Interviews are more than just a Q&A session—they’re a chance to prove your worth. This blog dives into essential FLSA interview questions and expert tips to help you align your answers with what hiring managers are looking for. Start preparing to shine!

Questions Asked in FLSA Interview

Q 1. Define the Fair Labor Standards Act (FLSA).

The Fair Labor Standards Act (FLSA) is a United States federal law which mandates minimum wage, overtime pay, recordkeeping, and child labor standards affecting full-time and part-time workers in the private sector and in Federal, State, and local governments.

Think of it as the foundational law protecting workers’ rights regarding their compensation and working conditions. It’s designed to ensure fair treatment and prevent exploitation.

Q 2. What are the key components of the FLSA?

The key components of the FLSA are:

- Minimum Wage: Establishes a minimum hourly wage that employers must pay their employees. This amount is periodically adjusted by Congress.

- Overtime Pay: Requires employers to pay overtime compensation (typically 1.5 times the regular rate of pay) for hours worked beyond 40 in a workweek.

- Recordkeeping: Mandates that employers maintain accurate records of employee wages, hours worked, and other relevant employment information.

- Child Labor: Sets restrictions on the employment of minors, outlining age limitations and permissible working hours for young workers. The regulations differ significantly depending on age.

Q 3. Explain the minimum wage requirements under the FLSA.

The FLSA sets a federal minimum wage, but states can have their own minimum wage laws, provided they are higher than the federal minimum. Employers must comply with the higher of the two. For instance, if the federal minimum wage is $7.25 and a state’s minimum wage is $12.00, employers in that state must pay at least $12.00 per hour.

It’s crucial to stay up-to-date on both federal and state minimum wage laws as they change periodically.

Q 4. Describe the overtime pay provisions of the FLSA.

The FLSA’s overtime pay provision mandates that employees are paid at a rate not less than one and one-half times their regular rate of pay for all hours worked beyond 40 in a workweek. The workweek is a fixed and regularly recurring period of 168 hours—seven consecutive 24-hour periods. It’s not necessarily Monday to Sunday.

For example, if an employee’s regular hourly rate is $20 and they work 45 hours in a week, they would be entitled to 40 hours of regular pay ($800) and 5 hours of overtime pay ($150 – 5 hours x $20 x 1.5).

Calculating the regular rate of pay can become more complex when dealing with multiple pay rates or bonuses.

Q 5. Who is exempt from overtime under the FLSA?

Certain employees are exempt from overtime pay under the FLSA. This exemption isn’t automatic; employers must meet specific requirements to classify employees as exempt. Misclassifying an employee as exempt can lead to significant legal and financial consequences for the employer.

Think of it as an exception, not a rule. The burden of proof to show an employee meets the criteria for an exemption rests entirely with the employer.

Q 6. Explain the different types of FLSA exemptions.

The FLSA outlines several types of exemptions, the most common being:

- Executive Exemption: For employees who primarily manage the enterprise or a customarily recognized department or subdivision.

- Administrative Exemption: For employees who perform office or non-manual work directly related to management policies or general business operations of the employer.

- Professional Exemption: For employees who work in learned or creative professions requiring advanced knowledge and independent judgment.

- Computer Employee Exemption: For employees who perform computer-related work requiring specialized skills.

- Outside Sales Exemption: For employees who are primarily engaged in making sales or obtaining orders or contracts for services or for the use of facilities for which a consideration will be paid by the client or customer.

Each exemption has specific tests that must be met, involving salary level, job duties, and other criteria.

Q 7. What are the criteria for the executive exemption?

To qualify for the executive exemption, an employee must meet all three of these tests:

- Salary Level Test: The employee must be paid a predetermined minimum salary on a salary basis (not hourly).

- Management Test: The employee must primarily manage the enterprise or a customarily recognized department or subdivision. This involves supervising two or more full-time employees.

- Duties Test: The employee’s primary duty must consist of managing the enterprise or department; this includes hiring, firing, directing the work of employees, and making decisions about the employees’ work.

Simply having a title like ‘Manager’ isn’t enough; the actual duties performed must meet the criteria. For example, a manager whose primary duty is performing the same tasks as their subordinates would likely not qualify for the executive exemption.

Q 8. What are the criteria for the administrative exemption?

