Are you ready to stand out in your next interview? Understanding and preparing for Escrow Officer Assistant interview questions is a game-changer. In this blog, we’ve compiled key questions and expert advice to help you showcase your skills with confidence and precision. Let’s get started on your journey to acing the interview.

Questions Asked in Escrow Officer Assistant Interview

Q 1. What is your experience with preparing escrow closing documents?

Preparing escrow closing documents is a critical aspect of my role, requiring meticulous attention to detail and a thorough understanding of real estate transactions. This involves compiling and verifying all necessary paperwork to ensure a smooth and legally sound closing. My experience encompasses preparing a wide range of documents, including but not limited to:

- Purchase and Sale Agreements: Reviewing these contracts to identify key terms and conditions related to the closing process.

- Loan Documents: Working with lenders’ documents, ensuring all information is accurate and consistent across all documents.

- Title Insurance Policies: Reviewing the title commitment and ensuring the policy accurately reflects the property’s ownership and any encumbrances.

- Closing Disclosures: Preparing accurate and compliant closing statements (like the HUD-1 or Closing Disclosure), detailing all debits and credits for both the buyer and seller.

- Deeds and other Transfer Documents: Preparing and executing deeds, and other necessary documents for property transfer.

For example, I once handled a complex closing involving a short sale. By carefully reviewing all documents and coordinating with multiple parties – the seller, buyer, lender, and real estate agents – I was able to successfully navigate the intricacies of the transaction and ensure a timely and legally sound closing.

Q 2. How familiar are you with RESPA regulations?

I am very familiar with the Real Estate Settlement Procedures Act (RESPA) regulations. RESPA mandates specific disclosures and procedures to ensure transparency and protect consumers in real estate transactions. My understanding of RESPA includes:

- Knowing the requirements for the Loan Estimate (LE) and Closing Disclosure (CD): I understand the timing and content requirements for these critical disclosures and can verify their accuracy.

- Understanding prohibited practices: I’m well-versed in RESPA’s prohibitions against kickbacks and referral fees, ensuring all transactions comply with these rules.

- Managing Affiliated Business Arrangements (ABAs): If a transaction involves ABAs, I understand the disclosure requirements and ensure compliance.

- Staying updated on regulatory changes: The regulatory landscape evolves constantly, and I actively stay informed about any changes or updates to RESPA regulations through continuing education and industry publications.

My experience ensures that all escrow transactions I handle are fully compliant with RESPA, minimizing any potential risks for all parties involved.

Q 3. Describe your experience with title searches and examining title reports.

Title searches and examining title reports are essential for ensuring clear ownership and identifying potential issues before closing. My experience in this area includes:

- Ordering and reviewing title searches: I collaborate with title companies to ensure thorough title searches are conducted to uncover any liens, judgments, or other encumbrances on the property.

- Analyzing title reports: I carefully examine the title reports to identify any potential problems, such as outstanding mortgages, easements, or boundary disputes. I can interpret complex legal descriptions and understand the implications of various title exceptions.

- Identifying and resolving title issues: When issues are identified, I actively participate in resolving them by working with the relevant parties, such as the sellers, buyers, and title company. This may involve obtaining releases of liens, correcting errors in property descriptions, or obtaining necessary waivers.

- Understanding title insurance policies: I understand the protection offered by title insurance and can explain the policies to clients.

For example, I once discovered a previously unknown easement during a title review. I immediately brought this to the attention of all parties and worked to resolve the situation before it impacted the closing, preventing potential delays and costly disputes.

Q 4. Explain the process of calculating escrow closing costs.

Calculating escrow closing costs involves meticulous attention to detail and a thorough understanding of various fees and charges. The process generally involves the following steps:

- Gathering all necessary documentation: This includes the purchase agreement, loan documents, appraisal, and other relevant documents.

- Identifying all charges: This includes loan origination fees, title insurance premiums, recording fees, transfer taxes, homeowner’s insurance premiums, property taxes, and any other applicable fees.

- Calculating prorations: Property taxes and homeowner’s insurance are typically prorated between the buyer and seller based on the closing date.

- Preparing the closing disclosure: This document summarizes all debits and credits for both the buyer and seller, and must comply with RESPA requirements.

- Verifying accuracy: A thorough review and verification process is essential to ensure accuracy before finalizing the closing statement.

