Interviews are opportunities to demonstrate your expertise, and this guide is here to help you shine. Explore the essential Customer Lifetime Value (CLTV) interview questions that employers frequently ask, paired with strategies for crafting responses that set you apart from the competition.

Questions Asked in Customer Lifetime Value (CLTV) Interview

Q 1. Define Customer Lifetime Value (CLTV).

Customer Lifetime Value (CLTV) is a prediction of the net profit attributed to the entire future relationship with a customer.

Think of it like this: Imagine you own a coffee shop. CLTV helps you figure out how much profit you’ll make from each customer over their entire time visiting your shop, from their first latte to their last.

It’s not just about how much they spend on a single visit, but the total revenue they generate, minus the costs associated with acquiring and servicing them, over their entire relationship with your business. A higher CLTV indicates a more valuable customer.

Q 2. Explain the importance of CLTV in business decision-making.

CLTV is crucial for strategic business decision-making because it provides a quantifiable measure of customer value. This allows businesses to:

- Prioritize customer acquisition and retention strategies: By identifying high-CLTV customer segments, businesses can focus their marketing and retention efforts on the most profitable customers.

- Optimize pricing and product strategies: Understanding CLTV helps determine the optimal price point for products and services, maximizing profit from each customer segment.

- Make informed investment decisions: CLTV allows businesses to assess the return on investment (ROI) of various initiatives, such as new product development, customer service improvements, or marketing campaigns.

- Improve customer relationship management (CRM): By understanding the factors that influence CLTV, businesses can tailor their CRM strategies to enhance customer loyalty and increase lifetime value.

- Evaluate the profitability of different customer acquisition channels: Knowing the CLTV associated with customers acquired through various channels (e.g., social media, email marketing) allows businesses to optimize their spending.

Q 3. What are the key components of a CLTV calculation?

The key components of a CLTV calculation typically include:

- Average Purchase Value (APV): The average amount a customer spends per transaction.

- Purchase Frequency (PF): How often a customer makes a purchase within a given timeframe.

- Average Customer Lifespan (ACL): The average length of time a customer remains a paying customer.

- Customer Acquisition Cost (CAC): The cost of acquiring a new customer.

- Gross Margin (GM): The percentage of revenue remaining after deducting the cost of goods sold.

These components are used in various formulas, depending on the chosen CLTV calculation method. For example, a simplified CLTV calculation might be: CLTV = APV * PF * ACL. However, more sophisticated methods incorporate gross margin and discount future revenue.

Q 4. Describe different CLTV calculation methods (e.g., simple, cohort-based).

Several methods exist for calculating CLTV, each with varying levels of complexity and accuracy:

- Simple CLTV: This method uses a simplified formula, like the one mentioned above (

CLTV = APV * PF * ACL), and is suitable for quick estimations. It doesn’t account for churn or the time value of money. - Cohort-based CLTV: This method groups customers into cohorts (e.g., customers acquired in the same month) and tracks their behavior over time. This provides a more accurate picture of CLTV by analyzing the lifetime value of specific customer groups, considering churn and the time value of money. It allows for more granular insights into customer behavior over time.

- Probability-based CLTV: This more advanced method incorporates the probability of a customer churning at each point in time. It provides a more nuanced understanding of CLTV by considering the likelihood of continued customer engagement. This approach requires more data and modeling expertise.

Q 5. How do you handle churn in CLTV calculations?

Churn, or customer attrition, is a critical factor in CLTV calculations. Ignoring churn will significantly overestimate the actual CLTV. There are several ways to handle churn:

- Churn Rate: Incorporate the churn rate (percentage of customers who stop doing business with a company during a given period) into the CLTV formula. This reduces the projected lifetime of a customer, leading to a more realistic CLTV estimate.

- Survival Analysis: Use survival analysis techniques to model the probability of a customer remaining a paying customer over time. This sophisticated approach directly accounts for the non-constant probability of churn over a customer’s lifecycle.

- Cohort Analysis with Churn Tracking: By tracking churn within customer cohorts, you can directly observe how churn affects the CLTV of different groups.

The choice of method depends on the available data and the desired level of accuracy.

Q 6. What are the limitations of CLTV models?

Despite its usefulness, CLTV models have limitations:

- Data Dependency: Accurate CLTV calculations require reliable and comprehensive data on customer behavior, which may not always be available.

- Assumptions and Simplifications: CLTV models often rely on assumptions and simplifications, such as constant purchase frequency and churn rate, which may not hold true in reality.

- Future Uncertainty: CLTV is a prediction of future behavior and is therefore susceptible to external factors and market changes that are difficult to predict accurately.

- Complexity and Cost: Developing and maintaining sophisticated CLTV models can be complex and require specialized skills and resources.

- Over-reliance: Using CLTV as the sole metric for decision-making can be misleading. It needs to be considered alongside other factors.