The administrative exemption under the Fair Labor Standards Act (FLSA) removes certain employees from minimum wage and overtime pay requirements. To qualify, an employee must meet all three criteria: a salary basis test, a salary level test (discussed later), and a duties test.

- Salary Basis Test: The employee must be paid a predetermined and fixed salary that doesn’t change based on the quantity or quality of work performed.

- Duties Test: The employee’s primary duty must consist of office or non-manual work directly related to the management or general business operations of the employer or the employer’s customers. This involves tasks like managing personnel, analyzing data, and conducting internal investigations. Examples include executive assistants, office managers, and human resources coordinators.

- Salary Level Test: The employee must earn a minimum weekly salary which the Department of Labor periodically updates. Failing to meet the minimum salary requirement disqualifies an employee from the administrative exemption, even if they meet all other criteria.

Example: A company’s executive assistant who earns a salary above the minimum threshold, and whose primary duties involve scheduling, managing correspondence, coordinating meetings, and handling confidential information, likely qualifies for the administrative exemption.

Q 9. What are the criteria for the professional exemption?

The professional exemption also exempts certain employees from minimum wage and overtime pay. Like the administrative exemption, it requires meeting all three criteria: a salary basis test, a salary level test, and a duties test.

- Salary Basis Test: Similar to the administrative exemption, the employee’s compensation must be a predetermined and fixed salary, not dependent on hours worked or output.

- Duties Test: The employee’s primary duty must be the performance of work requiring advanced knowledge, defined as work that is predominantly intellectual in character and which includes work requiring the consistent exercise of discretion and judgment. There are two categories: learned professionals (e.g., teachers, lawyers, doctors) and creative professionals (e.g., writers, composers, artists).

- Salary Level Test: The employee must meet the minimum weekly salary threshold set by the Department of Labor.

Example: A software engineer with a relevant advanced degree, earning above the minimum salary, and whose primary duty involves designing, testing, and implementing software code using independent judgment, likely qualifies for the professional exemption. Conversely, a software engineer primarily engaged in repetitive coding tasks might not meet the duties test.

Q 10. What are the criteria for the outside sales exemption?

The outside sales exemption applies to employees whose primary duty is making sales, or obtaining orders or contracts for services or goods, and who are customarily and regularly engaged away from the employer’s place of business. This exemption doesn’t require a specific salary level or have a ‘salary basis’ component, although the employee must be compensated accordingly under state laws.

- Primary Duty: The employee’s main focus must be on making sales, not on other tasks such as administrative work or merchandising.

- Customarily and Regularly Away from the Employer’s Place of Business: The employee must regularly work away from the office, meeting with clients and potential customers in various locations. Occasional trips to the office are not disqualifying.

Example: A pharmaceutical sales representative who spends their workday visiting doctors’ offices, hospitals, and clinics to promote and sell pharmaceuticals is typically exempt under the outside sales exemption. Conversely, a retail salesperson primarily working inside a store wouldn’t qualify.

Q 11. How is the salary basis test determined under the FLSA?

The salary basis test under the FLSA means an employee must receive a predetermined and fixed salary regardless of the quantity or quality of work performed. This means the employee’s pay cannot be docked for absences or performance issues unless they are related to specific circumstances such as leave without approved prior permission or violation of company policy.

To determine if an employee meets the salary basis test, employers must review the employee’s pay practices to confirm consistent salary payments. Deductions that violate the salary basis test include: Deductions for absences on the basis of the time missed, Deductions for imperfections in work quality.

Exceptions: There are limited exceptions to the salary basis rule, such as deductions for absences of a day or more for personal reasons, or for penalties under a bona fide plan or system of disciplinary suspension or discharge.

Important Note: Employers should carefully document all pay practices to ensure compliance with the FLSA’s salary basis test. Any deviation from the salary basis requirement can result in employees being reclassified as non-exempt, requiring payment of overtime.

Q 12. Explain the duties test under the FLSA.

The duties test under the FLSA determines whether an employee’s primary duty meets the specific requirements of the applicable exemption (administrative, professional, or executive). It’s not just about the job title; it’s about the actual responsibilities.

Employers should carefully analyze the employee’s daily tasks and responsibilities to determine if their primary duty aligns with the exemption criteria. This involves examining the percentage of time spent on each task and evaluating whether the most important responsibilities meet the exemption’s definition. For instance, an executive exemption requires managing the enterprise or a customarily recognized department or subdivision.

