Are you ready to stand out in your next interview? Understanding and preparing for AP/AR Processing interview questions is a game-changer. In this blog, we’ve compiled key questions and expert advice to help you showcase your skills with confidence and precision. Let’s get started on your journey to acing the interview.

Questions Asked in AP/AR Processing Interview

Q 1. Explain the process of invoice processing in Accounts Payable.

Invoice processing in Accounts Payable (AP) is the systematic handling of vendor invoices from receipt to payment. Think of it as the life cycle of an invoice within a company. It’s a crucial process ensuring vendors are paid accurately and on time, while maintaining strong financial control.

- Receipt and Data Entry: Invoices arrive – either physically or electronically – and the key data (invoice number, vendor information, items, amounts, due date) is entered into the AP system. This might involve scanning paper invoices using OCR (Optical Character Recognition) software for automation.

- Matching and Verification: This step involves comparing the invoice data against the purchase order (PO) and goods receipt note (GRN) to ensure accuracy. (This is three-way matching, explained further in the next question). Any discrepancies are flagged for investigation.

- Approval Workflow: The invoice progresses through an approval workflow, often involving multiple levels of authorization based on the invoice amount or vendor. This ensures proper authorization and prevents unauthorized payments.

- Payment Processing: Once approved, the invoice is scheduled for payment, usually through electronic methods like EFT (Electronic Funds Transfer) or ACH (Automated Clearing House).

- Record Keeping and Reconciliation: Finally, the payment is recorded, and the invoice is archived. Regular reconciliation with vendor statements helps to identify and resolve any outstanding discrepancies.

For example, imagine a company orders office supplies. The PO details the order, the GRN confirms the goods were received, and the vendor invoice specifies the cost. Three-way matching verifies these three documents align before payment.

Q 2. Describe your experience with invoice matching and three-way matching.

Invoice matching is a critical control in AP to ensure accuracy and prevent fraudulent payments. Two-way matching compares the invoice to the purchase order (PO), while three-way matching adds the goods receipt note (GRN) to the comparison.

Two-Way Matching: Invoice vs. PO. This checks if the quantity, price, and description of goods or services on the invoice match the PO. It’s simpler but doesn’t verify receipt of goods.

Three-Way Matching: Invoice vs. PO vs. GRN. This is the gold standard, comparing the invoice to both the PO and the GRN, confirming that what was ordered (PO), received (GRN), and billed (Invoice) is identical. This provides much stronger control against errors and fraud.

In my previous role, we implemented three-way matching for all high-value invoices (> $5,000) to minimize the risk of overpayment or payment for goods not received. For lower-value invoices, we used two-way matching, streamlining the process while maintaining reasonable controls. The choice depends on the risk tolerance and the volume of invoices handled.

Q 3. How do you handle discrepancies in vendor invoices?

Handling invoice discrepancies requires a methodical approach. The goal is to resolve the issue efficiently and accurately, ensuring the vendor is paid fairly while protecting company funds.

- Identify and Document: Clearly identify the discrepancy – is it a pricing error, quantity mismatch, or something else? Document all findings meticulously.

- Contact the Vendor: Communicate the discrepancy to the vendor professionally, providing supporting documentation (PO, GRN, etc.). Request clarification and a corrected invoice.

- Internal Review: If the vendor’s explanation isn’t satisfactory, review the internal processes. Were there errors in ordering, receiving, or data entry?

- Escalation: If the discrepancy can’t be resolved with the vendor, escalate it to a manager or the accounts payable manager for further action.

- Resolution: Once the discrepancy is resolved, update the system with the correct information and process the payment accordingly. Maintaining a detailed audit trail is crucial.

For example, if an invoice shows a higher quantity than what the GRN confirms, I would contact the vendor, providing copies of both documents. We might negotiate a credit note or a corrected invoice to reflect the actual quantity received. All communications and adjustments are carefully documented.

Q 4. Explain your experience with accounts payable automation tools.

I have extensive experience with various accounts payable automation tools, including ERP systems (such as SAP and Oracle), and cloud-based AP solutions (e.g., Coupa, Tipalti). These tools significantly improve efficiency and accuracy.

In my previous role, we implemented Coupa to automate invoice processing. This reduced processing time by 60%, minimized manual data entry errors, and improved visibility into the entire AP workflow. The system’s features, such as automated invoice routing, approval workflows, and payment processing, streamlined operations and reduced the risk of errors. We also leveraged its reporting capabilities for better financial analysis and compliance.

Before that, I worked with SAP, where the focus was on integrating the AP module with other modules within the ERP system to enhance data accuracy and consistency across various financial functions.

These tools are invaluable for managing large invoice volumes and maintaining a high level of accuracy. The specific advantages will vary depending on the software, but overall, they provide improved efficiency, reduced costs, and enhanced control.

Q 5. How do you ensure the accuracy of accounts payable data?

Ensuring accuracy in accounts payable data is paramount for maintaining financial integrity. This involves a combination of automated controls and well-defined processes.

- Three-way matching: As mentioned, this compares the invoice, PO, and GRN to identify discrepancies.

- Data validation rules: Setting up data validation rules within the AP system ensures data is entered correctly. For example, the system can prevent an invoice from being processed if it’s missing crucial information.

- Regular reconciliation: Comparing the AP ledger to vendor statements helps to identify and resolve any discrepancies.

- Automated workflows: Automating approval workflows minimizes the risk of human error and ensures timely processing.

- Internal controls: Segregation of duties ensures that no single person has complete control over the process, reducing the risk of fraud.

- Regular audits: Conducting periodic audits helps to identify weaknesses and areas for improvement in the AP process.

For example, we regularly reconcile our AP ledger with vendor statements, identifying any discrepancies and investigating their root cause. This helps ensure the accuracy of our financial records and facilitates prompt payment to vendors.

Q 6. What are the key controls you implement to prevent fraud in AP?

Preventing fraud in AP requires a multi-layered approach combining strong internal controls and technological safeguards.

- Segregation of duties: Different individuals should handle invoice receipt, data entry, approval, and payment processing to prevent collusion and fraud.

- Approval workflows: Implementing robust approval workflows ensures that invoices are reviewed and authorized by appropriate personnel before payment.

- Invoice verification: Implementing a robust invoice verification process, including three-way matching and detailed review of invoices, can help detect fraudulent invoices.

- Regular audits: Conducting regular internal audits helps identify weaknesses in the AP process and ensures compliance with financial regulations.

- Access controls: Restricting access to the AP system to authorized personnel only helps prevent unauthorized changes or access to sensitive data.

- Vendor vetting: Carefully vetting new vendors and regularly reviewing existing vendors can help identify and mitigate fraud risks.

- Automated anomaly detection: Utilizing AP automation tools with built-in anomaly detection capabilities helps flag suspicious transactions for review.

For example, we implement a two-signature requirement for all payments exceeding a specific threshold to add an additional layer of control and safeguard against fraudulent payments.

Q 7. Describe your experience with month-end/year-end closing procedures in AP.

Month-end and year-end closing procedures in AP involve ensuring all transactions are accurately recorded, reconciled, and reported. This is a critical process for producing accurate financial statements.

- Reconciliation: Reconciling vendor statements with the AP ledger to ensure all invoices have been processed and paid accurately.

- Accruals: Recording any outstanding invoices (accruals) at the end of the period to ensure financial statements reflect the complete picture.

- Clearing: Clearing any outstanding items or discrepancies identified during the reconciliation process.

- Reporting: Generating various reports, including the aged payables report and the trial balance, to support financial reporting.

- Review: Reviewing all transactions and reconciliations to ensure accuracy and completeness before closing the period.

During year-end closing, we also perform a more thorough review, including reviewing all open invoices to ensure accuracy and that appropriate accruals have been made. We also prepare supporting documentation for the annual audit.

The process is carefully documented, with clear responsibilities and deadlines. Thorough documentation ensures a smooth closing process and allows us to promptly address any issues that arise.

Q 8. How do you prioritize invoices for payment?

Prioritizing invoices for payment is crucial for maintaining positive vendor relationships and avoiding late payment penalties. My approach involves a multi-faceted strategy considering several factors. First, I identify invoices with early payment discounts – these are prioritized to maximize cost savings. Next, I prioritize invoices from vendors with stricter payment terms or those who are critical to our operations, ensuring uninterrupted supply chains. Finally, I review invoices for potential discrepancies or errors and flag those for immediate attention to resolve any issues promptly. This entire process is often managed using a sophisticated system where invoices are categorized and ranked based on these criteria, allowing for efficient allocation of funds.

Imagine a scenario where we have two key suppliers: Supplier A, providing essential raw materials with a 2% discount for payment within 10 days, and Supplier B providing packaging materials with a net 30 payment term. Even though Supplier B’s invoice might be older, Supplier A’s invoice would be prioritized to capitalize on the early payment discount, which is essentially a cost reduction strategy.

