Are you ready to stand out in your next interview? Understanding and preparing for Familiar with Industry-Specific Standards and Regulations interview questions is a game-changer. In this blog, we’ve compiled key questions and expert advice to help you showcase your skills with confidence and precision. Let’s get started on your journey to acing the interview.

Questions Asked in Familiar with Industry-Specific Standards and Regulations Interview

Q 1. Explain your understanding of ISO 9001.

ISO 9001 is an internationally recognized standard that outlines requirements for a quality management system (QMS). Think of it as a blueprint for consistently meeting customer and regulatory requirements. It’s not about the product itself, but the process of producing it. A robust QMS, compliant with ISO 9001, ensures consistent product quality, reduces waste, and improves customer satisfaction.

The standard focuses on several key areas, including:

- Customer focus: Understanding and meeting customer needs and expectations.

- Leadership: Establishing clear leadership and responsibility within the organization.

- Engagement of people: Empowering employees to contribute to quality improvement.

- Process approach: Managing processes to achieve consistent results.

- Improvement: Continuously improving the QMS through data analysis and corrective actions.

In my previous role, we implemented ISO 9001, leading to a 15% reduction in defects and a significant improvement in customer satisfaction scores, measured through regular surveys. The certification itself opened doors to new clients who valued our commitment to quality.

Q 2. Describe your experience with HIPAA compliance.

HIPAA, the Health Insurance Portability and Accountability Act, sets the standard for protecting sensitive patient health information (PHI) in the United States. Compliance involves a multifaceted approach, focusing on administrative, physical, and technical safeguards.

My experience includes developing and implementing HIPAA compliant data security policies and procedures. This involved conducting risk assessments, implementing access controls, and ensuring the proper disposal of PHI. We also conducted regular employee training to reinforce awareness of HIPAA regulations and best practices. For example, I oversaw the implementation of encryption for all electronic PHI and established strict protocols for data breaches – including notification procedures and remediation plans. Failure to comply with HIPAA can lead to significant fines and reputational damage.

Q 3. How familiar are you with GDPR regulations?

GDPR, the General Data Protection Regulation, is a comprehensive data privacy regulation in the European Union and the European Economic Area. It focuses on giving individuals more control over their personal data and holding organizations accountable for its protection. It’s not just about compliance; it’s about building trust with customers.

My familiarity extends to understanding the key principles of GDPR, including data minimization, purpose limitation, and accountability. I’ve worked on projects involving data subject access requests (DSARs), data breach notification procedures, and ensuring the lawful basis for processing personal data. Understanding the nuances of consent, legitimate interests, and other legal bases is crucial for ensuring GDPR compliance. For instance, I helped a client implement a consent management platform that ensured transparency and user control over data collection and usage.

Q 4. What is your experience with Sarbanes-Oxley (SOX) compliance?

Sarbanes-Oxley (SOX) is a US federal law designed to protect investors by improving the accuracy and reliability of corporate disclosures. It primarily focuses on financial reporting and internal controls. SOX compliance requires meticulous documentation and rigorous internal controls to prevent fraud and ensure the accuracy of financial statements.

My experience involves working with organizations to implement SOX compliant internal controls. This includes assisting with the design and testing of controls, documenting processes, and conducting audits to ensure compliance. A key aspect is understanding the control objectives and designing controls that effectively mitigate risks related to financial reporting. For example, I’ve helped companies implement segregation of duties and automated controls to enhance the accuracy and reliability of their financial processes. Non-compliance can result in substantial penalties and damage to an organization’s reputation.

Q 5. Explain the importance of industry-specific standards in your field.

Industry-specific standards are crucial for several reasons. They provide a common framework for quality, safety, and ethical practices, fostering trust among stakeholders. They also help streamline operations, reduce risks, and improve efficiency by providing a standardized approach. Compliance demonstrates a commitment to best practices, which can be a significant advantage in securing contracts and gaining a competitive edge.

In my field, adherence to these standards translates to building and maintaining trust with clients. For example, adhering to PCI DSS (Payment Card Industry Data Security Standard) is essential for any business handling credit card information. Non-compliance can lead to data breaches, financial losses, and legal ramifications, ultimately impacting the organization’s sustainability.

Q 6. How do you stay updated on changes to industry regulations?

Staying updated on changes in industry regulations requires a proactive approach. I regularly monitor official government websites and industry publications for updates and new legislation. I also subscribe to relevant newsletters and participate in professional development activities, such as webinars and conferences. Networking with colleagues and experts in the field helps share best practices and stay abreast of emerging trends and challenges.

Additionally, I leverage online resources and legal databases to access the latest interpretations and guidance on regulations. Proactive monitoring allows me to anticipate potential changes and adapt our practices accordingly, ensuring continuous compliance.

Q 7. Describe a time you identified a compliance gap. What was your approach?

During a recent audit of a client’s data security practices, we identified a compliance gap in their access control policies. Specifically, certain employees had excessive access privileges, exceeding their job requirements. This posed a significant risk in case of a malicious insider threat or accidental data exposure.

My approach involved a multi-step process:

- Assessment: We meticulously documented the existing access rights and compared them to the roles and responsibilities of each employee.

- Risk Analysis: We assessed the potential impact of the identified gap, considering the sensitivity of the data involved.

- Remediation Plan: We developed a remediation plan to revise access control policies, implementing the principle of least privilege. This involved reducing access rights for employees to only what was absolutely necessary for their roles.

- Implementation: We worked with IT to implement the revised access control policies, ensuring proper documentation and training for all affected employees.

- Follow-up Audit: A follow-up audit was conducted to confirm that the implemented changes had effectively mitigated the identified risk.

This proactive approach not only addressed the immediate compliance gap but also strengthened the overall security posture of the client’s system.

Q 8. How would you handle a situation where a standard conflicts with a regulation?

When a standard and a regulation conflict, the regulation always takes precedence. Standards are best practices and guidelines, often developed by industry bodies, while regulations are legally mandated requirements enforced by government agencies. Think of it like this: standards are suggestions, regulations are rules.

My approach involves a three-step process:

- Identification: Thoroughly document the conflict, specifying the relevant sections of both the standard and regulation. This often requires a deep understanding of both documents and their intended scopes.

- Escalation: Report the conflict to the appropriate management and compliance team immediately. This ensures that a coordinated response is developed and that the appropriate legal and operational steps are taken.

- Resolution: Work collaboratively with legal counsel, compliance officers, and other stakeholders to determine the best course of action. This might involve seeking clarification from the regulatory body, modifying internal processes to ensure compliance with the regulation, or even lobbying for changes to the conflicting standard if appropriate.

For example, imagine a safety standard recommends a specific type of fire suppression system, but a regulation mandates a different, potentially more stringent, system. In this case, the regulation’s requirements are mandatory, and deviations are not allowed.

Q 9. What are some common compliance challenges you’ve encountered?

Common compliance challenges often stem from evolving regulations, inadequate resources, and a lack of employee awareness.

- Evolving regulations: Industries, particularly technology-driven ones, face frequent updates to regulations. Keeping up with these changes, retraining staff, and updating systems accordingly can be a significant undertaking. For instance, data privacy regulations (like GDPR or CCPA) are constantly being refined, requiring continuous adaptation.

