Interviews are opportunities to demonstrate your expertise, and this guide is here to help you shine. Explore the essential Documentary Credits interview questions that employers frequently ask, paired with strategies for crafting responses that set you apart from the competition.

Questions Asked in Documentary Credits Interview

Q 1. Explain the difference between a confirmed and unconfirmed Documentary Credit.

The core difference between a confirmed and an unconfirmed Documentary Credit lies in the level of assurance provided to the beneficiary (the seller). Think of it like this: you’re selling goods internationally, and you want guaranteed payment.

An unconfirmed Documentary Credit means the issuing bank (the buyer’s bank) promises to pay only if it receives all the required documents and they comply with the credit terms. However, there’s a risk that the issuing bank might face financial difficulties and default. It’s a promise, but not a guaranteed promise.

A confirmed Documentary Credit adds an extra layer of security. A confirming bank (usually located in the beneficiary’s country) adds its own guarantee to the payment. Now, the beneficiary has the assurance of payment from two banks: the issuing bank and the confirming bank. This significantly reduces the risk for the seller. It’s like having two strong guarantees backing the payment.

In essence, confirmation provides additional creditworthiness and reduces the risk for the seller. It generally costs more but offers significantly more payment certainty.

Q 2. What are the key documents required in a Documentary Credit transaction?

The specific documents required vary depending on the nature of the transaction and the terms of the Documentary Credit itself. However, some common documents include:

- Commercial Invoice: A formal invoice detailing the goods sold, price, and other relevant information.

- Packing List: A detailed description of the goods packed, including quantity, weight, and packaging details.

- Bill of Lading (or Air Waybill): Proof of shipment of the goods, showing the consignee, shipper, and other relevant transport information. This is crucial for demonstrating the goods have been shipped as agreed.

- Insurance Certificate: Evidence that the goods are insured against loss or damage during transit. This protects both buyer and seller.

- Certificate of Origin: A document certifying the origin of the goods, often required for import/export purposes and trade regulations.

- Other documents: Depending on the transaction’s specifications, there might be additional documents like inspection certificates, phytosanitary certificates (for agricultural products), or other specific compliance documentation.

The Documentary Credit will explicitly list all required documents, and any discrepancies can lead to payment refusal. Therefore, precise and complete documentation is critical.

Q 3. Describe the process of issuing a Documentary Credit.

Issuing a Documentary Credit involves a multi-step process, typically initiated by the buyer (importer) and processed through their bank (the issuing bank).

- Application: The buyer submits an application to their bank, providing details of the transaction, including the amount, goods, seller’s information, and required documents.

- Credit Issuance: Upon approval, the issuing bank drafts the Documentary Credit, adhering to the UCP 600 rules and the buyer’s instructions. This is a legally binding document.

- Transmission: The issuing bank transmits the Documentary Credit to the advising bank (usually located in the seller’s country). This can be done electronically or physically.

- Advice to Beneficiary: The advising bank notifies the seller (beneficiary) about the issued Documentary Credit. This informs the seller about the payment terms and conditions.

- Presentation: Once the goods are shipped and all required documents are prepared, the seller presents these documents to the negotiating bank (often the same as the advising bank). This bank checks the documentation against the credit terms.

- Negotiation/Payment: If the documents are compliant, the negotiating bank pays the seller. It then forwards these documents to the issuing bank for reimbursement.

- Reimbursement: The issuing bank reimburses the negotiating bank for the payment made to the seller, concluding the transaction.

Each stage necessitates careful scrutiny to ensure compliance and minimize risks.

Q 4. What are the different types of Documentary Credits?

Documentary Credits come in various forms, each tailored to specific transaction needs:

- Irrevocable Credit: Cannot be amended or canceled without the agreement of all parties involved, offering strong security for the seller.

- Revocable Credit: Can be amended or canceled by the issuing bank at any time without the seller’s consent; hence, less secure for the seller.

- Confirmed Credit: Offers added security with a confirming bank’s guarantee of payment.

- Unconfirmed Credit: Payment is guaranteed only by the issuing bank.

- Transferable Credit: The beneficiary can transfer the credit to another party.

- Back-to-back Credit: Used when a buyer uses one credit to finance the purchase from their supplier and then establishes another credit for their own customers.

- Red Clause Credit: Allows for partial or advance payment to the beneficiary before the documents are presented.

Selecting the right type depends on the buyer’s and seller’s risk tolerance and the nature of the trade relationship.

Q 5. Explain the role of the issuing bank, advising bank, and confirming bank.

