Preparation is the key to success in any interview. In this post, we’ll explore crucial Compliance with Regulatory Frameworks interview questions and equip you with strategies to craft impactful answers. Whether you’re a beginner or a pro, these tips will elevate your preparation.

Questions Asked in Compliance with Regulatory Frameworks Interview

Q 1. Explain your understanding of the Sarbanes-Oxley Act (SOX).

The Sarbanes-Oxley Act of 2002 (SOX) is a landmark piece of legislation designed to protect investors by improving the accuracy and reliability of corporate disclosures. It was enacted in response to major corporate accounting scandals like Enron and WorldCom. At its core, SOX aims to increase corporate responsibility and ethical conduct.

- Increased Accountability: SOX holds senior management directly accountable for the accuracy of financial reporting. CEOs and CFOs must personally certify the accuracy of financial statements.

- Enhanced Internal Controls: The Act mandates the establishment and maintenance of robust internal controls over financial reporting. This includes regular assessments of these controls and remediation of any weaknesses identified.

- Independent Audits: SOX requires independent audits of financial statements by external auditors who are registered with the Public Company Accounting Oversight Board (PCAOB). This ensures an independent assessment of a company’s financial health.

- Increased Transparency: SOX aims to promote increased transparency by requiring companies to disclose more information about their financial condition and internal controls.

Imagine it like this: SOX is a rigorous health check for a company’s financial reporting. It ensures regular check-ups, independent verification, and clear reporting to ensure everything is functioning as it should be. A failure to comply can lead to significant financial penalties and reputational damage.

Q 2. Describe your experience with HIPAA compliance.

My experience with HIPAA compliance spans several years and includes developing and implementing HIPAA compliant systems for various healthcare organizations. I have hands-on experience with risk assessments, policy development, employee training, and breach response planning. I’ve worked with both covered entities and business associates, ensuring compliance with all relevant regulations. This includes:

- Risk Assessment and Mitigation: Conducting thorough risk assessments to identify potential vulnerabilities related to Protected Health Information (PHI) and implementing controls to mitigate those risks.

- Policy Development and Implementation: Creating and implementing policies and procedures that align with HIPAA’s security, privacy, and breach notification rules.

- Employee Training: Developing and delivering HIPAA training programs to ensure that all employees understand their responsibilities related to PHI protection.

- Vendor Management: Managing relationships with business associates to ensure they also comply with HIPAA’s requirements through Business Associate Agreements (BAAs).

- Incident Response: Developing and implementing incident response plans to handle potential breaches of PHI, which includes following proper reporting and notification procedures.

For example, in a recent project, I assisted a healthcare provider in updating their security policies to address vulnerabilities discovered during a security audit. This involved implementing stronger access controls, encryption protocols, and employee training programs. The successful implementation of these measures ensured the organization’s continued HIPAA compliance.

Q 3. What is the purpose of the General Data Protection Regulation (GDPR)?

The General Data Protection Regulation (GDPR) is a comprehensive data privacy regulation in the European Union (EU) and the European Economic Area (EEA). Its primary purpose is to give individuals more control over their personal data and to harmonize data protection laws across the EU.

- Data Protection by Design and Default: Organizations must incorporate data protection principles from the outset of any project that processes personal data.

- Individual Rights: GDPR grants individuals several key rights regarding their personal data, including the right to access, rectification, erasure (“right to be forgotten”), restriction of processing, data portability, and the right to object.

- Data Breaches: Organizations must report data breaches to the relevant authorities within 72 hours of becoming aware of them.

- Accountability: Organizations are responsible for demonstrating compliance with GDPR. This often involves maintaining detailed records of data processing activities.

- Cross-border Data Transfers: Strict rules govern the transfer of personal data outside the EU/EEA.

Think of GDPR as a fundamental right for individuals to control their personal information. It empowers individuals and sets a high standard for organizations handling personal data, regardless of their location if they target EU citizens.

Q 4. How familiar are you with the California Consumer Privacy Act (CCPA)?

I am very familiar with the California Consumer Privacy Act (CCPA), a state-level data privacy law in California. It grants California residents significant rights over their personal information. My understanding encompasses:

- Right to Know: Consumers have the right to request information about what personal information a business collects, uses, and shares.

- Right to Delete: Consumers can request that a business delete their personal information.

- Right to Opt-Out: Consumers can opt-out of the sale of their personal information.

- Right to Non-Discrimination: Businesses cannot discriminate against consumers for exercising their CCPA rights.

- Privacy Policy Requirements: Businesses must provide clear and conspicuous privacy policies that detail their data practices.

The CCPA shares similarities with GDPR but operates within a state-level context. Understanding its requirements is crucial for businesses operating in California or handling data of California residents. For example, I have assisted several clients in developing CCPA-compliant privacy policies and responding to consumer data requests, navigating the complexities of defining ‘personal information’ and ‘sale’ within the context of the law.

Q 5. Explain your understanding of anti-money laundering (AML) regulations.

Anti-Money Laundering (AML) regulations are designed to prevent the movement and use of illegally obtained funds. These regulations impose obligations on financial institutions and other designated businesses to identify and report suspicious activity. Key aspects include:

- Customer Due Diligence (CDD): Verifying the identity of customers and maintaining accurate records.

- Suspicious Activity Reporting (SAR): Reporting transactions that appear suspicious or may be related to money laundering or terrorist financing.

- Transaction Monitoring: Tracking transactions for unusual patterns or high-risk activities.

- Sanctions Screening: Checking customers and transactions against sanctions lists maintained by various governments and international organizations.