Think of it like balancing a detailed checkbook – every debit and credit must reconcile perfectly. Accuracy is paramount to avoid costly mistakes and disputes.

Q 5. How do you handle discrepancies in funds during escrow?

Discrepancies in funds during escrow are handled promptly and efficiently, prioritizing accuracy and legal compliance. My approach involves:

- Immediate identification: Discrepancies are identified through meticulous reconciliation of funds received and disbursed.

- Thorough investigation: The source of the discrepancy is investigated by carefully reviewing all documentation and communication with relevant parties (e.g., lenders, buyers, sellers).

- Communication: All parties are informed of the discrepancy and kept updated throughout the investigation and resolution process.

- Documentation: All actions and communication are thoroughly documented.

- Resolution: The discrepancy is resolved through appropriate adjustments, ensuring all parties are satisfied and the closing proceeds legally and accurately.

For instance, if a wire transfer was short, we’d contact the sending bank immediately to investigate and trace the funds. We wouldn’t proceed with the closing until the discrepancy was completely cleared up. Transparency and effective communication are vital in maintaining trust during these situations.

Q 6. What is your experience with managing escrow accounts?

Managing escrow accounts requires adherence to strict legal and regulatory guidelines, maintaining the highest level of security and accuracy. My experience includes:

- Opening and closing escrow accounts: Following all procedures to properly establish and close accounts.

- Depositing and disbursing funds: Ensuring timely and accurate processing of all financial transactions.

- Reconciling bank statements: Regularly reconciling bank statements to ensure accuracy and identify any potential discrepancies.

- Maintaining accurate records: Keeping meticulous records of all transactions, ensuring compliance with auditing standards.

- Ensuring compliance: Adhering to all applicable laws and regulations, including those related to the handling of trust funds.

This involves a deep understanding of banking protocols and a commitment to maintaining the integrity of the escrow account, safeguarding the funds involved until the successful completion of the transaction. It’s similar to being a financial custodian, ensuring that every penny is accounted for.

Q 7. How do you prioritize tasks in a fast-paced escrow environment?

Prioritizing tasks in a fast-paced escrow environment requires strong organizational skills and the ability to adapt to changing circumstances. My approach involves:

- Time management techniques: I utilize time management techniques like creating to-do lists and prioritizing tasks based on urgency and deadlines.

- Workflow management: I am adept at managing multiple tasks simultaneously, utilizing workflow systems and prioritizing transactions according to deadlines.

- Communication: Open and effective communication with all parties involved is crucial to manage expectations and prevent delays.

- Flexibility: Adaptability is critical in a fast-paced environment, allowing me to adjust to changing priorities and unforeseen circumstances.

- Proactive problem-solving: Identifying potential problems early on allows for prompt and effective solutions, preventing major delays.

Imagine juggling multiple balls in the air. You need to keep them all moving, but also prioritize the ones that are about to fall first. Effective prioritization ensures that all transactions progress smoothly despite the pressures of the job.

Q 8. Describe your experience with working with clients and real estate agents.

Throughout my career as an Escrow Officer Assistant, I’ve cultivated strong relationships with both clients and real estate agents. I believe in clear, proactive communication as the cornerstone of these relationships. With clients, this involves patiently explaining complex escrow processes in simple terms, addressing their concerns promptly, and keeping them updated every step of the way. For example, I recently guided a first-time homebuyer through the entire process, explaining each document and answering their questions with patience and understanding, ultimately easing their anxieties and ensuring a smooth closing. With real estate agents, I prioritize efficient collaboration. This includes promptly responding to inquiries, providing accurate updates on file status, and working proactively to overcome any obstacles that might delay the closing. A recent example involved coordinating with multiple agents across different firms to ensure a timely closing on a multi-party transaction, demonstrating my ability to manage intricate details and communicate effectively under pressure.

Q 9. How do you ensure the accuracy of escrow documents?

Accuracy in escrow documents is paramount, as even a small error can have significant legal and financial consequences. My approach to ensuring accuracy involves a multi-layered system of checks and balances. First, I meticulously review every document for completeness and consistency. This involves cross-referencing information across multiple documents, verifying figures and dates, and checking for any inconsistencies or missing details. Second, I utilize advanced software for verification including data-comparison tools and automated checks. This reduces manual error and helps catch even subtle discrepancies. For example, I utilize software that flags discrepancies in loan amounts or property addresses, thus preventing costly mistakes. Third, I always have a second pair of eyes review critical documents before they are finalized. This collaborative approach ensures accuracy and minimizes the risk of human error. Finally, I maintain meticulous records of every step of the process, creating an easily auditable trail that can be reviewed if necessary.

