The right preparation can turn an interview into an opportunity to showcase your expertise. This guide to Handling Payments interview questions is your ultimate resource, providing key insights and tips to help you ace your responses and stand out as a top candidate.

Questions Asked in Handling Payments Interview

Q 1. Explain the difference between ACH and wire transfers.

ACH (Automated Clearing House) and wire transfers are both electronic methods for transferring funds, but they differ significantly in speed, cost, and typical use cases. Think of ACH as sending a letter – it’s reliable but takes a few days to arrive. Wire transfers are like sending a courier – fast and expensive, perfect for urgent transactions.

- ACH: A batch-processing system that handles high volumes of low-value transactions. It’s slower (typically 1-3 business days) but cheaper. Common uses include direct deposit of payroll, recurring bill payments, and electronic payments between businesses.

- Wire Transfers: These are immediate, high-value transactions processed individually. They’re faster (often same-day) but more expensive due to the immediate processing and security measures involved. They are often used for large transactions like real estate purchases or international transfers.

For example, your monthly rent payment might go through ACH, while a down payment on a house would likely be a wire transfer.

Q 2. Describe your experience with different payment gateways (e.g., Stripe, PayPal).

I have extensive experience integrating and managing various payment gateways, including Stripe, PayPal, and Authorize.Net. My experience spans from initial setup and API integration to troubleshooting issues and optimizing for conversion rates.

- Stripe: I’ve utilized Stripe’s robust API to build custom checkout flows for e-commerce platforms, leveraging its features like recurring billing and fraud prevention tools. Its developer-friendly nature and extensive documentation made integration seamless.

- PayPal: My experience with PayPal includes managing accounts, resolving disputes, and optimizing payment processing for various business sizes. I’m proficient in using its tools for risk management and customer support.

- Authorize.Net: This gateway was particularly useful for integrating with legacy systems due to its versatility and extensive support options. I’ve used it to process payments for clients across diverse industries.

In each case, I focused on understanding the specific needs of the business, choosing the appropriate gateway, and implementing robust security measures.

Q 3. How do you ensure the accuracy of payment processing?

Ensuring payment processing accuracy is crucial. My approach involves a multi-layered strategy focusing on data validation, reconciliation, and regular audits.

- Data Validation: I implement rigorous checks at each stage, validating data against internal databases and external sources to prevent errors like incorrect amounts or duplicate transactions. This includes using checksums and other data integrity checks.

- Reconciliation: Daily and monthly reconciliation of payment gateway statements with internal accounting records is essential to identify discrepancies early on. This involves comparing transaction amounts, dates, and other key details.

- Regular Audits: Performing regular audits, both internal and potentially external, helps identify systemic issues and ensures compliance with regulations such as PCI DSS.

For instance, a daily reconciliation process allows me to promptly investigate and resolve any discrepancies before they escalate into major financial problems. Think of it as a daily check-up on your payment health.

Q 4. What are some common payment processing errors and how do you resolve them?

Common payment processing errors include declined transactions, insufficient funds, incorrect billing information, and duplicate payments. My approach to resolving these depends on the specific error.

- Declined Transactions: I investigate the reason for the decline (insufficient funds, expired card, fraud flags) and guide the customer through the appropriate steps, such as updating payment information or contacting their bank.

- Insufficient Funds: I implement mechanisms to alert customers and retry payments at a later time. This could involve using automated retry systems or contacting customers directly.

- Incorrect Billing Information: I verify the customer’s information, correct the issue if possible, and potentially implement stricter data validation checks to prevent future errors.

- Duplicate Payments: I use transaction IDs and timestamps to identify and prevent double payments. If a duplicate occurs, I immediately refund one payment and carefully document the process.

Effective logging and error handling mechanisms are essential to quickly diagnose and resolve these issues. A well-designed system allows for easy tracing of transactions and quick problem resolution.

Q 5. Explain the process of reconciling payment transactions.

Reconciling payment transactions is the process of comparing payment records from different sources to ensure accuracy and identify any discrepancies. It’s a critical step for financial reporting and regulatory compliance.

The process typically involves:

- Gathering data: Obtaining payment data from the payment gateway, bank statements, and internal accounting systems.

- Comparing data: Matching transactions based on transaction IDs, amounts, and dates.

- Identifying discrepancies: Investigating any differences between the various data sources.

- Resolving discrepancies: Determining the cause of discrepancies and taking corrective action (e.g., correcting data entry errors, contacting banks for inquiries).

- Documenting the process: Maintaining detailed records of the reconciliation process.

Regular reconciliation ensures financial integrity and helps detect and prevent fraud. Consider it the financial equivalent of balancing your checkbook—essential for accurate bookkeeping.

Q 6. How do you handle payment disputes?

Handling payment disputes requires a calm and methodical approach, focusing on gathering evidence and adhering to the payment gateway’s dispute resolution process.

- Gather evidence: Collect all relevant documentation such as order confirmations, shipping receipts, and customer communication.

- Follow established procedures: Adhere to the specific dispute resolution processes outlined by the payment gateway (e.g., PayPal’s dispute resolution system).

- Communicate with the customer: Attempt to resolve the dispute amicably with the customer. Clearly explain your position and provide supporting evidence.

- Escalate as needed: If the dispute cannot be resolved directly, escalate the issue to the payment gateway’s support team for further investigation.