Analyzing Duties: To perform the duties test, employers should consider several factors, including the amount of time spent on different duties, the relative importance of the duties, the frequency of the duties, and the employee’s level of independent judgment and discretion. A written job description is helpful, but it’s essential to cross-reference it with the employee’s actual work activities.

Importance of Documentation: Thorough documentation of job duties and responsibilities is critical to support a classification of employees as exempt. This protects the employer in case of a Department of Labor audit or a lawsuit.

Q 13. Describe the recordkeeping requirements under the FLSA.

The FLSA mandates detailed recordkeeping to ensure compliance. Employers must maintain accurate records of employee work hours, wages, and other compensation. These records must be kept for at least three years.

- Employee Information: Full name, address, social security number, occupation.

- Hours Worked: Daily or weekly hours, including start and end times, and any overtime worked.

- Wages and Other Compensation: Regular rates of pay, overtime pay, and any other compensation such as bonuses or commissions.

- Deductions: Details of any deductions from wages.

Record Formats: Records can be maintained electronically or manually, as long as they are readily accessible and easily auditable. It’s essential to maintain accurate and up-to-date records. Discrepancies can lead to fines and penalties.

Example: A time sheet accurately reflecting daily hours worked, including breaks, along with a separate record of weekly or bi-weekly pay stubs showing gross and net pay, deductions, and the applicable pay rate are examples of compliant documentation.

Q 14. What are the penalties for non-compliance with the FLSA?

Penalties for non-compliance with the FLSA can be substantial and include back wages, liquidated damages, and civil penalties. The severity of the penalties depends on the nature and extent of the violation and whether it was willful.

- Back Wages: Employers must pay unpaid wages owed to employees, including minimum wage and overtime pay.

- Liquidated Damages: In cases of willful violations, the employer may be liable for an additional amount equal to the unpaid wages, essentially doubling the penalty.

- Civil Penalties: The Department of Labor can impose civil money penalties for violations, with amounts varying depending on the severity and frequency of the violations.

Example: If an employer misclassifies employees as exempt and fails to pay overtime, they may be liable for back wages, liquidated damages (if the violation is deemed willful), and potential civil penalties. These penalties can be significant, especially for larger companies with numerous employees.

Preventing Non-Compliance: Proactive measures are crucial to prevent FLSA violations. Employers should have well-defined job descriptions, conduct regular reviews of employee classifications, and maintain thorough records of employee hours and compensation. Regular training for HR and management personnel on FLSA compliance is also recommended.

Q 15. How does the FLSA impact independent contractors?

The Fair Labor Standards Act (FLSA) doesn’t directly impact independent contractors in the same way it impacts employees. The core distinction lies in the employer-employee relationship. The FLSA’s minimum wage, overtime, and recordkeeping requirements apply to employees, not independent contractors. Determining the correct classification is crucial. The IRS uses a multi-factor test, considering factors like behavioral control, financial control, and the relationship’s type. If misclassified as an independent contractor, a worker might be entitled to back pay, overtime, and other benefits under the FLSA. Think of it like this: an employee works for a company, while an independent contractor works with a company. A key differentiator is the degree of control the ‘hirer’ exerts over the worker’s work methods. A company exercising significant control points towards an employee classification under the FLSA.

For example, a freelance writer who sets their own hours, uses their own equipment, and has a contract specifying deliverables is likely an independent contractor. However, a writer who works in a company office, follows strict editorial guidelines, and is given daily assignments would be considered an employee, subject to FLSA protections.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. How are tipped employees handled under the FLSA?

Tipped employees are a special category under the FLSA. They receive at least the federal minimum wage, but part of that minimum wage can be met by tips. The employer must ensure that the combined wages (direct cash wages + tips) meet the federal minimum wage requirement. If tips plus direct wages do not meet the minimum wage, the employer must make up the difference. There are specific rules regarding tip pooling and tip credits, and employers must keep accurate records of all wages and tips received by the employee.

For instance, if the federal minimum wage is $7.25/hour and a tipped employee earns $3 in tips per hour, the employer only needs to pay $4.25/hour in direct wages. However, if tips fall below $3/hour in a particular week, the employer must pay the difference to reach the federal minimum wage. Failure to do so constitutes a major FLSA violation.

Q 17. Explain the concept of a ‘workweek’ under the FLSA.