Q 9. Explain your understanding of different payment methods (e.g., ACH, wire transfer, check).

Understanding various payment methods is essential for efficient AP processing. Each method has its own advantages and disadvantages, and the optimal choice depends on the vendor’s preferences, the transaction amount, and processing speed requirements.

- ACH (Automated Clearing House): This is an electronic transfer system for making payments directly from one bank account to another. It’s cost-effective, relatively fast, and ideal for recurring payments to multiple vendors.

- Wire Transfer: This method offers immediate payment transfer, often used for larger, time-sensitive transactions, but it comes with higher transaction fees.

- Check: Traditional paper checks are still used but are slower and more expensive to process. They are becoming less prevalent due to inefficiencies.

For instance, for a regular monthly payment to a supplier of office supplies, an ACH transfer would be most efficient. However, for a large, urgent payment to a key manufacturing partner, a wire transfer might be necessary despite the higher cost. Using the wrong payment method can lead to delays and potential disputes.

Q 10. How do you manage vendor relationships?

Managing vendor relationships is a critical aspect of successful AP/AR processing. It goes beyond simply paying invoices on time. I strive to build strong, collaborative relationships with vendors through proactive communication, timely payments, and respectful dispute resolution. This involves regular communication about purchase orders, invoices, and any outstanding issues. Building trust with vendors ensures a smooth and reliable supply chain. Regular performance reviews of vendors help to identify and address any issues early.

For example, if a vendor consistently misses deadlines, I’d initiate a discussion to understand the reasons behind the delays and explore potential solutions collaboratively, rather than just resorting to complaints. By working together, we can identify and resolve supply chain issues, strengthening our business relationship.

Q 11. How do you handle vendor inquiries and disputes?

Handling vendor inquiries and disputes requires a systematic approach. I always begin by acknowledging the inquiry or dispute promptly and assuring the vendor that their concerns are being addressed. Then I thoroughly investigate the issue, reviewing the relevant documentation, such as invoices, purchase orders, and delivery receipts. I communicate my findings clearly and transparently to the vendor, explaining the next steps. If a discrepancy is identified, I work collaboratively with the vendor to resolve the issue, possibly involving internal stakeholders as necessary. Documentation throughout the process is crucial for future reference and audit trails.

For instance, if a vendor disputes an invoice due to a quantity mismatch, I’d cross-reference the invoice with the purchase order and delivery receipt. If the discrepancy is confirmed, I’d work with the vendor to agree on a resolution, adjusting the invoice accordingly and ensuring proper documentation of the adjustment.

Q 12. Describe the process of accounts receivable (AR) invoicing.

Accounts Receivable (AR) invoicing is the process of creating and sending invoices to customers for goods or services rendered. This process begins with order confirmation, followed by the accurate recording of the goods or services delivered or provided. The invoice itself typically includes crucial details such as invoice number, date, customer information, detailed description of goods or services, pricing, payment terms, and contact information. After generating the invoice, it is distributed to the customer—often electronically via email or through an online portal—and a copy is retained for internal records. A follow-up process is often implemented to track payments and address any payment discrepancies.

For example, a software company delivers a customized solution to a client. The AR department would then generate an invoice detailing the services rendered, the agreed-upon price, payment terms (e.g., net 30), and due date. The invoice is electronically sent to the client, and a copy is saved in the AR system, linked to the client’s account and project details. The system then automatically tracks the payment status of the invoice.

Q 13. Explain your experience with credit and collections.

My experience in credit and collections involves managing outstanding customer payments and minimizing bad debt. This includes assessing customer creditworthiness before extending credit, setting appropriate credit limits, and establishing clear payment terms. When payments are overdue, I follow a structured process to contact customers, reminding them of outstanding balances and working with them to create payment plans if needed. Escalation procedures are followed for persistent non-payment, which could involve legal action as a last resort. Regular reporting on aging receivables allows proactive identification of potential issues and timely intervention.

For example, if a customer consistently misses payment deadlines, I’d first attempt to contact them directly to understand the reason for the delay. Based on the situation, I might offer a payment plan or explore other options to recover the outstanding amount. Maintaining thorough records and documenting all communication is crucial in this process.

Q 14. How do you handle customer inquiries and disputes?

Handling customer inquiries and disputes is similar to handling vendor inquiries, requiring prompt acknowledgment, thorough investigation, and transparent communication. I begin by gathering all relevant information, such as order details, invoices, and any previous correspondence. I carefully analyze the situation to determine the root cause of the dispute and work collaboratively with the customer to find a mutually acceptable solution. If a mistake is identified on our end, I promptly rectify it and offer a sincere apology. Maintaining detailed records of all interactions is critical, ensuring accountability and transparency.

For example, if a customer disputes an invoice amount due to a billing error, I’d review the invoice and the original order to identify the discrepancy. If an error is found, I’d issue a corrected invoice and explain the situation clearly to the customer. Maintaining a professional and empathetic approach throughout the entire process is crucial for retaining customer trust.

Q 15. How do you manage overdue accounts receivable?

Managing overdue accounts receivable involves a proactive and systematic approach. It’s not just about chasing late payments; it’s about preventing them in the first place and minimizing losses. My strategy begins with clear communication and establishing expectations upfront. This includes sending out timely invoices with clear payment terms and utilizing automated email reminders.

For accounts that become overdue, I follow a tiered approach. I start with friendly reminders, escalating to more formal letters and phone calls. I maintain detailed records of all communication, documenting each attempt to collect the payment. For particularly persistent issues, I may engage a collections agency, but only as a last resort. The key is to balance maintaining good customer relationships with the need to recover outstanding funds. For example, I might offer a payment plan to a customer facing genuine financial difficulty, while taking more assertive action with a customer who consistently ignores payment requests.

- Tier 1: Friendly reminders (email, automated system).

- Tier 2: Formal letters, phone calls.

- Tier 3: Final demand letter before referral to collections.

- Tier 4: Collections agency referral.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. What strategies do you use to improve collections efficiency?

Improving collections efficiency requires a multi-pronged approach focused on prevention and proactive measures. One key strategy is implementing robust credit checks before extending credit to new customers to assess their risk profile. This helps minimize the likelihood of future bad debts. Automating invoice delivery and payment reminders reduces manual work and ensures timely communication. Regularly reviewing aging reports allows for early identification of potentially problematic accounts, enabling swift intervention.

Furthermore, offering multiple payment options, such as online portals, ACH transfers, and credit card payments, can improve customer convenience and promptness of payment. Training staff on effective communication techniques to handle customer inquiries and negotiate payment plans is also crucial. Finally, analyzing key performance indicators (KPIs) like Days Sales Outstanding (DSO) helps track progress and identify areas for improvement. For instance, a consistently high DSO might indicate a need for stricter credit policies or more effective collection procedures.

Q 17. How do you reconcile accounts receivable?

Reconciling accounts receivable ensures the accuracy of the company’s financial records. It involves comparing the company’s records of accounts receivable with the actual payments received from customers. This process typically involves several steps. First, I obtain a bank statement showing all deposits received. Second, I cross-reference these deposits with the sales invoices in our system. This reveals any discrepancies – payments that don’t match invoices or invoices without corresponding payments. Then, I investigate each discrepancy to identify the cause; this could be anything from a simple data entry error to a lost payment or a dispute over the invoice.

Once identified, I correct any errors in the company’s records and follow up with customers regarding missing or mismatched payments. The process usually ends with a reconciliation report that shows that the balance of the bank statement and the company’s account receivable ledger agree, confirming the accuracy of the financial reporting. Regular reconciliation is crucial not only for accurate financial reporting but also for identifying potential fraud or other financial irregularities.

Q 18. How do you identify and resolve discrepancies in customer payments?

Identifying and resolving discrepancies in customer payments requires a methodical and detail-oriented approach. I begin by carefully reviewing the payment received against the corresponding invoice. Discrepancies can arise from several reasons, including incorrect amounts, mismatched invoice numbers, or payments applied to the wrong account. I would start by comparing the payment amount with the invoice amount. If there’s a difference, I investigate to see if there are any applicable discounts or credits. Next, I verify the invoice number on the payment with our records.

If the invoice number doesn’t match, I’ll try to identify the correct invoice based on the payment amount or date. If the payment is for the correct amount but applied to the wrong account, I’ll work to rectify this internally. If I can’t resolve the discrepancy internally, I directly contact the customer to clarify the situation. Throughout the process, I maintain meticulous records of all communications and actions taken. Clear and effective communication with the customer is key to resolving these issues efficiently and maintaining a positive relationship.

Q 19. Describe your experience with accounts receivable software.

