Interviews are opportunities to demonstrate your expertise, and this guide is here to help you shine. Explore the essential Insurance Claim Management interview questions that employers frequently ask, paired with strategies for crafting responses that set you apart from the competition.

Questions Asked in Insurance Claim Management Interview

Q 1. Explain the claims process from initial report to final settlement.

The insurance claims process is a systematic approach to handling claims from the initial report to the final settlement. Think of it like a well-orchestrated play with several key acts.

- Claim Reporting: This is the first act, where the insured reports the incident to the insurance company. This is typically done via phone, online portal, or mobile app. The initial information gathered is crucial for the next steps.

- Claim Intake and Assignment: The claim is logged into the system, categorized, and assigned to a claims adjuster. This is where the claim is triaged – assessing its complexity and urgency.

- Investigation and Verification: The adjuster investigates the claim. This might involve reviewing the policy, gathering evidence (police reports, photos, witness statements), conducting interviews, and potentially visiting the scene. For example, in a car accident claim, this might involve inspecting vehicle damage and verifying driver information.

- Valuation and Negotiation: Once the investigation is complete, the adjuster evaluates the extent of the loss and determines the amount to be paid. This often involves negotiation with the claimant, especially in cases of disputed damages or liability.

- Settlement and Payment: If the claim is approved, the settlement amount is agreed upon, and payment is released. The claimant may receive a check, direct deposit, or other forms of payment. The claim is then closed in the system.

- Claim Closure and Review: After the settlement, the claim is reviewed to identify areas for improvement in the future. The process is monitored to meet regulatory standards and ensure efficiency.

For example, in a homeowner’s insurance claim for water damage, the process would involve assessing the extent of the damage, obtaining quotes from contractors, and negotiating the repair costs with the insured.

Q 2. Describe your experience handling high-value claims.

I have extensive experience handling high-value claims, often involving complex liability issues, significant property damage, or substantial bodily injury. These claims require a meticulous and comprehensive approach.

For instance, I successfully managed a claim involving a multi-million dollar liability lawsuit stemming from a construction accident. This involved coordinating with legal counsel, expert witnesses, and various stakeholders. Careful documentation, thorough investigation, and strategic negotiation were crucial in achieving a favorable outcome within the limits of the policy.

In another case, a high-value property claim due to a fire required detailed assessment of the property’s value, contents, and potential business interruption losses. Negotiating with contractors, appraisers, and the insured required strong communication skills and a clear understanding of the policy’s coverage to ensure a fair and efficient settlement.

My key approach to managing such claims involves: a structured investigation methodology, expert consultation where needed, effective communication with all parties, and a proactive risk management perspective.

Q 3. How do you prioritize competing claims and manage your workload?

Prioritizing claims and managing workload effectively is crucial. I utilize a combination of techniques, including:

- Triaging based on urgency and complexity: Claims involving immediate needs (e.g., medical emergencies) or high potential liability take precedence. Complexity, the amount of evidence required, and the potential cost of delay all factor into prioritization.

- Using a claims management system (CMS): A robust CMS allows for efficient tracking, task management, and workflow automation. Features like automated reminders and reporting tools help manage deadlines and resource allocation.

- Prioritization matrices: I often use matrices that weigh urgency and complexity to create a clear order of tasks. This provides a visual representation for efficient task management.

- Regular review and adjustments: Workload is dynamically adjusted based on incoming claims and changing priorities. This ensures flexibility and responsiveness to evolving situations.

For example, a catastrophic event like a hurricane would necessitate re-prioritizing all claims, focusing initially on life-saving and immediate needs before addressing property damage.

Q 4. What methods do you use to investigate and verify claim validity?

Investigating and verifying claim validity is paramount. My approach is multi-faceted:

- Reviewing policy documentation: This ensures coverage is valid and the claim falls within the policy’s terms and conditions.

- Gathering evidence: This involves collecting supporting documents like police reports, medical records, photographs, and witness statements. The quality and quantity of evidence are critical.

- Conducting interviews: Talking to the claimant, witnesses, and potentially other involved parties to gather firsthand information.

- Using technology: Tools like drone imagery, advanced mapping software, and digital forensic analysis can aid in investigating complex claims, offering objective and detailed evidence.

- Independent verification: Engaging external experts (e.g., engineers, appraisers, doctors) to provide unbiased assessments. This adds credibility and objectivity to the claims process.

For example, in a car accident claim, I’d verify driver’s license information, police reports, and vehicle damage assessments to determine liability and loss amount. In a fraud investigation, I might use data analytics to identify patterns or inconsistencies to support suspicion of fraudulent activity.

Q 5. How do you handle difficult or irate claimants?

Handling difficult or irate claimants requires empathy, patience, and strong communication skills. My approach involves:

- Active listening: Allowing claimants to express their concerns without interruption. Showing empathy helps de-escalate the situation.

- Clear and concise communication: Explaining the claims process clearly, providing regular updates, and maintaining professional communication are crucial.

- Emphasizing the next steps: Providing a concrete plan outlining the steps required to resolve the claim assures the claimant that their concerns are being addressed.

- Offering alternative communication methods: Providing options such as email or written correspondence for claimants who prefer to communicate in writing.

- Escalation procedures: Knowing when and how to escalate the claim to a supervisor or a specialized team is vital in managing highly escalated situations.

For example, I’ve successfully handled situations by acknowledging the claimant’s frustration, validating their concerns, and offering a clear timeline for resolution. This often diffuses tension and fosters a more collaborative approach to resolving the claim.

Q 6. Explain your experience with different types of insurance claims (auto, property, liability, etc.).

My experience spans a broad range of insurance claims, including:

- Auto Claims: Handling claims involving property damage, bodily injury, and uninsured/underinsured motorist coverage. This includes investigating accident scenes, assessing vehicle damage, and managing liability determinations.

- Property Claims: Managing claims related to residential and commercial property damage, including fire, water, wind, and theft. This involves assessing damage, coordinating repairs, and managing contractor relationships.

- Liability Claims: Investigating claims involving third-party liability, including premises liability, product liability, and professional liability. This demands a thorough understanding of legal principles and risk management strategies.

- Workers’ Compensation Claims: Handling claims involving employee injuries or illnesses that occurred at work. This requires familiarity with state-specific regulations, medical evaluations, and benefit determination processes.

My expertise allows me to effectively assess and manage the unique aspects of each claim type, ensuring fair and efficient claim resolution.

Q 7. What is your experience with claim reserving and forecasting?

Claim reserving and forecasting are crucial for financial stability in insurance. Claim reserving involves estimating the ultimate cost of outstanding claims, while forecasting involves projecting future claim payments. My experience includes:

- Utilizing various reserving methods: I’m proficient in using different reserving techniques, including chain-ladder, Bornhuetter-Ferguson, and Cape Cod methods, selecting the most appropriate method based on the available data and claim characteristics.

