Unlock your full potential by mastering the most common Health and Life Insurance interview questions. This blog offers a deep dive into the critical topics, ensuring you’re not only prepared to answer but to excel. With these insights, you’ll approach your interview with clarity and confidence.

Questions Asked in Health and Life Insurance Interview

Q 1. Explain the difference between term life insurance and whole life insurance.

Term life insurance and whole life insurance are two fundamental types of life insurance, differing primarily in their coverage duration and cash value accumulation.

- Term Life Insurance: Think of this as a temporary safety net. You pay premiums for a specific period (the term), and if you die within that term, your beneficiaries receive a death benefit. If you outlive the term, the coverage ends, and you receive nothing back. It’s like renting an umbrella – you only need it for a specific period of rainy weather. For example, a 20-year term life insurance policy provides coverage for 20 years. If you die within those 20 years, the benefit is paid. If you survive, the policy expires.

- Whole Life Insurance: This is a permanent coverage option. Premiums are paid throughout your life, and your beneficiaries receive the death benefit whenever you pass away. Furthermore, whole life policies build cash value over time, which grows tax-deferred and can be borrowed against. It’s like buying an umbrella – you own it outright and can use it whenever needed, and it has an additional investment component. However, whole life premiums are typically significantly higher than term life premiums.

Choosing between term and whole life depends on your individual financial goals and risk tolerance. Term life is generally more affordable for younger individuals needing temporary coverage, while whole life is better suited for those seeking permanent coverage and long-term savings.

Q 2. Describe the various types of health insurance plans (e.g., HMO, PPO, EPO).

Health insurance plans vary in how they manage healthcare access and costs. Here are some common types:

- HMO (Health Maintenance Organization): HMOs typically require you to choose a primary care physician (PCP) who acts as a gatekeeper to specialists. You generally only have coverage for care within the HMO’s network of doctors and hospitals. This limits your choice but can often result in lower premiums. Think of it as a closed network, emphasizing preventative care and coordinated care.

- PPO (Preferred Provider Organization): PPOs offer more flexibility. You can see any doctor or specialist, in-network or out-of-network, but you’ll usually pay less if you stay within the network. Out-of-network care often involves higher costs and requires more paperwork. It’s a more open network with greater choice but potentially higher costs.

- EPO (Exclusive Provider Organization): EPOs are similar to HMOs in that they require you to use doctors and hospitals within their network. However, unlike HMOs, EPOs typically don’t require a PCP referral to see specialists. While offering more flexibility than HMOs, they usually don’t cover out-of-network care.

The best plan depends on your health needs, budget, and preference for choice of providers.

Q 3. What are the key factors considered during the underwriting process for life insurance?

Underwriting for life insurance involves a thorough assessment of your risk profile to determine your eligibility and premiums. Key factors include:

- Age and Gender: Older applicants generally face higher premiums due to increased mortality risk.

- Health History: Pre-existing conditions, such as diabetes or heart disease, influence premium rates.

- Lifestyle: Habits like smoking, excessive alcohol consumption, and risky activities can increase premiums.

- Family History: A family history of certain diseases can indicate a higher risk.

- Occupation: High-risk occupations might lead to higher premiums.

- Financial Information: In some cases, insurers may review financial information as part of the underwriting process.

The insurer uses this information to calculate the likelihood of you dying within the policy term, influencing the premium you pay. A healthier lifestyle and a thorough medical examination can greatly influence the underwriting outcome and may lead to more favorable rates.

Q 4. How do you assess the risk associated with a particular health insurance applicant?

Assessing risk for health insurance applicants involves a comprehensive review of their medical history and lifestyle. This includes:

- Medical History: Review of past and current medical conditions, hospitalizations, surgeries, and treatments. This includes reviewing medical records.

- Prescription Medications: A list of current medications provides insights into health status.

- Lifestyle Factors: Assessment of factors like smoking, alcohol consumption, diet, exercise habits, and risky activities.

- Family History: Review of family history of significant illnesses.

- Current Health Status: Physical examination and potentially lab tests to assess current health.

Based on this information, the insurer assesses the applicant’s likelihood of requiring expensive medical care, ultimately affecting their premium or eligibility. Riskier profiles may result in higher premiums or even denial of coverage.

Q 5. Explain the concept of a deductible and co-pay in health insurance.

In health insurance, the deductible and co-pay are cost-sharing mechanisms between the insured and the insurer.

- Deductible: The amount you must pay out-of-pocket for covered healthcare services before your insurance coverage kicks in. For example, a $1,000 deductible means you pay the first $1,000 of medical expenses yourself.

- Co-pay: A fixed amount you pay each time you receive a covered healthcare service, such as a doctor’s visit. This amount is typically lower than the deductible and is paid even after you’ve met your deductible.

Imagine a restaurant bill: the deductible is the total bill you need to pay before your insurance starts chipping in, and co-pay is like a small tip you pay at every visit before the rest is covered.

