Feeling uncertain about what to expect in your upcoming interview? We’ve got you covered! This blog highlights the most important Claims handling support interview questions and provides actionable advice to help you stand out as the ideal candidate. Let’s pave the way for your success.

Questions Asked in Claims handling support Interview

Q 1. Explain the claims handling process from initial report to closure.

The claims handling process is a systematic approach to managing claims from initial notification to final resolution. It typically involves several key stages:

- First Notice of Loss (FNOL): This is the initial report of the incident, often via phone, email, or online portal. The claimant provides details of the event, their policy information, and any immediate concerns.

- Acknowledgement and Assignment: The claim is acknowledged, assigned a unique number, and allocated to a claims adjuster or handler. Initial triage is conducted to assess the potential severity and urgency.

- Investigation: This involves gathering information to verify the claim. This may include reviewing policy documents, contacting witnesses, inspecting damaged property, obtaining police reports, and reviewing medical records (for injury claims).

- Evaluation: The adjuster evaluates the claim’s validity, assesses the extent of losses, and determines the amount payable under the policy terms and conditions. This may involve obtaining independent valuations from experts.

- Negotiation and Settlement: The adjuster negotiates a settlement with the claimant. This might involve direct payments, reimbursements, or repairs. The goal is to reach a fair and equitable resolution.

- Payment and Closure: Once a settlement is agreed upon, the payment is processed, and the claim is officially closed. Documentation is carefully archived.

Example: Imagine a car accident. The FNOL would be the initial phone call to the insurance company. The investigation would include obtaining the police report, assessing vehicle damage, and possibly obtaining medical reports for injuries. Evaluation would determine liability and the cost of repairs or medical treatment. Negotiation might involve a settlement offer to cover repairs and medical expenses. Payment would then be issued, and the claim closed.

Q 2. Describe your experience with different types of claims (e.g., auto, property, liability).

My experience spans various claim types, each requiring a unique approach.

- Auto Claims: I’ve handled numerous auto claims, from minor fender benders to significant collisions involving injuries and substantial vehicle damage. This includes assessing liability, determining repair costs, managing medical payments, and dealing with subrogation (recovering costs from at-fault parties).

- Property Claims: My experience includes handling both residential and commercial property claims, including fire, water damage, theft, and vandalism. This often involves working with contractors, appraisers, and engineers to assess damage, determine repair costs, and oversee the restoration process.

- Liability Claims: I’ve worked extensively on third-party liability claims, where our insured is potentially at fault. This requires careful investigation to determine liability, negotiating settlements, and defending against lawsuits if necessary.

In each type, I’ve consistently focused on timely and accurate investigation, fair and equitable settlement, and strong communication with claimants.

Q 3. How do you prioritize claims based on urgency and severity?

Prioritization is crucial in claims handling. I use a system combining urgency and severity to ensure timely and effective response.

Urgency refers to how quickly the claim needs attention. Examples include claims involving significant injuries requiring immediate medical care or situations posing safety risks (e.g., a compromised building).

Severity relates to the potential financial impact. High-severity claims, like major property damage or catastrophic injuries, require immediate attention despite the urgency.

I often use a matrix system, visually representing claims based on urgency and severity. Claims in the high-urgency, high-severity quadrant get immediate attention, while lower-urgency, lower-severity claims can be addressed accordingly. This ensures that the most critical claims receive prompt resolution while less urgent ones are still efficiently handled.

Q 4. What is your experience with claims reserving and estimating?

Claims reserving is the process of estimating the ultimate cost of a claim. This is critical for accurate financial forecasting and determining the company’s financial liabilities. My experience includes:

- Analyzing claim details: Reviewing the initial information about the claim, including the nature of the incident, the extent of damages, and any potential complications.

- Considering historical data: Comparing the claim to similar past claims to determine average settlement costs.

- Using reserving models: Applying statistical models and algorithms to predict the final cost of the claim.

- Regular review and adjustment: Periodically reviewing the reserve as new information becomes available to ensure accuracy.

Accurate reserving is vital; underestimation can lead to financial shortfalls, while overestimation ties up unnecessary capital.

Q 5. How do you handle high-pressure situations and challenging claimants?

High-pressure situations and challenging claimants require a calm, professional, and empathetic approach. I focus on:

- Active listening: Understanding the claimant’s perspective and concerns.

- Clear communication: Explaining the claims process clearly and concisely, answering questions thoroughly, and managing expectations.

- Empathy and understanding: Recognizing that claimants are often experiencing stress and frustration.

- De-escalation techniques: Using calm and respectful language to diffuse tense situations. If necessary, seeking assistance from supervisors or legal counsel.

- Documentation: Meticulously documenting all interactions to protect the company’s interests and to ensure a clear record of the claim handling process.

Example: I once dealt with a claimant who was extremely upset about a delayed payment. By actively listening to their concerns, empathizing with their frustration, and clearly explaining the reasons for the delay, I was able to de-escalate the situation and find a satisfactory resolution.

Q 6. Explain your understanding of indemnity and subrogation.

Indemnity refers to the insurer’s obligation to compensate the insured for covered losses. It’s the core principle of insurance – to restore the insured to their pre-loss financial position.

