critical in determining potential risks and development limitations. I leverage this data to inform negotiations, ensuring that potential problems are identified and addressed upfront, mitigating future risks and costs. This is vital for realistic project planning and cost control.

Q 22. What are your strategies for managing project budgets in site acquisition?

Managing project budgets in site acquisition requires a multi-faceted approach that begins even before site selection. It’s not just about controlling costs during the negotiation phase; it’s about proactive planning and constant monitoring.

- Detailed Due Diligence Budgeting: I always include a contingency budget (typically 10-20%, depending on project complexity and risk) for unforeseen costs related to environmental assessments, surveys, legal fees, and appraisal valuations. This prevents budget overruns later in the process.

- Phased Budgeting: I break down the budget into distinct phases – from initial site identification and due diligence through to closing and post-acquisition costs. This allows for better tracking of spending and identification of potential issues early on. For example, Phase 1 might cover market research and preliminary site analysis, while Phase 3 handles legal and financial closing.

- Value Engineering: Throughout the process, I constantly assess the value of each element of the acquisition. Can we negotiate a lower price? Are there alternative solutions that reduce costs without compromising quality? For instance, if the required environmental remediation is expensive, exploring options like phased remediation might reduce the upfront capital outlay.

- Regular Reporting and Monitoring: I use project management software to meticulously track expenses, comparing actual costs against the budget. Regular reports highlight variances and allow for timely corrective action. This ensures transparency and accountability throughout the project.

For example, on a recent project, our initial budget for environmental remediation was exceeded due to unexpected contamination. By implementing a phased remediation plan and renegotiating with the seller, we managed to reduce the overall cost while staying within the revised budget.

Q 23. How do you ensure compliance with all relevant environmental regulations?

Ensuring compliance with environmental regulations is paramount. It’s not just about avoiding penalties; it’s about responsible land stewardship and protecting the environment. My approach involves several key steps:

- Early Engagement with Regulatory Agencies: I initiate contact with the relevant environmental agencies (e.g., EPA, state-level equivalents) at the beginning of the site selection process. This allows for early clarification on regulations and permits, preventing potential delays or conflicts later.

- Comprehensive Environmental Site Assessments (ESAs): I always commission thorough ESAs, performed by qualified environmental consultants, to identify potential environmental hazards (contamination, wetlands, endangered species habitats, etc.). The scope of the ESA is tailored to the specific site and regulatory requirements.

- Permitting and Approvals: I work closely with the consultants and regulatory agencies to navigate the permitting process. This includes preparing and submitting all necessary documentation, attending meetings, and addressing any agency concerns. I aim for proactive communication and transparency with the agencies.

- Ongoing Monitoring and Compliance: Even after closing the deal, I ensure ongoing compliance with environmental regulations. This may involve regular monitoring of remediation efforts, reporting to the agencies, and maintaining all necessary documentation.

For instance, on a recent project, early engagement with the EPA allowed us to identify a potential wetland issue early in the due diligence phase. This enabled us to adjust our plans and avoid significant delays and costs later in the process.

Q 24. How do you prepare for a negotiation?

Preparation is crucial for successful negotiations. I approach each negotiation with a structured and detailed plan:

- Thorough Due Diligence: This is the foundation of a strong negotiation. I ensure a comprehensive understanding of the site, its value, market conditions, and the seller’s motivations.

- Developing a Negotiation Strategy: I define clear objectives (e.g., price, closing date, contingencies), identify potential areas of compromise, and develop a range of negotiating tactics. I also consider best-alternative-to-a-negotiated-agreement (BATNA) as a fallback position.

- Understanding the Counterparty: I research the seller, their circumstances, and their likely negotiating style. This helps me tailor my approach and anticipate their responses.

- Assembling a Strong Team: I usually work with a team of legal, environmental, and financial experts to leverage their specialized knowledge.

- Document Preparation: I meticulously prepare all necessary documents – purchase agreements, environmental reports, appraisal valuations, etc. – ensuring accuracy and completeness.

For example, before negotiating the purchase of a brownfield site, I spent considerable time researching the environmental history, regulatory requirements, and potential remediation costs. This allowed me to make a more informed offer and effectively address the seller’s concerns.

Q 25. What are your strengths and weaknesses in negotiation?

My strengths in negotiation lie in my ability to build rapport, actively listen, and find creative solutions. I’m patient and persistent, and I strive to create win-win outcomes. I’m also adept at analyzing data and using it to support my arguments.

My main area for development is becoming even more assertive in negotiations, particularly when dealing with difficult or uncooperative parties. While I can effectively navigate challenging situations, there are always opportunities to improve my strategies for handling strong opposition.

Q 26. Describe your experience working with government agencies regarding permits.

