The right preparation can turn an interview into an opportunity to showcase your expertise. This guide to First-In, First-Out (FIFO) interview questions is your ultimate resource, providing key insights and tips to help you ace your responses and stand out as a top candidate.

Questions Asked in First-In, First-Out (FIFO) Interview

Q 1. Explain the FIFO (First-In, First-Out) method.

FIFO, or First-In, First-Out, is an inventory management method that assumes the oldest items in your inventory are the first ones sold. Think of it like a queue at a grocery store – the first person in line is the first person served. In accounting, this means the cost of goods sold (COGS) reflects the cost of the oldest inventory items.

For example, imagine a bakery that bakes 10 loaves of bread on Monday at $1 each and another 10 loaves on Tuesday at $1.20 each. If they sell 15 loaves, using FIFO, the cost of goods sold would be calculated as (10 loaves * $1) + (5 loaves * $1.20) = $16.

Q 2. What are the advantages of using the FIFO method?

FIFO offers several advantages. Firstly, it’s simple to understand and implement, making it straightforward for businesses of all sizes. Secondly, it tends to reflect the actual flow of goods in many businesses, especially those with perishable goods. This makes the financial statements more realistic and less prone to manipulation.

- Realistic COGS: Matches the physical flow of goods, resulting in a more accurate representation of COGS.

- Simplicity: Easy to understand and implement, minimizing accounting complexities.

- Reduced Risk of Inventory Obsolescence: Helps to reduce the risk of holding onto outdated or perishable inventory for too long.

Q 3. What are the disadvantages of using the FIFO method?

While FIFO is popular, it does have some drawbacks. One major disadvantage is that it can lead to higher taxes during periods of inflation. Because older, cheaper inventory is sold first, the COGS is lower, leading to higher reported profits and, consequently, higher tax liabilities. Additionally, the ending inventory value might not reflect the current market price, leading to a less accurate picture of the company’s current assets.

- Higher Taxes During Inflation: Higher profits reported due to lower COGS lead to increased tax burden.

- Inventory Valuation Discrepancy: Ending inventory may not accurately reflect current market values.

- Complexity with Multiple Inventory Items: Managing FIFO across many different items and batches can become complex.

Q 4. How does FIFO impact the cost of goods sold?

FIFO directly impacts the cost of goods sold by assigning the cost of the oldest inventory items to the goods sold. This means that during periods of inflation, the cost of goods sold will be lower, resulting in higher net income. Conversely, during periods of deflation, the cost of goods sold will be higher, resulting in lower net income. Let’s revisit the bakery example: Selling 15 loaves with FIFO assigns the cost of the first 10 loaves baked (at $1 each) and the next 5 loaves (at $1.20 each) to the COGS, totaling $16. This influences the profit margin calculation.

Q 5. How does FIFO impact inventory valuation?

FIFO impacts inventory valuation by assigning the cost of the most recently purchased inventory items to the ending inventory. This means that the ending inventory value reflects current market prices more closely than LIFO, particularly in times of rising prices. However, in periods of deflation, the ending inventory might be overvalued. Using the bakery example, if 5 loaves remain unsold, their valuation under FIFO would be 5 loaves * $1.20 = $6.

Q 6. Compare FIFO with LIFO (Last-In, First-Out).

Both FIFO and LIFO are inventory costing methods, but they differ significantly in their approach. FIFO assumes the oldest items are sold first, while LIFO assumes the newest items are sold first. This fundamental difference leads to variations in COGS, net income, and ending inventory valuation, especially during inflationary or deflationary periods. FIFO is generally considered to better reflect the actual flow of goods, while LIFO can result in lower taxes during inflation (though it’s less used now due to tax law changes).

Key Differences Summary:

- FIFO: Oldest items sold first, higher net income during inflation, simpler to understand.

- LIFO: Newest items sold first, lower net income during inflation (tax advantage historically), less reflective of actual flow of goods.

Q 7. When is FIFO most appropriate to use?

FIFO is most appropriate when:

- Perishable goods: For businesses dealing with perishable goods, using FIFO ensures that older items are sold before they expire or become obsolete.

- Easily identifiable inventory: It works best when the company can easily track the flow of inventory, identifying which items came in first.

- Matching physical flow: When the actual physical flow of inventory matches the FIFO assumption, it leads to the most accurate reflection of cost of goods sold.

- Stable prices or deflation: In stable or deflationary environments, FIFO provides a reasonable and less complex alternative to LIFO.

Industries like food and beverage, pharmaceuticals, and those with short shelf-life products often benefit most from FIFO’s approach.

Q 8. When might FIFO be less suitable?

FIFO, while generally efficient, isn’t always the best method. Its suitability depends heavily on the nature of the inventory. FIFO is less suitable when dealing with perishable goods that have a short shelf life. Imagine a bakery using FIFO for bread – older loaves would be sold first, potentially leading to significant waste if they spoil before sale. Similarly, products susceptible to obsolescence (like electronics or fashion) are better managed with different inventory methods. The cost of holding older, potentially outdated inventory might outweigh the benefits of FIFO. Another scenario where FIFO might be less suitable is when dealing with highly volatile prices. Using FIFO during periods of rapidly rising prices might inflate the cost of goods sold, lowering profits. A LIFO (Last-In, First-Out) or weighted-average cost method might be more appropriate in such instances.

