Feeling uncertain about what to expect in your upcoming interview? We’ve got you covered! This blog highlights the most important Adherence to compliance regulations interview questions and provides actionable advice to help you stand out as the ideal candidate. Let’s pave the way for your success.

Questions Asked in Adherence to compliance regulations Interview

Q 1. Explain the importance of a robust compliance program.

A robust compliance program is crucial for any organization, acting as a shield against legal and financial risks, reputational damage, and operational disruptions. Think of it as the organization’s ethical and legal framework – it ensures everyone operates within established rules and regulations.

Its importance stems from several key areas:

- Legal and Regulatory Adherence: It ensures the organization complies with all applicable laws, regulations, and industry standards, preventing hefty fines and legal repercussions. For example, failure to comply with HIPAA in the healthcare industry can result in significant penalties.

- Risk Mitigation: A strong program proactively identifies and mitigates potential risks, reducing the likelihood of violations and associated consequences. This involves regular risk assessments and internal audits.

- Enhanced Reputation and Trust: Demonstrating a commitment to compliance builds trust with stakeholders, including customers, investors, and employees. A company known for its ethical conduct enjoys a stronger reputation.

- Improved Operational Efficiency: Clear compliance procedures streamline operations, reducing errors and inefficiencies. Knowing the rules simplifies decision-making.

- Sustainable Growth: A culture of compliance fosters a responsible business environment, contributing to long-term sustainable growth and profitability. Investors often prioritize companies with strong ethical frameworks.

Q 2. Describe your experience conducting compliance risk assessments.

My experience in conducting compliance risk assessments involves a structured, multi-stage process. I begin by identifying all relevant regulations and standards applicable to the organization – this could include industry-specific rules, data privacy laws like GDPR and CCPA, or financial regulations like SOX. I then map these regulations to the organization’s operations and processes to pinpoint potential vulnerabilities. This involves interviews with key personnel, reviews of internal controls, and analysis of operational documents.

For example, in a recent assessment for a financial institution, I identified a gap in their anti-money laundering (AML) procedures. We discovered that transaction monitoring systems were not adequately capturing high-risk transactions, creating a vulnerability for non-compliance. My recommendations included system upgrades and enhanced employee training.

I utilize frameworks like the NIST Cybersecurity Framework or COSO ERM to structure the assessment and ensure a comprehensive approach. The final output includes a prioritized list of risks, their potential impact, and recommended mitigation strategies. This report is then presented to management to inform their decision-making and resource allocation for compliance initiatives.

Q 3. How do you ensure compliance with data privacy regulations (e.g., GDPR, CCPA)?

Ensuring compliance with data privacy regulations like GDPR and CCPA requires a multifaceted approach. These regulations demand stringent data protection measures, focusing on user consent, data minimization, and strong security practices. Think of it as building a fortress around sensitive data.

Key aspects include:

- Data Mapping and Inventory: We must first identify what personal data we collect, where it’s stored, and how it’s processed. This creates a complete picture of data flows.

- Consent Management: Implementing mechanisms to obtain clear and unambiguous consent from individuals before collecting and processing their personal data. This includes clear, accessible privacy policies.

- Data Security: Implementing robust technical and organizational measures to protect personal data from unauthorized access, loss, or alteration. This involves encryption, access controls, and regular security assessments.

- Data Subject Rights: Establishing procedures for individuals to exercise their rights, such as the right to access, rectify, erase, or restrict the processing of their personal data.

- Data Breach Response Plan: Developing a plan for handling data breaches, including notification procedures and remediation strategies. This is critical for minimizing harm.

I have experience implementing these measures using various technologies and strategies. For instance, I helped a company integrate a consent management platform to streamline the process of obtaining user consent and managing preferences.

Q 4. What is your experience with internal audits and compliance monitoring?

My experience with internal audits and compliance monitoring involves a systematic review of the organization’s compliance activities to ensure they are effective and aligned with regulations. It’s like a health check for the compliance program.

Internal audits are typically conducted regularly and focus on specific areas, like financial controls, data security, or environmental regulations. They involve reviewing documentation, interviewing personnel, and observing processes to identify potential weaknesses or non-compliance issues. I leverage established auditing methodologies and frameworks to ensure objectivity and thoroughness.

Compliance monitoring is an ongoing process that includes tracking key performance indicators (KPIs) and reviewing compliance reports. For example, monitoring the number of data breaches, the effectiveness of training programs, or the completion of required certifications. This provides ongoing insights into the effectiveness of the program and allows for timely adjustments.

In a previous role, I led an internal audit of a company’s supply chain, focusing on ethical sourcing and labor practices. This resulted in identifying several areas for improvement, leading to revised supplier agreements and enhanced monitoring processes.

Q 5. How do you identify and report compliance violations?

Identifying and reporting compliance violations requires a clear process that encourages reporting and ensures appropriate action. Think of it as a well-defined incident response system but for compliance issues.

The process typically includes:

- Establishing a Reporting Mechanism: Creating a safe and accessible channel for employees to report potential violations, such as a confidential hotline or online reporting system.

- Investigation Process: Implementing a procedure for investigating reported violations thoroughly and objectively. This often involves gathering evidence and interviewing relevant personnel.

- Remediation and Corrective Actions: Developing and implementing corrective actions to address the root cause of the violation and prevent recurrence. This may involve policy updates, system changes, or employee retraining.

- Documentation and Reporting: Maintaining detailed records of reported violations, investigations, and corrective actions. This documentation is critical for audits and regulatory inquiries.

- Escalation Procedures: Defining clear escalation paths for reporting serious or recurring violations to upper management or regulatory bodies.

In one instance, I developed a detailed reporting mechanism that allowed employees to anonymously report compliance concerns. This resulted in an early detection of a potential data breach, enabling us to contain the damage and avoid a significant regulatory penalty.

Q 6. Explain your understanding of the Sarbanes-Oxley Act (SOX).

The Sarbanes-Oxley Act of 2002 (SOX) is a US federal law designed to protect investors from fraudulent financial reporting. It’s a critical piece of legislation for publicly traded companies. It focuses on enhancing corporate responsibility and financial disclosures. Think of it as a major overhaul of corporate governance to improve transparency and accountability.

Key aspects of SOX include:

- Internal Controls: SOX mandates the establishment and maintenance of effective internal controls over financial reporting. This ensures the reliability of financial statements.