Effective communication and documentation are vital throughout the process to protect the business’s interests.

Q 7. What security measures do you employ to protect payment data?

Protecting payment data is paramount. My security measures are multifaceted and aligned with industry best practices, such as PCI DSS compliance.

- PCI DSS Compliance: Adhering to the Payment Card Industry Data Security Standard is non-negotiable. This involves implementing strict security controls across all aspects of payment processing.

- Encryption: All sensitive data, including credit card numbers and customer information, is encrypted both in transit and at rest using strong encryption algorithms.

- Regular Security Audits: Conducting regular security assessments and penetration testing to identify vulnerabilities and ensure the effectiveness of security controls.

- Firewall and Intrusion Detection Systems: Implementing robust firewalls and intrusion detection systems to protect against unauthorized access and cyber threats.

- Employee Training: Providing regular security awareness training to employees to educate them about best practices for handling sensitive data.

Security is not a one-time setup but an ongoing process. Regular updates, monitoring, and vigilance are crucial to maintaining the highest level of security.

Q 8. Describe your experience with PCI DSS compliance.

PCI DSS (Payment Card Industry Data Security Standard) compliance is paramount for any organization handling credit card information. It’s a set of security standards designed to ensure that ALL sensitive cardholder data is protected against unauthorized access, use, disclosure, disruption, modification, or destruction. My experience involves implementing and maintaining PCI DSS compliant systems across multiple projects. This includes:

- Vulnerability Assessments and Penetration Testing: Regularly conducting these assessments to identify and mitigate security weaknesses.

- Secure Coding Practices: Ensuring developers follow secure coding guidelines to prevent vulnerabilities in payment processing applications.

- Access Control Management: Implementing robust access control measures, including role-based access control (RBAC), to restrict access to sensitive data only to authorized personnel.

- Data Encryption: Utilizing strong encryption methods, both in transit and at rest, to protect cardholder data.

- Regular Security Audits: Conducting periodic internal and external audits to verify compliance with PCI DSS requirements.

- Incident Response Planning: Developing and regularly testing a comprehensive incident response plan to handle security breaches effectively.

For example, in a previous role, I led the effort to achieve PCI DSS certification for a new e-commerce platform. This involved working closely with developers, security engineers, and auditors to implement all necessary security controls. We successfully passed our audit on the first attempt, demonstrating a commitment to data security.

Q 9. How do you manage high volumes of payment transactions efficiently?

Managing high volumes of payment transactions efficiently requires a multifaceted approach. Think of it like managing a busy highway – you need well-designed infrastructure and traffic management systems to prevent bottlenecks. Key strategies include:

- Scalable Infrastructure: Utilizing cloud-based solutions and horizontally scalable architectures allows the system to handle fluctuating transaction volumes without performance degradation.

- Load Balancing: Distributing transactions across multiple servers prevents any single server from becoming overloaded.

- Asynchronous Processing: Processing transactions asynchronously (in the background) allows the system to remain responsive even during peak loads. This prevents users from experiencing delays.

- Optimization Techniques: Database optimization, efficient code, and caching mechanisms are crucial for enhancing performance.

- Real-time Monitoring and Alerting: Constant monitoring of transaction volume, error rates, and other key metrics enables proactive identification and resolution of performance issues.

For instance, I once worked on a project where we migrated a payment processing system to a cloud-based platform. This significantly improved scalability and allowed us to handle a 500% increase in transaction volume without any noticeable performance impact.

Q 10. What are your preferred methods for tracking payments?

Effective payment tracking involves using a combination of methods to ensure accuracy and completeness. My preferred methods include:

- Dedicated Payment Processing System: Integrating with a robust payment gateway that provides detailed transaction records with timestamps, amounts, and payment statuses.

- ERP System Integration: Linking the payment processing system with the ERP system allows for automatic reconciliation of payments with invoices and orders. This creates a unified view of financial transactions.

- Payment Reconciliation Reports: Generating regular reports that compare the transactions processed by the payment gateway with the entries in the accounting system. This helps identify discrepancies and ensure accuracy.

- Database Logging: Maintaining comprehensive logs of all payment-related events, including successful and failed transactions, for auditing and troubleshooting purposes.

Imagine it like a detailed ledger; we want to ensure every single transaction is meticulously recorded and easily accessible for auditing or investigation. This level of detail is essential for compliance and financial reporting.

Q 11. Explain your understanding of different payment methods (credit cards, debit cards, e-wallets).

Understanding different payment methods is crucial for offering diverse and convenient options to customers. Here’s a breakdown:

- Credit Cards: These are revolving credit accounts that allow users to borrow money up to a certain limit. Processing involves verifying the card details, authorization, and settlement with the acquiring bank. Examples include Visa, Mastercard, American Express.

- Debit Cards: These cards deduct funds directly from the user’s bank account. Processing is similar to credit cards, but the funds are immediately deducted. Examples include Visa Debit, Mastercard Debit.

- E-wallets: These are digital wallets that store payment information electronically, facilitating online transactions. Examples include PayPal, Apple Pay, Google Pay. Processing involves verifying the user’s identity and authorization with the e-wallet provider.

Each method has its own set of security protocols and processing nuances. Understanding these differences ensures secure and efficient transactions for all parties involved.

Q 12. How do you handle international payments?

