The right preparation can turn an interview into an opportunity to showcase your expertise. This guide to Financial Institutions Supervision interview questions is your ultimate resource, providing key insights and tips to help you ace your responses and stand out as a top candidate.

Questions Asked in Financial Institutions Supervision Interview

Q 1. Describe your understanding of Basel III capital adequacy requirements.

Basel III capital adequacy requirements are a set of international banking regulations designed to strengthen the regulation, supervision, and risk management of banks worldwide. The core goal is to prevent future financial crises by ensuring banks have enough capital to absorb potential losses. This is achieved through several key pillars:

- Minimum Capital Requirements: Basel III sets minimum capital ratios banks must maintain. These ratios include Tier 1 capital (high-quality capital such as common equity) and Tier 2 capital (supplementary capital, such as subordinated debt). A common ratio is the Common Equity Tier 1 (CET1) ratio, which is calculated as CET1 capital divided by risk-weighted assets. For example, a bank might be required to maintain a minimum CET1 ratio of 8%.

- Capital Conservation Buffer: An additional buffer of capital that banks must hold above the minimum requirements, acting as a cushion during periods of economic stress. This buffer is typically 2.5% of risk-weighted assets.

- Countercyclical Capital Buffer: A buffer that can be imposed by national authorities during periods of excessive credit growth, designed to mitigate systemic risk. This buffer varies based on national economic conditions.

- Systemically Important Banks (SIBs): Banks designated as systemically important face higher capital requirements due to their greater potential impact on the financial system. They are subject to additional capital surcharges.

- Leverage Ratio: A non-risk-weighted measure of capital adequacy, calculating the ratio of Tier 1 capital to total assets. It acts as a backstop to the risk-weighted approach.

Imagine a sturdy building: the minimum capital requirements are the foundation, the conservation buffer is like extra reinforcement, and the countercyclical buffer is added based on potential storms (economic downturns). SIBs are like skyscrapers, needing extra support due to their size and importance.

Q 2. Explain the role of stress testing in financial institution supervision.

Stress testing plays a crucial role in financial institution supervision by assessing a bank’s resilience to adverse economic scenarios. It’s essentially a ‘what if’ analysis, simulating potential negative events and evaluating the bank’s ability to withstand them. This helps supervisors identify vulnerabilities and potential weaknesses before they lead to significant problems.

Supervisors use various scenarios, such as a sharp downturn in the economy, a significant increase in interest rates, a major market crash, or a pandemic. The bank is then required to model its financial position under these stressed conditions. The results help supervisors assess:

- Capital Adequacy: Does the bank have sufficient capital to absorb losses under stress?

- Liquidity: Can the bank meet its obligations during times of market disruption?

- Profitability: How would the bank’s profitability be affected?

- Risk Management Practices: How effective are the bank’s internal risk management processes in identifying and mitigating potential risks?

For example, a stress test might simulate a scenario where house prices fall by 30%, exploring the impact on a bank’s mortgage portfolio and overall financial health. A bank that fails to withstand stress tests might require increased capital, changes to its risk management procedures, or potentially even supervisory intervention.

Q 3. How do you assess the effectiveness of a financial institution’s anti-money laundering (AML) program?

Assessing the effectiveness of a financial institution’s Anti-Money Laundering (AML) program involves a multi-faceted approach. It’s not just about checking boxes; it’s about understanding the program’s overall design, implementation, and effectiveness in preventing and detecting money laundering and terrorist financing.

My assessment would include:

- Risk Assessment: Evaluating the bank’s understanding of its AML/CFT risks, including customer due diligence (CDD), transaction monitoring, and sanctions screening. A robust risk assessment is the foundation of an effective AML program.

- Customer Due Diligence (CDD): Reviewing the effectiveness of the bank’s procedures for identifying and verifying customers’ identities. This involves examining the completeness and accuracy of customer information, as well as the ongoing monitoring of high-risk customers.

- Transaction Monitoring: Assessing the bank’s systems and processes for identifying suspicious transactions. This involves reviewing the bank’s alert system, investigation procedures, and the overall effectiveness of its transaction monitoring system.

- Sanctions Screening: Evaluating the bank’s procedures for screening customers and transactions against sanctions lists. This includes reviewing the accuracy and timeliness of sanctions screening.

- Suspicious Activity Reporting (SAR): Examining the bank’s SAR filing practices. This includes the quality, timeliness, and completeness of SAR filings.

- Independent Audits and Testing: Reviewing the results of independent audits and testing of the AML program to determine its effectiveness and identify areas for improvement.

- Training and Compliance: Assessing the adequacy of employee training programs and the overall compliance culture within the institution. Staff awareness is key.

In practice, this might involve reviewing internal documents, conducting interviews with staff, and examining transaction records to assess compliance. I would look for evidence of a strong compliance culture and a proactive approach to risk mitigation, rather than simply a reactive approach to regulatory requirements.

Q 4. What are the key indicators of financial institution distress?

Several key indicators can signal financial institution distress. These are often interconnected and should be viewed holistically, not in isolation.

- Deteriorating Asset Quality: A rising ratio of non-performing loans (NPLs) to total loans indicates a growing portfolio of bad debts and potential losses. This is often a leading indicator.

- Falling Capital Ratios: A decline in capital ratios (CET1, Tier 1, etc.) below regulatory minimums or below peer averages indicates a weakening financial position and vulnerability to losses.

- Decreased Liquidity: Difficulty in meeting short-term obligations or a decline in liquid assets suggests a potential inability to fund operations or meet customer demands.

- Eroding Profitability: Consistent losses or significantly declining profits indicate unsustainable business models and possible insolvency.

- Increased Funding Costs: A higher cost of borrowing reflects market concerns about the institution’s creditworthiness and stability.

- Rising Operational Costs: Uncontrolled growth in operational expenses might indicate inefficiencies or poor management practices, impacting profitability.

- Reputational Damage: Negative publicity, lawsuits, or regulatory enforcement actions erode trust and can trigger customer withdrawals.

- Management Changes: Frequent changes in senior management can signal internal turmoil or a lack of confidence in leadership.

Think of these indicators as warning lights on a dashboard. A single light might not indicate a serious problem, but a cluster of lights flashing red requires immediate attention.

Q 5. Explain the process of conducting a financial institution examination.

Conducting a financial institution examination is a comprehensive process aimed at assessing the safety and soundness of the institution. It typically involves several phases:

- Planning: This involves defining the scope of the examination, identifying key risks, and developing an examination plan. Risk-based supervision is prioritized, focusing on areas of higher risk.

- Data Collection: Gathering information through various methods, including reviewing financial statements, regulatory reports, internal controls documentation, and conducting interviews with bank staff. This is a time-intensive phase.

- On-site Examination: Visiting the bank’s premises to conduct interviews, observe operations, and examine physical documents.