Subrogation is the right of the insurer, after indemnifying the insured, to recover the losses paid from a third party who caused the loss. For example, if our insured’s car is damaged by another driver, we pay for the repairs (indemnity) and then sue the at-fault driver to recover those costs (subrogation). Subrogation helps to keep insurance premiums lower by reducing the overall cost of claims.

Q 7. How do you identify and investigate potentially fraudulent claims?

Identifying and investigating fraudulent claims is a critical aspect of claims handling. I use a multi-pronged approach:

- Data analysis: Identifying patterns or anomalies in claims data that may indicate fraud, such as unusually high claim frequency, inconsistent statements, or claims filed shortly before policy expiration.

- Verification: Thoroughly verifying information provided by claimants, including contacting witnesses, reviewing medical records, and obtaining independent assessments.

- Special investigation units: Collaborating with internal special investigation units or external investigators to conduct more in-depth investigations into suspected fraudulent claims.

- Forensic accounting: Utilizing forensic accountants to examine financial records and identify inconsistencies that may indicate fraud.

Suspected fraudulent claims require a rigorous investigation to protect the integrity of the claims process and the financial health of the company.

Q 8. What software or systems have you used for claims management?

Throughout my career, I’ve utilized several claims management software and systems. These range from large-scale enterprise resource planning (ERP) systems like Guidewire ClaimCenter and Sapiens ClaimCenter, which handle the entire lifecycle of a claim from first notice of loss to final settlement, to more specialized systems like those focused on specific claim types, such as auto claims or workers’ compensation. I’m also proficient with various case management systems that track claims progress, deadlines, and communications. My experience extends to using cloud-based solutions, which offer enhanced collaboration and accessibility.

For example, in my previous role at [Previous Company Name], we used Guidewire ClaimCenter. This platform allowed for streamlined workflows, automated tasks, and real-time data analysis, greatly improving efficiency and reducing processing times. In another role, I worked with a smaller, more specialized system for handling property damage claims, which integrated seamlessly with our appraisal and repair networks. I’m adept at learning new systems quickly and tailoring my approach to leverage the strengths of each.

Q 9. Describe your experience with negotiating settlements.

Negotiating settlements is a crucial aspect of claims handling. It requires a delicate balance of empathy, strong analytical skills, and a deep understanding of legal and insurance principles. My approach involves a thorough investigation of the claim, including reviewing all relevant documentation, assessing liability, and evaluating the claimant’s damages. I always aim for a fair and equitable settlement that is in the best interests of both the claimant and the insurer.

A successful negotiation starts with active listening. Understanding the claimant’s perspective and concerns allows me to address their needs effectively. I then present a reasoned and well-supported offer, explaining the basis for my valuation. I’m comfortable handling objections and counteroffers, always striving to find common ground. If a settlement cannot be reached through negotiation, I’m prepared to escalate the matter to litigation, but I always prioritize a negotiated resolution whenever possible. For example, I once successfully negotiated a settlement in a complex liability case involving multiple parties, by skillfully highlighting the strengths and weaknesses of each party’s case and leveraging my understanding of relevant precedents.

Q 10. How do you maintain accurate records and documentation throughout the claims process?

Maintaining accurate records and documentation is paramount in claims handling. It protects both the claimant and the insurer from disputes and ensures regulatory compliance. My approach involves using a combination of electronic and physical filing systems, depending on the specific requirements of the claim and the company’s policies. I meticulously document every step of the claims process, including communications with the claimant, adjusters, and other stakeholders; all relevant supporting documentation, such as medical records, police reports, and repair estimates; and the rationale behind every decision made.

Electronic systems often allow for version control and audit trails, providing a clear history of the claim. I also utilize digital tools for secure storage and accessibility of documents. All documentation is organized logically and consistently, using a standardized naming convention to ensure easy retrieval and management. Regularly reviewing and updating the claim file helps to avoid inconsistencies and ensures the information remains current and accurate.

Q 11. What are the key regulatory requirements you need to adhere to in claims handling?

Claims handling is subject to a multitude of regulatory requirements, varying by jurisdiction and the type of insurance coverage. These regulations often cover areas such as promptness of investigation, fair and timely payment of claims, handling of sensitive information (such as medical records), and reporting requirements. Some key regulations I consistently adhere to include those related to data privacy (e.g., HIPAA, GDPR), anti-fraud measures, and specific state insurance codes.

For example, I’m aware of the requirements for timely notification of claim decisions under state insurance regulations and the strict guidelines for handling personally identifiable information (PII). Staying updated on these ever-evolving regulations is a continuous process, often involving professional development courses, attending industry conferences, and closely monitoring changes in legislation.

Q 12. How do you handle complex or ambiguous claims?

Complex or ambiguous claims require a methodical and thorough approach. The first step is to clearly define the issues in question, gathering all available information. This often involves conducting additional investigations, consulting with experts (such as medical professionals or engineers), and reviewing relevant case law. Once the issues are clearly defined, I develop a strategy for addressing them, outlining the steps needed to resolve the claim fairly and efficiently.

For instance, a claim involving a dispute over the cause of a fire might require consulting with a fire investigator to determine the origin and cause. Similarly, a claim with conflicting witness statements may need further interviews or a review of security footage. Maintaining detailed documentation throughout this process is crucial to justifying the decisions made.

Q 13. Describe your experience with communicating with claimants, adjusters, and other stakeholders.