- Analyzing claim development patterns: I can identify trends and patterns in claim development to accurately predict future claim costs. This involves analyzing historical claim data, adjusting for inflation, and considering any external factors (e.g., changes in litigation environment).

- Developing predictive models: I can build and use statistical models to predict future claim costs, considering factors like claim severity, frequency, and inflation. This provides a more robust estimate compared to traditional methods.

- Communicating reserving and forecasting results: I clearly communicate the results of my analyses to stakeholders, including senior management, actuaries, and regulators.

Accurate claim reserving and forecasting are essential for setting appropriate premiums, managing capital adequacy, and ensuring the long-term financial health of an insurance company. My experience in this area allows for proactive financial management and risk mitigation.

Q 8. How familiar are you with insurance regulations and compliance?

Insurance regulations and compliance are paramount in my work. I’m intimately familiar with federal and state laws governing insurance practices, including those related to claim handling, data privacy (like HIPAA and GDPR), and anti-fraud measures. My understanding extends to specific regulations such as those concerning fair claim practices, timely payments, and the appropriate handling of sensitive customer information. I regularly stay updated on changes and new legislation through professional development courses, industry publications, and regulatory agency websites. For example, I’ve actively followed the evolving landscape of data privacy regulations and implemented procedures to ensure our compliance with all applicable laws. This includes secure data storage, access control measures, and employee training programs designed to prevent breaches and ensure compliance.

Q 9. Describe your experience using claims management software.

I have extensive experience using various claims management software platforms, including Guidewire ClaimCenter, Sapiens ClaimCenter, and internally developed systems. My proficiency extends beyond basic data entry and retrieval; I’m adept at leveraging these systems for workflow automation, report generation, and performance analysis. For example, in my previous role, I used Guidewire ClaimCenter to streamline the entire claims process from initial intake to final settlement. This included automating tasks such as assigning claims to adjusters, tracking deadlines, generating reports on key metrics like claim cycle time and average settlement amounts, and generating customized reports to identify trends and improve efficiency. I’m also comfortable adapting to new software and quickly learning new systems, which is essential in this ever-evolving field.

Q 10. How do you identify and investigate potential fraud?

Identifying and investigating potential fraud requires a multi-faceted approach. It starts with a thorough review of the initial claim documentation, looking for inconsistencies, inconsistencies between statements and supporting documentation or unusual patterns. I utilize fraud detection software, which analyzes data for anomalies and red flags, such as claims submitted around the same time or same doctor. For example, I once identified a pattern of suspiciously similar claims from different individuals in the same geographical area suggesting organized fraud. My investigation involved coordinating with law enforcement and other insurance companies to uncover the fraud ring. This included verifying addresses, interviewing witnesses, and gathering additional evidence, eventually resulting in significant cost savings for the company and bringing the perpetrators to justice. Beyond software, I also rely on my experience and intuition to identify suspicious activities. A keen eye for detail and understanding of common fraud schemes are crucial.

Q 11. What is your approach to negotiating settlements?

My approach to negotiating settlements is collaborative but firm. I begin by thoroughly investigating the claim, gathering all necessary evidence, and assessing the liability. I focus on building a rapport with the claimant or their representative while clearly outlining the insurance policy’s terms and conditions and the evidence supporting my company’s position. Negotiations usually involve a give-and-take approach, where I explore mutually beneficial solutions that consider the claimant’s needs and my company’s financial interests. For example, I might suggest a structured settlement or a combination of payments instead of a lump sum payment, and I document every step of the process. The goal is to reach a fair and equitable settlement that avoids lengthy litigation whenever possible.

Q 12. How do you document claims effectively and maintain accurate records?

Effective documentation is the cornerstone of successful claims management. I ensure all claims are meticulously documented, using a standardized system with easily retrievable information. This includes initial claim details, investigation notes, correspondence with claimants, medical records, expert reports, and settlement agreements. I use secure, version-controlled electronic systems to ensure data integrity and accessibility. I’m mindful of data privacy regulations and ensure sensitive information is handled confidentially and securely. Using a consistent and easily searchable system prevents confusion and speeds up the claims process. Clear and comprehensive documentation also serves as a critical defense in the event of a dispute or litigation.

Q 13. How do you handle claims with insufficient documentation?

Claims with insufficient documentation require a thorough and systematic approach. First, I try to obtain the missing information by contacting the claimant directly and requesting any additional documentation. If that fails, I might investigate alternative ways to obtain evidence, such as contacting medical providers or witnesses. I will document all attempts and results meticulously. In some cases, I may need to consult with legal counsel to assess the legal options available to us. If the lack of documentation prevents a fair and accurate evaluation of the claim, it may be necessary to deny the claim, but this decision is always made after exhausting all reasonable efforts to obtain sufficient information. The key is to document every step taken, justifying each decision along the way. This thorough documentation protects both the claimant’s rights and the insurance company’s interests.

Q 14. Explain your experience with subrogation and recovery efforts.

Subrogation and recovery efforts are crucial for cost control in insurance. Subrogation is the process of recovering losses from a third party responsible for causing the insured’s loss. My experience involves investigating accidents to identify potentially liable parties, such as negligent drivers or manufacturers of defective products. I then initiate legal action or negotiate settlements to recover our expenses. For example, I successfully recovered $50,000 in a case where our insured’s vehicle was damaged by a negligent driver. This involved extensive investigation, negotiation, and ultimately, litigation, showing I am well-versed in managing the entire subrogation process from start to finish. The skills involve not only legal knowledge but also strong negotiation and communication skills. I am proficient in managing external legal counsel and coordinating with other insurance companies involved in multi-party claims.

Q 15. What is your understanding of indemnity and its application in claims?

Indemnity, at its core, is the principle of restoring an insured party to their financial position before a loss occurred. It prevents them from profiting from an insurance claim. In claims, this means we aim to compensate for actual losses, not to enrich the claimant. For example, if someone’s car is totaled in an accident, indemnity means we’ll pay the actual cash value of the car before the accident, minus any deductible, not a penny more. We might consider depreciation, market value, and repair costs to arrive at a fair settlement. We don’t consider sentimental value or potential future earnings. This principle is crucial to maintaining the fairness and solvency of the insurance system.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. How do you handle complex or multi-party claims?