Q 9. How does FIFO affect tax liability?

FIFO directly impacts tax liability because it affects the calculation of the cost of goods sold (COGS). During periods of inflation, FIFO reports a lower COGS because the older, cheaper inventory is sold first. This results in higher taxable income and consequently, a higher tax liability. Conversely, during deflation, FIFO would report a higher COGS leading to lower taxable income and reduced tax liability. Think of it like this: if you bought flour for $10 a bag last year and $15 a bag this year, using FIFO in a year of price increases would report a lower COGS because those cheaper $10 bags are sold first, resulting in more taxable profit. This effect is significant for businesses with large inventory volumes.

Q 10. How is FIFO implemented in a warehouse setting?

In a warehouse setting, FIFO is implemented by physically organizing and managing inventory based on arrival dates. This often involves a clear labeling system indicating the date each batch of goods was received. Warehouse workers then prioritize removing and shipping the oldest items first. Imagine a warehouse with stacks of pallets. The newest pallets would be placed at the back, while the oldest are at the front for easy access. This can be supported by a robust inventory management system (IMS) tracking the exact location and date of each item. The IMS acts as a digital ‘map’ of the warehouse ensuring the correct location of the oldest items. Barcodes and RFID tags help automate the process, enabling seamless tracking and efficient picking based on FIFO principles. Regular inventory counts also verify the accuracy of the FIFO process.

Q 11. Describe a scenario where FIFO would be crucial.

FIFO is crucial in the food and beverage industry, particularly for perishable goods with expiration dates. Consider a dairy farm selling milk. Using FIFO guarantees that the oldest milk, nearing its expiration date, is sold first, minimizing spoilage and waste. The same logic applies to bakeries, supermarkets, and pharmaceuticals – businesses where product expiration significantly impacts profitability and public safety. Failure to use FIFO in such industries can lead to considerable losses and potential health hazards. Maintaining quality and preventing losses from spoilage makes FIFO an absolute necessity.

Q 12. How would you track FIFO in a spreadsheet?

Tracking FIFO in a spreadsheet requires meticulous record-keeping. You’ll need columns for at least: Item Name, Quantity Received, Date Received, Unit Cost, Quantity Sold, Date Sold, and Remaining Quantity. Each time a new batch arrives, a new row is added. When items are sold, you reduce the quantity from the oldest batch first. For instance:

| Item Name | Quantity Received | Date Received | Unit Cost | Quantity Sold | Date Sold | Remaining Quantity || --- | --- | --- | --- | --- | --- | --- || Widget A | 100 | 2023-10-26 | $10 | 50 | 2023-10-27 | 50 || Widget A | 150 | 2023-11-02 | $12 | 100 | 2023-11-05 | 50 || Widget B | 200 | 2023-10-26 | $5 | 100 | 2023-11-05 | 100 |

The ‘Remaining Quantity’ is constantly updated. When more widgets are sold, you deduct from the older batch first. Spreadsheet software often provides features for automating some calculations like calculating the COGS based on this data.

Q 13. How does FIFO impact financial reporting?

FIFO significantly impacts financial reporting by influencing the cost of goods sold (COGS) and consequently, the gross profit and net income. As discussed earlier, during periods of inflation, FIFO results in lower COGS, thus increasing reported profits. This can lead to a more favorable financial picture but doesn’t necessarily reflect the actual current market value of the inventory. It also impacts the valuation of ending inventory on the balance sheet, showing the value of the most recently acquired goods. Auditors carefully examine the inventory valuation method used to ensure accuracy and consistency in financial reporting. This is especially important for compliance with Generally Accepted Accounting Principles (GAAP).

Q 14. Explain the impact of FIFO on inventory turnover.

FIFO can positively impact inventory turnover. By prioritizing the sale of older inventory, FIFO keeps goods moving and reduces the risk of obsolescence or spoilage. A higher inventory turnover ratio indicates efficient inventory management, translating to better cash flow and potentially stronger profitability. This is because capital is not tied up for extended periods in unsold inventory. However, if the demand is low, FIFO might not significantly affect the turnover as the inventory still remains. The impact depends on other factors, including sales volume and demand for the products.

Q 15. How can you identify potential issues with FIFO implementation?

Potential issues with FIFO implementation often stem from its reliance on accurate inventory tracking. Problems can arise from:

- Inaccurate inventory counts: If your physical inventory count is incorrect, your FIFO cost of goods sold (COGS) and ending inventory values will be wrong. This leads to misstated financial statements.

- Poor inventory management: Inefficient tracking systems or a lack of clear identification of the oldest inventory can lead to errors in applying the FIFO method. Imagine a warehouse where items are haphazardly placed – identifying the ‘first in’ becomes a significant challenge.

- Spoilage or obsolescence: FIFO assumes that the oldest items are sold first. However, if older items become spoiled or obsolete before they’re sold, the COGS calculation will be inaccurate. A bakery throwing out stale bread, for example, would see their COGS calculation impacted, not just their inventory count.