- Record Keeping: Maintaining detailed records of customer information and transactions.

AML compliance is critical for preventing financial crime and maintaining the integrity of the financial system. Failure to comply can result in substantial fines and other penalties. Imagine AML regulations as a security system for the financial world, detecting and preventing the flow of illicit funds.

Q 6. Describe your experience conducting compliance audits.

I have extensive experience conducting compliance audits across various regulatory frameworks, including SOX, HIPAA, GDPR, and CCPA. My approach is methodical and risk-based. It typically involves:

- Planning and Scoping: Defining the scope of the audit, identifying key areas of risk, and developing an audit plan.

- Data Collection: Gathering relevant documentation, interviewing personnel, and performing testing procedures.

- Analysis and Evaluation: Analyzing the collected data to identify areas of compliance and non-compliance.

- Reporting: Preparing a comprehensive audit report that summarizes findings and recommendations.

- Follow-up: Following up on identified deficiencies to ensure that corrective actions are taken.

For example, I recently conducted a SOX compliance audit for a publicly traded company. This involved reviewing the company’s internal controls over financial reporting, testing the effectiveness of these controls, and issuing a report to management detailing any identified weaknesses. The audit helped the company strengthen its internal controls and improve its financial reporting accuracy.

Q 7. How do you identify and assess compliance risks?

Identifying and assessing compliance risks requires a proactive and systematic approach. I use a risk-based framework that involves:

- Identifying potential risks: This involves reviewing applicable regulations, industry best practices, and internal processes to pinpoint potential areas of vulnerability.

- Analyzing the likelihood and impact: For each identified risk, I assess the likelihood of a compliance failure and the potential impact if it were to occur.

- Prioritizing risks: Risks are prioritized based on their likelihood and potential impact, with high-priority risks addressed first.

- Developing mitigation strategies: For each prioritized risk, I develop strategies to mitigate the potential for a compliance failure. This could involve implementing new controls, enhancing existing controls, or providing additional training.

- Monitoring and reviewing: The effectiveness of the mitigation strategies is regularly monitored and reviewed, and the risk assessment process is repeated periodically to ensure that it remains relevant.

Imagine it like a building inspection: you systematically check for potential hazards (risks), assess their severity (likelihood and impact), prioritize repairs (mitigation), and schedule regular inspections to prevent future issues (monitoring). This ensures the building (your organization) is safe and compliant.

Q 8. What is your approach to developing and implementing a compliance program?

Developing and implementing a robust compliance program is a multifaceted process that begins with a thorough risk assessment. Think of it like building a house – you wouldn’t start constructing walls without a solid foundation and blueprint. My approach involves these key steps:

- Risk Assessment: Identifying potential compliance risks across all areas of the organization. This includes analyzing applicable regulations (e.g., GDPR, HIPAA, SOX), evaluating internal processes, and considering external factors. For example, a financial institution would assess risks related to anti-money laundering (AML) regulations, while a healthcare provider would focus on HIPAA compliance regarding patient data.

- Policy Development: Creating clear, concise, and accessible policies and procedures that align with identified risks and regulatory requirements. These policies should be regularly reviewed and updated to reflect changes in the legal landscape.

- Training and Awareness: Educating employees at all levels on compliance policies and procedures through interactive training programs, regular updates, and easily accessible resources. This ensures everyone understands their responsibilities and the consequences of non-compliance.

- Implementation and Monitoring: Putting policies into practice and establishing a system for ongoing monitoring and auditing. This involves regular checks, internal audits, and potentially external audits to ensure continuous compliance.

- Reporting and Remediation: Establishing a process for identifying, reporting, and addressing any compliance issues that arise. This may involve internal investigations, corrective actions, and potentially reporting to regulatory bodies.

- Continuous Improvement: Regularly reviewing and updating the compliance program based on lessons learned, changes in regulations, and best practices. This iterative approach ensures the program remains effective and relevant.

This structured approach ensures a proactive and effective compliance program, reducing the risk of penalties and reputational damage.

Q 9. Explain your experience with internal controls and their role in compliance.

Internal controls are the backbone of a strong compliance program. They are the processes, policies, and procedures designed to mitigate risks and ensure that business operations are conducted in accordance with laws, regulations, and ethical standards. My experience spans various industries, where I’ve designed and implemented internal controls encompassing:

- Financial Controls: These ensure the accuracy and reliability of financial reporting, preventing fraud and misappropriation of assets. For instance, implementing segregation of duties, regular bank reconciliations, and robust authorization processes.

- Operational Controls: These focus on the efficiency and effectiveness of business processes. Examples include inventory management systems to prevent stock loss, quality control measures to ensure product safety, and IT security protocols to protect data.

- Compliance Controls: These are specifically designed to ensure adherence to relevant laws and regulations. This can involve implementing KYC (Know Your Customer) procedures for financial institutions, data breach response plans for organizations handling sensitive data, and whistleblower hotlines to encourage ethical reporting.

The effectiveness of these controls is regularly tested through audits and reviews, allowing for continuous improvement and adaptation. A key aspect of my approach is to ensure controls are integrated into the daily operations of the business, making them a natural part of the workflow, not an afterthought.

Q 10. How do you stay updated on changes in relevant regulations?

Staying abreast of changes in regulations requires a proactive and multi-pronged approach. It’s not a one-time effort; it’s an ongoing commitment. My strategies include:

- Subscription to Regulatory Updates: I subscribe to newsletters, legal databases, and professional organizations focused on relevant regulatory areas. This provides timely alerts on significant changes and updates.

- Monitoring Government Websites: Regularly checking websites of relevant regulatory bodies for new legislation, guidance, and enforcement actions.

