Preparation is the key to success in any interview. In this post, we’ll explore crucial Budgets and Financial Planning interview questions and equip you with strategies to craft impactful answers. Whether you’re a beginner or a pro, these tips will elevate your preparation.

Questions Asked in Budgets and Financial Planning Interview

Q 1. Explain the difference between a budget and a forecast.

While both budgets and forecasts project future financial performance, they differ significantly in their purpose and approach. A budget is a detailed plan of how much money will be spent and earned over a specific period, often a fiscal year. It’s a formal, approved document used for resource allocation and control. Think of it as a roadmap with pre-approved spending limits. A forecast, on the other hand, is a prediction of future financial performance based on various assumptions and market analysis. It’s more flexible and can be revised frequently as new data emerges. It’s a compass, guiding you based on the current projected conditions, allowing for adjustment as needed.

Example: A company might create a budget allocating $1 million for marketing in 2024, broken down by channel. Separately, they might forecast their revenue for 2024 to be $5 million, based on market trends and sales projections. The budget dictates how the marketing money is spent; the forecast helps determine if the $5 million revenue goal is realistic.

Q 2. Describe your experience with variance analysis.

Variance analysis is a crucial part of my work. It involves comparing actual results against the budgeted or forecasted figures to identify and explain any differences (variances). I use this process to pinpoint areas of overspending, underspending, or unexpected revenue streams. My experience spans multiple industries and includes analyzing variances across various cost centers like marketing, R&D, and operations. I’m proficient in using both qualitative and quantitative methods. For instance, I’ve used statistical analysis to identify patterns in variances, and I’ve conducted interviews with department heads to gain an understanding of the underlying causes of deviations from the plan.

Example: If our marketing budget was $100,000 and actual spending was $120,000, there’s a $20,000 unfavorable variance. My analysis would investigate why this happened – was it due to higher advertising costs, unforeseen campaign expenses, or simply inefficient spending? Investigating the root cause allows for course correction.

Q 3. How do you handle budget overruns?

Budget overruns require a structured approach. First, I investigate the cause of the overrun: Is it due to unforeseen circumstances (e.g., supply chain disruptions), inaccurate forecasting, or poor budget management? Once the cause is identified, I work with the relevant department to develop corrective actions. This might involve renegotiating contracts, implementing cost-saving measures, or reallocating funds from other less critical areas. In some cases, it might necessitate a budget revision, requiring approval from senior management.

Example: If a project experiences an overrun due to unexpected material cost increases, I might explore options like finding alternative suppliers, negotiating better pricing, or reducing the project scope.

Transparency is key. I believe in proactively communicating the overrun, its cause, and the proposed solutions to stakeholders to maintain trust and accountability.

Q 4. What budgeting methods are you familiar with (e.g., zero-based, incremental)?

I’m familiar with several budgeting methods, including:

- Incremental Budgeting: This is a commonly used method that takes the previous year’s budget as a base and adjusts it based on anticipated changes. It’s simple but can be inflexible and perpetuate inefficiencies.

- Zero-Based Budgeting (ZBB): This method starts with a ‘clean slate’ each year, requiring each expense item to be justified from scratch. It promotes efficiency by eliminating unnecessary expenses but is more time-consuming and resource-intensive.

- Activity-Based Budgeting (ABB): This approach focuses on activities and their associated costs. It provides a more granular level of analysis and helps allocate costs more accurately.

- Value-Based Budgeting: Prioritizes funding based on the strategic value of different programs and initiatives. Aligns spending directly to the overarching goals of the organization.

The best method depends on the organization’s size, complexity, and strategic goals. I often use a hybrid approach, adapting elements from different methods to suit the specific needs of each project or department.

Q 5. Explain your understanding of key financial statements (Income Statement, Balance Sheet, Cash Flow Statement).

The three core financial statements provide a holistic view of a company’s financial health. The Income Statement shows the profitability over a period, summarizing revenues, expenses, and resulting net income or loss. Think of it as a snapshot of the company’s performance during that period. The Balance Sheet provides a snapshot of the company’s assets, liabilities, and equity at a specific point in time. It illustrates the company’s financial position – what it owns, what it owes, and the owners’ stake. The Cash Flow Statement tracks the movement of cash both into and out of the business over a period. It shows how the company generates and uses cash, revealing its liquidity and solvency. These three statements are interconnected; changes in one will likely affect the others. A strong understanding of each is essential for effective financial planning and decision-making.

Example: A high net income on the income statement might be misleading if the cash flow statement reveals significant cash outflows due to capital expenditures. Analyzing all three statements together provides a more complete picture.

Q 6. How do you prioritize competing budget requests?

Prioritizing competing budget requests requires a structured approach. I typically use a framework that considers:

- Alignment with strategic goals: Requests that directly support the company’s overall strategic objectives take precedence.

- Return on investment (ROI): Projects with higher potential ROI are prioritized.

- Urgency and criticality: Time-sensitive or crucial projects receive higher priority.

- Risk assessment: Projects with higher potential risks might be deprioritized or require more thorough evaluation.

- Resource availability: Realistic assessment of available resources, both financial and human, is crucial.

Often, this involves creating a prioritized list of projects using a scoring system based on these criteria. This approach allows for a fair and transparent process, ensuring that resources are allocated effectively.

Q 7. Describe your experience with financial modeling.

I have extensive experience in financial modeling, primarily using spreadsheet software like Excel. My skills encompass creating various models, including:

- Three-statement models: These models link the income statement, balance sheet, and cash flow statement, allowing for integrated financial forecasting.

- DCF (Discounted Cash Flow) models: I use these models to value businesses or projects by discounting their future cash flows back to their present value.

- Sensitivity analysis and scenario planning: I build models that allow for testing the impact of different assumptions on financial results, helping identify key risks and opportunities.