Complex or multi-party claims, like those involving multiple vehicles in an accident or a construction defect impacting many homeowners, demand a structured approach. My process starts with thorough documentation—gathering police reports, witness statements, photos, and expert assessments. I then create a clear timeline of events, identifying all involved parties and their respective claims. Using a dedicated claims management software helps me keep track of all documents, communication, and deadlines. This software provides a centralized view of the whole claim making it easy to communicate with everyone, coordinate investigations, and maintain transparency. Next, I determine liability, possibly engaging external experts such as engineers or lawyers if necessary. Ultimately, a well-defined communication strategy is key to fostering cooperation and facilitating a fair and timely resolution for all involved parties. Imagine a scenario where several cars are involved in a chain-reaction accident. My approach is to treat each party fairly and separately, while considering the interconnected nature of the events and how to fairly distribute liability.

Q 17. Describe your experience with catastrophe claims.

My experience with catastrophe claims—like hurricanes, wildfires, or earthquakes—involves a shift in scale and urgency. These events often lead to a high volume of claims, overwhelming resources. I’ve been involved in establishing temporary claims processing centers, coordinating with emergency services, and implementing streamlined processes to handle the influx of claims quickly and efficiently. Prioritization is key: focusing on the most urgent needs (e.g., temporary housing, medical care) first while ensuring equitable handling for all impacted individuals. Strong communication with claimants during such stressful times is paramount, providing regular updates and maintaining empathy. I’ve used advanced technologies like remote claims adjustment and drone imagery to speed up the assessment of damages. During a major hurricane, for instance, I helped deploy a team of adjusters to expedite the damage assessments of properties affected by flooding. We used both in-person and remote methods, utilizing drones to assess roofs to ensure safety and to minimize delays.

Q 18. What is your understanding of the different types of insurance policies?

Insurance policies are diverse, but broadly fall into several categories: Property insurance (covering homes, buildings, and contents), Auto insurance (covering vehicles and liability for accidents), Liability insurance (protecting against lawsuits), Health insurance (covering medical expenses), Life insurance (providing a death benefit), and Business insurance (covering various business risks). Each policy type has specific coverage limits, exclusions, and conditions. Within each category, there’s further variation. For example, property insurance could include homeowner’s, renter’s, or landlord insurance, each with unique features. Understanding the nuances of each policy is crucial for accurate claim assessment. This includes understanding the policy wording, especially terms such as deductibles, co-insurance, and subrogation.

Q 19. How do you communicate effectively with claimants, adjusters, and other stakeholders?

Effective communication is the cornerstone of successful claims management. With claimants, I maintain empathy, providing clear explanations of the process, promptly addressing concerns, and keeping them informed at every stage. With adjusters, I foster collaboration, sharing information openly and seeking consensus on claim assessments. With other stakeholders (e.g., legal teams, experts), I ensure clear and concise communication, avoiding misunderstandings. This includes using multiple channels – phone, email, and secure messaging platforms – to cater to individual preferences and update information efficiently. For instance, when dealing with a claimant who has suffered a significant loss, I ensure that the communication is clear and compassionate while maintaining professional courtesy.

Q 20. What are some common challenges in claims management and how have you overcome them?

Common challenges include fraudulent claims, inaccurate documentation, and delays caused by obtaining necessary information. To combat fraud, I utilize advanced data analytics to identify suspicious patterns and conduct thorough investigations. Addressing inaccurate documentation often involves clarifying information with the claimant or other parties, and possibly obtaining independent verification. To tackle delays, I proactively follow up on outstanding information, and when appropriate, I leverage technology such as digital document management and streamlined communication channels to maintain efficient workflows. In one instance, I identified a pattern of potentially fraudulent claims involving staged car accidents by analyzing claim data and discovering unusual similarities across multiple incidents. This led to an internal investigation that prevented significant financial losses.

Q 21. Describe your experience with claims audits and quality control.

Claims audits and quality control are essential for maintaining accuracy, efficiency, and compliance. I’ve participated in both internal and external audits, ensuring adherence to company policies, regulatory requirements, and best practices. This involves reviewing claim files for completeness, accuracy, and compliance with indemnity principles. It also includes analyzing key performance indicators (KPIs) such as claim cycle times, settlement ratios, and customer satisfaction scores. Based on audit findings, I contribute to developing corrective actions to improve processes and enhance the overall quality of claims handling. For example, I’ve used data analysis to discover that claims taking longer than 30 days were not receiving timely responses from the adjusters. Using this insight we created a system of automated alerts that ensured quick turnaround times going forward.

Q 22. How familiar are you with different claim adjustment methods (e.g., first-party, third-party)?

Claim adjustment methods are categorized primarily into first-party and third-party claims. First-party claims involve a claim made by an insured individual against their own insurance company. For example, if someone has homeowner’s insurance and their house is damaged in a fire, they would file a first-party claim. The process typically involves assessing the damage, determining the extent of coverage, and paying out the claim amount according to the policy terms. Third-party claims, on the other hand, involve a claim made by an injured party (the claimant) against the insurance policy of a negligent party (the insured). A common example is a car accident where one driver is at fault. The injured driver would file a third-party claim against the at-fault driver’s insurance company. These claims often involve more complex investigations, liability determinations, and potential legal proceedings. Both types require meticulous documentation, thorough investigations, and adherence to legal and regulatory frameworks.

Beyond these main categories, we also have other variations, including subrogation (where the insurer recovers losses from a third party responsible for the claim) and reinsurance claims (claims filed by one insurance company against another).

Q 23. What is your experience with bodily injury claims?

My experience with bodily injury claims is extensive. I’ve handled hundreds of cases ranging from minor soft-tissue injuries to catastrophic injuries resulting in permanent disability. This involved working closely with medical professionals to assess the extent and severity of injuries, obtaining medical records, and engaging with rehabilitation specialists. Determining the appropriate compensation required careful evaluation of medical reports, wage loss documentation, and future care needs. It also involved negotiating settlements, sometimes litigating when settlements couldn’t be reached. I have a strong understanding of medical terminology, injury causation, and the legal aspects involved in evaluating pain and suffering, lost wages, and future medical expenses. I’m proficient in managing the complexities of these claims, ensuring compliance with state regulations and best practices.

One particular case involved a client who suffered a severe back injury in a car accident. It required coordination with multiple specialists, including neurologists, orthopedists, and physical therapists. I meticulously documented all medical treatments and progress, negotiated with the opposing insurance company, and ultimately secured a fair settlement that covered the client’s past and future medical expenses, lost wages, and pain and suffering.

Q 24. How do you manage your time effectively when working on multiple claims simultaneously?

Managing multiple claims concurrently requires a strategic approach to time management. My system combines prioritization techniques with advanced technology. I begin by prioritizing claims based on urgency and potential complexity. Cases requiring immediate attention, like those involving severe injuries or significant financial exposure, take precedence. I use a project management system (like Trello or Asana) to meticulously track tasks, deadlines, and communications for each claim. This allows me to maintain a clear overview and avoid missing critical steps. Regular time blocking helps allocate specific time slots for various tasks – reviewing medical records, contacting claimants, negotiating settlements, etc.