Handling international payments requires navigating currency conversions, cross-border regulations, and varying payment methods preferred in different regions. Key considerations include:

- Currency Conversion: Accurately converting the transaction amount to the appropriate currency using real-time exchange rates.

- Cross-Border Regulations: Complying with relevant regulations and laws in both the sender’s and receiver’s countries, including anti-money laundering (AML) and know-your-customer (KYC) compliance.

- Payment Gateway Selection: Choosing a payment gateway that supports international transactions and multiple currencies.

- Foreign Transaction Fees: Understanding and managing the fees associated with international transactions.

- Localization: Adapting the payment process to suit the local preferences and language of the customer.

For example, when processing a payment from a European customer, we would need to consider things like SEPA (Single Euro Payments Area) regulations and the preferred payment methods in their region, such as iDEAL in the Netherlands or SOFORT in Germany.

Q 13. What experience do you have with different ERP systems and their payment modules?

My experience spans several ERP systems, including SAP, Oracle, and NetSuite. I’m familiar with their payment modules, understanding how they integrate with payment gateways and manage the entire payment lifecycle within the ERP system. This includes:

- Order-to-Cash Process: Managing the entire process from order creation to payment reconciliation within the ERP system.

- Payment Data Integration: Integrating payment data from various sources, such as payment gateways and banks, into the ERP system.

- Automated Payment Processing: Automating payment processes such as invoice generation, payment scheduling, and reconciliation.

- Reporting and Analytics: Generating reports and dashboards to track key payment metrics such as payment success rates, outstanding payments, and average payment times.

In one instance, I helped a company migrate their payment processing from a legacy system to SAP’s payment module. This improved efficiency, reduced manual effort, and provided better financial visibility.

Q 14. How do you identify and prevent fraudulent payment transactions?

Fraudulent payment transactions are a significant concern. A multi-layered approach is necessary to identify and prevent them. This includes:

- Address Verification System (AVS): Verifying the billing address provided by the cardholder with the address on file with the card issuer.

- Card Verification Value (CVV): Verifying the three- or four-digit security code on the back of the credit card.

- Velocity Checks: Monitoring transaction frequency and amounts to identify unusual patterns.

- IP Address Tracking: Tracking the IP addresses used to make payments to identify suspicious activity.

- Machine Learning Models: Using machine learning algorithms to identify fraudulent transactions based on historical data and patterns.

- 3D Secure Authentication: Implementing 3D Secure (like Verified by Visa or Mastercard SecureCode) to add an extra layer of authentication for online transactions.

For example, implementing a machine learning model allowed us to reduce fraudulent transactions by 40% by identifying unusual patterns that would have otherwise gone unnoticed. Regularly reviewing and updating these systems is crucial, as fraudsters constantly evolve their tactics.

Q 15. How do you ensure the timely processing of payments?

Ensuring timely payment processing involves a multi-pronged approach focused on efficiency and proactive problem-solving. It’s like a well-oiled machine where each part contributes to the smooth flow of transactions.

- Automated Systems: Relying heavily on automated systems for tasks like data entry, reconciliation, and routing payments minimizes manual errors and delays. Think of it as having a robotic assistant handling the repetitive tasks, freeing up human resources for more complex issues.

- Streamlined Workflows: Establishing clear, efficient workflows eliminates bottlenecks. This involves mapping out the entire payment process, from initial request to final settlement, identifying potential delays, and implementing solutions. For instance, automating approval processes speeds up the payment cycle significantly.

- Real-time Monitoring: Constant monitoring of the payment system through dashboards and alerts helps identify and address issues promptly. Imagine having a dashboard that displays the status of every transaction, providing immediate alerts for any delays or errors.

- Robust Error Handling: Having robust error handling mechanisms in place is crucial. This means having procedures to identify, troubleshoot, and resolve errors quickly. A robust system catches errors early, preventing them from cascading into larger problems.

- Strong Vendor Relationships: Building strong relationships with payment processors and banks ensures smoother communication and faster resolution of any issues. Having a reliable partner you can trust and communicate with openly is essential.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. Describe your experience with automated payment systems.

My experience with automated payment systems spans several years, encompassing various platforms and integrations. I’ve worked extensively with systems like Stripe, PayPal, and Authorize.Net, implementing and managing them across different business models.

- Implementation: I’ve led the implementation of automated systems in multiple organizations, integrating them with existing ERP and CRM systems, ensuring seamless data flow and minimizing disruptions. This involves meticulous planning, testing, and training to guarantee smooth transitions.

- Optimization: I’ve focused on optimizing existing automated systems to enhance efficiency and reduce processing times. For example, I’ve implemented rules-based automation to streamline approvals and reduce manual intervention, which dramatically improved processing speed.

- Troubleshooting: I’ve developed expertise in troubleshooting system failures and identifying root causes. For example, I once resolved a major payment processing bottleneck by identifying a configuration issue in a third-party integration, resulting in a significant reduction in processing delays.

- Security: I’m deeply aware of security implications and have implemented robust security measures, including encryption and fraud prevention tools, to safeguard sensitive payment data. Security is paramount; we employ multiple layers of protection against vulnerabilities.

Q 17. How do you prioritize payment processing tasks?

Prioritizing payment processing tasks involves a combination of factors, including urgency, value, and risk. It’s about making informed decisions to ensure that the most critical payments are processed first.

- Time Sensitivity: Payments with deadlines (e.g., payroll, vendor payments with discounts) are prioritized. Think of it as a triage system in a hospital – the most critical cases are handled first.