The FLSA defines the ‘workweek’ as a fixed and regularly recurring period of 168 hours – seven consecutive 24-hour periods. It doesn’t have to be Monday through Sunday; an employer can choose any seven consecutive days as their standard workweek, but it must remain consistent. This is crucial because overtime pay is calculated based on hours worked during this defined workweek. Overtime is generally any hours worked beyond 40 hours in a single workweek.

Imagine a company chooses a Sunday-Saturday workweek. An employee who works 50 hours that week would be entitled to 10 hours of overtime pay (at least 1.5x their regular rate).

Q 18. How does the FLSA affect employees who work in multiple states?

The FLSA’s impact on employees working in multiple states is complex and depends on the nature of their work and the employer’s operations. The general rule is that the state with the most significant connection to the employee’s work will generally determine the applicable minimum wage and overtime laws. This is often the state where the employee performs the majority of their work, but it can be nuanced. Employers with operations in multiple states often need legal counsel to ensure compliance in all applicable jurisdictions.

For example, a salesperson who travels across state lines to visit clients will likely be subject to the wage and hour laws of the state where they primarily work or where their employer is based. However, if a significant portion of their work is performed in another state, the regulations of that state might also come into play. Consulting legal professionals experienced in multi-state employment laws is often necessary to ensure full compliance.

Q 19. Discuss common FLSA violations.

Common FLSA violations include misclassifying employees as independent contractors (as discussed earlier), failing to pay minimum wage, not paying overtime correctly (including failing to calculate overtime on bonuses or commissions), improper recordkeeping (incomplete or inaccurate time records), and failing to compensate for off-the-clock work. Many violations stem from unintentional errors or misunderstandings of the law, highlighting the need for proper training and due diligence.

- Minimum Wage Violations: Paying employees less than the federal or state minimum wage.

- Overtime Pay Violations: Failing to pay 1.5x the regular rate for hours worked beyond 40 in a workweek; improperly calculating overtime on bonuses or commissions.

- Misclassifying Employees: Incorrectly labeling employees as independent contractors to avoid paying benefits or overtime.

- Recordkeeping Violations: Failing to maintain accurate records of hours worked, wages paid, and other required information.

The consequences of FLSA violations can be severe, including back pay, penalties, and legal fees.

Q 20. How would you handle an employee complaint about FLSA violations?

Handling an employee complaint about FLSA violations requires a careful and systematic approach. First, I would conduct a thorough investigation to understand the employee’s claim, gathering all relevant documents (timecards, pay stubs, contracts, etc.). This involves interviewing the employee, supervisors, and any other relevant witnesses. Next, I would review the company’s payroll and timekeeping records to identify any discrepancies or patterns. Then, I would assess whether the complaint merits further investigation based on the evidence gathered.

If a violation is found, I would take immediate corrective action, which may include paying back wages, adjusting future pay, and implementing measures to prevent similar situations from happening again. I would also document all steps taken in detail, including the results of the investigation and the corrective measures implemented. Transparency and a fair process are crucial during this process. In some cases, legal counsel may be necessary to guide the process.

Q 21. Describe your experience with FLSA audits.

I have extensive experience with FLSA audits, both internal and external. I’ve been involved in preparing for and conducting audits, ensuring compliance with all relevant regulations and ensuring records are accurate and easily accessible. This includes training employees on proper timekeeping practices and ensuring management understands FLSA requirements. I have successfully navigated audits by proactively identifying and correcting potential issues before they become serious problems. Experience has shown that clear, meticulous record-keeping is essential for reducing the risk of violations and ensuring a smooth audit process. Audits provide an excellent opportunity to refine processes and strengthen compliance programs.

During audits, I focus on ensuring all records are compliant, demonstrating clear evidence of adherence to policies and procedures. I work closely with auditors to answer their questions effectively and efficiently, facilitating a smooth and successful completion of the audit.

Q 22. What is your understanding of the Portal-to-Portal Act?

The Portal-to-Portal Act of 1947 is a crucial piece of legislation that clarifies which time spent by an employee is compensable under the Fair Labor Standards Act (FLSA). Essentially, it excludes from the definition of ‘hours worked’ certain activities that occur before and after the employee’s principal work activities. Think of it this way: it draws a line between the time you’re actually working and the time you’re simply getting to and from work.

