Are you ready to stand out in your next interview? Understanding and preparing for Claims Investigation and Adjustment interview questions is a game-changer. In this blog, we’ve compiled key questions and expert advice to help you showcase your skills with confidence and precision. Let’s get started on your journey to acing the interview.

Questions Asked in Claims Investigation and Adjustment Interview

Q 1. Describe your experience investigating and adjusting property damage claims.

Investigating and adjusting property damage claims involves a methodical process of assessing the extent of damage, determining the cause, and ultimately calculating the appropriate compensation. It starts with a thorough on-site inspection, meticulously documenting damage with photos and detailed notes. I carefully examine the policy to understand coverage limits and exclusions. For example, I recently investigated a claim involving a house fire. I meticulously documented the structural damage, contents loss, and the need for temporary living arrangements. I then used industry-standard software to estimate repair costs, obtaining multiple contractor bids to ensure accuracy. Finally, I prepared a comprehensive report summarizing my findings, including the cause of the fire (if determinable) and the calculated indemnity payable to the insured.

This process frequently involves interacting with contractors, engineers, and other specialists to obtain expert opinions when necessary. In instances of complex damage or when the cause is ambiguous, I might engage a specialized investigator to assist with the investigation. For example, in cases of suspected arson, engaging a fire investigator is crucial. The goal is always to provide a fair and accurate assessment of the loss, while adhering to the terms of the insurance policy.

Q 2. Explain your process for evaluating liability in a car accident claim.

Evaluating liability in a car accident claim requires a careful examination of all available evidence to determine who was at fault. This includes reviewing police reports (if available), witness statements, photographs of the accident scene, and medical reports documenting injuries. I use a structured approach, considering factors like traffic laws, driver behavior, and the physical evidence. For instance, if a driver ran a red light causing a collision, that driver is likely to be deemed at fault. However, if the evidence points to multiple contributing factors, I may determine a percentage of fault for each driver involved (comparative negligence). This might involve calculating the comparative negligence based on the severity of the actions of each driver.

I always consider the possibility of unforeseen circumstances or contributing factors not initially apparent. A thorough review of the accident reconstruction report (if obtained) is crucial. Ultimately, the goal is to reach a just and equitable determination of liability, supported by clear and compelling evidence. The legal precedents in the jurisdiction also play a significant role, especially in cases involving disputed liability.

Q 3. How do you handle a claim where the insured is suspected of fraud?

Suspected fraud requires a particularly cautious and thorough approach. My first step is to document all evidence suggesting potential fraud, maintaining a detailed record of every step taken. This includes comparing the claim with the insured’s past claims history and reviewing any inconsistencies or contradictions in statements. For example, if the insured claims damage from a specific event that cannot be corroborated by independent evidence, suspicion is raised. I then proceed with a comprehensive investigation, which may involve interviewing witnesses, obtaining additional documentation, and potentially engaging external experts, such as forensic accountants or investigators specializing in insurance fraud. This is done while protecting the rights of the insured and ensuring a fair process.

If evidence of fraud is found, I will prepare a detailed report outlining my findings and recommendations. Depending on the severity and nature of the suspected fraud, legal action may be necessary. This can involve working with legal counsel to pursue recovery of any funds paid out fraudulently, and possibly initiating legal proceedings against the insured. The process demands meticulous record keeping and adherence to strict legal guidelines to avoid potential legal ramifications.

Q 4. What are the key legal aspects you consider when handling a workers’ compensation claim?

Handling workers’ compensation claims involves a deep understanding of relevant state laws and regulations. These laws vary significantly by jurisdiction and dictate eligibility criteria, benefit levels, and the process for resolving disputes. Key legal aspects I consider include the definition of an ’employee,’ the nature of the injury or illness, the causal connection between the injury and the work environment, and the availability of medical treatment. I must meticulously document all aspects of the claim, from the initial injury report to the medical treatment provided and the claimant’s return-to-work plan. I must carefully adhere to reporting requirements and time limits to ensure compliance.

For instance, I must verify that the injury occurred during the course and scope of employment. I’ll review medical reports to determine the extent and nature of the injury, and whether the injury is work-related. I will also investigate the safety measures in place at the workplace and if those measures were followed. Any deviation from legal requirements will be thoroughly investigated. The goal is to ensure that the claimant receives the benefits they are entitled to under the law while protecting the employer’s interests and ensuring responsible management of compensation funds. In cases of dispute, familiarity with the relevant appeals process is crucial.

Q 5. How do you prioritize claims based on urgency and severity?

Prioritizing claims necessitates a system that balances urgency and severity. I utilize a system that incorporates several factors into a scoring matrix. Claims with life-threatening injuries or significant property damage that pose safety risks are given the highest priority. These are usually flagged immediately and routed to adjusters for immediate action. For instance, a claim involving a serious injury resulting from a workplace accident is given top priority. Claims involving significant financial exposure for the insurer also take precedence. The severity of the loss is also an important factor – a large-scale property damage claim warrants faster action than a small, low-impact incident.