Example: In a recent project, I developed a three-statement model to forecast a company’s financial performance over the next five years under different economic scenarios (e.g., optimistic, pessimistic, and base case). This allowed management to make informed decisions based on a range of possible outcomes.

Q 8. What software programs are you proficient in for budgeting and financial planning (e.g., Excel, Hyperion, Anaplan)?

My proficiency in budgeting and financial planning software is extensive. I’m highly skilled in Microsoft Excel, leveraging its advanced features like pivot tables, macros, and data visualization tools for complex budget modeling and analysis. I have significant experience with Hyperion Planning, a robust Enterprise Performance Management (EPM) system, particularly adept at its functionalities in building multi-dimensional budgets, forecasting, and reporting. Furthermore, I’m familiar with Anaplan, a cloud-based platform specializing in connected planning, offering unique capabilities in collaborative budgeting and scenario planning. My expertise extends to utilizing these tools for tasks ranging from creating detailed operational budgets to developing sophisticated financial models for long-term strategic planning.

Q 9. How do you ensure budget accuracy and reliability?

Ensuring budget accuracy and reliability is paramount. My approach involves a multi-faceted strategy. First, I focus on data quality: ensuring source data is accurate, complete, and consistently formatted. This often necessitates working closely with various departments to gather and validate data. Secondly, I meticulously review and reconcile budget figures, comparing them to actual results regularly. This involves a robust process of variance analysis to identify and explain any discrepancies. Thirdly, I utilize sophisticated modeling techniques and sensitivity analysis to account for uncertainties and potential risks. Finally, regular budget reviews and updates, involving key stakeholders, are critical in ensuring the budget remains relevant and accurate throughout the year. Think of it like a ship’s navigation – continuous course correction based on updated information guarantees we reach our destination.

Q 10. How do you communicate financial information to non-financial stakeholders?

Communicating financial information to non-financial stakeholders requires clear and concise language, avoiding jargon. I use visual aids like charts, graphs, and dashboards to present complex data in an easily digestible format. Storytelling is a key technique I employ – I frame financial information within the context of the overall business objectives and operational goals. For instance, instead of simply stating ‘revenue increased by 10%’, I might say ‘due to the successful launch of product X, revenue increased by 10%, exceeding our targets and contributing to a stronger market position’. This approach allows non-financial stakeholders to understand the impact and implications of financial performance. Finally, I always ensure ample opportunity for questions and discussion to clarify any misunderstandings.

Q 11. Describe a time you had to make a difficult budget decision.

In a previous role, we faced unexpected revenue shortfalls due to a major competitor launching a similar product. We had to make a difficult decision regarding marketing budget allocation. The initial plan heavily favored a large-scale advertising campaign. However, given the reduced revenue, continuing with the original plan was not feasible. I presented several alternative budget scenarios to the leadership team, including reduced advertising spend, reallocation of funds towards digital marketing, and potential temporary hiring freezes. After careful analysis and discussion, we opted for a more targeted digital marketing strategy, supplemented by cost optimization measures across other departments. While challenging, this decision ultimately helped us navigate the difficult situation, preserving key areas while minimizing the impact on the business.

Q 12. How do you identify and mitigate financial risks?

Identifying and mitigating financial risks is an ongoing process. I start by conducting thorough risk assessments, considering factors like market volatility, economic downturns, regulatory changes, and operational inefficiencies. This involves both qualitative and quantitative analysis. Once risks are identified, I develop mitigation strategies, which might include creating contingency plans, implementing internal controls, diversifying revenue streams, securing insurance coverage, or hedging against potential losses. Regular monitoring and reporting are key to tracking risk levels and making timely adjustments to mitigation strategies. It’s like building a house: you need to identify potential hazards (risk assessment) and implement preventive measures (mitigation strategies) to ensure stability and longevity.

Q 13. What are your strengths and weaknesses in budgeting and financial planning?

My strengths lie in my analytical abilities, strategic thinking, and strong communication skills. I can effectively analyze complex financial data, develop robust financial models, and communicate effectively with both financial and non-financial stakeholders. I’m also adept at problem-solving and navigating challenging situations. An area for development is expanding my experience with specific industry-specific regulations and compliance requirements. I’m actively working to enhance this area through continued professional development and seeking opportunities to work with diverse industries.

Q 14. What is your experience with long-term financial planning?

I have extensive experience in long-term financial planning, which involves developing multi-year financial forecasts and strategic plans aligned with business objectives. This includes building discounted cash flow models (DCF), projecting financial statements, and assessing the financial viability of long-term investments or projects. I am proficient in creating scenario planning models to explore various future outcomes and their impact on the organization’s financial position. My experience extends to using long-term financial planning to support major strategic decisions such as acquisitions, divestitures, and capital expenditures. Essentially, it’s about charting a course for sustainable growth and profitability over an extended period, taking into account potential headwinds and opportunities.

Q 15. Explain your understanding of capital budgeting.

Capital budgeting is the process a business uses for decision-making on capital projects – those projects with a life of a year or more. It involves evaluating potential long-term investments, such as purchasing new equipment, building new facilities, or developing new products. The goal is to maximize the return on investment (ROI) while minimizing risk. This process typically involves several key steps:

- Identifying potential projects: This involves brainstorming and evaluating various opportunities that align with the company’s strategic goals.

- Analyzing project proposals: Each project is assessed using various techniques, including net present value (NPV), internal rate of return (IRR), payback period, and discounted cash flow (DCF) analysis. These methods help determine the profitability and feasibility of each project.

- Evaluating project risk: Risk assessment is crucial, as capital projects often involve significant financial commitments and uncertainty. Factors such as market demand, technological changes, and economic conditions need to be considered.

- Selecting projects: Based on the analysis, projects are prioritized and selected, often considering budget constraints and strategic alignment.