For example, commuting time to and from work is generally not compensable. Neither is time spent changing clothes if it’s something done routinely outside of the employee’s main duties. However, if changing clothes is a necessary part of the job (like a surgeon changing into scrubs), that time is compensable. The key distinction lies in whether the activity is integral and indispensable to the employee’s principal activities.

There are some exceptions, of course. If an employer requires employees to travel as part of their job – say, a salesperson traveling between customer sites – that travel time may be considered compensable. The determination depends on the specifics of the job and the employer’s policies.

Q 23. How do you stay current with changes and updates to the FLSA?

Staying current with FLSA changes requires a multi-pronged approach. I regularly monitor official government sources like the Department of Labor’s Wage and Hour Division website. They publish updates, interpretations, and enforcement actions that are critical to understanding current regulations. I also subscribe to specialized legal newsletters and journals focusing on employment law. Attending relevant webinars and seminars offered by professional organizations like the Society for Human Resource Management (SHRM) provides valuable insights and networking opportunities. Finally, I maintain relationships with legal counsel specializing in employment law to receive advice on complex or ambiguous situations.

Q 24. What resources do you utilize to ensure FLSA compliance?

To ensure FLSA compliance, I leverage a combination of resources. This includes the official DOL website, as mentioned, but also reputable third-party compliance resources that offer expert analysis and practical tools. These resources often provide templates for policies, timekeeping systems, and training materials. I also utilize timekeeping software that integrates with payroll systems to ensure accurate tracking of employee hours. Crucially, I consult with employment law attorneys when dealing with complex situations or legal challenges to ensure we’re following the most up-to-date interpretations of the law.

Q 25. Explain how you would develop and implement an FLSA compliance program.

Developing and implementing an FLSA compliance program requires a systematic approach. First, I would conduct a thorough review of current practices to identify any potential gaps or areas of non-compliance. This includes analyzing job descriptions, timekeeping methods, and payroll processes. Second, I would develop clear written policies and procedures that reflect current FLSA regulations, covering areas like overtime pay, minimum wage, exemptions, and recordkeeping. These policies should be easily accessible to all employees.

Third, I would implement robust training programs for both employees and managers to ensure everyone understands their responsibilities under the FLSA. This training should be regularly updated to reflect any changes in the law. Fourth, I would establish a system for tracking and monitoring compliance, including regular audits of timekeeping and payroll data. Finally, I would implement a process for addressing and resolving any FLSA-related issues that arise, perhaps through an internal complaint procedure and ongoing communication.

A key aspect of this program would be establishing a culture of compliance throughout the organization. This involves fostering open communication, empowering employees to raise concerns, and ensuring that managers are held accountable for their adherence to the regulations.

Q 26. How do you approach training employees on FLSA regulations?

Training employees on FLSA regulations needs to be engaging and easy to understand. I would use a multi-faceted approach combining various methods. This could include interactive workshops, online modules, and easily digestible FAQs and handbooks. The materials should be tailored to different roles and responsibilities within the company. For example, managers need a deeper understanding of exemption rules than hourly employees. The training should also provide clear examples and scenarios related to their specific jobs. The goal is to make it relevant and memorable.

I believe in ongoing training, so I would incorporate regular updates and reminders, perhaps through short email messages or brief meetings, to reinforce key concepts and address any emerging issues. Post-training quizzes and assessments ensure comprehension and provide opportunities for clarification.

Q 27. Describe a situation where you had to resolve an FLSA-related issue.

In a previous role, we discovered a discrepancy in overtime calculations for a group of sales representatives. While they were classified as exempt, a closer review of their daily activities revealed that a significant portion of their time was spent on non-exempt tasks. This was identified during a routine audit of payroll records. We worked with our legal counsel to analyze the situation and reclassify the employees as non-exempt. We then recalculated their wages, paying them the appropriate overtime compensation, and revised our job descriptions to reflect the actual nature of their duties to ensure future compliance.

This situation highlighted the importance of regularly reviewing job duties and classifications to ensure that they align with FLSA regulations and that our internal controls were robust enough to identify such discrepancies.

Q 28. How would you handle a situation where an employee is misclassified?

Misclassifying an employee is a serious issue with potentially significant legal and financial consequences. If I discovered an employee was misclassified, I would immediately initiate a thorough investigation to determine the correct classification. This would involve a detailed review of the employee’s job duties, responsibilities, and compensation. We would consult with legal counsel and utilize the DOL’s guidance on exemptions to ensure accuracy.