I have extensive experience working with various government agencies, including local planning departments, environmental protection agencies, and transportation authorities. This experience involves:

- Navigating Permitting Processes: I have successfully guided numerous projects through complex permitting processes, understanding the requirements, preparing and submitting necessary documentation, and effectively communicating with agencies.

- Addressing Agency Concerns: I have a proven ability to proactively identify and address potential agency concerns before they become significant obstacles. This is often done through early communication, thorough documentation, and collaboration.

- Negotiating with Agencies: I understand the need for compromise and collaboration in dealings with government agencies. I’ve successfully negotiated modifications to permit conditions, timelines, and other requirements.

- Maintaining Strong Relationships: Building and maintaining positive relationships with agency representatives is key to efficient and effective project delivery. My focus is on respectful communication and transparent collaboration.

One example is a project where we needed several permits for a challenging site located within a sensitive ecosystem. Through open communication and collaboration with the state’s environmental agency, we were able to secure the permits without significant delay and mitigated potential environmental impacts.

Q 27. How do you assess the long-term value of a site?

Assessing the long-term value of a site requires a holistic approach that considers several factors extending beyond the immediate purchase price:

- Market Analysis: I assess current and projected market demand for the type of development planned for the site. This includes analyzing population growth, economic trends, and competitor activities.

- Site Characteristics: I evaluate the site’s physical attributes – size, location, accessibility, topography, utilities – and their impact on development costs and potential returns.

- Environmental Conditions: Environmental factors – potential contamination, wetland areas, flood plains – and their associated remediation costs heavily influence long-term value.

- Infrastructure and Amenities: Access to infrastructure (roads, utilities, public transportation), proximity to amenities (schools, hospitals, shopping centers), and zoning regulations play a significant role in determining long-term value.

- Development Potential: I carefully analyze the site’s potential for future development and redevelopment, considering zoning regulations, permitted uses, and market demand. A site’s potential for future expansion or increased density should always be accounted for.

- Financial Modeling: I create detailed financial models to project the long-term cash flows, return on investment (ROI), and net present value (NPV) of the development based on various scenarios.

For example, while a site might seem expensive initially, its location near a growing urban center, coupled with excellent transportation links and high development potential, could make it a lucrative long-term investment.

Q 28. What are your strategies for closing a deal effectively?

Closing a deal effectively requires meticulous attention to detail and proactive management. My approach involves:

- Final Due Diligence Review: A final review of all documents, reports, and agreements to ensure everything is in order before closing.

- Negotiating Final Terms: Addressing any outstanding issues or minor disagreements before signing the final documents.

- Coordinating Closing Activities: I coordinate with all parties involved – lawyers, lenders, environmental consultants – to ensure a smooth and timely closing.

- Document Execution and Funding: Overseeing the execution of all necessary documents and the transfer of funds.

- Post-Closing Activities: Ensuring that all post-closing activities, such as title transfer, permit approvals, and insurance, are handled efficiently.

A critical step is to review the closing documents thoroughly and make sure all conditions precedent have been met before transferring any funds. A smooth closing reduces potential disputes and ensures a successful outcome for all parties involved.

Key Topics to Learn for Site Acquisition and Negotiation Interview

- Due Diligence and Site Analysis: Understanding property regulations, zoning laws, environmental impact assessments, and conducting thorough site surveys to identify potential risks and opportunities.

- Negotiation Strategies and Tactics: Mastering effective communication, identifying stakeholder interests, developing win-win scenarios, and handling objections constructively. Practical application: Role-playing various negotiation scenarios to practice your skills.

- Contract Law and Legal Aspects: Familiarizing yourself with key clauses in real estate contracts, understanding legal implications of different contract types, and knowing when to seek legal counsel.

- Financial Analysis and Valuation: Analyzing property values, understanding different valuation methods, and justifying investment decisions based on sound financial principles. Practical application: Performing a sample property valuation exercise.

- Risk Management and Mitigation: Identifying potential risks associated with site acquisition, developing strategies to mitigate those risks, and incorporating contingency plans into your negotiation strategies.

- Stakeholder Management: Effectively communicating with landowners, legal teams, regulatory bodies, and internal stakeholders to ensure smooth project execution.

- Communication and Interpersonal Skills: Demonstrating strong communication, active listening, and persuasive negotiation skills during the interview process itself.

