The thought of an interview can be nerve-wracking, but the right preparation can make all the difference. Explore this comprehensive guide to Due Diligence and Contract Review interview questions and gain the confidence you need to showcase your abilities and secure the role.

Questions Asked in Due Diligence and Contract Review Interview

Q 1. Explain the key stages involved in a typical due diligence process.

Due diligence is a systematic process of investigating a business or asset before making a significant decision, like an acquisition or investment. It’s like a thorough background check, ensuring you’re not walking into an unexpected problem.

- Planning & Scoping: Defining the objectives, scope, and timeframe of the due diligence process. This includes identifying key areas to investigate and the resources required.

- Data Collection: Gathering information from various sources, including financial statements, legal documents, environmental reports, and interviews with management and employees. This is often the most time-consuming phase.

- Analysis & Evaluation: Scrutinizing the collected data to identify potential risks, opportunities, and inconsistencies. This involves comparing the information gathered against pre-determined criteria and benchmarks.

- Reporting & Communication: Documenting the findings in a comprehensive report, including a summary of key risks and recommendations. Clear communication with stakeholders is crucial.

- Negotiation & Closing: Based on the due diligence findings, negotiations may be necessary to address identified issues. This phase leads to the final decision on whether to proceed with the transaction.

Q 2. What are the main types of due diligence (e.g., financial, legal, environmental)?

Due diligence encompasses various types, each focusing on a specific aspect of the target entity. Think of it like assembling a puzzle – each piece is essential for a complete picture.

- Financial Due Diligence: Analyzing financial statements, cash flow, profitability, and debt levels to assess the financial health and performance of the target. This helps determine the target’s true value and identify any financial irregularities.

- Legal Due Diligence: Reviewing contracts, licenses, permits, intellectual property rights, and litigation history to ensure compliance with laws and regulations and identify potential legal risks.

- Environmental Due Diligence: Investigating potential environmental liabilities, such as pollution, contamination, or non-compliance with environmental regulations. This is especially important for businesses with manufacturing facilities or operations that impact the environment.

- Operational Due Diligence: Assessing the efficiency and effectiveness of the target’s operations, including its management team, processes, and technology. This is crucial for evaluating long-term viability and synergy with the acquiring company.

- Commercial Due Diligence: Evaluating the target’s market position, competitive landscape, customer relationships, and strategic direction. This helps understand the target’s market value and its future potential.

Q 3. Describe your experience in reviewing and analyzing financial statements during due diligence.

My experience with financial statement analysis during due diligence is extensive. I’ve reviewed hundreds of financial statements across various industries, from startups to large corporations. My approach focuses on understanding the ‘story’ the numbers tell.

I begin by scrutinizing the income statement, balance sheet, and cash flow statement for consistency and reasonableness. I look for red flags such as unusual fluctuations, discrepancies between different statements, and aggressive accounting practices. For instance, a sudden spike in revenue with no corresponding increase in accounts receivable might signal revenue recognition issues.

I then perform ratio analysis, calculating key financial ratios like profitability, liquidity, and solvency ratios to gauge the company’s financial health and performance. This allows for a comparison to industry benchmarks and helps uncover potential problems early. If there are inconsistencies, I delve deeper, requesting additional information or engaging external experts, such as forensic accountants, if needed. This methodical approach ensures a thorough and accurate assessment of the target’s financial position.

Q 4. How do you identify and assess potential risks during a due diligence exercise?

Identifying and assessing risks is at the core of due diligence. My approach is systematic and uses a risk-based framework. I start by defining the potential risks based on the transaction type and the target’s industry. Then, during the data collection and analysis phase, I actively look for indicators of those risks.

For example, in an acquisition, key risks might include environmental liabilities, undisclosed litigation, or intellectual property infringement. I employ a range of methods to uncover these risks, such as reviewing environmental reports, legal documents, and interviewing key personnel. Once identified, I quantify the likelihood and potential impact of each risk, prioritizing the most significant ones. This allows for a focused approach to mitigation strategies and negotiation points.

Risk assessment isn’t just about identifying problems; it’s also about uncovering opportunities. For instance, identifying a poorly managed inventory system could indicate opportunities for cost reduction, which I would highlight in my report.

Q 5. What is your approach to managing a large volume of documents during due diligence?

Managing a large volume of documents is a common challenge in due diligence. My approach combines technology and well-defined processes to ensure efficient document review. I leverage document management systems (DMS) and electronic data rooms (EDRs) to organize, categorize, and access documents efficiently. This is like building a well-organized library rather than a messy pile of papers.

Before starting the review, I work closely with the client to prioritize documents based on materiality and risk. We develop a clear indexing and tagging system to make searches quicker and easier. I also utilize advanced search functionalities within the DMS or EDR to locate specific terms or patterns. Technology is key, but effective team management and clear communication also play a vital role in efficiently completing the review process.

Q 6. How familiar are you with different contract types (e.g., NDA, SaaS, employment)?

I have extensive experience reviewing various contract types. My familiarity extends beyond simply understanding the terminology; I understand the implications and potential risks associated with each. Think of it like knowing the rules of different games – you need to understand the nuances to play effectively.