- Value: High-value transactions often receive higher priority due to potential financial implications of delays. Imagine prioritizing a large payment to a key supplier over a smaller one to prevent disruption of your operations.

- Risk: Payments that carry higher risk of penalties or chargebacks (e.g., international payments) are often given priority to mitigate losses. International payments, for example, may have more complex regulations and carry a higher risk of complications.

- Workload Balancing: I use a combination of automated routing and manual assignment to balance the workload across team members, ensuring fair distribution and avoiding bottlenecks. A balanced workflow prevents one person from becoming overwhelmed.

Q 18. How do you handle chargebacks?

Handling chargebacks requires a systematic and thorough approach, focusing on minimizing losses and learning from mistakes. It’s like investigating a crime scene to understand what happened and prevent future incidents.

- Dispute Resolution: The first step involves carefully reviewing the chargeback reason provided by the cardholder’s bank. This requires thorough documentation of the transaction.

- Evidence Gathering: Gathering supporting evidence is vital, such as order confirmation, shipping tracking information, and customer communication records. Strong evidence is your best defense against a chargeback.

- Representations & Rebuttals: Submitting well-reasoned representations and rebuttals to the card issuer to dispute the chargeback is essential. A clear and concise explanation of the transaction, backed by solid evidence, increases your chances of winning the dispute.

- Fraud Prevention: Chargebacks often point to weaknesses in fraud prevention measures. Analyzing the patterns and implementing preventative measures like address verification and enhanced fraud screening systems can help reduce future chargebacks.

- Process Improvement: Thoroughly reviewing the entire transaction process to identify and correct any weaknesses that led to the chargeback is crucial. Learning from mistakes is key to preventing future incidents.

Q 19. What is your experience with various reporting metrics related to payments?

My experience with payment reporting metrics is extensive. I’m proficient in analyzing key performance indicators (KPIs) to monitor the efficiency, effectiveness, and security of payment processes. Think of these metrics as a dashboard showing the health of your payment system.

- Transaction Volume: Tracking the number of transactions processed daily, weekly, and monthly gives insights into business growth and potential bottlenecks.

- Average Processing Time: Measuring the time taken to process payments reveals areas for improvement in efficiency.

- Chargeback Rate: Monitoring the percentage of transactions resulting in chargebacks helps identify and address issues in fraud prevention and customer service.

- Success Rate: Tracking the percentage of successful transactions helps to measure the effectiveness of the payment system.

- Average Transaction Value: This metric is crucial for business analysis and forecasting revenue.

- Payment Method Distribution: Analyzing the usage of various payment methods helps in optimizing payment gateway choices and marketing strategies.

I use these metrics to identify trends, highlight areas for improvement, and make data-driven decisions to optimize payment processes.

Q 20. Explain your understanding of payment processing fees and how to optimize them.

Payment processing fees can significantly impact profitability. Understanding these fees and optimizing them is crucial for cost management. Think of these fees as hidden costs that can eat into your profit margins if not managed carefully.

- Types of Fees: Common fees include transaction fees (percentage per transaction), monthly fees, setup fees, and potentially currency conversion fees for international transactions.

- Negotiation: Negotiating lower fees with payment processors is often possible, especially for businesses with high transaction volumes. This requires careful planning and understanding of the market.

- Fee Structure Analysis: Analyzing the fee structure of different payment processors is crucial for selecting the most cost-effective option. Comparing apples to apples is essential to make an informed decision.

- Optimization Strategies: Strategies like optimizing payment methods (encouraging lower-cost options), reducing failed transactions (minimizing chargebacks), and improving payment processing efficiency can contribute significantly to cost reduction.

- Batch Processing: For businesses with high volumes, using batch processing can potentially reduce fees by optimizing transaction timing.

Q 21. How do you stay updated on changes in payment regulations and compliance requirements?

Staying updated on payment regulations and compliance requirements is vital for avoiding hefty fines and maintaining customer trust. It’s an ongoing process that requires diligence and proactive measures.

- Regulatory Websites: Regularly reviewing websites of relevant regulatory bodies (e.g., PCI DSS, GDPR, local banking regulations) provides insight into changes and updates.

- Industry Publications & Newsletters: Subscribing to industry publications and newsletters provides timely updates on changes in payment landscapes.

- Professional Networks: Engaging with professional networks and attending industry events helps stay connected with peers and experts, exchanging knowledge and best practices.

- Compliance Software & Tools: Utilizing compliance software and tools that automate compliance checks helps identify and address potential issues quickly.

- Legal Counsel: Consulting with legal counsel specializing in payment processing regulations provides crucial guidance on complex compliance issues.

Q 22. How would you handle a sudden surge in payment volume?

Handling a sudden surge in payment volume requires a multi-pronged approach focusing on scalability, redundancy, and monitoring. Think of it like a highway: during rush hour, you need more lanes and efficient traffic management to avoid gridlock. In payment processing, this means:

- Scalable Infrastructure: Our systems are designed with cloud-based solutions that can automatically scale resources (servers, databases, etc.) up or down based on real-time demand. This prevents bottlenecks and ensures consistent performance even during peak periods.

- Redundancy and Failover Mechanisms: We utilize multiple payment gateways and processors to distribute the load. If one system experiences an issue, others automatically take over, preventing service interruptions. It’s like having backup generators during a power outage.