Q 10. What software programs are you proficient in using for escrow management?

I am proficient in a variety of software programs commonly used in escrow management. This includes comprehensive title and escrow platforms such as Resware and TitleSoft. My experience with these programs extends beyond basic data entry; I’m comfortable navigating complex features such as generating reports, managing electronic signatures, and tracking transaction details. In addition, I am skilled in using Microsoft Office Suite (Word, Excel, Outlook), essential for creating and managing documents, spreadsheets, and communication. My proficiency in these programs allows me to efficiently manage multiple transactions simultaneously and maintain a high level of accuracy and organization.

Q 11. How do you handle stressful situations or tight deadlines in escrow?

Handling stressful situations and tight deadlines is a regular aspect of working in escrow. My strategy involves prioritizing tasks, maintaining open communication, and proactively addressing potential issues. When faced with a tight deadline, I develop a detailed timeline outlining key milestones and ensuring each step is completed efficiently. For example, if a crucial document is delayed, I immediately contact the relevant parties to find a solution, whether it’s expediting the process or finding an alternative. Open communication is critical; I keep all parties involved – clients, agents, and lenders – updated on the progress and any potential delays, preventing misunderstandings and building trust. I find that a calm and organized approach, combined with clear communication, helps diffuse tension and ensures a successful closing, even under pressure.

Q 12. Describe your experience with preparing and processing wire transfers.

I have extensive experience preparing and processing wire transfers, a critical aspect of escrow. This includes verifying the accuracy of wire transfer instructions, ensuring the funds are sent to the correct account, and meticulously documenting the entire process. I understand the importance of security and compliance; I always follow strict protocols to minimize the risk of fraud and ensure the security of client funds. For instance, I verify all wire instructions multiple times before initiating the transfer, comparing the information with the escrow instructions and other relevant documents. Furthermore, I am familiar with various wire transfer platforms and can easily adapt to different bank systems. After each transfer, I generate a detailed record, which includes confirmation numbers, transaction IDs, and timestamps, creating a secure audit trail. This precise approach ensures compliance and protects the financial integrity of the transaction.

Q 13. Explain your understanding of different types of escrow transactions (residential, commercial).

I understand the nuances of various escrow transactions, including residential and commercial. Residential transactions typically involve the sale of single-family homes, townhouses, or condominiums. These transactions often have a simpler structure compared to commercial ones, although they still require careful attention to detail. Commercial transactions, on the other hand, can be significantly more complex, involving multiple parties, intricate financing arrangements, and specialized contracts. For example, a commercial escrow might involve a leasehold interest, an assignment of rents, or a complex partnership structure. My experience encompasses both types of transactions; I am proficient in handling the documentation, compliance requirements, and the unique challenges associated with each. I adapt my approach to each transaction, ensuring thorough understanding and careful management of all aspects, irrespective of the complexity.

Q 14. How familiar are you with ALTA policies?

I am very familiar with ALTA (American Land Title Association) policies. These policies are crucial for protecting both buyers and lenders in real estate transactions. I understand the different types of ALTA policies, including the Owner’s Policy, Lender’s Policy, and the various endorsements that can be added. For instance, I know the distinctions between standard coverage and extended coverage, and I can explain these differences to clients and agents clearly. My understanding of ALTA policies extends beyond just theoretical knowledge; I regularly review and interpret these policies to identify potential risks and ensure that the appropriate level of coverage is in place for each transaction. This knowledge allows me to proactively address potential issues and advise stakeholders effectively to prevent complications or disputes.

Q 15. How do you handle sensitive client information and maintain confidentiality?

Handling sensitive client information requires unwavering adherence to confidentiality protocols. Think of it like guarding a vault – the information entrusted to me is precious and requires the highest level of security. My approach involves several key steps:

- Strict Access Control: I only access client files and data on a need-to-know basis, using secure systems with password protection and multi-factor authentication.