- Non-Disclosure Agreements (NDAs): I’m proficient in reviewing NDAs to ensure confidentiality provisions are adequately protected. This includes understanding the scope of confidential information, the duration of the agreement, and remedies for breaches.

- Software as a Service (SaaS) Agreements: I’m adept at analyzing SaaS agreements, focusing on key clauses such as service levels, payment terms, intellectual property rights, liability limitations, and termination clauses.

- Employment Agreements: I have a thorough understanding of employment contracts, focusing on aspects like compensation, benefits, restrictive covenants (non-compete clauses), and termination provisions.

- Merger and Acquisition Agreements: I have considerable experience in M&A agreements, analyzing representations and warranties, conditions precedent, indemnities, and dispute resolution mechanisms.

My knowledge spans many other contract types including licensing agreements, distribution agreements, and supply agreements.

Q 7. Explain your process for reviewing and analyzing contracts for key clauses and risks.

My contract review process is rigorous and systematic. It’s not just about reading the words, but understanding the legal and business implications. I use a checklist approach, targeting key clauses and potential risks.

Firstly, I identify the purpose of the contract and the parties involved. Then, using a standardized checklist, I systematically review key clauses, including:

- Representations and Warranties: I examine these statements of fact to identify potential misrepresentations or breaches.

- Indemnification Provisions: I assess the extent of liability for each party and potential exposures.

- Termination Clauses: I review the circumstances under which the contract can be terminated and the consequences of termination.

- Dispute Resolution: I analyze how disputes will be resolved, looking for clauses specifying arbitration or litigation.

- Governing Law and Jurisdiction: I assess where disputes will be heard, considering the potential impact on cost and convenience.

After the detailed clause-by-clause review, I prepare a summary highlighting key risks and recommendations. This involves identifying any ambiguities, conflicts, or potentially unfavorable terms. This systematic approach ensures a comprehensive understanding of the contract’s implications and risks.

Q 8. How do you identify inconsistencies or ambiguities within a contract?

Identifying inconsistencies and ambiguities in a contract requires a meticulous and systematic approach. Think of it like proofreading a complex document, but with significantly higher stakes. I start by reading the entire contract thoroughly for a general understanding. Then, I move to a detailed line-by-line review, focusing on key areas such as definitions, payment terms, liabilities, and termination clauses.

Inconsistencies often arise from conflicting statements or different uses of the same term throughout the document. For example, one clause might refer to ‘net 30 days’ while another uses ‘net 60 days’ for payment terms. Ambiguities, on the other hand, occur when a clause is vaguely worded, leaving room for multiple interpretations. A phrase like ‘reasonable efforts’ is ambiguous because ‘reasonable’ is subjective and lacks a clear definition within the contract’s context.

To pinpoint these issues, I utilize a checklist based on my experience and best practices. I look for discrepancies between different sections, compare the final draft against earlier versions to spot changes, and use cross-referencing to ensure consistency in the use of key terms. I also employ a careful analysis of legal language, paying close attention to the use of ‘and’, ‘or’, ‘shall’, and ‘may’ which can significantly impact the meaning.

- Example: An inconsistency might be the mention of a specific delivery date in one clause, contradicting a broader timeframe outlined in the project schedule.

- Example: An ambiguity might be a clause mentioning ‘acceptable quality’ without defining what constitutes ‘acceptable’ for the goods or services provided.

Q 9. How do you handle conflicting clauses in a contract?

Conflicting clauses are a serious issue requiring careful consideration. Imagine a contract with two clauses pulling in opposite directions; one states ‘payment is due upon delivery,’ and another says ‘payment is due within 30 days.’ Resolving these conflicts requires a nuanced approach, understanding the contract’s hierarchy and the intent behind each clause.

My first step is to understand the context of the conflicting clauses. I look for clues within the contract itself – a ‘governing law’ clause can provide valuable insight into which interpretation is more likely to be legally sound. Then, I prioritize clauses based on their importance and specificity. Specific provisions often override general ones; for example, a detailed payment schedule in a particular annex might supersede a general payment clause in the main body of the agreement.

If the contract doesn’t offer clear guidance, I consider contractual interpretation rules and precedents. I might consult external legal resources or seek advice from legal counsel to determine the most legally defensible interpretation. Ultimately, the goal is to identify the most reasonable interpretation in light of the contract’s overall purpose. Sometimes, the resolution might involve negotiating amendments with the counterparty to clarify the ambiguity or explicitly address the conflict.

Q 10. Describe your experience with contract negotiation.

My experience in contract negotiation spans various industries and transaction types. I’ve participated in negotiations involving multi-million dollar contracts for technology licensing, mergers and acquisitions, and complex service agreements. My approach emphasizes collaboration and proactive communication.

Before any negotiation, I thoroughly analyze the contract to understand our client’s priorities and potential risks. This allows me to prepare a comprehensive negotiation strategy that identifies areas for compromise and potential leverage points. During the negotiation process, I maintain a clear and professional demeanor, aiming to build a collaborative relationship with the counterparty. I actively listen to their concerns and work to find mutually agreeable solutions.