Q 7. How do you validate the accuracy of your CLTV model?

Validating the accuracy of a CLTV model is essential. Several methods can be used:

- Backtesting: Apply the model to historical data to compare predicted CLTV with actual CLTV. This helps assess the model’s accuracy in predicting past behavior.

- Benchmarking: Compare the model’s results with industry benchmarks or CLTV values from similar businesses. This can help identify potential biases or inaccuracies.

- Sensitivity Analysis: Test the model’s sensitivity to changes in input parameters (e.g., churn rate, average purchase value). This helps understand the robustness of the model.

- Regular Monitoring and Updates: Continuously monitor the model’s performance and update it regularly to reflect changes in customer behavior and market conditions. This ensures the model remains relevant and accurate over time.

- A/B Testing: Test different acquisition strategies or retention initiatives and compare their impact on observed CLTV. This provides a real-world validation of the model’s predictions.

Q 8. Explain the relationship between CLTV and Customer Acquisition Cost (CAC).

Customer Lifetime Value (CLTV) and Customer Acquisition Cost (CAC) are intrinsically linked, representing two sides of the same coin in a business’s financial health. CLTV predicts the total revenue a business expects to generate from a single customer over their entire relationship. CAC, conversely, represents the total cost of acquiring a new customer. A healthy business model requires a CLTV significantly higher than its CAC. Ideally, CLTV should be several times greater than CAC to ensure profitability and sustainable growth.

Think of it like this: if it costs you $100 to acquire a customer (CAC), but that customer spends $1000 with you over their lifetime (CLTV), you’re in a strong position. However, if your CAC is $150 and your CLTV is only $100, you’re losing money on each customer. This crucial ratio, CLTV/CAC, informs critical business decisions about marketing spend, customer retention strategies, and overall business scalability.

Q 9. How do you use CLTV to inform marketing strategy?

CLTV is a cornerstone of effective marketing strategy. By understanding the projected revenue from each customer, businesses can make data-driven decisions about marketing budget allocation and channel optimization. For instance, if your CLTV analysis shows that customers acquired through social media marketing have a much higher CLTV than those acquired through paid search, you’d naturally want to shift a greater portion of your marketing budget towards social media.

Furthermore, CLTV informs decisions about customer retention strategies. Investing in customer retention efforts for high-CLTV segments is more justifiable because the return on investment is potentially far greater than targeting new customers with lower CLTV projections. It allows you to prioritize strategies like loyalty programs, personalized email campaigns, and exclusive offers for your most valuable customers.

Finally, CLTV helps justify marketing spend. Demonstrating a robust CLTV and a positive CLTV/CAC ratio allows you to present a strong case to leadership for increased marketing investment, knowing that you have a high likelihood of generating significant returns.

Q 10. How do you use CLTV to prioritize customer segments?

Prioritizing customer segments based on CLTV is vital for maximizing profitability and resource allocation. By segmenting customers based on their predicted CLTV, you can focus your efforts on those segments that offer the highest potential return. For example, you might segment customers into high-CLTV, medium-CLTV, and low-CLTV groups.

High-CLTV customers would receive personalized attention, proactive support, and exclusive offers designed to maintain and increase their engagement. Medium-CLTV customers could receive targeted marketing campaigns to encourage increased spending, while low-CLTV customers might receive less intensive nurturing or even be targeted with win-back campaigns if appropriate.

This targeted approach is much more efficient than a blanket approach. Instead of wasting resources on low-CLTV customers who are unlikely to generate significant revenue, you focus your resources on retaining and cultivating your most valuable customers, maximizing your overall profitability.

Q 11. Describe a situation where you had to improve a CLTV model.

In a previous role, we were using a simplified CLTV model that relied solely on average purchase frequency and average order value. This proved inaccurate because it didn’t account for customer churn or the variability in customer behavior over time. As a result, our marketing ROI calculations were significantly off, leading to misallocation of resources.

To improve the model, we incorporated customer segmentation based on purchase behavior and implemented a survival analysis approach to predict customer churn rates. We then used a more robust model that considered factors such as customer acquisition channel, customer lifetime, purchase frequency, average order value, and customer churn rate. This allowed for a much more nuanced understanding of customer value and improved the accuracy of our CLTV predictions. The result was a more effective allocation of marketing resources and a demonstrable increase in marketing ROI.

Q 12. How would you explain CLTV to a non-technical stakeholder?

Imagine CLTV as the total amount of money a customer is predicted to spend with your business throughout their relationship with you. It’s like forecasting the future revenue generated by a single customer. By knowing this number, we can make smart decisions about how much to invest in attracting and retaining them, ensuring the business makes a profit.

For example, if we know a customer is likely to spend $1000 over their lifetime, and it costs us only $50 to acquire them, we know we have a profitable customer. This allows us to focus our efforts on attracting more customers like them and enhancing their experience to maximize their spending.