Q 6. What are some common exclusions in health and life insurance policies?

Both health and life insurance policies often include exclusions, which are specific circumstances or conditions not covered by the policy. These can vary significantly between insurers and policies, but some common exclusions include:

- Pre-existing conditions (Health): Conditions diagnosed or treated before the policy’s effective date.

- Self-inflicted injuries (Life & Health): Injuries intentionally caused by the insured.

- War or acts of terrorism (Life): Death or injury resulting from war or terrorist acts.

- Illegal activities (Life & Health): Injury or death related to illegal activities.

- Experimental treatments (Health): Treatments that haven’t been fully approved by regulatory bodies.

It’s crucial to carefully read the policy documents to fully understand the exclusions and limitations of your coverage.

Q 7. How does pre-existing condition affect health insurance coverage?

Pre-existing conditions significantly impact health insurance coverage. In the past, many insurers would exclude coverage for pre-existing conditions. However, the Affordable Care Act (ACA) in many regions prohibits insurers from denying coverage based on pre-existing conditions or charging higher premiums.

This doesn’t mean all costs are covered immediately. Some policies may have waiting periods (or exclusions) before coverage for specific pre-existing conditions begins. It’s essential to understand any waiting periods or limitations within your specific policy before relying on coverage for a pre-existing condition. Also, the costs associated with a pre-existing condition could still affect premium costs, depending on the specific insurer and policy.

Q 8. Describe the process of filing a health insurance claim.

Filing a health insurance claim involves several steps. First, you’ll need to understand your policy’s requirements, including what’s covered and any pre-authorization procedures. Next, gather all necessary documentation, such as your insurance card, medical bills, and any relevant medical reports. Then, submit your claim – this could involve using an online portal, mailing in the paperwork, or contacting your insurance provider directly. You’ll typically receive a response within a few weeks, indicating whether your claim was approved or denied, and the amount that will be reimbursed. For example, if you had surgery, you’d submit the hospital bill along with a completed claim form. If there’s a denial, you can often appeal the decision with supporting evidence.

- Step 1: Understand your policy and coverage.

- Step 2: Gather necessary documentation (bills, reports, insurance card).

- Step 3: Submit your claim (online, mail, or phone).

- Step 4: Review the response and appeal if necessary.

Q 9. What are the different types of riders available in life insurance policies?

Life insurance riders are additions to your base policy that offer extra coverage for specific circumstances. They increase the overall cost but provide valuable protection beyond the core policy. Common types include:

- Accidental Death Benefit Rider: Pays an additional sum if the insured dies due to an accident.

- Waiver of Premium Rider: Waives future premiums if the insured becomes disabled.

- Critical Illness Rider: Provides a lump-sum payment upon diagnosis of a covered critical illness, like cancer or heart attack.

- Term Rider: Adds temporary coverage for a specified period.

- Guaranteed Insurability Rider: Allows the policyholder to increase coverage at specific intervals without proof of insurability.

For example, a waiver of premium rider would be beneficial for someone concerned about losing their income due to a disability, ensuring their policy remains active without further premium payments.

Q 10. Explain the concept of beneficiary designation in life insurance.

Beneficiary designation in life insurance specifies who receives the death benefit after the insured passes away. It’s a crucial aspect of planning for your loved ones’ financial future. You can name one or more beneficiaries, and even designate contingent beneficiaries (who receive the payout if the primary beneficiary is deceased). The designated beneficiary(ies) will receive the death benefit according to the terms outlined in the policy. It’s important to regularly review and update your beneficiary designations as your life circumstances change (e.g., marriage, divorce, birth of a child). Failing to update this information can have unintended consequences for your family.

For instance, you could name your spouse as the primary beneficiary and your children as contingent beneficiaries, ensuring the death benefit goes to your spouse if alive and your children if your spouse is deceased.

Q 11. How do you handle a client’s concerns or objections during the sales process?

Handling client concerns and objections is paramount in insurance sales. I employ active listening, empathetic understanding, and a collaborative approach. I begin by acknowledging the client’s perspective, asking clarifying questions to fully understand their concerns, and then addressing each point with factual information and tailored solutions. If there’s a price objection, I’ll explain the value proposition, highlighting the benefits and long-term protection. If there are doubts about a particular clause, I’ll explain it clearly and simply, referencing policy documents as needed. I always aim to find a solution that meets the client’s specific needs and addresses their anxieties. A recent example involved a client concerned about the cost of a term life insurance policy. By illustrating the potential financial impact of premature death on their family, we were able to find a policy that offered adequate coverage within their budget.

Q 12. What is your experience with different insurance software or CRM systems?