- Monitoring and post-audit: Once a project is underway, its performance is regularly monitored to ensure it stays on track and meets its objectives. A post-audit reviews the project’s actual performance against its projected performance.

For example, imagine a manufacturing company considering investing in a new automated production line. Capital budgeting would involve detailed financial modeling to project the line’s costs, revenues, and resulting profitability over its lifespan, considering factors like maintenance costs, potential downtime, and market demand for the product it produces. The company would then compare this investment to other potential projects, using the techniques mentioned above to choose the most promising option.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. How do you measure the success of a budget?

Measuring budget success goes beyond simply looking at whether the budget was met or not. A comprehensive approach involves comparing actual results against the budgeted figures and analyzing variances. This requires a multi-faceted perspective:

- Variance Analysis: Identifying the differences between actual and budgeted figures for revenue, expenses, and key performance indicators (KPIs). Significant variances should be investigated to understand their root causes.

- Performance Metrics: Tracking KPIs relevant to the business objectives. These metrics vary by industry and company but might include things like customer satisfaction, market share, production efficiency, or employee turnover. Alignment with these metrics ensures the budget contributes to overall organizational goals.

- Achieving Strategic Objectives: The budget’s ultimate success depends on its contribution to the overarching strategic objectives of the organization. For example, if the goal is to expand into a new market, success would be measured by market penetration, sales growth in that market, and customer acquisition cost, not just by meeting a revenue target in isolation.

- Flexibility and Adaptability: A successful budget isn’t rigid. It should allow for adjustments based on unforeseen circumstances or changing market conditions. The ability to adapt and re-forecast demonstrates robustness and strategic thinking.

For instance, if a marketing budget aimed to increase brand awareness by 20%, success would be measured by analyzing the actual increase in brand awareness from surveys and social media engagement, alongside the marketing campaign’s ROI. Simply spending the allocated amount doesn’t equate to success if the targeted objective wasn’t met.

Q 17. How do you stay current with industry trends and best practices in budgeting and financial planning?

Staying current in budgeting and financial planning requires a proactive and multi-pronged approach:

- Professional Development: Attending industry conferences, workshops, and webinars to learn about the latest trends and best practices. Pursuing relevant certifications like the Certified Budget Analyst (CBA) or Certified Management Accountant (CMA) demonstrates commitment to professional excellence.

- Industry Publications and Journals: Regularly reading trade publications, journals, and online resources focused on finance, accounting, and budgeting to stay informed about new techniques, technologies, and regulatory changes.

- Networking: Building relationships with other professionals in the field through networking events and online forums facilitates the exchange of ideas and experiences.

- Benchmarking: Analyzing the budgeting and financial planning practices of successful companies in similar industries to identify best practices and areas for improvement in my own processes.

- Software and Technology: Staying abreast of advancements in budgeting and financial planning software and technologies to leverage automation, data analysis, and predictive modeling capabilities.

For example, I actively participate in online forums dedicated to financial planning, read publications like the Journal of Finance, and attend annual conferences on budgeting and forecasting. This allows me to learn about new techniques like zero-based budgeting and scenario planning, and apply them to improve the accuracy and efficiency of the budgeting processes.

Q 18. Explain your experience with performance management and KPI tracking.

My experience in performance management and KPI tracking involves a data-driven approach focusing on setting clear goals, measuring progress, and taking corrective action when needed. This includes:

- KPI Identification and Alignment: Working with business leaders to define key performance indicators that directly reflect the strategic goals of the organization. These KPIs are carefully chosen to be measurable, achievable, relevant, and time-bound (SMART).

- Data Collection and Analysis: Utilizing various data sources, including financial systems, CRM platforms, and operational databases, to collect and analyze relevant data. This involves creating dashboards and reports to visualize key performance trends.

- Performance Reporting: Regularly generating reports and presentations that summarize performance against KPIs, highlighting both successes and areas for improvement. These reports are shared with relevant stakeholders to ensure transparency and accountability.

- Performance Improvement Initiatives: Identifying areas where performance is lagging and implementing improvement initiatives based on data analysis and best practices. This might involve process optimization, resource allocation, or training and development programs.

In a previous role, I implemented a performance management system that tracked key sales KPIs, including conversion rates, average order value, and customer lifetime value. Using this data, we identified a decline in conversion rates, leading to a review of the sales process and the implementation of targeted training to improve sales performance. This resulted in a significant improvement in overall sales figures.

Q 19. How do you handle conflicting priorities in budgeting?

Handling conflicting priorities in budgeting requires a structured and collaborative approach:

- Prioritization Framework: Using a prioritization framework, such as a weighted scoring system or a decision matrix, to objectively evaluate different projects or initiatives based on their strategic importance, urgency, and potential ROI.

- Stakeholder Collaboration: Facilitating open communication and collaboration among stakeholders to understand their perspectives and concerns. This involves actively listening to different viewpoints and seeking consensus where possible.

- Data-Driven Decision Making: Using data and analytical tools to objectively assess the impact of different budget allocations on overall organizational goals. This helps in making informed decisions and justifying choices to stakeholders.

- Negotiation and Compromise: Being prepared to negotiate and compromise to find mutually acceptable solutions. This might involve adjusting project timelines, re-allocating resources, or finding creative solutions to meet multiple objectives within budget constraints.

- Scenario Planning: Developing multiple budget scenarios that reflect different possible outcomes or priorities. This allows for flexibility and adaptability in case unforeseen circumstances arise.

For example, if there’s a conflict between investing in new technology and increasing marketing spend, a weighted scoring system could be used to evaluate the long-term strategic value and potential return of each investment. This allows for a data-driven decision rather than relying on subjective preferences.

Q 20. Describe your experience with cost-benefit analysis.