- Independent Audits: Companies must undergo independent audits of their financial statements by registered public accounting firms.

- Corporate Responsibility: SOX holds senior management accountable for the accuracy of financial reporting, strengthening corporate governance.

- Securities and Exchange Commission (SEC) Reporting: Companies must comply with SEC reporting requirements, ensuring transparency in their financial disclosures.

My understanding of SOX includes its implications for internal controls, audit procedures, and corporate governance. In previous roles, I have assisted companies in implementing SOX-compliant internal controls, including designing, documenting, and testing these controls to ensure compliance.

Q 7. Describe your experience with the development and implementation of compliance training programs.

Developing and implementing effective compliance training programs is essential for fostering a culture of compliance within an organization. It’s about educating employees on the importance of compliance and empowering them to make ethical decisions.

My approach involves:

- Needs Assessment: Identifying the specific compliance training needs of the organization, based on its industry, regulations, and risk profile.

- Curriculum Development: Developing engaging and informative training materials, including interactive modules, case studies, and quizzes. I aim to make the training relevant and relatable to employees’ daily tasks.

- Delivery Methods: Using a variety of delivery methods to suit different learning styles, such as online modules, instructor-led training, and on-the-job coaching.

- Assessment and Evaluation: Assessing the effectiveness of the training program through assessments, surveys, and monitoring of compliance behavior. This helps identify areas for improvement.

- Tracking and Reporting: Maintaining records of employee training completion and performance to demonstrate compliance with regulatory requirements.

For example, I once developed a gamified compliance training program for a large technology company, significantly improving employee engagement and knowledge retention. The interactive format resulted in a much higher completion rate compared to traditional training methods.

Q 8. How do you stay current with changes in compliance regulations?

Staying current with ever-changing compliance regulations requires a multi-pronged approach. It’s not a one-time task, but a continuous process.

- Subscription to Regulatory Updates: I subscribe to newsletters and alerts from relevant regulatory bodies like the SEC, FTC, GDPR, etc., depending on the industry and geographic locations we operate in. These provide immediate notification of changes.

- Professional Development: I actively participate in webinars, conferences, and workshops focused on compliance. This keeps me abreast of emerging trends and best practices. Attending these events also allows for networking with other professionals and learning from their experiences.

- Industry Publications and Journals: Regularly reviewing industry-specific publications and journals provides insights into regulatory interpretations and enforcement actions. This helps me anticipate potential issues and adapt our strategies proactively.

- Internal Knowledge Sharing: I actively participate in and contribute to internal training programs, sharing my knowledge and insights with colleagues. This fosters a culture of compliance within the organization.

- Legal Counsel: Maintaining close communication with our legal team ensures that we receive expert guidance on complex or ambiguous regulatory matters.

Think of it like this: just as a doctor needs to stay updated on medical advancements, I need to stay updated on changes in the regulatory landscape to ensure we remain compliant and avoid potential penalties.

Q 9. How do you manage conflicting compliance requirements from different jurisdictions?

Managing conflicting compliance requirements from different jurisdictions is a significant challenge, requiring a systematic and meticulous approach. It often involves a careful balancing act.

- Jurisdictional Mapping: The first step involves identifying all applicable jurisdictions and the specific regulations relevant to our operations in each location. This often requires detailed analysis of geographic scope and the services we provide.

- Prioritization based on Risk: Once identified, we prioritize regulations based on the potential risk of non-compliance. Higher-risk jurisdictions with stricter penalties receive greater attention.

- Legal Counsel and External Experts: Consulting with legal experts specializing in international compliance is crucial. They provide expert guidance in navigating the complexities of multi-jurisdictional regulations.

- Develop a Compliance Matrix: Creating a detailed compliance matrix that maps out requirements across jurisdictions helps streamline processes and identify potential conflicts upfront. This matrix can be regularly updated as regulations evolve.

- Documentation and Audit Trails: Comprehensive documentation is key to demonstrating our efforts to comply with conflicting requirements. Maintaining meticulous audit trails is essential for responding to regulatory inquiries.

For example, consider a company operating in both the EU and the US. They must adhere to GDPR in the EU and CCPA in California, which have overlapping but not identical requirements for data privacy. A robust compliance program needs to address both, and any conflicts must be carefully analyzed and resolved to ensure full compliance.

Q 10. Describe your experience in conducting compliance investigations.

My experience in conducting compliance investigations involves a structured, methodical approach that ensures objectivity and thoroughness.

- Defining Scope: The initial step involves clearly defining the scope of the investigation, including the specific allegations or concerns, relevant timeframes, and individuals involved.

- Gathering Evidence: I collect all relevant evidence, including documents, emails, interview transcripts, and system logs. This is done while maintaining the chain of custody and data integrity.

- Interviews: I conduct interviews with relevant individuals, employing techniques that encourage open communication and truthful responses. I always ensure individuals are aware of their rights and the purpose of the interview.

- Data Analysis: Collected data is thoroughly analyzed to identify patterns, inconsistencies, and potential violations. Data analytics tools may be employed for large datasets.

- Report Preparation: A detailed report is compiled outlining the findings of the investigation, conclusions, and recommendations for remedial actions. This report is objective and unbiased, focusing on factual evidence.

In one instance, I investigated a potential violation of insider trading regulations. Through thorough data analysis and interviews, I was able to identify the source of the leak and implement measures to prevent similar occurrences in the future.

Q 11. Explain your approach to mitigating compliance risks.

Mitigating compliance risks is a proactive strategy that involves implementing a robust compliance program. My approach is based on a risk-based framework.

- Risk Assessment: I begin by conducting a thorough risk assessment to identify potential areas of vulnerability. This involves evaluating the likelihood and impact of potential violations.

- Policy Development and Implementation: I develop and implement clear, concise compliance policies and procedures that align with relevant regulations. These policies are communicated and enforced consistently.

- Training and Education: Comprehensive training programs are provided to employees to ensure they understand their compliance responsibilities and obligations.

- Monitoring and Auditing: Regular monitoring and audits are conducted to ensure the effectiveness of the compliance program and identify any areas needing improvement. This involves both internal audits and external reviews.

- Continuous Improvement: The compliance program is continuously reviewed and updated to reflect changes in regulations, business practices, and risk profiles. This ensures the program remains relevant and effective.