- Analysis: Analyzing the collected data to assess the bank’s compliance with laws, regulations, and sound banking practices. This may involve advanced statistical analysis and modeling.

- Reporting: Preparing a comprehensive examination report documenting the findings, highlighting any significant deficiencies or areas of concern, and making recommendations for corrective actions. The report is tailored for both supervisory use and often shared (in redacted form) with the institution.

- Follow-up: Monitoring the bank’s implementation of corrective actions and ensuring remediation of identified weaknesses.

This process is akin to a thorough medical check-up for a bank. It’s designed to identify any underlying problems before they escalate into major health issues. The process emphasizes a risk-focused approach—concentrating resources where the biggest potential problems might lie.

Q 6. Describe your experience with reviewing financial statements of financial institutions.

My experience in reviewing financial statements of financial institutions is extensive. I am proficient in analyzing various financial reports, including balance sheets, income statements, and cash flow statements. This involves more than simply understanding the numbers; it requires a deep understanding of the underlying accounting principles, regulatory reporting requirements, and the specific business models of different types of financial institutions.

My review process involves:

- Understanding the Business Model: Before diving into the numbers, I focus on understanding the institution’s core business, its strategic objectives, and its inherent risks. This allows me to interpret financial data within context.

- Ratio Analysis: Using key financial ratios (e.g., profitability ratios, liquidity ratios, solvency ratios) to assess performance, financial health, and risk exposure. I compare these ratios to industry benchmarks, historical trends, and regulatory requirements.

- Trend Analysis: Examining financial data over time to identify emerging trends and potential risks. This often involves using financial modeling to project future outcomes under various scenarios.

- Comparative Analysis: Comparing the financial statements of the institution with those of its peers to gain insights into its relative performance and risk profile.

- Identifying Red Flags: Scrutinizing the financial statements for potential red flags such as unexplained discrepancies, unusual transactions, or inconsistencies in reporting. These often warrant further investigation.

I’ve been involved in numerous situations where thorough financial statement analysis uncovered potential problems ranging from accounting errors to evidence of fraud. For example, I once noticed a consistent underreporting of loan loss provisions, indicating a potential understatement of credit risk.

Q 7. How do you identify and assess operational risks within a financial institution?

Identifying and assessing operational risks within a financial institution requires a systematic approach. Operational risk is the risk of losses resulting from inadequate or failed internal processes, people, and systems or from external events. It covers a wide spectrum of potential issues.

My approach involves:

- Identifying Potential Risks: Using a combination of techniques, including self-assessment questionnaires, risk workshops with management, and review of internal documentation. This covers areas like fraud, cyber security breaches, model risk, regulatory breaches, and business disruptions.

- Risk Assessment: Evaluating the likelihood and potential impact of each identified risk. This involves considering factors such as the frequency of occurrence, severity of potential losses, and effectiveness of existing controls.

- Control Assessment: Reviewing the design and effectiveness of existing controls intended to mitigate operational risks. This may involve testing the effectiveness of internal controls, evaluating the adequacy of staff training, and assessing the resilience of technology systems.

- Gap Analysis: Identifying gaps in the existing control framework and recommending improvements. This may involve implementing new controls, enhancing existing controls, or improving staff training.

- Monitoring and Reporting: Establishing a process for ongoing monitoring of operational risks, tracking key risk indicators, and reporting on the effectiveness of risk mitigation measures.

For example, a bank might identify the risk of a cyberattack leading to data breaches or system outages. Assessing this risk involves estimating the likelihood of an attack, the potential financial and reputational damage, and the effectiveness of existing cybersecurity controls. If gaps are identified, recommendations might include investments in enhanced cybersecurity systems, employee training, and incident response planning.

Q 8. Explain your understanding of the Dodd-Frank Act and its impact on financial institutions.

The Dodd-Frank Wall Street Reform and Consumer Protection Act, enacted in 2010, was a sweeping response to the 2008 financial crisis. Its primary goal was to prevent another such crisis by increasing financial regulation and consumer protection. It significantly impacted financial institutions by introducing numerous reforms across various areas.

- Increased Regulatory Oversight: Dodd-Frank established the Financial Stability Oversight Council (FSOC) to identify and address systemic risk within the financial system. It also strengthened the powers of existing regulatory agencies like the Federal Reserve, the Securities and Exchange Commission (SEC), and the Commodity Futures Trading Commission (CFTC).

- Consumer Protection: The act created the Consumer Financial Protection Bureau (CFPB) to protect consumers from unfair, deceptive, or abusive financial practices. This includes regulations impacting mortgages, credit cards, and other consumer financial products.

- Volcker Rule: This prohibits banks from engaging in proprietary trading (i.e., trading for their own account) and limits their investments in hedge funds and private equity funds. The aim is to reduce the risk-taking behavior of banks.

- Derivatives Regulation: Dodd-Frank imposed stricter regulations on the over-the-counter (OTC) derivatives market, aiming to increase transparency and reduce systemic risk associated with these complex financial instruments. Standardization and clearing of derivatives were mandated.

- Increased Capital Requirements: The act increased capital requirements for banks, making them more resilient to losses and reducing the likelihood of bank failures.

For example, a large bank would now need to comply with stricter capital adequacy ratios (e.g., Basel III), implement robust risk management systems to identify and mitigate systemic risk, and ensure compliance with the Volcker Rule to avoid penalties. The impact is a more stringent and complex regulatory environment for financial institutions, leading to increased compliance costs but also potentially greater stability.

Q 9. How do you evaluate the effectiveness of a bank’s board of directors?

Evaluating a bank’s board of directors requires a multi-faceted approach. I would assess their effectiveness based on several key factors:

- Composition and Diversity: A high-performing board possesses diverse skills, experience, and perspectives. This includes financial expertise, legal acumen, risk management knowledge, and an understanding of the specific industry. Gender, ethnic, and age diversity are also important considerations.

- Independence and Objectivity: Board members must be independent from management and free from conflicts of interest. Their decisions should be based on sound judgment and the best interests of the institution, not personal gain.

- Strategic Oversight: An effective board actively engages in strategic planning, providing guidance on long-term goals, reviewing the bank’s business plan, and overseeing its execution. They should challenge management’s assumptions and proposals.

- Risk Management Oversight: The board plays a critical role in overseeing the bank’s risk management framework. They should ensure that appropriate risk appetite is defined, risk assessments are conducted regularly, and effective controls are in place to manage and mitigate risks.

- Performance Monitoring and Evaluation: The board should regularly review the bank’s performance against key metrics and hold management accountable for achieving its objectives. They should also conduct a self-assessment of their own effectiveness periodically.

- Culture and Ethics: The board sets the ethical tone at the top. They should foster a culture of integrity, transparency, and compliance. They actively promote a strong ethical framework within the organization.

