Unlock your full potential by mastering the most common Proficient in using survey software for data processing and reporting interview questions. This blog offers a deep dive into the critical topics, ensuring you’re not only prepared to answer but to excel. With these insights, you’ll approach your interview with clarity and confidence.

Questions Asked in Proficient in using survey software for data processing and reporting Interview

Q 1. What survey software platforms are you proficient in?

I’m proficient in several leading survey software platforms, each with its own strengths. These include Qualtrics, SurveyMonkey, and Alchemer. Qualtrics, for instance, excels in its advanced branching logic and robust data analysis features, making it ideal for complex studies. SurveyMonkey provides a user-friendly interface perfect for quicker surveys with straightforward analysis needs. Alchemer offers a good balance between functionality and ease of use, particularly beneficial for team collaborations. My choice of platform depends heavily on the project’s scope, budget, and the client’s specific requirements.

Q 2. Describe your experience with data cleaning and validation in surveys.

Data cleaning and validation are crucial for ensuring the accuracy and reliability of survey results. My process typically involves several steps. First, I check for incomplete responses, identifying surveys with missing crucial data points. Next, I look for outliers – responses that significantly deviate from the norm, possibly indicating errors or intentional misrepresentation. For example, an age response of ‘150’ would be flagged immediately. I then validate responses against pre-defined rules; for instance, ensuring that responses to multiple-choice questions are within the allowed options. Finally, I use consistency checks; if a respondent indicated they’re ‘married’ in one section, I verify that their answer in another section about their marital status aligns with this. I employ both automated checks within the survey software and manual review, particularly for open-ended questions, to catch subtle inconsistencies. This ensures data quality before any analysis begins.

Q 3. How do you handle missing data in survey datasets?

Missing data is a common challenge in surveys. My approach depends on the nature and extent of the missing data. For small amounts of missing data, I might simply exclude the incomplete responses, if they don’t significantly impact the overall sample size. If the missing data is more substantial or appears non-random, more sophisticated techniques are necessary. I often employ imputation methods, which involve estimating the missing values based on the available data. For example, I might use mean imputation (replacing missing values with the average of the existing data) for numerical variables, or mode imputation (using the most frequent value) for categorical variables. More advanced techniques like multiple imputation can also be employed, generating multiple plausible imputed datasets to account for the uncertainty inherent in imputation. The best method depends on the characteristics of the data and the research question.

Q 4. Explain your process for identifying and resolving data inconsistencies.

Identifying and resolving data inconsistencies requires careful attention to detail. I start by using the software’s built-in tools for identifying inconsistencies, such as cross-tabulations that reveal contradictions across different questions. For instance, if a respondent claims to be unemployed but also reports a high annual income, that’s a flag. I also perform frequency distributions to analyze response patterns and look for anomalies. Once inconsistencies are identified, I attempt to resolve them where possible. This might involve going back to the original survey responses to clarify ambiguous answers or, in severe cases, excluding problematic responses. Thorough documentation of the resolution process is crucial to maintain the transparency and reproducibility of the analysis. This meticulous approach ensures that the final dataset accurately reflects the survey findings.

Q 5. What statistical methods are you familiar with for analyzing survey data?

I’m proficient in various statistical methods for analyzing survey data. These include descriptive statistics (mean, median, mode, standard deviation) to summarize the data; inferential statistics (t-tests, ANOVA, chi-square tests) to draw conclusions about populations based on sample data; and correlation and regression analysis to examine relationships between variables. For example, I might use a t-test to compare the average satisfaction scores between two different customer groups or a regression model to predict customer loyalty based on several predictor variables. My choice of statistical method always depends on the research question and the nature of the data. I also utilize more advanced techniques, like factor analysis to reduce a large number of variables into a smaller set of underlying factors, and structural equation modeling to test complex relationships between variables.

Q 6. How do you ensure the accuracy and reliability of your survey data?

Ensuring accuracy and reliability involves a multi-faceted approach. First, careful survey design is paramount. This includes clear and concise questions, pilot testing to identify and resolve any ambiguities, and selecting a representative sample of respondents. Second, thorough data cleaning and validation, as discussed earlier, are essential. Third, using established statistical techniques correctly is critical to avoid biases and misinterpretations. Finally, transparency in reporting methods, including limitations of the study and potential sources of error, is crucial for ensuring the reliability of the findings. I always strive for reproducibility, documenting every step of the process so that the analysis can be easily replicated.