Claims are then categorized into various tiers based on their score, enabling efficient resource allocation. Less urgent claims are handled in accordance with service level agreements (SLAs) and the resources available. This system ensures that resources are appropriately deployed and ensures the most urgent claims receive the attention needed while maintaining efficient workflow and minimizing disruptions. Regularly reviewing the queue and adjusting prioritization based on emerging circumstances is essential for optimal claim handling.

Q 6. Describe your experience negotiating settlements with claimants.

Negotiating settlements requires strong communication and interpersonal skills. I begin by thoroughly understanding the claimant’s perspective, actively listening to their concerns and assessing the strength of their case. I then analyze the evidence, including medical records, repair estimates, and legal precedents, to determine a fair and reasonable settlement offer. I present my offer clearly, explaining the rationale behind it, while always maintaining a professional and respectful demeanor. My goal is to reach a mutually acceptable agreement that resolves the claim fairly and efficiently. For example, I recently negotiated a settlement with a claimant who suffered injuries in a car accident. After careful review of medical reports and determining the extent of injuries and potential future costs, I proposed a settlement that both parties found fair.

Sometimes negotiations require compromise and a willingness to explore alternative solutions. If negotiations reach an impasse, I’m prepared to utilize mediation or other alternative dispute resolution (ADR) methods. The objective is to achieve a resolution that is fair and equitable to all parties involved, while limiting unnecessary legal costs and delays. Successful negotiation requires patience, empathy, and a deep understanding of both legal and human factors.

Q 7. What software or systems are you familiar with for claims management?

Throughout my career, I’ve worked with various claims management software and systems. I am proficient in using industry-standard platforms such as Guidewire ClaimCenter, and similar systems used for case management. These systems allow for efficient tracking of claims, documentation management, and communication with stakeholders. They often include features for automating tasks, such as generating reports and calculating reserves. My experience also encompasses using specialized software for estimating repair costs, such as Xactimate, and other tools designed to improve accuracy and efficiency.

In addition to specialized claims software, I’m comfortable using various data analysis tools for identifying trends and patterns in claims data, which helps in proactive risk management and improving claims processes. My proficiency in these systems ensures accurate and timely processing of claims, effective communication, and efficient management of resources.

Q 8. How do you maintain accurate and detailed records of your investigations?

Maintaining accurate and detailed records is paramount in claims investigation. Think of it as building a solid, irrefutable case. My approach involves a multi-layered system. Firstly, I utilize a dedicated case management system that allows for chronological documentation of every step, from initial report to final settlement. This system often includes features for secure file storage, automated reminders for deadlines, and detailed reporting capabilities. Secondly, I meticulously document all communication, whether it’s a phone call, email, or in-person meeting, including date, time, individuals involved, and a concise summary of the discussion. I use standardized templates for reports and ensure all information is factual, objective, and supported by evidence such as photos, medical records, police reports, or witness statements. Finally, regular internal audits of my case files ensure consistency and adherence to company policies and best practices. This comprehensive approach minimizes the risk of errors and ensures that all information is readily available for review, litigation, or internal audits.

Q 9. How do you handle difficult or demanding claimants?

Handling difficult claimants requires a combination of empathy, strong communication skills, and a firm understanding of policy. My approach begins with active listening. I make sure to hear their concerns, validate their feelings (without necessarily agreeing with their claims), and explain the claims process clearly and patiently. I maintain a professional and respectful demeanor, even when faced with anger or frustration. I emphasize fairness and transparency, explaining the criteria used for claim assessment. If the claimant is making unreasonable demands or exhibiting disruptive behavior, I document everything thoroughly and escalate the issue to my supervisor if necessary. Sometimes, a neutral third party can be helpful in mediating the situation. Ultimately, my goal is to reach a fair and equitable resolution while upholding the integrity of the claims process. For example, one particularly difficult claimant consistently accused me of bias and demanded immediate payouts beyond what was reasonably supported by evidence. I maintained my composure, documented each interaction, provided clear explanations of the evidence reviewed and the applicable policy, and offered a reasonable alternative resolution that ultimately satisfied the claim.

Q 10. Explain your understanding of subrogation and its importance in claims adjustment.

Subrogation is the process by which an insurer, after paying a claim to its insured, seeks recovery from a third party responsible for the loss. Think of it as recovering the money already paid out. It’s crucial in claims adjustment because it helps to reduce the insurer’s financial burden and ultimately keeps premiums lower. For example, if our insured is involved in a car accident caused by another driver, we would pay out the claim for their damages. We then have the right to pursue the at-fault driver’s insurance company to recoup the money we paid. This is achieved by investigating the accident, gathering evidence of liability, and negotiating a settlement with the at-fault party’s insurer. If a settlement isn’t reached, litigation might be necessary. The success of subrogation relies heavily on thorough investigation and clear documentation of liability at the initial stage of the claim. The importance of subrogation lies in its ability to control costs and ensure fairness within the insurance system. By recovering funds from those responsible, subrogation helps distribute the financial impact of accidents and losses more equitably.