- Real-time Monitoring and Alerting: We continuously monitor key metrics like transaction volume, processing times, and error rates. Automated alerts notify us of any anomalies, allowing us to proactively address potential problems before they impact customers. Imagine having a dashboard displaying all vital signs of your payment system.

- Queue Management: For transactions that cannot be processed immediately due to high volume, a well-managed queue system ensures that they are processed in order and without data loss. This is like a virtual waiting line at a popular restaurant.

In a past role, we experienced a 500% increase in transactions during a major flash sale. Our scalable infrastructure and proactive monitoring prevented any significant service disruptions, ensuring a smooth experience for both customers and the business.

Q 23. Describe your experience with different currency exchange rates and their impact on payments.

Currency exchange rates are a critical factor in international payments. Fluctuations can significantly impact the final amount received or paid. Imagine buying something online from a foreign vendor – the price you see might not be the final price due to currency conversion. My experience encompasses:

- Understanding Exchange Rate Mechanisms: I’m familiar with various exchange rate models, including spot rates (current exchange rates), forward rates (rates locked in for future transactions), and mid-market rates (average of buying and selling rates). This knowledge is essential for accurate pricing and financial forecasting.

- Working with Payment Gateways: Most payment gateways offer tools to handle currency conversions. However, it’s crucial to understand their methods, fees, and markups to ensure optimal pricing for both the business and the customer. Some gateways offer better rates than others.

- Risk Management: Exchange rate fluctuations pose risks, especially for businesses dealing with high volumes of international transactions. Using hedging strategies or incorporating exchange rate clauses in contracts can mitigate these risks.

- Compliance: Understanding and complying with regulations around foreign exchange transactions and reporting is crucial to avoid penalties and maintain legal compliance.

For instance, in a previous project, we implemented a dynamic currency conversion system that provided customers with transparent exchange rates and minimized the impact of rate fluctuations on our business.

Q 24. Explain your understanding of different payment processing models (e.g., batch processing, real-time processing).

Payment processing models differ in how transactions are handled. Batch processing is like sending a bulk email, while real-time processing is like having an instant chat.

- Batch Processing: Transactions are collected over a period (e.g., daily, hourly) and processed in a single batch. This is efficient for high volumes of low-value transactions but introduces a delay in processing times. It’s cost-effective but lacks the immediacy needed for time-sensitive transactions. Example: processing payroll.

- Real-time Processing: Transactions are processed immediately upon authorization. This provides instant confirmation and is crucial for e-commerce and point-of-sale systems. It offers faster customer experience but can be more expensive due to the increased processing overhead. Example: online credit card purchases.

- Hybrid Models: Many businesses use a hybrid approach, combining batch and real-time processing to optimize efficiency and cost based on transaction type. For instance, high-value transactions might be processed in real-time, while lower-value, recurring transactions might be handled in batches.

Choosing the right model depends on the specific needs of the business and the nature of its transactions. Understanding the trade-offs between speed, cost, and security is key.

Q 25. What software or tools do you use for payment processing?

The choice of software and tools depends greatly on the scale and complexity of the operation. However, some common tools include:

- Payment Gateways: Stripe, PayPal, Square, Authorize.Net – these act as intermediaries between the merchant and various payment processors.

- Payment Processors: These are the companies that actually process the transactions, such as Worldpay, Adyen, and CyberSource.

- CRM Systems (Customer Relationship Management): Salesforce, HubSpot – integrating payment processing into CRM systems allows for better customer management and streamlined order fulfillment.

- Enterprise Resource Planning (ERP) Systems: SAP, Oracle – these systems often include modules for payment processing, particularly for larger enterprises.

- Fraud Detection Tools: These tools help identify and prevent fraudulent transactions.

Additionally, internal systems and custom-built applications are often used to manage and monitor payment flows. The specific tools used would depend on the scale, complexity and specific needs of a particular business.

Q 26. How do you ensure data integrity in payment processing?

Data integrity in payment processing is paramount. Compromised data can lead to financial losses, legal issues, and reputational damage. Our approach involves several layers of security:

- Secure Data Storage: We use encrypted databases and storage solutions to protect sensitive payment information. Data is encrypted both in transit (using HTTPS) and at rest.

- Access Control: Strict access controls limit who can access payment data. This involves role-based access control and multi-factor authentication to ensure only authorized personnel can view or modify sensitive information.

- Regular Audits and Penetration Testing: We conduct regular security audits and penetration testing to identify vulnerabilities and ensure our systems are secure. This is proactive risk management.

- Data Loss Prevention (DLP): We implement DLP measures to prevent unauthorized data exfiltration, ensuring that sensitive payment data stays within our secure systems.

- PCI DSS Compliance: We strictly adhere to the Payment Card Industry Data Security Standard (PCI DSS) to protect cardholder data.

Think of it like a high-security vault: multiple locks, alarms, and surveillance systems protect the valuable contents inside. Our approach is similar, using multiple layers of security to protect payment data.

Q 27. Describe your experience with integrating new payment systems into existing infrastructure.

Integrating new payment systems into existing infrastructure requires careful planning and execution. It’s like adding a new wing to a house; you need to ensure it’s structurally sound and seamlessly integrated with the existing structure.

- Requirements Gathering: We begin by thoroughly understanding the requirements of the new payment system and how it will integrate with existing systems.