- Technological limitations: Implementing FIFO effectively relies on a robust inventory management system. Outdated or poorly designed systems can struggle to keep track of inventory in a FIFO manner, causing errors.

- Lack of staff training: Personnel must understand how to apply FIFO correctly. Inadequate training can lead to accidental errors in recording inventory transactions.

Regular audits, robust inventory tracking systems, and employee training are crucial to mitigate these issues.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. How do you reconcile physical inventory with FIFO accounting?

Reconciling physical inventory with FIFO accounting requires a methodical approach. Imagine a small grocery store. They need to:

- Conduct a physical inventory count: This involves physically counting every item in stock and noting its quantity and cost. This is your ‘ground truth.’

- Calculate COGS using FIFO: Based on sales records, determine the cost of goods sold using the FIFO method (first items purchased are the first items sold).

- Compare ending inventory values: Compare the ending inventory value calculated using FIFO with the value obtained from the physical count. Any significant discrepancies indicate potential errors.

- Investigate discrepancies: If discrepancies exist, investigate the causes. This might involve reviewing sales records, purchase orders, and checking for damaged or lost goods.

- Adjustments (if necessary): If discrepancies are due to genuine errors, make necessary adjustments to the accounting records. It’s crucial to document all adjustments clearly.

Regular reconciliation, ideally monthly, prevents small errors from accumulating into large ones.

Q 17. How does FIFO handle damaged or obsolete goods?

FIFO doesn’t explicitly handle damaged or obsolete goods; it simply reflects what happens. If old inventory is damaged or obsolete, it will impact the cost of goods sold and ending inventory calculations.

Let’s say a clothing store using FIFO finds a batch of outdated sweaters. The cost of these outdated sweaters is factored into the cost of goods sold for the period when they’re deemed unsaleable and written off. This directly impacts profitability. If they were to attempt to sell them at a discounted rate, they might show up in the COGS for that period. Proper inventory management involves regularly identifying and disposing of damaged or obsolete goods. This way, the FIFO calculation is more accurate and reflects the reality of the business.

Q 18. How would you explain FIFO to someone with no accounting background?

Imagine a bakery making cupcakes. They bake 10 chocolate cupcakes first (at $1 each) and then 10 vanilla cupcakes (also at $1 each). FIFO means that when they sell cupcakes, they assume the chocolate ones (the oldest) are sold first. So, if they sell 5 cupcakes, the cost of goods sold will be $5 (5 chocolate cupcakes at $1 each). The remaining inventory would consist of 5 chocolate and 10 vanilla cupcakes.

It’s simply a way of keeping track of costs by assuming the oldest items are sold first. This helps businesses accurately calculate their profits and the value of their remaining inventory.

Q 19. What are the potential errors associated with FIFO?

Potential errors associated with FIFO include:

- Incorrect identification of the oldest inventory: This is the most common error. If the system doesn’t accurately track which items arrived first, the cost calculations will be wrong.

- Data entry errors: Incorrect recording of purchase prices or quantities can distort the cost of goods sold and ending inventory values.

- Inventory shrinkage not accounted for: Theft, spoilage, or damage not properly recorded will skew the final calculations.

- Lack of proper segregation of inventory: If older and newer inventory are mixed together, accurately applying FIFO becomes impossible.

- Failure to adjust for price changes: If the cost of purchasing similar items changes over time, not carefully tracking those changes can lead to inconsistencies in calculations.

Using a good inventory management system and implementing regular audits helps minimize these errors.

Q 20. How does FIFO affect the calculation of gross profit?

FIFO directly affects the calculation of gross profit. Since it uses the cost of the oldest inventory items for the COGS calculation, any change in inventory costs over time directly impacts your gross profit margin. If the cost of goods rises during a period, FIFO will result in a higher gross profit in that period compared to LIFO (last-in, first-out). This is because your COGS calculation uses the older, generally cheaper prices.

For instance, if costs are rising, FIFO will show a higher gross profit. Conversely, if costs are falling, FIFO will result in a lower gross profit compared to LIFO.

Q 21. How does FIFO impact the valuation of ending inventory?

FIFO impacts the valuation of ending inventory by using the cost of the most recently purchased items. This means that during periods of rising prices, the ending inventory value will be higher under FIFO than under LIFO. This is because the newest, generally more expensive items, are used to value the remaining inventory. Conversely, during periods of falling prices, the ending inventory value will be lower under FIFO than under LIFO.

This is significant for balance sheet reporting, as it directly impacts the reported value of assets held by the company.

Q 22. How do you adjust FIFO for seasonal demand fluctuations?

Adjusting FIFO for seasonal demand fluctuations requires a nuanced approach. The core principle of FIFO – first in, first out – remains, but we need strategies to manage inventory effectively during periods of high and low demand. Think of it like a bakery: during peak holiday seasons, you’ll bake much more than usual, and you want to ensure the oldest items are sold first to prevent spoilage. During slower periods, you carefully manage your production to avoid excess inventory.

- Forecasting Demand: Accurate sales forecasting is crucial. Predicting seasonal peaks and troughs allows you to adjust production schedules and inventory levels proactively. This ensures you have enough stock without accumulating excessive older inventory during slower times.