Q 11. Describe a time you had to make a difficult decision in a claims investigation.

I once had to decide whether to approve a claim for significant medical expenses resulting from a slip and fall accident at a grocery store. The claimant’s injury appeared genuine, supported by medical documentation, but the store’s security footage was inconclusive regarding the cause of the fall. There were no witnesses. Approving the claim would be a substantial payout, while denying it could result in legal action. After reviewing all available evidence – including the medical reports, accident report, and the low-resolution security footage that couldn’t definitively show what had caused the fall – I opted for a partial settlement. This wasn’t ideal for either party, but I believed it was the fairest outcome considering the ambiguous nature of the incident. My decision was based on the principle of balancing risk and fairness. I documented my reasoning in detail to justify the settlement, explaining the uncertainty and how I weighed the evidence accordingly. This demonstrated due diligence, and minimized our liability while ensuring a reasonable outcome for the claimant. The process strengthened my ability to navigate ambiguous situations.

Q 12. What is your experience with independent medical examinations (IMEs)?

Independent Medical Examinations (IMEs) play a vital role in assessing the validity and extent of injuries claimed. My experience involves working with various IME providers to schedule and manage these exams. I understand the importance of selecting qualified and impartial physicians specializing in the relevant injury types. I ensure that all necessary medical records are provided to the IME physician prior to the examination, promoting a comprehensive assessment. I also carefully review the IME physician’s report, evaluating its objectivity, methodology, and alignment with the available medical evidence. Differences of opinion between the treating physician and the IME physician are common and need to be carefully evaluated; I often seek second opinions to ensure impartiality. My role involves ensuring that the IME process is conducted fairly and ethically, while also serving the interests of the insurer. In essence, the IME report provides an independent, objective perspective that assists in determining the extent and causation of the injuries claimed and therefore plays a crucial part in claims evaluation and settlement.

Q 13. How do you identify and mitigate potential risks in a claim?

Identifying and mitigating potential risks in a claim is a proactive approach that starts from the initial report stage. Firstly, I assess the potential liability from the outset. This includes analyzing the facts of the incident, identifying potential contributing factors, and determining the extent of potential damages. Secondly, I review the policy coverage thoroughly to ensure that the claim falls within the scope of the policy. Exclusion clauses and limits of liability need specific attention. Thirdly, I actively search for evidence to support or refute the claim, leaving no stone unturned. This involves obtaining police reports, witness statements, medical records, and any other relevant documents. Fourthly, I continuously monitor the claim for any developments that might increase the risk, such as escalating medical costs or additional injuries. If potential problems arise, I implement strategies to minimize the risk. This could involve additional investigation, early settlement negotiations, or referral to legal counsel. By utilizing this multi-faceted approach, I aim to minimize the insurer’s exposure to potentially costly litigation and prevent adverse outcomes.

Q 14. What is your approach to handling claims with inadequate documentation?

Handling claims with inadequate documentation requires a systematic approach. I begin by trying to obtain missing information through various means. This may involve contacting the claimant, witnesses, healthcare providers, or law enforcement agencies. I request additional documentation explicitly, and follow up persistently. If these attempts are unsuccessful, I evaluate the available evidence carefully. I might analyze the available information to determine if a decision can be made on the basis of what is present. It is important to document every attempt to obtain missing information and the reasons for any inability to secure it. If a fair assessment cannot be conducted due to missing information, I might suggest a reasonable extension to allow time for collecting more data, or even recommend denial if there is insufficient information to support the claim, carefully documenting the reasons for this decision. In essence, a transparent and thorough approach is critical, balancing the insurer’s need for complete information with the claimant’s need for a timely resolution. Every step must be documented to maintain a clear audit trail.

Q 15. How familiar are you with different types of insurance policies (e.g., homeowners, auto, commercial)?

My experience encompasses a wide range of insurance policies. I’m deeply familiar with the nuances of homeowners insurance, understanding everything from dwelling coverage and personal property to liability and additional living expenses. Similarly, I possess extensive knowledge of auto insurance, including collision, comprehensive, liability, and uninsured/underinsured motorist coverage. In the commercial insurance realm, I’m proficient in various lines, such as general liability, commercial auto, workers’ compensation, and commercial property. This broad understanding allows me to effectively assess risk and handle claims across multiple sectors.

For example, understanding the intricacies of a commercial general liability policy requires a grasp of the insured’s operations, potential exposures, and the specific wording of the policy’s exclusions and endorsements. This knowledge is crucial for determining coverage and handling claims appropriately.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. Describe your understanding of the claims process from initial report to final settlement.