- Inadequate resources: Compliance often requires dedicated personnel, specialized software, and significant time investment. Insufficient budget or staffing can lead to gaps in compliance, creating vulnerabilities.

- Lack of employee awareness: Even with the best policies and procedures, compliance depends on employee understanding and adherence. Inadequate training or a culture that doesn’t prioritize compliance can lead to unintentional violations. Imagine a scenario where employees aren’t aware of data handling protocols, unintentionally leading to a data breach.

Addressing these challenges requires proactive measures, such as continuous monitoring of regulatory changes, investment in robust compliance programs, and effective employee training and engagement.

Q 10. Explain your approach to risk assessment regarding industry standards.

My approach to risk assessment regarding industry standards is systematic and data-driven. I utilize a framework that considers the likelihood and impact of potential non-compliance.

- Identification of Standards: First, we identify all applicable industry standards relevant to our operations. This requires a thorough review of our processes and activities.

- Gap Analysis: We then conduct a gap analysis to identify any discrepancies between our current practices and the requirements of the standards.

- Risk Assessment Matrix: Each identified gap is evaluated based on its likelihood of occurrence and potential impact (e.g., financial loss, reputational damage, legal penalties). This is often represented in a risk assessment matrix.

- Prioritization: Gaps are prioritized based on their overall risk score, allowing us to focus on the most critical areas first.

- Mitigation Strategies: We develop and implement mitigation strategies to address the identified risks, reducing the likelihood or impact of non-compliance.

For instance, if a standard mandates regular equipment calibration, and a failure to do so could result in inaccurate measurements and potential safety hazards, this would receive a high risk score, requiring immediate attention.

Q 11. Describe your experience with conducting internal audits for compliance.

I have extensive experience conducting internal audits for compliance, utilizing a structured approach that ensures thoroughness and objectivity.

- Planning: The audit begins with careful planning, defining the scope, objectives, and timeline. This includes selecting the relevant standards and regulations to be audited.

- Data Collection: Data collection methods include reviewing documentation, interviewing employees, observing processes, and analyzing data. I always ensure that the data collection process is documented and auditable.

- Analysis: The collected data is analyzed to identify any non-conformances or areas needing improvement. This might involve the use of checklists, spreadsheets, or specialized audit software.

- Reporting: A comprehensive audit report is prepared that summarizes the findings, including both positive aspects and areas for improvement. This report is typically presented to management.

- Follow-up: A critical step is the follow-up on identified issues. This includes ensuring that corrective actions are implemented and verified to prevent recurrence.

In a recent internal audit of a software development team, I identified a gap in the code review process that increased the risk of security vulnerabilities. The audit report detailed this finding, along with recommendations to enhance the code review process and increase security training for the development team.

Q 12. How do you ensure compliance within a team environment?

Ensuring compliance within a team environment requires a multi-pronged approach focused on leadership, training, communication, and accountability.

- Leadership Commitment: Strong leadership commitment is crucial. Leaders must clearly communicate the importance of compliance and actively model the desired behavior.

- Comprehensive Training: Employees need comprehensive training on relevant standards and regulations, with ongoing refresher courses to account for updates.

- Open Communication: A culture of open communication is essential. Employees should feel comfortable reporting potential compliance issues without fear of reprisal. Regular communication updates on compliance matters keep everyone informed.

- Clear Roles and Responsibilities: Clearly defined roles and responsibilities ensure that everyone understands their compliance obligations.

- Accountability Mechanisms: Mechanisms for accountability, such as regular audits and performance reviews, ensure that compliance is taken seriously.

For example, I implemented a system of regular team meetings dedicated to compliance updates and discussions, encouraging open dialogue and feedback. This created a more collaborative and responsible environment.

Q 13. What are some key performance indicators (KPIs) used to measure compliance?

Key Performance Indicators (KPIs) for measuring compliance vary depending on the specific industry and regulations, but common examples include:

- Number of Non-conformances: Tracks the frequency of identified compliance issues.

- Time to Remediation: Measures the speed of addressing identified non-conformances.

- Audit Scores: Reflects the overall performance in internal or external audits.

- Training Completion Rates: Shows the level of employee engagement with compliance training.

- Number of Incidents/Breaches: Measures the occurrence of compliance-related incidents or breaches (e.g., data breaches, safety incidents).

- Employee Compliance Survey Scores: Gathers employee feedback on understanding and adherence to compliance policies.

These KPIs, when tracked and analyzed, provide valuable insights into the effectiveness of the compliance program and identify areas needing improvement.

Q 14. How would you explain complex regulations to non-technical stakeholders?

Explaining complex regulations to non-technical stakeholders requires clear, concise communication, avoiding jargon and using relatable analogies.

- Start with the “Why”: Begin by explaining the purpose and importance of the regulation in simple terms. For instance, highlight how it protects customers, employees, or the environment.

- Use Plain Language: Avoid technical jargon and legal terms. Translate complex concepts into everyday language that everyone can understand.

- Visual Aids: Use visual aids like flowcharts, infographics, or presentations to simplify complex information.

- Real-World Examples: Illustrate the regulation’s application with real-world examples or case studies that are relevant to the audience.

- Interactive Sessions: Use interactive sessions, Q&A, or workshops to allow stakeholders to ask questions and clarify any misunderstandings.

For example, when explaining data privacy regulations, I’d focus on the core principle of protecting personal information and illustrate this with relatable scenarios, such as the consequences of a data breach. This approach makes the information more accessible and encourages engagement.

Q 15. Describe your experience with implementing a new compliance program.

Implementing a new compliance program is like building a house – you need a solid foundation, a detailed blueprint, and consistent construction. It starts with a thorough risk assessment to identify potential vulnerabilities and areas needing attention. For example, if we’re implementing HIPAA compliance for a healthcare startup, the risk assessment will focus on Protected Health Information (PHI) storage, access controls, and employee training.

Next, we develop a comprehensive program document outlining policies, procedures, and responsibilities. This is the blueprint. For HIPAA, this document would detail how PHI is secured, who has access, and the protocols for data breaches. We then establish a training program, conduct regular audits (internal and external), and create a system for tracking and addressing non-compliance issues. Finally, ongoing monitoring and improvement are crucial – regular reviews of the program and its effectiveness are essential. We might discover we need to adjust access controls based on audit findings. This iterative process is key to sustaining compliance.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. How do you document and track compliance activities?

Documenting and tracking compliance activities is vital for demonstrating due diligence. We use a combination of methods, including a centralized compliance management system (CMS), which provides a single source of truth for all compliance-related information. This system may include features like document repositories, audit trails, and task management functionalities. Think of it as a digital filing cabinet, organized and easily searchable.

For example, in a CMS, we would upload all policies, training materials, audit reports, and remediation plans. We also use spreadsheets to track specific compliance activities, such as employee training completion dates or the results of regular security scans. Furthermore, we maintain a comprehensive audit trail for all actions undertaken, including who made the changes, when, and why. This ensures transparency and accountability. This detailed documentation not only facilitates internal audits but also supports external audits and regulatory investigations.

Q 17. What is your understanding of the consequences of non-compliance?