I’d use a combination of reviewing board meeting minutes, interviewing board members and senior management, and analyzing the bank’s overall performance and risk profile to assess their effectiveness. A poorly performing board might show a lack of oversight in risk management leading to financial losses or regulatory issues.

Q 10. What are the key elements of a sound risk management framework?

A sound risk management framework is a cornerstone of any financially stable institution. Key elements include:

- Risk Appetite and Tolerance: Clearly defining the level of risk the institution is willing to accept is crucial. This should align with the institution’s strategic goals and risk capacity.

- Risk Identification and Assessment: A comprehensive process to identify potential risks across all areas (credit, market, operational, liquidity, reputational, strategic, cybersecurity etc.) and assess their likelihood and potential impact.

- Risk Measurement and Monitoring: Developing methods for measuring and tracking key risks, using quantitative and qualitative data. Regularly monitoring risk exposures and comparing them to established risk appetite.

- Risk Mitigation and Control: Implementing appropriate strategies to mitigate identified risks. This may include diversification, hedging, internal controls, stress testing, and contingency planning.

- Risk Reporting and Communication: Establishing clear lines of reporting on risk exposures and control effectiveness to senior management and the board. Open and transparent communication is key.

- Independent Review: Regular independent reviews of the risk management framework and its effectiveness. This might involve internal audit or external consultants.

For example, a bank using a sound risk framework would regularly assess its exposure to credit risk by analyzing the creditworthiness of its borrowers, implementing appropriate loan loss provisions, and diversifying its loan portfolio. A robust framework also includes mechanisms for identifying and mitigating operational risks, such as fraud and cyberattacks.

Q 11. Describe your experience with regulatory reporting requirements for financial institutions.

My experience with regulatory reporting for financial institutions spans several years, encompassing various regulatory frameworks and reporting requirements. I have been involved in:

- Preparing and submitting regulatory reports: This includes reports related to capital adequacy, liquidity, risk exposures, and financial performance to regulatory authorities such as the Federal Reserve, OCC, FDIC, and state banking departments.

- Ensuring compliance with regulatory deadlines: Meeting strict deadlines for submissions is critical to avoid penalties and maintain a good regulatory standing.

- Managing data integrity and accuracy: Regulatory reports require precise and reliable data. Implementing robust data management systems and controls is vital to ensure data accuracy and consistency.

- Working with internal audit and compliance teams: Collaboration with internal teams is necessary to ensure that the reporting process is efficient, reliable and in compliance with regulatory requirements.

- Staying updated on regulatory changes: Regulatory environments constantly evolve. Continuously updating knowledge of changes and incorporating these into reporting procedures is essential.

I’ve handled reports such as the Call Report (for US banks), regulatory capital calculations based on Basel accords and various stress testing scenarios. The complexity and frequency of these reports requires strong organizational skills, attention to detail, and a thorough understanding of the applicable regulations.

Q 12. How do you identify and assess cybersecurity risks within a financial institution?

Identifying and assessing cybersecurity risks within a financial institution requires a systematic and comprehensive approach. This involves:

- Vulnerability Assessments: Regularly scanning systems and applications for vulnerabilities and weaknesses. Penetration testing simulates real-world attacks to identify exploitable security gaps.

- Threat Modeling: Identifying potential threats to the institution’s information systems and data, including internal and external threats (e.g., malware, phishing attacks, insider threats).

- Risk Assessment: Evaluating the likelihood and potential impact of identified threats and vulnerabilities. This helps prioritize remediation efforts based on criticality.

- Security Controls: Implementing appropriate security controls to mitigate risks. This includes access controls, firewalls, intrusion detection/prevention systems, data encryption, security awareness training for employees, and incident response plans.

- Third-Party Risk Management: Assessing the cybersecurity risks posed by third-party vendors and service providers. Financial institutions often rely on external entities, so ensuring their security posture is crucial.

- Incident Response Planning: Developing a comprehensive plan to address and manage cybersecurity incidents. This includes procedures for containment, eradication, recovery, and communication.

For instance, a bank might use vulnerability scanning tools to detect weaknesses in its network infrastructure. Threat modeling helps anticipate potential attacks, such as a phishing campaign targeting employees to steal login credentials. Implementing multi-factor authentication and employee training programs can then significantly mitigate this risk.

Q 13. Explain your understanding of the different types of financial institution supervision models.

Different models of financial institution supervision exist, each with its strengths and weaknesses. Some key models include:

- Principle-Based Supervision (PBS): This model focuses on principles and outcomes rather than detailed prescriptive rules. Supervisors assess the effectiveness of a financial institution’s risk management framework and internal controls. It allows for greater flexibility but requires robust supervisory judgment and expertise.

- Rule-Based Supervision (RBS): This is a more prescriptive approach, with detailed regulations and specific compliance requirements. It provides greater certainty and consistency but can be inflexible and may not adapt well to rapidly evolving risks.

- Consolidated Supervision: This model focuses on supervising financial groups or conglomerates as a whole, rather than individual entities. It helps address systemic risk stemming from interconnectedness within financial groups.

- On-site vs. Off-site Supervision: On-site supervision involves direct examination of the institution’s operations and records, while off-site supervision relies on reports, data analysis, and other indirect methods. A combined approach is typically used.

- Cooperative Supervision: This involves collaboration between different supervisory authorities, especially in the case of internationally active institutions. It enhances coordination and consistency across jurisdictions.

The choice of model depends on various factors such as the size and complexity of the financial institution, the level of risk it poses, and the supervisory capacity of the regulatory authority. A smaller bank might be suitable for rule-based supervision, while a large, complex financial group might require a consolidated and principle-based approach with strong collaboration between supervisory agencies.

Q 14. How do you handle conflicts of interest in financial institution supervision?

Conflicts of interest in financial institution supervision can undermine the integrity and effectiveness of the supervisory process. They must be proactively addressed through robust mechanisms. My approach includes:

- Transparency and Disclosure: Requiring supervisors to disclose any potential conflicts of interest, even if perceived, is crucial. This ensures that any potential bias is identified and managed appropriately.

- Recusal and Avoidance: Supervisors with actual or perceived conflicts of interest should recuse themselves from decisions related to the institution involved. This prevents any unfair advantage or undue influence.

- Ethical Guidelines and Codes of Conduct: Clear ethical guidelines and codes of conduct should be established and strictly enforced for all supervisory staff. This provides a framework for ethical decision-making and behaviour.

- Independent Oversight and Review: Having an independent body to oversee the supervisory process helps identify and address potential conflicts of interest. This might involve internal audits or external review mechanisms.

- Rotation of Supervisors: Periodic rotation of supervisors assigned to specific institutions can help mitigate the risk of developing close relationships that could lead to conflicts of interest.