Q 7. Describe your experience with data transformation and manipulation.

Data transformation and manipulation are integral parts of my workflow. This often involves recoding variables (e.g., grouping age ranges or transforming numerical data into categorical data), creating new variables based on existing ones (e.g., calculating a composite score from several items), or reshaping the data for different analysis techniques. I’m proficient in using software like R and SPSS for these tasks. For example, I might recode a continuous variable, such as income, into categorical levels (low, medium, high) to facilitate easier analysis and interpretation. Or, I might use R to create dummy variables for categorical predictors before performing a regression analysis. These transformations and manipulations are always guided by the research question and the need for a data structure suitable for the chosen statistical methods.

Q 8. How do you create effective data visualizations from survey results?

Creating effective data visualizations from survey results is crucial for communicating insights clearly and concisely. I leverage several techniques depending on the data and the audience. For categorical data (like responses to multiple-choice questions), I often use bar charts to compare frequencies or pie charts to show proportions. For continuous data (like age or satisfaction ratings on a scale), histograms or box plots provide a clear picture of the distribution. Line charts are excellent for tracking trends over time if the survey is repeated.

For more complex relationships, I might use scatter plots to explore correlations between two variables. And if I need to show the relationship between many variables, I use heatmaps or network graphs. It’s crucial to choose the right chart type for the data and the story you are trying to tell. For example, using a pie chart with too many slices becomes confusing; in that case, a bar chart is better.

Finally, I always ensure the visualization is clean, well-labeled (with clear titles, axis labels, and legends), and aesthetically pleasing to aid understanding. Tools like Tableau, Power BI, and even Excel’s charting capabilities are valuable for this.

Q 9. What are your preferred methods for data reporting and presentation?

My preferred methods for data reporting and presentation depend heavily on the audience and the purpose of the report. For executive summaries, I favor concise reports with key findings and actionable recommendations, often incorporating compelling visuals like dashboards. For more detailed analysis, I create comprehensive reports that include methodology, data tables, statistical analysis (e.g., t-tests, chi-square tests), and visualizations.

I often use presentation software such as PowerPoint or Google Slides to present findings to stakeholders, focusing on a narrative approach. I start with a compelling introduction, outline key findings with supportive visuals, discuss implications, and end with a clear conclusion and recommendations. For technical audiences, I might include more details on the methodology and statistical analysis. The key is tailoring the report and presentation to the audience’s level of understanding and their needs.

Q 10. How do you interpret and communicate survey findings to stakeholders?

Interpreting and communicating survey findings requires a combination of statistical expertise and communication skills. First, I thoroughly analyze the data, considering the sampling method, response rates, and potential biases. I look for statistically significant differences between groups, identify trends, and assess the reliability and validity of the findings.

When communicating to stakeholders, I translate complex statistical results into plain language, avoiding jargon as much as possible. I focus on the key takeaways, highlighting the most important findings and their implications. I use visuals to support my points and tailor my language to the audience’s understanding. For example, if presenting to executives, I might focus on high-level trends and strategic recommendations; for researchers, I may present more detailed statistical analyses and methodology. I always encourage questions and discussions to ensure everyone understands the findings and their implications.

Q 11. Explain your experience with different data file formats (e.g., CSV, SPSS, SAS).

I have extensive experience working with various data file formats. CSV (Comma Separated Values) is a common format for importing and exporting data from survey software. It’s simple and widely compatible. SPSS (Statistical Package for the Social Sciences) and SAS (Statistical Analysis System) are powerful statistical software packages that use their proprietary file formats (.sav for SPSS, .sas7bdat for SAS). These formats can handle large datasets and complex statistical procedures.

I’m proficient in importing data from these formats into various analysis tools. For instance, I might import a CSV file into R or Python for data cleaning and analysis, then export the results to an SPSS file for more advanced statistical modeling. I’m also familiar with converting between different formats as needed using tools provided by the software or using scripting languages like Python.

Q 12. Describe your experience with database management systems (e.g., SQL).

My experience with database management systems (DBMS) like SQL is significant. I’ve used SQL to manage and query large survey datasets stored in relational databases. I can write SQL queries to select, filter, sort, and aggregate data.

For example, I might write a query to retrieve the average satisfaction score for a specific demographic group from a survey database: SELECT AVG(SatisfactionScore) FROM SurveyResponses WHERE DemographicGroup = 'Group A'; This is just a simple example; I can handle much more complex queries involving joins, subqueries, and aggregate functions. I’m also familiar with database design principles and can create tables and relationships to effectively store and manage survey data.