The consequences of non-compliance can be severe, ranging from financial penalties to reputational damage and even legal action. The severity depends on the specific regulation violated and the extent of the non-compliance.

For instance, violating GDPR (General Data Protection Regulation) can result in significant fines, impacting profitability. Non-compliance with environmental regulations could lead to costly clean-up operations and legal battles. In the case of HIPAA violations, significant fines and the erosion of public trust can have a detrimental impact on a healthcare provider’s business. It’s not just about the immediate penalties; it’s also about the long-term reputational damage that can impact customer loyalty and investor confidence. Therefore, a proactive and comprehensive compliance program is critical to mitigate these risks.

Q 18. How do you ensure data security and privacy compliance?

Ensuring data security and privacy compliance involves a multi-layered approach. It begins with implementing robust security measures, such as firewalls, intrusion detection systems, and encryption, to protect sensitive data from unauthorized access. Access controls, which limit access based on roles and responsibilities, are also paramount.

We conduct regular security assessments and penetration testing to identify vulnerabilities and remediate them promptly. Employee training on data security best practices is crucial. We adhere to data privacy regulations like GDPR and CCPA, ensuring that data collection and processing practices comply with the law. This includes obtaining appropriate consent, providing transparency around data usage, and offering data subjects the right to access, correct, and delete their personal information. Incident response planning is essential; we have documented procedures to handle data breaches effectively and minimize their impact.

Q 19. Describe your experience with supply chain compliance.

Supply chain compliance requires verifying that all suppliers adhere to relevant industry standards and regulations. This process typically involves supplier audits, both on-site and remotely, to assess their compliance programs. We also analyze supplier documentation, including certifications and compliance reports.

Consider a company manufacturing electronics; they need to ensure their suppliers comply with regulations related to conflict minerals, fair labor practices, and environmental protection. We use a scoring system to evaluate suppliers based on their compliance performance and identify potential risks. Regular communication and collaboration with suppliers are critical in addressing any compliance shortcomings. This might involve providing guidance, training, or requiring corrective actions. Strong contractual agreements with clear compliance clauses are essential to hold suppliers accountable.

Q 20. How do you handle conflicting industry standards from different regions?

Handling conflicting industry standards from different regions requires a careful analysis of the applicable regulations. We determine which standards apply based on the location of operations, the nature of the business activities, and the jurisdiction of the relevant authorities.

For example, if a company operates in both the EU and the US, it needs to comply with both GDPR and CCPA, along with other relevant regulations. This often requires a harmonized approach, adopting the strictest standard or implementing different procedures for different regions. Legal counsel is frequently engaged to navigate these complex situations and ensure compliance across all jurisdictions. Detailed documentation outlining the specific compliance measures adopted in each region is critical for demonstrating due diligence.

Q 21. What is your approach to continuous improvement regarding compliance?

Continuous improvement in compliance is an ongoing journey, not a destination. We implement a system for regularly reviewing and updating our compliance program. This includes analyzing audit findings, reviewing emerging regulations, and incorporating best practices from the industry. Regular employee training keeps everyone informed about evolving standards and processes.

Using key performance indicators (KPIs) helps us track progress and identify areas needing attention. For instance, we might track the number of compliance incidents, the time taken to remediate non-compliance issues, or the number of successful audits. We also actively seek feedback from employees and stakeholders, using surveys and focus groups to gather insights and identify areas for improvement. This continuous monitoring and adjustment ensures that our compliance program remains effective and robust in the face of evolving risks and regulations.

Q 22. How familiar are you with the relevant standards in [mention a specific industry]?

My familiarity with relevant standards in the healthcare industry, specifically focusing on HIPAA (Health Insurance Portability and Accountability Act), is extensive. I’ve worked directly with HIPAA’s various components, including the Privacy Rule, Security Rule, and Breach Notification Rule, for over seven years. This includes hands-on experience in developing and implementing HIPAA compliant systems and procedures. I understand the intricacies of protected health information (PHI) handling, access controls, risk assessments, and business associate agreements. Beyond HIPAA, I’m also conversant with other relevant standards like NIST Cybersecurity Framework and FDA regulations for medical devices, depending on the specific context of the role.

For example, in a previous role, I led the implementation of a new electronic health record (EHR) system, ensuring full compliance with HIPAA’s security requirements. This involved rigorous risk assessments, implementation of access controls, and employee training programs to mitigate potential risks related to PHI breaches.

Q 23. Explain your understanding of due diligence related to industry compliance.

Due diligence in industry compliance involves a thorough and systematic process of identifying, assessing, and mitigating potential risks related to regulatory non-compliance. It’s essentially a proactive approach to risk management, designed to prevent legal and financial repercussions. This includes reviewing all relevant regulations, conducting internal audits to check current practices against those regulations, and identifying any gaps or weaknesses.

The process usually involves:

- Identifying applicable laws and regulations: This requires a thorough understanding of the specific industry and the legal landscape governing it.

- Risk assessment: Evaluating the likelihood and potential impact of non-compliance. This often involves identifying vulnerabilities and potential threats.

- Gap analysis: Comparing current practices against the regulatory requirements to identify any inconsistencies or shortcomings.

- Mitigation planning: Developing and implementing strategies to address identified risks and close compliance gaps.

- Monitoring and reporting: Regularly monitoring compliance efforts and reporting on progress to relevant stakeholders.

Imagine building a house: due diligence is like meticulously checking the blueprints and ensuring that every component (foundation, plumbing, electrical) meets the building codes before construction even begins. This prevents costly rework and potential safety hazards later.

Q 24. Describe your experience with regulatory inspections and audits.

I have extensive experience with regulatory inspections and audits, particularly within the healthcare sector. I’ve actively participated in numerous HIPAA audits, both internal and external. These experiences have provided valuable insights into the expectations of regulatory bodies and the critical areas they scrutinize.

During these inspections, my responsibilities included:

- Preparation: Gathering and organizing documentation, ensuring all necessary policies and procedures were up-to-date and readily available.

- Collaboration: Working closely with auditors to provide information and address their questions and concerns.

- Remediation: Identifying and correcting any identified deficiencies and implementing corrective action plans to prevent future issues.

- Follow-up: Monitoring the effectiveness of corrective actions and ensuring sustained compliance.

For example, during one particular audit, we were able to proactively address a minor deficiency related to employee training before the auditor even raised it, demonstrating our commitment to compliance. This proactive approach resulted in a positive audit outcome and strengthened our organization’s compliance posture.

Q 25. How do you identify potential compliance risks proactively?

Proactive identification of compliance risks relies on a multi-faceted approach. I typically utilize a combination of techniques including:

- Regular risk assessments: Conducting periodic assessments to evaluate potential risks across all areas of the organization.

- Monitoring of industry news and changes in regulations: Staying informed about any updates or changes to relevant regulations and standards.

- Internal audits: Performing regular internal audits to check adherence to compliance policies and identify areas for improvement.

- Employee training: Providing regular training to employees to raise awareness of compliance requirements and responsibilities.

- Use of compliance management software: Utilizing software solutions to streamline compliance processes, track progress, and automate tasks.

- Vulnerability assessments and penetration testing: Identifying potential security vulnerabilities that could lead to non-compliance.