- Whistleblower Protection: Establishing a secure system for reporting potential conflicts of interest. This ensures that individuals can raise concerns without fear of retaliation.

For example, if a supervisor had previously worked for a bank that is now under supervision, they should recuse themselves from any decision affecting that bank. Strong ethical standards and independent oversight are vital in maintaining the integrity of the supervisory process and public trust.

Q 15. Explain your experience in conducting on-site inspections of financial institutions.

On-site inspections are crucial for assessing the health and compliance of financial institutions. My experience involves leading teams in comprehensive examinations, encompassing various aspects of the institution’s operations. This includes reviewing policies and procedures, examining transaction records, interviewing staff at all levels, and validating the accuracy of financial reporting. For example, during an inspection of a regional bank, we identified a weakness in their anti-money laundering (AML) procedures related to the verification of customer identities. This led to recommendations for improved training and enhanced due diligence processes. Another inspection involved a credit union where we focused on loan origination and underwriting processes. We uncovered inconsistencies in the application of credit scoring models resulting in an elevated risk of loan defaults. The findings from these inspections are meticulously documented and presented in detailed reports, including recommendations for corrective actions.

The process typically follows a risk-based approach, focusing on areas identified as high-risk based on previous inspections, regulatory alerts, or internal risk assessments. We use a combination of analytical techniques, including data analysis and sampling, to obtain a representative view of the institution’s activities. Effective communication with institution management is crucial to ensure a smooth and collaborative inspection process.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. How do you evaluate the adequacy of a financial institution’s liquidity risk management?

Evaluating the adequacy of a financial institution’s liquidity risk management involves assessing their ability to meet short-term obligations without incurring unacceptable losses. I assess this by examining several key aspects. First, I review their liquidity planning and forecasting processes. This includes evaluating the accuracy of their stress testing methodologies and the realism of their liquidity scenarios. A well-designed stress test incorporates various macroeconomic shocks and considers their potential impact on the institution’s funding sources. Second, I analyze their sources of liquidity. This involves reviewing their cash reserves, access to funding markets, and the quality of their collateral. I look for diversification in funding sources to mitigate concentration risks. Third, I scrutinize their liquidity management tools and techniques, examining the use of various liquidity metrics, including the liquidity coverage ratio (LCR) and net stable funding ratio (NSFR). The LCR, for example, mandates a certain level of high-quality liquid assets to cover potential outflows over a 30-day period. Finally, I review the effectiveness of their contingency planning in the event of a liquidity crisis.

For instance, in reviewing a commercial bank, I found their stress testing methodology insufficiently conservative. They hadn’t adequately considered scenarios like a sudden loss of confidence in the institution, leading to large-scale deposit withdrawals. This prompted recommendations for incorporating more severe scenarios and developing more robust contingency plans.

Q 17. What are the key components of a sound internal control system?

A sound internal control system is the cornerstone of a well-managed financial institution. It comprises several interconnected components working in synergy to mitigate risks and ensure the accuracy, reliability, and integrity of financial reporting. These key components include:

- Control Environment: This sets the tone at the top, establishing ethical values and a commitment to internal control. A strong control environment fosters a culture of accountability and responsibility.

- Risk Assessment: A thorough risk assessment identifies potential threats to the institution’s objectives and assesses the likelihood and impact of those threats. This involves identifying risks related to operations, compliance, and financial reporting.

- Control Activities: These are the specific actions put in place to mitigate the identified risks. Examples include segregation of duties, authorization procedures, reconciliations, and physical security measures.

- Information and Communication: A robust system for capturing, processing, and communicating information is critical. This ensures that relevant data is readily available to those responsible for taking action.

- Monitoring Activities: Ongoing monitoring is needed to track the effectiveness of the internal control system. This includes regular reviews, audits, and exception reports.

Imagine a scenario where a bank lacks adequate segregation of duties. A single employee could potentially authorize and process transactions, creating an opportunity for fraud. A robust internal control system would prevent such a scenario.

Q 18. Describe your experience working with financial institution regulators.

My experience with financial institution regulators has been extensive and collaborative. I’ve worked closely with various regulatory bodies, providing information, responding to inquiries, and participating in on-going discussions regarding regulatory compliance and examination findings. This includes proactively engaging with regulators to address potential concerns and demonstrating a commitment to transparency. I’ve presented findings from inspections and audits to regulatory staff, explaining our methodology and rationale for our conclusions. In one instance, we worked closely with the central bank to develop a tailored approach to supervising a newly established fintech institution, combining traditional supervisory techniques with newer methods appropriate to the nature of their business. In another example, collaboration with the regulator helped to improve the methodology used for calculating regulatory capital requirements.

Successful collaboration relies heavily on building trust and fostering open communication. Regulators appreciate transparency and the willingness to address concerns proactively, leading to more constructive supervisory relationships. It is a two-way street; regulators provide crucial insights and guidance to institutions, and institutions provide data and insight to the regulators.

Q 19. How do you assess the credit risk of a loan portfolio?

Assessing the credit risk of a loan portfolio is a multi-faceted process. I utilize a variety of methods to achieve a comprehensive assessment, including:

- Quantitative analysis: This involves analyzing statistical data on loan defaults, recovery rates, and borrower characteristics. This can include using statistical models like credit scoring models to predict the likelihood of default.

- Qualitative analysis: This involves reviewing individual loan files, assessing the creditworthiness of borrowers, and evaluating the quality of collateral. This often requires in-depth knowledge of the industry and the borrowers’ business models.

- Concentration risk assessment: This focuses on identifying areas of concentration within the loan portfolio, such as over-exposure to a specific industry or geographic region. This assesses vulnerabilities to changes in those sectors.

- Stress testing: I use stress testing to simulate the impact of adverse economic scenarios on the loan portfolio. This includes considering macroeconomic factors such as changes in interest rates and economic downturns.

For example, during the analysis of a bank’s commercial loan portfolio, we identified a high concentration of loans to the real estate sector. A subsequent stress test, simulating a real estate market downturn, revealed the significant potential impact on the portfolio’s credit quality. This led to recommendations for diversification and more robust underwriting standards.

Q 20. How do you evaluate the effectiveness of a financial institution’s compliance program?

Evaluating the effectiveness of a financial institution’s compliance program is critical for ensuring adherence to all applicable laws, regulations, and internal policies. My assessment involves reviewing the design and implementation of the program, encompassing several key areas:

- Policy and Procedures: I review policies and procedures to determine whether they are comprehensive, up-to-date, and effectively communicated to all staff.

- Training and Awareness: I assess the effectiveness of the institution’s compliance training programs, ensuring staff members understand their responsibilities and the consequences of non-compliance.

- Monitoring and Oversight: I examine the mechanisms put in place to monitor compliance, including internal audits, independent reviews, and self-assessments.

- Enforcement and Remediation: I review the institution’s approach to addressing identified compliance failures, including corrective actions and disciplinary measures.