Q 13. How do you ensure data security and confidentiality in your work?

Data security and confidentiality are paramount in my work. I adhere strictly to ethical guidelines and relevant regulations when handling sensitive data. This includes anonymizing or pseudonymizing data whenever possible, removing personally identifiable information (PII) before analysis or sharing.

I also use secure data storage and transfer methods, encrypting data both in transit and at rest. Access to the data is restricted to authorized personnel only, with appropriate access controls in place. I’m familiar with data governance policies and best practices to minimize risks and ensure data integrity. When working with sensitive data, I always obtain appropriate consent and inform participants of how their data will be used and protected.

Q 14. How familiar are you with survey weighting and adjustment techniques?

I’m very familiar with survey weighting and adjustment techniques. These are crucial for ensuring the results accurately reflect the target population when the sample is not perfectly representative. Weighting assigns different weights to different respondents based on their characteristics (e.g., age, gender, location) to correct for imbalances in the sample.

For example, if a survey sample has an overrepresentation of women, we can assign a lower weight to female respondents and a higher weight to male respondents to balance the sample. I use various weighting methods, including post-stratification, raking, and propensity score weighting. These techniques are performed using statistical software packages like R, SPSS, or SAS. Proper weighting and adjustment is crucial to obtain unbiased and accurate results and ensure the validity of the survey’s conclusions.

Q 15. What is your experience with longitudinal data analysis?

Longitudinal data analysis involves observing the same variables in the same subjects over a period of time. This allows us to track changes and identify trends. For example, imagine a study tracking customer satisfaction with a new product over a year. We’d collect survey data at regular intervals (e.g., monthly). This differs from cross-sectional data which collects data at a single point in time. In my experience, I’ve used longitudinal data extensively to analyze customer loyalty programs, measuring changes in engagement and spending over time. This involved using statistical techniques like repeated measures ANOVA or mixed-effects models to account for the correlation between repeated measurements on the same individual. The software I typically employ includes SPSS and R, leveraging their capabilities for analyzing panel data and modeling temporal trends.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. How do you handle outliers and extreme values in survey data?

Outliers and extreme values in survey data can skew results and misrepresent the true distribution. I handle them using a multi-step approach. First, I visually inspect the data using box plots and histograms to identify potential outliers. Next, I investigate the cause of these values. Were they data entry errors? Do they represent a genuinely extreme response? If it’s a data entry error, I correct it. If the extreme value is legitimate, I consider several options: I might winsorize or trim the data, replacing extreme values with less extreme ones while preserving the overall distribution. Another approach is to use robust statistical methods, like median instead of mean, that are less sensitive to outliers. For example, I once worked on a survey with a few respondents giving extremely high ratings for a particular feature. Investigation revealed a misunderstanding of the question, leading to a re-analysis excluding those responses. The choice of method depends on the context and the potential impact on the conclusions. Always documenting the reasoning behind outlier handling is crucial for transparency and reproducibility.

Q 17. Describe your experience with A/B testing and its application to survey design.

A/B testing, or split testing, is a powerful method to optimize survey design. It involves creating two versions of a survey (A and B) with slight variations, such as different question wording or question order. Then, we randomly assign respondents to either version and compare their responses. For instance, I once A/B tested two different question introductions for a sensitive topic. Version A used a more formal approach, while version B adopted a conversational tone. By analyzing the response rates and data quality for each version, we could determine which introduction yielded better results. This iterative process helps refine the survey instrument, leading to improved data quality and more reliable results. Key metrics to compare would include response rate, completion rate, and specific responses to sensitive questions. I leverage survey platforms that have built-in A/B testing functionalities.

Q 18. How do you assess the validity and reliability of a survey instrument?

Assessing the validity and reliability of a survey is critical to ensuring the quality of the data. Validity refers to whether the survey actually measures what it intends to measure. We assess this through various methods, including face validity (does the question make sense?), content validity (does it cover all aspects of the construct?), and criterion validity (does it correlate with other established measures?). Reliability, on the other hand, refers to the consistency of the survey. We assess reliability using measures such as Cronbach’s alpha (for internal consistency) and test-retest reliability (consistency over time). For example, if we’re measuring job satisfaction, we might check criterion validity by correlating our survey results with employee performance reviews. Low reliability may indicate ambiguous questions or issues with respondent understanding. A well-designed and validated survey provides confidence in the accuracy and dependability of the collected data.