Cost-benefit analysis (CBA) is a systematic approach to evaluating the relative merits of different options by comparing the total expected costs against the total expected benefits. This helps make informed decisions by quantifying the trade-offs involved.

- Identify Costs and Benefits: The first step involves meticulously identifying all relevant costs and benefits associated with each option. Costs can include direct costs (materials, labor), indirect costs (overheads, opportunity costs), and intangible costs (reputation). Benefits can include tangible benefits (increased revenue, cost savings) and intangible benefits (improved brand image, increased customer satisfaction).

- Quantify Costs and Benefits: Translate costs and benefits into monetary values wherever possible. This may involve using market prices, estimates, or discounted cash flow analysis for longer-term projects. For intangible benefits, it may involve assigning monetary values based on surveys or expert opinions.

- Perform the Analysis: Calculate the net present value (NPV) or benefit-cost ratio (BCR) for each option. NPV considers the time value of money and calculates the overall profitability of an investment. BCR expresses benefits as a multiple of costs. A higher NPV or BCR indicates a more favorable option.

- Sensitivity Analysis: Test the sensitivity of the results to changes in key assumptions. This helps understand the uncertainty associated with the analysis and identify critical factors that could significantly influence the outcome.

For example, in deciding whether to implement a new software system, CBA would involve calculating the costs of purchasing, implementing, and maintaining the software against the benefits of increased efficiency, reduced errors, and improved customer service. This analysis could help determine whether the investment is financially justified.

Q 21. What is your approach to developing a realistic and achievable budget?

Developing a realistic and achievable budget is a collaborative, iterative process requiring careful planning and continuous monitoring. My approach involves:

- Strategic Alignment: Ensuring the budget aligns with the overall strategic goals and objectives of the organization. This involves understanding the company’s vision, mission, and key priorities.

- Data-Driven Forecasting: Using historical data, market research, and industry trends to develop realistic revenue and expense forecasts. This involves considering various factors that could impact financial performance.

- Collaboration and Input: Involving key stakeholders from different departments to gather input and ensure buy-in for the budget. This fosters a sense of ownership and accountability.

- Contingency Planning: Building in a contingency buffer to account for unforeseen circumstances or risks. This allows for flexibility and adaptability in case of unexpected events.

- Regular Monitoring and Adjustments: Regularly tracking actual performance against the budgeted figures and making adjustments as needed. This ensures the budget remains relevant and effective throughout the year.

- Zero-Based Budgeting (Optional): In certain situations, employing a zero-based budgeting approach, where all expenses are justified from scratch each year, can enhance efficiency and resource allocation.

For example, before finalizing a marketing budget, I would collaborate with the marketing team to understand their goals, review past marketing campaign performance, and analyze market trends to create a realistic forecast. We would then incorporate a contingency buffer to handle unforeseen events, such as a decline in advertising effectiveness or changes in consumer preferences.

Q 22. How do you incorporate qualitative factors into financial planning?

Incorporating qualitative factors into financial planning is crucial because purely quantitative models often miss critical nuances. These qualitative aspects represent the ‘soft’ data that significantly impact the financial picture. I approach this by using a structured framework that combines quantitative analysis with qualitative insights.

- Scenario Planning: We develop multiple scenarios based on different potential qualitative outcomes (e.g., a competitor launching a new product, a change in government regulation, or a shift in consumer preferences). Each scenario will have a different impact on the financial projections.

- Sensitivity Analysis: We test the financial model’s sensitivity to changes in key qualitative assumptions. For instance, we might model the impact of varying levels of employee morale on productivity and thus on revenue.

- Stakeholder Interviews & Surveys: Gathering insights directly from employees, customers, and other stakeholders provides invaluable qualitative data. This helps refine assumptions and identify potential risks or opportunities not reflected in purely numerical data.

- Management Judgment: Experienced management teams possess crucial qualitative knowledge about market trends, competitive dynamics, and internal capabilities. Their insights are integrated into the financial plan to enhance its realism.

For example, during the planning phase for a new product launch, we wouldn’t just focus on projected sales figures. We’d also assess the market’s receptiveness (through surveys, focus groups), the potential impact of marketing campaigns (qualitative assessment of effectiveness), and the likelihood of successful distribution partnerships (qualitative risk assessment).

Q 23. How familiar are you with different types of financial ratios?

I’m very familiar with a wide range of financial ratios, categorized by their purpose:

- Liquidity Ratios: These assess a company’s ability to meet its short-term obligations. Examples include the current ratio (Current Assets/Current Liabilities) and the quick ratio ((Current Assets – Inventory)/Current Liabilities).

- Solvency Ratios: These measure a company’s long-term financial stability and ability to meet its debts. Examples include the debt-to-equity ratio (Total Debt/Total Equity) and the times interest earned ratio (EBIT/Interest Expense).

- Profitability Ratios: These show how efficiently a company is generating profits. Examples include gross profit margin (Gross Profit/Revenue), net profit margin (Net Profit/Revenue), and return on equity (Net Income/Shareholder Equity).

- Activity Ratios: These measure how efficiently a company uses its assets. Examples include inventory turnover (Cost of Goods Sold/Average Inventory) and accounts receivable turnover (Revenue/Average Accounts Receivable).

- Market Value Ratios: These relate to the market’s perception of a company’s value. Examples include the price-to-earnings ratio (P/E ratio) and the market-to-book ratio.

I use these ratios not in isolation but in combination to gain a holistic understanding of a company’s financial health. Analyzing trends over time and comparing ratios to industry benchmarks is also essential.

Q 24. Explain your understanding of working capital management.

Working capital management is the process of efficiently managing a company’s current assets and liabilities to ensure it has enough liquidity to meet its short-term obligations while maximizing profitability. It’s about finding the right balance between having enough cash on hand and tying up too much capital in inventory or receivables.