- Production Scheduling: Align production with anticipated demand. Increase production before peak seasons to build up inventory, and scale it down as demand decreases. This helps balance the inventory turnover rate without rushing production.

- Prioritization of Older Stock: Actively manage the oldest inventory during peak demand. Implement strategies such as special promotions or discounts to accelerate the sale of older products before they expire or become obsolete.

- Inventory Segmentation: Consider segregating your inventory based on production dates or batches. This makes it easier to track and manage the flow of older stock during periods of high demand.

For example, imagine a clothing retailer. During the summer, they might produce a large batch of summer dresses. As fall approaches, they strategically reduce the price of these dresses to clear inventory before the winter collection arrives. This prevents carrying over excessive summer stock into the next season.

Q 23. Describe a situation where you had to implement or troubleshoot a FIFO system.

In my previous role at a pharmaceutical company, we faced a significant challenge with a FIFO system managing temperature-sensitive medications. Our warehouse management system (WMS) had a bug that occasionally mislabeled the expiration dates of incoming shipments. This meant that, in some cases, older, nearly expired medications were being incorrectly designated as newer stock, violating strict FIFO protocols and potentially endangering patients.

My team and I tackled this by first identifying the root cause of the error within the WMS. Once identified, we collaborated with IT to deploy a hotfix and re-check all medication entries. To prevent future occurrences, we implemented a double-checking system where two warehouse staff members independently verified the expiration dates before recording them in the WMS. We also introduced regular system audits to ensure the integrity of inventory data. This multi-pronged approach resolved the immediate issue and significantly reduced the risk of future errors.

Q 24. What software or systems have you used to manage FIFO inventory?

Throughout my career, I’ve worked with a variety of software and systems to manage FIFO inventory. These range from simple spreadsheet-based systems for smaller businesses to sophisticated enterprise resource planning (ERP) systems and dedicated warehouse management systems (WMS) for larger enterprises.

- Spreadsheet Software (e.g., Microsoft Excel, Google Sheets): These are suitable for very small businesses with limited inventory. However, they can become cumbersome and prone to errors as the inventory grows.

- Enterprise Resource Planning (ERP) Systems (e.g., SAP, Oracle): ERP systems integrate inventory management with other business processes, offering advanced features like automated tracking, reporting, and forecasting. These are effective for larger organizations managing complex inventory.

- Warehouse Management Systems (WMS): WMS are specifically designed for warehouse operations, providing real-time tracking, optimized picking and packing, and robust reporting features. These are particularly beneficial in environments with high inventory turnover.

The choice of system always depends on the scale and complexity of the business and its specific needs. For example, a small artisan bakery might find a simple spreadsheet sufficient, while a large pharmaceutical company requires a robust ERP and WMS integration.

Q 25. How do you ensure accuracy in a FIFO inventory system?

Ensuring accuracy in a FIFO inventory system is paramount. It requires a combination of rigorous processes, technological tools, and regular audits.

- Barcoding and RFID: Using barcodes or RFID tags on each item allows for accurate and automated tracking of inventory movement, minimizing manual data entry errors.

- Regular Cycle Counting: Performing frequent cycle counts—verifying a subset of inventory regularly—rather than relying on annual physical inventory counts provides a more up-to-date picture of inventory accuracy. This detects discrepancies early.

- Automated Data Entry: Integrating inventory systems with point-of-sale (POS) systems or other relevant systems helps automate data entry, minimizing human error. Automated alerts for low stock or near-expiration items are also extremely helpful.

- Proper Training of Staff: Thorough training ensures staff members understand FIFO procedures and data entry protocols, minimizing manual errors.

- Reconciliation of Data: Regularly reconcile inventory records with physical counts to identify and correct discrepancies.

Imagine a restaurant: using a POS system directly linked to their inventory management system allows for real-time updates on ingredient usage and stock levels. This provides accuracy in tracking the FIFO flow of ingredients.

Q 26. How would you handle discrepancies in a FIFO inventory count?

Handling discrepancies in a FIFO inventory count requires a systematic approach to identify the root cause and take corrective action. The goal is not just to correct the numbers but to understand *why* the discrepancy occurred to prevent it from happening again.

- Investigate the Discrepancy: Start by thoroughly investigating the nature and extent of the discrepancy. Is it a small variation or a significant difference? Which items are affected?

- Physical Inventory Count: Conduct a thorough physical inventory count of the affected items to verify the actual quantity on hand.

- Review Inventory Transactions: Examine recent inventory transactions – receipts, issues, and adjustments – to identify any errors in data entry, incorrect stock movements, or other irregularities.

- Identify Root Cause: Determine the root cause of the discrepancy. This could involve issues with scanning equipment, human error in data entry, or perhaps theft.

- Corrective Action: Based on the identified root cause, implement corrective actions. This might include retraining staff, improving data entry procedures, upgrading equipment, or enhancing security measures.

- Documentation: Meticulously document the entire process, including the discrepancy, the investigation, the root cause analysis, and the corrective actions taken.