Imagine a building’s fire safety system. A proactive approach would include regular inspections, fire drills, and updates to safety equipment, all aimed at minimizing the risk of a fire. Similarly, a strong compliance program proactively minimizes the risk of regulatory violations.

Q 12. How do you prioritize compliance tasks and manage competing deadlines?

Prioritizing compliance tasks and managing competing deadlines requires a structured approach. I utilize several techniques to ensure timely completion of critical tasks.

- Prioritization Matrix: I use a prioritization matrix to rank tasks based on urgency and importance. This matrix uses a framework that considers factors like regulatory deadlines, potential impact, and resource availability.

- Project Management Tools: I leverage project management tools like Gantt charts or Kanban boards to visualize deadlines, allocate resources, and track progress. This enhances visibility and promotes accountability.

- Regular Review and Adjustment: I regularly review the schedule and adjust priorities as needed based on new information or changing circumstances. This ensures that the most critical tasks are always addressed first.

- Communication and Collaboration: I foster open communication with stakeholders to manage expectations and ensure everyone is informed of priorities and potential delays.

- Delegation: Where appropriate, I delegate tasks to ensure workload is distributed effectively, maximizing team efficiency.

Think of it like a conductor of an orchestra. They have many instruments and players to coordinate, each with its own role and tempo. Similarly, managing compliance requires coordinating various tasks and deadlines, ensuring everything works in harmony.

Q 13. What is your experience with regulatory reporting?

My experience with regulatory reporting encompasses a wide range of activities, from preparing and submitting reports to analyzing data for reporting purposes.

- Data Collection and Aggregation: I’m experienced in collecting and aggregating data from various sources, ensuring accuracy and completeness. This may involve working with different systems and departments within the organization.

- Report Preparation: I’m proficient in preparing various types of regulatory reports, including those required by securities regulators (e.g., 10-K, 8-K), tax authorities, and other relevant agencies. This includes ensuring reports comply with specific formatting requirements.

- Compliance with Reporting Deadlines: I have a strong track record of meeting all regulatory reporting deadlines, ensuring timely and accurate submission. This involves setting internal reminders and deadlines to facilitate on-time submissions.

- Data Analysis for Reporting: I analyze data trends and patterns to identify potential areas of concern or non-compliance, and incorporate these findings into reports when necessary.

- System Implementation and Automation: I’ve worked on implementing systems to streamline the reporting process, improving efficiency and reducing the risk of errors. Automation can improve the accuracy and timeliness of reports.

For instance, preparing a Sarbanes-Oxley (SOX) compliance report requires meticulous attention to detail and adherence to strict regulatory guidelines. My experience guarantees accuracy and compliance in this process.

Q 14. Describe a time you had to resolve a compliance issue.

In a previous role, we discovered a discrepancy in our data privacy practices that could have violated GDPR regulations. A routine audit uncovered inconsistencies in how customer data was being handled.

- Immediate Action: We immediately launched an investigation to identify the root cause and scope of the issue. This involved reviewing internal policies, interviewing staff, and analyzing data flows.

- Root Cause Analysis: We identified the issue as a lack of proper training and inconsistent interpretation of the company’s data privacy policy among employees.

- Remedial Actions: We implemented several remedial actions. These included enhanced employee training on GDPR compliance, revision of the data privacy policy to ensure clarity, and the introduction of new data management procedures.

- Reporting and Remediation: We reported the issue to the relevant authorities, proactively demonstrating our commitment to compliance and transparency. We implemented a robust system to prevent similar issues from arising in the future.

- Lessons Learned: This incident highlighted the importance of continuous monitoring, regular employee training, and consistently reviewing and updating internal policies and procedures. The experience strengthened our overall compliance program.

This experience taught me the critical importance of proactive measures, thorough investigation, and transparent communication in addressing compliance issues. It also reinforced the value of a strong culture of compliance throughout the organization.

Q 15. How do you build and maintain effective relationships with regulatory bodies?

Building and maintaining strong relationships with regulatory bodies is crucial for any organization aiming for consistent compliance. It’s not just about reacting to audits; it’s about proactive engagement and transparent communication.

- Proactive Communication: I regularly schedule meetings with relevant regulatory authorities to discuss emerging trends, clarify interpretations of regulations, and proactively address any potential concerns before they escalate into issues. For example, I’d proactively inform the relevant agency about a planned system upgrade that might impact reporting requirements.

- Transparency and Open Dialogue: When an issue arises, I believe in addressing it head-on with honesty and transparency. This includes providing timely and accurate information, even if it means admitting to shortcomings. This builds trust and fosters a collaborative problem-solving approach.

- Relationship Building: Attending industry conferences and workshops allows me to network with regulatory personnel, understand their perspectives, and build rapport. It’s about forming professional relationships built on mutual respect and understanding.

- Documentation and Record-Keeping: Meticulous record-keeping of all communication and interactions with regulatory bodies is paramount. This provides a clear audit trail and helps demonstrate our commitment to compliance.

For instance, in my previous role, our proactive engagement with the data protection authority allowed us to address a minor data breach internally, preventing a formal investigation and potential penalties.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. What are the key elements of an effective compliance culture?

A strong compliance culture isn’t just about policies; it’s about embedding ethical behavior into the very fabric of the organization. It’s a shared understanding and commitment to following rules and regulations, driven from the top down.

- Leadership Commitment: Visible and active support from leadership is paramount. This includes clear communication of compliance expectations and the consequences of non-compliance.

- Training and Education: Comprehensive and regular training programs, tailored to different roles and responsibilities, are essential. This should go beyond simple awareness training and incorporate practical scenarios and interactive exercises.

- Open Communication and Reporting Channels: Employees must feel comfortable reporting compliance concerns without fear of reprisal. Establishing anonymous reporting mechanisms and ensuring confidentiality are crucial.

- Accountability and Enforcement: Consistent enforcement of compliance policies and procedures is necessary. This doesn’t necessarily mean punitive measures always, but it does mean clear consequences for non-compliance.

- Continuous Improvement: Regular audits and reviews are needed to identify areas for improvement and to ensure the compliance program remains effective. This includes gathering feedback from employees and adapting accordingly.