- Networking and Professional Development: Attending industry conferences, webinars, and workshops to learn from experts and share best practices. Discussions with peers often reveal challenges and insights not found in official publications.

- Utilizing Legal Counsel: Consulting with legal professionals specialized in relevant compliance areas to gain expert advice and interpretation of complex regulations. They often provide early warnings of impending changes.

By combining these approaches, I can ensure my knowledge remains current and that our compliance program adapts to the evolving regulatory landscape.

Q 11. Describe a time you identified a compliance issue. What actions did you take?

In a previous role, during an internal audit, we discovered a discrepancy in our data security protocols. Specifically, a significant amount of sensitive customer data was stored on a shared network drive without adequate encryption or access controls. This violated several data privacy regulations. My immediate actions were:

- Immediate Remediation: We immediately restricted access to the shared drive and initiated the process of migrating the data to a more secure, encrypted environment.

- Root Cause Analysis: We conducted a thorough investigation to understand how this vulnerability occurred. This involved reviewing existing policies, employee training records, and system configurations.

- Gap Analysis: We identified gaps in our data security policies and procedures, including shortcomings in employee training and the lack of regular security audits.

- Policy Updates: We revised our data security policies and procedures to address the identified vulnerabilities. This included implementing stronger access controls, mandatory encryption of sensitive data, and additional employee training.

- Incident Reporting: We reported the incident to relevant stakeholders, including senior management and, where appropriate, regulatory bodies.

- Follow-up Audits: We conducted follow-up audits to verify that the corrective actions were implemented effectively and that the vulnerability had been fully mitigated.

This experience highlighted the critical importance of proactive risk management, thorough internal audits, and a robust incident response plan.

Q 12. How do you handle conflicts between business objectives and regulatory requirements?

Conflicts between business objectives and regulatory requirements are inevitable. The key is to find a balance that allows the business to achieve its goals while remaining compliant. My approach involves:

- Open Communication: Facilitating open dialogue between the business units and the compliance team to understand the business objectives and identify potential conflicts with regulatory requirements.

- Creative Solutions: Exploring alternative approaches and solutions that meet both business objectives and regulatory requirements. This may involve adjusting timelines, modifying processes, or seeking regulatory clarifications.

- Prioritization: Prioritizing compliance risks and focusing on the most critical areas. This requires a risk-based approach, prioritizing actions that mitigate the most significant potential risks.

- Documentation: Documenting the decision-making process, including the reasons for choosing a specific course of action. This helps demonstrate due diligence and accountability.

- Escalation: Escalating unresolved conflicts to senior management for decision-making and oversight. This provides a framework for resolving difficult situations.

It’s important to remember that compliance is not an obstacle to business success; it’s an integral part of sustainable growth and long-term viability.

Q 13. What is your experience with regulatory reporting and documentation?

Regulatory reporting and documentation are crucial for demonstrating compliance. My experience encompasses a range of reporting requirements, including:

- Financial Reporting: Preparing and submitting accurate and timely financial statements in accordance with Generally Accepted Accounting Principles (GAAP) and relevant regulations.

- Compliance Reports: Generating regular reports to track compliance with specific regulations, such as those related to data privacy, anti-money laundering, or environmental protection. These reports often highlight metrics, trends, and potential issues.

- Audit Support: Providing detailed documentation and support to internal and external auditors to facilitate efficient and effective audits.

- Regulatory Filings: Preparing and submitting regulatory filings, such as those required for licensing, permits, or notifications.

I utilize various technologies, including specialized software and databases, to streamline the reporting and documentation process, ensuring accuracy and efficiency. Proper record-keeping is paramount, and a clear archival system is critical for easy retrieval of information when needed.

Q 14. Explain your understanding of data security and its importance in compliance.

Data security is paramount for compliance. It’s not just about protecting sensitive information; it’s about ensuring business continuity and avoiding significant legal and reputational risks. My understanding encompasses:

- Data Classification: Categorizing data based on its sensitivity, enabling appropriate security controls to be implemented. This includes identifying Personally Identifiable Information (PII) and other protected data.

- Access Controls: Implementing robust access control measures to restrict access to sensitive data to authorized personnel only. This includes implementing role-based access control (RBAC).

- Encryption: Utilizing encryption techniques to protect data both in transit and at rest. This is crucial for safeguarding data from unauthorized access, even if a breach occurs.

- Data Loss Prevention (DLP): Implementing DLP measures to prevent sensitive data from leaving the organization’s control without authorization.

- Incident Response: Developing and implementing a comprehensive incident response plan to address data breaches or security incidents effectively and efficiently. This involves clear steps for containment, investigation, remediation, and reporting.

Compliance with data security regulations, such as GDPR and CCPA, is crucial. Failure to adequately protect data can result in significant fines, legal actions, and reputational harm. A proactive and comprehensive approach to data security is essential for any organization.

Q 15. How would you respond to a regulatory inquiry or audit?

Responding to a regulatory inquiry or audit requires a proactive and organized approach. It’s not about reacting defensively, but demonstrating transparency and cooperation. My first step would be to assemble a comprehensive response team, including legal counsel if necessary. We’d then meticulously gather all relevant documentation, ensuring its accuracy and completeness. This includes policies, procedures, transaction records, and employee communications. We’d analyze the inquiry or audit’s scope to identify specific areas of focus and prioritize our response accordingly. The goal is to provide clear, concise, and factual information promptly, addressing all questions directly and thoroughly. If there are any discrepancies or gaps in information, we’d openly acknowledge them and outline the steps we are taking to rectify the situation. For example, if an audit reveals a deficiency in our data security protocols, we’d detail the steps we are taking to implement stronger controls and prevent future occurrences. This collaborative and transparent approach fosters trust and builds confidence with the regulatory body.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. Describe your experience working with external auditors.