I view negotiation as a process of creating value, not just claiming it. I look for opportunities to enhance the deal’s overall value proposition for both parties. I don’t shy away from using data and market insights to justify my position and build consensus. When necessary, I leverage my knowledge of legal principles and precedents to strengthen my client’s position.

Example: In a recent technology licensing deal, I successfully negotiated a clause protecting our client’s intellectual property rights and securing more favorable royalty payments through meticulous preparation and understanding of the market rate for similar technologies.

Q 11. What software or tools do you use for contract management and review?

Effective contract management and review require leveraging the right tools. I’m proficient in several software applications that streamline the process. These include:

- Contract Lifecycle Management (CLM) platforms: Such as Agiloft or Ironclad, these platforms offer centralized contract repositories, automated workflows for approvals, and advanced search functionalities for quick access to specific clauses or documents. They are excellent for managing large volumes of contracts and tracking key dates.

- Document review software: Tools like Kira Systems or Relativity can significantly speed up the review process by identifying key clauses, extracting data from documents, and highlighting potential risks or inconsistencies. They’re especially beneficial during due diligence exercises involving numerous contracts.

- Legal research databases: Platforms like Westlaw or LexisNexis provide access to case law, statutes, and legal precedents, which are critical for contract interpretation and risk assessment.

- Microsoft Office suite: The standard tools for creating, editing, and sharing contracts remain essential. The use of track changes and comments provides clear collaboration amongst team members.

The choice of software depends on the project’s scope and complexity. For simple contracts, a combination of Microsoft Office and a CLM system might suffice. For large-scale due diligence projects involving thousands of contracts, a more advanced CLM system integrated with document review software is often necessary.

Q 12. How do you ensure compliance with relevant regulations in contract review?

Ensuring compliance with relevant regulations is paramount in contract review. It’s akin to building a house on solid ground – without it, the entire structure is at risk. I approach this by proactively identifying all applicable regulations early in the process.

My first step is to understand the nature of the contract and the industries involved. This helps me identify relevant legislation, such as data privacy laws (like GDPR or CCPA), antitrust regulations, environmental regulations, or specific industry-specific rules. Then, I systematically review the contract to identify potential compliance gaps. I pay particular attention to clauses relating to data handling, intellectual property, payment terms, termination, and dispute resolution.

I use legal research databases to stay updated on changes in legislation and interpret their impact on the contract. For contracts with significant international components, I carefully consider conflicts of law and jurisdictional issues. Where necessary, I collaborate with legal counsel specializing in specific regulatory areas to ensure thorough compliance. I document all compliance considerations and findings within a comprehensive report, clearly outlining potential risks and recommendations for mitigation.

Example: In reviewing a contract for a data-driven service, I’d ensure compliance with data privacy laws by scrutinizing clauses related to data collection, storage, processing, and transfer, ensuring they align with GDPR or CCPA requirements.

Q 13. How do you prioritize tasks during a high-pressure due diligence project?

High-pressure due diligence projects demand efficient prioritization. It’s like managing a complex orchestra—every instrument needs to play its part in harmony and in time. I use a combination of techniques to ensure critical tasks are addressed efficiently.

First, I work closely with the project team to define clear objectives and establish a timeline. This includes breaking down the project into manageable tasks, assigning responsibilities, and identifying dependencies. I then prioritize tasks based on urgency and impact, using frameworks like the Eisenhower Matrix (urgent/important). High-risk areas, such as potential breaches of contract or regulatory non-compliance, usually take precedence.

I utilize project management tools to track progress, manage deadlines, and identify potential bottlenecks. Regular communication with stakeholders is crucial to ensure everyone is aligned and any emerging issues are addressed promptly. Flexible adaptation is key; unforeseen circumstances can arise, and the prioritization strategy might need to be adjusted accordingly. I always prioritize tasks that provide the greatest value in the shortest time frame, focusing on areas that could most impact the project’s outcome.

Q 14. Describe your experience working with external legal counsel.

Collaboration with external legal counsel is essential for many due diligence and contract review projects, particularly when dealing with complex legal issues or specialized regulations. It’s like having a highly skilled specialist join your team to handle critical aspects of the project.

My experience working with external counsel involves clearly defining the scope of their engagement. This includes providing them with all relevant documentation, clarifying our objectives, and setting realistic deadlines. I maintain clear and consistent communication throughout the process, providing regular updates and seeking their input on complex issues. I view them as a valued partner, not just an external resource. I leverage their specialized expertise while still maintaining ownership of the overall process.

I appreciate the importance of building a strong working relationship with counsel. This includes understanding their working style, expertise, and preferred communication methods. I strive to give them clear instructions, making sure they have all the information they need to perform their role effectively. After receiving their input, I incorporate their findings and recommendations into my analysis and reporting.

Example: In a recent acquisition, external counsel provided crucial expertise in antitrust matters, ensuring compliance with regulations and mitigating potential risks.

Q 15. How do you handle disagreements with clients or colleagues regarding contract interpretation?