Effective working capital management involves:

- Inventory Management: Optimizing inventory levels to minimize storage costs and avoid stockouts while ensuring sufficient supply to meet demand. Techniques like Just-In-Time (JIT) inventory management can be very effective.

- Accounts Receivable Management: Implementing efficient credit policies, monitoring outstanding payments, and using techniques like factoring to speed up cash collection.

- Accounts Payable Management: Negotiating favorable payment terms with suppliers to extend payment deadlines and improve cash flow.

- Cash Management: Forecasting cash flows, optimizing cash balances, and using short-term investments to earn returns on excess cash.

Poor working capital management can lead to liquidity problems, hindering growth and even leading to bankruptcy. Conversely, excellent working capital management frees up capital for investment, reducing reliance on expensive financing and ultimately boosting profitability.

Q 25. Describe your experience with financial forecasting techniques.

My experience encompasses a range of financial forecasting techniques, each suited to different situations and data availability:

- Time Series Analysis: This involves analyzing historical data to identify trends and patterns that can be projected into the future. Methods include simple moving averages, exponential smoothing, and ARIMA models.

- Regression Analysis: This statistical technique helps to identify the relationships between different variables and use those relationships to forecast future values. For example, we might use regression to predict sales based on marketing expenditure and economic indicators.

- Causal Forecasting: This method uses economic or industry-specific models to predict future performance. For instance, forecasting revenue for a retail company might involve analyzing consumer spending trends and retail sales indices.

- Qualitative Forecasting: This incorporates expert opinions, market research, and other qualitative factors to create forecasts, especially useful when historical data is limited or unreliable.

I often employ a combination of these techniques, selecting the most appropriate ones based on the specific context and data available. The key is always to critically evaluate the assumptions underlying the forecast and to perform sensitivity analysis to understand the potential impact of various uncertainties.

Q 26. How do you use data analysis to improve budgeting and financial planning?

Data analysis is fundamental to improving budgeting and financial planning. I leverage data analytics in several ways:

- Data Visualization: Creating dashboards and reports that clearly display key financial metrics and trends helps to identify areas needing attention and facilitates better decision-making.

- Variance Analysis: Comparing actual results to budgeted figures helps pinpoint areas where performance deviated from expectations. This allows for proactive corrective actions and improvements in future budgets.

- Predictive Modeling: Using statistical techniques to forecast future financial performance, allowing for more accurate budgeting and proactive resource allocation.

- Trend Analysis: Examining historical data to identify trends in revenue, expenses, and other key metrics helps inform budget assumptions and improve forecasting accuracy.

- Scenario Planning: Data analysis enables us to test different scenarios (e.g., changes in market conditions, pricing strategies) and their potential impact on the financials.

For example, by analyzing sales data, we can identify seasonal patterns and adjust our staffing and inventory levels accordingly. Analyzing expense data can reveal opportunities for cost optimization, enhancing profitability and improving budget accuracy.

Q 27. What is your experience with different types of budgeting software?

I have experience with various budgeting software, including:

- Spreadsheet Software (Excel, Google Sheets): While basic, these are still widely used for smaller organizations and simpler budgets. I’m proficient in using advanced features like macros and formulas to build sophisticated budgeting models. However, for larger organizations, more robust solutions are often preferred.

- Cloud-Based Budgeting and Financial Planning Software (e.g., Anaplan, Planful, Vena): These platforms offer greater scalability and collaboration capabilities. They are better suited to complex budgeting processes and large datasets. They also offer advanced features like data integration, scenario planning, and reporting capabilities.

- Enterprise Resource Planning (ERP) Systems (e.g., SAP, Oracle): These integrated systems typically include budgeting and financial planning modules. They are best suited to large organizations with complex needs requiring integration with other business functions.

My choice of software depends on the size and complexity of the organization, its specific needs, and the level of integration required with other systems. I prioritize software that offers robust reporting, data visualization, and collaboration features to facilitate effective budgeting and financial planning.

Q 28. How would you explain a complex financial concept to a non-financial audience?

Explaining complex financial concepts to a non-financial audience requires clear, concise language, relatable examples, and avoiding jargon. I use a few key strategies:

- Start with the ‘Why’: Begin by explaining the relevance and importance of the concept in a simple way, connecting it to the audience’s interests or daily lives. For example, explaining the concept of Net Present Value (NPV) could begin with a simple analogy like comparing the value of receiving $100 today versus receiving $100 a year from now.

- Use Analogies and Metaphors: Relate the financial concept to something familiar to the audience. For instance, explaining debt-to-equity ratio can be compared to a homeowner’s mortgage – the higher the mortgage (debt), the more leveraged they are.

- Visual Aids: Charts, graphs, and other visuals are incredibly helpful in simplifying complex data and illustrating key points.

- Avoid Jargon: Replace technical terms with plain language. If you must use a technical term, define it clearly in simple terms.

- Focus on the Big Picture: Don’t get bogged down in the intricate details. Highlight the essential takeaway points that are relevant to the audience’s understanding.

For example, when explaining discounted cash flow (DCF) analysis, I’d avoid complex formulas. Instead, I might illustrate the concept by showing how the value of a future cash flow decreases as the time to receive it increases. I might use a simple example of deciding between two investment options with different payout timelines.

Key Topics to Learn for Budgets and Financial Planning Interview

- Budgeting Fundamentals: Understanding different budgeting methods (zero-based, incremental, etc.), variance analysis, and budget preparation processes.

- Financial Forecasting: Developing short-term and long-term financial forecasts, incorporating key assumptions and risk assessments. Practical application: Explain how to forecast revenue and expenses based on historical data and market trends.

- Financial Modeling: Building and interpreting financial models to simulate various scenarios and evaluate their impact on the organization’s financial health. Practical application: Describe your experience with building models in Excel or other financial modeling software.