For example, if a discrepancy is due to damaged goods, the process might involve physically removing the damaged goods, adjusting inventory records accordingly, and analyzing why the damage occurred to prevent similar issues in the future.

Q 27. How can you optimize the efficiency of a FIFO system?

Optimizing the efficiency of a FIFO system focuses on streamlining processes, improving accuracy, and minimizing waste.

- Improved Inventory Management Software: Investing in better software can automate tasks, improve accuracy, and provide better insights into inventory levels.

- Streamlined Warehouse Layout: An efficient warehouse layout minimizes movement and handling time, improving the speed and accuracy of inventory flows. A clearly defined path for inbound and outbound goods ensures proper FIFO management.

- Efficient Picking and Packing Processes: Optimized picking and packing strategies ensure that the oldest items are selected first, maximizing FIFO adherence.

- Regular Inventory Reviews: Regular review of slow-moving or near-expiration items allows for proactive strategies such as discounts or adjustments to prevent waste.

- Technology Integration: Integrating inventory management systems with other systems (POS, production systems, etc.) creates a seamless flow of information, enhancing efficiency and reducing manual interventions.

Consider a large supermarket: they might use a WMS to optimize shelf stocking to ensure that older products are placed in front and sold first. This minimizes spoilage and maximizes efficiency.

Q 28. What are the best practices for implementing FIFO in a specific industry (e.g., food, pharmaceuticals)?

Best practices for implementing FIFO vary across industries due to unique regulatory requirements and product characteristics. Let’s look at the food and pharmaceutical industries as examples.

- Food Industry: Strict adherence to FIFO is crucial to prevent food spoilage and maintain food safety. This involves:

- Clear Labeling and Dating: All food products should be clearly labeled with production dates or expiration dates to ensure proper FIFO rotation.

- Temperature Monitoring: Maintaining proper temperature controls throughout the storage and handling process is essential, especially for perishable goods.

- Regular Cleaning and Sanitation: Maintaining a clean and sanitary environment minimizes the risk of contamination and spoilage.

- First-Expired, First-Out (FEFO): Often, FEFO is prioritized over FIFO, ensuring the products with the soonest expiration dates are used first.

- Pharmaceutical Industry: The pharmaceutical industry requires exceptionally stringent FIFO management due to product expiration dates and potential safety hazards. This includes:

- Lot Number Tracking: Meticulous tracking of lot numbers ensures the traceability of each batch, essential for identifying and recalling potentially faulty products.

- Temperature-Controlled Storage: Maintaining appropriate temperature and humidity levels is critical for drug stability and efficacy.

- Strict Documentation: Detailed record-keeping of all inventory movements, including dates, times, and personnel involved, is essential for compliance with regulatory requirements.

- Regular Audits: Frequent audits by internal and external regulatory bodies ensure adherence to FIFO principles and regulatory guidelines.

In both industries, comprehensive documentation, robust inventory management systems, and stringent quality control procedures are essential for effective FIFO implementation and compliance.

Key Topics to Learn for First-In, First-Out (FIFO) Interview

- FIFO Definition and Core Principles: Understand the fundamental concept of FIFO – first in, first out – and its implications in various contexts.

- FIFO in Inventory Management: Explore how FIFO is applied to track and manage inventory, considering cost of goods sold and valuation.

- FIFO in Accounting: Learn how FIFO impacts financial statements, particularly the balance sheet and income statement, and its effects on profitability.

- FIFO vs. LIFO and Weighted-Average Cost: Compare and contrast FIFO with other inventory costing methods, understanding their strengths and weaknesses.

- Practical Applications of FIFO: Analyze real-world examples of FIFO implementation across different industries (e.g., manufacturing, retail).

- FIFO and its impact on Tax Liability: Understand how the choice of inventory costing method influences tax calculations.

- Problem Solving with FIFO: Practice solving scenarios involving inventory valuation, cost calculations, and adjustments using the FIFO method.

- Data Structures and Algorithms related to FIFO: Explore the implementation of FIFO using queues, a fundamental data structure.