Think of it like building a house: the foundation is leadership commitment, the walls are training and communication, and the roof is accountability and enforcement. A strong foundation ensures a stable and secure structure.

Q 17. How do you measure the effectiveness of a compliance program?

Measuring the effectiveness of a compliance program is an ongoing process, not a one-time event. It involves a combination of qualitative and quantitative measures.

- Key Risk Indicators (KRIs): Identifying and monitoring KRIs helps proactively identify potential compliance issues. For example, tracking the number of near misses or reported violations can indicate weaknesses in the program.

- Compliance Audit Results: Regular internal and external audits provide valuable insights into the effectiveness of controls and processes. The number and severity of findings, along with remediation timelines, are key metrics.

- Employee Surveys and Feedback: Gathering employee feedback on the compliance program can highlight areas needing improvement. Are employees aware of policies? Do they feel comfortable reporting issues?

- Incident Reporting and Response Times: Monitoring the number of incidents, the time taken to resolve them, and the effectiveness of the response mechanism provides insights into the program’s responsiveness.

- Metrics related to specific frameworks: If using a framework like ISO 27001, adherence to specific clauses and controls should be measured.

By regularly analyzing these metrics, we can identify trends, assess the program’s effectiveness, and make data-driven improvements. Regular reporting to senior management keeps compliance at the forefront of organizational priorities.

Q 18. Explain your experience with different compliance frameworks (e.g., ISO 27001, NIST).

I have extensive experience working with several compliance frameworks, including ISO 27001 and NIST Cybersecurity Framework. Understanding these frameworks is crucial for building a robust compliance program.

- ISO 27001: This international standard focuses on Information Security Management Systems (ISMS). My experience includes conducting gap analyses, implementing necessary controls, developing and maintaining the ISMS documentation, and managing annual certifications. I’ve been involved in projects requiring ISO 27001 certification across various sectors, ensuring alignment with specific organizational needs.

- NIST Cybersecurity Framework: I’ve utilized the NIST framework to assess and improve cybersecurity posture. This involves aligning organizational activities with the framework’s five functions: Identify, Protect, Detect, Respond, and Recover. This framework offers a more flexible approach than ISO 27001, allowing tailoring to organizational contexts.

In a recent project, I successfully guided an organization through ISO 27001 certification, improving their information security posture and reducing their risk profile. The NIST framework was instrumental in a separate project that focused on improving the organization’s response to cyber threats.

Q 19. How do you ensure compliance within a distributed or remote workforce?

Ensuring compliance within a distributed or remote workforce requires a multifaceted approach focusing on technology, training, and communication.

- Secure Remote Access: Providing secure access to company resources using VPNs, multi-factor authentication, and endpoint protection solutions is crucial. This protects sensitive information and prevents unauthorized access.

- Cloud-Based Compliance Solutions: Utilizing cloud-based compliance management tools allows for central management of policies, procedures, and training materials, ensuring consistent access across geographical locations.

- Remote Training and Awareness Programs: Regular online training modules and webinars keep remote employees informed about compliance requirements and best practices. Interactive modules and regular quizzes can help monitor comprehension.

- Enhanced Communication: Clear and frequent communication is key. Utilizing platforms like instant messaging and video conferencing facilitates quick clarification of doubts and the dissemination of updates.

- Regular Audits and Monitoring: Remote access controls and employee activities must be regularly monitored to detect any anomalies or potential breaches.

For example, in my previous role, we implemented a cloud-based compliance platform that provided all remote employees with easy access to relevant policies, training materials, and reporting mechanisms, significantly improving compliance levels.

Q 20. Describe your experience using compliance management software or tools.

I have extensive experience using various compliance management software and tools, including those specializing in GRC (Governance, Risk, and Compliance). The choice of software depends heavily on the organization’s specific needs and size.

- Software Selection and Implementation: I’ve been involved in the selection, implementation, and ongoing management of several compliance management systems, evaluating features, security, and integration capabilities with existing systems.

- Policy and Procedure Management: I’ve utilized software to create, manage, and distribute policies and procedures, ensuring version control and easy accessibility for all employees.

- Risk Assessment and Mitigation: Many platforms allow for risk assessments, enabling identification of vulnerabilities and the tracking of mitigation efforts.

- Audit Management: Software often simplifies the audit management process, helping schedule, conduct, and track audit findings.

- Reporting and Analytics: The ability to generate compliance reports and analyze key performance indicators is crucial for monitoring progress and identifying areas for improvement.

For example, using a particular GRC platform, I successfully streamlined our audit process, reducing the time needed for audits by 30% and improving the accuracy of reporting.

Q 21. What is your understanding of whistleblower protection programs?

Whistleblower protection programs are essential components of a strong compliance culture. They provide a safe and confidential mechanism for employees to report potential violations without fear of retaliation.

- Confidentiality: The program must ensure the confidentiality of the whistleblower’s identity and the reported information, protecting them from any potential negative consequences.

- Accessibility: Multiple channels for reporting, such as hotlines, online forms, and in-person reporting, should be available to maximize accessibility and ensure ease of use.

- Protection from Retaliation: Clear policies outlining protection against retaliation are crucial. This includes specific measures to prevent any adverse actions against whistleblowers.

- Investigation Process: A clear and well-defined process for investigating reported allegations is essential. This ensures impartiality and a thorough investigation.

- Feedback Mechanism: Providing feedback to the whistleblower on the status of the investigation helps maintain trust and transparency.

A robust whistleblower program not only helps detect and prevent compliance violations but also fosters a culture of ethical conduct and accountability. It’s a vital component of a truly effective compliance framework. I have experience designing and implementing such programs, ensuring compliance with relevant legislation and best practices.

Q 22. How do you handle conflicts of interest within a compliance framework?

Handling conflicts of interest is paramount to maintaining ethical and legal compliance. It requires a proactive, multi-layered approach. First, a clear and comprehensive conflict of interest policy needs to be established, defining what constitutes a conflict and outlining reporting procedures. This policy should be easily accessible to all employees and regularly reviewed.

Secondly, a robust disclosure mechanism must be in place. Employees should be encouraged – and in some cases, mandated – to disclose any potential conflicts, no matter how minor they may seem. This ensures transparency and allows for early intervention.