Furthermore, I utilize technology to automate repetitive tasks, such as sending out claim status updates or generating reports. Regular review and adjustment of the schedule is crucial to ensure efficiency and prevent being overwhelmed. It’s essential to remember that maintaining a healthy work-life balance prevents burnout and enhances long-term productivity.

Q 25. Describe your experience with liability assessments.

Liability assessments are crucial in determining fault in third-party claims. My experience involves examining accident reports, police reports, witness statements, and expert opinions to determine the degree of negligence on the part of each party involved. I understand the legal principles of negligence, comparative negligence, and proximate cause. The process may include analyzing photographic evidence, reviewing surveillance footage, and even consulting with accident reconstruction experts in complex cases. The goal is to establish clear liability in order to determine who is responsible for the damages and to what extent.

For instance, in a car accident, I would evaluate the speed of each vehicle, the road conditions, and the actions of each driver to determine which driver was at fault. This assessment would include evaluating whether any traffic violations occurred and whether those violations contributed to the accident. This would then inform the negotiation and settlement of the claim.

Q 26. What is your approach to managing and mitigating risk in claims handling?

Managing and mitigating risk in claims handling is paramount. My approach is multifaceted, focusing on prevention, early detection, and proactive response. Prevention involves thorough policy reviews, clear communication with insureds, and comprehensive training programs to avoid claims resulting from preventable events. Early detection relies on efficient claim reporting procedures, quick investigations, and proactive communication with all stakeholders. Proactive response involves using data analytics to identify trends and patterns in claims, allowing for early intervention and preventative measures. This may include adjusting policy terms, strengthening risk assessments, or improving safety procedures. Furthermore, thorough documentation and compliance with regulations are critical for minimizing legal exposure.

For instance, identifying a pattern of water damage claims in a specific region might prompt an initiative to proactively reach out to insured parties with home inspections or discounted preventative maintenance options. This proactive approach helps reduce future claims and limits risk exposure. Thorough investigation also reduces fraudulent claims.

Q 27. How do you stay current with changes in insurance regulations and best practices?

Staying current in the ever-evolving landscape of insurance regulations and best practices is a continuous process. I accomplish this by attending industry conferences and webinars, participating in professional development courses, and actively engaging with professional organizations like the National Association of Insurance Commissioners (NAIC). I subscribe to relevant industry publications and newsletters to stay informed about legislative changes, emerging trends, and best practices. Furthermore, I maintain a network of professional contacts within the insurance industry, fostering ongoing dialogue and knowledge exchange. I regularly review and update my knowledge of relevant state and federal laws to ensure compliance. Continuous learning is crucial in this dynamic field.

Q 28. Describe a time you had to make a difficult decision in a claim situation and explain your reasoning.

In one case, I had to decide whether to settle a claim significantly below the policy limits despite having a strong case. The claimant was elderly and had a complex medical history. While our investigation showed clear liability on the part of our insured, the claimant’s health raised concerns about their life expectancy and the potential for significantly higher future medical costs. A lengthy trial with uncertainty regarding future medical expenses could have resulted in far greater costs for the insurance company even if we ultimately won. Settling the claim for a lower amount, while still providing fair compensation to the claimant, minimized long-term financial risk and provided certainty to all involved parties. This involved careful evaluation of both the legal aspects and the human considerations of the situation and prioritized responsible risk management for our insured and the company.

Key Topics to Learn for Insurance Claim Management Interview

- Claim Intake and Assessment: Understanding the initial steps of receiving a claim, verifying coverage, and assessing the validity of the claim. Practical application: Discuss your experience in efficiently processing high volumes of claims while maintaining accuracy.

- Investigation and Documentation: Gathering evidence, conducting interviews, and meticulously documenting all aspects of the claim investigation. Practical application: Describe your approach to thorough investigation and your ability to handle complex or ambiguous situations.

- Liability Determination: Analyzing the facts to determine responsibility for the loss and the extent of coverage. Practical application: Explain your process for evaluating liability in different claim scenarios, including those with multiple parties involved.

- Claims Negotiation and Settlement: Effectively negotiating settlements with claimants and other involved parties. Practical application: Showcase your negotiation skills and ability to reach fair and reasonable resolutions.

- Claims Reserving and Forecasting: Accurately estimating the potential cost of claims and managing reserves. Practical application: Explain your understanding of reserving methodologies and how you use this information in decision-making.

- Fraud Detection and Prevention: Identifying and mitigating fraudulent claims. Practical application: Describe strategies you would employ to detect and prevent fraudulent activity.

- Regulatory Compliance: Understanding and adhering to relevant insurance regulations and compliance requirements. Practical application: Explain how you ensure compliance within your work process.

- Claims Technology and Systems: Familiarity with claims management software and databases. Practical application: Describe your experience using various claim management systems and your ability to adapt to new technologies.

- Communication and Customer Service: Effectively communicating with claimants, agents, and other stakeholders. Practical application: Share examples of how you’ve handled difficult conversations or maintained positive relationships with clients during challenging situations.