Effective communication is the cornerstone of successful claims handling. I strive to communicate clearly, concisely, and empathetically with claimants, adjusters, and other stakeholders throughout the entire process. My communication style is adaptable, tailoring my approach to the individual’s understanding and communication preferences. With claimants, I prioritize empathy and transparency, explaining the process clearly and keeping them informed of progress. With adjusters and other professionals, I maintain a professional and efficient approach, focusing on factual information and collaborative problem-solving.

I use a variety of communication channels, including phone calls, emails, and letters, selecting the most appropriate method for each situation. I also document all communications meticulously to ensure a complete record of the claim’s history. For example, when dealing with a claimant experiencing emotional distress due to a loss, I prioritize active listening and a compassionate tone, ensuring they feel heard and understood. Conversely, when communicating with adjusters, I emphasize clarity and efficiency, utilizing clear and concise language to facilitate swift resolution.

Q 14. How do you manage your workload and prioritize tasks effectively?

Effective workload management and prioritization are crucial in the fast-paced world of claims handling. I utilize several strategies to stay organized and manage my time effectively. These include prioritizing claims based on urgency, complexity, and regulatory deadlines. I often use project management tools to track my tasks, deadlines, and progress. This allows for a clear overview of my workload and helps me identify potential bottlenecks early on.

Furthermore, I regularly review my workload to ensure I’m allocating my time efficiently. Time blocking helps to allocate specific time slots for different tasks, leading to improved focus and reduced multitasking. Delegation where appropriate is another key strategy to ensure efficient workload management. For instance, routine tasks might be delegated to junior staff, allowing me to focus on more complex or sensitive cases. Regular breaks and self-care are also vital in maintaining productivity and preventing burnout.

Q 15. What is your experience with independent medical examinations (IMEs)?

Independent Medical Examinations (IMEs) are crucial in claims handling, especially for bodily injury claims. They provide an objective medical assessment of the claimant’s injuries by a physician chosen by the insurance company. My experience encompasses coordinating IMEs, from selecting appropriate specialists based on the nature of the injury to managing the scheduling and communication with both the claimant and the physician. I ensure the physician receives all relevant medical records beforehand to allow for a comprehensive evaluation. I’m proficient in reviewing the IME reports, comparing them to the claimant’s medical history and other supporting documentation, and utilizing the findings to determine the validity and extent of claimed injuries.

For example, in a case involving a back injury, I ensured the claimant received an IME with an orthopedic specialist experienced in spine injuries. The report helped us objectively assess the severity of the injury, the need for ongoing treatment, and the potential long-term impact, which in turn informed our settlement negotiations.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. How do you ensure compliance with company policies and procedures?

Compliance is paramount in claims handling. I meticulously adhere to all company policies and procedures, which are regularly reviewed and updated. This includes understanding and applying regulations such as HIPAA for protecting claimant information and adhering to state-specific insurance regulations. I utilize internal compliance tools and training modules to ensure my understanding remains current. I also regularly document all actions and decisions taken throughout the claims process, ensuring a clear audit trail and promoting transparency.

For instance, before making any payment, I thoroughly check our internal guidelines on acceptable medical billing practices and ensure the claim meets the criteria specified in our policy. This prevents errors, protects the company from fraud, and ensures all actions remain within legal and ethical boundaries.

Q 17. Explain your experience with claims audits and reviews.

Claims audits and reviews are critical for ensuring accuracy and identifying areas for improvement. My experience involves conducting both internal and external reviews, analyzing claim files for compliance with company policies, regulatory requirements, and best practices. I identify potential errors, inconsistencies, or areas of vulnerability. This includes reviewing documentation, verifying medical necessity, assessing the reasonableness of charges, and evaluating the overall handling of the claim. I’ve actively participated in claim audits, providing detailed reports and recommendations for corrective actions and process improvements. This has led to improved efficiency and reduced claim costs.

In one instance, a review of closed claims revealed inconsistencies in the application of specific guidelines regarding the valuation of pain and suffering. My findings led to the implementation of clearer guidelines, reducing variability in future claims processing and enhancing consistency.

Q 18. How do you stay updated on industry best practices and legal changes?

The claims handling landscape is constantly evolving. I actively stay updated on industry best practices and legal changes through several methods. I subscribe to professional journals and publications in the insurance and legal fields, attend industry conferences and webinars, and actively participate in professional organizations dedicated to claims handling. I also leverage online resources such as legal databases and regulatory websites to access the latest updates and information.

For example, I recently attended a seminar focusing on changes to state regulations regarding pain management treatment coverage, ensuring my knowledge remained current and my future claims handling reflected these changes.

Q 19. Describe your experience with using claims handling software.

Proficiency in claims handling software is essential for efficiency and accuracy. I’m experienced using multiple claims management systems, including [mention specific software if comfortable, otherwise use generic terms like] industry-standard claims platforms that handle all aspects of the claims lifecycle, from initial intake and investigation through to settlement or denial. My skills encompass data entry, document management, case tracking, reporting, and communication features within these systems. I’m adept at leveraging the software’s functionalities to streamline workflows and improve efficiency.

For example, I regularly use the system’s reporting tools to generate data on key metrics like average claim cycle times, allowing for identification of potential bottlenecks and opportunities for process optimization.

Q 20. How do you handle difficult or aggressive claimants?