These three banks play distinct roles in a Documentary Credit transaction:

- Issuing Bank: The buyer’s bank that issues the Documentary Credit and undertakes the ultimate payment obligation to the seller once the documents are compliant. Think of them as the guarantor making the initial promise to pay.

- Advising Bank: Usually located in the seller’s country, this bank advises the seller of the existence of the Documentary Credit. It verifies the authenticity of the credit but does not guarantee payment. They act as a messenger and verifier.

- Confirming Bank: In a confirmed credit, this bank adds its own guarantee of payment to the issuing bank’s promise. This greatly reduces the seller’s risk as they now have two banks guaranteeing payment. They act as an additional layer of security for the seller.

Effective collaboration between these banks is crucial for the smooth execution of the transaction.

Q 6. What is a UCP 600 and its significance in Documentary Credits?

UCP 600, or Uniform Customs and Practice for Documentary Credits, is a set of internationally recognized rules established by the International Chamber of Commerce (ICC). It standardizes the practices and procedures for Documentary Credits, making them consistent and predictable globally. It’s like a universal rulebook for international trade finance.

Its significance is paramount because it minimizes disputes by providing a common framework for all parties involved. This framework outlines the responsibilities of each party and provides clear guidelines for handling documents and resolving discrepancies. Without UCP 600, international trade finance would be chaotic and unreliable, making it challenging to establish trust and ensure smooth transactions.

Q 7. Explain the concept of ‘strict compliance’ in Documentary Credits.

Strict compliance is a fundamental principle in Documentary Credits. It means that the documents presented by the seller must precisely match the terms and conditions stipulated in the Documentary Credit. Even minor discrepancies can lead to the issuing bank rejecting the documents, and consequently, the seller not receiving payment.

Imagine the credit specifies ‘commercial invoice in English’ and the seller submits it in Spanish. This is a discrepancy. Or if the credit mentions ‘100 cartons’ and the packing list shows ’98 cartons’. This is also a major discrepancy. Strict compliance is not about nitpicking; it’s about ensuring that all information is accurate and consistent, matching exactly what was agreed upon. Any deviation is a breach of strict compliance which risks non-payment to the seller.

The principle of strict compliance reduces risks for the buyer by ensuring only the exact goods and services as per agreement are received. It also establishes a clear and predictable process for all parties.

Q 8. How do you handle discrepancies in Documentary Credits?

Discrepancies in documentary credits arise when the presented documents don’t perfectly match the terms and conditions stipulated in the credit. Think of it like a recipe: if a baker substitutes an ingredient, the final product might be different. Similarly, even a small deviation can invalidate the documents and prevent payment.

Handling discrepancies involves careful examination by the issuing bank. They assess the severity of the discrepancy. Minor discrepancies, like a slightly misspelled name or a minor date variation, might be waived. However, major discrepancies, such as incorrect goods description, missing documents, or discrepancies in amounts, will usually lead to the rejection of the documents. The issuing bank will notify the applicant (importer) of the discrepancy and usually request instructions on whether to accept or reject the documents. This often involves negotiating with the exporter to rectify the issues, potentially leading to amendments to the credit, or even leading to a claim under the credit if the discrepancies are the fault of the issuing bank.

- Example: A credit requires a certificate of origin from ‘Country X’, but the presented document is from ‘Country Y’. This is a major discrepancy and would likely result in rejection.

- Example: The credit specifies that the shipment must be made by sea, but the presented bill of lading indicates shipment by air. This is also a major discrepancy requiring attention.

The process requires a thorough understanding of the Uniform Customs and Practice for Documentary Credits (UCP 600), which guides the interpretation and handling of discrepancies. The careful review process ensures that all parties are protected.

Q 9. What are the common risks associated with Documentary Credits?

Documentary credits, while mitigating risk, still carry inherent risks for all parties involved. These risks can be broadly categorized as:

- Political Risks: Changes in government regulations, political instability in the exporter’s or importer’s country, or sanctions can disrupt the flow of goods and payment.

- Commercial Risks: These include risks related to the quality, quantity, and timely delivery of goods. Even with a credit, there’s a risk the exporter might ship inferior goods or fail to meet deadlines.

- Financial Risks: The issuing bank faces the risk of non-payment from the applicant (importer), while the beneficiary (exporter) risks non-payment if documents aren’t compliant or if the bank rejects the documents due to discrepancies. Currency fluctuations also present a risk.

- Operational Risks: These involve delays, errors in documentation, communication breakdowns between parties, and potential fraud.

- Legal Risks: Disputes over interpretation of credit terms, fraud claims, or inconsistencies in contracts can lead to legal battles.