- Reporting and Recordkeeping: I evaluate the quality of the institution’s compliance reporting to regulatory bodies and internal management.

A well-designed compliance program is not merely a collection of policies and procedures; it’s a living, breathing entity that adapts to changing regulatory landscapes and internal risks. A bank’s failure to adequately address a compliance deficiency, for example, demonstrates a critical flaw in its overall program effectiveness.

Q 21. Describe your experience with analyzing large datasets of financial information.

Analyzing large datasets of financial information is a routine part of my work. I leverage various techniques and tools to gain meaningful insights from this data, including:

- Data mining: I employ data mining techniques to identify patterns, anomalies, and trends within the data, which can highlight potential risks or areas of concern.

- Statistical modeling: I use statistical models to forecast key financial metrics, such as credit losses or operational expenses. This allows for proactive risk management.

- Data visualization: Effective data visualization tools such as dashboards and reports help me to communicate complex financial information in a clear and concise manner, making it readily understandable for both technical and non-technical audiences.

- Programming languages: My proficiency in programming languages such as Python or R allows for automated data analysis, cleaning, and manipulation, improving efficiency and accuracy.

For example, during an analysis of a large insurance company’s claims data, we were able to identify a pattern of fraudulent claims based on unusual claim frequency and amounts in a specific geographical region. This led to improved fraud detection mechanisms.

Q 22. How do you assess the impact of macroeconomic factors on financial institutions?

Assessing the impact of macroeconomic factors on financial institutions requires a holistic approach, considering their interconnectedness and potential ripple effects. We analyze factors like interest rate changes, inflation, economic growth, unemployment rates, and geopolitical events to understand their influence on various aspects of a financial institution’s operations.

Interest Rate Risk: Rising interest rates can impact net interest margins, particularly for institutions with significant interest-sensitive assets and liabilities. For example, a bank with a large portfolio of fixed-rate mortgages might face reduced profitability if market interest rates climb significantly.

Credit Risk: Economic downturns increase the likelihood of loan defaults. We examine indicators like unemployment rates and GDP growth to gauge the potential increase in non-performing loans and assess the resilience of the institution’s loan portfolio. For example, during a recession, businesses in specific sectors might be more vulnerable, requiring closer scrutiny of related credit exposures.

Market Risk: Fluctuations in equity and bond markets can affect the value of investment portfolios held by financial institutions. A sudden market crash can lead to significant losses, impacting capital adequacy and potentially triggering regulatory actions. We use stress testing and scenario analysis to evaluate these potential impacts.

Liquidity Risk: Economic instability can trigger runs on banks or limit access to funding. We carefully monitor liquidity ratios and the institution’s ability to meet its obligations during periods of stress. We consider both short-term and long-term liquidity scenarios.

By systematically assessing these macroeconomic influences and their impact on key risk areas, we can provide a comprehensive evaluation of an institution’s financial health and stability.

Q 23. Explain your understanding of the different types of financial institution failures.

Financial institution failures can stem from various causes, broadly categorized as follows:

Liquidity Crises: These occur when an institution cannot meet its short-term obligations, often triggered by a sudden loss of confidence or a large-scale withdrawal of deposits (bank run). The 2008 financial crisis saw many institutions facing this, leading to government bailouts.

Solvency Issues: This arises when an institution’s assets are less than its liabilities, rendering it unable to meet its long-term obligations. This can be due to poor lending practices, excessive risk-taking, or significant losses in investments. The failure of Lehman Brothers is a prime example of solvency failure.

Fraud and Mismanagement: Internal failures such as fraud, embezzlement, or poor management practices can lead to significant financial losses and erode the institution’s capital base. The Madoff Ponzi scheme is a tragic example of this category.

Operational Failures: These are failures related to the day-to-day running of the institution, such as systemic technology failures, inadequate internal controls, or cybersecurity breaches. A large-scale system outage causing significant operational disruption could fall under this category.

Regulatory Non-Compliance: Failure to adhere to regulatory requirements can result in penalties, reputational damage, and ultimately, failure. Non-compliance with anti-money laundering regulations, for example, can have severe consequences.

Understanding these various failure modes is crucial for effective supervision, enabling the development of preventative measures and robust early warning systems.

Q 24. How do you communicate complex regulatory information to non-technical audiences?

Communicating complex regulatory information to non-technical audiences requires careful planning and a tailored approach. I utilize several key strategies:

Plain Language: I avoid technical jargon and use simple, everyday language. Complex concepts are broken down into smaller, easily digestible parts. Instead of saying ‘non-performing assets’, I might say ‘loans that are unlikely to be repaid’.

Visual Aids: Charts, graphs, and infographics can effectively convey complex data and trends more easily than lengthy text. For example, a simple bar chart illustrating the change in capital adequacy ratios over time would be more accessible than a table of numbers.

Analogies and Real-World Examples: Relating regulatory concepts to everyday scenarios makes them more relatable and memorable. For instance, I might explain the concept of diversification in investments by using the analogy of not putting all your eggs in one basket.

Interactive Sessions and Q&A: Facilitating interactive sessions encourages questions and helps clarify any doubts or misunderstandings. This allows me to tailor my explanations based on their specific concerns.

Layered Communication: For very complex issues, I use a tiered approach, starting with a high-level overview and then progressively introducing more detail only when necessary.

The goal is to ensure that the audience understands the key messages, the implications for them, and their responsibilities under the regulations.

Q 25. Describe your experience in developing and implementing supervisory policies and procedures.

My experience in developing and implementing supervisory policies and procedures spans several years and various regulatory frameworks. I have been involved in:

Risk-Based Supervision Framework Development: I’ve participated in designing and implementing risk-based supervisory frameworks, focusing on identifying and mitigating key risks faced by financial institutions. This involved defining risk categories, developing assessment methodologies, and establishing supervisory priorities.

Supervisory Procedures and Guidelines Creation: I have drafted and refined supervisory procedures and guidelines for on-site examinations, off-site monitoring, and enforcement actions. This involved careful consideration of legal requirements, best practices, and practical implementation aspects.

Policy Implementation and Monitoring: My role has included ensuring effective implementation of established supervisory policies and procedures, including the development of training materials and conducting staff training sessions to ensure consistent application across the supervisory team.

Regulatory Change Management: I have actively participated in managing the implementation of new regulations and supervisory guidance, adapting existing policies and procedures to reflect these changes. This often involves coordinating with other departments and external stakeholders.

Supervisory Technology Integration: I’ve worked on integrating technology into the supervisory process, leveraging data analytics and advanced tools for improved efficiency and risk identification.

Throughout these experiences, I’ve emphasized a collaborative approach, ensuring that developed policies are practical, effective, and proportionate to the risks involved.