The claims process is a structured sequence of steps, beginning with the initial report of a loss. Once a claim is reported, the initial investigation commences, including verifying the loss, identifying the insured, and determining preliminary coverage. This often involves reviewing the policy, contacting the insured, and potentially conducting a site visit or taking statements from witnesses. Next, we determine liability – was the insured at fault? – and then assess the damages. This might include appraisals, medical records reviews, or obtaining repair estimates. Once the damages are assessed, we negotiate a settlement with the claimant or their representative. The settlement is then documented and paid. The entire process is tracked meticulously, with detailed records maintained throughout.

Imagine a car accident claim: First, we’d receive a report. Then we’d investigate – police reports, witness statements, damage assessments. We’d then determine fault, assess repair costs, and potentially medical bills. Finally, we’d settle, perhaps via a direct payment to the repair shop and the insured’s medical provider, or a direct payout to the insured.

Q 17. How do you stay up-to-date on changes in insurance regulations and laws?

Staying current on insurance regulations and laws is crucial. I actively monitor legislative changes at both the state and federal levels through professional organizations such as the National Association of Insurance Commissioners (NAIC) and relevant industry publications. I subscribe to legal updates and attend continuing education courses and seminars focusing on emerging trends and legal precedents in insurance law. I also regularly review changes to state-specific regulations that impact claim handling. This continuous learning ensures my practice aligns with the latest legal and regulatory frameworks.

For instance, changes in data privacy laws significantly affect how we handle sensitive information obtained during investigations. Staying updated ensures compliance and avoids potential legal pitfalls.

Q 18. What is your experience with different types of claim investigation techniques?

My experience includes various investigation techniques. I’m proficient in conducting thorough interviews with claimants, witnesses, and other involved parties. I’m adept at reviewing and analyzing documentation such as police reports, medical records, and repair estimates. I also utilize technology, such as utilizing online databases to verify information or conduct background checks when appropriate and in compliance with privacy laws. In complex cases, I might engage external experts, like engineers or accident reconstruction specialists, to gain further insights. The goal is always to gather comprehensive evidence to support a fair and accurate claim settlement.

An example is using digital forensics to analyze data from a vehicle’s event data recorder (EDR) in a car accident to determine the speed and other contributing factors of the crash.

Q 19. How do you handle claims involving multiple parties or complex scenarios?

Claims involving multiple parties or complex scenarios require a methodical and organized approach. I begin by clearly identifying all parties involved and their respective roles in the incident. I then systematically gather evidence from each party, ensuring a balanced perspective. I create a detailed timeline of events, documenting all interactions and evidence gathered. This meticulous record-keeping helps to avoid confusion and ensures a comprehensive understanding of the situation. When necessary, I will involve legal counsel to ensure compliance with all regulations and to navigate the complexities of multi-party disputes or litigation.

Consider a multi-vehicle accident: I’d meticulously document each driver’s statement, vehicle damage, witness accounts, and police reports. This detailed information helps me assess liability amongst the parties and determine a fair settlement for each based on their degree of fault.

Q 20. What is your approach to conflict resolution in claims handling?

My approach to conflict resolution emphasizes clear communication and empathy. I strive to understand each party’s perspective, actively listening to their concerns and addressing them with respect and fairness. I present all relevant evidence objectively, explaining the reasoning behind my decisions. I encourage open dialogue and seek mutually agreeable solutions whenever possible. Mediation or arbitration may be explored if direct negotiation fails to reach a resolution.

A situation might involve a disagreement between the insured and a contractor over repair costs. I’d facilitate communication, review the estimates, and potentially involve an independent appraiser to find a fair resolution acceptable to both parties.

Q 21. How do you balance the needs of the insured with the financial interests of the insurance company?

Balancing the needs of the insured with the financial interests of the insurance company is a core aspect of my role. It’s not a zero-sum game; rather, it’s about finding a fair and equitable outcome. I strive to ensure the insured receives the coverage they are entitled to under their policy while also acting as a responsible steward of the company’s financial resources. This means thoroughly investigating claims to ensure the validity of the claim and the accuracy of the damages assessment. It also means clearly communicating the policy’s terms and conditions to the insured, and working collaboratively to resolve disputes fairly and efficiently. I believe that a fair and prompt resolution benefits both the insured and the company in the long run.

Imagine a homeowner’s claim for water damage. I’d need to assess the extent of the damage fairly, ensuring the insured isn’t overpaid, but also that they receive enough to cover reasonable repairs and avoid additional financial hardship. This requires a balance of compassion and financial prudence.

Q 22. Describe your experience with using various investigative tools and techniques.

Throughout my career, I’ve utilized a wide array of investigative tools and techniques to thoroughly assess claims. This includes everything from basic record review and witness interviews to more advanced methods.

Record Review: I meticulously examine policy documents, medical records, police reports, and any other relevant documentation to establish the facts of the case and identify inconsistencies or discrepancies. For instance, in a car accident claim, I’d compare the police report’s account with the claimant’s statement and the medical bills to look for any discrepancies.