Q 13. What are the key metrics you track to monitor CLTV?

To effectively monitor CLTV, I track several key metrics:

- Average Purchase Value (APV): The average amount a customer spends per transaction.

- Purchase Frequency (PF): How often a customer makes a purchase.

- Customer Churn Rate: The percentage of customers who stop doing business with the company within a specific period.

- Customer Lifetime (CL): The average length of time a customer remains a customer.

- Gross Margin: The percentage of revenue remaining after deducting the cost of goods sold.

Tracking these metrics allows for a dynamic CLTV calculation, providing a clear picture of the evolving value of customer segments and the overall effectiveness of business strategies.

Q 14. How do you use CLTV to measure the ROI of marketing campaigns?

Measuring the ROI of marketing campaigns using CLTV provides a much more holistic view than simply looking at immediate revenue. Instead of focusing only on short-term sales, we examine the long-term impact of a campaign on customer acquisition and retention. This is crucial because a campaign may not yield immediate returns but could generate substantial long-term value through increased CLTV.

For instance, a successful loyalty program might not see an immediate spike in sales, but it could dramatically increase customer lifetime and reduce churn, ultimately leading to a significantly higher CLTV and a positive ROI over the long term. By comparing the cost of the campaign to the increase in predicted CLTV generated by the new customers and the retained customers, we can assess the long-term profitability and effectiveness of the campaign.

Q 15. How can you improve CLTV by enhancing customer onboarding?

A strong onboarding experience is crucial for setting the stage for a long and profitable customer relationship. Improving CLTV through enhanced onboarding focuses on quickly establishing value and building trust.

- Personalized Welcome: Instead of generic emails, tailor the welcome message to the customer’s specific needs and purchase history. For example, a new fitness app user could receive a personalized workout plan based on their fitness goals.

- Clear Value Proposition Reinforcement: Remind customers why they chose your product or service. Highlight key features and benefits through interactive tutorials or short videos.

- Early Engagement: Proactively reach out to customers within the first few days of signing up, offering assistance or answering questions. This shows you care and helps prevent early churn.

- Progressive Onboarding: Don’t overwhelm the customer with information upfront. Gradually introduce new features and functionalities as they gain proficiency. A SaaS company might unlock advanced features after a customer demonstrates understanding of the basics.

- Feedback Mechanism: Early feedback collection helps identify pain points and areas for improvement in the onboarding process itself.

By focusing on these aspects, you create a smoother, more engaging onboarding experience, increasing customer satisfaction and retention, leading to a higher CLTV.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. How can you improve CLTV by improving customer service?

Exceptional customer service is directly linked to customer loyalty and, consequently, CLTV. Addressing customer issues quickly and efficiently significantly reduces churn and fosters positive word-of-mouth.

- Proactive Support: Anticipate common issues and provide solutions before customers even encounter them (e.g., FAQs, help articles). Think of a software company providing comprehensive documentation and video tutorials.

- Multiple Support Channels: Offer various ways for customers to reach out – email, phone, chat, social media – to accommodate different preferences. This is critical for a younger demographic who might prefer social media.

- Personalized Interactions: Train agents to personalize interactions, using the customer’s name and referring to past interactions. This builds rapport and fosters a sense of loyalty.

- Efficient Resolution: Empower agents to resolve issues quickly and efficiently. A streamlined ticketing system with clear escalation paths is essential.

- Customer Feedback Loop: Collect regular feedback through surveys and reviews to identify areas for improvement and understand customer pain points. Use this data to refine your service strategy.

Investing in customer service excellence is not an expense; it’s a strategic investment that directly improves CLTV by fostering loyalty and reducing churn.

Q 17. How can you improve CLTV by implementing a loyalty program?

Loyalty programs are powerful tools for increasing CLTV by rewarding repeat customers and incentivizing continued engagement. The key is to design a program that resonates with your target audience.

- Tiered Rewards: Offer different levels of rewards based on spending or engagement, creating a sense of progression and exclusivity. Think of frequent flyer programs with different tiers of benefits.

- Personalized Rewards: Tailor rewards to individual customer preferences, offering choices that cater to their interests. A coffee shop might offer personalized discounts on preferred drinks.

- Exclusive Access: Grant loyalty members access to exclusive events, products, or early sales. This creates a sense of community and appreciation.

- Gamification: Incorporate elements of gamification, such as points, badges, and leaderboards, to increase engagement and motivation. A fitness app could award badges for completing certain workouts.

- Data-Driven Optimization: Regularly analyze program participation and effectiveness to identify areas for improvement and optimize rewards accordingly.

A well-designed loyalty program can significantly increase customer retention and lifetime spending, resulting in a substantially higher CLTV.

Q 18. What are the ethical considerations when using CLTV data?

Using CLTV data responsibly requires careful consideration of ethical implications. The potential for misuse necessitates a proactive approach to responsible data handling.