- Secure Storage: All documents, both physical and digital, are stored in secure, locked locations or encrypted cloud services compliant with industry best practices.

- Confidentiality Agreements: I understand and uphold the confidentiality clauses within my employment contract and any relevant client agreements.

- Data Encryption: I ensure all electronic data is encrypted both at rest and in transit, utilizing industry-standard encryption methods.

- Limited Sharing: I only share information with authorized individuals, and only to the extent necessary for completing the escrow transaction. I always obtain explicit consent before sharing any sensitive data.

- Reporting Procedures: I have established procedures for reporting any breaches of confidentiality or suspected security vulnerabilities immediately to my supervisor.

For instance, in one case, I discovered a minor clerical error on a client’s document that could have potentially exposed personal details. I immediately reported it and we implemented corrective action to prevent future occurrences, ensuring the client’s privacy was protected.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. What is your experience with recording documents and filing paperwork?

My experience with recording documents and filing paperwork is extensive. I’m proficient in managing both physical and digital records, ensuring accuracy and timely submission. I utilize a variety of methods depending on the document type and jurisdictional requirements.

- Document Preparation: I meticulously prepare all documents for recording, ensuring they are complete, accurate, and properly formatted to meet the requirements of the relevant recording office (county recorder, etc.).

- Electronic Recording: I’m adept at using e-recording platforms and software to submit documents electronically, which streamlines the process and ensures faster turnaround times. This includes understanding specific requirements for electronic signatures and document formatting for each jurisdiction.

- Physical Recording: I’m experienced in preparing and submitting physical documents for recording, including proper organization and preparation of accompanying fees and documentation.

- Filing Systems: I maintain organized filing systems, both physical and digital, to ensure easy retrieval of documents as needed. This often involves using a combination of alpha-numeric and chronological filing systems.

- Tracking Systems: I use tracking numbers and databases to monitor the progress of recorded documents and ensure they are properly recorded and indexed. I follow up on any outstanding documents.

For example, in a recent complex real estate transaction, I successfully managed the recording of over a dozen documents across multiple jurisdictions, ensuring each was properly recorded and indexed while staying on schedule.

Q 17. Explain your understanding of escrow disbursement procedures.

Escrow disbursement procedures are the crucial final steps in a real estate or other escrow transaction where funds are released to the appropriate parties. Think of it as the carefully orchestrated finale of a play. Each move must be precise and aligned with the escrow instructions. It involves several critical stages:

- Verification of Conditions: First, all conditions precedent outlined in the escrow instructions must be verified. This might include confirming the title is clear, all inspections are complete, and all contingencies are met.

- Reconciliation of Funds: The escrow account is meticulously reconciled to ensure all funds, debits, and credits are accurately accounted for. This includes comparing the final closing statement to the escrow account balance.

- Preparation of Disbursement Documents: Once all conditions are satisfied, the appropriate disbursement documents, such as checks or wire transfer instructions, are prepared. These must precisely reflect the amounts and parties as stipulated in the escrow instructions.

- Disbursement of Funds: The funds are then disbursed to the appropriate parties according to the verified instructions. This is usually done electronically, but can involve issuing physical checks.

- Documentation and Record Keeping: A comprehensive record of all disbursements is maintained, including copies of checks, wire transfer confirmations, and any other relevant documentation. This is critical for auditing and compliance.

A potential complication might be a disagreement between parties about the disbursement. In this case, my understanding of the escrow instructions and relevant laws helps to resolve any disputes and ensure that funds are disbursed correctly and legally.

Q 18. How do you track and manage escrow deadlines?

Tracking and managing escrow deadlines is paramount to ensure a smooth transaction. Think of it as conducting an orchestra – all instruments must play in perfect harmony and at the right time. My approach involves:

- Detailed Calendars and Schedules: I maintain detailed calendars and schedules outlining all key dates and deadlines for each escrow transaction, including recording deadlines, contingency deadlines, and closing dates.

- Reminders and Notifications: I set up reminders and notifications for myself and other relevant parties (e.g., escrow officer, real estate agents, clients) well in advance of crucial deadlines.

- Regular Monitoring: I consistently monitor the progress of each transaction, actively checking for any potential delays or complications that might impact deadlines.

- Proactive Communication: I communicate proactively with all parties involved to address any potential issues and ensure that everyone is aware of and working towards the established deadlines.