Think of it as preventative maintenance for your compliance program. Regular checks and updates prevent larger issues from arising later.

Q 26. What are the ethical considerations involved in compliance?

Ethical considerations in compliance are paramount. It’s not just about following the letter of the law; it’s about acting with integrity and upholding the highest standards of conduct. This encompasses several key aspects:

- Transparency and honesty: Being open and honest about compliance efforts and any potential issues. This includes promptly reporting any violations or potential breaches.

- Fairness and impartiality: Ensuring that compliance measures are applied fairly and consistently across the organization, avoiding favoritism or bias.

- Confidentiality: Protecting sensitive information and maintaining confidentiality throughout the compliance process.

- Accountability: Taking responsibility for compliance failures and implementing corrective actions to prevent future occurrences.

- Conflict of interest management: Identifying and managing any potential conflicts of interest that could compromise compliance efforts.

Ethical considerations are the cornerstone of a robust compliance program. Without them, the program becomes merely a check-the-box exercise, lacking genuine integrity.

Q 27. Describe a time you had to escalate a compliance issue. What was the outcome?

In a previous role, I discovered a potential breach of HIPAA regulations related to the improper disposal of patient medical records. These records were inadvertently placed in a dumpster without proper shredding, posing a significant risk to patient privacy.

I immediately escalated the issue to my supervisor and the compliance officer. We immediately initiated an investigation, identified the responsible parties, implemented corrective actions (including secure disposal of all remaining records), and reported the incident to the appropriate authorities. We also conducted thorough employee retraining on proper data disposal procedures. The outcome was a successful resolution of the issue, preventing a potential HIPAA violation and reinforcing our commitment to data security and patient privacy. The incident served as a valuable learning experience, prompting us to enhance our internal controls and protocols.

Q 28. How do you measure the effectiveness of your compliance program?

Measuring the effectiveness of a compliance program requires a multifaceted approach, focusing both on quantitative and qualitative data. Key metrics include:

- Number and nature of compliance incidents: Tracking the frequency and severity of compliance violations to identify trends and areas needing improvement.

- Time taken to remediate issues: Measuring the time it takes to address compliance issues helps evaluate the efficiency of processes.

- Employee compliance training completion rates: Assessing employee understanding and adherence to compliance regulations.

- Audit outcomes: Evaluating the results of internal and external audits to gauge the effectiveness of the program.

- Number of reported compliance-related concerns: Monitoring employee reports on potential compliance violations reflects a culture of compliance.

- Cost of compliance: Tracking the financial resources allocated to compliance efforts to assess efficiency.

Ultimately, the effectiveness of a compliance program is judged not only by the absence of violations but also by the strength and resilience of the program itself – its ability to adapt to changing regulations and to foster a culture of compliance within the organization.

Key Topics to Learn for Familiar with Industry-Specific Standards and Regulations Interview

- Understanding the Regulatory Landscape: Explore the key regulations and standards relevant to your industry. This includes knowing the governing bodies, the purpose of each regulation, and potential penalties for non-compliance.

- Practical Application of Standards: Focus on how these standards are implemented in day-to-day operations. Consider case studies or examples to illustrate your understanding of practical application and problem-solving within the regulatory framework.

- Compliance Procedures and Documentation: Learn about the processes involved in ensuring compliance. This includes understanding documentation requirements, audit trails, and reporting procedures. Be prepared to discuss your experience in maintaining accurate records and conducting self-audits.

- Risk Assessment and Mitigation: Demonstrate your ability to identify potential regulatory risks and develop effective mitigation strategies. This is crucial for showing proactive compliance and minimizing potential liabilities.

- Staying Updated: Discuss your approach to staying current with changes in regulations and industry best practices. Highlight your ability to adapt to evolving standards and maintain compliance.

- Ethical Considerations: Explore the ethical implications of adhering to industry standards and regulations. Show that you understand the importance of professional conduct and responsible behavior within the regulatory environment.