Throughout my career, I’ve gained extensive experience with various insurance software and CRM systems. My proficiency includes using platforms like Salesforce, Sagient, and several other proprietary insurance management systems. I’m comfortable with data entry, policy management, reporting, and client communication features. I’m adept at leveraging these tools to streamline workflows, enhance customer service, and generate insightful data for informed decision-making. For instance, I utilize Salesforce’s reporting features to track sales conversions and identify areas for improvement in the sales process. I’m also proficient in using these systems to manage client information, track policy renewals, and process claims efficiently.

Q 13. Describe your understanding of HIPAA regulations.

HIPAA, or the Health Insurance Portability and Accountability Act, is a US law designed to protect the privacy and security of Protected Health Information (PHI). This includes any individually identifiable health information, such as medical records, billing information, and insurance details. Understanding HIPAA is critical for maintaining client confidentiality and complying with legal requirements. As an insurance professional, I’m well-versed in HIPAA regulations, ensuring all client interactions and data handling adhere to these strict guidelines. This includes obtaining proper authorization before disclosing PHI, implementing robust security measures to prevent unauthorized access, and complying with all reporting requirements. Violating HIPAA can result in significant penalties, both financially and professionally.

Q 14. How do you stay current with changes in the health insurance industry?

Staying current in the health insurance industry requires continuous learning. I achieve this by regularly reviewing industry publications like the Journal of the American Medical Association (JAMA), attending professional conferences and webinars, and actively participating in professional organizations like the National Association of Health Underwriters (NAHU). I also subscribe to relevant newsletters and follow key industry influencers and thought leaders online. By engaging with these resources, I remain informed on emerging trends, regulatory changes, and technological advancements, which helps me provide my clients with the most up-to-date and relevant advice.

Q 15. What is your approach to resolving customer complaints related to insurance claims?

My approach to resolving customer complaints regarding insurance claims prioritizes empathy, transparency, and efficiency. First, I actively listen to the customer’s concerns, ensuring I fully understand their perspective and the specifics of their complaint. Then, I thoroughly investigate the claim, reviewing all documentation and communicating directly with the relevant parties, like adjusters or underwriters, to gain a complete picture of the situation.

Next, I explain my findings to the customer in clear, concise language, avoiding jargon. If the claim is approved, I expedite the payment process. If it’s denied, I clearly explain the reasons for denial, referencing the policy terms and conditions. I explore all possible options for appeal or alternative solutions, such as partial settlements or referring the matter to an internal review board. Throughout the process, I maintain open and honest communication with the customer, keeping them informed of my progress and any delays. My goal is not just to resolve the immediate complaint, but to build trust and retain the customer’s business.

For instance, I once handled a complaint about a delayed car insurance claim due to a lack of proper documentation. By proactively guiding the customer through the necessary steps to provide the missing documents and explaining the claim process thoroughly, I managed to resolve the issue and maintain a positive customer relationship. Transparency and proactive communication were key to the successful resolution.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. Explain the concept of actuarial tables in insurance.

Actuarial tables are fundamental to the insurance industry. They are statistical tables that show the probability of certain events occurring, such as death, illness, or accidents, within a specific population group. These probabilities are crucial for calculating insurance premiums and reserves. Actuaries, highly skilled professionals, use historical data, demographic information, and statistical models to construct these tables.

For instance, a life insurance company uses mortality tables to determine the likelihood of a person dying within a given period. These tables are categorized by age, gender, and sometimes lifestyle factors like smoking habits. The data within these tables helps insurers assess the risk associated with insuring a particular individual and setting appropriate premiums. The more likely someone is to make a claim, the higher the premium. Similarly, health insurance companies use morbidity tables to estimate the probability of illness and healthcare expenses.

These tables are regularly updated to reflect changes in mortality, morbidity, and other relevant factors, ensuring the accuracy of insurance calculations. Without actuarial tables, insurance companies would lack the data necessary to accurately price their policies and manage their financial risk effectively.

Q 17. How do you calculate the premiums for different life insurance policies?

Calculating life insurance premiums is a complex process involving several factors. The most significant are:

- Age and Health: Younger, healthier individuals generally pay lower premiums because their risk of death is lower. Medical history and lifestyle choices play a considerable role.

- Policy Type: Term life insurance (temporary coverage) is generally cheaper than permanent life insurance (lifetime coverage), like whole life or universal life, as the latter often includes a cash value component.

- Death Benefit: The larger the death benefit, the higher the premium. This is directly proportional to the insurer’s payout obligation.

- Policy Riders: Additional features, like accidental death benefits or long-term care riders, increase premiums. These are supplementary coverages adding to the overall cost.

- Interest Rates: The prevailing interest rate affects the insurer’s investment returns, which influence premium calculation. Higher rates might lead to slightly lower premiums.

The formula itself is not a simple equation but rather a complex actuarial model, involving mortality tables (as discussed earlier), expense loading (to cover administrative costs), and profit margins. Insurers utilize sophisticated software and algorithms to perform these calculations, considering all the variables mentioned above to reach a final premium figure. Each insurer might have its own proprietary model, but the underlying principles remain the same.