Once the correct classification is determined, we would take corrective action. This might involve reclassifying the employee, adjusting their pay to reflect the correct wage and overtime rates, and back-paying any owed wages. We would also review our internal processes to determine how the misclassification occurred and implement corrective measures to prevent similar incidents in the future. Transparency and open communication with the affected employee are crucial throughout this process.

Key Topics to Learn for FLSA Interview

- Wage and Hour Requirements: Understand the intricacies of minimum wage, overtime pay calculations (including regular rate of pay), and exemptions (executive, administrative, professional).

- Overtime Compensation: Learn how to calculate overtime pay accurately for various pay periods and scenarios, including situations with fluctuating workweeks and different pay rates.

- Recordkeeping Requirements: Familiarize yourself with the specific documentation needed to comply with FLSA regulations, including accurate timekeeping methods and proper storage of records.

- Exemptions and Classifications: Master the criteria for determining employee exemptions from overtime pay, focusing on the practical application of these rules and potential pitfalls.

- Child Labor Provisions: Understand the restrictions and regulations surrounding the employment of minors, including permissible hours and types of work.

- Enforcement and Penalties: Learn about the potential consequences of non-compliance, including fines and back pay liabilities, and how to avoid them.

- Practical Application: Prepare to discuss real-world scenarios where FLSA knowledge is crucial – for example, calculating overtime for employees with irregular schedules or addressing disputes regarding classification.

- Problem-Solving: Practice analyzing hypothetical situations related to wage and hour compliance, and develop strategies to resolve potential conflicts and ensure legal compliance.