Next Steps

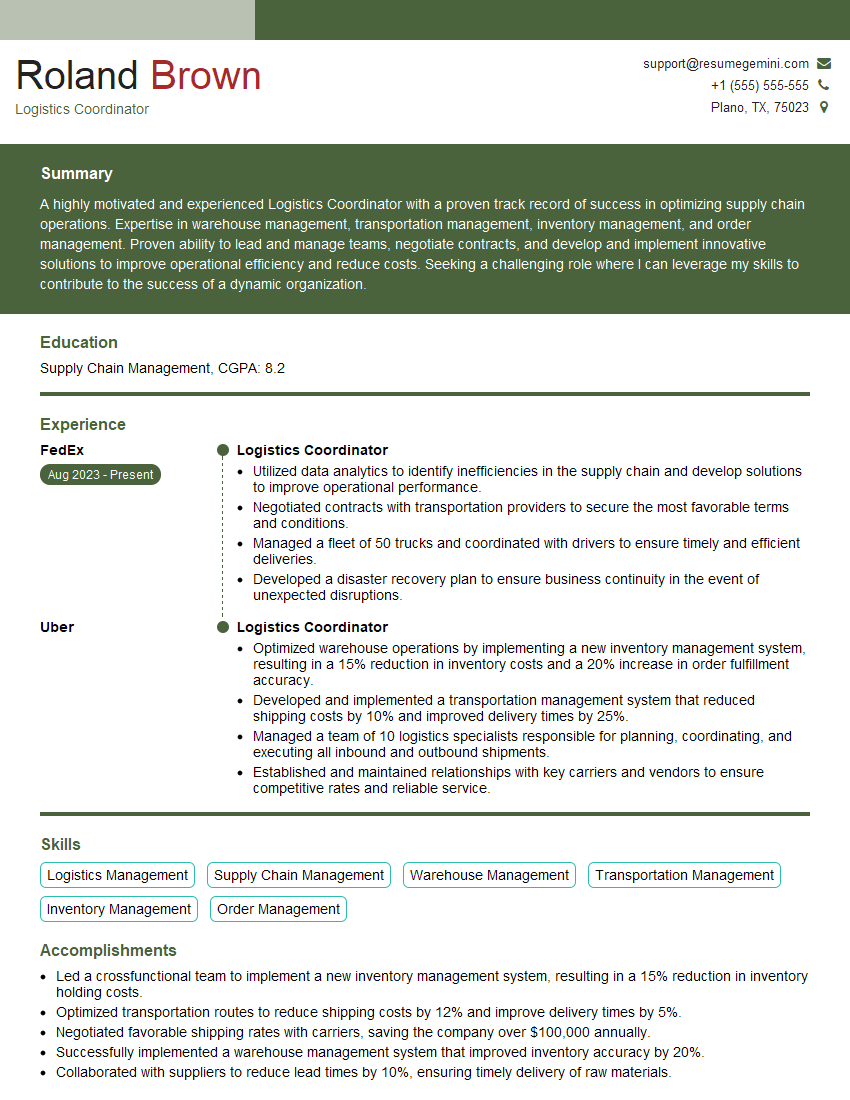

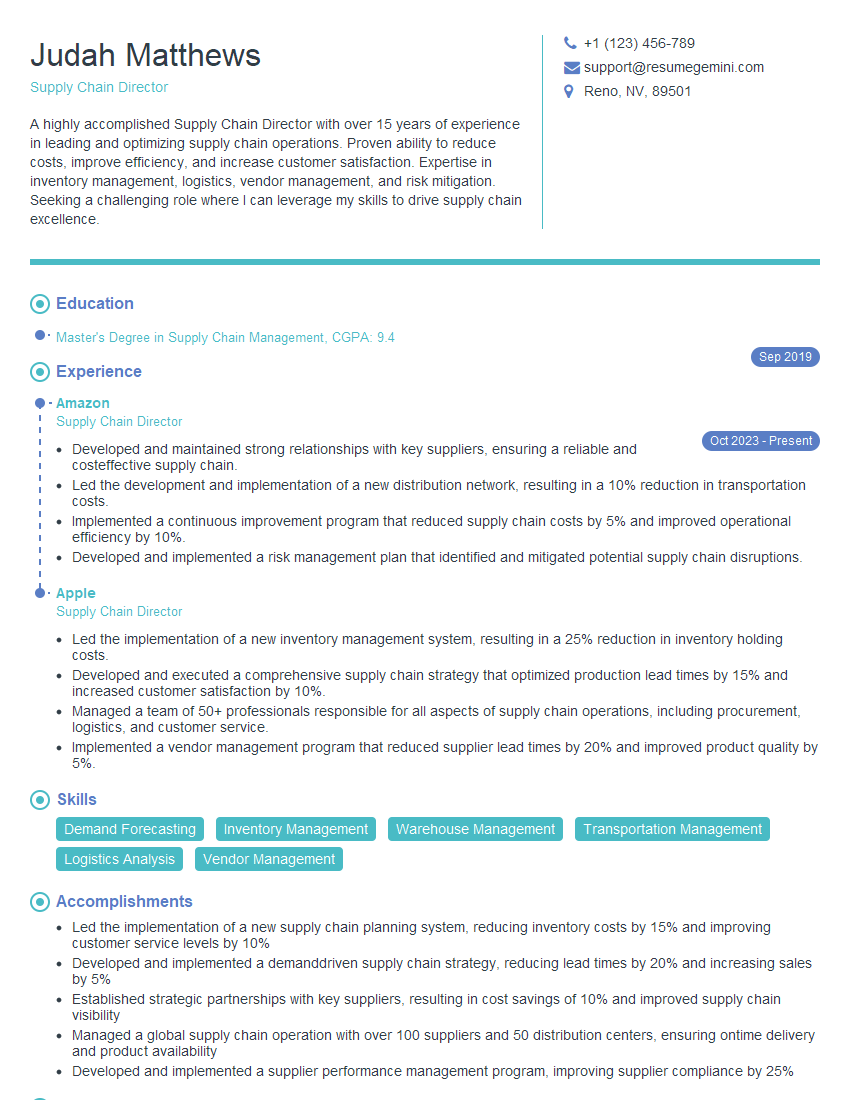

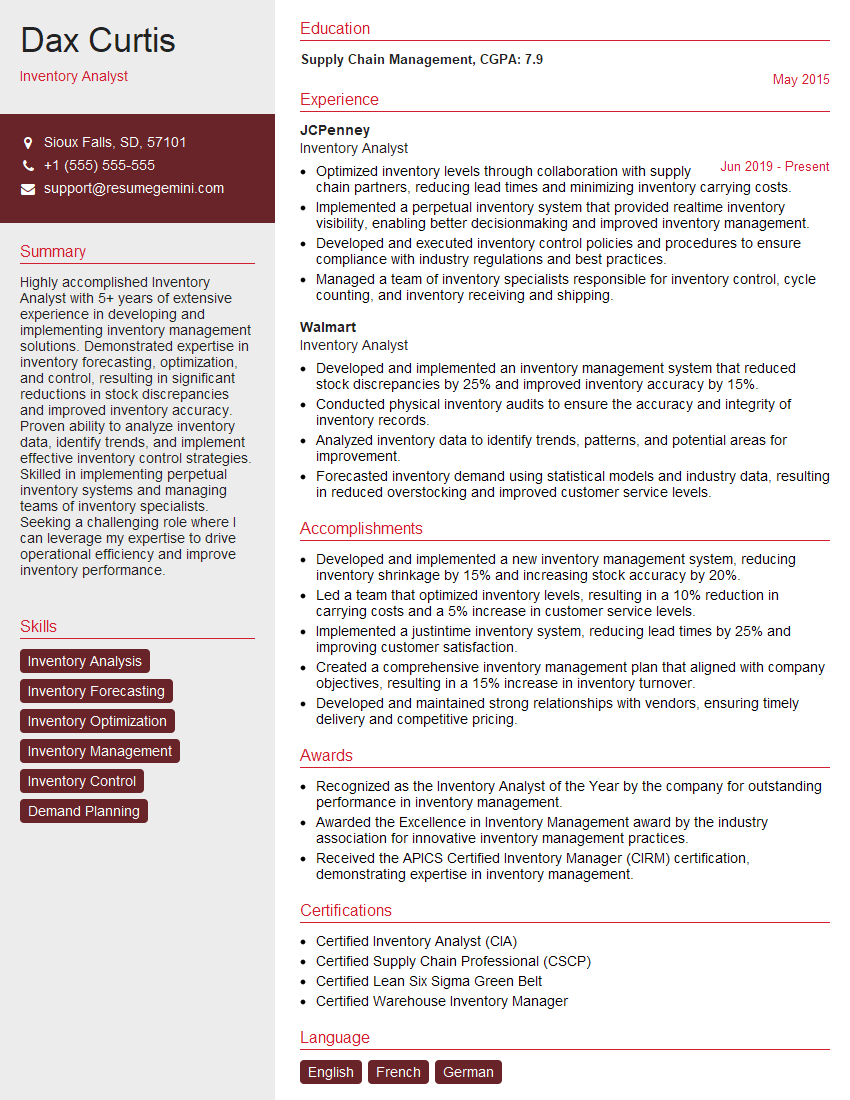

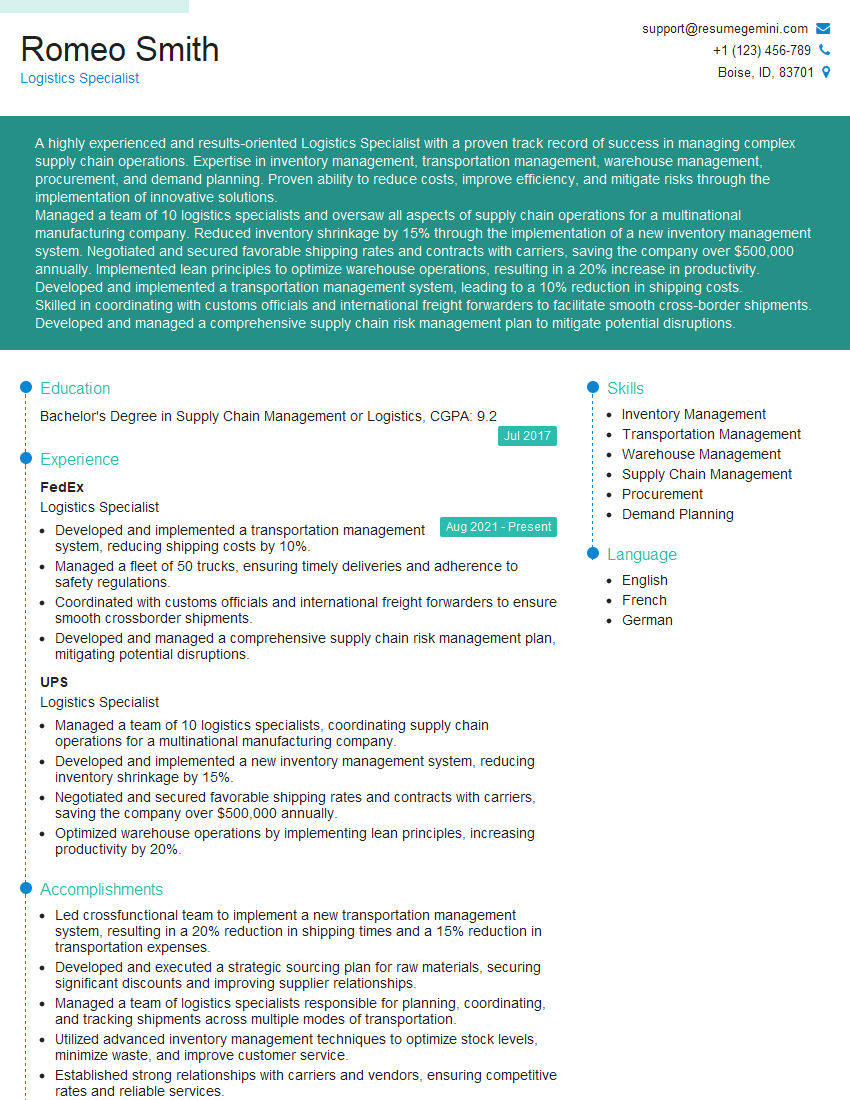

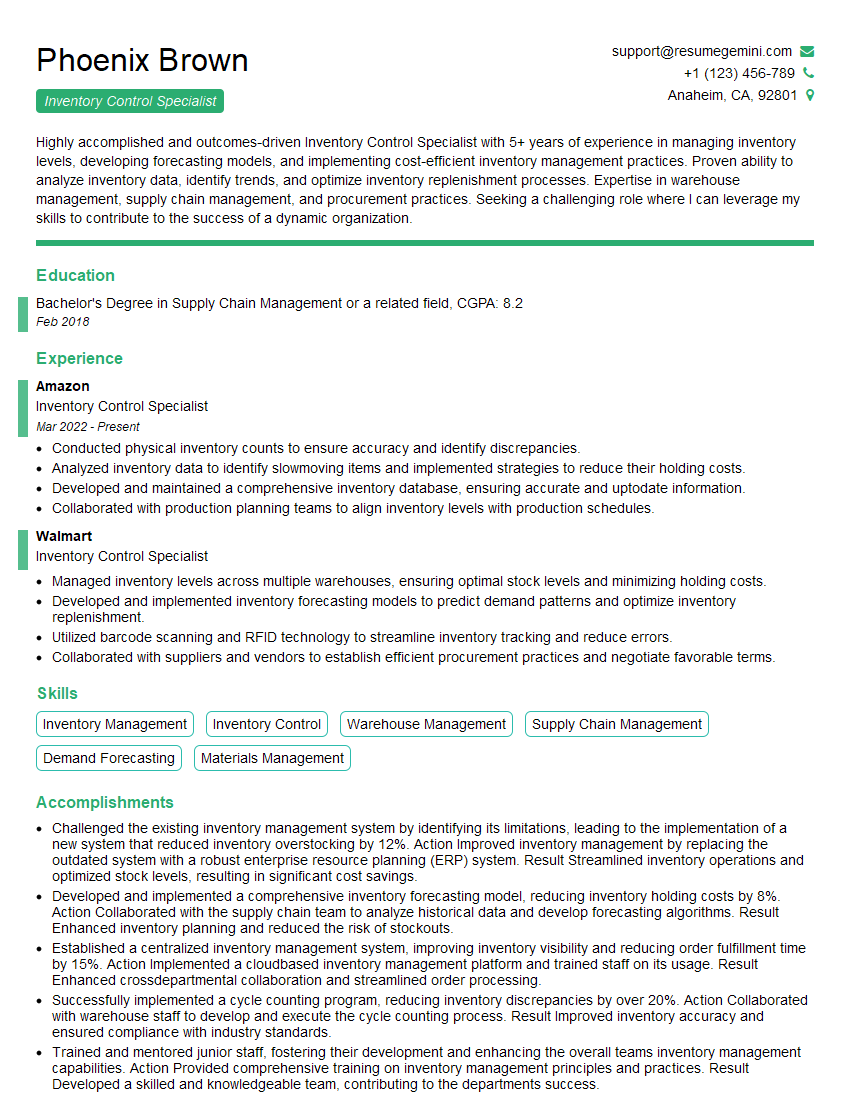

Mastering First-In, First-Out (FIFO) demonstrates a strong understanding of fundamental accounting and inventory management principles, significantly enhancing your value to potential employers. A well-crafted resume is crucial for showcasing your skills effectively. Building an ATS-friendly resume is essential to maximizing your job prospects. ResumeGemini is a trusted resource to help you build a professional and impactful resume that highlights your FIFO expertise. Examples of resumes tailored to First-In, First-Out (FIFO) roles are available to help guide your creation process.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

I Redesigned Spongebob Squarepants and his main characters of my artwork.

https://www.deviantart.com/reimaginesponge/art/Redesigned-Spongebob-characters-1223583608

IT gave me an insight and words to use and be able to think of examples

Hi, I’m Jay, we have a few potential clients that are interested in your services, thought you might be a good fit. I’d love to talk about the details, when do you have time to talk?

Best,

Jay

Founder | CEO