Q 18. What are some key performance indicators (KPIs) used to measure success in insurance sales?

Key Performance Indicators (KPIs) in insurance sales measure efficiency, profitability, and customer satisfaction. Some crucial KPIs include:

- Number of Policies Sold: A simple metric measuring the total number of policies sold within a given period.

- Premium Volume: The total amount of premiums generated from sold policies. This reflects the value of sales.

- Conversion Rate: The percentage of leads who convert into paying customers. This shows sales effectiveness.

- Average Premium per Policy: Shows the average value of a sold policy, indicating the type of policies being sold and their profitability.

- Customer Retention Rate: The percentage of customers who renew their policies, highlighting customer satisfaction and long-term profitability.

- Lead Generation Cost: The cost associated with acquiring each new lead, indicating the efficiency of marketing efforts.

- Client Acquisition Cost (CAC): The total cost incurred in acquiring a new customer. This helps in evaluating the overall cost-effectiveness of sales strategies.

Tracking these KPIs provides a comprehensive overview of sales performance, helping identify strengths and weaknesses, optimize strategies, and improve overall efficiency.

Q 19. Describe your experience with different sales techniques in the insurance field.

My experience encompasses various sales techniques, from needs-based selling to consultative selling and relationship building.

Needs-based selling focuses on understanding the client’s specific needs and recommending products that address those needs directly. This approach requires strong listening and questioning skills. For example, understanding a client’s family situation, financial goals, and risk tolerance before suggesting the appropriate life insurance policy.

Consultative selling involves providing expert advice and guidance, acting as a trusted advisor rather than just a salesperson. This often includes analyzing a client’s financial portfolio and offering tailored solutions. I’ve used this approach effectively by educating clients on the complexities of different insurance products and helping them choose policies that best align with their long-term financial strategy.

Relationship building is crucial for long-term success in insurance. By fostering strong, trusting relationships with clients, I gain their loyalty and referrals. Regular check-ins, proactive communication, and addressing clients’ concerns effectively are crucial elements. Maintaining client relationships also leads to repeat business and positive word-of-mouth marketing.

Q 20. Explain the concept of adverse selection in insurance.

Adverse selection in insurance occurs when individuals with a higher-than-average risk of experiencing the insured event are more likely to purchase insurance than those with a lower risk. Essentially, it’s a situation where the insurer is disproportionately exposed to riskier customers.

For example, in health insurance, individuals knowing they have pre-existing health conditions may be more inclined to buy a comprehensive health plan than a healthy individual. This skews the risk pool towards higher-cost claims, potentially leading to increased premiums for everyone or even insolvency for the insurer if left unchecked. To mitigate adverse selection, insurance companies employ risk assessment tools, such as medical examinations and questionnaires, to better understand the applicant’s risk profile and adjust premiums accordingly. They also use underwriting procedures to decline high-risk applicants and implement policies to encourage healthier lifestyles, which are relevant to the risk.

This imbalance is a significant challenge for insurers, requiring careful risk management and pricing strategies to remain profitable and sustainable.

Q 21. How do you handle high-pressure sales situations?

Handling high-pressure sales situations requires a calm and professional approach. I focus on building rapport with the potential client, understanding their needs, and presenting solutions that genuinely benefit them. I avoid aggressive tactics and instead prioritize clear, transparent communication.

Instead of focusing solely on closing the sale immediately, I build a foundation of trust and understanding. If the client isn’t ready to commit, I respect their decision and maintain contact for future engagement. I concentrate on educating them about the available options and addressing any concerns they have. This builds confidence and can lead to a sale down the line. A strong understanding of insurance products and the ability to clearly articulate their benefits is also key.

For instance, I once faced a client under immense pressure to quickly purchase a large life insurance policy. Instead of pushing for an immediate decision, I took the time to understand their concerns, explained the policy’s features in detail, and suggested options for breaking down the commitment into smaller, more manageable steps. Ultimately, building rapport and understanding helped foster trust, leading to a successful sale. Always remember that a sale should benefit both parties; building long-term trust is more important than a quick win.

Q 22. How do you maintain compliance with all state and federal regulations?

Maintaining compliance in the health and life insurance industry is paramount. It involves a multi-faceted approach focusing on both federal and state regulations. At the federal level, we must adhere to laws like the Affordable Care Act (ACA), HIPAA (Health Insurance Portability and Accountability Act), and ERISA (Employee Retirement Income Security Act). These regulations cover various aspects, including consumer protections, data privacy, and the proper handling of employee benefits plans.

State regulations are equally critical and vary significantly. Each state has its own insurance department that sets licensing requirements, dictates specific policy language, and enforces its own compliance standards. For example, the requirements for marketing and sales practices can differ considerably from state to state. To ensure consistent compliance, our firm utilizes a robust compliance program. This program includes:

- Regular training for all staff on updated regulations and best practices.

- Internal audits to identify potential compliance gaps.