- Data Privacy: Ensure compliance with all relevant data privacy regulations (e.g., GDPR, CCPA). Transparency and informed consent are crucial.

- Algorithmic Bias: Be mindful of potential biases in CLTV models. Ensure fairness and equity in how the model is used to avoid discriminatory practices.

- Transparency: Be transparent with customers about how their data is used to calculate CLTV and how this information might influence marketing and service interactions.

- Data Security: Implement robust security measures to protect CLTV data from unauthorized access or breaches.

- Purpose Limitation: Use CLTV data only for its intended purpose – improving customer relationships and business outcomes. Avoid using it for manipulative or exploitative practices.

Ethical considerations should be at the forefront of any CLTV strategy, ensuring that its use benefits both the business and its customers.

Q 19. How do you identify at-risk customers based on CLTV?

Identifying at-risk customers requires analyzing CLTV trends and identifying those showing signs of declining value or increased churn risk.

- Churn Rate Analysis: Monitor customer churn rate over time and identify cohorts with high churn probabilities. These cohorts warrant closer attention.

- Decreasing Purchase Frequency: Customers reducing their purchase frequency or engagement could be at risk of churning.

- Negative Sentiment Analysis: Monitor customer feedback (reviews, surveys) to gauge their satisfaction. Negative sentiment often predicts churn.

- Engagement Metrics: Track key engagement metrics (e.g., website visits, app usage, email opens) to identify customers with declining engagement levels.

- CLTV Decline: Directly monitor the CLTV of individual customers or segments. A significant decline in projected CLTV is a clear warning sign.

By combining these methods, you can build a comprehensive system for identifying at-risk customers, enabling proactive intervention strategies to retain them.

Q 20. How do you use CLTV to inform pricing strategies?

CLTV informs pricing strategies by providing a clear understanding of the long-term value of each customer. This allows for more strategic pricing decisions.

- Premium Pricing for High-CLTV Customers: High-CLTV customers justify premium pricing or customized offerings since they are more likely to remain loyal and spend more over time.

- Value-Based Pricing: Price products or services based on their perceived value to the customer, aligning pricing with the potential CLTV they generate.

- Personalized Pricing: Offer dynamic pricing based on individual CLTV predictions, providing targeted discounts or promotions to retain or reactivate at-risk customers.

- Upselling and Cross-selling: Identify high-CLTV customers who are likely to respond positively to upselling or cross-selling efforts.

- Subscription Tier Optimization: For subscription businesses, CLTV analysis helps optimize subscription tiers and pricing to maximize revenue from loyal customers.

By understanding CLTV, businesses can make more informed pricing decisions that maximize revenue and profitability while maintaining customer satisfaction.

Q 21. How does CLTV differ for different business models (e.g., subscription, transactional)?

CLTV calculations differ significantly across various business models due to the nature of customer interactions and revenue streams.

- Subscription Businesses: CLTV is typically easier to predict for subscription businesses as revenue is recurring and predictable. The focus is on customer retention rate and average revenue per user (ARPU) over the subscription period. A SaaS company, for example, can project CLTV based on the average lifespan of a subscription and its associated revenue.

- Transactional Businesses: CLTV for transactional businesses is more complex as it depends on factors like purchase frequency, average order value (AOV), and the customer’s lifespan. Predicting the future purchase behavior of a customer who only buys occasionally requires more sophisticated models. An e-commerce store, for example, would need to estimate the likelihood of repeat purchases to accurately calculate CLTV.

- Freemium Models: Freemium models present a unique challenge as they combine transactional (one-time purchases) and subscription (premium features) elements. The CLTV calculation needs to consider both types of revenue streams and the probability of a free user converting to a paid subscriber.

The key is to adapt the CLTV calculation method to the specific business model and data available. Understanding the nuances of each model is crucial for accurate prediction and effective business strategy.

Q 22. What are some common mistakes in CLTV calculation and interpretation?

Calculating and interpreting Customer Lifetime Value (CLTV) accurately is crucial for business success. However, several common pitfalls can lead to flawed estimations and poor decision-making. One frequent mistake is using inaccurate or incomplete data. For example, relying on average purchase frequency instead of incorporating individual customer behavior leads to a skewed CLTV. Another common error is ignoring churn rate. A high churn rate drastically reduces CLTV, and failing to account for it results in an overly optimistic forecast. Furthermore, many fall into the trap of assuming constant customer behavior over time. Customer preferences, buying habits, and market trends shift, so a static CLTV model quickly becomes outdated and unreliable. Finally, neglecting the impact of marketing campaigns and promotions can significantly distort CLTV calculations. Promotional periods might inflate short-term revenue but don’t necessarily reflect long-term value.

- Example: A company using average purchase frequency instead of individual customer purchase history might overestimate the CLTV of low-frequency buyers and underestimate the CLTV of high-value customers, leading to poor resource allocation.