- Contingency Planning: I have strategies in place to handle unexpected delays, such as obtaining necessary extensions or mitigating any potential negative impacts.

For example, in one transaction, a crucial document was delayed due to a postal service issue. By proactively monitoring its status and immediately informing all parties, I managed to obtain an extension and avert a potential missed closing deadline.

Q 19. Describe your experience with reconciling escrow accounts.

Reconciling escrow accounts is a critical process that verifies the accuracy and balance of the funds held in escrow. It’s like balancing a meticulous budget – every penny must be accounted for. My reconciliation process usually involves:

- Matching Deposits and Withdrawals: I meticulously compare all deposits and withdrawals against the escrow instructions and supporting documentation.

- Reviewing Bank Statements: I carefully review bank statements for the escrow account to ensure that the balance matches the calculated balance.

- Identifying and Investigating Discrepancies: If discrepancies arise, I thoroughly investigate the cause and make necessary adjustments.

- Preparing Reconciliation Reports: I prepare detailed reconciliation reports that document all transactions and highlight any significant variances.

- Regular Reconciliation Schedule: I perform reconciliations on a regular basis (often weekly or bi-weekly) to maintain accurate records and to identify any issues early.

A real-world example: I once noticed a small discrepancy in the escrow account. My investigation revealed a minor data entry error on a disbursement. By catching this early, I prevented potential issues and maintained the integrity of the account.

Q 20. How do you ensure compliance with state and federal regulations related to escrow?

Ensuring compliance with state and federal regulations related to escrow is a non-negotiable aspect of the job. This is about upholding the law and protecting both the clients and the company. My approach to compliance includes:

- Staying Updated on Regulations: I diligently keep up-to-date on all relevant state and federal regulations, including changes in laws and best practices. This often involves attending seminars, reviewing professional publications, and actively participating in industry-related continuing education.

- Following Internal Compliance Policies: I meticulously adhere to all internal compliance policies and procedures established by the company.

- Proper Record Keeping: I maintain comprehensive and accurate records of all escrow transactions and related documentation to facilitate audits and regulatory reviews.

- Regular Audits and Reviews: I actively participate in and cooperate fully with any internal or external audits or regulatory reviews.

- Seeking Guidance When Necessary: If I encounter any situations that are unclear or potentially non-compliant, I seek guidance from my supervisor or legal counsel to ensure compliance.

An example: Recent changes in our state’s real estate regulations required updated escrow procedures. I immediately updated my work processes and ensured that all my actions reflected the new rules.

Q 21. What is your experience with handling escrow disputes?

Handling escrow disputes requires tact, diplomacy, and a thorough understanding of the escrow instructions and relevant laws. This involves a delicate balance of mediating disagreements and ensuring legal compliance. My approach includes:

- Understanding the Dispute: I first work to fully understand the nature of the dispute, carefully reviewing all relevant documentation and escrow instructions.

- Facilitating Communication: I facilitate communication between the involved parties to foster a clear understanding of the perspectives and issues involved.

- Mediation and Negotiation: I strive to mediate the dispute through negotiation, attempting to reach a mutually acceptable resolution that adheres to the escrow instructions and relevant laws.

- Escalation Procedures: If negotiation fails, I follow established escalation procedures, which might involve referring the matter to legal counsel or arbitration.

- Documentation of the Dispute Resolution: I maintain meticulous records of all communications, negotiations, and resolutions related to the dispute.

One instance involved a dispute over the disbursement of earnest money. Through careful review of the contract and clear communication, I helped the parties reach a settlement preventing further conflict and possible legal action.

Q 22. How do you maintain effective communication with all parties involved in an escrow transaction?

Maintaining effective communication in escrow is crucial for a smooth transaction. Think of it like orchestrating a complex dance – everyone needs to know their steps and when to move. I utilize a multi-pronged approach. First, I establish clear communication preferences with each party at the outset – email, phone, or a combination. This includes setting expectations for response times. Second, I regularly provide updates, not just when problems arise, but also to keep everyone informed of progress. Think of it as sending out a regular newsletter keeping everyone in the loop. Third, I maintain meticulous records of all communications, including dates, times, and content – this is my audit trail, proving what was said and when. Finally, I’m proactive about addressing any misunderstandings or concerns immediately. For example, if a buyer is anxious about appraisal contingencies, I’ll directly address their concerns with a clear and concise explanation, possibly including referencing the contract itself. This prevents minor issues from escalating into major delays.