Disagreements are inevitable in contract interpretation, especially when dealing with complex legal language. My approach focuses on collaborative problem-solving and clear communication. First, I ensure we’re all working from the same document version and clearly define the point of contention. I then meticulously research relevant case law, industry standards, and the contract’s overall context to support my interpretation. Instead of directly arguing, I present my findings logically and factually, highlighting potential risks and benefits associated with each interpretation. I actively listen to opposing viewpoints and try to understand the underlying concerns. Ultimately, my goal is to reach a consensus that aligns with the client’s overall business objectives and minimizes legal risk. If a consensus can’t be reached, I advocate for mediation or seek clarification from external legal counsel.

For example, in a recent dispute about a termination clause, my thorough research revealed a precedent-setting case with similar language, which supported my client’s interpretation, ultimately resolving the disagreement.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. What is your understanding of material adverse change (MAC) clauses?

A Material Adverse Change (MAC) clause is a provision in a contract that allows one party to terminate or renegotiate the agreement if a significant negative event affects the other party’s business. Think of it as a safety net. It’s crucial to define ‘material’ and ‘adverse’ precisely, as the interpretation can vary significantly depending on context. Generally, a MAC involves an event that significantly impacts the target company’s financial condition, operating results, or business prospects, making it substantially less valuable to the acquiring party. Factors considered often include the duration, severity, and persistence of the adverse event. It’s not simply a minor setback; it needs to be a substantial and unforeseen change.

For example, a significant drop in revenue due to unforeseen regulatory changes, a major lawsuit with substantial damages, or the loss of a key customer could trigger a MAC clause. However, it’s important to note that ordinary business downturns or seasonal fluctuations usually don’t qualify. Each MAC clause is unique and should be evaluated in its specific context.

Q 17. Explain your experience with intellectual property due diligence.

My experience in intellectual property (IP) due diligence encompasses a wide range of activities, from identifying and verifying IP assets to assessing the potential risks and opportunities associated with them. This includes reviewing patent portfolios, trademarks, copyrights, and trade secrets. I systematically analyze the validity, enforceability, and freedom-to-operate of each IP asset. I also investigate potential infringement issues and identify any gaps in IP protection. This often involves reviewing licensing agreements, technology transfer agreements, and other relevant contracts. Furthermore, I assess the quality and value of the IP portfolio in relation to the target company’s business, identifying potential future revenue streams or liabilities.

In one project, we discovered a crucial patent was nearing expiration without renewal applications filed, which represented a significant risk. Early identification and subsequent action by the client mitigated potential future losses.

Q 18. How do you conduct environmental due diligence?

Environmental due diligence involves identifying and assessing potential environmental liabilities associated with a property or business. This is often crucial for acquisitions or financing. The process typically begins with a Phase I Environmental Site Assessment, which reviews historical records, site reconnaissance, and interviews to identify potential contamination. If contamination is suspected, more intensive investigations like Phase II and Phase III assessments may follow. These involve soil and groundwater sampling to analyze the extent and nature of the contamination. The goal is to identify and quantify potential environmental risks and compliance issues, enabling the client to make informed decisions and factor those costs into their offer or strategy. This includes assessing compliance with environmental regulations, identifying potential cleanup liabilities, and estimating remediation costs.

For example, uncovering past industrial activities on a site requiring costly remediation impacted the negotiation terms significantly in a real estate transaction.

Q 19. What are some common red flags to look for during due diligence?

Numerous red flags can arise during due diligence, requiring careful scrutiny. Some common ones include:

- Inconsistent financial reporting: Discrepancies between financial statements and operational data raise concerns about accounting practices.

- High levels of related-party transactions: These can mask financial issues or improper dealings.

- Significant litigation or regulatory actions: Outstanding lawsuits or regulatory fines represent substantial liabilities.

- Weak internal controls: Inadequate internal controls suggest poor risk management and potential fraud.

- Unusual accounting practices: Deviation from generally accepted accounting principles (GAAP) should be investigated.

- Material weaknesses in internal controls: identified during the audit process point to significant operational risks

- Employee turnover issues: High turnover in key positions could signal problems with management or workplace culture.

Identifying and assessing these flags requires a thorough and systematic review of the target company’s documentation and operations, complemented by interviews with key personnel. Each flag must be fully investigated before drawing definitive conclusions.

Q 20. How do you manage the confidentiality of sensitive information during due diligence?

Confidentiality is paramount in due diligence. We implement robust measures to protect sensitive information. These include:

- Confidentiality agreements (NDAs): All parties involved sign NDAs to legally bind them to confidentiality.

- Secure data rooms: Virtual data rooms (VDRs) with access controls and audit trails are used to store and share sensitive documents.

- Data encryption: Sensitive data is encrypted both in transit and at rest.

- Limited access: Access to sensitive information is granted only to authorized personnel on a need-to-know basis.

- Regular security audits: Security measures are regularly reviewed and updated to ensure compliance with relevant regulations.

We also maintain strict internal protocols and regularly train our team members on data security best practices. This comprehensive approach ensures the confidentiality of client information throughout the due diligence process.

Q 21. Explain your experience with data room review.

My experience with data room reviews involves systematically navigating large volumes of data to extract relevant information supporting the due diligence process. This involves efficiently searching, reviewing, and analyzing documents provided by the target company. I utilize advanced search techniques and leverage data room software features to identify relevant documents quickly and accurately. I’m proficient in various data room platforms and understand the importance of documenting all review activities. The goal is to efficiently identify key information, verify information from different sources, and build a comprehensive understanding of the target’s operations, finances, and legal compliance.