- Cost Accounting: Understanding cost behavior (fixed, variable, mixed), cost allocation methods, and their impact on budgeting and decision-making.

- Performance Measurement and Reporting: Tracking key performance indicators (KPIs) related to budget performance, generating insightful reports, and presenting findings to stakeholders. Practical application: Describe how you would communicate budget variances to senior management.

- Financial Analysis and Interpretation: Analyzing financial statements (balance sheet, income statement, cash flow statement), identifying trends and key drivers of financial performance.

- Capital Budgeting: Evaluating investment opportunities using techniques such as Net Present Value (NPV) and Internal Rate of Return (IRR).

- Long-Term Financial Planning: Understanding strategic financial planning, long-term investment strategies, and capital structure decisions.

- Risk Management in Financial Planning: Identifying and mitigating financial risks, developing contingency plans, and incorporating risk analysis into budget development.

- Software Proficiency: Demonstrating competency in relevant software like Excel, budgeting software (e.g., Anaplan, Hyperion), and financial modeling tools.

Next Steps

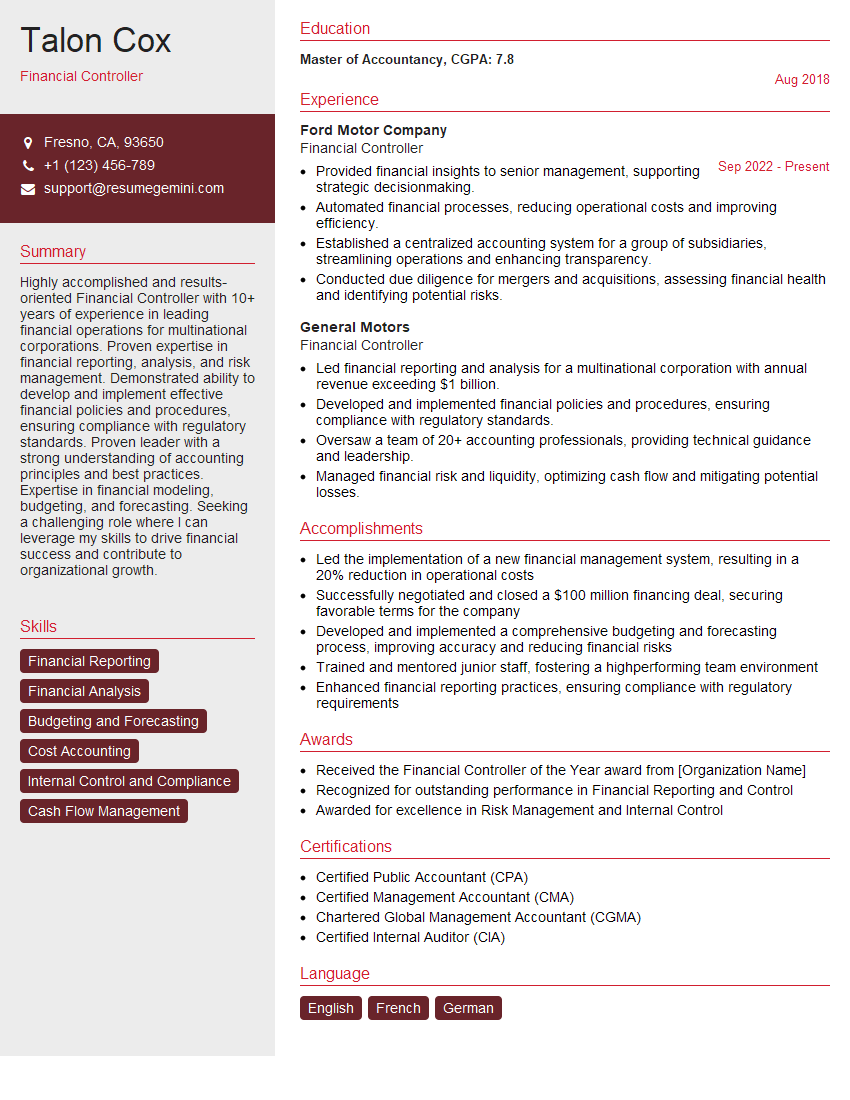

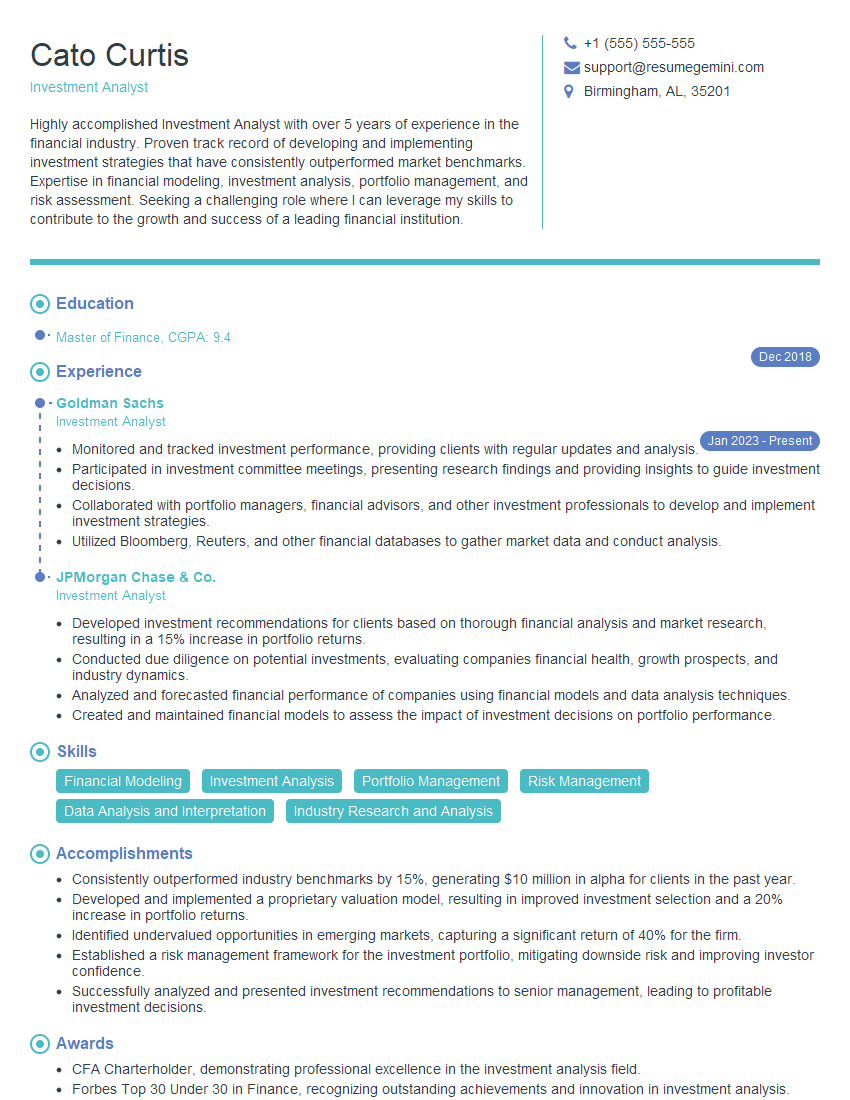

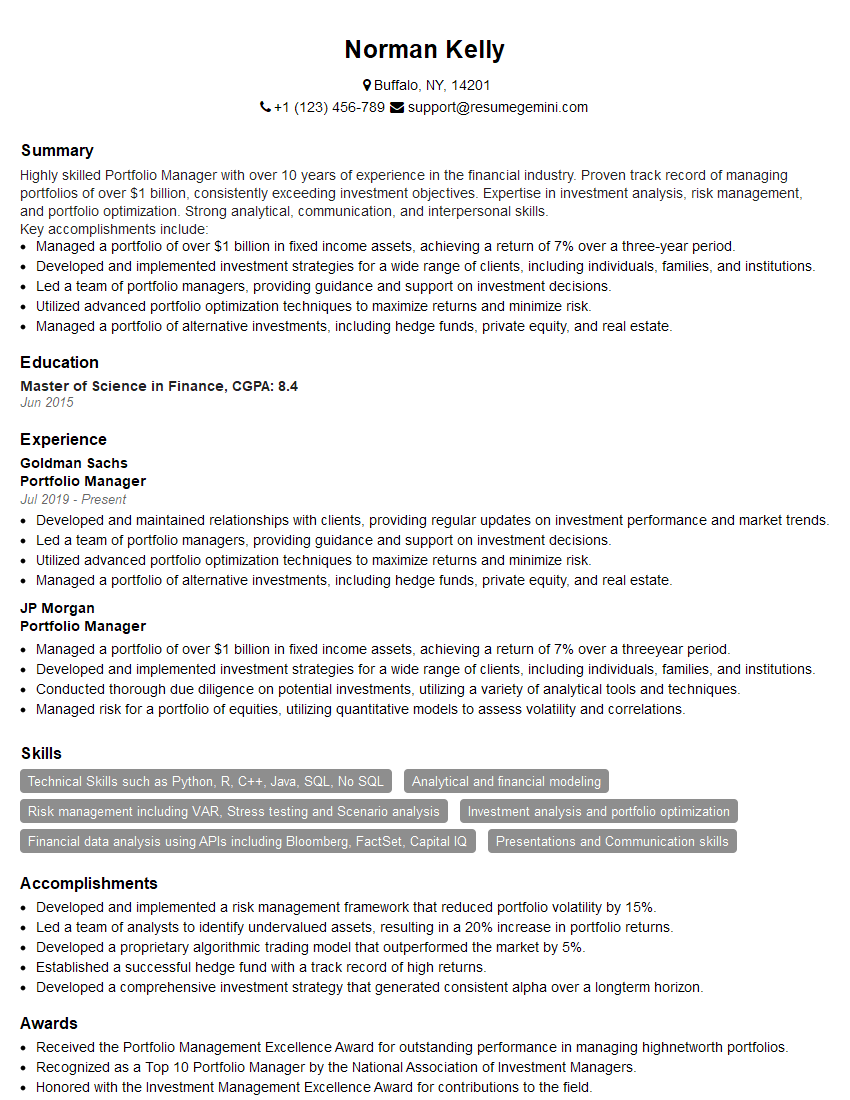

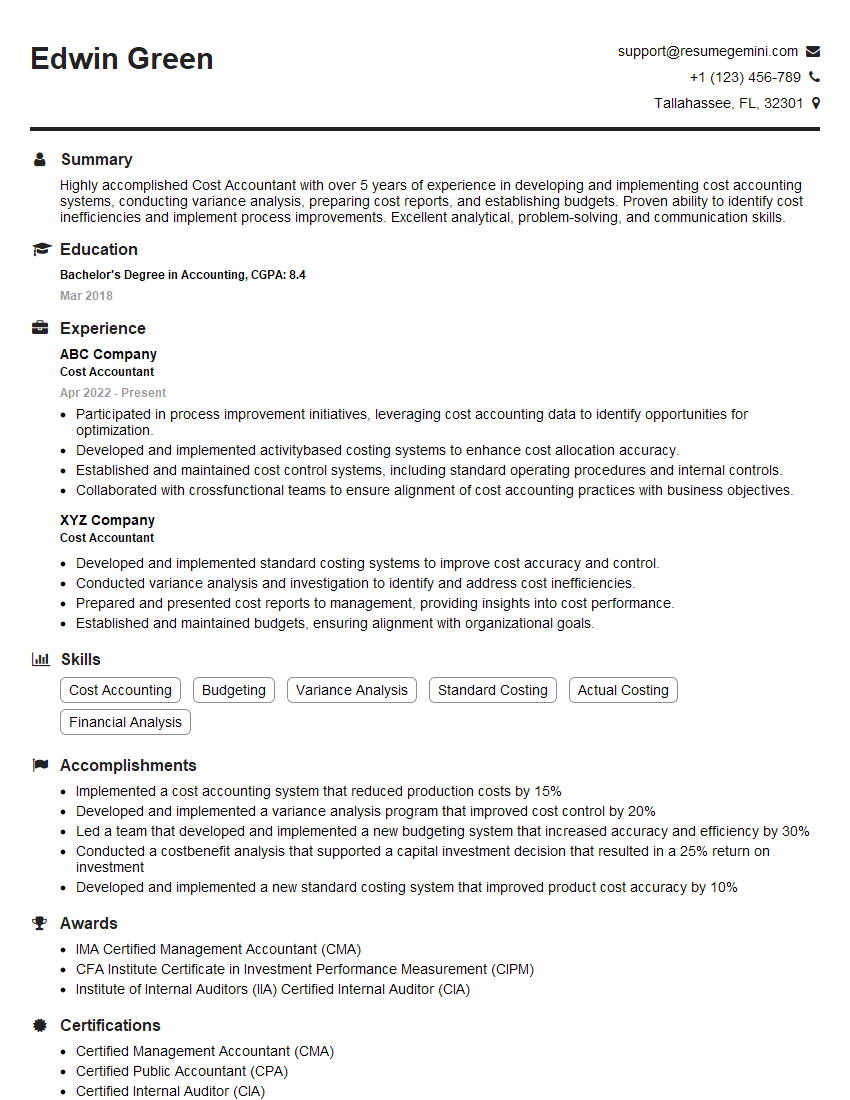

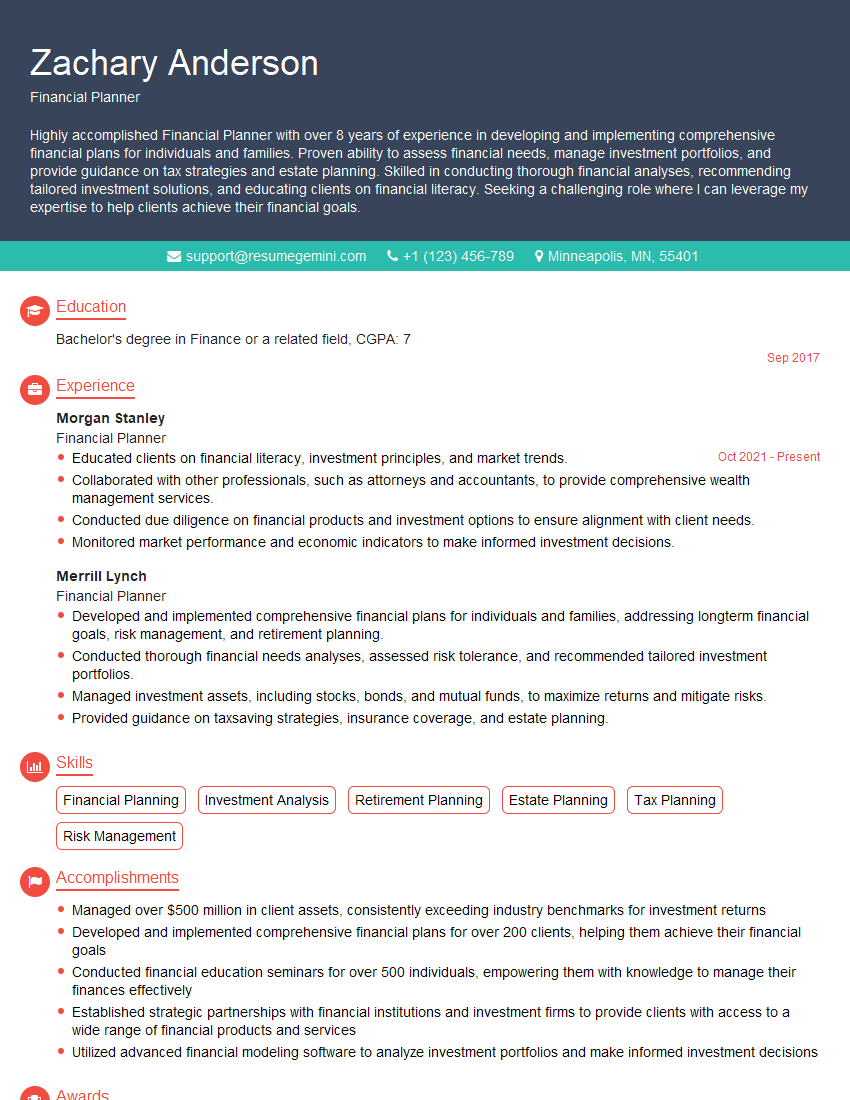

Mastering Budgets and Financial Planning is crucial for career advancement in finance and related fields. Strong skills in this area open doors to leadership positions and higher earning potential. To maximize your job prospects, invest time in creating an ATS-friendly resume that highlights your relevant skills and experience. ResumeGemini is a trusted resource that can help you build a professional and effective resume. They offer examples of resumes tailored to Budgets and Financial Planning to guide you through the process.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

I Redesigned Spongebob Squarepants and his main characters of my artwork.

https://www.deviantart.com/reimaginesponge/art/Redesigned-Spongebob-characters-1223583608

IT gave me an insight and words to use and be able to think of examples

Hi, I’m Jay, we have a few potential clients that are interested in your services, thought you might be a good fit. I’d love to talk about the details, when do you have time to talk?

Best,

Jay

Founder | CEO