Q 26. How do you utilize technology to enhance the efficiency of financial institution supervision?

Technology plays a crucial role in enhancing the efficiency and effectiveness of financial institution supervision. We leverage several technological tools and techniques:

Data Analytics: Using data analytics and machine learning algorithms to identify patterns and anomalies in large datasets from financial institutions. This allows for early detection of potential problems and more targeted supervisory interventions.

Automated Reporting and Monitoring: Implementing automated systems to collect, analyze, and report on key supervisory data, reducing manual effort and improving timeliness. This allows for more frequent and comprehensive monitoring.

Supervisory Information Systems: Utilizing dedicated supervisory information systems to track and manage all aspects of the supervisory process, ensuring data integrity and facilitating effective communication and collaboration among supervisors.

Regtech Solutions: Employing Regtech solutions to streamline compliance monitoring and reporting, improving the efficiency of regulatory compliance reviews.

Cloud Computing: Utilizing cloud-based technologies to store and access supervisory data securely, enhancing accessibility and collaboration.

By integrating these technologies, we can shift from reactive to proactive supervision, allowing for earlier identification of potential problems and more effective allocation of supervisory resources.

Q 27. Explain your understanding of the principles of fair lending and consumer protection.

Fair lending and consumer protection are cornerstones of responsible financial institution supervision. Fair lending prohibits discrimination in lending practices based on factors such as race, color, religion, national origin, sex, marital status, age, or because an applicant receives income from a public assistance program. Consumer protection aims to safeguard consumers from unfair, deceptive, or abusive practices by financial institutions. Key principles include:

Transparency: Financial products and services must be clearly explained to consumers, avoiding misleading or confusing language. This includes clear disclosure of fees, interest rates, and other relevant terms and conditions.

Non-discrimination: All consumers should have equal access to credit and financial products, regardless of their protected characteristics. Supervisors scrutinize lending data for evidence of discriminatory practices.

Responsible Lending: Financial institutions must assess a consumer’s ability to repay loans before extending credit. This includes evaluating income, expenses, and debt levels to ensure that the consumer can manage the repayment burden.

Consumer Education and Protection: Financial literacy programs and consumer protection mechanisms, such as complaint handling procedures, should be in place to help consumers understand their rights and protect them from predatory practices.

Data Privacy and Security: Financial institutions must ensure the security and privacy of consumer data, complying with relevant data protection regulations.

We use various methods to ensure compliance, including on-site examinations, data analysis, and consumer complaint reviews, to protect consumers and maintain fair lending practices.

Key Topics to Learn for Financial Institutions Supervision Interview

- Regulatory Framework: Understand the legal and regulatory landscape governing financial institutions, including Basel Accords, Dodd-Frank Act (or equivalent regional regulations), and national supervisory authorities’ mandates. Consider the evolution of these frameworks and their impact on institutions.

- Risk Management Frameworks: Master the principles of risk management within financial institutions, encompassing credit risk, market risk, operational risk, liquidity risk, and capital adequacy. Be prepared to discuss practical applications of these frameworks and common methodologies used for risk assessment and mitigation.

- Supervisory Processes & Techniques: Familiarize yourself with on-site and off-site supervisory techniques, including stress testing, scenario analysis, and the evaluation of internal controls. Understand the role of data analytics and technology in modern supervision.

- Financial Statement Analysis: Develop strong skills in analyzing financial statements (balance sheets, income statements, cash flow statements) to assess the financial health and stability of financial institutions. Be prepared to discuss key ratios and indicators of financial distress.

- Bank Resolution and Crisis Management: Understand the processes and mechanisms for resolving failing financial institutions, including bailouts, receivership, and other resolution strategies. Explore the role of supervisors in managing financial crises.

- Conduct and Culture: Be prepared to discuss the importance of ethical conduct and a strong risk culture within financial institutions and how supervisors assess and promote these factors.

- Emerging Risks and Technologies: Demonstrate awareness of emerging risks such as cyber threats, climate change, and the impact of fintech innovations on the stability of the financial system.