Next Steps

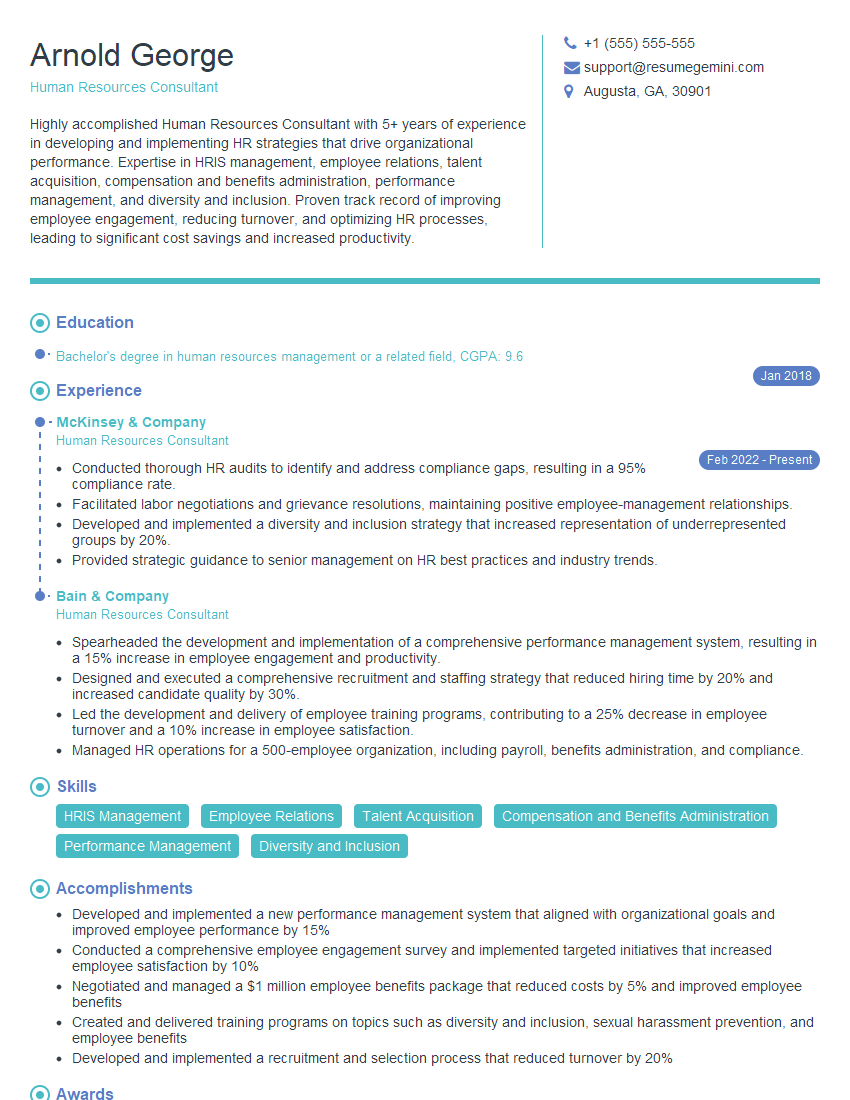

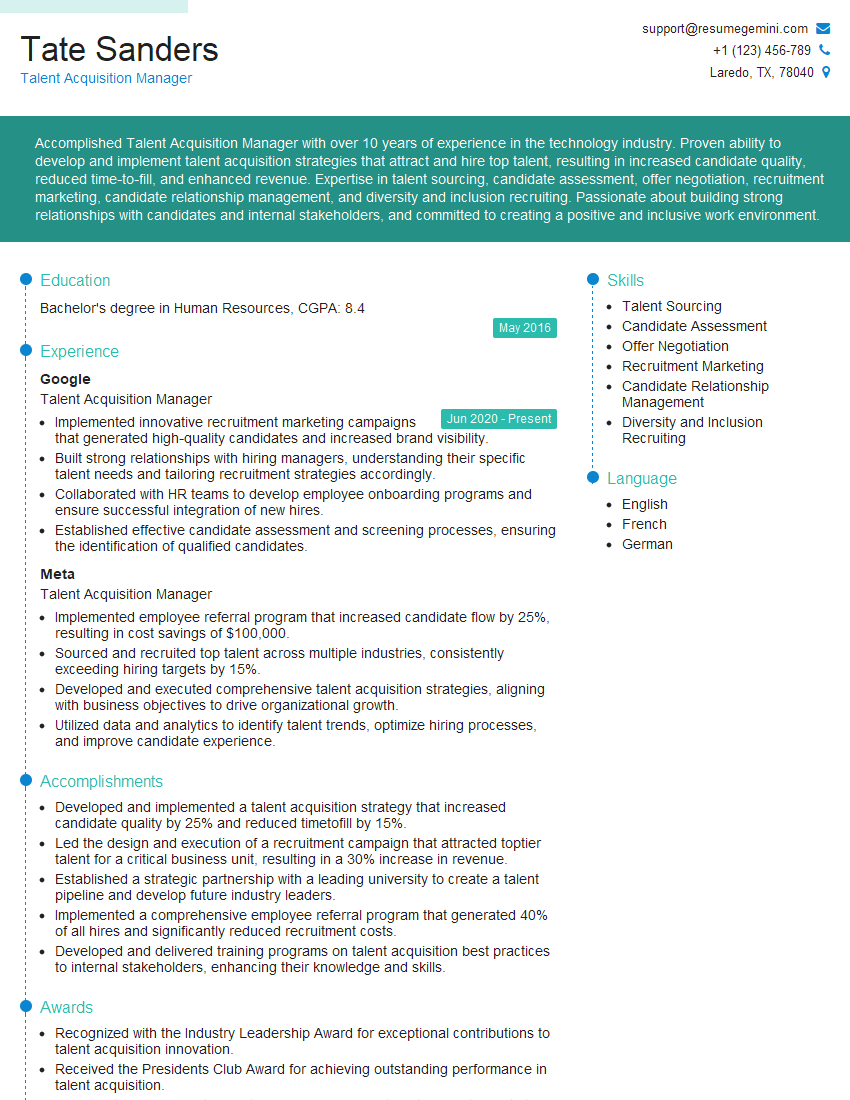

Mastering FLSA demonstrates a commitment to legal compliance and ethical business practices, significantly enhancing your value to any employer. This specialized knowledge opens doors to more advanced roles and higher earning potential. To maximize your job prospects, invest time in creating an ATS-friendly resume that showcases your expertise. ResumeGemini is a trusted resource to help you build a professional, impactful resume that stands out to recruiters. Examples of resumes tailored to FLSA expertise are provided to help guide your process.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

I Redesigned Spongebob Squarepants and his main characters of my artwork.

https://www.deviantart.com/reimaginesponge/art/Redesigned-Spongebob-characters-1223583608

IT gave me an insight and words to use and be able to think of examples

Hi, I’m Jay, we have a few potential clients that are interested in your services, thought you might be a good fit. I’d love to talk about the details, when do you have time to talk?

Best,

Jay

Founder | CEO