I have extensive experience with various accounts receivable software packages, including both cloud-based and on-premise solutions. My experience includes using software such as NetSuite, SAP, and QuickBooks. I’m proficient in using these systems to manage the entire AR lifecycle, from invoice creation and sending to payment processing and reconciliation. I’m familiar with features such as automated invoice generation, electronic payments, and reporting tools which significantly improve efficiency and accuracy. I understand the importance of data integrity and proper system configuration to optimize the use of the software for effective AR management.

For example, in a previous role, I implemented a new cloud-based AR system which automated the previously manual process of invoice generation and payment posting. This resulted in a significant reduction in processing time and error rates, freeing up staff to focus on higher-value tasks. I’m also adept at integrating AR systems with other business applications like CRM systems, improving data flow and enabling a holistic view of customer interactions.

Q 20. What are the key performance indicators (KPIs) you track in AP/AR?

Key performance indicators (KPIs) are essential for tracking the effectiveness of AP/AR processes. In accounts receivable, I track:

- Days Sales Outstanding (DSO): This metric measures the average time it takes to collect payments from customers. A lower DSO indicates efficient collections.

- Average Collection Period (ACP): Similar to DSO, but sometimes considers only outstanding invoices, providing a more precise picture.

- Past Due Percentage: The proportion of invoices that are overdue, highlighting areas needing attention.

- Bad Debt Expense: The amount of uncollectible invoices written off, indicating the effectiveness of credit risk management.

- Customer Payment Cycle Time: Measures the time from invoice issue to payment receipt, identifying bottlenecks.

In accounts payable, I monitor:

- Days Payable Outstanding (DPO): The average time it takes to pay suppliers. Balancing efficient payments with favorable vendor relationships is important.

- Invoice Processing Time: The time from invoice receipt to payment approval, signifying operational efficiency.

- Payment Discount Taken: The percentage of discounts obtained by timely payment to suppliers.

Regularly monitoring these KPIs provides valuable insights for process improvement and identifying potential problems before they escalate.

Q 21. How do you ensure compliance with relevant accounting standards and regulations?

Ensuring compliance with relevant accounting standards and regulations is paramount. I maintain a thorough understanding of Generally Accepted Accounting Principles (GAAP) and any industry-specific regulations that apply. This includes staying updated on changes in accounting standards and legislation, which often requires continuous professional development. I adhere to strict internal controls and processes to ensure data accuracy and prevent errors. This might involve segregation of duties, regular audits, and robust documentation of processes.

For example, I would ensure invoices are properly documented and archived according to retention policies. Regular reconciliation of accounts receivable and accounts payable ensures accuracy and compliance. I maintain detailed audit trails for all transactions and ensure that the company’s practices align with relevant tax laws and regulations. Compliance is not just a checkbox exercise; it’s an ongoing commitment to maintaining the integrity of the company’s financial records and mitigating potential risks.

Q 22. Explain your experience with general ledger accounting.

General ledger accounting is the heart of any financial system, acting as a central repository for all financial transactions. Think of it as a detailed diary of a company’s financial life, recording every debit and credit. My experience encompasses a wide range of activities within this domain, including chart of accounts maintenance, ensuring accurate posting of journal entries from various sources (like AP/AR, payroll, and fixed assets), and the reconciliation of general ledger accounts to subsidiary ledgers. For example, I’ve been responsible for ensuring that the total of all accounts receivable subsidiary ledger balances matches the general ledger’s accounts receivable control account balance. This process is critical for identifying potential errors and discrepancies in financial reporting. I also have experience in preparing trial balances, which are summaries of all general ledger account balances, used to prepare the financial statements.

In a previous role, I was instrumental in implementing a new general ledger system, which involved migrating data, training staff, and developing new procedures to ensure data integrity. This involved meticulous planning and close collaboration with IT and other departments. The successful implementation resulted in significant improvements in efficiency and accuracy.

Q 23. How do you prepare and analyze financial reports related to AP/AR?

Preparing and analyzing financial reports related to AP/AR involves a multi-step process. First, I ensure the accuracy and completeness of data in the AP and AR modules. Then, I generate reports focusing on key metrics such as Days Sales Outstanding (DSO) for AR and Days Payable Outstanding (DPO) for AP, which provide insights into the efficiency of cash collection and payment cycles respectively. Other crucial reports include aging reports (showing outstanding invoices categorized by age), vendor payment summaries, and customer payment summaries. Analysis of these reports helps identify trends, potential problems (like slow-paying customers or overdue payments to vendors), and areas for improvement. For instance, a consistently high DSO might signal inefficiencies in the billing process or a need to tighten up credit policies, whereas a consistently high DPO could point to potential negotiation opportunities with vendors.

I also prepare financial statements like the balance sheet and income statement, using information from the AP and AR modules. My analytical skills allow me to identify any unusual fluctuations in accounts receivable or payable and investigate the underlying causes. This might involve reviewing individual customer accounts, reconciling bank statements, and working closely with other departments to identify and resolve issues.

Q 24. Describe your experience with internal controls related to AP/AR.

Internal controls are crucial for maintaining the integrity and accuracy of AP/AR processes and protecting against fraud. My experience encompasses the design, implementation, and monitoring of these controls across various aspects of AP/AR. Examples include:

- Segregation of duties: Ensuring different individuals are responsible for authorizing payments, recording transactions, and reconciling accounts to prevent fraud and errors.

- Authorization and approval workflows: Implementing clear procedures for approving invoices and payments to ensure that only legitimate transactions are processed.

- Reconciliations: Regularly reconciling bank statements, vendor statements, and customer statements to identify discrepancies and ensure accuracy.

- Document management: Maintaining well-organized records and proper documentation of all transactions.

- Data security: Implementing appropriate access controls to protect sensitive financial information.

In a previous role, I identified a weakness in our invoice processing system where a single person was responsible for both receiving and approving invoices. I implemented a three-way match process (purchase order, invoice, and receiving report) and introduced a second approval level to mitigate the risk of fraudulent invoices being paid. This significantly improved the control environment and reduced the risk of errors and fraud.

Q 25. What is your experience with different accounting software packages (e.g., QuickBooks, SAP, Oracle)?

I have extensive experience with various accounting software packages. My proficiency includes:

- QuickBooks: Used for smaller businesses, QuickBooks is great for its user-friendliness and ease of use. I’m experienced with managing accounts payable and receivable, generating reports, and performing bank reconciliations.

- SAP: A comprehensive enterprise resource planning (ERP) system, SAP is used by large organizations. My expertise lies in managing the FI (Financial Accounting) and CO (Controlling) modules, managing AP/AR processes within SAP, and leveraging its reporting capabilities for in-depth financial analysis.

- Oracle: Similar to SAP, Oracle is a robust ERP system, and I am skilled in navigating its modules for financial management, including AP/AR. My experience with Oracle includes data migration, system configuration, and user training.

My experience isn’t limited to just these; I’m also familiar with other accounting software and adaptable to new systems. I believe that a strong understanding of accounting principles is more important than any single software package, as the core concepts remain consistent across different platforms.

Q 26. How do you handle large volumes of transactions efficiently?

Handling high transaction volumes efficiently requires a combination of technological and procedural strategies. First, I leverage automation wherever possible. Many accounting software packages offer automated features such as automated invoice processing, electronic payments, and automated bank reconciliations. This significantly reduces manual effort and speeds up processing times. Second, I prioritize data accuracy through proper data entry and validation procedures. Using standardized templates, data entry checklists, and validation rules helps to prevent errors from the outset, reducing the time spent correcting mistakes later on. Third, I regularly review and optimize processes to identify bottlenecks and inefficiencies. This might involve streamlining workflows, automating manual tasks, or implementing improved reporting procedures. Fourth, I use reporting and analysis tools to track key metrics, identify areas for improvement and ensure that processes are running smoothly. Finally, collaborating effectively with other departments ensures a smooth flow of information and reduces processing delays.

For example, in a previous role, we processed over 10,000 invoices monthly. By implementing automated invoice matching and electronic payments, we reduced processing time by 40% and freed up staff to focus on more strategic tasks.

Q 27. Describe a time you had to resolve a significant AP/AR issue. What was your approach?

In my previous role, we faced a significant issue with a large discrepancy in our accounts receivable. Initial reports showed a shortfall of approximately $50,000. My approach was systematic and involved the following steps:

- Identify the Problem: I started by thoroughly analyzing the aging report to identify which customer accounts contributed most significantly to the discrepancy.

- Gather Data: I collected supporting documentation, including invoices, remittance advices, bank statements, and customer communication logs.

- Investigate Potential Causes: The investigation revealed several contributing factors, including errors in data entry, unapplied cash receipts, and discrepancies in customer payment schedules. One key finding was a system glitch that miscoded several payments.