For example, in a recent data room review, I effectively used keyword searches and filtering functionalities to locate crucial contracts related to intellectual property, revealing hidden liabilities that significantly impacted the client’s decision.

Q 22. How do you document your findings and recommendations from due diligence?

Documenting due diligence findings and recommendations is crucial for transparency, accountability, and future reference. My approach involves a structured, multi-stage process. First, I compile all relevant information gathered during the due diligence process – this includes financial statements, legal documents, contracts, and any other pertinent data – into a centralized repository, often a secure online platform or a dedicated project folder. This allows easy access and auditability.

Next, I create a detailed report that summarizes my findings. This report usually follows a standard format, including an executive summary highlighting key risks and opportunities, a detailed analysis of each area investigated (e.g., financial, legal, operational), and a section detailing my recommendations with supporting evidence. I use clear, concise language, avoiding jargon wherever possible, and include visual aids like charts and graphs to improve understanding.

Finally, I present the findings in a clear and concise manner, using a narrative structure to connect the various findings to the overall conclusion. I tailor the level of detail to the audience, offering a more in-depth analysis for senior management while providing a concise summary for less technical stakeholders. This ensures everyone understands the implications of my findings.

- Executive Summary: High-level overview of key findings, risks, and recommendations.

- Detailed Analysis: In-depth examination of specific aspects of the target, supported by evidence.

- Recommendations: Clear, actionable steps based on the findings.

- Appendices: Supporting documents and data.

Q 23. How do you communicate complex legal and financial information to non-legal audiences?

Communicating complex legal and financial information to non-legal audiences requires a strategic approach focusing on clarity, simplicity, and relevance. I avoid technical jargon and legalistic language, instead opting for plain English and easily understandable analogies. For example, when explaining complex financial ratios, I might use everyday examples like comparing the cost of a car to its resale value to illustrate concepts like profitability and asset turnover.

Visual aids are invaluable. Charts, graphs, and tables effectively convey complex data in an easily digestible format. I also use storytelling to engage the audience, presenting information within a narrative context that makes it relatable and memorable. Think of it like explaining a complicated recipe – instead of just listing ingredients and instructions, I’d paint a picture of the delicious final result.

Interactive sessions and Q&A are crucial for ensuring understanding. I encourage questions and actively respond to any areas of confusion, creating a collaborative learning environment. Ultimately, the goal is to empower the audience to understand the information, not just receive it passively.

Q 24. What is your experience in using due diligence reports to inform business decisions?

Due diligence reports are the cornerstone of informed business decisions. Throughout my career, I’ve consistently used them to guide acquisitions, investments, and strategic partnerships. I’ve seen firsthand how thorough due diligence can prevent costly mistakes and identify lucrative opportunities. For instance, in one acquisition, our due diligence report highlighted significant environmental liabilities not previously disclosed by the seller. This information allowed my clients to renegotiate the purchase price, ultimately saving them millions of dollars.

In another case, the due diligence process uncovered a previously unknown intellectual property portfolio that significantly increased the perceived value of a target company, influencing the client’s decision to proceed with a higher-than-initially-anticipated bid.

The reports I produce are not just documents; they are critical decision-making tools. They provide quantifiable data and qualitative assessments that allow clients to understand the risks and rewards associated with potential ventures. My role is to interpret the data and present it in a manner that clearly informs strategic choices.

Q 25. Describe a situation where you identified a critical risk during due diligence.

During a due diligence review for a potential acquisition of a manufacturing company, we uncovered significant discrepancies in their reported inventory levels. Initial financial statements showed healthy inventory levels, but our on-site physical inventory count revealed a substantial shortfall. Further investigation revealed outdated inventory management practices and a potential cover-up of obsolete or damaged goods. This was a critical risk as it directly impacted the company’s profitability and asset valuation.

We immediately flagged this issue to the client, emphasizing the potential financial implications and recommending a thorough forensic accounting investigation. This investigation confirmed our suspicions, resulting in a significant downward adjustment of the purchase price and the implementation of new inventory control measures as a condition of the deal. This case highlights the importance of going beyond the surface level and conducting thorough on-site inspections to validate the information provided.

Q 26. How did you resolve a significant contract dispute?

In one instance, a client was involved in a significant contract dispute related to a software licensing agreement. The other party claimed breach of contract due to alleged non-performance. Our strategy involved a multi-pronged approach. First, we carefully reviewed the contract, identifying ambiguities and potential loopholes. Second, we gathered and analyzed all relevant evidence, including emails, meeting minutes, and project documentation. Third, we engaged in extensive communication with the other party, aiming for a mutually agreeable solution through negotiation and mediation.

We found that while there were indeed some performance shortfalls, the other party’s interpretation of the contract clauses was overly restrictive. Ultimately, we successfully negotiated a settlement that was favorable to our client, mitigating potential legal costs and reputational damage. The key to success was a combination of thorough contract review, meticulous evidence gathering, and skillful negotiation.

Q 27. What is your approach to continuous professional development in due diligence and contract review?