- API Integration: We focus on leveraging APIs (Application Programming Interfaces) for seamless integration. This minimizes disruption to existing workflows.

- Testing and Validation: Thorough testing, including unit testing, integration testing, and user acceptance testing, is crucial to ensure the system works as expected and doesn’t introduce bugs.

- Data Migration: If necessary, data migration from the old system to the new one is carefully planned and executed to minimize data loss and ensure data integrity.

- Change Management: We work with stakeholders to communicate changes and train personnel on the new system, minimizing disruption and ensuring a smooth transition.

In one instance, we integrated a new mobile payment system into our existing e-commerce platform. Careful planning and phased rollout minimized disruption to customers and resulted in a significant increase in mobile transactions.

Q 28. How do you troubleshoot payment processing issues?

Troubleshooting payment processing issues requires a systematic approach. It’s like detective work, systematically eliminating possibilities until the root cause is found.

- Gather Information: Start by collecting information about the error, including error messages, timestamps, transaction IDs, and any other relevant details.

- Check Logs: Examine system logs for clues about the problem. These logs often provide valuable information about errors and their causes.

- Review Payment Gateway Documentation: Consult the documentation of the payment gateway for troubleshooting tips and known issues.

- Test Transactions: Conduct test transactions to isolate the problem. This can help identify whether the issue is with the payment gateway, the merchant’s system, or a network issue.

- Contact Support: If necessary, contact the payment gateway’s support team for assistance. They often have tools and expertise to help diagnose and resolve issues.

Recently, we encountered an issue where payments were failing intermittently. By systematically checking logs and testing transactions, we identified a network connectivity issue that was causing intermittent outages. Addressing the network issue resolved the problem.

Key Topics to Learn for Handling Payments Interview

- Payment Processing Systems: Understanding various payment gateways (e.g., Stripe, PayPal, Square), their functionalities, and integration with different platforms. Practical application: Analyzing the efficiency and security of different payment systems for a specific business model.

- Security and Fraud Prevention: Exploring measures to protect sensitive financial data, including PCI DSS compliance, fraud detection techniques, and risk mitigation strategies. Practical application: Designing a secure payment process for an e-commerce website, including handling potential vulnerabilities.

- Transaction Reconciliation and Reporting: Mastering the process of matching transactions, identifying discrepancies, and generating accurate financial reports. Practical application: Investigating and resolving payment discrepancies, ensuring accurate financial records.

- Payment Regulations and Compliance: Familiarizing yourself with relevant laws and regulations (e.g., KYC/AML, GDPR) impacting payment processing. Practical application: Evaluating the compliance of a payment system with relevant regulations.

- Customer Support and Dispute Resolution: Understanding how to effectively handle customer inquiries and resolve payment disputes. Practical application: Developing strategies for efficient customer support regarding payment issues.

- Data Analysis and Reporting: Analyzing payment data to identify trends, improve efficiency, and inform business decisions. Practical application: Creating reports to track key performance indicators (KPIs) related to payment processing.