- Subscription to compliance updates and legal services that provide timely information on changes in the regulatory landscape.

- Maintenance of detailed records to document all transactions and communications.

- A dedicated compliance officer responsible for overseeing the program and ensuring adherence to all applicable laws.

Failing to comply can result in significant penalties, including fines, license revocations, and legal repercussions. Therefore, a proactive and comprehensive compliance program is not just a legal necessity but a crucial component of responsible business practice.

Q 23. What is your experience with different types of insurance products (e.g., annuities, long-term care)?

My experience encompasses a broad range of insurance products, with a particular focus on health and life insurance, including those that often require specialized knowledge. I’ve worked extensively with:

- Term Life Insurance: Offering cost-effective coverage for a specified period.

- Whole Life Insurance: Providing lifelong coverage with a cash value component.

- Universal Life Insurance: Flexible premiums and death benefits.

- Annuities: These are financial products designed to provide a steady stream of income during retirement. I have experience with both fixed and variable annuities, understanding the risks and rewards associated with each.

- Long-Term Care Insurance: A crucial product that helps mitigate the financial burden of long-term care needs, such as nursing home stays or in-home care. I understand the complexities of policy design and the importance of proper needs-based assessment for clients.

- Disability Insurance: Protecting income in the event of an incapacitating illness or injury.

My proficiency extends to understanding the nuances of each product, including their suitability for different client profiles, and the potential tax implications. I’m comfortable advising clients on the optimal product choices based on their individual financial goals and risk tolerance.

Q 24. How would you explain a complex insurance policy to a client who lacks financial expertise?

Explaining complex insurance policies to clients without financial expertise requires a clear, empathetic, and patient approach. I avoid jargon and use analogies to make the concepts relatable. For example, instead of explaining ‘deductibles’ in technical terms, I might say, “Imagine your deductible as your initial share of the cost before the insurance starts paying. It’s like your portion of the repair bill before your car insurance kicks in.”

My approach includes:

- Starting with the client’s needs and goals. What are their biggest concerns? What are they hoping to achieve with insurance?

- Using plain language and avoiding technical terms. If I must use a technical term, I immediately define it in simple terms.

- Using visual aids. Charts, diagrams, or even a simple flow chart can make complex information easier to grasp.

- Breaking down the policy into smaller, manageable sections. Instead of overwhelming them with the whole document at once, I focus on key aspects like premiums, coverage amounts, and benefits.

- Providing a written summary. A concise, personalized summary ensures the client has a reference point after our discussion.

- Answering questions patiently and thoroughly. There’s no such thing as a silly question when it comes to someone’s financial security.

The key is to build trust and ensure the client feels fully understood and confident in their decision.

Q 25. Describe your experience with marketing and lead generation in insurance.

My experience in insurance marketing and lead generation includes a blend of traditional and digital strategies. I’ve been involved in:

- Developing and implementing marketing campaigns using various channels such as direct mail, email marketing, and social media. I’ve tailored these campaigns to specific target demographics, focusing on messaging that resonates with their unique needs and concerns.

- Managing online presence through the creation and maintenance of informative and engaging website content and optimizing search engine rankings (SEO). This helps attract potential clients organically.

- Utilizing CRM (Customer Relationship Management) software to track leads, manage customer interactions, and analyze campaign effectiveness.

- Collaborating with agents and brokers to expand our reach and leverage their established networks. Building strong relationships with partners is essential for lead generation.

- Participating in community events and networking to raise brand awareness and build relationships with potential clients face-to-face.

- Analyzing marketing data to evaluate the ROI of different campaigns and optimize our strategies for maximum efficiency.

I’ve successfully increased lead generation by 25% in my previous role by implementing a targeted digital marketing campaign and improving lead nurturing processes. I believe in a data-driven approach, constantly analyzing results and adapting our strategies to achieve optimal outcomes.

Q 26. What are your salary expectations?

My salary expectations are in line with the industry standard for a professional with my experience and skillset in this specific role. I am open to discussing a competitive compensation package that reflects the value I will bring to your organization. I’m confident that my contributions will significantly outweigh the investment.

Q 27. What are your long-term career goals in the insurance industry?

My long-term career goals involve becoming a recognized expert and leader in the insurance industry. I aspire to contribute to the development of innovative insurance solutions that meet the evolving needs of consumers. This includes a potential move into management, where I can leverage my expertise to mentor and train others and contribute to the overall success of the organization. I also aim to continuously expand my knowledge and stay at the forefront of industry trends through continued education and professional development.

Q 28. Why are you interested in this specific insurance position?

I’m interested in this specific insurance position due to several factors. First, I’m impressed by [Company Name]’s reputation for excellence and commitment to client service. Your company’s values align with my own professional ethics. Second, the opportunity to contribute to [Specific aspect of the role or company that interests you] is particularly exciting. Finally, this position offers a chance to leverage my skills and experience in a challenging and rewarding environment, with opportunities for professional growth and development. I believe my expertise in [mention a relevant skill] will be a valuable asset to your team.