Q 19. What is your approach to identifying and addressing sampling bias?

Sampling bias occurs when the sample selected doesn’t accurately represent the target population. Addressing this involves careful planning and execution. First, defining the target population precisely is key. Second, choosing an appropriate sampling method (e.g., stratified random sampling, cluster sampling) ensures that all segments of the population have a chance to be included. Third, we actively monitor response rates to identify any groups that are underrepresented. For example, if we’re surveying adults about their health habits, and our sample predominantly includes women, we may have a gender bias. We might use weighting techniques during analysis to adjust for the imbalance. In addition, we often use methods like post-stratification to correct for known biases. This requires detailed knowledge of the population characteristics.

Q 20. How do you evaluate the quality of survey data?

Evaluating survey data quality involves several steps. First, I check for completeness – were all questions answered? Then, I examine the data for inconsistencies and errors (e.g., illogical responses). I also look for patterns suggesting response bias, such as straight-lining (responding the same to all questions) or satisficing (providing minimal effort). Finally, I assess the representativeness of the sample, comparing it to known population characteristics. This often involves data cleaning and employing quality control checks during the data collection phase. For example, I might identify questions with high levels of missing data and investigate why. Addressing these issues improves the validity and reliability of the analysis. A comprehensive quality assessment ensures the trustworthiness of research findings. I utilize various quality control measures during data entry and use various statistical techniques to identify anomalies and biases.

Q 21. How do you determine the appropriate sample size for a survey?

Determining the appropriate sample size depends on several factors: the desired precision, the variability in the population, and the confidence level. Larger samples generally offer greater precision but come with increased costs and time. I usually use sample size calculators that take into account these factors, or I apply statistical power analysis to determine the minimum sample size required to detect a meaningful effect. For example, if we’re investigating a relatively rare phenomenon, a larger sample size is required to ensure sufficient representation of that group. The acceptable margin of error also plays a critical role. I utilize statistical software to perform these calculations, ensuring a statistically sound sample for robust results.

Q 22. Describe your experience using R or Python for survey data analysis.

I’ve extensively used both R and Python for survey data analysis, leveraging their powerful statistical packages and data manipulation capabilities. In R, I’m proficient with packages like dplyr for data wrangling, tidyr for data tidying, and ggplot2 for creating compelling visualizations. For example, I recently used dplyr to efficiently filter and summarize responses from a large customer satisfaction survey, identifying key demographic segments with significantly different satisfaction levels. Python, with libraries like pandas and NumPy, provides similar functionality, offering flexibility and scalability for large datasets. I often use Python’s scikit-learn library for more advanced statistical modeling, such as logistic regression to predict customer churn based on survey responses.

My approach typically involves importing the data, cleaning and transforming it to a suitable format (often ‘tidy’ data), performing exploratory data analysis (EDA) to understand the data’s structure and identify potential issues, and finally, conducting statistical analysis and creating visualizations to communicate insights. I carefully document each step of my code for reproducibility and collaboration.

Q 23. How do you create dashboards to visualize key survey metrics?

Creating effective dashboards to visualize key survey metrics is crucial for clear communication of findings. I usually start by identifying the key metrics the stakeholders need to understand – for instance, overall satisfaction scores, demographic breakdowns of responses, and trends over time. Then, I select appropriate visualization techniques depending on the data type and the message I want to convey. For example, bar charts are great for showing comparisons across categories, line charts illustrate trends, and heatmaps display correlations between variables.

I utilize tools like Tableau and Power BI extensively to build interactive dashboards. These tools allow me to create dynamic visualizations that can be easily filtered and explored by users. For instance, I built a dashboard for a recent client that allowed them to interactively filter survey results by region, age group, and product usage, providing real-time insights into customer satisfaction across different segments. The dashboard included interactive maps, charts displaying key metrics, and detailed tables for drill-down analysis.

Q 24. What are some common challenges in survey data processing and how do you address them?

Survey data processing presents several challenges. Missing data is a frequent issue; I address it using imputation techniques – replacing missing values with plausible estimates based on other data points. This might involve simple methods like mean imputation or more sophisticated approaches like k-nearest neighbors. Another common problem is inconsistent data entry, such as typos or variations in responses. I employ data cleaning techniques, including regular expressions and string manipulation functions to standardize and correct such inconsistencies. Finally, dealing with open-ended text responses requires careful consideration. I utilize text analysis techniques, like sentiment analysis and topic modeling, to extract meaningful insights from qualitative data.