Handling difficult or aggressive claimants requires a calm, empathetic, and professional approach. My strategy focuses on active listening, clear and concise communication, and maintaining a respectful demeanor, even in challenging situations. I ensure I thoroughly document all interactions, focusing on factual accuracy and objectivity. I utilize de-escalation techniques to diffuse tense situations and strive to provide a fair and unbiased assessment of each claim. When necessary, I involve supervisors or legal counsel to manage particularly challenging situations.

In one situation, a claimant became very upset about a perceived delay in processing their claim. Through patient listening and clear communication regarding the steps required to complete the investigation, I successfully de-escalated the situation and reached a satisfactory resolution.

Q 21. What is your experience with bodily injury claims?

Bodily injury claims represent a significant portion of my experience. This includes claims arising from car accidents, slip and falls, and other events resulting in physical harm. My experience encompasses all aspects of handling these claims, from initial reporting and investigation to liaising with medical professionals, assessing damages, negotiating settlements, and managing litigation when necessary. I am adept at evaluating medical reports, determining liability, and applying relevant legal principles to assess the validity and value of each claim.

For instance, I recently managed a case involving a car accident that resulted in multiple injuries. Through thorough investigation, analysis of medical reports, and negotiation with the claimant’s attorney, I successfully reached a fair settlement that avoided costly litigation.

Q 22. How familiar are you with different types of insurance policies?

My familiarity with insurance policies spans a wide range, encompassing various types like auto, home, health, commercial general liability (CGL), professional liability (errors and omissions), workers’ compensation, and umbrella policies. I understand the nuances of each, including their coverage limits, exclusions, deductibles, and specific policy language. For example, I’m adept at differentiating between actual cash value (ACV) and replacement cost coverage in property insurance, a crucial distinction when assessing damage claims. I’m also well-versed in understanding different types of endorsements and riders that modify standard policy coverage. This deep understanding allows me to accurately assess claims and ensure fair settlements based on the specific policy provisions.

Q 23. How do you handle claims involving multiple parties?

Handling claims involving multiple parties requires a systematic approach. First, I meticulously document all involved parties, including their insurance information, contact details, and potential liabilities. I then gather evidence from all sources, such as police reports, witness statements, and medical records, to establish the sequence of events and determine the degree of each party’s fault. This often involves comparative negligence analysis, which apportions responsibility based on each party’s contribution to the incident. I then use this information to negotiate settlements that are fair and equitable to all involved parties. Sometimes, this necessitates involving independent adjusters or mediators to facilitate the process and ensure an unbiased outcome. For instance, in a multi-car accident, I would carefully examine each driver’s policy, the police report, and witness testimonies to determine fault before negotiating settlements with the involved insurance companies.

Q 24. Describe a situation where you had to make a difficult decision in a claims case.

I once handled a claim where a policyholder claimed significant damage to their home due to a burst pipe. The initial assessment indicated substantial water damage, necessitating extensive repairs. However, during a thorough investigation, I discovered evidence suggesting the pipe burst due to the homeowner’s negligence in not winterizing their plumbing system. The policy, however, didn’t explicitly exclude coverage for negligence. Making the decision to partially deny the claim, rather than fully deny or fully approve it, was difficult. It required careful consideration of the policy language, the homeowner’s actions, and the principle of fairness. I ultimately decided on a partial settlement, covering a portion of the repairs that were not directly attributable to the homeowner’s negligence, while clearly explaining the reasoning behind the decision to the policyholder. This ensured transparency and prevented future misunderstandings.

Q 25. What steps do you take to ensure fair and equitable claim settlements?

Ensuring fair and equitable claim settlements involves several crucial steps: 1. Thorough Investigation: A comprehensive investigation is paramount. This includes gathering evidence from all relevant sources. 2. Objective Assessment: I strive for an unbiased evaluation of the claim, irrespective of personal feelings or pressures. 3. Policy Compliance: All decisions are aligned with the policy terms and conditions and applicable laws and regulations. 4. Transparency and Communication: I maintain open communication with the policyholder throughout the process, providing regular updates and explaining the rationale behind every decision. 5. Documentation: All aspects of the claim are meticulously documented to ensure accountability and maintain a clear audit trail. 6. Independent Review: In complex or high-value cases, an independent review helps ensure objectivity and fairness. By consistently adhering to this framework, I work to ensure every settlement reflects the principles of fairness and equity.

Q 26. How do you manage your time effectively to meet deadlines?

Effective time management is crucial in claims handling. I utilize several techniques: 1. Prioritization: I prioritize claims based on urgency and complexity. 2. Time Blocking: I allocate specific time slots for particular tasks. 3. Task Management Tools: I leverage tools such as project management software and calendars to organize my workload and track deadlines. 4. Delegation: When appropriate, I delegate tasks to other team members. 5. Regular Review: I routinely review my progress and adjust my schedule as needed. This systematic approach helps me meet deadlines consistently, even under pressure.

Q 27. Describe your experience with liability and causation determination.

Liability and causation determination are fundamental aspects of claims handling. I determine liability by investigating who was at fault and to what extent. Causation involves establishing a direct link between the event and the resulting damages. For instance, in a car accident, I’d examine police reports, witness statements, and vehicle damage assessments to determine if one driver’s negligence directly caused the accident and the resulting injuries or property damage. This often necessitates applying legal precedents and understanding concepts such as proximate cause. If the link between the event and damages is unclear or debatable, further investigation might be required, potentially involving expert witnesses or forensic analysis.