Q 23. Describe your experience with preparing closing statements.

Preparing closing statements is a cornerstone of my role. I’m proficient in using various software programs like [mention specific software, e.g., RESPA, TitleSoft] to accurately calculate all debits and credits. This involves meticulous attention to detail, ensuring every item – from loan payoffs to taxes and insurance – is accounted for precisely. For instance, I recently handled a complex transaction involving a seller financing component. I painstakingly reconciled all figures, ensuring the seller received the correct amount after loan payoffs and closing costs were deducted. I also meticulously prepare a detailed breakdown for the parties, ensuring they understand each line item, addressing any questions they may have. This prevents surprises and misunderstandings at closing. Accuracy is paramount; a simple error can have significant financial implications.

Q 24. How do you organize and manage large volumes of escrow files?

Managing a high volume of escrow files requires a systematic approach. I utilize a combination of digital and physical organization. Digitally, I leverage a robust file management system, categorizing files by client name, transaction type, and date. I utilize a color-coding system within the digital system to quickly identify the status of each file (e.g., open, in progress, closed). Physically, I maintain a clean and organized workspace, with files stored in clearly labeled folders. Additionally, I employ a robust digital backup system, ensuring data redundancy and protection against loss. Think of this as a layered security approach – preventing data loss from multiple angles. Regular purging of obsolete files is also crucial to maintain efficiency. This ensures that my workspace remains clutter-free and easily navigable. This organizational system is crucial for me to stay efficient and always know where to find necessary information in a timely manner.

Q 25. What is your experience with reviewing and interpreting contracts related to escrow?

Reviewing and interpreting contracts is fundamental to my work. I have extensive experience reviewing purchase agreements, escrow instructions, deeds, and other relevant legal documents. I’m skilled at identifying key clauses, potential conflicts, and discrepancies. For example, I recently identified a discrepancy in a purchase agreement where the closing date was ambiguous. I immediately flagged this to the escrow officer and the parties involved, preventing a potential delay at closing. My experience allows me to readily identify any contractual ambiguities and proactively initiate communication to resolve them before they become problematic. I understand the legal implications of each clause and can effectively explain complex contractual language to clients in plain terms. This ensures everyone is aware of their rights and responsibilities.

Q 26. How do you proactively identify and mitigate potential risks in escrow transactions?

Proactive risk mitigation is a critical aspect of escrow. I approach this by performing a thorough due diligence process at the beginning of each transaction. This involves verifying the identity of all parties, confirming ownership of the property, reviewing title reports for any potential issues (liens, easements), and ensuring all necessary documentation is in place. For instance, I recently identified a potential title defect early in a transaction, allowing us to address it promptly before the closing date, preventing a costly delay. I also regularly monitor for any changes in regulations or industry best practices that could impact transactions. I proactively communicate any potential risks or delays to the escrow officer and all parties, recommending appropriate solutions. This ensures transparency and helps prevent costly mistakes or disputes later on.

Q 27. What is your experience working independently and as part of a team in an escrow setting?

I thrive both independently and as part of a team. I’m adept at managing my workload efficiently and meeting deadlines independently. However, I also understand the value of teamwork. I enjoy collaborating with my colleagues, sharing knowledge and expertise, and contributing to a positive team environment. For example, I frequently assist other team members with complex tasks or when they are facing high workload periods. This collaborative approach allows us to handle complex transactions efficiently and maintain a high level of quality in our work. I value open communication, mutual respect, and a shared commitment to success within the team.

Q 28. How do you stay updated on changes in escrow regulations and industry best practices?

Staying updated on changes in escrow regulations and industry best practices is essential. I subscribe to relevant industry publications and attend continuing education courses and webinars regularly. I also actively participate in professional organizations to network with peers and stay abreast of current trends and issues. This ongoing learning ensures that I remain proficient in my role and can provide the highest quality of service to clients. I actively follow changes from agencies like the [mention relevant agencies, e.g., ALTA, your state’s real estate commission] and make sure to incorporate any new best practices into my daily work.