- Develop and Implement Solutions: To address the issue, I corrected the data entry errors, applied the unapplied cash receipts, and worked with IT to fix the system glitch which was causing many of our problems. I also implemented a more rigorous reconciliation process, involving a second review of all bank reconciliations.

- Monitor and Prevent Recurrence: Following the resolution, I implemented stricter controls to prevent similar issues in the future, including improved training for staff on data entry procedures and more frequent bank reconciliations.

This systematic approach allowed me to quickly identify the root cause of the discrepancy, resolve the issue effectively, and implement preventive measures to minimize the risk of recurrence. The successful resolution reinforced the importance of rigorous internal controls, thorough investigation, and proactive problem-solving.

Q 28. How do you stay up-to-date with changes in accounting regulations and best practices?

Staying current with accounting regulations and best practices is crucial for maintaining compliance and enhancing efficiency. I actively employ several strategies:

- Professional Development: I regularly attend industry conferences, webinars, and workshops to stay informed about the latest updates in accounting standards (like GAAP or IFRS), best practices, and technological advancements.

- Professional Organizations: Membership in professional organizations like the American Institute of CPAs (AICPA) provides access to resources, publications, and continuing professional education opportunities.

- Industry Publications and Journals: I subscribe to leading accounting journals and publications that provide insights into industry trends and regulatory changes.

- Online Resources: I regularly consult reputable online resources for updates on accounting regulations, software updates, and industry best practices.

- Networking: Engaging with colleagues and other professionals through networking events helps to exchange knowledge and stay updated on current issues.

For example, I recently completed a course on the latest updates to revenue recognition under ASC 606, ensuring my practice aligns with the current regulations.

Key Topics to Learn for AP/AR Processing Interview

- Accounts Payable (AP) Process: Understanding the entire cycle from invoice receipt to payment, including invoice verification, coding, and processing.

- Accounts Receivable (AR) Process: Mastering the complete cycle from invoicing to cash collection, including generating invoices, applying payments, and managing outstanding balances.

- General Ledger Integration: Understanding how AP and AR transactions impact the general ledger and ensuring accurate financial reporting.

- Internal Controls and Compliance: Knowledge of best practices for maintaining accurate records, preventing fraud, and adhering to relevant regulations.

- Software Proficiency: Demonstrating familiarity with common AP/AR software (e.g., ERP systems, accounting software) and their functionalities.

- Reconciliation Techniques: Proficiency in reconciling bank statements, vendor statements, and customer accounts to ensure accuracy.

- Problem-Solving and Troubleshooting: Experience identifying and resolving discrepancies in AP/AR processes, including addressing payment discrepancies and resolving customer queries.

- Financial Statement Analysis: Understanding how AP and AR balances and aging reports reflect the overall financial health of a business.

- Workflow Optimization: Ability to identify inefficiencies in AP/AR processes and suggest improvements for better efficiency and accuracy.

- Communication and Collaboration: Demonstrating strong communication skills in interacting with vendors, customers, and internal teams.