Q 28. How do you handle claims involving significant financial losses?

Handling claims with significant financial losses demands a highly structured approach. I begin by conducting an even more exhaustive investigation, engaging specialists like engineers or accountants as needed. This meticulous examination seeks to establish the precise extent of the losses. I work closely with the policyholder to thoroughly document all damages. Transparent communication and clear explanations of the valuation process are paramount. For very large losses, I’ll often collaborate with senior claim handlers or external experts to ensure accuracy and mitigate potential disputes. Furthermore, I explore all avenues for recovery, including subrogation (recovering losses from third parties) where applicable. Throughout the process, I maintain a detailed record of all communications, decisions, and supporting evidence.

Key Topics to Learn for Claims Handling Support Interview

- Understanding Claim Types: Learn to differentiate between various claim types (e.g., property, liability, health) and their specific requirements and processes.

- Claims Intake and Documentation: Master the process of receiving and accurately documenting claim information, ensuring completeness and accuracy to avoid delays.

- Data Entry and Management: Practice efficient and error-free data entry within claims management systems. Understand data validation and the importance of data integrity.

- Policy and Procedure Adherence: Demonstrate your understanding of company policies and procedures related to claims handling, highlighting your ability to follow established protocols.

- Communication and Customer Service: Practice effective communication skills, focusing on empathy and clear, concise interactions with claimants and internal stakeholders.

- Investigative Techniques (Basic): Familiarize yourself with the basic investigative processes involved in claims handling, such as gathering evidence and verifying information.

- Problem-Solving and Decision-Making: Prepare examples illustrating your ability to identify and solve problems efficiently and effectively, particularly in situations requiring quick decision-making within a claims context.

- Regulatory Compliance: Understand the relevant laws and regulations impacting claims handling in your jurisdiction.

- Technology Proficiency: Highlight your familiarity with claims management software and other relevant technologies used in the claims handling process.