Continuous professional development (CPD) is paramount in the ever-evolving fields of due diligence and contract review. My approach to CPD is multifaceted. I regularly attend industry conferences and webinars to stay abreast of the latest legal precedents, regulatory changes, and best practices. I actively participate in professional organizations like the Association of Certified Fraud Examiners (ACFE) and similar groups, engaging with peers and accessing specialized resources.

I maintain subscriptions to relevant legal and financial publications, ensuring I’m up-to-date on the latest case law and industry trends. Furthermore, I actively seek out challenging assignments that allow me to expand my skillset and apply new knowledge in real-world scenarios. Finally, I dedicate time to self-study, focusing on areas where I identify a need for improvement or further specialization. This proactive approach ensures that my skills remain sharp and relevant, enabling me to provide the highest quality service to my clients.

Key Topics to Learn for Due Diligence and Contract Review Interview

- Financial Due Diligence: Understanding financial statements, identifying key financial ratios and trends, and assessing the target company’s financial health. Practical application: Analyzing a company’s cash flow statements to predict future liquidity.

- Legal Due Diligence: Reviewing contracts, permits, licenses, and intellectual property rights to ensure compliance and identify potential liabilities. Practical application: Identifying potential litigation risks based on contract clauses and regulatory compliance.

- Operational Due Diligence: Assessing the target company’s operational efficiency, management team, and key processes. Practical application: Evaluating the efficiency of supply chain processes and identifying potential bottlenecks.

- Contract Review Fundamentals: Understanding contract interpretation, identifying key clauses (e.g., termination clauses, indemnification clauses), and recognizing potential risks and liabilities. Practical application: Analyzing a contract to identify potential breaches and mitigating strategies.

- Risk Assessment and Mitigation: Identifying, analyzing, and developing strategies to mitigate potential risks associated with a transaction or contract. Practical application: Developing a risk mitigation plan based on identified due diligence findings.

- Data Analysis and Interpretation: Utilizing data analysis techniques to identify trends, patterns, and anomalies relevant to the due diligence process. Practical application: Using data visualization tools to present due diligence findings clearly and concisely.

- Communication and Presentation Skills: Effectively communicating findings and recommendations to stakeholders, both orally and in writing. Practical application: Preparing a concise and informative presentation summarizing key due diligence findings.