Witness Interviews: I conduct structured interviews with witnesses, employing active listening and open-ended questions to gather unbiased information. Effective questioning is key; I focus on factual details and avoid leading questions to maintain objectivity. For example, instead of asking ‘Were you speeding?’, I’d ask ‘Can you describe the speed of the vehicles involved?’

Site Inspections: Where appropriate, I conduct on-site investigations to visually assess the damage or scene of the incident. This provides crucial context and helps corroborate or refute statements made by the claimant or other parties. Imagine a homeowner’s claim for storm damage – a site visit allows me to assess the extent of the damage and identify any pre-existing conditions.

Special Investigations Units (SIUs): In cases of suspected fraud, I collaborate closely with SIUs, leveraging their expertise in identifying and documenting fraudulent claims. For example, if a claim shows suspicious patterns or inconsistencies, I would escalate it to the SIU for a more in-depth fraud investigation.

Technology: I am proficient in using various software applications for claim management, data analysis, and fraud detection. These tools enhance efficiency and help identify trends or patterns that might indicate fraud.

Q 23. How do you ensure compliance with regulatory requirements in your claims handling?

Compliance with regulatory requirements is paramount in claims handling. I ensure adherence through a multi-faceted approach.

Staying Updated: I regularly review and stay current on all applicable state and federal regulations, including those concerning privacy (like HIPAA), fair claims practices, and anti-fraud legislation. This involves attending industry conferences, reading regulatory updates, and participating in continuing education programs.

Documentation: Meticulous documentation is crucial. I maintain detailed records of every step of the claims process, ensuring all actions are compliant and defensible. This includes detailed notes from interviews, copies of all relevant documents, and clear explanations of all decisions made.

Internal Policies & Procedures: I strictly follow my company’s internal policies and procedures, which are designed to ensure compliance with all relevant regulations. This includes adhering to established timelines for investigation, communication, and payment.

Ethical Conduct: Maintaining ethical conduct is essential. I prioritize fairness and transparency in all interactions with claimants and other stakeholders. This ensures that claims are handled equitably and prevents potential conflicts of interest.

For example, if a claim involves personally identifiable information (PII), I ensure its secure storage and handling in accordance with HIPAA regulations. I regularly review my company’s policies on handling sensitive data to ensure that I am complying with the latest standards.

Q 24. What are your strengths and weaknesses as a claims adjuster?

My strengths lie in my analytical skills, attention to detail, and ability to effectively communicate with diverse individuals. I’m adept at identifying inconsistencies in information and building strong, yet objective, cases. I also pride myself on my empathy and ability to connect with claimants, even during stressful situations.

One area for improvement is delegation. While I can handle a high volume of cases independently, I’m working on becoming more efficient by identifying tasks that can be delegated to others to increase overall team productivity. This is something I actively focus on improving, and I’m seeking opportunities to refine this skill.

Q 25. How do you handle stressful situations and high-pressure deadlines?

Handling stressful situations and high-pressure deadlines is a critical aspect of this role. My approach involves a combination of effective time management, prioritization, and maintaining a calm demeanor.

Prioritization: I prioritize claims based on urgency and complexity, focusing first on time-sensitive cases or those requiring immediate attention. I use tools like task management software to track deadlines and progress.

Time Management: I utilize various time management techniques such as time blocking and the Pomodoro Technique to efficiently manage my workload. This prevents feeling overwhelmed and allows for focused work periods.

Stress Reduction: I acknowledge the pressures of the job and actively practice stress reduction techniques such as taking regular breaks, exercising, and maintaining a healthy work-life balance.

Seeking Support: When necessary, I don’t hesitate to seek support from colleagues or supervisors. Collaboration and open communication are crucial in managing complex or high-stress situations.

For example, during a period of high claim volume, I utilized time blocking to allocate specific time slots for different tasks, ensuring that I addressed urgent claims promptly while still making progress on less urgent ones.

Q 26. What are your salary expectations?

My salary expectations are in line with the industry standard for experienced claims adjusters with my qualifications and experience in this market. I’m open to discussing a competitive compensation package that reflects my contributions to the team and the value I bring to the organization.

Q 27. Why are you interested in this specific claims adjuster position?

I’m particularly drawn to this claims adjuster position because of [Company Name]’s reputation for its commitment to ethical claims handling and its innovative approach to claims management. The opportunity to contribute to a company with such a strong focus on customer satisfaction and a positive work environment is very appealing. Furthermore, the specific aspects of this role, such as [mention specific aspects like working with a certain type of claim or using specific technology], directly align with my skills and career interests.

Q 28. What are your long-term career goals in claims investigation and adjustment?

My long-term career goals involve becoming a respected leader in claims investigation and adjustment. I aspire to advance my expertise in fraud detection and prevention, potentially taking on a supervisory role where I can mentor and train others. I also envision leveraging my skills to develop and implement innovative solutions to improve the efficiency and fairness of the claims process within the company.