Key Topics to Learn for Escrow Officer Assistant Interview

- Real Estate Transactions: Understanding the entire process from contract to closing, including title searches, escrow instructions, and disbursement of funds. Practical application: Be prepared to discuss your understanding of the different stages and potential challenges at each stage.

- Title and Escrow Procedures: Knowledge of title insurance, deed preparation, recording documents, and compliance with relevant regulations. Practical application: Illustrate your understanding by describing a scenario where you had to resolve a title issue or ensure compliance with a specific regulation.

- Document Management and Organization: Proficiency in maintaining accurate and organized records, both physical and digital, adhering to strict confidentiality protocols. Practical application: Describe your experience with document management systems and strategies for maintaining order and security in a fast-paced environment.

- Client Communication and Customer Service: Effective communication with clients, real estate agents, lenders, and other stakeholders. Practical application: Share examples of how you’ve handled challenging client interactions or resolved conflicts professionally.

- Financial Calculations and Reconciliation: Accuracy in handling financial transactions, balancing accounts, and preparing closing statements. Practical application: Describe your experience with accounting software or your ability to perform accurate calculations under pressure.

- Regulatory Compliance: Understanding and adhering to all relevant state and federal regulations related to escrow and real estate transactions. Practical application: Discuss your awareness of key regulations and how you would ensure compliance within a given scenario.

- Technology Proficiency: Familiarity with relevant software and technology used in the escrow process, such as title software, document management systems, and communication platforms. Practical application: Highlight your experience with specific software or your ability to quickly adapt to new technologies.