Next Steps

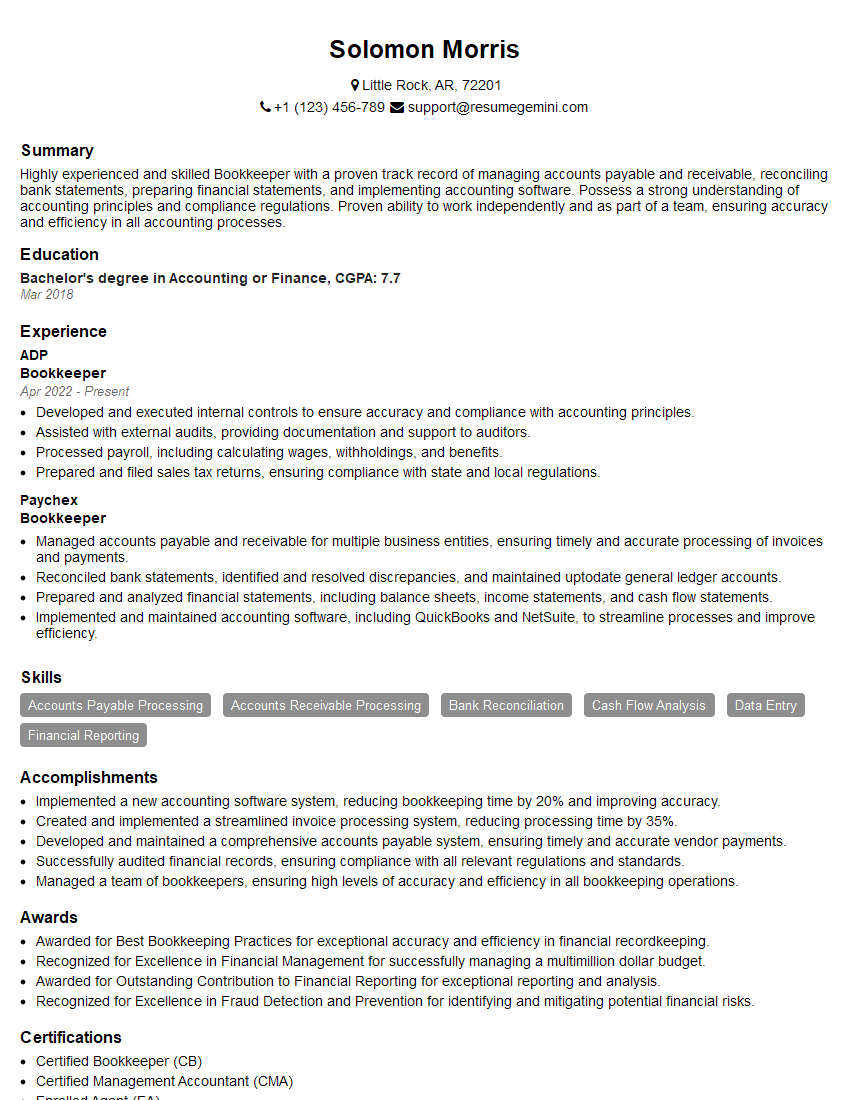

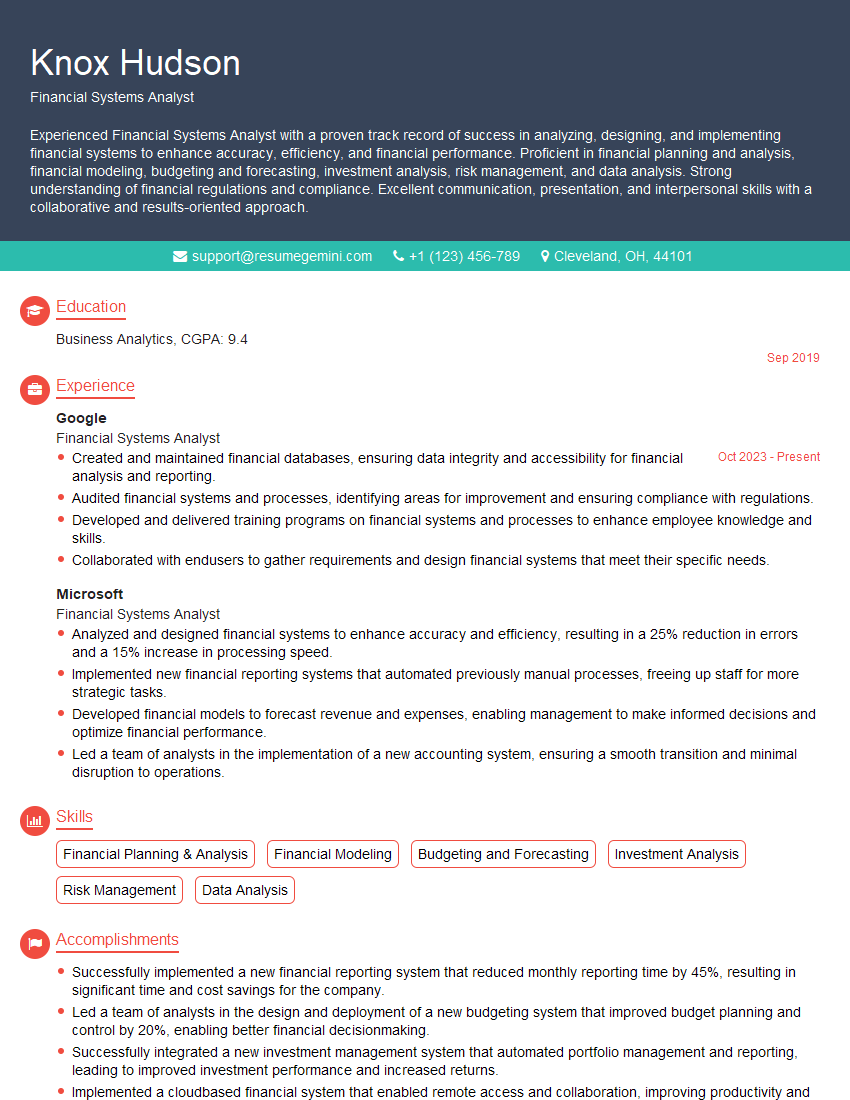

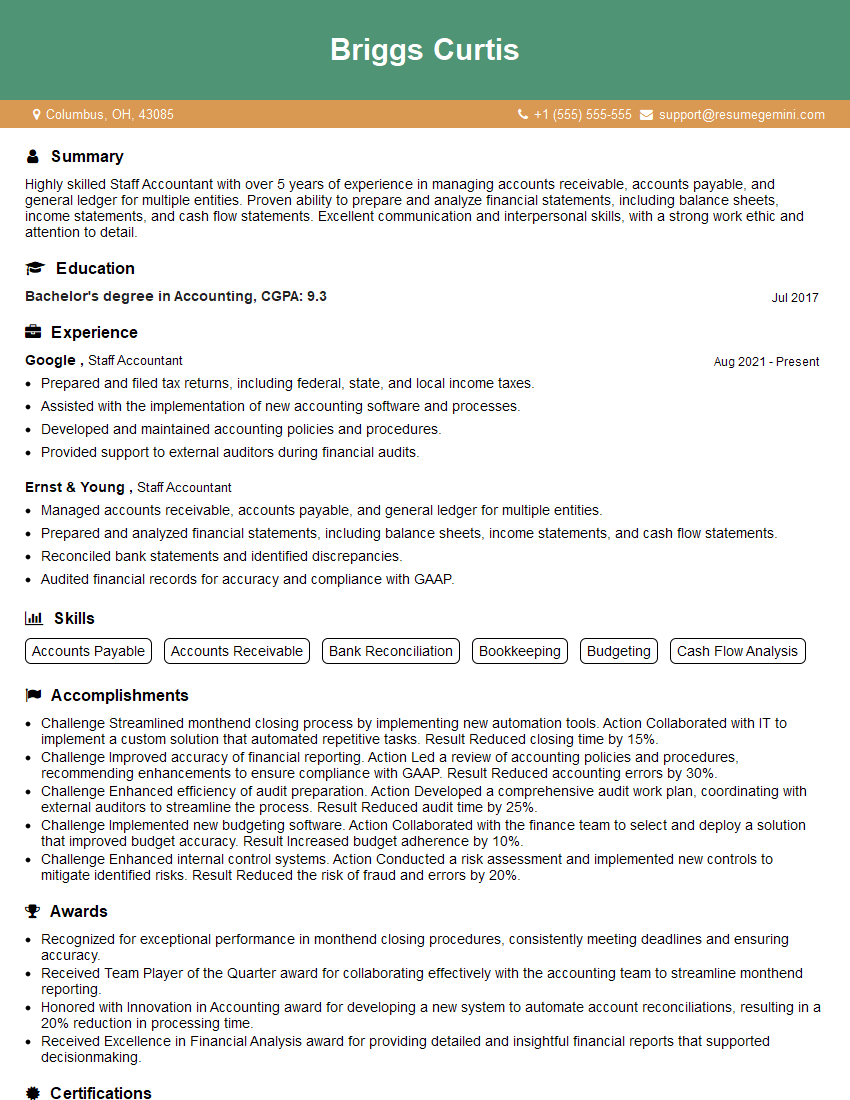

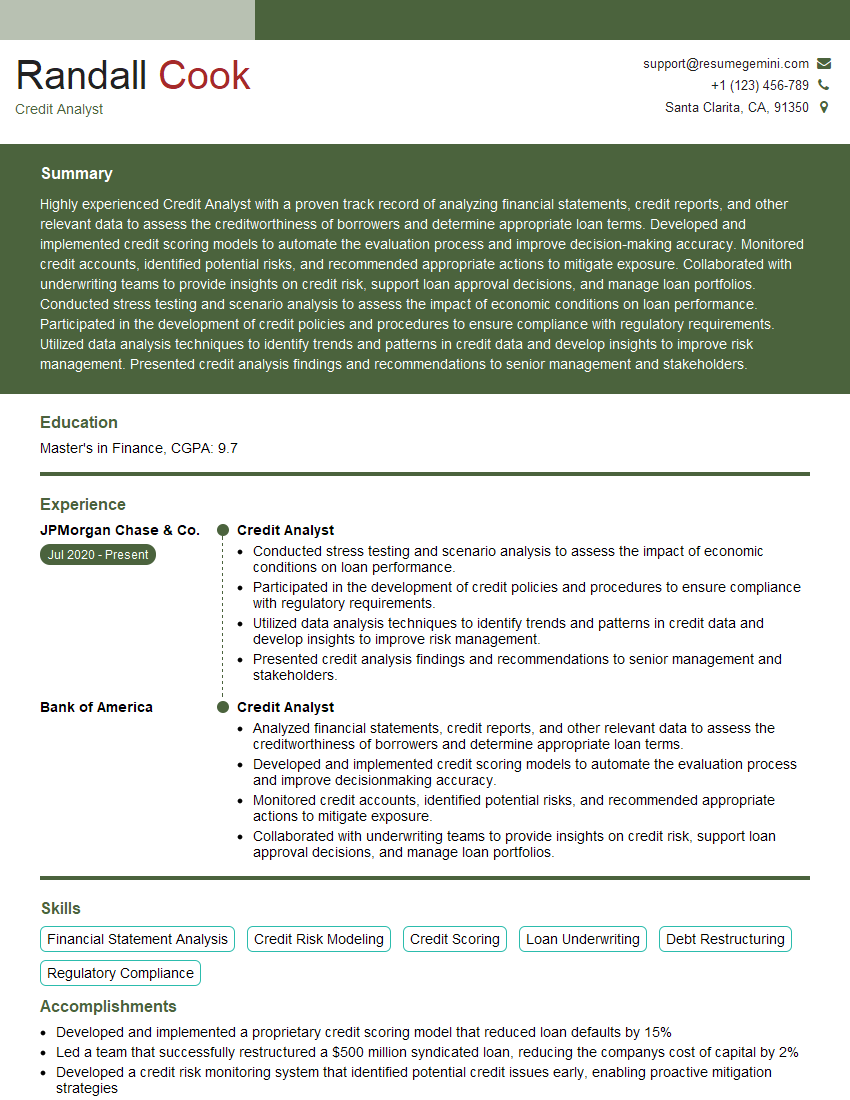

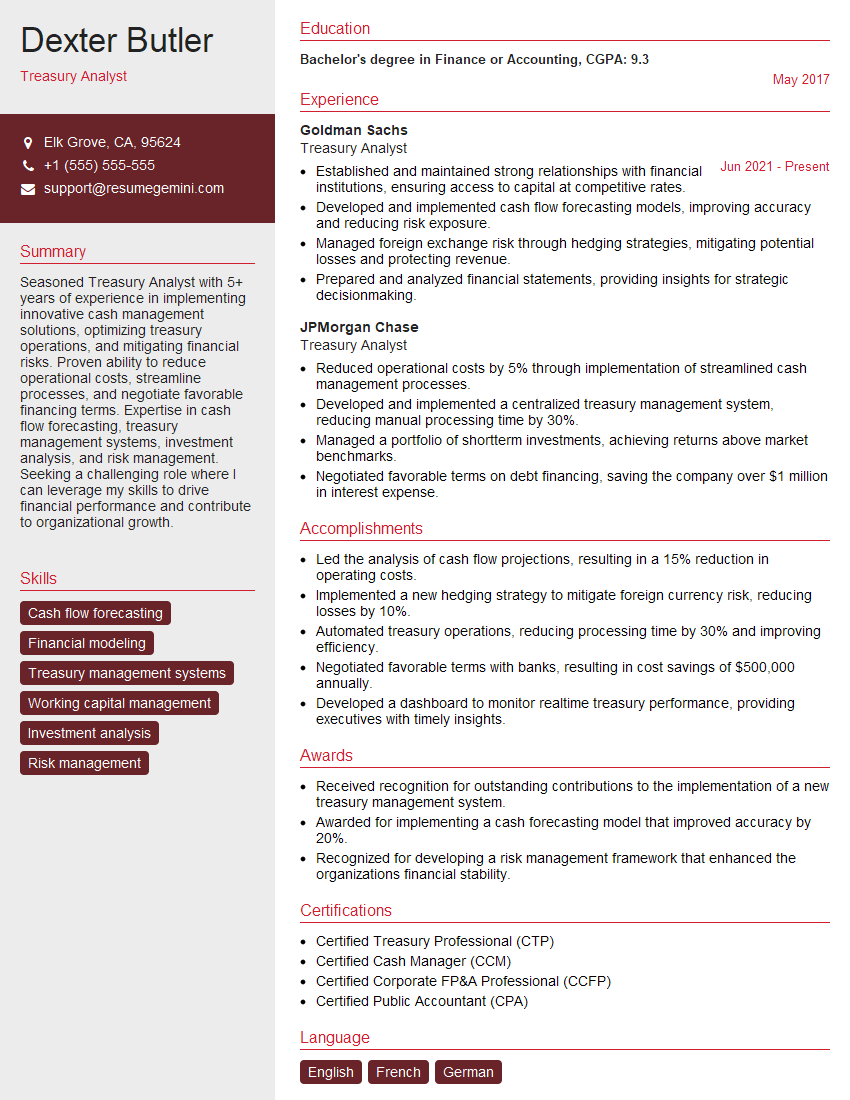

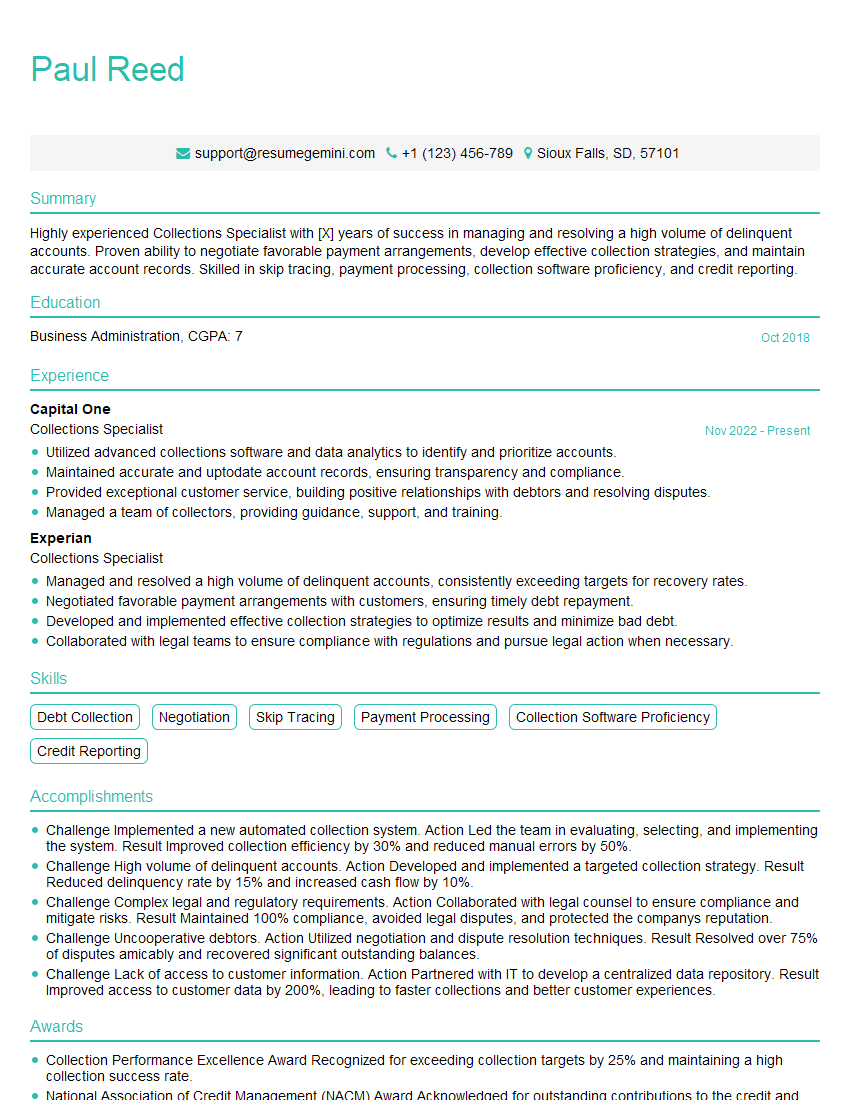

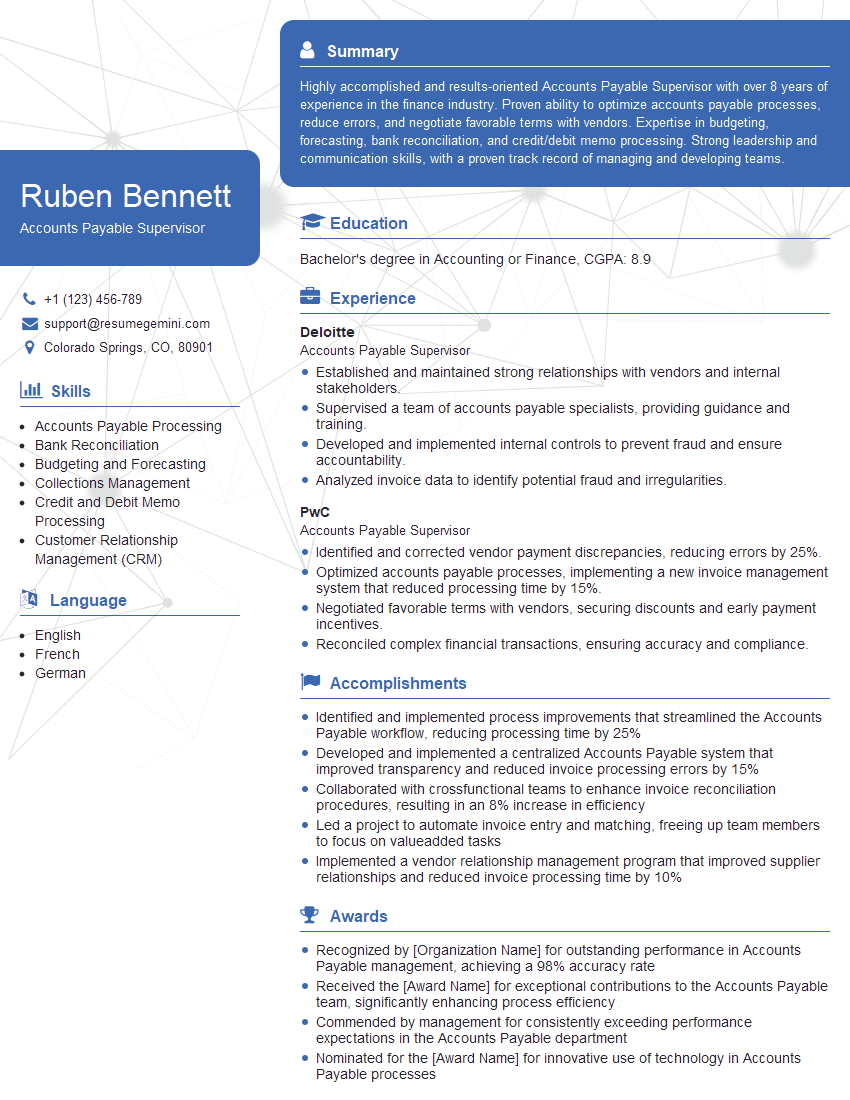

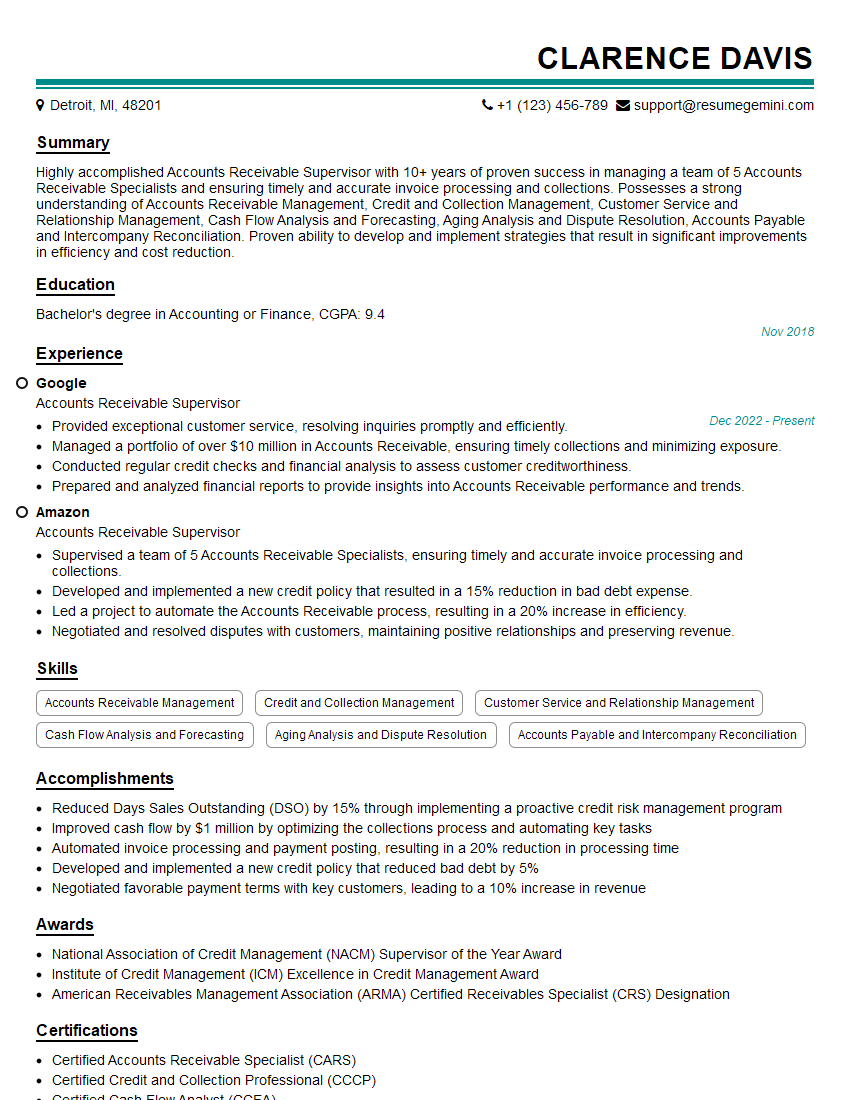

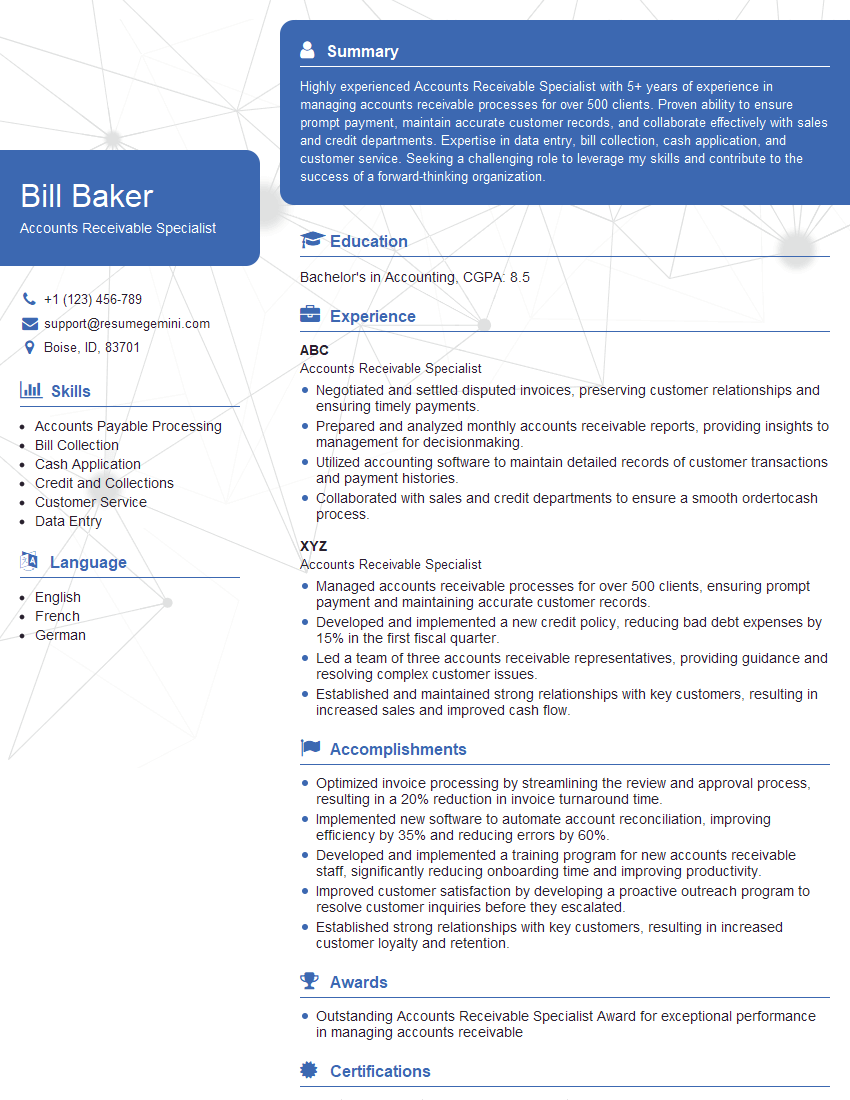

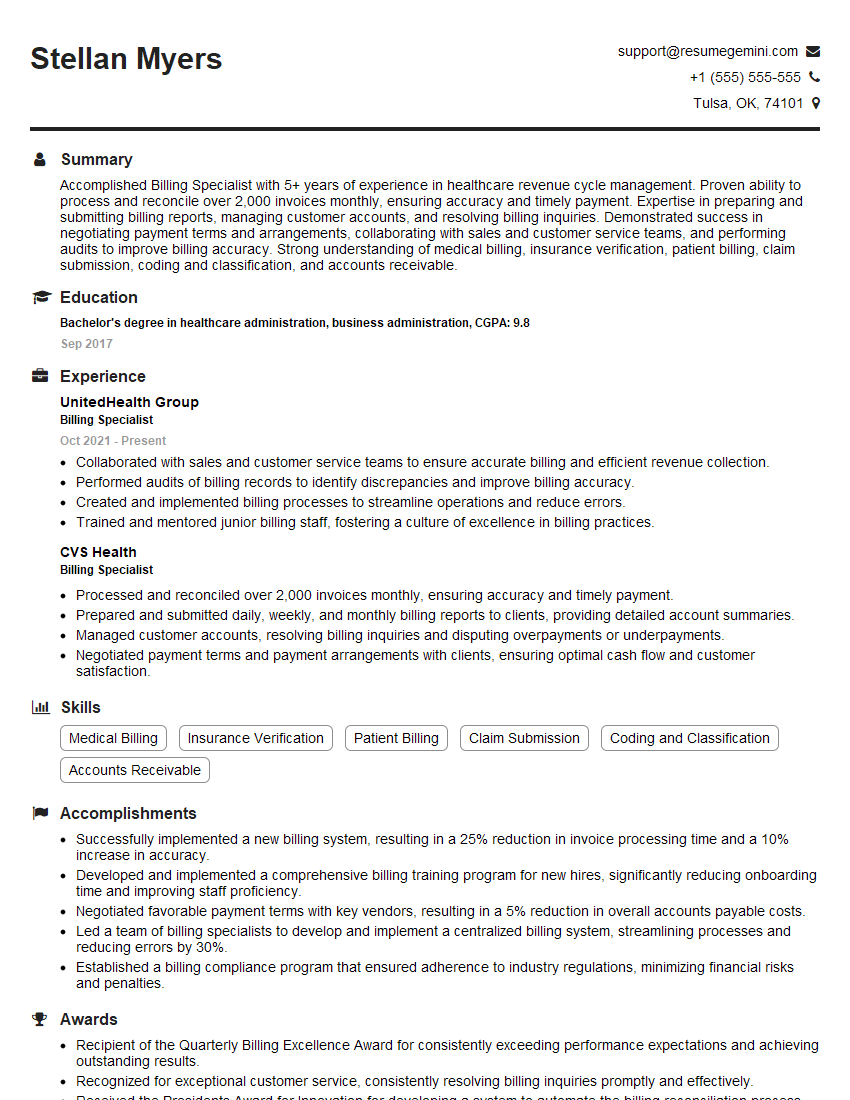