- Example: Failing to account for a high churn rate in a subscription service can result in massive overestimation of the lifetime revenue from each new subscriber.

Q 23. How do you incorporate predictive analytics into your CLTV model?

Incorporating predictive analytics significantly enhances CLTV model accuracy. We leverage machine learning techniques to forecast future customer behavior, rather than relying solely on historical data. This is achieved by building predictive models that analyze various customer attributes and transactional data to predict future purchases, churn probability, and average order value. For instance, we can use regression models to predict future spending based on factors like age, location, past purchases, and engagement with marketing campaigns. Survival analysis helps to model customer churn probability more accurately, accounting for time-varying covariates. Furthermore, clustering techniques can segment customers based on their predicted CLTV, enabling more targeted marketing efforts.

Example: A predictive model might use a logistic regression to predict the probability of a customer churning based on features such as recency, frequency, monetary value (RFM) and engagement with customer support.By incorporating these predictions, our CLTV model becomes dynamic and adaptive to changing customer behaviors and market conditions. This allows for proactive adjustments in marketing strategies and resource allocation.

Q 24. What software or tools are you familiar with for CLTV analysis?

I’m proficient with several software and tools for CLTV analysis. I frequently utilize R and Python programming languages, leveraging packages like lifelines (for survival analysis) and scikit-learn (for machine learning models). These languages provide the flexibility to build highly customized CLTV models. For more streamlined analysis, I’m familiar with platforms like Excel (for simpler calculations) and dedicated Customer Relationship Management (CRM) systems that have built-in CLTV functionality. Many CRM systems offer ready-to-use CLTV reports and dashboards, which are useful for quick overview and strategic decision-making. However, I typically prefer the flexibility and granularity afforded by R and Python for more in-depth analyses and model customization.

Q 25. How do you address data quality issues in CLTV calculations?

Data quality is paramount in accurate CLTV calculations. I address data quality issues through a multi-step process. First, I conduct thorough data cleaning and validation to identify and correct inconsistencies, missing values, and outliers. Techniques like imputation (filling missing values) or outlier removal might be applied. Next, I perform data transformation, standardizing formats and ensuring data consistency across different sources. For example, I might need to convert date formats or currency units to a common standard. Data validation is crucial throughout the process to ensure data integrity. This includes checks for data type consistency, range checks, and cross-referencing data across multiple sources to identify anomalies. Finally, I conduct sensitivity analysis to assess the impact of data uncertainties on the CLTV estimates, helping to understand the reliability and robustness of our calculations.

Q 26. Explain the difference between average CLTV and predicted CLTV.

Average CLTV and predicted CLTV differ significantly in their approach and applicability. Average CLTV is a simple calculation based on historical data. It represents the average revenue a business expects to generate from a customer throughout their relationship. It’s a valuable indicator, but it doesn’t account for individual customer variations or future changes. Predicted CLTV, on the other hand, uses predictive analytics and machine learning to forecast future customer behavior. It provides a more personalized estimate of the expected revenue from each individual customer, incorporating factors like purchase history, demographics, and engagement levels. Predicted CLTV gives a much more nuanced understanding of customer value, allowing for better-targeted marketing and resource allocation.

Analogy: Average CLTV is like taking the average height of everyone in a room; it gives you a general idea but doesn’t tell you anything about individual heights. Predicted CLTV is like measuring each person’s height individually — a much more precise picture.

Q 27. How do you use CLTV to segment customers for personalized marketing?

CLTV is a powerful tool for customer segmentation and personalized marketing. By predicting CLTV for each customer, we can stratify them into distinct segments based on their predicted value. For example, we can create segments like ‘High-Value Customers,’ ‘Medium-Value Customers,’ and ‘Low-Value Customers’. This enables us to tailor marketing strategies to each segment. High-value customers might receive personalized offers, exclusive promotions, or dedicated account managers, while lower-value customers may receive more general marketing communications. Furthermore, we can identify customers at risk of churning (low predicted CLTV) and implement targeted retention strategies to improve their lifetime value. This precision marketing approach enhances customer engagement and maximizes return on investment (ROI).

Q 28. Describe a time you used CLTV to influence a significant business decision.

In a previous role, we were considering a significant investment in a new marketing campaign targeting a specific customer segment. We had the choice between two campaigns: one focused on brand awareness and another on driving immediate sales. Using a detailed CLTV model incorporating predictive analytics, we were able to forecast the return on investment (ROI) of each campaign for different customer segments. The model revealed that while the brand awareness campaign had a lower immediate ROI, it had a considerably higher long-term impact on CLTV for the target segment due to increased customer loyalty and retention. This analysis influenced the decision to prioritize the brand awareness campaign, which ultimately resulted in a significantly higher overall return on investment compared to the short-term sales-driven approach. The CLTV-driven approach led to a more sustainable growth strategy focused on building strong customer relationships, instead of short-term gains.