Thirdly, a formal review and mitigation process is crucial. A designated compliance officer or committee should review disclosed conflicts and determine the appropriate course of action. This might involve recusal from decision-making, additional oversight, or even disciplinary action if necessary. For example, if a procurement manager’s spouse owns a company bidding on a contract, a clear conflict exists, requiring either recusal or a rigorous, transparent bidding process overseen by an independent party.

Finally, regular training on conflict of interest recognition and management is essential. Employees need to understand the policy, their responsibilities, and the potential consequences of failing to disclose or manage conflicts effectively. This training shouldn’t be a one-time event but an ongoing process to reinforce understanding and adapt to evolving circumstances.

Q 23. Explain your approach to ensuring data security and compliance.

Ensuring data security and compliance is a multifaceted process requiring a strong security posture and adherence to relevant regulations like GDPR, CCPA, HIPAA, etc. My approach starts with a thorough risk assessment, identifying vulnerabilities and potential threats to our data. This includes assessing both internal and external risks, such as phishing attacks, accidental data breaches, and insider threats.

Based on this assessment, I implement a comprehensive data security plan encompassing technical, administrative, and physical safeguards. Technical controls might include encryption, firewalls, intrusion detection systems, and access control lists. Administrative controls involve policies and procedures for data handling, access management, incident response, and employee training. Physical safeguards protect our data centers and physical storage media from unauthorized access.

Regular security audits and penetration testing are vital to identify and address weaknesses proactively. We also employ data loss prevention (DLP) tools to monitor and prevent sensitive data from leaving the organization’s control. Further, we maintain detailed data inventory and mapping, understanding where our data is stored, who has access, and what its sensitivity level is. This allows for targeted protection and efficient response to security incidents.

Finally, employee awareness and training are crucial. Employees need to understand their responsibilities regarding data security and how to recognize and report potential threats. Think of it like building a castle – robust walls (technical controls), vigilant guards (security monitoring), and well-trained soldiers (employees) all contribute to a strong defense.

Q 24. Describe your experience with third-party vendor risk management.

Managing third-party vendor risk is critical, as vendors often handle sensitive data or perform critical functions on behalf of our organization. My approach begins with a thorough due diligence process before engaging any vendor. This includes vetting their security practices, compliance certifications (e.g., ISO 27001, SOC 2), and insurance coverage.

Next, I negotiate robust contracts that clearly define security and compliance responsibilities. These contracts should include provisions for data security, breach notification, audit rights, and termination clauses. Regular performance monitoring and audits are then conducted to ensure the vendor continues to meet the agreed-upon requirements. This may involve reviewing their security reports, conducting on-site audits, or requesting independent assessments.

A key element is establishing a vendor risk management program, a centralized system for tracking and managing the risks associated with all third-party vendors. This system allows for consistent monitoring, efficient reporting, and proactive mitigation of potential risks. For instance, if a vendor experiences a security breach affecting our data, the program helps us coordinate the response and minimize the impact.

Finally, maintaining a strong communication channel with vendors is essential. This ensures that any security issues or compliance changes are addressed promptly and effectively. Think of it as a partnership; we need to work collaboratively to ensure a strong security posture throughout our entire ecosystem.

Q 25. How do you document compliance activities and maintain records?

Maintaining accurate and comprehensive compliance documentation is critical for demonstrating adherence to regulations and responding to audits. My approach employs a combination of electronic and physical records, using a centralized document management system for easy access and version control. This system ensures that all relevant documentation is easily retrievable, organized, and backed up regularly.

Documentation includes policies and procedures, training records, audit reports, incident logs, risk assessments, and vendor contracts. We use a standardized naming convention and metadata tagging to facilitate searching and retrieval. For example, all policy documents might follow a format like ‘Policy-[Year]-[Number]-[Subject].pdf’.

Furthermore, we establish a document retention policy, defining how long different types of documents need to be kept, complying with legal and regulatory requirements. This ensures that we neither retain unnecessary documents nor delete essential information prematurely. Regular internal audits verify the accuracy and completeness of our documentation, ensuring our records are reliable and up-to-date.

Finally, we utilize version control and audit trails to track changes and ensure accountability. This is particularly important for sensitive documents like policies and contracts. Think of it like a meticulously organized library, where every book (document) has its place, is properly catalogued, and can be easily located when needed.

Q 26. What metrics do you use to track compliance performance?

Tracking compliance performance requires a data-driven approach, using key metrics to measure our progress and identify areas for improvement. Some of the key metrics I utilize include:

- Number of compliance incidents: This helps track the frequency of security breaches, policy violations, or other compliance-related issues.

- Time to remediate incidents: This measures the efficiency of our incident response processes.

- Employee training completion rates: This ensures that employees are adequately trained on compliance policies and procedures.

- Audit findings: This indicates the effectiveness of our compliance programs and identifies areas needing improvement.

- Vendor compliance scores: This monitors the performance of our third-party vendors in relation to security and compliance requirements.

- Percentage of policies reviewed and updated: This ensures that our policies are current and relevant.

These metrics are tracked using dashboards and reporting tools, allowing for regular monitoring and timely identification of trends. This data is then used to inform strategic decisions, prioritize resources, and continuously improve our compliance posture. It’s like a car’s dashboard – providing critical information about its performance to guide the driver.

Q 27. Explain your experience with developing and implementing a code of conduct.

Developing and implementing a code of conduct is a foundational step in building a culture of compliance. My approach starts with a thorough understanding of our organization’s values and the relevant legal and regulatory requirements. This helps in drafting a code that reflects our commitment to ethical business practices and aligns with applicable laws.

The code should be clear, concise, and easily understood by all employees, regardless of their role or level of experience. It should cover key areas such as ethical decision-making, conflict of interest, data security, anti-bribery, and anti-discrimination. The language should be straightforward and avoid legal jargon whenever possible.

Employee involvement is crucial during the development process. This can involve surveys, focus groups, or workshops to solicit feedback and ensure the code reflects the organization’s culture and the employees’ perspectives. Following development, the code needs to be effectively communicated and implemented, requiring training programs, regular reminders, and accessible resources. This might include workshops, online modules, or presentations.

Finally, establishing a mechanism for reporting violations is essential. This could be a confidential hotline, an online reporting system, or a designated compliance officer. The process must be straightforward and encourage employees to report violations without fear of retribution. A well-crafted and effectively implemented code of conduct acts as a compass, guiding employees towards ethical and legal behavior.