Next Steps

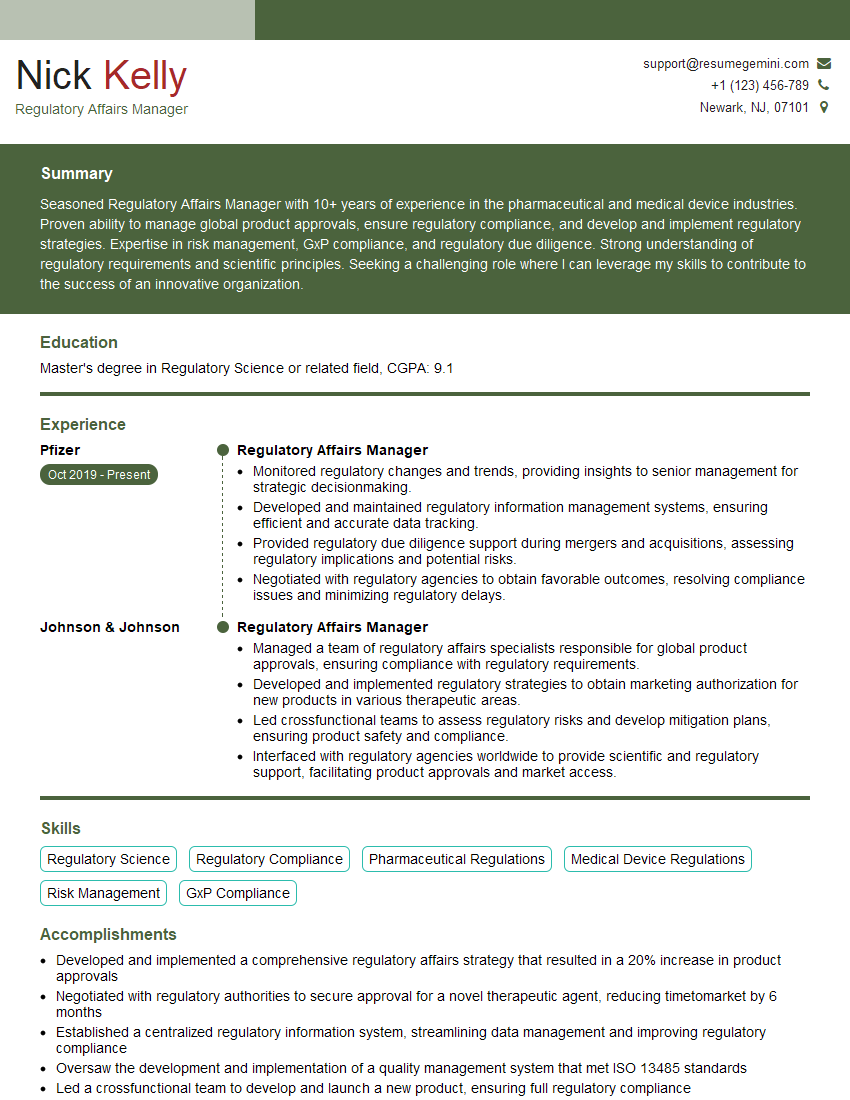

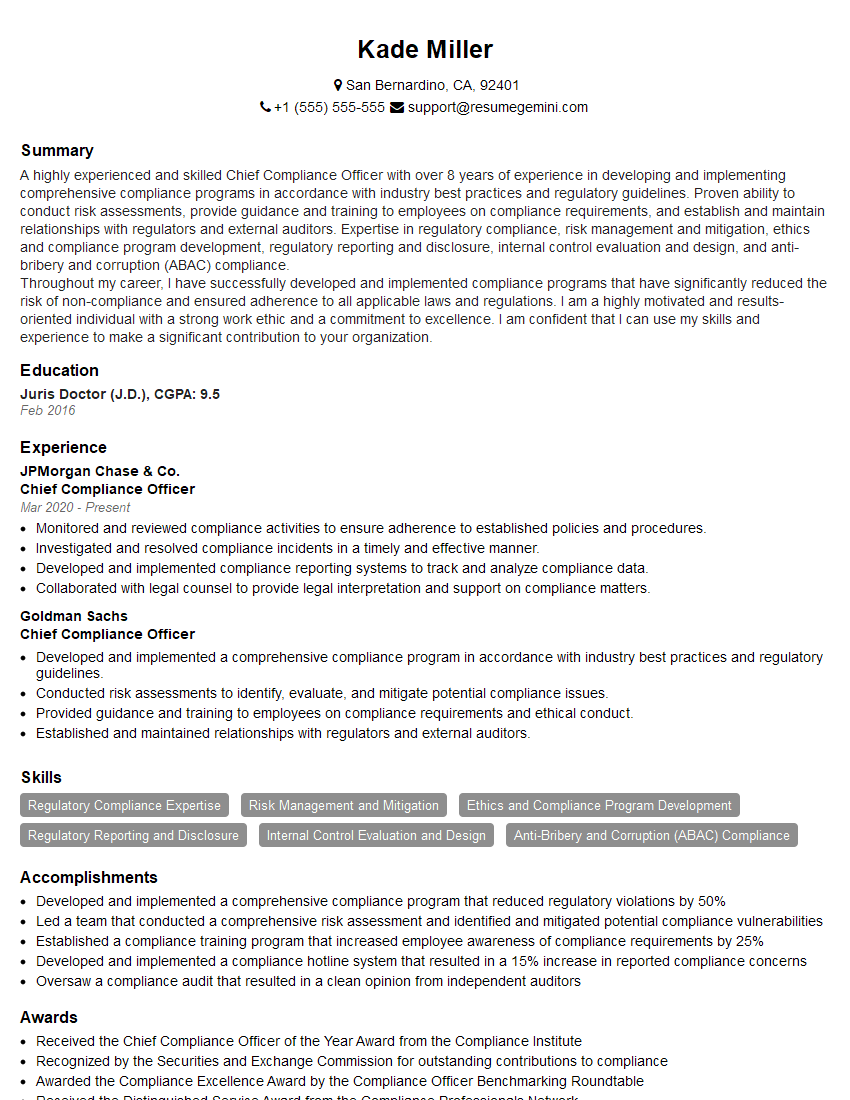

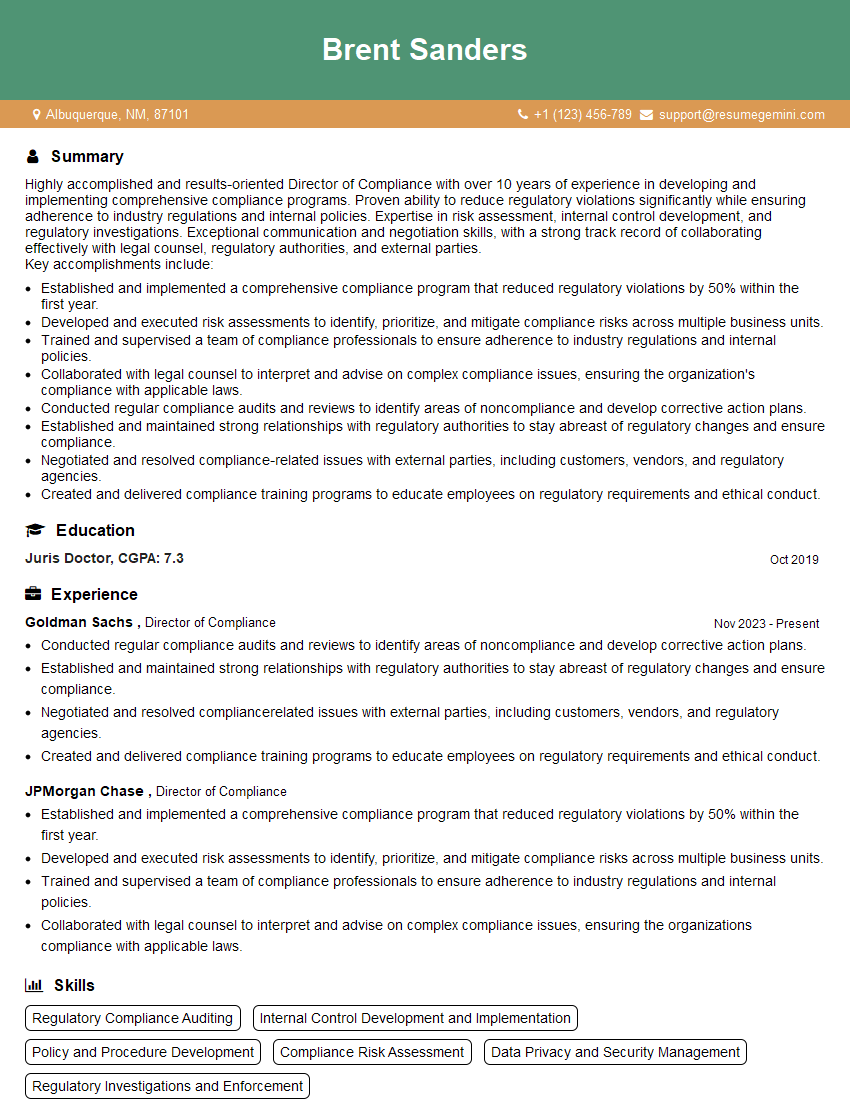

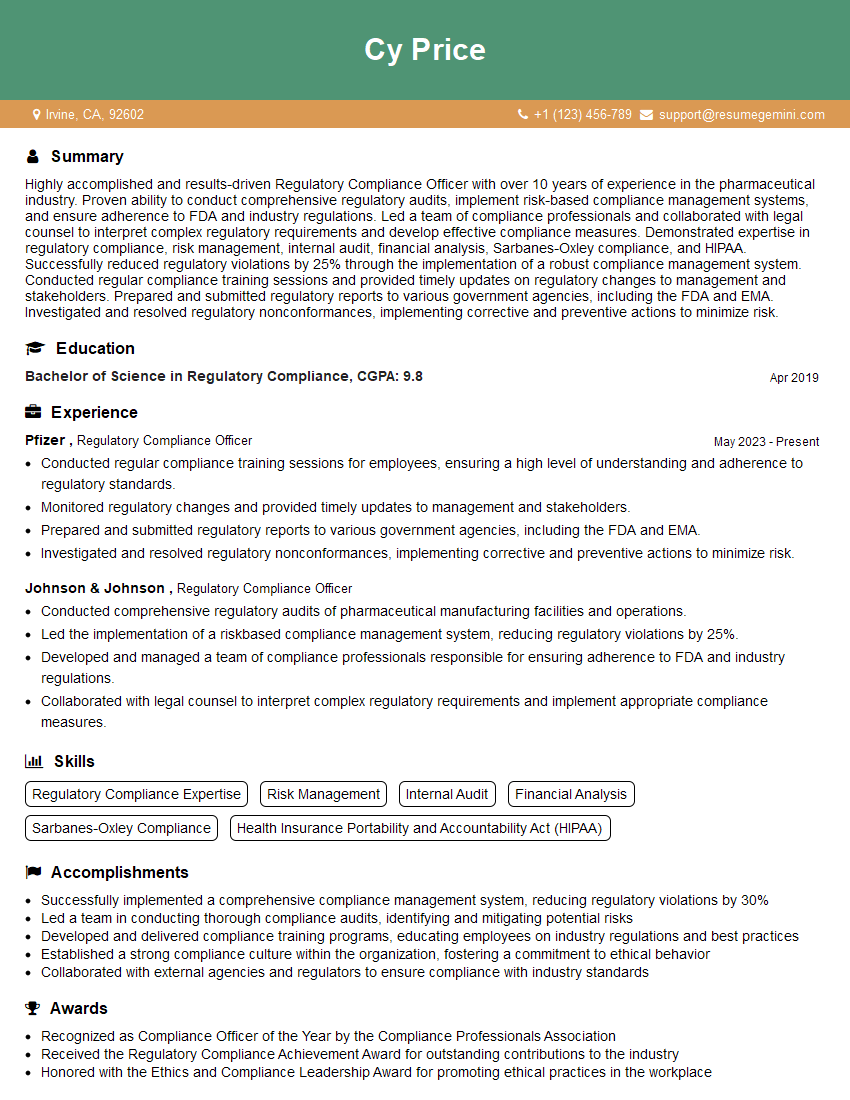

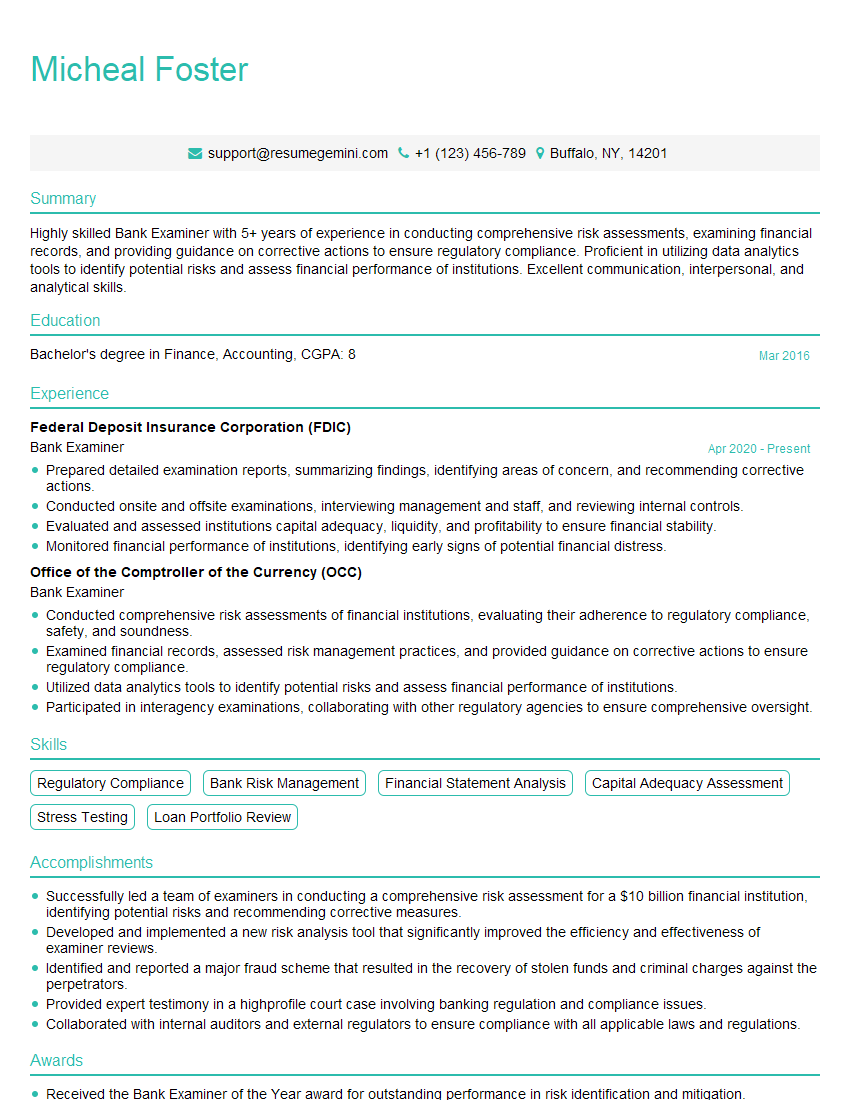

Mastering Financial Institutions Supervision opens doors to a rewarding career with significant impact on global financial stability. A strong understanding of these concepts is crucial for advancement in this field. To maximize your job prospects, it’s vital to present your skills effectively. Creating an ATS-friendly resume is key to getting your application noticed. ResumeGemini is a trusted resource that can help you build a professional and impactful resume. Examples of resumes tailored to Financial Institutions Supervision are provided to guide you. Invest time in crafting a compelling resume; it’s your first impression on potential employers.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

I Redesigned Spongebob Squarepants and his main characters of my artwork.

https://www.deviantart.com/reimaginesponge/art/Redesigned-Spongebob-characters-1223583608

IT gave me an insight and words to use and be able to think of examples

Hi, I’m Jay, we have a few potential clients that are interested in your services, thought you might be a good fit. I’d love to talk about the details, when do you have time to talk?

Best,

Jay

Founder | CEO