I have extensive experience collaborating with external auditors across various engagements. This involves facilitating access to necessary information, answering their questions comprehensively, and providing them with a thorough understanding of our compliance programs. I’ve worked with both internal and external audit teams. In one instance, we were undergoing a SOC 2 Type II audit. To ensure a smooth process, I developed a detailed project plan mapping out timelines, key deliverables, and responsibilities. This involved coordinating with different teams within the organization to gather evidence and ensure that all audit requirements were met promptly. We implemented a centralized document repository to streamline information sharing and reduce response times. This proactive approach resulted in a successful audit completion within the scheduled timeframe and without any significant findings. Building a strong working relationship with auditors is key; open communication and proactive collaboration are crucial to achieving a successful outcome.

Q 17. What is your experience with risk assessments and mitigation strategies?

Risk assessments are fundamental to a robust compliance program. My experience includes conducting both qualitative and quantitative risk assessments, identifying vulnerabilities, and developing mitigation strategies. For instance, in a previous role, we conducted a thorough risk assessment focusing on data privacy, identifying potential threats like unauthorized access or data breaches. This involved analyzing our systems, processes, and employee practices. We then prioritized the identified risks based on their likelihood and potential impact, focusing on the highest-priority vulnerabilities first. Our mitigation strategies included implementing multi-factor authentication, strengthening access controls, and enhancing employee training on data security best practices. We also established a regular review process to update the risk assessment and mitigation strategies as our business evolves and new threats emerge. Regular monitoring and evaluation are essential to ensure the effectiveness of these strategies and to adapt to changing circumstances.

Q 18. How do you ensure compliance with industry-specific regulations?

Ensuring compliance with industry-specific regulations requires a multifaceted approach. It starts with a deep understanding of the relevant laws and regulations, whether it’s HIPAA for healthcare, PCI DSS for payment card processing, or GDPR for data protection. We then translate these regulations into actionable policies and procedures, ensuring that they are clearly communicated and understood by all employees. This often involves creating internal control frameworks, implementing regular compliance monitoring and testing, and staying abreast of any changes or updates to the regulations. For example, when GDPR came into effect, we implemented a comprehensive data privacy program, updating our policies, providing employee training, and establishing a process for handling data subject requests. Regular internal audits and compliance reviews are crucial to identify any gaps and address them promptly. Proactive monitoring and adapting to regulatory changes are vital to maintaining a consistent state of compliance.

Q 19. Explain your knowledge of whistleblower protection programs.

Whistleblower protection programs are critical for fostering a culture of ethical conduct and compliance. These programs provide a confidential channel for employees to report potential violations without fear of retaliation. A strong program includes clearly defined reporting procedures, guaranteed confidentiality, and a robust investigation process. It’s vital that employees understand the program’s scope, how to report concerns, and what protections are in place. In my experience, I’ve helped design and implement such programs, ensuring they align with relevant legal requirements and best practices. This includes creating a confidential reporting hotline, developing an independent investigation process, and providing regular training to employees on the program’s guidelines. A successful program requires trust and transparency, ensuring employees feel comfortable reporting potential misconduct without fear of repercussions.

Q 20. Describe your experience with employee training on compliance matters.

Effective employee training on compliance matters is paramount. It’s not enough to simply provide a policy manual; training needs to be interactive, engaging, and tailored to the specific roles and responsibilities of the employees. My approach includes using a variety of methods such as online modules, interactive workshops, and role-playing exercises. For instance, when training employees on data security, we use simulated phishing attacks to show them how to identify and respond to such threats effectively. We also conduct regular refresher training to ensure that employees stay updated on the latest compliance requirements and best practices. The training is documented, and employee acknowledgment of understanding is obtained. This proactive approach helps to create a culture of compliance, minimizes risks, and demonstrates a commitment to upholding regulatory standards. Tracking the completion and effectiveness of the training is also essential.

Q 21. How familiar are you with the Foreign Corrupt Practices Act (FCPA)?

The Foreign Corrupt Practices Act (FCPA) prohibits U.S. companies and individuals from bribing foreign officials to obtain or retain business. My understanding of the FCPA extends to its key provisions, including the anti-bribery and accounting provisions. I am familiar with the nuances of the act, such as the definition of a ‘foreign official’ and the types of payments that constitute a bribe. I know that the FCPA has extraterritorial reach, meaning it applies to actions taken outside the United States by U.S. companies or individuals. We must have robust internal controls and compliance programs to prevent violations. These programs often include risk assessments, code of conduct policies, rigorous due diligence procedures, and employee training. For example, we would implement a rigorous vetting process for all international business transactions and ensure all employees understand the potential legal ramifications of violating the FCPA. Compliance with the FCPA necessitates a proactive and comprehensive approach, including regular reviews and updates to ensure the effectiveness of our controls.

Q 22. What metrics do you use to measure the effectiveness of a compliance program?

Measuring the effectiveness of a compliance program requires a multi-faceted approach, going beyond simply tracking the number of violations. We need to assess the program’s design, implementation, and overall impact. Key metrics I use fall into these categories:

- Violation Rate: This tracks the number of compliance violations detected per employee or per transaction. A decreasing trend indicates improvement, while a rising trend signals potential weaknesses in the program. For example, a consistent high rate of data privacy breaches might indicate inadequate training or insufficient security measures.