Q 28. Describe your experience communicating compliance requirements to employees.

Communicating compliance requirements effectively is essential for fostering a culture of compliance. My approach involves a multi-channel strategy, using a variety of methods to reach employees with different learning styles and preferences.

Initial training is critical, providing a comprehensive overview of all relevant policies and procedures. This could involve in-person sessions, online modules, or a combination of both. The training should be engaging and interactive, going beyond simply reading through documents. Case studies, scenarios, and interactive quizzes can greatly improve understanding and retention.

Regular communication is also crucial, reinforcing key messages and addressing emerging issues. This might involve newsletters, email updates, posters, or intranet announcements. These communications should be concise and focused on key takeaways, avoiding overwhelming employees with excessive detail. Think of it like drip irrigation – consistently providing small doses of information to ensure absorption.

Accessible resources are important, providing employees with easy access to policies, procedures, and FAQs. This could involve a centralized compliance portal or a dedicated section on the company intranet. Providing multiple channels to access information caters to different learning styles and preferences. Lastly, a feedback mechanism is vital, allowing employees to ask questions and provide input. This promotes open communication and helps address any concerns or misunderstandings.

Key Topics to Learn for Adherence to Compliance Regulations Interview

- Understanding Regulatory Frameworks: Explore the key compliance regulations relevant to your target industry (e.g., HIPAA, GDPR, SOX). Focus on understanding the core principles and objectives of these frameworks.

- Practical Application of Compliance Policies: Discuss how compliance regulations translate into daily operational procedures. Consider examples of implementing and maintaining compliance within a specific workflow or project.

- Risk Assessment and Mitigation: Learn to identify potential compliance risks, analyze their impact, and articulate strategies for mitigation. This includes understanding internal controls and audit processes.

- Data Privacy and Security: Understand the significance of data privacy and security in relation to compliance. Explore practical applications such as data encryption, access controls, and incident response protocols.

- Ethical Considerations and Conflicts of Interest: Discuss how ethical considerations intersect with compliance. Be prepared to discuss scenarios involving potential conflicts of interest and how to navigate them responsibly.

- Internal Controls and Auditing: Understand the role of internal controls in maintaining compliance and the procedures involved in internal and external audits. Be ready to discuss your experience with these processes.

- Reporting and Documentation: Learn about best practices for documenting compliance activities, generating reports, and maintaining accurate records.

- Staying Current with Regulatory Changes: Demonstrate your awareness of the dynamic nature of compliance regulations and your ability to stay informed about updates and amendments.

Next Steps

Mastering adherence to compliance regulations is crucial for career advancement in today’s business environment. It demonstrates your commitment to ethical practices and your ability to navigate complex legal landscapes. This expertise is highly valued across various industries, leading to increased job opportunities and higher earning potential.