For example, a political coup in the exporter’s country could halt shipment, leaving both the importer and the issuing bank at risk. Similarly, a dispute over the quality of goods received could lead to a lengthy commercial dispute despite the presence of a documentary credit.

Q 10. How do you mitigate the risks associated with Documentary Credits?

Risk mitigation in documentary credits involves proactive measures taken by all parties. These include:

- Thorough Due Diligence: Applicants (importers) should carefully vet their suppliers, verifying their financial stability and reputation. Issuing banks should assess the creditworthiness of the applicant.

- Precise Credit Formulation: Carefully drafting the credit terms, including clear descriptions of goods, quantities, delivery deadlines, and required documents. Ambiguity should be avoided.

- Strong Document Review: Banks must diligently review presented documents for any discrepancies. Having a specialized team for this is crucial.

- Insurance: Export credit insurance can protect exporters against non-payment or other risks associated with export transactions.

- Strong Communication: Maintaining open and transparent communication throughout the transaction between all parties (exporter, importer, and banks).

- Regular Monitoring: Tracking the shipment and ensuring timely presentation of documents.

- Using Reputable Banks: All parties benefit from using well-established and reputable banks with significant international experience in handling documentary credits.

By employing these methods, the risks associated with documentary credits can be significantly reduced, fostering a safer and more secure trade environment.

Q 11. Explain the process of amending a Documentary Credit.

Amending a documentary credit requires a formal process, usually involving a written amendment signed by the issuing bank. This ensures all parties are aware of the changes and prevents misunderstandings. The amendment typically includes the original credit number, the date of amendment, and a clear description of the modifications.

The Process:

- Request for Amendment: The applicant (importer) or beneficiary (exporter) initiates the request for an amendment, outlining the necessary changes. This might be due to changes in the shipment details, required documentation, or payment terms.

- Amendment Issuance: The issuing bank reviews the request and, if approved, issues a formal amendment to the original credit. Amendments usually have their own unique number for tracking.

- Notification: The amended credit is communicated to the beneficiary (exporter) by the advising bank, or directly by the issuing bank if no advising bank is involved.

- Acceptance: The beneficiary reviews the amendment and, if acceptable, proceeds with the transaction according to the amended terms.

Example: If the original credit specified a delivery date of October 31st, but the exporter requests an extension to November 15th, an amendment would be required to reflect this change. Without a formal amendment, the exporter might risk non-payment if they fail to meet the original deadline.

The UCP 600 provides detailed guidance on the amendment process, highlighting the need for clarity and the formal nature of any modifications to the original credit terms.

Q 12. What are the responsibilities of a beneficiary in a Documentary Credit transaction?

The beneficiary (exporter) has several key responsibilities in a documentary credit transaction:

- Fulfillment of Contractual Obligations: The exporter must ensure they produce and ship the goods as specified in the sales contract and the credit.

- Preparation of Documents: The exporter is responsible for preparing and presenting accurate and compliant documents as specified in the credit. This requires meticulous attention to detail to avoid discrepancies.

- Timely Presentation of Documents: Documents must be presented to the nominated bank within the time frame specified in the credit. Late submission can result in non-payment.

- Compliance with Credit Terms: The exporter must fully comply with all the terms and conditions stipulated in the documentary credit. Any deviation might invalidate the documents.

- Notification: The exporter is responsible for keeping the importer informed about the progress of the shipment.

For instance, if the credit specifies ‘clean on board’ bill of lading, presenting a ‘received for shipment’ bill of lading is a discrepancy, and could lead to non-payment. It’s crucial the exporter understands and meets all the requirements.

Q 13. What are the responsibilities of an applicant in a Documentary Credit transaction?

The applicant (importer) has the following key responsibilities:

- Opening the Credit: The importer applies for and opens the documentary credit with their bank, providing all necessary information regarding the transaction.

- Providing Information: The importer should provide complete and accurate information to the issuing bank to ensure the credit accurately reflects the terms of the sales contract.

- Paying the Bank: The importer is obligated to pay the issuing bank for the amount of the credit once the compliant documents are presented.

- Monitoring: The importer should monitor the progress of the shipment and the presentation of documents to their bank.

- Instructions on Discrepancies: If discrepancies arise, the importer must provide clear instructions to their bank on how to proceed.

For example, the importer needs to provide precise details on the goods being imported, ensuring accurate descriptions to prevent discrepancies when the exporter presents the documents. Failing to provide clear payment instructions can also delay the entire process.

Q 14. Explain the concept of a Standby Letter of Credit.