Key Topics to Learn for Customer Lifetime Value (CLTV) Interview

- Defining CLTV: Understand the fundamental concept of Customer Lifetime Value and its various calculation methods (e.g., simple, cohort-based, predictive).

- CLTV Calculation & Metrics: Master the formulas and key metrics involved in calculating CLTV, including average purchase value, customer lifespan, and churn rate. Practice calculating CLTV with different scenarios.

- Practical Applications of CLTV: Explore how CLTV informs strategic business decisions, such as customer acquisition cost (CAC) analysis, customer segmentation, marketing ROI optimization, and pricing strategies.

- CLTV and Customer Segmentation: Learn how to utilize CLTV to identify and prioritize high-value customers for targeted marketing efforts and personalized experiences.

- Predictive CLTV Modeling: Understand the principles of predictive modeling for CLTV, including the use of statistical methods and machine learning techniques to forecast future customer value.

- Limitations and Challenges of CLTV: Be prepared to discuss the inherent limitations of CLTV and potential challenges in its accurate calculation and application, such as data accuracy and forecasting uncertainty.

- CLTV in Different Business Models: Explore how CLTV is applied differently across various business models (e.g., subscription-based, e-commerce, SaaS).

- Case Studies & Examples: Analyze real-world case studies illustrating the successful implementation and impact of CLTV strategies.