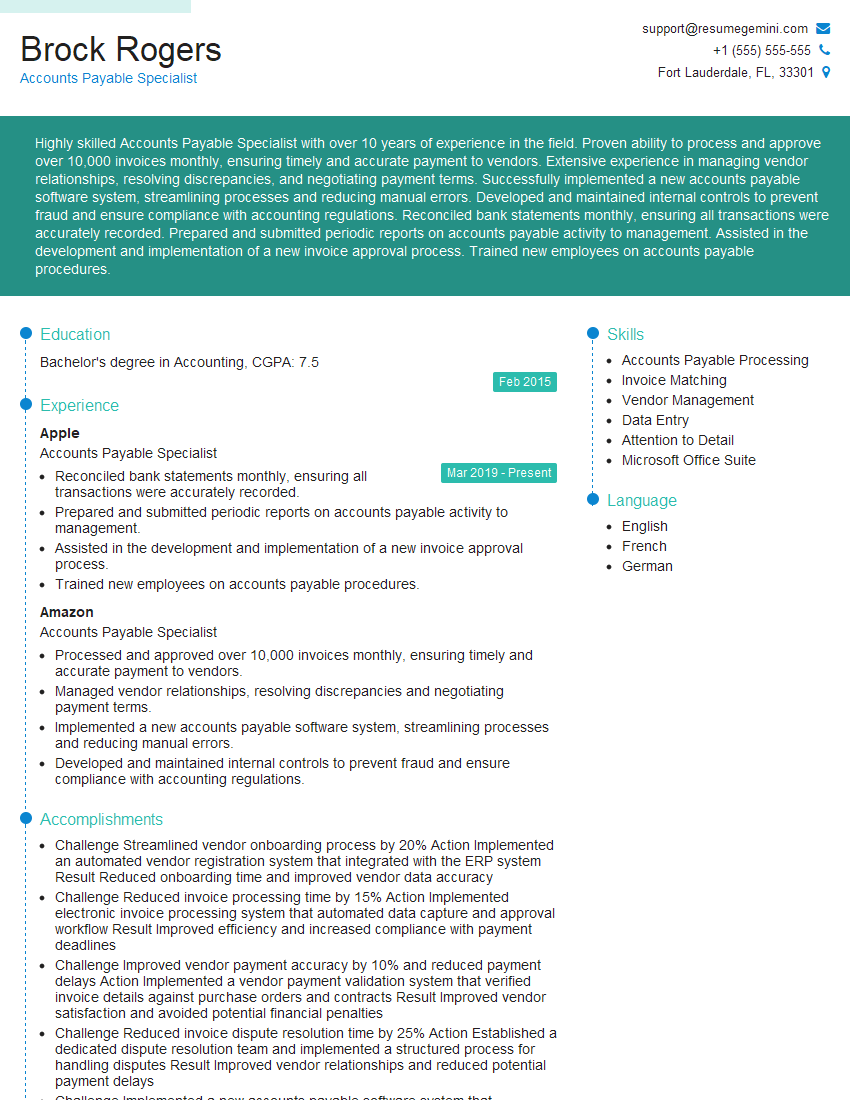

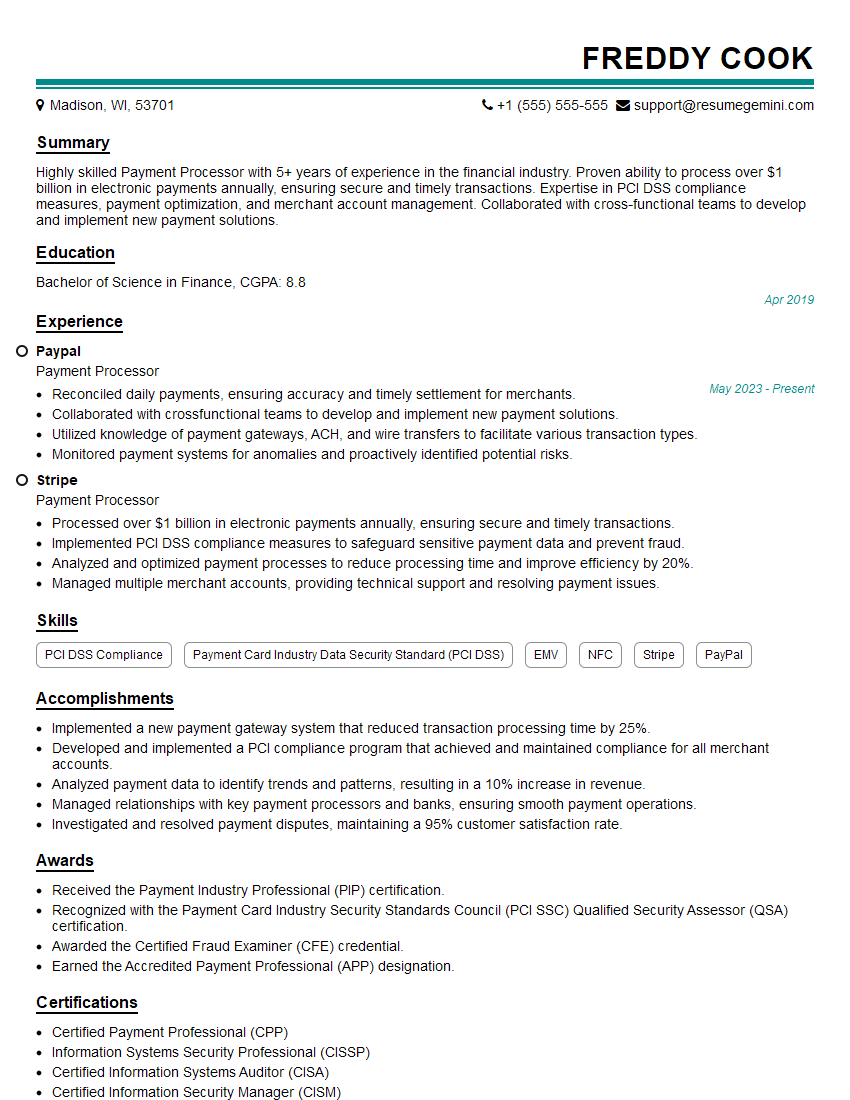

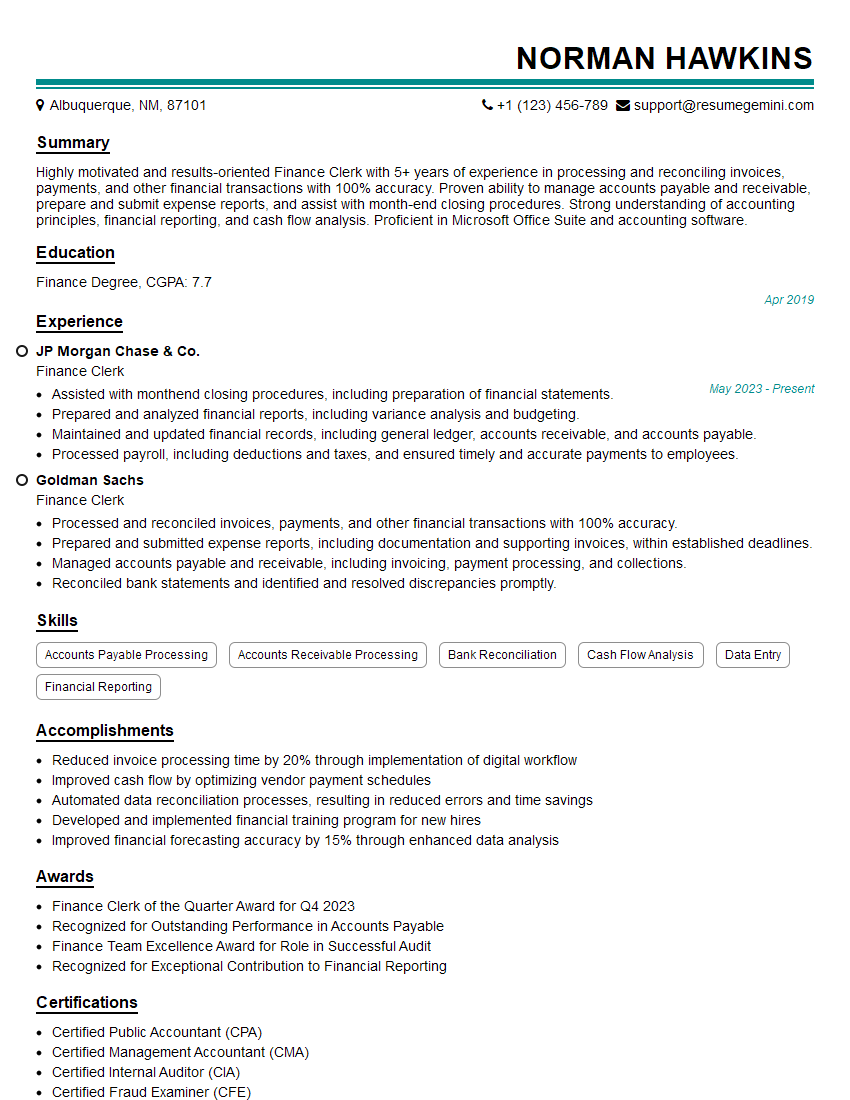

Mastering AP/AR processing opens doors to exciting career opportunities in finance and accounting, offering growth potential and higher earning potential. To maximize your chances of landing your dream role, it’s crucial to present yourself effectively. Creating an ATS-friendly resume is key to getting your application noticed by recruiters and hiring managers. We strongly encourage you to leverage ResumeGemini, a trusted resource, to craft a professional and impactful resume tailored to your unique skills and experience in AP/AR Processing. Examples of resumes specifically designed for AP/AR Processing roles are available to help guide you.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

I Redesigned Spongebob Squarepants and his main characters of my artwork.

https://www.deviantart.com/reimaginesponge/art/Redesigned-Spongebob-characters-1223583608

IT gave me an insight and words to use and be able to think of examples

Hi, I’m Jay, we have a few potential clients that are interested in your services, thought you might be a good fit. I’d love to talk about the details, when do you have time to talk?

Best,

Jay

Founder | CEO