For example, in a recent project, I encountered a significant amount of missing data in a key demographic variable. After exploring the patterns of missingness, I applied multiple imputation using the mice package in R, generating multiple plausible datasets to account for the uncertainty introduced by the missing values and analyzing the results across the imputed datasets.

Q 25. How do you prioritize tasks when working with large datasets?

Prioritizing tasks when working with large datasets requires a structured approach. I typically start by defining clear objectives and outlining the deliverables. Then, I break down the project into smaller, manageable tasks, estimating the time required for each. I use tools like project management software to track progress and allocate resources effectively. I prioritize tasks based on their dependencies, urgency, and impact on the overall project goals. Tasks with high impact and short deadlines are usually given priority.

For instance, in a recent project involving a massive survey dataset, I first focused on data cleaning and preprocessing steps – ensuring data quality – before moving on to more advanced analyses. This prioritized the foundation upon which all further analysis depended.

Q 26. Explain your experience with automating data processing tasks.

I have significant experience automating data processing tasks using scripting languages like R and Python. This significantly improves efficiency and reduces the risk of human error. I use techniques such as creating custom functions and scripts to automate repetitive tasks like data cleaning, transformation, and analysis. For example, I developed a Python script to automatically import data from multiple survey platforms, perform data validation checks, and export the cleaned data to a standardized format. This streamlined the data processing workflow, saving significant time and effort.

Automation also allows for easy reproducibility. My scripts are well-documented and version-controlled, ensuring that the analysis can be easily repeated and verified. Furthermore, I often integrate these scripts into automated pipelines using tools like Jenkins or GitLab CI/CD for continuous data processing.

Q 27. How do you stay current with best practices in survey data analysis?

Staying current with best practices in survey data analysis requires continuous learning and engagement with the field. I actively follow leading academic journals and industry publications, attending webinars and conferences to stay updated on the latest methodologies and techniques. I’m also an active member of online communities and forums, participating in discussions and learning from other experts. Moreover, I regularly explore new statistical packages and software tools to enhance my skills and expand my capabilities.

For example, I recently attended a workshop on causal inference techniques and applied this knowledge to a project analyzing the impact of a new marketing campaign based on survey data, leading to a more robust and insightful analysis.

Q 28. Describe your experience collaborating with cross-functional teams on survey projects.

I thrive in collaborative environments and have extensive experience working with cross-functional teams on survey projects. I believe in open and transparent communication, regularly engaging with stakeholders to clarify project requirements and ensure alignment on goals. I actively participate in team meetings, sharing my expertise and contributing to decision-making processes. I also utilize collaboration tools like Slack and Microsoft Teams to maintain clear communication channels and facilitate the smooth flow of information among team members.

For example, in a recent large-scale customer satisfaction survey, I worked closely with marketing, product development, and customer service teams to ensure that the survey questions accurately reflected their needs and that the results were interpreted and acted upon effectively. My ability to translate complex statistical findings into actionable insights for different stakeholders was crucial to the project’s success.

Key Topics to Learn for Proficient in using survey software for data processing and reporting Interview

- Data Import and Cleaning: Understanding different data import methods (CSV, Excel, etc.), handling missing data, identifying and correcting inconsistencies, and data transformation techniques.

- Data Analysis & Interpretation: Performing descriptive statistics (mean, median, mode, standard deviation), identifying trends and patterns, creating meaningful visualizations (charts, graphs), and drawing accurate conclusions from the data.

- Report Generation & Customization: Mastering the software’s reporting features, creating professional-looking reports with clear visualizations and concise summaries, tailoring reports to different audiences (e.g., executives vs. researchers).

- Survey Software Specifics: Gaining in-depth knowledge of the specific survey software mentioned in the job description. This includes understanding its features, limitations, and best practices for efficient data handling.

- Data Validation & Quality Control: Implementing checks to ensure data accuracy and reliability. Understanding how to identify and handle outliers and potential biases in the data.

- Exporting and Sharing Data: Knowing different export formats (e.g., PDF, Excel, SPSS) and understanding best practices for securely sharing data with colleagues and stakeholders.

- Advanced Techniques (if applicable): Depending on the role, you might need to explore more advanced techniques like weighting data, statistical modeling, or using scripting languages for automation.