Next Steps

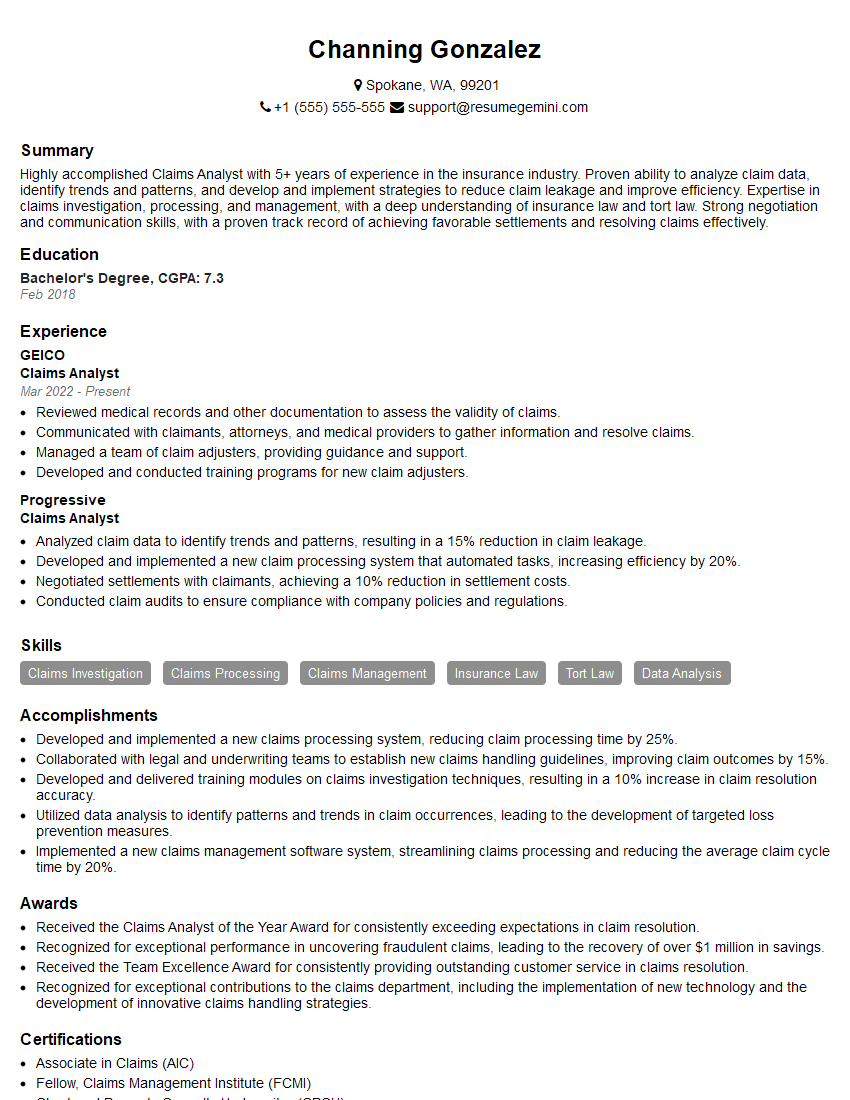

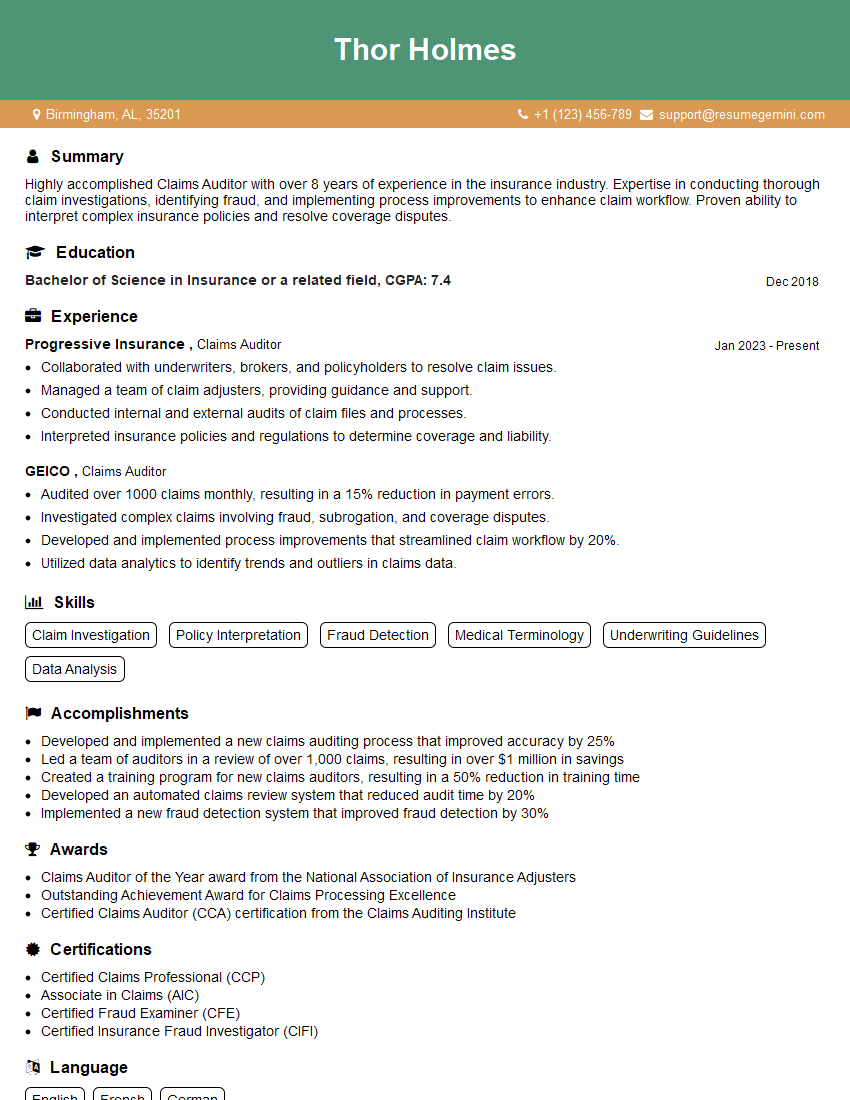

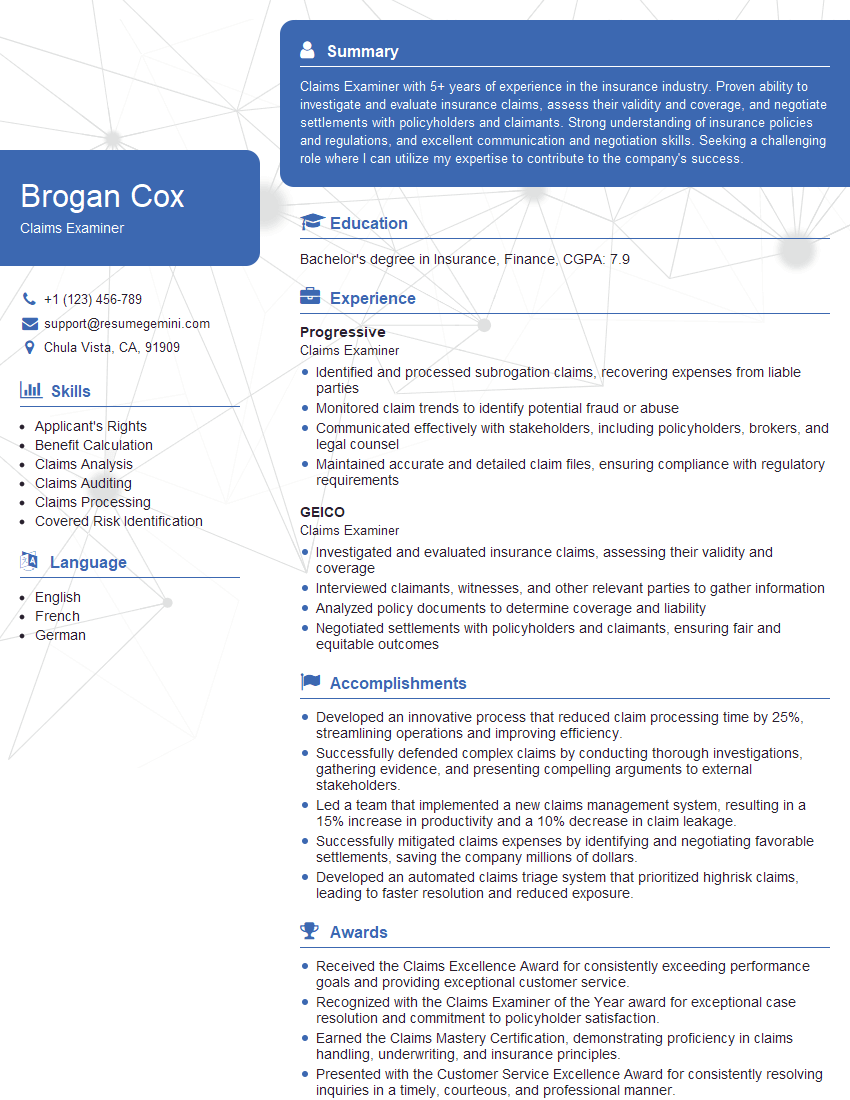

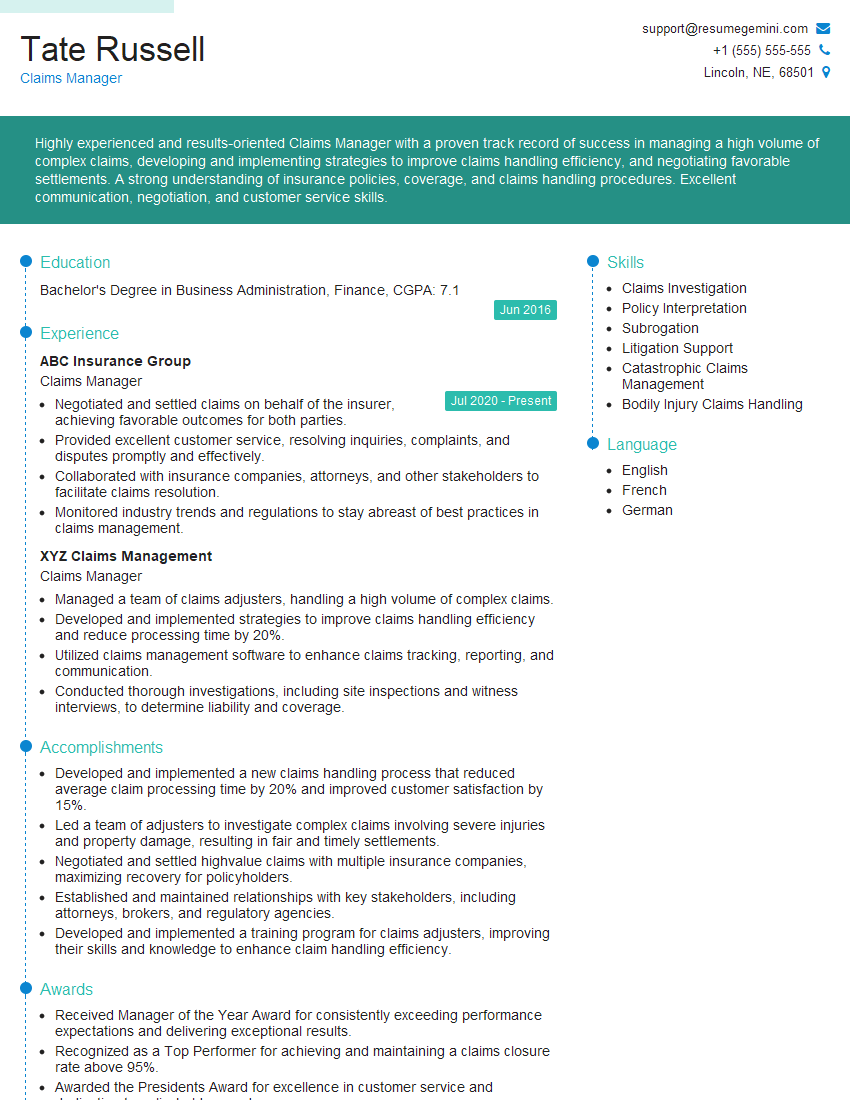

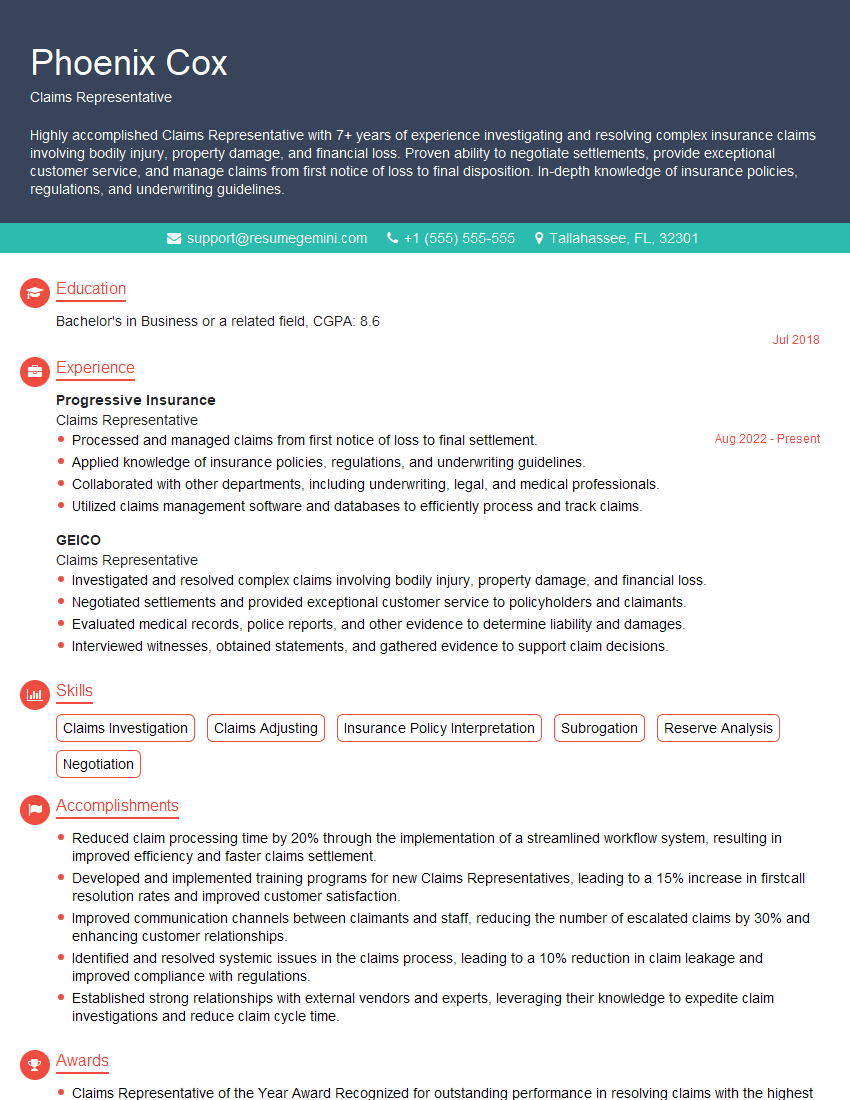

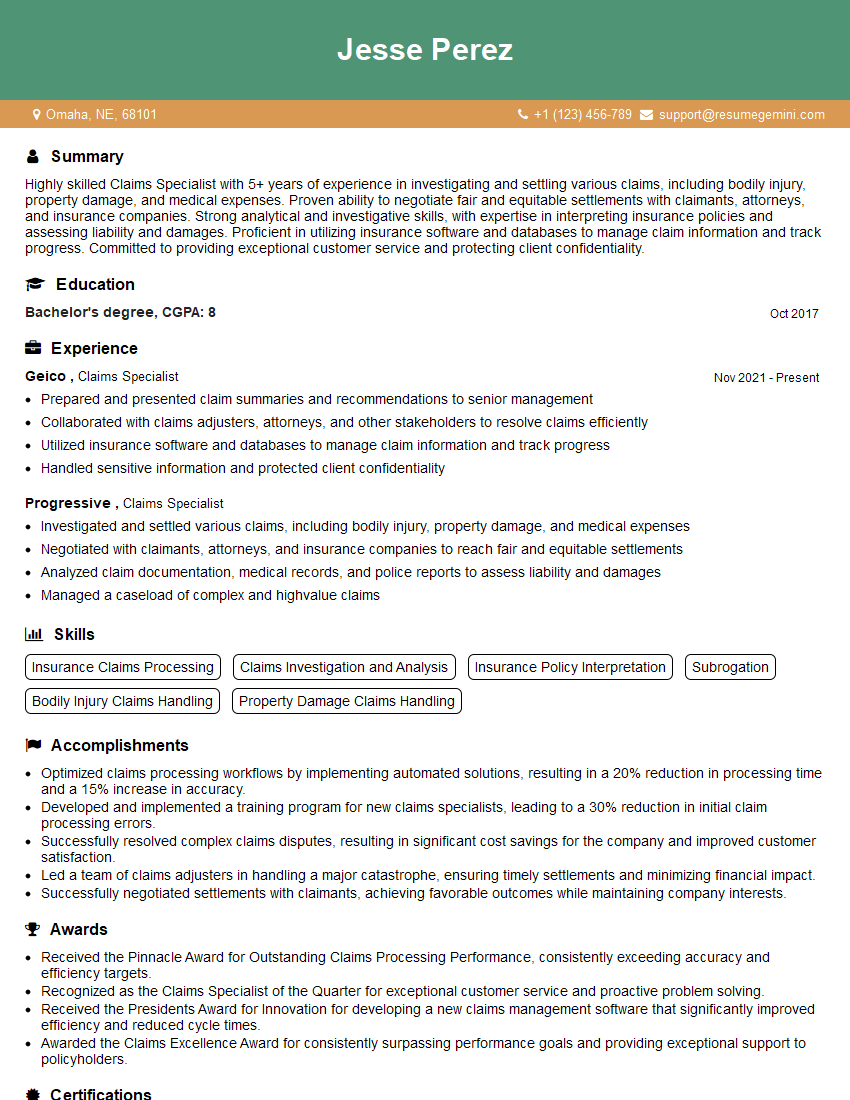

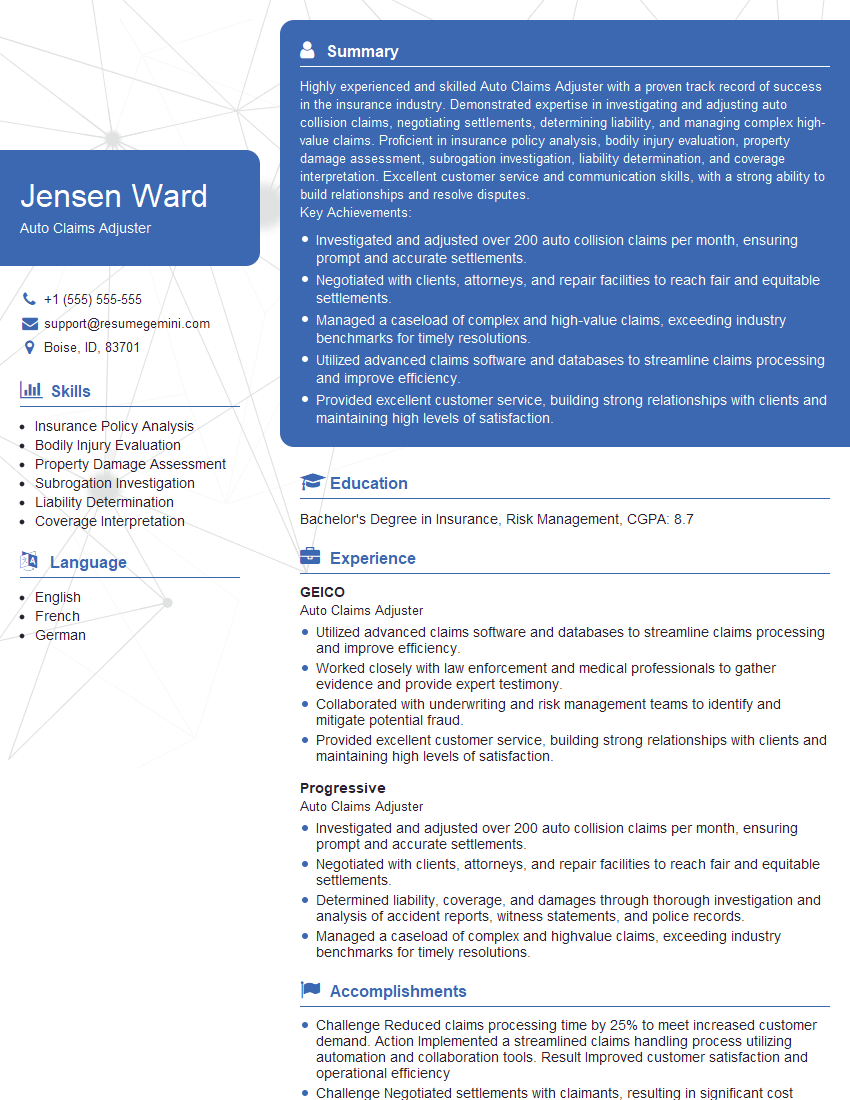