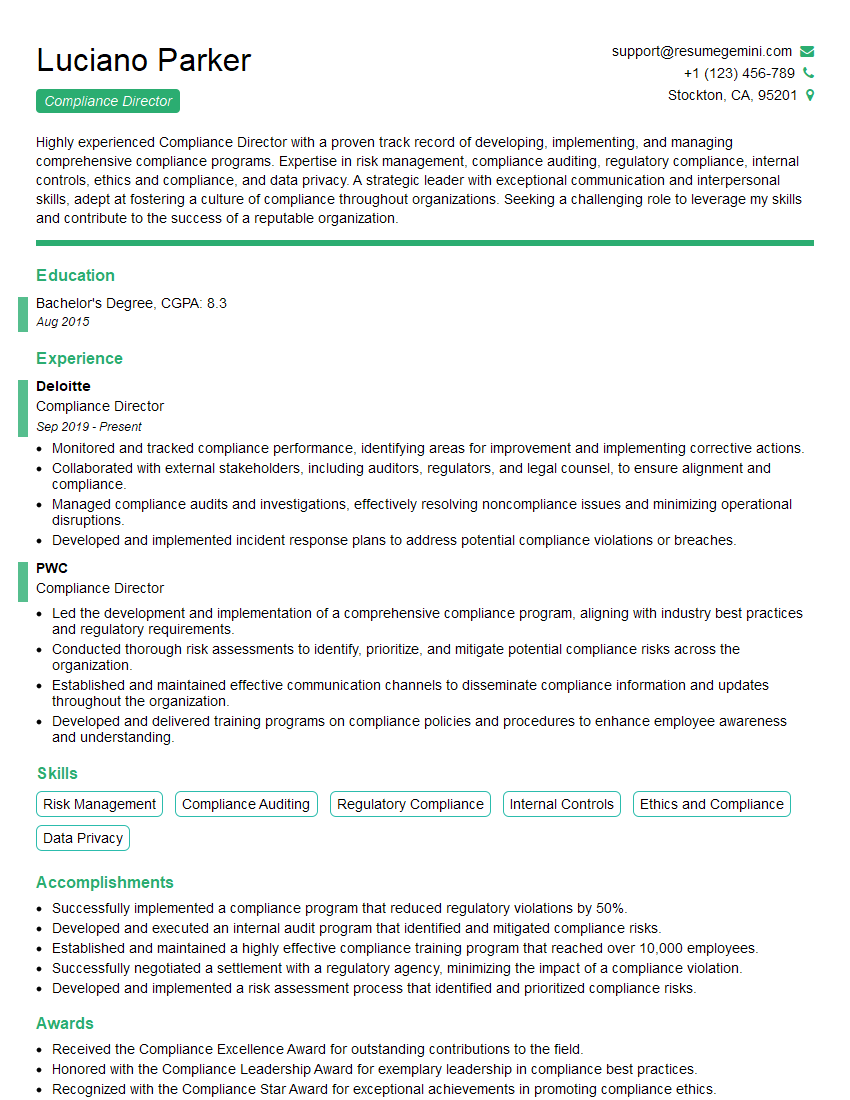

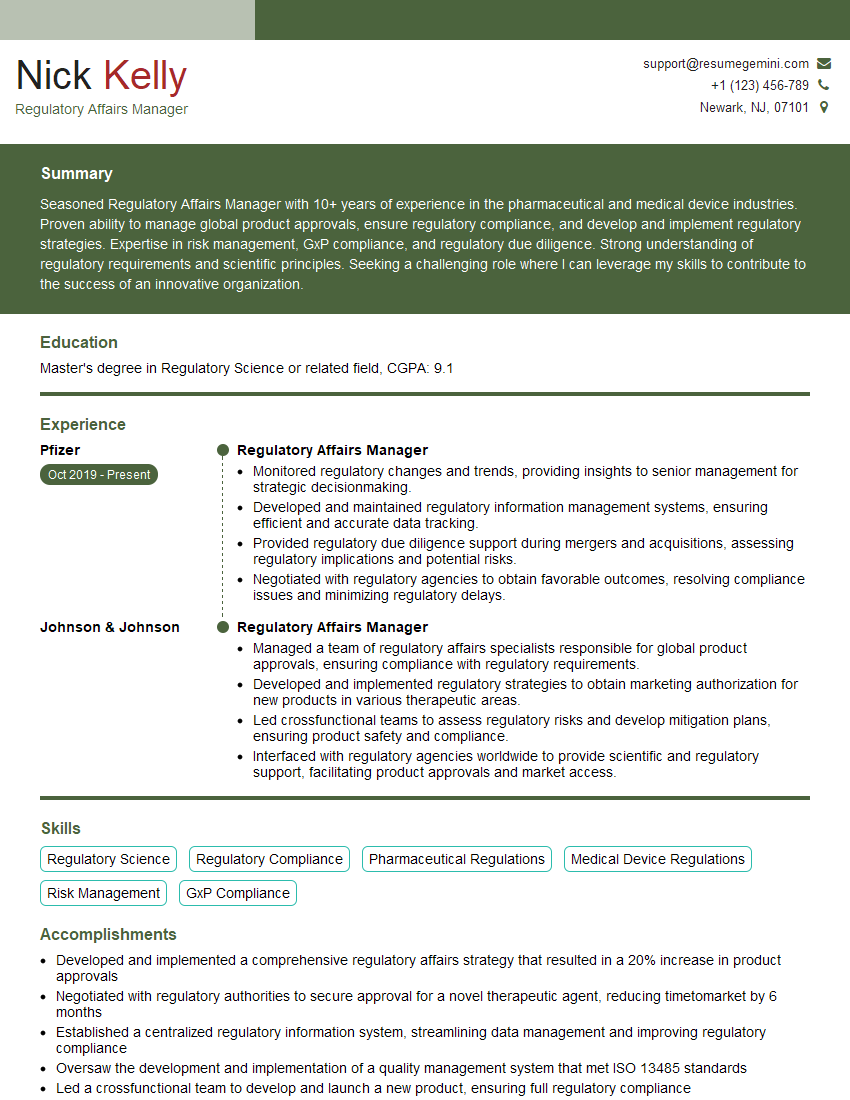

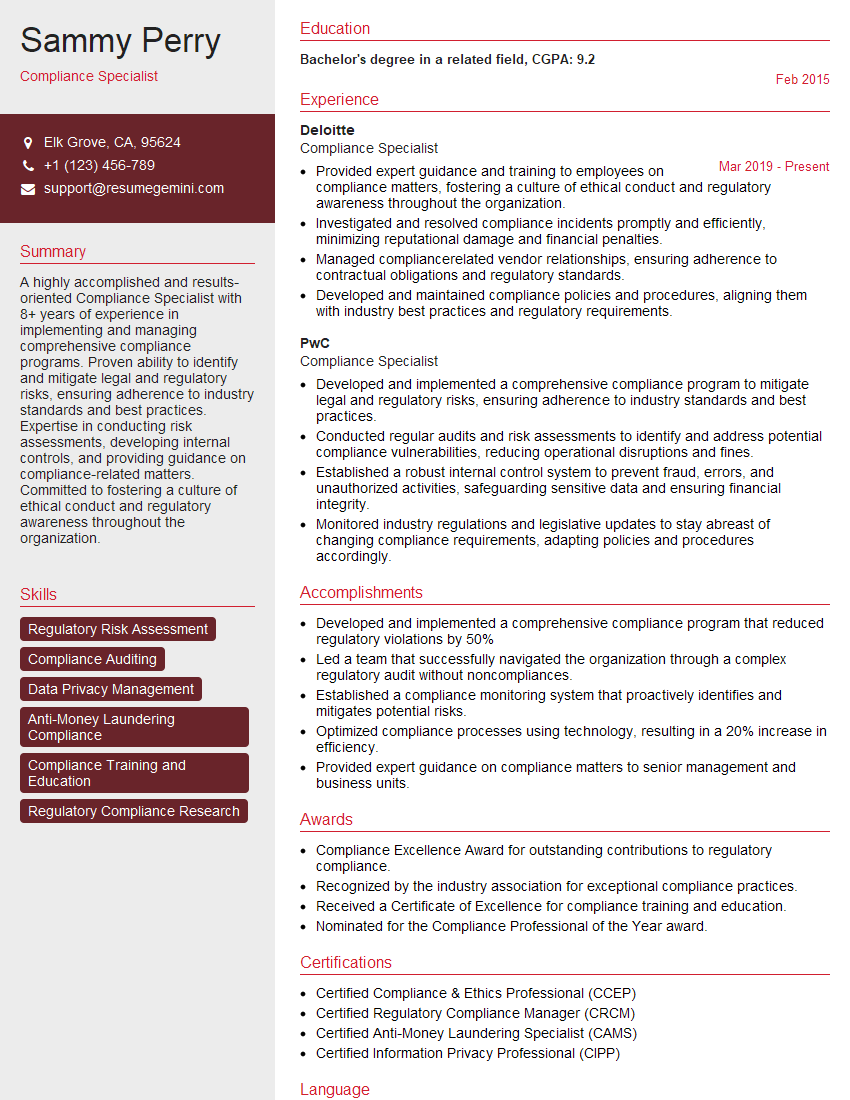

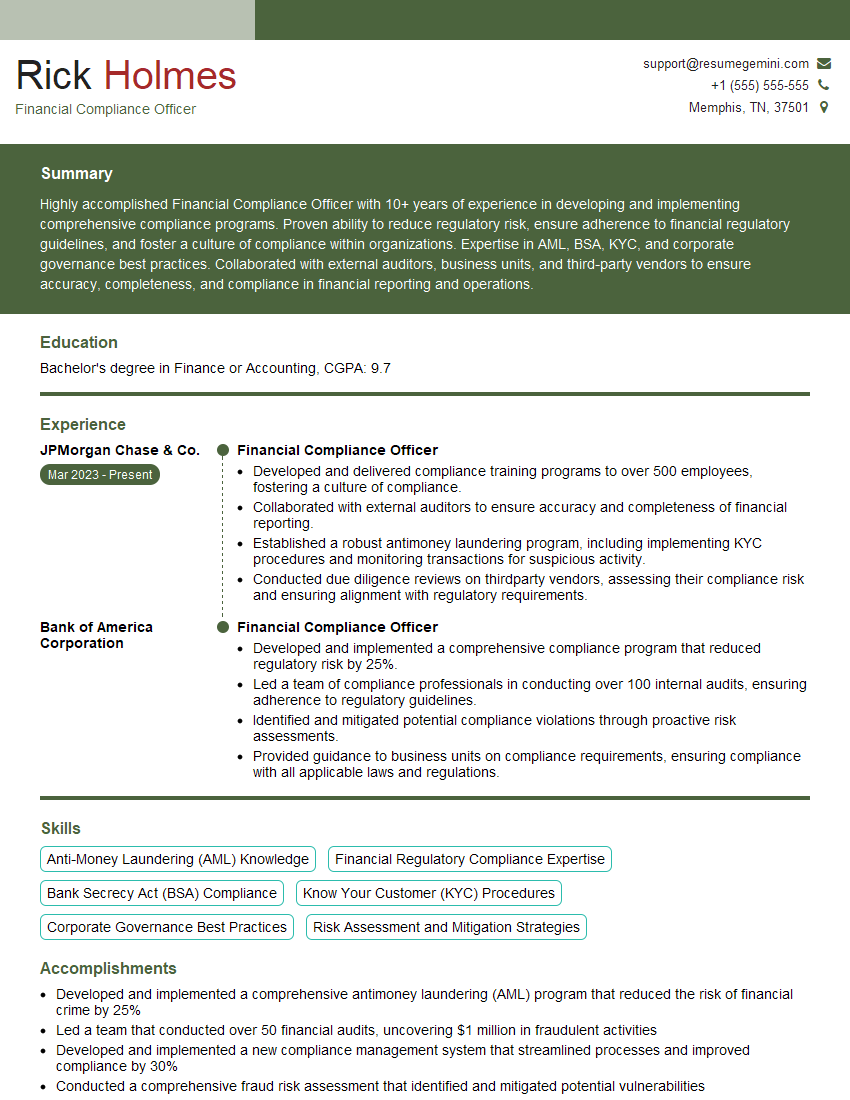

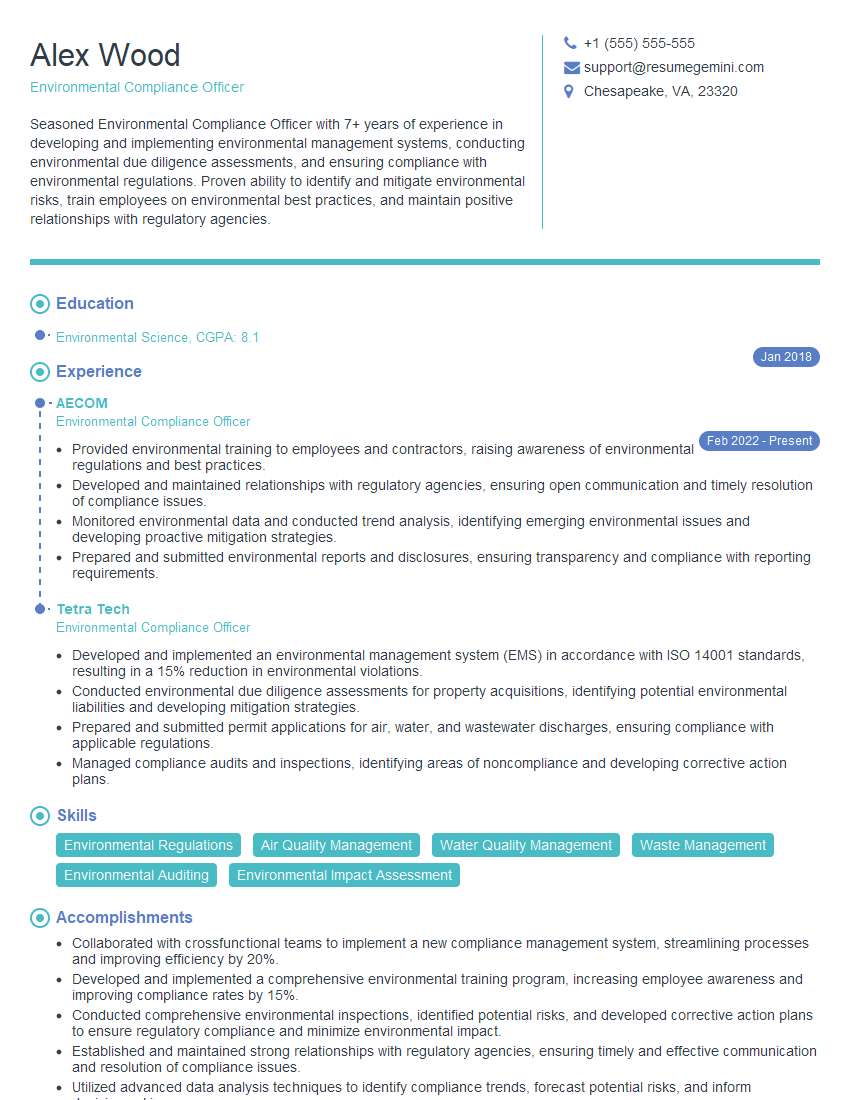

To maximize your job prospects, crafting an ATS-friendly resume is essential. A well-structured resume that highlights your compliance experience and skills will significantly improve your chances of getting noticed by recruiters. We encourage you to leverage ResumeGemini, a trusted resource for building professional resumes, to create a compelling document that showcases your abilities effectively. Examples of resumes tailored to Adherence to Compliance Regulations are available to guide you.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

Hi, I’m Jay, we have a few potential clients that are interested in your services, thought you might be a good fit. I’d love to talk about the details, when do you have time to talk?

Best,

Jay

Founder | CEO