Key Topics to Learn for Claims Investigation and Adjustment Interview

- Investigative Techniques: Understanding various investigative methods, including interviewing witnesses, gathering evidence, and analyzing documentation. Practical application: Developing a structured approach to investigating a complex claim involving multiple parties.

- Claims Evaluation and Assessment: Mastering the process of evaluating the validity and extent of claims, considering liability, damages, and policy coverage. Practical application: Calculating appropriate indemnity payments based on policy terms and supporting documentation.

- Legal and Regulatory Compliance: Familiarity with relevant laws, regulations, and industry best practices related to claims handling. Practical application: Ensuring all investigations and claim settlements adhere to legal and ethical standards.

- Communication and Negotiation Skills: Effectively communicating with claimants, witnesses, and other stakeholders; negotiating settlements fairly and efficiently. Practical application: Successfully mediating a dispute between a claimant and an insured party.

- Documentation and Reporting: Maintaining accurate and comprehensive records of investigations and claim adjustments. Practical application: Preparing clear and concise reports summarizing findings and supporting settlement recommendations.

- Fraud Detection and Prevention: Identifying red flags and indicators of potential fraud; applying appropriate techniques to investigate and mitigate fraudulent claims. Practical application: Developing strategies to reduce the company’s exposure to fraudulent activity.

- Technology and Software Proficiency: Demonstrating proficiency with claims management software and other relevant technologies. Practical application: Utilizing claims software to track case progress, manage documentation, and generate reports efficiently.