- Time to Remediation: This measures the time taken to identify and resolve a compliance violation. A shorter timeframe suggests a responsive and efficient program. Delays can indicate inefficiencies in processes or a lack of resources.

- Employee Training Completion Rates: High completion rates indicate effective training delivery and employee engagement. I often track not just completion, but also test scores to assess understanding.

- Risk Assessment Accuracy: Regularly reviewing and updating the risk assessment process is crucial. Metrics should track the accuracy of risk identification and the effectiveness of mitigation strategies. For instance, if a previously low-risk area experiences a high number of violations, it highlights the need to re-assess and strengthen the controls.

- Audit Findings: Internal and external audits provide valuable insights. Tracking the number and severity of audit findings over time allows for continuous improvement.

- Employee Feedback: Surveys and feedback mechanisms offer valuable insights into employees’ understanding and perceptions of the compliance program. Regular feedback helps identify areas needing improvement and promotes employee buy-in.

By monitoring these metrics and analyzing trends, we can identify areas of strength and weakness and adjust the compliance program accordingly. It’s not just about the numbers; it’s about using data to drive improvements and ensure ongoing effectiveness.

Q 23. Describe your experience with implementing and managing a compliance management system (CMS).

In my previous role, I was instrumental in implementing and managing a comprehensive Compliance Management System (CMS). We utilized a software solution that integrated various compliance-related functions, including policy management, risk assessment, training, and audit tracking.

The implementation involved several key steps:

- Needs Assessment: We identified all relevant regulations and internal policies that needed to be addressed.

- System Selection and Configuration: We chose a software solution that could effectively manage all compliance requirements. This included customizing workflows, user roles, and reporting features.

- Policy Development and Documentation: We developed and updated relevant policies, ensuring alignment with regulatory requirements and best practices.

- User Training and Adoption: We provided thorough training to all users, addressing how to use the system effectively and reinforcing the importance of compliance.

- Ongoing Monitoring and Maintenance: We established a process for ongoing monitoring, including regular system updates, policy reviews, and performance tracking.

The CMS proved to be invaluable in streamlining our compliance efforts. It enabled centralized policy management, automated workflows, improved reporting and visibility, and minimized manual efforts. It also facilitated more efficient audit preparation by providing readily available documentation and audit trails.

Q 24. How do you communicate compliance requirements to different stakeholders?

Effective communication of compliance requirements is critical, and it needs to be tailored to different stakeholders. I employ a multi-pronged approach:

- Senior Management: I use concise executive summaries and reports focusing on high-level risks and the overall effectiveness of the compliance program. They need information quickly, and it must be clearly aligned with business objectives.

- Middle Management: I provide detailed information, including specific compliance requirements, responsibilities, and key performance indicators. Training materials and regular updates are key here.

- Employees: Communication should be clear, concise, and accessible. Interactive training modules, videos, and easily understandable policy documents are essential. Using plain language and avoiding jargon is crucial.

- External Stakeholders: Communication needs to comply with relevant regulations and industry standards. This may involve providing reports to regulators or collaborating with external auditors.

Regardless of the audience, consistency, clarity, and accessibility are key. I always ensure that communication channels are open and readily available for questions and clarification. A feedback mechanism allows me to adapt my communications to better address stakeholder needs.

Q 25. How do you prioritize compliance activities in a fast-paced environment?

Prioritizing compliance activities in a fast-paced environment requires a structured approach. I typically use a risk-based prioritization method:

- Risk Assessment: I conduct a thorough risk assessment, identifying potential compliance violations and their associated likelihood and impact. This might involve reviewing existing compliance metrics, consulting with subject matter experts, or employing risk assessment software.

- Impact Analysis: I determine the potential impact of each identified risk on the organization, considering financial implications, reputational damage, and legal penalties.

- Prioritization Matrix: I use a matrix to visually prioritize activities based on their risk level. For example, high-impact, high-likelihood risks receive immediate attention. Low-impact, low-likelihood risks might be addressed later or delegated.

- Resource Allocation: I allocate resources effectively, assigning the right personnel to critical tasks based on their expertise and experience.

- Regular Review and Adjustment: I regularly review the priority list, adjusting it based on new information, changing circumstances, or emerging risks. This ensures that compliance efforts remain aligned with the evolving needs of the business.

This method ensures that critical compliance activities are handled swiftly and effectively, even amidst the pressures of a fast-paced environment. It’s not about doing everything at once, but about focusing on the most important tasks first.

Q 26. Describe your experience with remediation of compliance violations.

Remediating compliance violations requires a systematic and thorough approach. My process typically involves these steps:

- Investigation: Thoroughly investigate the violation to determine its root cause, scope, and impact. This may involve interviewing employees, reviewing documents, and analyzing data.

- Corrective Actions: Develop and implement corrective actions to address the root cause of the violation and prevent its recurrence. This might include enhanced training, process improvements, or system upgrades.

- Documentation: Meticulously document all aspects of the remediation process, including the investigation findings, corrective actions taken, and any follow-up activities. This documentation helps prevent future violations and supports audit trails.

- Monitoring and Follow-up: Monitor the effectiveness of the corrective actions implemented and conduct regular follow-up to ensure the issue is resolved and does not recur. This might involve reviewing key performance indicators or conducting periodic audits.

- Reporting: Report the violation and the remediation process to relevant stakeholders, including senior management and regulatory bodies as required.

For example, if a data breach occurred due to inadequate password security, remediation would involve implementing stronger password policies, providing additional employee training on password security best practices, and potentially upgrading security systems.

Q 27. What is your understanding of the role of ethics and compliance?