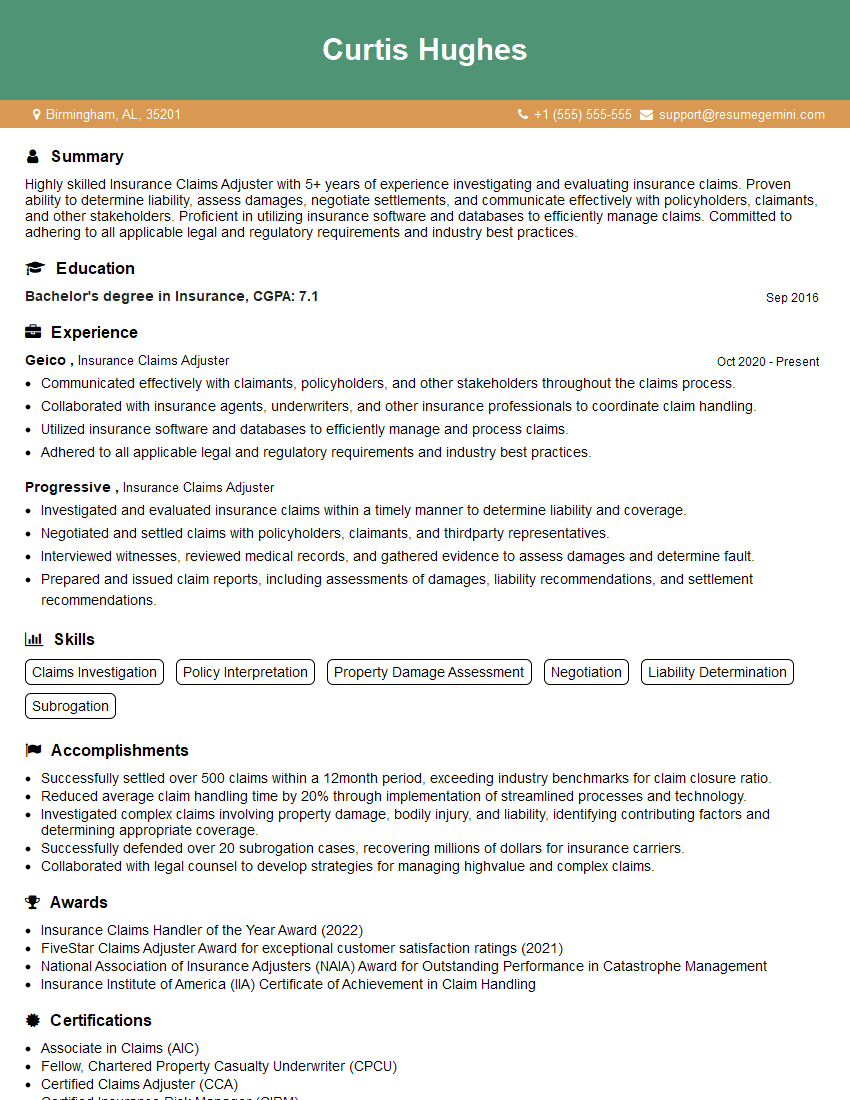

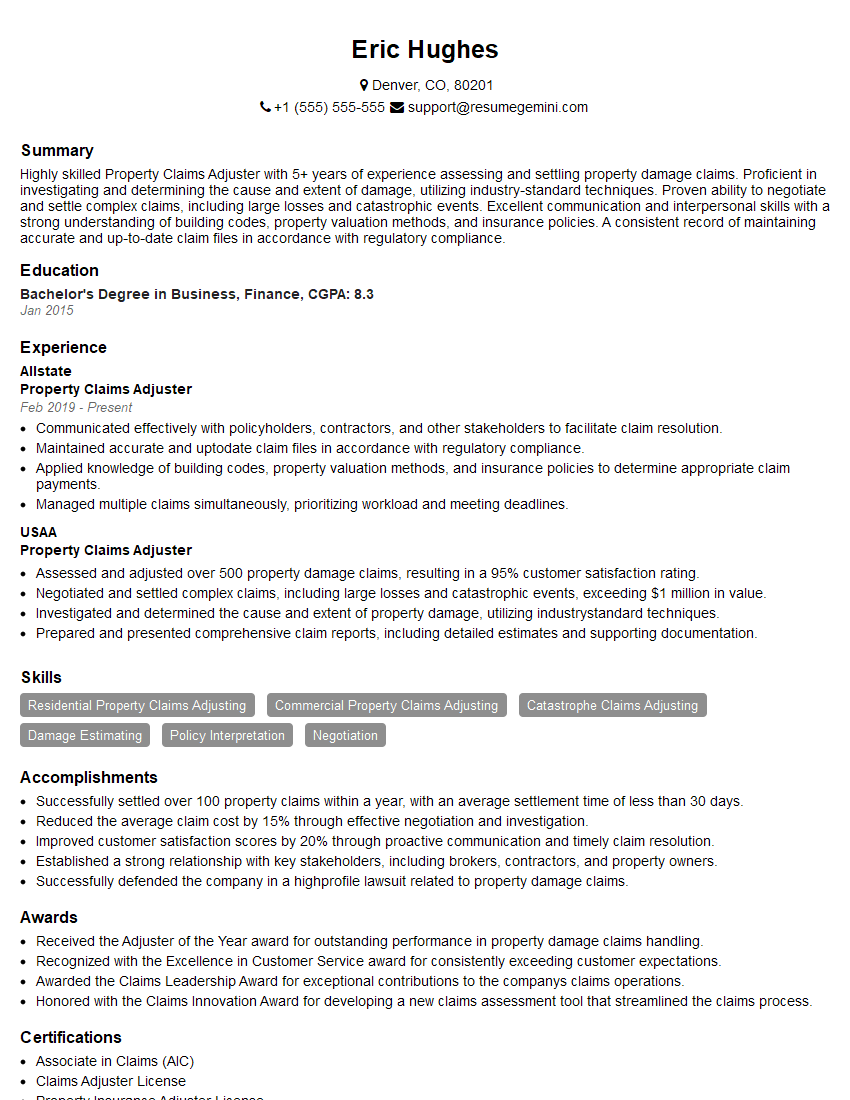

Mastering Insurance Claim Management is crucial for a rewarding and successful career in the insurance industry. It opens doors to specialized roles, increased responsibility, and higher earning potential. To stand out from the competition, invest time in crafting a compelling and ATS-friendly resume that highlights your skills and experience. ResumeGemini is a trusted resource that can help you build a professional resume that effectively showcases your qualifications. We offer examples of resumes tailored specifically to Insurance Claim Management to help you get started.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

Hi, I’m Jay, we have a few potential clients that are interested in your services, thought you might be a good fit. I’d love to talk about the details, when do you have time to talk?

Best,

Jay

Founder | CEO