Next Steps

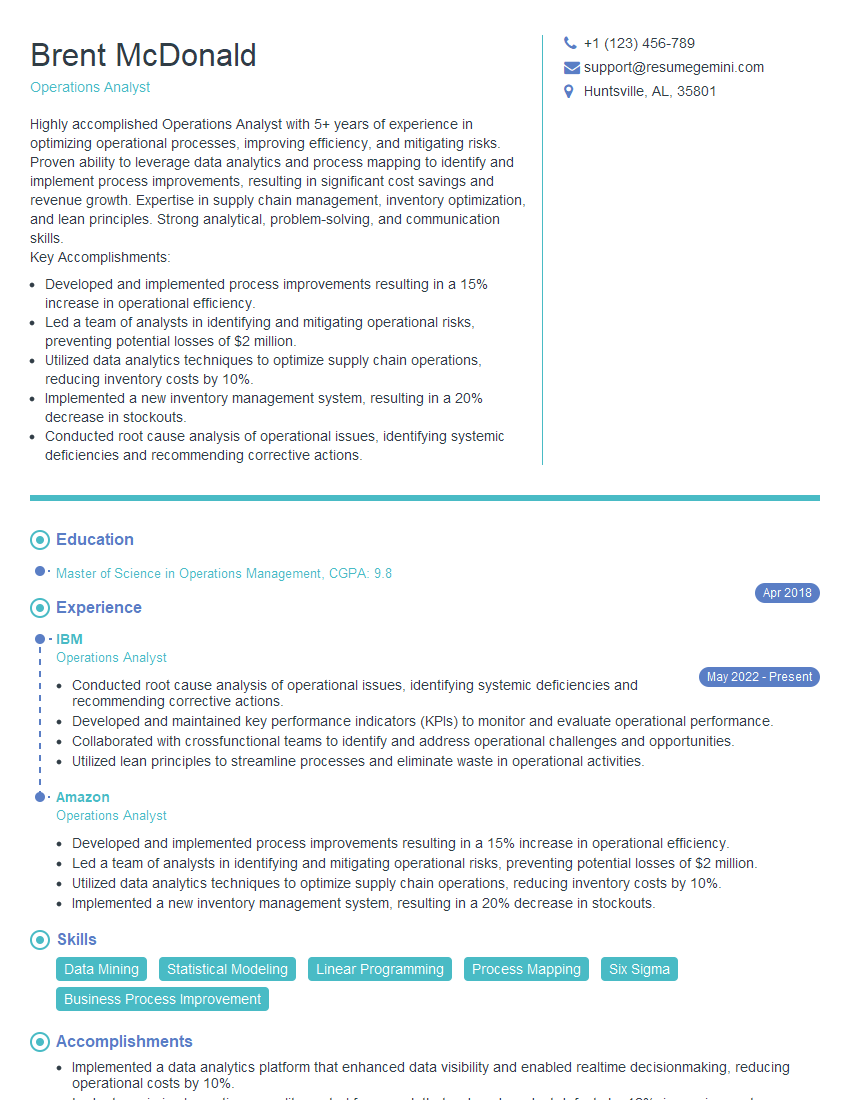

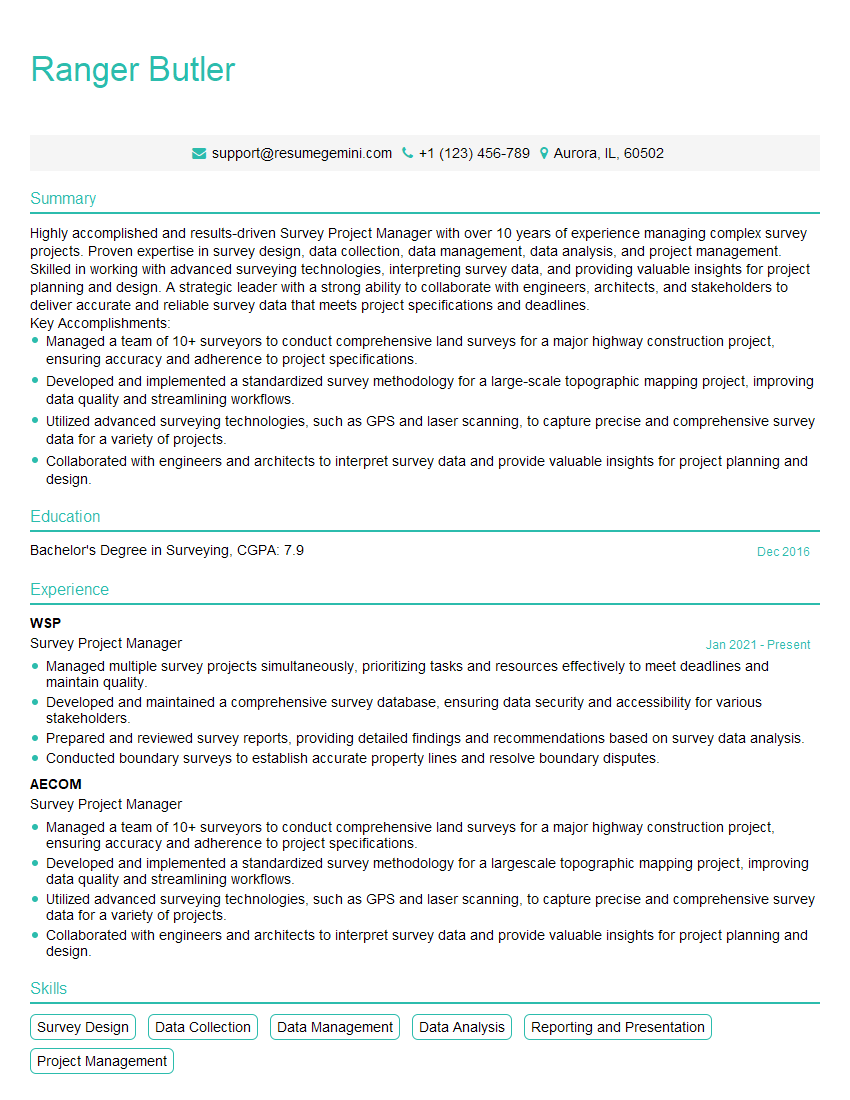

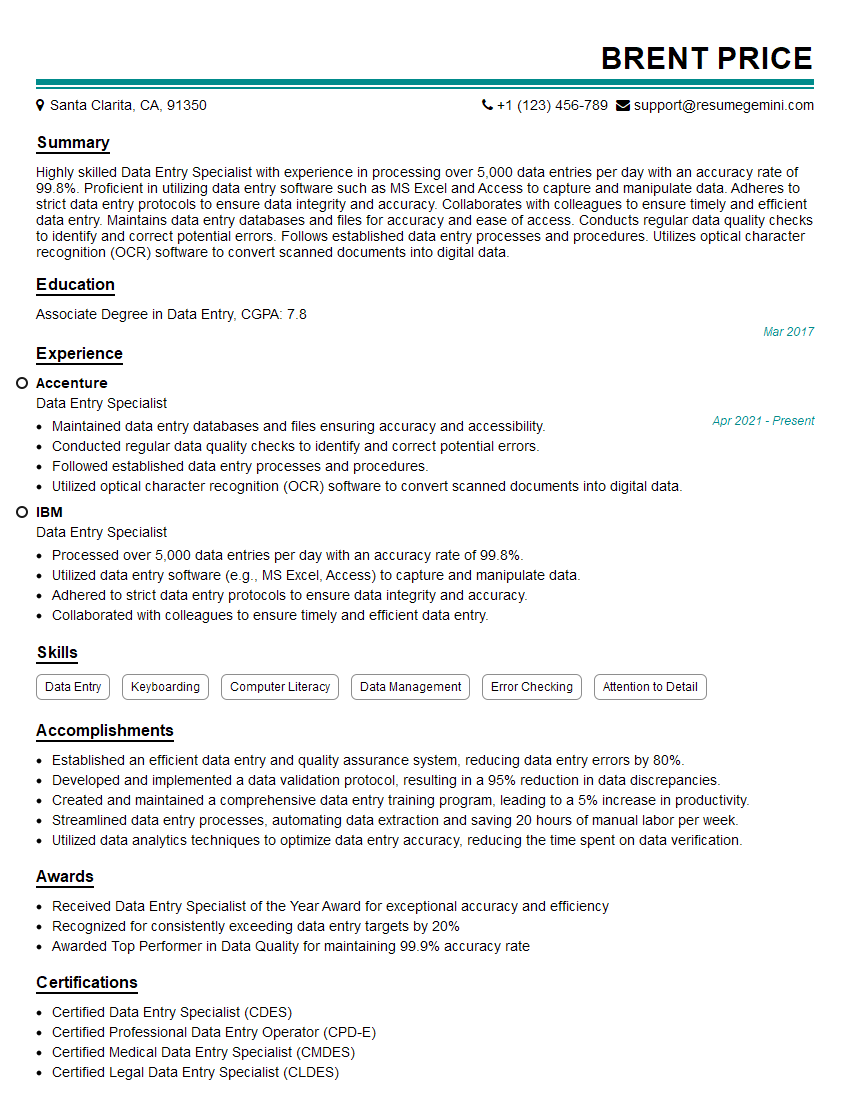

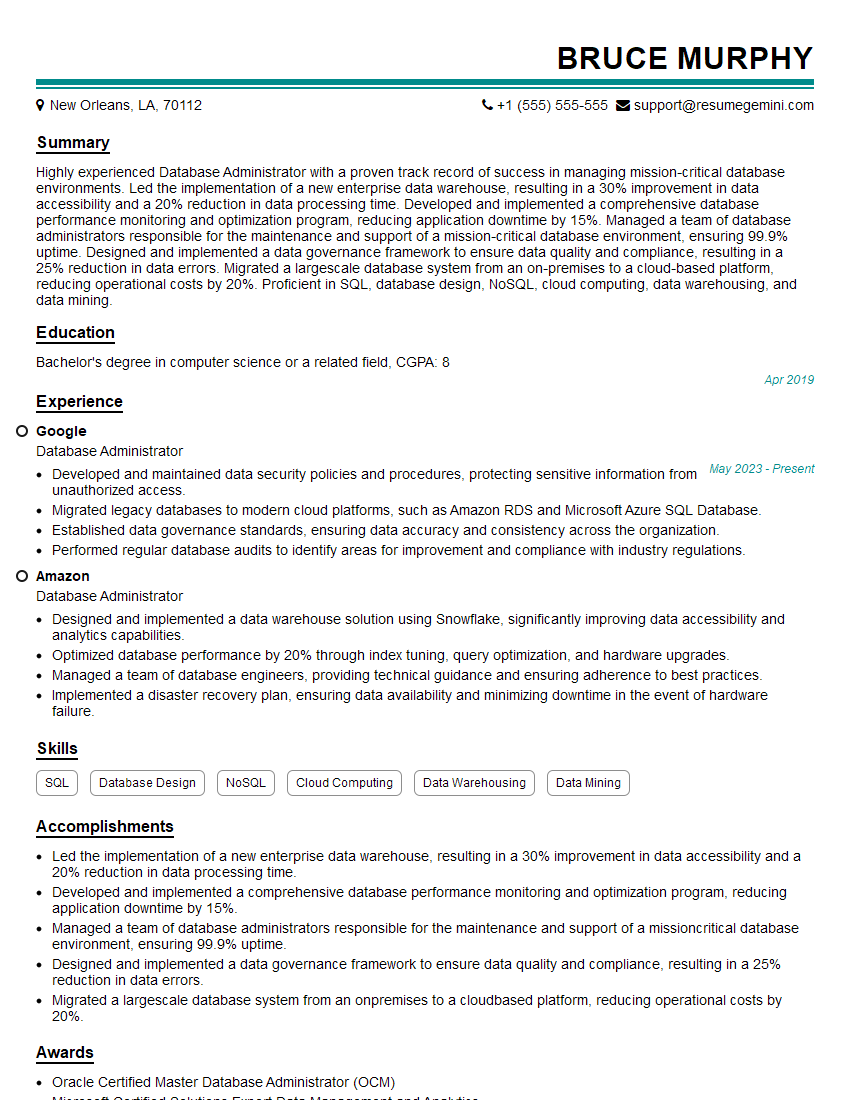

Mastering survey data processing and reporting significantly enhances your value to employers in market research, analytics, and many other fields. It demonstrates strong analytical skills and the ability to extract actionable insights from complex data sets. To maximize your chances of landing your dream job, crafting a strong, ATS-friendly resume is crucial. ResumeGemini is a trusted resource that can help you build a professional and impactful resume, highlighting your skills and experience effectively. Examples of resumes tailored to showcasing proficiency in survey software for data processing and reporting are available [within ResumeGemini/this platform]. Take the next step towards your career success!

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

Hi, I’m Jay, we have a few potential clients that are interested in your services, thought you might be a good fit. I’d love to talk about the details, when do you have time to talk?

Best,

Jay

Founder | CEO