Ethics and compliance are inextricably linked. A strong ethical culture is the bedrock of a successful compliance program. Compliance focuses on adhering to rules and regulations, while ethics focuses on acting with integrity and doing what is right, even when not legally mandated. A robust compliance program fosters an ethical culture, and an ethical culture supports adherence to compliance.

The role of ethics and compliance is to:

- Promote Integrity: Establish a culture of integrity and accountability within the organization.

- Mitigate Risk: Reduce legal and financial risks associated with non-compliance.

- Enhance Reputation: Protect and enhance the organization’s reputation and brand image.

- Improve Decision-Making: Provide guidance and frameworks for ethical decision-making.

- Build Trust: Foster trust with customers, partners, and stakeholders.

When ethics and compliance are integrated effectively, it creates a culture where employees are empowered to do the right thing, leading to better decision-making, improved operational efficiency, and enhanced organizational success.

Q 28. How would you address a situation where a colleague is not following compliance procedures?

Addressing a situation where a colleague isn’t following compliance procedures requires a careful and sensitive approach. I would follow these steps:

- Private Conversation: I would start by having a private conversation with my colleague, expressing my concerns and explaining why compliance is important. I would focus on understanding their perspective and identifying any underlying reasons for their non-compliance.

- Education and Training: If the issue stems from a lack of knowledge or understanding, I would provide additional education and training to clarify the requirements. I’d make sure they understand not just the ‘what’ but the ‘why’ behind the compliance procedures.

- Documentation: If the issue persists or is more serious, I would document the situation. This documentation protects both the organization and the individual involved. It forms a clear record of events and actions taken.

- Reporting to Supervisor: If my attempts to resolve the issue informally are unsuccessful, I would report the matter to my supervisor or a designated compliance officer. This ensures the issue is handled appropriately and consistently with the company’s policies.

- Company Policy and Procedures: I would work within the company’s existing policies and procedures when addressing the non-compliance.

The goal is not to punish, but to correct the behavior and ensure compliance. This approach balances protecting the organization with supporting the individual, fostering a culture of compliance and learning.

Key Topics to Learn for Compliance with Regulatory Frameworks Interview

- Regulatory Landscape: Understanding the key regulatory bodies and frameworks relevant to your target industry (e.g., SEC, GDPR, HIPAA). This includes knowing the history and evolution of these frameworks.

- Risk Assessment & Management: Applying risk assessment methodologies to identify, analyze, and mitigate compliance risks. Practical application involves developing and implementing risk mitigation strategies.

- Internal Controls & Procedures: Designing and implementing effective internal controls to ensure compliance. This includes understanding the importance of documentation and audit trails.

- Policy & Procedure Development: Creating and maintaining clear, concise, and easily understood compliance policies and procedures. Practical application involves drafting, revising, and disseminating policies.

- Compliance Monitoring & Auditing: Conducting regular compliance monitoring and audits to identify potential issues and ensure ongoing adherence to regulations. This includes understanding audit methodologies and reporting.

- Data Privacy & Security: Understanding and implementing data privacy and security measures in compliance with relevant regulations (e.g., GDPR, CCPA). Practical application involves data breach response planning.

- Investigations & Remediation: Conducting internal investigations of potential compliance violations and implementing effective remediation strategies. This includes understanding disciplinary procedures.

- Reporting & Disclosure: Understanding the requirements for reporting compliance-related issues to regulatory bodies and stakeholders. This includes accurate and timely reporting.

- Ethical Considerations: Applying ethical principles to compliance decision-making and navigating ethical dilemmas in a regulatory environment.