A Standby Letter of Credit (SBLC) is a financial instrument similar to a documentary credit but serves a different purpose. While a documentary credit facilitates the payment for goods, an SBLC guarantees payment if a specified event (or default) occurs. Think of it as an insurance policy against non-performance of a contract.

How it works: The applicant (usually the buyer) requests the SBLC from a bank. This guarantees payment to the beneficiary (usually the seller) if the applicant fails to meet their contractual obligations. The beneficiary only draws on the SBLC if the applicant defaults. The trigger for payment is typically non-payment or non-performance of a specific contractual obligation. Unlike a traditional documentary credit, documents supporting the shipment of goods are not typically required.

Example: A construction contractor (beneficiary) might require an SBLC from the developer (applicant). If the developer fails to pay for completed work according to the contract, the contractor can draw on the SBLC to receive payment.

Key Differences from Documentary Credit:

- Purpose: Documentary credit facilitates payment for goods; SBLC guarantees payment in case of default.

- Documents: Documentary credits rely on a set of documents; SBLCs typically don’t.

- Trigger for Payment: Documentary credits trigger payment upon presentation of documents; SBLCs trigger payment upon a defined event of default.

SBLCs provide a strong guarantee for the beneficiary, reducing the risk of non-payment, especially in high-value or complex transactions.

Q 15. What is a back-to-back Letter of Credit?

A back-to-back Letter of Credit is essentially a chain of Letters of Credit. Imagine a scenario where Company A in Country X wants to import goods from Company B in Country Y. Company A might approach their bank (Bank A) to issue a Letter of Credit in favor of Company B. However, Company A might also need to secure financing for this purchase. To do this, they may get a second Letter of Credit from their own supplier, Company C. This second Letter of Credit (issued by Bank A to Company C) is ‘backed’ by the first Letter of Credit (issued by Bank A to Company B). Bank A is now acting as both a buyer and seller of Letters of Credit, essentially ‘mirroring’ the transactions. This second Letter of Credit issued by Bank A to Company C is what makes it a back-to-back arrangement.

In simpler terms, it’s like a domino effect: Company A secures credit from Company C, which is then used to secure credit for Company B. The risk is partially transferred and managed through this interconnected structure. The success of a back-to-back arrangement hinges on the creditworthiness of all parties involved and the strict adherence to the terms and conditions of both Letters of Credit.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. How do you ensure compliance with sanctions regulations in Documentary Credits?

Compliance with sanctions regulations in Documentary Credits is paramount. A single oversight can result in severe financial penalties and reputational damage. Our process involves a multi-layered approach:

- Screening: We meticulously screen all parties involved – the applicant, beneficiary, issuing bank, advising bank, and any intermediaries – against sanctioned entities lists maintained by relevant bodies like the OFAC (Office of Foreign Assets Control), the EU, and the UN. This involves automated screening tools along with manual review of high-risk transactions.

- Due Diligence: We conduct thorough due diligence on the nature of goods and services being traded, ensuring they are not subject to sanctions. This includes careful examination of the commercial invoices, packing lists, and other documentary evidence.

- Transaction Monitoring: We continuously monitor transactions for any red flags, such as unusual payment patterns or involvement of high-risk jurisdictions. This involves real-time monitoring of SWIFT messages and regular internal audits.

- Training and Awareness: All staff involved in processing Documentary Credits receive regular training on sanctions compliance best practices and updated regulations. We maintain a culture of vigilance and immediate reporting of any suspicious activity.

Non-compliance can lead to freezing of assets, hefty fines, and even criminal prosecution. Therefore, maintaining a robust and proactive sanctions compliance program is not merely a legal requirement but a vital aspect of responsible banking.

Q 17. Describe your experience with different types of Documentary Credit applications (e.g., import, export).

My experience encompasses a wide range of Documentary Credit applications, both import and export. In export transactions, I’ve handled numerous scenarios where we’ve issued Letters of Credit on behalf of importers (our clients) to support overseas exporters. This involves careful review of export documentation, ensuring compliance with Incoterms, and managing the release of payments upon presentation of compliant documents. For example, I recently assisted a textile company exporting garments to Europe, ensuring proper documentation of origin, quality certificates, and shipping documents were provided.

On the import side, I’ve worked with numerous clients who have used Letters of Credit to purchase goods from international suppliers. This involves careful negotiation of credit terms with the beneficiary’s bank, ensuring the Letter of Credit aligns perfectly with the underlying contract, and managing the client’s obligation to present the required documents to obtain payment. A recent example involved an agricultural firm importing coffee beans, where we had to ensure that the quality and quantity were precisely defined in the Letter of Credit and verified through certifications.