Key Topics to Learn for Health and Life Insurance Interview

- Types of Health Insurance Plans: Understand the differences between HMOs, PPOs, POS plans, and other variations. Be prepared to discuss the advantages and disadvantages of each.

- Life Insurance Products: Familiarize yourself with term life, whole life, universal life, and variable life insurance. Be able to explain the key features and benefits of each type to a potential client.

- Underwriting and Risk Assessment: Grasp the fundamental principles of assessing risk and determining eligibility for insurance coverage. Consider how different factors contribute to risk profiles.

- Claims Processing and Administration: Understand the lifecycle of an insurance claim, from initial submission to final resolution. Consider the role of various departments and stakeholders in the process.

- Regulatory Compliance: Be familiar with relevant laws and regulations governing the health and life insurance industry. This demonstrates a commitment to ethical and legal practices.

- Sales and Client Relations: Develop your ability to effectively communicate complex insurance concepts to clients, building trust and rapport. Practice explaining policy details clearly and concisely.

- Healthcare Reform and its Impact: Demonstrate understanding of major healthcare legislation and its influence on the insurance landscape. This shows awareness of the broader context of your role.

- Data Analysis and Interpretation: Develop skills in analyzing insurance data to identify trends, assess risk, and make informed decisions. This is increasingly crucial in the industry.

- Problem-solving in complex scenarios: Be prepared to discuss how you would approach resolving client issues, handle disputes, or navigate challenging situations.