Next Steps

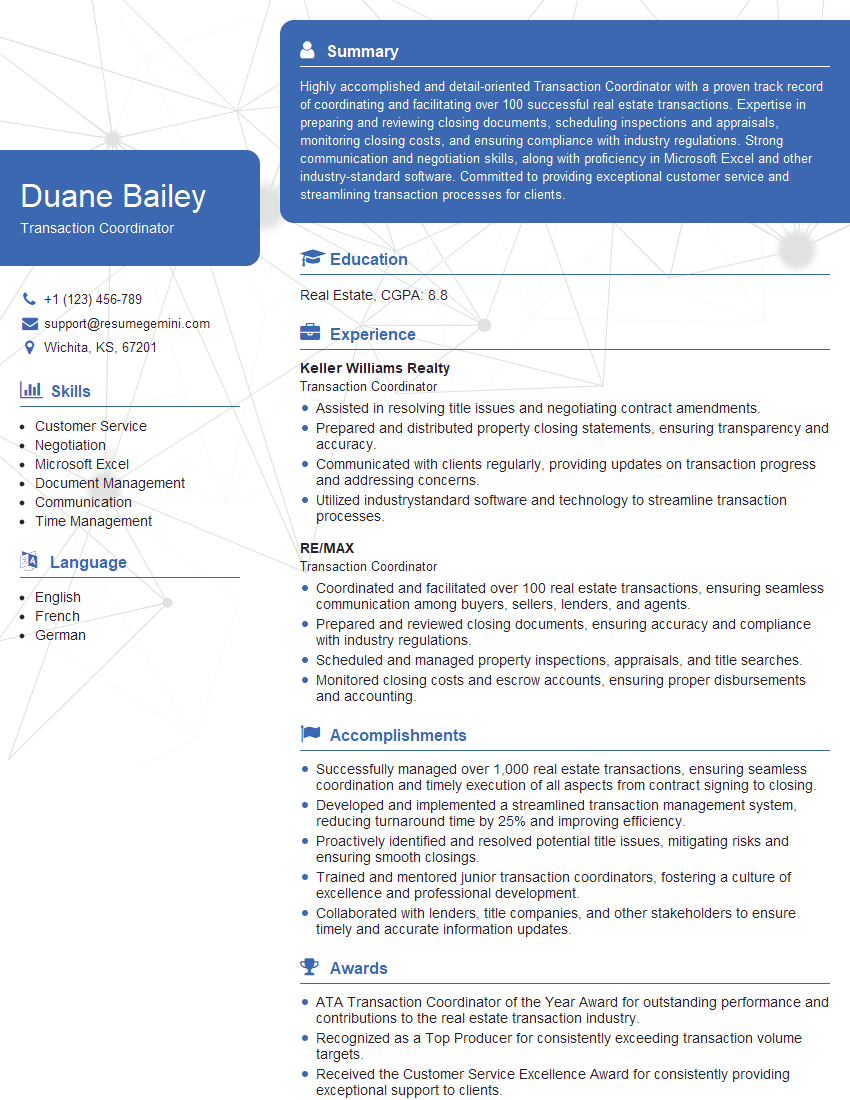

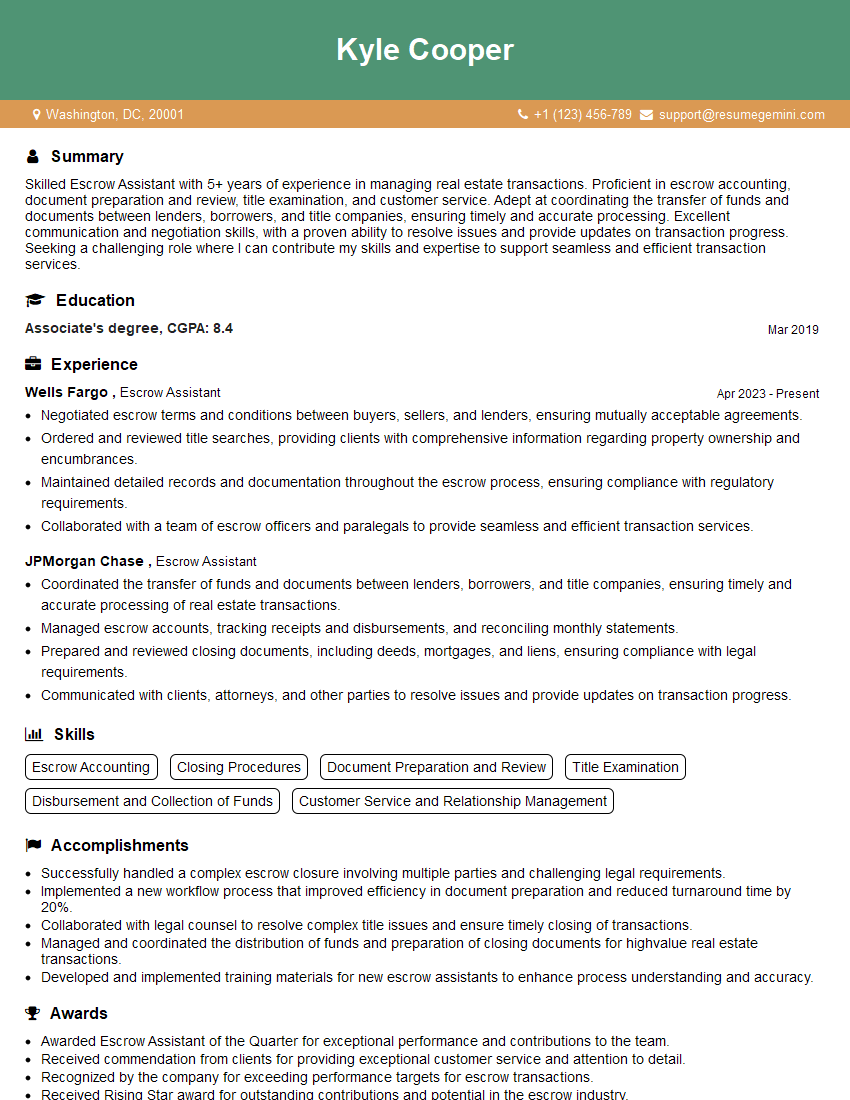

Mastering the skills and knowledge required of an Escrow Officer Assistant is crucial for a successful and rewarding career in real estate. It opens doors to advancement within the industry and provides a strong foundation for future roles. To significantly increase your job prospects, create an ATS-friendly resume that highlights your qualifications and experience effectively. ResumeGemini is a trusted resource to help you build a professional and impactful resume that stands out to recruiters. Examples of resumes tailored to the Escrow Officer Assistant role are available to guide you.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

I Redesigned Spongebob Squarepants and his main characters of my artwork.

https://www.deviantart.com/reimaginesponge/art/Redesigned-Spongebob-characters-1223583608

IT gave me an insight and words to use and be able to think of examples

Hi, I’m Jay, we have a few potential clients that are interested in your services, thought you might be a good fit. I’d love to talk about the details, when do you have time to talk?

Best,

Jay

Founder | CEO