The nuances differ depending on the commodity, country of origin/destination, and the buyer/seller’s specific requirements; understanding these nuances is key to successful transaction management.

Q 18. How do you handle situations involving fraudulent documents?

Handling fraudulent documents is a critical aspect of Documentary Credit operations. Our approach is multi-pronged:

- Document Examination: A thorough and meticulous examination of all presented documents is the first line of defense. This includes verifying signatures, comparing shipment details across various documents, and checking for inconsistencies or discrepancies. We use advanced document verification techniques and often involve external experts if required.

- Verification with Third Parties: We actively verify information with third parties like shipping companies, insurance providers, and chambers of commerce to validate the authenticity of presented documents. For example, we might directly contact a shipping line to confirm the details of a bill of lading.

- Legal Consultation: In cases of suspected fraud, we immediately consult with our legal team to explore all available options and to assess the level of risk. We have to weigh the risks involved in potentially paying out under a fraudulent claim against the potential losses from rejecting a legitimate claim.

- Reporting and Investigation: Fraudulent attempts are reported to relevant authorities, including the police and any relevant regulatory bodies. Internal investigations are conducted to identify any weaknesses in our processes and to prevent future occurrences. We also thoroughly document all findings.

The key is prompt action and decisive response, balancing the need to protect our client’s interests with adherence to the rules and regulations governing Letters of Credit.

Q 19. Explain the process of negotiating a Documentary Credit.

Negotiating a Documentary Credit involves a collaborative process between the buyer (applicant), the seller (beneficiary), and their respective banks. It’s essentially a contract, meticulously outlining the terms and conditions under which payment will be released. The process typically involves these steps:

- Application Preparation: The buyer provides detailed information about the transaction to their bank, including information on the goods, supplier, payment terms, and any specific requirements.

- Credit Appraisal: The issuing bank assesses the buyer’s creditworthiness and the risk associated with the transaction. The bank may need to check the credit history of the buyer and understand the details of the transaction, including a review of the underlying sale contract.

- Credit Issuance: Once approved, the bank issues the Letter of Credit, which sets out the terms of payment and the documents required from the seller to claim payment. This is often done in close consultation with the buyer to ensure their needs are met.

- Negotiation and Confirmation: The Letter of Credit is often passed on to the seller’s bank (advising/negotiating bank) which confirms that the Letter of Credit is genuine and will honour it. This stage is critical because it provides the seller with the confidence to proceed with the shipment.

- Document Presentation: Once the seller has fulfilled their obligations, the seller presents the stipulated documents to their bank. This presentation must be in precise compliance with the terms and conditions of the Letter of Credit.

- Payment Release: The advising bank examines the presented documents. If the documents are compliant and in order, payment is released to the seller.

Effective negotiation involves clear communication and mutual understanding between all parties, minimizing ambiguities and potential disputes. The goal is to create a secure and efficient mechanism for international trade.

Q 20. What is the role of SWIFT in Documentary Credits?

SWIFT (Society for Worldwide Interbank Financial Telecommunication) plays a crucial role in Documentary Credits by facilitating secure and standardized messaging between banks involved in international transactions. It provides a network for the transmission of electronic messages, including the issuance, amendment, and confirmation of Letters of Credit. SWIFT messages are used to communicate crucial information efficiently and securely, ensuring the timely exchange of documents and funds.

For example, when a bank issues a Letter of Credit, a specific SWIFT message (MT700) is used to transmit the details to the advising bank. Similarly, other messages are utilized to confirm the issuance, amend the Letter of Credit, or advise the beneficiary that the Letter of Credit has been received. The use of SWIFT helps to ensure accuracy, speed, and security in the transmission of information, thereby minimizing delays and errors in the process.

The standardized nature of SWIFT messages also helps to streamline the process and reduce the risk of misunderstandings. It forms the backbone of global trade finance, enabling seamless communication across geographical boundaries.

Q 21. How do you manage the lifecycle of a Documentary Credit?

Managing the lifecycle of a Documentary Credit involves careful monitoring and coordination across several stages. The process can be broken down into:

- Application and Issuance: This begins with the applicant’s application and continues until the Letter of Credit is issued by the bank.

- Advising/Confirmation: The Letter of Credit is sent to the advising/negotiating bank for confirmation and then to the beneficiary.

- Shipping and Document Preparation: The beneficiary fulfills their obligations and prepares the required documents to claim payment.

- Document Presentation and Examination: The beneficiary presents the documents to their bank, which then examines them for compliance.

- Payment Release: If the documents are compliant, payment is released to the beneficiary.