Next Steps

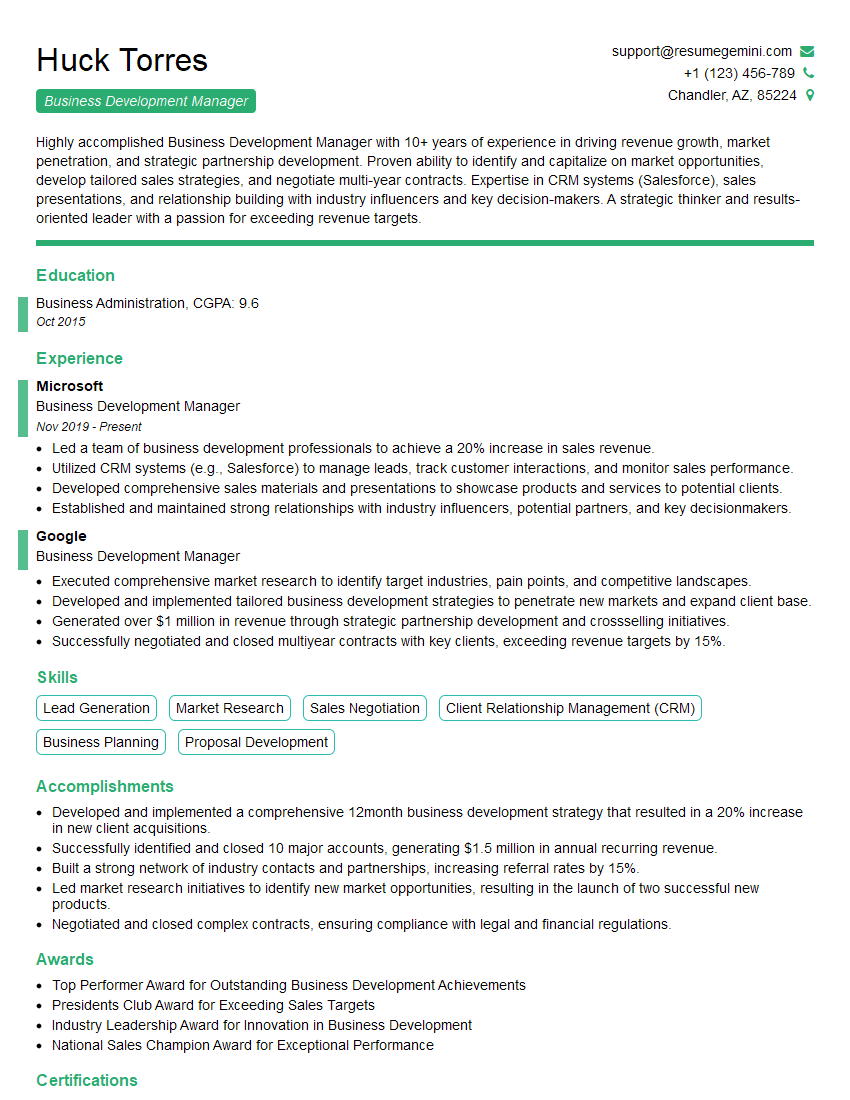

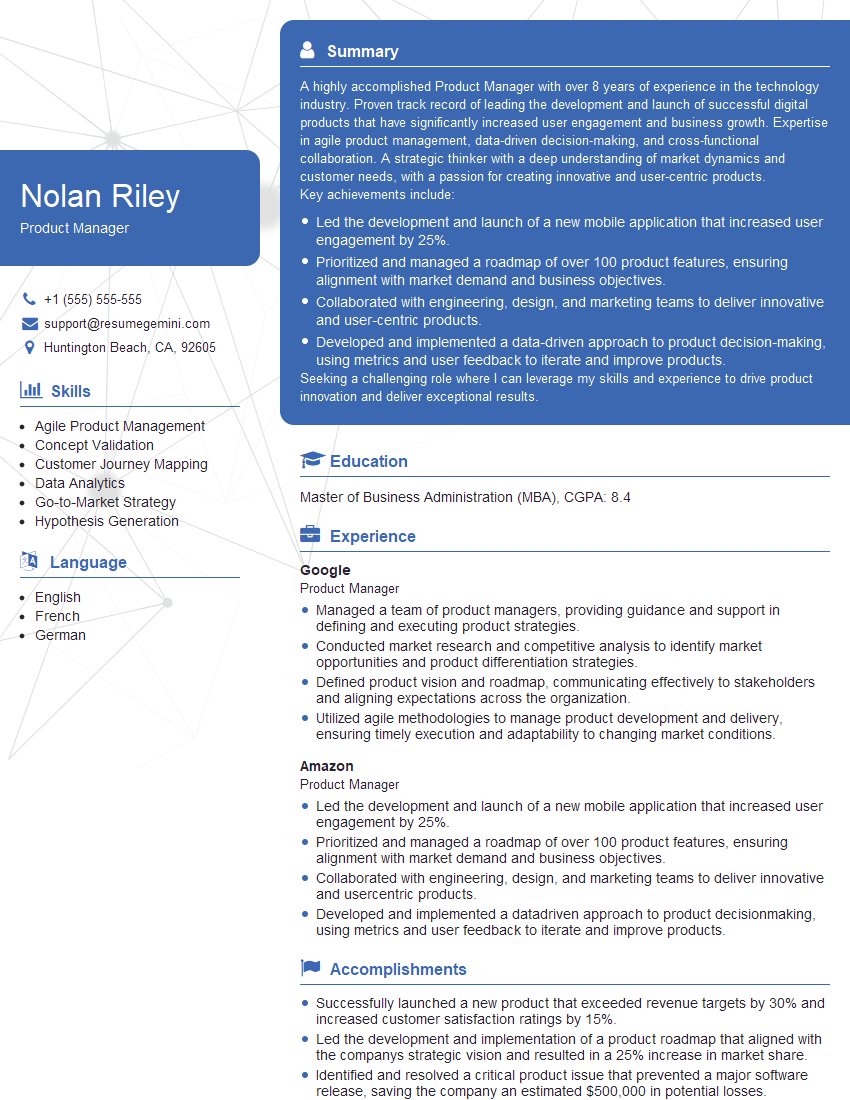

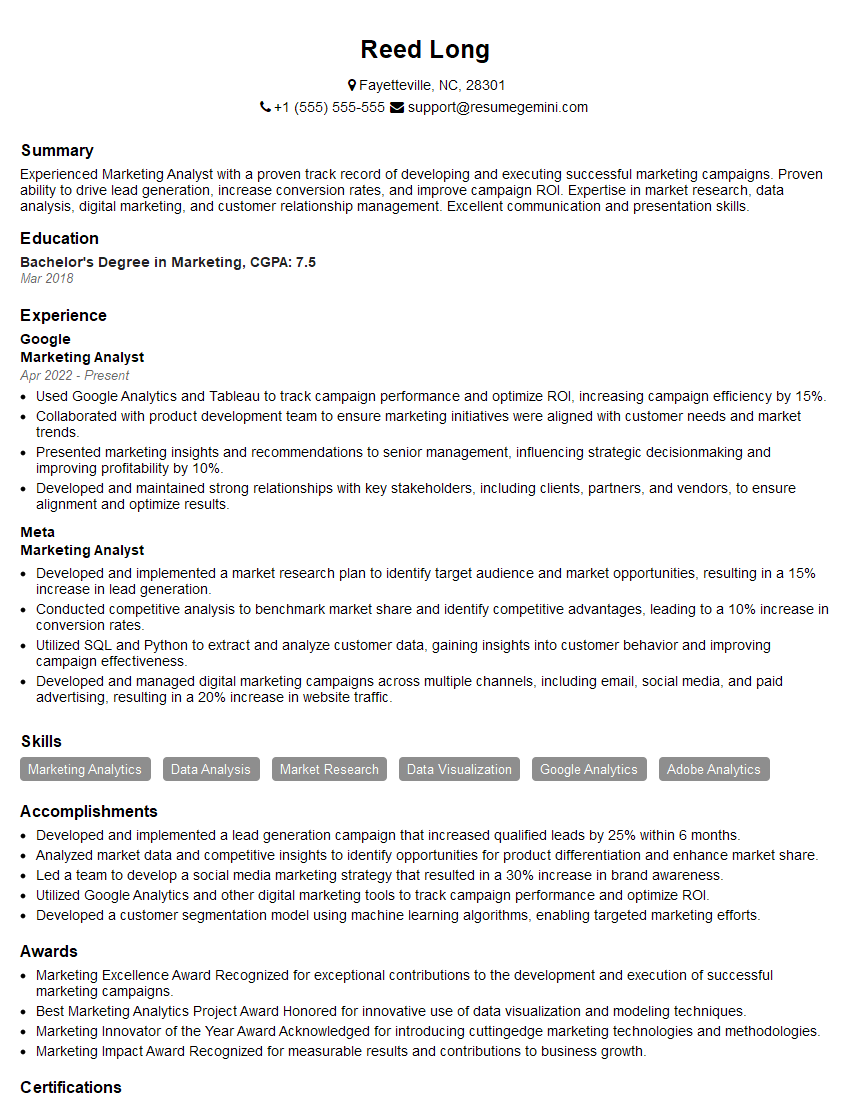

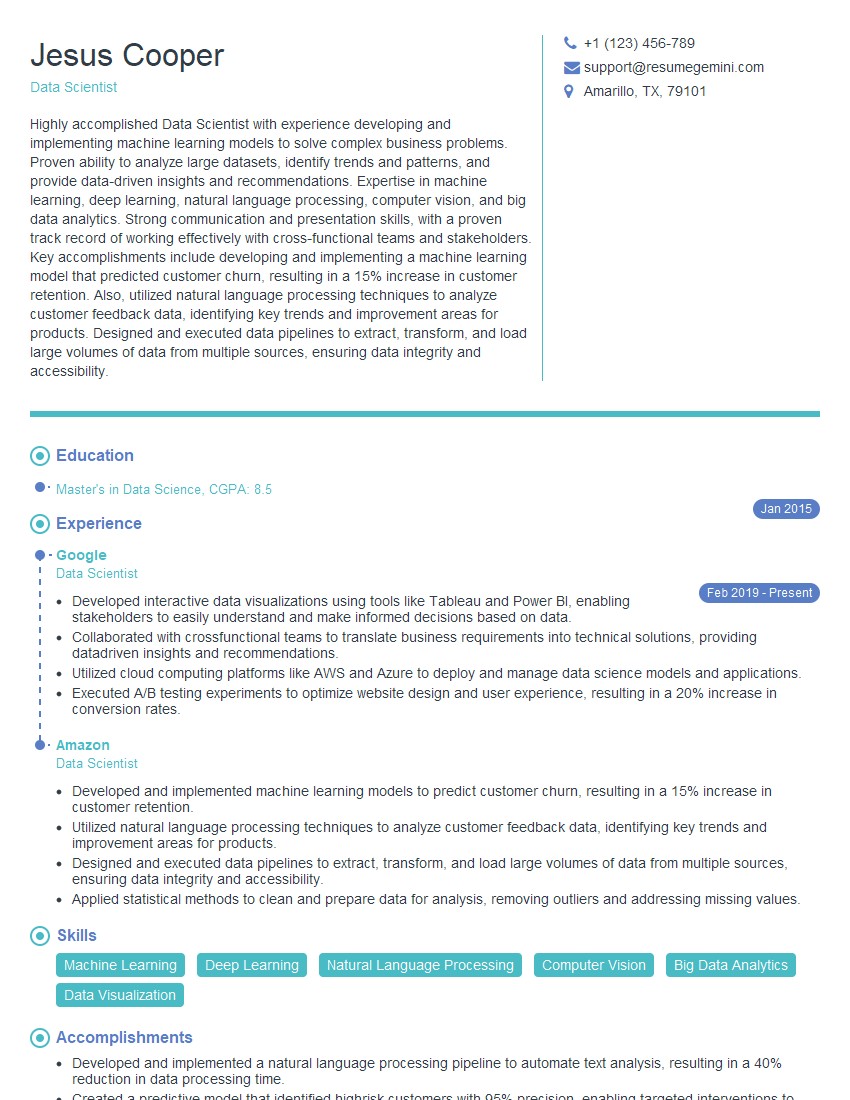

Mastering Customer Lifetime Value is crucial for career advancement in analytics, marketing, and business development. A strong understanding of CLTV demonstrates valuable analytical skills and a strategic mindset highly sought after by employers. To significantly enhance your job prospects, focus on crafting an ATS-friendly resume that highlights your CLTV expertise. ResumeGemini is a trusted resource to help you build a professional and impactful resume, ensuring your skills and experience shine. Examples of resumes tailored to Customer Lifetime Value (CLTV) roles are available to guide you.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

Hi, I’m Jay, we have a few potential clients that are interested in your services, thought you might be a good fit. I’d love to talk about the details, when do you have time to talk?

Best,

Jay

Founder | CEO