Next Steps

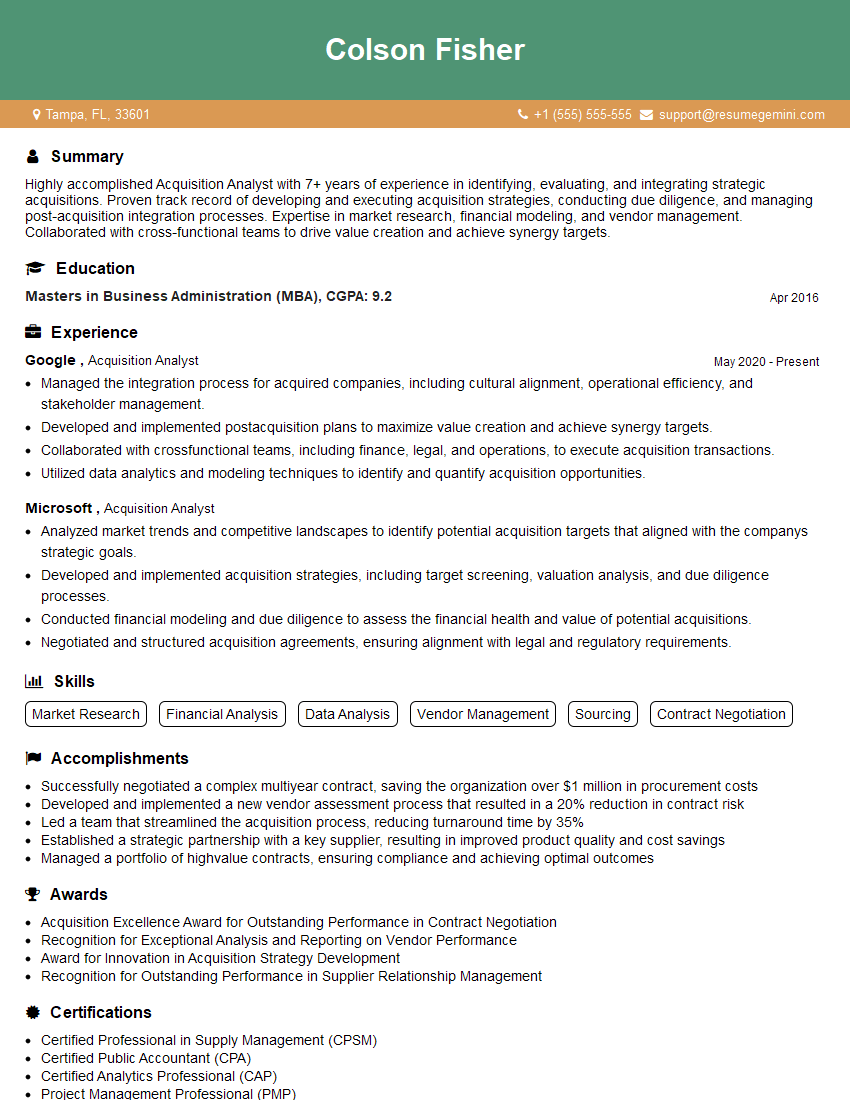

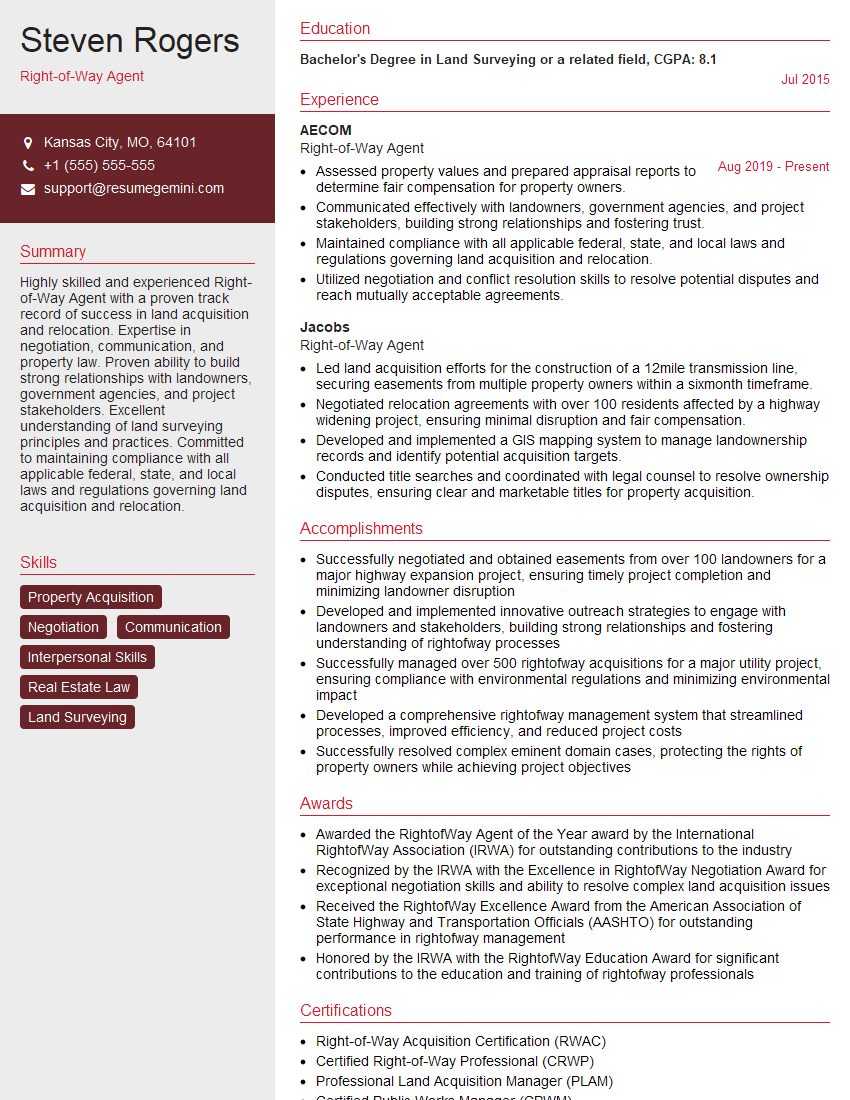

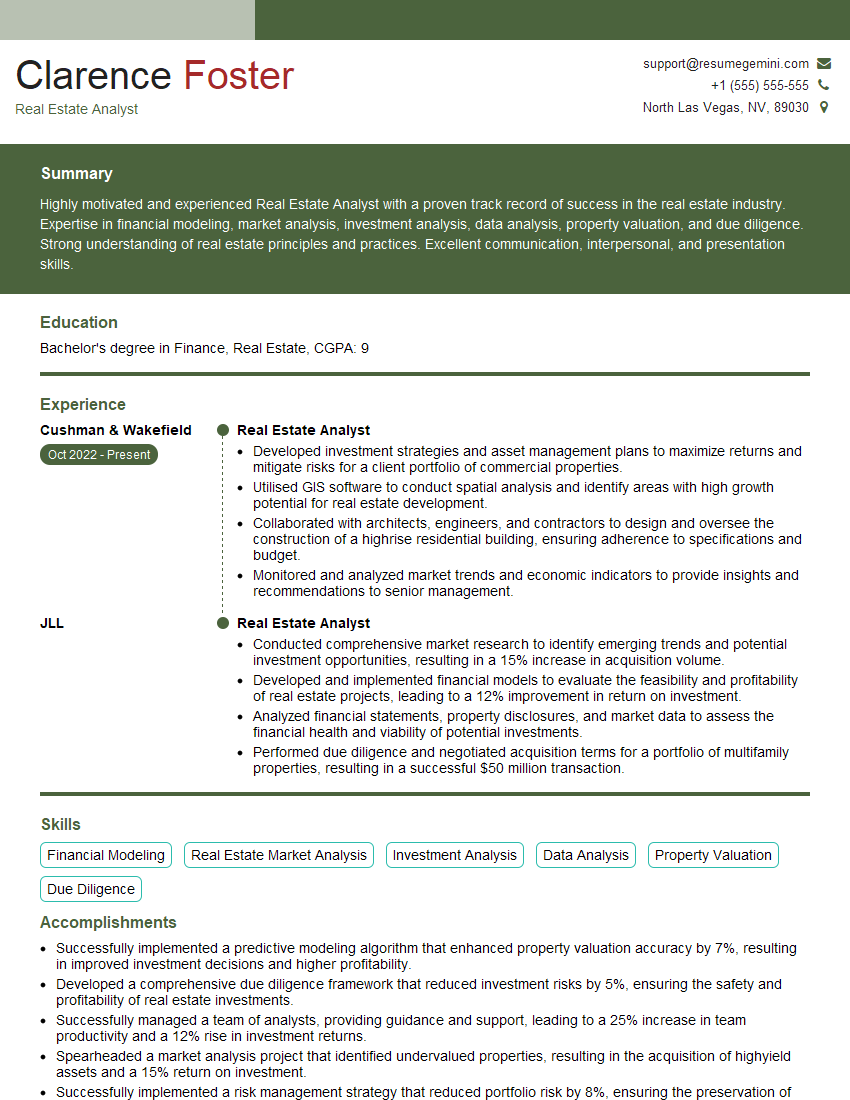

Mastering Site Acquisition and Negotiation is crucial for career advancement in real estate, infrastructure development, and related fields. It opens doors to higher-paying roles with increased responsibility and leadership opportunities. To maximize your job prospects, create an ATS-friendly resume that highlights your relevant skills and experience. ResumeGemini is a trusted resource to help you build a professional and impactful resume that stands out to recruiters. Examples of resumes tailored to Site Acquisition and Negotiation are available to help guide you through the process.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

I Redesigned Spongebob Squarepants and his main characters of my artwork.

https://www.deviantart.com/reimaginesponge/art/Redesigned-Spongebob-characters-1223583608

IT gave me an insight and words to use and be able to think of examples

Hi, I’m Jay, we have a few potential clients that are interested in your services, thought you might be a good fit. I’d love to talk about the details, when do you have time to talk?

Best,

Jay

Founder | CEO