- Archiving: All documentation is carefully archived for future reference and audit trails. This step is crucial for compliance and potential dispute resolution.

Throughout the entire lifecycle, we maintain regular communication with all parties involved, ensuring transparency and proactively addressing any potential issues. We employ specialized software to track the progress of each Letter of Credit and alert us to any deviations from the expected timeline or any potential problems. Effective management of the lifecycle minimizes risk and ensures smooth and efficient completion of the transaction.

Q 22. What is your experience with different banking systems used for Documentary Credits?

My experience spans various banking systems used for Documentary Credits, including SWIFT (Society for Worldwide Interbank Financial Telecommunication), which is the industry standard for secure messaging and transaction processing. I’ve also worked with numerous local and international banking platforms, each with its own nuances in handling credit applications, document presentation, and communication protocols. For example, some banks utilize proprietary systems for internal processing while relying on SWIFT for interbank communication. Others may integrate their systems with external platforms for trade finance data management. Understanding these different systems is crucial for efficient and compliant processing of Documentary Credits, ensuring seamless transactions regardless of the participating banks’ technological infrastructure. This includes navigating variations in data formats, message types, and security protocols.

Q 23. How do you ensure the accuracy of documentation in Documentary Credits?

Accuracy in documentation is paramount in Documentary Credits. A single discrepancy can lead to delays or even rejection of the credit. My approach involves a multi-layered system of checks and balances. Firstly, we meticulously review all documents against the terms and conditions stipulated in the Letter of Credit (LC). This includes checking for consistency in details like invoice amounts, shipping documents (bill of lading, packing list, certificate of origin), and insurance certificates. Secondly, we utilize specialized software designed to detect inconsistencies and errors. These systems cross-reference data across documents, flagging potential mismatches or discrepancies. Thirdly, we have established robust internal procedures, incorporating multiple levels of review by experienced professionals. This helps to catch errors that might slip through individual reviews. Finally, we maintain a detailed audit trail of all actions taken, ensuring complete transparency and accountability.

Q 24. Describe your experience with resolving disputes related to Documentary Credits.

Dispute resolution in Documentary Credits often involves careful examination of the LC, the accompanying documentation, and relevant industry regulations (like UCP 600 – Uniform Customs and Practice for Documentary Credits). My experience includes negotiating amicable settlements between buyers and sellers, mediating disputes arising from discrepancies in documents or delays in presentation. In cases where negotiation fails, I’ve been involved in processes leading to arbitration or litigation as a last resort. A key aspect of resolution is the ability to objectively assess the evidence, apply relevant rules and regulations, and communicate clearly with all parties involved. Successful resolution requires a strong understanding of international trade law and the ability to navigate complex legal and commercial issues.

Q 25. Explain the concept of a red clause in a Documentary Credit.

A red clause in a Documentary Credit allows the beneficiary (exporter) to draw a portion of the credit amount *before* the presentation of the required shipping documents. It’s a crucial element for exporters requiring funds upfront to cover pre-shipment costs such as raw materials or manufacturing expenses. The red clause is typically incorporated in the LC itself, specifying the amount that can be drawn and the conditions for drawing. It involves a high degree of risk for the issuing bank because it relies on the exporter’s promise to ultimately deliver the goods. Example: The LC might state: “A Red Clause is hereby incorporated allowing the beneficiary to draw up to 60% of the credit amount upon presentation of a pro-forma invoice and the issuing bank’s approval.” This clearly outlines the condition and percentage permissible.

Q 26. What are the key differences between Documentary Credits and other forms of payment?

Documentary Credits offer a significantly higher level of security compared to other payment methods such as open account or pre-payment. Open account involves extending credit to the buyer with no collateral. Pre-payment requires the buyer to pay the full amount upfront, which may be difficult for many. In contrast, a Documentary Credit offers a guaranteed payment to the seller provided they comply with the stipulated terms and conditions of the LC. The payment is contingent on the presentation of specific, compliant documents, acting as a form of collateral and reducing the risk of non-payment for the seller, and the risk of non-delivery for the buyer. This makes Documentary Credits particularly suitable for international trade where trust and security are paramount, especially when dealing with unfamiliar buyers or sellers.

Q 27. How do you stay updated on changes in regulations and best practices related to Documentary Credits?

Staying abreast of changes in regulations and best practices within Documentary Credits is critical. I actively monitor publications from organizations like the International Chamber of Commerce (ICC), which publishes the UCP 600 rules. I also attend industry conferences and webinars, network with other professionals, and subscribe to specialized trade finance publications and journals. This multifaceted approach ensures that my knowledge remains current and that our practices remain compliant with the latest regulatory and best practice standards. Ongoing professional development is fundamental to this process.