Next Steps

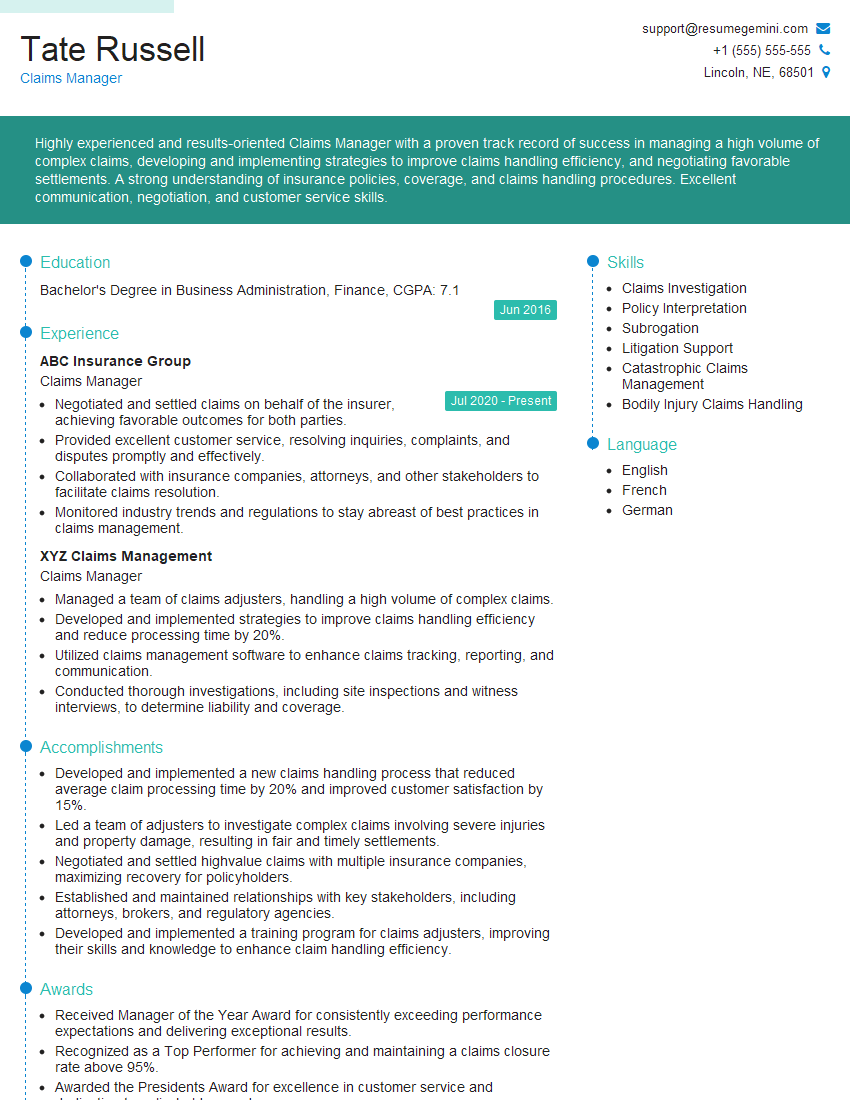

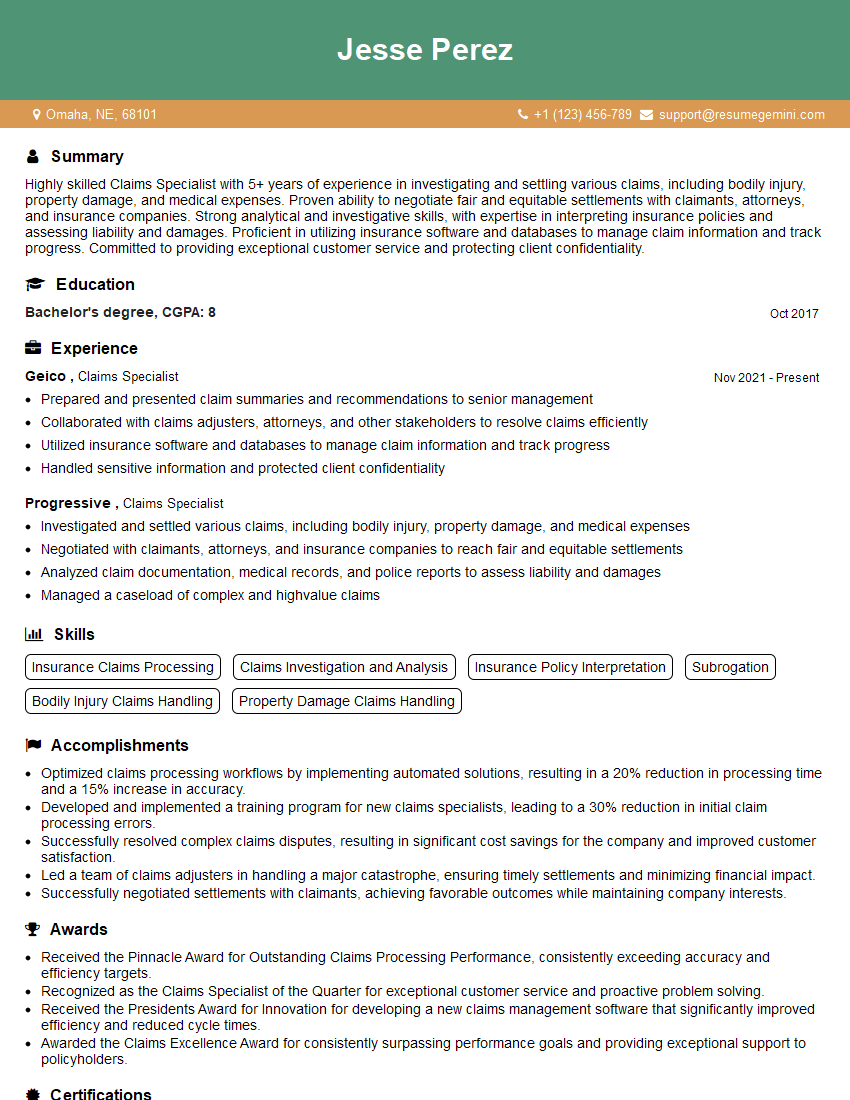

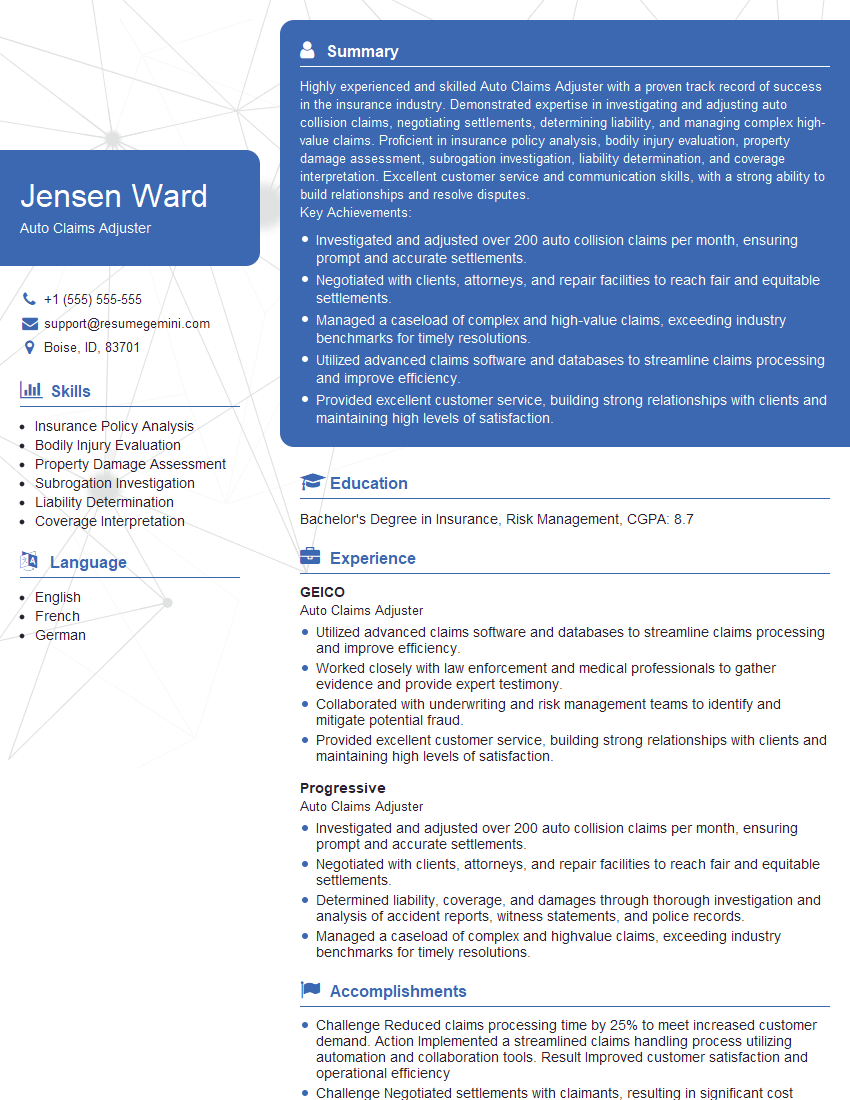

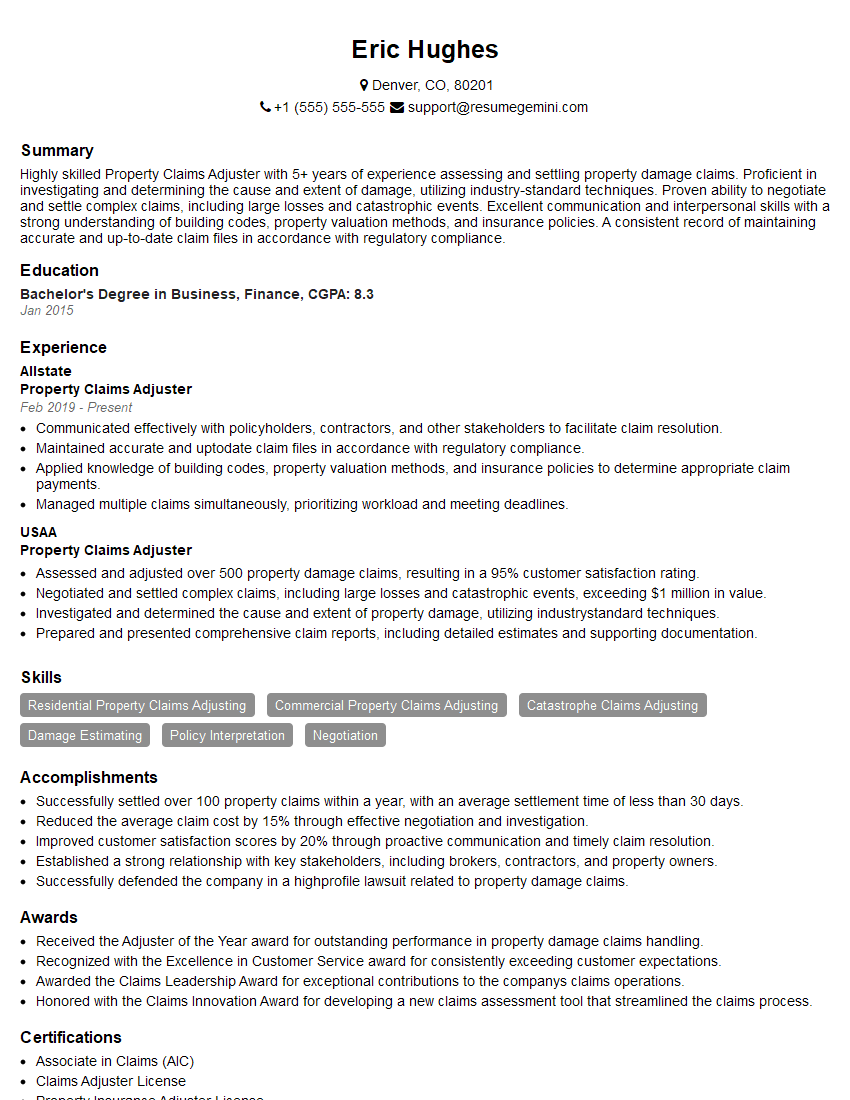

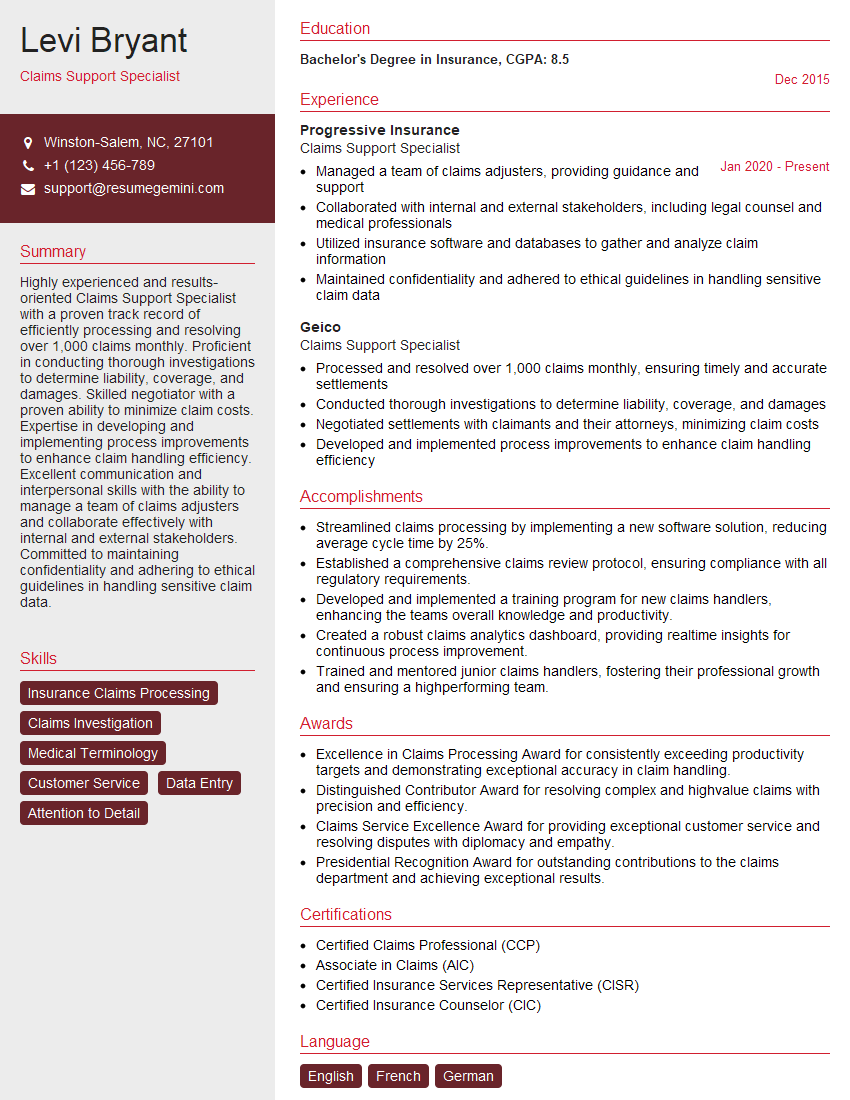

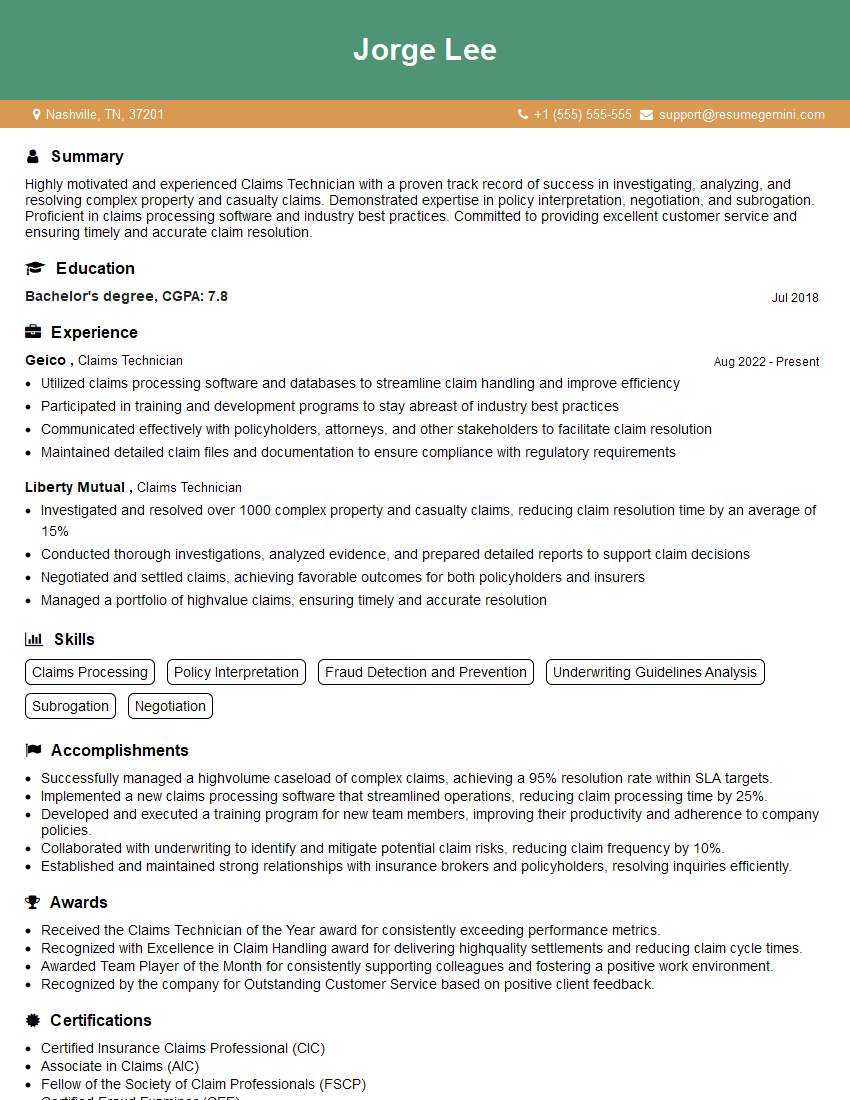

Mastering claims handling support opens doors to a rewarding career with excellent growth potential. Advancement opportunities often include specialized roles, team leadership, and increased responsibility within the claims department. To significantly boost your job prospects, invest time in creating a strong, ATS-friendly resume that showcases your skills and experience effectively. ResumeGemini is a trusted resource to help you build a professional and impactful resume. We provide examples of resumes tailored to Claims Handling Support to help you get started – use them as inspiration and build your own compelling narrative.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

Hi, I’m Jay, we have a few potential clients that are interested in your services, thought you might be a good fit. I’d love to talk about the details, when do you have time to talk?

Best,

Jay

Founder | CEO