Next Steps

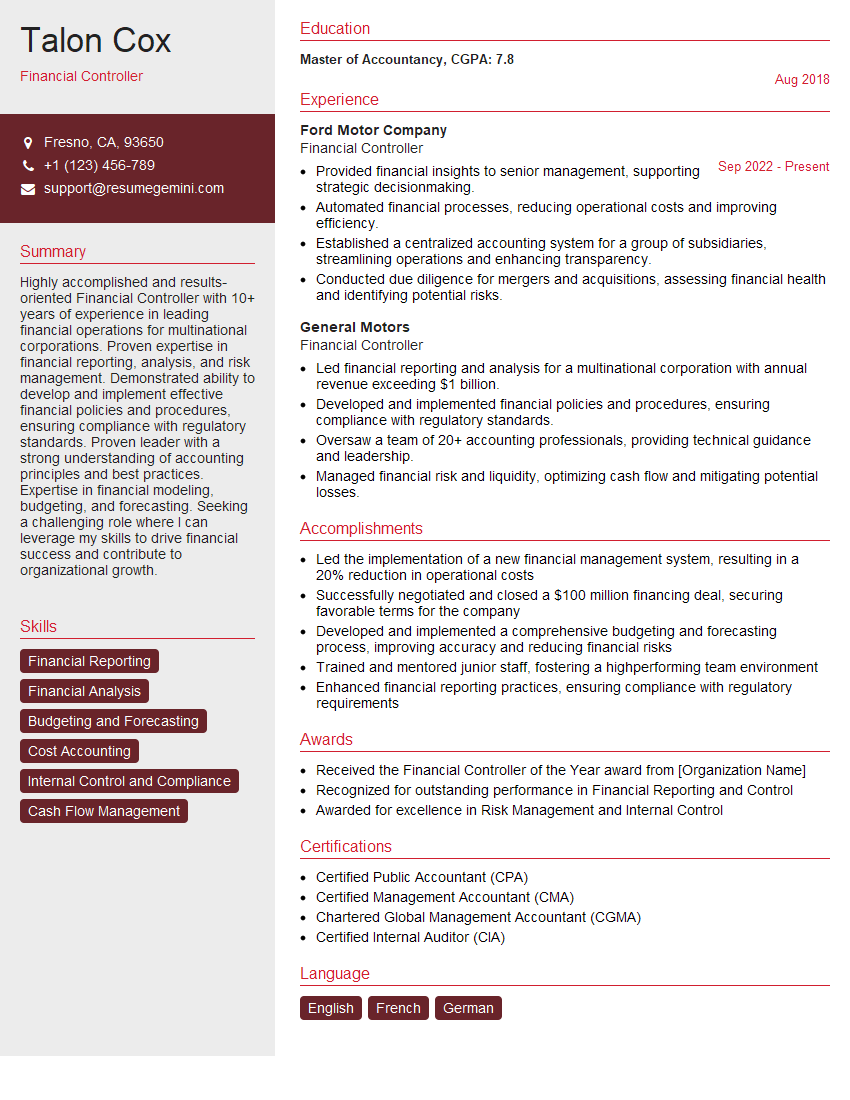

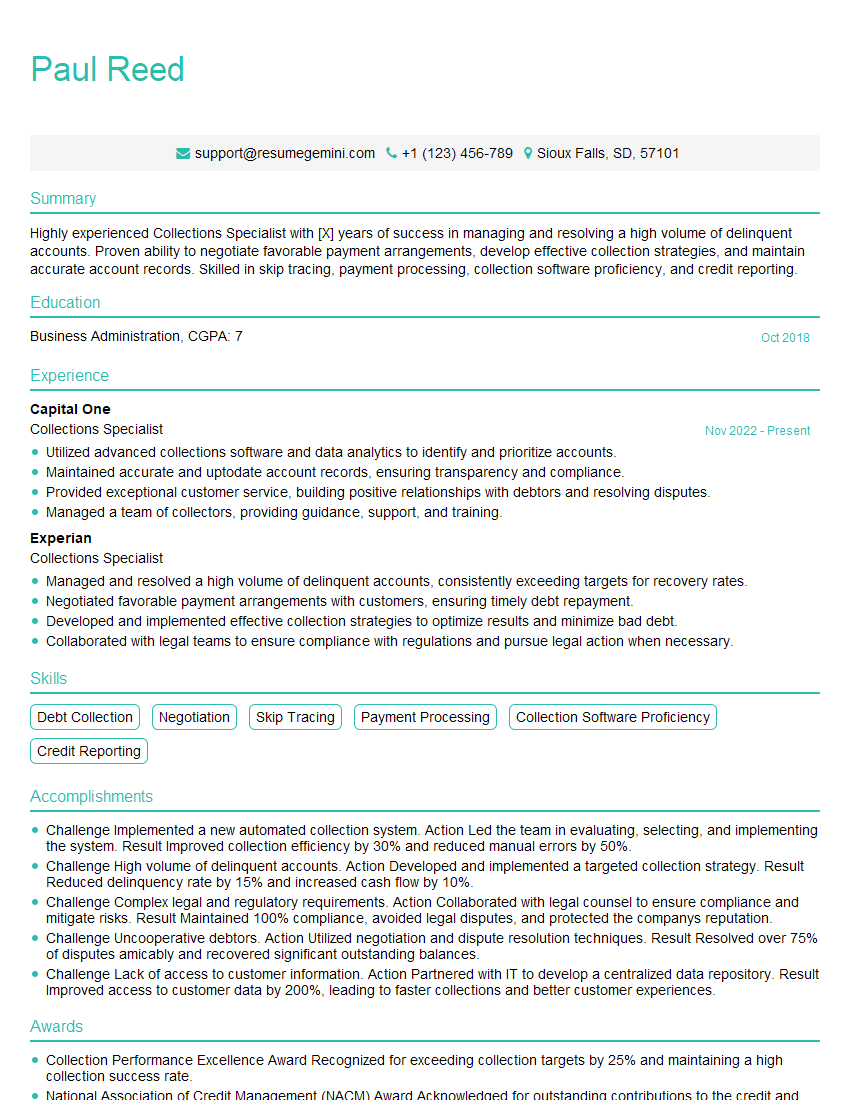

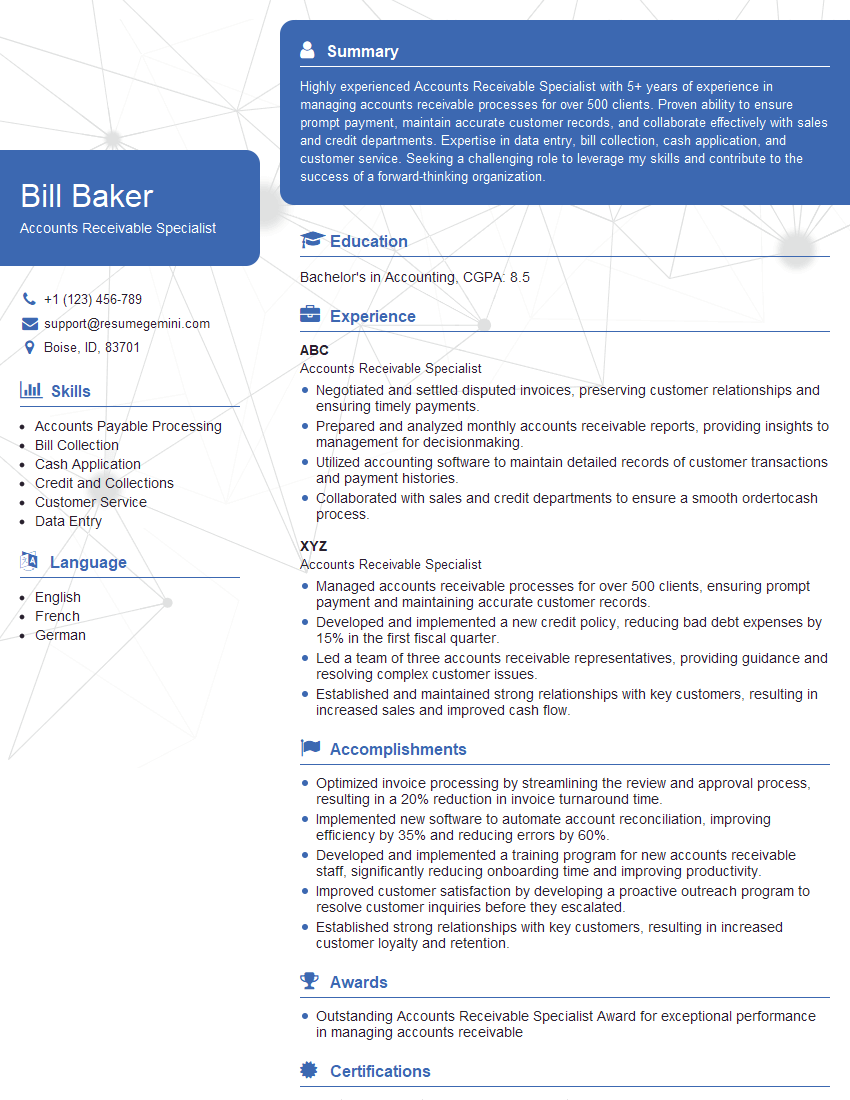

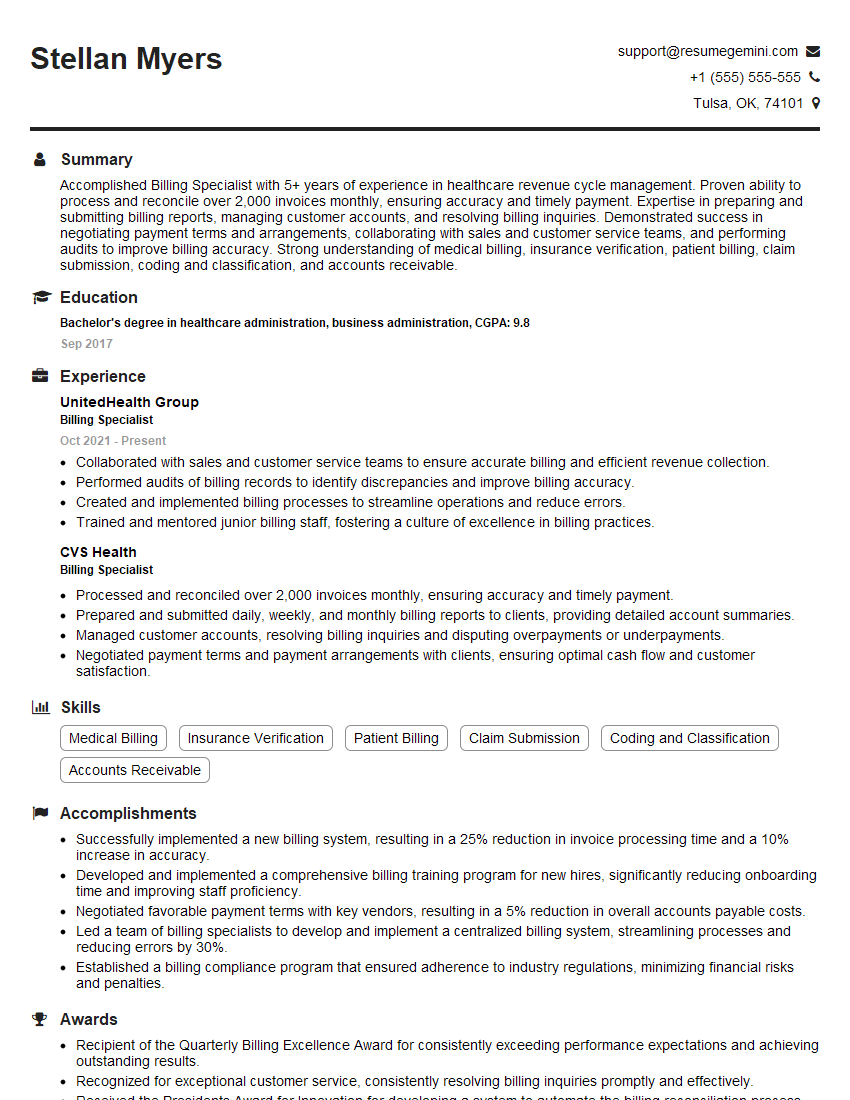

Mastering Handling Payments significantly enhances your career prospects in finance, technology, and e-commerce. A strong understanding of these processes makes you a highly valuable asset to any organization. To increase your chances of landing your dream role, focus on crafting an ATS-friendly resume that highlights your relevant skills and experience. ResumeGemini is a trusted resource to help you build a professional and impactful resume. We provide examples of resumes tailored to Handling Payments to guide you through the process, ensuring your qualifications shine through.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

Hi, I’m Jay, we have a few potential clients that are interested in your services, thought you might be a good fit. I’d love to talk about the details, when do you have time to talk?

Best,

Jay

Founder | CEO