Next Steps

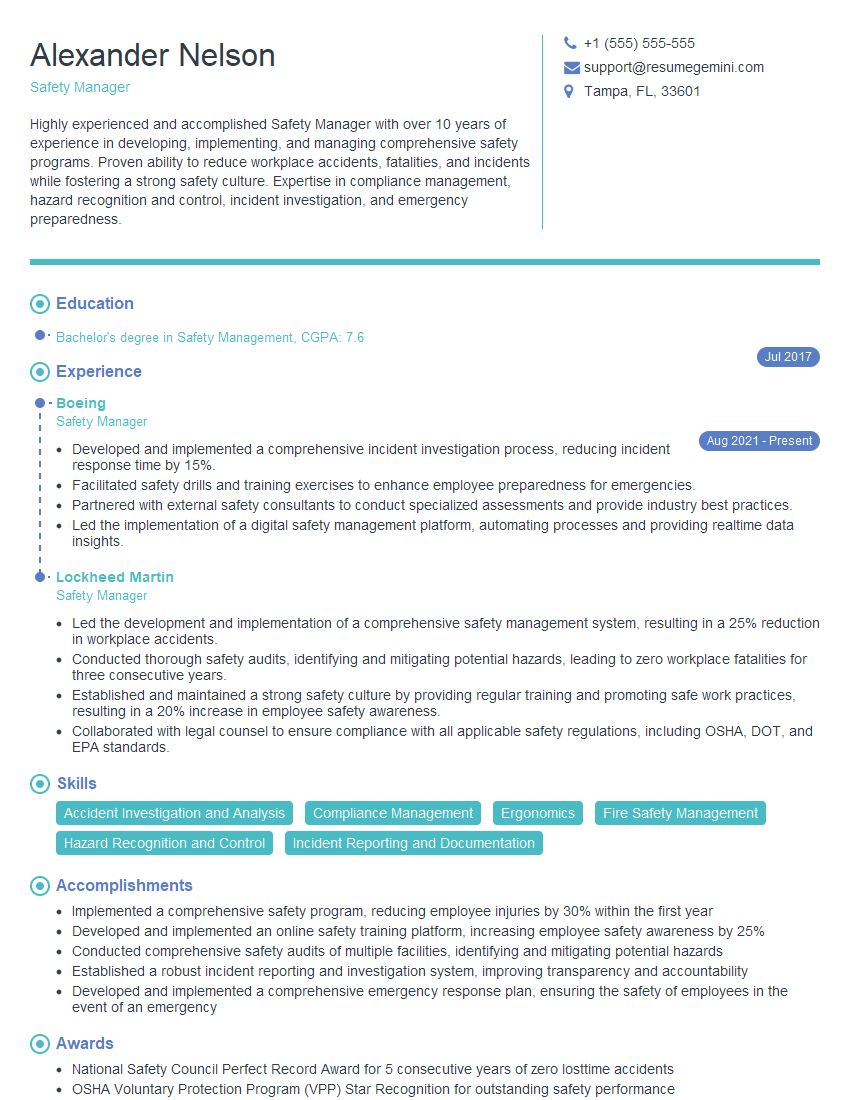

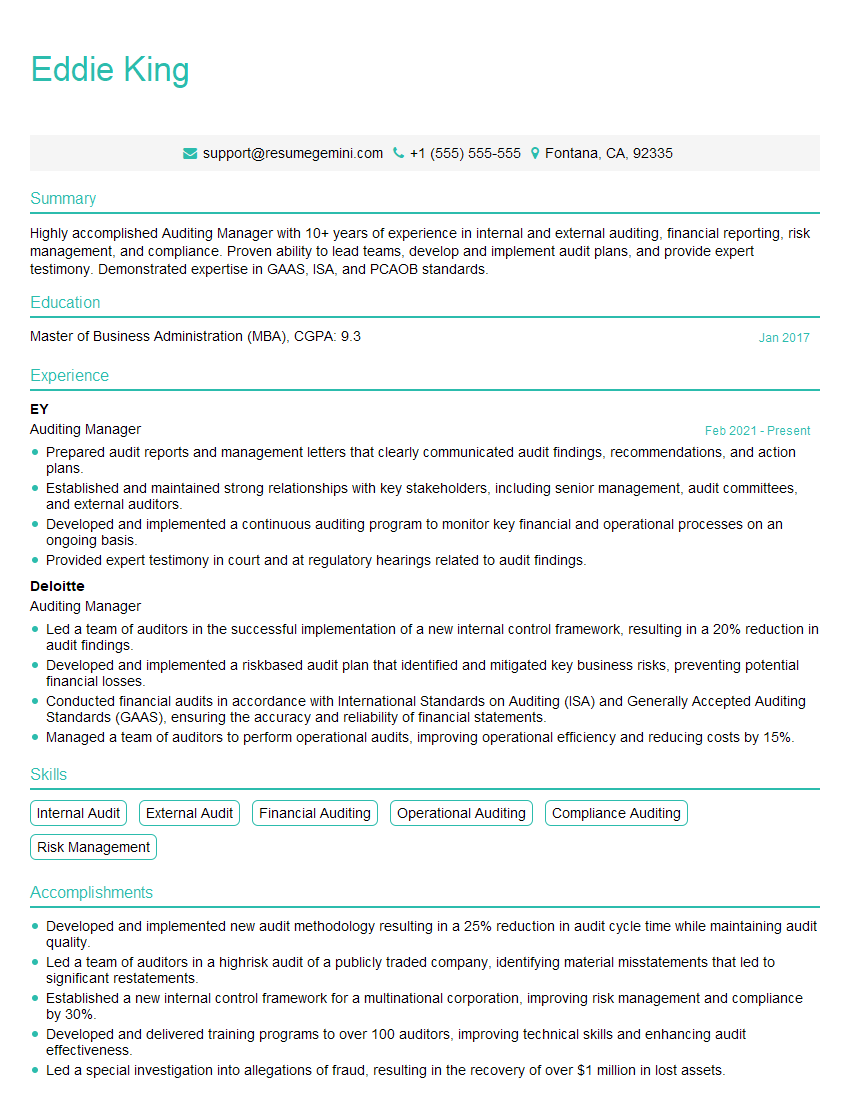

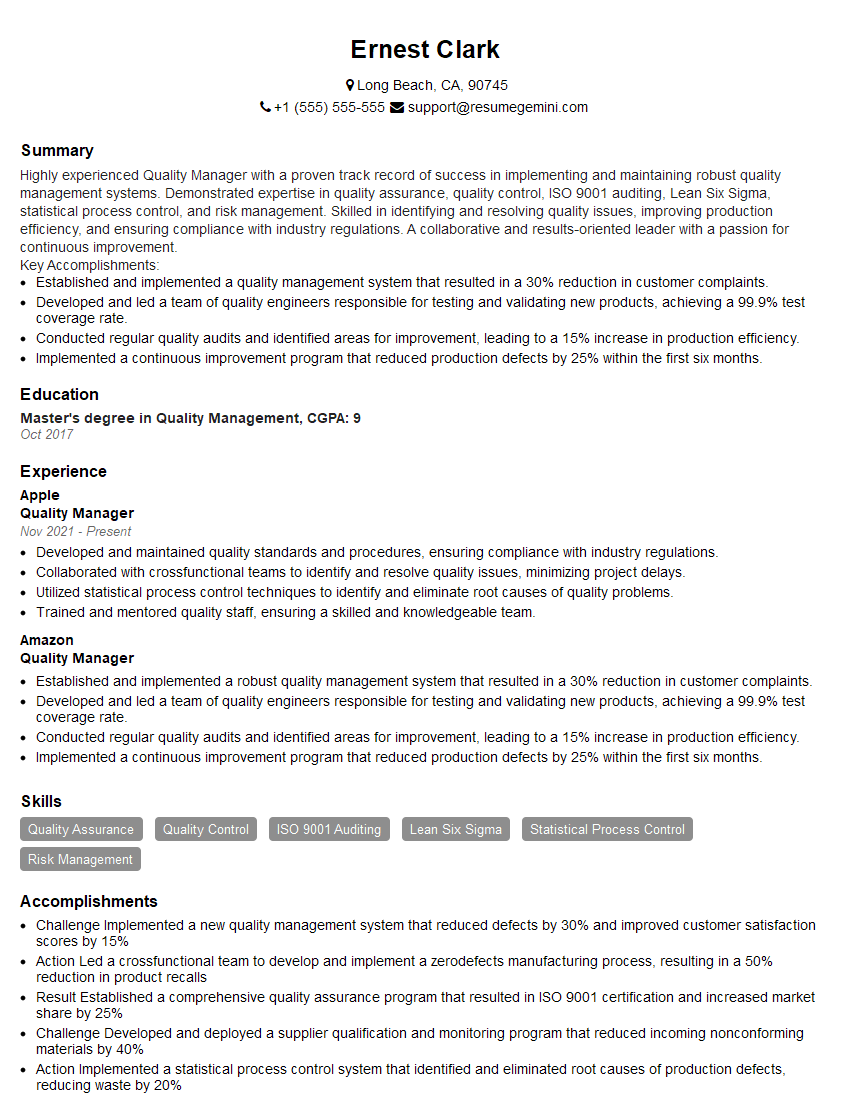

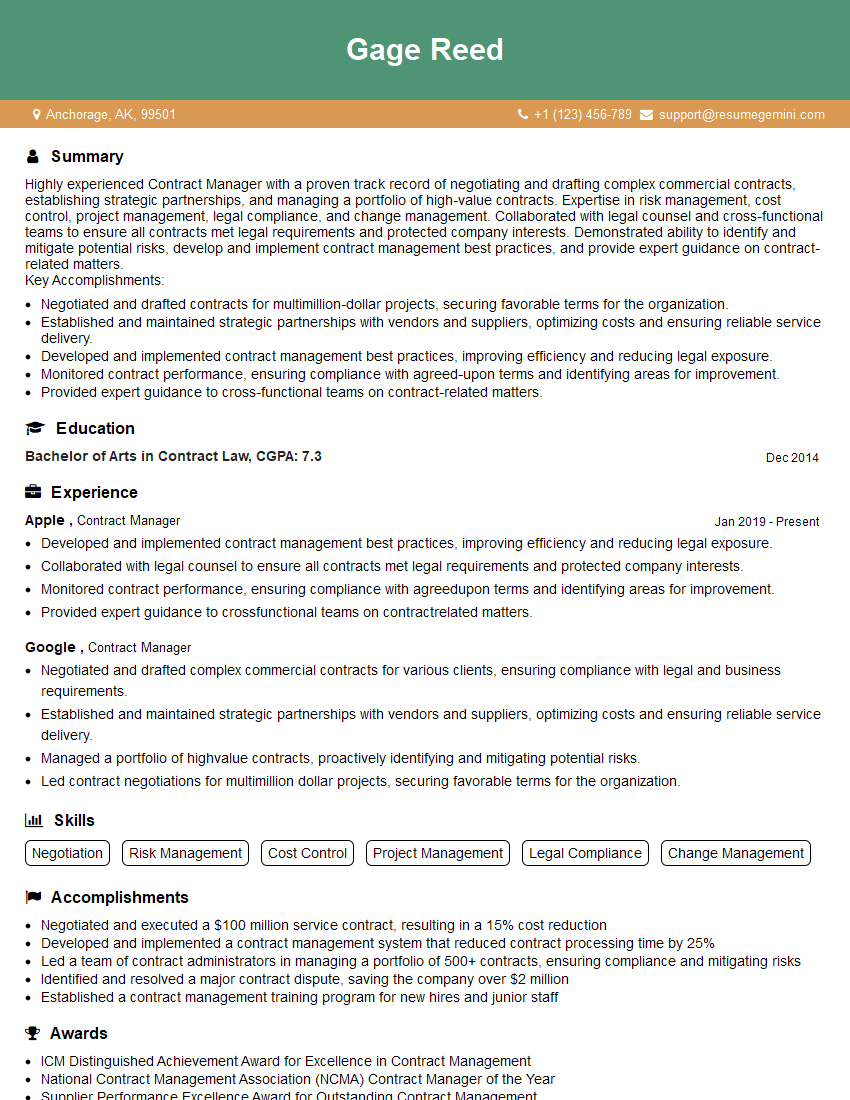

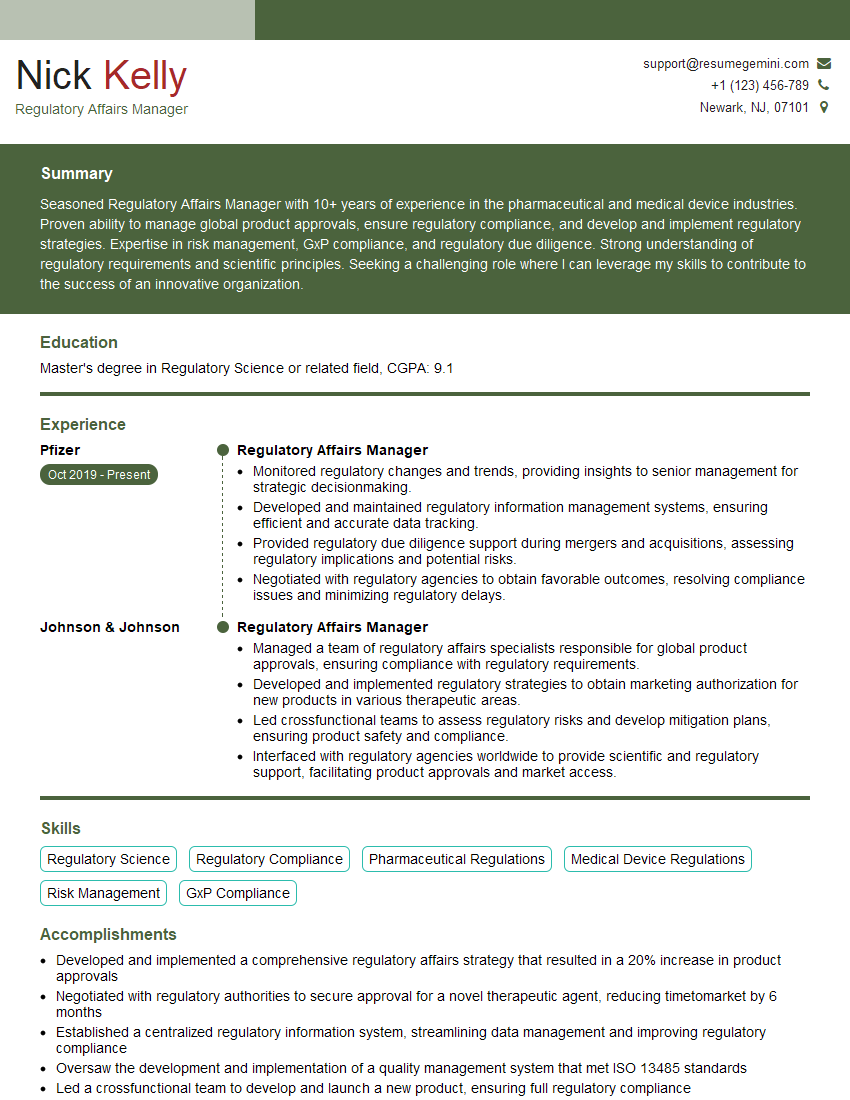

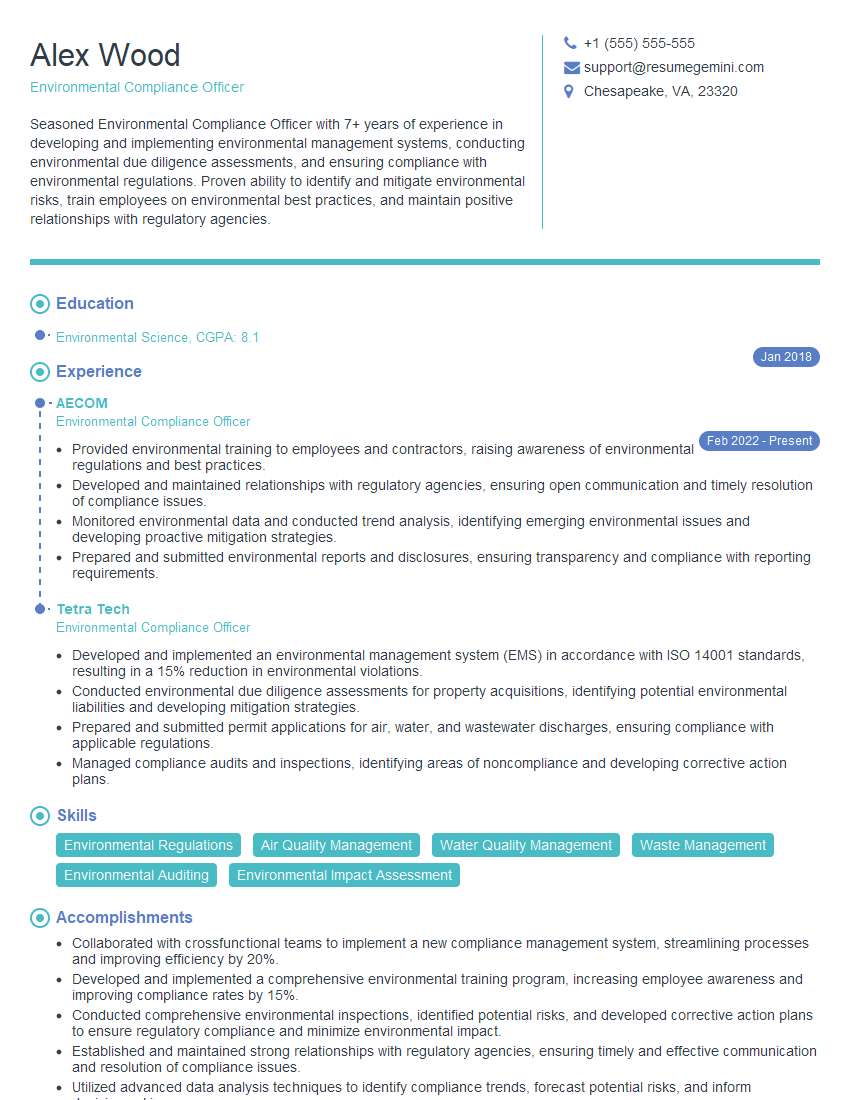

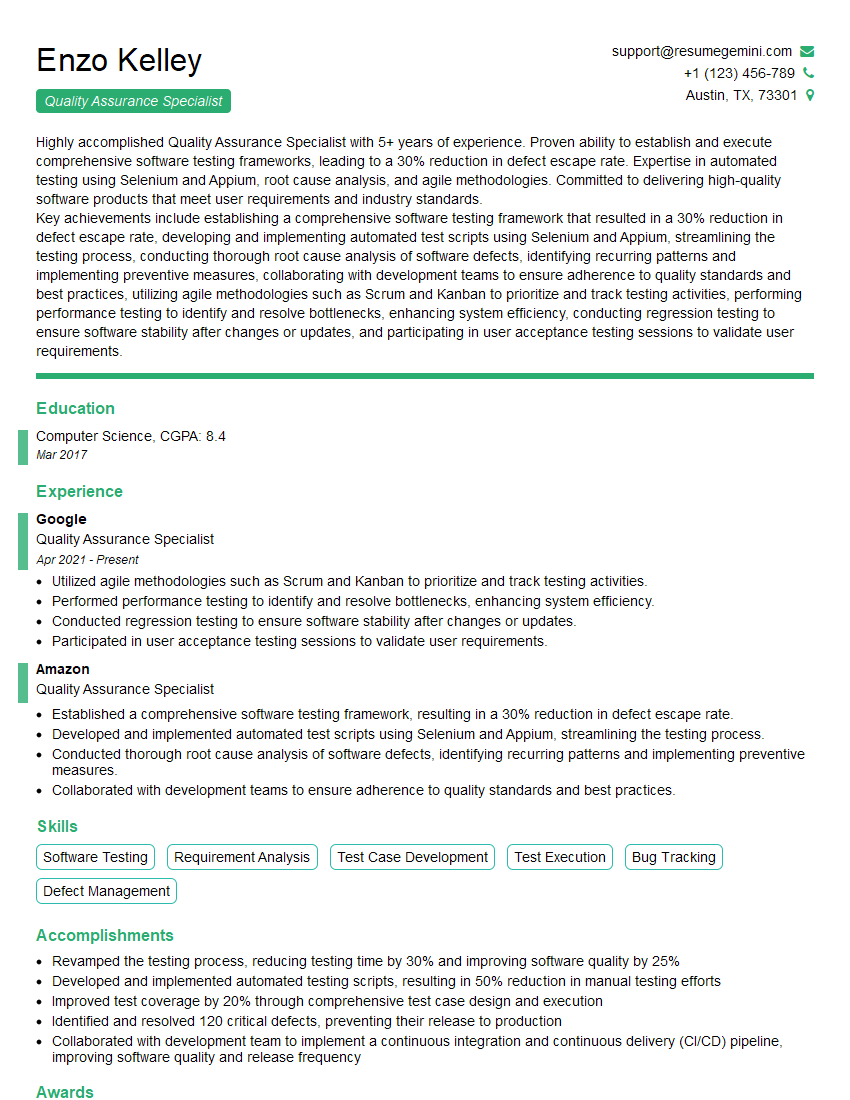

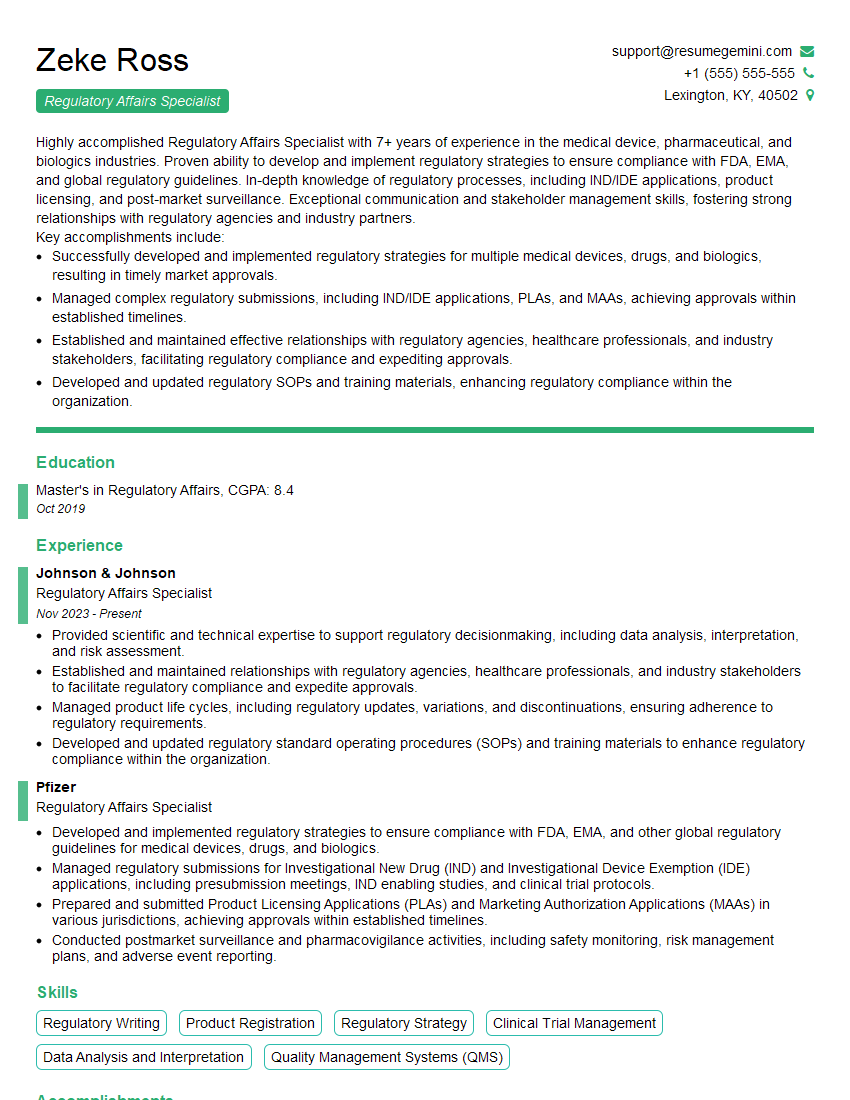

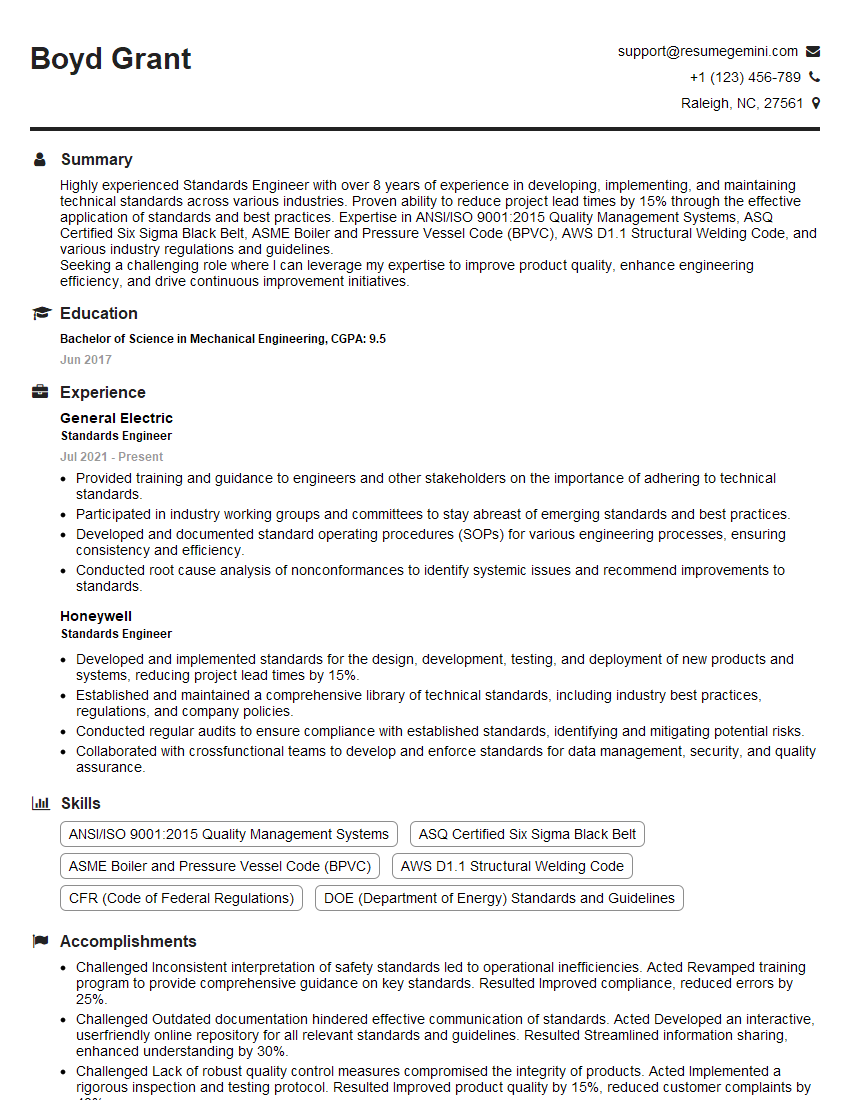

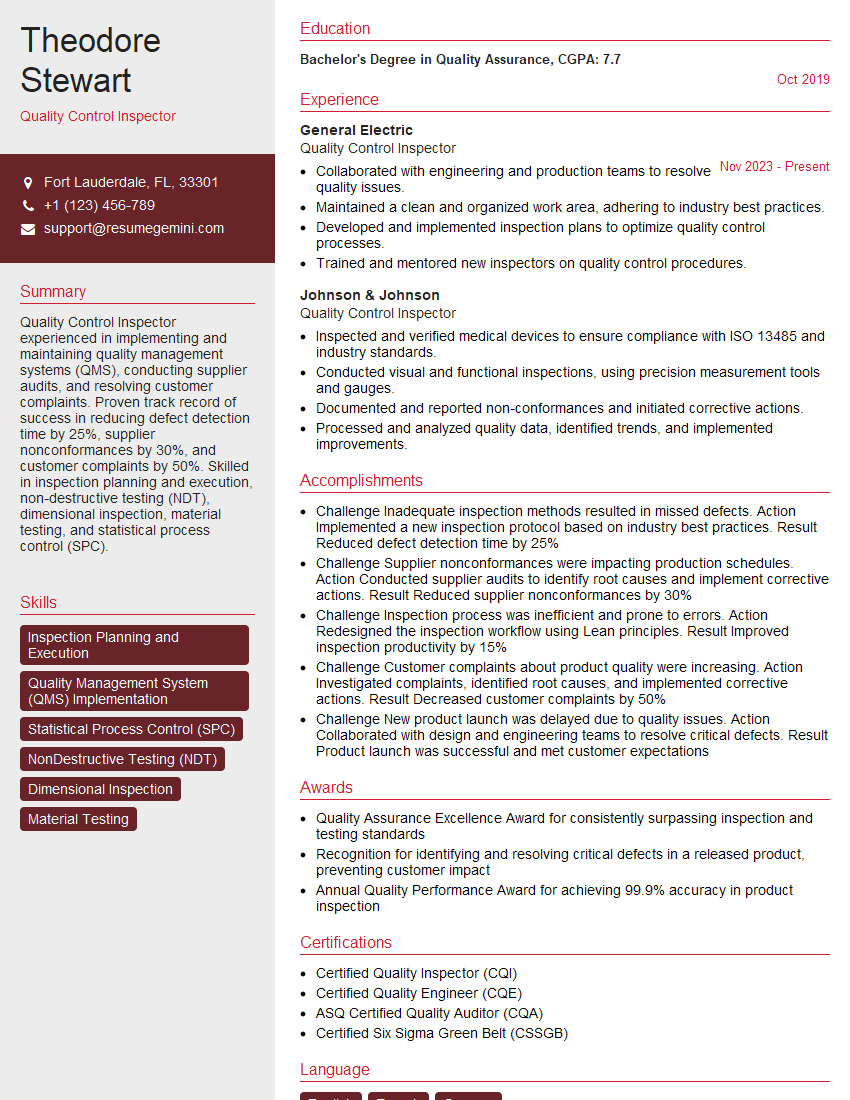

Mastering industry-specific standards and regulations is paramount for career advancement. Demonstrating a strong understanding of compliance not only reduces risk for your future employer but showcases your commitment to professionalism and ethical conduct, making you a highly desirable candidate. To significantly boost your job prospects, create an ATS-friendly resume that highlights your relevant skills and experience. ResumeGemini is a trusted resource to help you build a professional and impactful resume that stands out. We provide examples of resumes tailored to showcasing expertise in “Familiar with Industry-Specific Standards and Regulations,” so you can see how to best present your qualifications.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

I Redesigned Spongebob Squarepants and his main characters of my artwork.

https://www.deviantart.com/reimaginesponge/art/Redesigned-Spongebob-characters-1223583608

IT gave me an insight and words to use and be able to think of examples

Hi, I’m Jay, we have a few potential clients that are interested in your services, thought you might be a good fit. I’d love to talk about the details, when do you have time to talk?

Best,

Jay

Founder | CEO