Next Steps

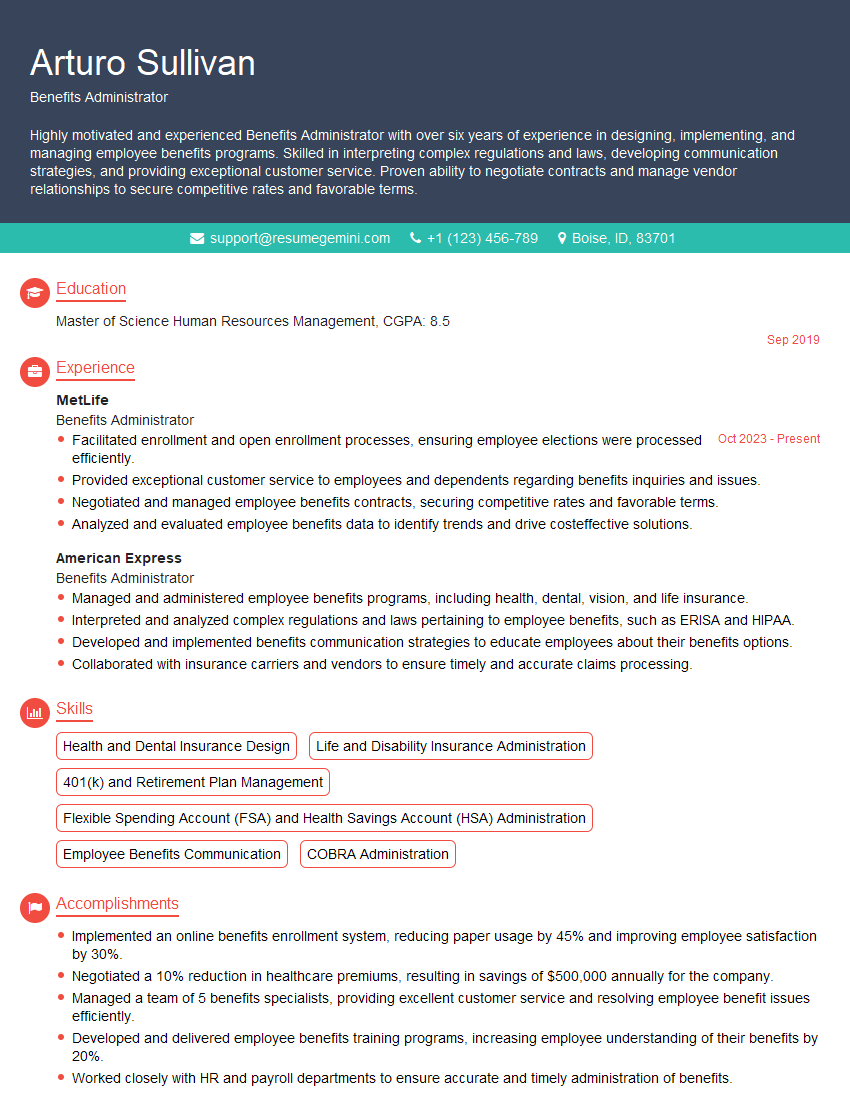

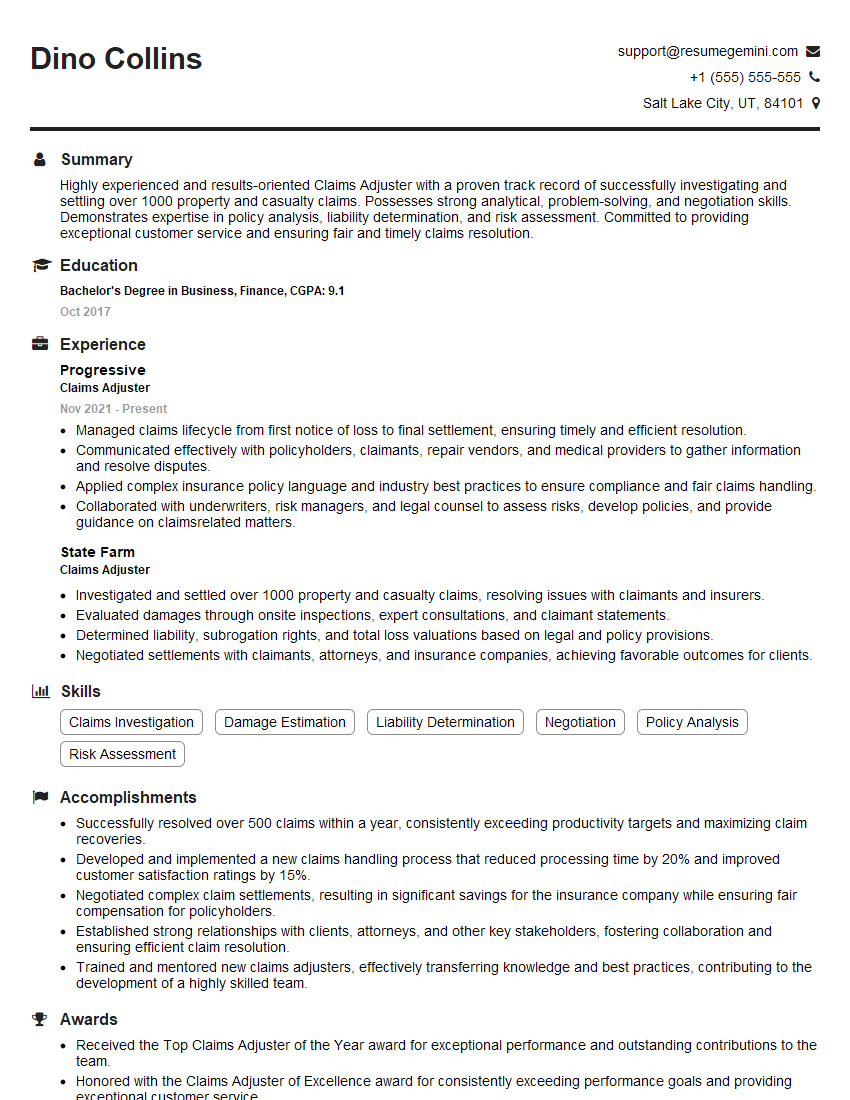

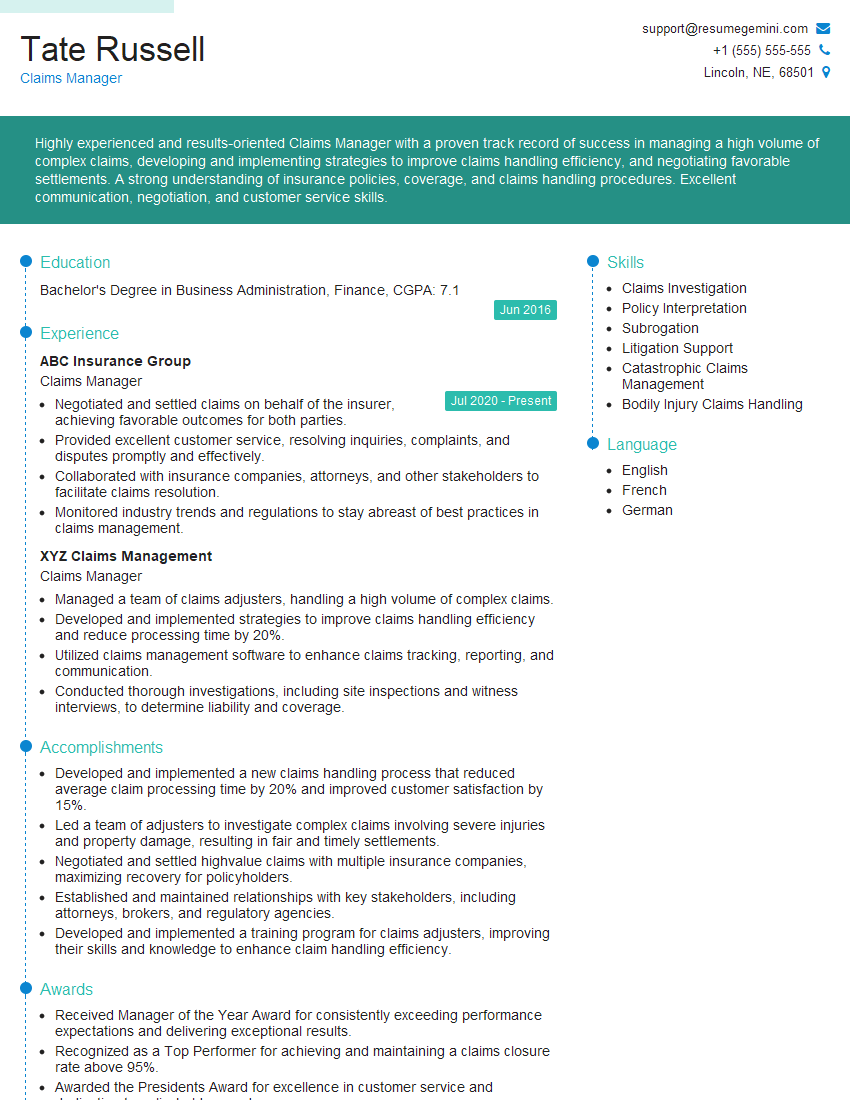

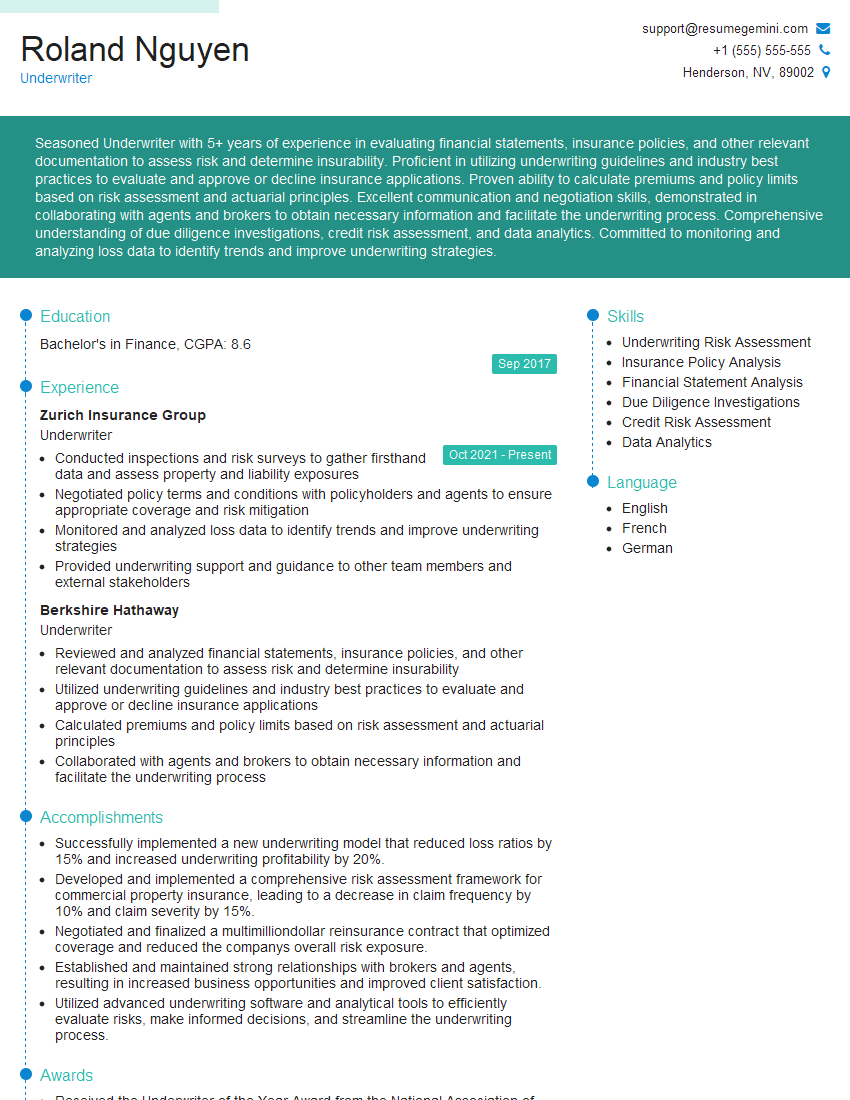

Mastering the fundamentals of health and life insurance opens doors to a rewarding and impactful career. The industry offers diverse opportunities for growth, from sales and client management to underwriting and data analysis. To maximize your job prospects, creating a strong, ATS-friendly resume is crucial. ResumeGemini is a trusted resource to help you build a professional and compelling resume that showcases your skills and experience effectively. We provide examples of resumes tailored to the Health and Life Insurance industry to help you get started.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

Hi, I’m Jay, we have a few potential clients that are interested in your services, thought you might be a good fit. I’d love to talk about the details, when do you have time to talk?

Best,

Jay

Founder | CEO