Next Steps

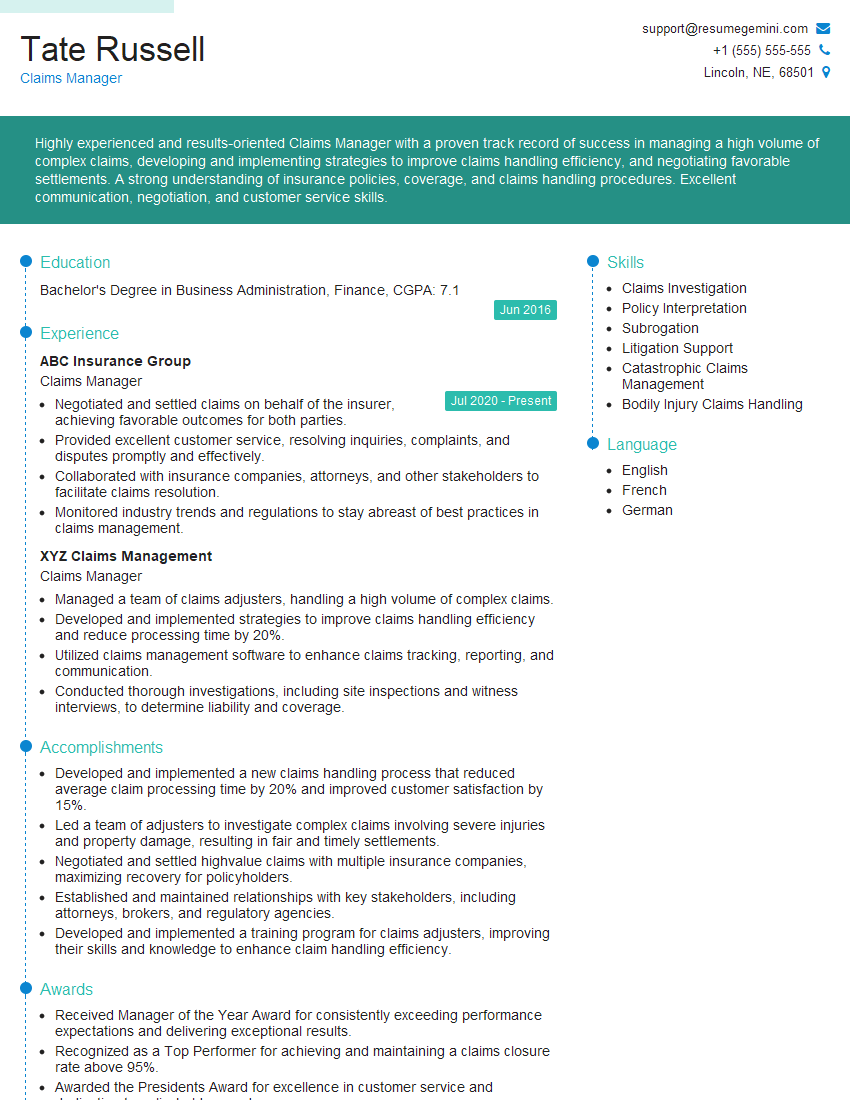

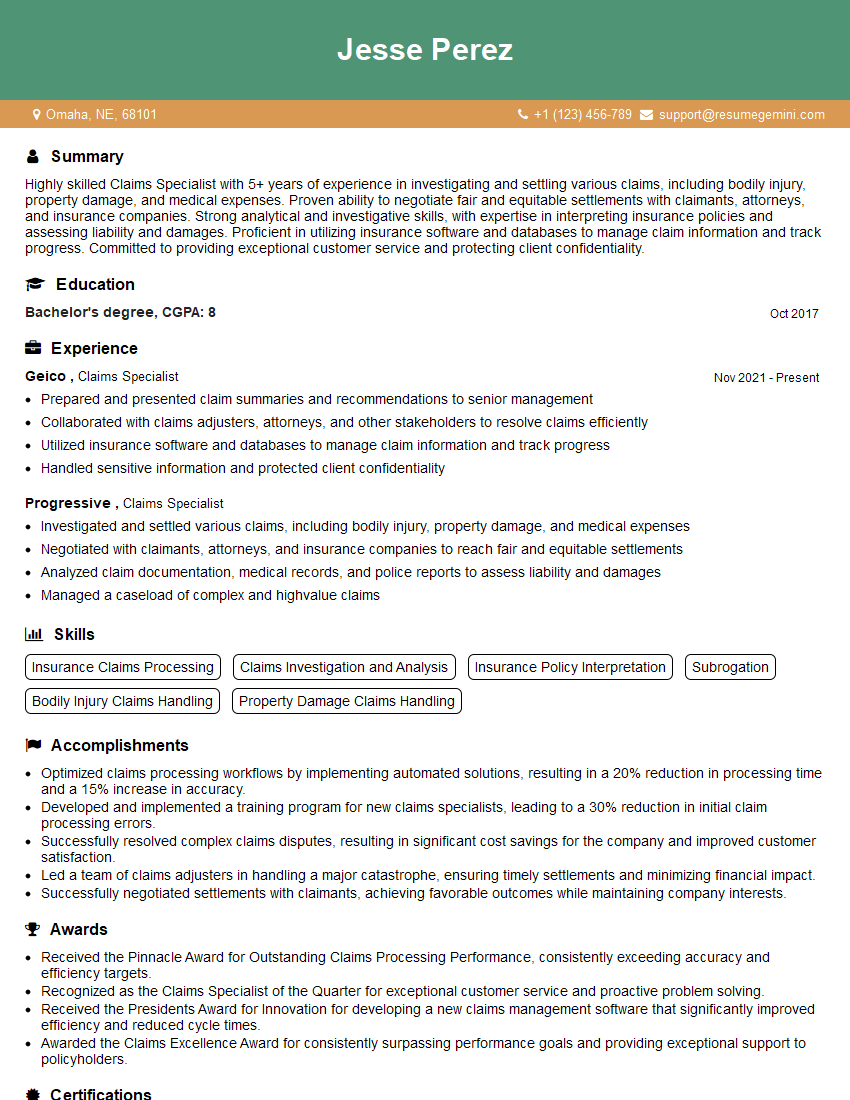

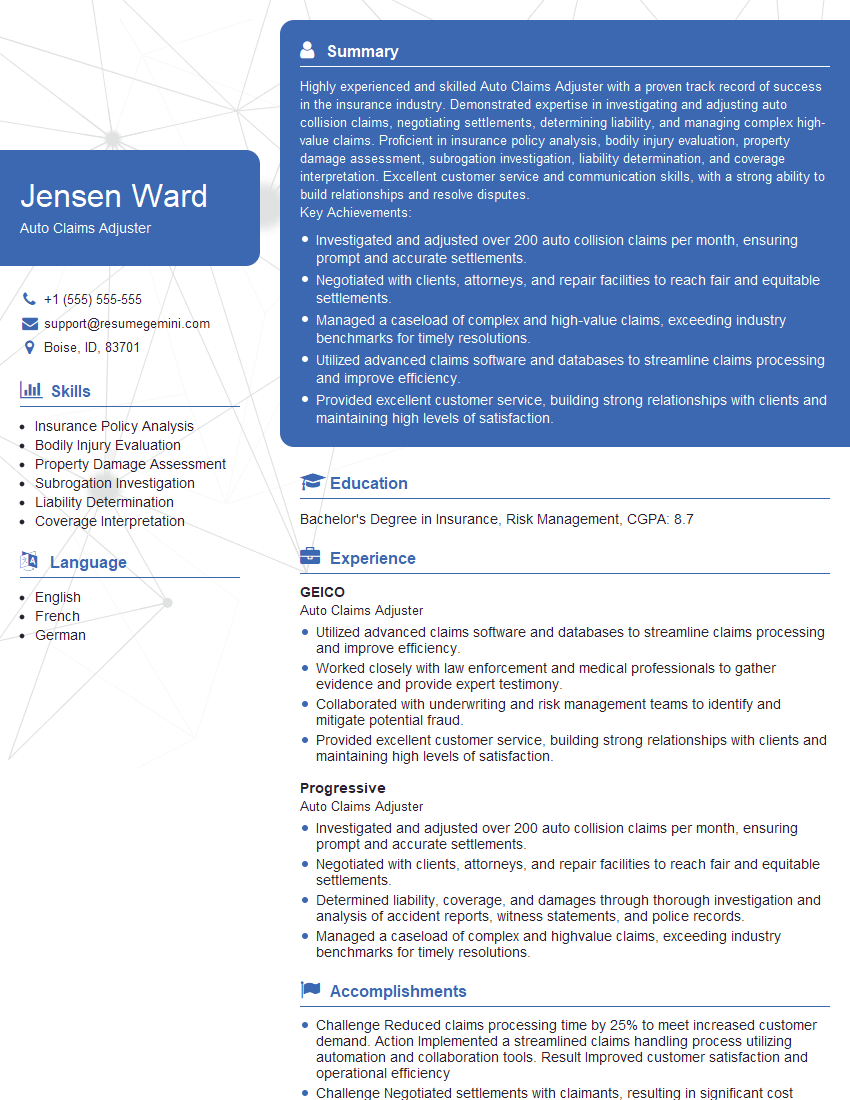

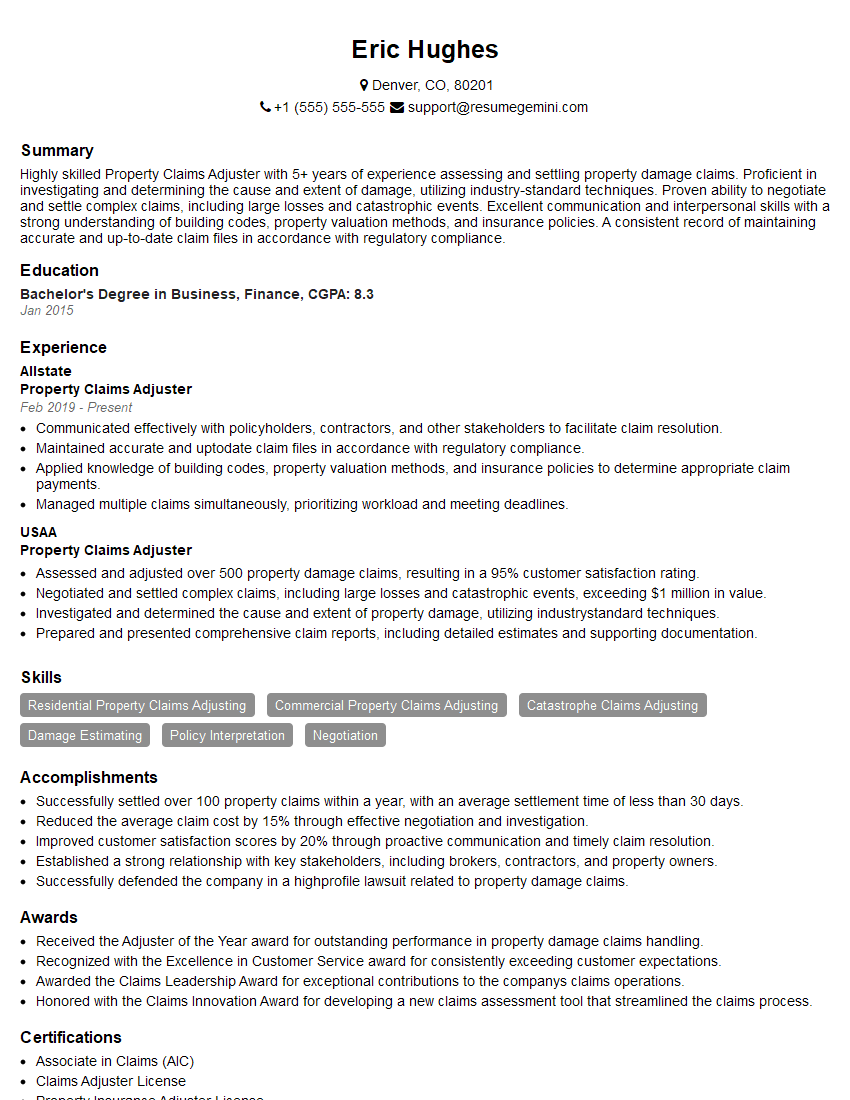

Mastering Claims Investigation and Adjustment opens doors to a rewarding career with significant growth potential. Advancement opportunities often include increased responsibility, specialized roles, and higher earning potential. To maximize your job prospects, creating a strong, ATS-friendly resume is crucial. ResumeGemini is a trusted resource that can help you build a professional resume that highlights your skills and experience effectively. Examples of resumes tailored to Claims Investigation and Adjustment are available to help guide your efforts.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

Hi, I’m Jay, we have a few potential clients that are interested in your services, thought you might be a good fit. I’d love to talk about the details, when do you have time to talk?

Best,

Jay

Founder | CEO