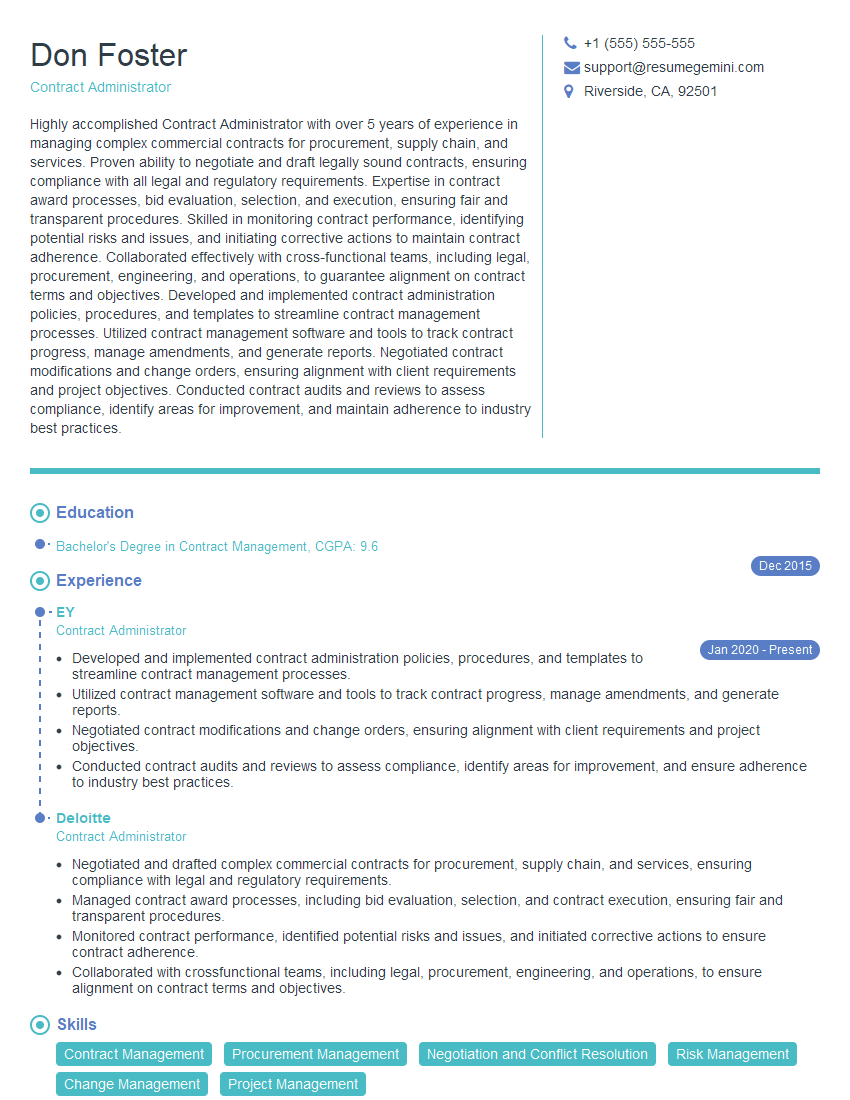

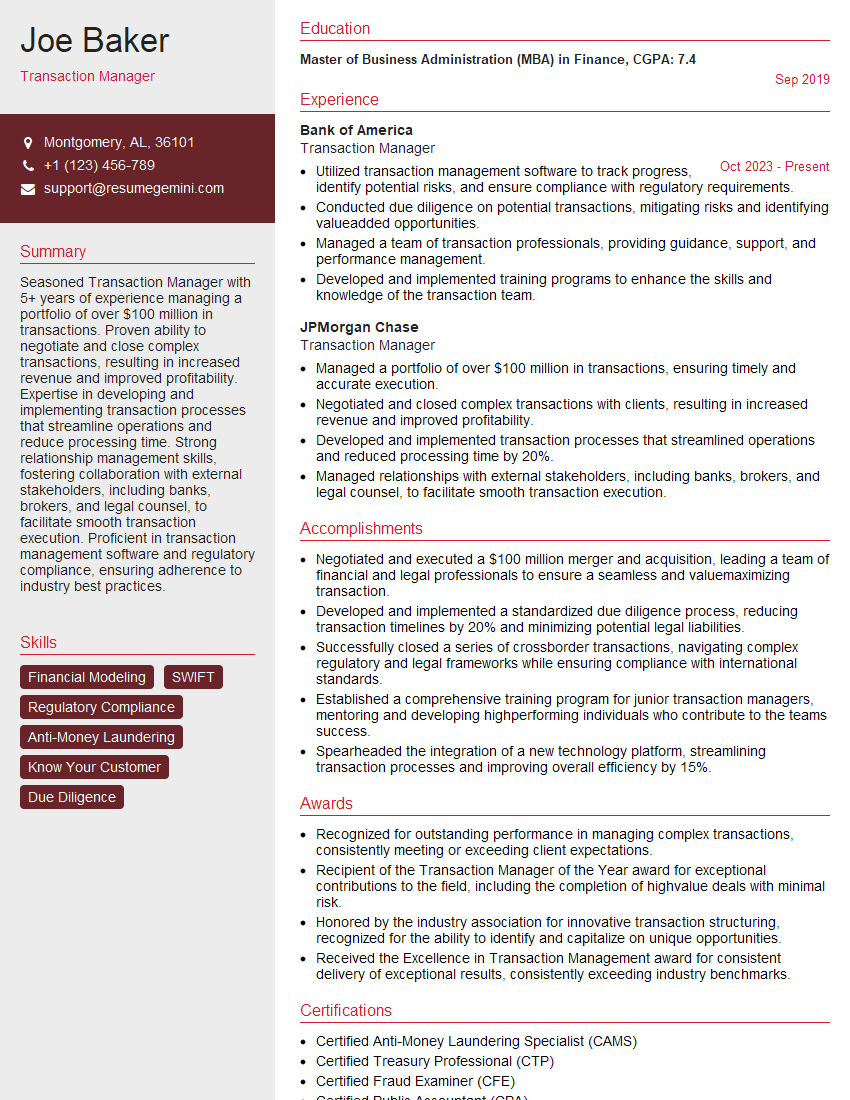

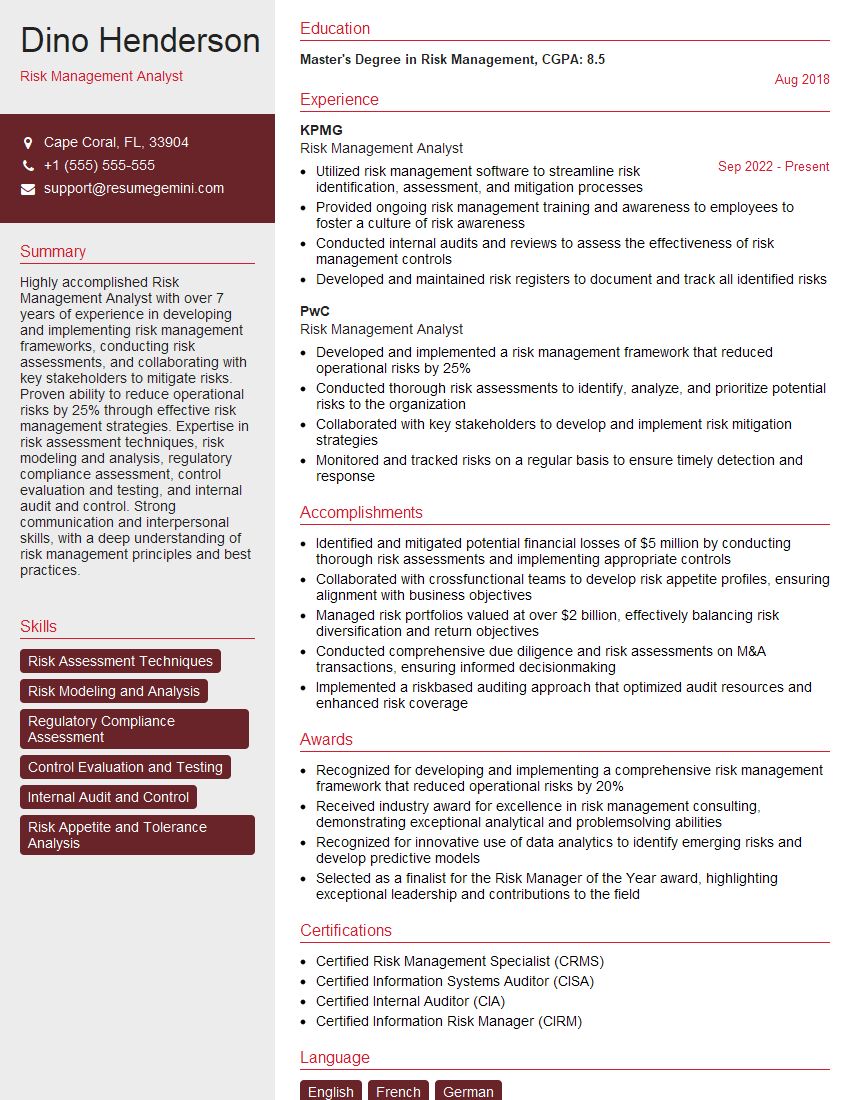

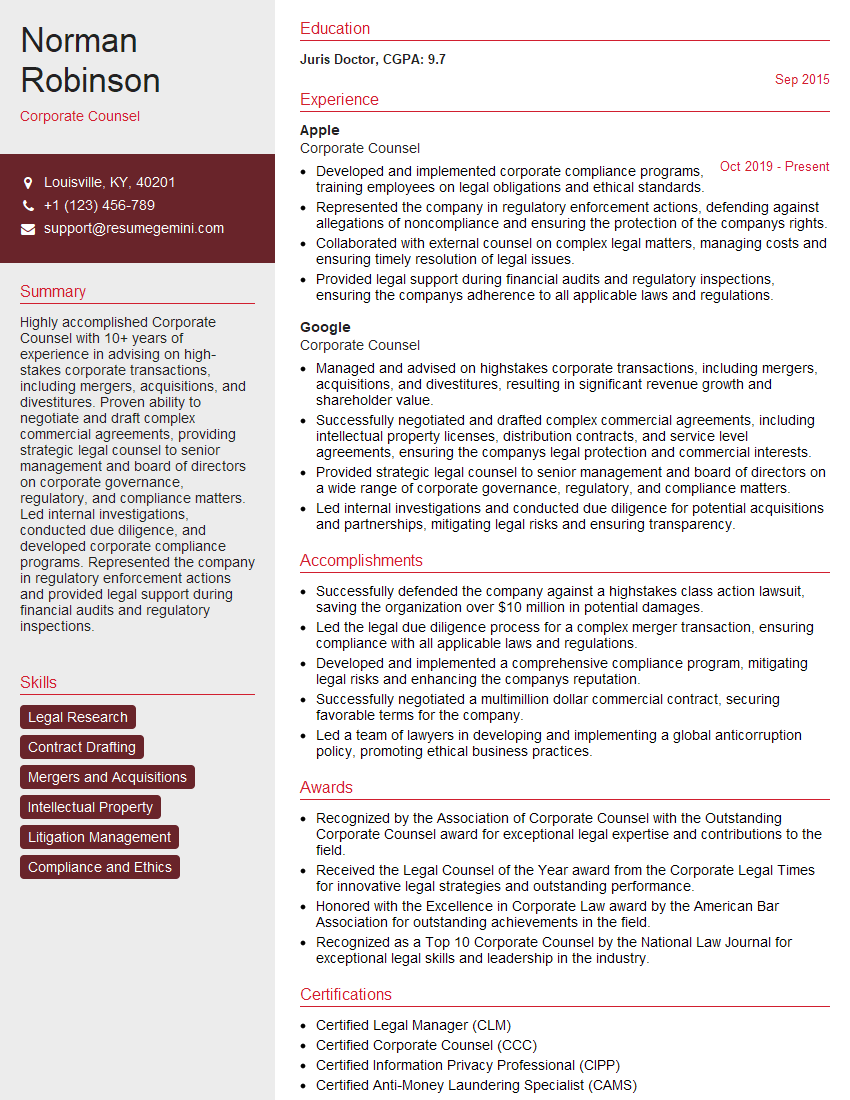

Next Steps

Mastering Due Diligence and Contract Review is crucial for career advancement in finance, law, and consulting. These skills are highly sought after, opening doors to exciting opportunities and higher earning potential. To significantly boost your job prospects, focus on creating an ATS-friendly resume that highlights your relevant skills and experience. ResumeGemini is a trusted resource to help you build a professional and impactful resume. We provide examples of resumes tailored specifically to Due Diligence and Contract Review to help guide your creation. Take the next step towards your dream career – build a standout resume with ResumeGemini today!

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

Hi, I’m Jay, we have a few potential clients that are interested in your services, thought you might be a good fit. I’d love to talk about the details, when do you have time to talk?

Best,

Jay

Founder | CEO