Next Steps

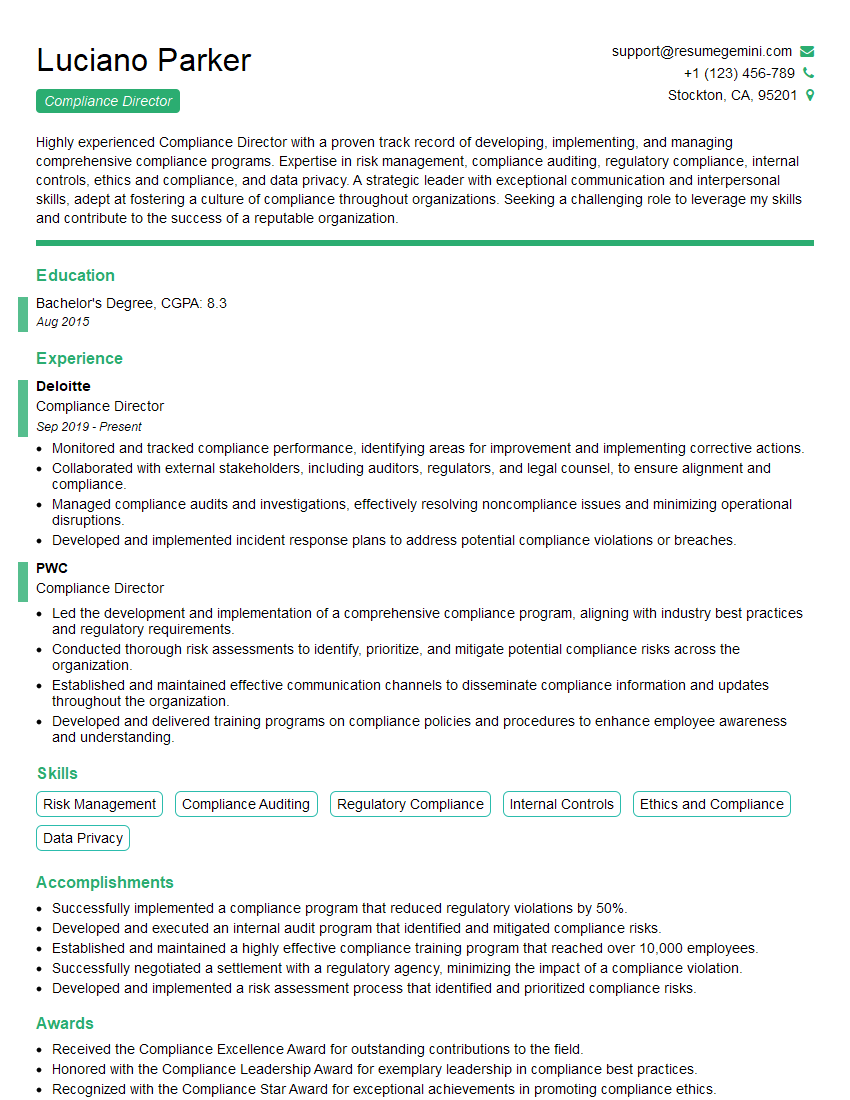

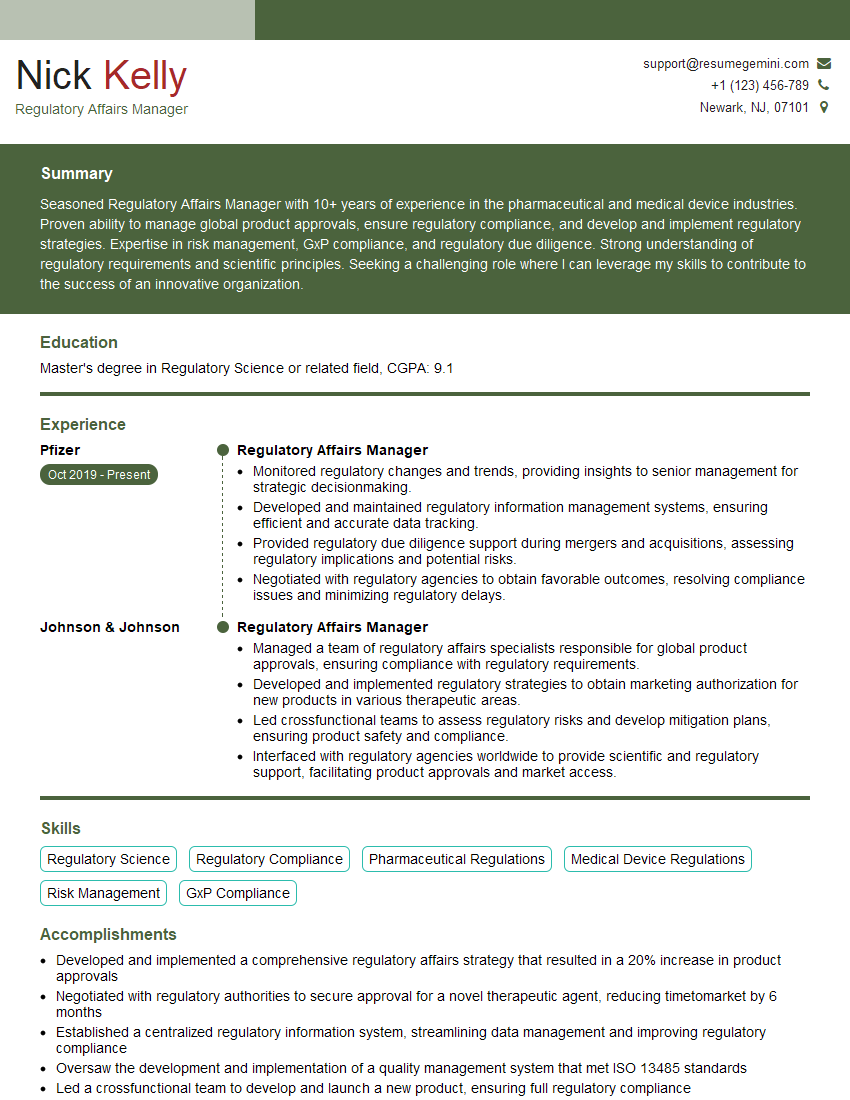

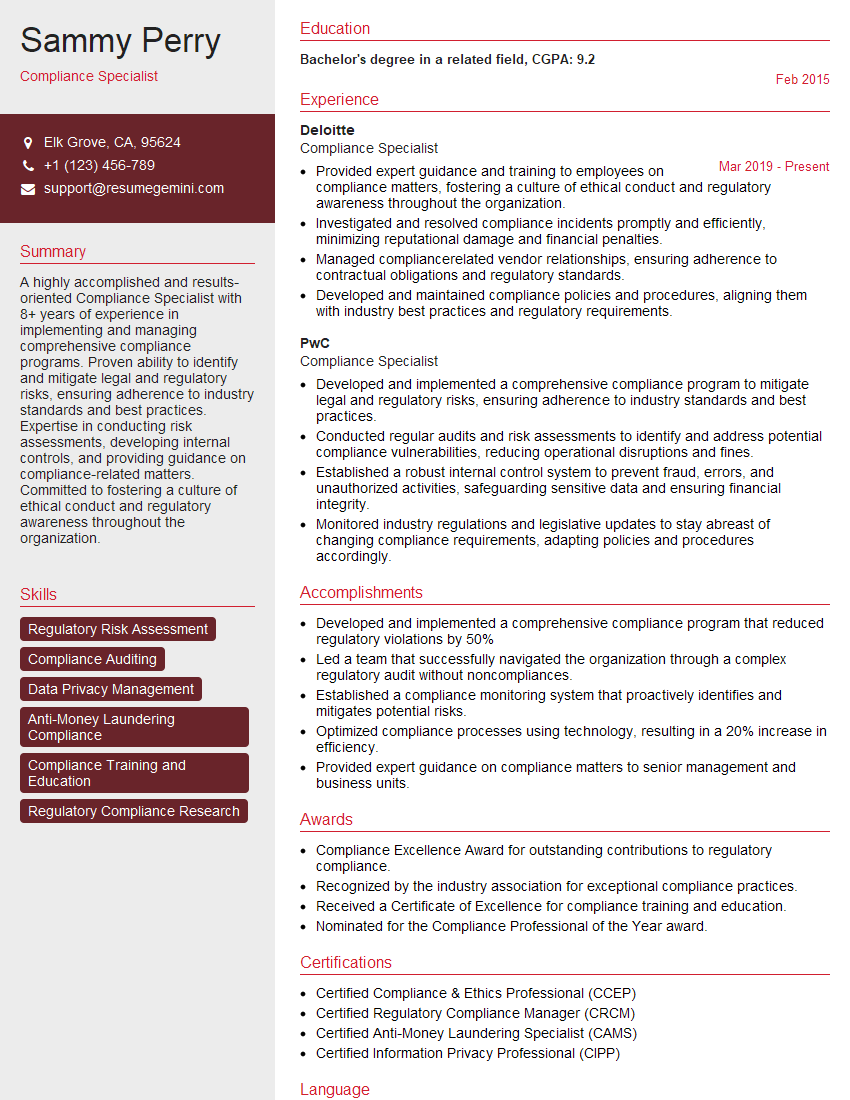

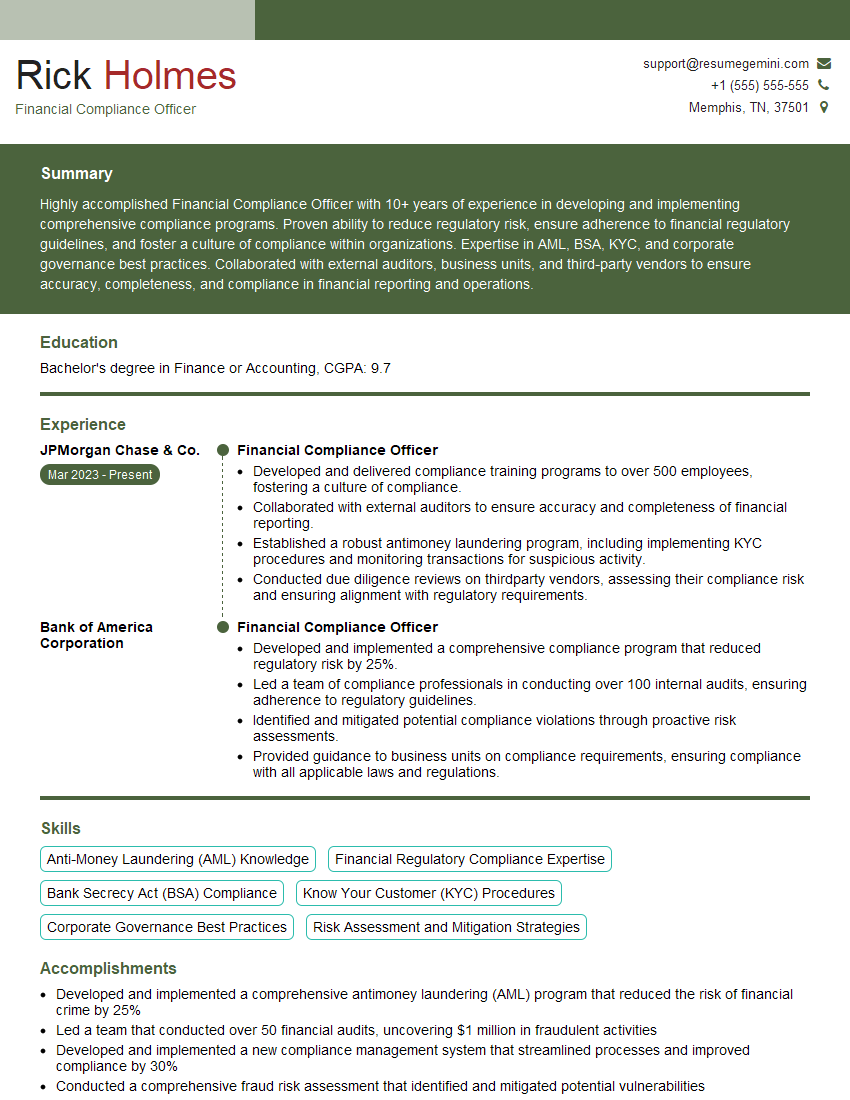

Mastering Compliance with Regulatory Frameworks is crucial for career advancement in today’s increasingly regulated business world. A strong understanding of these principles demonstrates your commitment to ethical practices and risk mitigation, making you a highly valuable asset to any organization. To maximize your job prospects, focus on building an ATS-friendly resume that highlights your relevant skills and experience. ResumeGemini is a trusted resource that can help you create a professional and impactful resume. They provide examples of resumes tailored to Compliance with Regulatory Frameworks to guide you in crafting your own compelling application materials.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

Hi, I’m Jay, we have a few potential clients that are interested in your services, thought you might be a good fit. I’d love to talk about the details, when do you have time to talk?

Best,

Jay

Founder | CEO