Q 28. Describe a situation where you had to resolve a complex issue related to a Documentary Credit.

In one instance, we faced a complex issue involving a Documentary Credit where the shipment was delayed due to unforeseen port congestion. The documents presented were technically compliant, but the buyer argued that the delay violated the shipment timeframe stipulated in the LC. The situation required a detailed analysis of the LC, consideration of the force majeure clause (which deals with events beyond reasonable control), and thorough communication with all parties involved, including the shipping company, the buyer, and the seller. We collaborated with all parties to gather evidence of the port congestion and negotiated an extension for presentation of the documents. It required extensive negotiation and careful documentation to resolve this complex situation, underscoring the need for a thorough understanding of the contract’s specifics and a strategic approach to mediation.

Key Topics to Learn for Documentary Credits Interview

- Understanding Documentary Credits Fundamentals: Grasp the core principles, definitions, and terminology associated with documentary credits, including letters of credit, bills of exchange, and other key instruments.

- Types of Documentary Credits: Explore the different types of documentary credits (e.g., irrevocable, confirmed, transferable) and their practical applications in international trade.

- Documentary Credit Lifecycle: Understand the stages involved in a documentary credit transaction, from application and issuance to presentation, negotiation, and payment. Practice tracing the flow of documents and funds.

- Risk Management in Documentary Credits: Analyze potential risks for each party involved (applicant, beneficiary, issuing bank, advising bank) and explore mitigation strategies.

- Uniform Customs and Practice for Documentary Credits (UCP 600): Familiarize yourself with the key rules and interpretations of UCP 600 and their practical implications in resolving discrepancies.

- Documentary Credit Compliance: Understand the importance of strict compliance with all terms and conditions outlined in the documentary credit to ensure smooth transactions and avoid potential disputes.

- Problem-Solving in Documentary Credits: Practice analyzing case studies involving discrepancies, amendments, and other challenges that may arise during a documentary credit transaction.

- Technology in Documentary Credits: Explore the role of technology in streamlining documentary credit processes, including electronic platforms and digitalization initiatives.

- Legal Aspects of Documentary Credits: Understand the legal frameworks governing documentary credits and their implications for contract enforcement.

Next Steps

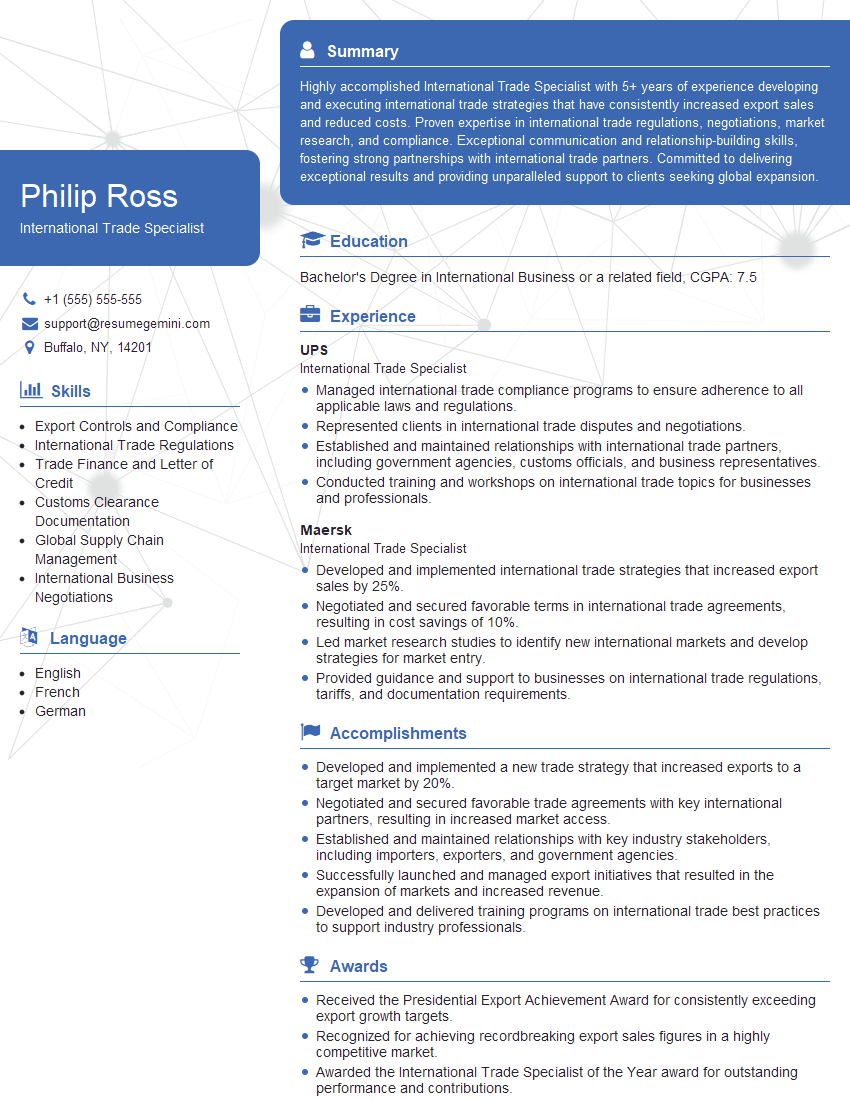

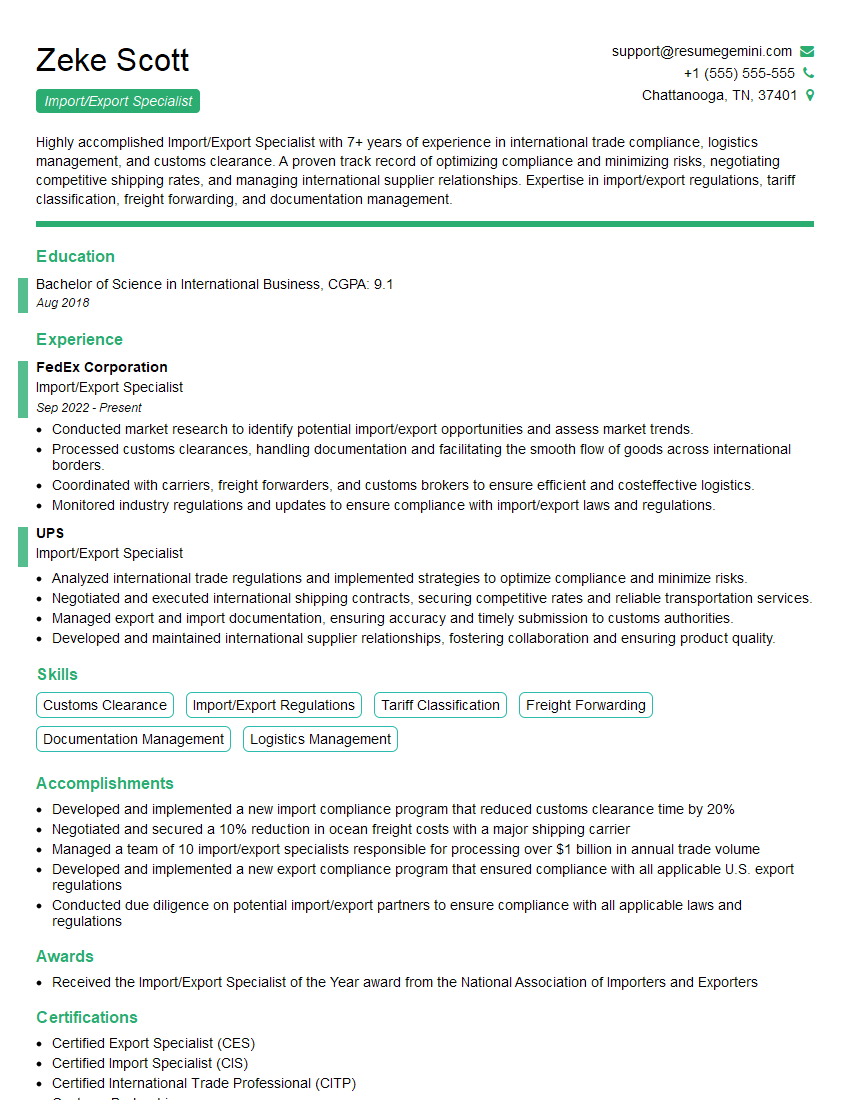

Mastering Documentary Credits opens doors to exciting career opportunities in international trade finance, offering high earning potential and intellectual stimulation. To stand out, a strong resume is crucial. Building an ATS-friendly resume significantly increases your chances of getting your application noticed. ResumeGemini is a trusted resource to help you craft a professional and impactful resume that highlights your skills and experience. Examples of resumes tailored specifically to Documentary Credits roles are available through ResumeGemini to guide your creation process. Invest the time to build a winning resume – it’s your first impression.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

Hi, I’m Jay, we have a few potential clients that are interested in your services, thought you might be a good fit. I’d love to talk about the details, when do you have time to talk?

Best,

Jay

Founder | CEO